- 1School of Economy, Shandong Women’s University, Jinan, China

- 2School of Economics and Trade, Shandong Management University, Jinan, China

- 3College of Economics and Management, Northeast Agricultural University, Harbin, China

Improving food total factor productivity is a necessary way to break the double constraint of resources and environment, and promote the transformation of the food production system and the realization of the sustainable development goal of zero hunger. Based on the panel data of 729 counties in China from 2010 to 2019, this paper analyzes the effect of county financial marketization reform on food total factor productivity by using a two-way fixed effects model, focusing on the mechanism of the quality of factors such as land, labor and capital. The results show that county financial marketization reform promoted food total factor productivity growth by promoting technical progress, while technical efficiency did not play a significant role. Heterogeneity analysis shows that the effect of county financial marketization reform on grain total factor productivity is not significantly different in eastern and central China. There is a significant difference in the western region, where county financial market reform hindered the growth of grain total factor productivity. In terms of different functional areas of grain production, the facilitating effect is only played in the main grain production area, and the inhibiting effect is played in the main grain marketing area. Mechanistic analysis shows that the county financial marketing reform promoted the growth of food total factor productivity by improving the quality of labor and land, while the quality of agricultural capital has a masking effect. On this basis, it is necessary for the government to implement differentiated financial market-oriented reform strategies, and to guide and encourage county financial institutions to provide financial services to improve the quality of agricultural labor and farmland through tax incentives and loan interest subsidies.

1 Introduction

According to The State of Food Security and Nutrition in the World 2023, there will be about 735 million hungry people in the world in 2022, an increase of 122 million compared to 2019, the year before the New Crown outbreak.1 Increasing the supply capacity of food production and eradicating hunger has become the most important agenda for global sustainable development. China is the world’s largest food producer, solving the problem of feeding about 1/5 of the world’s population with less than 9% of the world’s arable land, and making important contributions to the global goal of zero hunger.2 However, while China’s total grain production has been steadily increasing, it is facing a severe test of many problems, such as excessive resource consumption, serious non-point source pollution, and deterioration of the ecological environment (Ghose, 2014; Guo et al., 2023). The traditional food production model characterized by high input, high output, and high waste is unsustainable, and there is an urgent need to reform the food production system and invest in a sustainable and efficient food production model (Yu et al., 2023). Total factor productivity of food refers to the part of the growth of food production that cannot be explained by the growth of production factor inputs, but by the growth brought about by advanced technology, knowledge and skills, factor allocation, organization and management, institutional innovation, and other factors other than production factors (Solow, 1957; Schultz, 1964; Jorgenson and Gollop, 1992). It can comprehensively reflect the development and utilization efficiency of labor, capital, land and other factors in food production (Hulten, 2001; Comin, 2010). Improving the total factor productivity of food is a necessary way to break the double constraint of resources and environment and promote the transformation of the food production system and the realization of the sustainable development goal of zero hunger (Melfou et al., 2007; Zidouemba and Gerard, 2018). Therefore, how to improve the total factor productivity of food and find a way to increase food production in a sustainable and efficient way is currently an urgent issue.

Compared with the traditional food production mode, the modern food production mode driven by total factor productivity pays more attention to the contribution of agricultural technology, factor allocation, factor quality, institutional innovation, infrastructure construction and other factors (Avila and Evenson, 2010; Bao et al., 2021; Luo et al., 2022; Guo and Zhang, 2023). And many activities such as agricultural technology innovation and application, structural adjustment of factor allocation, factor quality enhancement, promotion and implementation of agricultural policies cannot be separated from the support of financial capital (Lemecha, 2023). As the frontier of urban and rural financial services, county finance is closely related to the multiple drivers of food total factor productivity improvement. Under the combined effect of a series of policy promotion, institutional innovation, economic development and other multiple factors, the development of financial marketization in China’s counties has made important progress. The reform of interest rate marketisation has been completed and financial liberalization is gradually increasing (Wang and He, 2019). According to financial deepening theory, reducing excessive government intervention in county financial markets and giving full play to the regulatory role of market mechanisms can help improve the efficiency of county financial resource allocation and enhance the operational capacity and service level of county rural financial institutions (McKinnon, 1973; Shaw, 1973). However, a problem arises from the low profitability and high risk of food cultivation and the profit oriented and risk-averse nature of financial institutions. Will the county financial marketization reforms still be a driving force for food total factor productivity growth if the county finance is fully marketed, liberalized, and the market distributes financial resources? And what is the role of factor quality of land, labor and capital in the relationship? The answer to this question helps to accurately grasp the current operational mechanism and laws of county financial market-oriented development in the process of enhancing total factor productivity of food.

The established literature focuses on the performance of financial market-oriented reforms and the relationship between financial credit and total factor productivity of food. On the one hand, as financial market-oriented reforms deepen and financial markets become increasingly competitive, scholars have assessed the effects of their reforms in terms of economic development (Hossin, 2023), corporate financing constraints (Sanga and Aziakpono, 2022), corporate performance (Ochanda, 2014), financial institution performance (Olawumi et al., 2017), and the urban–rural income gap (Hassan and Meyer, 2021). In the field of agricultural production, the financial support effect of financial marketization is still controversial in academia, with some scholars arguing that financial market reforms have reduced the support of rural financial institutions to agriculture (Paul, 1999). The county rural financial system shrank, and there were less credit resources available, as a result of some state-owned commercial banks leaving county areas when the county financial market was reformed. Financial institutions will reduce financial support for agriculture under the effect of both economic profit and risk-taking. In contrast to the above view, as the gap between the return on investment in agriculture and the commercial and industrial sectors closes and the credit conditions in the agricultural sector are optimized, some academics think that the market-oriented reform of financial institutions at this point has contributed to the deepening of inclusive financial services (Muhammad Adnan and Wizarat, 2011; Onuka and Odinakachukwu, 2020). On the other hand, most of the literature on the impact of financial credit on total factor productivity in food has looked at the micro demand side of financial credit constraints and availability. For example, Amoah and Kwarteng (2020) argue that financial credit constraints have a negative impact on food total factor productivity. A few literatures have explored the fiscal and financial perspective, and most scholars believe that agricultural subsidy policies play a positive role in total factor productivity growth of food (Gao et al., 2017). The influence of digital inclusive finance and rural financial development on total factor productivity in agriculture is also examined in another category of research from a macro supply-side viewpoint (Shen et al., 2023).

In conclusion, research to far has concentrated on examining the effects of financial credit restrictions and government led finance on the productivity of all factors affecting food. The influence of county financial marketization on food total factor productivity and its mode of action following the reform of county financial marketization to distribute financial resources more by the market, however, have not yet been the subject of studies. However, there have been no studies that have focused on the impact of county financial market reforms on total factor productivity of food and its mechanisms of action. To this end, this paper uses panel data of 729 counties (county-level cities) from 2010 to 2019 to systematically examine the effects of county financial marketization on total factor productivity of food. It then focuses on the mechanistic role of agricultural factor quality through a mediating effects model.

The possible innovations in this paper include, firstly, the construction of an analytical framework for the impact of county financial marketization on total factor productivity of food, which enriches the research related to the evaluation of the implementation effect of county financial marketization reform policies. Second, to further close the gap between existing studies that primarily examine the mechanism of financial credit affecting total factor productivity in agriculture from the perspectives of agricultural technological advancement and agricultural capital deepening with credit support, this paper analyzes the intrinsic mechanism of county financial marketization affecting total factor productivity in food from the perspective of factors quality of land, labor, and capital. Thirdly, empirical studies based on Meso-level county panel data compensate for the fact that most prior research has focused on the effects of financial availability on total factor productivity in agriculture at the provincial and municipal levels or the effects of credit restrictions on total factor productivity of farm households at the individual micro level.

2 Theoretical analysis and research hypothesis

2.1 Analysis of the impact of county financial marketization reforms on food total factor productivity

Combined with the practice of financial development in China’s counties, in the context of the central and local governments’ continuous promotion of county financial market-oriented reforms and county financial support for farmers and beneficiaries, China’s county financial scale has been expanding, the financial structure has been continuously optimized, financial efficiency has been gradually improved, and county financial marketization has reached a new level (Liu and Yan, 2022). The savings effect, the investment effect, and the marginal productivity of agricultural capital (technological innovation effect) are the three main ways that county financial marketization affects total factor productivity of food, in accordance with the financial marketization theory of McKinnon (1973) and Shaw (1973), endogenous economic growth theory, and endogenous financial development theory.

2.1.1 Theoretical logic analysis of the savings effect of county financial marketisation reforms and the increase in agricultural lending

Firstly, we address the savings effect of county-level financial market reform. The central idea of financial market reform is to liberalize interest rate controls and loosen restrictions on the admission of financial institutions to accomplish market-based pricing and free competition, thereby improving the efficiency of capital allocation (McKinnon, 1973). Before the reform of the county-level financial market in China, the pervasive problem of interest rate control in rural areas had suppressed the deposit rates of financial institutions. This suppressed tendency of rural residents in these counties to turn their income into bank savings, resulting in the smaller scale of savings in the county financial institutions.

