- 1School of Business, Minnan Normal University, Zhangzhou, China

- 2College of Life Science, Longyan University, Longyan, China

- 3Chinese International College, Dhurakij Pundit University, Bangkok, Thailand

The development of specialized agricultural product insurance is crucial for perfecting China’s agricultural insurance system and promoting rural revitalization. Currently, specialized agricultural product insurance in China faces numerous challenges in key areas such as rate determination, risk assessment, and loss adjustment, which have become bottlenecks restricting its sustainable development. This paper explores how insurance technology (InsurTech) can enhance the ecological system of specialized agricultural product insurance through technological innovation and overcome these industry pain points. It elaborates on how InsurTech can enhance farmers’ interactive experience and satisfaction, improve the management efficiency of insurance companies, strengthen government regulation, and promote the sustainable development of the insurance business. Moreover, this study deeply analyzes the practical barriers in implementing InsurTech and proposes corresponding strategies, including establishing innovative incentive mechanisms, improving relevant policies and regulations, building a multidimensional data platform to achieve data interoperability, and strengthening the construction of digital rural infrastructure to enhance farmers’ technological literacy, thereby advancing the sustainable development of InsurTech in specialized agricultural product insurance.

1 Introduction

In the context of global agricultural development, China has emphasized specialty agriculture as a cornerstone of its national strategy to enhance food security and diversify food systems (Long and Fan, 2023). Defined by its cultivation in unique geographic, climatic, and cultural contexts, specialty agriculture encompasses products such as Yangcheng Lake hairy crabs (Dai, 2022), Changbai Mountain ginseng (Zhang et al., 2023), and Wuyi Mountain rock tea (Lin et al., 2022). These products are not only pivotal for boosting the international competitiveness of Chinese agriculture but also play a critical role in enhancing farmers’ incomes and improving agricultural efficiency. Specialty agricultural products (SAPs), characterized by their distinctive production and operational characteristics, geographical specificity, and moderate-scale operations, inherently face multiple risk factors throughout their production cycle. These risks encompass both environmental uncertainties, particularly those stemming from climate change and natural disasters, and market-related challenges, including price volatility and demand uncertainty in the marketplace. The complexities associated with SAPs’ production and management present unique challenges in risk mitigation and insurance coverage development.

Climate change and market instability pose significant risks to agriculture, garnering extensive academic attention in recent literature. First and foremost, the impact of climate change on agricultural production is particularly profound, especially regarding crop yields and land use patterns. Recent empirical evidence, such as demonstrates that climate change is simultaneously affecting multiple major global food-producing regions (commonly referred to as “breadbasket” areas), potentially triggering a widespread food security crisis. Research has established that interannual climate variability patterns, specifically the El Niño Southern Oscillation (ENSO) and North Atlantic Oscillation (NAO), significantly and negatively affect the yields of key staple crops such as corn and wheat in these regions. Furthermore, research by Arora et al. (2020) demonstrates how climate change could fundamentally alter regional agricultural productivity and comparative advantages in crop production, thereby affecting land use patterns. Their models predict significant reductions in the yield of major crops in the northern Great Plains of the United States, potentially necessitating the conversion of arable land to grassland or pasture. These findings underscore the far-reaching implications of climate change for agricultural productivity and food security decision-making.

In terms of risk assessment methodology, incorporating climate change factors into agricultural production risk assessment models has become increasingly crucial. In his seminal work on risk assessment in agricultural production analysis, Antle (1983) established that traditional mean–variance analysis methods are insufficient for accurately assessing risks in agriculture, particularly when evaluating the extreme risk of crop failure. Building on this foundation, employed Quantile Autoregression (QAR) models to analyze the long-term temporal dependencies of climate change and market shocks on crop yield distributions. Their findings indicate that asymmetric climate events significantly affect the lower distribution of crop yields, suggesting that climate-related extreme events could increase the frequency of crop failures. Regarding risk management frameworks, Moschini and Hennessy (2001) emphasized the critical importance of applying expected utility theory in agricultural production to analyze risk aversion behavior. However, the increasing severity of climate change suggests that traditional risk aversion models based on Arrow (1964) and Pratt (1964) may no longer adequately address contemporary climate risks. Consequently, future research imperatively needs to develop more flexible and robust risk management tools to more effectively address the uncertainties associated with weather impacts.

The evidence suggests that climate change’s impact on food security is multifaceted, affecting not only crop yields but also directly threatening global food security systems. Through an analysis of Italian agricultural production data, demonstrated that agricultural diversification significantly mitigates food security risks posed by climate change. Their analysis indicates that by enhancing agricultural productivity and improving crop resilience, agricultural diversification helps buffer the negative impacts of climate change on food security. Moreover, projections by Gammans et al. (2017) suggest that, assuming constant planting areas and technologies, yields are expected to decline substantially by the end of this century: winter wheat by 21.0%, winter barley by 17.3%, and spring barley by 33.6%. While ongoing technological advancement may partially offset these climate-induced impacts, significant challenges remain. Ray et al. (2012) further emphasized these challenges through their analysis of global crop production trends from 1961 to 2008, revealing that while some regions have experienced yield increases, most have demonstrated stagnation or decline, indicating that regions with lower risk resilience require more effective measures to enhance food production efficiency.

