- 1School of Economics and Management, Yanshan University, Qinhuangdao, China

- 2The Regional Economic Development Research Center, Yanshan University, Qinhuangdao, China

- 3Hebei Provincial Higher Education Research Base of Educational Science Planning, Yanshan University, Qinhuangdao, China

Introduction: As an effective tool and public welfare product of the state to support and benefit agriculture, policy-oriented agricultural insurance has unique advantages in dispersing agricultural risks and guaranteeing stable grain production and supply.

Methods: Based on provincial panel data from 2002 to 2021, this paper analyzes the impact of policy-oriented agricultural insurance on grain production resilience. It constructs a comprehensive indicator system to assess grain production resilience and examines the impact of the insurance premium subsidy policy and the insurance development level on grain production resilience.

Results: The study finds that policy-oriented agricultural insurance significantly improves grain production resilience and passes the robustness test. The heterogeneity analysis shows that the policy-oriented agricultural insurance development level in major grain producing areas has a significantly positive impact on grain production resilience, and the impact is higher than that in non major grain producing areas. Additionally, the impact of policy-oriented agricultural insurance on grain production resilience in high risk areas is more pronounced than that in low risk areas. At the same time, the mechanism analysis shows that policy-oriented agricultural insurance can have a positive impact on grain production resilience by improving agricultural technology progress, land transfer, and grain cultivation specialization.

Discussion: This paper reveals that policy-oriented agricultural insurance has a positive impact on grain production resilience and provides relevant policy suggestions for the government. This has a considerable impact on promoting sustainable grain production.

Highlights

• Policy-oriented agricultural insurance has an important impact on grain production resilience.

• Analyzing the impact of Policy-oriented agricultural insurance on China's grain production resilience in terms of the implementation of the insurance premium subsidy policy and the level of insurance development.

• Policy-oriented agricultural insurance can positively impact grain production resilience by improving agricultural technological progress, land transfer, and grain cultivation specialization.

1 Introduction

Grain production is essential for the country’s long-term development and serves as the foundation for sustained economic growth and social stability. To date, China’s grain production has reached a historic milestone of consecutive bounties and has remained stable at over 650 million tonnes for nine consecutive years. This stability, coupled with a steady increase in comprehensive grain production capacity, provides a robust guarantee for national grain security.

Despite the remarkable growth in China’s grain output, the structure and characteristics of grain production have undergone significant transformations. However, various risks associated with grain production continue to persist. On one hand, the potential pressures and shocks affecting grain production are becoming increasingly pronounced due to multiple challenges, including frequent emergencies, tightening resource constraints, and fluctuations in international market (Li et al., 2023; Miao et al., 2016; Mrówczyńska-Kamińska et al., 2023; Xue et al., 2024); On the other hand, as industrialization and urbanization continue to advance, the available space of land resources continues to be compressed, the quality of land resources gradually declines, and the costs of labor, land, and other grain production factors rise significantly, which seriously restricts the improvement of grain yield (Jónsdóttir and Gísladóttir, 2023; Lee and Song, 2024). Grain production resilience refers to the ability of a grain production system to maintain or rapidly recover its productivity in the face of various natural and man-made disturbances. Such resilience is critical to ensuring grain security, as it reduces the negative impacts of factors such as climate change, natural disasters, market volatility, and policy changes on the grain supply (Ye, 2023). Based on the above considerations, the process of grain production can no longer be limited to the pursuit of grain production but should focus on improving grain production resilience to effectively cope with the risks in the process of grain production. Therefore, how to modernize agriculture and rural areas and ensure grain security by improving grain production resilience has become an urgent issue.

Policy-oriented agricultural insurance, recognized as one of the most effective tools for managing modern agricultural risks, is increasingly becoming a vital component in ensuring grain security (Cha et al., 2024; Tuo and Zhang, 2018). It plays a significant role in mitigating agricultural risks (Xie et al., 2024), providing economic compensation (Zeng and Mu, 2010), expanding the scale of grain production (Hou and Wang, 2024), and transforming planting structure (Fang et al., 2021), among other benefits. Policy-oriented agricultural insurance is a type of policy instrument that borrows insurance techniques and methods to serve the government’s agricultural support, protection, and financial transfers. It is a fiscal transfer instrument at the macro level and a risky financial instrument at the micro level. The primary objective of the national development of agricultural insurance is to provide risk protection for farmers and help them cope with natural disasters, harvest losses, and other agricultural risks, in order to realize the objectives of sustainable agricultural management, national grain security, and stabilization of farmers’ incomes. Therefore, policy-oriented agricultural insurance has a completely different purpose and nature from commercial agricultural insurance. Policy-oriented agricultural insurance is for non-profit purposes, with a focus on public welfare and inclusivity. Policy-oriented agricultural insurance involves both the risk of dealing with financial means and the income transfer expenditure pathway, serving a dual function of support for agricultural policy (Tuo and Feng, 2024). Unlike ordinary insurance businesses, the specificity of agriculture determines that the development of agricultural insurance models differs from general commercial insurance. International experience shows that the formation of the agricultural insurance market needs to be promoted by the government, with financial subsidies supporting its establishment. Therefore, in this study, the concepts of “agricultural insurance” and “policy-oriented agricultural insurance” are not distinguished.

Since 2007, China’s policy-oriented agricultural insurance has been in operation for 17 years. In 2022, the scale of agricultural insurance premiums in China reached 121.935 billion yuan, surpassing the 100 billion yuan threshold and ranking first globally. So, in the process of promoting a strong agricultural country, does policy-oriented agricultural insurance enhance China’s grain production resilience? And what is its impact mechanism? Based on 31 provincial panel data from 2002 to 2021, this paper measures and compares China’s grain production resilience with the agricultural insurance development level in each province and explores the impact of policy-oriented agricultural insurance on China’s grain production resilience from the perspectives of the implementation of policy-oriented agricultural insurance and the policy-oriented agricultural insurance development level.

The marginal contribution of this paper is mainly reflected in the following aspects: first, from the implementation of the insurance premium subsidy policy and the insurance development level, we analyze the impact of policy-oriented agricultural insurance on China’s grain production resilience; second, we define the connotation and main characteristics of grain production resilience based on the concept of resilience in physics and engineering, with fracture resilience and impact resilience as the two main primary indicators, constructing a resilience evaluation indicator system for grain production. Third, according to the regional differentiation of grain production and the differentiation of disaster degree, we empirically examine the regional heterogeneity of the impact of policy-oriented agricultural insurance development level on grain production resilience. Finally, from the perspective of the insurance development level, we analyze the impact mechanism of policy-oriented agricultural insurance on grain production resilience from both theoretical and empirical perspectives.

2 Literature review

Derived from the concepts of physics and engineering, resilience initially refers to the ability of a system to recover from stress, i.e., the ability of a system to resist and recover from an impact. With the development of multidisciplinary integration, resilience research has gradually covered a variety of fields such as psychology, urbanism, and economics.

Grain production is one of the most important aspects of agriculture, and in the field of economics, research on the grain system focuses mainly on overall grain security (Bouteska et al., 2024; Tabe-Ojong et al., 2024; Zhang and Lu, 2024), grain production efficiency (Shen et al., 2024; Wang et al., 2019; Zhang et al., 2021), grain production capacity (Araya et al., 2018; Wang et al., 2024a), etc. However, there is relatively little research on the grain system resilience, especially the resilience of the production end. In terms of the definition of grain system resilience, Tendall et al. (2015) introduced the theory of “resilience” into the grain system and defined grain system resilience as the ability to remain stable when the grain system suffers from internal and external shocks. Béné et al. (2023) regarded grain system resilience as a multidimensional concept that refers to the capacity to adapt and innovate in the face of various factors affecting grain system resilience. Hao and Tan (2022) constructed a comprehensive evaluation indicator system for grain system resilience and found that digital village construction can significantly improve grain system resilience. Jiang et al. (2023) found that the urbanization rate, scientific and technological factors, and changes in the prices of agricultural means of production are the main factors affecting grain production resilience.

Policy-oriented agricultural insurance is gradually becoming an important part of the protection of grain production, and most scholars are now focusing on grain production and yield. Akinrinola and Okunola (2014) found that agricultural insurance can increase the inputs of agricultural practitioners to agriculture, which in turn increases the production of grain crops. Liu and Sun (2016) found that grain growers gradually increase the number of grain crops with high subsidies or high yields, which leads to a change in the structure of grain cultivation. Yoshioka (2017) argues that innovative crop insurance products can effectively diversify the risks posed by climate change and ensure the stability of grain production. Habtemariam et al. (2021) argue that policy agricultural insurance is an important tool for managing climate risks and promoting grain production.

However, there are also studies that take a negative view of the positive impact of agricultural insurance on grain production. Miao et al. (2016) argued that after farmers enroll in insurance, grain growers increase the use of chemical fertilizers and pesticides, which accelerates soil acidification and reduces soil fertility and arable land quality. Zhang et al. (2019) found that grain growers may, based on the yields from different grain crops, purchase more insurance for high-yield crops while reducing insurance for low-yield crops, creating under-insurance and over-insurance, which is detrimental to grain production.

3 Theories and hypotheses

3.1 Analysis of impact effects

According to the theory of double-cold supply and demand for agricultural insurance, purely commercial agricultural insurance is difficult to operate, and the supply of agricultural insurance under the market mechanism will be less than the optimal social demand, requiring the government to implement various incentive policies to increase the level of demand for and supply of agricultural insurance in order to improve the efficiency of resource allocation. Therefore, to solve the problem of “double cold” agricultural insurance supply and demand, it is necessary to carry out policy-oriented agricultural insurance with financial subsidies and policy support.

Policy-oriented agricultural insurance is promoted by the government, which provides certain policy support and premium subsidies. This subsidy mechanism makes it easier for farmers to accept and purchase insurance, as they can bear lower costs when purchasing insurance (Tuo and Feng, 2024). The business objectives of policy-oriented agricultural insurance are more focused on the macroeconomic benefits to society and supporting the development of the agricultural economy. Even if certain programs will bring losses to the insurance company, the government will provide moderate support or underwriting, which ensures the stability of agricultural production. In contrast, commercial agricultural insurance, with profit maximization as its business objective, may be reluctant to underwrite projects with high risks and thin profits, which, to some extent, limits its ability to protect grain production. Grain production is subject to the dual constraints of natural and economic risks and is characterized by high risks and high payouts (Wu et al., 2024). Policy-oriented agricultural insurance is designed to address this specificity and can better meet the needs of grain production. Based on this, this paper proposes the following Hypothesis 1:

H1: The implementation of policy-oriented agricultural insurance premium subsidy policies can promote grain production resilience.

As an effective tool for supporting and benefiting agriculture, policy-oriented agricultural insurance plays a positive role in spreading risks and guaranteeing national grain security. The theoretical foundations of policy-oriented agricultural insurance affecting grain production are mainly based on risk diversification and compensation, incentive effects, and market stabilization and expectation management. The following is a detailed description of these theoretical foundations:

Risk diversification and compensation are the core functions of policy-oriented agricultural insurance (Abdi et al., 2022; Alam et al., 2020; Sun et al., 2024). Grain production faces many risks, such as natural disasters and epidemics, which may lead to the reduction or extinction of grain crops. Policy-oriented agricultural insurance effectively disperses the risks faced by agricultural practitioners by pooling many risks to form a large-scale risk pool (Xie et al., 2024). When the risk occurs, the insurance company will provide the insurer with the corresponding economic compensation according to the contract agreement to help the insurer resume production and reduce economic loss. Specifically, policy-oriented agricultural insurance promotes grain production resilience, which is manifested in the pre-disaster risk dispersion effect of premium expenditure and the post-disaster loss compensation effect of insurance payout. This risk diversification and compensation mechanism helps to stabilize the production expectations of agricultural practitioners and improve the sustainability of grain production.

Policy-oriented agricultural insurance has an incentive effect. On the one hand, the financial compensation from insurance can stimulate the production motivation of agricultural practitioners and encourage them to increase their inputs to grain production, thereby improving both grain production and quality (Adzawla et al., 2019; Zhu and Yang, 2023). On the other hand, policy-oriented agricultural insurance can also promote the innovation and application of agricultural technology. As insurance reduces the risks associated with grain production activities, agricultural practitioners are more willing to try new planting techniques and methods to improve the efficiency and effectiveness of grain production. This incentive effect helps to promote the modernization of grain production.

Policy-oriented agricultural insurance helps to stabilize market expectations and manage market risks. The existence of an agricultural insurance system allows agricultural practitioners to have more stable expectations in the face of uncertainty, which helps to stabilize grain market prices and reduce market volatility. Based on this, this paper proposes the following Hypothesis 2:

H2: The development of policy-oriented agricultural insurance promotes grain production resilience.

3.2 Analysis of impact mechanisms

Highly efficient new agricultural technologies are characterized by high costs and high risks, while the vulnerability of grain production makes agricultural practitioners with low economic capacity more cautious about increasing investment in technology, limiting their incentives to introduce and adopt new technologies. Policy-oriented agricultural insurance can enhance the risk tolerance of agricultural practitioners, stabilize the expectation of returns from planting grain crops, and increase the willingness to adopt new technologies and new production models (Fu and Qin, 2022). Such insurance provides risk protection for the introduction of new technologies and promotes the development of agricultural technology. Policy-oriented agricultural insurance can also alleviate the financial pressure on agricultural practitioners in the introduction and purchase of new technologies, further stimulating their motivation to adopt new technologies and promote the innovation of agricultural technology. Advances in agricultural technology can help reduce production costs, improve operational efficiency, and enhance the stability of grain production (Wang et al., 2024b); at the same time, it can also promote the quality of grain crops and increase the added value of grain products. Based on this, this paper proposes the following Hypothesis 3:

H3: Policy-oriented agricultural insurance can enhance grain production resilience by promoting agricultural technology progress.