To promote county-level financial market reform, the Chinese Government has launched a series of policies. On the one hand, easing admission restrictions in the county-level financial market and implementing incremental reform of rural finance in these counties. For instance, a new round of reform was initiated for the rural credit union system in 2003; “entrance policy” and cross-regional operations of city commercial banks relaxed in 2006; incremental reform of rural finance in county-level regions encouraging the establishment of rural banks and other new financial institutions in 2012. On the other hand, the implementation of interest rate marketization reform. In 2013, the People’s Bank of China fully liberalized the lending interest rate control of financial institutions, and in October 2015, completely canceled the deposit rate ceiling for commercial banks and rural cooperative financial institutions. Driven by financial liberalization, a financial system gradually formed in county-level regions, consisting of large-scale state-owned commercial banks, national joint-stock commercial banks, city shareholding banks, rural credit unions, rural commercial banks, rural cooperative banks, as well as non-banking financial institutions like insurance companies, securities companies, and guarantee companies. According to the latest statistics from the China Banking and Insurance Regulatory Commission, the current coverage of township banking institutions in China is 97.92%. Basic financial services and township insurance services have been primarily extended to all administrative villages, meeting the financial needs of rural residents such as cash deposits and withdrawals, remittances, and daily payments.

As the number and variety of financial institutions in county regions increase, competition among them becomes increasingly fierce, forcing these institutions to accelerate the development of financial products. They aim to attract idle funds from rural residents by offering high-interest financial products. Ultimately, this brings the actual interest rate level in the county financial market closer to the equilibrium interest rate level, increasing the overall financial savings scale in the county. At the same time, with the advancement of market-oriented reforms and the relaxation of interest rate controls in county financial markets, financial institutions are becoming more and more enthusiastic about participating in the construction of the county’s credit system. As the regional credit environment improves, the risk factors for depositors and investors will be greatly reduced, which helps to strengthen residents’ savings intentions and attract more economic entities to participate in investment and financing activities. This lays a foundation for increasing agricultural loans.

Secondly, the mechanism of county-level financial market reform promoting the increase of agricultural loans is elaborated. An important source of funds for improving the total factor productivity of grain is the deposit savings of local county-level financial institutions. The savings effect of county-level financial market reforms will contribute to the increase of agricultural loans. The reasons come from two aspects. On the one hand, there is the role of policy promotion. In the past, due to the high risk and low returns of agriculture, commercial banks played the role of a “water pump,” transferring savings from rural areas in counties to urban areas for urban construction, thus reducing the savings scale in rural regions. Under the background of county-level financial market reform, the Chinese government has introduced a series of measures to prevent excessive capital outflow in county-level finance, such as “strengthening performance appraisal guidance and reasonably increasing the loan-to-deposit ratio in counties with severe capital outflows” and “increasing support for financial institutions with legal-person branches and business operations in county-level regions.” At the same time, in response to the rural revitalization strategy, a series of financial support policies for agriculture and benefiting farmers have been introduced, such as “supporting rural financial institutions to actively expand rural financial business,” “establishing market incentive mechanisms to serve agriculture, rural areas, and farmers,” and “supporting cities and counties to build shared agricultural credit information databases within their regions.” With government policy incentives, county-level financial institutions will increase agricultural loan funds supply to alleviate rural credit constraints.

On the other hand, there is the role of market competition. With the advancement of county-level financial market reform, the number and types of county-level financial institutions continue to expand, and the degree of competition in the financial market becomes increasingly fierce. Under the circumstances of intensified competition and limited customer resources, on one hand, it encourages banks to focus more on high-quality customers, maintain relationships with them by improving financial service efficiency, innovating business models, and increasing credit lines to prevent customer diversion (Zhang et al., 2021), such as providing credit support to leading agricultural enterprises and high-quality agricultural operators. On the other hand, to seize a larger market share in the competition and consolidate its position in the county-level rural financial market, financial institutions will increase agricultural loan supply and lower loan interest rates, prompting financial services to extend to blank and rural areas, enhancing the penetration of rural financial services, and alleviating credit constraints for disadvantaged groups like small farmers (Wang and He,2019). In addition, the development and application of financial technology such as big data information collection also contribute to the construction of the rural credit system, reducing banks’ agricultural-related lending costs, thus reducing agricultural loan interest rates (Cornelli et al., 2023), and alleviating farmers’ loan constraints.

From a practical perspective, the scale of China’s agricultural loans has expanded steadily. According to the financial lending statistics report for the third quarter of 2023 issued by the People’s Bank of China, at the end of the third quarter of 2023, the rural (county and below) loan balance was 46.6 trillion yuan, a year-on-year increase of 15.4%, and the household loan balance was 16.67 trillion yuan, a year-on-year increase of 12.6%. In comparison, the rural loan balance at the end of 2010 was 9.8 trillion yuan, an increase of 475%, and the household loan balance was 2.6 trillion yuan, an increase of 641%. This fully demonstrates that China’s county-level market-oriented reform has indeed promoted the increase in the scale of agricultural loans.

2.1.2 Theoretical logic analysis of accelerating savings to investment conversion through county-level financial market reform

Firstly, county-level financial market reform helps to enhance the capacity to obtain farmer’s information, reduce asymmetry between financial institutions, funds demanders, and savers, lower transaction costs when transforming savings into investment funds, thus significantly improving the efficiency of county-level savings-to-investment conversion. County-level financial market reform intensifies competition among financial institutions and reduces the value of marginal returns of financial institutions. To improve client acquisition and reduce the costs of searching and processing farmer’s credit information, rural financial institutions opt for digitization (Diener and Špaček, 2021). Also, in the context of interest rate marketization and financial liberalization, the need to compete with internet finance compels rural financial institutions to embrace digital transformation, thereby accelerating the development of financial technology innovation. Under the traditional financial loan model, it is hard or costly to collect and process farmers’ credit information and production information, resulting in higher credit constraints for farmers. Under the bank digital transformation facilitated by financial market reform, banks can provide a modern symmetric mechanism for rural credit subjects such as farmers by using big data credit investigation and intelligent credit evaluation systems.

Regarding agricultural production and management information, satellite remote sensing credit technology enables rural financial institutions to monitor crop conditions in real time. Moreover, in the era of fintech, all information related to farmers which includes production, sales, payment trajectories, and default information is recorded on the blockchain under the “blockchain technology + agricultural supply chain + rural credit system”(Bhatia et al., 2023). Therefore, based on diverse heterogeneous information, the comprehensive evaluation of farmers’ credit can solve the problems of insufficient data sources, low efficiency, high difficulty, and high cost when collecting information for credit evaluation. This allows for the assessment and selection of grain planting projects and entities with higher investment returns. Rural financial institutions, actively combining with fintech, can develop online lending products like “e-loan” with features such as online application, online intelligent auditing, and online fund transfer breaking the limitations of traditional “one-to-one” manual services and saving a significant amount of branch construction and maintenance costs, as well as labor costs (Ghose and Maji, 2022).

Moreover, to increase profits in a competitive market environment, rural financial institutions will focus more on the efficiency of collecting farmer’s credit information, actively communicate with farmers, and promote financial literacy through online and offline methods. The higher the degree of financial marketization, the better the information environment in which farmers are situated. The larger the collection of elements related to information acquisition, communication, and utilization, the more ways for farmers to collect information and acquire more financial knowledge. As financial literacy improves, farmers are likely to be more willing to obtain formal financial loans, and less likely to hide personal information due to conservatism, hence effectively mining farmer’s credit information and reducing the information barriers between banks and farmers (Raza et al., 2023).

Secondly, market-oriented reform of the county-level financial system can promote rural financial institutions to develop financial services such as agricultural supply chain finance, agricultural land management right mortgages, and rural housing mortgages, which will help alleviate the problem of quality of collateral for agricultural production entities. In the agricultural supply chain financing model, core enterprises can utilize their credit advantages to provide financing guarantees for agricultural production subjects in the supply chain (Liu and Yan, 2020). Facilitating loans with farmland operation rights and rural housing as collateral deftly grapples with the problematic issues of substandard guarantees and the scarcity of quality collateral pertaining to the operations of farmers and other agricultural entities.

Within the financial liberalization and interest rate marketization reforms, innovative finance models, epitomized by online banks, have flourished rapidly. Taking advantage of their unrivaled channel positioning, big data capabilities, and advanced technology (Cornelli et al., 2023), they offer inventive financing solutions such as “Wang Nong Loan” that are custom-made to suit the needs of agricultural entities. This strategic move effectively fills the service void left by traditional financial institutions. Additionally, digital finance platforms provide assurance and funding support for agricultural operations via digital agricultural supply chain finance solutions (Bhatia et al., 2023). This approach promptly rectifies the limitations tied to collateral. Concurrently, the growth of digital finance ignites robust competition within rural finance markets, inducing traditional financial institutions to veer toward digital transformation and innovate in rural finance services via a “catfish effect” (Shen et al., 2023). This evolution eventually reduces issues related to information asymmetry among farmers and the insufficiency of agricultural collateral, ultimately steering toward expanded agricultural lending options.

