- College of Economics, Sichuan Agricultural University, Chengdu, Sichuan, China

Introduction: Food production stands as a critical global concern necessitating comprehensive investigation. This study utilizes provincial-level data from China to explore the intricate relationships between farmland transfer, agricultural loans, and grain production, with the aim of shedding light on the complexities of these dynamics.

Methods: A two-way fixed effects model and instrumental variable approach are applied to assess the interplay between farmland transfer, agricultural loans, and grain production. These methods provide a robust framework for understanding the complex relationships among these variables.

Results and discussion: The study reveals a notable positive correlation between farmland transfer and grain production. Conversely, agricultural loans demonstrate a significantly negative impact on grain production. However, the positive interaction term between farmland transfer and agricultural loans suggests a nuanced relationship. While profit-driven financial activities may not inherently favor grain production, they contribute to more efficient utilization of farmland resources, ultimately promoting grain production. The findings underscore the significance of continued government support for rural land system reform and active guidance of farmland transfer. It is emphasized that a moderate-scale operation of farmland is crucial for finance to play a lubricating and catalytic role. Furthermore, there is a need to guide agricultural finance towards investing in medium and long-term projects of agricultural production. Attention is also directed to preventing potential food crises arising from the phenomenon of “non- farming” associated with agricultural loans.

1 Introduction

The market-oriented economic reforms implemented in China have resulted in a significant increase in agricultural production and the income levels of rural residents. Indeed, over the period 1980 to 2020, China’s total grain output and per capita income of farmers have risen from 320.56 million tons and 216 yuan to 669.49 million tons and 17,132 yuan, respectively.1 The income and agricultural output of farmers are largely determined by the impact of their livelihood activities, in which farmland transfer and agricultural production are two critical activities.

Farmland is the primary input required for agriculture, playing a vital role in food security, ecosystems, and the living standards of farmers (Fei et al., 2021). To optimize farmland and other resources such as capital and labor, bounded rational farmers will allocate farmland and resources from production sectors with lower marginal productivity to sectors with higher marginal productivity through appropriate land transfers, thereby addressing inefficiencies arising from farmland fragmentation and enhancing farm productivity and income (Berry, 1972; Barrett, 1996). Factors such as industrialization and urbanization (Liu et al., 2018), land finance system (Sippel et al., 2017) and labor migration (Gao et al., 2020), may lead to land transfer out of agriculture. On the other hand, the development of “appropriate-scale” farming (Rogers et al., 2021), farmland protection system (Li et al., 2021), and agricultural incentive policies (Lin and Huang, 2021) tend to promote the transfer of land into agriculture or within the agricultural sector. A well-functioning land market is critical, not only for non-agricultural growth but also for efficiently reallocating idle land resources (Jin and Deininger, 2009; Leimer et al., 2022). In addition, clear farmland property rights secure farmers’ ability to use the land for specific purposes, stabilize labor supply, increase investment, and promote economic growth (Luo and Fu, 2009; Hornbeck, 2010).

Farmland transfer, accompanied by improvements in property rights reform, has proven to be an effective approach in achieving agricultural modernization and large-scale operation, and has also become a prerequisite for harmonizing urban and rural land demands to realize industrialization and urbanization (Kan, 2021). An example of such progress is the Chinese government’s “Separation of Three Rights” principle, proposed in 2011 and formally established in 2018. This principle separates ownership rights, contract rights, and management rights for contracted rural land, aligning with the development trend of modern society. It satisfies the requirements of agricultural industrialization, allowing farmers to retain contract rights while transferring management rights. However, some studies have found that allocating land for large-scale investment projects may reduce food security (Shete and Rutten, 2015). Additionally, promoting farmland transfer has not always been effective in improving agricultural economies of scale (Luo, 2018) and, in some instances, may even result in reduced crop yields (Zhang et al., 2021).

Exploring the linkages between farmland transfer and agricultural production is therefore crucial in shaping future agricultural policies, particularly in light of the growing significance of food-related concerns. Clearly, the impact of farmland transfer on agricultural production is closely tied to the role of agricultural loans, which have been demonstrated in studies highlighting their potential to enhance financial inclusion and stimulate increased investment in the agricultural sector (Yang et al., 2018). Several studies have found that increased uptake of agricultural loans can lead to higher average agricultural productivity and raise agricultural income (Emerick et al., 2016; Khandker and Koolwal, 2016; Fink et al., 2020). Equally important is the inherent uncertainty involved in the development of agricultural loan programs related to farmland markets. Despite the availability of farmland mortgage loans through these markets, farmers often do not seek to align their access to formal credit with land rental market (Kochar, 1997). In addition, access to credit can facilitate potential tenants in securing more efficient land rental contracts (Das et al., 2019), and specific forms of loans may play a particularly pivotal role in stimulating investment in off-farm production and operations (Peng et al., 2020).

In China, substantial structural transformations are currently unfolding within the agricultural and rural domains. These transformations encompass the orderly and efficient flow of resources, such as farmland, labor force, and capital, between urban and rural areas and between agricultural and non-agricultural sectors. This dynamic has given rise to the emergence of novel agricultural entities such as agricultural cooperatives, family farms and agricultural enterprises, thereby amplifying the specialization of agricultural production. As a result, the farmland transfer market has gained momentum, leading to an upsurge in agricultural loans and the advancement of agricultural production. This phenomenon has spurred out interest in delving into various facets of farmland, including the mechanisms through which it influences agricultural loans, and how to promote farmland transfers while maximizing the use of agricultural loans to increase agricultural production and ensure food security.

Understanding the nexus between farmland transfer, agricultural loans and agricultural production is important, given that investments in agriculture – which directly boost agricultural production – are driven by the financing of financial capital, which, among other factors, is profoundly influenced by the allocation of farmland resources. The primary contributions of this study to the literature are threefold. First, this paper presents a novel attempt to examine the effects of farmland transfer and agricultural loans on grain production in China. Although there are multiple factors that affect grain production, farmland is the most fundamental element in the entire agricultural industry chain, and finance serves as a lubricant and catalyst for the flow of other elements. Secondly, food security is of paramount importance, and it is essential to answer the important question of whether the free flow of farmland factors and the capitalization of agriculture will lead to the non-food issue of farmland, which will in turn affect food security. Third, we show that the inverse agricultural loan-grain production relationship persists across various types of farmland transfers, possibly due to loans being used for trade and other commercial purposes rather than investment in grain production, but it is also found that agricultural loans will enhance the positive effect of farmland transfer on grain production.

The rest of the paper is structured as follows. Section 2 presents a comprehensive literature review. Section 3 presents the data and the methodology used in the study. The empirical results are then reported in section 4. The final section presents concluding remarks and implications.

2 Literature review

2.1 The economic impact of farmland transfer

Farmland transfer can be categorized into two types: transfer outside and within the agricultural sector. The former entails converting land from agricultural to non-agricultural use, while the latter involves the transfer of farmland among agricultural operators without changing its agricultural use, which is the focus in this study. Studies have identified several economic benefits of farmland transfer, including enhanced land use efficiency, increased farmers’ household income, and shifts in agricultural structure. In an investigation of rural land rental markets in Malawi and Zambia, Chamberlin and Ricker-Gilbert (2016) revealed efficiency gains from transferring land to more productive users. Recent studies in developing countries like Vietnam, Ethiopia, and China (Adamie, 2021; Fei et al., 2021; Nguyen et al., 2021) also found positive effects of farmland transfer on production efficiency. These findings underscore the role of farmland rental markets in improving resource allocation and driving economic transformation in rapidly growing rural economies.

Farmland transfer can be categorized into rented-in and rented-out land (Wang et al., 2019). Farmers with rented-in land tend to centralize and engage in large-scale farming, reaping economies of scale, optimizing input utilization, and improving efficiency and productivity (Huang and Ding, 2016; Cao et al., 2020). In contrast, land rental markets provide stable income to farmers with limited non-land resources, enabling them to rent out land management rights and freeing redundant rural workers for off-farm employment (Grimm and Klasen, 2015; Peng et al., 2020). The farmland rental market contributes to a more balanced farm size distribution by facilitating efficient transfers from less productive to more efficient operators (Deininger et al., 2012). Research also shows that farmers can mitigate disaster-related losses by optimizing their farm size through land transfers, enhancing both efficiency, and resilience in the agricultural sector (Eskander and Barbier, 2022).

However, alongside these positive effects, Jin and Jayne (2013) and Baumgartner et al. (2015) have highlighted potential downsides, including income inequality and power imbalances resulting from large-scale farmland operations. Moreover, farmers who lease rather than own land face greater risks, as land ownership offers better tenure security (Sommerville and Magnan, 2015). While scaled farms can drive agricultural transformation, it remains crucial to strengthen land tenure security for local rural communities to protect land rights and support productivity investments by smallholder farmers (Jayne et al., 2019). Consequently, the outcomes of farmland transfer are nuanced, and non-food and non-agricultural issues deserve attention.