Land transfer, as an important initiative to increase land productivity and grain production, expands the operating area of agricultural land and promotes land scaling through the reuse of abandoned and inefficient agricultural land (Chen et al., 2024). This helps achieve returns to scale in agriculture and enhances the efficiency of agricultural production (Fei et al., 2021; Liu et al., 2019), thereby increasing grain production resilience. However, at the same time, the concentrated production of grain increases the likelihood of exposure to risks such as natural disasters and price fluctuations, which makes agricultural practitioners relatively conservative in their decision-making regarding the expansion of grain cultivation. In addition, the increase in the cost of land transfer significantly limits the ability of agricultural practitioners to carry out large-scale and intensive operations. Policy-oriented agricultural insurance can help diversify the risk of natural disasters in the course of agricultural production and reduce the market risk of agricultural price fluctuations. Such an insurance mechanism can effectively encourage agricultural practitioners to increase the area under grain cultivation through land transfer and the reuse of abandoned, uncultivated, or inefficiently used farmland, thus promoting the large-scale operation of agricultural land (Liu, 2010). Based on this, this paper proposes the following Hypothesis 4:

H4: Policy-oriented agricultural insurance can enhance grain production resilience by promoting land transfer.

The trend of structural specialization and division of labor in grain crops not only promotes the increase of China’s total agricultural output value but also improves the level of China’s agricultural production efficiency. The specialization of agricultural production is an important way to form economies of scale in production services and break through the small and fragmented scale of China’s current land operation by farmers (Yang et al., 2019). Additionally, grain cultivation specialization can create certain comparative advantage effects and economies of scale, which can help save production costs, improve production efficiency (Campi et al., 2021), and enhance grain production resilience. Policy-oriented agricultural insurance can significantly increase farmers’ tendency to specialize in planting and weaken diversified planting behavior because it provides risk protection for designated grain crops, reducing the need for diversified planting to mitigate risks, and thus incentivizing farmers to adjust their planting structure and specialize in planting (Chai and Zhang, 2023; Yuan and Xu, 2024). Based on this, this paper proposes the following Hypothesis 5:

H5: Policy-oriented agricultural insurance can enhance grain production resilience by promoting grain cultivation specialization.

4 Materials and methods

4.1 Variable selection

4.1.1 Dependent variable

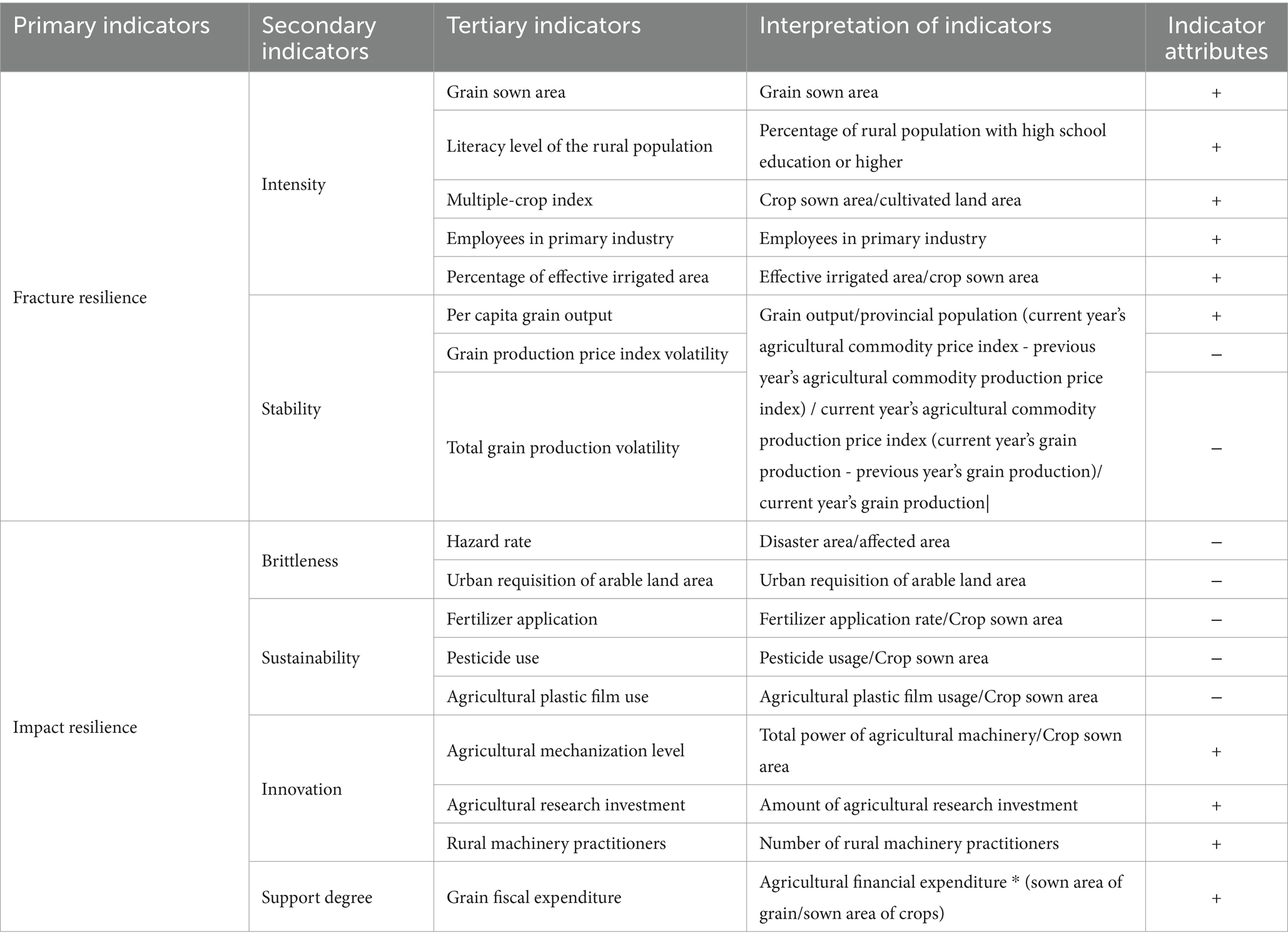

At present, the measurement of grain system resilience in the field of economics mainly relies on the comprehensive indicator system method, with multi-level and multi-angle comprehensive measurement. This paper takes the grain production of China’s provinces as the research object, based on the concept of resilience from physics and engineering, and considers fracture resilience and impact resilience as the two primary indicators to construct the grain production resilience indicator system in a more systematic way.

Grain production fracture resilience contains intensity and stability indicators. Intensity indicates the inherent scale attributes formed in the development process of the research object or system. In this paper, the intensity indicator reflects the capacity of each region in China in grain production. Stability indicates the strength of maintaining the original function and recovery ability. In this paper, the stability indicator reflects the stability of grain production in each region of China within a certain time frame and is an important parameter for comprehensively assessing the stability of grain production. The grain production impact resilience includes indicators of brittleness, sustainability, innovation, and support degree. The brittleness indicator refers to the degree to which resilience is susceptible to loss or damage in the face of external risk shocks. The sustainability indicator measures the impact of grain production activities on the ecosystem. The innovation indicator measures the ability to adjust and renew, and the support degree indicator measures the government’s policy and financial support for grain production activities.

In terms of the assignment method, taking into account objectivity and scientificity, the entropy method is used to assign weights to the indicator system as the final weights. Ultimately, the indicator of grain production resilience in China’s provinces from 2002 to 2021 is measured. The grain production resilience indicators are presented in Table 1.

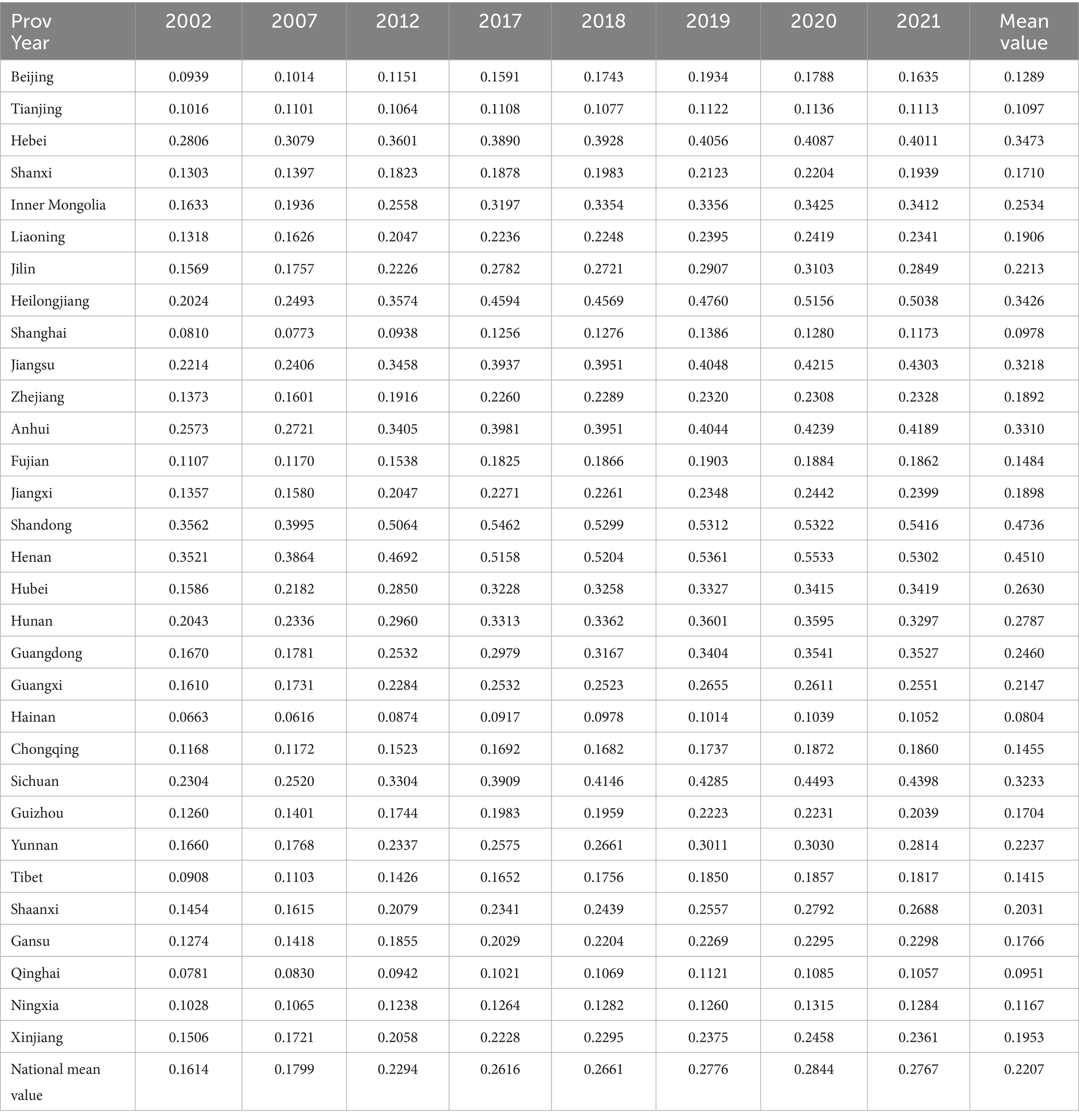

The entropy method is applied to measure the total indicator of grain production resilience of 31 provinces in China from 2002 to 2021, and the results are shown in Table 2. From 2002 to 2021, the grain production resilience in China’s provinces showed a year-on-year increase; however, the overall grain production resilience is generally lower, the year-on-year increase rate is slower, and there is a certain gap between the provinces.

From the perspective of national grain production resilience, the resilience index grew from 0.1614 in 2002 to 0.2207 in 2021, with an average annual growth rate of 2.90%. From the viewpoint of grain production resilience in the provinces, the resilience index also shows a gradual increasing trend. Among them, Shandong (0.4736), Henan (0.4510), Hebei (0.3473), Heilongjiang (0.3426), and other major grain-producing provinces have a higher resilience index. In recent years, the main grain-producing provinces have continued to improve production conditions, significantly enhance production capacity, and strive to develop agricultural demonstration zones and functional grain production zones, taking the lead in modernizing the agricultural system and making great contributions to China’s grain production. Beijing (0.1289), Ningxia (0.1167), Tianjin (0.1097), Shanghai (0.0978), Qinghai (0.0951), Hainan (0.0804), and other provincial-level areas have lower resilience in grain production. On the one hand, grain production in Beijing, Tianjin, Shanghai, and Hainan is limited by the size of the administrative divisions; the degree of urbanization in these areas is high, and land resources are relatively tight, making it difficult to provide sufficient land space for large-scale grain production. On the other hand, although Tibet, Qinghai, Ningxia, and other regions have a vast area, the landscape is dominated by icebergs, hills, and deserts, with insufficient arable land resources and a dry and harsh climate. The conditions of the relevant agricultural infrastructure are poor, and the water conservancy facilities serving agricultural production are backward and cannot meet the needs of agricultural production.

