- 1Department of Social Sciences, Qufu Normal University, Qufu, China

- 2School of Government, University of Chinese Academy of Social Sciences, Beijing, China

- 3School of Economics, Shandong University of Finance and Economics, Jinan, China

- 4School of Economics, Qufu Normal University, Rizhao, China

From the perspective of rural household income, this paper discusses the relationship between the proportion of land transfer proceeds for rural development and the debt risk of rural households and carries out the empirical testing by using a two-way fixed-effects model based on the data from the Chinese Household Finance Survey (CHFS) and the data matching the prefecture-level city data. The study suggests that the debt risk of rural households can be inhibited significantly in case of an increase in the proportion of proceeds from land transfer supporting rural development, and there is a “U”-shaped relationship between the proportion and the risk, which indicates that the proportion should be controlled reasonably to maximum the use efficiency of land transfer fund, and according to the system analysis, the increase in the proportion can enhance the debt-repayment ability of the rural households and reduce their debt risk by increasing their transfer income and agriculture income. Moreover, thus, this paper is of great importance for resolving the debt risk of rural households, consolidating the achievements of poverty alleviation, preventing large-scale relapse into poverty, and promoting rural revitalization.

1 Introduction

With the development of the economy and society, enhancement of the financial availability of rural households, and their increasing demands on funds, the debt scale of rural households in China is growing particularly rapidly, and thus, it is self-evident that they have a high debt risk. In particular, according to CHFS data 2019, with respect to the liability average, the average debt of rural households was RMB 41195 yuan, whereas that of urban households was RMB 106609 yuan, so that the average debt of rural households is much lower than that of urban households. However, from the perspective of repayment pressure, the debt-to-income ratio1 of rural residents was 147%,2 and that of urban residents was 125%, so that the debt pressure of the rural households is much higher than that of the urban households, a situation similar to that observed in countries like India (Reddy et al., 2020a). Therefore, the debt risk has been a real problem that many rural households have to face.

The debt is a double-edged sword. When the debt risk is under control, a loan can meet the capital needs of rural households in production and operation to a certain extent and promote the growth of rural household income and is of great significance for consolidating the achievements of the poverty alleviation and promoting rural revitalization. However, if the debt scale is too large, the rural households have to reduce the income for consumption, so as to further lead to shortage of domestic demand. Meanwhile, if the debt scale of rural households grows rapidly, the saving rate of residents sector in China will be reduced, resulting in decline of investment rate and slowdown of economic growth and other problems. Furthermore, it will be more difficult to prevent and control the debt risk, thus aggravating the possibility of systemic financial risks in China (Cynamon and Fazzari, 2011). As a result, it is very important to prevent and resolve the debt risk of the rural households.

According to existing researches, the land finance is an important cause of debt risk of the rural households. The local governments always return the proceeds from land transfer3 to industrial enterprises in a certain form (Fan, 2015), leading to some disadvantages in the distribution form of proceeds from land transfer and aggravate the debt risk of rural households. On the one hand, the distribution form that partial proceeds are returned to the industrial enterprises has resulted in a relatively low proportion of proceeds from land transfer for agriculture, so that the compensation obtained by the rural households who have lost their land is far lower than the net income of land incurred in the Land Demising (bidding, auction, and listing) Institute, and thus, it is hard to guarantee their future production and life to aggravate their debt risk (Jiang and An, 2015). On the other hand, the distribution form that partial proceeds are returned to the industrial enterprises has caused great financial pressure on the local governments, so that the governments are driven to obtain financial revenue by raising the price of commercial and residential lands so as to supplement the financial gap, thus resulting in rise of housing prices (Li and Hua, 2018). When the housing price rises, rural households will undertake more debt for purchasing the house to increase the debt burden and risk of breach of contract (Ryan et al., 2016). Therefore, the unreasonable distribution of the proceeds from the land transfer is a critical cause of debt risk for rural households. It can be seen that the essence of the debt risk of rural households is the risk of financial and resource distribution mechanisms, rather than the risk of financial speculation (Lan, 2021). So, is there a new financial and resource distribution mechanism to resolve the debt risk of rural households?

In 2020, President Xi Jinping pointed out that more land value-added revenue should be spent on “Agriculture, Rural areas, and Rural residents” to resolve the problems, such as the land value-added revenue that is taken from agriculture is used to the city, and the capitals for rural revitalization is not enough. In the same year, the CPC Central Committee and State Council introduced the “Opinions on Giving Priority to Supporting Rural Revitalization by Adjusting and Improving the Scope of Use of Revenue from Land Sale,” in which the revenue from land sale is considered as the most reliable source of capitals for rural revitalization. In combination with the important comments of President Xi and the spirits of the important documents issued by CPC, a new distribution mechanism of proceeds from land transfer is forming. Can the debt risk of the rural households be reduced by increasing the proportion of land transfer proceeds for rural development with such new mechanism? What is its function mechanism? Is there a significant difference in the influence of different proportions on the debt risk of the rural households?

Although existing research has provided us with valuable insights, there remain some critical issues that have yet to be clearly addressed in the current literature, leaving research gaps. On one hand, although several studies have extensively explored the impact of financial support for agriculture, rural areas, and farmers within the general public budget, these studies have not deeply investigated the specific role of land transfer proceeds in supporting rural development and their impact on rural household debt risk. On the other hand, while theoretical analyses and empirical studies based on national data have made some progress, empirical research based on micro-level data regarding land transfer proceeds supporting rural development is still insufficient. Moreover, although the impact of financial literacy and social capital on rural household debt risk has received widespread attention, empirical studies on the impact of land transfer proceeds supporting rural development on rural household debt risk still need further verification.

Therefore, in order to verify the relationship between the proportion of land transfer proceeds for rural development and the debt risk of rural households, this paper selects the CHFS data to match the prefecture-level city data and carries out the empirical test by the two-way fixed-effects model.4 The test result reflects three points as follows. First, the debt risk of rural households can be significantly inhibited by increasing the proportion of land transfer proceeds for rural development. Second, there is a “U”-shaped relationship between the proportion and the debt risk, which suggests that the proportion should be controlled reasonably to maximize the use efficiency of the capital for land transfer. Third, the mechanism system shows that the proportion can enhance the debt repayment ability and reduce their debt risk by increasing the transfer income and the agriculture income of the rural households.

Compared with the existing literature, there are some marginal contributions of this paper as follows. First, with respect to the research topic, this paper, from the prospective of the funds for supporting rural development from the proceeds from land transfer, discusses the comprehensive impact of the proportion of the proceeds of land transfer for agriculture on the debt risk of the rural households, which effectively supplements the relevant theoretical researches on household debt and non-tax income. Second, with respect to the research sample, we manually collect the relevant data such as expenditure of proceeds from land transfer in the government fund budget in the budget report of prefecture-level cities, so as to lay a foundation for accurately identifying the influence of the proportion of land transfer proceeds for rural development on debt risk of the rural households.

The remaining parts of this paper are arranged as follows. The second part describes the institutional background and theoretical hypothesis, which mainly introduces the reform process, theoretical basis, and research hypothesis of the distribution system of the proceeds from land transfer; The third part illustrates the research design, including model setting, variable selection, data source, and descriptive statistics; The fourth part is the empirical results and analysis, including benchmark regression results, mechanism test, and robustness test; and the last part is the research conclusions and political suggestions.

2 Institutional background

Since the reform of the distribution system of the proceeds from land transfer, it has gone through such three stages as sharings of land transfer proceeds of central and local governments, defining the income and expenditure scope of the land transfer, and tendency of land expenditure onto support rural development (Xu et al., 2020). In the first stage, 48% of the proceeds from the land transfer is used as the fixed income of local finance mainly for urban construction and land development,5 but the farmers do not directly benefit from the huge earnings brought by land-transferring fees. At the same time, local governments have considerable autonomy in land transfer. In order to obtain huge proceeds from land transfer and develop the local economy, the local governments obtain the right to use agricultural lands through illegal expropriation and occupation of agricultural lands, which harms the interests of the farmers.