Thirdly, the reform of financial marketisation in counties will help to increase the willingness of farmers to take out loans and allocate more funds to agricultural operators with genuine credit needs, thus accelerating the conversion of savings into investment. With the advancement of financial liberalization and interest rate marketization, financial institutions have gained the autonomous right to price deposit and loan interest rates. Under intensified market competition, the marginal returns of rural financial institutions will decline. To this end, rural financial institutions will timely adjust the interest rate pricing of financial products. They might raise deposit interest rates and simultaneously lower loan rates to seize market share. Moreover, as analyzed previously, county-level financial marketization reform helps reduce information asymmetry, overcome collateral insufficiency, and lower loan transaction costs. As transaction costs decrease, banks have more room to reduce agricultural loan rates. Thus, as agricultural loan rates drop and service efficiency improves, agricultural producers’ willingness to utilize financial credit to expand their agricultural operations or increase consumption will be enhanced (Nwaru et al., 2005).

Besides loan interest rates, the financial literacy of farmers, the innovation of mortgage loan models, and the service capabilities of financial institutions are also key influencing factors on the loan willingness of agricultural producers (Widhiyanto et al., 2018). As discussed earlier, county-level financial marketization reform will elevate the financial literacy level of farmers, accelerate the digital transformation of rural financial institutions, and encourage innovations in financial products like farmland mortgage loans and agricultural supply chain finance, increasing the efficiency and level of rural financial services. This, in turn, will boost agricultural producers’ personalized loan demand and willingness.

2.1.3 Analysis of technological innovation effects of county financial marketisation reforms

From neoclassical growth theory to endogenous growth theory, a basic theorem follows: in order to achieve positive total factor productivity growth in the long run, technological innovation and continuous progress in advanced knowledge must be maintained (Solow, 1956; Swan, 1956; Hicks and Meade, 1961; Romer, 1986; Lucas, 1988). A significant increase in the level of innovation and application of food production technology in a region would undoubtedly have a profound impact on total factor productivity growth in the food sector (Comin, 2010; Lu et al., 2023). According to Schumpeter, technological R&D innovation and transformation of results require significant financial support; however, food production technology R&D enterprises face financing challenges due to information asymmetry and higher transaction costs in rural financial markets (Islam et al., 2011). On the one hand, financial marketization in the county area can reduce the agency cost of assessing the credit status of food production technology R&D enterprises through economies of scale, thereby increasing the availability of credit. On the other hand, the higher the degree of financial marketization, the better the information environment for market investors, and the larger the collection of various elements related to information acquisition, exchange, sharing and utilization. Market investors can obtain more investment opportunities at lower costs, which in turn will guide private capital to invest in technological innovation projects with higher expected returns, providing financial support for the process of research and development, innovation, and transformation of food production technology, and ultimately promoting the growth of total factor productivity in food.

In addition, innovation activities in food production technology are highly risky because the process of technological innovation is full of uncertainty, and innovation activities do not necessarily bring additional benefits, but on the contrary, may result in negative losses due to innovation expenditures (Mastroeni et al., 2021). The risk management function of financial institutions themselves can reduce the riskiness of the initial stage of food production technology research and development through internal risk control and diversification of investment decisions. At the same time, financial institutions will also monitor and evaluate the feasibility and process of food production technology research and development projects in the process of investing in food production technology innovation activities, which can limit the waste of financial credit resources caused by blind innovation of innovation subjects. In addition, the risk-spreading function of financial markets helps to spread the risk of risky innovation activities of individual enterprises to the social level (Fabozzi, 2015), thus ensuring the sustainable development of food production technology R&D enterprises and contributing to the improvement of food total factor productivity. Based on the above analysis, this paper proposes research hypothesis H1:

H1: County financial marketization reforms can help increase total factor productivity in food.

2.2 Analysis of the mechanism of the role of factors quality of land, labor, and capital

It is biased to attribute all total factor productivity growth in food to technological progress in agriculture, some of which is reflected in changes in the quality of land, labor, and capital factors (Gong, 2018). First, the quality of rural labor is mainly reflected in the level of rural human capital, and Schultz argues that investment in human capital for farmers is an important way to transform traditional agriculture and increase total factor productivity in agriculture. An increase in the level of rural human capital helps to promote the application and diffusion of new agricultural technologies and the efficiency of agricultural capital use, which in turn increases labor productivity and total factor productivity (Habib et al., 2019). Second, the quality of land factor is a key factor in improving food yield, and some studies have pointed out that the higher the quality grade of arable land, the higher the total factor productivity of food (Zhang and Yang, 2020). The quality of farmland mainly depends on the implementation of projects such as the construction of high-standard farmland, the improvement of low-yield fields, and land reclamation, as well as the application of soil testing and fertilization techniques, the return of straw to the fields, and other conservation farming techniques. For example, the construction of high-standard farmland promotes the growth of total factor productivity of food by creating conditions for the application of integrated agricultural technologies, such as the matching of good seeds and good methods, the integration of agricultural machinery and agronomy, the unified measurement and supply of fertilizers, and the unified control of agricultural and forestry pests and diseases. Third, according to Solow’s (1957) idea of embedded technological progress, “new” capital invested at a later stage leads to higher total factor productivity than “old” capital invested at an earlier stage due to the embedding or materialization of the new technology (Huang and Liu, 2006).

The lack of rural capital is a serious obstacle to improving the quality of land, labor and capital factors. First, the improvement of farmland quality relies on the government’s large-scale one-time investment in the construction of high-quality farmland, but also requires farmers to continuously adopt agricultural technology represented by less tillage, deep pine by farm machinery, soil improvement, and land leveling (Seitz et al., 2019). However, large-scale investment in high-quality farmland construction is difficult to sustain due to limited government budgets, and farmers’ own lack of capital accumulation and credit constraints also severely limit their adoption of cutting-edge agricultural conservation farming techniques (Gras and Caceres, 2020), especially for capital-intensive agricultural technologies such as soil improvement and land leveling. Second, government agencies are unable to provide farmers with more opportunities for public welfare vocational training with public funds, which is detrimental to improving the quality of rural labor factors-especially in light of China’s current significant budget deficit. Third, higher credit restrictions in the agricultural sector also make it difficult to research and develop cutting-edge agricultural technologies and upgrade agricultural equipment, which further hampers efforts to raise the standard of agricultural capital elements.

With the deepening of financial market reform in the county, the competition in the financial market is becoming more and more intense, and rural financial institutions will prevent the diversion of high-quality customers by improving the efficiency of financial services, innovating the business model, and increasing the credit line (Zhang et al., 2021). At the same time, the county financial marketization reform will promote the expansion of the scope of financial services to rural and gap areas and encourage banking institutions to provide more credit services to vulnerable groups, such as ordinary farmers and new agricultural enterprises, thereby increasing the penetration rate of rural financial services. With the easing of credit constraints, farmers can adopt capital-intensive agricultural technologies to improve the quality of their land and improve the quality of their labor factors by participating in socio-professional training and exchanges. In addition, the county’s financial marketization will encourage banking institutions to increase innovation in financial credit products and business models related to agriculture, such as developing agricultural supply chain finance businesses, improving the credit level of farmers and farmers’ cooperatives by leveraging the creditworthiness of core enterprises, and easing the financial constraints of farmers’ cooperatives (Liu and Yan, 2020). This will help cooperatives to expand the organization of training exchanges for their members and improve the scientific and technological literacy and application skills of farmers, which in turn will lead to an improvement in the quality of the labor force. Based on the above study, this paper presents research hypothesis H2:

H2: County financial marketization reforms can drive food total factor productivity growth by improving the quality of land, labor, and capital factors.

3 Methods and data

3.1 Methods setting

3.1.1 Regression model

This study uses the total factor productivity of food in each county administrative region as the explanatory variable and county financial marketization as the primary explanatory variable to examine the relationship between county financial marketization and total factor productivity of food. The benchmark model is established as follows:

In Equation (1), the level of total factor productivity of food in the ith county (county-level city) in year t is represented by. is the level of county financial marketization. In addition, denotes a range of other control variables affecting total factor productivity of food, denotes area fixed effects, denotes time fixed effects, is a random disturbance term, is coefficients to be estimated. To reduce heteroskedasticity and multicollinearity among the variables, natural logarithms were performed on the corresponding variables when the model parameters were estimated. The study by Zhang and Guo (2021), which estimated the regression with the index of change in technical progress and the index of change in technical efficiency as dependent variables, is cited in this paper to further explore how financial marketization in counties affects the total factor productivity of food. The formulas are as follows:

In Equations (2) and (3), is the index of change in technological progress in food for the ith county (county-level city) in year t, and is the index of change in technical efficiency in food for the ith county (county-level city) in year t. and are the estimated coefficients, respectively. The rest of the variables are explained in the same way as in Equation (1).

