- School of Finance, Anhui University of Finance and Economics, Bengbu, China

The inherent fragility of the agricultural industry significantly restricts the financing channels available to new agricultural operating entities. Access to credit loans emerges as a pivotal means to address capital shortages among farmers and enhance production inputs. Drawing on survey data from 17,745 new agricultural operating entities engaged in food production in Lu’an City, Anhui Province, and agricultural households documented in the China Household Finance Survey Database, this paper employs the Logit model and the Heckman selection model to empirically analyze the loan decision-making behavior of these entities from two perspectives: loan willingness and credit scale. The research reveals that several key variables exert a significant positive influence on the borrowing willingness of grain producers. Specifically, the planting area range, input range per hectare, the rate range of return on investment, membership in cooperatives, and operation as a family farm all notably enhance their willingness to seek loans. Conversely, the net income per hectare and the number of crop types cultivated significantly diminish their inclination to borrow. Additionally, male operators and those with higher educational backgrounds demonstrate a stronger willingness to obtain loans. Furthermore, the study indicates that the planting area and membership in cooperatives also positively correlate with the scale of loans secured by these agricultural operating entities. Therefore, from the perspective of food security, it is essential to cultivate food-producing new agricultural operating entities. This requires a focus on the counter-cyclical adjustment of financial support, increasing credit support during years of low investment returns. Additionally, it is necessary to develop multiple forms of moderate-scale operations, enhance policy support, and boost the production enthusiasm of food-producing new agricultural operating entities.

1 Introduction

Food security is a major strategic issue that is closely related to China’s economic development and social stability (National Development and Reform Commission, 2008). In terms of ensuring national food security, the new agricultural operating entities of grain production play an important role (Zhang and Zhang, 2024). In the context of China’s land transfer speed and the acceleration of agricultural modernization, the scale of land management of new agricultural operating entities of grain production has gradually expanded, and has become an important force in stabilizing grain production and promoting the transformation and upgrading of grain production (Niu and Shang, 2024). In the process of production and operation, the new agricultural operating entities of grain production are faced with the dual risks of market environment and natural environment. There are characteristics such as a large seasonal demand for capital, a short response period for loans, and a significant influence from agricultural timing. It is often difficult for agricultural production and operation entities to provide collateral recognized by financial institutions, which leads to the complexity and personalization of loan decision-making behavior of new agricultural operating entities of grain production (Luo, 2019, 2021). Due to the slow development of traditional rural finance, the financing needs of new agricultural operating entities cannot be met accordingly, and the shortage of funds is becoming a bottleneck restricting their further development (Lin and Fa, 2015a,b). The financing obstacles of new agricultural operating entities mainly come from three aspects: itself, formal financial institutions such as banks and policy environment (Lin and Fa, 2015a,b). Currently, agricultural credit guarantee resources face several issues, including the coexistence of idle capacity and scarcity, as well as elevated transaction costs stemming from information asymmetry (Xu, 2021). Therefore, it is of great significance to analyze the loan decision-making behavior and its influencing factors of new agricultural operating entities in grain production, and to clarify the key variables of loan decision-making of operating entities, so as to solve financing constraints and improve loan availability. In particular, the loans referred to in the study refer to bank loans.

The new agricultural operating entity represents a unique concept within China; however, cooperative financing and family farm financing have been extensively studied. From the perspective of cooperative financing, the research on cooperative credit mutual assistance mainly focuses on mutual financial assistance and risk prevention (Wang et al., 2016; Zedda et al., 2023). This kind of credit relationship based on the trust relationship is traditional and effective (Iqbal, 2017; Santos et al., 2022; Liu et al., 2024). However, when the proportion of members’ investment is not related to the benefits obtained, the members’ willingness to invest will be weakened, thus exacerbating the risk of mutual financial assistance. Family farm financing is often regarded as small and medium-sized enterprise financing. The theory applicable to small and medium-sized enterprise financing is also applicable to family farms. The Macmillan Gap, the Modigliani-Miller (M-M) Theory, and the Enterprise Life Cycle Theory all offer valuable theoretical frameworks for further analysis of family farm financing. However, worldwide, most family farms are small family farms (Lowder et al., 2016). From the perspective of the production scale of family farms, the acquisition of credit can significantly improve the scale efficiency of family farms (Cai et al., 2024). Concurrently, financial literacy is also a critical factor influencing the financing pathways of family farms. Farmers with higher education are more likely to obtain formal financing through formal channels, while farmers with lower education are more likely to obtain informal financing to achieve scale operation (Li et al., 2022).

Research focusing on food-producing new agricultural operating entities is predominantly concentrated on areas such as food security, financing challenges, and production efficiency. As an important carrier to promote the comprehensive revitalization of rural areas, the new agricultural operating entities of grain production have important practical significance for ensuring the safe production of grain. The study found that new agricultural management entities play a significant role in promoting grain production not only in the county but also in the surrounding counties (Zhang, 2024). Although the new agricultural operating entities exhibit clear scale benefits and higher educational levels compared to ordinary farmers, they are confronted with significant challenges. These include an overall aging population, a scarcity of highly educated talent, and difficulties in securing insurance, financing, and government subsidies (Liu et al., 2018; Zhang et al., 2018). Different types of operating entities demonstrate varying degrees of efficiency in grain production. The technical efficiency of large professional households and professional cooperatives is relatively high, and the technical efficiency of family farms is the lowest. Family farms and cooperatives have lower scale efficiency (Yin et al., 2017). As the scale of operations expands, the demand for loans among operating entities escalates; however, the enduring challenge of ‘difficulty, costliness, and sluggishness’ in financing for new agricultural operating entities engaged in grain production continues to be pervasive, impeding the further enhancement of grain production efficiency (Niu and Shang, 2024). Therefore, in the process of supporting national grain production and innovating new agricultural operating entities, it is very important to optimize the supply system and service mechanism of financial services and strengthen the supply of financial products in key areas (Li, 2021). Beyond the financial supply side perspective, it is equally important to examine the demand side’s willingness and loan scale from the viewpoint of the new agricultural operating entities themselves.

Research on the factors influencing the loan willingness of food-producing new agricultural operating entities predominantly focuses on the individual characteristics, family status, and loan conditions of the operators. With respect to individual characteristics, a farmer’s age, gender, and education level significantly impact the demand for credit (Hananu et al., 2015; Mutamuliza and Mbaraka, 2021; Mwonge and Alexis, 2021). Regarding household status, factors such as household savings, total annual household assets, and non-farm income also influence the willingness of farmers to engage in credit activities (Kalaiah and Mutamuliza, 2017). Concerning the objective conditions of loans, loan interest rates and collateral requirements emerge as pivotal factors affecting farmers’ access to credit (Fecke et al., 2016). Furthermore, the protracted application process and the uncooperative demeanor of lending institution staff significantly impact the loan selection for farmers (Khatun, 2019). Some scholars, based on China’s socialist system, have utilized Logit models to evaluate the impact of farmland property rights and land transfer on the demand for agricultural loans. Research indicates that the transfer of land out reduces the demand for agricultural loans, while conversely, it increases the demand for agricultural loans (Gong and Elahi, 2022). Beyond individual farmers, family farms, often considered an ‘expanded’ version of farming operations, exhibit a greater propensity to secure loans. An empirical analysis of survey data from 440 family farms and 12 financial institutions in Togo revealed that the number of years a farmer has been in operation, their membership in a farming organization, and their primary activity income significantly influence their ability to access credit (Yang et al., 2021). In addition, farmers with better access to information and large physical assets exhibit a significantly positive impact on their credit access, but agricultural experience has a significant negative effect on farm loans (Ullah et al., 2020). In addition to the individuals and family farms that were the subject of the study, firms also had a strong willingness to lend, and this was more pronounced among larger firms (Guercio et al., 2020). In terms of model selection, in addition to using the common logistic regression model, a few scholars used the Ordinary Least Squares model to analyze the factors affecting the loan demand of farm households, and similarly found that loan cost, age of farm households, family size, education level, farm size, collateral, and farm income are all important factors affecting the willingness to take credit (Onwuagba et al., 2021).