The State Council Office clarified the scope6 in the second stage. However, on the one hand, the net income after deducting the costs is low because the land transfer income includes the costs of related land development taxes such as paid use fees of land and land value-added tax. Statistically, China’s land transfer income racked up RMB 28 trillion yuan from 2013 to 2018. After deducting the cost expenditure, the land transfer income was RMB 5,400 billion yuan, accounting for 19% of the land transfer income, of which RMB 1,850 billion yuan was used for agriculture and rural areas, accounting for only 34%of the land transfer income.7 On the other hand, local governments have different implementation standards, and thus, it is difficult for the central government to estimate related information, such as the transfer costs of the local lands, so it is difficult to supervise the management and use of land transfer fees. Therefore, although the central government constantly emphasizes that the land-transferring fee is “taken from agriculture and used for agriculture,” its proportion used for agricultural and rural development is still low.

In the third stage, the proceeds from land transfer become the most reliable source8 of capitals for rural revitalization. In 2020, President Xi Jinping pointed out that more land value-added revenue should be spent on “Agriculture, Rural areas, and Rural residents” to resolve the problems, such as the land value-added revenue is taken from agriculture but used to the city, and capital for rural revitalization is not enough. Meanwhile, the 14th Five-Year Plan in China has proposed that the proportion of land transfer proceeds for rural development should be more than 50% at the end of the Plan. With the reform of the distribution system of the proceeds from land transfer, the proportion of the capitals from the proceeds for agriculture also further increases, which is beneficial to the improvement of agriculture and rural development, raise of income of the rural households, enhancement of the ability of the rural households to response the risk, so as to fully promote the rural revitalization.

3 Theoretical hypothesis

The distribution mechanism of the proceeds from land transfer is changing from “taking from the agriculture but mainly being used for the city” to “taking from the agriculture and also being used for the agriculture” to gradually increase the proportion of land transfer proceeds for rural development. Then, can the increase in the proportion resolve the debt risk of the rural households? If it can, what is its function path? Then, this paper will answer these two questions in detail from the perspective of the income of rural households.

The expenditure of the proceeds from land transfer on supporting rural development includes such four parts as funds for agricultural land development, social security expenditure on land-expropriated farmers, subsidy expenditure on maintaining the original living standards of land-expropriated farmers, and expenditure on rural infrastructure construction; among them, the funds for agricultural land development are mainly used for construction and protection of basic farmlands, consolidation and reclamation of agricultural lands, and improvement of agricultural production conditions. An increase in the proportion of supporting rural development by the proceeds from land transfer can reduce the debt risk of rural households by raising the transfer income and agricultural income of rural households.

First of all, the increase in the proportion of supporting rural development by the proceeds from land transfer can raise the transfer income of rural households. The increase in the proportion has raised funds for subsidizing the expenditure of the land-expropriated farmers on social security and maintaining the original living standards of the land-expropriated farmers, so that the rural households can obtain more transfer incomes (Lu, 2023). Specifically, the funds for subsidizing the expenditure of the land-expropriated farmers on social security are mainly used for subsidizing the payment of the rural households to social insurance, such as old-age insurance, and the government pays the old-age insurance fees for the land-expropriated rural households at one time or several times. As the pension benefits are determined according to the insurance payment level, increase in funds for subsidizing such expenditure of the land-expropriated farmers improves their payment level of old-age insurance to increase their transfer incomes such as pensions (Hu et al., 2023). The subsidy expenditure on maintaining the original living standard of the land-expropriated farmers is a minimum guarantee for the farmers in short time, which is used to maintain the stability of rural household incomes, and the financial expenditure becomes the transfer income of rural households to directly increase the rural household income (Lu, 2023).

Second, the increase in the proportion of supporting rural development by the proceeds from land transfer can raise the agricultural income of rural households. The increase in the proportion is conducive to the raise of the expenditure funds for agricultural land development and rural infrastructure construction, among which the funds for the agricultural land development are mainly used for construction and protection of the basic farmland, consolidation and reclamation of the agricultural lands, and improvement of the agricultural production conditions. The increase in the funds for agricultural land development has many affects. First, it is conducive to expanding the protection funds for basic farmland construction and ensuring a relative stable income source of the rural households (Liang and Wang, 2021); second, consolidation and reclamation of the agricultural lands has a strengthened support, so as to promote the large-scale operation of agriculture, and expand the agricultural income sources of rural households (Luo et al., 2023); Third, it is conducive to improving the agricultural production conditions, accelerating the development of agricultural modernization and improving total factor productivity of agriculture to promote the growth of the agriculture income of the rural households (Das, 2016; Reddy et al., 2020b). Generally speaking, the increase in the proportion can enhance the internal foundation of agricultural production and operate through raising the funds for agricultural land development so as to realize the increase in the agricultural income of the rural households.

The expenditure on rural infrastructure can be divided into expenditure on economic infrastructure and on social infrastructure (Jin, 2012). The former is mainly used for rural water conservancy, roads, electricity and other engineerings; the increase in this expenditure can improve the external environment of the agricultural production and operation faced by rural households, reduce the production cost of the rural households, and improve the total factor productivity of the agriculture (Jain et al., 2009). The latter is mainly used for the construction of rural medical care, education, and health. The increase in this expenditure can improve the soft environment in which labor capitals are located, accelerate the accumulation of agricultural and rural labor capitals, so as to improve the willingness and intensity of rural households to the new technologies (Ma and Feng, 2013), thus improving the total factor productivity. The improvement of the total factor productivity is beneficial for rural households to obtain higher yield9 in agricultural production and operation activities so as to increase their agricultural income (Zhang and Fan, 2023).

Based on the above analysis, the increase in the proportion of supporting rural development by the proceeds from land transfer can raise the transfer income and agricultural income of rural households, while the increase in these two incomes would reduce the debt risk of rural households. The increase in the transfer income, agricultural income, and other income of the rural households has many effects on the debt risk of the rural households. First, the motivation that the rural households borrow money from financial institutions or private lending organizations to meet their capital needs will decrease with the increase in income, so there is a negative relationship between the debt and income of rural households (Ignacio and Graciela, 2022). Second, the debt-repayment ability of rural households can be expressed by the debt-to-income ratio. The higher the income of rural households, the stronger the debt-paying ability. Therefore, the increase in the income of rural households enhances their debt repayment ability and reduces their debt risk (Getter, 2003). Third, the increase in their income can raise the proportion of allocation of the household financial assets, optimize the structure of the financial assets, and increase the property income of rural households (Sun, 2018), which makes the rural households own more wealth, have stronger debt-payment ability and reduce their own debt risk.

Based on the above analysis, the hypotheses H1 and H2 are put forward in this paper.

H1: Increase in the proportion of supporting rural development by proceeds from land transfer will raise the transfer income of the rural households to reduce their debt risk.

H2: Increase in the proportion of supporting rural development by proceeds from land transfer will raise the agriculture income of the rural households to reduce their debt risk.

4 Research hypothesis

4.1 Model construction

In order to empirically analyze the impact of the proportion of supporting rural development by proceeds from land transfer on the debt risk of rural households, this paper constructs a two-way fixed-effect model as follows:

In which i stands for prefecture-level city, j for rural households, t for years, and debt for the debt risk level of rural households; TD for the proportion of supporting rural development by proceeds from the land transfer, and X for a series of control variables, including rural households variable and head of the household variable. γ is the regional fixed effect, μ is the time fixed effect, ε is the random disturbance term, and β0 is the constant. β1 is the coefficient of the core explanatory variable, and its positive and negative values represent the influence of the proportion of land transfer proceeds for rural development on the debt risk of rural households.

If increasing the proportion can gradually reduce the debt risk of rural households, then with the increase of the proportion, the debt risk of rural households may be reduced to zero. However, on the one hand, according to the life cycle theory, rural households use loans to smooth their consumption during the life cycle so as to maximize the utility, so the household debt should not be zero (Chantarat et al., 2020). On the other hand, if the debt risk of rural households is reduced to zero, which may suggest that rural households will no longer borrow money, thus greatly limiting the development of rural households (Wang et al., 2023). Therefore, we think that there may be an inflection point before the debt risk of the rural households is reduced to zero, that is, a non-linear influence possible between the proportion of proceeds from land transfer for agriculture and the debt risk of the rural households. In order to test such non-linear influence, the model is obtained by adding a square (TD2) of the proportion as an explanatory variable, with reference to the research carried out by Li and Wang (2020):

In (Model 2), the meanings of other variables are the same as those in (Model 1). β1 is significantly less than zero, and β2 is significantly greater than zero, which indicates that there is a “U”-shaped relationship between the proportion of land transfer proceeds for rural development and the debt risk of the rural households.