The research demonstrates that climate change also indirectly affects food security through market price mechanisms and food supply chain dynamics. Identified significant heterogeneity in responses to climate shocks across different market levels within the Italian agricultural product supply chain. Specifically, their findings indicate that retail prices exhibit high sensitivity to market shocks, whereas price adjustments at the farm level remain relatively modest. This asymmetric price transmission mechanism suggests that climate change, through its effect on market prices, could further exacerbate food supply instability. As global climate change intensifies, agricultural production faces increasing risks and uncertainties. Climate trend variations not only affect crop production directly but also modify the impact of biotic and abiotic factors on agricultural productivity. These changes amplify agricultural production risks, emerging as a primary driver of global food insecurity (Moschini and Hennessy, 2001; Just and Pope, 2002; Chavas, 2004; Fuglie and Walker, 2001).

The unpredictable nature of climate change, natural disasters, and market risk impacts poses substantial challenges to agricultural production, underscoring the critical importance of implementing effective agricultural risk management strategies. While technological advancement in agriculture and improved disaster forecasting can mitigate certain risks, market volatility-induced risks remain difficult to control through these means alone. In this context, agricultural insurance has emerged as a crucial risk management tool, currently adopted in over 100 countries worldwide for risk transfer and diversification (Liu and Dong, 2017). Since 2007, the Chinese government’s implementation of a central financial agricultural insurance subsidy model has significantly catalyzed the development of the agricultural insurance market. By 2023, agricultural insurance has provided 4.98 billion yuan (approximately USD 690 million) in risk protection for Chinese agricultural development. The 2024 Central No. 1 Document emphasizes the development of specialized insurance solutions as a key instrument for risk management and sustainable agricultural practice promotion (Central Committee of the Communist Party of China and State Council, 2024). However, insurance companies often demonstrate reluctance to engage due to factors such as the small scale of specialty agricultural product production, significant market risks, and strong geographical constraints. In this context, the application of InsurTech presents novel possibilities for specialty agricultural product insurance solutions.

The advent of insurance technology (InsurTech) represents a transformative approach to addressing these challenges. By integrating advanced technologies such as blockchain, big data, and internet-based platforms, InsurTech revolutionizes insurance practices by enhancing underwriting precision, enabling scientific pricing, and facilitating rapid claims processing (Xu, 2017). This innovation is crucial for the adaptation and sustainability of specialty agricultural insurance, offering a blueprint for the sector’s evolution toward more efficient and responsive practices. This paper delves into the operational mechanisms of InsurTech in the specialty agriculture insurance sector, assesses the challenges of transitioning toward a more technologically advanced industry, and provides strategic recommendations to leverage these innovations for enhanced growth and sustainability.

The paper proceeds as follows: Section 2 reviews relevant literature on InsurTech in agricultural insurance. Section 3 explores InsurTech’s role in enhancing specialty agricultural insurance. Section 4 discusses challenges and offers recommendations. The paper concludes with Section 5, summarizing key insights and future directions.

2 Literature review

InsurTech, originating from financial technology, was initially defined as “information technology applied to the insurance industry” (Chuang et al., 2016). In 2017, the International Association of Insurance Supervisors (IAIS) described it as a branch of financial technology in the insurance sector, involving emerging technologies and innovative business models with the potential to transform the industry (Chen, 2021). In the same year, the “China InsurTech Development White Paper” emphasized that InsurTech is “technology first, insurance second,” highlighting its technology-leading nature (Xu and Yang, 2018). Although there is no unified perspective on the definition of InsurTech within academic and industry circles, its impact is already evident in areas such as life insurance (Tang and Liu, 2019), long-term care insurance (Hu et al., 2023), and property insurance (Xie and Zhao, 2021), as well as in driving innovation in insurance products. Additionally, the development models and experiences of InsurTech in various countries provide valuable lessons for global advancements in InsurTech (Neale et al., 2020; Sarkar, 2021; Kim and Kim, 2024).

Current research on insurance for specialty agricultural products mainly includes two aspects: theoretical, policy, and experience studies. Scholars have systematically summarized the experiences and shortcomings in the development of local advantage agricultural product insurance in Fujian Province (Zhuo and Shi, 2021), Hebei Province (Feng and Shang, 2021), and nationwide (Hu and Li, 2022), and have proposed optimization strategies for specialty agricultural product insurance. Gao et al. (2022) focused on the vegetable insurance sector, studying the operational mechanisms and product implementations in the United States and Japan to provide references for domestic policies in China. Secondly, specific aspects of the implementation process of specialty agricultural product insurance, such as product pricing and policy design, are also researched. He et al. (2022) and Su et al. (2023) respectively designed weather index insurance for fresh grapes in the Bohai Sea area and winter-over tomatoes in facilities in Fuzhou. Zhao and Yue (2020) applied prospect theory to analyze the risk preferences of American producers and discussed the differences in preferences between commodity crop producers and specialty crop producers. Hou (2020) studied the demand for vegetable insurance among farmers in Fujian Province from a heterogeneity perspective. Based on a comparative analysis of livestock management practices in South Korea and the Netherlands, Park et al. (2020) developed an advanced livestock insurance framework that integrates blockchain technology, Internet of Things (IoT) protocols, and InsurTech-based solutions.