Research on the factors influencing the loan scale of food-producing new agricultural operating entities primarily focuses on individual characteristics, family status, and the mortgage of rural land management rights. As a significant force within the agricultural industry, food-producing new agricultural operating entities play a crucial role. Enhancing their financing scale and loan access to resolve their financing challenges is of substantial practical importance. Individual characteristics of farmers, such as age, experience, education level, scale of operation, party membership, and frequency of internet use, significantly impact the scale of agricultural credit (Chaiya et al., 2023; Perveen et al., 2020; Sun et al., 2022). However, some scholars posit that not all farmers have credit needs, and some maintain zero loan amounts; hence, the Heckman model should be employed to mitigate sample selection bias (Yang and Zhang, 2019). An analysis based on panel data from 3,255 Chinese farmers indicates that credit behavior of rural households significantly enhances the technical efficiency of grain production. Specifically, the technical efficiency of grain production is 0.017 higher for rural households with credit behavior compared to those without. Additionally, rural households’ party membership, agricultural technical training, the number of family non-agricultural labor force, and participation in cooperatives all significantly promote grain production technical efficiency. In contrast, the number of household labor force has a significant inhibitory effect on grain production technical efficiency (Yang et al., 2023). Furthermore, an empirical analysis based on 510 large-scale grain growers in China’s major grain-producing areas reveals that the number of years as a large household, the area of arable land, family income, social relations, understanding of credit policy, and collateral significantly impact large household loan applications. Similarly, the number of years as a large household, household income, understanding of credit policy, expected financing period, and collateral significantly influence the credit support from financial institutions (Luo, 2021).

From the perspective of research methodology selection, scholars have predominantly employed the logit model, cost–benefit functions, and game theory for analysis. Some researchers have utilized the Ordinary Least Squares model and ordered Logit regression to analyze data from new farmers in Zhejiang Province in 2020, discovering that factors such as farmers’ party membership, participation in agricultural technology programs, annual operating income, and frequency of internet use significantly impact their financing loan scale (Sun et al., 2022). From the viewpoint of cost–benefit functions, the willingness of farmers to take out loans and the scale of their credit depend on a comparison of their operational returns during the production process with the opportunity cost. In other words, if the expected operational return after applying for a loan is higher than the opportunity cost, then the farmer is motivated to apply for a loan; otherwise, they are reluctant. The opportunity cost of the operating entity ‘s willingness to apply for loans is composed of the income when it does not apply for loans or withdraws from the loan link (Amigues et al., 2002; Yu and Wei, 2021). From the perspective of game theory, the pre-loan decision-making process of operating entities is essentially a coordinated game-playing process between the borrower and the lender. Generally speaking, the pre-loan decision-making process of operating entities is essentially a process of coordinated game-playing between the borrower and the lender (Featherstone et al., 2007; Li et al., 2021).

It is evident from existing research that scholars have analyzed numerous factors influencing the willingness of farmers to take out loans and the scale of credit. The factors affecting farmers’ loan decision-making behavior exhibit slight regional variations, which offers significant reference value for this study. However, there is a dearth of research focusing on loan decision-making among food-producing new agricultural operating entities. Consequently, this study utilizes survey data from food-producing new agricultural operating entities in typical regions of Anhui Province to examine the factors influencing their loan willingness and credit scale. Under a consistent macro policy environment, the loan decision-making behavior of food-producing new agricultural operating entities is similar. Although Anhui Province has a large number of food-producing new agricultural operating entities, the loan decision-making behavior of these entities across different cities displays distinct similar characteristics (Gao, 2005). China is home to 13 major grain-producing regions, which consistently contribute over 70% to the nation’s total grain output throughout the year (National Bureau of Statistics of the People's Republic of China, 2024). The primary net grain-exporting provinces include Heilongjiang, Henan, Jilin, Inner Mongolia and Anhui, with Anhui being the sole net grain-exporting province in southern China (Anhui Provincial Bureau of Grain and Material Reserves, 2024). In 2023, China’s total grain production reached 695.41 million tons, with the major grain-producing areas accounting for 77.89% of this total (National Bureau of Statistics of the People's Republic of China, 2023). Huoqiu County, within Lu’an City, has been a top grain-producing county in Anhui Province, leading in grain output from 2000 to 2022. The new agricultural operating entities engaged in grain production in this region exhibit strong typicality and representativeness (Lu’an Municipal Bureau of Statistics, 2023). Hence, this study has chosen Lu’an City, Anhui Province, as a quintessential case study to investigate the loan decision-making behaviors of food-producing new agricultural operating entities. Specifically, the term ‘loans’ within the scope of this study denotes bank loans exclusively.

The purpose of this paper is to contribute to the relevant discussion through the following three aspects: (i) Identify the influencing factors that affect the loan decision-making behavior of new agricultural operating entities in grain production, and apply these factors to loan practice; (ii) Analyze the loan decision-making behavior of grain production new agricultural operating entities from the two dimensions of loan willingness and loan scale, and clarify the impact of these factors on loan willingness and loan scale. (iii) The sample data is derived from credit practice, encompassing the majority of new agricultural operating entities engaged in grain production with more than 3.33 hectares in the designated research area. The data is extensive and highly representative. Consequently, the research findings can reflect the typical characteristics of loan decision-making behavior among food-producing new agricultural operating entities, offering significant reference value for the development of analogous credit initiatives.

The marginal contributions of this study are primarily manifested in three distinct aspects: (i) while the majority of existing studies concentrate on agricultural operating entities, there is a dearth of research specifically focusing on food-producing new agricultural operating entities. (ii) The research subject is situated in the largest county of the sole net grain-exporting province in southern China, making its loan decision-making behavior highly significant to the execution of loan operations. (iii) The varying degrees of influence that diverse factors exert on loan willingness and loan scale offer valuable insights for enhancing the credit risk assessment of operating entities within the context of bank loan practices.

The main contents of the study include the following three aspects: Next, the research will establish an empirical analysis model from the aspects of data selection, variable selection and model construction. Then, further analysis starts with the influencing factors of loan willingness and loan scale; the last part is the conclusion and shortcomings.