3.1.2 Mediating effects model

Referring to Jiang’s (2022) operationalization proposal for mediation effect analysis, this paper explores possible mediation effects based on equation (1) by identifying in one step the causality of the core explanatory variables to different mediating variables. The model is as follows:

In Equation (4): is the mediating variable, which corresponds to the quality of the labor factor, the quality of the land factor and the quality of the capital factor, respectively; is the constant term, and are the coefficients to be estimated; the other variables are consistent with Equation (1). Since the positive effects of the quality of labor input factors, the quality of land input factors and the quality of capital input factors in food production on the total factor productivity of food are direct and obvious, the existence of mediating effects is confirmed if the statistic of is significant.

3.2 Selection of variables

3.2.1 Explained variable

The explanatory variable in this paper is total factor productivity of food. This paper constructs a three-stage DEA-Malmquist productivity index to measure total factor productivity of food based on county panel data from 2009 to 2019, to remove factors such as management inefficiency, external environment, and random error from the TFP growth analysis framework. Since the Malmquist index is a dynamic growth rate that represents the change in efficiency between 2 years, it needs to be transformed into a cumulative form first when estimating the parameters in the model regression. This paper draws on the studies of Zhang and Guo (2021) to obtain the cumulative values of county food total factor productivity indices for 2010–2019 by cumulative multiplication, using 2009 as the base period.

The input–output indicators are as follows: Land input: It is measured by the total sown area of grain crops in each county, and the unit of measurement is hectares (ha). This indicator reflects the amount of land dedicated to grain cultivation. Agricultural machinery input: It is measured by the total mechanical power of grain cultivation. The unit of measurement is kilowatt-hours (kWh). This indicator represents the amount of machinery power used in grain production. Agricultural fertilizer input: It is measured by the amount of chemical fertilizer applied to grain cultivation, expressed as a folded pure quantity. The unit of measurement is tons (t). This indicator indicates the quantity of fertilizer used in grain production. Agricultural labor input: It is measured by the number of personnel involved in grain cultivation. The unit of measurement is the number of persons. This indicator reflects the human labor utilized in grain production. To estimate the use of factor inputs specifically for food production, the paper adopts a method of weight coefficients. This method separates the factor inputs for food production from the broader agricultural sector, which includes both food crops and cash crops. The paper refers to the research of scholars like Wang et al. (2013) to determine the weight coefficients. For example, the total power of grain planting machinery is calculated as the total power of agricultural machinery multiplied by the ratio of grain sowing area to total crop sowing area. Similarly, the amount of fertilizer applied to grain planting is determined by multiplying the amount of fertilizer applied to agriculture by the ratio of grain sowing area to total crop sowing area. The labor force input to grain planting is computed by multiplying the number of employees in the agriculture, forestry, animal husbandry, and fishery industry by a weighting coefficient derived from the ratio of the value of agricultural output in grain production to the total value of agricultural output in the broader sector, and also considering the ratio of grain sowing area to total crop sown area. By utilizing the weighting coefficient method, the paper aims to isolate the factor input usage specifically for food production, providing a more accurate estimation of the inputs utilized in the food production process. Meanwhile, this paper selects the total grain production (in tons) of each county area as the output variable.

In addition, in the process of measuring the total factor productivity of food using the three-stage DEA-Malmquist method, population density, industrial structure and human capital level are selected as environmental variables to eliminate the effects of management inefficiency, external environment and random error on the total factor productivity of food. The specific variables are selected as follows: The first variable is population density, which measures the number of people living in each county region divided by the administrative area of that region. This variable represents the demographic conditions affecting food cultivation in each county and is considered an uncontrollable external social condition. The second variable is the industrial structure of the county region. It is determined by the ratio of the value-added of the secondary and tertiary industries to the regional gross domestic product (GDP). This variable reflects the composition of the primary, secondary, and tertiary sectors within the county’s economy and is considered an uncontrollable external economic condition. The third variable is the level of human capital, with reference to existing studies that divide the number of students enrolled in secondary schools by the regional population. This variable represents the quality of human resources available in each county and is considered an uncontrollable external social condition.

The three-stage DEA-Malmquist method constructed in this paper is as follows: The first stage is to construct the DEA-Malmquist index model. This paper calculates the distance function of Malmquist productivity index based on the DEA model with variable returns to scale (VRS). The model is as follows:

In Equation (5), denotes the inputs of the ith decision unit, denotes the outputs of the ith decision unit, n is the number of decision units, is the combination coefficient of input indexes of the decision unit, is the slack variable reflecting the lack of outputs, is the residual variable reflecting the redundancy of inputs, and is the efficiency of the decision unit, and whenindicates that the DEA is effective, and the other way around, it indicates that the DEA is ineffective. Where the Malmquist productivity index takes the following specific form:

Where, denotes the technical distance between periods from t to (t + 1), when represents the growth of TFP from t to (t + 1), represents the stabilization of TFP from t to (t + 1), and represents the decline of TFP from t to (t + 1). Based on the first-stage model, the target values and slack variables for each sample input indicator can be derived.

The second stage is to construct a panel stochastic frontier analysis (SFA) model. The slack variables derived in the first stage are adjusted using the SFA to remove environmental factors and statistical noise so as to place the decision units under the same conditions for efficiency measurement. The specific SFA model is as follows:

is the input slack variable of the nth type of input factor for the ith decision unit in period t, represents the stochastic frontier production function, and are the environmental variables and parameter estimates, respectively, is the composite error term, is the stochastic error term, and , are the managerial inefficiency terms, and , and are independently un-correlated.

The third stage is to use the DEA-Malmquist model to measure the total factor productivity of food based on the input–output indicator data after kicking out the effects of environmental factors and random errors.

3.2.2 Explanatory variables

The explanatory variable is county financial marketization. For the measurement of financial marketization, the more influential one is the financial marketization index constructed by Fan and Wang (2011), but unfortunately, this index only contains the financial marketization index by province from 1999 to 2009, which is not applicable to the conduct of this study. The essence of financial marketization is the theory of financial deepening, which advocates reducing excessive government intervention in finance and establishing the fundamental role of market mechanisms. It has been studied that financial marketization is expressed in terms of scale as the size of financial assets relative to GNP, and its measurement can be summarized into two categories: monetization degree and financial-related ratio. Among them, the monetization share is mainly measured by M2/GDP, while the financial-related ratio uses the ratio of loan balances of financial institutions to GDP. Based on the specificity of the research content and sample, this paper draws on studies such as Paramati et al. (2020) to measure the level of financial marketization in counties by using the ratio of the year-end loan balance of financial institutions to GDP in each county area. This indicator not only reflects the level of financial marketization, but also better circumvents the shortcomings of the M2/GDP indicator.

3.2.3 Mechanism variables

The quality of food production factors in this paper, mainly include: First, labor quality is mainly reflected in the level of human capital accumulation. The human capital is often measured in the existing literature using the years of schooling or the population of educated persons (Blandin and Christopher, 2022). As a surrogate for human capital in the county, Liu et al. (2021) used the ratio of middle school enrollment to the total population at the end of the year. Due to data limitations, this report also uses the percentage of middle school pupils in the region as a whole who are enrolled in school to describe the county’s level of human capital. Second, the cultivated land quality helps to improve food yields and stabilize the supply of food production. In this paper, we draw on Chen et al. (2021) to measure the quality of arable land using the marginal land output rate in the stochastic frontier production function. Third, the ability for producing food depends on the quality of agricultural capital elements. Sheng et al. (2019) examined agricultural capital factor quality in terms of factor price differences, whereas Gong (2018) contended that factor quality and marginal productivity are theoretically identical. Therefore, the factor quality of agricultural capital is assessed in this work using the marginal mechanical output rate in the stochastic frontier production function.

3.2.4 Control variables

Considering the impact of other factors on total factor productivity of food, the following variables are used as control variables in this paper based on relevant studies.

First, the fiscal self-sufficiency ratio may have a beneficial impact on the total factor productivity of food. In this study, the fiscal self-sufficiency rate is defined as the ratio of general budget revenue to planned fiscal spending. Second, higher population density is not conducive to the scale of food cultivation, and therefore may have a negative relationship with total factor productivity of food. In this paper, the ratio of the total population of a county to its administrative area is used to measure population density. Third, farmers’ ability to invest in agriculture and motivation of growing food are both tied to their income. Farmers’ income improvement helps to increase capital investment in agriculture during food cultivation, which positively affects food production efficiency. However, the capital investment in food cultivation may also be reduced by farmers when non-farm income is significantly higher than the revenue from food production, which is counterproductive to increasing the efficiency of food production. This paper measures farmers’ income level by disposable income of rural residents. Fourth, the level of economic development is related to agricultural capital inputs and has a positive relationship with food production efficiency. In this paper, we use GDP per capita to measure the economic development level variable. Fifth, the industrial structure determines the quality of economic development and the amount of resources available to support it. The growth of agricultural capital is facilitated by the non-agricultural sector’s prosperity, but the “three rural” industries are not facilitated if the link between urban and rural areas is not handled appropriately. In this paper, the industrial structure is measured by the share of the value added of the secondary and tertiary industries in the regional GDP. Sixth, rural electric energy supply is a prerequisite for the scale, industrialization, mechanization, and Informa ionization of food cultivation. In this paper, total rural electricity consumption is used to measure rural electric energy supply variables. Seventh, in this paper, the share of sown area of food crops in the total sown area of crops is used to measure the structure of agricultural cultivation. Eighth, the expansion of commercial activity can exacerbate food demand. This paper measures the degree of expansion of business activity in terms of total retail sales of consumer goods per capita. Ninth, agricultural material inputs such as fertilizers and pesticides play an important role in increasing food yields. In this paper, the ratio of fertilizer application to the number of labor inputs for food cultivation is used to characterize the agricultural material input variables.

