- 1Institute of Agricultural Economics and Information, Anhui Academy of Agricultural Sciences, Hefei, China

- 2School of Economics and Management, Huzhou University, Huzhou, China

- 3Institute of Agricultural Economics and Development, Chinese Academy of Agricultural Sciences (CAAS), Beijing, China

How to achieve a win-win situation between agricultural economic growth and environmental protection has become an urgent issue to be resolved. This study takes China as an example and employs econometric methods to explore the impact of science and technology finance on agricultural green development and its underlying mechanisms. The findings indicate that science and technology finance has a significant positive impact on agricultural green development and can effectively promote it. This conclusion remains robust after replacing the explained variables, adding control variables, removing samples from municipalities, and conducting endogeneity tests. The impact of science and technology finance on agricultural green development is significant across different regions, showing no obvious regional differences. Rural human capital acts as a mediator in the relationship between science and technology finance and agricultural green development, while agricultural industrial agglomeration has a certain “masking effect” on this relationship. The impact of science and technology finance on agricultural green development exhibits a complex non-linear relationship. When science and technology finance is used as a threshold variable, it shows a significant positive marginal effect that increases; however, when rural human capital and agricultural industrial agglomeration are used as threshold variables, it shows a significant positive marginal effect that decreases. Future research can be further expanded in three areas: first, using spatial econometric models to study the spatial spillover effects of science and technology finance on agricultural green development; second, identifying more mediating variables and incorporating them into the research framework to more comprehensively demonstrate the mechanisms through which science and technology finance affects agricultural green development; third, data at the municipal level are used for the relevant analysis to address the issue of insufficient detail in studies that rely on provincial-level data.

1 Introduction

The interactive integration of financial development and technological innovation has effectively promoted sustained economic development (Foster et al., 2008; Samila and Sorenson, 2011; Allen et al., 2016). Science and technology finance is a systematic and innovative arrangement of financial tools, financial systems, financial policies, and financial services to promote technological development, achievement transformation, and the development of high-tech industries (Zhao et al., 2009). China attaches great importance to the development of science and technology finance, introducing multiple policy plans, including the “Opinions on Promoting the Integration of Science and Technology and Finance to Accelerate the Implementation of the Independent Innovation Strategy,” to encourage and promote the stable development of science and technology finance. Foreign scholars mainly focus on the interactive impact between finance and technological innovation (Giannetti, 2012; Atanassov, 2015; Kim et al., 2016), while Chinese scholars prefer to consider science and technology finance as a whole based on the construction of evaluation index systems, exploring its impact on industrial structure (Ding and Liu, 2020), high-quality economic development (Lyu and Li, 2024), and regional innovation (Du and Lian, 2022).

Green development is sustainable development that meets economic growth needs while maintaining a friendly relationship with the natural environment (Jacobs, 1991), and it is an essential part of sustainable ecological development (Shannon et al., 2014; Kates et al., 2001). Agricultural green development is a key measure to transform production methods and respond to global environmental changes, relating to the sustainable and effective development of agriculture (Hobbs et al., 2008), nutrition and health (Welch and Graham, 1999), food security (Scherer et al., 2018), and agricultural product quality and safety (Ikerd, 1993). Factors influencing agricultural green development include technological innovation (Lopez-Rodriguez and Martinez-Lopez, 2017), finance (Yuan et al., 2024), incentive policies (Tilman et al., 2002), and infrastructure levels (Dhehibi et al., 2016). As the practice of green development concepts deepens in Chinese agriculture, agricultural green development has become the inevitable direction for deepening agricultural and rural reforms (Yin et al., 2021). Agricultural green development enables agriculture to not only be a production sector providing grains, cotton, oil, meat, eggs, and milk but also a service sector providing fresh air, clean water, clean fields, and biodiversity (Li, 2022).

Supporting green development requires multi-faceted coordination and the participation of various elements, with finance and technology being the two most critical factors. The concept of “science and technology finance “is not independently recognized in the international academic community, and scholars have explored the driving mechanisms of green development from two dimensions: finance and technology. For instance, Khan et al. (2021) argue that financial development is a significant positive determinant for the renewable energy sector; Majeed and Mazhar (2019) suggest that support from the financial system can significantly improve environmental quality; Baloch et al. (2019) concludes that financial development has a reverse effect on green development; Dagar et al. (2022) find that financial development has contributed to environmental degradation in OECD countries. Studies by Nathaniel et al. (2021), Abid et al. (2022), and Gyamfi et al. (2022) confirm the positive effect of technological innovation on green development, highlighting that green innovation significantly impacts environmental sustainability and serves as an effective tool in reducing environmental pollution. Conversely, Usman and Hammar (2021) conclude that technological innovation has a negative impact on green development. As a product of the organic combination of technology and finance, science and technology finance must support both emerging and traditional industries. Existing research has already proven that science and technology finance has a green development effect (Liu et al., 2024; Wang and Jiang, 2022; Hua et al., 2021), but these studies mainly focus on cities and enterprises, with no research on agricultural green development.

Science and technology finance, as a systematic arrangement of policies and institutions that provide financing support and financial services to technology enterprises at various stages of development from start-up to maturity, inherently embodies a green development orientation. At the same time, agricultural green development relies heavily on the support of both capital and technology. Therefore, there is a theoretical connection between science and technology finance and agricultural green development. However, in reality, does science and technology finance truly have a driving effect on agricultural green development? If so, is there a more complex relationship than a linear one? What is the mechanism of its role? Answering these questions will help better present the intrinsic link between science and technology finance and agricultural green development, further fully leveraging the green development effect of science and technology finance, which is significant for China in promoting high-quality agricultural green development and achieving agricultural and rural modernization.

How to achieve a win–win situation between agricultural economic growth and environmental protection has become an urgent issue to be resolved. This study extends the research scope of science and technology finance to the field of agricultural green development, making two main marginal contributions: first, it empirically examines the impact of science and technology finance on agricultural green development from both linear and nonlinear dimensions, enriching the research of science and technology finance in the field of agricultural development; second, it explores the mechanism of how science and technology finance affects agricultural green development from the perspectives of rural human capital and agricultural industrial agglomeration, providing a basis for future research.

2 Research hypothesis

2.1 The impact of science and technology finance on agricultural green development

Firstly, from the perspective of the technological innovation effect, science and technology finance promotes the development of agricultural green technology innovation. On one hand, science and technology finance provides direct or indirect financing services for technology enterprises at various development stages from seed to maturity (Yi et al., 2019), further eliminating the “market failure” problem and providing ample funding support for green agricultural technology innovation throughout the process of research and development, transformation, and extension. On the other hand, the development of science and technology finance helps alleviate information asymmetry, assisting technology research and development entities and agricultural management entities in making scientific decisions (Zhai et al., 2022; Sun et al., 2022), thereby helping to maintain the correct direction of agricultural green technology innovation. What’s more, science and technology finance provides security for agricultural green technology innovation by establishing risk dispersion mechanisms (Ma and Li, 2019), sharing the risks of agricultural green technology innovation. And forth, science and technology finance promotes the development of agricultural green technology innovation by prioritizing the allocation of resources to high-tech, environmentally friendly projects, forcing enterprises to undertake technological transformation (Wang and Gu, 2021).

Secondly, from the perspective of the financial development effect, science and technology finance provides financial support for agricultural green development. On one hand, science and technology finance alleviates the financing constraints of agricultural green development by providing funding support through loans, venture capital, insurance guarantees, etc., eliminating inferior resources, retaining high-quality resources, and improving the mismatch of financial resources. On the other hand, the involvement of science and technology finance not only reduces corporate financial default risks but also enables more effective financial supervision of corporate behavior (Liu et al., 2022), urging agricultural enterprises to follow the path of green development due to its environmentally friendly characteristics.

In the early stages of science and technology finance development, due to various deficiencies in basic conditions and supporting measures, the marginal cost is relatively high, limiting its supportive effect on green agricultural development. As science and technology finance develops, internal and external environments improve, marginal costs decrease, and the supportive effect of science and technology finance for agricultural green development are further fully realized, presenting a dynamically enhancing pattern. Therefore, the impact of science and technology finance on agricultural green development may not be a simple linear relationship but a nonlinear one, with a threshold effect.

Hypothesis 1. Science and technology finance can effectively promote agricultural green development.

Hypothesis 1.1. There is a threshold effect between science and technology finance and agricultural green development based on science and technology finance itself. When science and technology finance is within different threshold intervals, it shows a nonlinear relationship with a positive trend between science and technology finance and agricultural green development.

2.2 Mechanisms of science and technology finance’s impact on agricultural green development

2.2.1 Rural human capital

Human capital refers to the knowledge and skills possessed by workers that can help improve work efficiency and yield higher outputs (Schultz, 1961). Human capital is the carrier of innovation; highly skilled individuals often have novel ideas that can lead to groundbreaking innovations, driving long-term economic development (Aghion and Howitt, 1990), and it is the main driving force for continuous progress in the economy and society.

Science and technology finance effectively improves the level of rural human capital. On one hand, the development of science and technology finance relies on establishing a “talent program” funding pool to support rural employers in attracting high-level talents through market-based methods, enhancing talent teams in key areas such as smart agriculture and digital villages (Guo et al., 2024). On the other hand, the development of science and technology finance increases the supply of new agricultural technology products, providing knowledge and technology to business entities through various product promotion training sessions and compelling farmers to actively learn and improve their skills during usage. This enhances the learning and cognitive abilities of business entities regarding knowledge and technology, as well as their abilities to collect and process information.

Compared to other production factors, human capital’s initiative and creativity are the most prominent; and the key to transforming traditional agriculture lies in investing in human capital for farmers (Schultz, 1964). The improvement of rural human capital will affect agricultural green development. On one hand, the enhancement of rural human capital strengthens the ability of business entities to master advanced agricultural technological innovations, reduces the transaction costs of extension, facilitates the application of new technologies, products, and management, reduces consumption, and decreases pollution, thereby enhancing the capacity for green agricultural production and operation and providing intellectual support for agricultural green development. On the other hand, the improvement of rural human capital aids in the awakening of environmental awareness among business entities, helping them to proactively choose green products and technologies and follow green production and operation paths. Additionally, during interactions with other business entities, they actively promote environmental ideas, using demonstration and learning effects to change inertial behaviors in traditional agricultural production, leading more people to participate in green agricultural development, thereby reducing the negative environmental impact of agricultural production and operations on a larger scale. Thirdly, the enhancement of rural human capital can invigorate the flow of other factors, achieve optimal allocation of various resource elements in agricultural green development, create a favorable factor endowment environment for agricultural green development, and influence its development path. Fourthly, the enhancement of rural human capital can drive the transformation and upgrading of the agricultural industrial structure, adopting more green technologies, equipment, and production methods, endowing the agricultural industry with more green attributes.