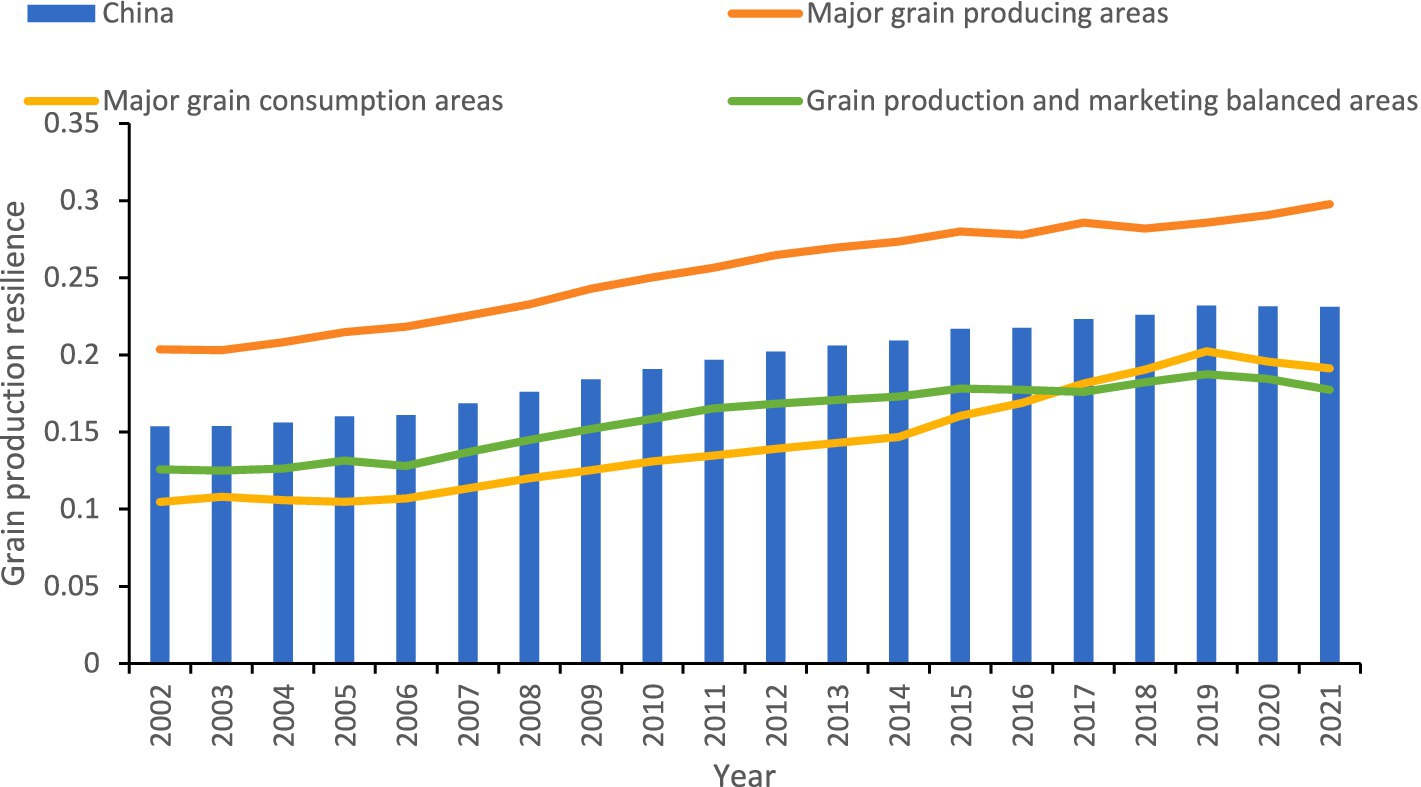

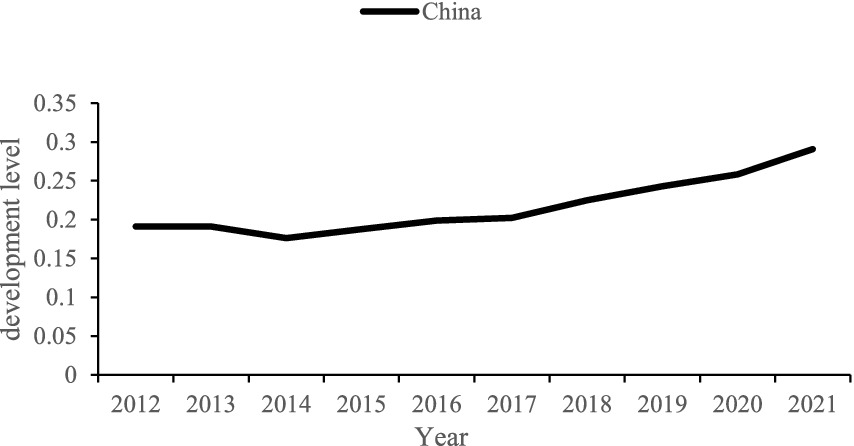

Figure 1 shows the trend of the total indicator of grain production resilience for the whole country and the three major functional grain areas. At the national level, the average value of the total grain production resilience index has shown a year-on-year upward trend, indicating that China’s grain production resilience has gradually increased. However, the overall level of grain production resilience is still on the low side, with greater room for improvement.

From the regional level, the trend of grain production resilience in different grain functional areas is basically the same as that of the whole country, but it shows regional differences. The grain production resilience index of the main grain producing areas rose from 0.2193 in 2002 to 0.3875 in 2021, with an average annual growth rate of 3.07%; the grain production resilience index of the balanced production and marketing areas rose from 0.1268 to 0.2064, with an average annual growth rate of 2.63%; and the grain production resilience index of the main grain marketing areas rose from 0.1083 in 2002 to 0.1813 in 2021, with an average annual growth rate of 2.78%. Specifically, the total level of grain production resilience in the three major grain functional areas, from high to low, is as follows: the main grain producing areas, the production and marketing balance areas, and the main grain marketing areas; the average annual growth rate, from high to low, is as follows: the main grain producing areas, the main grain marketing areas, and the production and marketing balance areas.

The possible reasons for the above differences are the different geographical advantages, resource endowments, transportation infrastructure, and market development in different regions, resulting in a marked difference in the resilience of grain production. The main grain producing areas are rich in natural resources, have well-developed agricultural infrastructures, and have a high degree of organization and scale of grain production, so the level of grain production resilience is higher. The main grain marketing areas are economically developed and have a high level of urbanization, but such characteristics are often accompanied by land resource constraints, making it difficult to provide sufficient land space for large-scale grain production. The balance of production and marketing areas has neither economic nor scientific and technological support to help them, and agricultural resources are relatively scarce, so there is a certain gap in the development of the grain production resilience.

4.1.2 Core explanatory variables

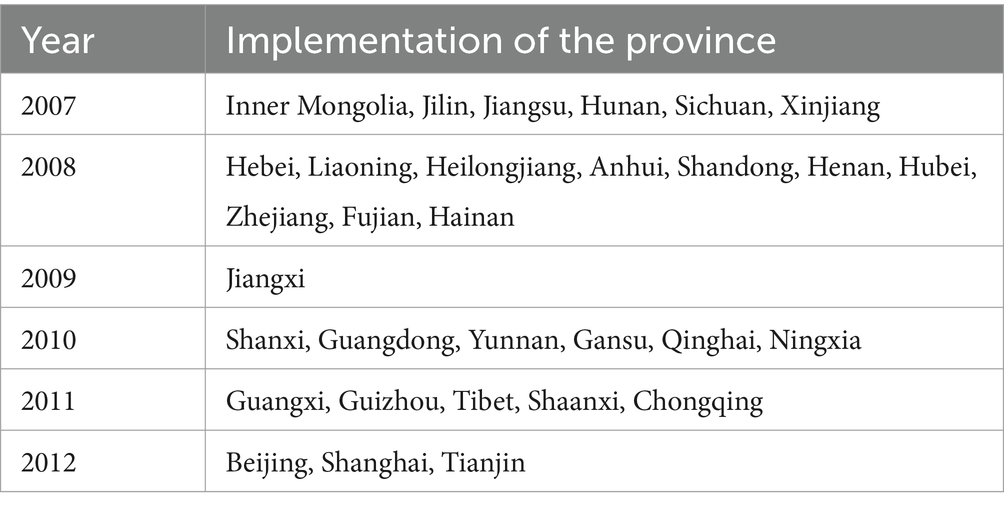

1. Policy-oriented agricultural insurance premium subsidy policy implementation. This paper organizes the implementation time of the central financial agricultural insurance premium subsidy in 31 provinces, as shown in Table 3. Policy dummy variables are constructed based on the timing of the premium subsidy policy in each province, with the dummy variable assigned a value of 0 before the implementation of the subsidy policy in each province and a value of 1 after the implementation of the policy.

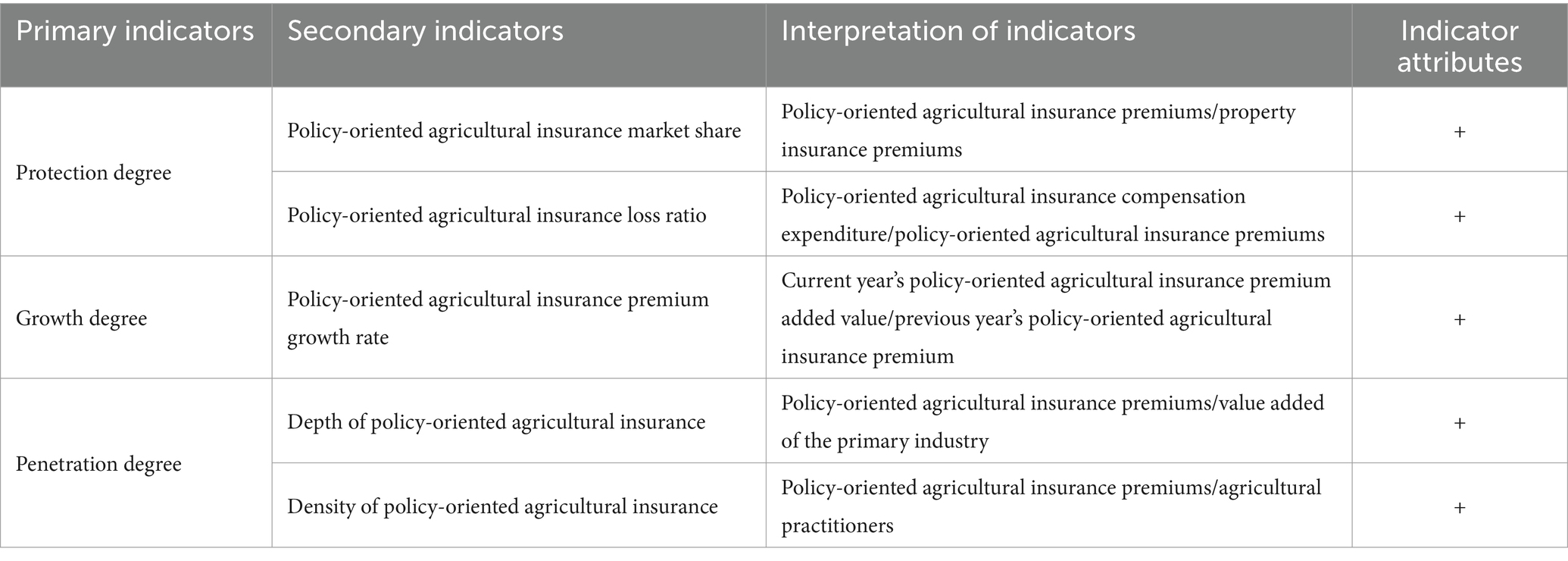

2. Policy-oriented agricultural insurance development level. Scholars mostly use insurance premium income, compensation expenditure, insurance density, and depth as indicators (Missikpode et al., 2019; Tsiboe and Turner, 2023; Xu and Liao, 2014). Compared with single indicators, the comprehensive indicator system is more systematic and comprehensive. This paper selects the protection degree, growth degree, and penetration degree of policy-oriented agricultural insurance as the primary indicators, using the entropy method to measure the policy-oriented agricultural insurance development level in China’s 31 provinces from 2012 to 2021. Specific indicators are shown in Table 4.

Table 3. The point at which provinces implemented the policy of subsidizing premiums for policy-oriented agricultural insurance.

In this paper, the policy-oriented agricultural insurance market share and policy-oriented agricultural insurance payout rate are selected to measure the policy-oriented agricultural insurance protection degree indicators. The policy-oriented agricultural insurance market share is an important indicator reflecting the status of policy-oriented agricultural insurance in the overall agricultural insurance market. A higher market share means that policy-oriented agricultural insurance is more widely accepted and recognized, and more farmers choose to avoid risks through policy-oriented agricultural insurance (Zhang and Jiao, 2022). The high or low payout rate of policy-oriented agricultural insurance directly reflects the ability of policy-oriented agricultural insurance to compensate for farmers’ losses after the occurrence of disasters, and a higher payout rate means that policy-oriented agricultural insurance can provide farmers with timely and full economic compensation when disasters occur (Nannos et al., 2013; Niu and Chen, 2022).