2 Data source, variable description, and model setting

2.1 Data source

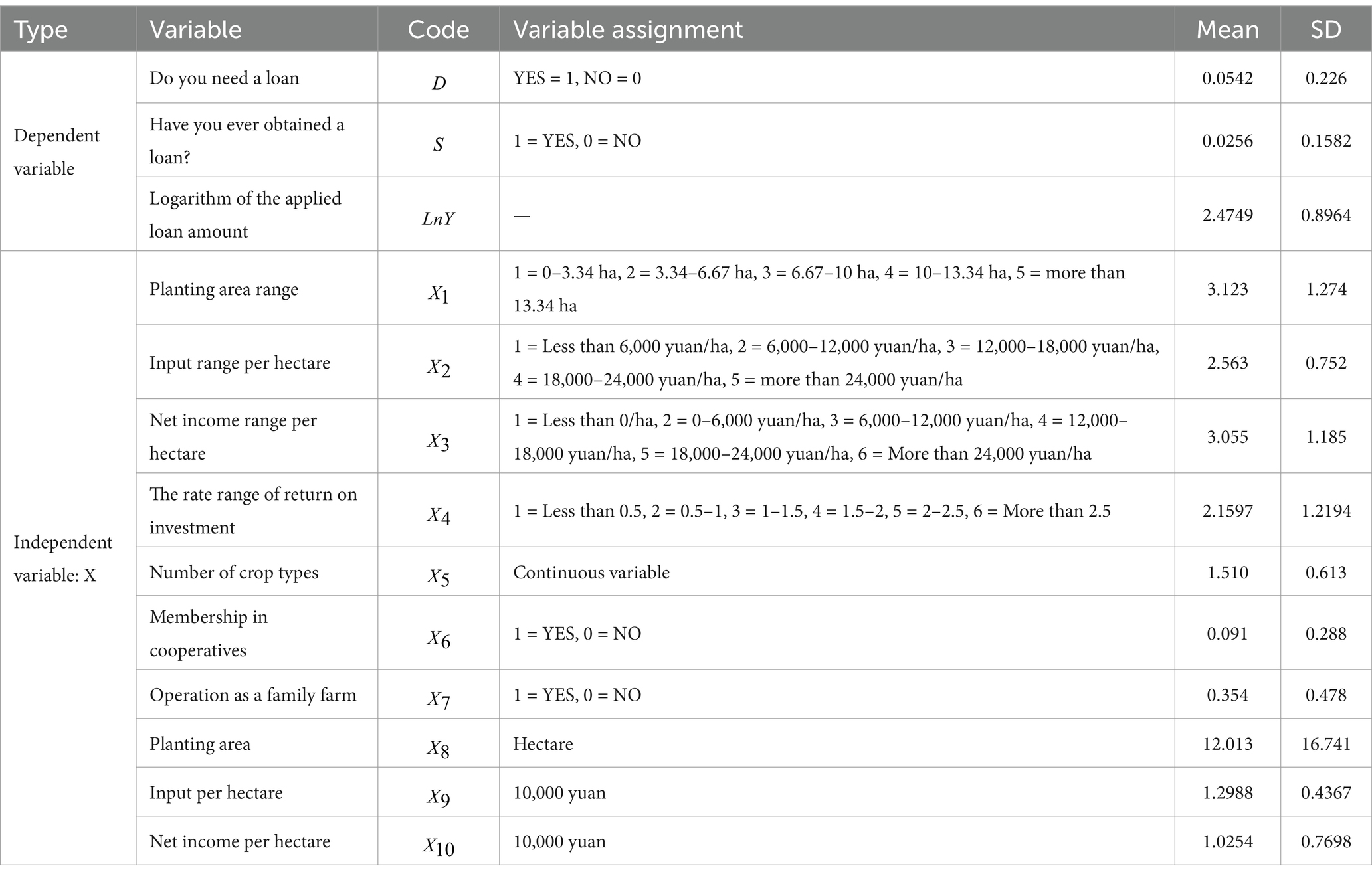

The micro data used by the institute is derived from field research and data collection in Lu’an City, Anhui Province from April to October 2023. A total of seven counties were investigated. Among them, there were 9,572 observation data from Huoqiu County, accounting for 53.94% of the total sample. The data collection encompasses the planting activities, income levels, borrowing requirements, and loan behaviors of agricultural operating entities, thereby offering robust empirical support for the analysis of lending willingness and credit scale among operating entities. To mitigate the impact of invalid samples, the study excluded samples with missing data and those exhibiting extreme values, ultimately yielding 17,745 valid sample observations. The variable descriptions are shown in Table 1.

2.2 Variable description

2.2.1 Variable being explained

In the study of factors influencing the willingness of operating entities to take loans, “do you need a loan” is used as adependent variable, and if there is a need for a loan, it is assigned a value of 1, otherwise, it is assigned a value of 0. Among all the samples of this study, a total of 962 operating entities have the willingness to lend, and the rest have no willingness to lend. When examining the factors influencing the credit scale of operating entities, to address the issue of sample selection bias, this study employs the Heckman two-stage model for regression analysis. The dependent variables in the first and second stages are ‘Have you ever obtained a loan?’ and ‘the logarithm of the applied loan amount,’ respectively.

2.2.2 Explanatory variables and identifying variables

During the production and operational processes, the input and output status of the operating entity is a critical variable that determines both the expected post-loan income and the operational income in the absence of borrowing. This includes factors such as the planting area, input per hectare and net income per hectare. In China, agricultural operating entities are eligible for preferential loan interest rate policies, although the types of concessions vary by entity type. Therefore, the cost of interest payment is related to the type of operating entities. Concurrently, since the research is centered on new agricultural operating entities in food production, the analysis includes the number of crop types cultivated by these entities to preclude the inclusion of non-food producing new agricultural operating entities.

Drawing on existing literature, combined with the research content and objectives of this paper, this study identifies the following explanatory variables to analyze the loan demand of operating entities: planting area range, input range per hectare, net income range per hectare, rate range of return on investment, number of crop types, membership in cooperatives and operation as a family farm. According to the requirements of the Heckman model for the selection of independent variables, the explanatory variables in the second stage regression should be a true subset of all explanatory variables in the first stage. In this paper, “operation as a family farm” is selected as the identification variables.

2.2.3 Variable statistics analysis

2.2.3.1 Do you need a loan

In the sample data, a total of 962 operating entities need loans, accounting for only 5.42% of the total sample. This is related to the time of data collection and is dynamic.

2.2.3.2 Have you ever obtained a loan?

According to the data, a total of 456 operating entities have received loans, with an average loan amount of 180,637 yuan.

2.2.3.3 Planting area range

The average planting area of the operating entity is about 12 hectares, of which the largest planting area is 518.53 hectares, and the lowest planting area is 2.67 hectares. The planting area between 3.33 hectares and 6.67 hectares has the largest number of operating entities, accounting for 40.58% of the total sample.

2.2.3.4 Input range per hectare

A value of 1 signifies that the input per hectare is less than 6,000 yuan, totaling 488 samples. A value of 2 represents an input per hectare ranging between 6,000 and 12,000 yuan, encompassing a total of 8,748 samples, which constitutes 49.3% of the entire sample. A value of 3 indicates an input per hectare between 12,000 and 18,000 yuan, summing up to 6,911 samples. A value of 4 denotes an input per hectare between 18,000 and 24,000 yuan, totaling 1,224 samples. Lastly, a value of 5 signifies an input per hectare exceeding 24,000 yuan, with 374 samples, accounting for 2.11% of the total sample.

2.2.3.5 Net income range per hectare

Samples assigned a value of 1 represent net incomes per hectare that are less than or equal to zero, comprising 0.1043% of the total sample. Samples with a value of 2 indicate net incomes per hectare ranging from 0 to 6,000 yuan, totaling 7,489 samples and accounting for 42.2034% of the overall sample. Samples valued at 3 signify net incomes per hectare between 6,000 and 12,000 yuan, summing up to 5,319 samples. Samples assigned a value of 4 denote net incomes per hectare within the range of 12,000 to 18,000 yuan, totaling 2,226 samples. Samples with a value of 5 represent net incomes per hectare between 18,000 and 24,000 yuan, encompassing 1812 samples. Lastly, samples valued at 6 indicate net incomes per hectare exceeding 24,000 yuan, totaling 881 samples.

2.2.3.6 The rate range of return on investment

The rate of return on investment used in the study is equal to the ratio of the net income per hectare of the operating entity to the input per hectare, which is a more rational evaluation index of operating entities’ business performance. The greater the rate of return on investment, the better the operating conditions. From the sample data, in the process of agricultural production, the highest return on investment can reach 288%, while the lowest is-19.78%. And about 39.49% of the operating entities’ return on investment is below 50%.

2.2.3.7 Number of crop types

The sample data show that 54.43% of the operating entities mainly plant a class of crops, and a few operating entities plant a large number of crop types, but the main crops they plant are still rice, wheat and other food crops. At the same time, due to the mixed cultivation of rice and shrimp fields, interplanting of economic crops, and promotion of oil crops, the number of crop types planted by large grain growers is on the high side.

2.2.3.8 Membership in cooperatives

A total of 1,623 operating entities joined the cooperatives in the sample data, accounting for 9.15% of the total sample.

2.2.3.9 Operation as a family farm

There are 6,215 family farms in the sample data, accounting for 35.02% of the total sample.

2.2.3.10 Input per hectare

The average input per hectare of operating entities is about 12,988 yuan. However, there is a significant gap between different operating entities, with the highest average investment per hectare exceeding 31,500 yuan, while the lowest is only 1,500 yuan. The majority of operating entities input between 6,000 and 12,000 yuan per hectare, accounting for 49.28% of the total sample.

