- 1School of Business, Minnan Normal University, Zhangzhou, China

- 2College of Life Science, Longyan University, Longyan, China

- 3Chinese International College, Dhurakij Pundit University, Bangkok, Thailand

Introduction: Agricultural insurance has become a vital instrument in risk diversification, loss compensation, and farmer support, with China emerging as the largest agricultural insurance market globally by premium volume. However, the extent to which agricultural insurance influences grain production scale and the underlying mechanisms remain insufficiently explored.

Methods: Differentiating itself from previous studies, this paper conducts a rigorous theoretical and empirical analysis of how agricultural insurance affects grain planting scale. It further examines the mediating role of farmers’ income in this process, providing novel insights into the complex dynamics between agricultural insurance and production behavior. This study applies the von Neumann-Morgenstern expected utility model, coupled with theories on economies of scale, technology diffusion, and rational choice, to examine the theoretical links between agricultural insurance, farmers’ income, and grain production scale.

Results: Using panel data from 27 Chinese provinces between 2011 and 2021, analyzed through fixed-effects and mediation models, the study finds that agricultural insurance positively, albeit moderately, impacts the scale of grain production, with farmers’ income serving as a partial mediating factor.

Discussion: Based on these findings, we recommend expanding agricultural insurance coverage, developing a multi-level insurance framework, and enhancing insurance protection levels to bolster sustainable agricultural development and food security in China.

1 Introduction

This article investigates how agricultural insurance influences the scale of grain planting, with a specific focus on the mediating role of farmers’ income in this relationship. Agricultural insurance plays a pivotal role in mitigating agricultural risks, compensating for disaster-related losses, facilitating capital flow, and promoting disaster prevention and mitigation. As an essential mechanism for risk transfer, agricultural insurance provides critical support and benefits to farmers (Tuo and Feng, 2024). Globally, nearly 100 countries have implemented agricultural insurance programs, with market scale expanding steadily (Liu and Dong, 2017). China, in particular, has been actively advancing its agricultural insurance initiatives. Since the early 21st century, China’s agricultural insurance sector has grown rapidly, especially following the introduction of an agricultural insurance premium subsidy policy in 2007. This policy has driven sustained increases in both premium volume and coverage. By 2020, China had surpassed the United States in agricultural insurance premiums, making it the largest agricultural insurance market worldwide. In tandem with the growth of agricultural insurance, China’s agricultural sector has undergone notable transformations, marked by advancements in modernization, steady improvements in sustainable practices, a stable and diversified supply of essential agricultural products, and the gradual establishment of a modern agricultural system (Tuo, 2021). However, the extent to which the expansion of agricultural insurance affects the scale of grain cultivation—and the mechanisms through which such an impact may occur—remains unclear. This study, therefore, aims to examine the effects of agricultural insurance on the scale of grain cultivation in China, with a particular focus on the mediating role of farmers’ income.

The existing literature extensively examines the effects of agricultural insurance on agricultural production inputs, focusing primarily on three areas. First, numerous studies explore how agricultural insurance influences the use of chemical inputs, such as pesticides and fertilizers (Babcock and Hennessy, 1996; Smith and Goodwin, 1996; Möring et al., 2020). Second, there is substantial discussion on the role of agricultural insurance in technology adoption, particularly in relation to the use of agricultural machinery and advanced farming technologies (Lithourgidis et al., 2011; Roll, 2019). Third, although some research investigates the effect of agricultural insurance on the overall scale of agricultural production, these studies often fail to explore the specific mechanisms by which agricultural insurance affects the scale of grain cultivation (Ye et al., 2020; Yu et al., 2018). In response to these gaps, this paper investigates the impact of agricultural insurance on land input as a key component of agricultural production. Theoretically, it explores the relationships among agricultural insurance, farmers’ income, and the scale of grain cultivation. Empirically, it analyzes provincial panel data from China covering the period from 2011 to 2021 to provide insights into these relationships.

This paper makes three primary contributions. Firstly, it provides a theoretical clarification of the relationship between agricultural insurance, farmer income, and the scale of grain cultivation. Unlike prior studies, this paper employs the Von Neumann-Morgenstern Expected Utility Model (Von Neumann and Morgenstern, 1944) to construct a utility model for grain cultivation from a farmer’s perspective, thereby analyzing the linkage between agricultural insurance and farmer income. Additionally, it investigates the theoretical mechanisms through which farmer income influences the scale of grain cultivation, incorporating concepts from scale economies (Marshall, 1890), technology diffusion theory (Rogers, 1962), and rational choice theory (Simon, 1955). This approach establishes a robust theoretical foundation for the study. Secondly, this paper examines the influence mechanism of agricultural insurance with farmer income as a mediating variable, integrating both theoretical and empirical analysis. While existing literature has rarely explored how agricultural insurance affects grain cultivation scale through specific mechanisms, focusing instead on aspects like premium subsidies or factor allocation, this paper hypothesizes that farmer income serves as a mediating variable in this relationship. Empirical testing supports this hypothesis, revealing that agricultural insurance influences grain cultivation scale by affecting farmer income. Thirdly, although provincial panel data cannot capture individual farmer-level details as micro-level cross-sectional data might, it provides a broader perspective on socio-economic trends over time. The objectivity and comprehensiveness of panel data enhance the reliability of the empirical findings, making them more representative of actual conditions in the study of agricultural insurance and grain cultivation scale.

The structure of this paper is as follows: Section 2 reviews the relevant literature, Section 3 presents the theoretical framework and research hypotheses, Section 4 outlines the research design, Section 5 discusses the empirical results, and Section 6 concludes with policy implications.

2 Literature review

The impact of agricultural insurance on the scale of agricultural production has received considerable scholarly attention. Existing literature explores this topic primarily from three perspectives:

Agricultural insurance exerts a significant influence on farmers’ production behavior. Scholars generally agree that agricultural insurance can influence farmers’ decision-making, particularly regarding critical production inputs. For example, Li et al. (2022) found that agricultural insurance can reduce the use of chemicals, such as pesticides, in farming. Similarly, Fang et al. (2021) demonstrated that agricultural insurance positively affects green inputs, promoting environmentally sustainable practices in agricultural production. Suchato et al. (2022) found that crop insurance can incentivize irrigation, especially when irrigation costs are high, although it may also introduce moral hazard risks. With regard to production scale, Enjolras and Sentis (2011) found that agricultural insurance encourages farmers to expand their production scale, as insured farms typically exhibit larger scales and greater diversity of production, especially in response to catastrophic climate events. Zou et al. (2022) further indicated that agricultural insurance can enhance labor productivity and increase per capita arable land area, thus supporting specialized cultivation practices. Additionally, Fu et al. (2024a) observed that agricultural insurance has a significant impact on the scale of agricultural inputs, including land and other resources. Conversely, some studies have reported negative impacts of agricultural insurance on production scale. For instance, Li et al. (2019) noted that agricultural insurance could negatively affect agricultural production in pre-disaster contexts. Similarly, Sakurai and Reardon (1997) identified a substitution effect in drought insurance, where large livestock farms may reduce herd size as an alternative to relying on drought insurance. These mixed findings suggest that the impact of agricultural insurance on production scale remains inconclusive, highlighting a need for further investigation into the conditions and mechanisms that mediate this relationship.