In this paper, the premium growth rate of policy-oriented agricultural insurance is chosen to measure the effectiveness of policy-oriented agricultural insurance. The premium growth rate of policy-oriented agricultural insurance can directly reflect the activity and expansion speed of the agricultural insurance market. The promotion and popularization of policy-oriented agricultural insurance can provide farmers with effective risk protection and reduce economic losses caused by disasters and other factors. Additionally, the improvement of the premium growth rate of policy-oriented agricultural insurance can help enhance the ability of agriculture to withstand risks (Zhang and Jiao, 2022).

The depth and density of policy-oriented agricultural insurance are important indicators for assessing the degree of penetration of agricultural insurance in China’s provincial areas. The depth of policy-oriented agricultural insurance mainly focuses on the ratio of policy-oriented agricultural insurance premiums to the value added of the primary industry. This indicator measures the size of policy-oriented agricultural insurance relative to the overall agricultural economy (Bhuiyan et al., 2022). Policy-oriented agricultural insurance density, on the other hand, is calculated by comparing policy-oriented agricultural insurance premiums to the number of people working in agriculture. It reflects the average share of policy-oriented agricultural insurance costs per agricultural employee, or the degree of insurance coverage received by each agricultural employee (Breckner et al., 2016). The specific indicators are summarized in Table 4.

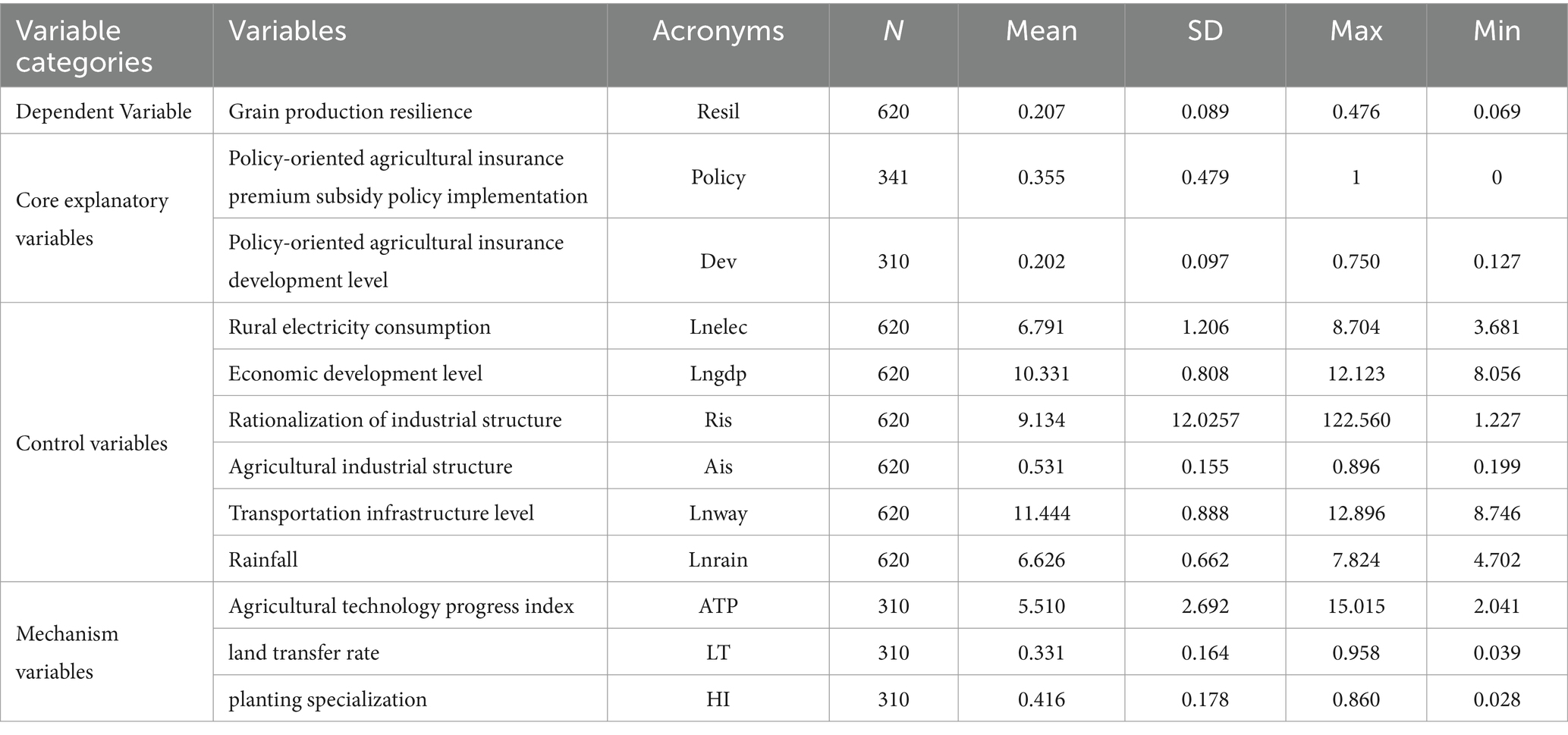

Based on the indicator system and data sources described above, a database for measuring the policy-oriented agricultural insurance development level in China has been established. Following the measurement steps of the entropy method, the index of the policy-oriented agricultural insurance development level in each province of China from 2012 to 2021 has been calculated, and the average has been taken to represent the whole country. Figure 2 shows the policy-oriented agricultural insurance development level in China from 2012 to 2021.

The policy-oriented agricultural insurance development level in China leveled off before 2017, and the policy-oriented agricultural insurance development level has steadily risen after 2017, but the growth has been slow. The reason may be that China’s policy-oriented agricultural insurance started late and is now in the development stage. There is more room for development in terms of coverage, level of protection, penetration rate, and payout efficiency of policy-oriented agricultural insurance.

4.1.3 Control variables

The control variables selected in this article include:

1. Rural electricity consumption. Electricity is an indispensable source of energy in modern agricultural production and is used in all aspects of grain irrigation, harvesting, and processing. The use of electricity in rural areas can improve the efficiency of grain production, reduce labor intensity, and also ensure the continuity and stability of agricultural production (Han et al., 2024; Hao and Tan, 2022).

2. Economic development level. Areas with better economic conditions are able to invest more in agricultural infrastructure, thereby increasing the efficiency and productivity of grain production. Economic development can improve the income level of farmers, enhance their ability to invest in grain production, mitigate production risks, and improve the reliability of the grain supply (Rask and Rask, 2011; Schneider et al., 2011).

3. Rationalization of industrial structure. Rationalization of the industrial structure can improve the efficiency of the use of land, water resources, and labor by optimizing the planting structure within agriculture, thus enhancing the stability of grain production. Drawing on Gan et al. (2011), the level of industrial structure rationalization is measured to control the regional industrial structure.

4. Agricultural industrial structure. Differences in the level of agricultural development and structure across areas lead to inconsistencies in the importance of grain production and production capacity (Zhang et al., 2022). The agricultural industry structure is measured using the proportion of regional agricultural gross output value in the total output value of agriculture, forestry, animal husbandry, and fishery.

5. Transportation infrastructure level. Good transportation networks help to reduce transportation costs and increase farmers’ incomes, thereby providing them with incentives to increase grain production. The level of transport infrastructure is an important condition for the mechanization of agriculture and has a significant impact on grain production resilience (He et al., 2024; Wang et al., 2024c). The level of transportation infrastructure is expressed in terms of road miles.

6. Rainfall. Moderate rainfall is one of the necessary conditions for crop growth, providing plants with essential water that helps with photosynthesis and nutrient uptake. However, too much or too little rainfall can adversely affect grain production. Rainfall is utilized to measure the impact of climatic factors on grain production resilience (Generoso, 2015; Olayide and Alabi, 2018; Sassi and Cardaci, 2013).

4.1.4 Mechanism variables

Based on the analysis of the impact mechanism in the previous paper, this paper adds three mechanism variables: agricultural technology progress index, land transfer rate, and grain cultivation specialization. The agricultural technology progress index (ATP) refers to Tao and Hu (2011), which is measured as follows.

In Equation 1: Where ATPt is the agricultural technological progress index in each province, B denotes the gross agricultural product, A1 is the arable land area, A2 is the number of rural laborers, A3 is the total power of agricultural machinery, and A4 is the quantity of agricultural fertilizers. θ1, θ2, θ3, and θ4 denote the contributions of arable land, rural laborers, agricultural machinery, and agricultural fertilizers to the output, respectively. In Equation 2: In order to estimate the values of the parameters θ1, θ2, θ3, and θ4 of the agricultural production function, the logarithmic regression equation is first established based on the variables selected in this paper.

In Equation 3: Considering the condition of constant returns to scale for the agricultural production function, it needs to be assumed.

The land transfer rate (LT) is expressed by using (area of family-contracted arable land transferred/area of family-contracted operated arable land) (Shi and Zhang, 2022).

The Herfindahl Index (HI) was selected as the index of grain cultivation specialization (Chai and Zhang, 2023), where Si is the proportion of crop i to the total planted area of all examined crops. HI takes a value ranging from 0 to 1, and the larger HI is, the higher the grain planting specialization is proved to be. The calculation was performed as described in Equation 4.

4.2 Data sources

The data for empirical analysis in this study are panel data from 31 provinces in China from 2002 to 2021. The premium subsidy implementation time comes from the Administrative Measures for Pilot Agricultural Insurance Premium Subsidies of the Central Government1 and various notices issued by 31 provinces during 2007–2012 for the implementation of policy-oriented agricultural insurance. The raw data used in this paper mainly come from the patent database of China Knowledge Network2, the China Rural Statistical Yearbook3, the China Financial Yearbook4, the China Agricultural Yearbook5, the China Statistical Yearbook6, and the statistical yearbooks of each region. The data related to policy-oriented agricultural insurance mainly come from the China Insurance Yearbook7 and the official website of the State Administration of Financial Supervision and Administration of the People’s Republic of China8.

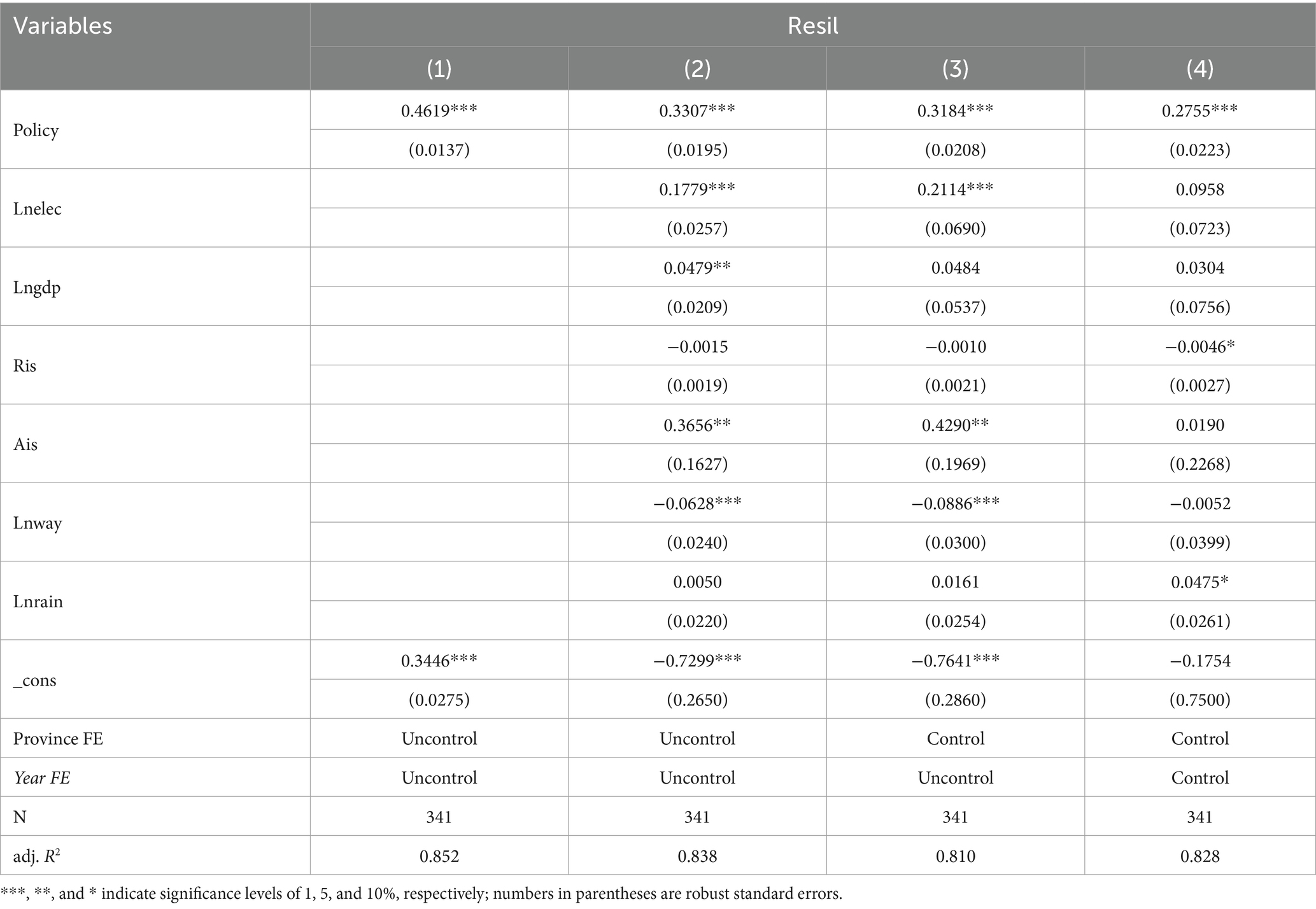

In order to eliminate the problem of heteroskedasticity that exists and to make the data smoother, some of the variables are logarithmized in this paper. The descriptive statistics of the relevant variables are shown in Table 5.