In the dynamic process of rural human capital evolving from low-end to high-end, the impact of science and technology finance on agricultural green development also varies. The impact of science and technology finance on agricultural green development changes with the level of rural human capital. Low-end human capital has a greater marginal effect when absorbing knowledge and technology than high-end human capital, making the influence of science and technology finance on agricultural green development through rural human capital more powerful. As low-skill human capital evolves into high-skill human capital, its marginal effects on absorbing knowledge, technology, and processing information gradually decrease, thus the influence of science and technology finance on agricultural green development through rural human capital correspondingly diminishes.

Hypothesis 2. Science and technology finance promotes agricultural green development by enhancing rural human capital.

Hypothesis 2.1. There is a threshold effect between science and technology finance and agricultural green development based on rural human capital. When rural human capital is within different threshold intervals, there is a nonlinear relationship with a positive trend between science and technology finance and agricultural green development.

2.2.2 Agricultural industrial agglomeration

Industrial agglomeration refers to the phenomenon of economic activities being relatively concentrated in a certain geographic area (Lin and Tan, 2019). Agricultural industrial agglomeration is the phenomenon or process where farmers, enterprises, and related support institutions gather in a specific area due to commonality or complementarity and form an organic network system through mutual association and cooperation (Xue, 2019).

Science and technology finance influences agricultural industrial agglomeration through two dimensions: agricultural technology innovation and financial supply. First, from the perspective of agricultural technology innovation, science and technology finance effectively facilitates the development of agricultural technology innovation by providing more technological loans, venture capital, and financing support, encouraging the development of agricultural technology innovation. Agricultural technology innovation directly provides knowledge and technology innovation results to the agricultural industry, bringing advanced equipment, processes, and procedures, promoting the transformation and upgrading of traditional industries. Additionally, agricultural technology innovation guides and promotes the formation of complementary functional characteristics in industrial chains, thereby driving the development of agricultural industrial agglomeration.

Second, from the dimension of financial supply, compared to secondary and tertiary industries, agricultural production and operations usually face stronger financing constraints (Fishman et al., 2022). Science and technology finance better matches the characteristics of high risk and long cycles in agricultural enterprises, bringing them diverse financial products and services, including credit and insurance. This guides more financial resources into the agricultural industry, strengthens the financial environment for agricultural industrial development, better meets the financial needs of agricultural industrial development, and provides financial guarantees for agricultural industrial agglomeration.

Agricultural industrial agglomeration has a dual impact on agricultural green development. On one hand, agricultural industrial agglomeration brings positive externalities to agricultural green development, encouraging its progress. From the perspective of scale effects, the spatial clustering of the agricultural industry leads to increased production scale and output, improves sharing levels, reduces the marginal costs of pollution control, and enhances the rational allocation of green resource elements among enterprises, improving allocation efficiency. Additionally, agricultural industrial agglomeration helps to strengthen the environmental awareness of enterprises (Baomin et al., 2012), reinforcing their sense of responsibility for ecological environmental protection. From the perspective of knowledge and technology spillover effects, by reducing the geographical distance and time costs of communication, agricultural industrial agglomeration facilitates exchanges and interactions among different knowledge and technology groups, thereby stimulating innovative thinking. This is conducive to the generation and absorption of heterogeneous green knowledge and technology, enhancing the dissemination of green knowledge and technology. From the perspective of competition effects, agricultural industrial agglomeration improves the competitiveness of the agricultural product market, prompting the optimization and transformation of the agricultural industrial structure, thereby promoting agricultural green development (Han and Yang, 2023).

On the other hand, agricultural industrial agglomeration brings negative externalities to agricultural green development, inhibiting its progress. From the perspective of crowding effects, the high energy consumption, high pollution, and high emissions brought by agricultural industrial agglomeration lead to crowding of resources and the environment, putting more pressure on the agricultural ecological environment and negatively impacting agricultural green development. From the perspective of excessive competition, agricultural industrial agglomeration intensifies competition among enterprises for limited resources (Simonen et al., 2015), preventing enterprises from investing more resources in green production and operations. From the perspective of siphoning effects, the clustering of agricultural industries in a certain area attracts agricultural production resources from surrounding areas, which is detrimental to the green development of agriculture in those surrounding areas (Yin et al., 2022). From the perspective of path dependence effects, the formation of agricultural industrial agglomeration leads to development path lock-in, not only crowding out resources from other areas but also restricting the generation and spillover of knowledge and technological innovations, negatively impacting agricultural green development.

When agricultural industrial agglomeration lack scientific planning and the degree of aggregation is excessively high, the negative externalities associated with green development are amplified by the excessive concentration. When negative externalities outweigh positive externalities, the impact of agricultural industrial agglomeration on agricultural green development may shift from positive to negative. This, in turn, hinders agricultural green development.

The process of agricultural industrial agglomeration is a dynamic development process (Zhou, 2009). When it is in different stages of clustering, the role of the allocation of clustered resources and elements varies (Xue and Wen, 2023), and its effects differ as well. Agglomeration has an optimal scale, exceeding which will exacerbate pollution, while staying below this scale will improve it (Henderson, 2003). When agricultural industrial agglomeration serves as a threshold variable, the impact of science and technology finance on agricultural green development through agricultural industrial agglomeration may also exhibit nonlinear characteristics. The impact of science and technology finance on agricultural green development changes with the level of agricultural industrial agglomeration.

When agricultural industrial agglomeration is on the path to optimal scale, science and technology finance can exert a better promoting effect through agricultural industrial agglomeration, thus having a greater driving force on agricultural green development. Conversely, when agricultural industrial agglomeration deviates from the path to optimal scale, the energy exerted by science and technology finance through agricultural industrial agglomeration will be restricted to varying degrees, thereby weakening its driving force on agricultural green development.

Hypothesis 3. Science and technology finance influences agricultural green development by promoting agricultural industrial agglomeration, but the direction of the impact is uncertain. When agricultural industrial agglomeration positively affects agricultural green development, it acts as a “mediating effect” in the relationship between science and technology finance and agricultural green development. Conversely, when agricultural industrial agglomeration negatively affects agricultural green development, it acts as a “masking effect” in the relationship between science and technology finance and agricultural green development.

Hypothesis 3.1. There is a threshold effect based on agricultural industrial agglomeration between science and technology finance and agricultural green development. When agricultural industrial agglomeration is in different threshold intervals, the relationship between science and technology finance and agricultural green development exhibits a positive non-linear trend.

3 Research design

3.1 Model specification

To empirically analyze the impact of science and technology finance on agricultural green development, the Equation 1 is specified:

Where i and t denote region and time, respectively; agd represents agricultural green development; stf represents the core independent variable, science and technology finance. If is significantly positive, it indicates that the core independent variable significantly promotes agricultural green development; controls represent the set of control variables; represents the random disturbance term.

3.2 Variable description

3.2.1 Dependent variable

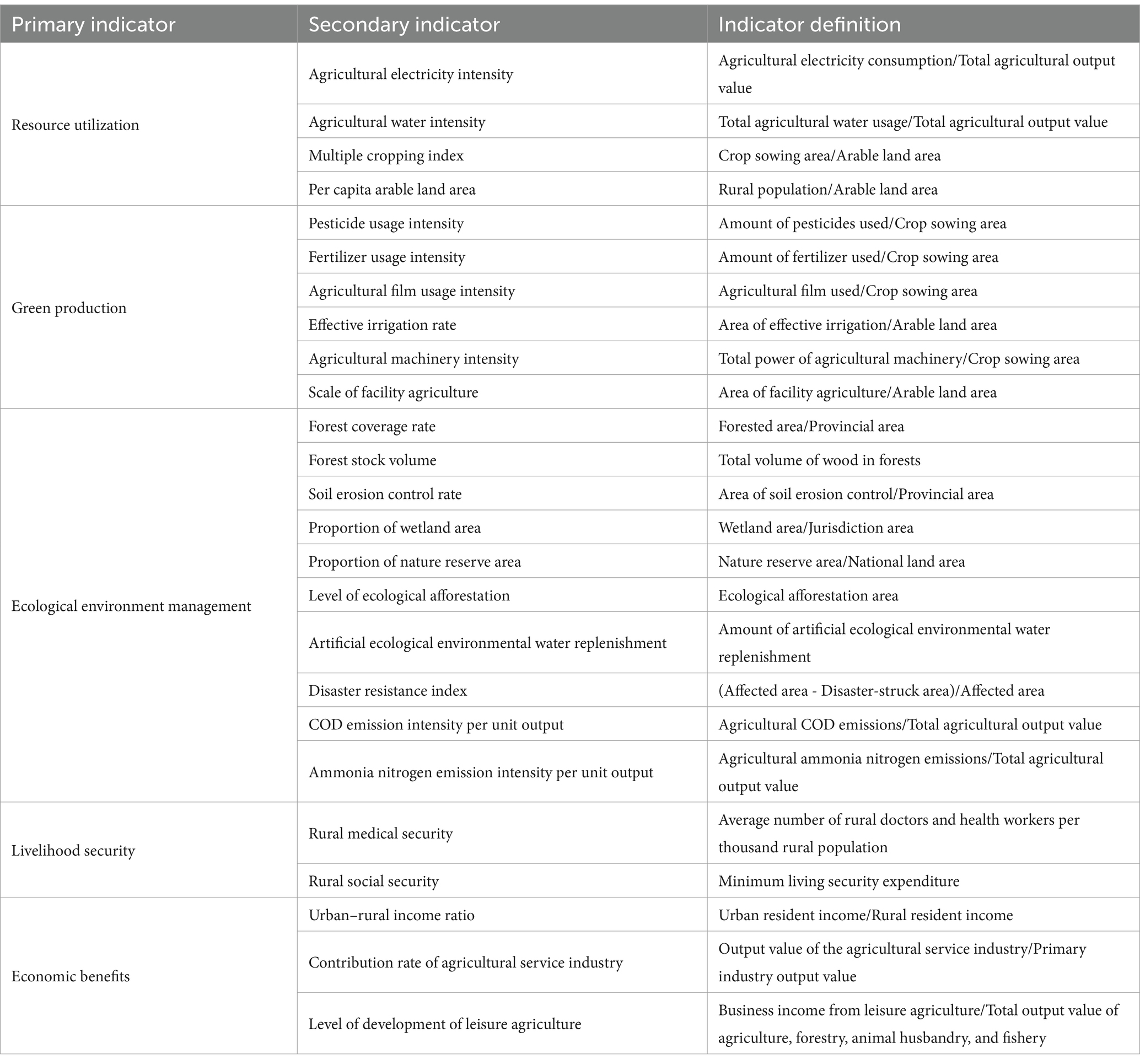

The dependent variable in this paper is agricultural green development (agd). To comprehensively reflect the situation of agricultural green development, this paper considers the complexity of agricultural green development and the availability of research data. Referring to the “14th Five-Year Plan for National Agricultural Green Development” issued and implemented by China in 2021, this paper also draws on and optimizes the existing research results of Zou et al. (2023), Su et al. (2021), and He et al. (2021). From five dimensions: resource utilization, green production, ecological environment management, living security, and economic benefits, 25 indicators were selected to construct a measurement system for the level of agricultural green development (Table 1), and the entropy method was used to calculate the green agricultural development index.