Understanding how agricultural insurance policies influence changes in crop cultivation scale and structure is a critical research area. This section analyzes the impact of policy adjustments on these aspects. Young et al. (2001) found that crop insurance subsidies increase both cultivated area and production. However, due to the low demand elasticity of major crops, these subsidies also lead to reduced market returns for farmers. Goodwin et al. (2004) further support this finding, noting that while increased participation in crop insurance programs and enhanced subsidies expand cultivated areas, the resulting lower market returns partially offset the financial benefits of these subsidies. Adkins et al. (2020) analyzed the “prevented planting” provisions within the U.S. crop insurance program, highlighting how farmers’ risk preferences and coverage levels influence planting decisions. Specifically, risk-averse farmers are more likely to opt for prevented planting options that offer full compensation, providing economic security when faced with uncertainty. However, if the coverage level of prevented planting is reduced, farmers may be less inclined to forgo planting due to the decreased compensation for potential losses, thereby increasing their financial risk. Shi et al. (2020) studied the effects of crop insurance on specialty crop acreage and production in California, finding that insurance can influence growers’ responses to climate and soil conditions. Notably, moral hazard effects associated with crop insurance tend to increase the acreage and production of specialty crops. Similarly, Yuan and Xu (2024) demonstrated that adjustments in agricultural insurance policies positively impact the planting area and structure of staple crops, primarily facilitated through increased agricultural mechanization.

Many studies have examined the mechanisms through which agricultural insurance influences production scale, with substantial evidence highlighting its positive effects through changes in farmers’ behavior. Waiters et al. (2012) demonstrated that crop insurance premium subsidies can significantly alter farmers’ production decisions, particularly in crop selection and scale allocation, resulting in expanded planting areas for subsidized crops. Zhang et al. (2024) further elucidate how crop insurance promotes large-scale land operations through multiple mechanisms, including encouraging capital investment, optimizing rural labor allocation, and facilitating the adoption of advanced agricultural technologies. Nevertheless, some studies reveal complex and potentially adverse effects of crop insurance. Wang et al. (2021) found that crop insurance participation may negatively impact average yields under climate change conditions and may modulate the timing and extent of yield variations associated with global warming. In a quasi-natural experimental study on China’s agricultural insurance fiscal subsidy policy, Jiang et al. (2022) demonstrated that this policy significantly expanded the cultivation area of staple crops such as rice and wheat, facilitating structural adjustments in the agricultural sector. These effects were found to be persistent over time, highlighting the lasting influence of agricultural insurance policies on crop production structure.

In summary, although existing literature has extensively examined the impact of agricultural insurance on production scale from both theoretical and empirical perspectives, several critical research gaps remain unexplored. Firstly, the discussion of theoretical mechanisms in existing studies remains relatively underdeveloped, lacking comprehensive and systematic theoretical frameworks. Secondly, while micro-level household surveys effectively capture individual circumstances, their limited scope may not represent broader trends. Conversely, studies using meso- and macro-level data often lack rigorous research design and indicator selection, limiting their ability to provide comprehensive insights; these are areas where existing research could benefit from refinement. Thirdly, although some studies (as discussed in Section 2.3) explore impact mechanisms, they often lack robust theoretical grounding, leading to a disconnect between theoretical and empirical analyses. Studies that employ multi-pathway mechanisms may also produce potentially unstable conclusions.

In response to these limitations, this study focuses on the impact of agricultural insurance on grain cultivation area and investigates the mediating role of farmers’ income. Unlike existing literature, this article attempts to clarify the role of farmers’ income in the impact of agricultural insurance on grain planting scale from both theoretical and empirical perspectives. By drawing upon Scale Economies (Marshall, 1890), Technology Diffusion Theory (Rogers, 1962), and Rational Choice Theory (Simon, 1955), the study establishes logical relationships among agricultural insurance, farmers’ income, and grain cultivation scale, providing a fresh research perspective. Using provincial panel data from China, this study constructs fixed-effects and mediation-effect models with carefully selected indicators to empirically test these theoretical mechanisms. This approach ensures both theoretical rigor and empirical validity, allowing for a clear, rational, and objective validation of impact pathways.

3 Theoretical analysis and research hypotheses

This study theoretically examines how agricultural insurance influences the scale of grain cultivation through its impact on farmers’ income (see Figure 1). In China, grain crop insurance is a fundamental component of the agricultural insurance system, supported by several key policy developments. Beginning in 2008, the central government introduced a premium subsidy policy specifically for agricultural insurance, initially focusing on grain crops before gradually expanding to cover additional varieties. Since 2018, China has also launched pilot programs for full-cost and income insurance for three major grain crops, with plans for nationwide implementation by 2024. This study is based on two key assumptions about China’s grain crop insurance market. First, it assumes that insurance coverage and participation are comprehensive across all crop varieties, with universal access to premium subsidies. Second, it assumes that farmers generally exhibit risk-averse behavior, aligning with previous findings (Song, 2018; Shang and Xiong, 2020). Shang et al. (2020), based on survey data from 417 maize farmers in Inner Mongolia, Heilongjiang, and Liaoning Provinces of China, found that 68.6% of farmers exhibit risk-averse behavior. Similarly, Wang et al. (2019), through a survey of 1,429 farmers in Henan, Shandong, Anhui, Hebei, and Jiangsu Provinces, evaluated farmers’ risk attitudes using scores from 1 (“adoption”) to 5 (“non-adoption”) for new agricultural technologies. The average scores of 2.66 in 2015 and 2.62 in 2017 exceeded the midpoint of the scale, further indicating that most Chinese farmers are risk-averse.

Figure 1. The mechanism pathway of agricultural insurance affecting grain planting scale based on the income effect.

3.1 The impact of agricultural insurance on farmers’ income

Based on previous analysis, this section uses expected utility theory to examine the relationships among agricultural insurance, farmers’ income, and grain cultivation scale. In modern economics, the expected utility theory developed by von Neumann and Morgenstern (1944) is a foundational tool for analyzing economic behavior under uncertainty (Wang and Ji, 2023). The utility function for farmers can be represented as follows:

Where represents farming returns, denotes the risk premium, and given the assumption of risk-averse farmers, >0. The probability of incurring an agricultural risk loss of units is .

After purchasing insurance, let x represent the insurance compensation when state S1 occurs, P be the insurance premium, S be the premium subsidy, and S2 the state in which no loss occurs. Thus, the farmer’s returns can be defined as follows:

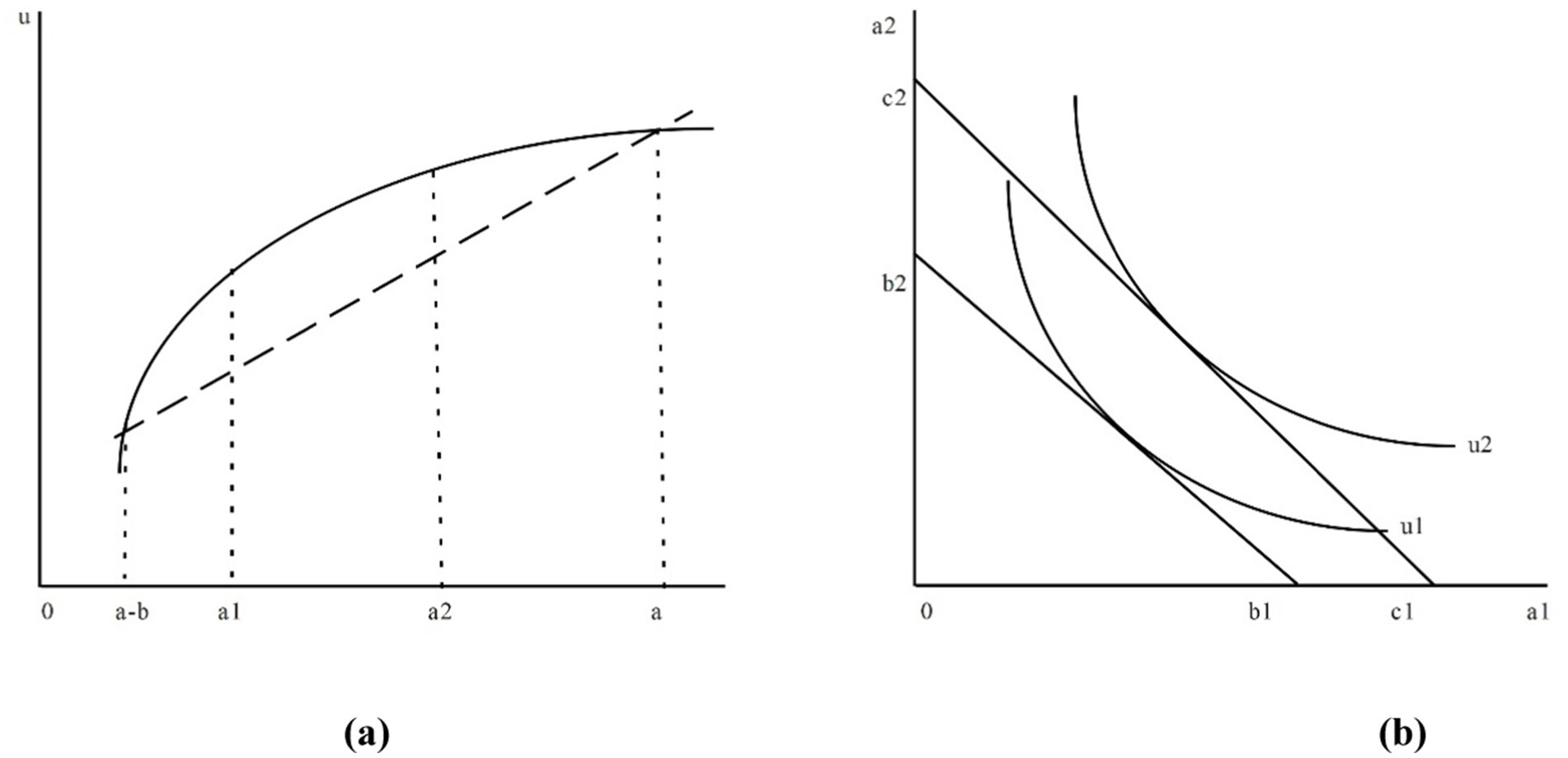

Given farmers’ risk aversion, their indifference curves are convex to the origin (Takayama, 1993), reflecting the demand for insurance among risk-averse individuals (see Figure 2A). Further analysis of farmers’ utility reveals that government subsidies on agricultural insurance premiums generate an income effect, resulting in a new equilibrium in farmers’ grain risk decisions (see Figure 2B). Without premium subsidies, farmers’ indifference curve is U1 with budget line C2-D1. When the government introduces premium subsidies, a2 increases while a1 decreases, steepening the slope of the budget line. This policy effectively reduces the cost of agricultural insurance, increasing farmers’ real income and shifting their indifference curve rightward, thereby establishing a new equilibrium with enhanced utility.

Figure 2. Mechanism of insurance demand and risk choice equilibrium for risk-averse farmers. (A) Insurance demand of risk-averse farmers. (B) Risk choice equilibrium of risk-averse farmers.

Based on this analysis, we propose the following research hypotheses:

H1a: Agricultural insurance has a positive impact on farmers’ income.

H1b: Agricultural insurance has a negative impact on farmers’ income.

3.2 The impact of farmers’ income on agricultural production scale

Drawing on the theories of Scale Economies (Marshall, 1890), Technology Diffusion (Rogers, 1962), and Rational Choice (Simon, 1955), this study examines how an increase in farmers’ income may motivate them, as rational agricultural producers, to expand their production scale (Figure 3).

Agriculture, like industry, benefits from “economies of scale” (Marshall, 1890; Wu et al., 2018). As farmers’ income rises, they have greater capacity to invest in agricultural machinery, improved crop varieties, and expanded cultivation areas, thus generating scale effects. In conditions of income growth, farmers’ motivation to increase profits through scale expansion is likely to intensify. Additionally, higher income enables farmers to adopt advanced agricultural technologies, which significantly improve production efficiency. To maximize returns on these technological investments, farmers typically expand their production scale to fully leverage the benefits of new technologies.

Based on this analysis, we propose the following hypotheses:

H2a: Agricultural insurance has a positive impact on agricultural cultivation scale.

H2b: Agricultural insurance affects agricultural cultivation scale.

As farmers’ operational income grows, they weigh production costs against potential returns to optimize their gains. According to Rational Choice Theory, there exists an instrumental rationality between purposeful actions and achievable outcomes (Qiu and Zhang, 1998; Liu, 2011). Consequently, farmers make decisions based on rational considerations, particularly in times of high agricultural market demand, when increased income may further incentivize production expansion.

Building on these theoretical foundations, we propose the following hypotheses:

H3a: Agricultural insurance influences grain cultivation scale through its impact on farmers’ income.

H3b: Agricultural insurance does not influence grain cultivation scale through its impact on farmers’ income.

4 Research design

4.1 Sample selection and data sources

This study examines grain cultivation across 27 provinces and autonomous regions in China from 2011 to 2021. Due to substantial data gaps, Beijing, Tianjin, Shanghai, and the Tibet Autonomous Region are excluded from the analysis, resulting in a final sample of 27 regions. Grain cultivation data for these regions were sourced from the China Rural Statistical Yearbook (2012–2022), while agricultural insurance data were obtained from the China Insurance Yearbook (2012–2022).

4.2 Model construction and variable definition

4.2.1 Model construction

To investigate the relationship between agricultural insurance and grain cultivation scale, this study employs the following fixed-effects model:

Where Yit represents the per capita grain sowing area in province i at year t, serving as the dependent variable; Insdi,t denotes the agricultural insurance density in province i at year t, functioning as the key explanatory variable; Xi,t represents the control variables; is the constant term; is the coefficient of the key explanatory variable; denotes the coefficients of control variables; captures the province-level fixed effects; is the error term.