4.3 Model construction

This paper analyzes the impact of policy-oriented agricultural insurance on grain production resilience from the aspects of insurance policy implementation and insurance development level. Due to the difference in the year of implementation of policy-oriented agricultural insurance in different provinces, this paper constructs a multi-period difference-in-difference (DID) model to test the impact of the implementation of the policy-oriented agricultural insurance premium subsidy policy on grain production resilience. The model is constructed as follows:

In Equation 5: Yit denotes the grain production resilience indicator of province i in year t; Policyit is the core explanatory variable, where Policyit = 1 if province i implemented the insurance premium subsidy policy in year t, and otherwise Policyit = 0. λ1 is the treatment effect of the estimated coefficients; Controlsit represents the control variables affecting grain production resilience, as shown in Table 5; δi is the province fixed effect; γt is the time fixed effect; and ℇit is the random disturbance term. The policy-oriented agricultural insurance pilot started in 2007, and the pilot extension was gradually progressive over time, until 2012 when full coverage was realized in 31 provinces. Therefore, this paper uses provincial panel data from 2002 to 2012 to fit Equation 5.

In 2012, the policy-oriented agricultural insurance pilot was fully implemented in 31 provinces across the country. In order to ensure data completeness, this paper uses provincial panel data from 2012 to 2021 to fit Equation 6. This analysis aims to examine the impact of policy agricultural insurance development level on grain production resilience. The model is constructed as follows:

In Equation 6, Yit denotes the grain production resilience of province i in year t; Devit represents the policy-oriented agricultural insurance development level, and the coefficient β1 is the impact of policy-oriented agricultural insurance development on grain production resilience. Controlsit represents the control variables; δi is a province fixed effect; γt is a time fixed effect; and ℇ2it is a random perturbation term.

5 Results and discussion

5.1 Analysis of the impact of the implementation of policy-oriented agricultural insurance on grain production resilience

5.1.1 Benchmark regression

Table 6 shows the results of the benchmark regression of the impact of the implementation of the policy-oriented agricultural insurance premium subsidy policy on grain production resilience. Column (1) in Table 6 indicates the impact of the implementation of the agricultural insurance premium subsidy policy on grain resilience when control variables are not considered. Columns (2) to (4) incorporate control variables, with Column (2) not controlling for province fixed effects and time fixed effects, Column (3) controlling for province fixed effects only, and Column (4) controlling for both province fixed effects and time fixed effects. The explanatory variables in Columns (1) to (4) are all significant at the 1% level, and the estimated coefficients are all positive.

This paper analyzes column (4). According to column (4), the estimated coefficient of the policy-oriented agricultural insurance premium subsidy policy implementation is 0.2755, which implies that there is a significant positive impact of the policy-oriented agricultural insurance policy implementation on grain production resilience. The policy-oriented agricultural insurance policy implementation can enhance grain production resilience, and H1 is verified in this study.

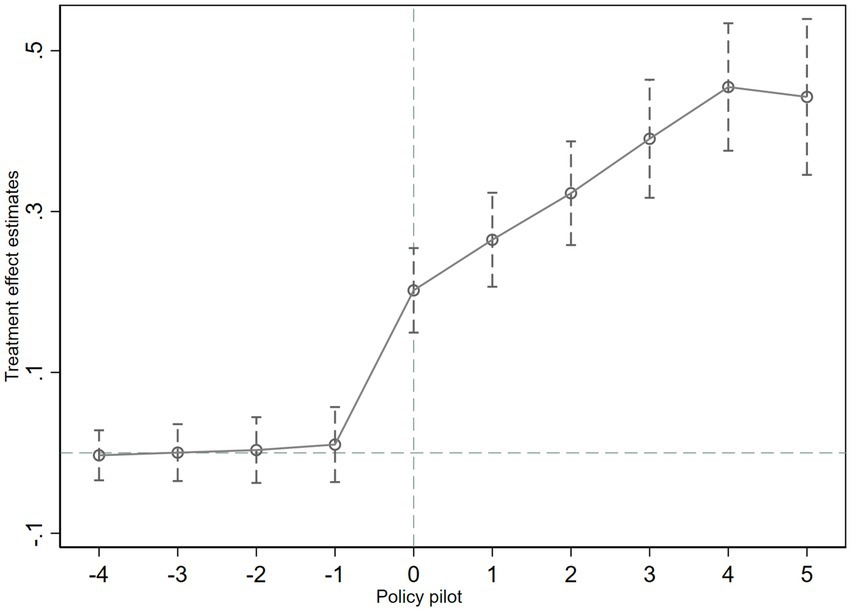

5.1.2 Parallel trend test

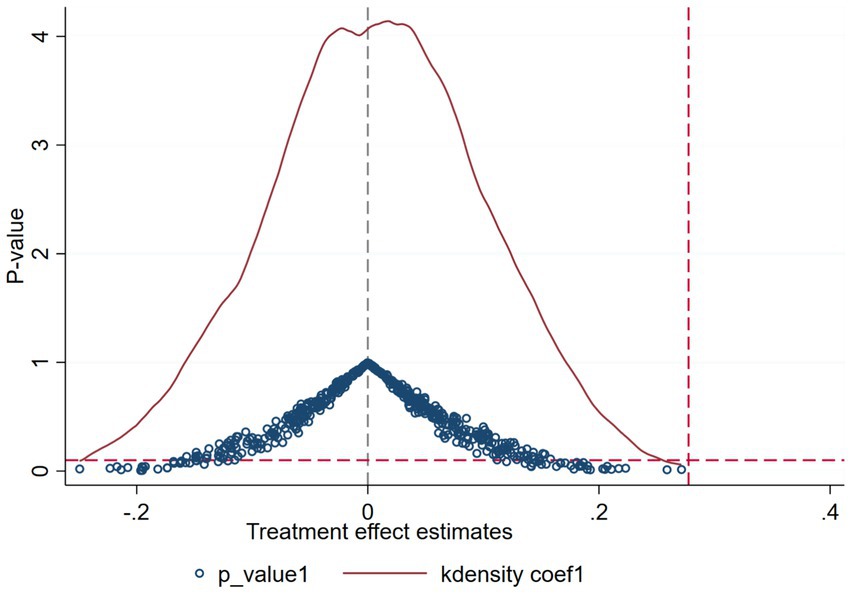

This paper draws preliminary conclusions on the impact of policy-oriented agricultural insurance subsidy policy on grain production resilience through the multi-period difference-in-difference method (DID), but the robustness of this conclusion still needs to be further confirmed. The multi-period difference-in-difference method (DID) requires the fulfillment of the parallel trend assumption that pilot and non-pilot provinces have similar trends when they are not subject to policy shocks. To test this key assumption, this paper conducts a parallel trend test, the results of which are shown in Figure 3.

As can be seen from Figure 3, before the implementation of the insurance premium subsidy policy, none of the estimated coefficients is significantly different from zero, indicating that there is no significant difference between the grain production resilience of pilot and non-pilot provinces, which satisfies the parallel trend assumption. After the implementation of the insurance premium subsidy policy, the estimated coefficients rise significantly, indicating that the agricultural insurance premium subsidy policy has a contributing impact on grain production resilience, which strengthens the robustness of the conclusions of this paper.

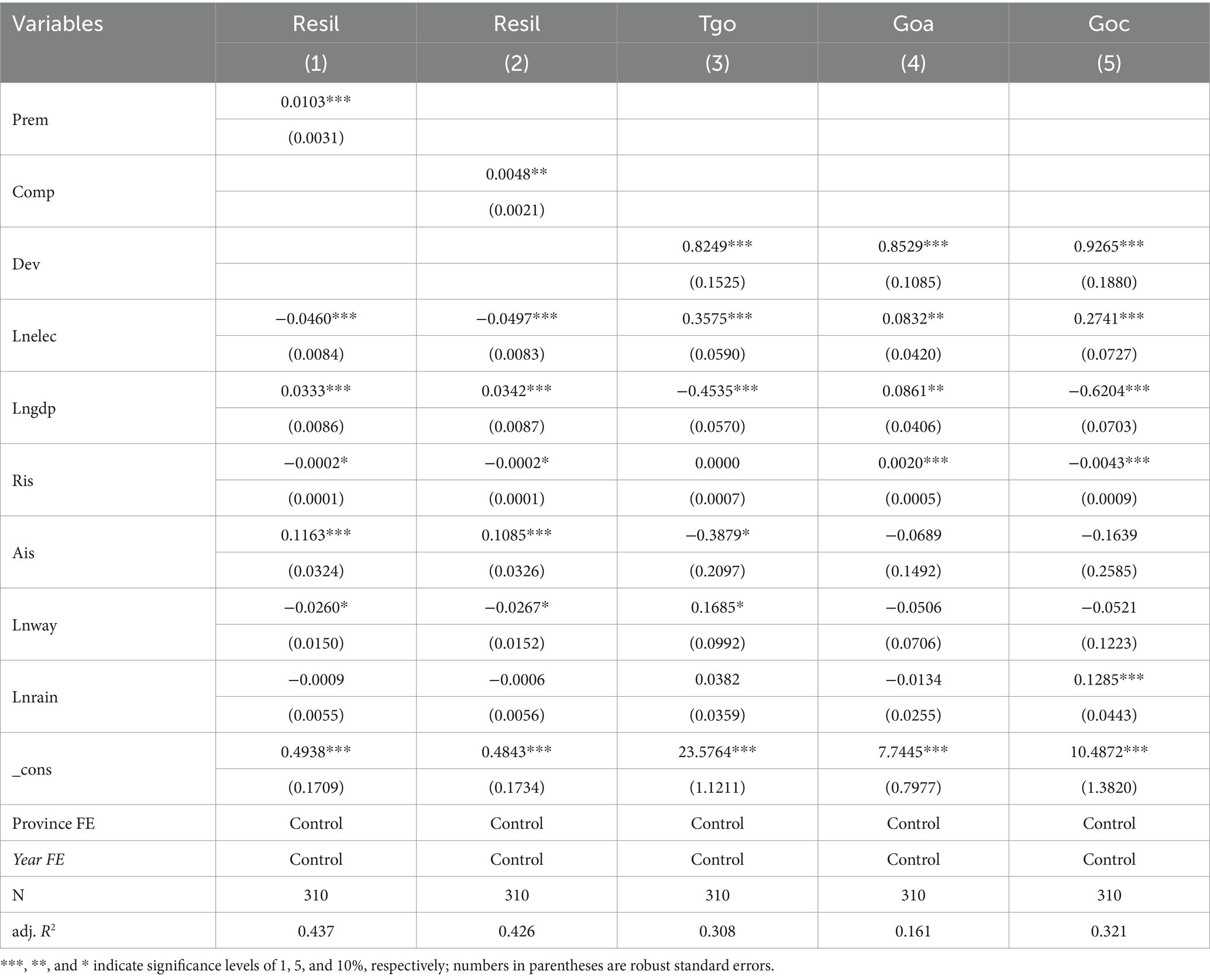

5.1.3 Placebo test

In order to test that the impact of the implementation of the policy-oriented agricultural insurance subsidy policy on grain production resilience is not interfered with by individual and time factors, this paper implements a rigorous placebo test. In the placebo test, the method of constructing “pseudo-dummy variables” by randomly sampling 500 times is mainly used to re-estimate the regression of model (5), through which we can observe the significance and distribution of regression coefficients. Figure 4 shows the estimation results of the pseudo-policy regression, where the horizontal axis represents the regression coefficients of the pseudo-policy dummy variables on grain production resilience, and the vertical axis shows the corresponding p-value size. According to Figure 4, the estimated coefficients of the real policy variables are significantly larger than those of the pseudo-policy variables, and the mean of the estimated coefficients of the pseudo-policy variables is close to 0, which is normally distributed. Most of the p-values are larger than 0.1, which does not pass the significance level test. The placebo test was passed, and the conclusion that the impact of the policy on grain production resilience was not caused by other random factors is reliable.