3.2.2 Core independent variable

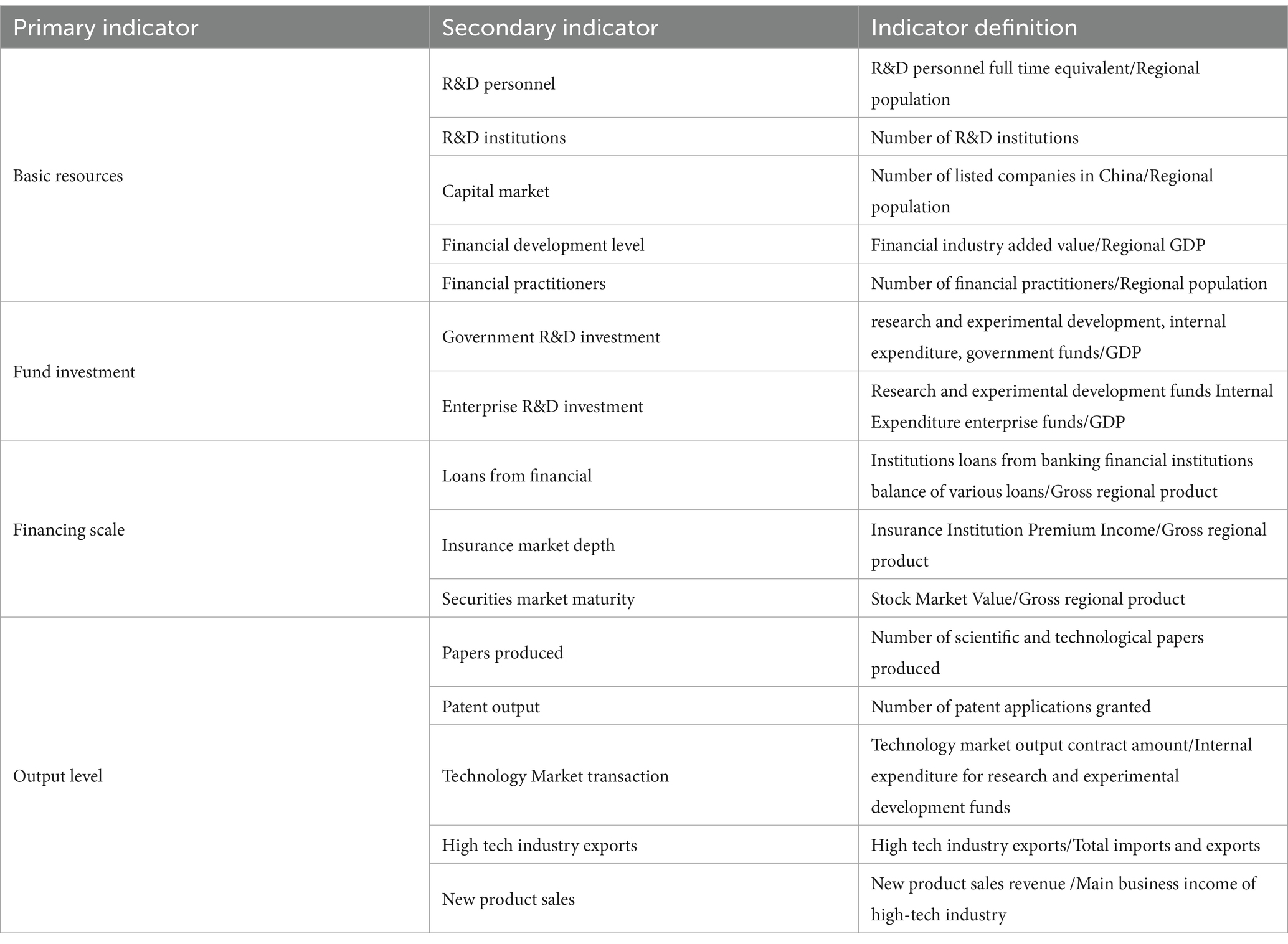

The core independent variable in this paper is science and technology finance (stf). Drawing on and optimizing the research results of Zhang (2019) and Cao et al. (2011), this paper focuses on how to provide efficient and comprehensive financial products and services for technological innovation in small and medium-sized enterprises. Based on the idea of “resource allocation—funding input–output level, “15 indicators were selected from four dimensions: basic resources, funding input, financing scale, and output level, to construct a measurement system for the level of development of science and technology finance (Table 2). The entropy method was used to calculate the science and technology finance development index.

3.2.3 Mechanism variables

The mechanism variables in this paper are rural human capital (ahc) and agricultural industrial agglomeration (aia). Rural human capital is represented by the average years of schooling of the rural population, calculated as: proportion of people with primary education × 6 + proportion of people with junior high education × 9 + proportion of people with high school education × 12 + proportion of people with college education and above × 16.

Agricultural industrial agglomeration is an expression of the spatial distribution trend of production factors, referring to the process of agricultural production resources clustering within a specific area, reflecting the main characteristics of factor distribution concentration and production intensification (Deng et al., 2020). Since the location quotient can effectively reflect the spatial distribution of geographical elements and measure the level of agricultural industrial agglomeration at the provincial spatial scale (Han and Yang, 2023), this paper uses the location quotient to measure the degree of agricultural industrial agglomeration. The degree of agricultural industrial agglomeration is represented by the ratio of the total agricultural output value of each region to the national total agricultural output value, divided by the ratio of the GDP of each region to the national GDP. The calculation formula is shown in Equation 2.

In the above formula, LQit represents the location quotient of region i, Qit represents the total agricultural output value of region i; represents the national total agricultural output value; Git represents the GDP of region i; represents the national GDP. If LQit > 1, it indicates that the agriculture of the region has a comparative advantage in the country, and the degree of agricultural industrial agglomeration is high; if LQit = 1, it indicates that the degree of agricultural industrial agglomeration in the region is at the national average level; if LQit < 1, it indicates that the degree of agricultural industrial agglomeration in the region is below the national average level.

3.2.4 Control variables

Focusing on agricultural green development, this study also considers some closely related factors as control variables, including:

(1) The level of agricultural product circulation (apc) connects agricultural production and consumption, relates to the realization of agricultural product value, and is closely related to green agricultural development. This study refers to Sun’s (2011) method, using the ratio of the total wholesale and retail sales of food, beverages, and tobacco products to the rural population as the proxy variable.

(2) Economic openness (eo) promotes the effective allocation of domestic and foreign resources, thereby affecting agricultural green development. This paper uses the ratio of the total import and export value to the year-end population of the region as the proxy variable.

(3) The level of rural transportation (rtl) reflects the construction of rural infrastructure. Since secondary roads in China connect urban and suburban areas and indirectly affect the rural economy, while tertiary and quaternary roads directly promote urban–rural links and directly impact the rural economy (Zhou et al., 2022), this paper uses the ratio of the total mileage of secondary, tertiary, and quaternary roads to the rural population as the proxy variable.

(4) The level of fiscal support for agriculture (fsa) measures the level of financial support from fiscal funds in the process of agricultural development. This paper uses the ratio of agricultural fiscal expenditure to the rural population as the proxy variable.

(5) Rural revitalization policy (rrp), Implementing the rural revitalization strategy is the most important guarantee for realizing the modernization of China’s agriculture and rural areas and building a strong agricultural country. It is the focus of China’s work of “agriculture, rural areas and farmers” at this stage and has a huge impact on agricultural and rural development. This variable is a dummy variable, taking the value of 1 for 2018 and beyond, and 0 otherwise.

(6) Regional economic level (rel) affects agricultural green development at the regional level. This paper uses the ratio of the year-end population to the regional GDP as the proxy variable.