2.2 The impact of agricultural loans on agricultural production

Finance is one of the main constraints that hinder agricultural modernization in developing countries. Access to finance has been confirmed effective in promoting technology adoption and inputs use, leading to heightened agricultural productivity, increased rural incomes, and improved food security (Abate et al., 2016; Balana et al., 2022). Without access to such loans, cash-constrained households are often unable to adopt new seed, fertilizer, or chemical technologies that would enable them to intensify production (Poulton et al., 2010; Fink et al., 2020). Developed countries like the United States, Canada, and Australia have extended great support to agriculture, including credit support, such as farm mortgages aimed at providing capital for purchasing inputs and equipment (Martin and Clapp, 2015). Recent global food economy trends, such as growing demand, rising commodity prices, and ongoing agricultural industrialization, have made agriculture increasingly attractive to financial stakeholders. These stakeholders have introduced new models and logics into farmland ownership and agricultural production (Magnan, 2015). Thus, in order to realize returns from agricultural production, finance pushes for the increased capitalization of agricultural production (Clapp et al., 2017).

However, some studies have argued against the efficacy of microfinance in enhancing agricultural productivity and income derived from agriculture (Phan et al., 2014; Khandker and Koolwal, 2016; Thanh et al., 2019; Nakano and Magezi, 2020). For example, in a recent study on Vietnam, Thanh et al. (2019) found that while microfinance significantly increased total income and output value from all earned sources, these gains were largely driven by self-employment rather than agricultural activities like crop cultivation, livestock rearing, or aquaculture. Similarly, using a randomized control trial of microfinance in Tanzania, Nakano and Magezi (2020) found that microfinance did not lead to greater technology adoption or rice productivity. This is partly attributed to loans being used for trading and other business purposes instead of on-farm investments (Ksoll et al., 2016), as the agricultural productivity benefits of agricultural loans hinge on their appropriate use for on-farm purposes (Elahi et al., 2018). Another reason to consider is that loans from microfinance institutions may not yield significant effects in the short term, for instance, one year (Hossain et al., 2019).

2.3 Research on the farmland finance

In recent years, research in the realm of farmland and agri-food has increasingly focused on the concept of financialization. Land, traditionally perceived for its “use value” in meeting human needs, is now being treated as a pure financial asset alongside its “exchange value” in the market (Harvey, 1982; Haila, 1988). However, Coakley (1994) and Ouma (2015) have highlighted the unique nature of agricultural land, which is intrinsically tied to factors such as weather dependence, geographical variability, socioecological embedment, and political significance, making it less amenable to transformation into a standard asset class. In an era of increasing resource scarcity, the financialization of farmland as a quasi-financial asset is becoming increasingly prominent (Fairbairn, 2014; Ashwood et al., 2022). The argument for considering farmland as an investment opportunity is rooted in the principles of contemporary portfolio management theory, which assert that diversification increases expected portfolio returns while minimizing volatility (Chen et al., 2015; Fairbairn et al., 2021). In particular, clear farmland property rights play a central role, not only as a crucial aspect of investor’s economization strategy but also as a key driver of the “value creation” process (Ouma, 2016).

In China, as land cannot be privately owned, farmland finance relies on using land as collateral for financial services. This practice serves to enhance the economic value of farmland and attract funding for agriculture. Recent empirical studies have found that legal guarantees of land property rights and land transfer have a significant and positive impact on the demand for and likelihood of obtaining agricultural loans (Zhang et al., 2019; Gong and Elahi, 2022). This agricultural loans represent a crucial source of investment for farmers, and easier access to them can incentive farmers to invest more in their land (Peng et al., 2020; Wang et al., 2023). The combination of lengthening rental tenures, escalating land prices, and increased capitalization has emboldened farmland consolidation, augmenting both the financial and productive appeal of land (Rotz et al., 2019). While some farmers perceive this interest from financial actors as a means to increase the value of their assets, others view it as a threat to family farming and a contributor to further disparities in land resource distribution (Sippel et al., 2017).

Despite insights from previous literature on the economic impact of farmland transfers, the relationship between agricultural loans, farm production, and the financialization of farmland, the connections among farmland transfer, agricultural loans, and grain production in China remain intricate. Ongoing rural revitalization is altering how farmland transfers among agricultural operators. Farmland transfer promotes the shift from small-scale farmers to larger farms, encourages farm size and specialization, and effectively boosts food crop yields, a significant driver behind the growth of farmland transfers. However, the land rent cost associated with farmland transfer, along with the challenge of “limited profits from grain cultivation,” may result in substantial farmland allocation to “non-grain” crops, reducing the area devoted to food crops and subsequently impacting grain production. In addition, previous studies have overlooked the influence of farmland transfers and agricultural loans on China’s grain production. This study addresses this research gap by investigating the relationships among farmland transfer, agricultural loans, and grain production using a panel dataset from China.

3 Data and methodology

3.1 Data

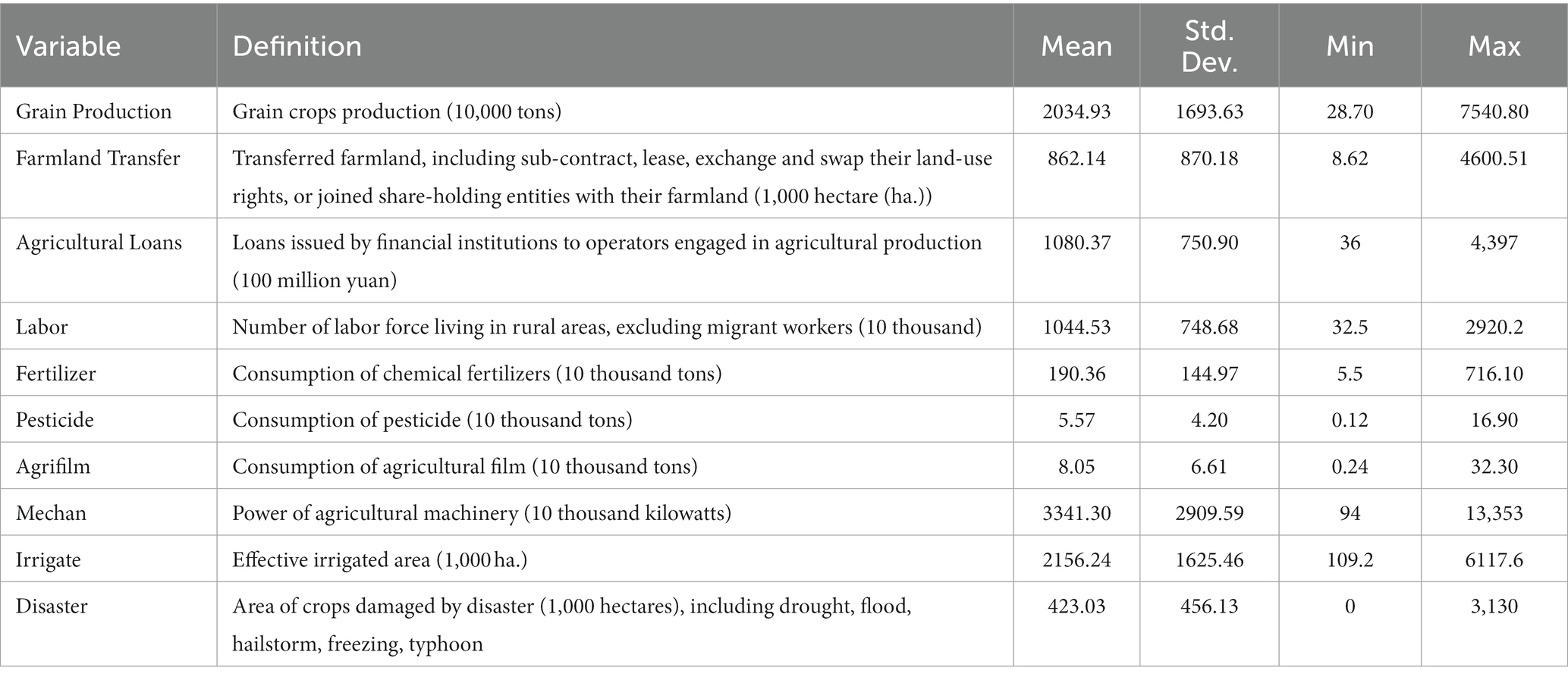

The primary objective of this paper is to investigate the nexus between farmland transfer, agricultural loans and grain production in China. This study utilizes a panel dataset that covers 30 provinces and spans the years from 2009 to 2020. We employ two-way fixed effects and instrumental viable techniques to explore the interrelationship among the factors. The variable used in the study were compiled from diverse resources, including the China Statistical Yearbooks, China’s Rural Operation and Management Statistics Annual Reports, Almanac of China’s Finance and Banking, China Rural Statistical Yearbooks and China Population & Employment Statistical Yearbook. Table 1 presents a summary of the variables. In addition to the core variables, the study incorporates other variables closely related to grain production, such as labor force, fertilizer and pesticide consumption, plastic film usage, machinery, irrigated areas and crop damaged areas.

