- Business school, University of Jinan, Jinan, Shandong, China

Based on the panel data of 30 provinces (except Tibet) from 2011 to 2020, the article examines the impact of digital financial inclusion on the resilience of the agricultural industry chain as well as the mechanism of its action. The results show that: (1) Digital inclusive finance promotes the enhancement of the resilience of the agricultural industry chain, in which the degree of influence on “marketing resilience” and “distribution resilience” is much larger than that on “production resilience,” “processing resilience,” and “product resilience.” The degree of impact on “marketing resilience” and “distribution resilience” is much larger than “production resilience,” “processing resilience,” and “product resilience.” (2) Digital inclusive finance can promote the resilience of the agricultural industry chain through the promotion of agricultural technology innovation and the development of new agricultural business entities. (3) The enhancement of the resilience of the agricultural industry chain is more significant in the eastern region, where the level of digital inclusive finance is high. Based on the results of the study, the article puts forward relevant suggestions in terms of promoting the in-depth integration of digital inclusive finance and the agricultural industry chain, increasing the support for new agricultural business subjects, and strengthening agricultural technological innovation to promote sustainable development of the agricultural industry chain.

1 Introduction

As a foundational industry, agriculture ensures the primary condition for all production through the guarantee of agricultural supply. The stable and sustainable development of agriculture plays a crucial role in promoting the sustainable growth of the national economy and maintaining social stability. Given the inherent vulnerabilities in agriculture, modernizing this sector requires a certain degree of development stability. Improving the ability of agricultural industry to withstand natural disasters, emergencies, and other risks, ensuring basic food security, and enhancing the resilience of the agricultural industry chain have become important topics for the long-term development of agriculture (He and Yang, 2021). Strengthening the resilience of the industrial chain is a policy necessity, a requirement for building a robust agricultural nation, a pragmatic choice for China to handle complex domestic and international situations, and a significant initiative for achieving agricultural modernization.

Financial support is indispensable for promoting agricultural development (Zhao and Zhang, 2023). However, financial exclusion persists in China’s rural areas due to factors such as geographical remoteness, the unique nature of agricultural activities, and farmers’ financial literacy levels. Currently, the mismatch between financial services for the agricultural industry and actual demand is becoming increasingly pronounced. First, small- and medium-sized agricultural enterprises and farmers face significant financing difficulties. The agricultural industry itself is characterized by low returns, long investment recovery cycles, high-risk uncertainties, and dispersed funding needs among farmers. Traditional financial service systems make it challenging for small- and medium-sized agricultural enterprises to secure funds due to their limited risk resilience and outdated lending awareness (Zhu and Zheng, 2023; Zhou and Li, 2023; Dai et al., 2023).

Second, the lack of financial innovation in the rural financial market, coupled with the relative scarcity of diverse and innovative financial products and services, limits the development of the rural financial market and exacerbates financing constraints for rural economic development (Li, 2015; Zhang and He, 2023). Although the state has introduced various credit support policies, the decentralized nature of credit investments prevents the formation of a cohesive strategy. As a result, significant funding gaps remain for rural infrastructure projects and rural industrial integration development projects that require substantial financial support. The lack of capital investment limits the long-term development capacity of rural industries, thereby restricting the enhancement and development of the resilience of the rural industrial chain.

Digital inclusive finance, which integrates finance and technology, is more capable of supporting the development of inclusive finance compared to traditional finance. It provides financial services through online platforms, mobile applications, and other digital channels, transforming the way traditional financial institutions offer services to low-income populations and rural areas. This improves both the efficiency and coverage of financial services (Guo et al., 2020; Liu and Liu, 2020). By leveraging a new financial model based on the Internet, digital inclusive finance can deeply mine and analyze the soft information behind farmers’ online behaviors, thereby reducing information asymmetry between borrowers and lenders. Additionally, online transaction services lower the operating costs of financial institutions, expand their reach and service scope, and better meet the needs of financially underserved populations, thereby alleviating the financial constraints faced by farmers.

Given the insufficiency of traditional financial support for agricultural and rural development, the rise of digital inclusive finance presents new opportunities for enhancing the resilience of the agricultural industry chain. This raises important questions: How does digital inclusive finance impact the resilience of the agricultural industry chain? Through which channels does this impact occur? Does the impact vary across regions and according to the level of digital inclusive finance development? Addressing these questions can not only clarify the role of digital inclusive finance in enhancing the resilience of the agricultural industry chain but also provide a theoretical foundation for leveraging digital inclusive finance to better serve the agricultural sector.

The existing literature on digital financial inclusion primarily focuses on two aspects. The first aspect involves the measurement of digital financial inclusion, usually based on indices such as the Peking University Digital Financial Inclusion Index (Guo et al., 2020). The second aspect focuses on the applications of digital inclusive finance. Scholars have examined its effects on urban–rural disparities, enterprise innovation, and poverty reduction (Liu and Liu, 2020; Xie et al., 2018; Wan et al., 2020). However, the specific impact of digital inclusive finance on the resilience of the agricultural industry chain has not yet received widespread attention.

In terms of the resilience of the agricultural industry chain, scholars tend to analyze its development opportunities and existing obstacles, while studies directly involving the construction of indicators and quantitative measurement are relatively scarce. The academic community widely recognizes a four-dimensional measurement framework for the level of industry chain resilience, which includes the ability of the system to resist shocks, recover from shocks, adapt to new environments, and restructure itself for adaptation (Maria and Marco, 2022).

Regarding the factors influencing the resilience of the agricultural industry chain, extensive studies have been conducted both domestically and internationally. Internal factors include the structure of agricultural products, the innovation enthusiasm of agricultural actors, and the supply of basic factors (Li et al., 2024). External factors include the integration of rural industries, the agglomeration of productive service industries, green technology innovation, and industrial digitalization (Song and Liu, 2023; Hao and Tan, 2023). Despite this, there are relatively few studies investigating how digital financial inclusion impacts the resilience of the agricultural industry chain.

To summarize, while the existing literature provides a useful reference for this paper, further investigation is needed. Previous studies have predominantly focused on economic resilience in different regions, with relatively few examining the resilience of the agricultural industry chain, particularly from the perspective of digital financial inclusion. This paper aims to fill that gap by exploring the mechanisms through which digital financial inclusion affects the resilience of the agricultural industry chain.

Additionally, most existing studies on human capital mechanisms are centered on the research and development personnel of high-tech industries. However, new agricultural management entities, closely linked to small farmers, play a crucial role in advancing agricultural modernization. Therefore, examining the impact of digital financial inclusion on the resilience of the agricultural industry chain from the perspective of new agricultural management subjects is highly significant.

To this end, this paper builds upon previous research to explore the impact and role channels of digital financial inclusion on the resilience of the agricultural industry chain. This study holds substantial practical significance for the development of the agricultural industry, offering new insights for promoting high-quality development within China’s agricultural economy.

2 Mechanisms of digital financial inclusion on the resilience of the agricultural industry chain

Digital inclusive finance, characterized by its low thresholds and widespread accessibility, extends financial services to those excluded by traditional finance through digital technology and internet platforms. This inclusive approach provides low-cost, low-barrier financial services, enabling more small farmers to access loans, savings, and payment services, thereby narrowing the gap in financial service accessibility (Liang and Zhang, 2018; Gong and Cheng, 2018; Chen and Yao, 2019). Such financial support is crucial for the development of all segments within the agricultural industry chain.

First, from the perspective of the production chain, digital financial inclusion serves as an effective risk management tool. Through digital technology, farmers can more easily access insurance services, including weather insurance and crop insurance, which can significantly mitigate losses from unforeseen events and enhance the ‘resilience of industrial chain to risks (Zhang et al., 2021).

Second, on the sales front, digital inclusive finance promotes information transparency. Platforms that integrate market information and agricultural production data empower farmers with better insights into market dynamics, enabling them to optimize production decisions and reduce resource wastage, thus enhancing the flexibility and adaptability of the industrial chain (Pang and Wu, 2023). Unlike traditional finance, digital inclusive finance leverages digital technology to accelerate the execution speed and process of financial services. This automation and online operation significantly improve the efficiency and convenience of financial services, providing small farmers with network technology and credit support. The adoption of new settlement and payment services considerably reduces the costs associated with matching, purchasing, supplying, and marketing agricultural production factors, lowers intermediate consumption, and supports low-cost, deep processing, thereby increasing the value-added agricultural products (Liu et al., 2021).

Moreover, digital inclusive finance is highly innovative. In recent years, it has continually introduced new financial products and services tailored to specific needs or scenarios, promoting the adoption of advanced technological elements and accelerating the penetration of agricultural technology. This, in turn, helps improve the resilience of the agricultural industry chain (Li and Dai, 2024). Based on the above analysis, this paper proposes Hypothesis 1.

H1: Digital financial inclusion can enhance the resilience of the agricultural chain.

Digital inclusive finance facilitates the development of new agricultural management entities (Lin and Fa, 2015; Zhang and Wen, 2021). These new entities are crucial for promoting appropriately scaled agricultural operations, which are essential for the transformation and upgrading of traditional agriculture to modern agriculture. In traditional agricultural business models, operations are largely family-based, characterized by limited production scales and high costs. In contrast, new agricultural management entities—such as cooperatives, enterprises, and family farms—can achieve large-scale production through structured, intensive management (Cao and Yuan, 2024).

However, new agricultural entrepreneurs often operate on a large scale and require significant initial capital investments to prepay land rents, purchase agricultural materials, and adopt new technologies. The long return cycles and inherent high risks in agriculture create substantial financing constraints. Digital inclusive finance, with its widespread accessibility and low entry barriers, can expand the financing options available to these new agricultural entrepreneurs, thereby meeting their financing needs and ensuring the sustainable development of their production and operations (Li et al., 2024).