Regarding the impact of InsurTech on specialty agricultural product insurance, research focuses on two main aspects. First, in the context of a new round of technological revolution and industrial transformation, scholars have analyzed how InsurTech influences Chinese agricultural insurance. By applying modern technology to transform or innovate agricultural insurance product forms (Zhang and Zhao, 2022), business processes (Wu and Wang, 2020), business models (Chen and Pan, 2024), service channels (Zheng and Hu, 2023), and regulatory methods (Lü and Tu, 2021), InsurTech is considered a key force driving agricultural insurance toward more refined and precise development, providing important support for the sustainable development of agricultural insurance. Secondly, scholars’ research also explores the specific impacts of different technologies or scenarios on agricultural insurance, including the applications of internet technology (Jiang et al., 2023), artificial intelligence (Hu and He, 2022), and remote sensing technology (Dhakar et al., 2022; Feng and Zheng, 2021; Jełowicki et al., 2020) in the field of agricultural insurance, and provides detailed analyses of these technologies’ roles in insurance pricing and claims adjustment. Omar et al. (2023) introduced a novel blockchain-enabled agricultural insurance framework that fundamentally enhances transparency throughout the insurance ecosystem. The implementation of an immutable distributed ledger system facilitates the secure documentation of transactions and data exchanges among key stakeholders, including agricultural producers, insurers, and meteorological data providers, thereby fostering unprecedented levels of trust among participating entities.

