95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Sustain. Food Syst. , 19 October 2023

Sec. Social Movements, Institutions and Governance

Volume 7 - 2023 | https://doi.org/10.3389/fsufs.2023.1224152

Based on 2018 China Family Panel Studies data, this study uses quantile regression models and a propensity score matching (PSM) method to examine land transfer and the effects of different land transfer behaviors on the income disparity of farm households. The results show that first, participation in land transfer has a general income-increasing effect on rural households’ per capita income, and the effect is more significant for rural middle-and low-income groups; this helps reduce the income disparity among rural households. Second, after distinguishing between leased-in land and leased-out land as types of participation in land transfer, this study finds that the effect of land transfer is mainly attributed to the leased-out land type, while the effect of leased-in land on increasing income and reducing income disparity are not significant. Third, the effect of leasing out land to reduce income disparity may be realized by unlocking the business and investment potential of rural non-farm industries. Moreover, compared with other areas, rural areas with potential policy interference or higher non-farm industry participation rates have weaker income-increasing effects on land transfer and weaker suppressive effects on income disparity among rural households. Therefore, to alleviate the problem of widening rural income disparity, improve rural economic vitality, and consolidate the results of poverty alleviation, farmers should continue to be encouraged to participate in land transfer. Therefore, their transfer rights and interests should be effectively guaranteed, and support and convenience should be provided to engage in other non-farm fields.

Since China’s reform and opening up, the income level of its rural households has generally increased, from CNY134 in 1978 to CNY20100 in 2022. However, the income gap has widened in rural China. According to the China Statistical Yearbook, the gap between the per capita net income of high-income and low-income households in rural China widened from CNY5481 in 2003 to CNY33839 in 2020. In 2019, China’s rural Gini coefficient was at a high level of approximately 0.36, close to the international alert level of 0.4; however, a turning point for the trend reduction of the rural internal income gap has not yet been observed (Xie and Wei, 2022). Excessive intra-rural income disparity seriously weakens the effect of China’s poverty alleviation policies and exacerbates social conflicts in rural areas. If this deteriorating trend does not change, when income disparity continues to widen and exceeds a certain threshold, it will inevitably lead to rural class antagonism and over-concentrated wealth; this will seriously interfere with the sustainable development of China’s rural economy.

It has been shown that the widening of the intra-rural income gap can lead to a series of negative impacts, such as inhibiting the degree of participation in village collective action, reducing the physical and mental health of rural residents, depriving farmers of their sense of well-being, and exacerbating the problem of rural poverty, etc. (Ye et al., 2023). Therefore, it is particularly important to examine the causes of the widening of the intra-rural income gap, and thus to propose targeted measures to alleviate the gap (Gong et al., 2022; Kakwani et al., 2022; Ye et al., 2023). In a way, numerous studies have examined the causes of China’s rural income disparity by focusing on the aspects of investment, human capital, and labor outflow. However, the reform of the land system, which was the starting point of China’s reform and opening up, has been neglected by most studies. Previous studies have explored in depth the causes of the formation of the intra-rural income gap in terms of factor mobility, technological progress, and entrepreneurship among farm households, but little literature has focused on participation in land transfers and, on that basis, differentiated between the impact of inflow and outflow patterns on the intra-rural income gap. Even if part of the literature focuses on land transfers, the discussion on transfer modes and transmission mechanisms is inadequate, and fails to make targeted distinctions based on different directions of land transfers.

Land is a resource unique to rural households and relative to urban residents. Owing to the household registration system and the dualistic economic structure in urban and rural areas, land has production functions for rural households as well as certain social security and property subsidiary functions; it is an important source through which farmers increase their income (Zhu and Hu, 2015; Gong et al., 2022; Kakwani et al., 2022; Ye et al., 2023). Increasing urbanization rates has resulted in a large number of people flowing into cities. To solve the problems of insufficient rural labor and land abandonment and to accelerate industrialization and large-scale agriculture, the Chinese government has been promoting land transfer. Land transfer is an important initiative in China’s land system reform of “three rights division” (Zhao and Lu, 2010; Gong et al., 2022). According to the Department of Policy and Reform of the Ministry of Agriculture and Rural Affairs, the area of land transfer in China reached 565 million mu in 2020, accounting for 36.2% of the contracted arable land in the country; more than one-third of the farmers transferred their contracted land. Land transfer has profoundly changed the pattern of land production in rural China as well as the original distribution structure of land among rural households. This has broadened the income sources of rural households, which has undoubtedly had a significant impact on the income pattern of rural households (Zhao and Lu, 2010; Wang, 2011; Zhu and Hu, 2015; Xiao and Zhang, 2017; Luan et al., 2021; Ye et al., 2023). Then, what is the impact of land transfers on the income distribution of farm households? Does it address the problem of widening rural income disparity? What are the mechanisms of action? The analysis of the above questions is directly related to whether the land transfer reform in China is in the right direction and whether it can significantly benefit the rural people. Additionally, these findings provide policy references for third world countries, helping them to carefully design rural reform programs that are consistent with their current development status and achieve the poverty reduction goals of the UN 2030 Agenda for Sustainable Development.

In summary, this study attempted to contribute to two research areas. Most of the studies in the first research field have only examined the effect of land transfer on rural household income; only a few studies have explored intra-rural income disparity, although the findings of such studies are divergent. The conclusions of some studies show that land transfer reduces income disparity among rural households and that a well-developed land transfer market enables poor farmers to obtain a more stable income, alleviating income inequality among farm households. Thus, encouraging land transfer and establishing a system focused on continuously improving land property rights can help alleviate chronic poverty (Wan et al., 2005; Jin and Deininger, 2009; Feng et al., 2010; Mao and Xu, 2015; Yu and Zhang, 2019; Udimal et al., 2020; Huang and Du, 2022; Ye et al., 2023). However, some studies distinguish between the different effects of leasing in and leasing out land, which can lead to differences in the returns of different rural households participating in land transfer (Zhang et al., 2018; Meinzen-Dick et al., 2019). Some scholars have argued that, in addition to raising the income of rural households, land transfer produces results similar to the Matthew effect. The income-increasing effect is less pronounced or lower for low-and middle-income farmers than for high-income farmers (Kemper et al., 2015; Li et al., 2019; Ye et al., 2023). Additionally, it has been argued that because of the different economic levels of the regions where it is located, heterogeneity rather than definitive conclusion exists on how land transfers affect income disparities (Jin and Deininger, 2009; Lin and Wang, 2010; Xu and Yu, 2020). In the second research area, studies have focused on the mechanism of action; however, the results are extremely limited, and the endogeneity issue has not been addressed adequately. Therefore, it is necessary to further deepen the research on the impact of land flow on income disparity among rural households; this needs to be further discussed at the level of the mechanisms of action.