These new agricultural management entities typically possess a high level of knowledge and technological innovation capabilities, along with relatively strong financial resources. They can enhance agricultural production efficiency through large-scale operations and establish their own product brands, leveraging the brand effect to their advantage. Additionally, new agricultural management entities usually have well-established supply chain management systems, enabling comprehensive management of agricultural products from production to sales, which, in turn, enhances the resilience of the agricultural industry chain (Zhao and Xu, 2024). Based on the above analysis, this paper proposes Hypothesis 2.

H2: Digital inclusive finance enhances the resilience of the agricultural industry chain through new agricultural management subjects.

Enhancing the resilience of the agricultural industry necessitates the deep processing and technological innovation of the sector, both of which cannot occur without financial support. The scarcity of financial institutions in rural areas, low credit ratings of farmers, and unstable incomes have led to significant financial constraints for rural entrepreneurial activities (Wang et al., 2024; Wen and Bi, 2016). Digital inclusive finance, with its timeliness and convenience, enables farmers to connect with financial institutions more easily and efficiently. This quick matching of fund supply and demand improves the efficiency of capital allocation and increases the likelihood of obtaining credit resources for agricultural technology innovation.

Digital inclusive finance supports innovation financing and offers transaction cost empowerment through digital technology for agricultural enterprises willing to innovate. This provides potential technical support for these enterprises to seek innovative partners and expand the breadth and depth of their open innovation (Sun et al., 2022; Wang and Cao, 2024). Once sufficient financial support is secured, new agricultural business entities can reduce their risk expectations in agricultural production and increase the application of high-quality seeds, advanced machinery, and new agricultural technologies, thereby achieving efficient use of agricultural inputs (Jiao and Liu, 2022).

Thus, digital inclusive finance can meet the financial needs of the agricultural industry, effectively promote agricultural technological innovation, and enhance the dissemination of agricultural technology. This influx of technological innovation into rural areas can help achieve economies of scale in agricultural operations, improve the efficiency of agricultural techniques, optimize the agricultural industry chain structure, and facilitate the transformation and upgrading agriculture. Additionally, it accelerates the spatial flow of technological innovation elements, thereby promoting high-level agricultural development and enhancing the resilience of the agricultural industry chain. Based on the above analysis, this paper proposes Hypothesis 3.

H3: Digital inclusive finance enhances the toughness of the agricultural industry chain through agricultural technological innovation.

3 Research design and data description

3.1 Benchmark regression model

First, we analyze the impact of the development status of digital inclusive finance on the resilience of the agricultural industry chain. In this paper, the level of agricultural industry chain resilience is selected as the explanatory variable, and the regression model is constructed as shown in Equation 1 with reference to the method of Li et al. (2024):

where is the resilience of the agricultural industry chain of province i in period t, is the level of digital financial inclusion development of province i in period t, is a series of control variables, is an individual effect, and is a random disturbance term.

3.2 Mediating effects model

In order to test the specific transmission mechanism of digital financial inclusion on the toughness of the agricultural industry chain, this paper draws on the method of Jiang (2022) and further constructs the mediation effect model to excavate the transmission mechanism of the impact of digital financial inclusion on the toughness of the agricultural industry chain on the basis of equation 1, and the model is as follows:

where indicates that the mediating variable is the new agricultural management main body, indicates that the mediating variable is agricultural technology innovation, and the meanings of the rest of the variables are consistent with equation 1.

3.3 Description of data sources and variables

3.3.1 Data sources

The article utilizes panel data from 30 provinces in China (excluding Tibet, Hong Kong, Macao, and Taiwan) covering the period from 2011 to 2020. The data sources for the study include the China Statistical Yearbook, the China Regional Statistical Yearbook, the China Rural Statistical Yearbook, and the China Agricultural Yearbook, supplemented by the China Agricultural and Forestry Database. Any individual missing data points were addressed using interpolation methods.

3.3.2 Explained variables

The development of the agricultural supply chain is instrumental in driving the steady expansion of the agricultural industry. Enhancing the agricultural supply chain is an effective means of improving the resilience of the agricultural industry chain. Most of the existing literature constructs index systems based on five dimensions: the ability of the system to resist shocks, its ability to recover after shocks, its ability to adapt to new environments, and its ability to reorganize after adaptation (Li and Dai, 2024; Hao and Tan, 2023).

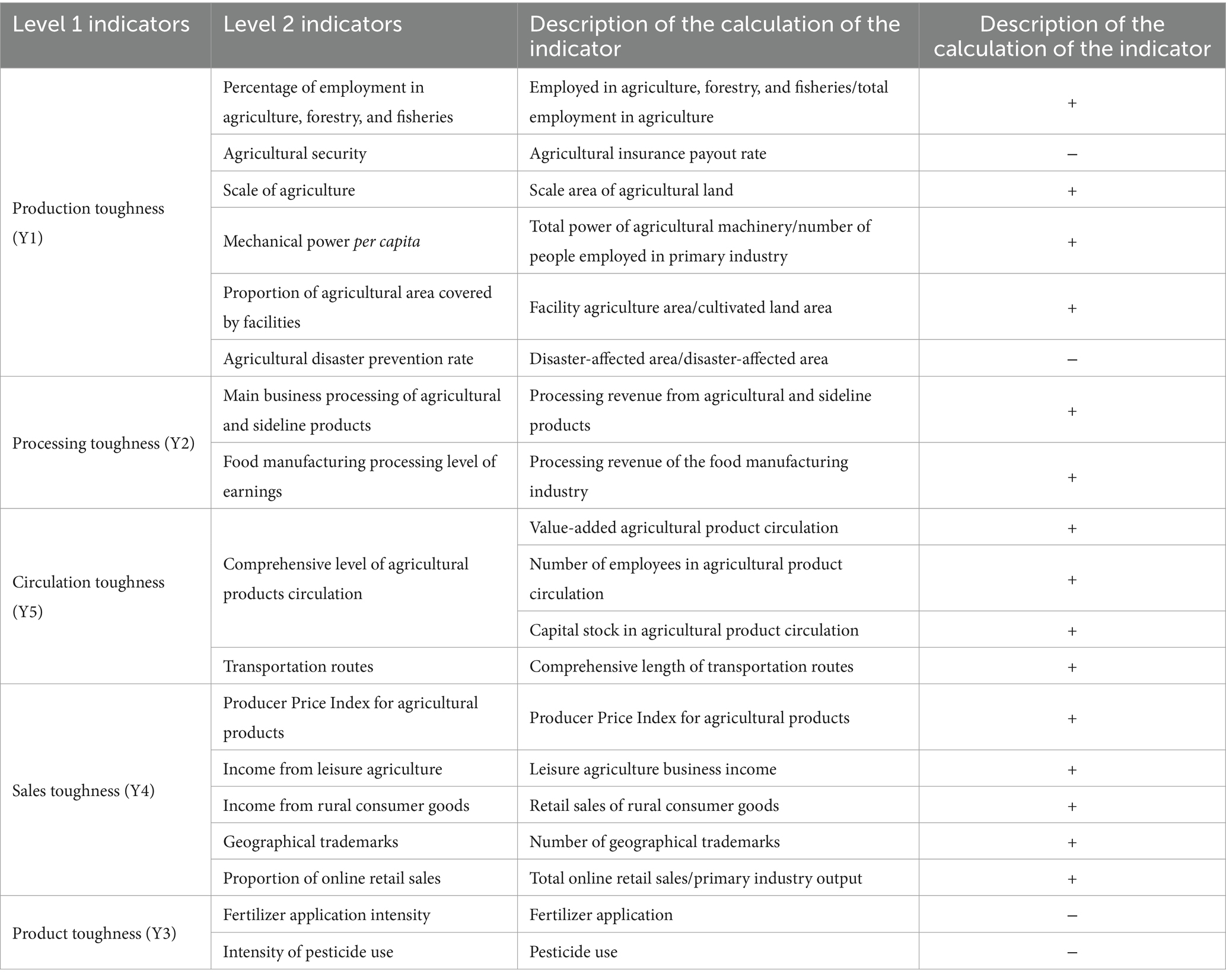

Building on and incorporating these existing findings, this paper selects the resilience of the agricultural industry chain as the explanatory variable. An index system is constructed using five primary dimensions: “processing resilience,” “production resilience,” “product resilience,” “marketing resilience,” and “circulation resilience.” The measurement indicators from the perspective of agricultural industry chain resilience help verify the coherence of industrial organization, production processes, and value realization. The specific indicator system is detailed in Table 1.

3.3.3 Core explanatory variables

Guo et al. (2020) compiled the Peking University Digital Inclusive Finance Index containing 33 specific indicators using Ant Group’s digital inclusive finance data, and this digital inclusive finance index system has been widely used at this stage. Therefore, the measurement results of “Peking University Digital Inclusive Finance Index (2011–2020)” compiled by the research group of Digital Finance Research Center of Peking University were chosen to measure the development level of digital inclusive finance, and as the digital inclusive finance index is of a different order of magnitude from the explanatory variable of the toughness of the agricultural industry chain, it was divided by 100 as the empirical data (Pang and Wu, 2023; Zhao and Zhang, 2023).