2.2.3.11 Net income per hectare

The net income per hectare refers to the net profit per hectare of the operator. From the sample data, the average net income per hectare is about 10254.45 yuan, the lowest value is −2,700 yuan, and the maximum income per hectare is as high as 37,920 yuan, which is related to mixed farming.

2.3 Model setting

2.3.1 The decision-making behavior equation of food-producing new agricultural operating entities

In general, the opportunity cost for farming households willing to apply for loans is composed of the income from not applying for loans or withdrawing from the loan process. Hence, based on the assumption of “rational behavior,” the loan propensity function for food-producing new agricultural operating entities is expressed as Equation 1:

In the above equation, is the expected income of the operating entity after taking the loan, represents the business income of the operating entity when he exits the loan segment, is the probability of exiting, is the expected income if he does not apply for the loan, is the cost of interest paid when he applies for the loan, is the relevant tax rate, and is the cash discount rate of the operating entity.

When is greater than 0, the food-producing new agricultural operating entities will apply for a loan if the expected benefit post-loan application exceeds the opportunity cost; otherwise, they will refrain from applying. Given that operating entities have the autonomy to select the loan amount and to decide whether to pursue a loan based on the anticipated returns and opportunity costs at any given time, the functional expression of can be transformed as follows:

Since the agricultural tax rate in China is zero, Equation 2 can be further simplified to:

From Equation 3, it can be seen that the loan decision-making behavior of the operating entity depends on the expected income after the loan, the operating income when the loan is not made, and the interest payment cost.

2.3.2 The basic equation of loan willingness of food-producing new agricultural operating entities

Set D as a binary classification variable, when D = 1, it means that the agricultural operating entity has the willingness to lend, and when D = 0, it means that it has no willingness to lend.

The cumulative distribution function corresponding to Logit model is:

where is the linear combination of , as shown in Equation 6:

represents the number of individuals, represents the constant term, ( =1,2,……, n) represents the coefficients that the model needs to determine. In this model, … is the relevant independent variable.

By dividing the above Equations 4, 5, the expression for the odds ratio is obtained, as shown in Equation 7:

2.3.3 The basic equation for the size of credit to food-producing new agricultural operating entities

The loan size behavior of operating entities mainly involves two processes, one is whether operating entities have received a loan, and the other is the scale of the loan received by operating entities. Utilizing food-producing new agricultural operating entities that have received loans as the research sample may introduce sample selection bias. Current research primarily employs the Heckman model to address such biases. Specifically, this study dissects the credit behavior of food-producing new agricultural operating entities into the following two stages.

The first stage: Using all the research samples, the Probit model was used to study the factors influencing the behavior of whether the operating entity has ever obtained a loan or not, whether the operating entity can obtain a loan or not can be indicated by the following formula:

represents explanatory variables, is the estimated coefficient, is the random disturbance term. If Equation 8 is bigger than zero, take = 1, indicating that operating entities have received loans; on the contrary, if Equation 8 is less than or equal to zero, then = 0, operating entities have not received loans.

The second stage: If OLS is directly used for regression, there will be a problem of sample selection bias. Therefore, at this stage, we need to use the results of the first-stage regression to calculate the Inverse Mills Ratio firstly:

The molecule in Equation 9 is the density function published by the standard normal distribution, and the denominator is the cumulative distribution function. The sample with = 1 is selected for OLS regression. The regression model is as follows:

The in Equation 10 is the logarithm of the loan amount. is the explanatory variable in the second stage regression. According to the model’s requirement for independent variable selection, the explanatory variables in the second stage regression should be a proper subset of all explanatory variables in the first stage. If the inverse mills coefficient passes the significance test, it shows that the sample does have a selective bias problem, and it is correct to use the model to study the scale of operating entities’ loans.

3 Empirical analysis

3.1 Analysis of influencing factors on loan willingness of food-producing new agricultural operating entities

In the empirical analysis, this study utilizes a binary dependent variable to represent whether food-producing new agricultural operating entities have loan demand, aligning with the characteristics of 0–1 variables. The Logit model, widely accepted by scholars, is employed to investigate the factors influencing the propensity to take out loans. However, since the Logit model is mainly applicable to the data whose independent variables are discrete, this study carries out the assignment processing of the raw data, and the results are shown in Table 1.