5.2 Analysis of the impact of policy-oriented agricultural insurance development level on grain production resilience

5.2.1 Benchmark regression

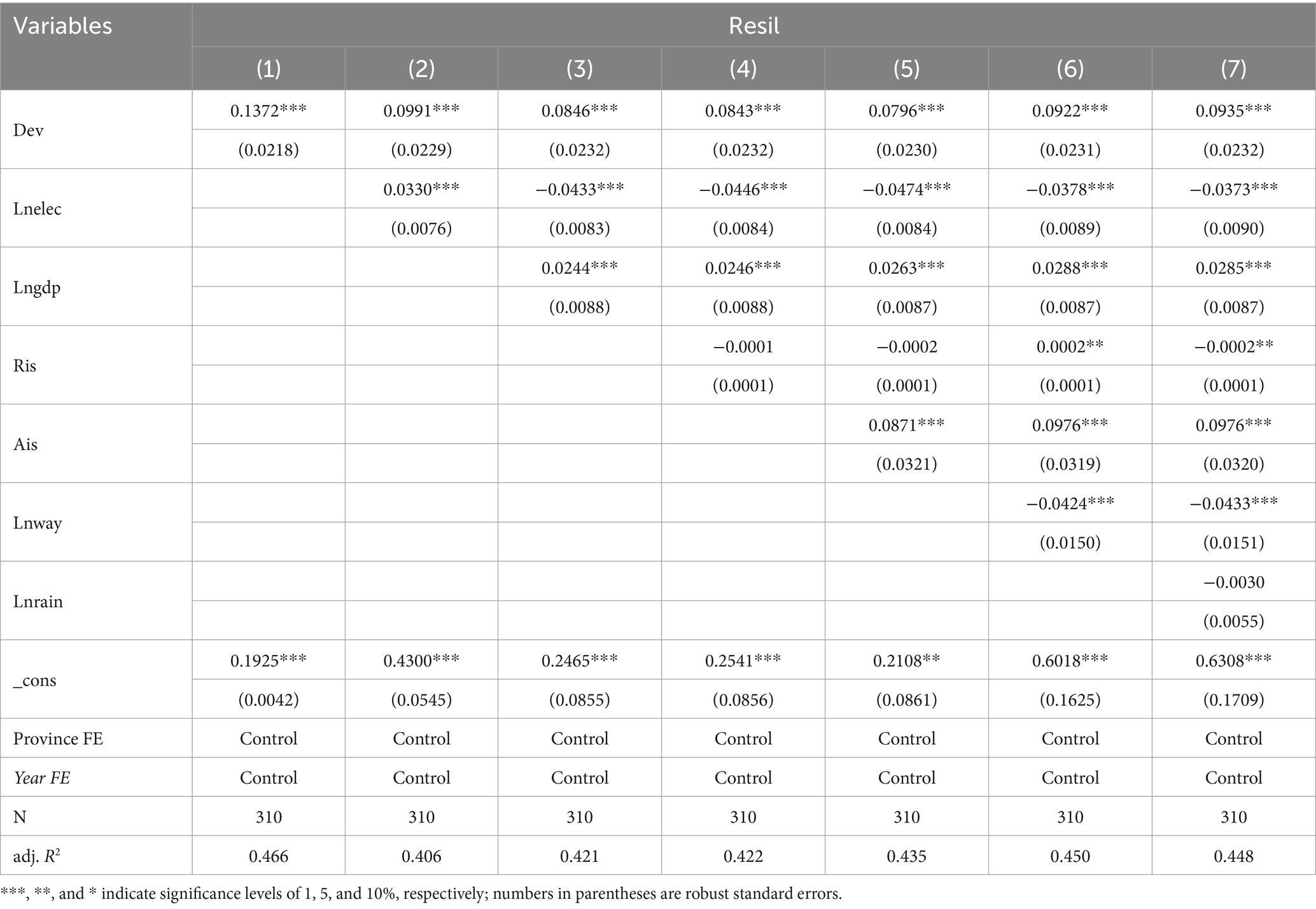

Table 7 presents the results of the benchmark regression estimates of the impact of the policy-oriented agricultural insurance development level on grain production resilience, controlling for province fixed effects and time fixed effects. Columns (1) to (7) show the regression results of the impact of the policy-oriented agricultural insurance development level on grain production resilience obtained by gradually adding control variables. It can be found that the coefficient of the core explanatory variable, the policy-oriented agricultural insurance development level, is always significantly positive, indicating that, at the national level, policy-oriented agricultural insurance has a significant positive effect on grain production resilience.

Table 7. The impact of insurance development level on grain production resilience: benchmark regression.

In column (1), without adding control variables, the estimated coefficient of the policy agricultural insurance development level is 0.1372 at the 1% significance level. In column (7), after adding all the control variables, the sign of the estimated coefficient of the policy-oriented agricultural insurance development level does not change, and at the 1% significance level, the policy agricultural insurance development level is still manifested as promoting grain production resilience. The above relationship between agricultural insurance development level and grain production resilience initially proves the explanatory power of H2.

5.2.2 Robustness test

In order to test the stability of the relationship between the variables, a robustness test is conducted by changing the statistical expressions of the dependent variables and core explanatory variables, as shown in Table 8. Columns (1) and (2) report the results of the robustness test by replacing the core explanatory variables, in which the core explanatory variable in Column (1) is the policy-oriented agricultural insurance premiums (Prem). According to Column (1), the effect of the policy-oriented agricultural premium on grain production resilience is significant at the 1% statistical level, and the coefficient is 0.0103, proving that the pre-disaster risk diversification effect of policy-oriented agricultural insurance development promotes grain production resilience. By the end of 2022, China’s policy-oriented agricultural insurance depth reaches 1.38%, and the insurance density reaches 690.3 yuan per capita. The targets of agricultural insurance depth of 1% and agricultural insurance density of 500 yuan per capita by 2022, as set out in the Guiding Opinions on Accelerating the High-Quality Development of Agricultural Insurance, have both been exceeded. Column (2) shows that the impact of policy-oriented agricultural insurance post-disaster compensation (Comp) on grain production resilience is significant at the 1% statistical level, and the estimated coefficient is 0.0048, proving that the post-disaster loss compensation effect of policy-oriented agricultural insurance development promotes grain production resilience. Overall, the pre-disaster risk diversification effect of policy-oriented agricultural insurance is greater than the post-disaster loss compensation effect.

Columns (3) to (5) report the results of the robustness test for the replacement of the core explanatory variables, which are total grain output (Tgo), grain output per unit area (Goa), and grain output per capita (Goc) in Columns (3) to (5). The estimated coefficients on the policy-oriented agricultural insurance development level are all significantly positive at the 1% level, consistent with the results of the benchmark regression, indicating the robustness of the results on the positive effect of policy-oriented agricultural insurance on grain production resilience.

5.2.3 Heterogeneity analysis

China has implemented a grain security guarantee mechanism based on functional zoning, which divides the country’s 31 provinces into major grain producing areas, major grain consumption areas, and grain production and marketing balanced areas, based on natural geography as well as differences in location. Then, does the degree of impact of policy-oriented agricultural insurance on the resilience of grain production vary? Building on this, this paper further analyzes each of the three major grain functional areas.

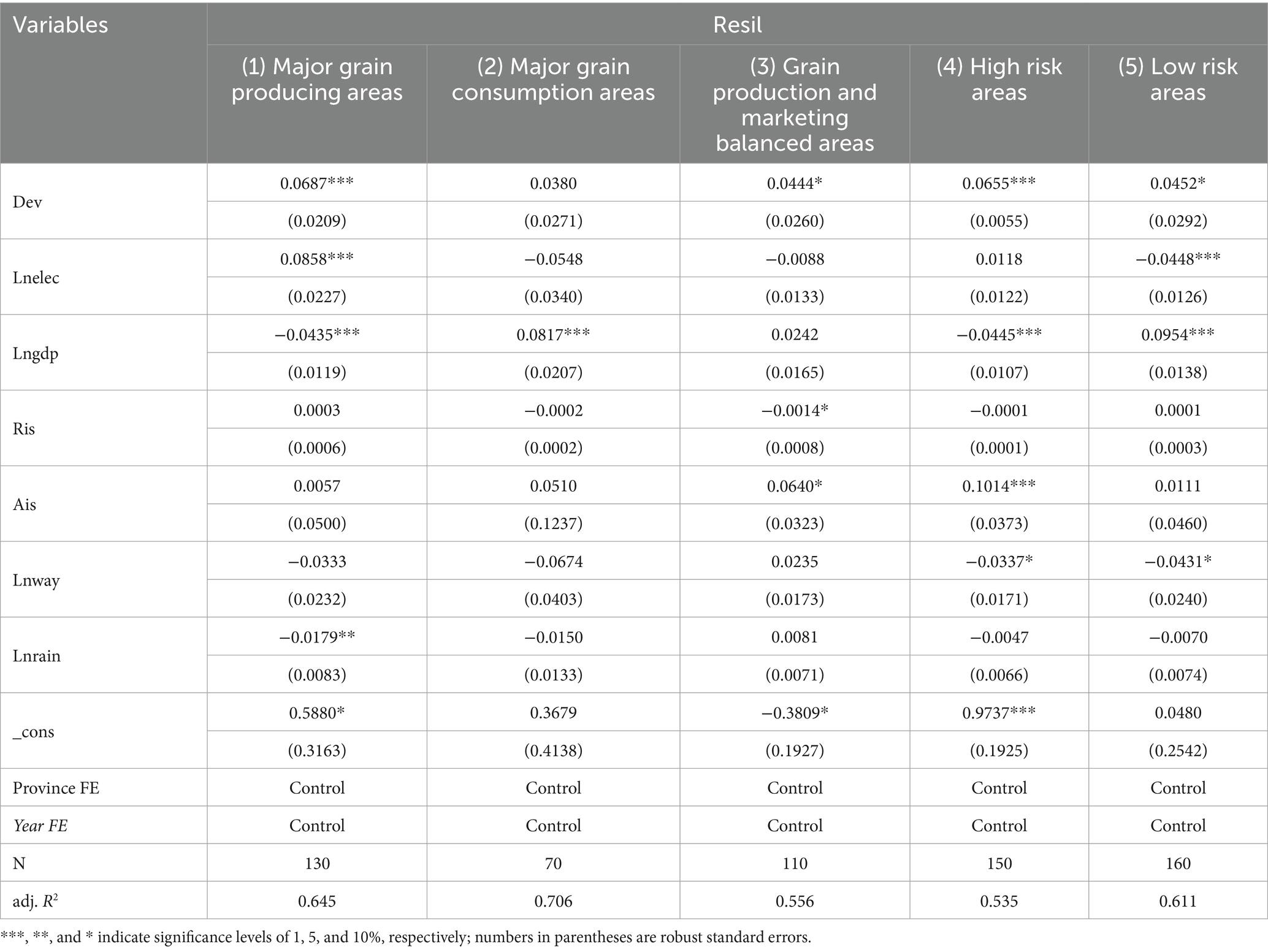

Table 9 reports the estimated results of the heterogeneity analysis of the policy-oriented agricultural insurance development level on grain production resilience. Columns (1) to (3) are grouped regressions based on the categorization of the three major grain functional areas. In this paper, group regressions are conducted for major grain producing areas, major grain consumption areas, and grain production and marketing balanced areas. From the regression results, the impact of the policy-oriented agricultural insurance development level on grain production resilience in major grain producing areas and the grain production and marketing balanced areas is significantly positive at the 1% level and the 10% level, respectively, while the regression results for major grain consumption areas are not significant. From the estimated coefficient values, the impact of the policy-oriented agricultural insurance development level on grain production resilience is higher in grain producing areas than in non-major grain producing areas because grain producing areas usually concentrate a large amount of agricultural resources and production activities. Therefore, agricultural production in these areas is more sensitive to natural conditions and market fluctuations, and agricultural insurance in grain producing areas usually has a higher participation rate and coverage, which allows the insurance mechanism to play a greater role in the event of risks. At the same time, agricultural insurance in major grain producing areas often first receives policy support and subsidies from the government, and government support enables agricultural insurance to be implemented more intensively in grain producing areas, thus enhancing grain production resilience.

Table 9. The impact of insurance development level on grain production resilience: heterogeneity analysis.

According to the magnitude of the disaster rate, provincial administrative divisions in our 31 provinces, municipalities, and autonomous areas where the disaster rate is higher than the average are categorized as high risk areas, while provincial administrative divisions where the disaster rate is lower than the average are categorized as low risk areas. The provincial administrative divisions of China’s 31 provinces, municipalities, and autonomous areas with disaster rates higher than the average are categorized as high risk areas, and those lower than the average are categorized as low risk areas. As shown in Table 9, Column (4) and Column (5), the impact of the policy-oriented agricultural insurance development level on grain production resilience in high risk areas and low risk areas is significant at the 1 and 10% levels, respectively. In high risk areas, the impact of policy-oriented agricultural insurance is better, which proves that the impact of policy-oriented agricultural insurance on grain production resilience in the severely affected areas is more pronounced than that in the less severely affected areas.