3.3.4 Mediating variables

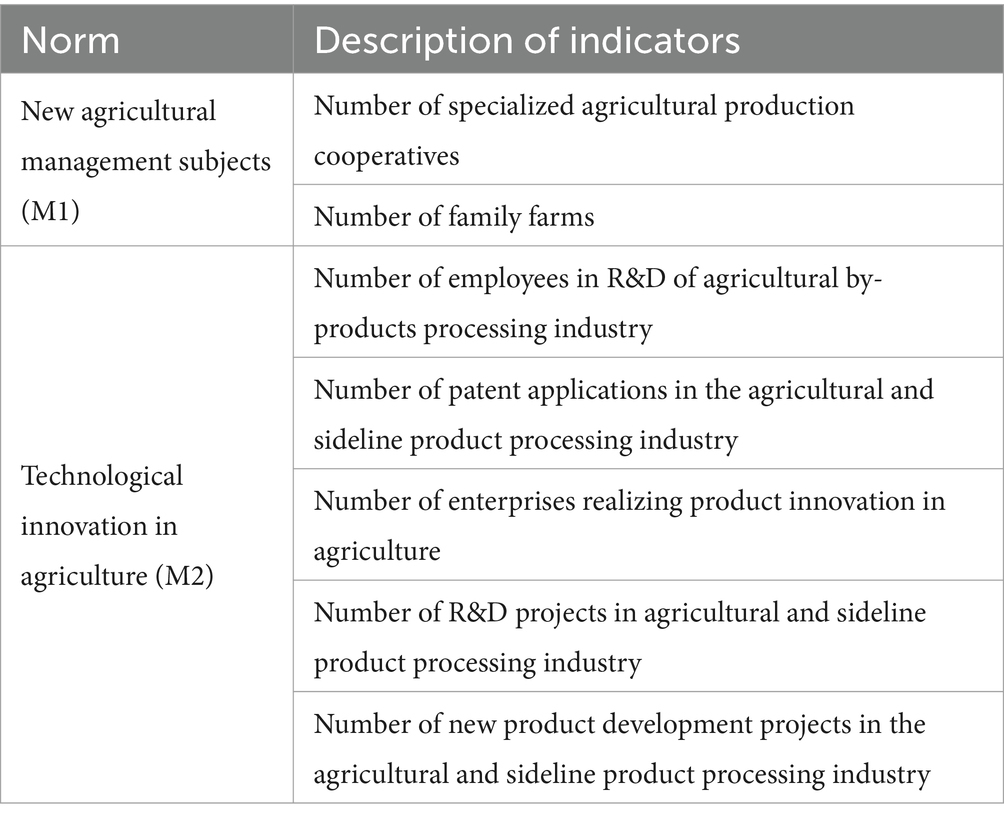

New agricultural management subjects (M1) and agricultural technology innovation (M2) were selected as mediating variables; agricultural technology innovation and new agricultural management subjects were generally measured by the entropy method; and the specific measurements are shown in Table 2.

3.3.5 Control variables

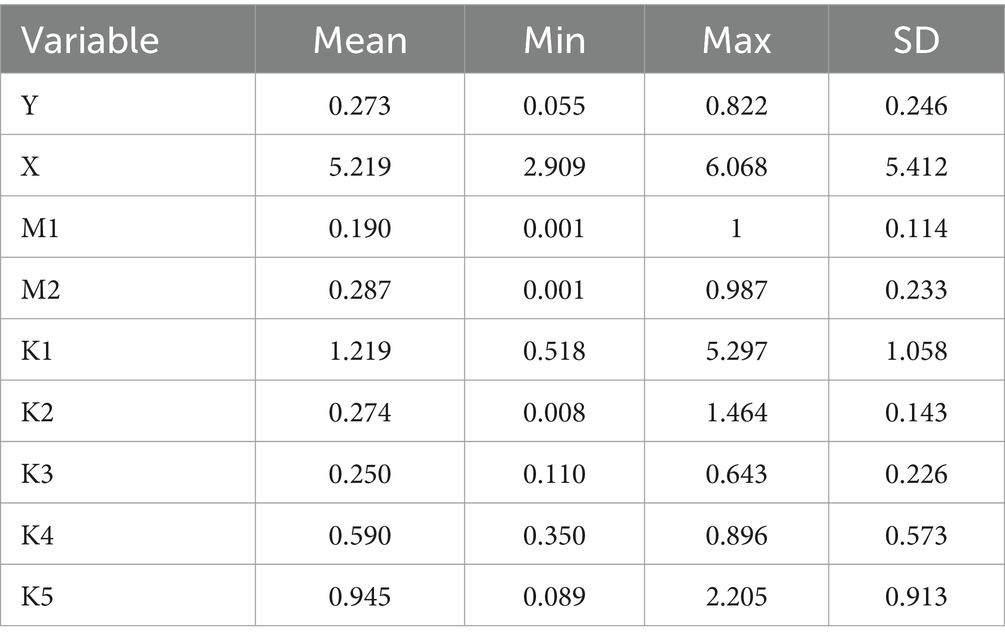

1. The degree of regional openness (K1), which is measured by choosing the ratio of total imports and exports to GDP for each province;

2. Rural human capital (K2), choosing as a proxy variable the number of years of schooling per rural resident, calculated as follows: (no schooling*0 + elementary school*6 + junior high school*9 + high school*12 + junior college and above*15)/(population of 3 years of age and above-number of preschoolers);

3. The level of economic development (K3), which is measured by selecting the GDP per capita of each province;

4. Primary industry share (K4), expressed as the ratio of primary industry to total industry revenue;

5. Urbanization ratio (K5), expressed as the share of urban population in the population of the province (Table 3).

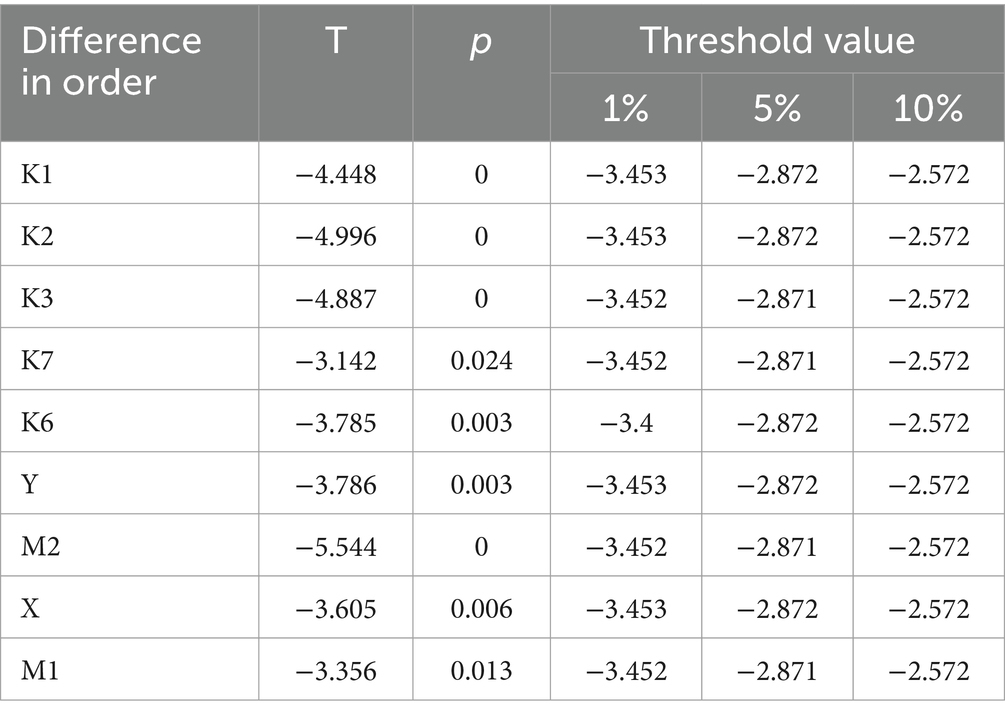

As direct regression equations for non-stationary series may result in pseudo-regression, the data are first tested for stationarity to see whether the variables are stationary series. In this study, the unit root test is done using the ADF test. The results show that the original hypothesis of the existence of unit root is rejected. This means that the series data are smooth and the results of the test are shown in Table 4.