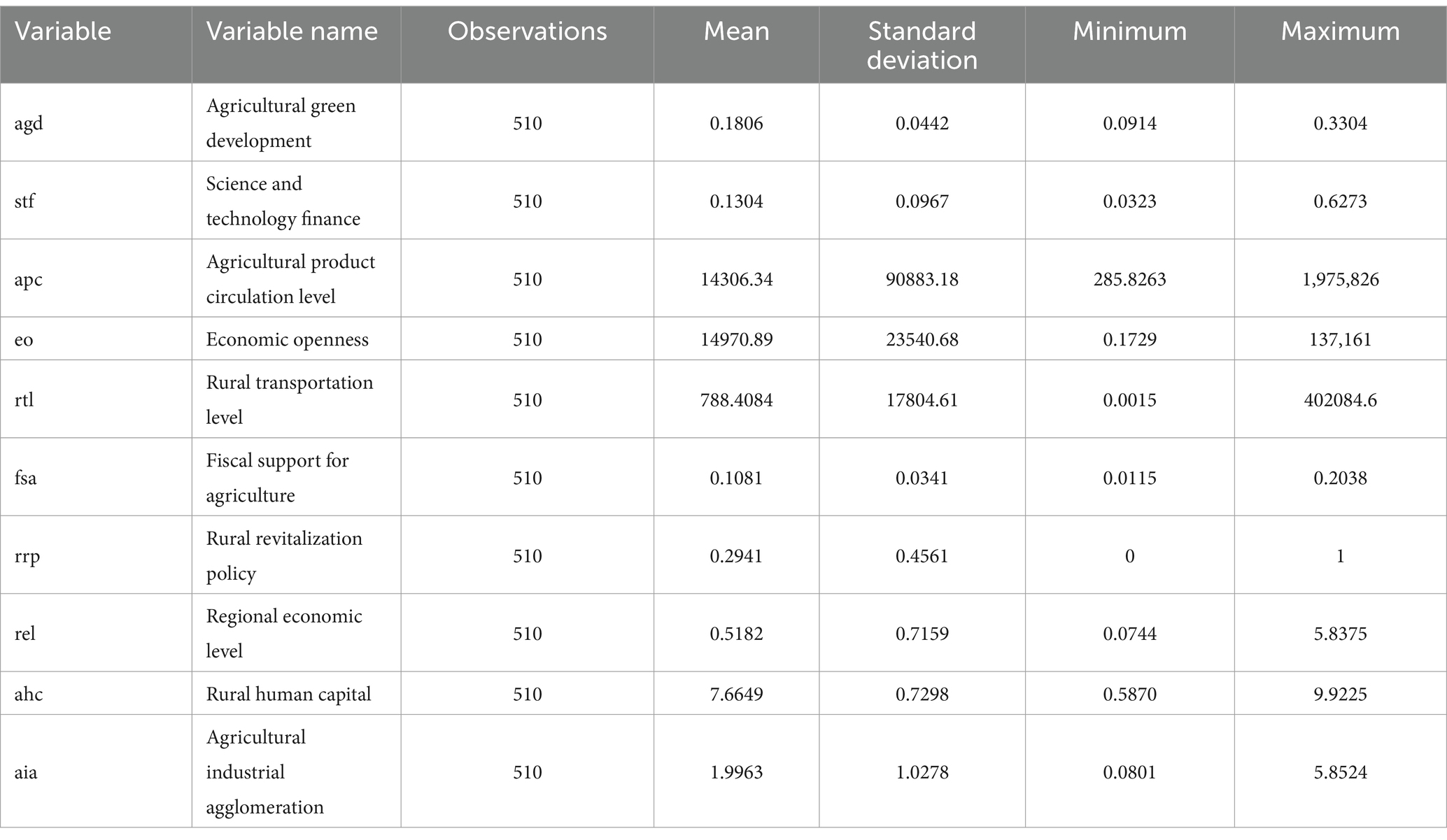

Considering that if there is a high autocorrelation between variables, it will lead to biased regression results, resulting in multicollinearity problems between variables. Therefore, multicollinearity tests need to be performed on each variable. Using the variance inflation factor (VIF) for multicollinearity testing of each variable, it was found that the VIF values of all variables were less than 5, and the average VIF value of the variables was 2.71, also less than 5, indicating that there is no serious multicollinearity among the variables used in this study. Then descriptive statistical analysis was performed on each variable, and the results are shown in Table 3.

3.3 Data sources

Limited by the availability of some variable data, this study selects panel data from 30 provinces, municipalities, and autonomous regions in China, excluding Hong Kong, Macau, Taiwan, and Tibet, from 2006 to 2022 for analysis. The sample data used comes from the “China Rural Statistical Yearbook,” “China Science and Technology Statistical Yearbook,” “China Statistical Yearbook,” “China Financial Yearbook,” “China Leisure Agriculture Yearbook,” and “China Tertiary Industry Statistical Yearbook”; linear interpolation was used to fill in missing data. For the price-related data, the Consumer Price Index (CPI) with 2006 as the base year was used to deflate the values, eliminating the impact of inflation.

4 Results

4.1 Baseline regression

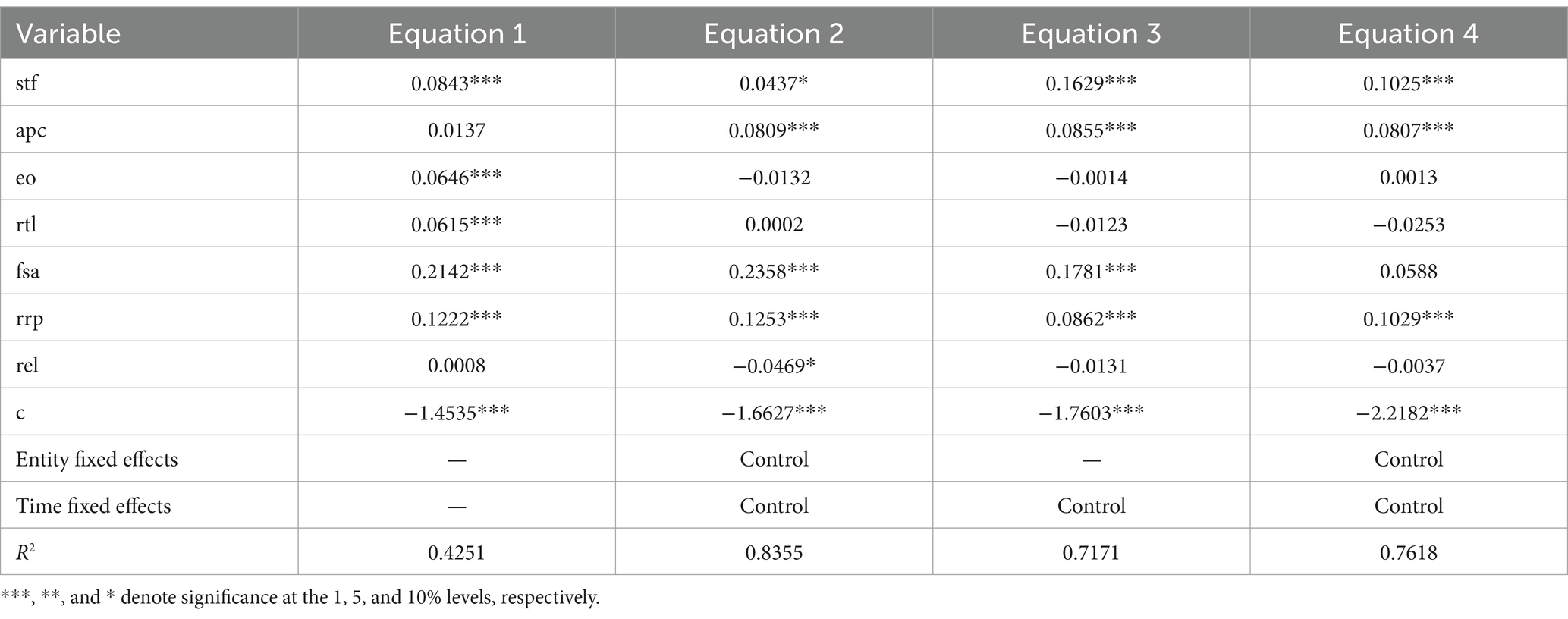

This paper uses four models for baseline regression: OLS without controlling for individual and time fixed effects (Equation 1), OLS with controlling for individual and time fixed effects (Equation 2), robust clustered standard errors without controlling for time fixed effects (Equation 3), and robust clustered standard errors with controlling for individual and time fixed effects (Equation 4). The estimation results (Table 4) show that the estimated coefficients of the core independent variable are positive in all four models and are significant at least at the 10% level, indicating that science and technology finance can effectively promote agricultural green development, thus verifying Hypothesis 1.

4.2 Endogeneity analysis

Although this paper controls for individual and time fixed effects, endogeneity issues may still arise due to bidirectional causality, omitted variable bias, measurement error, and sample selection bias. To mitigate potential endogeneity problems in the equation, this study uses two methods.

First, the average science and technology finance of other regions (excluding the local region) and the shortest distance from each provincial capital to the nearest coastal port (calculated using latitude and longitude) are used, respectively, as instrumental variables, and the instrumental variable two-stage least squares (IV-2SLS) method is employed for estimation. Second, a lagged dependent variable is introduced into the equation to construct a dynamic panel model. Considering that system generalized method of moments (SYS-GMM) has smaller estimation bias and higher efficiency compared to difference GMM (DIF-GMM), SYS-GMM is used for estimation. The estimation results of these two methods validate each other.

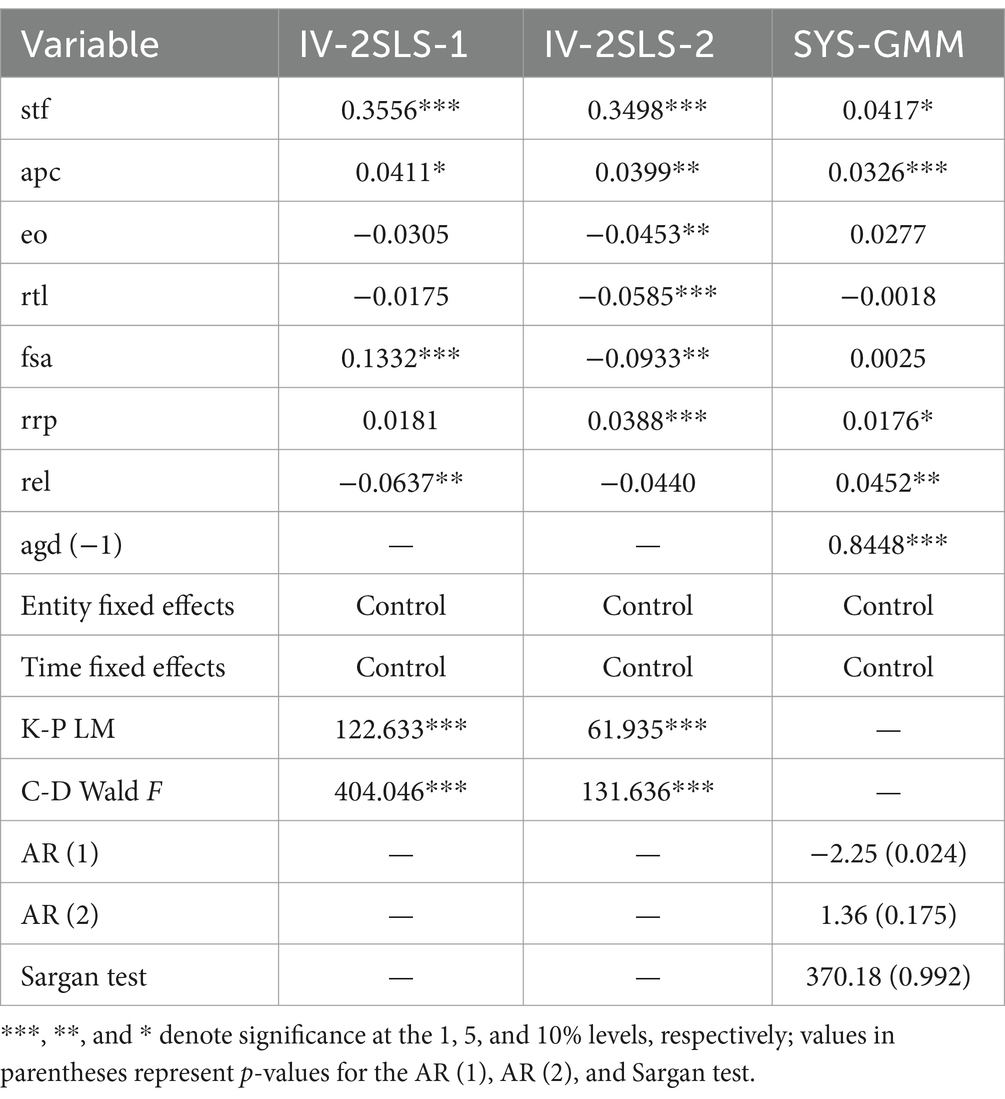

Table 5 reports the estimation results of endogeneity tests. IV-2SLS-1 uses the average science and technology finance of other regions (excluding the local region) as the instrumental variable, and IV-2SLS-2 uses the shortest distance from each provincial capital to the nearest coastal port (calculated using latitude and longitude) as the instrumental variable. Both equations pass the under identification test and weak identification test, indicating that the instrumental variables used are reasonable. According to the SYS-GMM estimation results, the AR (2) and Sargan test results indicate that there is no second-order autocorrelation or overidentification problem.