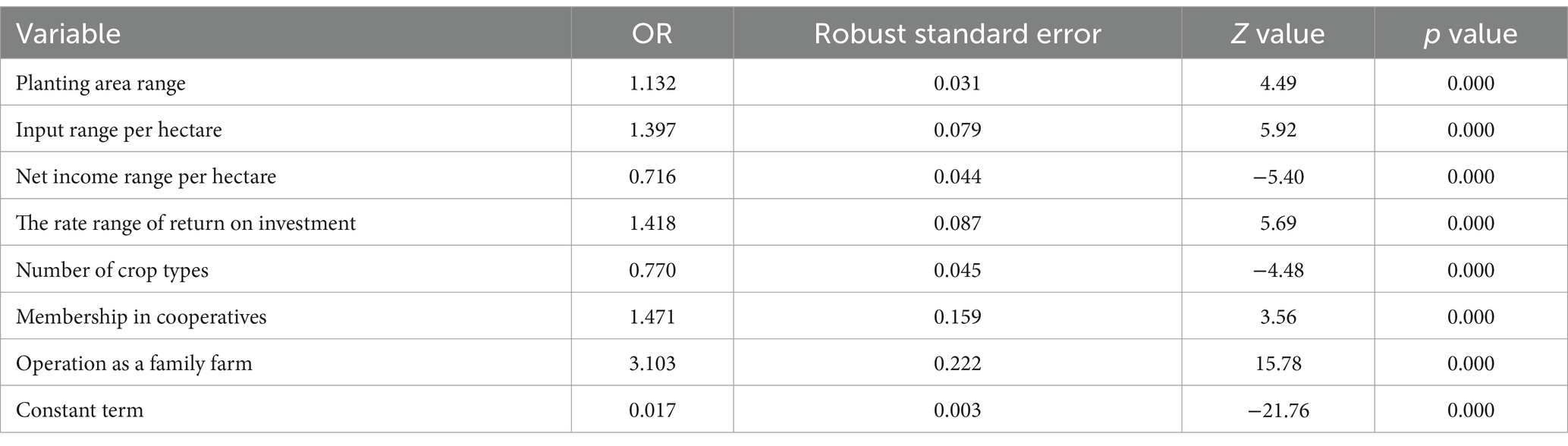

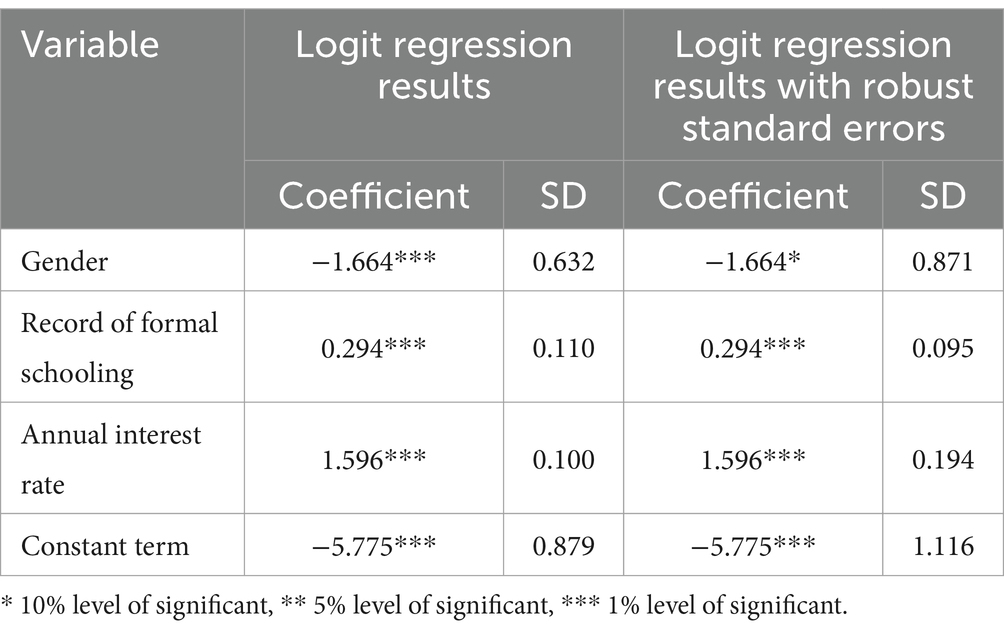

Prior to conducting the benchmark regression analysis, it is imperative to address the potential for model estimation bias stemming from the high correlation among independent variables. Consequently, a multicollinearity test must be conducted for each independent variable included in this model before proceeding with the logistic regression. The calculation results indicate that the Variance Inflation Factor for the rate of return on investment is the highest, at 5.39. Based on the criterion that a variance inflation factor of less than 10 for independent variables indicates the absence of significant multicollinearity, it is determined that the independent variables selected for this study do not exhibit pronounced multicollinearity. Furthermore, to assess potential model specification issues, a Logit regression with robust standard errors was conducted. The results demonstrated that the robust standard errors were nearly identical to the conventional standard errors, suggesting that there are no model specification concerns. These findings are presented in Table 2.

The regression analysis reveals that the coefficients for all variables are statistically significant at the 1% confidence level, suggesting that each variable exerts a significant influence on loan demand. Specifically, the planting area range, input range per hectare, rate range of return on investment, membership in cooperatives, and operation as a family farm are found to substantially enhance the propensity of operating entities to seek loans. In contrast, other variables such as net income range per hectare and number of crop types have a negative effect on loan demand. The increase in average input raises the loan willingness of the operating entities, while the increase in average revenue reduces their loan willingness, which is related to the cyclical nature of the operating entities’ production. Additionally, when operating entities intend to expand their operation scale, factors such as planting area range, the rate range of return on investment, membership in cooperatives or operation as a family farm will all increase their borrowing intention. However, this situation will decline as average returns increase.

After the assignment process for the variables, since the minimum unit of change for each explanatory variable is one and the coefficients of the Logit model are not marginal effects, further calculation of the odds ratios for each of the explanatory variables is usually required for a reasonable interpretation of the regression results. The results are shown in Table 3. From the basic situation variables. Planting area range has a significant positive impact on loan demand (p = 0.000), indicating that the larger planting area range, the stronger the loan demand. In addition, the OR value (odds ratio) of planting area range is 1.132, indicating that when planting area range increases by one unit, the probability of operating entities having loan demand will increase by 13.2%. From the input and output point of view. There is a significant positive impact between the input range per hectare of grain production operators and their willingness to lend (p = 0.000), and the OR value of input range per hectare is 1.397, indicating that when the input range per hectare increases by one unit, the willingness of operating entities to lend will increase by 39.7%. However, net income range per hectare has a significant negative impact on its willingness to lend (p = 0.000), and the OR value of the net income range per hectare is 0.716, indicating that for every unit increase in the net income range per hectare, the willingness of the operating entity to lend will decrease by 28.4%. The rate range of return on investment will significantly increase the willingness of operating entities to lend (p = 0.000), and its OR value is 1.418, indicating that whenever the rate of return increases by one unit, the probability of loan demand will increase by 41.8%. From the perspective of business behavior. Number of crop types will significantly reduce operating entities’ willingness to lend (p = 0.000), the more the number of crop species, the lower the operating entities’ loan demand. From the OR value of the number of crop types, for every unit increase in the number of crop types, the loan willingness of the operating entity will decrease by 27%. The coefficients of the two dependent variables of membership in cooperatives and operation as a family farm are 0.386 and 1.132, respectively, and this variable has a significant positive impact on the operating entities’ willingness to lend (p = 0.000). The OR value of the dummy variable membership in cooperatives is 1.471, indicating that the probability that the operating entities who join the professional cooperative have loan demand is 1.471 times that of the operating entities who do not join the professional cooperative. Similarly, the OR value of the dummy variable operation as a family farm is 3.103, indicating that the probability that the new agricultural operating entities of grain production as a family farmer has loan demand is 3.103 times that of ordinary farmers.

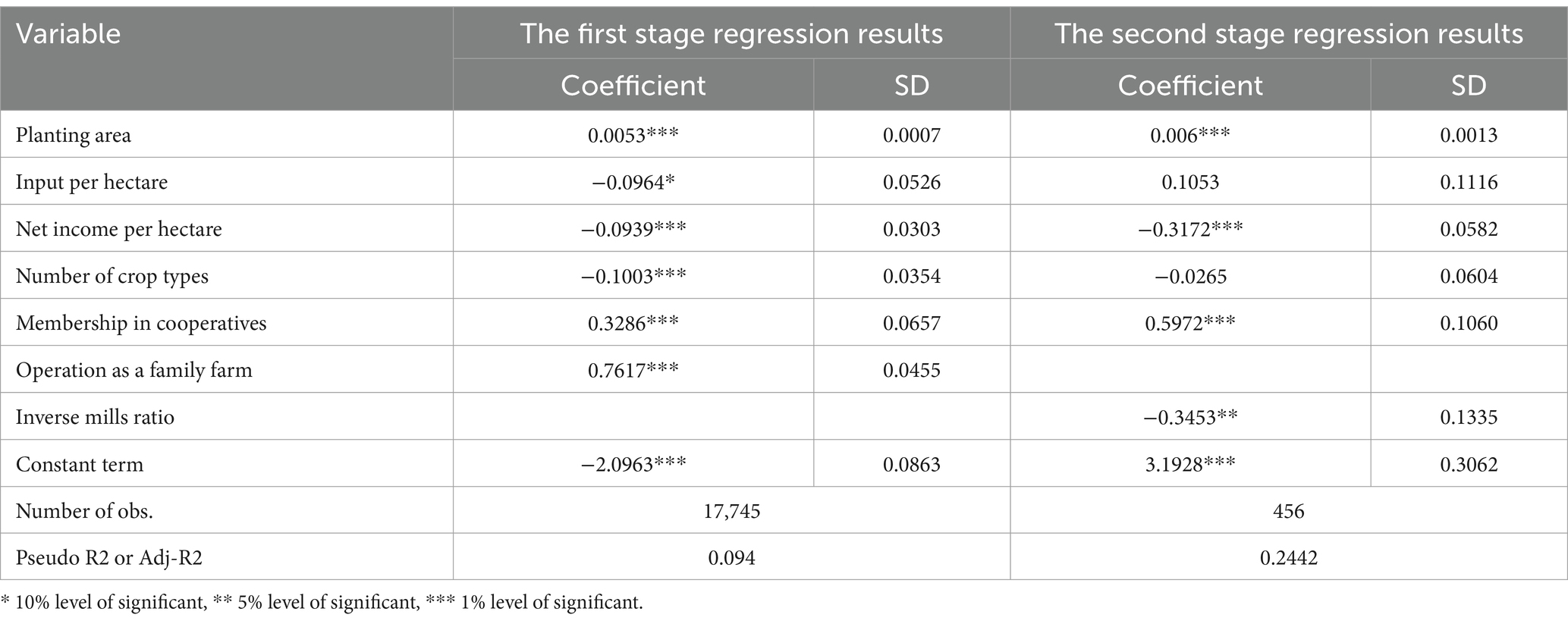

3.2 Analysis of the influencing factors of the loan scale of the food-producing new agricultural operating entities

In the study of the influencing factors of the loan scale of the new agricultural operating entities of grain production, if 456 operating entities who have received loans are selected as the research sample, the data with zero loan scale will be ignored, which leads to the problem of sample selection bias. Therefore, in the first stage, all samples were used when using the Heckman model, and in the second stage, 456 samples were screened out through the Heckman model. When using the Heckman model to analyze the factors affecting the scale of operating entities’ loans, in order to eliminate the influence of the dimension between variables, each variable is pre-processed. Accordingly, the first stage selects planting area, input per hectare, net income per hectare, number of crop types, membership in cooperatives, and operation as a family farm as the independent variables, while the second stage identifies operation as a family farm as the identifying variable. In the first stage, the probit model is used to perform the first-stage regression with “Have you ever obtained a loan?” as the dependent variable. The Inverse Mills Ratio, which is the sample bias adjustment term for “Have you ever obtained a loan?” is calculated and included as an independent variable in the second-stage regression equation. In the second stage, the “logarithm of the applied loan amount” is used as the dependent variable. The identification variable “operation as a family farm” has passed the significance test in both empirical models, and the Inverse Mills Ratio is significant, indicating that the sample selection bias problem does exist, and the selection of the Heckman two-stage model has certain rationality. The results are shown in Table 4.