The findings of the study are as follows: First, participation in land transfer has a significant income-increasing effect on farm households. This effect is more pronounced among low-and middle-income groups, which reduces income disparity among rural households. Second, the income-increasing effect of participating in land transfer occurs mainly from leasing out land. We find that leasing out land can release labor and other factors of production originally bound to agricultural production; these factors enter non-farm businesses and investments, causing a strong income-generating effect. Third, it can be seen from the heterogeneity analysis that regions deeply involved in non-farm business and investment have a weaker income-generating effect from land transfer compared to other regions. The income-generating effect of land transfer is also weaker in areas with potential policy interference in rural non-farm businesses and investments than in other areas. Similarly, the effect of reducing income disparities resulting from participating in land transfers is weaker in these regions.

Compared with previous research, the possible marginal contributions of this study are as follows: First, it provides a new perspective for analyzing the causes of income disparity-land transfer. This study further distinguishes between leased-in and leased-out land based on land transfer, deepening the social perception of land transfer in terms of rural income disparity. The emphasis of China’s rural economy has gradually shifted from incremental quantity to quality, and the focus of agricultural reform has changed from “reducing absolute poverty” to “building a more harmonious rural social structure.” In this context, the widening income disparity trend among rural households is ironic. This study attempts to address the methodological, data, and perspective limitations of previous studies with inconsistent findings. Second, this study expands the scope of research on the mechanism of action to include the non-farm sector in the analytical framework and makes two regional distinctions in terms of heterogeneity to address the characteristics of China’s wide regional differences. These findings provide ample theoretical support for the formulation of targeted policies. Finally, this study combines the quantile regression model with the propensity score matching (PSM) method to solve the self-selection problem of farm household samples and improve the accuracy of the empirical estimation. Additionally, this study uses more representative micro data from the China Family Panel Studies (CFPS), which is a large nationally representative micro household survey. Improving the empirical method and basic data can significantly improve the accuracy and completeness of this research on income disparity among rural households due to land transfer; this makes the conclusions of this study more explanatory and convincing.

The remainder of this paper is organized as follows: Section 2 analyzes in detail the impact of land transfer on rural household income disparity through a literature review and theoretical analysis. Section 3 describes the sources of survey data, variables, and model selection. Section 4 analyzes the empirical results and uses PSM for comparison. Section 5 presents mechanistic tests and conducts a heterogeneity analysis. Section 6 discusses the study results. Finally, Section 7 summarizes the conclusions of the study and provides policy recommendations.

Land system reform is an important driving force for China’s rural development. Starting with the implementation of the household contract system in the late 1970s, rural Chinese households were given a more even distribution of land, their basic needs were met, and their agricultural productivity increased. Owing to the widespread poverty in rural China at that time, the development of agricultural productivity enabled most rural households to enjoy higher income levels than before the reform (Benjamin and Brandt, 1997; Xu et al., 2008; Han and Zhong, 2011; Mao and Xu, 2015; Nie and Xia, 2016; Yang et al., 2017; Guo et al., 2018). However, due to the outflow of rural labor and the growing problem of idle land, China has been promoting land transfer to maintain the stability of agricultural production, which in turn has created an uneven land distribution pattern (Wan et al., 2005; Feng et al., 2010; Lin and Wang, 2010; Kimura et al., 2011; Wang and Wan, 2015; Chen et al., 2017; Zhen, 2017; Liu et al., 2021; Luan et al., 2021), creating the premise for the widening of rural income disparity. Previous studies have focused on the relationship between land transfer and farmers’ income growth, arguing that land transfer increases farmers’ income sources (Jin and Deininger, 2009; Shi et al., 2017; Zhang et al., 2019; Tan et al., 2020; Ye et al., 2023). However, an increase in absolute income does not imply an improvement in relative income. However, current studies on land transfer and income disparity among rural households are relatively limited, and there are significant differences in conclusions (Lin and Wang, 2010; Yu and Zhang, 2019). Different studies differ in data use and model selection; however, the inconsistency in conclusions makes the research unconvincing. In terms of the research base, there is a wide divergence in the literature regarding the theoretical mechanisms of action. At present, China’s agricultural production is in a stage of intensive development at the business scale, and there is still a residual income disparity between the farm and non-farm sectors (Fei, 2018; Shi, 2019; Gong et al., 2022; Ye et al., 2023). After long-term, large-scale urbanization, the rural population with non-agricultural business conditions has already completed an industry switch. Therefore, the current stage of land transfer has further liberated the labor force that was not equipped for non-farm businesses and enabled them to participate in non-farm employment without being constrained by land management problems (Wan et al., 2005; Zhao and Lu, 2010; Shi et al., 2017; Liu et al., 2021; Wang and Wang, 2022). Additionally, does the controversy over land transfer effects stem from the heterogeneous characteristics of households and regions? There is scope for further discussion in this research area (Godfray et al., 2010; Fei, 2018; Sang et al., 2023).

In conclusion, the vast majority of studies have a favorable opinion on the income-raising effect of land transfer. However, results regarding the effect of land transfer on income distribution among rural households are divergent. Additionally, previous literature has not sufficiently examined the complex and diverse regional characteristics of rural China, and there is still room for improvement in the analysis of the mechanism of action. At present, China’s agricultural reform is in full swing, and the official slogan of “common prosperity” has been put forward. It is urgent to reverse the trend of widening income disparity. Therefore, it is necessary to systematically determine the relationship between land transfer and income disparity and guide the next stage of China’s land reform.

This study draws on the analytical framework proposed by Benjamin and Brandt (Yang et al., 2017). They assume that farmers have two aggregate factor endowments: land () and labor (), which are invested in production as and , respectively. Information is open in factor markets and there is no market failure; thus, farmers can sell or buy factors of production. Thus, farmers’ inputs of factors of production are divided into two categories: own land and labor and purchased land and labor from the market. The existence of migrant workers and land transfer can result in farmers selling their land, and labor to the outside world. The factors of production owned and purchased from the market are perfectly homogeneous and can be fully substituted. Therefore, farm household income is determined by resource endowment and factor prices, and is represented as.