5.2.4 Mechanism analysis

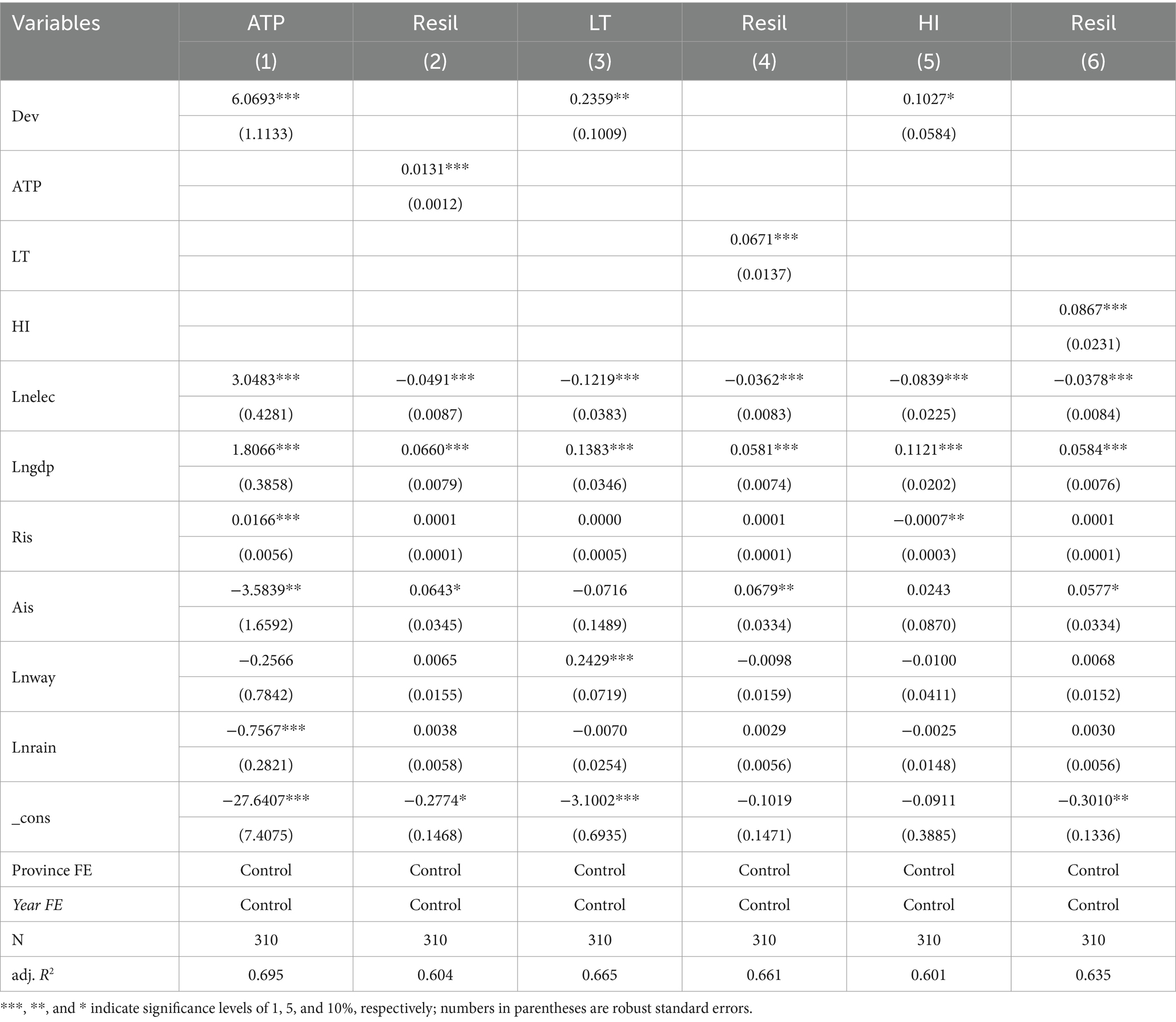

According to the theory in the previous section, policy-oriented agricultural insurance can contribute to grain production resilience by influencing agricultural technological progress, land transfer, and grain cultivation specialization. Based on this, this part will try to test the above potential impact mechanisms. When the mechanism variable is M, the first stage should first test the impact of the core explanatory variable X on M, and the second stage should test the impact of the mechanism variable M on the dependent variable Y.

Column (1) of Table 10 demonstrates the estimation results of the policy-oriented agricultural insurance development level on agricultural technological progress, and the results demonstrate that the estimated coefficient of the policy-oriented agricultural insurance development level is 6.0693 and passes the test of significance at the 1% level. This indicates that the policy-oriented agricultural insurance development improves agricultural technological progress. The paper goes on to test the impact of agricultural technological progress on grain production resilience, and the results in column (2) show that the estimated coefficient of agricultural technological progress is 0.0131 and passes the significance test at the 1% level. This suggests that the policy-oriented agricultural insurance development level contributes to grain production resilience by affecting agricultural technology progress. H3 is tested.

Table 10. The impact of insurance development level on grain production resilience: mechanism analysis.

Column (3) demonstrates the estimation results of the policy-oriented agricultural insurance development level on the land transfer rate, and the results show that the estimated coefficient of the policy-oriented agricultural insurance development level is 0.2359, passing the test of significance at the 5% level. This indicates that policy-oriented agricultural insurance development increases the land transfer rate. The paper goes on to test the impact of land transfer on grain production resilience, and the results in column (4) show that the estimated coefficient of the land transfer rate is 0.0671, passing the significance test at the 1% level. This indicates that the policy-oriented agricultural insurance development level contributes to grain production resilience by affecting land transfer. H4 is tested.

Column (5) demonstrates the estimation results of the policy-oriented agricultural insurance development level on grain cultivation specialization, and the results demonstrate that the estimated coefficient of the policy-oriented agricultural insurance development level is 0.1027 and passes the test of significance at the 10% level. This indicates that policy-oriented agricultural insurance development has increased the level of grain cultivation specialization. This paper goes on to test the impact of grain cultivation specialization on grain production resilience, and the results in column (6) show that the estimated coefficient of grain cultivation specialization is 0.0871 and passes the significance test at the 1% level. This suggests that the policy-oriented agricultural insurance development level contributes to grain production resilience by affecting land transfer. H5 is tested.

6 Conclusions and policy recommendations

The purpose of this paper is to analyze how policy-oriented agricultural insurance affects and enhances grain production resilience, and then empirically verify and analyze this theoretical framework through actual data. This paper takes of grain production resilience in each province of China as the research object, based on the concept of resilience in physics and engineering, and considers fracture resilience and impact resilience as the two primary indicators. It constructs the indicator system of grain production resilience and measures the indicator of grain production resilience in each province of China during the period of 2002–2021. On this basis, the impact of policy-oriented agricultural insurance premium subsidy policy on grain production resilience is tested using provincial panel data from 2002 to 2012. As the policy-oriented agricultural insurance premium subsidy policy was comprehensively implemented nationwide in 2012, a system for assessing the policy-oriented agricultural insurance development level was established. This system was tested using provincial panel data from 2012 to 2021.The policy-oriented agricultural insurance development level indicator system was designed to evaluate the impact of the policy-oriented agricultural insurance development level on grain production resilience, utilizing the provincial panel data from 2012 to 2021.

The study found that: firstly, the implementation of the policy-oriented agricultural insurance premium subsidy policy significantly enhances grain production resilience and passes the parallel trend test and the placebo test; secondly, the policy-oriented agricultural insurance development has an enhancing impact on grain production resilience and passes the robustness test, but the impact of insurance payout on grain production resilience in terms of compensation for post-disaster loss is weaker; thirdly, in the analysis of heterogeneity, the impact of the policy-oriented agricultural insurance development level on grain production resilience is higher in major grain producing areas than in non-major grain producing areas, and the impact of policy-oriented agricultural insurance on grain production resilience is more obvious in high risk areas than in low risk areas; finally, the results of the mechanism test show that policy-oriented agricultural insurance can positively impact grain production resilience by improving agricultural technological progress, land transfer, and grain cultivation specialization. Based on the above conclusions, this paper draws the following policy implications:

First, the agricultural insurance subsidy policy should be gradually improved. As far as the scope of policy-oriented agricultural insurance subsidies is concerned, there is a single method of subsidization, and the amount of subsidies is so low that it can only be used for part of the physical costs and does not cover the full costs. Therefore, it is suggested that the support for policy-oriented agricultural insurance should be increased. First of all, under the circumstance that the total amount of subsidies remains unchanged, the direction of subsidy funds can be appropriately adjusted to increase the subsidy funds for policy insurance and reduce the funds for direct agricultural subsidies. Alternatively, in the case of increasing the total amount of subsidies, the amount of agricultural direct subsidies will remain unchanged, and the amount of policy-oriented agricultural insurance subsidies will be increased. Once again, it is necessary to change the method of agricultural insurance subsidy and increase the support for operation and management costs as well as reinsurance costs. Finally, the financial subsidies should be directed toward important agricultural products, as well as functional grain production zones or large grain producing provinces.

Second, expand the coverage of policy-oriented agricultural insurance to enhance grain production resilience. Adjust the policy-oriented agricultural insurance business philosophy around the diversified needs of grain production risk protection, transforming from the traditional planting industry’s “small agricultural insurance” to the comprehensive “big agricultural insurance” concept that covers the entire process of grain production safety and security. Shift from “after-the-fact claims” to a proactive approach of “before disaster prevention, loss reduction, and claims after the event” in the whole process of risk management. Transition from insuring grain quantity risk to insuring multi-dimensional risks, including grain quantity, quality, and ecological factors. At the same time, increase the variety of insurance products to cover more grain crops and agricultural risks, ensuring that farmers are protected against natural disasters and market fluctuations.

Third, enhance the directionality of agricultural insurance policies. First, differentiate between different areas of land and different levels of coverage; special insurance policies should be formulated for different grain functional areas to encourage and support farmers in adopting advanced planting techniques and improving grain production and quality. Second, agricultural insurance products should be designed to optimize agricultural insurance financial subsidy policies and operation modes, to give full play to the synergistic effects of policy-oriented agricultural insurance and capital, land, and technology, and to attract more factors of production to be deployed in the agricultural sector through insurance products, to promote the transfer of land and large-scale operations, as well as to support the innovation and application of agricultural science and technology, in order to increase grain production resilience.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found at: China Statistical Yearbook (see footnote 6), China Rural Statistical Yearbook (see footnote 3), China Financial Yearbook (see footnote 4), China Agricultural Yearbook (see footnote5), and China Insurance Yearbook (see footnote 7).

Author contributions

TZ: Conceptualization, Funding acquisition, Project administration, Resources, Supervision, Validation, Visualization, Writing – review & editing. GZ: Data curation, Formal analysis, Investigation, Methodology, Software, Writing – original draft.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This work was supported by the Hebei Provincial Social Science Fund, grant number HB22YJ050; and the Funded Projects of Key Research Bases of Humanities and Social Sciences in Higher Educational Institutions in Hebei Province, grant number JJ2307.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^Administrative Measures for Pilot Agricultural Insurance Premium Subsidies of the Central Government: https://www.mof.gov.cn/gkml/caizhengwengao/caizhengbuwengao2007/caizhengbuwengao20077/200805/t20080519_26640.htm

2. ^China Knowledge Network: https://kns.cnki.net/kns/advsearch?dbcode=SCOD

3. ^China Rural Statistical Yearbook: https://data.cnki.net/yearBook/single?id=N2024010048&pinyinCode=YMCTJ

4. ^China Financial Yearbook: https://data.cnki.net/yearBook/single?id=N2024010159&pinyinCode=YZGCZ

5. ^China Agricultural Yearbook: https://data.cnki.net/yearBook/single?id=N2024081134&pinyinCode=YZGNV

6. ^China Statistical Yearbook: https://data.cnki.net/yearBook/single?nav=%E7%BB%9F%E8%AE%A1%E5%B9%B4%E9%89%B4&id=N2024110295&pinyinCode=YINFN

7. ^China Insurance Yearbook: https://data.cnki.net/yearBook/single?id=N2024091943&pinyinCode=YXCVB

8. ^The official website of the State Administration of Financial Supervision and Administration of the People’s Republic of China: https://www.cbirc.gov.cn/cn/view/pages/index/index.htmlViewless

References

Abdi, M. J., Raffar, N., Zulkafli, Z., Nurulhuda, K., Rehan, B. M., Muharam, F. M., et al. (2022). Index-based insurance and hydroclimatic risk management in agriculture: a systematic review of index selection and yield-index modelling methods. Int. J. Disaster Risk Reduc. 67:102653. doi: 10.1016/j.ijdrr.2021.102653

Adzawla, W., Kudadze, S., Mohammed, A. R., and Ibrahim, I. I. (2019). Climate perceptions, farmers’ willingness-to-insure farms and resilience to climate change in northern region, Ghana. Environ. Dev. 32:100466. doi: 10.1016/j.envdev.2019.100466

Akinrinola, O. O., and Okunola, A. M. (2014). Evaluation of effects of agricultural insurance scheme on agricultural production in Ondo state. Russian J. Agric. Soc. Econ. Sci. 28, 3–8. doi: 10.18551/rjoas.2014-04.01

Alam, A. S. A. F., Begum, H., Masud, M. M., Al-Amin, A. Q., and Filho, W. L. (2020). Agriculture insurance for disaster risk reduction: a case study of Malaysia. Int. J. Disaster Risk Reduc. 47:101626. doi: 10.1016/j.ijdrr.2020.101626

Araya, A., Kisekka, I., Gowda, P. H., and Prasad, P. V. V. (2018). Grain sorghum production functions under different irrigation capacities. Agric. Water Manag. 203, 261–271. doi: 10.1016/j.agwat.2018.03.010

Béné, C., Frankenberger, T. R., Nelson, S., Constas, M. A., Collins, G., Langworthy, M., et al. (2023). Food system resilience measurement: principles, framework and caveats. Food Secur. 15, 1437–1458. doi: 10.1007/s12571-023-01407-y

Bhuiyan, M. A., Davit, M., XinBin, Z., and Zurong, Z. (2022). The impact of agricultural insurance on farmers' income: Guangdong Province (China) as an example. PLoS One 17:e0274047. doi: 10.1371/journal.pone.0274047

Bouteska, A., Sharif, T., Bhuiyan, F., and Abedin, M. Z. (2024). Impacts of the changing climate on agricultural productivity and food security: evidence from Ethiopia. J. Clean. Prod. 449:141793. doi: 10.1016/j.jclepro.2024.141793

Breckner, M., Englmaier, F., Stowasser, T., and Sunde, U. (2016). Resilience to natural disasters — insurance penetration, institutions, and disaster types. Econ. Lett. 148, 106–110. doi: 10.1016/j.econlet.2016.09.023

Campi, M., Dueñas, M., and Fagiolo, G. (2021). Specialization in food production affects global food security and food systems sustainability. World Dev. 141:105411. doi: 10.1016/j.worlddev.2021.105411

Cha, J., Deng, Y., Zheng, S., and Li, F. (2024). Crop insurance, factor allocation, and farmers’ income: evidence from Chinese pear farmers. Front. Sust. Food Syst. 8:1378382. doi: 10.3389/fsufs.2024.1378382

Chai, Z., and Zhang, X. (2023). The impact of agricultural insurance on planting structure adjustment—an empirical Study from Inner Mongolia Autonomous Region, China. Agriculture 14:41. doi: 10.3390/agriculture14010041

Chen, L., Xia, X., Zhang, J., Zhu, Y., Long, C., Chen, Y., et al. (2024). The food security risks in the Yangtze River Delta of China associated with water scarcity, grain production, and grain trade. Sci. Total Environ. 948:174863. doi: 10.1016/j.scitotenv.2024.174863

Fang, L., Hu, R., Mao, H., and Chen, S. (2021). How crop insurance influences agricultural green total factor productivity: evidence from Chinese farmers. J. Clean. Prod. 321:128977. doi: 10.1016/j.jclepro.2021.128977

Fei, R., Lin, Z., and Chunga, J. (2021). How land transfer affects agricultural land use efficiency: evidence from China’s agricultural sector. Land Use Policy 103:105300. doi: 10.1016/j.landusepol.2021.105300

Fu, L. W., and Qin, T. J. C. P. R. E. (2022). The income-increasing effect of agricultural insurance and its mechanism. China Popul. Resour. Environ. 32, 153–165. doi: 10.12062/cpre.20220509

Gan, C., Zheng, R., and Yu, D. (2011). An empirical study on the effects of industrial structure on economic growth and fluctuations in China. Econ. Res. J. 46, 4–16.