The first-stage regression analysis reveals that the coefficients for planting area, operation as a family farm, and membership in cooperatives are 0.0053, 0.7617, and 0.3286, respectively. These coefficients indicate that each of these factors significantly enhances the likelihood of operating entities obtaining loans. During the actual operational process, a larger planting area correlates with higher capital requirements, and both cooperatives and family farms can offer support to help the operating entity secure larger loan amounts. The coefficients for input per hectare and net income per hectare are −0.0964 and − 0.0939, respectively, and are statistically significant at the 10% and 1% confidence levels, respectively. Combining actual field research, it has been observed that a unique cultivation model exists in the region, which integrates rice planting with shrimp farming. This combination significantly increases the input per hectare and net income per hectare, thereby markedly suppressing the loan demand of operating entities. The number of crop types cultivated by operating entities exhibits a significant negative correlation with the likelihood of having obtained a loan. This relationship is primarily attributed to the planting area offering greater flexibility in crop selection, which allows operating entities to diversify into the production of economic crops alongside their focus on grain production, consequently leading to a substantial increase in their average income.

In the second stage of the analysis, the Inverse Mills Ratio is incorporated into the regression equation, with the logarithm of the applied loan amount serving as the dependent variable. The Inverse Mills Ratio was found to be statistically significant at the 5% confidence level, validating the use of the Heckman two-stage regression model to assess the influencing factors on the credit scale of new agricultural operating entities. Based on the coefficient and significance level from Heckman’s second-stage regression, there is a positive correlation between the planting area and the logarithm of the applied loan amount. Specifically, for each unit increase in the planting area, the loan size is expected to increase by 0.006 units. The coefficient of net income per hectare is −0.3172, and it significantly affects the credit scale of operating entities at the 1% confidence level, for every unit of per hectare net income of operating entities, the loan scale will decrease by 0.3172 units. In addition, membership in cooperatives will also significantly increase the loan size of the operating entity (p = 0.000).

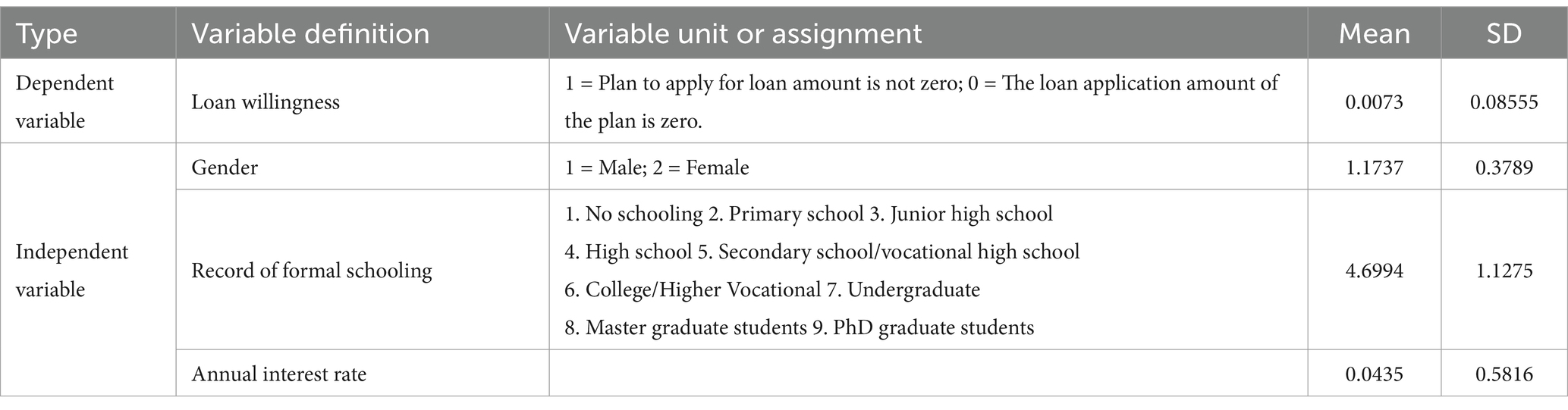

3.3 Analysis of agricultural household loan decision-making behavior based on China household finance survey database

In order to analyze the impact of interest rates and financial literacy on the decision-making behavior of agricultural household loans, samples of agricultural household households were selected from the China Household Finance Survey Database (Li et al., 2016). As of now, the China Household Finance Survey Database has released tracking survey data prior to 2019, with a total of 34,643 households and 107,008 family members. Focusing on agricultural households, this analysis selected a total of 19,281 samples, among which 142 farmers expressed a willingness to borrow, representing only 0.73% of the total sample size. In the selected samples, there are 15,932 households headed by males and only 3,349 households headed by females. The number of male-headed households is significantly higher than that of female-headed households. This study employs academic qualifications as a proxy for financial literacy. Regarding educational attainment, 3.3% of the sample holds a college degree or higher, 94.77% has a high school education or lower, and families with primary school education or less account for 34.52% of the total sample. The average level of education is relatively low. Regarding the annual interest rate, a specific rate for a particular type of loan cannot be determined. The annual interest rate indicated in the sample encompasses not only bank loan interest rates but also those from other financial institutions and non-financial institution loans. Consequently, the average annual interest rate is 4.35%. The basic information regarding the variables is presented in Table 5.

Based on the results of the logit regression, the coefficient for the gender variable is −1.664, which is significant at the 1% level, indicating that households headed by male have a higher willingness to take loans. This may be attributed to the different roles that males and females play in household decision-making, with females potentially being more conservative in household financial decisions. With the record of formal schooling serving as an indicator of financial literacy, the coefficient is 0.294 and is significant at the 1% level, suggesting that a higher level of financial literacy is positively correlated with a stronger willingness of farmers to obtain loans. This could be attributed to the fact that farmers with higher educational levels possess a deeper understanding of financial knowledge and exhibit better financial management skills, which in turn makes them more inclined to leverage loans for the purpose of expanding their production. The empirical analysis results indicate that the coefficient for the annual interest rate is 1.596, which is significant at the 1% level. This suggests a positive relationship between interest rates and the willingness to borrow, with higher interest rates associated with a stronger propensity to borrow. The primary reason for this outcome is that the collected annual interest rate data is not specific to a particular type of loan but includes a broad range, encompassing bank loans and other financial institution loans, as well as non-financial institution loans. For certain groups with borrowing needs, when conventional loan channels fail to meet their borrowing intentions, they are willing to bear higher interest rate costs. Empirical analysis results are shown in Table 6.