The estimation results show that the estimated coefficients of the core independent variable are positive in all three models and are significant at least at the 10% level. This indicates that after addressing endogeneity, science and technology finance still significantly promotes agricultural green development, supporting the baseline regression conclusions.

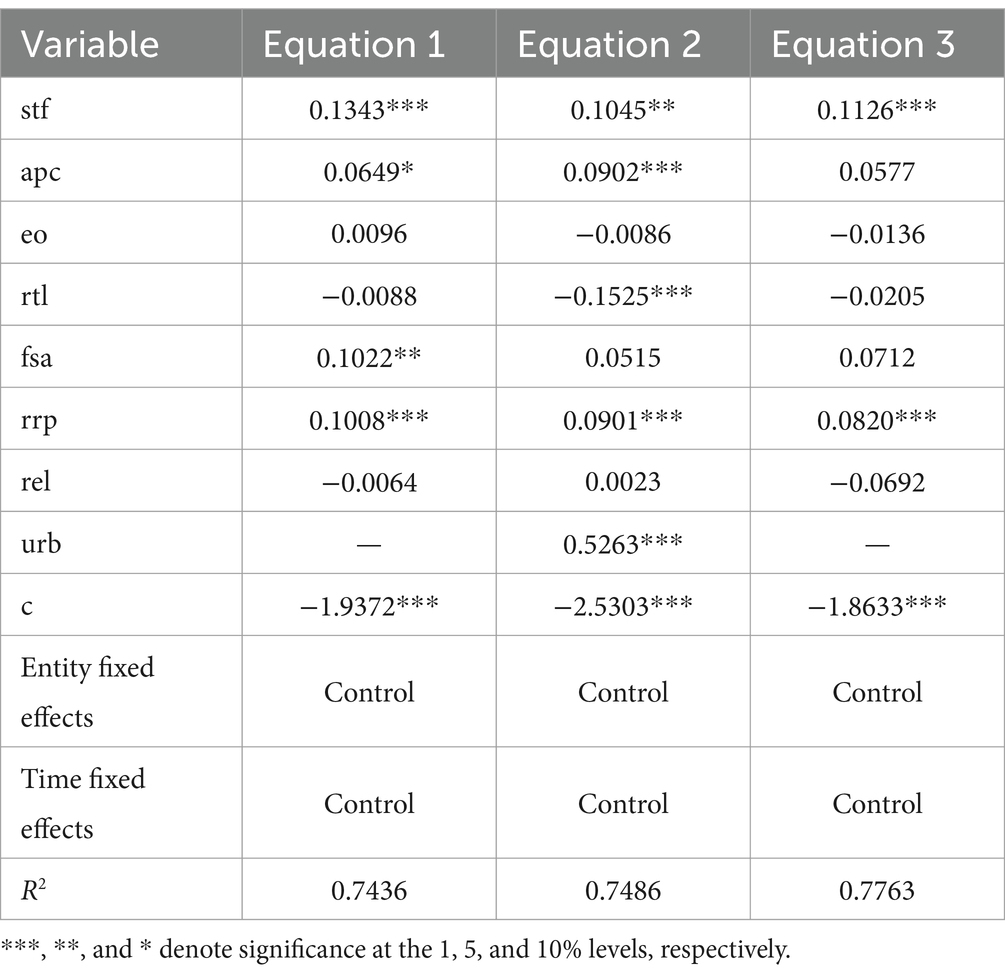

4.3 Robustness test

To ensure the stability of the regression results, this paper conducts further robustness tests using three methods. First, considering the lag effect of agricultural green development, a lag effect robustness test is performed by introducing the lagged agricultural green development variable into the model and re-running the regression. The results are shown in Table 6, Equation 1. Second, control variables are added, and urbanization (urb) is introduced into the model, using the urban population ratio as its proxy variable. The results are shown in Table 6, Equation 2. Third, the regression is re-run after excluding the four municipalities directly under the central government from the sample. The results are shown in Table 6, Equation 3. The estimation results indicate that the estimated coefficients of the core independent variable, science and technology finance, are positive in all three robustness test models and are significant at least at the 5% level, consistent with the baseline regression results.

4.4 Heterogeneity test

The geographical scope covered by the sample regions in this paper is broad, with significant heterogeneity observed between the eastern, central, and western regions. From the perspective of economic development, the eastern region is geographically closer to the coast and benefits from relatively favorable natural conditions, such as climate, topography, and hydrology. It also has a more developed economic level, a more diverse and advanced industrial structure, a more open policy environment, a higher level of technological innovation, as well as a better financial ecosystem and richer financial resources, thus creating a relatively more favorable environment for science and technology finance and agricultural green development. The western region is the farthest from the coast geographically, with relatively poor natural conditions. Its economic level is relatively underdeveloped, with an industrial structure primarily based on traditional industries. Technological innovation capabilities are relatively lagging, the financial ecosystem is weak, and financial resources are scarce, creating a less favorable environment for science and technology finance and agricultural green development. The central region has better natural conditions and economic development than the western region, but is behind the eastern region. The environment for science and technology finance and agricultural green development is better than in the western region, but less favorable than in the eastern region. Due to the aforementioned factors, there may be significant regional differences in science and technology finance and agricultural green development, which could, in turn, result in varying impacts of tech-finance on green agricultural development. Therefore, the sample is divided into eastern, central, and western regions, and regressions are conducted separately. The estimation results are shown in Table 7. The results indicate that the estimated coefficients of the core independent variable are positive and significant at least at the 10% level across all regions, suggesting that science and technology finance has a significant positive impact on agricultural green development in different regions without significant regional differences.

4.5 Mechanism test

4.5.1 Rural human capital

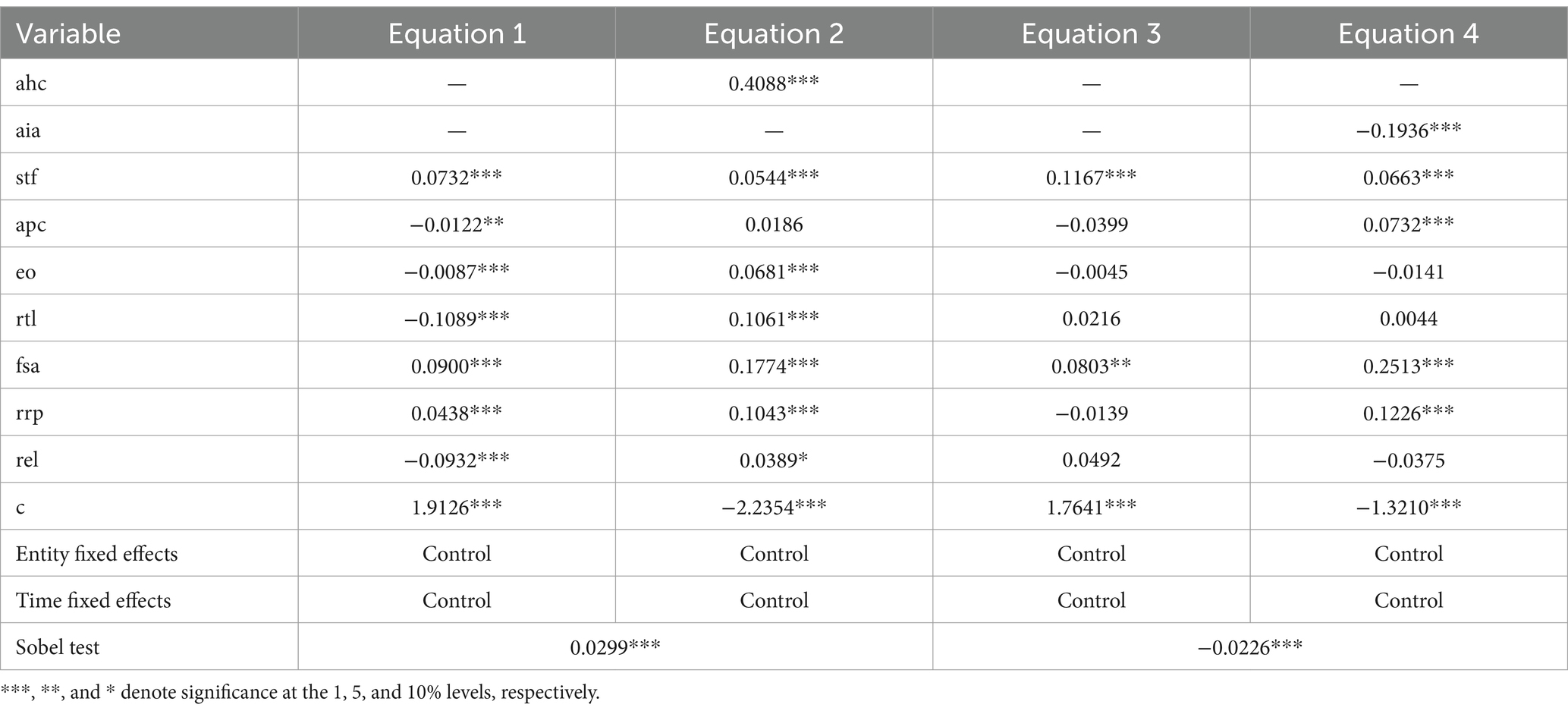

Equations 1 and 2 in Table 8 report the estimation results of the mediation effect model with rural human capital as the mediator. In Equation 1, the estimated coefficient of science and technology finance is positive and significant at the 1% level, indicating that the development of science and technology finance can significantly promote the development of rural human capital. Equation 2 shows the estimation results after introducing rural human capital. The estimated coefficients of both rural human capital and science and technology finance are positive and significant at the 1% level. The Sobel test value is significantly positive, with the indirect effect accounting for 35.47% of the total effect. This indicates that rural human capital mediates the relationship between science and technology finance and agricultural green development, proving that improving rural human capital is a mechanism through which science and technology finance enhances agricultural green development. Therefore, the path of science and technology finance → rural human capital → agricultural green development is validated, supporting Hypothesis 2.