In Eq. 1, is the profit received by the farmer for agricultural production, is the labor wage, is the land rent, and is the price of agricultural products. Further, the profit from agricultural production is assumed to be.

In Eq. 1, it can be seen that the levels of land rent and labor wages determine the size of the farmer’s production profit. Assuming that the market is perfectly competitive, the profit from agricultural production is zero, and thus the net income that the farmer can receive is the farmer’s own part of the inputs in the production process. Thus,

Thus, the total income of the farm household is equal to the sum of the net income and proceeds received from the sale of resources in the market, that is,

Due to differences in resource endowments across farmers, they are classified as high-endowment farmers and low-endowment farmers. We further simplify the model by assuming that high-endowment farmers have access to better factor markets, so the land rent remains r and the labor wage remains w. Thus, the income of high-endowment farmers is.

In contrast, low-endowment farmers are subject to various market constraints, and there are inconsistent levels of land rent and labor wages, and , respectively. Thus, the income of low-endowment farmers is.

We assume that there is an endowment difference between high and low endowment farmers as and , so the difference between Eqs 5, 6 is the income gap between farmers with different endowments.

Equation 7 shows that part of the income disparity among farm households is the result of their resource allocation factors, which are essentially transaction costs. The second is the difference in resource endowments. Currently, rural China is facing the problem of large-scale land management rights transfer and massive transfer of surplus rural labor. Market opportunities for land transfer are unequal for farmers with different endowments. Poor and weak farmers at the lower end of the income distribution, on the one hand, generally cannot afford to transfer more land from the market due to their low income level and increasing land rent; on the other hand, low-income households are more dependent on land than high-income farmers are, and they are more reluctant to transfer their land out of their hands due to risk concerns (Godfray et al., 2010; Chen et al., 2017; Shi, 2019; Zhang et al., 2019). Consequently, in the land transfer process, low-income farmers are either completely excluded from the land transfer market, or the actual amount of land transferred is much lower than their willingness to transfer. Differences in land transfer opportunities and the amount of land transferred to farm households with different income levels create income disparities within rural groups.

This study selected the 2018 CFPS data as the sample for analysis, which was implemented by the Institute of Social Science Survey, Peking University (ISSS). This survey aimed to reflect the social, economic, demographic, educational, and health changes in China by tracking and collecting data at the individual, household, and community levels. The CFPS survey has a broad scope and can be considered a national sample. In this study, variables related to the household economic database and the individual information database in the CFPS were combined into cross-sectional data, and samples that did not meet the requirements and had incorrect data were excluded. These samples total 9,503, covering 1,164 villages in 626 counties across 31 provinces.

is the natural logarithm of per capita household income plus 1, which measures the variation in individual income. Per capita household income was the total annual household income divided by the number of household members in the CFPS sample. The effect of the core explanatory variables on different deciles of income distribution is examined by selecting the deciles from the distribution of to the ninetieth decile.

represents whether rural households participate in land transfer and takes 1 if they do and 0 if they do not. By replacing with (lease-in) or (lease-out), the impact of leased-in and leased-out land on rural household income can be further examined.

To mitigate omitted variable bias, this study draws on existing literature to include a series of control variables that may affect the per capita income disparity of rural households, divided into individual-and household-level variables. Individual-level variables: Gender of the head of household (Gender), 1 if the head of household is male, and 0 otherwise. In general, the biological advantage of men in all productive activities in rural areas is obvious, so the gender of the head of the household has an impact on the income of rural households (Ma et al., 2018). Age of head of household (Age). In general, the head of the household, as the most important income provider in the household, is more favorable to the farm household’s income if he or she is in young adulthood. Marital status of the household head (Marr): 1 if married, and 0 otherwise. Married versus unmarried families have a potential impact on household spending. Whether anyone in the household works outside the home (WF). It can be known through the theoretical model that an important way for rural households to increase their income is to work outside the home. If a family has the situation of working outside the home, it is favorable to increase the income of the family (Adu-Baffour et al., 2019). Educational level (Edu). The level of education of the head of household will significantly affect the production and investment decisions of rural households, which will have a significant impact on rural household income. Health of household head (Health). The healthier the head of household, the lower the cost of medical care will be, and the ability of farmers to increase their incomes will increase significantly. Household-level variables: Current Assets (CA). Value of household farm machinery (Farm Machinery, FM). The use of agricultural machinery has a certain value in terms of rural production in China (Firpo et al., 2009; Benin, 2015; Zhang and Feng, 2016). Whether financial assets (FA) are held: 1 if held and 0 otherwise. The situation in terms of financial assets can reflect the capital stock of farm households, which has a significant impact on household income. Courtesy Expenses (CE). Courtesy expenses in rural China account for a certain percentage of household expenditures and are therefore included in the control variables. Political Leanings (PL) takes 1 if you are a member of the Communist Party, and 0 otherwise. In rural China, being a party member generally means that the villager has a certain status and prestige in the local area, and possesses relatively higher personal qualities, which has a positive impact on the increase of farm income. Medical Insurance (MI), 1 for participation, 0 otherwise. Participation in medical insurance cuts health care costs for farmers and saves household expenses. Pension Insurance (PI), 1 for participation, 0 otherwise. Participation in pension insurance reduces the cost of living for older members of the family. Family Residence (Region), 1 in the east, 2 in the central region, and 3 in the western region. It is well known that there are large differences in regional development in China, and differentiation in terms of region helps to obtain more comprehensive results. Additionally, to facilitate the follow-up study, we count the non-farm industry investment (NFI) of rural households and determine whether the household location is a main grain-producing area (MGA). Descriptive statistical information for the selected variables is presented in Table 1.

This article focuses on the relationship between farmers’ participation in land transfer and intra-rural income disparity. Previous related studies have mostly used OLS equal mean regression methods to analyze the mean impact of land transfer on the Gini coefficient of farmers’ incomes, and have been unable to identify the heterogeneous impact of land transfer on the increased incomes of farmers at different income levels. This type of practice cannot provide a reasonable explanation for the unconditional influence of the explanatory variables on the changes in the explained variables, resulting in estimation results that are contrary to the original intention of the policy makers’ concern, but the empirical analysis cannot discard other control variables, otherwise the regression results are biased. In the process of policy formulation, the topic of focus at the practical level is the unconditional impact of land transfer on the income increase of farm households at different income levels, regardless of the similarity of their household and individual characteristics.