4 Analysis of empirical results

4.1 The direct impact of digital financial inclusion on the resilience of the agricultural chain

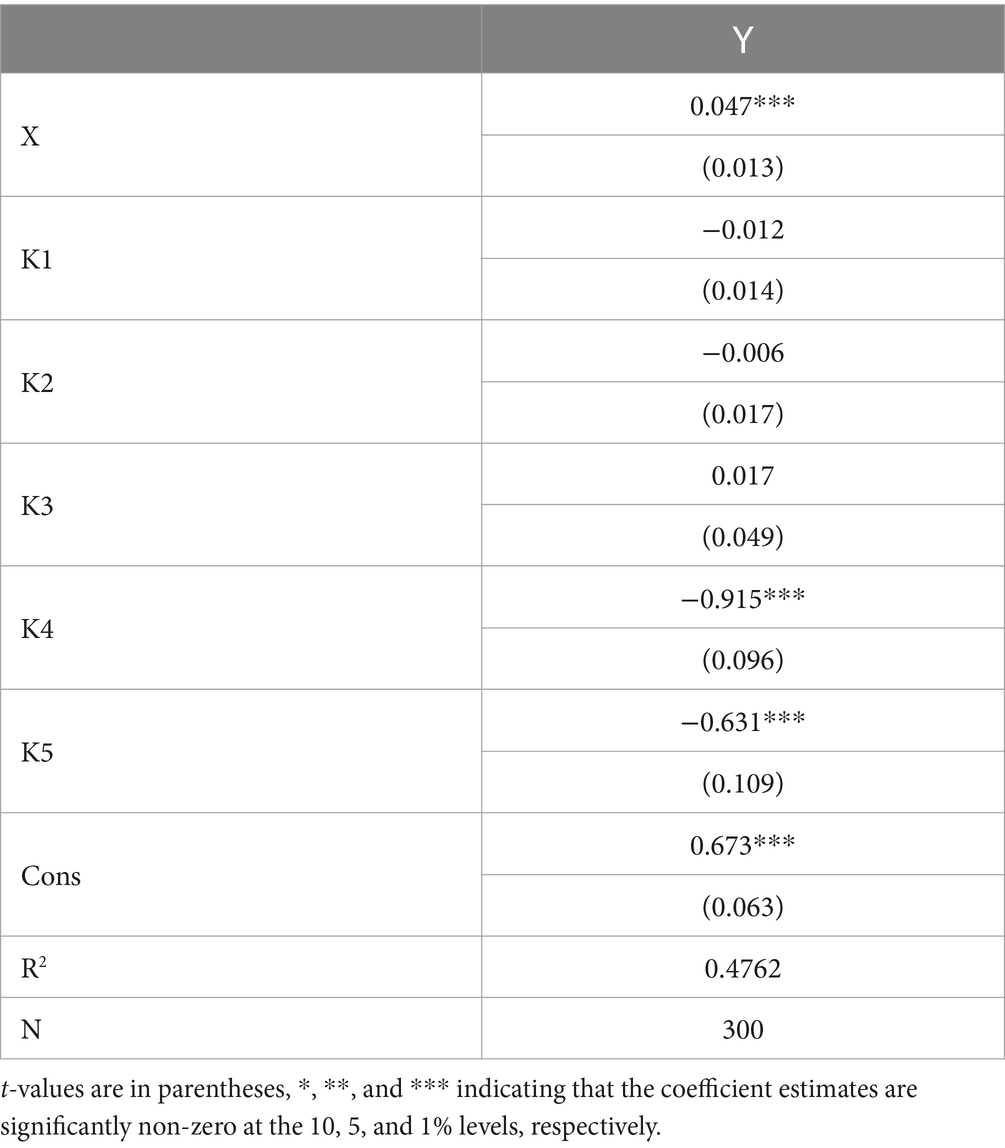

Table 5 presents the linear estimation results of the impact of digital financial inclusion on the resilience of the agricultural industry chain. According to the Hausman test results, the p-value is 0.000, which rejects the null hypothesis at the 1% significance level. Therefore, the paper employs a two-way fixed-effects model. The test results, as shown in Table 5, indicate that an increase in digital financial inclusion by one unit enhances the resilience of the agricultural industry chain by 0.047 units. This positive correlation is significant at the 1% level, suggesting that the development of digital financial inclusion effectively promotes the resilience of the agricultural industry chain. Consequently, Hypothesis 1 is verified.

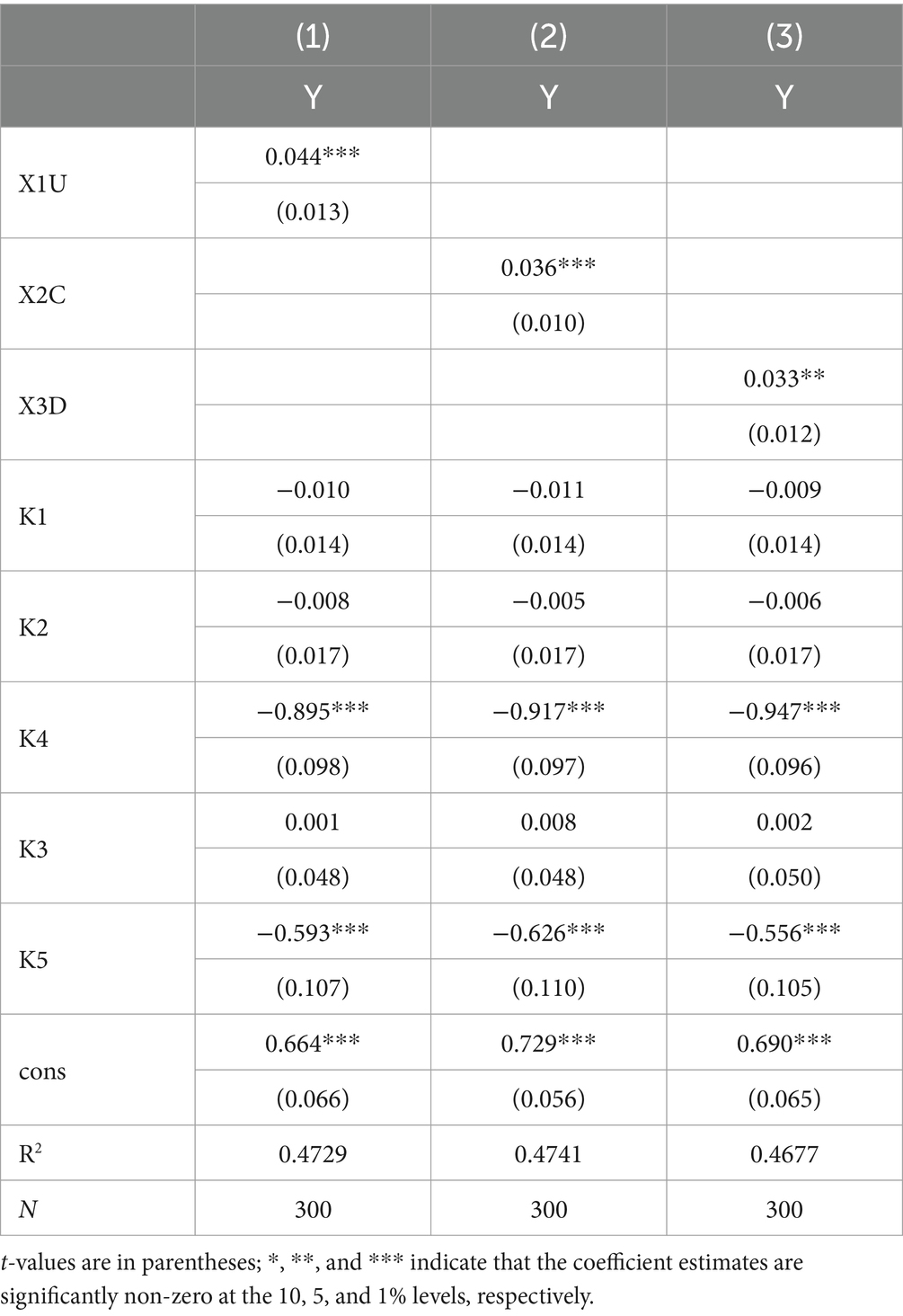

4.2 Sub-dimensional regression of agricultural chain toughness

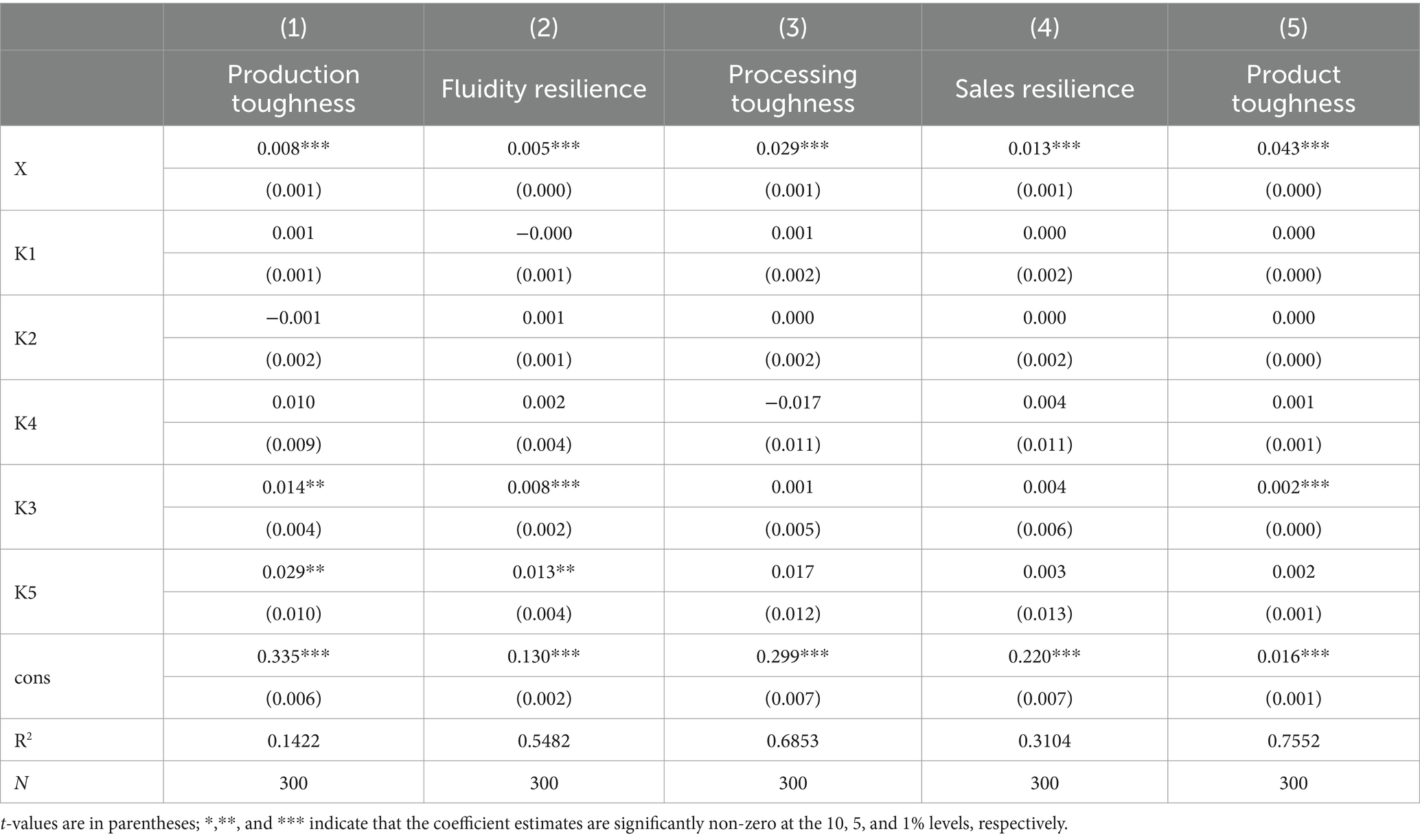

The sub-dimensions of the agricultural industry chain resilience—namely, “production resilience,” “processing resilience,” “product resilience,” “marketing resilience,” and “circulation resilience”—are regressed against digital financial inclusion to explore the impact of digital financial inclusion on these sub-dimension indicators.

As shown by the regression results in Table 6, the impact coefficients for “production resilience” and “circulation resilience” are slightly lower. The lower impact coefficient for production resilience may be attributed to the seasonality, cyclicality, and uncertainty inherent in agricultural production, which makes it challenging for digital inclusive financial products and services to meet the specific needs of agricultural production. Agricultural production faces risks such as weather and market volatility, and digital financial inclusion has limited capabilities in managing these risks. Consequently, farmers may require additional risk management tools and services to cope with production uncertainties, areas where role of digital financial inclusion is relatively limited.