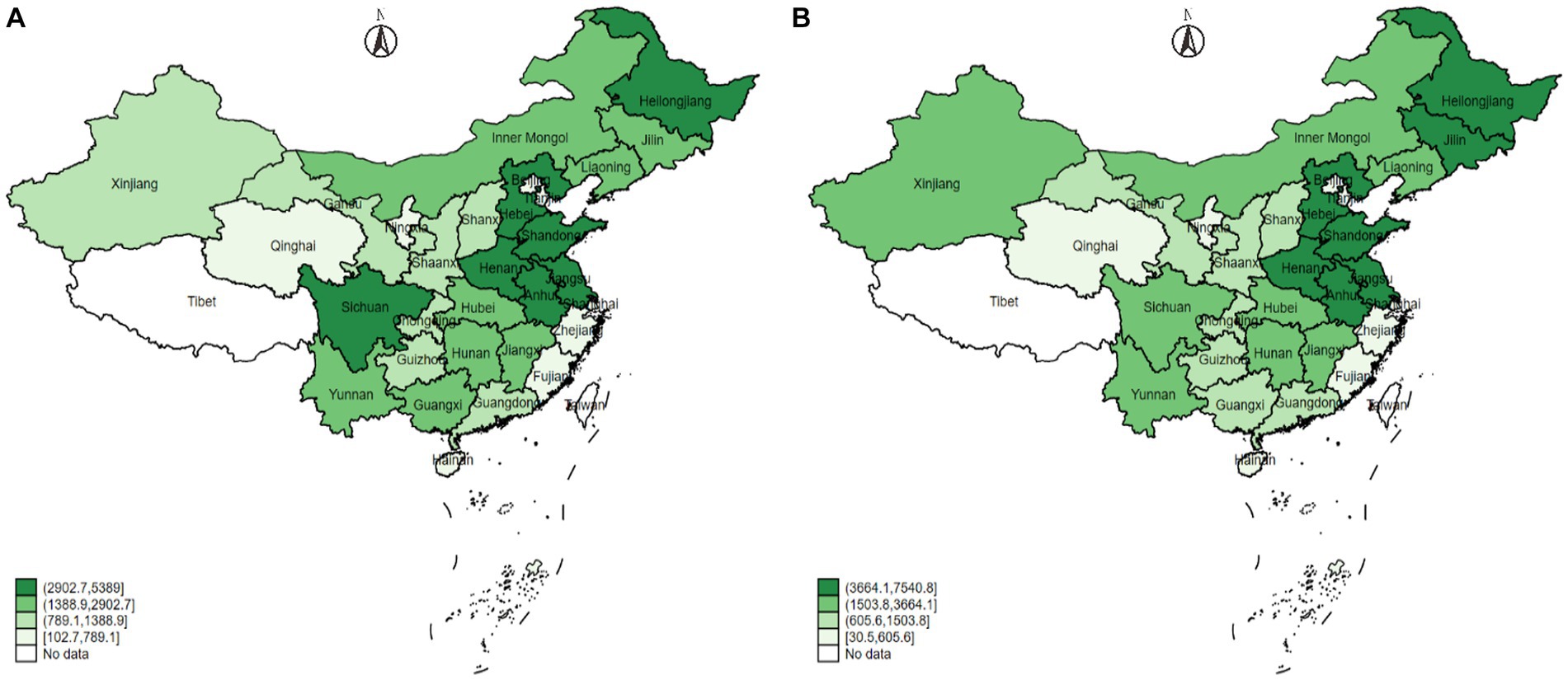

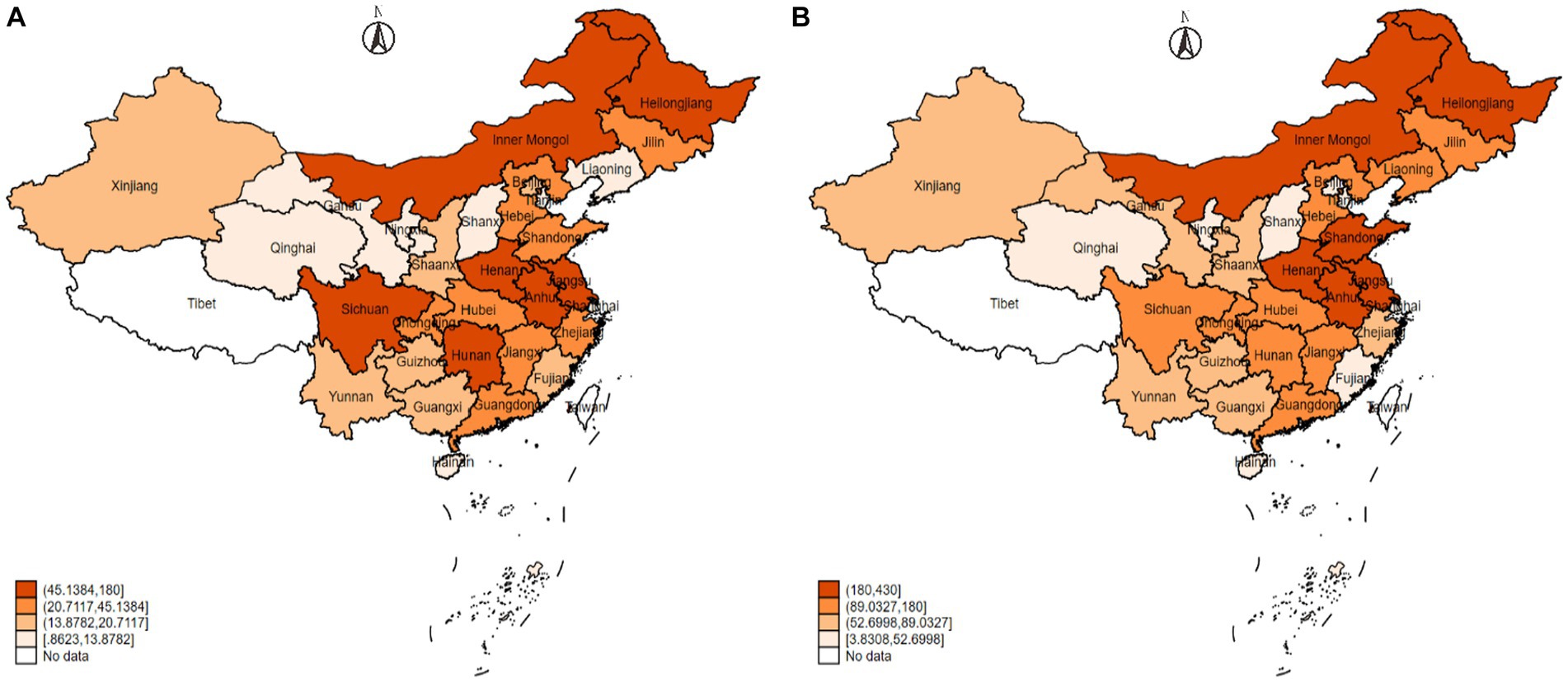

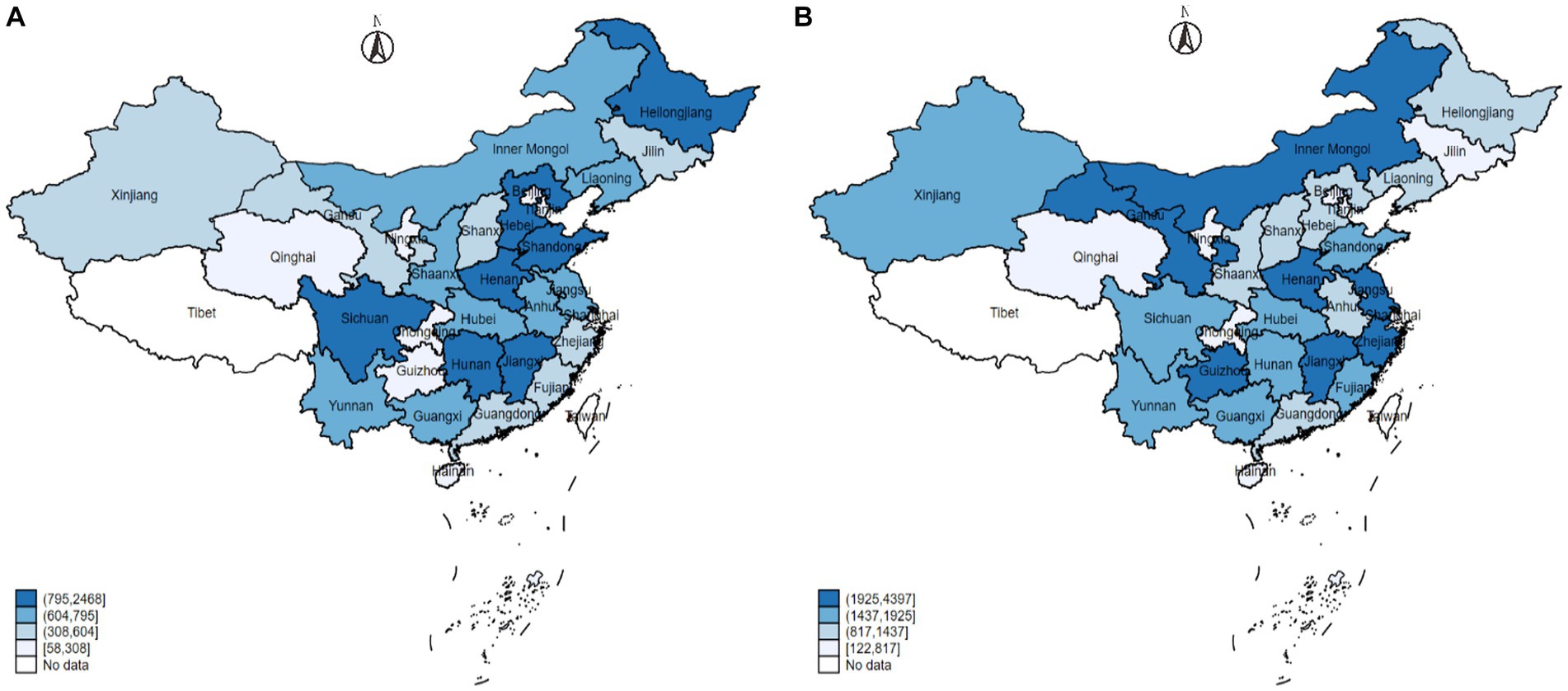

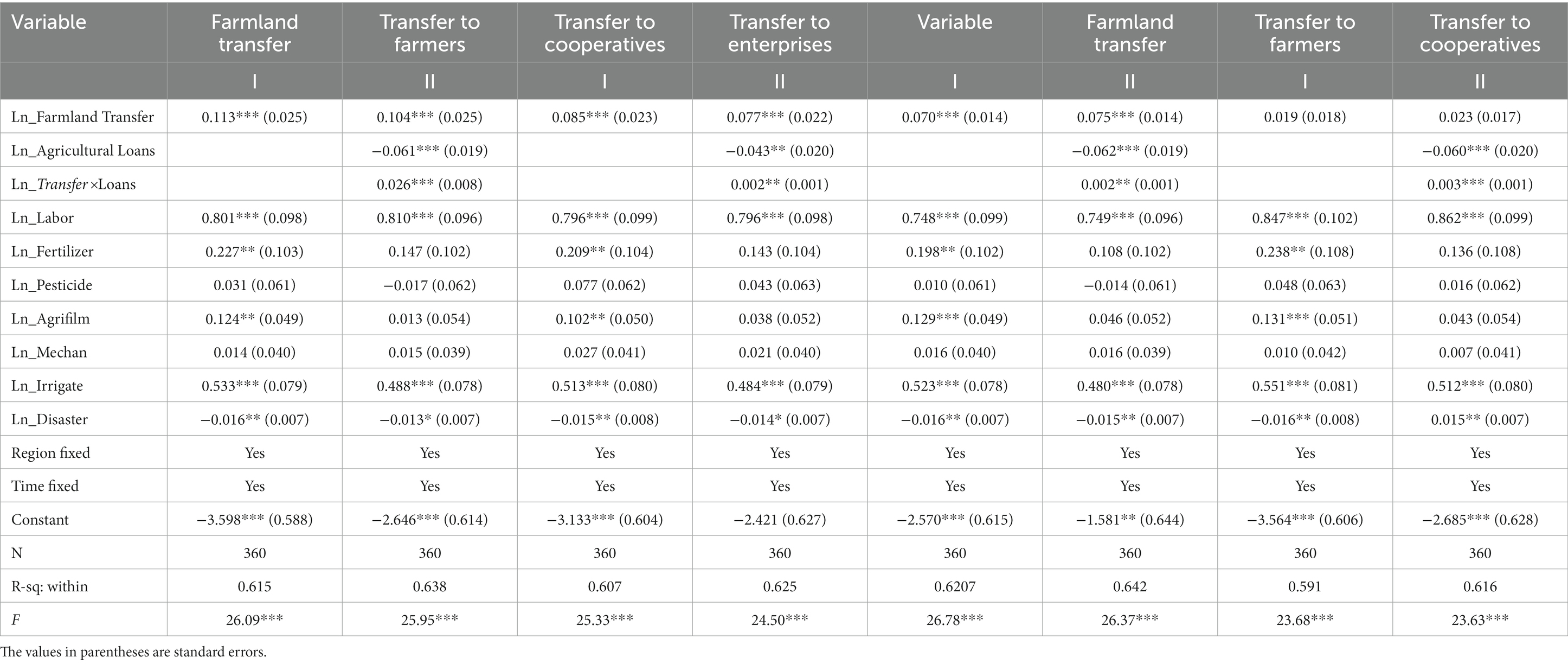

In particular, grain production is measured as the total output of grain crops, including cereals, beans and tubers. The mean of grain production is approximately 2035 (10,000 tons), but the standard deviation indicates that data of grain production is widely dispersed. As we can see from the Figure 1. The geographical distribution of grain production in 2009 and 2020 is evident. Farmland transfer refers to the transfer of farmland management rights from farmers who possess such rights to other farmers or economic organizations. This process encompasses sub-contracting, leasing, exchanging, and swapping land-use rights, as well as establishing joint share-holding entities with their farmland. Agricultural loans are loans issued by financial institutions to provide funds for agricultural production. These loans are extended to various entities involved in agricultural, forestry, animal husbandry, and fishery production. Figures 2, 3 reveal substantial variations in farmland transfer and agricultural loans across different provinces in 2009 and 2022, revealing apparent correlations with changes in grain production.

Figure 1. China’s grain production in 2009 and 2020. (A) Grain production in 2009. (B) Grain production in 2020.

Figure 2. China’s farmland transfer in 2009 and 2020. (A) Farmland transfer in 2009. (B) Farmland transfer in 2020.

Figure 3. China’s agricultural loans in 2009 and 2020. (A) Agricultural loans in 2009. (B) Agricultural loans in 2020.

3.2 Methodology

The empirical approach applied in this study explores the relationship between farmland transfer, agricultural loans and grain production through an extension of the standard production function.

This framework is able to examine the impact of farmland transfer and agricultural loans in addition to the basic drivers of inputs.