Therefore, for the above OLS regression and Gini coefficient mean-based estimation limitations, this article uses quantile regression. The idea of quantile regression was first proposed by Koenker and Bassett (1978). It is an extension of OLS, which regresses the independent variable X based on the conditional quantile of the dependent variable Y. A regression model can be obtained at all quantile levels. Quantile regression is widely used because of the special asymmetric form of the absolute value residual estimation method and the non-normality requirement for outliers and error terms. The quantile regression estimates are calculated based on an asymmetric form of absolute residual minimization that uses the least absolute deviation estimator (LAD). Quantile regression provides a more comprehensive picture of the conditional distribution of explanatory variables than simply analyzing the conditional expectations of explanatory variables. The quantile regression estimation method is more robust to outliers than is the least-squares method. Moreover, quantile regression does not require strong assumptions regarding the error term; therefore, quantile regression coefficient estimates are more robust for non-normal distributions.

Additionally, we used PSM to address the endogeneity problem in the baseline regression. Both observable and unobservable factors, such as rural households’ own employment situation, the scale of local land transfer, and the government’s support for land transfer affect farmers’ participation in land transfer, and there is a certain “self-selection” problem. In the baseline regression analysis, the observable factors can be included in the control variables, but the unobservable factors make land transfers related to the random error term, leading to endogeneity problems. Rosenbaum and Rubin (1983) proposed a PSM method to solve the “self-selection” problem. The basic idea is to find a control group (not participated in land transfer) similar to the experimental group (participated in land transfer) according to the model setting, and to use the data of the control group to simulate the “counterfactual situation” of the experimental group where farmers do not participate in land transfer. By comparing the data of the two groups, we obtain the net income effect of farmers’ participation in land transfer, which is the average treatment effect (ATT) of the treatment group in the model. The ATT is calculated as follows:

In the above equation, is the income of the farmer marked as i after participating in land transfer, and is the farmer’s income when they do not participate in land transfer. Therefore, ATT is the difference between the income generated by participation and non-participation in land transfers, which is the net income generated by participation in land transfers only. However, because the farmer participated in land transfer, there was no in the real sample; thus, was not available. Therefore, we constructed a PSM model to find a sample close to the farmer from a sample of nonparticipants in land transfer. First, we constructed a logit model to estimate the conditional probability of a farmer participating in land transfer, which was considered the propensity score (p-score). Subsequently, a sample similar to the experimental group was selected using the proximity-matching method, and a balance test was used to verify that the characteristics of farmers’ participation in land transfer were not significantly different from those of farmers’ non-participation in farmland transfer. This is considered sufficient if the results meet the standard bias of 10% or less. Finally, the average treatment effect of farmers’ participation in land transfer is calculated based on the results of the previous matching.

Eventually, this study uses quantile regression, and the expression of the baseline regression model is as follows: represents one of the variables of , used to analyze the effects of land transfer, leased-in land, and leased-out land, respectively, on household per capita income. represent the control variables. is the random disturbance term.

The results of the baseline quantile regression are shown in Table 2. The explanatory variable for Eq. 1 is the total per capita income of rural households; the regression results show that the effect of participation in land transfer is positive at the 1% significance level, indicating that participation in land transfer has a positive effect on increasing the income of rural households, and participation in land transfer can increase the per capita income of rural households by 0.158 in general. Regarding the other control variables, the gender of the household head being male, working outside the home, having a certain amount of liquid assets, holding farm machinery at home, participating in financial investment, participating in social security and medical insurance, and receiving education all had positive effects on rural household per capita income. In contrast, rising age, deteriorating health status, and the shift in household location from east to west have a negative effect on rural households’ per capita incomes. Political orientation and courtesy expenses positively affect rural households’ per capita income. This may be because, in the vast rural areas of China, becoming a party member enhances one’s local prestige. Additionally, according to the Chinese tradition, rural gift-giving tends to cost less than returning gifts, which is a possible reason for the positive coefficients of both variables. Further examination of Eqs 2–6 indicates the effect of land transfer on income in the 10th, 30th, 50th, 70th, and 90th quartiles of , respectively. Overall, land transfer has a significant income-increasing effect on rural households at all income levels, but the income-increasing effect of land transfer shows a significant decreasing trend as the income distribution quantile increases. Specifically, the income-increasing effect of land transfer was 22.2% at the 10th quantile, 18.2% at the 30th quantile, and decreased to 8.44% at the 90th quantile, and the significance level decreased from 1% to 10%. This indicates that land transfer can achieve the effect of “significantly increasing low income and consolidating middle income,” which can eventually have a suppressive effect on income disparity.

This result may be explained by the fact that the income-generating effect of land transfer by farmers comes mainly from the inclusion of non-agricultural labor and capital inputs. As high-income households in rural areas tend to engage in non-agricultural fields earlier, or even if they engage in agricultural fields, they also join a large number of agricultural machinery and large-scale business investment, the original agricultural production mode of relying on the inputs of individual households’ labor force has been changed. Therefore, after high-income households participate in land transfer, the increase of their further engagement in non-agricultural fields is limited. If high-income households continue to expand the scale of agricultural production as land tenants, the rate of return in agriculture will be lower than that in non-agricultural fields, which will negatively affect their income-generating efficiency (it is a basic fact that the rate of return in agriculture and the price of agricultural products are low in China). On the other hand, low-and middle-income households, on the other hand, have realized a clear tendency for factors of production to move to the non-agricultural sector through land transfer, and thus they have a higher potential for income generation compared to high-income households. Ultimately, these two different trends will gradually reduce the intra-rural income gap.

Additionally, we check the regression results for leased-in land versus leased-out land in Table 3. Columns 1–6 show the effect of leased-in land on income, and it is clear that the income-increasing effect of leased-in land is not significant. Columns 7–12 are for leased-out land, which is consistent with the significance trend shown in the baseline regression. Leased-out land has a significant positive effect on income and produces a mostly decreasing income effect as the income quantile rises. After distinguishing between leased-in and leased-out land, we can infer that the income-increasing effect of participating in land transfers mainly comes from leasing out one’s contracted land for labor to work in non-farm industries or receiving land dividends, which provides a direction for the mechanism research below.

To address the endogeneity issue, we used the PSM method for the robustness analysis. Propensity scores were obtained, and a logit model was constructed with farmers’ participation in land transfer as the dependent variable. Nearest-neighbor matching was used to screen the control group, similar to the experimental group, and ATT was calculated for both groups. The results of the equilibrium test showed that the standardized deviations of all variables were below 10%, the standardized deviations of most variables were substantially reduced after matching compared with those before matching, and the t-test results of most variables did not reject the original hypothesis of no systematic differences between the experimental and control groups. Additionally, the pseudo R2, chi-square, and deviation means of the matched samples, with a much lower B value of less than 25% and an r value of 1.65, satisfy the balancing hypothesis well (see Table 4).

