- 1Department of Trade and Finance, Faculty of Economics and Management, Czech University of Life Sciences Prague, Prague, Czechia

- 2Department of Econometrics and Statistics, Institute of Economics and Finance, Warsaw University of Life Sciences, Warsaw, Poland

- 3Department of Economics and Economic Policy, Institute of Economics and Finance, Warsaw University of Life Sciences, Warsaw, Poland

- 4Department of Economics, Faculty of Economics and Management, Czech University of Life Sciences Prague, Prague, Czechia

In recent years, research on trade rebalancing in agri-food supply chains has gained prominence due to trade sanctions, supply chain disruptions, and vulnerabilities exposed by pandemics and conflicts. This study focuses on the recalibration of agri-food trade dynamics, using the 2014 Russian import ban as a case study. The ban significantly altered the structure of agri-food export destinations for affected countries, particularly those sharing a border with Russia (e.g., Poland, Finland, Estonia, Latvia, Lithuania). Employing a cross-section regression model and structural break tests, we assess the trade rebalancing process. Our findings reveal short-term trade rebalancing effects, primarily observed in product groups not traditionally considered main trade specializations. There is evidence that significant part of the lost trade was redirected to EU28 or EAEU countries and end up in the common trade areas of these countries. Furthermore, we argue that the Russian import ban initiated a long-term structural shift in export patterns for non-traditionally traded banned products, while rebalancing for traditionally traded products was significantly quicker.

1 Introduction

Trade creation and trade diversion are tightly connected topics and are usually considered together. Studies in international trade, including agricultural trade, investigate the trade creation and diversion effects of a range of shocks, positive and negative, such as negotiating new trade agreements or introducing trade restrictions. Many works in the field support the argument about the trade creation effect of free trade agreements and other forms of trade liberalization, however, to the best of our knowledge, the other side of the argument, namely the trade diversion effects of restrictive measures, still represents an opportunity for further inquiry. Supply chain disruptions invoked by pandemic, as well as recent trade sanctions connected with conflicts, provoked unfavorable economic effects in different parts of the world and unveiled the fragilities of the international trade as a result. International trade developments in recent decades have seen several episodes of newly introduced restrictive measures, and the import ban on specified agri-food products introduced by Russia in 2014 represents one of the remarkable cases of trade restrictions in the relationship between the European Union and the Russian Federation, two closely connected trading partners at that time. Geographic proximity, which should provide an incentive to trade, as well as the high values of trade before the ban, points to the significance of studying the process of how impacted trading partners have rebalanced their portfolio of export destinations because of the ban.

According to Erokhin et al. (2014), regarding Russia’s high dependency on foreign agri-food products, the imposed ban is a double-edged sword for Russia. Western sanctions on Russia substantially affected Russian trade and, in consequence, decreased the Russian GDP by 9% (Bayramov et al., 2020). However, Bělín and Hanousek (2021) calculate that Russian sanctions imposed on European and American food imports reduced imports by approximately USD 12.6 billion (and resulted in about an 8 times stronger decline in trade flows than those imposed by the EU and the US on exports of extraction equipment).

In continuation to previous works on the topic of Russian import ban (Liefert et al., 2019; Cheptea and Gaigné, 2020; Bělín and Hanousek, 2021), current paper addresses the existing research gap by looking into how quick and how significant the neighboring countries’ trade has reacted to the imposition of Russian import ban. The goal of this paper is to assess the process of trade rebalancing driven by the introduction of the Russian import ban introduction. The assessment of this process should provide insights into how the mix of export destinations for affected product groups – exporting country pairs – has changed. Additionally, an assessment should determine whether the import ban has changed the pattern of the trade rebalancing process, which would mean the presence of the long-term impact of the ban on the exporting destinations mix.

The contribution of this paper is two-fold. Firstly, the paper proposes a methodology to assess the process of trade rebalancing of a selected country between two selected periods. The proposed methodology calculates a coefficient (a trade diversion coefficient or, alternatively, a trade rebalancing coefficient are used interchangeably in the current paper), which describes changes in trading partners’ shares; the value of the coefficient indicates whether the directions of trade flows have changed in comparison to the reference period. We argue that this approach can be used to assess the impact of one-off events, such as the imposition of a trade ban or any other instant change of the trade regime. Secondly, the paper applies the proposed methodology to the case of Russian import ban imposition and its effects on Russia’s direct neighbors. The main changes in the trade rebalancing coefficient are described in the context of the introduction of Russian import ban. Additionally, the paper provides evidence of structural breaks in the time series of trade rebalancing coefficients for neighboring countries and discusses trade rebalancing process for products in the scope of the import ban. All in all, we show that Russian import ban has provoked trade rebalancing for a specific product group – trade partner pairs, especially in the case of product groups which are not usually considered the main trading specializations of the studied countries. For specific product groups – trade partner pairs, we show evidence for the structural break which means that the pattern of changes in trade partners changed after the ban was imposed.

International trade has a transformational function in the economy, as it positively affects the creation of the internal economic balance and growth function, resulting in saving national resources and labor (Smutka et al., 2016). Political and diplomatic relations determine trade flows among countries (Morrow et al., 1998; Rose, 2007; Heilmann, 2016). Trade policy belongs among the popular tools in relations between countries, and international trade is being used as a policy means in the case of conflict through the implementation of sanctions, embargoes, and boycotts (Hufbauer et al., 1990; Caruso, 2003; Morgan et al., 2009). Throughout history, these tools have been used to punish or coerce the specific behavior of trading partners (Heilmann, 2016). Schultz (2015) claims that territorial disputes to violence fuel conflicts, and these conflicts reduce economic integration, including dampening trade. Long (2008) observes that conflict expectations, such as the existence of a long-running rivalry, hurt bilateral trade. There is strong evidence that extremely violent conflicts, including wars between countries, enormously disrupt trade (Glick and Taylor, 2010). However, lower-level conflicts such as militarized interstate disputes or even diplomatic conflicts also disrupt trade relations (Keshk et al., 2004; Kim and Lee, 2021). Trade balance might be affected by a financial and economic crisis. Pettis and Pettis (2015) claims that substantial trade imbalances spurred on the 2008–2009 global financial crisis and were the consequence of unfortunate policies that distorted savings and consumption patterns worldwide.

This paper focuses on the issue of rebalancing trade in relation to the different sanctions and bans on trade. International economic sanctions are a common feature of political interactions between countries, and the phenomenon of international sanctions is generally analyzed concerning their effectiveness (Caruso, 2003). The success of sanctions is most frequently limited. Nevertheless, sanctions might be more successful if policy goals are defined realistically and narrowly (Fedoseeva and Herrmann, 2019). Felbermayr et al. (2020) provide a comprehensive database on sanctions worldwide (the Global Sanctions Data Base) and present the effects of sanctions on international trade. Nowadays, we observe rising political tensions between states accompanied by sanctions, including threats and impositions (Afesorgbor, 2019). Sági and Nikulin (2017), analyzing other research studies, claim that import sanctions can be ineffective in achieving the desired aims, as this tool has a limited impact on the welfare of the country on which the sanctions are imposed. Particularly, when an exporting country can effectively redirect exports to other countries or resell its products through countries that did not fall under the sanctions.

In this paper we deal with the effect of the Russian ban on European Union countries trade rooted in the Russia-Ukraine conflict. The sanctions regime has its origins in the escalating diplomatic conflict over the political and military crisis in Ukraine. Following Russian involvement in separatist movements in eastern Ukraine and particularly the annexation of Crimea after the Maidan Revolution, 37 countries, including all EU member states, the United States, Canada, and Japan, levied sanctions on the Russian Federation starting in March 2014 (Crozet and Hinz, 2020). Firstly, the EU imposed diplomatic sanctions limited to selected Russian persons and companies. Then, after the downing the Malaysian airplane in July 2014, the sanctions were extended to the whole Russian economy. On the rebound in August 2014, Russia imposed an embargo on selected agricultural products, raw materials and food from the EU, USA, Australia, Canada, and Norway (Kašťaková and Baumgartner, 2018).

Until 2014, Russia was the third biggest trading partner of the European Union, after the United States and China, and the second biggest importer of EU agricultural products. Since the implementation of the import embargo, the exporters of EU agri-food products have made great efforts to compensate for the losses in export sales to Russia by increasing exports of their products to other countries (Stankaitytė, 2016).

Erdőháti-Kiss et al. (2023), in their examination of the Russian ban’s effects on the international trade network, note that the embargo has profoundly influenced and substantially modified the worldwide trading dynamics for this specific agricultural commodity. Furthermore, they assert that the imposed sanctions have failed to alter Russia’s stance regarding Ukraine, and currently, there appears to be no likelihood of any imminent change in this policy. Additionally, they observe some degree of effectiveness in the sanctions’ impact on the Russian economy. Fedoseeva (2016), in her examination of the Russian ban’s effect on German agricultural and food exports to Russia, proposes that while the ban had an adverse impact, its magnitude was not as extensive as might be initially estimated without taking into account the wider context of trade barriers imposed by Russia on German exporters in recent years. Banse et al. (2019), through their analysis of various trade policy scenarios and their impacts on agricultural production and trade in Russia, the EU, and Germany for the period 2020–2030, suggest that lifting the Russian food import ban would have a minimal impact on Russian agricultural production, with no significant effect on the EU. Conversely, the establishment of an extensive free trade zone stretching from Lisbon to Vladivostok could, depending on the competitiveness of Russian farmers, predominantly favor EU farmers over their Russian counterparts.

Trade constraints exerted significant strain on the agriculture and food sector of the European Union due to a temporary shortfall. For the EU nations, it was imperative to achieve three primary objectives: firstly, to uphold the stability of the internal market through efficient and well-adjusted market crisis management at the EU level; secondly, to mitigate the adverse effects of these restrictions on certain susceptible EU sectors through compensatory measures; and thirdly, to enhance the robustness of the agricultural and food sector, promoting a shift towards new markets and prospects (Kapsdorferová and Sviridova, 2016).