For circulation resilience, the insufficiency of coefficient may be due to the logistics of agricultural products relying heavily on infrastructure such as transportation, warehousing, and information systems. In some areas, underdeveloped infrastructure, inconvenient transportation, insufficient storage facilities, and poor information flow result in inefficient logistics for agricultural products. Additionally, the lack of specialized logistics service providers leads to issues such as product loss and quality degradation during transportation, which also constrains the rapid development of agricultural industry resilience.

Conversely, digital financial inclusion has the most significant impact coefficient on “product resilience.” The coefficients for “sales resilience” and “processing resilience” are significantly positive at the 1% level, at 0.013 and 0.029, respectively. This significant positive correlation may be due to the rapid development of e-commerce, live streaming, and other new sales methods facilitated by digital financial inclusion, providing more efficient channels and methods for the sale of agricultural products. Moreover, the integration of digital finance with agricultural processing enhances the supply and added value of agricultural products, further strengthening the resilience of the agricultural industry chain.

Based on the overall findings, the participation of digital financial inclusion significantly enhances key areas of the resilience of agricultural industry chain, particularly in product and sales processes, thus validating the hypotheses proposed.

4.3 Endogeneity test

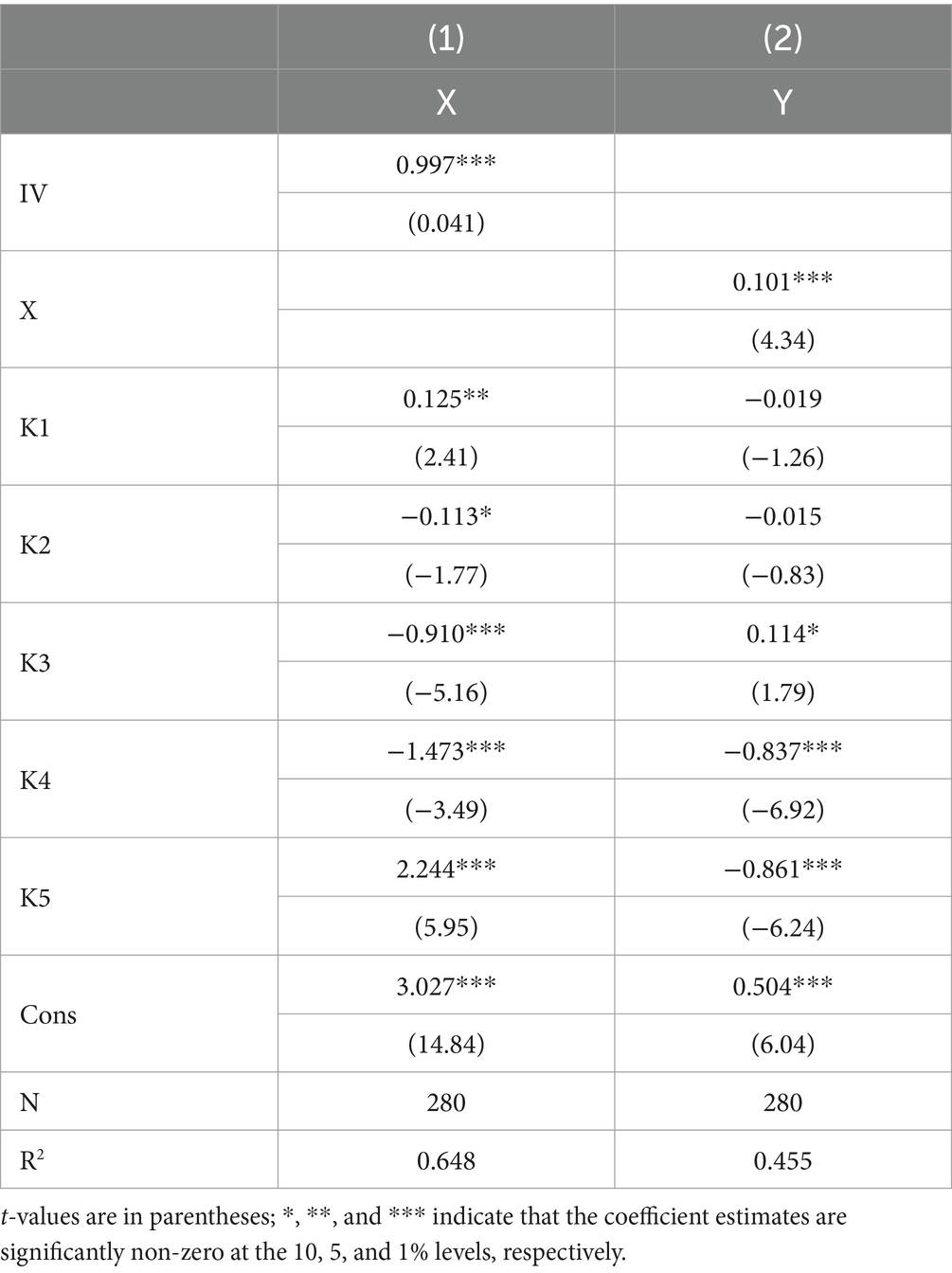

Considering the impact of indicator measurement error and omitted variables, this paper selects the distance between provinces and Hangzhou as an instrumental variable to deal with the endogeneity problem (Huang et al., 2023; Liao et al., 2020) and chooses “the distance between the province where the family is located and Hangzhou” as an instrumental variable for the level of development of digital inclusive finance. First, because distance affects economic activities, the further away from Hangzhou a ‘province of household is, the lower the level of development of digital financial inclusion may be, thus meeting the conditions for instrumental variable correlation. Second, the “distance between the home province and Hangzhou” does not directly affect the economic behavior of individuals and will not change due to the development of digital financial inclusion, which is a typical exogenous variable. The regression results of the instrumental variables are shown in Table 6. From the first stage of the results in column (1), the instrumental variables are significantly positively correlated with the resilience of the agricultural industry chain, which confirms that the instrumental variables satisfy the correlation hypothesis. Column (2) shows the second-stage regression results. After the regression using instrumental variables, the results are consistent with the benchmark regression results above that digital financial inclusion can significantly improve the resilience of the agricultural industry chain. The Cragg–Donald Wald F-value for the instrumental variables in the first stage is 2073.828 and the Kleibergen–Paap rk Wald F-value is 149.927, both of which are greater than 10, which excludes the problem of weak instrumental variables (Table 7).

4.4 Robustness tests

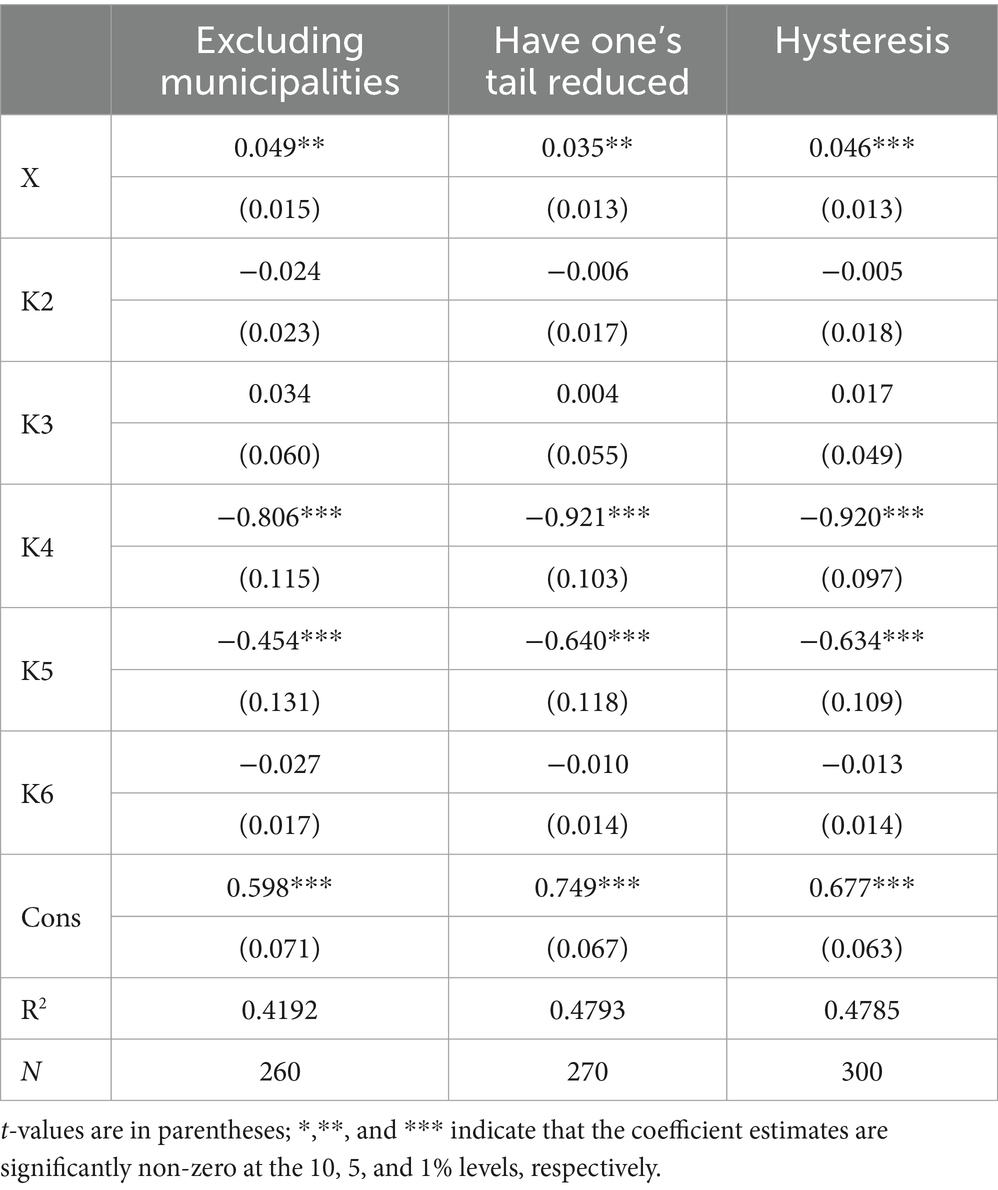

In order to verify the reliability of the above results, this paper adopts three robustness tests: first, excluding municipalities directly under the central government. Considering the special status of municipalities, the development level of digital inclusive finance and resilience of the agricultural industry chain is quite different from that of other provinces, so the samples are re-estimated after eliminating the four municipalities of Beijing, Shanghai, Tianjin, and Chongqing. Second, shrinking tail treatment. In order to avoid the impact of extreme values of data on the regression results, the sample values of all variables are subjected to the upper and lower 1% shrinking tail treatment. Third, lagged variables. Because the impact of digital financial inclusion has a time lag, this paper uses the digital financial inclusion index with a lag of one period to rerun the regression.