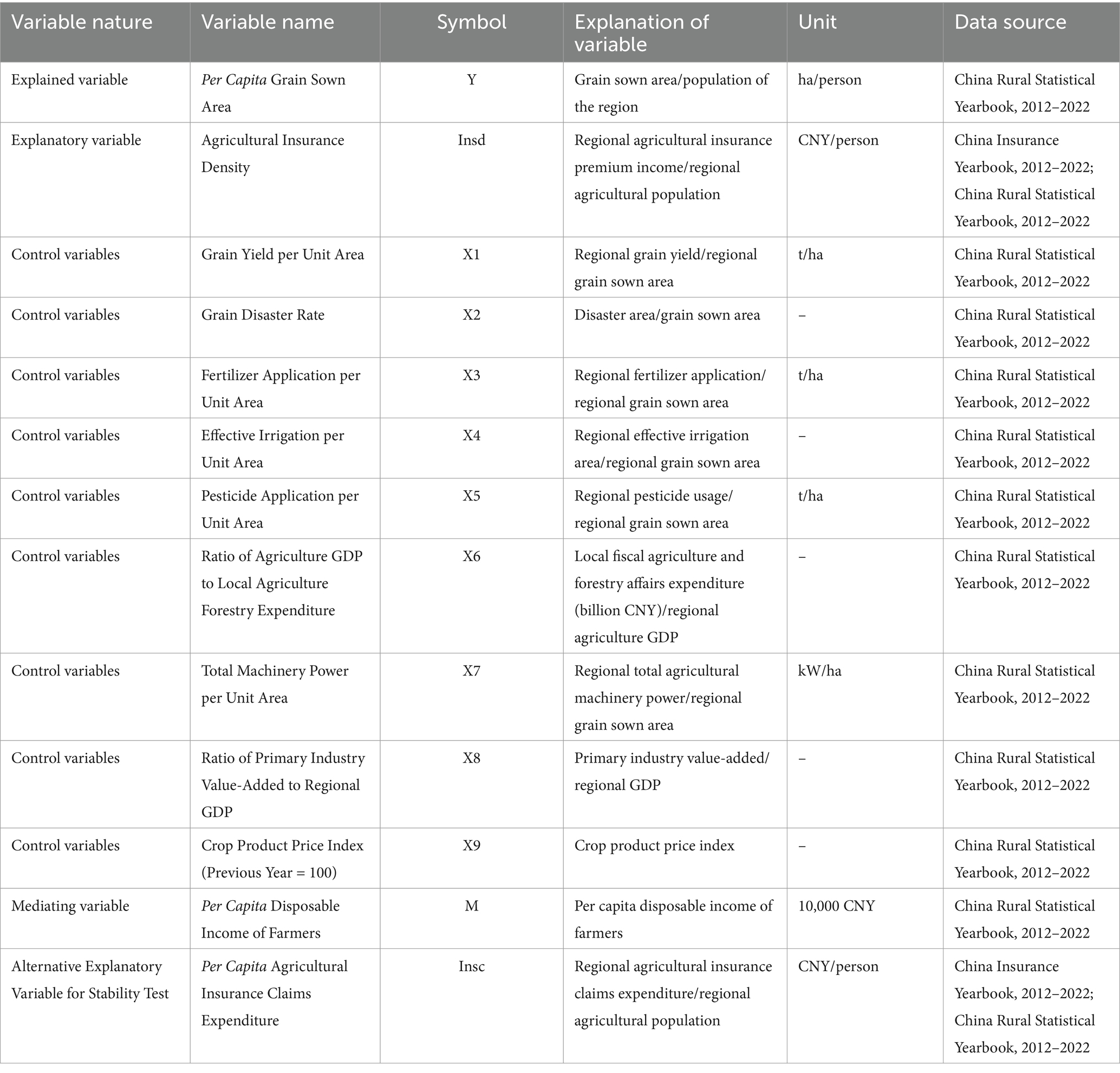

4.2.2 Variable definition

4.2.2.1 Dependent variable

This study uses “per capita grain sowing area by region” as a measure of grain cultivation scale, calculated as the grain sowing area divided by the regional population. Previous studies have used various indicators, such as total sowing area (Fang et al., 2022), grain value-added (Guan and Si, 2024), and grain yield per unit area (Zhang and Xu, 2023). While total sowing area directly reflects regional grain planting volume, value-added indicates output variation, and yield per unit area focuses on production efficiency. Given the geographical and demographic heterogeneity in China’s provincial panel data, per capita measurements more accurately capture the scale of grain cultivation across different regions.

4.2.2.2 Explanatory variable

This study employs “agricultural insurance density” to represent the level of agricultural insurance, calculated as regional agricultural insurance premium income divided by the regional agricultural population. This indicator reflects the insurance market penetration rate within a region, effectively indicating the level of development of regional agricultural insurance. However, differences in regional policies, climatic conditions, and farmers’ willingness to participate in insurance make agricultural insurance density insufficient to fully account for these factors. For robustness checks, per capita agricultural insurance expenditure is used as an alternative measure.

4.2.2.3 Control variables

Based on the research focus and reference literature (Zhang and Xu, 2023; Fu et al., 2024b; Zhang and Chai, 2024), this study includes nine control variables across five dimensions: regional agricultural output (X1, X9), natural characteristics (X2), agricultural production inputs (X3, X4, X5, X7), government support (X6), and agricultural production characteristics (X8).

4.2.2.4 Mechanism analysis variable

This study uses “regional farmers’ per capita disposable income” to measure farmers’ income, a commonly used indicator in existing literature. Detailed information on these variables is provided in Table 1.

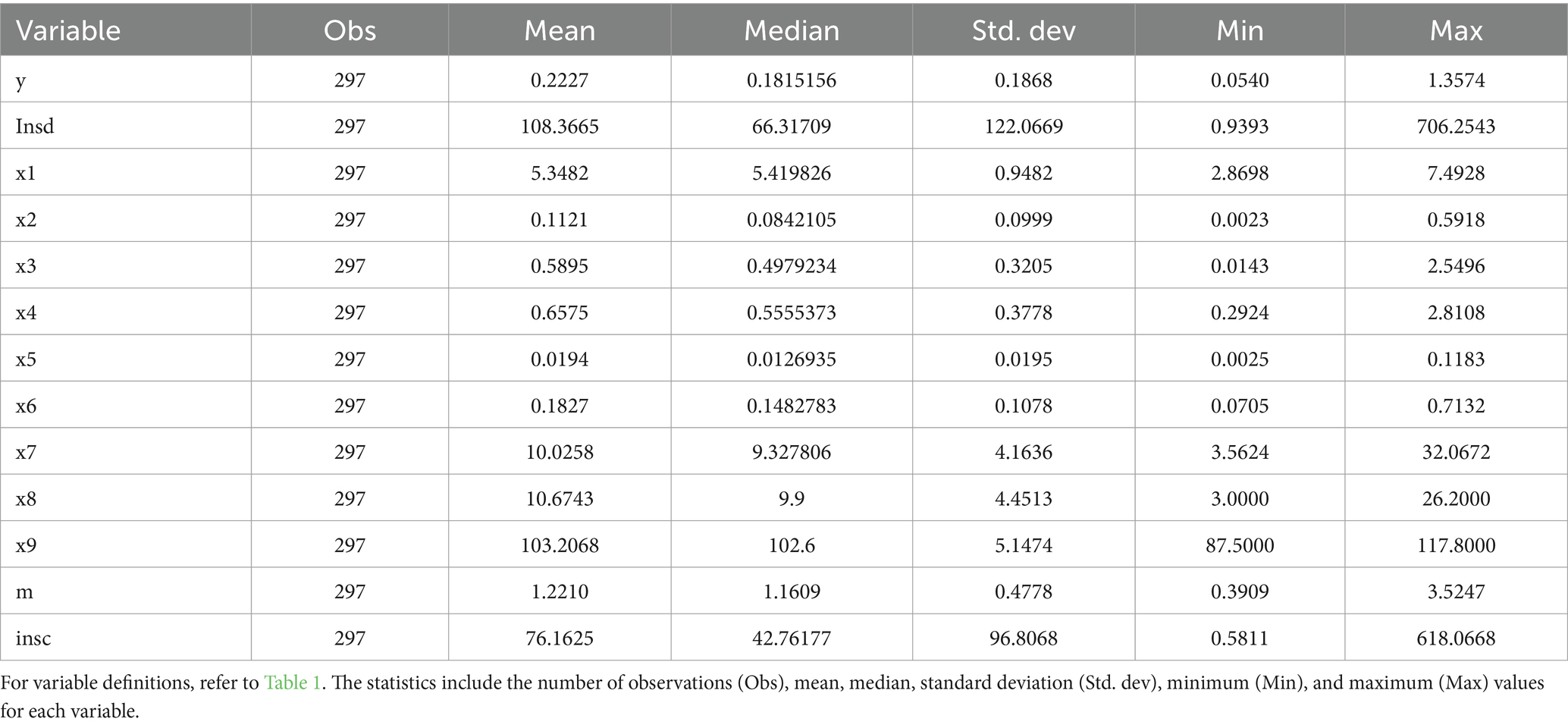

4.2.3 Descriptive statistical analysis

Table 2 provides descriptive statistics for all variables used in this study. The dependent variable, per capita grain sowing area (y), has a maximum value of 1.3574, a minimum of 0.0540, a median of 0.1815, a mean of 0.2227, and a standard deviation of 0.1868, indicating significant variation in per capita grain sowing area across provinces and regions.

The key explanatory variable, agricultural insurance density (insd), shows a maximum value of 706.2543, a minimum of 0.9393, a median of 66.3171, a mean of 108.3665, and a standard deviation of 122.0669, suggesting substantial regional disparities in the development of agricultural insurance and considerable variability over the study period.