The production function is assumed to be Cobb–Douglas form,

where denotes the province, denotes time, represents grain production, is the index of technological progress, are farmland, capital, labor and intermediate inputs. are the output elasticity of each input.

In order to assess the nexus among the studied variables, we reinterpret the figures of the variables by taking their natural logarithm. When taking the logarithm of Equation (1), the following linear multivariate regression is produced,

where denotes grain yield, denotes the transferred farmland, represents regional fixed effects and is used to capture specific features averaged across provinces, such as topography, precipitation, temperature and other unobservable factors, and is time-specific effects and captures seasonal or cyclical effects, and other changes over time.

The Equation (2) can be employed to examine the relationship between farmland transfer and grain production, while controlling for farm fixed effects that remain constant over time. However, other inputs such as capital usage, which is subject to change over time, may also influence the farmland – grain production relationship.

Therefore, we include agricultural loans as a moderating variable and incorporate labor, fertilizer usage, pesticide usage, agricultural film usage, total power of agricultural machinery, effective irrigation area, and crop disaster area to control for farm fixed effects. In theory, apart from the negative impact of disaster area on agricultural production, the input of other factors are supposed to increase grain yield. Based on this, the empirical model of this study is formulated as Equation (3):

The two-way fixed effects model with agricultural loans included as a moderating variable is then as Equation (4):

In addition, in order to address potential endogeneity issues in the model, this study further employs the instrumental variable method.