The results are shown in Table 8, and the conclusions of this paper still hold after considering possible endogeneity and robustness.

4.5 Sub-dimensional regression

Drawing on the framework of Guo et al. (2020), digital financial inclusion can be subdivided into three distinct dimensions: breadth of coverage, depth of use, and degree of digitization. This paper further analyzes the impact of these three dimensions on the resilience of the agricultural industry chain. The results, as shown in Table 8, indicate that all three dimensions—breadth of coverage, depth of use, and degree of digitization—positively promote the resilience of the agricultural industry, with their impact coefficients being significant. The significant impact coefficient of the degree of digitization suggests that the current development of digital technology for digital financial inclusion in China has made substantial progress and that the constraints on the development of digital technology have been alleviated. The significant influence of the breadth of coverage on the resilience of the agricultural industry chain could be attributed to the well-developed state of digital finance in China, which minimizes the gap between the extent of digital financial inclusion development in underdeveloped and developed regions. The significant coefficient for the depth of use likely indicates that as digital financial inclusion becomes more widespread, farmers are receiving increased financial support. The extensive range of financial services currently covered by digital technology allows more individuals to invest their money in agricultural production and rural development. This, in turn, enhances the resilience of the agricultural industry. In summary, the analysis indicates that the breadth of coverage, depth of use, and degree of digitization of digital financial inclusion all contribute positively and significantly to enhancing the resilience of the agricultural industry chain. This underscores the importance of advancing digital financial inclusion across all its dimensions to foster a more resilient agricultural sector (Table 9).

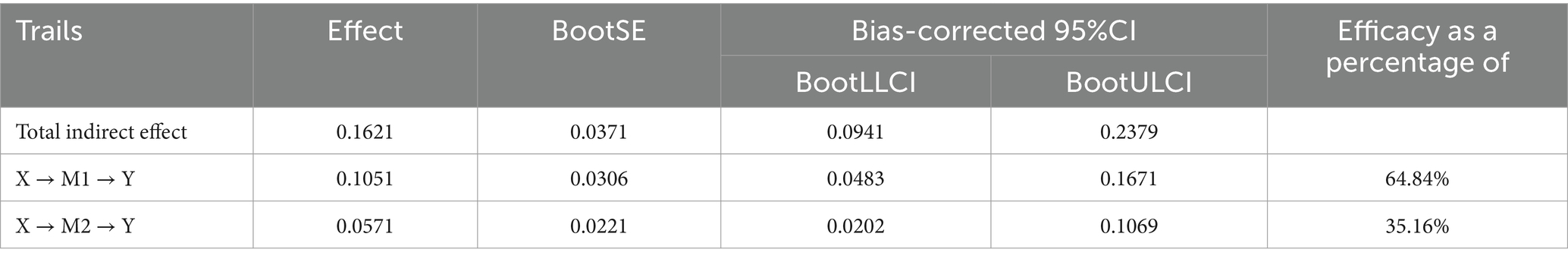

4.6 Analysis of intermediation effects

The Bootstrap method was used to test the mediation effect, repeated with 1,000 samples and a 95% confidence interval. The results are shown in Table 10. The value of the indirect effect of digital financial inclusion on the resilience of the agricultural industry chain through new agricultural management entities is 0.1051, with the 95% confidence interval not containing 0. Similarly, the value of the indirect effect through agricultural technology innovation is 0.0571, with the 95% confidence interval also not containing 0.

These results indicate that the characteristics of new agricultural management entities—such as scale operation, specialized production, and innovation-driven practices—significantly enhance the resilience of the agricultural industry. To bolster the resilience of the agricultural sector, it is important to leverage the demonstration-driven role of these new agricultural entities, improve the brand efficiency and pricing capabilities of agricultural products, and elevate the marketization level. This approach contributes to the ability of entire industrial chain to withstand market risks, thereby confirming Hypothesis 2.

Furthermore, digital inclusive finance can provide essential financial support for agricultural technological innovation, guiding and promoting improvements in agricultural technology levels and diffusion. This positively influences the level of agricultural technological innovation, thereby confirming Hypothesis 3.

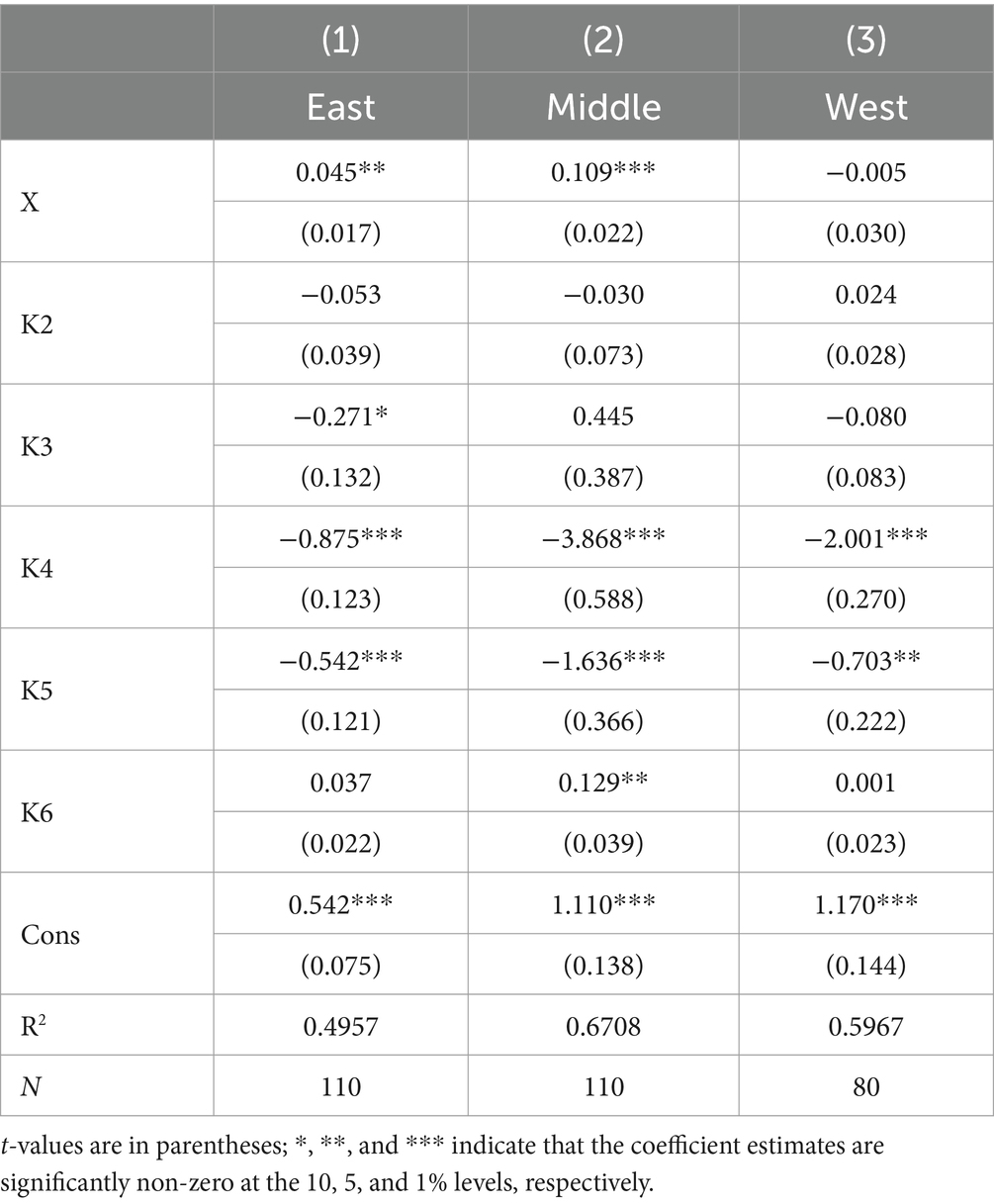

4.7 Heterogeneity analysis

While focusing on the impact of digital financial inclusion on the resilience of the agricultural industry, regional differences and gaps in the level of digital financial inclusion may lead to different results. The regression results on regional heterogeneity are shown in Table 11. Columns (1), (2), and (3) present the empirical regression results for the eastern, central, and western regions, respectively. The findings indicate that the regression coefficient for digital financial inclusion is significantly positive in both the eastern and central regions, but its impact coefficient decreases progressively. The significance of digital financial inclusion is notably weaker in the Western region. From these regression results, it can be inferred that the impact of digital financial inclusion on the resilience of the agricultural industry in China exhibits regional heterogeneity. Specifically, the promotional effect of digital financial inclusion on the resilience of the agricultural industry chain is strongest in the eastern region, followed by the central region, and weakest in the Western region. Several potential reasons account for these results. First, the earlier development of eastern region of digital financial inclusion and a higher level of regional economic development resulted in the most significant role of digital financial inclusion in promoting agricultural industry chain resilience. Second, the central region enjoys favorable resource factors and policy preferences, creating advantageous conditions for regional development. The development of digital financial inclusion in this area reduces financing costs and thresholds, facilitating the free flow of production factors such as labor, capital, and data, thereby promoting the resilience of the agricultural industry chain. In contrast, the Western region has a comparatively weak foundation for the development of digital financial inclusion. Digital industrialization and intelligent transformation lag behind, and there are numerous disadvantaged groups, such as small and micro-enterprises and low-income individuals. The influence of the traditional financial foundation and financial literacy in these areas has led to a lower application level of digital technology in financial services and support. Consequently, the development dividends of digital financial inclusion have not been fully realized in the Western region.