For control variables, variability differs across indicators. High variability is observed in total mechanical power per unit area (x7), primary industry value-added as a proportion of regional GDP (x8), and planting industry product price index (previous year = 100) (x9). In contrast, lower variability is evident in grain yield per unit area (x1), grain disaster rate (x2), fertilizer application per unit area (x3), effective irrigation per unit area (x4), pesticide application per unit area (x5), and the ratio of GDP from agriculture, forestry, animal husbandry, and fisheries to local agricultural and forestry expenditure (x6).

5 Empirical results analysis

5.1 Baseline regression

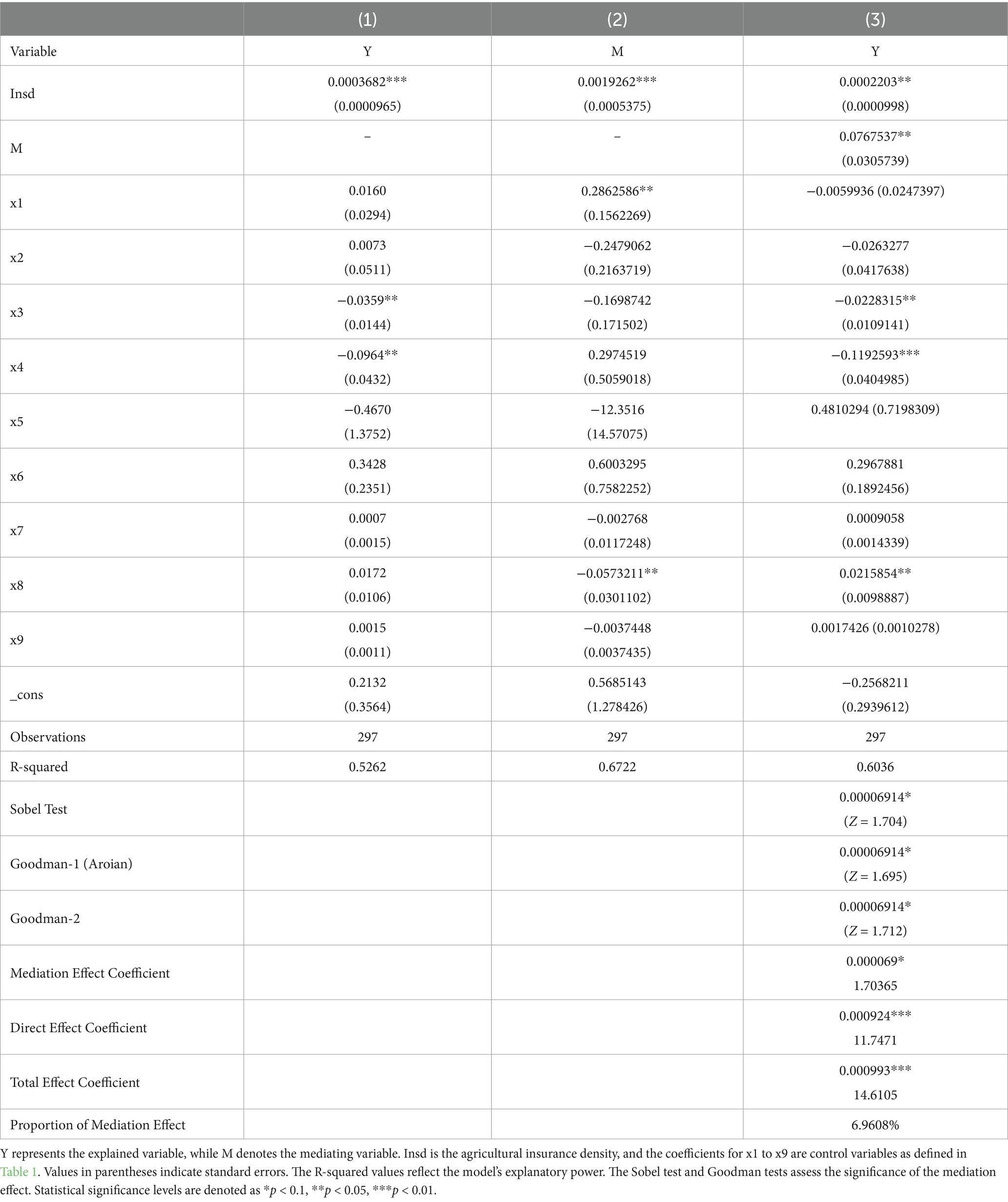

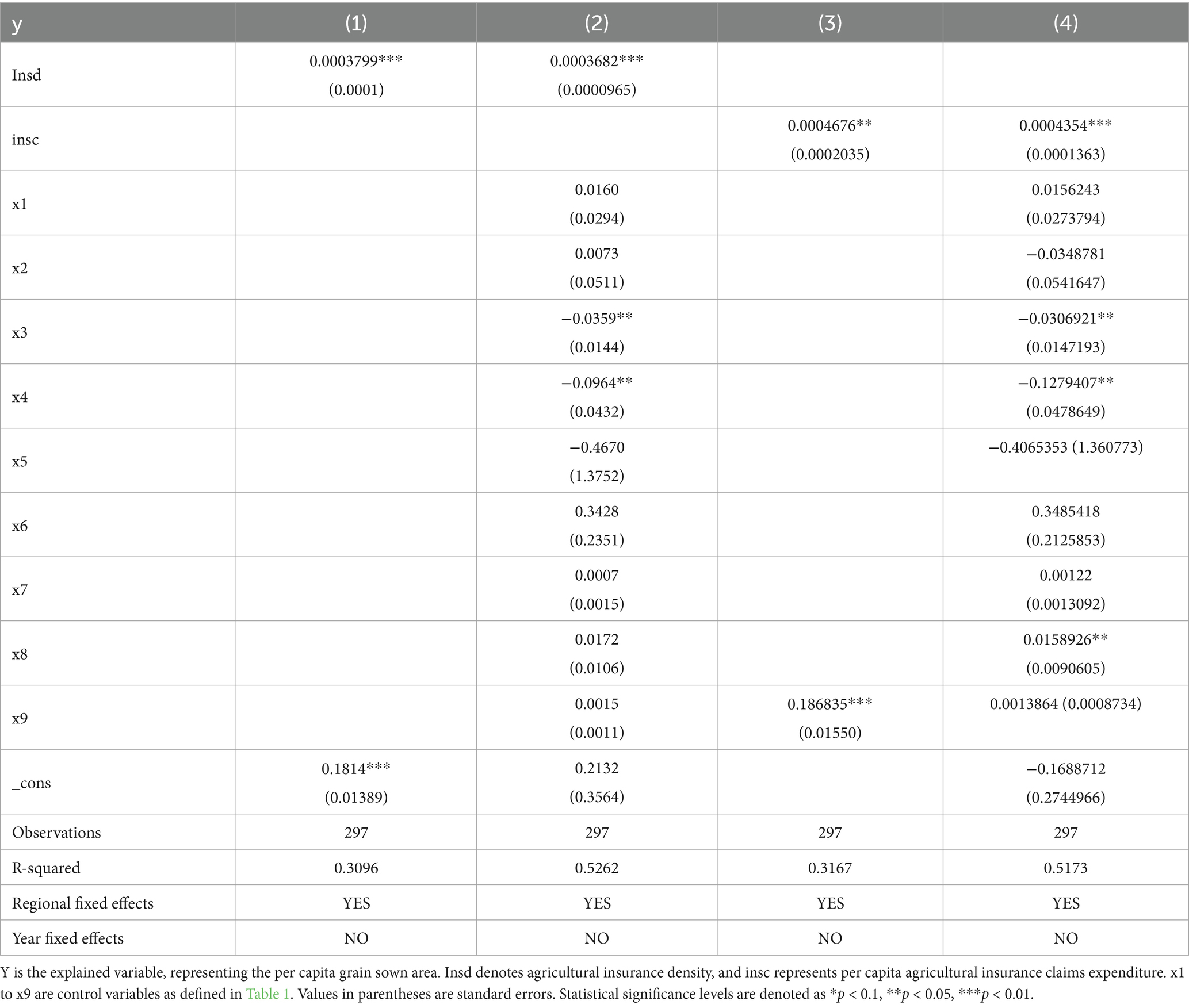

This study employs panel data and fixed-effects models to examine the impact of agricultural insurance on grain cultivation scale. In column (1) of Table 3 (according to Equation 1), the regression results for the key explanatory variable indicate a significant positive effect of agricultural insurance on grain cultivation scale at the 1% significance level. This finding suggests that the development of agricultural insurance contributes to the expansion of grain cultivation scale, though the increase in the regression coefficient is relatively modest.