4.2 Variable selection

4.2.1 Core explanatory variables

This paper takes the proportion of land transfer proceeds for rural development as the core explanatory variable. The proportion of land transfer proceeds for rural development refers to the proportion of the proceeds from land transfer allocated for the development of agriculture, rural areas, and farmers, which is generally reserved according to a certain proportion of the average net proceeds from the land transfer or of the proceeds from land transfer. However, because the power of income and expenditure of the proceeds from land transfer is controlled by the local government, the final proportion will change according to the actual implementation of the local governments. In addition, due to the difficulty in estimating the net proceeds from land transfer, this paper uses the ratio of expenditure on agriculture, rural development, and farmers’ support from land transfer proceeds to the total land transfer proceeds to measure the proportion of land transfer proceeds allocated for rural support. By employing a fixed-effects model, the study examines the relationship between this ratio and the debt risk of rural households, thereby investigating whether increasing the proportion of land transfer proceeds allocated for rural support can help reduce the debt risk of rural households (Yin et al., 2021).

4.2.2 Explained variables

This paper takes the debt risk of rural households as the explained variable and selects debt-to-income ratio of the rural households as the proxy variable of the debt risk of rural households; that is, the debt risk is the ratio of total debt to total income of rural households, which can truly reflect the debt repayment pressure of the rural households. The higher the ratio, the higher the debt risk (Getter, 2003).

4.2.3 Mediating variables

This paper takes the transfer income and agricultural income of rural households as intermediary variables to examine the path mechanism of the effect of the proportion of land transfer proceeds for rural development on the debt risk of rural households. Among these, rural household transfer income (transfer_inc) includes monetary compensation for house demolition, monetary compensation for land acquisition, car insurance payouts, private transfer income, government subsidies, severance pay, other income (such as gambling and card playing), pensions, housing provident fund income, medical insurance reimbursements, and commercial insurance payouts. Moreover, their agricultural income (agri_inc) mainly refers to the income of rural households engaged in agricultural production and operation.

4.2.4 Control variables

Based on the relevant studies of Song et al. (2023) and Yin et al. (2021), this paper finally selects the control variables that affect the debt risk of rural household from the aspects of individual characteristics of the householder and family characteristics. At the level of personal characteristics of the householder, this paper selects such five control variables as gender, age, marital status, health, and work status. At the level of family characteristics, this paper selects such three control variables as family size (famn), house-to-asset ratio (houseb), and household consumption (consum). These variables can reflect the borrowing preferences of householder or the debt repayment ability of the household to some extent. The control variables are defined in Table 1.

At the level of regional characteristics, considering that the debt risk of the rural households may have different characteristics due to the economic and social environment and cultural differences in the region where they are located, this paper controls the regional fixed effect in the model to reduce the estimation bias caused by missing variables as much as possible.

4.3 Data sources and descriptive statistics

This paper selects CHFS data from Southwestern University of Finance and Economics in 2015, 2017, and 2019 and matches them with data from prefecture-level cities to empirically analyze the impact of the proportion of land transfer proceeds for rural development on the debt risk of the rural households. On the one hand, the explained variable of this paper is the debt risk of the rural households, and CHFS data is a relatively authoritative database for collecting the information on household assets and liabilities in China at present, and it is characterized by reasonable sampling and large data samples. Second, the database not only involves the data of household assets and liabilities but also provides the researchers with rich data of householder and household characteristics, so as to provide the data basis for selection of control variables in this paper. So, we chose CHFS data.

According to the availability of data related to the proceeds from land transfer, we can only collect data from prefecture-level cities and above after 2014, and most cities will no longer publish specific data on the land for supporting rural development after 2020, and only report urban and rural community expenditure. Combining the characteristics of the China Household Finance Survey (CHFS) data from the Southwestern University of Finance and Economics, this study utilizes prefecture-level city codes to match the CHFS databases from 2015, 2017, and 2019 with city-level data (the proportion of land transfer proceeds supporting rural development). An empirical analysis is conducted to examine the relationship between the proportion of land transfer proceeds supporting rural development and rural household debt risk. The data related to land transfer proceeds were manually compiled from the fiscal final accounts reports published by each prefecture-level city. The original data on rural household debt risk, control variables, and mediating variables were sourced from the China Household Finance Survey (CHFS). The descriptive statistics of the main variables in this paper are shown in Table 1.