3 The role of InsurTech in supporting the sustainable development of specialty agricultural product insurance

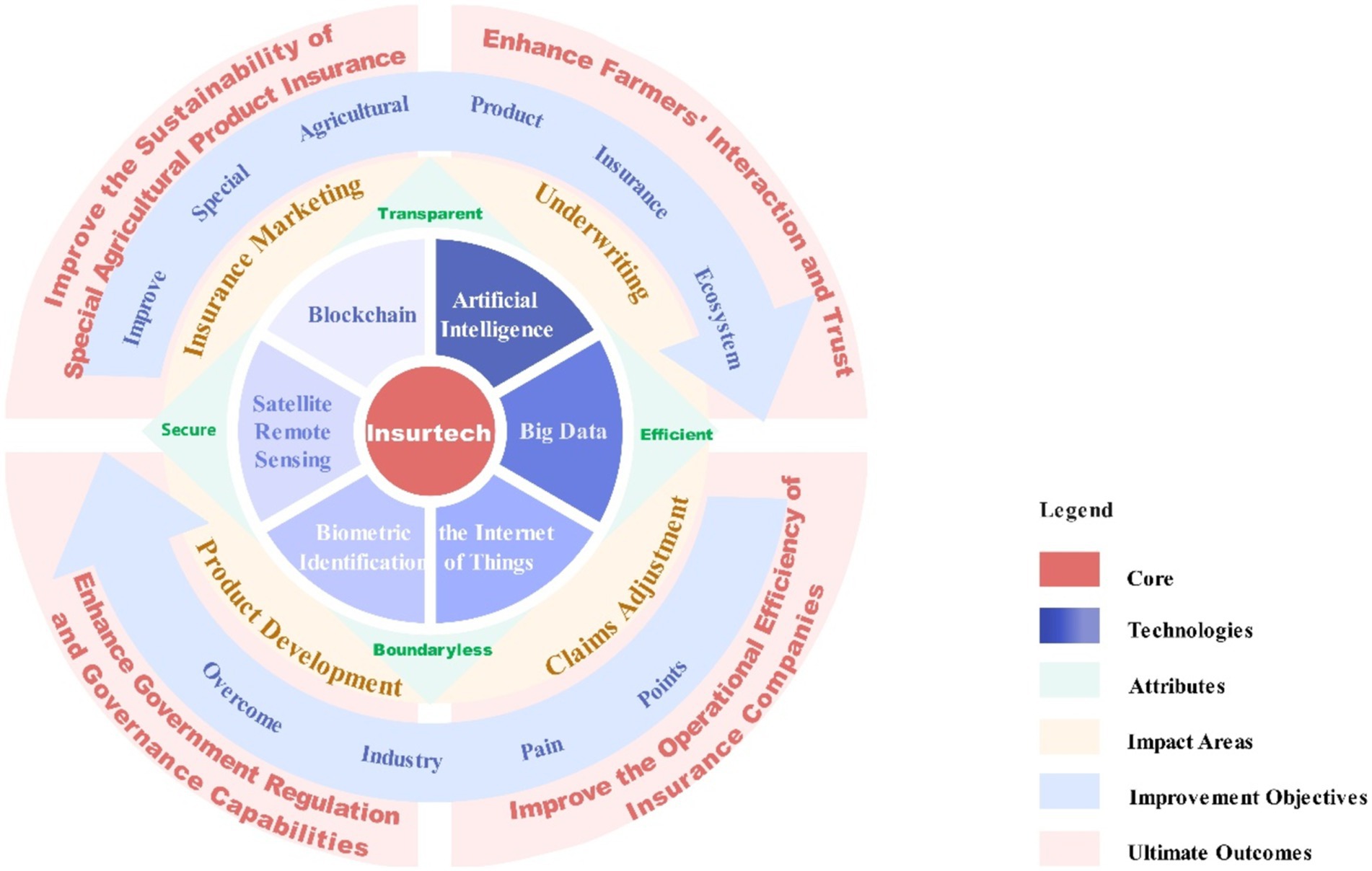

InsurTech, an innovation-based vertical enterprise ecosystem, aims to innovate, transform, and upgrade traditional insurance operations using modern technological methods (Christy, 2020). As a new form of insurance, it extensively applies core technologies such as blockchain (Park et al., 2020), artificial intelligence (Jo, 2020), big data (Infantino, 2022), and the Internet of Things (Davis, 2020a) in critical scenarios such as insurance product development, marketing, underwriting, and claims adjustment, thus improving the entire insurance ecosystem. These technological applications help overcome industry pain points, such as information asymmetry, transforming the market from opacity to transparency, enhancing operational efficiency, reducing costs, and improving service quality and security, while also expanding service scope and facilitating cross-industry integration. These improvements not only meet diverse customer needs but also provide effective pathways for the sustainable development of specialty agricultural product insurance (as shown in Figure 1).

Enhanced transparency and interactivity through InsurTech significantly boost farmers’ trust and participation in the field of specialty agricultural product insurance. Traditional agricultural insurance often suffers from information asymmetry and a lack of interactivity, resulting in low perceived value among farmers. The application of InsurTech effectively breaks this asymmetry, enhancing transparency and thereby boosting farmers’ sense of interaction and trust. For instance, the widespread use of mobile connectivity and devices allows farmers to easily access information about insurance, cultivation, operational processes of insurance companies, and details about insured categories, significantly enhancing the interactive experience. Blockchain technology ensures the authenticity and immutability of insurance and claims data, greatly enhancing farmers’ trust. Additionally, the use of big data enables insurance companies and relevant departments to collect and analyze cultivation data, disaster data, and meteorological data, providing real-time monitoring of cultivation conditions, transparent risk management, and early warning systems, allowing farmers to receive timely risk alerts, thus increasing their trust in insurance and enhancing their resilience against risks. These technologies not only improve the business processes of agricultural insurance but also better meet the needs of farmers, driving the transition of specialty agricultural product insurance toward sustainable development.

The application of InsurTech greatly enhances the operational efficiency of insurance companies, which not only boosts their revenue and motivation but also helps improve the service levels and participation rates of specialty agricultural product insurance, thereby providing a robust guarantee for its sustainable development. In the development of specialty agricultural product insurance products, InsurTech can break through traditional geographical and scale limitations, developing insurance products that better meet the needs of farmers, thereby enriching the agricultural insurance product system. Moreover, the integrated application of technologies such as mobile devices (Sibindi, 2022), big data, artificial intelligence, blockchain, the Internet of Things, and satellite remote sensing (Leo et al., 2021) significantly enhances service efficiency, enabling farmers to complete the entire process from insurance purchase to claims settlement on mobile devices. At the same time, big data and artificial intelligence precisely match insurance needs and premium calculations, while satellite remote sensing, drones (Davis, 2020b), the Internet of Things, and biometric identification (Shaheed et al., 2021) not only provide personalized insurance solutions but also effectively identify insurance fraud and rapidly adjust claims, greatly increasing the accuracy of claims settlements. These technological applications not only enhance the operational effectiveness of insurance companies but also strengthen farmers’ service experiences and satisfaction.

The integration of government regulatory strategies with InsurTech provides a more efficient and secure regulatory environment for specialty agricultural product insurance. Given the diversity and management differences in specialty agricultural product insurance, the application of InsurTech is particularly crucial as it can timely identify and address issues, enhancing the traceability and security of insurance data, thereby improving the efficiency and quality of government regulation and governance. For example, satellite remote sensing technology can effectively increase the accuracy of loss assessments and the efficiency of claims processing in agricultural insurance, while also assisting in risk management and formulating more precise insurance strategies. The application of big data allows the government to collect and analyze agricultural information, cultivation data, and meteorological data in real time, monitoring potential risks in agricultural production and providing insights for policy-making. The comprehensive application of these technologies not only promotes the healthy development of the agricultural insurance market but also significantly enhances the government’s regulatory and governance capabilities in the field of specialty agricultural product insurance.

Overall, InsurTech leverages cutting-edge technologies such as blockchain, artificial intelligence, big data, and the Internet of Things to innovate and enhance traditional insurance operations. It significantly improves transparency, interactivity, and operational efficiency within the entire insurance ecosystem. By developing insurance products that better meet the needs of farmers, InsurTech promotes the sustainable development of specialty agricultural product insurance.