3.3 Data sources and descriptions

According to the availability of data, this paper selected the relevant variables of 729 China’s counties (county-level cities) from 2010 to 2019 as the sample data for empirical analysis. It should be noted that China’s municipal districts have obvious urban economic characteristics and differ significantly from counties in terms of economic and financial characteristics and the division of financial authority, so we do not consider municipal districts when screening the sample, and we also exclude a small number of counties that are divided into districts due to the removal of counties. In addition, we also excluded some counties that did not publish rural economic development indicators or had serious missing data on food production indicators.

The representativeness of the sample data in this paper is explained as follows. First, China’s food production is mainly concentrated in the main food-producing areas and the balanced production and marketing areas. Three hundred and eighty-one counties are distributed in the main food-producing areas, 277 counties are distributed in the balanced production and marketing areas, and 71 counties are distributed in the main marketing areas among the 729 county samples selected in this paper. Second, the samples were selected from different geographical regions considering the obvious heterogeneity in resource endowment, economic development level, degree of financial marketization of counties and food production. According to the three major regions divided by the China Bureau of Statistics in 2017, 233 counties are distributed in the eastern region, 315 counties in the central region, and 181 counties in the western region among the 729 county samples selected in this paper. Third, the unbalanced level of economic and financial development in the sample areas has commonality with the overall economic development of the country, and to a certain extent can represent the national situation.

The data in this paper are mainly obtained from the China County Statistical Yearbook, China County (City) Social and Economic Statistical Yearbook, Wind database, EPS database, CEE statistical database, and statistical bulletins of counties (county-level cities and banners). The processing of raw data is explained as follows. First, for the missing values of the sample, we supplemented them through the statistical yearbooks of the provinces and cities where the sample counties are located. Moreover, smoothed the data of individual indicators that are still missing using linear interpolation and linear extrapolation. Second, for the outliers of the sample, we use the non-censored bilateral 1% tail reduction method for processing. Third, in order to truly reflect the economic growth, this paper uses the provincial GDP price deflator for 2010 as the base period to deflate the nominal economic variables.

3.4 Descriptive statistics of the data

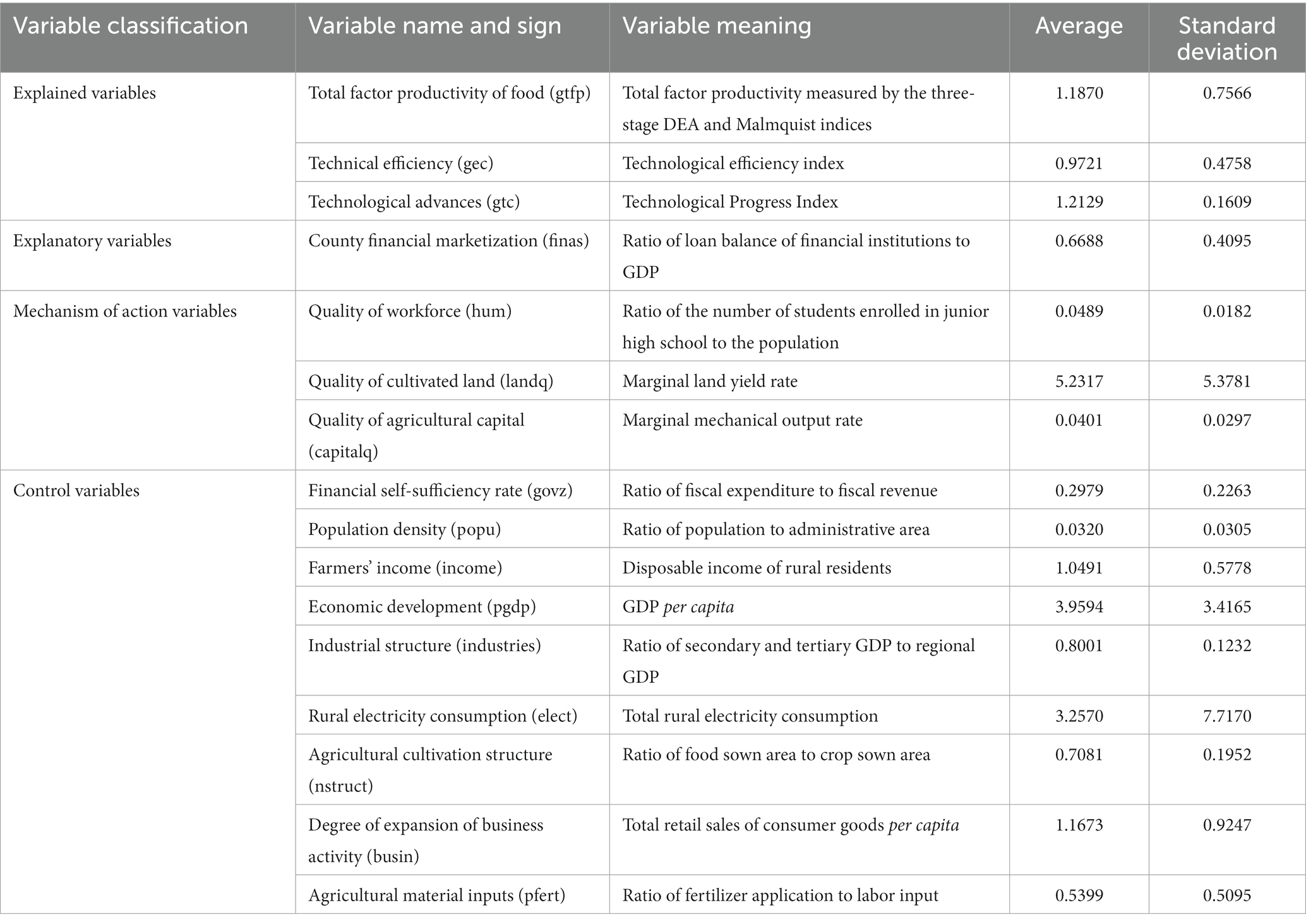

The results of the descriptive statistical analysis of the variables are shown in Table 1.

4 Empirical analysis

4.1 Analysis of the results of the benchmark regression

This study tests the smoothness of the variable data using the LLC, HT, Fisher-ADF, and Fisher-PP methods to prevent the “pseudo-regression” of the model estimate. The test results showed that all variables passed the LLC test and Fisher-ADF test, and most of the variables also passed the HT test and Fisher-PP test, so that all variables can be judged as smooth. In addition, to avoid the influence of data outliers on the regression results, we used the tailing method to deal with the outliers before the baseline regression. In this paper, LSDV, random effects model, and Two-way FE were used for model estimation, and the Two-way FE model was determined to be suitable by the Hausman test. The estimation results are reported in Table 2.

According to column (1) in Table 2, it can be found that county financial marketization has a significant positive effect on total factor productivity of food without introducing other control variables. We introduce control variables based on column (1), estimate them with two-way FE, and report the estimation results in column (2). The results show that the county financial marketization variable is still significantly positive, indicating that the increase in the degree of financial marketization in the county helps to promote the growth of total factor productivity of food. For every 1% increase in county financial marketization, food total factor productivity increases by 0.05%. Moreover, Table 2 shows the results of the effect of county financial marketization on technical progress and technical efficiency of food production to sort out in what way county financial marketization affects total factor productivity of food. It can be found that county financial marketization has a significant positive effect on technical progress, but the estimated results on technical efficiency are not significant. It indicates that the effect of county financial marketization on TFP is driven mainly by the effect on technical progress of food production, while it does not play a significant role through technical efficiency of food production. The combined analysis above verifies hypothesis H1.

For the control variables in the regression results, the coefficients of the variables are largely in line with theoretical expectations and are largely consistent with some previous studies (Liu and Yan, 2021). Among them, the fiscal self-sufficiency variable has a significant positive effect on food total factor productivity, indicating that an increase in government fiscal self-sufficiency promotes food total factor productivity growth. The regional population density variable is significantly negative, indicating that the sparsely populated regions increase food total factor productivity through the scale and intensification of food cultivation, however, the higher regional population density is not conducive to the increase of food total factor productivity. Farmers’ income has a significant negative effect on total factor productivity of food. The decreasing income of farmers from the food growing field will reduce the input of food production, which will be detrimental to the application of new production methods and production technologies in the food growing field, resulting in the decrease of total factor productivity of food. The effect of regional economic development level on total factor productivity of food has a net substitution effect, which is consistent with the direction of farmers’ income variables. The industrial structure variable has a significant negative effect on total factor productivity of food, implying that advanced industrial restructuring will further reduce total factor productivity of food. As the value added by secondary and tertiary industries rises in the regional GDP, the significance of food production will decrease, which will be detrimental to the growth of the food TFP.