5 Empirical analysis

5.1 Result analysis of reference regression

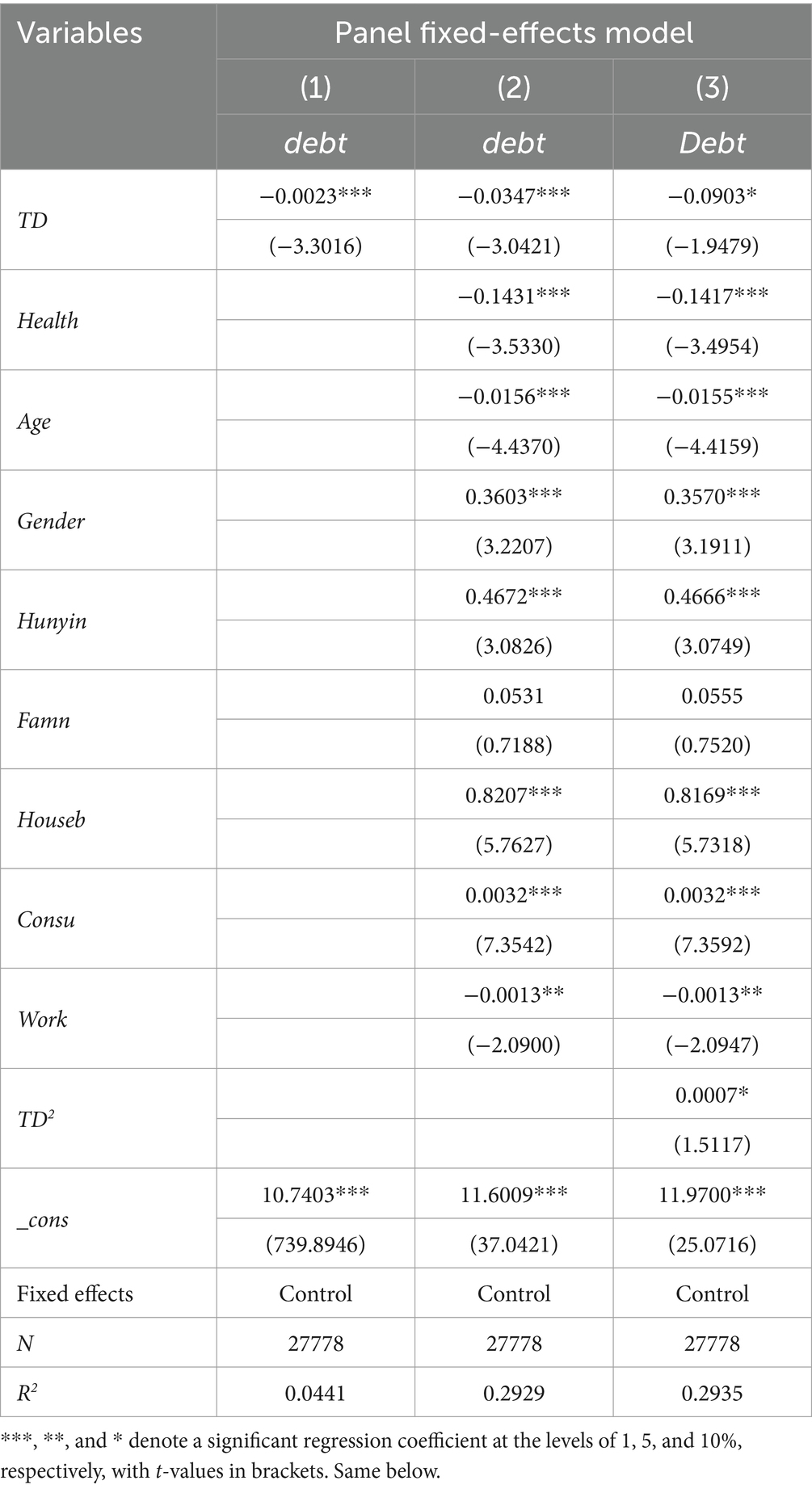

This paper uses the two-way fixed-effect model to test the impact of the proportion of land transfer proceeds for rural development on the debt risk of the rural households. The estimated results are shown in Table 2, in which (Model 1) tests the linear relationship between the proportion of land transfer proceeds for rural development and the debt risk of the rural households, and the results are shown in columns (1)–(2) of Table 2. As can be seen from column (1) of the Table 2, without adding control variables, the coefficient of the proportion of land transfer proceeds for rural development is significantly negative at the confidence level of 1%, which preliminarily proves that the increase in the proportion can reduce the debt risk of the rural households. According to column (2), after adding these two control variables the personal characteristics of the householder and the household characteristics, the coefficient of the proportion increases significantly, and is still significantly negative at the confidence level of 1%, indicating that increase in the proportion can indeed resolve the debt risk of the rural households to a certain extent. Xin et al. (2020) found that the government should introduce a formal major illness risk-sharing mechanism and increase the fiscal reimbursement ratio for major illnesses to alleviate the debt burden of patients with severe diseases. This finding further supports the conclusions of this paper. Wim et al. (2004), through their study of the proportion of out-of-pocket medical expenses in Cambodia, found that in the long run, relying on national finances to establish a comprehensive public health system and increasing the proportion of publicly funded medical expenses has a more significant impact on household debt risk. Our results also confirm this finding as shown in Table 2.

(Model 2) adds the square (TD2) of the proportion of land transfer proceeds for rural development based on (Model 1) to test the non-linear effect of the proportion on the debt risk of the rural households, and its results are shown in column (3) of Table 2. According to the results in column (3), the elasticity coefficients of the proportion and its square on the debt risk of the rural households are both significant at the level of 10%. Moreover, the coefficient of the proportion of land transfer proceeds for rural development is still significantly negative, and the coefficient of its square is significantly positive, suggesting that there is a U-shaped relationship between the proportion and the debt risk of the rural households, which indicates that with an increase in the proportion the use efficiency of the funds for agriculture falls down gradually so as to inhibit the growth of the income of the rural households, even the rural households borrow money from the financing institution to meet their fund demand due to loss of the income, thus promoting the debt risk of the rural households (Mao et al., 2018), which indicates that the proportion of funds for agriculture in the proceeds from land transfer should be reasonably controlled to maximize the use efficiency of land transfer funds.

5.2 Mechanism inspection

The empirical analysis mentioned above has shown that an increase in the proportion of land transfer proceeds for rural development can significantly resolve the debt risk of the rural households, but what is the intermediate mechanism and transmission process of the effect of the proportion on the debt risk of the rural households? These are the main questions that are studied in this paper. In order to further answer this question, two variables such as transfer income and agricultural income of rural households are selected as the intermediate variables in this paper to perform the mechanism test. Most of the existing papers about mechanism analysis carry out the stepwise regression using a three-step method, which should be supported and proved by scientific theories and empirical attempts and has certain limitations. Therefore, with reference to the corresponding operational suggestions given by Jiang (2022), this paper explores the relationship between core explanatory variables and intermediary variables, and between intermediary variables and explained variables, respectively, to conduct a mechanism test and build a model as follows:

Wherein M is the intermediary variable, representing the transfer income of rural households (transfer_inc) and agriculture income (agri_inc), respectively. The other variables have the same meaning as in (Model 1). Through theoretical analysis, it can be seen that the increase in the proportion of land transfer proceeds for rural development promotes the growth of the transfer income and agricultural income of rural households, thus strengthening the debt-repayment ability of rural households and restraining the debt risk of rural households. Therefore, if the mediating effect is valid, both α1 and φ1 are significant, and α1 is greater than zero and φ1 is less than zero.

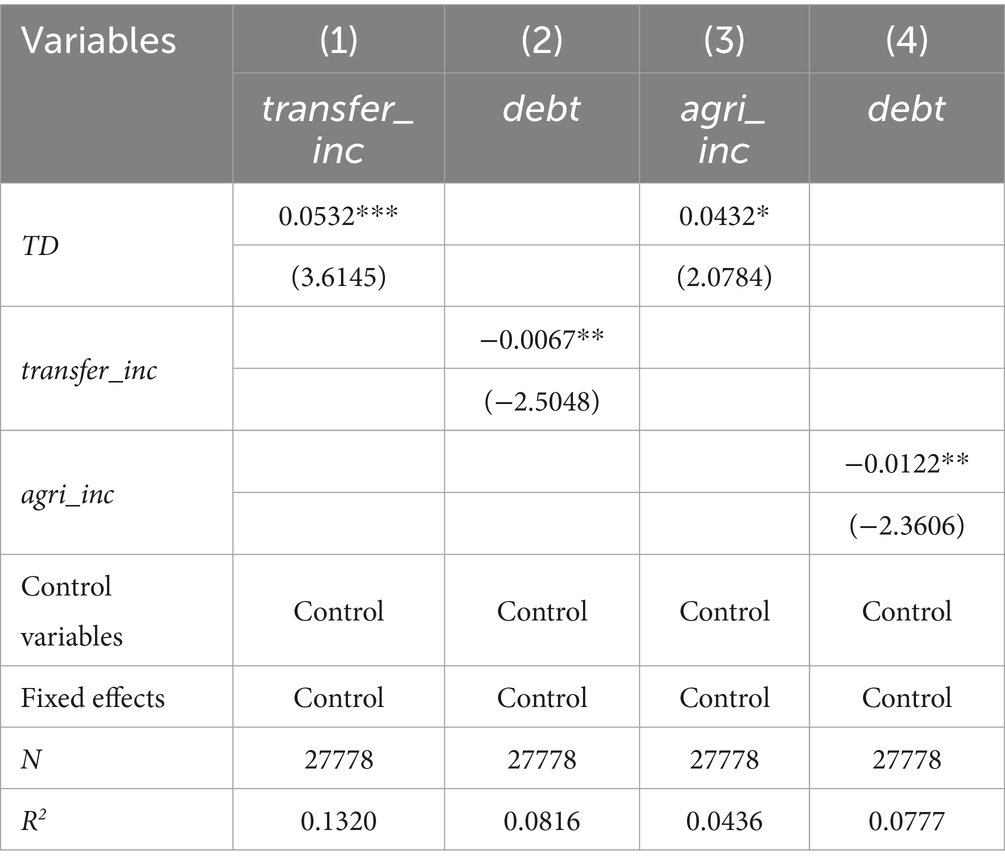

Based on (Models 3 and 4), this paper examines the mediating effect of household income. Table 3 reports the test results that the proportion of land transfer proceeds for rural development resolves the debt risk of the rural households through the path of transfer income of the rural household. The results in column (1) show that there is a significant positive correlation between the proportion of land transfer proceeds for rural development and the transfer income of rural households at the confidence level of 1%, which indicates that the higher the proportion, the higher the transfer income. According to column (2), the coefficient of the transfer income of the rural household is significantly negative and passes the test at a confidence level of 5%, which indicates that the increase in the transfer income can significantly restrain the debt risk of the rural households. According to the results of columns (1) and (2), it can be seen that the transfer income of the rural households plays an intermediary role in the process of influencing the debt risk of the rural households by the proportion of land transfer proceeds for rural development. Therefore, the empirical results in Table 3 show that local governments can increase the transfer income of rural households by increasing the proportion of land transfer proceeds for rural development so as to improve the debt-repayment ability of the rural households and resolve their debt risks, and thus, it is proved that the hypothesis H1 is confirmed.