The impact of the banned exports varied greatly across the EU countries, with Lithuania and Poland being the most affected in nominal terms (Havlik, 2014; Hagemejer, 2017). Nevertheless, certain countries such as the Baltic states and Finland have experienced a significant negative impact on specific sectors and companies, as Russia was an important export market, accounting for 60–80% of extra-EU exports of the banned products prior to the imposition of the bans (Korhonen et al., 2018). The goods exports affected by the 2014 Russian import ban in 2014 represented 2.6% of Lithuania’s GDP, 0.4% of Estonia’s GDP, and 0.3% of Latvia’s GDP, but these figures include re-exports (Oja, 2015). Russia has consistently been a significant market for Finnish goods, particularly food items such as milk and meat products (Berg-Andersson and Kotilainen, 2016). However, the Finnish food trade experienced a major challenge due to the Russian food import embargo. Prior to the Ukrainian crisis, Russian-bound exports accounted for one-third of Finland’s agricultural and food exports, but this figure dropped to 8.6% in 2015 (Hyytiä, 2020). As a result of the Russian embargo, the value of Lithuania’s agricultural exports experienced a significant decrease in 2014–2015. Consequently, the dairy processing industry’s production profile underwent changes beginning in 2014, and between 2015 and 2016, the export of banned agricultural products was redirected toward alternative markets (Vitunskiene and Serva, 2017). Smutka and Steininger (2019) found that the import ban led to a marked decrease in Russian agrarian import value, with a reduction of $7,389 million in the first 3 years. The ban primarily impacted imports competing with domestic production, showing a clear potential for local substitution. It significantly affected imports from Lithuania, Germany, the Netherlands, Denmark, Spain, Belgium, Finland, and France. The countries most impacted in terms of their trade performance with Russia were Lithuania, Latvia, Estonia, Finland, and Poland. Sümer (2015) notes that the anticipated effect of Russia’s embargo on agricultural and food imports from the EU, initiated in August 2014, is likely to be most significant in the Baltic nations. Nonetheless, while these losses are certainly challenging, they are deemed to be within manageable limits.

As the Russian market has been closed for many agricultural products, EU farmers have been forced to sell their products to other countries. Due to the increase in the EU trade surplus, world market prices have been expected to fall (Boulanger et al., 2016; Klomp, 2020). Cheptea and Gaigné (2020) observe that Russian sanctions led to an average 80% decrease in the value of EU export flows of banned agri-food products to Russia (Liefert et al., 2019). Total Russian agricultural imports sharply dropped from USD 43 billion in 2013 to USD 25 billion in 2016. Krivko et al. (2021) argue that the Russian agri-food import ban has increased protectionism in agricultural trade. In consequence, Russian agricultural producers have gained after the embargo was imposed, while EU agricultural producers suffered losses despite the compensating effect from the re-export of banned products via neighboring countries. Smutka and Abrhám (2022) argue that the imposed ban should be perceived not merely as a retaliatory measure. The import limitations are also intended to diminish Russia’s reliance on foreign food imports and to bolster its national food security. Krivko and Smutka (2020) observe that economic sanctions between the European Union and Russia have significantly changed trade relations and affected both economies unequally. They argue that increasing Russian self-sufficiency triggered sustainable growth in its agricultural production. Venkuviene and Masteikiene (2015) claimed that the prolonged geopolitical crisis between Russia and Ukraine and the Russian embargo on EU countries’ agri-food products should have a tremendous impact on Central and Eastern European economies, considering a substantial decrease in their exports to Russia. Krivko and Smutka observe that the effect of the Russian import ban on the EU member states’ trade is diversified and show that Germany, the Netherlands, Latvia, Lithuania, Italy, and Poland are the most affected (Krivko and Smutka, 2021). Smutka et al. (2019) observe substantial changes in EU agri-food export to the Russian Federation, including vegetables, fruits, meat and animal products, dairy and dairy products, and fish in the aftermath of Russian import sanctions. The imposed import ban resulted in a significant reduction in the Russian agricultural import value. The import ban improved the overall competitiveness of Russian agricultural trade but reduced some product groups’ competitiveness (Smutka et al., 2016). They find that Russian sanctions imposed on European and American agri-food imports caused an eight times stronger decrease in trade flows than those imposed by the EU and the US on exports of extraction equipment. The limited retroactivity of the EU and the US sanctions has resulted in differences in sanctions’ effectiveness (Bělín and Hanousek, 2021).

To the best of the authors’ knowledge, most literature sources on the topic of Russian import ban did not address the problematic of export destinations mix changes due to the ban. In other words, the topic of trade rebalancing has not been addressed. This study distinguishes itself from existing literature by offering a novel methodological approach to assess the trade rebalancing process, particularly in the context of the Russian import ban of 2014. The current paper attempts to fill in the gap by proposing an original methodology for assessing trade rebalancing and applying it to the case of the countries directly neighboring Russia and their export destination changes as a result of the ban on imports. While previous research has primarily focused on the immediate economic impacts of trade sanctions on international trade, this paper delves into the specific effects on countries sharing borders with Russia, such as Poland, Finland, Estonia, Latvia, and Lithuania. Current study’s contribution to the literature is twofold: firstly, it provides a detailed analysis of short-term trade rebalancing for certain product groups, highlighting shifts in trade patterns for products not typically considered as main trade specializations. Secondly, the paper identifies a structural break or a significant alteration in the pattern of export destinations for non-traditionally traded banned products. This insight offers a new perspective on the long-term effects of trade bans, enriching the understanding of international trade dynamics under geopolitical constraints, particularly in constantly turbulent times.

2 Materials and methods

The rebalancing of trade flows means substituting trade flow (e.g., export or import) with a specific trading partner by trade flows with another trade partner. In essence, it is about changing the destination of trade flows. Usually, one would expect that trade flows change in time due to economic reasons, such as changes in trade terms, trade competitiveness or trade specialization. At the same time, studies of economic sanctions throughout the 20th century offer a lot of examples of shocks that change the direction and intensity of trade flows. Russian import ban of 2014 is one of such example (Krivko and Smutka, 2021).

Rebalancing trade flows can be empirically estimated by employing cross-sectional regression model as follows:

Where – is the set of export trade flows of product with trade partner for country in period ; – is the set of export trade flows of product with trade partner for country in period ; and – are the regression coefficients; – is the error term.

The empirical model (Eq. 1) is estimated for every time period . The following specification can be obtained by using trade shares instead of absolute trade values:

Where - number of trading partners in period ; - number of trading partners in period ;

In this specification, the interpretation of coefficient is that it shows average change in trade shares between trade partners of country . In case there is no change in weight of all trade partners, one would expect this coefficient to be equal to 1. If there are more trading partners with decreasing weight than the ones with increasing weight, one would expect the coefficient to be negative. This case can also be called regression towards the mean, or a tendency to balance the shares of the trading partners. Alternatively, this can be interpreted as a decrease in the concentration of trade destinations or trade diversion. If there are more trading partners with increasing weights, then one would expect this coefficient to be positive. Alternatively, this is equal to the increase in concentration of trade destinations.

Additionally, this coefficient can also be used to evaluate the change in destination specialization of the country and to illustrate the changes in export destination concentration. The concentration of export destinations rises when the coefficient is positive, and the concentration decreases when the coefficient is negative. In general terms, the estimated coefficient can characterize trade diversion and show the degree of the trade diversion process.

Interpretation of the coefficient is as follows:

: there are more partners with increasing shares than with decreasing shares; : there are more trading partners with decreasing shares than with increasing shares;

The proposed methodology yields a time series of the regression coefficients estimates, and changes in these time series can describe the trade rebalancing effect of the import ban. The time series of regression coefficients estimates (or coefficients of trade diversion) helps to capture the dynamic effect of the Russian import ban and the dynamic nature of the trade rebalancing process. Major changes in the data generating process of the time series, which is the trade regime in the current case, entail structural breaks. We investigated the impact of the introduction of the Russian import ban in August 2014 on the average change in trade shares between the trade partners of countries measured by (Eq. 2). Structural change is identified based on the first-order autoregressive model for coefficients. A structural break occurs when a time series abruptly changes at a certain point in time. The presence of a structural break can be tested using the Chow-test (Chow, 1960). According to Hansen (2001), the main limitation of the Chow-test, in comparison to other more advanced tests like, e.g., Andrews (1993) or Bai and Perron (1998, 2003), is that the researcher needs to know the structural break date in advance. Nevertheless, in the case of checking if there is a structural break in the time series for a specific date, i.e., the introduction of the Russian import ban, the Chow test seems to be correct and justified. The Chow test’s null hypothesis is the equality of coefficient estimations for the split of the original dataset; under our specification this is equal to the absence of a structural break. Therefore, the trade rebalancing effect of Russian import ban can be detected by testing the following hypothesis:

H0: A structural break of the trade rebalancing coefficients time series is not present at the time of the introduction of the Russian import bans.

H1: A structural break of the trade rebalancing coefficients time series is present at the time of the introduction of the Russian import bans.

The interpretation of the test results is as follows. Based on the specification (2), the regression coefficient estimate is equal to 1 when either shares of trading partners have not significantly changed between two consequent periods or perfect trade rebalancing has taken place. The presence of a structural break in time series of trade rebalancing coefficients estimates shows that the pattern has significantly changed. This can point to the absence of trade rebalancing over significant amount of time; the country was not able to quickly find new export destinations. In other words, the presence of a structural break in the time series indicates the evidence of the long-term effect of Russian import ban, as well as the fact that trade rebalancing required a longer time. It is important to mention that trade rebalancing coefficient can change not only due to effect of import ban but due to other factors too. At the same time, we attempted to overcome this challenge by focusing on the product groups with highest concentration of banned products. In other words, we focus on the product groups which are highly likely to experience the effect of Russian import ban.

The proposed methodology of trade rebalancing analysis and structural break identification allows an analysis using the quantity of trade or value of trade, while nominal values or relative (the percentage of the total for the period) values can be used. Opting for the quantity of trade rather than the value of trade allows for control for the changes in demand, which is naturally affected by the introduction of the Russian import ban. By design, the Russian import ban did not impose additional trade costs directly but was intended to decrease the quantity of trade to zero. Therefore, we opt in to the quantities of trade and weights of the trading partners.

Data for the research is sourced from the Eurostat Comex database (Eurostat, 2021) and contains monthly trade flows (imports and exports, value in euros and quantity in 100 kgs) for five countries as the reporter (Finland, Poland, Estonia, Latvia, Lithuania) and 33 countries as partners and HS02, HS03, HS04, HS07, HS08 product groups for the period of 2008–2020. The dataset also contains the 34th technical trading partner for the trade flows for the rest of the world. Each observation in the dataset represents a trade flow (export or import) where one of the five countries of interest is the reporter and one of the EU28 (including the United Kingdom) or EAEU countries (Russia, Belarus, Kazakhstan, Kyrgyzstan, Armenia) is a trade partner. Descriptive statistics of the used dataset are shown in Appendix 1,the product categories included in the analysis are shown in Appendix 2, while Appendix 4 summarizes export of selected commodities and from selected countries to Russia before and immediately after the import ban introduction. The choice of reporter countries is determined by the fact that these countries share common features: all of them have a common border with Russia and their exports were affected by Russian import ban. The choice of EAEU countries to be included into the dataset is driven by the intention to control for the effect of the re-export of banned products via the EAEU trade area. The proposed methodology can be applied to any set of trading partners, given the availability of relevant trading data.