4 Results and discussion

4.1 Results

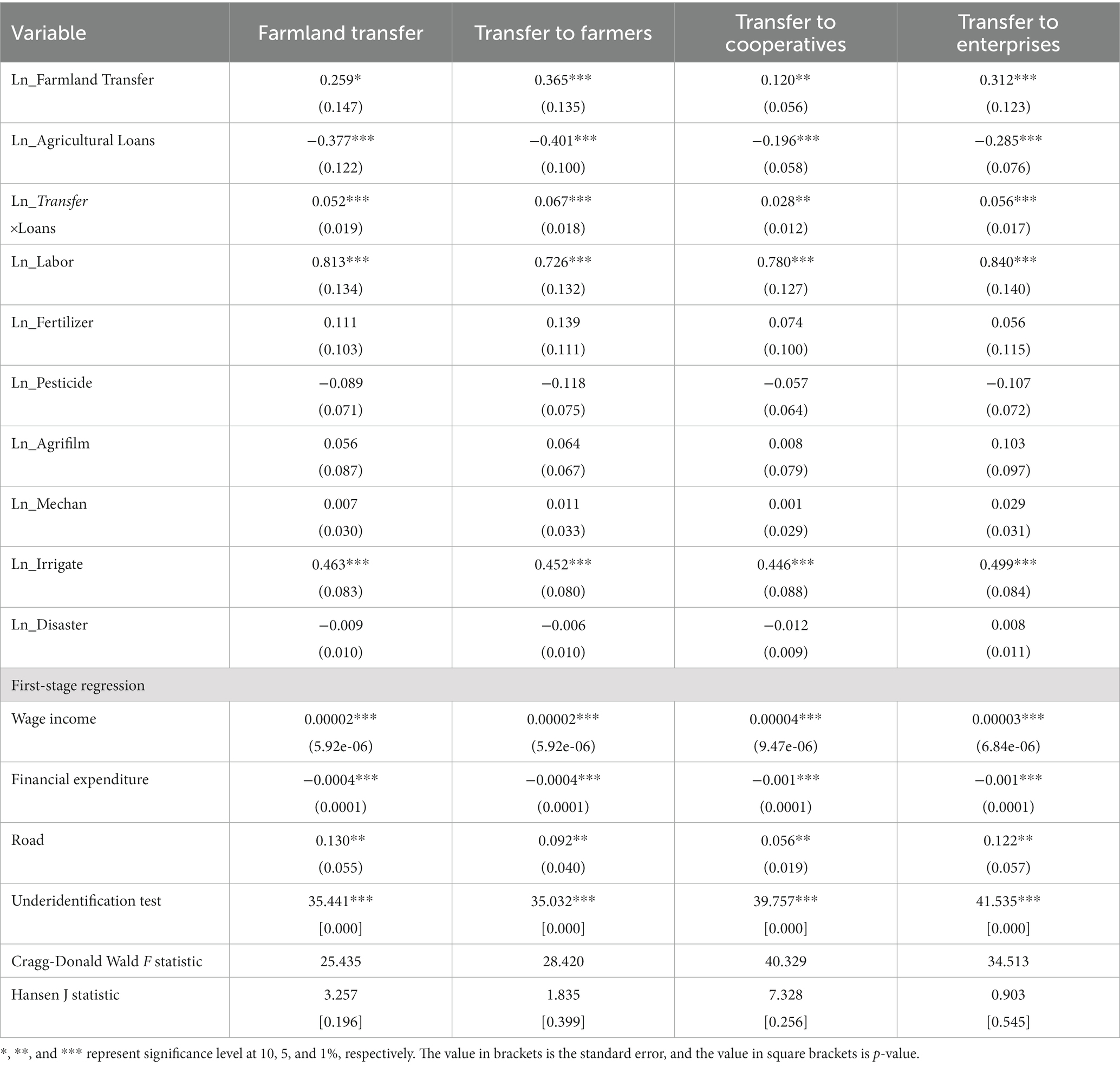

This study employs a two-way fixed effects model to conduct regression analysis, and the results are presented in Table 2. Since farmland transfer involves three main directions – transfer to farmers, professional cooperatives, and enterprises – we not only examine the overall effect of farmland transfer on grain production but also separately analyze its impacts on grain production when transferred to each of these entities.

Table 2. The estimation results on farmland transfer, agricultural loans, and grain production relationship.

As can be seen from the columnI, after controlling for other variables, farmland transfer demonstrates a significant positive correlation with grain production at the 1% level. This indicates a strong positive relationship between farmland transfer and grain production. The results suggest that for every 1% increase in the quantity of farmland transfer, there is a corresponding 0.113% increase in grain yield. This finding is consistent with the results of Fei et al. (2021) and Rogers et al. (2021), that is, Land transfer can improve land use efficiency. In addition, the results further suggest that when farmland is transferred to farmers, cooperatives, and enterprises, a 1% increase in quantity results in grain yield increases of 0.085, 0.07, and 0.019%, respectively. This highlights the significant contributions of farmland transfer to both farmers and cooperatives in enhancing grain production. In addition, the coefficients of labor force, fertilizer usage, agricultural film, and irrigation exhibit significant effects at a level of 5% or higher. This indicates that these inputs noticeably impact grain production. Although the area affected by natural disasters shows a significant negative correlation with grain yield, the coefficient is relatively small. This suggests that agriculture possesses a strong capacity for resilience against disasters.

The results in column II incorporate agricultural loans and the interaction terms between agricultural loans and different types of farmland transfer. It is interesting to note that agricultural loans show a significant negative correlation with grain production, indicating that a 1% increase in agricultural loans leads to a 0.06% decrease in grain yield. However, the coefficient of the interaction term between farmland transfer and agricultural loans is significantly positive, indicating that agricultural loans act as a moderating effect that enhances the main effect. In other words, although agricultural loans alone do not lead to increased grain production, their combination with farmland transfer contributes to the improvement of grain yield. One possible reason might be that agricultural loans can provide farmers with additional resources and capital, and when combined with farmland transfers, can improve land use efficiency and productivity. This infusion of resources may produce benign interactive effects. In addition, agricultural loans often face increased uncertainties and challenges due to the inherently risky nature of agriculture. The property attributes of farmland can help reduce agricultural credit risks, thereby enhancing the overall effect in a positive direction.

Given the potential influence of endogeneity in the benchmark regression results due to omitted variables and reverse causality between farmland transfer and agricultural production, this paper employs an instrumental variable (IV) approach to address the endogeneity issue. The primary focus of this paper is to assess the impact of farmland transfer on grain production. Therefore, our main objective is to find instrumental variables for farmland transfer. In this study, wage income, financial expenditure, and per capita road area are selected as instrumental variables for farmland transfer.

The findings of Su et al. (2018) and Fan et al. (2021) have indicated that non-agricultural employment has a significantly positive impact on farmland transfer, primarily due to the higher attractiveness of non-agricultural wages. Therefore, in this paper, we consider wage income as an instrumental variable for farmland transfer since it does not directly affect grain production but influences the decision to transfer farmland. Financial expenditure refers to government spending on agricultural and water affairs, encompassing investments and expenditures made by the government in the agricultural sector. These expenditures contribute to the improvement of rural infrastructure and agricultural production conditions, potentially exerting a significant impact on farmland transfer. While per capita road area may not directly influence agricultural production, accessible road transportation plays a vital role in facilitating the transportation of agricultural products. This, in turn, enhances market opportunities and serves as a motivating factor for farmland transfer.

The regression results using the instrumental variable (IV) approach are presented in Table 3. The validity test of instrumental variables shows that the regression coefficients of wage income, financial expenditure, and per capita road area in the first-stage regression are all statistically significant at a 5% level or higher, indicating a positive correlation with farmland transfer. In particular, the coefficient of financial expenditure is significantly negative, suggesting that increased government investment in the agricultural sector and improvements in agricultural production conditions lead farmers to be more inclined to cultivate the farmland themselves rather than transferring it. In addition, compared to the promoting effect of road on farmland transfer, the coefficient of wage income is relatively small, implying a limited role of wage income improvement in facilitating farmland transfer. The results of the under-identification test, Hansen J statistic, and Cragg-Donald Wald F statistic also indicate that the instrumental variables are appropriate. Consistent with the baseline regression results, different types of farmland transfer exhibit a significant positive effect on grain production, while agricultural loans show a significant negative impact at the 1% level. However, the coefficient of the interaction term between farmland transfer and agricultural loans is significantly positive at the 1% level, suggesting that agricultural loans enhance the main effect, and the combination of agricultural loans and farmland transfer contributes to an increase in grain production.