As Table 5 shows, the PSM estimate (0.158) is significantly positive, which is consistent with the results of the benchmark model. This indicates that participation in land transfer has a significantly positive effect on rural household income after data processing, verifying the robustness of the baseline regression results. Additionally, the quantile regression trend of the PSM regression is consistent with the baseline regression, and the income-increasing effect is not significant in the 90th quantile, which further indicates that land transfer has a poor income-increasing effect among high-income farmers and a more significant income-increasing effect on low-income farmers. Therefore, land transfer can achieve the effect of “significantly increasing low income and consolidating middle income,” which can eventually produce a suppression effect on income disparity.

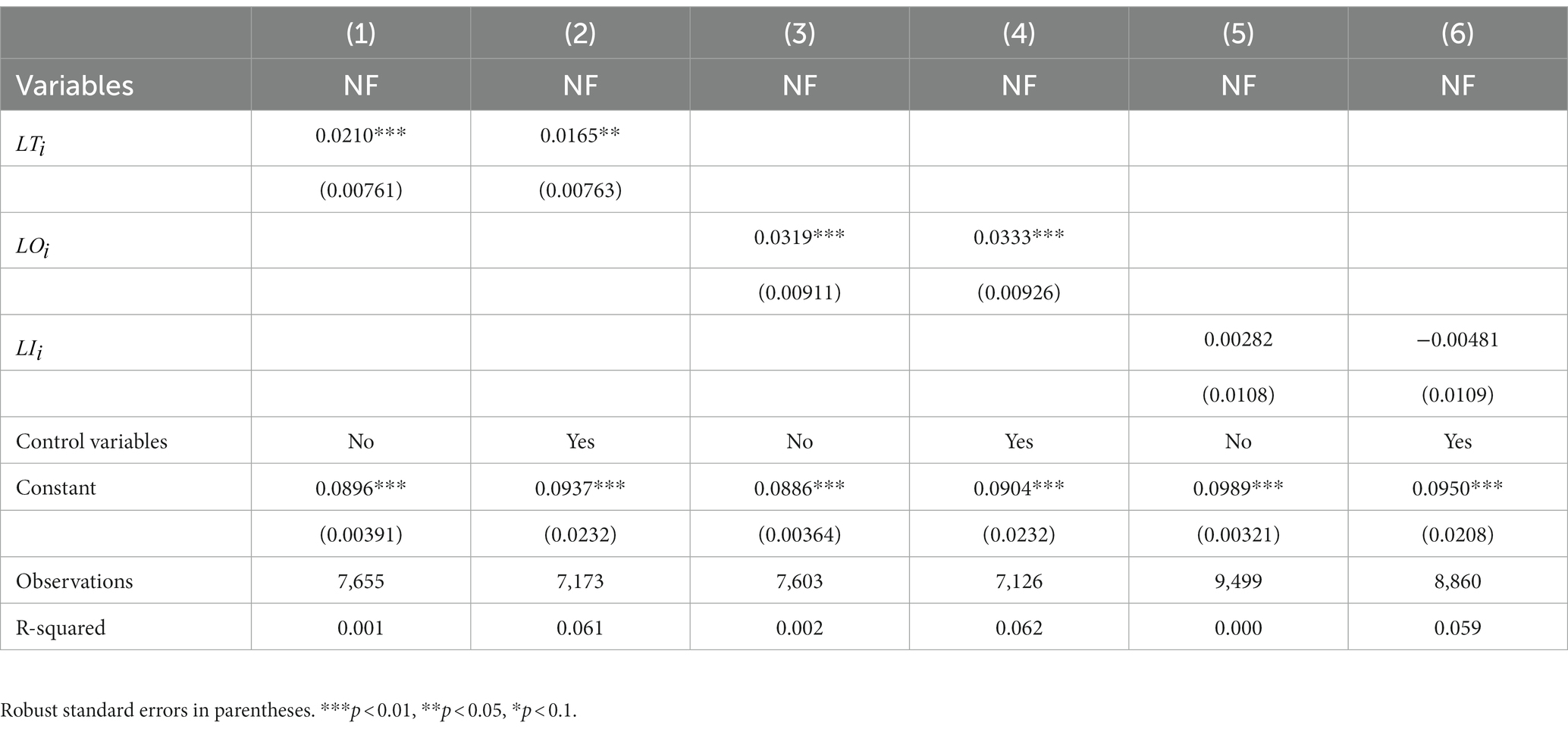

In the benchmark regressions, we further distinguish the impact of leased-in land from leased-out land on rural household per capita incomes. The comparison revealed that the impact of participation in land transfer on rural household income was overwhelming in the leased-out land approach. The per capita income of rural households increased significantly after leasing out land, and the effect of the income increase was more pronounced for low-income groups, thus reducing income disparity within rural areas. This study argues that this is because when land is leased out, farm households release more labor, capital, and other factors to invest in other jobs, such as non-farm businesses. This increases the efficiency of income generation while widening its avenues of income generation. Therefore, we chose the variable NF (Non-farm business and investment) to represent whether the farmer has a non-farm business and investment for further research. The estimation results in Table 6 show that participation in land transfer has a positive effect on non-farm businesses and investments, and the estimated coefficient is significant at the 1% level. Additionally, the estimated coefficient of leasing out land for non-farm businesses and investments is also positive at the 1% level and is greater than that of land transfer. In contrast, the effect of leases on land was not significant, and the coefficient was negative after the inclusion of the control variables. In other words, the mechanism analysis shows that land transfer (leased out land) can release farmers’ labor and other factors of production, such as capital, and put them into non-farm business and investment, resulting in higher economic benefits compared to continuing farming business.

Table 6. Mechanistic test: the impact of participation in land transfer on non-farm business and investment.