3 Results

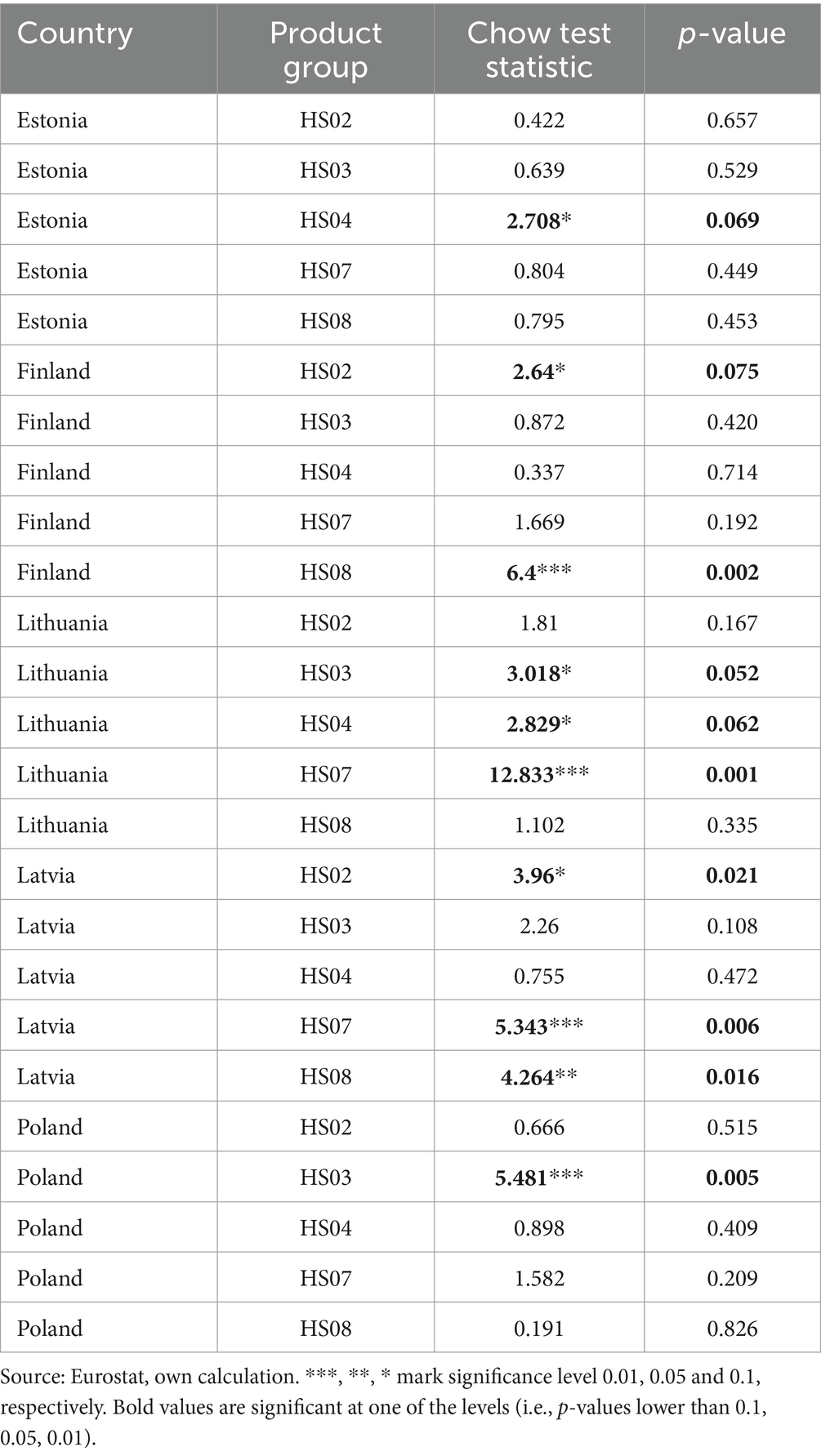

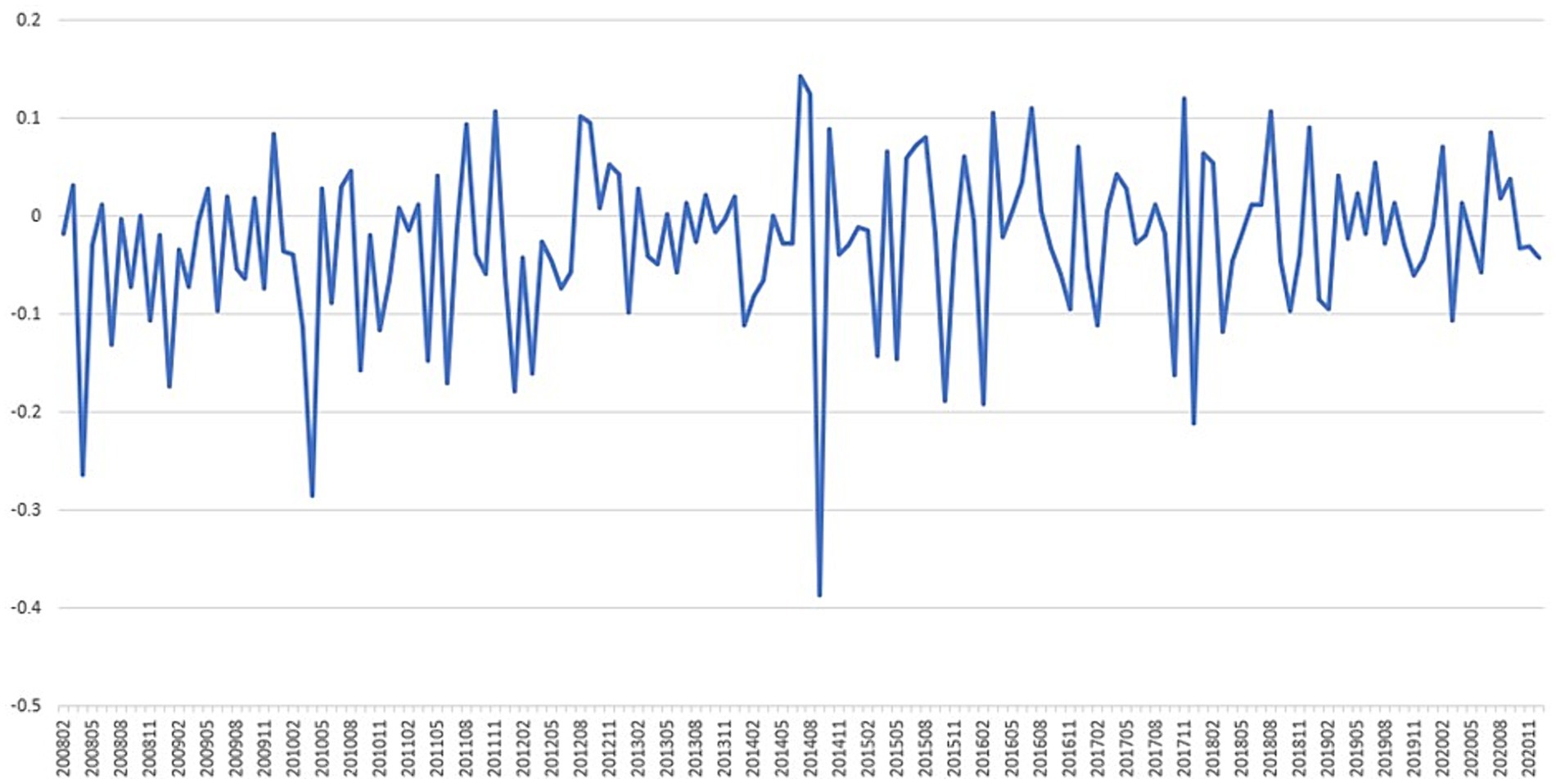

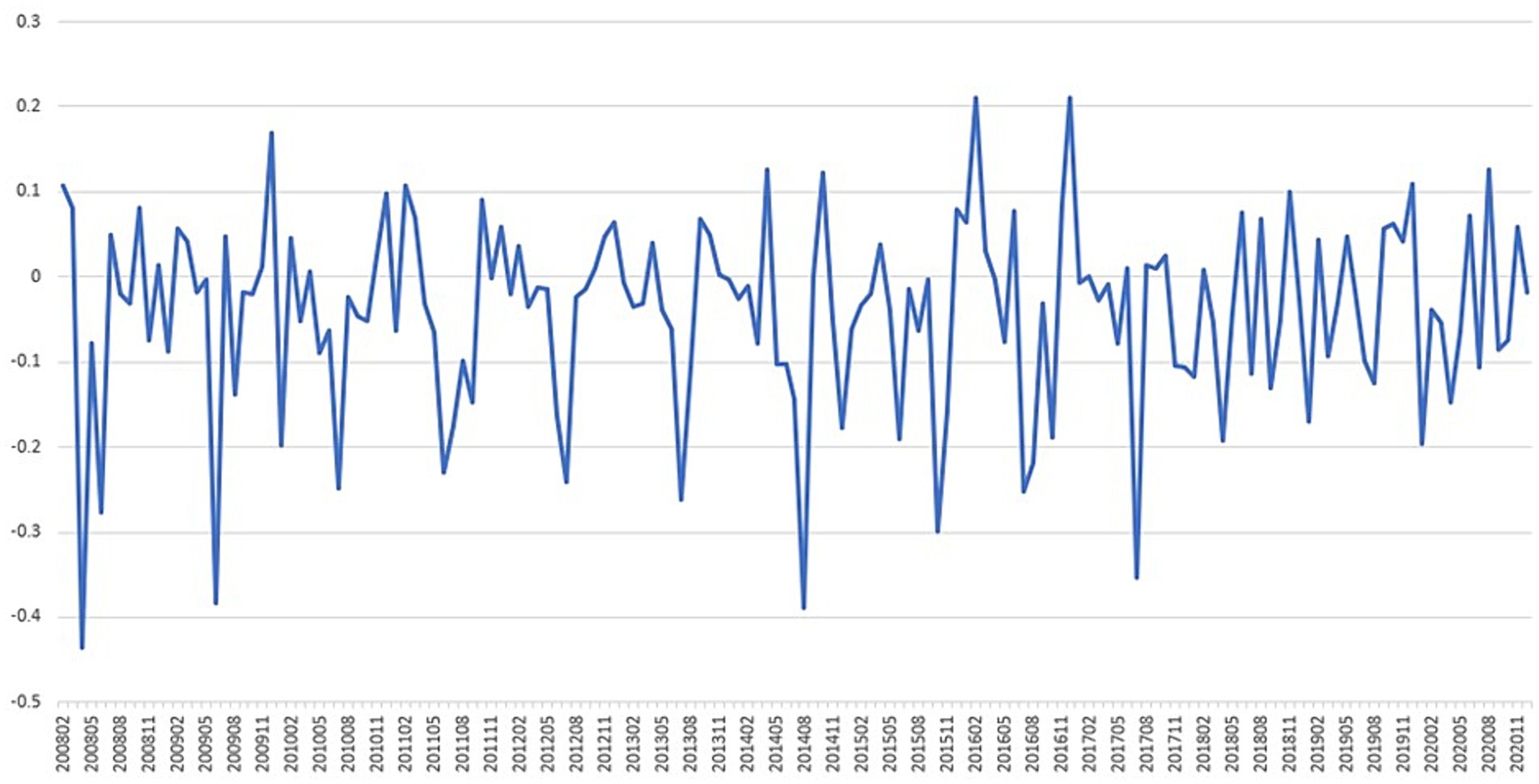

The estimation of the coefficients in the case of quantities of trade and weights of trading partners shows several important results. In the case of Estonia, two product categories show the impacts of the Russian import ban: HS03 (Fish and crustaceans) and HS07 (Vegetables). HS03 shows oscillation across zero, however, in most of the periods the coefficient is negative, which shows that there are more trading partners with decreasing shares than with increasing shares (Figure 1). There is a significant change in the pattern for this product in August–September of 2014, where the coefficient dropped to-0.549 and then increased to 0.43. Based on this evidence, it is possible to state that Estonia has managed to rebalance its trade flows for one of the major banned products (fish and crustaceans) with the remaining trading partners. The Russian import ban has created new trade connections for the country.