In this part, the agricultural income of the rural households is selected as the intermediary variable to investigate whether the proportion of land transfer proceeds for rural development can affect the debt risk of the rural households through agricultural income. According to Table 3 (3), there is a significant positive correlation between the proportion of land transfer proceeds for rural development and the agriculture income of the rural households at the confidence level of 10%, that is, the higher the proportion, the higher the agricultural income. According to column (4), the coefficient of agri_inc is significantly negative at the confidence level of 5%, suggesting that the higher the agriculture income, the lower the debt risk level. According to the results of columns (3) and (4) in Table 3, the agricultural income of the rural households is the intermediary factor that affects the debt risk level of the rural households by the proportion of land transfer proceeds for rural development. Therefore, the increase in the proportion can restrain the debt risk of rural households by increasing their agricultural income, and thus, it is proved that hypothesis H2 is confirmed.

6 Robustness test

Although the benchmark regression results in this paper are consistent with theoretical expectations, it is necessary to conduct further robustness tests in order to verify the reliability of the conclusions. Based on the setting ideas of the existing robustness test and the research reality of this paper, this paper performs the test by replacing the explained variables, shortening the time window, and excluding the samples of municipalities and sub-provincial cities.

6.1 Replace the explained variables

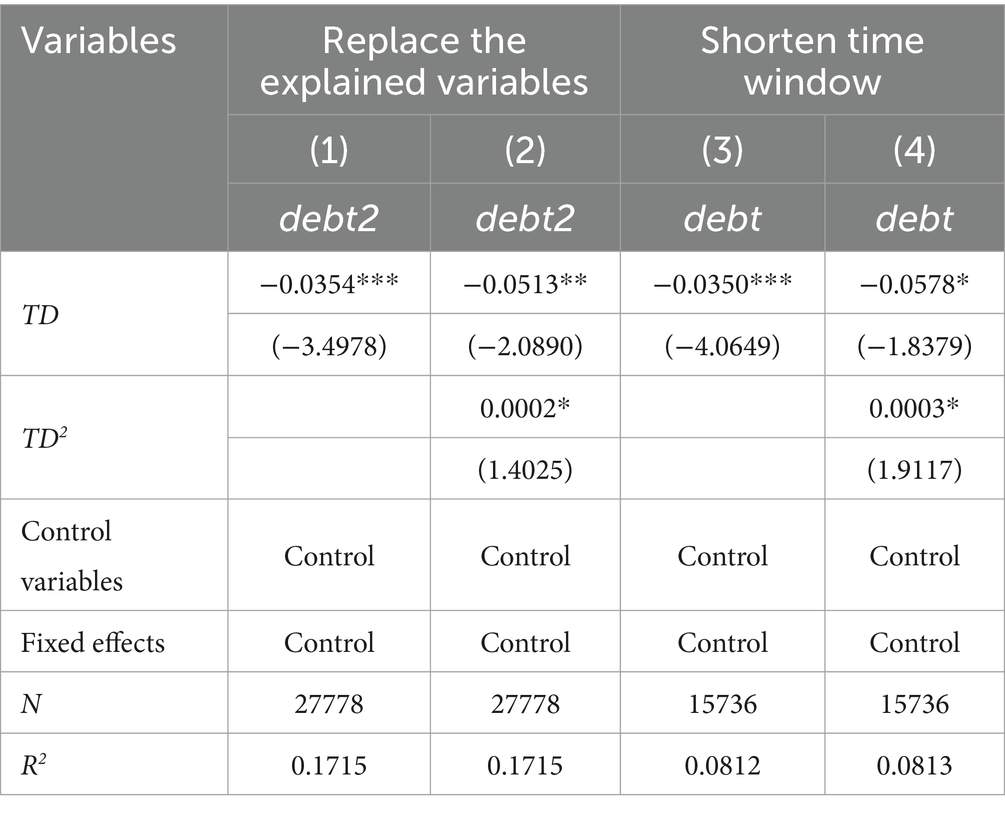

This part mainly carries out the robustness analysis by replacing the explained variables. As differences in the measurement methods of the explained variables may affect the accuracy and significance of the results of this paper, this part replaces the asset–liability ratio of the rural households with their debt-to-income ratio as the explained variable for robustness analysis (Nuugulu et al., 2019). The asset–liability ratio of rural households is the ratio of their total liabilities to total assets, which can reflect the long-term debt-repayment ability and long-term liquidity of rural households to a certain extent. The higher the ratio, the greater the risk (Dynan, 2012). According to the results shown in columns (1) and (2) of Table 4, the symbols of the estimated coefficient of the proportion of land transfer proceeds for rural development (TD) are the same as those of the benchmark estimation results and pass the test at a significance level of 1 and 5%, respectively, indicating that the benchmark regression results are robust.

6.2 Shorten time window

In this part, we mainly carry out the robustness analysis by shortening the time window of the sample. According to the government budget and final accounts reports of prefecture-level cities, local governments have gradually released the final accounts of government-managed funds since 2014. Considering that there may be some differences in the statistical standards of the data related to the proportion of land transfer proceeds for rural development in the earlier period, this part only retains the data of 2017 and 2019 to analyze the impact of the proportion on the debt risk of the rural households. According to the specific results shown in columns (3) and (4) of Table 4, the regression results do not change the symbols of the proportion (TD) and its square (TD2) coefficient and are both significant, which are consistent with the result of the benchmark regression results, indicating that the benchmark regression results are robust.

6.3 Excluding the influence of municipalities directly under the central government and sub-provincial cities

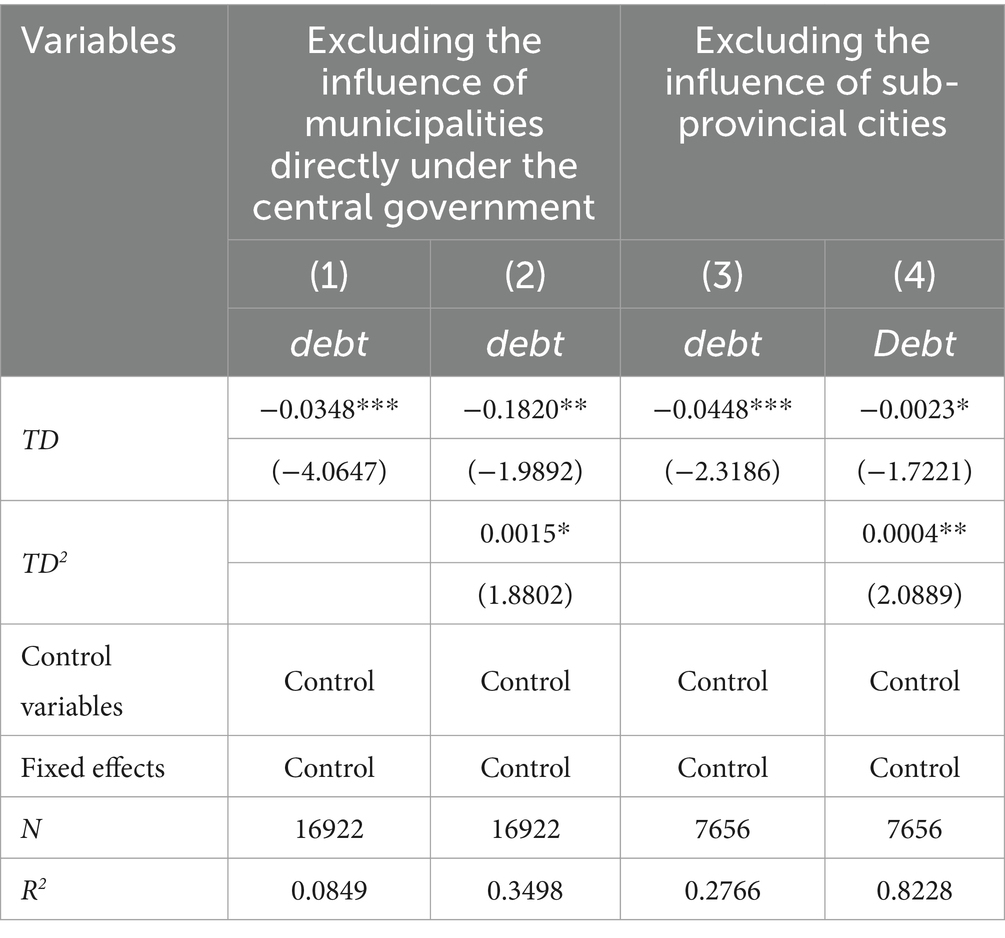

In this part, we mainly carry out a robustness test by excluding samples of municipalities directly under the central government and sub-provincial cities.10 Under the institutional dilemma that the financial power does not match with the administrative power, local governments at different levels are faced with different financial pressures, leading to differences in the extent to which the local governments reduce the proportion of the proceeds of land transfer for agriculture (Fan, 2015). In addition, the financing capabilities of local governments at different levels are differentiated, and the stronger their financing capabilities, the less motivation the local governments support their local economic and social development by reducing the proportion of land transfer proceeds for rural development (Li et al., 2022). Therefore, the local governments at different levels have different motives and capabilities to intervene in the distribution of the proceeds from land transfer, thus causing different impacts on the debt risk of rural households.