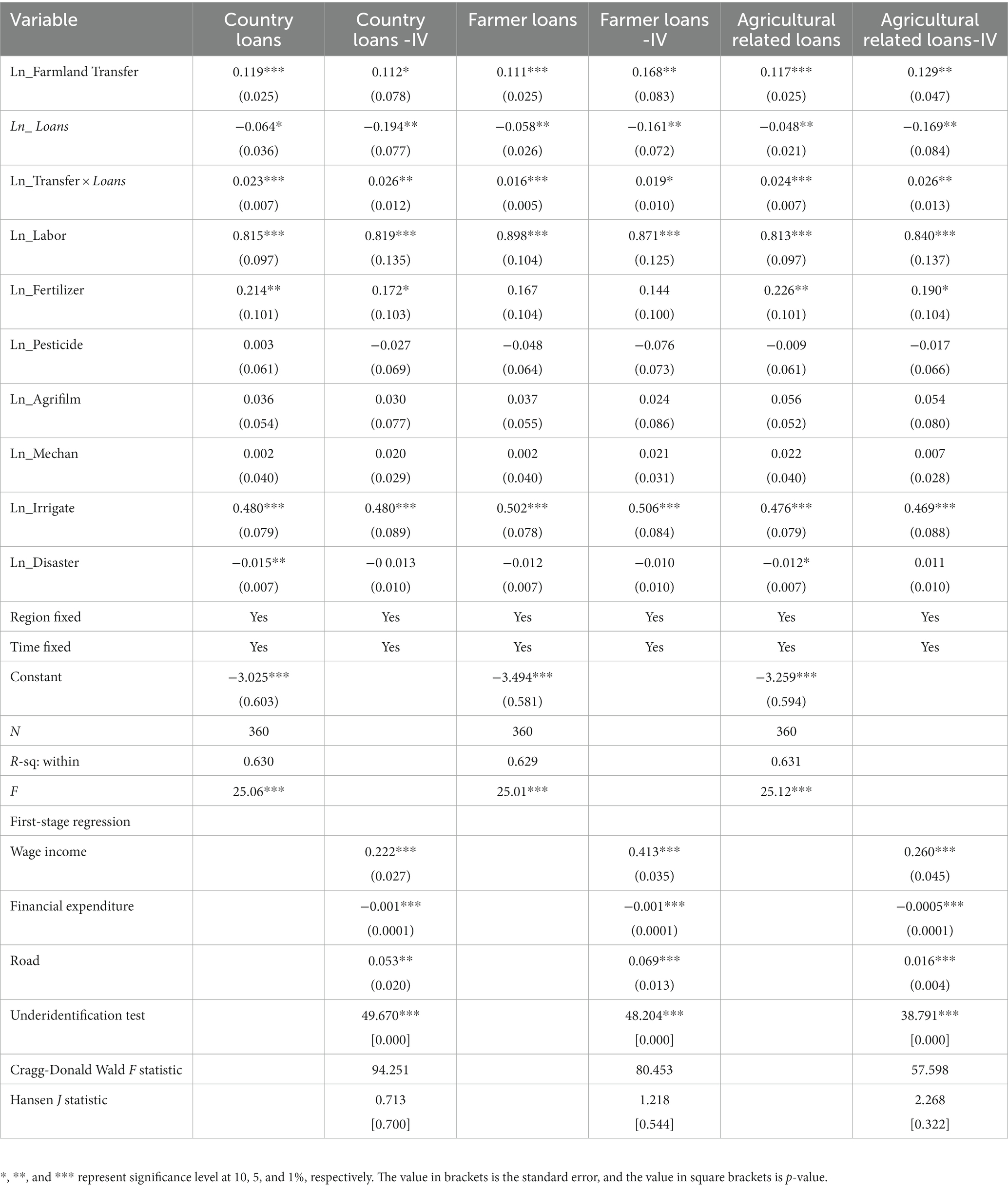

According to various statistical criteria, apart from agricultural loans, there are different types of loans in the agricultural sector, including rural loans, rural household loans and agriculture-related loans. In particular, rural loans refer to loans provided to rural households, rural enterprises and various organizations, emphasizing loans within the administrative scope of counties and below. Rural household loans, on the other hand, are loans issued by commercial banks to eligible rural households for purposes such as production, operation, consumption, and other needs. Agricultural-related loans can be broadly classified into two main categories: loans for agriculture, forestry, animal husbandry, and fisheries (commonly known as “agricultural loans”), and other loans associated with agriculture. The latter category encompasses loans for agricultural materials and the circulation of agricultural products, loans for rural infrastructure construction, loans for agricultural product processing, loans for manufacturing agricultural production materials, loans for farmland construction, loans for agricultural technology, as well as loans for real estate, the construction industry, and rural individual businesses. Due to the different focuses of these various types of loans, their moderating effects on the relationship between farmland transfer and grain production may also differ.

Table 4 presents the role of loans in different agricultural sectors regarding the impact of farmland transfer on grain production. The results indicate that rural loans, rural household loans, and agriculture-related loans are significantly and negatively correlated with grain yield. However, their interaction terms with farmland transfer are all positive, indicating an enhancement of the main effects. Specifically, the findings in columns 1, 3, and 5 reveal that a 1% increase in rural loans, rural household loans, and agriculture-related loans results in a decrease in grain yield of 0.064, 0.058, and 0.048%, respectively. However, when effectively combined with farmland transfer, these loans contribute to an increase in grain yield by 0.119, 0.111, and 0.117%, respectively. Among the control variables, both the labor force and irrigated area remain significant at the 1% level, indicating their importance in grain production. In addition, the application of chemical fertilizers also has a significant positive impact on grain yield.

4.2 Discussion

As global policymakers increasingly focus on food security, food production has become a key area of academic attention. While existing research has explored the economic impacts of farmland transfer and the effects of farmland and finance on agricultural production, the connections among farmland transfer, agricultural loans, and grain production in China remain intricate. And in China, ongoing rural revitalization is altering the agricultural investment and financing model as well as changing how farmland transfers among agricultural operators. In contrast, this study utilizes provincial-level data from China spanning 2009–2020. Employing a two-way fixed effects model and an instrumental variable approach, we assess the impact of farmland transfer and agricultural loans on grain production.

Our findings reveal that farmland transfer contributes to an increase in grain production. The positive effects of farmland transfer to farmers, cooperatives, and enterprises differ, with the most significant effects observed when farmland is transferred to farmers and cooperatives. Therefore, this study argues that farmland transfer to farmers and cooperatives is most conducive to enhancing grain production. This finding aligns with recent studies focusing on farmland transfer and food production (Zang et al., 2021, 2023; Kuang et al., 2022), which highlight the optimization of arable land resource allocation, increased investment, and the promotion of agricultural economic growth through farmland transfer. Continuing to encourage farmland transfer is beneficial for promoting agricultural production and China’s “rural revitalization” initiative.

Interestingly, agricultural loans show a significant negative correlation with grain production. This result is similar to the findings of Khandker and Koolwal (2016), who discovered that microcredit raises agricultural income from activities such as livestock rearing but does not affect crop production. Additionally, this finding aligns with research conducted by Ksoll et al. (2016) and Nakano and Magezi (2020), suggesting that agricultural loans are being utilized for trading and other business purposes rather than investments in grain production, thus not contributing to an increase in grain yield. Although agricultural loans alone do not lead to increased grain production, we find that the interaction between agricultural loans and farmland transfer contributes to the improvement of grain yield. This finding is consistent with Jiang et al. (2023), who recently found that farmland transfer improved credit demand and increased agricultural investment. Luo (2018) also suggests that using land contracting rights as a financing tool integrates the profit-seeking nature, liquidity, exclusivity, and profitability of capital, achieving the financialization of farmland and forming productive entities that provide “specialization production.” Therefore, we argue that while finance serves as a lubricant and catalyst for the flow of other elements in the development of the agricultural industry, its profit-seeking nature may lead to non-agriculturalization. Hence, financial instruments in the agricultural sector should be more closely integrated with medium- to long-term agricultural industry projects. For example, governments should consider relaxing pilot programs for mortgage loans secured by farmland management rights.

Furthermore, we find that farmland transfer, especially when transferred to farmers with financial support, contributes more to grain production compared to transfers to cooperatives and enterprises. Thus, we argue that despite the growing importance of new agricultural operating entities, including cooperatives and family farms, in China’s agricultural industry development, the participation of farmers with a certain scale of cultivation remains a crucial force for grain production.

5 Conclusions and policy implications

The current global food security faces multiple challenges, including dwindling land resources, water scarcity, and insufficient agricultural technology and infrastructure. This study, using provincial-level data from China spanning 2009–2020, employed a two-way fixed effects model and instrumental variable approach to assess the impact of farmland transfer and agricultural loans on grain production. Our findings indicate that farmland transfer has a significantly positive effect on grain production, particularly when farmland is transferred to farmers. In contrast, agricultural loans exhibit a notable negative influence on grain production. However, the interaction between farmland transfer and agricultural loans is positive, suggesting that while financial capital’s profit-oriented nature may not favor low-profit grain crops, it contributes to increasing overall farmland productivity and, subsequently, grain yields. In addition, loans from different statistical categories within the agricultural sector demonstrate a significant negative impact on grain production, but their interaction effects with farmland transfer remain positive, reinforcing the robustness of our results.

These findings carry important policy implications for ensuring food security through the lenses of farmland and finance. Firstly, the government should continue promoting rural land system reforms and actively facilitate farmland transfer. A moderate-scale farmland operation is essential for finance to play a supportive role, and farmland transfer is crucial for promoting large-scale operations. Establishing standardized farmland transfer markets can incentivize agricultural entities to make long-term investments in farmland, thereby enhancing the efficient use of financial and other resources and ensuring the long-term sustainability of grain production. In addition, through the development of farmland finance that integrates farmland and finance, such as farmland mortgage loans, the property attributes of large-scale agricultural land can be leveraged, which will also help to further enhance agricultural productivity. Secondly, it is essential to remain cautious about non-grain challenges that may arise from financial development. While finance has been acknowledged for its positive impact on rural economies, including ours, inconsistent results regarding its influence on grain production suggest the need for careful guidance of agricultural finance. This guidance should direct investments toward medium and long-term agricultural production projects while preventing potential food crises resulting from “non-agricultural” agricultural loans. Thirdly, giving due importance to the rural labor force is significant. Our research reveals that the rural labor force consistently has a positive effect on grain production. Higher non-agricultural wages can drive farmland transfer, free up rural labor from farming, and attract rural labor to urban employment opportunities. Excessive rural-to-urban migration can be detrimental to grain production. Therefore, in addition to increasing grain subsidies for farmers, promoting market-oriented labor factor reforms and facilitating the two-way flow of urban and rural labor is essential.