Figure 1. Estimated coefficients of trade diversion for Estonia, product category HS03 Fish and crustaceans. No weighting applied. Source: own calculations based on the Eurostat Comex database.

Category HS07 (Vegetables) shows significant changes in April 2015, when the coefficient reached an all-time high level of 4.716 and then returned to more usual levels in the range of 0 to-1.

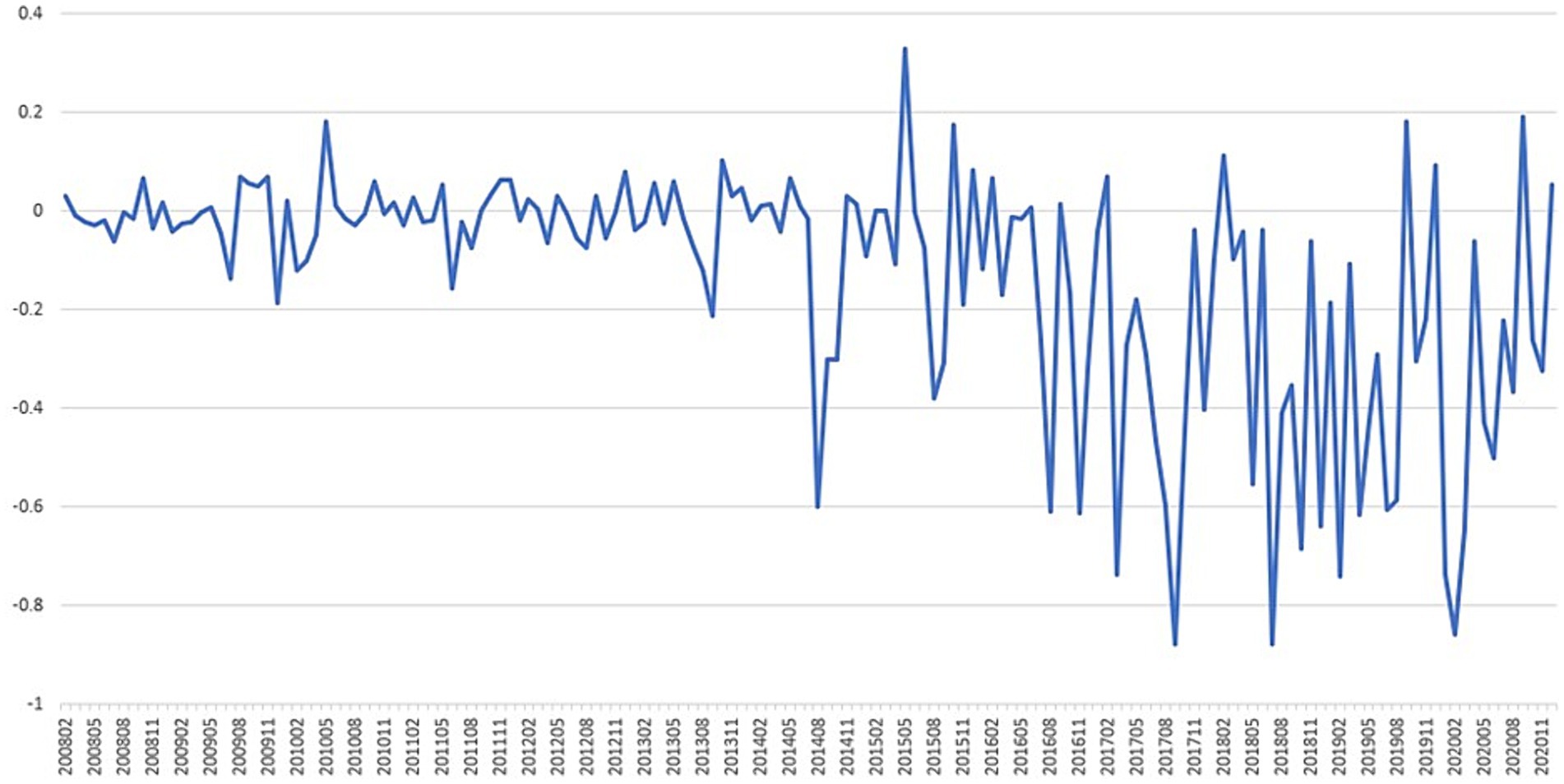

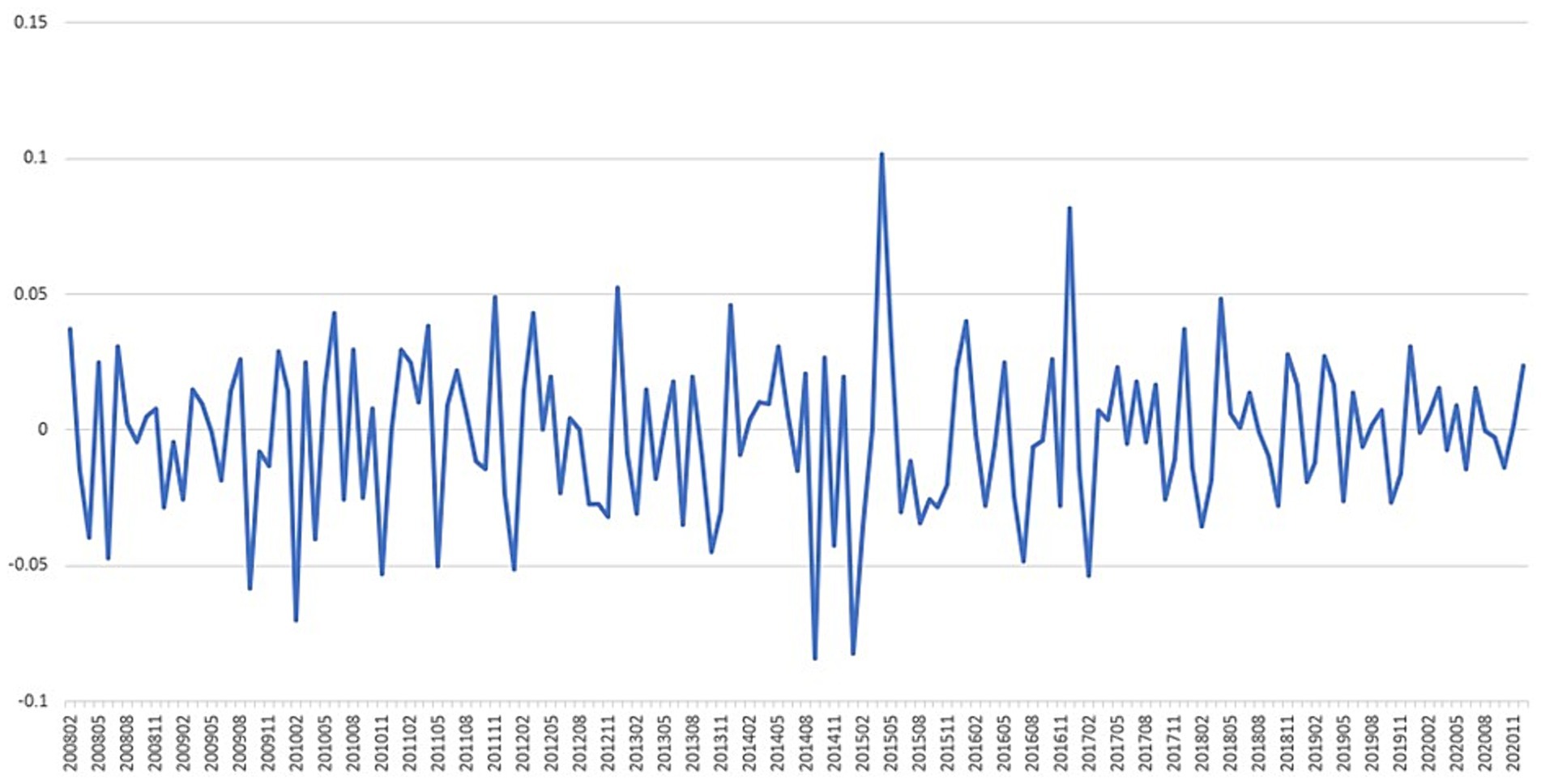

For Finland, the biggest changes have happened in the product category HS04 Dairy produce (Figure 2). The coefficient dropped to the lowest level of-0.185 in the month the import ban was introduced (August 2014). This pattern is similar to the case of Lithuania for the same product category (Figure 3). The main difference between Finland and Lithuania is that lowest level of the coefficient was reached 1 month later, in September 2014.

Figure 2. Estimated coefficients of trade diversion for Finland, product category HS04 Dairy produce. No weighting applied. Source: own calculations based on the Eurostat Comex database.

Figure 3. Estimated coefficients of trade diversion for Lithuania, product category HS04 Dairy produce. No weighting applied. Source: own calculations based on the Eurostat Comex database.

It is important to mention that calculated R-squared value for regressions for the HS07 and HS08 categories in the case of Estonia and Finland show significant fluctuations and are lower than in the case of HS02-04 categories for the same countries. Regressions for HS07 in the case of Lithuania also show lower values of R-squared, but only after August 2016, which is two years after the introduction of ban on imports.

Lithuania has experienced significant impacts in two product categories. The trade diversion coefficient for dairy products exports (HS04) reached the lowest level of-0.386 in September 2014 (Figure 3). This decrease represents the lowest point in the period of 2008–2020. The coefficient bounced back relatively quickly in the following months and showed several decreases at the end of 2015 and 2017.