4.5.2 Agricultural industrial agglomeration

Equations 3 and 4 in Table 8 report the estimation results of the mediation effect model with agricultural industrial agglomeration as the mediator. In Equation 3, the estimated coefficient of science and technology finance is positive and significant at the 1% level, indicating that the development of science and technology finance can significantly promote agricultural industrial agglomeration. Equation 4 shows the estimation results after introducing agricultural industrial agglomeration. The estimated coefficient of agricultural industrial agglomeration is negative and significant at the 1% level, while the estimated coefficient of science and technology finance is positive and significant at the 1% level, and the Sobel test value is significantly negative. This indicates that agricultural industrial agglomeration has a negative effect on agricultural green development, meaning that the negative externalities of agricultural industrial agglomeration currently outweigh its positive externalities in China. Under the premise of a significant total effect, the direct and indirect effects are in opposite directions, with the indirect effect offsetting part of the direct effect, the indirect effect accounts for 34.09% of the direct effect. This suggests that the indirect path through which science and technology finance influences agricultural green development via agricultural industrial agglomeration weakens the direct effect of science and technology finance on agricultural green development, indicating that agricultural industrial agglomeration has a “masking effect” in the relationship between science and technology finance and agricultural green development. Hypothesis 3 is thus validated. The presence of the “masking effect” of agricultural industrial agglomeration suggests that while the mechanism through which science and technology finance indirectly influences agricultural green development via promoting agricultural industrial agglomeration exists, but it weakens the positive impact of science and technology finance on agricultural green development. Additionally, controlling for the variable of agricultural industrial agglomeration can enhance the influence of science and technology finance on agricultural green development.

4.6 Nonlinear analysis

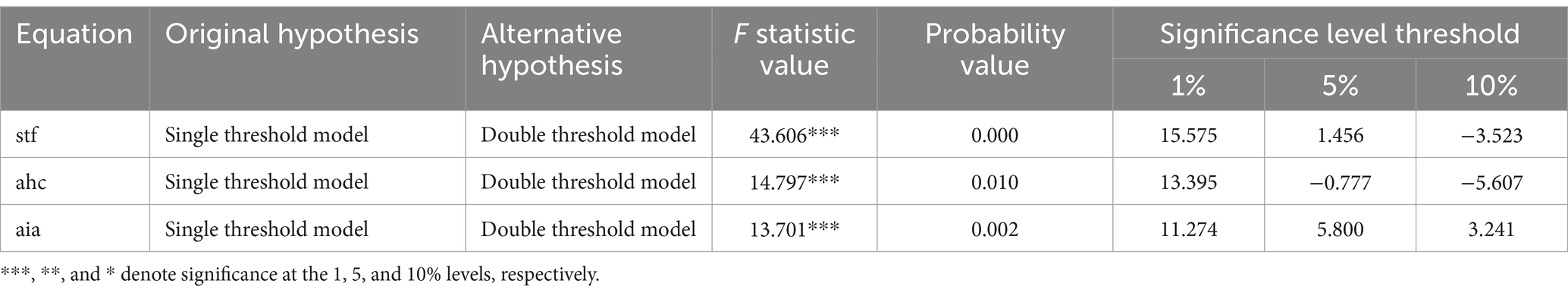

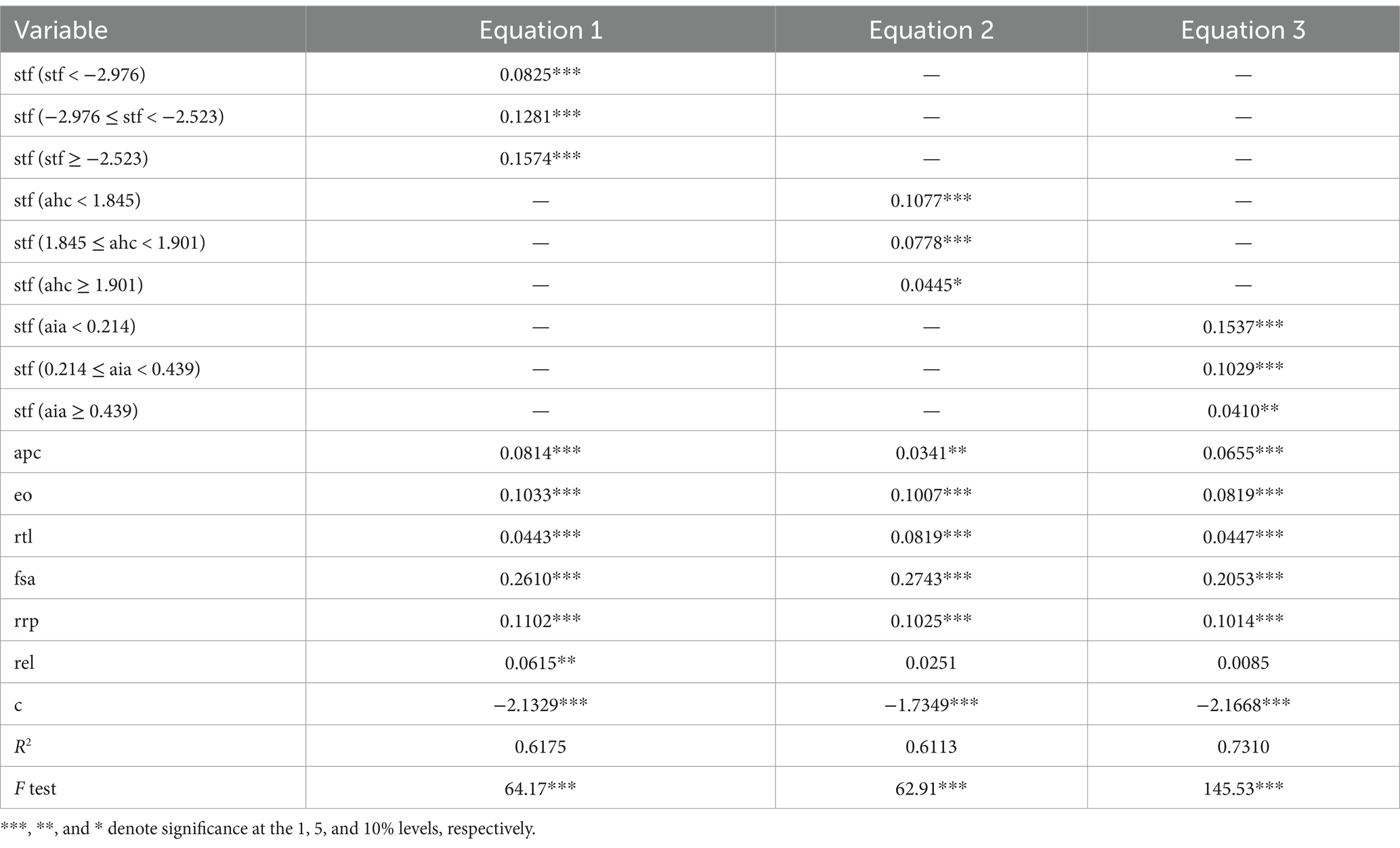

The panel threshold model (PTR) is used to examine the nonlinear relationship between science and technology finance and agricultural green development, with agricultural green development, rural human capital, and agricultural industrial agglomeration as threshold variables. The F-values and related critical values for the threshold effect test are obtained through 500 bootstrap resampling (Table 9), and a double-threshold effect model is used for parameter estimation.

According to the estimation results of the panel threshold model (PTR) (Table 10), when science and technology finance is used as the threshold variable (Equation 1), the estimated coefficients of science and technology finance are positive in all three intervals and are significant at the 1% level. Unlike Equation 2 and 3, the estimated coefficients of science and technology finance increase with the level of science and technology finance, showing a significant positive marginal effect increment. This indicates that the impact of science and technology finance on agricultural green development increases with the level of science and technology finance, meaning that the optimization of science and technology finance itself provides more impetus for its role in enabling agricultural green development, thus verifying Hypothesis 1.1.

When rural human capital is used as the threshold variable (Equation 2), the estimated coefficients of the core independent variable, science and technology finance, are positive in all three intervals defined by the two threshold values and are significant at least at the 10% level. However, the estimated coefficients of science and technology finance decrease with the development level of rural human capital, showing a significant positive marginal effect decrement. This may be because the impact of science and technology finance on agricultural green development is greater at lower levels of rural human capital, but this effect starts to decrease as the level of rural human capital increases, thus verifying Hypothesis 2.1.

When agricultural industrial agglomeration is used as the threshold variable (Equation 3), the estimated coefficients of science and technology finance are positive in all three intervals and are significant at least at the 5% level. Similar to Equation 2, the estimated coefficients of science and technology finance decrease with the level of agricultural industrial agglomeration, showing a significant positive marginal effect decrement. This indicates that the impact of science and technology finance on agricultural green development is more pronounced at lower levels of agricultural industrial agglomeration, but this effect decreases as the level of agricultural industrial agglomeration.

5 Discussion

Science and technology finance as an important financial tool, theoretically empowers agricultural green development. However, whether this is true in practice requires further evidence. If science and technology finance indeed promotes agricultural green development, through what mechanisms does it achieve this? Additionally, is the relationship between science and technology finance and agricultural green development linear or more complex and nonlinear? These are questions worth exploring.

Based on the consideration of these issues, this study constructed research hypotheses grounded in theoretical analysis and validated them through empirical analysis. Our findings show that science and technology finance has a significant positive impact on agricultural green development. As no related studies on science and technology finance and agricultural green development have been found, longitudinal comparison is not possible. However, in broader fields, studies by Liu et al. (2024), Wang and Jiang (2022), and Hua et al. (2021) have concluded that science and technology finance effectively reduces environmental pollution, improves regional ecological efficiency, and drives green development, this aligns with our findings.

The reason why science and technology finance can effectively promote agricultural green development is partly due to the continuous optimization of the science and technology finance policy environment, the effective role of banking financial institutions and capital markets, and the further improvement of risk management mechanisms, all of which have contributed to the continuous advancement of science and technology finance development (Hu and Liu, 2022; Ma et al., 2020). On the other hand, this is also due to the strengthening of the policy system and the gradual social consensus on agricultural green development (Li and Gong, 2020), leading to a significant improvement in the level of agricultural green development (Cui et al., 2021; Li et al., 2022).

Rural human capital has a significant positive impact on agricultural green development, consistent with the findings of Yang et al. (2022), Wang et al. (2023), and Wu and Song (2018). This indicates that the enhancement of rural human capital provides more impetus for agricultural green development. Rural human capital not only acts as a mediator in the relationship between science and technology finance and agricultural green development but also exhibits a threshold effect. This suggests that maintaining balance and rationality in human capital is crucial in the path where science and technology finance influences agricultural green development.