4 Challenges and recommendations

Although China has implemented policies to encourage technological innovation and the transformation of achievements in multiple fields, a specific innovation incentive mechanism for InsurTech has not yet been established. From a financial perspective, although technologies such as artificial intelligence, blockchain, and big data have been applied to specialty agricultural product insurance, the integration and application of these technologies still require substantial financial support, yet there is a lack of specific fiscal subsidies in the field of InsurTech. Moreover, InsurTech innovation has not received specialized support from tax relief on R&D expenses. Some insurance companies face issues such as untimely assessment of technological innovation and insufficient recording of R&D contracts, preventing them from fully utilizing the policy of pre-tax deductions for R&D expenses. To promote the sustainable development of InsurTech-enabled specialty agricultural product insurance, it is recommended to establish an innovation incentive mechanism specifically for InsurTech, optimize fiscal funding policies to expand the scope of fiscal subsidies for InsurTech, and clearly define the applicable fields and projects for subsidy policies. In terms of taxation, tax relief categories for InsurTech innovations should be established, and the policy of pre-tax additional deductions for R&D expenses should be optimized. Concurrently, the construction of legal regulations for InsurTech innovation should be strengthened, improving the evaluation mechanisms and service systems for the transformation of technological achievements, optimizing regulatory regulations, enhancing risk control, and managing technology information security to provide a healthier and more orderly policy environment for InsurTech innovation.

Despite the high costs and often long payback periods involved in R&D for InsurTech in the field of specialty agricultural product insurance, major insurance companies like PICC, Ping An, and CPIC continue to increase their investments. For instance, ZhongAn Insurance’s technology R&D investment in 2022 reached 1.345 billion yuan, while its technology business revenue was only 592 million yuan, a 13.8% year-over-year increase, yet there remains a significant gap between investment and output (Tao, 2022). The main challenges faced by this investment model are the regional and dispersed nature of specialty agricultural product insurance, which leads to significant variations in rates, management costs, and payout rates among different farmers within the same region. Consequently, the scale of specialty agricultural product insurance is relatively small, and the risk is concentrated, which often leads to concentrated payouts, resulting in high costs and low returns on technological investments. Moreover, the widespread application of InsurTech in the field of specialty agricultural product insurance is still immature, primarily reflected in its application scope, technological stability, and level of innovation. Currently, InsurTech is mainly applied in the insurance and claims processing stages, while development and expansion in other stages still need to be strengthened. Due to the diverse regions and categories involved in specialty agricultural product insurance, high demands are placed on technological stability. However, existing technologies such as drones and biometric recognition still lack stability in specific environments. In the context of agricultural unmanned aerial vehicles (UAVs), contemporary autonomous navigation systems exhibit limitations in real-time obstacle avoidance capabilities, necessitating human operator intervention for unforeseen impediments. Moreover, the operational flight duration of agricultural UAVs available in the Chinese market ranges from 10 to 15 min, substantially constraining their deployment efficiency in extensive agricultural operations and failing to address the comprehensive plant protection requirements of large-scale farming operations (Zhou, 2023). Moreover, many InsurTech innovations have not deeply considered the actual needs of specialty agricultural product insurance but have directly borrowed technological solutions from grain insurance or other fields, leading to insufficient practicality of these innovations. To effectively address these challenges, it is recommended to establish a multi-dimensional specialty agricultural product insurance data information platform, which can facilitate data sharing and support insurance farmers, InsurTech innovation, optimization of insurance company services and risk management, and government regulation. This platform should cover detailed descriptions of insurance types, meteorological data, cultivation knowledge, policy information, and include underwriting data, claims data, weather data, and financial data, providing practical bases for InsurTech innovation. Additionally, government departments should use the platform to timely detect and adjust policies, curb illegal activities, and promote the orderly and healthy development of specialty agricultural product insurance, while establishing unified data standards for effective data analysis and application. Finally, it is suggested that multiple departments collaborate to tackle the operational issues in specialty agricultural product insurance. Within this collaboration, InsurTech companies should specifically conduct field research and tailor their technological innovations to meet the needs of insurance companies, comply with government regulations, and fulfill the specific requirements of farmers.