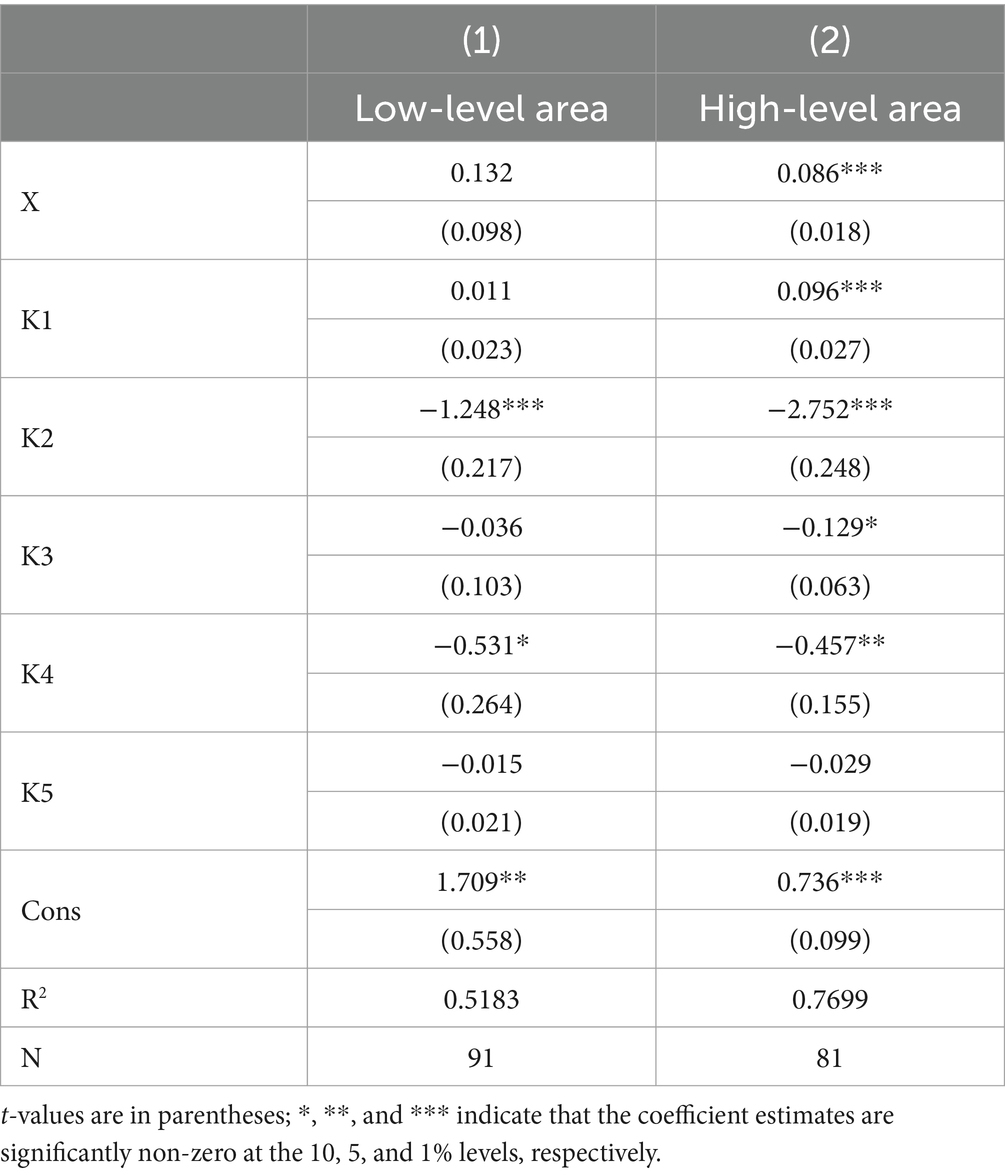

Building upon this basis, the paper categorizes the 30 provinces into regions with high levels of digital financial inclusion and regions with low levels of digital financial inclusion, using the average value of digital financial inclusion over the years as the threshold for grouping. Regions with an average digital financial inclusion index below the threshold are classified as low-level regions, while those with an average value above the threshold are classified as high-level regions. The regression results for the heterogeneity of digital financial inclusion are presented in Table 10. Columns (1) and (2) display the empirical regression results for low-level and high-level digital financial inclusion regions, respectively. The results indicate that regions with high levels of digital financial inclusion exhibit a more significant positive impact on the resilience of the agricultural industry chain compared to low-level regions. This may be attributed to the more advanced agricultural infrastructure and relatively mature conditions for agricultural development in regions with high levels of digital financial inclusion. Consequently, the ‘effect of digital financial inclusion on promoting the resilience of the agricultural industry is most pronounced in these high-level regions (Table 12).

5 Conclusion and policy recommendations

This paper analyzes the impact of digital inclusive finance on the toughness of the agricultural industry chain by constructing the agricultural industry chain toughness index system and draws the following main conclusions. First, digital inclusive finance has an obvious promotion effect on the improvement of the toughness of the agricultural industry chain. Second, agricultural technological innovation and new agricultural management subjects play an intermediary role in the impact of digital financial inclusion on the resilience of the agricultural industry chain. Third, the impact of digital financial inclusion on the resilience of the agricultural industry chain varies in the region as well as in the level of digital financial inclusion. The impact of digital financial inclusion on the resilience of the agricultural industry chain is more significant in the eastern region and regions with high levels of digital financial inclusion.

Based on the above findings, the following policy recommendations are made:

First, promote the deep integration of digital inclusive finance and the agricultural industry chain. There are regional differences in digital inclusive finance; backward regions should continue to improve infrastructure construction and increase investment in the construction of base stations, to create hard conditions for the promotion and popularization of digital inclusive finance; regions with relatively high levels of development should focus on the development and application of digital equipment and digital technology in the process of agricultural production and operation, to stimulate digital productivity. At the same time, it is necessary to strengthen the training related to the use of digital technology for farmers and improve their digital literacy. In addition, it is necessary to focus on the collection, organization, and release of relevant information and data in the process of agricultural production and operation, strengthen the exchange of information and collaboration between regions, establish a digital sharing platform, continuously improve the role of data in the production and operation process, and transform the traditional mode of agricultural production and operation and improve the toughness of the agricultural industry chain through the use of data elements.

Second, support for new agricultural business entities should be increased. Relax the policy constraints on financial system innovation in rural areas, guide financial institutions to reasonably position themselves in rural areas, promote rural financial supply, innovate financial products, and stimulate the effective financial demand of new agricultural business mainstays; tailor-made financial products can be designed to meet the special needs of new agricultural business mainstays, including flexible lending programs, low-interest loans, and unsecured loans, in order to satisfy their financing needs; set up a perfect credit assessment system, including assessing and recording the credit records of new agricultural business entities, which will help farmers obtain more financial support and more favorable loan terms; provide financial education and training targeted at new agricultural business entities to help them improve their financial management capabilities and make better use of financial tools for business management; it is necessary to give full play to the demonstration role of new agricultural management main bodies, create the brand benefits of agricultural products and broaden the market for agricultural products. In addition, new agricultural management main bodies are encouraged to take the initiative to absorb small farmers to join them or to help neighboring small farmers, to give full play to the economy of scale drive the role of the agricultural industry, and to realize the improvement of economic efficiency and the resilience of the agricultural industry.

Third, agricultural technological innovation should be strengthened to promote the sustainable development of the agricultural industry chain. The government should cultivate farmers’ awareness of innovation, improve the concept of innovation, and carry out education and training for agricultural technology innovators to help them understand financial instruments and financial markets, improve their awareness of fund management and risk prevention, and better utilize financial resources to support technology innovation projects; financial institutions can design loan products specifically designed to support agricultural technological innovation, including research and development loans and technological innovation loans, to help agricultural research institutions, farmers’ cooperatives, and agricultural enterprises to obtain funds for technological innovation projects, promoting financial science and technology innovation to provide more convenient and efficient financial services for agricultural technology innovation, such as realizing the traceability of agricultural products and the transparency of capital flow through blockchain technology, and providing precise management of agricultural production through big data analysis. Financial institutions can cooperate with scientific research institutes and agricultural enterprises to establish a technology innovation-sharing platform to provide agricultural technology innovators with opportunities for resource sharing, technology exchanges, and cooperation, promote the popularization and application of technological innovation achievements, smooth the chain of transformation of agricultural technological innovation achievements, guide healthy competition, and encourage scientific research institutes to provide intellectual support to the agricultural industry chain. Financial institutions should promote the downward sinking of credit to rural areas, increase funding for high-end agricultural technologies, and alleviate the financing constraints of enterprises in the whole chain of the agricultural industry, to enhance the resilience of the agricultural industry chain.