Regional differences in rural China are extremely pronounced, with the natural endowment environment, development base, and policy efforts differing among the eastern, central, and western rural regions. For this reason, we further divided the national sample into eastern, central, and western regions to compare the effects of participation in land transfer on rural household per capita income at the regional level, as well as the trends exhibited by the quantile regressions. As shown in Table 7, the effect of on rural household per capita income is significantly positive, regardless of the region. This finding indicates that participation in land transfers has a significant income-increasing effect across the country. Analyzing the quantile regression results of different regions, we find that the regression coefficients in the eastern region show a trend of “rising first and then falling,” and the effect of raising middle-income farmers is more obvious. The eastern region is the most developed coastal region in China, with many non-farm employment and business opportunities, a vibrant economy, and an efficient society. The coefficients and significance of the regressions in the central and western regions are essentially the same as the benchmark regressions: the effect of participation in land transfer is more effective in increasing the income of the low-income group, and the effect weakens as income increases. This phenomenon is due to the fact that there are more opportunities and potential for development in the non-agricultural sector in the rural areas of the central and western regions than in the eastern regions, where the market economy is more developed. In addition, the average income base in the rural areas of the central and western regions is lower, and the growth rate generated by an equal percentage increase in income is significantly higher than that in the eastern regions with higher incomes. Therefore, the transfer of land at the national level can also effectively reduce the internal income gap between rural areas in the East, the Middle East and the West.

The relatively weak market-oriented nature of the agricultural economy has led national governments to adopt supportive policies for their own agriculture, leading to policy intervention in agricultural development. The Chinese government has been emphasizing “food security,” “guarding the red line of 1.8 billion mu of arable land,” and “building basic farmland,” and has issued various policies to strengthen the main grain-producing areas (e.g., “The State Council’s Guidance on Establishing Functional Zones for Grain Production and Important Agricultural Product Production Reserves”). Additionally, there are significant differences in agricultural development endowments between the main grain-producing areas and other regions, which will strengthen agricultural production in the main grain-producing areas and perhaps have a crowding-out effect on farm household employment and investment in non-farm areas. We distinguished farm households into main grain-producing areas and other areas according to their locations. The main grain-producing areas are Heilongjiang, Henan, Shandong, Sichuan, Jiangsu, Hebei, Jilin, Anhui, Hunan, Hubei, Inner Mongolia, Jiangxi, and Liaoning. From the results in Table 8, the income-increasing effect of the main grain-producing areas participating in land transfer is weaker than that of other areas. The quantile regression results show that the income-increasing effect of participation in land transfer is greater for low-income people in other regions, and the weakening effect of land transfer on rural household income disparity is more obvious. This finding is consistent with the hypothesis that the presence of administrative interventions and differences in natural endowments make it more difficult for farmers in main grain-producing areas to participate in land transfers and engage in non-agricultural work than in other areas, and that the constraints of being tied to the traditional agricultural sector are greater. This situation makes it difficult for them to enter the non-agricultural field by liberating their labor, and the income-generating effect of land transfer is weakened.

Although land transfer is an important topic, prior research has mostly focused on its income-generating effects and failed to analyze the impact of land transfer on rural household income disparity. By contrast, this study analyzes the impact of land transfer on rural household income disparity from the perspective of a broadly representative sample of rural households in the CFPS. We find that the effect of participation in land transfer on the income of rural households with different income levels differs significantly; the increase in income is greater for the low-and middle-income groups than for the high-income groups. Therefore, this study argues that participation in land transfer can regulate rural income imbalances and mitigate the widening trend of rural income disparities. This finding is consistent with those of the recent studies that have focused on land transfer and income disparity (Wan et al., 2005; Jin and Deininger, 2009; Feng et al., 2010; Mao and Xu, 2015; Yu and Zhang, 2019; Udimal et al., 2020; Huang and Du, 2022; Ye et al., 2023). Previous research has shown that land transfer can reduce the income gap among rural households and that a well-developed land transfer market enables poor farmers to obtain more stable income, thus alleviating income inequality among farmers. Therefore, continuing to encourage land transfer and improving the rural land property rights system will be an important contribution to the “rural revitalization” that China is committed to promoting (Xing, 2008; Feng et al., 2010; Shi, 2020; Wang and Wang, 2022). We find that if we distinguish between leased-out and leased-in land, the increase in farmers’ income mainly comes from the former. After leasing out land, labor and other factors of production tied to agricultural production are released to other non-farm areas, which is the fundamental way to generate the farmers’ income-increasing effect. Compared to the high-income group, the low-and middle-income groups have been involved in the non-farm sector for a shorter period and have less initial input; hence, they can generate higher marginal returns. Additionally, this finding holds true in general in the eastern, central, and western regions, whereas this additional income-generating effect on the lower-and middle-income groups decreases as local farmers’ participation in nonfarm operations and investments becomes more prevalent.

This study has some limitations that should be addressed in the future. On the one hand, the data used are cross-sectional rather than panel, which depend on further mining of the CFPS data. On the other hand, dummy variables are used for some of the variables because of the underlying data; however, the use of quantitative variables significantly improves the persuasive and explanatory power of the model, which is a key direction for future enhancement.

Based on the CPFS micro survey data, this study employs quantile regression models and a PSM method to empirically analyze the effect of land transfer on rural household income disparity. The findings are as follows: First, participation in land transfer has a significant income increasing effect on rural households, and this effect is more obvious among the middle-and low-income groups, which helps reduce the income gap among rural households. Second, the income-generating effect of participating in land transfers is mainly attributed to leasing out the land. The results of the mechanism study show that leasing out one’s own land can release labor and other factors of production that are originally bound in agricultural production; these factors enter non-farm business and investment, resulting in a strong income-generating effect. Third, the heterogeneity analysis shows that regions with a higher overall level of participation in non-farm businesses and investments have weaker income-generating effects from land transfer than other regions, while regions with potential policy interference in rural non-farm businesses and investments also have weaker income-generating effects from land transfer than other regions. Correspondingly, the suppressive effect of participation in land transfers on rural household income disparity is weaker.