Agricultural industrial agglomeration has a negative impact on agricultural green development, consistent with the findings of Yin et al. (2022). This implies that the negative externalities brought by agricultural industrial agglomeration currently outweigh its positive externalities in China. Agricultural industrial agglomeration exerts a “masking effect” in the relationship between science and technology finance and agricultural green development, weakening the direct impact of science and technology finance on agricultural green development. It also shows a threshold effect, suggesting that optimizing agricultural industrial layout around key characteristics such as uniqueness, moderate scale, and strong driving force is necessary to effectively reduce the negative externalities of agricultural industrial agglomeration on agricultural green development.

Future research can be further expanded in two areas: first, using spatial econometric models to study the spatial spillover effects of science and technology finance on agricultural green development; second, identifying more mediating variables and incorporating them into the research framework to more comprehensively demonstrate the mechanisms through which science and technology finance affects agricultural green development; third, data at the municipal level are used for the relevant analysis to address the issue of insufficient detail in studies that rely on provincial-level data.

6 Research conclusions and implications

6.1 Research conclusions

This study explores the impact of science and technology finance on agricultural green development and its mechanisms. The empirical results show that: (1) science and technology finance has a significant positive impact on agricultural green development and can effectively promote it. This conclusion remains robust after replacing the explained variable, adding control variables, removing the sample of municipalities, and conducting endogeneity tests, providing empirical evidence for further strengthening the support effect of science and technology finance on agricultural green development. (2) Heterogeneity analysis results show that the impact of science and technology finance on agricultural green development is significant across different regions without obvious regional differences. (3) Mechanism test results show that rural human capital acts as a mediator in the relationship between science and technology finance and agricultural green development, while agricultural industrial agglomeration exerts a “masking effect” in the relationship between science and technology finance and agricultural green development. (4) Nonlinear analysis results show that the impact of science and technology finance on agricultural green development exhibits a complex nonlinear relationship. When science and technology finance is used as the threshold variable, it shows a significant positive marginal effect increment with agricultural green development. When rural human capital and agricultural industrial agglomeration are used as threshold variables, the relationship between science and technology finance and agricultural green development shows a significant positive marginal effect decrement.

6.2 Policy implications

Currently, China’s agricultural green development is at a critical stage of transformation and upgrading. Mobilizing various factors, including science and technology finance, to unleash their driving effects and provide strong support is essential for achieving high-quality agricultural green development. This study’s conclusions offer the following policy implications:

First of all, further promote the development of science and technology finance. Continue to promote the effective integration of science and finance, deepen the combination of science and finance; improve the technology investment and financing system, diversify the sources of science and technology finance funds; establish a long-term interactive mechanism between government, enterprises, and financial institutions; improve the construction of science and technology finance infrastructure, strengthen its resource allocation orientation, and diversify its methods; further improve the comprehensive and multi-tiered science and technology finance service system by enhancing aspects such as venture capital, bank credit, bond markets, stock markets, insurance, and financing guarantees, thereby strengthening the capacity of tech-finance services.

Secondly, improve the top-level design of science and technology finance supporting agricultural green development. First, based on the characteristics of agricultural green development, targeted comprehensive policies should be introduced to provide a better policy environment for science and technology finance to support agricultural green development; second, encourage different regions to formulate plans based on their actual situations in science and technology finance and agricultural green development; third, guide regions to actively engage in interaction and cooperation, encourage regional collaboration in science and technology finance activities supporting agricultural green development, and achieve balanced development across regions.

Thirdly, transform the operational mechanism of science and technology finance supporting agricultural green development. First, optimize the investment mechanism, and based on the identification function of science and technology finance, selectively support agricultural green development projects, thereby improving investment efficiency; second, improve the legal mechanism to provide legal guarantees for science and technology finance support for agricultural green development; third, improve the risk management mechanism and credit mechanism to reduce transaction costs and risks and enhance transaction security; fourth, build an information-sharing platform to eliminate information asymmetry; fifth, improve the evaluation mechanism by increasing the proportion of agricultural green development content in evaluations.

Fourthly, optimize the level of rural human capital and the development of agricultural industrial agglomeration. First, it is necessary to increase investment in rural human capital, accelerate the development of rural talent through multiple channels and methods, and promote the increase in the stock, improvement in the quality, and optimization of the structure of rural human capital; second, it is necessary to adjust the development strategy of agricultural industrial agglomeration, with a focus on regional advantages and characteristics, to conduct scientific planning, reasonable spatial distribution, and improve resource allocation. This will promote the optimization of agricultural industrial agglomeration and achieve coordinated progress between agricultural industrial agglomeration and other sectors.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

SY: Conceptualization, Data curation, Formal analysis, Methodology, Software, Writing – original draft. GW: Conceptualization, Data curation, Investigation, Supervision, Writing – review & editing. SZ: Conceptualization, Data curation, Software, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This work was supported by the National Natural Science Foundation of China, grant no. 72003184 (NSFC 72003184).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abid, N., Ceci, F., Ahmad, F., and Aftab, J. (2022). Financial development and green innovation, the ultimate solutions to an environmentally sustainable society: evidence from leading economies. J. Clean. Prod. 369:133223. doi: 10.1016/j.jclepro.2022.133223

Aghion, P., and Howitt, P. (1990). A model of growth through creative destruction. Econometrica 60, 323–351. doi: 10.3386/w3223

Allen, F., Demirguc-Kunt, A., Klapper, L., and Peria, M. S. M. (2016). The foundations of financial inclusion: understanding ownership and use of formal accounts. J. Financ. Intermed. 27, 1–30. doi: 10.1016/j.jfi.2015.12.003

Atanassov, J. (2015). Arm’s length financing and innovation: evidence from publicly traded firms. Manag. Sci. 62, 128–1155. doi: 10.1287/mnsc.2014.2097

Baloch, M. A., Zhang, J. J., Iqbal, K., and Iqbal, Z. (2019). The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ. Sci. Pollut. Res. 26, 6199–6208. doi: 10.1007/s11356-018-3992-9

Baomin, D., Jiong, G., and Zhao, X. (2012). FDI and environmental regulation: pollution haven or a race to the pop? J. Regul. Econ. 41, 216–237. doi: 10.1007/s11149-011-9162-3

Cao, H., You, J. X., Lu, R., and Chen, H. Y. (2011). EmpiricaL research on finance of science and technology development index in China. Chinese J. Manag. Sci. 19, 134–140. doi: 10.16381/j.cnki.issn1003-207x.2011.03.020

Cui, Y., Liu, W. X., Cai, Y., Zhu, J., and Zhao, M. J. (2021). Has the efficiency of rural green development converged in China? An empirical analysis from 1997 to 2017. J. Agrotech. Econ. 2, 72–87. doi: 10.13246/j.cnki.jae.2021.02.007

Dagar, V., Khan, M. K., Alvarado, R., Rehman, A., Irfan, M., Adekoya, O. B., et al. (2022). Impact of renewable energy consumption, financial development and natural resources on environmental degradation in OECD countries with dynamic panel data. Environ. Sci. Pollut. Res. 29, 18202–18212. doi: 10.1007/s11356-021-16861-4

Deng, Q. Q., Li, E. L., and Ren, S. X. (2020). Impact of agricultural agglomeration on agricultural non-point source pollution: evidences from the threshold effect based on the panel data of prefecture-level cities in China. Geogr. Res. 39, 970–989. doi: 10.11821/dlyj020181090

Dhehibi, B., El-Shahat, A., Frika, A., and Hassan, A. A. (2016). Growth in total factor productivity in the Egyptian agriculture sector: growth accounting and econometric assessments of sources of growth. Sustain. Agric. Res. 5, 38–48. doi: 10.5539/sar.v5n1p38

Ding, R. J., and Liu, R. N. (2020). The dual effects of science and technology finance on the structural optimization of manufacturing industry. Sci. Technol. Prog. Policy 37, 55–63. doi: 10.6049/kjjbydc.2019070437

Du, B. G., and Lian, Y. J. (2022). What kind of science and technology finance will contribute to regional innovation? Configuration analysis based on TRE framework. Sci. Manag. Res. 40, 130–137. doi: 10.19445/j.cnki.15-1103/g3.2022.06.017

Fishman, R., Smith, S. C., Bobic, V., and Sulaiman, M. (2022). Can agricultural extension and input support be discontinued? Evidence from a randomized phaseout in Uganda. Rev. Econ. Stat. 104, 1273–1288. doi: 10.1162/rest_a_01029

Foster, L., Haltiwanger, J., and Syverson, C. (2008). Reallocation, firm turnover, and efficiency: selection on productivity or profitability? Am. Econ. Rev. 98, 394–425. doi: 10.1257/aer.98.1.394

Giannetti, C. (2012). Relationship lending and firm innovativeness. J. Empir. Financ. 19, 762–781. doi: 10.1016/j.jempfin.2012.08.005

Guo, J., Yang, Q., and Wu, H. M. (2024). Sci-tech finance improve agricultural production efficiency: empirical evidence from the pilot policies of sci-tech finance. Chinese Rural Econ. 5, 81–105. doi: 10.20077/j.cnki.11-1262/f.2024.05.005

Gyamfi, B. A., Agozie, D. Q., and Bekun, F. V. (2022). Can technological innovation, foreign direct investment and natural resources ease some burden for the BRICS economies within current industrial era? Technol. Soc. 70:102037. doi: 10.1016/j.techsoc.2022.102037

Han, H. B., and Yang, D. Y. (2023). Spatial spillover effects of agricultural industrial agglomeration on the growth of agricultural green total factor productivity. J. Arid Land Resour. Environ. 37, 29–37. doi: 10.13448/j.cnki.jalre.2023.134

He, K., Li, F. L., Zhang, J. B., and Li, X. T. (2021). Green development levels and regional differences of agriculture in the Yangtze river economic belt. J. Huazhong Agric. Univ. 40, 43–51. doi: 10.13300/j.cnki.hnlkxb.2021.03.006

Henderson, V. (2003). The urbanization process and economic growth: the so-what question. J. Econ. Growth 8, 47–71. doi: 10.1023/A:1022860800744

Hobbs, P. R., Sayre, K., and Gupta, R. (2008). The role of conservation agriculture in sustainable agriculuture. Philos. Trans. Roy. Soc. B 363, 543–555. doi: 10.1098/rstb.2007.2169

Hu, H. H., and Liu, C. M. (2022). Regional difference and dynamic evolution of sci-tech finance efficiency in China. Stat. Decis. 24, 117–122. doi: 10.13546/j.cnki.tjyjc.2022.24.023

Hua, J., Shi, M. Y., and Wang, Y. F. (2021). Technology finance, industrial structure optimization and regional ecological efficiency: empirical analysis based on spatial econometric model. J. Technol. Econ. 40, 16–26.