4.2 Heterogeneity analysis

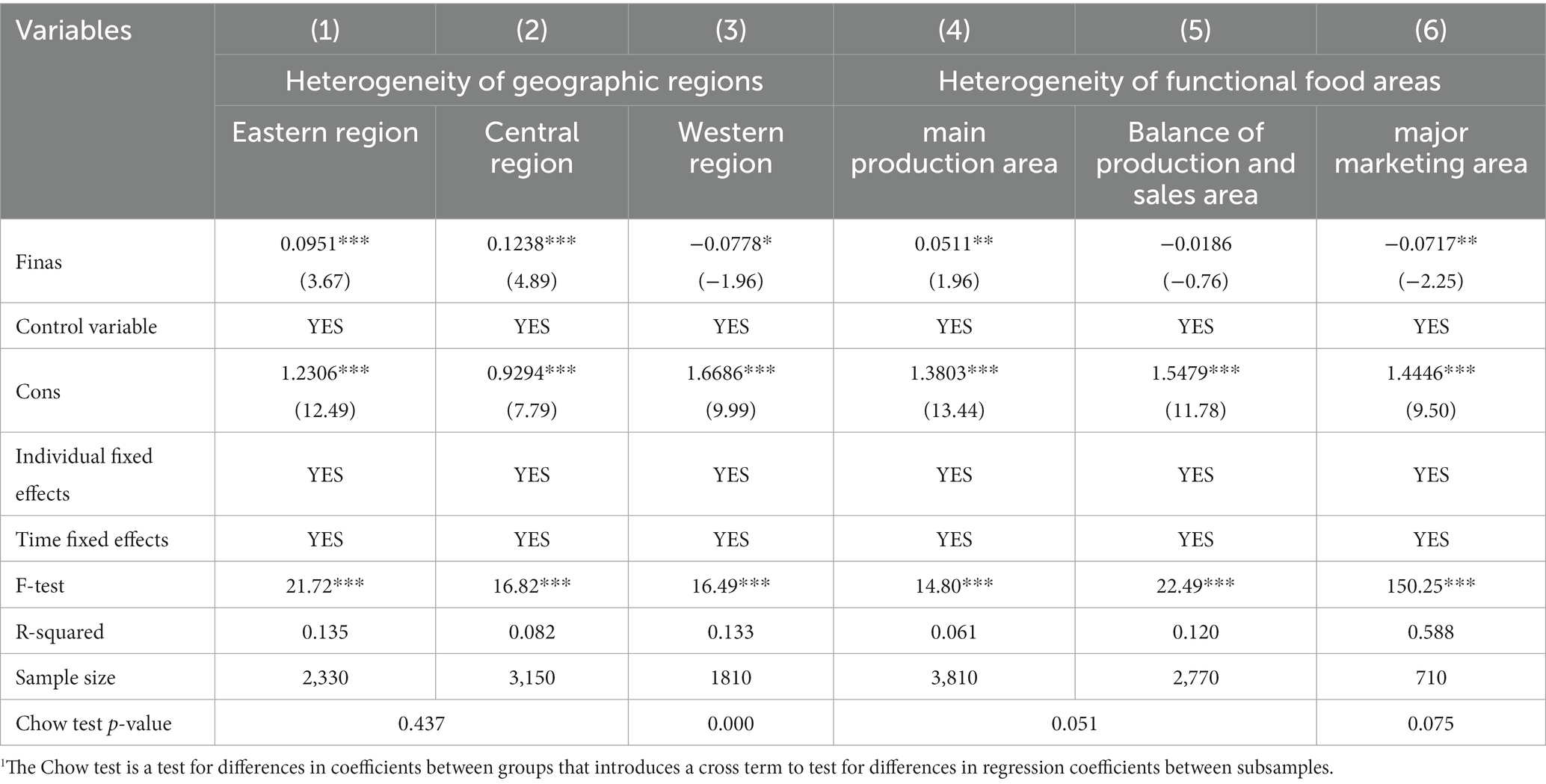

Considering the differences in resource endowment, industrial structure and financial development in different regions, this paper examines the heterogeneous effects of county financial marketization on total factor productivity of food by geographical regions and functional food zones. The estimation results are shown in Table 3. The following conclusions can be drawn:

As far as different geographical regions are concerned, although the coefficient of county financial marketization in the central region is larger than that in the eastern region, the test of the difference in coefficients between the groups is not significant (value of p of Chow test is greater than 0.1). It indicates that there is no significant difference in the promotion effect on food production efficiency generated by the county financial market reform in the eastern and central regions. Based on (3) of Table 3, the coefficient of financial marketization in the western counties is significantly negative, and the test of coefficient difference between groups is also significant. It indicates that the impact of county financial marketization reform on total factor productivity of food is significantly different in the western region and the east-central region. Commercial banks, agricultural credit cooperatives and other financial institutions will move many of their business outlets from counties with low economic development and low profitability and set them up in areas with high economic development, resulting in a low degree of financial marketization and slow growth in the diversity and number of financial institutions in western China. In addition, because of the low profitability of food production, county financial institutions prefer to invest their loans in secondary and tertiary industries with higher total factor productivity. This crowds out investment in agriculture, especially in the food production sector, which is detrimental to the efficiency and progress of food technology.

As far as different functional areas of food production are concerned, the effect of county financial market reform on total factor productivity of food shows significant differences in different functional areas of food production. In addition, the Chow test of coefficient variability between groups is also significant. Specifically, the county financial marketization reform has a promoting effect on food total factor productivity within the main grain production area, and its results are consistent with the whole sample. However, from column (5) of Table 3, the county financial marketization reform has no effect in the production and marketing balance area. The possible reason is that the production and marketing balance areas are generally located in the central and western regions of China, where the degree of county financial marketization is relatively low, and the food sown area and food production only account for about 20% of the country, and agriculture, especially food agriculture, is not valued by regional economic development. Therefore, county financial marketization is not yet sufficient to promote food technology progress and agricultural capital deepening, and thus cannot have a significant impact on food total factor productivity.

Based on column (6) of Table 3, county financial marketization reforms have a significant negative effect on total factor productivity of grain in the main marketing areas. The main food marketing areas are mostly concentrated in the developed eastern coastal regions, which have a high degree of county financial marketization and intense competition among financial institutions. In pursuit of short-term profitability, financial institutions may use a large number of financial resources for speculation or regulatory arbitrage in the capital market, which leads to financial resource mismatch and crowding out of financial resource input in the agricultural sector, which in turn is detrimental to the total factor productivity growth of food. In addition, with the excessive investment of financial resources in non-agricultural industries, it will accelerate the industrial restructuring of county areas, resulting in a further decline in the proportion of agricultural output value and non-agricultural industry becoming the dominant industry in the county. The wage income of non-agricultural industries is much higher than the income of agricultural enterprises (Ojiegbe and Duruech, 2015), which will accelerate the complete separation of agricultural labor from agricultural production to work in the non-agricultural sector and bring about a decline in the quantity and quality of rural labor. Faced with tightening labor constraints, farm households will further respond with sloppy operations, while the declining level of rural human capital will also reduce the adoption of new production methods and new production technologies, which is detrimental to the total factor productivity growth of food.

4.3 Endogeneity discussion and robustness test

There may be endogeneity issues in examining the effect of county financial marketization on total factor productivity of food, leading to inconsistent bias in the parameter estimates. On the one hand, the baseline model regressions may have omitted variables. In addition to the core explanatory variables and control variables selected in this paper, there may be other factors that affect total factor productivity of food but are not measurable or observable. Although the impact of some unobservable factors can be controlled for using area fixed effects and time fixed effects, it is still difficult to control for all variables, especially some unmeasurable factors, such as the area of food crops affected within a county. On the other hand, there may be a reciprocal causal relationship between financial marketization and total factor productivity of food in the county. For this purpose, this paper uses the following approach for endogeneity test. The results are shown in Table 4.