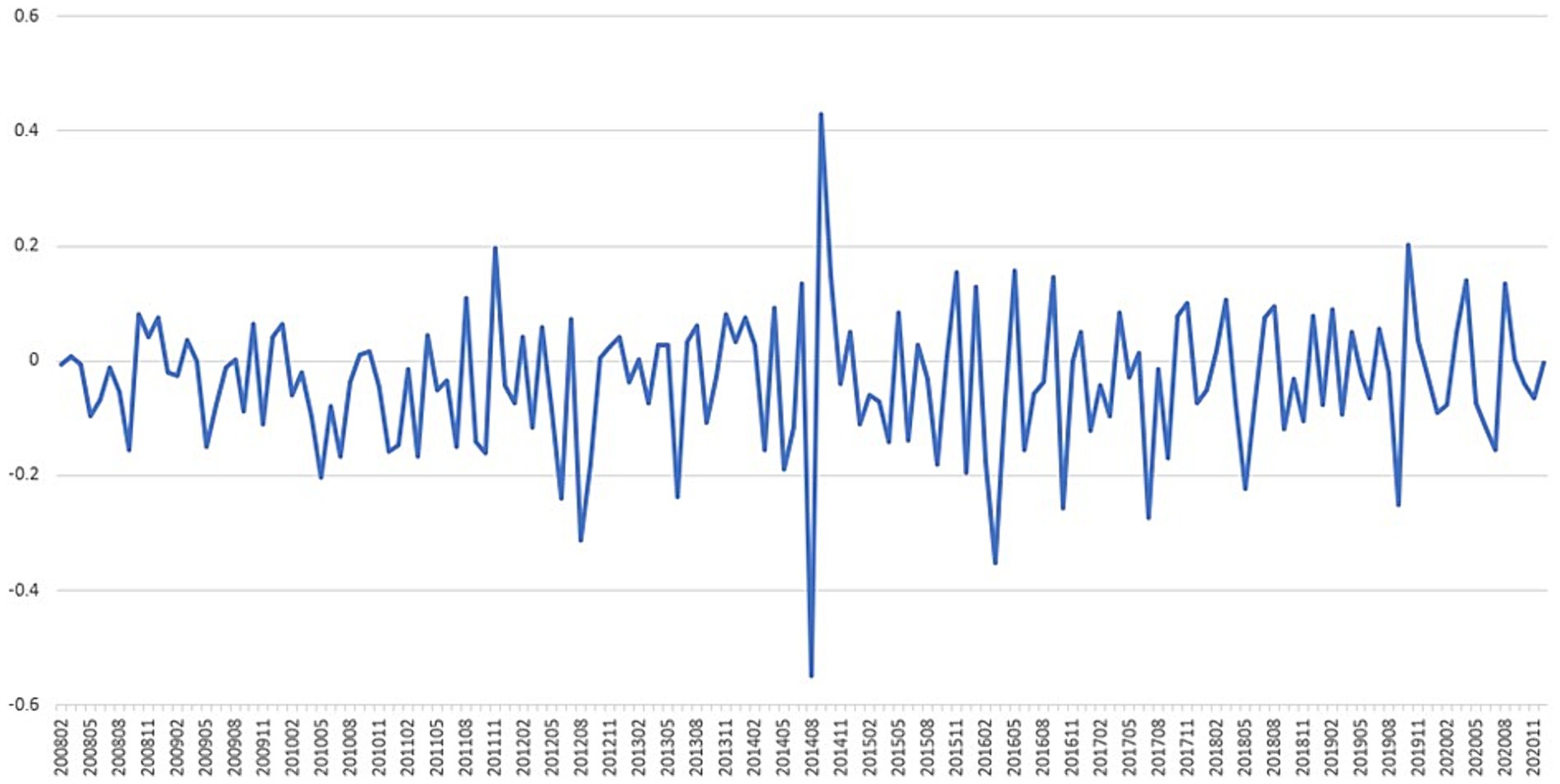

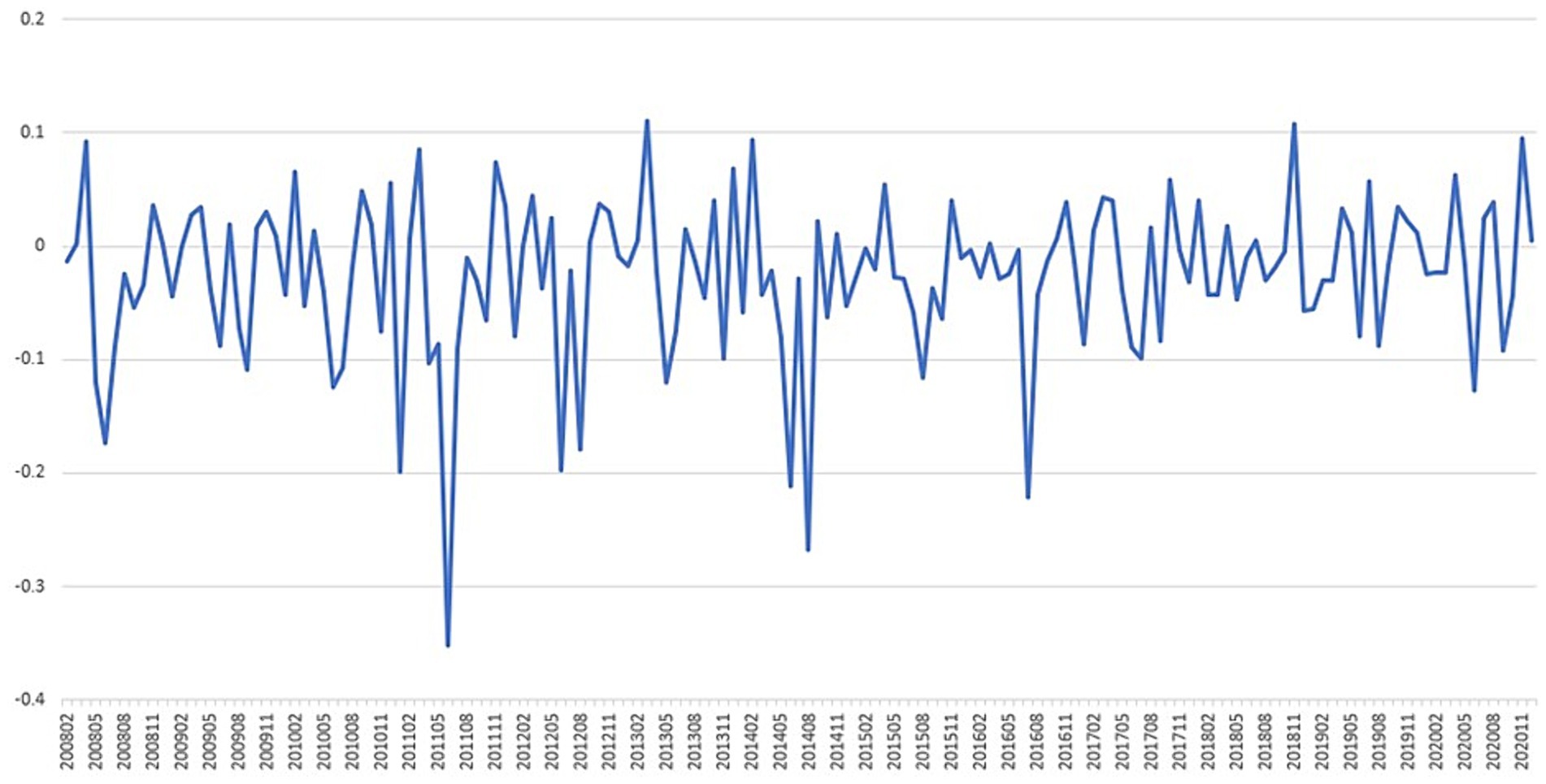

The most remarkable Lithuanian development of the trade diversion coefficient can be observed in the case of vegetables (HS07). The coefficient reached the level of-0.6 in August 2014, then showed a positive peak (0.329) in May 2015, which was followed by a significantly long period of negative values (Figure 4). As it will be shown later, there is evidence of a structural break in this time series, which happened in August 2014. In this case, it is possible to state that Russian import ban initiated the decrease in the shares of the export destinations of vegetables from Lithuania, which lasted from the end of 2014 until mid-2020. This finding deepens the one presented by Uzun and Loginova (2016), where the authors stated that Lithuania had experienced losses in vegetables. As can be seen in Figure 4, Russian import ban not only caused trade rebalancing instantly after it was imposed, but also had long-term effects by provoking the mix of Lithuania’s export destinations to become less diverse. In other words, it suppressed trade diversion.

Figure 4. Estimated coefficients of trade diversion for Lithuania, product category HS07 Vegetables. No weighting applied. Source: own calculations based on the Eurostat Comex database.

Another study (Boulanger et al., 2016) predicted that as a result of imposing the import ban Lithuania and Poland should experience a rise in domestic prices and a fall in production in the vegetable sector, driven by the missing exports to Russia. Our findings partially confirm this finding, however, our findings extend it with the fact that there is no statistically significant evidence that Lithuania managed to redirect export flows for this product group to other destinations either in the short-term, or in the long-term. Interestingly, Skvarciany et al. (2020) attempted to model the developments of exports from banned EU countries to Russia after the imposition of the import ban by applying a gravity model framework and have come to the conclusion that only Germany has experienced short-term losses, while other EU countries, including Lithuania, did not experience either short-term or long-term losses. The authors base their estimate on the assumption that EU exports to Russia are dependent on Russia GDP growth, therefore decreasing Russian GDP per capita entails a lower forecast for EU exports. This is a valid assumption in most cases, however, it is less applicable to the case of Russian import ban, as the decrease in Russian GDP per capita had the same causes as the introduction of Russian import ban and the decrease in EU exports that followed. In other words, it is fair to say that if there would be no international sanctions on Russia and no Russian import ban as a retaliation measure, EU exports and Russian GDP per capita would have different dynamics than predicted by the authors and there is an opportunity cost for EU countries. Moreover, Kholodilin and Netšunajev (2019) claim that in general sanctions are harmful for all participants, however, their research does not observe strong evidence of sanctions’ adverse effect on the GDP growth rate, both in Russia and EU member states.

Latvia shows an interesting and important example of trade diversion coefficient’s development (Figure 5). The coefficient reached its two lowest points in September 2014 and January 2015 followed by an all-time high in April 2015. After this, the coefficient moved mostly in the positive area, suggesting the presence of a higher number of trading partners with increasing shares than with decreasing shares.

Figure 5. Estimated coefficients of trade diversion for Latvia, product category HS04 Dairy produce. No weighting applied. Source: own calculations based on the Eurostat Comex database.

The presence of the coefficient in the positive area suggests that Russian import ban had a short-term effect on the export of Latvian dairy products but did not have a long-term effect. Partially this can be explained by the effect of re-routing banned exports to Belarus, as this country has free trade with Russia. In other words, Latvian exports attempted to circumvent the ban restrictions and therefore a quick rebalancing of exports occurred (Priede and Skapars, 2017). However, the re-export of Latvian dairy products through Belarus was just a short-term solution, just for a few months as per some estimates (Priede and Skapars, 2017). Another option for the Latvian dairy sector was to find new markets. Given the positive values of the trade rebalancing coefficient, it is fair to say that this was the case after the potential of Belarus re-exporting declined.

A relatively similar situation can be observed in case of dairy exports from Poland (Figure 6). Similar to Latvia, exports have gone through the process of rebalancing, which is suggested by the negative value of the coefficient in September 2014. At the same time, the coefficient bounced back in December of the same year, and the values of the coefficient moved into positive territory in the following years, with rare negative values. Despite the fact that Poland was one the leaders in impacted volumes of banned products, especially among the Visegrad countries (Erokhin et al., 2014), Polish exporters of dairy products have attempted to find new destinations instead of Russia and it is possible to state that they were relatively successful in the long run.