4 Main conclusions and shortcomings

4.1 Main conclusions

The seasonal capital demand of the food-producing new agricultural operating entities is large, and their loan willingness and credit scale are closely related to the agricultural production cycle. Combined with empirical analysis, the main conclusions are as follows. Regarding the loan willingness of food-producing new agricultural operating entities, several factors play pivotal roles. Planting area range, the rate range of return on investment, membership in cooperatives and operation as a family farm positively influence these entities’ inclination to seek loans. A higher planting area range and input range per hectare indicate greater initial investment costs, thus increasing the likelihood of loan demand. The positive correlation between the rate range of return on investment and loan willingness can be attributed to improved production and operational performance of the operating entities when investment returns are high. Consequently, to capitalize on higher returns and expand their operations, these entities are more prone to seek loans. Conversely, net income range per hectare and number of crop types have a negative impact on loan willingness. As income increases and operating entities’ profits suffice to cover their operational expenses, their need for loans diminishes. Furthermore, the diversification of crop types cultivated by farmers impedes the achievement of economies of scale in their production and operational processes, thereby placing these entities at a competitive disadvantage within the industry. This situation, compounded by their inherent risk aversion, tends to diminish their demand for loans. Market dynamics, including demand and price volatility, significantly influence planting decisions. When there is high demand for a particular crop and low price volatility, operating entities are more inclined to concentrate on such crops. However, diversifying the number of crop types planted exposes these entities to the dual uncertainties of market demand and price fluctuations. This unpredictability induces caution in planting decisions, prompting entities to mitigate credit risk by curtailing their loan demand. Additionally, this study, which utilizes a sample of agricultural households from the China Household Finance Survey Database, reveals that male operators demonstrate a stronger propensity to seek loans compared to their female counterparts. Furthermore, a higher level of education is positively correlated with an increased willingness to borrow among operating entities. Considering that the loan willingness of food-producing new agricultural operating entities represents only the subjective demand of individuals, in the actual production process, they place greater emphasis on the scale of loans obtained. Consequently, the Heckman model is employed to further analyze the factors influencing the loan scale of operating entities. The study finds that the planting area and membership in cooperatives significantly amplify the loan scale of operating entities. There is a significant negative correlation between net income per hectare and loan scale, indicating that as net income per hectare increases, the loan scale of food-producing new agricultural operating entities decreases. In conclusion, for new agricultural operating entities, their willingness to borrow is closely tied to production costs, net income per hectare, gender, and financial literacy. Furthermore, the scale of their loans is significantly influenced by factors such as input per hectare, net income per hectare, and membership in cooperatives. Therefore, from the standpoint of food security, cultivating food-producing new agricultural operating entities necessitates attention to the counter-cyclical adjustment of financial support, particularly increasing credit support in years when the return on investment is low. Concurrently, it is imperative to foster diverse forms of moderate-scale operations, enhance policy support, and bolster the production enthusiasm of new agricultural operating entities.

4.2 Shortcomings

It should be acknowledged that while the study boasts a substantial data sample size, it is predominantly concentrated in specific regions. Although the study area is representative, its generalizability is limited, as it does not encompass the full diversity and regional disparities found nationwide. During the variable selection process, constraints in data collection have made it challenging to gather sensitive information such as age and education levels of the subjects under study. Consequently, there are inherent limitations in the variable selection aspect of the research.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JW: Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Writing – review & editing. TF: Data curation, Methodology, Software, Validation, Writing – original draft.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. Education Humanities and Social Sciences Research Youth Fund Project (23YJC790149), Anhui University of Finance and Economics Graduate Innovation Fund Project (ACYC2023100).

Acknowledgments

Thank you for the support and help provided by the School of Finance of Anhui University of Finance and Economics during the data collection and collation process.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2024.1443022/full#supplementary-material

References

Amigues, J. P., Boulatoff, C., Desaigues, B., Gauthier, C., and Keith, J. (2002). The benefits and costs of riparian analysis habitat preservation: a willingness to accept/willingness to pay contingent valuation approach. Ecol. Econ. 43, 17–31. doi: 10.1016/S0921-8009(02)00172-6

Anhui Provincial Bureau of Grain and Material Reserves. (2024). Anhui explores new paths for grain production and sales cooperation. Available at: https://www.lswz.gov.cn/html/dfdt2024year/2024-03/22/content_280618.shtml (Accessed December 14, 2024).

Cai, R., Ma, J., Wang, S., and Cai, S. (2024). Access to credit and scale efficiency: evidence from family farms in East China. Econ. Anal. Policy 84, 1538–1551. doi: 10.1016/j.eap.2024.10.021

Chaiya, C., Sikandar, S., Pinthong, P., Saqib, S., and Ali, N. (2023). The impact of formal agricultural credit on farm productivity and its utilization in Khyber Pakhtunkhwa, Pakistan. Sustainability 15:1217. doi: 10.3390/su15021217

Featherstone, A., Wilson, C., Kastens, T., and Jones, J. (2007). Factors affecting the agricultural loan decision-making process. Agric. Finan. Rev. 67, 13–33. doi: 10.1108/00214660780001195

Fecke, W., Feil, J. H., and Musshoff, O. (2016). Determinants of loan demand in agriculture: empirical evidence from Germany. Agric. Finan. Rev. 76, 462–476. doi: 10.1108/AFR-05-2016-0042

Gao, H. M. (2005). Information, uncertainty, and the mechanism of lending determination in China’s credit markets. Finan. Res. 5, 40–52. doi: 10.16538/j.cnki.jfe.2005.05.004

Gong, M. G., and Elahi, E. (2022). A nexus between farmland rights, and access, demand, and amount of agricultural loan under the socialist system of China. Land Use Policy 120:106279. doi: 10.1016/j.landusepol.2022.106279

Guercio, M. B., Martinez, L., Bariviera, A. F., and Scherger, V. (2020). Credit crunch or loan demand shortage: what is the problem with the SMEs' financing? Finan Uver 70, 521–540. doi: 10.32065/CJEF.2020.06.02

Hananu, B., Abdul-Hanan, A., and Zakaria, H. (2015). Factors influencing agricultural credit demand in northern Ghana. African J. Agric. Res. 10, 645–652. doi: 10.5897/AJAR2014

Iqbal, I. (2017). Cooperative credit in colonial Bengal: an exploration in development and decline, 1905–1947. Indian Econ. Soc. History Rev. 54, 221–237. doi: 10.1177/0019464617695673

Kalaiah, V., and Mutamuliza, E. (2017). Cooperative societies and their effect on small scale farmers’ sustainable livelihood: a Rwandan perspective. Int. J. Soc. Econ. Res. 7:61. doi: 10.5958/2249-6270.2017.00021.6

Khatun, M. N. (2019). What are the drivers influencing smallholder farmers access to formal credit system? Empirical evidence from Bangladesh. Asian Dev. Policy Rev. 7, 162–170. doi: 10.18488/journal.107.2019.73.162.170

Li, L. L. (2021). China banking and insurance regulatory commission: give priority to supporting the National Grain Production Innovation Service for new agricultural business entities. Rural Sci. Technol. 12:1. doi: 10.19345/j.cnki.1674-7909.2021.11

Li, M. F., Yang, C., and Wu, Y. L. (2021). Research on decision-making behaviors of supply and demand sides of farmland management rights mortgage based on evolutionary game theory. J. Huazhong Agric. Univ. 4, 165–175 + 186. doi: 10.13300/j.cnki.hnwkxb.2021.04.019

Li, G., Yin, Z. C., and Tan, J. J. (2016). Report on the development of household finance in rural China (2014). Singapore : Springer.