Although this study has produced valuable findings, there are still areas requiring further exploration and enhancement. For instance, the reliance on macro-level data in this study poses challenges in integrating the individual characteristics, behaviors, and perspectives of farmers and agricultural operators into the analysis. Moreover, the relatively short timeframe of this study may limit its ability to capture long-term impacts and evolving dynamics. Future research endeavors could contemplate extending the observation period to encompass a more comprehensive view of trends. In addition, given the spatial mobility associated with farmland transfer and agricultural loans, future research may also benefit from exploring spatial measurements as a methodological approach.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

ZD contributed to conception and design of the study, and wrote the first draft of the manuscript. QZ organized the database. YT made significant contributions during the paper revision. He played a crucial role in enhancing the introduction and literature review sections in response to reviewers’ feedback, addressing grammatical issues and ensuring overall improvement in the paper. ZD and QZ performed the statistical analysis. All authors contributed to the article and approved the submitted version.

Funding

This study is supported by the National Social Science Fund of China (21CGL026).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^Data was compiled from China Statistical Yearbook.

References

Abate, G. T., Rshid, S., Borzaga, C., and Getnet, K. (2016). Rural finance and agricultural technology adoption in Ethiopia: does the institutional Design of lending organizations matter? World Dev. 84, 235–253. doi: 10.1016/j.worlddev.2016.03.003

Adamie, B. A. (2021). Land property rights and household take-up of development programs: evidence from land certification program in Ethiopia. World Dev. 147:105626. doi: 10.1016/j.worlddev.2021.105626

Ashwood, L., Canfield, J., Fairbairn, M., and De Master, K. (2022). What owns the land: the corporate organization of farmland investment. J. Peasant Stud. 49, 233–262. doi: 10.1080/03066150.2020.1786813

Balana, B. B., Mekonnen, D., Haile, B., Hagos, F., Yimam, S., and Ringler, C. (2022). Demand and supply constraints of credit in smallholder farming: evidence from Ethiopia and Tanzania. World Dev. 159:106033. doi: 10.1016/j.worlddev.2022.106033

Barrett, C. B. (1996). On price risk and the inverse farm size-productivity relationship. J. Dev. Econ. 51, 193–215. doi: 10.1016/S0304-3878(96)00412-9

Baumgartner, P., von Braun, J., Abebaw, D., and Müller, M. (2015). Impacts of large-scale land investments on income, prices, and employment: empirical analyses in Ethiopia. World Dev. 72, 175–190. doi: 10.1016/j.worlddev.2015.02.017

Berry, R. A. (1972). Farm size distribution, income distribution, and the efficiency of agricultural production: Colombia. Am. Econ. Rev. 62, 403–408.

Cao, H., Zhu, X., Heijman, W., and Zhao, K. (2020). The impact of land transfer and farmers’ knowledge of farmland protection policy on pro-environmental agricultural practices: the case of straw return to fields in Ningxia China. J. Clean. Product. 277:123701. doi: 10.1016/j.jclepro.2020.123701

Chamberlin, J., and Ricker-Gilbert, J. (2016). Participation in rural land rental markets in sub-Saharan Africa: who benefits and by how much? Evidence from Malawi and Zambia. Am. J. Agric. Econ. 98, 1507–1528. doi: 10.1093/ajae/aaw021

Chavas, J. P., Petrie, R., and Roth, M. (2005). Farm household production efficiency: evidence from the Gambia. Am. J. Agric. Econ. 87, 160–179. doi: 10.1111/j.0002-9092.2005.00709.x

Chayanov, A. (1966). The theory of the peasant economy. American Economic Association, Homewood, Illinois: Richard D. Irwin, Inc.

Chen, S., Wilson, W. W., Larsen, R., and Dahl, B. (2015). Investing in agriculture as an asset class. Agribusiness 31, 353–371. doi: 10.1002/agr.21411

Clapp, J., Isakson, S. R., and Visser, O. (2017). The complex dynamics of agriculture as a financial asset: introduction to symposium. Agric. Hum. Values 34, 179–183. doi: 10.1007/s10460-016-9682-7

Coakley, J. (1994). The integration of property and financial markets. Environ Plan A 26, 697–713. doi: 10.1068/a260697

Das, N., de Janvry, A., and Sadoulet, E. (2019). Credit and land contracting: a test of the theory of sharecropping. Am. J. Agric. Econ. 101, 1098–1114. doi: 10.1093/ajae/aaz005

Deininger, K. (2011). Challenges posed by the new wave of farmland investment. J. Peasant Stud. 38, 217–247. doi: 10.1080/03066150.2011.559007

Deininger, K., Savastano, S., and Carletto, C. (2012). Land fragmentation, cropland abandonment, and land market operation in Albania. World Dev. 40, 2108–2122. doi: 10.1596/1813-9450-6032

Elahi, E., Abid, M., Zhang, L., Haq, S., and Sahito, J. G. M. (2018). Agricultural advisory and financial services; farm level access, outreach and impact in a mixed cropping district of Punjab, Pakistan. Land Use Policy 71, 249–260. doi: 10.1016/j.landusepol.2017.12.006

Emerick, K., De Janvry, A., Sadoulet, E., and Dar, M. H. (2016). Technological innovations, downside risk, and the modernization of agriculture. Am. Econ. Rev. 106, 1537–1561. doi: 10.1257/aer.20150474

Eskander, S. M. S. U., and Barbier, E. B. (2022). Adaptation to natural disasters through the agricultural land rental market: evidence from Bangladesh. Land Econ. 2022, 032421–0031R. doi: 10.3368/le.032421-0031R

Fairbairn, M. (2014). ‘Like gold with yield’: evolving intersections between farmland and finance. J. Peasant Stud. 41, 777–795. doi: 10.1080/03066150.2013.873977

Fairbairn, M., LaChance, J., De Master, K., and Ashood, L. (2021). In vino veritas, in aqua lucrum: farmland investment, environmental uncertainty, and groundwater access in California’s Cuyama Valley. Agric. Hum. Values 38, 285–299. doi: 10.1007/s10460-020-10157-y

Fan, D., Wang, C., Wu, J., Wang, Q., and Liu, X. (2021). Nonfarm employment, large-scale farm enterprises and farmland transfer in China: a spatial econometric analysis. J. Asia Pac. Econ. 27, 84–100. doi: 10.1080/13547860.2021.1927476

Fei, R., Lin, Z., and Chunga, J. (2021). How land transfer affects agricultural land use efficiency: evidence from China’s agricultural sector. Land Use Policy 103:105300. doi: 10.1016/j.landusepol.2021.105300

Fink, G., Jack, B. K., and Masiye, F. (2020). Seasonal liquidity, rural labor markets, and agricultural production. Am. Econ. Rev. 110, 3351–3392. doi: 10.1257/aer.20180607

Gao, J., Song, G., and Sun, X. (2020). Does labor migration affect rural land transfer? Evidence from China. Land Use Policy. 99:105096. doi: 10.1016/j.landusepol.2020.105096

Gong, M., and Elahi, E. (2022). A nexus between farmland rights, and access, demand, and amount of agricultural loan under the socialist system of China. Land Use Policy 120:106279. doi: 10.1016/j.landusepol.2022.106279

Grimm, M., and Klasen, S. (2015). Migration pressure, tenure security and agricultural intensification: evidence from Indonesia. Land Econ. 91, 411–434. doi: 10.3368/le.91.3.411

Haila, A. (1988). Land as a financial asset: the theory of urban rent as a mirror of economic transformation. Antipode 20, 79–101. doi: 10.1111/j.1467-8330.1988.tb00170.x

Hornbeck, R. (2010). Barbed wire: property rights and agricultural development. Q. J. Econ. 125, 767–810. doi: 10.1162/qjec.2010.125.2.767

Hossain, M., Malek, M. A., Hossain, M. A., Reza, M. H., and Ahmed, M. S. (2019). Agricultural microcredit for tenant farmers: evidence from a field experiment in Bangladesh. Am. J. Agric. Econ. 101, 692–709. doi: 10.1093/ajae/aay070

Huang, J., and Ding, J. (2016). Institutional innovation and policy support to facilitate small-scale farming transformation in China. Agric. Econ. 47, 227–237. doi: 10.1111/agec.12309

Jayne, T. S., Muyanga, M., Wineman, A., Ghebru, H., Stevens, C., Stickler, M., et al. (2019). Are medium-scale farms driving agricultural transformation in sub-Saharan Africa? Agric. Econ. 50, 75–95. doi: 10.1111/agec.12535

Jiang, M., Paudel, K. P., Mi, Y., and Li, J. (2023). Farmland transfer and rural financial structure: evidence from China. Int. Rev. Financ. Anal. 90:102897. doi: 10.1016/j.irfa.2023.102897

Jin, S., and Deininger, K. (2009). Land rental markets in the process of rural structural transformation: productivity and equity impacts from China. J. Comp. Econ. 37, 629–646. doi: 10.1016/j.jce.2009.04.005