Table 3. Empirical analysis of the impact of agricultural insurance on grain sown area and stability test results.

In column (2) of Table 3, after incorporating control variables, the results continue to show a significant positive effect of agricultural insurance on grain cultivation scale at the 1% significance level, further validating the positive impact of agricultural insurance on grain cultivation scale.

Moreover, fertilizer application per unit area (x3) and effective irrigation per unit area (x4) demonstrate significant negative effects at the 5% significance level. These findings imply that both fertilizer use and effective irrigation per unit area are negatively associated with grain sowing area. Generally, lower fertilizer application and effective irrigation per unit area may reflect farmers’ increased focus on agricultural technology and environmentally sustainable practices, leading to more efficient agricultural resource allocation and, consequently, a greater propensity to expand grain cultivation scale.

5.2 Robustness test

To assess the robustness of our findings, we replaced the original core explanatory variable, agricultural insurance density, with per capita agricultural insurance claims expenditure as an alternative measurement. Fixed-effects regression analysis was then performed, with the results presented in columns (3) and (4) of Table 3. In column (3), the alternative core explanatory variable exhibits a significant positive correlation at the 5% significance level, consistent with the baseline regression results. In column (4), after incorporating control variables, the results remain significantly positive at the 1% significance level, further validating the baseline findings. These results demonstrate that our conclusions remain robust even when the measurement indicator for the core explanatory variable is modified.

5.3 Mechanism analysis

To further explore the potential transmission mechanism of how agricultural insurance affects the scale of grain planting, this study draws on relevant theoretical research (Baron and Kenny, 1986; Wen and Ye, 2014; Yao et al., 2024) and introduces the variable of farmer income, constructing a mediation effect model. The stepwise regression method is used to analyze whether agricultural insurance can affect the scale of grain planting by influencing farmer income. The models are constructed as follows:

Where, Mi,t represents the mediator variable of farmer income, and this study uses farmer disposable income as the indicator; Insdi,t represents the agricultural insurance density; Yi,t denotes the grain planting area.

The control variables Xit are consistent with those described previously. In model (2), the coefficient β1 of Insdi,t captures the total effect of agricultural insurance on grain planting scale, and the coefficient β2 of Insdi,t in model (2) reflects the impact of agricultural insurance on farmer income. Based on theoretical analysis, the coefficient β2 is expected to be positive, indicating that the development of agricultural insurance can increase farmer income. Model (4) is based on the addition of the Mi,t indicator to model (2), in which case the coefficient β3 of Insdi,t represents the direct effect of agricultural insurance on grain planting scale, while the coefficient c of Mi,t represents the effect of farmer income on grain planting scale after controlling for Insdi,t. α1-α3 are the intercept terms, and is the random error term.

The stepwise regression results of the mediation effect are shown in Table 4 (according to Equations 1–4). Column (1) of Table 4 indicates that the development of agricultural insurance positively impacts planting scale, with a total effect of 0.0003682. Column (2) shows that agricultural insurance contributes to increasing farmer income, reflecting a positive income effect. In Column (3), the coefficients of both Insdi,t and Mi,t are significantly positive. Further mediation effect tests, including the Sobel and Goodman tests, confirm the presence of a partial mediation effect, accounting for 6.9608% of the total effect. This finding verifies that agricultural insurance can promote the expansion of grain planting scale by enhancing farmer income.

6 Conclusion and policy implications

6.1 Conclusion

Agricultural insurance, a globally recognized policy instrument, is critical in mitigating agricultural risks and addressing disaster-related losses. This study investigates the theoretical linkages among agricultural insurance, farmers’ income, and grain production scale. It further employs provincial panel data from China (2012–2022) to perform an empirical analysis and propose policy recommendations for improving agricultural insurance systems. The findings provide valuable insights for adjusting China’s agricultural insurance policies and hold significant theoretical and practical implications. The main conclusions are as follows:

1. Agricultural insurance has a significant positive effect on farmer income, supporting Hypothesis H1a, though the effect size is relatively small, with an impact coefficient of 0.0003682. This indicates that while agricultural insurance development has promoted the expansion of grain planting, the increase remains limited. Studies like Ning et al. (2024) support this finding, showing that policy-based agricultural insurance in Jiangxi Province enables farmers to expand rice planting areas and achieve intensive production. Additionally, new agricultural entities—such as large-scale growers, family farms, and cooperatives—that adopt green technologies and improved varieties show superior outcomes in this process compared to traditional smallholders. Further analysis suggests that the modest impact size may be due to variations in resources and insurance demand between farmer types. Research by Ye and Zhu (2018) highlights significant differences in insurance demand between new agricultural entities and smallholders, with the former preferring yield insurance, which aligns with and supports our findings.

2. Agricultural insurance positively influences the scale of grain planting, validating Hypothesis H2a. Moreover, agricultural insurance indirectly affects grain planting area by increasing farmer income, supporting Hypothesis H3a. This empirical finding passes the partial mediation effect test. In line with these findings, Li et al. (2024) identified farmer income and income disparity as key factors influencing staple food production scale in their meta-analysis, lending further support to our conclusions. Additionally, many studies suggest that agricultural insurance subsidies impact the scale and structure of grain planting. For instance, Zhang et al. (2019) propose that differentiated premium subsidies can guide farmers to adjust crop planting areas, thereby expanding the scale of food crops, a mechanism thoroughly analyzed in this study. Empirical research based on micro-survey data also corroborates this conclusion. Chai and Zhang (2023) found that policy reforms increasing premium subsidies and coverage levels raise farmers’ expected income, encouraging them to expand both total planting area and food crop area. Similarly, Jiang et al. (2022) reported that fiscal subsidy policies have significantly boosted agricultural insurance demand, enhancing farmers’ willingness to insure and further promoting crop planting adjustments.

6.2 Policy implications

To enhance the effectiveness of agricultural insurance in supporting agricultural production, based on the research conclusions, this paper proposes the following policy recommendations:

6.2.1 Expand agricultural insurance coverage

Increase awareness of agricultural insurance through targeted outreach and policy guidance, helping farmers recognize its critical role in risk diversification. By expanding agricultural insurance coverage, especially for staple crops, comprehensive protection can be achieved. Governments and insurance institutions at all levels should effectively utilize traditional and new media platforms, including broadcast, television, and WeChat, to disseminate agricultural insurance policies. In the agricultural off-season, they can coordinate visits by technical experts and insurance representatives to rural areas, offering farmers comprehensive explanations of these policies. Although agricultural insurance differs from conventional commercial insurance, broader coverage supports more effective risk management and rate-setting, while reducing adverse selection. For farmers, expanded coverage facilitates better financial planning and risk diversification.