In order to verify whether the existence of samples of the municipalities directly under the central government and sub-provincial cities will affect the accuracy of the benchmark regression results, this paper first excludes the samples of municipalities directly under the central government and analyzed the impact of the proportion of land transfer proceeds for rural development on the debt risk of the rural households. According to the results shown in columns (1) and (2) of Table 5, the absolute value of the TD coefficient increases and the symbols and significance remain unchanged, compared with the benchmark regression results. Second, on the basis of excluding the samples of municipalities directly under the central government, this paper further excludes the samples of sub-provincial cities and repeats the benchmark regression. The results are shown in columns (3) and (4) of Table 5. Compared with the benchmark regression results, the absolute value of the TD coefficient has increased somewhat but is still significantly negative, indicating that the benchmark regression results in this paper are robust.

6.4 Exogeneity test

There may be an endogenous problem between the proportion of land transfer proceeds for rural development and the debt risk of the rural households, thus resulting in untrustworthy results. First, although the control variables such as the personal characteristics of the householder and the household characteristics are added to the (Model 1), some important variables affecting the relationship between the proportion and the debt risk may still be omitted. Second, according to the definition of the proportion of land transfer proceeds for rural development in this paper, with the increase in the debt risk of the rural households, on the one hand, their housing demand may be reduced to restrain the price of real estates; On the other hand, the rural households are unable to afford mortgage loans, leading to a debt crisis and a decline in housing prices, which, in turn, cause a decline in land prices of the region and a decrease in proceeds from land transfer, thus affecting the proportion of land transfer proceeds for rural development. Therefore, there may be a two-way cause-and-effect question between the proportion of land transfer proceeds for rural development and the debt risk of rural households.

As it is difficult to find an instrumental variable directly related to the proportion of land transfer proceeds for rural development, with reference to the study performed by Yu et al. (2020), we select the river density and area of the administrative region of the prefecture-level cities as instrumental variables to solve the endogenous problem in this paper. On the one hand, the river density of prefecture-level cities is used as an instrumental variable of the proportion of land transfer proceeds for rural development. In terms of correlation, the more rivers in the administrative region, the greater the river density, which can improve the urban environmental quality and increase the land price and the proceeds from land transfer to a certain extent, and further affect the proportion of land transfer proceeds for rural development (Wen et al., 2017). In terms of externality, the river density of prefecture-level cities only depends on the local natural and geographical conditions, and it is very difficult to directly affect the debt risk of rural households. Therefore, we choose river density as the instrumental variable of the proportion of land transfer proceeds for rural development, which satisfies the assumption of correlation and exogeneity. On the other hand, the area of the administrative region of prefecture-level cities is taken as another instrumental variable of the proportion. First of all, the area of prefecture-level cities determines the land supply of the city to a certain extent and then further affects the proceeds from land transfer. Furthermore, the larger the area, the stronger the continuity of land supply in prefecture-level cities, and the more guaranteed the proceeds from land transfer. Therefore, we choose the area of the administrative region of the prefecture-level city as an instrumental variable, which satisfies with the correlation requirements. Second, the area of prefecture-level cities remains basically unchanged during the sample period, thus meeting the requirements of exogeneity.

As the two-way fixed-effect panel model is applied in this paper, and the river density and the area of the administrative region of prefecture-level cities do not change with time during the sample period, it is impossible to estimate them directly as an instrumental variable for regression due to the fixed effect, so it is necessary to select an exogenous time-varying variable. Therefore, when constructing the instrumental variable of the proportion of land transfer proceeds for rural development in this paper, we refer to the methods of Nunn and Qian (2014), and multiply the river density and area of the administrative region of the prefecture-level cities with the national fiscal revenue (related to time) of the previous year, recording as IV1 and IV2, respectively, which are used as the instrumental variables of the proportion of land transfer proceeds for rural development.

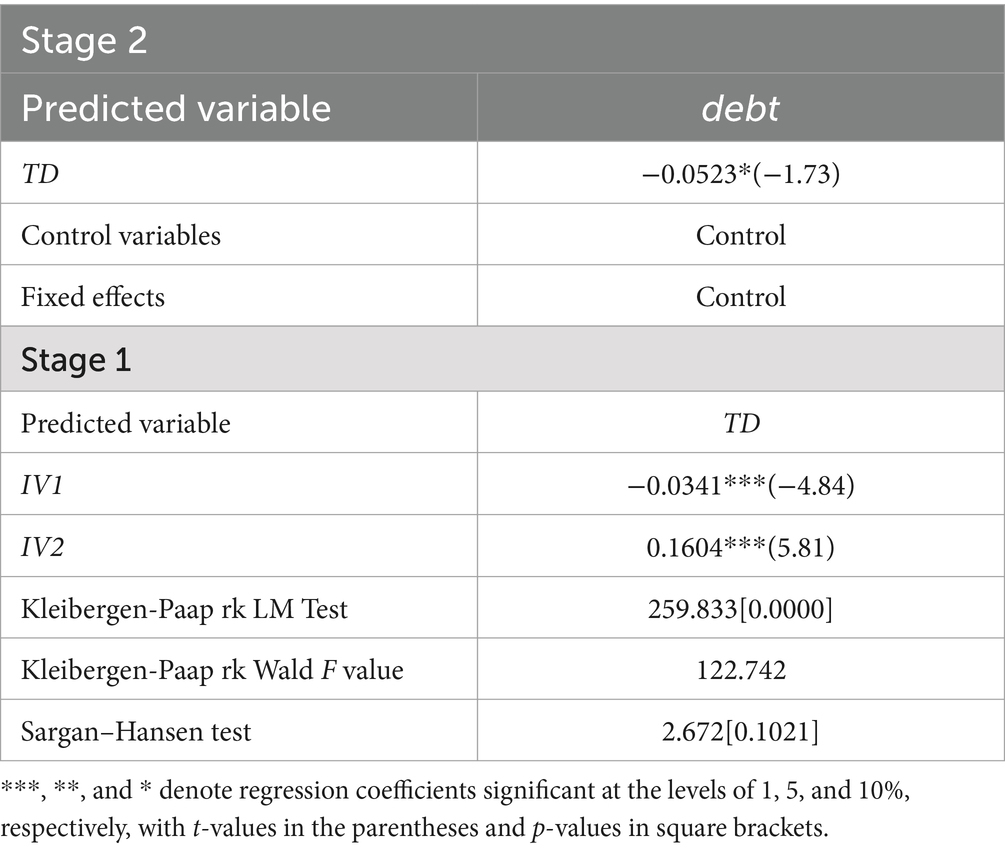

The estimated results of the instrumental variables are shown in Table 6. According to the estimation results in the first stage, first, the Kleibergen–Paap rk LM test statistic is 259.833 with p-values of 0.000, which passes the significance level test of 1% and rejects the null hypothesis of insufficient identification of instrumental variables. Second, the Kleibergen–Paap rk Wald F statistic is 122.742, which is significantly larger than the critical value (19.93) at the 10% level given by Stock and Yogo, indicating that there are no weak instrumental variables. Third, the p-values of Sargan–Hansen test are greater than 0.1, which indicates that the two exogenous instrumental variables are selected for the proportion of land transfer proceeds for rural development. Therefore, the instrumental variables selected in this paper satisfy the assumptions of correlation and externality. According to the estimation results in the second stage in Table 6, the estimated coefficient of the proportion of land transfer proceeds for rural development passes the significance test of 10%, and the symbol is consistent with the benchmark regression, which indicates that the results of this paper are still robust after alleviating the potential exogeneity; that is, the increase in the proportion of land transfer proceeds for rural development can significantly restrain the debt risk of the rural households.