Based on these findings, the paper draws a number of policy recommendations: First, improve land transfer laws and regulations. Enhancing land transfer laws and regulations is crucial for safeguarding the rights of farmers and promoting rural economic development. Here are some specific measures: Protection of Lease Rights: Ensure that farmers’ lease rights are effectively protected during land transfer processes, preventing harm due to contract breaches or rent disputes. Establish an arbitration mechanism for quick dispute resolution. Land Price Assessment: Develop a fair method for assessing land prices to avoid unreasonably low or high land rental rates, ensuring fairness in the land transfer market. Land Ownership Registration: Utilize a modern land ownership registration system to ensure clear and distinct ownership for each piece of land, reducing land transfer risks. Second, promote land ownership verification. Land ownership verification is the foundation for addressing land transfer issues and requires strong policy support: Data Sharing for Verification: Establish a rural land ownership verification database, promoting information sharing among the government, farmers, and investors to enhance market transparency. Incentives for Transfer: To encourage active participation in land ownership verification by farmers, the government can provide incentives such as subsidies for land ownership verification or support for comprehensive land resource utilization. Land Use Planning: Develop rural land use planning, encouraging diverse land utilization, including agriculture, rural tourism, and rural industries. Third, establish a land transfer trading system. To stimulate the growth of the land transfer market, the government can take the following actions: Information Dissemination Platform: Create a comprehensive information dissemination platform offering data on land supply and demand, market prices, sample transfer contracts, and more, facilitating better market understanding for farmers and investors. Financial Support: Establish dedicated transfer funds to provide low interest loans or guarantees, encouraging rural households to actively participate in the land transfer market. Market Regulation Authority: Set up a specialized market regulation authority responsible for monitoring and managing the land transfer market to ensure fair competition and legal transactions (Danso-Abbeam et al., 2020). Fourth, strengthen training support. To enhance farmers’ competitiveness and adaptability in nonagricultural sectors, the government can implement the following measures: Skill Training Programs: Implement extensive skill training programs covering various industry sectors, including rural business management and technical training. Employment Guidance: Offer employment guidance and career planning services to help farmers find suitable job opportunities or entrepreneurial directions. Entrepreneurial Support: Establish entrepreneurship incubation centers, providing necessary resources and support for startups, encouraging active entrepreneurship among farmers. Fifth, improve rural public services. The government should continue to elevate the quality of rural public services, particularly in education, healthcare, and elderly care: Increased Education Investment: Increase education budgets, upgrade rural school facilities, and provide more scholarships and subsidies to enhance educational opportunities. Healthcare Assurance: Develop rural medical institutions, provide basic healthcare coverage, promote telemedicine services, and advance medical insurance systems. Elderly Care Services: Support the establishment of elderly care homes and community based elderly care centers, offering elderly care and rehabilitation services.

In conclusion, the comprehensive implementation of these policy recommendations will help promote rural land transfer, diversify rural economic development, improve farmers’ living standards, and achieve the goal of building a modernized agriculture, rural areas, and rural residents. Collaboration among the government, various sectors of society, farmers, and relevant institutions is essential to ensure the successful implementation of these policies. This will contribute to the construction of more prosperous, stable, and sustainable rural communities.

Publicly available datasets were analyzed in this study. This data can be found at: 2018 China Family Panel Studies data (http://www.isss.pku.edu.cn/cfps/download/login#/fileTreeList).

XS, XY, and BW contributed to the conception and design of the study. XS and BW organized the database. BW performed the statistical analysis. XS wrote the first draft of the manuscript. XS, XY, and HX wrote parts of the manuscript. All authors contributed to the article and approved the submitted version.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Adu-Baffour, F., Daum, T., and Birner, R. (2019). Can small farms benefit from big companies’ initiatives to promote mechanization in Africa? A case study from Zambia. Food Policy 84, 133–145. doi: 10.1016/j.foodpol.2019.03.007

Benin, S. (2015). Impact of Ghana’s agricultural mechanization services center program. Agric. Econ. 46, 103–117. doi: 10.1111/agec.12201

Benjamin, D., and Brandt, L. (1997). Land, factor markets, and inequality in rural China: historical evidence. Explor. Econ. Hist. 34, 460–494. doi: 10.1006/exeh.1997.0683

Chen, Y., Lei, X., and Zhou, L.-A. (2017). Does raising family income cause better child health? Evidence from China. Econ. Dev. Cult. Chang. 65, 495–520. doi: 10.1086/691002

Danso-Abbeam, G., Dagunga, G., and Ehiakpor, D. S. (2020). Rural non-farm income diversification: implications on smallholder farmers’ welfare and agricultural technology adoption in Ghana. Heliyon 6:e05393. doi: 10.1016/j.heliyon.2020.e05393

Fei, Z. (2018). Farmers’ land transfer-out behavior from the perspective of household livelihood endowment based on the survey in Anhui, Hubei and Sichuan. Asian Agric. Res. 10, 28–34.

Feng, S., Heerink, N., Ruben, R., and Qu, F. (2010). Land rental market, off-farm employment and agricultural production in Southeast China: a plot-level case study. China Econ. Rev. 21, 598–606. doi: 10.1016/j.chieco.2010.06.002

Firpo, S., Fortin, N. M., and Lemieux, T. (2009). Unconditional quantile regressions. Econometrica 77, 953–973. doi: 10.3982/ECTA6822

Godfray, H. C. J., Beddington, J. R., Crute, I. R., Haddad, L., Lawrence, D., Muir, J. F., et al. (2010). Food security: the challenge of feeding 9 billion people. Science 327, 812–818. doi: 10.1126/science.1185383

Gong, M., Li, H., and Elahi, E. (2022). Three rights separation reform and its impact over farm's productivity: a case study of China. Land Use Policy 122:106393. doi: 10.1016/j.landusepol.2022.106393

Guo, J., Qu, S., Xia, Y., and Lu, K. (2018). Income distribution effects of rural land transfer. China Popul. Resour. Environ. 28, 160–169.

Han, H., and Zhong, F. (2011). The impact of "surplus land" flow on local farmers' income distribution after labor force outflow. China Rural Econ. 4, 18–25.

Huang, Z., and Du, Y. (2022). Does the transfer of agricultural land help to "raise the low and expand the center" of agricultural household groups? J. Northwest Agric. For. Uni. Soc. Sci. Ed. 22, 87–99. doi: 10.13968/j.cnki.1009-9107.2022.06.11

Jin, S., and Deininger, K. (2009). Land rental markets in the process of rural structural transformation: productivity and equity impacts from China. J. Comp. Econ. 37, 629–646. doi: 10.1016/j.jce.2009.04.005

Kakwani, N., Wang, X., Xue, N., and Zhan, P. (2022). Growth and common prosperity in China. China World Econ. 30, 28–57. doi: 10.1111/cwe.12401

Kemper, N., Ha, L. V., and Klump, R. (2015). Property rights and consumption volatility: evidence from a land reform in Vietnam. World Dev. 71, 107–130. doi: 10.1016/j.worlddev.2013.11.004

Kimura, S., Otsuka, K., Sonobe, T., and Rozelle, S. (2011). Efficiency of land allocation through tenancy markets: evidence from China. Econ. Dev. Cult. Chang. 59, 485–510. doi: 10.1086/649639

Koenker, R., and Bassett, G.Jr. (1978). Regression quantiles. Econometrica: Journal of the Econometric Society 33–50. doi: 10.2307/1913643

Li, R., Li, Q., Lv, X., and Zhu, X. (2019). The land rental of Chinese rural households and its welfare effects. China Econ. Rev. 54, 204–217. doi: 10.1016/j.chieco.2018.11.004

Lin, L.-F., and Wang, J. (2010). A review of agricultural land property rights reforms and their market effects in transition and developing countries. J. Econ. 12, 121–125.