Currently, Chinese farmers’ acceptance of InsurTech services is generally low, mainly due to several key factors. First, although China has made significant progress in building digital rural infrastructure, the construction of new infrastructure is still relatively lagging, agricultural digital technology support is insufficient, agricultural digital resources are lacking, and regional development is uneven. Secondly, the internet acceptance level among rural residents remains below the national average, although according to data released by Ministry of Industry and Information Technology (2023), the internet penetration rate in rural areas has exceeded 60%, but it is still behind the national average. Third, farmers have low digital literacy; according to the “China Human Capital Report” released by the Central University of Finance and Economics in 2023, the average age of rural male labor is 40.39 years, and the average years of education is 9.30 years for men and 9.06 years for women. The older age and lower educational level may lead to a lack of willingness among farmers to accept InsurTech services, lacking the motivation to embrace new things (Li, 2023). To address these challenges, it is recommended to take the following measures to enhance farmers’ acceptance of InsurTech. First, strengthen the construction of digital rural infrastructure, continue to promote the digitization and intelligence upgrade of existing facilities, advance internet cost reduction and speed enhancement to alleviate the economic pressure on farmers using the internet, and promote the use of smart mobile devices to enhance farmers’ digital access capabilities. Secondly, relevant departments and institutions should intensify the promotion and training of technology and insurance to farmers, through various forms such as financial outreach, insurance outreach, and technology outreach, to enhance farmers’ awareness and understanding of specialty agricultural product insurance. Moreover, enhance farmers’ scientific awareness by training in agricultural cultivation techniques and the use of intelligent agricultural equipment, creating an atmosphere of understanding and utilizing science, thereby allowing farmers to no longer resist InsurTech but to actively engage and utilize these technologies. These comprehensive measures are expected to effectively enhance farmers’ acceptance of InsurTech and promote the popularization and development of specialty agricultural product insurance.

5 Conclusion

This study highlights InsurTech’s transformative potential in specialty agricultural product insurance in China, enhancing precision and efficiency despite challenges of infrastructure and low digital literacy. InsurTech’s integration of advanced technologies significantly improves underwriting, pricing, and claims processes, boosting the insurance industry’s overall responsiveness. Crucial to its success is the need for multi-sector collaboration, sustained policy support, and continual education, particularly in digital infrastructure development in rural areas. By aligning technological applications with farmers’ real needs, InsurTech can effectively meet the specific demands of the agricultural insurance market, playing a pivotal role in the sustainable development of agriculture and supporting comprehensive rural revitalization.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

DH: Conceptualization, Funding acquisition, Writing – original draft. XW: Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was funded by the National Social Science Fund of China Western Project (Grant No. 23XJY011), and Fujian Provincial University Research Project on Basic Theoretical Research in Philosophy and Social Sciences Guided by Marxism (Grant No. FJ2024MGCA022).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Antle, J. M. (1983). Incorporating risk in production analysis. Am. J. Agric. Econ. 65, 1099–1106. doi: 10.2307/1240428

Arora, G., Feng, H., Anderson, C. J., and Hennessy, D. A. (2020). Evidence of climate change impacts on crop comparative advantage and land use. Agric. Econ. 51, 203–217. doi: 10.1111/agec.12551

Arrow, K. J. (1964). The role of securities in the optimal allocation of risk-bearing. The Review of Economic Studies. 31, 91–96. doi: 10.2307/2296188

Central Committee of the Communist Party of China and State Council . (2024). Opinions on learning from and applying the "thousand villages demonstration, ten thousand villages rectification" project to promote comprehensive rural revitalization effectively. The State Council Gazette, 6. Available at: https://www.gov.cn/gongbao/2024/issue_11186/202402/content_6934551.html

Chen, J. (2021). Risks and regulatory countermeasures of InsurTech applications with examples of blockchain and big data technologies. Audit Observ. 4, 88–93.

Chen, J., and Pan, X. R. (2024). Accelerating the formation of a financial system that empowers agricultural technology innovation. Rural Fin. Res. 4, 3–11. doi: 10.16127/j.cnki.issn1003-1812.20240410.001

Christy, Q. (2020). InsurTech: the authoritative guide to insurance technology. Beijing China: China Renmin University Press.

Chuang, L. M., Liu, C. C., and Kao, H. K. (2016). The adoption of FinTech service: TAM perspective. Int. J. Manag. Admin. Sci. 3, 1–15. doi: 10.3390/su12187669

Dai, X. (2022). Discussion on the social benefits of the development of Yangcheng Lake hairy crabs. Food Safety Guide 6, 151–153. doi: 10.16043/j.cnki.cfs.2022.06.040

Davis, C. S. (2020b). InsurTech concepts: the use of artificial intelligence and robotics. TortSource 23:16.

Dhakar, R., Sehgal, V. K., Chakraborty, D., Sahoo, R. N., Mukherjee, J., Ines, A. V. M., et al. (2022). Field scale spatial wheat yield forecasting system under limited field data availability by integrating crop simulation model with weather forecast and satellite remote sensing. Agric. Syst. 195:103299. doi: 10.1016/j.agsy.2021.103299

Feng, W. L., and Shang, B. Q. (2021). Development ideas for specialized agricultural insurance in Hebei Province to boost the rural revitalization strategy. China Insur. 2, 14–17.