7 Research conclusion and policy recommendations

It is a hot topic in current academic circles how to prevent and resolve the debt risk of rural households, consolidate the achievements of poverty alleviation in the new era, and prevent the large-scale relapse into poverty. President Xi Jinping pointed out that more proceeds from land transfer should be spent on agriculture, rural, and farmer development, which provides a direction for the debt risk of the rural households. In order to verify the relationship between the proportion of land transfer proceeds for rural development and the debt risk of rural households, this paper selects the CHFS data to match with the data of prefecture-level cities and performs the empirical test by the two-way fixed-effect model to get the following conclusions:

First, the increase in the proportion of land transfer proceeds for rural development has a significant inhibitory effect on the debt risk of rural households; after a series of robustness tests, the benchmark regression results are still robust. Second, there is a U-shaped relationship between the proportion of land transfer proceeds for rural development and the debt risk of the rural households, which indicates that the proportion of land transfer proceeds for rural development should be reasonably controlled in order to maximize the use efficiency of land transfer funds. Third, mechanism analysis shows that the proportion of land transfer proceeds for rural development can enhance the debt-repayment ability of rural households by increasing their transfer income and agricultural income, so as to reduce their debt risk. Based on the conclusions mentioned above, this paper puts forward the following political recommendations from the perspectives of rural households and the government:

First, optimize the allocation ratio of land transfer proceeds to promote agricultural development. The government should focus on how increasing the proportion of land transfer proceeds allocated to agriculture can alleviate rural household debt risk. It is also essential to monitor changes in the efficiency of fiscal fund usage during this process, ensuring that improvements in the proportion of land transfer proceeds allocated to agriculture also enhance fiscal fund utilization efficiency. By optimizing the distribution ratio and increasing investment in agriculture, not only can agricultural development be effectively promoted and farmers’ incomes raised, but rural household debt pressure can also be alleviated. Furthermore, agricultural growth can stimulate related industries, boost the overall rural economy, and achieve balanced urban–rural economic development.

Second, advance land transfer policy reforms to optimize rural resource allocation. This includes implementing and refining relevant laws and regulations to standardize land transfer market development and establish a reasonable land transfer proceeds distribution mechanism. Such reforms will not only improve land use efficiency and promote agricultural modernization and scale operations but also enhance land market management and services. For example, establishing land transfer service centers to provide information dissemination, contract signing, and legal consultation will ensure the legality and fairness of land transfers, increase farmers’ participation, and optimize rural resource allocation, thereby fostering sustainable rural economic development.

Third, establish and improve the rural financial system to lower loan costs and relieve farmers’ debt pressure. This involves diversifying the rural financial market’s credit supply structure by strengthening the role of large state-owned banks like the Agricultural Development Bank in providing financial services for agriculture, while also supporting the establishment of small rural financial institutions such as village and township banks. This will reduce rural household loan costs and inject vitality into rural revitalization. Additionally, new credit systems should be developed based on the actual needs of rural new business entities, ensuring convenience, speed, and safety to address the difficulty of obtaining loans for agriculture. Finally, a combination of new media, traditional media, and on-site outreach should be used to spread financial knowledge and deepen rural households’ understanding of debt risks.

In exploring the impact of the allocation ratio of land transfer proceeds on rural household debt risk, this study, despite some important findings, also has several limitations that need to be addressed and further explored in future research. First, the limitations of data sources are a significant issue. While the China Household Finance Survey (CHFS) data used in this study cover a wide range of regions and samples, they also have certain limitations. For example, the CHFS data are primarily based on self-reports, which may contain reporting biases and errors. Additionally, the timespan and geographical coverage of the data may not fully reflect the national situation, especially in some remote and impoverished areas where data may be insufficient, potentially limiting the external validity of the research results. Second, the impact of the allocation ratio of land transfer proceeds on rural household debt risk may also be constrained by cultural and social factors. For instance, land use practices, farmers’ risk preferences, and social security levels in different regions could all influence the research outcomes. Due to data limitations, this study did not examine these aspects.

To address the limitations of the current research, future studies should consider using more comprehensive data to validate the findings, thereby overcoming the data constraints in this research. For example, employing big data and artificial intelligence techniques to extract information from non-traditional data sources such as social media and e-commerce platforms could provide new perspectives for research, enhancing the diversity of data and the reliability of research results. Additionally, the impact of the allocation ratio of land transfer proceeds on rural household debt risk may be influenced by social and cultural factors. Future research could incorporate methods from sociology, anthropology, and behavioral economics to deeply investigate the mechanisms of factors such as farmers’ land use practices, risk preferences, and levels of social trust. This would help to more comprehensively understand the effects of policies and develop measures that better align with the actual conditions of rural society.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

LZ: Funding acquisition, Visualization, Writing – original draft, Writing – review & editing. ZM: Data curation, Validation, Visualization, Writing – original draft, Writing – review & editing. JL: Formal analysis, Supervision, Writing – review & editing, Project administration, Resources. LG: Conceptualization, Supervision, Investigation, Methodology, Software, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. The authors express their gratitude to the National Social Science Fund Project for financially supporting this research, grant number 23BJL117 and the “Mount Taishan Scholar” Project in Shandong Province, grant number tsqn202312180.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The author(s) declared that they were an editorial board member of Frontiers, at the time of submission. This had no impact on the peer review process and the final decision.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^Debt-to-income ratio: This is a measure of how much debt a household has compared to its income. It is calculated by dividing total debt by total income. A lower ratio indicates a lower debt burden relative to income, while a higher ratio suggests a higher debt burden.

2. ^The types of rural household debt mainly include agricultural debt, housing debt, medical debt, industrial and commercial debt, shop debt, vehicle debt, other non-financial asset debt, educational debt, and credit card debt. Among these, the total amounts of agricultural debt, housing debt, and medical debt account for approximately 80% of the total rural debt.

3. ^Land transfer is defined as the conversion of farmland to other uses (such as commercial or industrial), with a portion of the proceeds allocated for the development of agriculture, rural areas, and farmers.

4. ^Two-way fixed-effects model: This is a statistical method used to analyze data that changes over time. It controls for factors that are constant within groups (such as households or regions) and over time, helping to isolate the true effect of the variable of interest.

5. ^Refer to the Information Office of The State Council’s Press Conference on Adjusting and Perfecting the Use Scope of Land Transfer Income. Website: http://www.gov.cn/xinwen/2020-09/24/content_5546664.htm.

6. ^In 2006, the Notice of the General Office of the State Council on Standardizing the Management of Revenue and Expenditure on the Transfer of Use Rights of State-owned Lands stipulated that the scope of expenditure for supporting agriculture includes the provision of agricultural land development funds, social security expenditure for supplementing the land-expropriated farmers, subsidy expenditure for maintaining the original living standards of land-expropriated farmers and expenditure for rural infrastructure construction.

7. ^Refer to the Information Office of The State Council’s Press Conference on Adjusting and Perfecting the Use Scope of Land Transfer Income. Website: http://www.gov.cn/xinwen/2020-09/24/content_5546664.htm.

8. ^In 2020, the CPC Central Committee and State Council introduced the “Opinions on Giving Priority to Supporting Rural Revitalization by Adjusting and Improving the Scope of Use of Revenue from Land Sale.”

9. ^The production and operation activities here refer to both large-scale agriculture and small-scale agriculture activities taking a family as a unit.

10. ^China’s sub-provincial cities include Harbin, Changchun, Dalian, Shenyang, Jinan, Qingdao, Xi ‘an, Nanjing, Wuhan, Ningbo, Hangzhou, Xiamen, Shenzhen, Guangzhou, and Chengdu.