Generoso, R. (2015). How do rainfall variability, food security and remittances interact? The case of rural Mali. Ecol. Econ. 114, 188–198. doi: 10.1016/j.ecolecon.2015.03.009

Habtemariam, L. T., Will, M., and Müller, B. (2021). Agricultural insurance through the lens of rural household dietary diversity. Glob. Food Sec. 28:100485. doi: 10.1016/j.gfs.2020.100485

Han, G., Cui, W., Chen, X., and Gao, Q. (2024). The sustainability of grain production: the impact of agricultural productive services on farmers’ grain profits. Front. Sust. Food Syst. 8:1430643. doi: 10.3389/fsufs.2024.1430643

Hao, A., and Tan, J. (2022). Impact of digital rural construction on food system resilience. J. South China Agric. Univ. 21, 10–24. doi: 10.7671/j.issn.1672-0202.2022.03.002

He, J., Zhang, Z., Tan, Z., and Zheng, S. (2024). Analyzing the transportation infrastructure–rural industry integration relationship in China. Chin. J. Pop. Res. Environ. 22, 157–166. doi: 10.1016/j.cjpre.2024.06.006

Hou, D., and Wang, X. (2024). Unveiling the role of agricultural insurance in driving rural industry revitalization in China. Heliyon. 10:e34483. doi: 10.1016/j.heliyon.2024.e34483

Jiang, H., Chen, Y., and Liu, Z. (2023). Spatiotemporal pattern and influencing factors of grain production resilience in China. Econ. Geogr. 43, 126–134. doi: 10.15957/j.cnki.jjdl.2023.06.013

Jónsdóttir, S., and Gísladóttir, G. (2023). Land use planning, sustainable food production and rural development: a literature analysis. Geography Sust. 4, 391–403. doi: 10.1016/j.geosus.2023.09.004

Lee, C.-C., and Song, T. (2024). Green finance and food production: evidence from cities in China. J. Clean. Prod. 458:142423. doi: 10.1016/j.jclepro.2024.142423

Li, Y., Liu, Q., Zhang, Y., Han, J., Li, M., and Li, T. (2023). Situational deductions and emergency decisions in response to food quality and safety emergencies in food production enterprises. J. Clean. Prod. 430:139651. doi: 10.1016/j.jclepro.2023.139651

Liu, Z. (2010). Interaction relationship between agricultural insurance and transfer of land contract rights based on game analysis of farmer selection. Agric. Sci. Procedia. 1, 187–192. doi: 10.1016/j.aaspro.2010.09.023

Liu, W., and Sun, R. (2016). The transmission mechanism of crop insurance subsidy on farmers’ behaviors and farming structure—based on a comparative study on national panel data before and after the application of premium subsidy. Insur. Insur. Stu. 7, 11–24. doi: 10.13497/j.cnki.is.2016.07.002

Liu, Y., Yan, B., Wang, Y., and Zhou, Y. (2019). Will land transfer always increase technical efficiency in China?—a land cost perspective. Land Use Policy 82, 414–421. doi: 10.1016/j.landusepol.2018.12.002

Miao, R., Hennessy, D. A., and Feng, H. (2016). The effects of crop insurance subsidies and Sodsaver on land-use change. J. Agric. Resour. Econ. 41, 247–265. doi: 10.22004/ag.econ.235189

Missikpode, C., Peek-Asa, C., Wright, B., and Ramirez, M. (2019). Characteristics of agricultural and occupational injuries by workers’ compensation and other payer sources. Am. J. Ind. Med. 62, 969–977. doi: 10.1002/ajim.23040

Mrówczyńska-Kamińska, A., Łukasiewicz, J., Bajan, B., and Poczta, W. (2023). Emission intensities in EU countriesʼ food production systems and their market resilience during the 2020 global economic turmoil. J. Clean. Prod. 426:139209. doi: 10.1016/j.jclepro.2023.139209

Nannos, N., Bersimis, S., and Georgakellos, D. (2013). Evaluating climate change in Greece through the insurance compensations of the rural production damages. Glob. Planet. Chang. 102, 51–66. doi: 10.1016/j.gloplacha.2013.01.006

Niu, H., and Chen, S. (2022). Does the policy-based agricultural insurance achieved“real compensation”:based on National Panel DataFrom 2011 to 2018 at the provincial Leve. Issues Agric. Econ. 10, 113–122. doi: 10.13246/j.cnki.iae.2022.10.006

Olayide, O. E., and Alabi, T. (2018). Between rainfall and food poverty: assessing vulnerability to climate change in an agricultural economy. J. Clean. Prod. 198, 1–10. doi: 10.1016/j.jclepro.2018.06.221

Rask, K. J., and Rask, N. (2011). Economic development and food production–consumption balance: a growing global challenge. Food Policy 36, 186–196. doi: 10.1016/j.foodpol.2010.11.015

Sassi, M., and Cardaci, A. (2013). Impact of rainfall pattern on cereal market and food security in Sudan: stochastic approach and CGE model. Food Policy 43, 321–331. doi: 10.1016/j.foodpol.2013.06.002

Schneider, U. A., Havlík, P., Schmid, E., Valin, H., Mosnier, A., Obersteiner, M., et al. (2011). Impacts of population growth, economic development, and technical change on global food production and consumption. Agric. Syst. 104, 204–215. doi: 10.1016/j.agsy.2010.11.003

Shen, L., Sun, R., and Liu, W. (2024). Examining the drivers of grain production efficiency for achieving energy transition in China. Environ. Impact Assess. Rev. 105:107431. doi: 10.1016/j.eiar.2024.107431

Shi, C., and Zhang, Y. (2022). Land certification and rural labor migration in China: evidence from provincial panel data. Res. Sci. 44, 647–659. doi: 10.18402/resci.2022.04.01

Sun, J.-L., Tao, R., Wang, J., Wang, Y.-F., and Li, J.-Y. (2024). Do farmers always choose agricultural insurance against climate change risks? Econ. Anal. Policy 81, 617–628. doi: 10.1016/j.eap.2023.12.019

Tabe-Ojong, M. P. Jr., Nana, I., Zimmermann, A., and Jafari, Y. (2024). Trends and evolution of global value chains in food and agriculture: implications for food security and nutrition. Food Policy 127:102679. doi: 10.1016/j.foodpol.2024.102679

Tao, Q., and Hu, H. (2011). Analysis on the relationship of environmental regulation and agricultural technological progress: based on the study of porter’s hypothesis. China Popul. Resour. Environ. 21, 52–57. doi: 10.3969/j.issn.1002-2104.2011.12.009

Tendall, D. M., Joerin, J., Kopainsky, B., Edwards, P., Shreck, A., Le, Q. B., et al. (2015). Food system resilience: defining the concept. Glob. Food Sec. 6, 17–23. doi: 10.1016/j.gfs.2015.08.001

Tsiboe, F., and Turner, D. (2023). The crop insurance demand response to premium subsidies: evidence from U.S. Agric. Food Policy 119:102505. doi: 10.1016/j.foodpol.2023.102505

Tuo, G. Z., and Feng, W. L. (2024). Further considerations on“policy agricultural insurance”. Insur. Stu. 22, 3–11. doi: 10.13497/j.cnki.is.2024.05.001

Tuo, G., and Zhang, Q. (2018). On the policy objectives of agricultural insurance in China. Insur. Stu. 2018, 7–15. doi: 10.13497/j.cnki.is.2018.07.002

Wang, P., Deng, X., and Jiang, S. (2019). Global warming, grain production and its efficiency: case study of major grain production region. Ecol. Indic. 105, 563–570. doi: 10.1016/j.ecolind.2018.05.022

Wang, X., Du, R., Cai, H., Lin, B., Dietrich, J. P., Stevanović, M., et al. (2024b). Assessing the impacts of technological change on food security and climate change mitigation in China’s agriculture and land-use sectors. Environ. Impact Assess. Rev. 107:107550. doi: 10.1016/j.eiar.2024.107550

Wang, W., Huang, Z., Fu, Z., Jia, L., Li, Q., and Song, J. (2024a). Impact of digital technology adoption on technological innovation in grain production. J. Innov. Knowl. 9:100520. doi: 10.1016/j.jik.2024.100520

Wang, Z., Martha, G. B., Liu, J., Lima, C. Z., and Hertel, T. W. (2024c). Planned expansion of transportation infrastructure in Brazil has implications for the pattern of agricultural production and carbon emissions. Sci. Total Environ. 928:172434. doi: 10.1016/j.scitotenv.2024.172434

Wu, Y., Duan, X., Liu, R., Ma, H., and Zhang, Y. (2024). How does full-cost insurance for wheat affect pesticide use? From the perspective of the differentiation of farmers' production scale. Environ. Res. 242:117766. doi: 10.1016/j.envres.2023.117766

Xie, S., Zhang, J., Li, X., Xia, X., and Chen, Z. (2024). The effect of agricultural insurance participation on rural households' economic resilience to natural disasters: evidence from China. J. Clean. Prod. 434:140123. doi: 10.1016/j.jclepro.2023.140123

Xu, J., and Liao, P. (2014). Crop insurance, premium subsidy and agricultural output. J. Integr. Agric. 13, 2537–2545. doi: 10.1016/s2095-3119(13)60674-7

Xue, S., Fang, Z., van Riper, C., He, W., Li, X., Zhang, F., et al. (2024). Ensuring China's food security in a geographical shift of its grain production: driving factors, threats, and solutions. Resour. Conserv. Recycl. 210:107845. doi: 10.1016/j.resconrec.2024.107845

Yang, J., Xiang, C., and Zhang, X. (2019). The division of labor in Chinese agricultural: based on production service outsourcing perspective. J. Huazhong Univ. Sci. Technol. Soc. Sci. Ed. 33, 45–55. doi: 10.19648/j.cnki.jhustss1980.2019.02.07

Ye, L. (2023). Editorial: enhancing food production system resilience for food security facing a changing environment. Front. Sust. Food Syst. 7:1204098. doi: 10.3389/fsufs.2023.1204098

Yoshioka, N. (2017). A reconsideration of crop insurance as climate change adaptation approach. J. Econ. Sust. Dev. 8, 1–8.

Yuan, Y., and Xu, B. (2024). Can agricultural insurance policy adjustments promote a ‘grain-oriented’ planting structure?: measurement based on the expansion of the high-level agricultural Insurance in China. Agriculture 14:708. doi: 10.3390/agriculture14050708

Zeng, Y., and Mu, Y. (2010). Development evaluation of China's policy-oriented agricultural insurance: based on the realization degree of policy objectives. Agric. Sci. Procedia. 1, 262–270. doi: 10.1016/j.aaspro.2010.09.033

Zhang, D., and Jiao, Y. (2022). Agricultural insurance, total factor productivity in agriculture and the economic resilience of farm households. J. South China Agric. Univ. 21, 82–97. doi: 10.7671/j.issn.1672-0202.2022.02.008

Zhang, Y., and Lu, S. (2024). Food politics in China: how strengthened accountability enhances food security. Food Policy 128:102692. doi: 10.1016/j.foodpol.2024.102692

Zhang, W., Yi, P., Xu, J., and Huang, Y. (2019). Incentivizing effect of policy agricultural insurance on grain output. Insur. Stu. 1, 32–44. doi: 10.13497/j.cnki.is.2019.01.003

Zhang, H., Zhang, J., and Song, J. (2022). Analysis of the threshold effect of agricultural industrial agglomeration and industrial structure upgrading on sustainable agricultural development in China. J. Clean. Prod. 341:130818. doi: 10.1016/j.jclepro.2022.130818