6.2.2 Establish a multi-level agricultural insurance system

Tailor the agricultural insurance system to the unique needs of China’s agricultural sector and the diverse requirements of farmers. On one hand, this system delivers a progressively enhanced level of protection, transitioning from cost insurance to income insurance and ultimately to profit insurance. On the other hand, in terms of insurance coverage, it should include both basic and additional insurance, addressing both staple and cash crops. Continued promotion of staple crop insurance is essential to safeguard national food security, while local specialty crop insurance should be developed steadily to meet the needs of various farming communities. Insurance products should offer multi-level protection, covering basic, cost, and income protection to address farmers’ diverse risk management needs. Additionally, leveraging insurance technology can enhance service efficiency and quality, providing farmers with more personalized and diversified insurance products.

6.2.3 Enhance the protection level of agricultural insurance

By 2024, China’s three primary staple crops are expected to have full cost insurance and basic income protection. However, many other food crops still lack cost and income coverage. For crop varieties critical to national food security, strategic priorities, and public welfare, it is important not only to establish a multi-level agricultural insurance system but also to increase the level of protection. Enhanced coverage will strengthen farmers’ confidence in crop cultivation and support sustainable agricultural development.

6.3 Limitations and future outlook

This study conducted an empirical analysis of the impact of agricultural insurance on grain planting scale using provincial panel data from China between 2011 and 2021, and it explored the mechanism through which agricultural insurance influences grain planting scale by affecting farmer income. However, certain limitations remain due to constraints such as knowledge reserves and disciplinary boundaries.

In the empirical analysis, while the study covers most provinces in China over an 11-year period, it is limited by the absence of micro-level data, which prevents a more nuanced understanding of individual farmers’ circumstances. Future research could address this limitation by incorporating micro-level data obtained through field surveys and other direct data collection methods, enabling a deeper exploration of farmers’ experiences and responses.

Agricultural economics remains a field with vast research potential, and we hope this study provides valuable insights for both researchers and policymakers. In future work, we aim to conduct more detailed investigations on this topic to further contribute to the advancement of research in this field.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

DH: Conceptualization, Data curation, Formal analysis, Funding acquisition, Methodology, Validation, Visualization, Writing – original draft. XW: Supervision, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by the Minnan Normal University President’s Fund Project (Grant No. SK18017), Special Project on New Quality Productivity Research at Minnan Normal University in 2024 (Grant No. MSXZ2024005), National Social Science Foundation of China (Grant No. 23XJY011), the Innovation Strategy Research Plan Project of Fujian Province (Grant No. 2024R0053), and the Major Project of Basic Theoretical Research Base of Philosophy and Social Sciences under the Guidance of Marxism in Fujian Province (Grant No. FJ2024MGCA022).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adkins, K., Boyer, C. N., Smith, S. A., Griffith, A. P., and Muhammad, A. (2020). Analyzing corn and cotton producers optimal prevented planting decision on moral hazard. Agron. J. 112, 2047–2057. doi: 10.1002/agj2.20173

Babcock, B. A., and Hennessy, D. A. (1996). Input demand under yield and revenue insurance. Am. J. Agric. Econ. 78, 416–427. doi: 10.2307/1243713

Bao, Y. Z., Yu, Y., Zhou, Y., and Niu, M. J. (2018). Study on the distribution and evolution of vegetable industry in China from 1990 to 2014. J. Arid Land Resources Environ. 11, 53–58. doi: 10.13448/j.cnki.jalre.2018.333

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51, 1173–1182. doi: 10.1037/0022-3514.51.6.1173

Chai, Z. H., and Zhang, X. X. (2023). Gradual reform of agricultural insurance policy and adjustment of planting structure: an empirical study based on provincial data. J. China Agric. Univ. 28, 275–290. doi: 10.11814/J.ISSN,1007-4333.2023.10.23

Dastagiri, M. B., Chand, R., Kingsly, I., and Hanumanthaiah, C. V. (2014). Indian vegetables: production trends, marketing efficiency and export competitiveness. Am. J. Agric. For. 1, 1–11. doi: 10.11648/j.ajaf.20130101.11

Enjolras, G., and Sentis, P. (2011). Crop insurance policies and purchases in France. Agricultural Economics, 42, 475–486. doi: 10.1111/j.1574-0862.2011.00535

Fang, L., Hu, R., Mao, H., and Chen, S. (2021). How crop insurance influences agricultural green total factor productivity: evidence from Chinese farmers. J. Clean. Prod. 321:128977. doi: 10.1016/j.jclepro.2021.128977

Fang, Z., Li, G. C., and Liao, W. M. (2022). Impact of main grain-producing areas policy on grain production security. Res. Agric. Modernization 43, 790–802. doi: 10.13872/j.1000-0275.2022.0078

Fu, L. S., Qin, T., Li, G. Q., and Wang, S. G. (2024a). Efficiency of agricultural insurance in facilitating modern agriculture development: from the perspective of production factor allocation. Sustain. For. 16:6223. doi: 10.3390/su16146223

Fu, L. S., Wang, S. G., Qin, T., Li, G. Q., and Wang, Y. (2024b). Analysis of poverty prevention effect and mechanism of agricultural insurance: From the perspective of farmers’ production behavior[J/OL]. China Agricultural Resources and Regional Planning. Available at: http://kns.cnki.net/kcms/detail/11.3513.S.20240925.1743.026.html.

Goodwin, B. K., Vandeveer, M. L., and Deal, J. L. (2004). An empirical analysis of acreage effects of participation in the federal crop insurance program. Am. J. Agric. Econ. 86, 1058–1077. doi: 10.1111/j.0002-9092.2004.00653.x

Guan, H. J., and Si, X. M. (2024). Evolution of spatial pattern of grain production in Huang-Huai-Hai plain and its influencing factors. China Agric. Resources Regional Plan. 45, 31–43.

Jiang, S. Z., Fu, S., and Li, W. Z. (2022). Can agricultural insurance subsidy policies adjust crop planting structure? Evidence from China's quasi-natural experiment. Insurance Stud. 6, 51–66. doi: 10.13497/j.cnki.is.2022.06.004

Li, R. Q., Chen, X., and Shi, L. Z. (2024). Influencing factors of China’s main grain planting area changes: based on meta-analysis. Sci. Technol. Rev. 42, 76–83.

Li, Y. B., Xie, T., Du, X. P., and Liang, S. (2019). Empirical analysis of the impact of agricultural insurance on agricultural production in China: from the perspective of targeted poverty alleviation. Contemp. Fin. Res. 1, 109–122.

Li, H., Yuan, K., Cao, A., Zhao, X., and Guo, L. (2022). The role of crop insurance in reducing pesticide use: evidence from rice farmers in China. J. Environ. Manag. 306:114456. doi: 10.1016/j.jenvman.2022.114456

Lithourgidis, A. S., Dordas, C. A., Damalas, C. A., and Vlachostergios, D. N. (2011). Annual intercrops: an alternative pathway for sustainable agriculture. Aust. J. Crop. Sci. 5, 396–410. doi: 10.1016/j.agwat.2011.01.017

Liu, J. W. (2011). Research on influencing factors of migrant workers’ participation in new rural pension insurance system based on rational choice theory. Zhejiang Soc. Sci. 4:77-83+157-158. doi: 10.14167/j.zjss.2011.04.021

Liu, Y., and Dong, J. (2017). Experience and enlightenment of foreign agricultural insurance organization operation system. World Agric. 1, 32–38. doi: 10.13856/j.cn11-1097/s.2017.01.005

Möhring, N., Dalhau, T., Enjolras, G., and Finger, R. (2020). Crop insurance and pesticide use in European agriculture. Agric. Syst. 184:102902. doi: 10.1016/j.agsy.2020.102902

Möring, N, Dalhaus, T, Enjolras, G, and Finger, R. (2020). Crop insurance and pesticide use in European agriculture. Agricultural Systems 184.