Feng, W. L., and Zheng, H. Y. (2021). Application analysis of remote sensing technology in the field of agricultural insurance. Rural Fin. Res. 7, 3–8. doi: 10.16127/j.cnki.issn1003-1812.2021.07.001

Fuglie, K. O., and Walker, T. S. (2001). Economic incentives and resource allocation in U.S. public and private plant breeding. J. Agric. Appl. Econ. 33, 459–473. doi: 10.1017/S1074070800020939

Gammans, M., Mérel, P., and Ortiz-Bobea, A. (2017). Negative impacts of climate change on cereal yields: Statistical evidence from France. Environ. Res. Lett. 12:054007. doi: 10.1088/1748-9326/aa6b0c

Gao, Y. D., Song, Y., Cui, H. X., and Zong, Y. X. (2022). Vegetable insurance in the United States and Japan: Operating mechanisms, product implementation, and lessons learned. J. Hebei Agric. Univ. 24, 97–105. doi: 10.13320/j.cnki.jauhe.2022.0053

He, J. N., Liu, B. C., Liu, Y., Yin, H., Qiu, M. J., Yang, X. J., et al. (2022). Design of fresh grape weather index insurance: A case study of continuous rainy weather disasters in Wafangdian, the main production area around the Bohai Sea. Chin. Agric. Meteorol. 43, 810–820. doi: 10.3969/j.issn.1000-6362.2022.10.004

Hou, D. N. (2020). Identification of vegetable growers' insurance needs from a heterogeneity perspective. Northern Hortic. 23, 146–152. doi: 10.11937/bfyy.20200595

Hu, F., and He, X. Y. (2022). Study on digital business management of agricultural insurance companies powered by artificial intelligence. Fin. Theory Pract. 4, 99–108.

Hu, S. H., and Li, J. (2022). Specialty agricultural product insurance: history, unique attributes, and development directions. Rural Econ. 477, 89–95.

Hu, F., Wei, Y. M., and Wang, X. M. (2023). InsurTech empowerment for long-term care insurance systems: Internal mechanisms, existing problems, and practical pathways. Southwest Finance 2, 57–69.

Infantino, M. (2022). Big data analytics, InsurTech and consumer contracts: a European appraisal. Europ. Rev. Private Law 30, 613–634. doi: 10.54648/ERPL2022030

Jełowicki, Ł., Sosnowicz, K., Ostrowski, W., Osińska-Skotak, K., and Bakuła, K. (2020). Evaluation of rapeseed winter crop damage using UAV-based multispectral imagery. Remote Sens. 12:2618. doi: 10.3390/rs12162618

Jiang, S. Y., Feng, R. Y., and Zhang, C. C. (2023). Real challenges and development suggestions for "Internet + agricultural insurance" empowering rural revitalization—case studies from Jiangsu and Qinghai provinces. Rural Fin. Res. 5, 35–43. doi: 10.16127/j.cnki.issn1003-1812.2023.05.004

Jo, J. W. (2020). Case studies for insurance service marketing using artificial intelligence (AI) in the InsurTech industry. J. Digi. Conver. 18, 175–180. doi: 10.14400/JDC.2020.18.10.175

Just, R. E., and Pope, R. D. (2002). Past progress and future opportunities for agricultural risk research. A Comprehensive Assessment of the Role of Risk in U.S. Agriculture. Springer, Boston, MA: Natural Resource Management and Policy. 23, doi: 10.1007/978-1-4757-3583-3_25

Kim, E. S., and Kim, Y. J. (2024). Determinants of user acceptance of digital insurance platform service on InsurTech: an empirical study in South Korea. Asian J. Technol. Innov., 1–31. doi: 10.1080/19761597.2024.2337629

Leo, J., Srinivasan, S., and Nanda Kumar, C. D. (2021). The feasibilities of modern technology for India’s crop insurance scheme. Int. J. Aquat. Sci. 12, 466–471.

Li, H. Z. (2023). China human capital report 2023. Beijing: Central University of Finance and Economics, Human Capital and Labor Economy Research Center.

Lin, H. L., Huang, X. T., Huang, F. N., Liu, S. Y., and Ni, Y. X. (2022). Analysis of the integration models and paths of the tea tourism industry under the rural revitalization background—Research and thoughts based on Wuyishan City. Taiwan Agric. Expl. 4, 76–81. doi: 10.16006/j.cnki.twnt.2022.04.011

Liu, Y., and Dong, J. (2017). Experiences and insights from the operational system of agricultural insurance organizations abroad. World Agric. 1, 32–38. doi: 10.13856/j.cn11-1097/s.2017.01.005

Long, W. J., and Fan, S. G. (2023). Study on the construction of a diversified food supply system based on a broad food perspective. J. Agric. Modern. 44, 233–243. doi: 10.13872/j.1000-0275.2023.0033

Lü, B. Q., and Tu, L. L. (2021). Digital regulation as a means to enhance regulatory effectiveness. China Rural Fin. 4, 38–40.