Figure 6. Estimated coefficients of trade diversion for Poland, product category HS04 Dairy produce. No weighting applied. Source: own calculations based on the Eurostat Comex database.

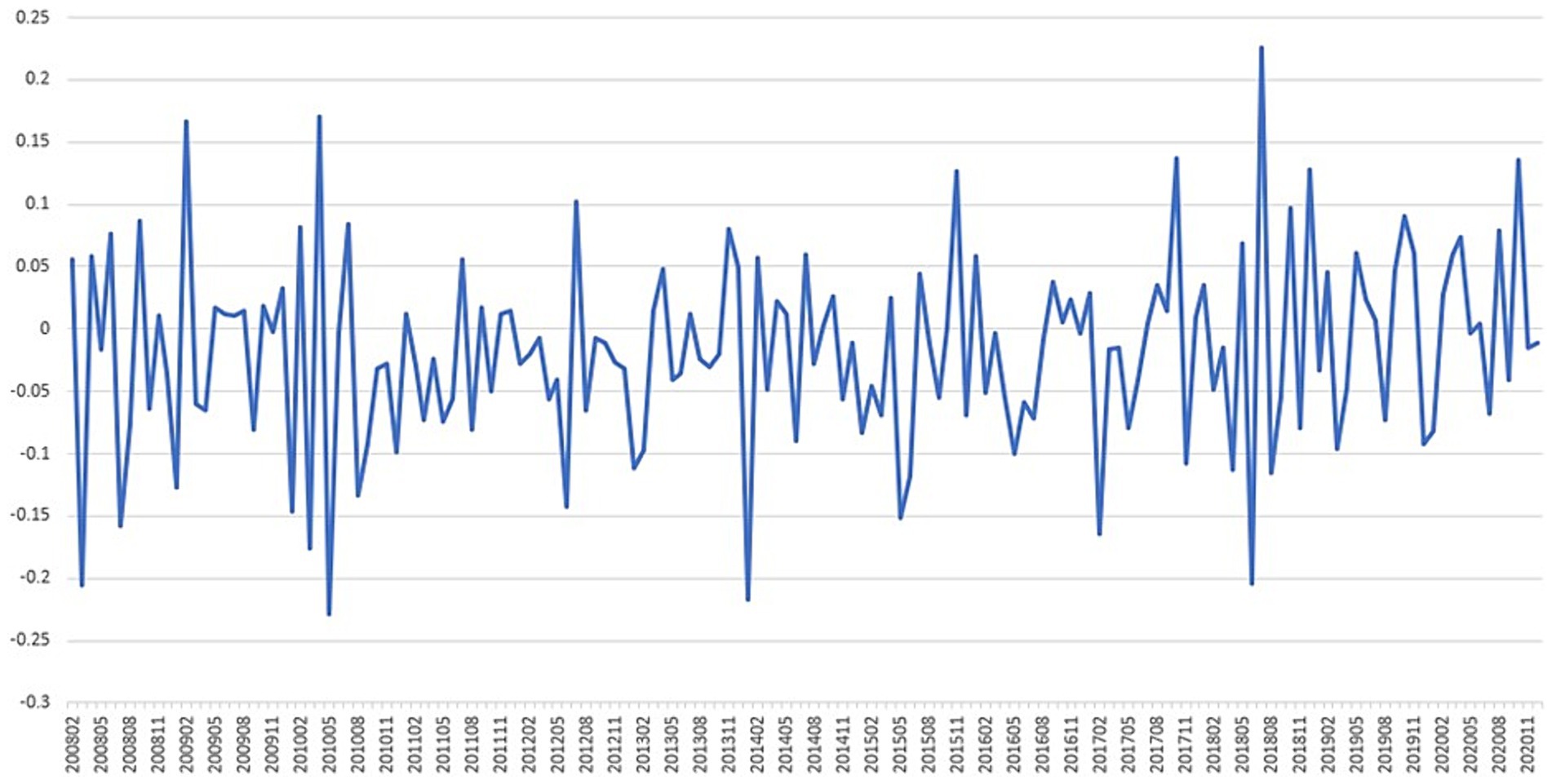

The case of vegetables, fruits, and nuts exports (Figures 7, 8) from Poland is different to dairy products. In both cases, a decrease of the coefficient of similar magnitude happened in the same month as Russian import ban was introduced. There is a significant effect of seasonality in the fruits and nuts exports destinations mix, as can be seen in Figure 8. Even before the introduction of Russian import ban, the structure of Poland’s export destinations was changing regularly, as characterized by the negative values of the trade rebalancing coefficient.

Figure 7. Estimated coefficients of trade diversion for Poland, product category HS07 Vegetables. No weighting applied. Source: own calculations based on the Eurostat Comex database.

Figure 8. Estimated coefficients of trade diversion for Poland, product category HS08 Fruits and Nuts. No weighting applied. Source: own calculations based on the Eurostat Comex database.

Values of trade diversion coefficients also point out to the fact that trade rebalancing happened within the group of trading partners in scope of current study. In other words, there is evidence that significant part of the lost trade was redirected to EU28 or EAEU countries and end up in the common trade areas of these countries. Determining the directions of lost trade goes beyond the goals of current study and represents an opportunity for further research on the topic.

The results confirms the results of Bojnec and Ferto (2016), who looked on patterns of intra-industry trade among the EU countries. Once the economic development and economic integration of countries increases, the intra-industry trade goes up. From that perspective we can assume, that development of the EU 2004 accession countries (PL, ES, LT, LV) led to easier trade creation in the other EU countries. This could be also applied to non-European export destinations (within the EAEU), where economic development at the supply and demand level and liberal trade approach to the EAEU markets (excluding Russian Federation) opened more opportunities to trade. According to other source (Bojnec et al., 2021), Lithuania and Estonia were countries that were able to increase the number of exported products and find a new markets after entering EU, while Poland experienced the expansion of average exports per existing product with existing trade partners. This particular topic has not been investigated; however we believe that it is a very interesting field of further investigation.

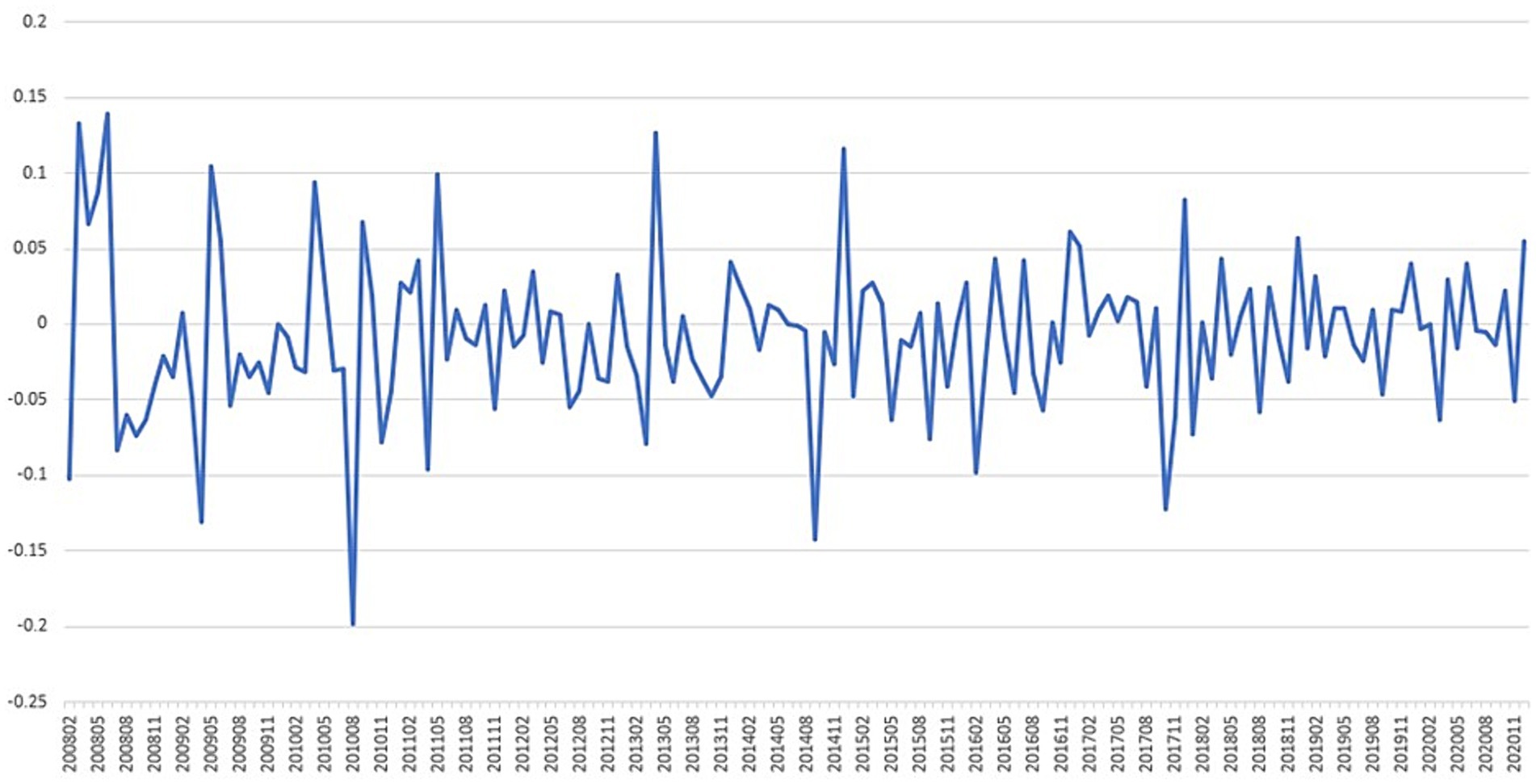

Studying the changes in the trade rebalancing coefficients of Russia’s neighboring countries might lead to the question of whether these changes are short term or long term, as well as whether trade rebalancing was a one-off event or rather a process extended over time. As the data used in the current research has a time component, it is possible to answer this question by applying a structural break test. In case of the current research, the Chow-test is used for the detection of structural breaks in the time series of trade rebalancing coefficients (Eq. 2). The null hypothesis in the Chow test assumes that there are no structural breaks at a specified date, i.e., the date the Russian import ban was introduced in August 2014. In Table 1, the bold Chow statistics indicate product groups for which a statistically significant structural change in trade shares between trade partners occurred in a given country due to the introduction of the Russian import ban. The test statistics follows the F-distribution with 2 and 150 degrees of freedom.