Li, Z., Zhang, Z., Elahi, E., Ding, X., and Li, J. (2022). A nexus of social capital-based financing and farmers' scale operation, and its environmental impact. Front. Psychol. 13:950046. doi: 10.3389/fpsyg.2022.950046

Lin, L. F., and Fa, N. (2015a). An empirical analysis of Bank financing barriers of new agricultural business entities: based on a survey of 460 new agricultural business entities in 31 townships. J. Sichuan Univ. 6, 119–128. doi: 10.3969/j.issn.1006-0766.2015.06.014

Lin, L. F., and Fa, N. (2015b). The deep reason of financing difficulties and the resolve path for the new type of agricultural management Main body. Nanjing J. Soc. Sci. 7, 150–156. doi: 10.15937/j.cnki.issn1001-8263.2015.07.022

Liu, Z., Xie, Y., Yang, J., and Zhu, D. (2024). Credit cooperatives and income growth: analyzing the role of financial sustainability. Discret. Dyn. Nat. Soc. 2024:9263896. doi: 10.1155/2024/9263896

Liu, Y., Zhang, X. C., and Zhang, J. W. (2018). Multiple development models of new agricultural management entities of grain production in Shandong Province and analysis of typical cases. Shandong agric. Sci. 50, 158–162. doi: 10.14083/j.issn.1001-4942.2018.12.031

Lowder, S., Skoet, J., and Raney, T. (2016). The number, size, and distribution of farms, smallholder farms, and family farms worldwide. World Dev. 87, 16–29. doi: 10.1016/j.worlddev.2015.10.041

Lu’an Municipal Bureau of Statistics (2023). Lu'an statistical Yearbook, 2001–2023. Lu'an: Lu'an Municipal Bureau of Statistics.

Luo, Z. J. (2019). Credit research on new agricultural business entities: review and Prospect. Econ. Res. Guid. 30, 82–84. doi: 10.3969/j.issn.1673-291X.2019.30.034

Luo, Z. J. (2021). Research on Financial Support for Major Grain Producers in the Context of Food Security in China. Journal of Central South University of Forestry and Technology (Social Science Edition). 14, 103–109+117. doi: 10.14067/j.cnki.1673-9272.2021.04.013

Mutamuliza, E., and Mbaraka, S. (2021). Determinants of smallholder farmers' participation in microfinance markets in Huye district, southern province, Rwanda. Afr. J. Food Agric. Nutr. Dev. 21, 18319–18329. doi: 10.18697/ajfand.102.19445

Mwonge, L., and Alexis, N. (2021). Determinants of credit demand by smallholder farmers in Morogoro, Tanzania. African J. Agric. Res. 17, 1068–1080. doi: 10.5897/AJAR2020.15382

National Bureau of Statistics of the People's Republic of China. (2023). Announcement on grain output data for 2023. Available at: https://www.stats.gov.cn/sj/zxfb/202312/t20231211_1945417.html (Accessed December 14, 2024).

National Bureau of Statistics of the People's Republic of China. (2024). Announcement on grain output data for 2024. Available at: https://www.stats.gov.cn/sj/zxfb/202412/t20241213_1957744.html (Accessed December 14, 2024).

National Development and Reform Commission (2008). Outline of the medium- and long-term plan for National Food Security (2008–2020). Beijing: National Development and Reform Commission.

Niu, W. T., and Shang, W. W. (2024). The theoretical logic and realistic dilemma of sustainable operation for new agricultural business entities in China. Res. Dev. Market 40, 427–436. doi: 10.3969/j.issn.1005-8141.2024.03.01

Onwuagba, I., Oguoma, S., Onyeagocha, A., and Nwaiwu, I. (2021). Determinants of institutional credit demand by small scale food crop farmers in Owerri agricultural zone of Imo state, South East Nigeria. Asian J. Agric. Extens. Econ. Sociol. 12, 1–7. doi: 10.9734/ajaees/2016/25002

Perveen, F., Shang, J., Zada, M., Alam, Q., and Rauf, T. (2020). Identifying the determinants of access to agricultural credit in southern Punjab of Pakistan. Geo J. 86, 2767–2776. doi: 10.1007/s10708-020-10227-y

Santos, A., Soerger, Z. E., and Oliveira, J. (2022). Cooperativism and microcredit: an analysis of the participation of cooperatives in the supply of microcredit in Brazil. Res. Soc. Dev. 11:e16311225534. doi: 10.33448/rsd-v11i2.25534

Sun, Q. F., Wu, L. C., and Wu, X. Z. (2022). Research on the influencing factors of the financing loan scale of new farmers under the background of rural revitalization: based on survey data in Zhejiang Province. Res. Agric. Modernization 43, 455–464. doi: 10.13872/j.1000-0275.2022.0025

Ullah, A., Mahmood, N., Zeb, A., and Kaechele, H. (2020). Factors determining Farmers' access to and sources of credit: evidence from the rain-fed zone of Pakistan research area 2 "land use and governance" Working Group: Sustainable Land Use in Developing Countries. Agriculture (Switzerland). 10:586. doi: 10.10.3390/agriculture10120586

Wang, H. Q., Tian, B. B., and Wang, G. Z. (2016). A study on farmer credit risk assessment in agricultural value chain financing: a case of Lixin County, Anhui Province. J. Zhengzhou Univ. Aeronautics 34, 92–99+140. doi: 10.19327/j.cnki.zuaxb.1007-9734.2016.02.015

Xu, P. (2021). Synergy mechanism and effects of financing guarantee on agricultural operating entities: an explorative and practical perspective from Zhejiang agricultural credit guarantee. Issues Agric. Econ. 10, 113–126. doi: 10.13246/j.cnki.iae.2021.10.008

Yang, S. L., Tchewafei, A., Tchewafei, L., Sambiani, L., Tchewafei, A., and Kaghembega, S. H. W. (2021). Analyses of the determinants of access to credit by smallholder farmers in Togo.In Proceedings of the 2021 International Conference on E-business and Mobile Commerce, 58–68. doi: 10.1145/3472349.3472357

Yang, M. W., and Zhang, L. Z. (2019). Research on the impact of social capital intensity on rural household borrowing behavior: based on data from the 2016 CFPS. Rev. Econ. Manag. 35, 71–83. doi: 10.13962/j.cnki.37-1486/f.2019.05.007

Yang, Y. T., Ding, Q., and Wang, G. G. (2023). The impact of household borrowing on grain production technical efficiency: a study based on panel data from 3,255 households in three provinces from 2012 to 2018. Chinese Journal of Agricultural Resources and Regional Planning 44, 84–94. doi: 10.7621/cjarrp.1005-9121.20231210

Yin, Z. Y., Han, X. Q., Gu, J. F., Cheng, P. Y., and Wang, Z. B. (2017). Comparison of grain crop production efficiency of new agricultural management entities in economically developed areas: taking Suzhou as an example. Jiangsu Agric. Sci. 45, 251–256. doi: 10.15889/j.issn.1002-1302.2017.14.065

Yu, Y. W., and Wei, J. Z. (2021). Analysis of the influencing factors of the willingness of technological transformation of cotton processing Enterprises in China. Chin. J. Agric. Mach. Chem. 42, 76–84. doi: 10.13733/j.jcam.issn.2095-5553.2021.04.12

Zedda, S., Modina, M., and Gallucci, C. (2023). Cooperative credit banks and sustainability: towards a social credit scoring. Res. Int. Bus. Financ. 68:102186. doi: 10.1016/j.ribaf.2023.102186

Zhang, Y. (2024). The promoting role of new agricultural management entities in grain production: spatial econometric research based on county-level data from the three eastern provinces of China from 2017 to 2021. J. Beijing Voc. Coll. Finan. Comm. 40, 33–40. doi: 10.3969/j.issn.1974-2923.2024.04.006

Zhang, X. C., Liu, Y., and Zhang, J. W. (2018). Analysis on grain production and management status of new agricultural management entities in Shandong Province. Shandong Agric. Sci. 50, 143–147. doi: 10.14083/j.issn.1001-4942.2018.09.03

Keywords: new agricultural operating entities, loan willingness, credit scale, decision-making behavior, food security

Citation: Wei J and Fang T (2025) Behavioral analysis of loan decision-making and influencing factors among food-producing new agricultural operating entities in China. Front. Sustain. Food Syst. 8:1443022. doi: 10.3389/fsufs.2024.1443022

Edited by:

Wenjin Long, China Agricultural University, ChinaReviewed by:

Dong Chong, Chinese Academy of Social Sciences (CASS), ChinaZhen Zhong, Renmin University of China, China

Copyright © 2025 Wei and Fang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jingzhou Wei, YXJnZWNvZG90QDEyNi5jb20=

Jingzhou Wei

Jingzhou Wei Taihuang Fang

Taihuang Fang