Ministry of Industry and Information Technology . (2023). Industrial and informational development was overall stable in the first three quarters with positive results in sustainable development. Available at: https://www.miit.gov.cn/xbymdz/xwfb/xwfbh/gxbxwfbh/art/2023/art_69fdd4414a4a4b06811093062ea11aa3.html

Moschini, G., and Hennessy, D. A. (2001). Uncertainty, risk aversion, and risk management for agricultural producers. Handb. Agric. Econ. 1, 87–153. doi: 10.1016/S1574-0072(01)10005-8

Neale, F. R., Drake, P. P., and Konstantopoulos, T. (2020). InsurTech and the disruption of the insurance industry. J. Insur. Issues 43, 64–96. Available at: https://www.jstor.org/stable/26931211

Omar, I. A., Jayaraman, R., Salah, K., Hasan, H. R., Antony, J., and Omar, M. (2023). Blockchain-based approach for crop index insurance in agricultural supply chain. IEEE Access 11, 118660–118675. doi: 10.1109/ACCESS.2023.3327286

Park, B. K., Yeo, S. H., Lee, S., and Yang, H. (2020). A case study on the application of blockchain technology for the InsurTech: development of livestock insurance product. J. Inform. Technol. Serv. 19, 125–138. doi: 10.9716/KITS.2020.19.4.125

Pratt, J. W. (1964). Risk aversion in the small and in the large. Econometrica. 32, 122–136. doi: 10.2307/1913738

Ray, D. K., Ramankutty, N., Mueller, N. D., West, P. C., and Foley, J. A. (2012). Recent patterns of crop yield growth and stagnation. Nat. Commun. 3:1293. doi: 10.1038/ncomms2296

Sarkar, S. (2021). The evolving role of InsurTech in India: trends, challenges, and the road ahead. Manag. Account. J. 56, 30–37. doi: 10.33516/maj.v56i12.30-37p

Shaheed, K., Mao, A., Qureshi, I., Kumar, M., Abbas, Q., Ullah, I., et al. (2021). A systematic review on physiological-based biometric recognition systems: current and future trends. Arch. Comput. Methods Eng. 28, 1–44. doi: 10.1007/s11831-021-09560-3

Sibindi, A. B. (2022). Information and communication technology adoption and life insurance market development: evidence from Sub-Saharan Africa. J. Risk Fin. Manag. 15:568. doi: 10.3390/jrfm15120568

Su, R. R., Lin, R. K., Chen, J. J., Huang, C. R., Lin, L. X., Li, Z. L., et al. (2023). Design of weather index insurance for winter frost damage to greenhouse tomatoes in Fuzhou. Meteorol. Environ. Sci. 46, 26–31. doi: 10.16765/j.cnki.1673-7148.2023.03.004

Tang, J. C., and Liu, L. (2019). Response strategies of the life insurance industry in the era of InsurTech. Southwest Fin. 11, 60–69.

Tao, H. Z. (2022). Study on the performance enhancement of ZhongAn Online Insurance in the digital economy. Small Medium Enterp. Manag. Technol. 23, 89–91.

Wu, T., and Wang, X. N. (2020). Exploration of business innovation in InsurTech. China Insur. 4, 20–25.

Xie, T. T., and Zhao, X. L. (2021). Study on the impact of InsurTech on the operational efficiency of property insurance companies under digital transformation—based on the DEA-Tobit panel model. Finan. Dev. Res. 3, 53–60. doi: 10.19647/j.cnki.37-1462/f.2021.03.008

Xu, X., and Yang, N. N. (2018). InsurTech startups and artificial intelligence. China Insur. 7, 7–11.

Zhang, Z. C., Chen, X. L., Zhang, K. X., Zhang, R., and Wang, Y. P. (2023). Research on the current situation and development strategies of the ginseng industry in Jilin Province. J. Jilin Agric. Univ. 45, 649–655. doi: 10.13327/j.jjlau.2023.1901

Zhang, Q., and Zhao, S. J. (2022). The significance, challenges, and recommendations for the development of agricultural insurance technology in China. Sci. Technol. China 3, 45–49.

Zhao, S., and Yue, C. (2020). Risk preferences of commodity crop producers and specialty crop producers: an application of prospect theory. Agric. Econ. 51, 359–372. doi: 10.1111/agec.12559

Zheng, J., and Hu, S. D. (2023). Study on the effects of InsurTech on the integration of the three industries under the rural revitalization perspective. J. Hebei Univ. Sci. Technol. 23, 11–22. doi: 10.7535/j.issn.1671-1653.2023.03.002

Zhou, Q. (2023). Problems and strategies in the application of drone-based plant protection technology. Agric. Eng. Technol. 43, 34–36. doi: 10.16815/j.cnki.11-5436/s.2023.11.013

Keywords: InsurTech, specialized agricultural product insurance, sustainable development, technological innovation, risk management

Citation: Hou D and Wang X (2024) The impact of InsurTech on advancing sustainable specialty agricultural product insurance in China. Front. Sustain. Food Syst. 8:1477773. doi: 10.3389/fsufs.2024.1477773

Edited by:

Pier Paolo Miglietta, Dipartimento di Scienze e Tecnologie Biologiche ed Ambientali - Università del Salento, ItalyReviewed by:

Leonardo Agnusdei, University of Salento, ItalyFabian Capitanio, University of Naples Federico II, Italy

Copyright © 2024 Hou and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xin Wang, ODIwMTkwMDhAbHl1bi5lZHUuY24=

Dainan Hou1

Dainan Hou1 Xin Wang

Xin Wang