The presence of a structural break in the time series of the trade rebalancing coefficient estimates shows that the trade pattern has significantly changed. This can point to the absence of trade rebalancing for a significant amount of time; the country was not able to quickly find new export destinations. Thus, the presence of a structural break in the time series implies evidence of the long-term effect of the Russian import ban, as well as the fact that trade rebalancing required a longer time. The Chow test’s results presented in Table 1 reveal that a structural break in the time series of trade rebalancing coefficients occurs in Estonia for dairy products (HS04), in Finland for meat (HS02), and fruits and nuts (HS08), in Lithuania for fish and crustaceans (HS03), dairy products (HS04) and vegetables (HS07), in Latvia for meat (HS02), vegetables (HS07), and fruits and nuts (HS08), in Poland only for fish and crustaceans (HS03). The results show that Lithuania and Latvia are the countries that seem to be affected the most. The structural breaks are detected for 3 out of 5 product groups in the time series of Latvian and Lithuanian trade rebalancing coefficients.

The Chow test results correspond to results presented by other researchers (Havlik, 2014; Oja, 2015; Hagemejer, 2017; Korhonen et al., 2018; Hyytiä, 2020), as these results confirm the distribution and magnitude of the import ban impact on the trade of Finland, Poland and the Baltic countries. At the same time, the results of the Chow test reveal additional findings. The obtained results imply that the structural breaks are identified mainly for products which are not traditionally associated with corresponding exporter countries. For example, exports of fruits and nuts from Finland to Russia, vegetables from Lithuania, or fish and crustaceans from Poland. This might indicate that the Russian import ban has eliminated export opportunities in non-traditional sectors or goods, while exporters managed to re-direct trade flows to new markets relatively quickly after the introduction of the Russian import ban.

From the EU point of view, as Kutlina-Dimitrova (2017) proves, the overall effect of Russian sanctions is small, but it is rather country-specific. This statement is supported by the above-mentioned results, which clearly present the effects on countries, however, in different intensities and durations. Sure, the Russian embargo has challenged EU exporters, as it has prodded them to search for new export markets (Stankaitytė, 2016).

Although the period that we on purpose selected does not cover the events of 2022, it is important to state, that the conflict even more affected agri-food markets resulting into increased food insecurity in the EU [referred as food poverty (Rabbi et al., 2023)] and around the world (Lin et al., 2023) and resulted in food trade limitations, mainly in Ukrainian wheat (Devadoss and Ridley, 2024). In general, the conflict in Ukraine is expected to reshape international trade and global value chains. Trade rebalancing will become more gradual, rather than sudden. It is expected to observe reverse-globalization with more regional blocks (Estrada and Koutronas, 2022). According to Mardones (2023), the hypothetical scenario of isolating Russia from international trade shall have the largest effects on the countries of our selection, i.e., countries bordering with Russia.

4 Discussion

The effects of trade distortions are studied by many researchers. The effects of policy interventions on international trade do not always meet the originally intended goals. The Russian import ban applied after turbulent political events in 2014 affected European agri-food exporters. EU countries neighboring the Russian Federation, which use the Russian market as a destination for agri-food products, were heavily affected due to their close geographical proximity. The conducted literature review proved that there is no specific research focusing on the trade rebalancing of targeted countries. From that perspective we aimed to propose a methodological tool, which would assess the process of rebalancing. We employ a specific approach by developing a trade rebalancing coefficient. The coefficient describes the changes in the shares of trading partners and its value indicates whether the mix of trade flows directions have changed in comparison to the reference period.

We apply the proposed methodology to the case of imposing the Russian import bans and its effects on Russia’s direct neighbors (Finland, Estonia, Latvia, Lithuania, Poland) among the selected banned trade categories (HS02, HS03, HS04, HS04). As expected, the trade between the reporter countries and the Russian Federation in the banned categories of products has significantly decreased, however, there is a rebalancing effect among the EU28 and EAEU. Part of the lost trade has been redirected almost perfectly to other trading partners in this group.

Studying the changes in trade rebalancing led us to the questions, whether these changes are short or long term, and whether the rebalancing was a one-off event or a longer process. By applying the Chow test, we identified structural breaks among non-traditionally traded commodities, which implies that trade in those commodities has not rebalanced since the import ban was introduced, i.e., the import ban had a long-term effect on trade in these product categories. The rebalancing of more traditional products seems to be a quicker process due to the involvement of larger quantities, and Russian import ban had a short-term disturbing effect on trade. This implied to the findings of Hummels and Klenow (2005) who concludes that larger countries (or sectors in our case) are able to export to more destinations, while smaller sectors will need longer time to rebalance (Estrada and Koutronas, 2022).

Based on the current findings, several conclusions regarding policy implications can be made. Firstly, the selected countries have shown different patterns of trade rebalancing. Secondly, there is evidence that trade rebalancing process of Finland, Poland, Estonia, Latvia and Lithuania has helped to find alternative markets outside of EU28, primarily in EAEU and mostly for traditional export goods. Thirdly, as structural breaks in trade rebalancing coefficients’ series are present mostly in non-traditional export sectors or goods, it can be stated that Russian import ban had marginal long-term impact on the neighboring countries trade. It can also be concluded that Russian import ban did invoke significant and long-term circumvention of import ban via countries of EAEU customs union, which is an important consideration for policy making.

The situation resulted into the fact that producers started to develop new trade destinations. Policy makers shall put attention to the agenda related to the trade policy, in order to help with the long-term rebalancing activities. Trade diplomacy is able to open new markets and new trade relations, provide insight into new markets and new export product opportunities. Investment incentives shall enable to refocus the current traditional production lines into new product lines and alternative profitable niche markets. Creation of quality measures could support export success, as well as development of specific geographical indicators or other quality schemes. However, at the same time, quality scheme heterogeneity decreases the trade flow (Fiankor et al., 2021). Development of innovations also requires access to sources of finance (private and public) as well as pro-innovative environments without a problematic legal obstacles.

The focus on the analysis of trade quantities instead of trade in monetary terms can be considered one of the limitations of the current study. The main reasoning for applying this approach was due to the inflationary regime and currency fluctuations that coincided with the introduction of Russian import ban. At the same time, the Russian import ban was intended to decrease to quantity of imported products to zero, not to increase the cost of imported goods. Further research might explore the analysis in monetary terms, which might bring additional insight into the net effect of the ban.

The current study has intentionally not considered the 2022 sanctions, as the authors had the goal of analyzing the effects of the Russian import ban in isolation. Consideration of the events of 2022 can be a topic of further research.

Another important feature of the current study is the focus on neighboring countries and selected product groups. While selected countries had a significant share of trade with Russia in agri-food products before the ban, geographical proximity might not be the only factor in the ban equation. Testing the trade rebalancing methodology on an additional set of trade partners in the scope of the Russian import ban, such as other EU countries, Australia, Canada, Norway and United States, and other commodities, might help to reveal additional effects of the import ban.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

MK: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Software, Writing – original draft, Writing – review & editing. KC: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Software, Validation, Writing – original draft, Writing – review & editing. MW: Conceptualization, Investigation, Methodology, Validation, Writing – original draft, Writing – review & editing. PK: Conceptualization, Methodology, Validation, Writing – review & editing, Writing – original draft. LS: Conceptualization, Methodology, Project administration, Supervision, Validation, Writing – review & editing, Writing – original draft, Funding acquisition.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. The work on this paper is partially funded by the internal research Project No. 2021B0002: The Post-Soviet Region in the Context of International Trade Activities: Opportunities and Threats Arising from Mutual Cooperation, supported by the Internal Grant Agency (IGA) of the Faculty of Economics and Management, Czech University of Life Sciences Prague.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2024.1420945/full#supplementary-material

References

Afesorgbor, S. K. (2019). The impact of economic sanctions on international trade: how do threatened sanctions compare with imposed sanctions? Eur. J. Polit. Econ. 56, 11–26. doi: 10.1016/j.ejpoleco.2018.06.002

Andrews, D. W. K. (1993). Tests for parameter instability and structural change with unknown change point. Econometrica 61:821. doi: 10.2307/2951764

Bai, J., and Perron, P. (1998). Estimating and testing linear models with multiple structural changes. Econometrica 66:47. doi: 10.2307/2998540

Bai, J., and Perron, P. (2003). Computation and analysis of multiple structural change models. J. Appl. Econ. 18, 1–22. doi: 10.1002/jae.659

Banse, M., Duric, I., Götz, L., and Laquai, V. (2019). From the Russian food import ban to free trade from Lisbon to Vladivostok – will farmers benefit? J. Int. Stud. 12, 20–31. doi: 10.14254/2071-8330.2019/12-4/2

Bayramov, V., Rustamli, N., and Abbas, G. (2020). Collateral damage: the Western sanctions on Russia and the evaluation of implications for Russia’s post-communist neighbourhood. Int. Econ. 162, 92–109. doi: 10.1016/j.inteco.2020.01.002

Bělín, M., and Hanousek, J. (2021). Which sanctions matter? Analysis of the EU/russian sanctions of 2014. J. Comp. Econ. 49, 244–257. doi: 10.1016/j.jce.2020.07.001

Berg-Andersson, B., and Kotilainen, M. (2016). Pakotteiden vaikutus Suomen vientiin Venäjälle. Helsinki, Finland: ETLA muistio, 1–5.

Bojnec, Š., Čechura, L., Fałkowski, J., and Fertő, I. (2021). Agri-food exports from Central-and Eastern-European member states of the European Union are catching up. EuroChoices 20, 11–19. doi: 10.1111/1746-692X.12307

Bojnec, S., and Ferto, I. (2016). Export competitiveness of the European Union in fruit and vegetable products in the global markets. Agric. Econ. 62, 299–310. doi: 10.17221/156/2015-AGRICECON

Boulanger, P., Dudu, H., Ferrari, E., and Philippidis, G. (2016). Russian roulette at the trade table: a specific factors cge analysis of an agri-food import ban. J. Agric. Econ. 67, 272–291. doi: 10.1111/1477-9552.12156

Caruso, R. (2003). The impact of international economic sanctions on trade: an empirical analysis. Peace Econ. Peace Sci. Public Policy 9:1061. doi: 10.2202/1554-8597.1061

Cheptea, A., and Gaigné, C. (2020). Russian food embargo and the lost trade. Eur. Rev. Agric. Econ. 47, 684–718. doi: 10.1093/erae/jbz032

Chow, G. C. (1960). Tests of equality between sets of coefficients in two linear regressions. Econometrica 28:591. doi: 10.2307/1910133

Crozet, M., and Hinz, J. (2020). Friendly fire: the trade impact of the Russia sanctions and counter-sanctions. Econ. Policy 35, 97–146. doi: 10.1093/epolic/eiaa006

Devadoss, S., and Ridley, W. (2024). Impacts of the Russian invasion of Ukraine on the global wheat market. World Dev. 173:106396. doi: 10.1016/j.worlddev.2023.106396

Erdőháti-Kiss, A., Janik, H., Tóth, A., Tóth-Naár, Z., and Erdei-Gally, S. (2023). The effectiveness of Russian import sanction on the international apple trade: network theory approach. J. Eastern European Central Asian Res. 10, 712–726. doi: 10.15549/jeecar.v10i5.1249

Erokhin, V., Heijman, W., and Ivolga, A. (2014). Trade tensions between EU and Russia: possible effects on trade in agricultural commodities for Visegrad countries. Visegrad J. Bioecon. Sustain. Dev. 3, 52–57. doi: 10.2478/vjbsd-2014-0010

Estrada, M. A. R., and Koutronas, E. (2022). The impact of the Russian aggression against Ukraine on the Russia-EU trade. J. Policy Model 44, 599–616. doi: 10.1016/j.jpolmod.2022.06.004

Eurostat . (2021). Comext. Available at: http://epp.eurostat.ec.europa.eu/newxtweb/

Fedoseeva, S. (2016). Russian agricultural import ban: quantifying losses of german agri-food exporters.