Ikerd, J. (1993). The need for a system approach to sustainable agriculture. Agric. Ecosyst. Environ. 46, 147–160. doi: 10.1016/0167-8809(93)90020-P

Jacobs, M. (1991). The green economy: Environment sustainable development and the politics of the future. Massachusetts: Pluto Press, 1991.

Kates, R. W., Clark, W. C., and Corell, R. W. (2001). Sustainability science. Science 292, 641–642. doi: 10.1126/science.1059386

Khan, A., Yang, C. G., Hussain, J., and Zhou, K. (2021). Impact of technological innovation, financial development and foreign direct investment on renewable energy, non-renewable energy and the environment in belt & road initiative countries. Renew. Energy 171, 479–491. doi: 10.1016/j.renene.2021.02.075

Kim, S., Lee, H., and Kim, J. (2016). Divergent effects of external financing on technology innovation activity: Korean evidence. Technol. Forecast Soc. 106, 22–30. doi: 10.1016/j.techfore.2016.02.002

Li, Z. (2022). The green development of agriculture in China: institutional evolution and practical action. Seeker 5, 97–105. doi: 10.16059/j.cnki.cn43-1008/c.2022.05.012

Li, X. M., and Gong, Q. W. (2020). Evolution and optimization of agricultural green development support policies since the founding of new China. Word Agric. 4, 40–59. doi: 10.13856/j.cn11-1097/s.2020.04.005

Li, Q. N., Li, G. C., and Yin, C. J. (2022). Regional differences and convergence of China’s agricultural green development level: empirical analysis based on the panel data of prefecture-level cities. J. China Agric. Univ. 27, 230–242. doi: 10.11841/j.issn.1007-4333.2022.02.21

Lin, B. Q., and Tan, R. P. (2019). Economic agglomeration and green economy efficiency in China. Econ. Res. J. 54, 121–134.

Liu, T., Xu, Z. Y., and Song, T. T. (2024). A quasi-natural experiment based on the pilot combination of science and technology and finance. Sci. Technol. Manag. Res. 3, 56–66. doi: 10.3969/j.issn.1000-7695.2024.3.007

Liu, Y. W., Zhou, S. C., and Chen, X. J. (2022). The impact of Sci-tech finance development on green innovation of Enterprise. Theory Pract. Finance Econ. 43, 17–23. doi: 10.16339/j.cnki.hdxbcjb.2022.06.003

Lopez-Rodriguez, J., and Martinez-Lopez, D. (2017). Looking beyond the R&D effects on innovation: the contribution of non- R&D activities to total factor productivity growth in the EU. Struct. Change Econ. D 40, 37–45. doi: 10.1016/j.strueco.2016.11.002

Lyu, Y. W., and Li, Y. T. (2024). Has technology finance empowered high – quality economic development? Based on the perspective of innovation motivation. Stud. Sci. Sci. 42, 964–976. doi: 10.16192/j.cnki.1003-2053.20240202.002

Ma, L. Y., and Li, X. M. (2019). Does science and technology finance policies promote regional innovation? Quasi – natural experiment based on the policy of combining science and technology with finance. China Soft Sci. 12, 30–42.

Ma, Y. L., Ma, Y. P., and Peng, W. B. (2020). Research on regional difference and dynamic evolution of sci-tech finance efficiency in China. Macroeconomics 7, 124–137. doi: 10.16304/j.cnki.11-3952/f.2020.07.012

Majeed, M. T., and Mazhar, M. (2019). Financial development and ecological footprint: a gobal panel data analysis. Pak. J. Commer. Soc. Sci. 13, 487–514.

Nathaniel, S. P., Murshed, M., and Bassim, M. (2021). The nexus between economic growth, energy use, international trade and ecological footprints: the role of environmental regulations in N11 countries. Energy Ecol. Environ. 6, 496–512. doi: 10.1007/s40974-020-00205-y

Samila, S., and Sorenson, O. (2011). Venture capital, entrepreneurship, and economic growth. Rev. Econ. Stat. 93, 338–349. doi: 10.1162/REST_a_00066

Scherer, L. A., Verburg, P. H., and Schulp, C. J. E. (2018). Opportunities for sustainable intensification in European agriculture. Global Environ. Change 48, 43–55. doi: 10.1016/j.gloenvcha.2017.11.009

Schultz, T. W. (1964). Transforming traditional agriculture. New Haven and London: Yale University Press.

Shannon, N. Z., Aay, J. S., and Barbara, A. I. (2014). Food shopping behaviours and exposure to discrimination. Public Health Nutr. 17, 1167–1176. doi: 10.1017/S136898001300075X

Simonen, J., Svento, R., and Juutinen, A. (2015). Specialization and diversity as drivers of economic growth: evidence from high-tech industries. Pap. Reg. Sci. 94, 229–248. doi: 10.1111/pirs.12062

Su, K., Meng, H. B., and Zhang, H. (2021). Construction of the green development indicators for agriculture and its prediction in the 14th five-year plan in China. Trans. Chinese Soc. Agric. Eng. 37, 287–294. doi: 10.11975/j.issn.1002-6819.2021.20.032

Sun, J. (2011). The measurement and evolution trends of the circulation efficiency of agricultural products in China- an empirical analysis based on the panel data from 1998 to 2009. China Bus. Market 25, 21–25. doi: 10.14089/j.cnki.cn11-3664/f.2011.05.017

Sun, X. T., Yu, T., and Yu, F. W. (2022). The impact of digital finance on agricultural mechanization: evidence from 1869 counties in China. Chinese Rural Econ. 2, 76–93.

Tilman, D., Cassman, K. G., Matson, P. A., Naylor, R., and Polasky, S. (2002). Agricultural sustainability and intensive production practices. Nature 418, 671–677. doi: 10.1038/nature01014

Usman, M., and Hammar, N. (2021). Dynamic relationship between technological innovations, financial development, renewable energy, and ecological footprint: fresh insights based on the STIRPAT model for Asia Pacific economic cooperation countries. Environ. Sci. Pollut. Res. 28, 15519–15536. doi: 10.1007/s11356-020-11640-z

Wang, S. J., and Gu, S. (2021). Research on the impact of S&T finance on the high-quality development of Chinese economy: theoretical analysis and empirical test. Economics 2, 81–91. doi: 10.16158/j.cnki.51-1312/f.2021.02.009

Wang, K. L., and Jiang, W. (2022). Can the science and technology financial policy reduce environmental pollution? Quasi-natural experiment based on “the pilot of combining science and technology with finance”. J. Technol. Econ. 41, 109–121.

Wang, F., Sun, S. H., and Liu, T. J. (2023). Has the development of digital economy promoted changes in agricultural production methods? Evidence from prefectures in the yellow river basin. Chinese Rural Econ. 9, 122–143. doi: 10.20077/j.cnki.11-1262/f.2023.09.007

Welch, R. M., and Graham, R. D. (1999). A new paradigm for world agriculture: meeting human needs: productive, sustainable, nutritious. Field Crop Res. 60, 1–10. doi: 10.1016/S0378-4290(98)00129-4

Wu, C. Q., and Song, Z. Y. (2018). Study on the measurement and affecting factors of agricultural green total factor productivity in the Yangtze river economic belt. Sci. Technol. Prog. Policy 35, 35–41. doi: 10.6049/kjjbydc.2017120210

Xue, L. (2019). Research on the impact of agricultural industry agglomeration on agricultural green development. (Doctoral Dissertation): Southwestern University of Finance and Economics.

Xue, X. D., and Wen, Y. Y. (2023). The impact of agricultural industrial agglomeration on ecological efficiency in the yellow river basin: research on empirical research on PCA-DEA and panel tobit models. Chinese J. Agric. Resour. Reg. Plan. 44, 150–160. doi: 10.7621/cjarrp.1005-9121.20230715

Yang, Y., Wu, L. Y., Zhang, Q. J., and Wang, Y. F. (2022). The impact of digital financial inclusion on agricultural green growth: on the adjustment function of rural human capital investment. Inq. Econ. Iss. 6, 165–180.

Yi, M., Zhang, L., Yang, L. S., and Fu, L. N. (2019). The spatial and temporal differentiation characteristics and regional equilibrium of T & F efficiency in China. Sci. Technol. Prog. Policy 36, 34–40. doi: 10.6049/kjjbydc.2018090292

Yin, X. Y., Jia, X. J., and Li, D. M. (2022). The impact of agricultural industrial agglomeration on green total factor productivity: based on the perspective of spatial spillover effect. Chinese J. Agric. Resour. Reg. Plan. 43, 110–119. doi: 10.7621/cjarrp.1005-9121.20221011

Yin, C. B., Li, F. D., Wang, S., and Hao, A. B. (2021). The concept, connotation and principle of agricultural green development in China. Chinese J. Agric. Resour. Reg. Plan. 42, 1–6. doi: 10.7621/cjarrp.1005-9121.20210101

Yuan, X., Zhang, J. L., Shi, J., and Wang, J. C. (2024). What can green finance do for high-quality agricultural development? Fresh insights from China. Socio Econ. Plan. Sci. 94, 101920–101913. doi: 10.1016/j.seps.2024.101920

Zhai, S. P., Han, X., Zhang, X. L., and Chen, X. (2022). Can digital finance reduce the risk of corporate debt default? Account. Res. 2, 117–131.

Zhang, Z. R. (2019). Research on coupling relationship between sci-tech finance and regional economic development. (Doctoral Dissertation): Northeast Normal University.

Zhao, C. W., Chen, C. F., and Tang, Y. K. (2009). 2009. Science and technology finance. Beijing: Science Press.

Zhou, X. D. (2009). Analysis on the agricultural industry’s cluster composing on life cycle stage and evolvement mechanism. Econ. Geogr. 29, 1134–1138. doi: 10.15957/j.cnki.jjdl.2009.07.014

Zhou, Z., Duan, J. Q., Li, W. X., and Geng, S. Q. (2022). Rural roads construction, agricultural labor productivity, and urban-rural income gap. Econ. Theory Bus. Manag. 42, 23–36.

Keywords: science and technology finance, agricultural green development, rural human capital, agricultural industrial agglomeration, China

Citation: Yao S, Wu G and Zhang S (2025) How does science and technology finance affect the agricultural green development: an interpretation from the perspective of rural human capital and agricultural industrial agglomeration. Front. Sustain. Food Syst. 9:1540645. doi: 10.3389/fsufs.2025.1540645

Edited by:

Juan Lu, Nanjing Agricultural University, ChinaReviewed by:

Zhiyuan Xu, Zhejiang Sci-Tech University, ChinaJinchen Yan, Renmin University of China, China

Copyright © 2025 Yao, Wu and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Guosong Wu, cGxveWJveTQzOUAxMjYuY29t

Sheng Yao

Sheng Yao Guosong Wu

Guosong Wu Shu Zhang

Shu Zhang