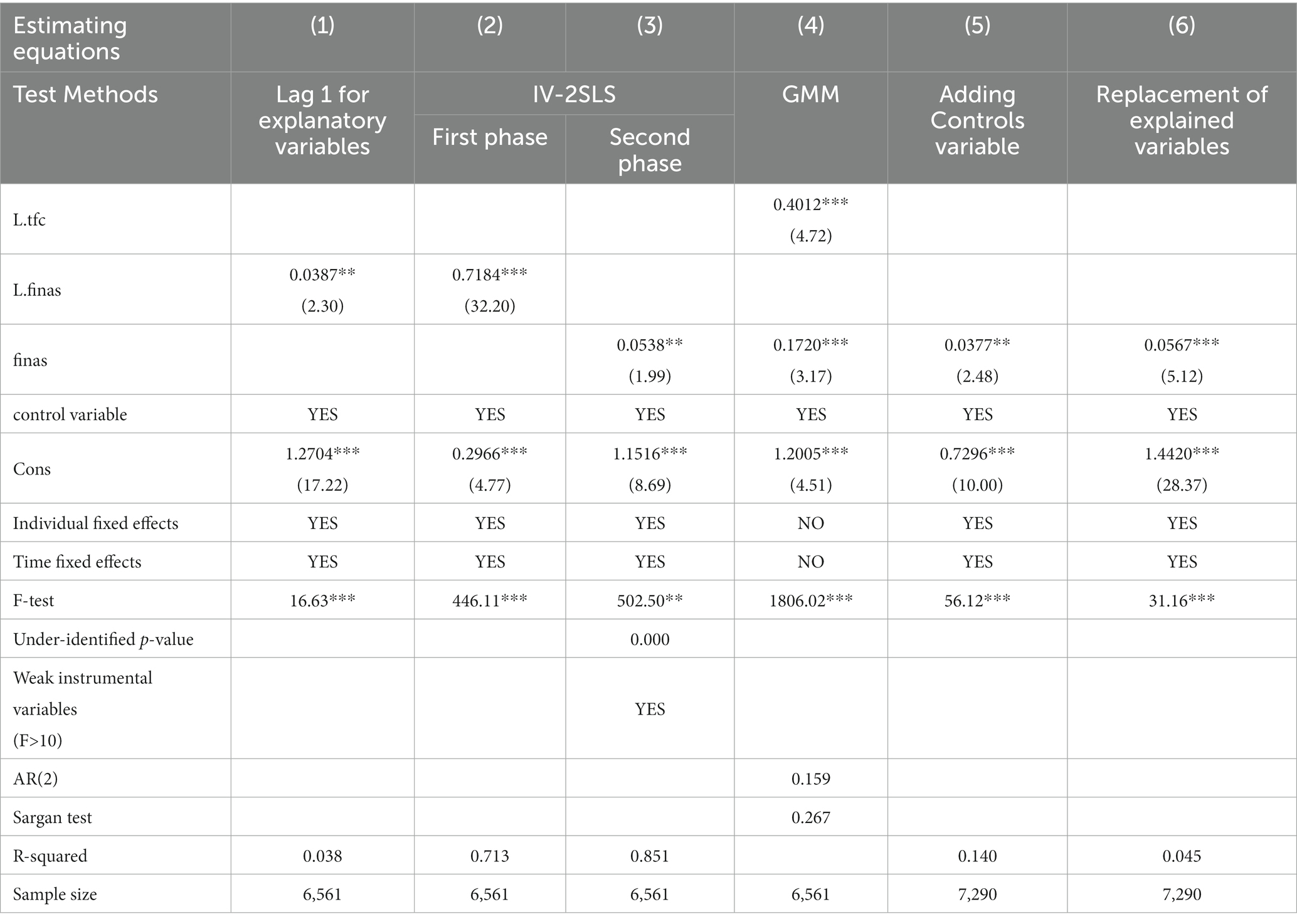

First, drawing on the studies of Guo and Luo (2016), the lag of financial marketisation in counties is used as an explanatory variable and estimated using a two-way fixed effects model, the results of which are shown in column 1 of Table 4. The logic lies in the fact that the effect of the current period’s increase in food total factor productivity on the lagged term of county financial marketization is non-existent, while the lagged term of county financial marketization still has the relationship on the current period’s food total factor productivity as analyzed above, then it can be shown that there is only a unidirectional causal relationship. Secondly, we use one-period lagged county financial marketization as an instrumental variable and test it using two-stage least squares (IV-2SLS). Column (3) in Table 4 show that the F-value of the weak instrumental variable test is greater than the general criterion, indicating that the selection of instrumental variables is effective overall. Finally, the dynamic panel model is estimated by the generalized method of moments (GMM), which is divided into differential GMM and systematic GMM. The systematic GMM can better solve the problem of weak instrumental variables and improve the estimation efficiency than the differential GMM. Column (4) in Table 4 shows the estimation results of the systematic GMM method, from which Sargan’s test accepts the original hypothesis of “all instrumental variables are valid” at the significance level of 10%, which indicates that the instrumental variables selected in this paper are valid. The AR(2) test for second-order serial correlation does not reject the hypothesis that “there is no second-order autocorrelation in the residual terms of the model,” indicating that the endogeneity problem of the model is solved. From the estimation results in columns (1)–(4) of Table 4, it can be concluded that the coefficients of county financial liberalization reforms are consistent with the benchmark regression in terms of direction and significance. The above benchmark regression results are robust after accounting for endogeneity. It is shown that the above benchmark regression results are robust after accounting for endogeneity issues.

To enhance the robustness of the results, the paper also uses the following robustness tests. The first is the method of adding control variables. This paper adds to the existing control variables other variables that may affect total factor productivity of food, such as the structure of agricultural cultivation (nstruct), the degree of expansion of business activities (busin), rural electricity consumption (elect), and material inputs to agriculture (pfert). The estimation results are presented in column 5 of Table 4. The second is to change the measurement of the explanatory variables. Total factor productivity of food is measured using the DEA-Malmquist index and re-estimated based on a panel fixed effects model, the results of which are shown in column 6 of Table 4. It can be found that the county financial marketisation variable is still significant and the direction of the coefficients is consistent with the baseline regression model. Accordingly, the paper concludes that the conclusion that county financial marketisation has a promotional effect on food total factor productivity is robust.