Fedoseeva, S., and Herrmann, R. (2019). The price of sanctions: an empirical analysis of German export losses due to the Russian agricultural ban. Can. J. Agric. Econ. 67, 417–431. doi: 10.1111/cjag.12194

Felbermayr, G., Kirilakha, A., Syropoulos, C., Yalcin, E., and Yotov, Y. V. (2020). The global sanctions data base. Eur. Econ. Rev. 129:103561. doi: 10.1016/j.euroecorev.2020.103561

Fiankor, D.-D. D., Curzi, D., and Olper, A. (2021). Trade, price and quality upgrading effects of agri-food standards. Eur. Rev. Agric. Econ. 48, 835–877. doi: 10.1093/erae/jbaa026

Glick, R., and Taylor, A. M. (2010). Collateral damage: trade disruption and the economic impact of war. Rev. Econ. Stat. 92, 102–127. doi: 10.1162/rest.2009.12023

Hagemejer, J. (2017). “Potential macroeconomic effects of the trade collapse due to economic and political crises: the case of Poland” in Economics of European crises and emerging markets. eds. P. Havlik and I. Iwasaki (Singapore: Springer), 197–216.

Hansen, B. E. (2001). The new econometrics of structural change: dating breaks in U.S. Labor productivity. J. Econ. Perspect. 15, 117–128. doi: 10.1257/jep.15.4.117

Havlik, P. (2014). Economic consequences of the Ukraine conflict (14). Vienna, Austria: The Vienna Institute for International Economic Studies.

Heilmann, K. (2016). Does political conflict hurt trade? Evidence from consumer boycotts. J. Int. Econ. 99, 179–191. doi: 10.1016/j.jinteco.2015.11.008

Hufbauer, G. C., Schott, J. J., and Elliott, K. A. (1990). Economic sanctions reconsidered. 2nd Edn. Washington, D.C., USA: Institute for International Economics.

Hummels, D., and Klenow, P. J. (2005). The variety and quality of a nation’s exports. Am. Econ. Rev. 95, 704–723. doi: 10.1257/0002828054201396

Hyytiä, N. (2020). Russian food import ban – impacts on rural and regional development in Finland. Eur. Countryside 12, 506–526. doi: 10.2478/euco-2020-0027

Kapsdorferová, Z., and Sviridova, O. (2016). Impact of sanctions on agricultural policy in European Union and Russia. International scientific days 2016: the agri-food value Chain: challenges for natural resources management and Society: proceedings, 190–200.

Kašťaková, E., and Baumgartner, B. (2018). The impact of the russian embargo on its agri-food trade with the eu: analysis by selected indicators. Int. Organ. Res. J. 13, 256–271. doi: 10.17323/1996-7845-2018-04-12

Keshk, O. M. G., Pollins, B. M., and Reuveny, R. (2004). Trade still follows the flag: the primacy of politics in a simultaneous model of interdependence and armed conflict. J. Polit. 66, 1155–1179. doi: 10.1111/j.0022-3816.2004.00294.x

Kholodilin, K. A., and Netšunajev, A. (2019). Crimea and punishment: the impact of sanctions on Russian economy and economies of the euro area. Baltic J. Econ. 19, 39–51. doi: 10.1080/1406099X.2018.1547566

Kim, H., and Lee, J. (2021). The economic costs of diplomatic conflict: evidence from the South Korea–China THAAD dispute. Korean Econ. Rev. 37, 225–262. doi: 10.22841/KERDOI.2021.37.2.002

Klomp, J. (2020). The impact of Russian sanctions on the return of agricultural commodity futures in the EU. Res. Int. Bus. Financ. 51:101073. doi: 10.1016/j.ribaf.2019.101073

Korhonen, I., Simola, H., and Solanko, L. (2018). Sanctions, counter-sanctions and Russia: Effects on economy, trade and finance. Helsinki, Finland: BOFIT Policy Brief.

Krivko, M., Heijman, W., and Smutka, L. (2021). “Russia’s agricultural import ban: winners and losers” in Shifting patterns of agricultural trade. eds. V. Erokhin, G. Tianming, and J. V. Andrei (Singapore: Springer), 437–453.

Krivko, M., and Smutka, L. (2020). Trade sanctions and agriculture support in milk and dairy industry: case of Russia. Sustain. For. 12:10325. doi: 10.3390/su122410325

Krivko, M., and Smutka, L. (2021). Agricultural and foodstuff trade between EU28 and Russia: (Non)uniformity of the Russian import ban impact distribution. Agriculture 11:1259. doi: 10.3390/agriculture11121259

Kutlina-Dimitrova, Z. (2017). The economic impact of the Russian import ban: a CGE analysis. IEEP 14, 537–552. doi: 10.1007/s10368-017-0376-4

Liefert, W. M., Liefert, O., Seeley, R., and Lee, T. (2019). The effect of Russia’s economic crisis and import ban on its agricultural and food sector. J. Eurasian Stud. 10, 119–135. doi: 10.1177/1879366519840185

Lin, F., Li, X., Jia, N., Feng, F., Huang, H., Huang, J., et al. (2023). The impact of Russia-Ukraine conflict on global food security. Glob. Food Sec. 36:100661. doi: 10.1016/j.gfs.2022.100661

Long, A. G. (2008). Bilateral trade in the shadow of armed conflict. Int. Stud. Q. 52, 81–101. doi: 10.1111/j.1468-2478.2007.00492.x

Mardones, C. (2023). Economic effects of isolating Russia from international trade due to its ‘special military operation’ in Ukraine. Eur. Plan. Stud. 31, 663–678. doi: 10.1080/09654313.2022.2079074

Morgan, T. C., Bapat, N., and Krustev, V. (2009). The threat and imposition of economic sanctions, 1971—2000*. Confl. Manag. Peace Sci. 26, 92–110. doi: 10.1177/0738894208097668

Morrow, J. D., Siverson, R. M., and Tabares, T. E. (1998). The political determinants of international trade: the major powers, 1907–1990. Am. Polit. Sci. Rev. 92, 649–661. doi: 10.2307/2585487

Oja, K. (2015). No milk for the bear: the impact on the Baltic states of Russia’s counter-sanctions. Baltic J. Econ. 15, 38–49. doi: 10.1080/1406099X.2015.1072385

Pettis, M., and Pettis, M. (2015). The great rebalancing: trade, conflict, and the perilous road ahead for the world economy. Princeton, NJ, USA: Princeton University Press.

Priede, J., and Skapars, R. (2017). Russian federation trade embargo and its impact on the Baltic states trade. Economic and social development: book of proceedings, 386–391.

Rabbi, M. F., Ben Hassen, T., El Bilali, H., Raheem, D., and Raposo, A. (2023). Food security challenges in Europe in the context of the prolonged Russian–Ukrainian conflict. Sustain. For. 15:4745. doi: 10.3390/su15064745

Rose, A. K. (2007). The foreign service and foreign trade: embassies as export promotion. World Econ. 30, 22–38. doi: 10.1111/j.1467-9701.2007.00870.x

Sági, J., and Nikulin, E. E. (2017). The economic effect of Russia imposing a food embargo on the European Union with Hungary as an example. Stud. Agric. Econ. 119, 85–90.

Schultz, K. A. (2015). Borders, conflict, and trade. Annu. Rev. Polit. Sci. 18, 125–145. doi: 10.1146/annurev-polisci-020614-095002

Skvarciany, V., Jurevičienė, D., and Vidžiūnaitė, S. (2020). The impact of Russia’s import embargo on the EU countries’ exports. Economies 8:62. doi: 10.3390/economies8030062

Smutka, L., and Abrhám, J. (2022). The impact of the Russian import ban on EU agrarian exports. Agric. Econ. 68, 39–49. doi: 10.17221/351/2021-AGRICECON

Smutka, L., Jindrich, S., Natalia, I., and Richard, S. (2016). Agrarian import ban and its impact on the Russian and European Union agrarian trade performance. Agric. Econ. 62, 493–506. doi: 10.17221/294/2015-AGRICECON

Smutka, L., Maitah, M., and Svatoš, M. (2019). Policy impacts on the EU-Russian trade performance: the case of agri-food trade. J. Int. Stud. 12, 82–98. doi: 10.14254/2071-8330.2019/12-2/5

Smutka, L., and Steininger, M. (2019) in Applied agrarian import ban and its impact on mutual trade among Russian Federation and European Union & other selected countries. eds. P. Maresova, P. Jedlicka, and I. Soukal, 325–332.

Stankaitytė, B. (2016). Competitiveness of dairy products export to Russia and alternative markets. Manag. Theory Stud. Rural Bus. Infrastructure Dev. 38, 425–435. doi: 10.15544/mts.2016.34

Sümer, K. (2015). The economic consequences of sanctions against Russia after the invasion of Russia in the Crimea. Eurasian Bus. Econ. J. 3, 83–94. doi: 10.17740/eas.econ.2015-V3-07

Uzun, V. Y., and Loginova, D. (2016). Russian food embargo: minor losses in western countries. Russian Econ. Dev. 9, 32–37. doi: 10.2139/ssrn.2842146

Venkuviene, V., and Masteikiene, R. (2015). The impact of Russian Federation economic embargo on the Central and Eastern European countries business environments. Procedia Econ. Finan. 26, 1095–1101. doi: 10.1016/S2212-5671(15)00935-1

Keywords: agri-food trade, import ban, economic sanctions, Poland, Finland, Estonia, Latvia, Lithuania

Citation: Krivko M, Czech K, Wielechowski M, Kotyza P and Smutka L (2024) Rebalancing agri-food trade flows due to Russian import ban: the case of direct neighbors. Front. Sustain. Food Syst. 8:1420945. doi: 10.3389/fsufs.2024.1420945

Edited by:

Bojan Matkovski, University of Novi Sad, SerbiaReviewed by:

Karolina Pawlak, Poznan University of Life Sciences, PolandTamás Mizik, Corvinus University of Budapest, Hungary

Copyright © 2024 Krivko, Czech, Wielechowski, Kotyza and Smutka. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mikhail Krivko, a3JpdmtvQHBlZi5jenUuY3o=

Mikhail Krivko

Mikhail Krivko Katarzyna Czech

Katarzyna Czech Michał Wielechowski3

Michał Wielechowski3 Pavel Kotyza

Pavel Kotyza Luboš Smutka

Luboš Smutka