References

Chantarat, S., Lamsam, A., Samphantharak, K., and Tangsawasdirat, B. (2020). Household debt and delinquency over the life cycle. Asian Dev. Rev. 37, 61–92. doi: 10.1162/adev_a_00141

Cynamon, Z. B., and Fazzari, M. S. (2011). Household debt in the consumer age: source of growth--risk of collapse. Capital. Soc. 3:32. doi: 10.2202/1932-0213.1037

Das, K. V. (2016). Agricultural productivity growth in India: an analysis accounting for different land types. J. Dev. Areas 50, 349–366. doi: 10.1353/jda.2016.0079

Dynan, E. K. (2012). Is a household debt overhang holding Back consumption? Brook. Pap. Econ. Act. 2012, 299–362. doi: 10.1353/eca.2012.0001

Fan, Z. (2015). The source of finance: fiscal pressure or investment incentives. China Ind. Econ. 6, 18–31. doi: 10.19581/j.cnki.ciejournal.2015.06.003

Getter, D. E. (2003). Contributing to the delinquency of Borrowers. J. Consum. Aff. 37, 86–100. doi: 10.1111/j.1745-6606.2003.tb00441.x

Hu, H., Wang, W., and Xin, G. (2023). Enrollment in public pension program and household land transfer behaviour: evidence from rural China. Appl. Econ. 55, 3443–3457. doi: 10.1080/00036846.2022.2115001

Ignacio, J. W. R., and Graciela, S. (2022). Household debt and debt to income: the role of business ownership. Q. Rev. Econ. Finance 83, 52–68. doi: 10.1016/j.qref.2021.11.001

Jain, R., Arora, A., and Raju, S. S. (2009). A novel adoption index of selected agricultural technologies: linkages with infrastructure and productivity. Agric. Econ. Res. Rev. 22, 109–120. doi: 10.22004/AG.ECON.57386

Jiang, T. (2022). Mediating effects and moderating effects in causal inference. China Ind. Econ. 5, 100–120. doi: 10.19581/j.cnki.ciejournal.2022.05.005

Jiang, Z., and An, T. (2015). The impact of local Government's "land finance" on income distribution. Tax. Res. 7, 71–76.

Jin, G. (2012). Is money neutral in long run: An empirical study for China based on fisher-Seater's definition. Econ. Res. J. 4, 89–100.

Lan, X. (2021). Being inside: the Chinese government and economic development. Shanghai: Shanghai People's Publishing House.

Li, X., Feng, G., and Hao, S. (2022). Market-oriented transformation and development of local government financing platforms in China: exploratory research based on multiple cases. Systems 10:65. doi: 10.3390/systems10030065

Li, Y., and Hua, B. (2018). Research on the relationship between fiscal deficit, land finance and house Price level. J. Cent. Univ. Finan. Econ. 11, 3–14. doi: 10.19681/j.cnki.jcufe.2018.11.001

Li, Z., and Wang, X. (2020). Local Fiscal Risks from the Perspective of Public Expenditure Efficiency: Empirical Analysis Based on Panel Data of 239 Prefecture level Cities in China. Fiscal Research. 12, 35–48.

Liang, Y., and Wang, W. (2021). The willingness of farmers to participate in the later stage Management of Permanent Prime Farmland. Chin. Agric. Sci. Bull. 37, 149–155.

Lu, X. (2023). The poverty reduction effect of People's livelihood fiscal expenditure — a study based on multi-dimensional poverty index. Acad. J. Bus. Manag. 5:51515. doi: 10.25236/AJBM.2023.051515

Luo, J., Huang, M., Hu, M., and Bai, Y. (2023). How does agricultural production agglomeration affect green total factor productivity?: empirical evidence from China. Environ. Sci. Pollut. Res. Int. 30, 67865–67879. doi: 10.1007/s11356-023-27106-x

Ma, S., and Feng, H. (2013). Will the decline of efficiency in China's agriculture come to an end? An analysis based on opening and convergence. China Econ. Rev. 27, 179–190. doi: 10.1016/j.chieco.2013.04.003

Mao, H., Yu, S., and Zhang, S. (2018). Regional differences in the performance of fiscal support for agriculture expenditure: measurement and decomposition. Econ. J. 35, 144–152.

Nunn, N., and Qian, N. (2014). US food aid and civil conflict. Am. Econ. Rev. 104, 1630–1666. doi: 10.1257/aer.104.6.1630

Nuugulu, M., Hamutoko, T., and Julius, T. (2019). Namibian Household’s indebtedness and the impact on overall financial stability. Indian J. Econ. Dev. 7, 1–16.

Reddy, A. A., Raju, S. S., and Bose, A. (2020a). Farmers' income, indebtedness and agrarian distress in India. Microfinance Rev. 12, 20–38. doi: 10.3390/land10111236

Reddy, A. A., Ricart, S., and Cadman, T. (2020b). Tribal and non-tribal farmers’ land rights and food security promotion in Telangana. South Asia Res. 40, 75–93. doi: 10.1177/0262728019894753

Ryan, G., Peter, C., and Phillips, B. (2016). Hot property in New Zealand: empirical evidence of housing bubbles in the metropolitan centres. N. Z. Econ. Pap. 50, 88–113. doi: 10.1080/00779954.2015.1065903

Song, J., Hu, M., Li, S., and Ye, X. (2023). The impact mechanism of household financial debt on physical health in China. Int. J. Environ. Res. Public Health 20:4643. doi: 10.3390/ijerph20054643

Sun, Y. , (2018). Research on the relation between household income and financial asset allocation——take Beijing-Tianjin-Hebei region as an example// Institute of Management Science and Industrial Engineering. Proceedings of 2018 2nd International Conference on e-Education,e-Business and Information Management (EEIM 2018). Ottawa, Canada: Clausius Scientific Press.

Wang, F., Du, L., and Tian, M. (2023). Does agricultural credit input promote agricultural green Total factor productivity? Evidence from spatial panel data of 30 provinces in China. Int. J. Environ. Res. Public Health 20:529. doi: 10.3390/ijerph20010529

Wen, H., Xiao, Y., and Zhang, L. (2017). Spatial effect of river landscape on housing price: An empirical study on the Grand Canal in Hangzhou, China. Habitat Int. 63, 34–44. doi: 10.1016/j.habitatint.2017.03.007

Wim, D. V., Luc, L. V., Ir, P., et al. (2004). Out-of-pocket health expenditure and debt in poor households: evidence from Cambodia. Trop. Med. Int. Health 9, 273–280. doi: 10.1046/j.1365-3156.2003.01194.x

Xin, Y. J., Jiang, J. N., Chen, S. Q., Gong, F. X., and Xiang, L. (2020). What contributes to medical debt? Evidence from patients in rural China. BMC Health Serv. Res. 20:696. doi: 10.1186/s12913-020-05551-5

Xu, G., Lu, Q., Xu, K., and Zhang, J. (2020). Reform of the income distribution system of land transfer: History, Current situation and prospects. Price 12, 4–9.

Yin, Z., Li, J., and Yang, L. (2021). Can the development of Fintech improve the well-being of rural households? An analysis from the perspective of happiness economics. Chin. Rural Econ. 8, 63–79.

Yu, Y., Sun, P., and Xuan, Y. (2020). Do constraints on local Governments' environmental targets affect industrial transformation and upgrading? Econ. Res. J. 8, 57–72.

Keywords: proceeds from land transfer, funds for agriculture, rural households, debt risk, two-way fixed-effects model

Citation: Zhu L, Ma Z, Liu J and Gao L (2024) Proportion of land transfer proceeds for rural development, the rural household income, and the debt risk of the rural households in China. Front. Sustain. Food Syst. 8:1428897. doi: 10.3389/fsufs.2024.1428897

Edited by:

Xingwei Li, Sichuan Agricultural University, ChinaReviewed by:

Maogang Gong, Shandong University of Technology, ChinaPeng Jiquan, Jiangxi University of Finance and Economics, China

Copyright © 2024 Zhu, Ma, Liu and Gao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhida Ma, bWF6aGlkYWVkdUAxNjMuY29t

Liya Zhu

Liya Zhu Zhida Ma

Zhida Ma Jianxu Liu

Jianxu Liu Lemin Gao4

Lemin Gao4