4.4 Mechanisms for testing the quality of labor, arable land, and capital factors

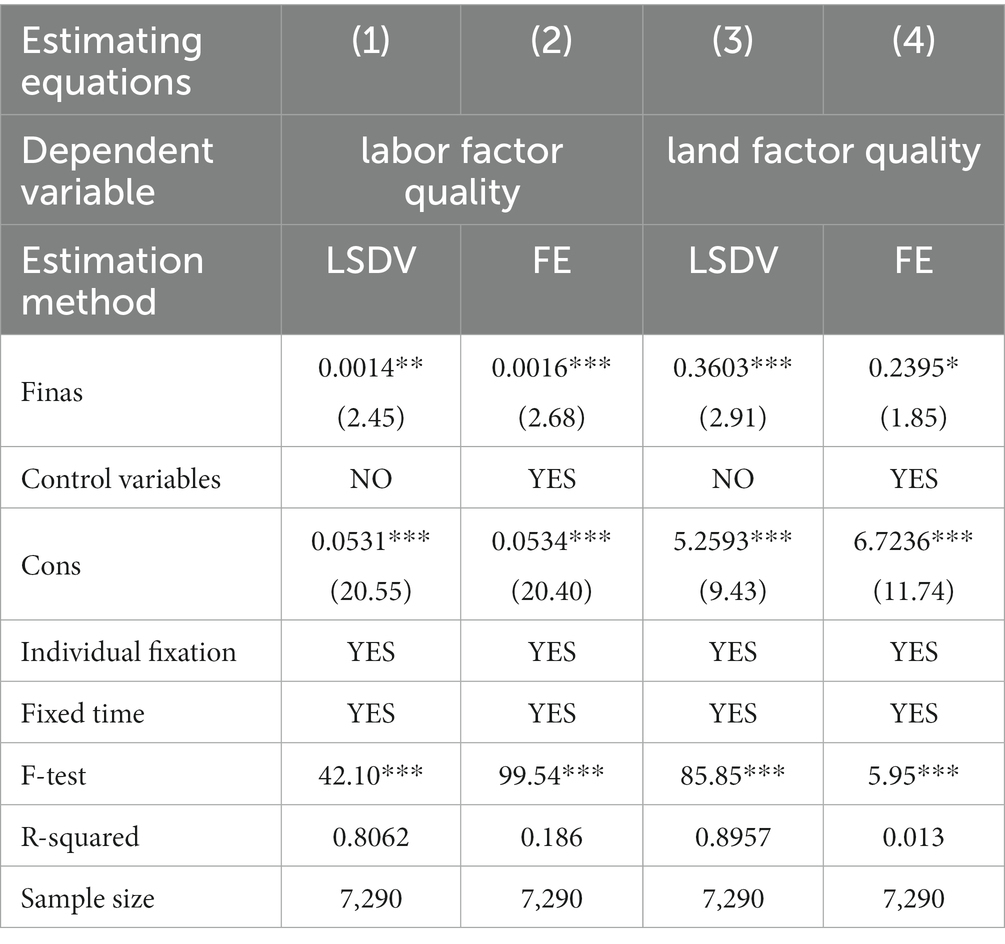

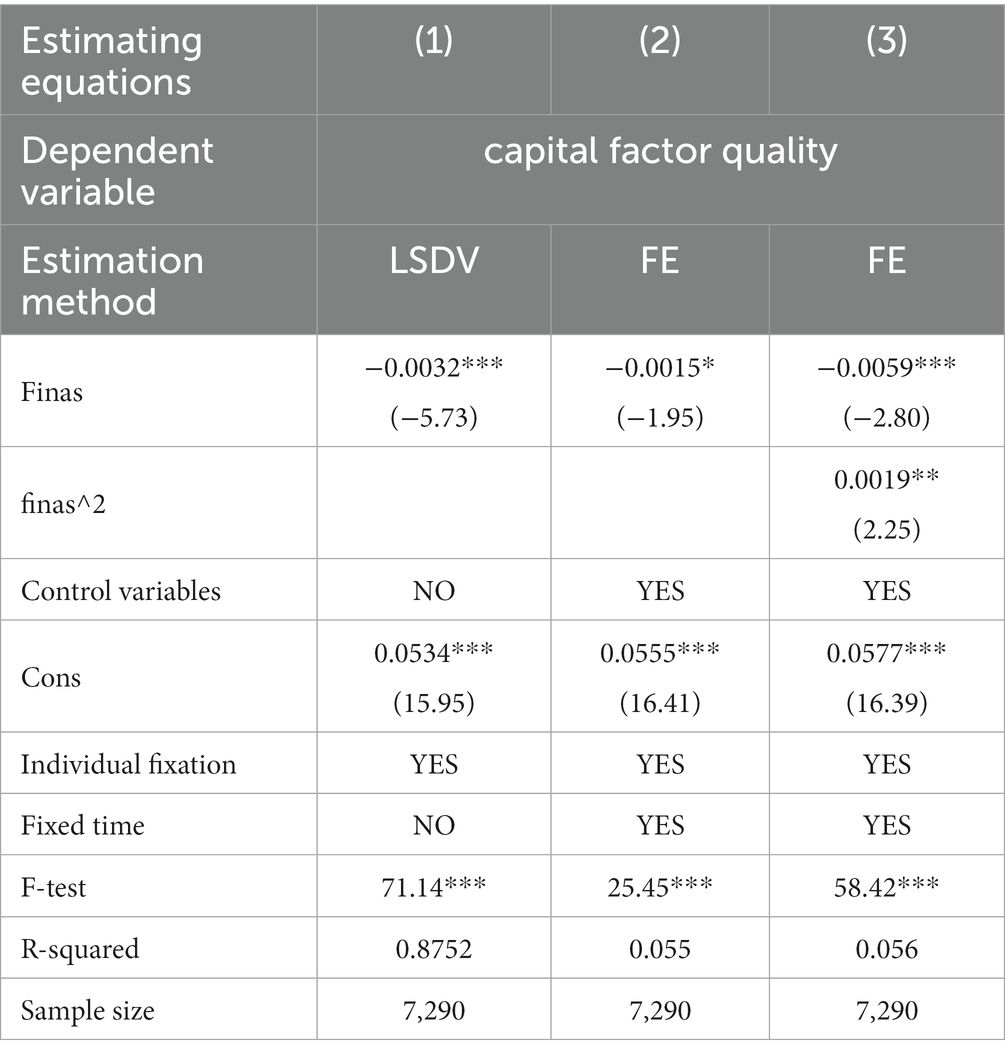

To investigate the mechanism of county financial marketization on total factor productivity of food, this paper estimates the effect of county financial marketization on the quality of land, labor, and capital factors according to Equation (4) using the least squares dummy variable method (LSDV) and the two-way fixed effects model, respectively. The estimation results are presented in Tables 5, 6. According to columns (1) and (2) of Table 5, it can be found that the coefficient of county financial marketization is positive and passes the 5% significance test. It indicates that county financial marketization can improve total factor productivity of food by promoting the quality of labor factors. According to columns (3) and (4) of Table 5, it can be noticed that county financial marketization also has a significant positive effect on land quality, indicating that the quality of land factors plays an important mediating transmission role in the relationship between county financial marketization and total factor productivity of food. According to columns (1) and (2) of Table 6, county financial marketization has a significant negative effect on the quality of agricultural capital. To further explore whether there is a non-linear relationship between the effect of county financial marketisation on the quality of agricultural capital factors, this paper adds the quadratic term of county financial marketisation for re-estimation (see column (3)). Accordingly, we find that the quadratic term of county financial marketisation is significantly positive, indicating that county financial marketisation has a U-shaped effect on the quality of agricultural capital. At this point, research hypothesis H2 has been partially tested. on agricultural capital quality. At this point, research hypothesis H2 was partially tested.

5 Discussions

5.1 Results and discussion

From the previous analysis, we can see that county financial marketization reforms have a significant positive impact on food total factor productivity growth. There are commonalities with existing literature findings. For example, agricultural credit promotes food production (Ojiegbe and Duruech, 2015; Asghar and Salman, 2018), agricultural credit improves the technical efficiency of food production by farmers (Koricho and Ahmed, 2022), rural financial development contributes to the improvement of food ecological total factor productivity (Ye et al., 2023), digital inclusive finance has a significant and positive impact on food security (Lin et al., 2022), food subsidy policies increase the efficiency of food production (Gao et al., 2017), and social capital increases agricultural productivity of food producers and improves food security (Kehinde et al., 2021).

However, compared to the existing literature, which mainly focuses on the relationship between government-led rural financial development and food (agricultural) productivity (Peng and Lu, 2010), this paper takes county financial marketization reform as an entry point to analyze the impact on food production efficiency after financial resources are allocated by the market. Its findings highlight the economic effects of market-oriented rural financial policies, which are of great significance for deepening the market-oriented reform of rural finance and ensuring food security. In reality, county financial marketization reforms are still in their infancy in many rural areas of China, and there is still much room for deeper policy development. This paper uses meso-level county panel data for empirical analysis. On the one hand, it extends existing studies that only examine the impact of financial credit on agricultural productivity from the macro level of provinces and municipalities (Iftikhar and Mahmood, 2017), or the impact of credit constraints on farm household productivity from the micro level of individuals (Ekwere and Edem, 2014). On the other hand, it helps to assess and test the implementation effect of the county financial marketization reform policy from the perspective of food total factor productivity growth, adding new evidence for deepening policy implementation.

In the mechanism test part of factor quality, we find that county financial marketization reforms can promote food total factor productivity through improving labor factor quality. This is in common with Kargbo et al. (2016) and Sarwar et al. (2021) who found that the interaction of financial development and human capital can significantly promote economic growth. In contrast, we focus on rural financial reforms in developing countries and on labor factors and food production activities in the agricultural sector. The improvement of education and training mechanisms in county areas can effectively improve farmers’ ability to apply science and technology and their overall quality (Zakaria et al., 2020), which is of great significance in promoting the total factor productivity of food and ensuring food security. However, the level of education and human capital in the rural areas of China’s counties is still low. According to the Third National Agricultural Census Data Bulletin (No. 5), only 7.1% of agricultural production and operation personnel nationwide have received high school or junior college education, and only 1.2% have received college education or above, which is much lower than other industries. Moreover, it is also much lower than the education level of farmers in other countries, such as, the United States, Germany, Japan, France, the United Kingdom, and the Netherlands, where the education level of farmers in high school and above accounted for 87.3, 87, 80.6, 75.9, 70.1 and 66.3%, respectively. We find that the development of county financial marketization can provide financial support for farmers’ vocational training, which in turn improves the quality of agricultural labor factors, promotes the efficiency of the promotion and application of agricultural technology, and ultimately brings about an increase in total factor productivity of food. Based on this, the government should pay attention to the role of county finance in supporting agricultural training and rural human capital enhancement and promote the coordinated development of rural finance and the quality of the agricultural labor.

Second, we find that land quality also plays an important role as a mediating mechanism. Land quality is the key to stabilizing overall food production capacity (Kumar and Sharma, 2020). However, the quality of farmland in China has been undermined by the misuse and residues of agrochemicals, ecological degradation, and sanding of farmland (Liu et al., 2020). The restoration and improvement of farmland quality has attracted great attention from the government and agricultural enterprises. The research and development and application of land improvement technology cannot be separated from financial investment (Nkonya et al., 2016). However, existing studies have focused on the supporting role of government financial capital investment on cropland quality improvement (e.g., Debonne et al., 2021), and studies on the impact of financial support from financial institutions on cropland quality improvement are lacking. The findings of this paper provide a theoretical and practical basis for guiding county-level financial institutions to carry out specialized lending operations for arable land quality improvement.

In addition, we find that county financial marketization reforms do not lead to food total factor productivity growth by improving agricultural capital factor quality. This finding is at variance with Liu et al. (2021) who argue that rural financial development contributes significantly to agricultural technological progress and capital quality. Further research finds that there is a turning point between county financial marketization and agricultural capital quality. This view has commonality with Khafagy and Vigani (2023) who argue that there is a non-linear relationship between external financing and agricultural productivity. When the level of county financial marketization is low, counties face strong financial exclusion, and agricultural technology research and development and transformation are not supported by financial capital, which hinders the improvement of agricultural capital quality. When the level of county financial marketization increases and passes the turning point, the infrastructure of county rural financial system will be improved, and the cost of pre-lending investigation and post-lending supervision will be reduced, which will help provide credit support for advanced agricultural equipment and seed technology R&D and production and promote the improvement of agricultural capital quality (Naidu et al., 2013; Liu and Yan, 2020).

Improvement in the quality of food production factors is the power source of food total factor productivity growth (Luo et al., 2022). So far, we have analyzed the role mechanism of county financial marketization affecting total factor productivity of food from the perspective of factor quality of labor, arable land, and agricultural capital. It makes up for the fact that the existing literature only looks at the mechanism of financial credit affecting agricultural productivity from the perspectives of agricultural technology and agricultural capital inputs (Koricho and Ahmed, 2022).

5.2 Limitations and perspectives