Ning, C. W., Hu, W. B., Xiong, F. X., You, C. X., Zhang, L., and Zhu, S. B. (2024). The impact of policy-oriented agricultural insurance and farmer differentiation on grain yield per unit area: a case study of Jiangxi Province. Res. Agric. Modernization 45, 197–209. doi: 10.13872/j.1000-0275.2024.0019

Qiu, H. X., and Zhang, Y. X. (1998). A review of rational choice theory. J. Sun Yat-sen Univ. 1, 118–125.

Roll, K. H. (2019). Moral hazard: the effect of insurance on risk and efficiency. Agric. Econ. 50, 367–375. doi: 10.1111/agec.12490

Sakurai, T., and Reardon, T. (1997). Potential demand for drought insurance in Burkina Faso and its determinants. Am. J. Agric. Econ. 79, 1193–1207. doi: 10.2307/1244277

Shang, Y., and Xiong, T. (2020). Not what it seems? Analysis of the divergence between farmers’ risk management willingness and behavior. J. Huazhong Agric. Univ. 5:19-28+169. doi: 10.13300/j.cnki.hnwkxb.2020.05.003

Shang, Y., Xiong, T., and Li, C. G. (2020). Risk perception, risk attitude, and farmers’ willingness to adopt risk management tools: taking agricultural insurance and "insurance + futures" as examples. China Rural Survey 5, 52–72.

Shi, J., Wu, J., and Olen, B. (2020). Assessing effects of federal crop insurance supply on acreage and yield of specialty crops. Can. J. Agric. Econ. 68, 65–82. doi: 10.1111/cjag.12211

Simon, H. A. (1955). A behavioral model of rational choice. Q. J. Econ. 69, 99–118. doi: 10.2307/1884852

Smith, V. H., and Goodwin, B. K. (1996). Crop insurance, moral hazard, and agricultural chemical use. Am. J. Agric. Econ. 78, 428–438. doi: 10.2307/1243714

Song, Y. H. (2018). The impact of market information and risk attitude on vegetable growers' production decisions. China Vegetables 2, 10–15. doi: 10.19928/j.cnki.1000-6346.2018.02.003

Suchato, P., Mieno, T., Schoengold, K., and Foster, T. (2022). The potential for moral hazard behavior in irrigation decisions under crop insurance. Agric. Econ. 53, 257–273. doi: 10.1111/agec.12676

Tuo, G. Z. (2021). Developing policy-oriented agricultural insurance to support rural revitalization strategy. China Rural Fin. 16, 11–13. doi: 10.3969/j.issn.1674-9162.2021.16.004

Tuo, G. Z., and Feng, W. L. (2024). Rethinking the basic principles of agricultural insurance. Insurance Theory Pract. 3, 1–13.

Von Neumann, J., and Morgenstern, O. (1944). Theory of games and economic behavior. Princeton: Princeton University Press.

Waiters, C. G., Shumway, C. R., Chouinard, H. H., and Wandschneider, P. R. (2012). Crop insurance, land allocation, and the environment. J. Agric. Resour. Econ. 37, 301–320. doi: 10.22004/ag.econ.134289

Wang, Q., Guan, R., and Yu, J. (2019). Analysis of the impact of risk attitude and risk perception on farmers' farmland transfer behavior: based on panel data of 1,429 farmers in Henan, Shandong, Anhui, Hebei, and Jiangsu provinces. J. Huazhong Agric. Univ. 6:149-158+167. doi: 10.13300/j.cnki.hnwkxb.2019.06.018

Wang, K., and Ji, L. (2023). The development and evolution of agricultural insurance in China: a product form perspective. Insurance Stud. 5, 9–19. doi: 10.13497/j.cnki.is.2023.05.002

Wang, R., Rejesus, R. M., and Aglasan, S. (2021). Warming temperatures, yield risk and crop insurance participation. Eur. Rev. Agric. Econ. 48, 1109–1131. doi: 10.1093/erae/jbab034

Wen, Z. L., and Ye, B. J. (2014). Mediation analysis: methods and model development. Adv. Psychol. Sci. 22, 731–745. doi: 10.3724/SP.J.1042.2014.00731

Wu, Y., Xi, X., Tang, X., and Chen, D. (2018). Policy distortions, farm size, and the overuse of agricultural chemicals in China. Proc. Natl. Acad. Sci. 115, 7010–7015. doi: 10.1073/pnas.1806645115

Yao, J. Q., Zhang, K. P., Guo, L. P., and Feng, X. (2024). How does artificial intelligence improve enterprise production efficiency? From the perspective of labor skill structure adjustment. Manage. World 40:101-116+133+117-122. doi: 10.19744/j.cnki.11-1235/f.2024.0018

Ye, T., Hu, W., Barnett, B. J., Wang, J., and Gao, Y. (2020). Area yield index insurance or farm yield crop insurance? Chinese perspectives on farmers' welfare and government subsidy effectiveness. J. Agric. Econ. 71, 144–164. doi: 10.1111/1477-9552.12326

Ye, M. H., and Zhu, J. S. (2018). Research on heterogeneity of agricultural insurance preferences between new agricultural business entities and traditional small farmers: based on field surveys in 9 major grain-producing provinces. Econ. Issues 2, 91–97. doi: 10.16011/j.cnki.jjwt.2018.02.015

Young, C. E., Vandeveer, M. L., and Schnepf, R. D. (2001). Production and price impacts of US crop insurance programs. Am. J. Agric. Econ. 83, 1196–1203. doi: 10.1111/0002-9092.00267

Yu, J., Smith, A., and Sumner, D. A. (2018). Effects of crop insurance premium subsidies on crop acreage. Am. J. Agric. Econ. 100, 91–114. doi: 10.1093/ajae/aax058

Yuan, Y., and Xu, B. (2024). Can agricultural insurance policy adjustments promote a 'grain-oriented' planting structure? Measurement based on the expansion of the high-level agricultural insurance in China. Agriculture 14:708. doi: 10.3390/agriculture14050708

Zhang, X. G., and Chai, Z. H. (2024). Research on the impact of policy-oriented agricultural insurance on farmers’ green production: based on survey data of wheat farmers in 4 provinces. Insurance Stud. 6, 70–80. doi: 10.13497/j.cnki.is.2024.06.006

Zhang, J. H., and Xu, W. (2023). Can full cost insurance pilot stimulate grain output? Chinese Rural Econ. 11, 58–81. doi: 10.20077/j.cnki.11-1262/f.2023.11.003

Zhang, W., Yi, P., Xu, J., and Huang, Y. (2019). The incentive effect of policy-oriented agricultural insurance on grain output. Insurance Stud. 1, 32–44. doi: 10.13497/j.cnki.is.2019.01.003

Zhang, W., Zhong, W. X., Chen, X. Z., Liu, X. Y., and Yi, P. (2024). The incentive effect of crop insurance on agricultural land scale management: evidence from provincial panel data from 2011 to 2021. Insurance Stud. 4, 34–47. doi: 10.13497/j.cnki.is.2024.04.003

Keywords: agricultural insurance, grain production scale, income mediation, sustainable agriculture, China

Citation: Hou D and Wang X (2025) How does agricultural insurance influence grain production scale? An income-mediated perspective. Front. Sustain. Food Syst. 9:1524874. doi: 10.3389/fsufs.2025.1524874

Edited by:

Amar Razzaq, Huanggang Normal University, ChinaReviewed by:

Muhammad Waseem, Huazhong Agricultural University, ChinaMuhammad Irshad Ahmad, Zhengzhou University, China

Copyright © 2025 Hou and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xin Wang, ODIwMTkwMDhAbHl1bi5lZHUuY24=

Dainan Hou1

Dainan Hou1 Xin Wang

Xin Wang