Jin, S., and Jayne, T. S. (2013). Land rental markets in Kenya: implications for efficiency, equity, household income, and poverty. Land Econ. 89, 246–271. doi: 10.3368/le.89.2.246

Kan, K. (2021). Creating land markets for rural revitalization: land transfer, property rights and gentrification in China. J. Rural. Stud. 81, 68–77. doi: 10.1016/j.jrurstud.2020.08.006

Khandker, S. R., and Koolwal, G. B. (2016). How has microcredit supported agriculture? Evidence using panel data from Bangladesh. Agric. Econ. 47, 157–168. doi: 10.1111/agec.12185

Kinsey, J. (1985). Measuring the well-being of farm households: farm, off-farm, and in-kind sources of income: discussion. Am. J. Agric. Econ. 67, 1105–1107. doi: 10.2307/1241381

Kochar, A. (1997). Does lack of access to formal credit constrain agricultural production? Am. J. Agric. Econ. 79, 754–763. doi: 10.2307/1244417

Ksoll, C., Lilleør, H. B., Lønborg, J. H., and Rasmussen, O. D. (2016). Impact of village savings and loan associations: evidence from a cluster randomized trial. J. Dev. Econ. 120, 70–85. doi: 10.1016/j.jdeveco.2015.12.003

Kuang, Y. P., Yang, J. L., and Abate, M. C. (2022). Farmland transfer and agricultural economic growth nexus in China: agricultural TFP intermediary effect perspective. China Agric. Econ. Rev. 14, 184–201. doi: 10.1108/CAER-05-2020-0076

Leimer, D., Levers, C., Sun, Z., and Müller, D. (2022). Market proximity and irrigation infrastructure determine farmland rentals in Sichuan Province, China. J. Rural. Stud. 94, 375–384. doi: 10.1016/j.jrurstud.2022.07.009

Li, Y., Fan, Z., Jiang, G., and Quan, Z. (2021). Addressing the differences in farmers’ willingness and behavior regarding developing green agriculture—a case study in Xichuan County China. Land 10:316. doi: 10.3390/land10030316

Lin, W., and Huang, J. (2021). Impacts of agricultural incentive policies on land rental prices: new evidence from China. Food Policy 104:102125. doi: 10.1016/j.foodpol.2021.102125

Liu, Y., Li, J., and Yang, Y. (2018). Strategic adjustment of land use policy under the economic transformation. Land Use Policy 74, 5–14. doi: 10.1016/j.landusepol.2017.07.005

Luo, B. (2018). 40-year reform of farmland institution in China: target, effort and the future. China Agric. Econ. Rev. 10, 16–35. doi: 10.1108/CAER-10-2017-0179

Luo, B., and Fu, B. (2009). The farmland property rights deformity: the history, reality and reform. China Agric. Econ. Rev. 1, 435–458. doi: 10.1108/17561370910989266

Magnan, A. (2015). The financialization of Agri-food in Canada and Australia: corporate farmland and farm ownership in the grains and oilseed sector. J. Rural. Stud. 41, 1–12. doi: 10.1016/j.jrurstud.2015.06.007

Martin, S. J., and Clapp, J. (2015). Finance for agriculture or agriculture for finance? J. Agrar. Chang. 15, 549–559. doi: 10.1111/joac.12110

Nakano, Y., and Magezi, E. F. (2020). The impact of microcredit on agricultural technology adoption and productivity: evidence from randomized control trial in Tanzania. World Dev. 133:104997. doi: 10.1016/j.worlddev.2020.104997

Nguyen, T. T., Tran, V. T., Nguyen, T. T., and Grote, U. (2021). Farming efficiency, cropland rental market and income effect: evidence from panel data for rural Central Vietnam. Eur. Rev. Agric. Econ. 48, 207–248. doi: 10.1093/erae/jbaa013

Ouma, S. (2015). Getting in between M and M′ or: how farmland further debunks financialization. Dialog. Hum. Geogr. 5, 225–228. doi: 10.1177/2043820615588160

Ouma, S. (2016). From financialization to operations of capital: historicizing and disentangling the finance–farmland-nexus. Geoforum 72, 82–93. doi: 10.1016/j.geoforum.2016.02.003

Peng, K., Yang, C., and Chen, Y. (2020). Land transfer in rural China: incentives, influencing factors and income effects. Appl. Econ. 52, 5477–5490. doi: 10.1080/00036846.2020.1764484

Phan, D. K., Gan, C., Nartea, G. V., and Cohen, D. A. (2014). The impact of microcredit on rural households in the Mekong River Delta of Vietnam. J. Asia Pac. Econ. 19, 558–578. doi: 10.1080/13547860.2014.920591

Poulton, C., Dorward, A., and Kydd, J. (2010). The future of small farms: new directions for services, institutions, and intermediation. World Dev. 38, 1413–1428. doi: 10.1016/j.worlddev.2009.06.009

Rogers, S., Wilmsen, B., Han, X., Wang, Z. J., Duan, Y., He, J., et al. (2021). Scaling up agriculture? The dynamics of land transfer in inland China. World Dev. 146:105563. doi: 10.1016/j.worlddev.2021.105563

Rotz, S., Fraser, E. D. G., and Martin, R. C. (2019). Situating tenure, capital and finance in farmland relations: implications for stewardship and agroecological health in Ontario Canada. J. Peas. Stud. 46, 142–164. doi: 10.1080/03066150.2017.1351953

Shete, M., and Rutten, M. (2015). Impacts of large-scale farming on local communities’ food security and income levels–empirical evidence from Oromia region, Ethiopia. Land Use Policy 47, 282–292. doi: 10.1016/j.landusepol.2015.01.034

Sippel, S. R., Larder, N., and Lawrence, G. (2017). Grounding the financialization of farmland: perspectives on financial actors as new land owners in rural Australia. Agric. Hum. Values 34, 251–265. doi: 10.1007/s10460-016-9707-2

Sommerville, M., and Magnan, A. (2015). ‘Pinstripes on the prairies’: examining the financialization of farming systems in the Canadian prairie provinces. J. Peasant Stud. 42, 119–144. doi: 10.1080/03066150.2014.990894

Su, B., Li, Y., Li, L., and Wang, Y. (2018). How does nonfarm employment stability influence farmers' farmland transfer decisions? Implications for China’s land use policy. Land Use Policy 74, 66–72. doi: 10.1016/j.landusepol.2017.09.053

Thanh, P. T., Saito, K., and Duong, P. B. (2019). Impact of microcredit on rural household welfare and economic growth in Vietnam. J. Policy Model. 41, 120–139. doi: 10.1016/j.jpolmod.2019.02.007

Wang, Y., Lu, H., Chen, Y., Yang, P., Cheng, X., and Xie, F. (2023). The impact of farmland management rights mortgage loan on the Agri-food industrial agglomeration: case of Hubei Province. Land 12:1389. doi: 10.3390/land12071389

Wang, Y., Xin, L., Zhang, H., and Li, Y. (2019). An estimation of the extent of rent-free farmland transfer and its driving forces in rural China: a multilevel logit model analysis. Sustainability 11:3161. doi: 10.3390/su11113161

Yang, X., Luo, J., and Yan, W. (2018). Heterogeneous effects of rural land property mortgage loan program on income: evidence from the western China. China Agric. Econo. Rev. 10, 695–711. doi: 10.1108/CAER-12-2015-0179

Zang, L., Wang, Y., and Su, Y. (2021). Does farmland scale management promote rural collective action? An empirical study of canal irrigation systems in China. Land 10:1263. doi: 10.3390/land10111263

Zhang, L., Cao, Y., and Bai, Y. (2019). The impact of the land certificated program on the farmland rental market in rural China. J. Rural. Stud. 93, 165–175. doi: 10.1016/j.jrurstud.2019.03.007

Zhang, X., Hu, L., and Yu, X. (2023). Farmland leasing, misallocation reduction, and agricultural total factor productivity: insights from rice production in China. Food Policy 119:102518. doi: 10.1016/j.foodpol.2023.102518

Zhang, J., Mishra, A. K., and Hirsch, S. (2021). Market-oriented agriculture and farm performance: evidence from rural China. Food Policy 100:102023. doi: 10.1016/j.foodpol.2021.102023

Keywords: farmland transfer, agricultural loans, grain production, non-farming, China

Citation: Ding Z, Zhang Q and Tang Y (2024) Nexus between farmland transfer, agricultural loans, and grain production: empirical evidence from China. Front. Sustain. Food Syst. 8:1229381. doi: 10.3389/fsufs.2024.1229381

Edited by:

Tibebu Kassawmar, Addis Ababa University, EthiopiaReviewed by:

Noshaba Aziz, Shandong University of Technology, ChinaSatis Devkota, University of Minnesota Morris, United States

K. V. Suryabhagavan, Addis Ababa University, Ethiopia

Copyright © 2024 Ding, Zhang and Tang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhao Ding, emRpbmdAc2ljYXUuZWR1LmNu

Zhao Ding

Zhao Ding Qianyu Zhang

Qianyu Zhang