Admittedly, this article has many shortcomings. Based on the availability of data, this article chooses to study the impact of digital financial inclusion on the toughness of the agricultural industry chain from the provincial level, and fails to go deep into the prefectural level or even the county level, and looks forward to further in-depth research with more complete data in the future; at present, a unified indicator construction system has not yet been reached regarding the toughness of the agricultural industry chain, and this article combines the theory with the existing literature and builds the comprehensive evaluation index system of the toughness of the agricultural industry chain on the basis of theory and its own thinking. Based on the existing literature, this paper constructs a comprehensive evaluation index system of the toughness of the agricultural industry chain by combining theory and our own thinking, and we expect that there will be a more authoritative and unified construction method in the future, so as to better carry out the research on the toughness of the agricultural industry chain.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

XG: Methodology, Writing – review & editing. RG: Data curation, Methodology, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. National Social Science Fund of China, Research on the Mechanism and Realization Path of Rural New Business Development in the Context of Digital Countryside Construction (22BJY208).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Cao, L., and Yuan, H. R. (2024). The impact of digital inclusive finance on the total factor productivity of new agricultural enterprises. J. China Agricul. University 29, 285–296. doi: 10.11841/j.issn.1007-4333.2024.11.27

Chen, D., and Yao, M. (2019). Empirical analysis of the impact of digital inclusive finance on rural residents' income. Shanghai Finance 6, 74–77. doi: 10.13910/j.cnki.shjr.2019.06.011

Dai, H., Wei, J. Y., and Yin'e, C. (2023). Research on the impact of digital financial inclusion on the resilience of China's agricultural economy. Price Theory and Practice 8, 144–148. doi: 10.19851/j.cnki.CN11-1010/F.2023.08.233

Gong, Q. Y., and Cheng, X. Z. (2018). Digital financial inclusion, rural poverty and economic growth. Gansu Soc. Sci. 6, 139–145. doi: 10.15891/j.cnki.cn62-1093/c.2018.06.021

Guo, F., Wang, J. Y., Wang, F., et al. (2020). Measuring the development of digital inclusive finance in China: indexing and spatial characterization. Economics(Quarterly) 19, 1401–1418. doi: 10.13821/j.cnki.ceq.2020.03.12

Hao, A. M., and Tan, J. Y. (2023). Mechanism and effect measurement of rural industrial integration empowering agricultural resilience. Agricul. Technol. Econ. 7, 88–107. doi: 10.13246/j.cnki.jae.20220418.002

He, Y., and Yang, S. (2021). Research on toughness forging of agricultural industry chain under “double cycle” scenario. Agricul. Eco. 10, 78–89. doi: 10.13246/j.cnki.iae.20210714.001

Huang, Z. H., Song, W. H., and Ye, C. H. (2023). The impact and mechanism of digital inclusive finance on the creation of new agricultural business entities-empirical evidence from 1845 counties in China. Financial Res. 4, 92–110.

Jiang, T. (2022). Mediating and moderating effects in empirical studies of causal inference. China Industrial Economy 5, 100–120. doi: 10.19581/j.cnki.ciejournal.2022.05.005

Jiao, Q. X., and Liu, Y. Z. (2022). Digital inclusive finance, agricultural science and technology innovation and rural industry integration development. Statistics and Decision Making 38, 77–81. doi: 10.13546/j.cnki.tjyjc.2022.18.015

Li, R. Y. (2015). A study on the priority order of farmers' demand for agricultural socialization services--an analysis based on micro-survey data in 15 provinces. J. Northwest Agricul. Forestry University (Soc. Sci. Edn.) 15, 86–94. doi: 10.13968/j.cnki.1009-9107.2015.01.014

Li, Y. Q. (2023). Integration of rural three industries, agglomeration of productive service industry and modernization of agricultural industry chain supply chain. China Circulation conomy 37, 48–60. doi: 10.14089/j.cnki.cn11-3664/f.2023.03.004

Li, A. B., and Dai, H. (2024). Research on the influence mechanism of digital inclusive finance on the upgrading of agricultural industry structure. Zhejiang Agricul. Sci. 65, 475–482. doi: 10.16178/j.issn.0528-9017.20230204

Li, P., He, R. S., and Liu, C. (2024). Influence mechanism and effect of digital rural construction empowering agricultural economic resilience. Statistics and Decision Making 40, 11–17. doi: 10.13546/j.cnki.tjyjc.2024.02.002

Liang, B., and Zhang, J. H. (2018). Can China's inclusive financial innovation alleviate the financing constraints of small and medium-sized enterprises. China Sci. Technol. Forum 11, 94–105. doi: 10.13580/j.cnki.fstc.2018.11.013

Liao, K., Yang, J., and Zeng, J. (2020). Agricultural technological progress, food security and farmers’ income - a panel data analysis based on 31 provinces in China. Rural Eco. 4, 60–67.

Lin, L. F., and Fa, N. (2015). The deep reasons for financing difficulties of new agricultural management subjects and the path of dissolution. Nanjing Soc. Sci. 7, 150–156. doi: 10.15937/j.cnki.issn1001-8263.2015.07.022

Liu, J. Y., and Liu, C. Y. (2020). The rural poverty reduction effect of digital inclusive finance:effects and mechanisms. Financ. Econ. 1, 43–53. doi: 10.13762/j.cnki.cjlc.2020.01.004

Liu, X., Zang, W., and Zhang, Y. (2021). Digital inclusive finance drives the integrated development of rural industry: effect assessment and mechanism test. J. Shanghai Lixin Coll. Accounting and Finance. 33, 35–50. doi: 10.13230/j.cnki.jrsh.2021.05.002

Maria, S. G., and Marco, M. (2022). Industrial resilience, regional diversification and related variety during times of crisis in the US urban–rural context. Reg. Stud. 56, 1605–1617.

Pang, J. B., and Wu, N. L. (2023). Research on the influence effect and mechanism of digital inclusive finance on the integrated development of rural industry. J. Hubei University Nationalities (Philos. Soc. Sci. Edn.) 41, 94–103. doi: 10.13501/j.cnki.42-1328/c.2023.02.010

Pang, H. W., Yang, Y., and Gong, Y. H. (2024). Digital inclusive finance, new quality productivity and urban-rural integrated development. Statistics and Decision Making 40, 24–30. doi: 10.13546/j.cnki.tjyjc.2024.19.004

Song, M., and Liu, X. Y. (2023). Research on the resilience mechanism of digital economy-enabled agriculture--an analysis of the mediating effect based on human capital. Jiangsu Soc. Sci. 1, 103–112. doi: 10.13858/j.cnki.cn32-1312/c.20230207.008

Sun, X. T., Yu, T., and Yu, F. (2022). The impact of digital financial inclusion on agricultural mechanization-evidence from 1,869 counties in China. China Rural Econ. 2, 76–93.

Wan, J. Y., Zhou, Q., and Xiao, Y. (2020). Digital finance, financing constraints and corporate innovation. Econ. Rev. 1, 71–83. doi: 10.19361/j.er.2020.01.05

Wang, Y., and Cao, W. J. (2024). Analysis of the role mechanism of digital inclusive finance in enhancing agricultural science and technology innovation. J. Yunnan Agricul. University (Soc. Sci.) 18, 9–14. doi: 10.12371/j.ynau(s).202406134

Wang, J. Y., Mao, J., and Zhang, X. (2024). Digital finance, financing constraints and corporate innovation. Econ. Rev. 1, 71–83. doi: 10.16127/j.cnki.issn1003-1812.2024.02.001

Wen, F., and Bi, H. (2016). Empirical analysis of coupled coordination of agricultural factor endowment and technological progress in Tai’an City. Science and Industry. 16, 61–63.

Xie, X. L., Shen, Y., and Zhang, H. X. (2018). Can digital finance promote entrepreneurship?--evidence from China. Economics(Quarterly) 17, 1557–1580. doi: 10.13821/j.cnki.ceq.2018.03.12

Zhang, L., and He, B. (2023). Rural financial services for the construction of a strong agricultural country: realistic dilemma and breakthrough path. J. Agricul. Forestry Eco. Manage. 22, 692–699. doi: 10.16195/j.cnki.cn36-1328/f.2023.06.72

Zhang, H., Wang, H., and Li, Z. (2021). Measuring the level of high-quality development of China's digital agriculture in the context of rural revitalization - an analysis based on data from 31 provinces and cities across China from 2015-2019. J. Shaanxi Normal University (Philos. Soc. Sci. Edition) 50, 141–154. doi: 10.15983/j.cnki.sxss.2021.0525

Zhang, L., and Wen, T. (2021). Realistic problems and cracking path of rural finance high quality Service for Rural Revitalization. Modern Econ. Discussion 5, 110–117. doi: 10.13891/j.cnki.mer.2021.05.013

Zhang, L. Y., and Zhang, H. N. (2013). Financial constraints and household entrepreneurship - urban-rural differences in China. Beijing: Financial Res. 9, 123–135.

Zhao, Y., and Xu, Y. (2024). Exploring the cultivation and development of rural characteristic industries in poverty-stricken areas--based on the case study of jiubao village. Shanxi Agricultural Economy. 18, 169–172. doi: 10.16675/j.cnki.cn14-1065/f.2024.18.050

Zhao, Z., and Zhang, Y. (2023). How does rural finance affect modern agricultural development? Based on financial function perspective. J. Hunan Eng. Coll. 33, 28–38.

Zhou, P. F., and Li, M. H. (2023). Digital rural construction empowers agricultural economic resilience: influence mechanism and empirical investigation. Res. World 9, 15–24. doi: 10.13778/j.cnki.11-3705/c.2023.09.002

Keywords: digital inclusive finance, agricultural industry chain resilience, agricultural technology innovation, new agricultural management main body, mediation effect

Citation: Gao X and Gao R (2024) A study of the impact of digital financial inclusion on the resilience of the agricultural chain. Front. Sustain. Food Syst. 8:1448550. doi: 10.3389/fsufs.2024.1448550

Edited by:

Jianxu Liu, Shandong University of Finance and Economics, ChinaReviewed by:

Zlati Monica Laura, Dunarea de Jos University, RomaniaShutong Liu, Nankai University, China

Copyright © 2024 Gao and Gao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ruyun Gao, MTM2NDM1ODM0NUBxcS5jb20=

Xia Gao

Xia Gao Ruyun Gao

Ruyun Gao