Liu, X., Zhou, H., and Wang, X. (2021). Has farmland transfer narrowed the income gap of farm households? Micro evidence based on CFPS. J. Agric. For. Econ. Manag. 20, 501–510. doi: 10.16195/j.cnki.cn36-1328/f.2021.04.52

Luan, J., Zhang, Y., Li, D. W., and Guo, J. (2021). A study on the income distribution effect of land management right transfer among rural residents: heterogeneity estimation based on quantile treatment effect. Statist. Res. 38, 96–110. doi: 10.19343/j.cnki.11-1302/c.2021.08.008

Ma, W., Renwick, A., and Grafton, Q. (2018). Farm machinery use, off-farm employment and farm performance in China. Aust. J. Agric. Resour. Econ. 62, 279–298. doi: 10.1111/1467-8489.12249

Mao, P., and Xu, J. (2015). Agricultural land system, land management right transfer and farmers' income growth. Manage. World 5, 63–74. doi: 10.19744/j.cnki.11-1235/f.2015.05.007

Meinzen-Dick, R., Quisumbing, A., Doss, C., and Theis, S. (2019). Women’s land rights as a pathway to poverty reduction: framework and review of available evidence. Agric. Syst. 172, 72–82. doi: 10.1016/j.agsy.2017.10.009

Nie, L., and Xia, H. (2016). Land transfer income in China: the past, present situation and the future. J. Shanxi Agric. Univ. Soc. Sci. Ed. 15, 723–728. doi: 10.13842/j.cnki.issn1671-816x.2016.10.021

Rosenbaum, P. R., and Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika 70, 41–55. doi: 10.1093/biomet/70.1.41

Rubin, D. B. (2001). Using propensity scores to help design observational studies: application to the tobacco litigation. Health Services and Outcomes Research Methodology 2, 169–188. doi: 10.1023/A:1020363010465

Sang, X., Luo, X., Razzaq, A., Huang, Y., and Erfanian, S. (2023). Can agricultural mechanization services narrow the income gap in rural China? Heliyon 9:e13367. doi: 10.1016/j.heliyon.2023.e13367

Shi, C. L. (2019). Heterogeneity analysis of the income effect of land transfer among farmers. Learn. Pract. 3, 37–46. doi: 10.19624/j.cnki.cn42-1005/c.2019.03.005

Shi, C. L. (2020). Land transfer and intra-farm household income gap: exacerbation or alleviation? Econ. Manage. Res. 41, 79–92. doi: 10.13502/j.cnki.issn1000-7636.2020.12.007

Shi, C. L., Luan, J., Zhu, J., and Chen, Y. (2017). The impact of land transfer on farm household income growth and income gap – an empirical analysis based on farm household survey data in 8 provinces. Econ. Rev. 5, 152–166. doi: 10.19361/j.er.2017.05.12

Tan, R., Wang, R., and Heerink, N. (2020). Liberalizing rural-to-urban construction land transfers in China: distribution effects. China Econ. Rev. 60:101147. doi: 10.1016/j.chieco.2018.01.001

Udimal, T. B., Liu, E., Luo, M., and Li, Y. (2020). Examining the effect of land transfer on landlords’ income in China: an application of the endogenous switching model. Heliyon 6:e05071. doi: 10.1016/j.heliyon.2020.e05071

Wan, G., Zhou, Z., and Lu, Q. (2005). Income inequality in rural China: a regression decomposition using farm household data. China Rural Econ. 5, 4–11.

Wang, C. C. (2011). Rural land transfer, labor resource allocation and farmers' income growth: an empirical study based on a household survey in 17 provinces of China. Agric. Technol. Econ. 1, 93–101. doi: 10.13246/j.cnki.jae.2011.01.009

Wang, C., and Wan, G. (2015). Income polarization in China: trends and changes. China Econ. Rev. 36, 58–72. doi: 10.1016/j.chieco.2015.08.007

Wang, P., and Wang, F. (2022). A study of the impact of land transfer decisions on household income in rural China. PLoS One 17:e0276559. doi: 10.1371/journal.pone.0276559

Xiao, L. D., and Zhang, B. (2017). Land transfer and the widening of intra-farm household income gap-an analysis based on a survey of 725 farm households in 39 villages in Jiangsu. Finance Econ. Series 9, 10–18. doi: 10.13762/j.cnki.cjlc.20170419.002

Xie, L. H., and Wei, G.-X. (2022). Challenges and paths to narrowing the internal income gap in rural areas under the perspective of common wealth. De Economist 9, 119–128. doi: 10.16158/j.cnki.51-1312/f.2022.09.001

Xing, C. (2008). Quantile regression, returns to education and income disparity. Stat. Res. 5, 43–49. doi: 10.19343/j.cnki.11-1302/c.2008.05.008

Xu, Q., Tian, S. C., Xu, Z. G., and Shao, T. (2008). Agricultural land system, land fragmentation and farmers' income inequality. Econ. Res. 2, 83–92.

Xu, C., and Yu, J. (2020). Analysis of the income effect of land transfer in the context of "three rights transfer"-based on a survey of farmers in 10 counties of three provinces in the main grain producing areas. J. Huazhong Agric. Univ. Soc. Sci. Ed. 1, 18–27+162. doi: 10.13300/j.cnki.hnwkxb.2020.01.003

Yang, Z., Ma, X., Zhi, P., and Ma, D. (2017). Research on land transfer and Farmers' income changes. China Popul. Resour. Environ. 27, 111–120.

Ye, F., Wang, L., Razzaq, A., Tong, T., Zhang, Q., and Abbas, A. (2023). Policy impacts of high-standard farmland construction on agricultural sustainability. Total factor productivity-based analysis. Land 12:283. doi: 10.3390/land12020283

Yu, F., and Zhang, Y. L. (2019). Outward labor, social capital and intra-farm household income gap. Econ. Manage. Res. 40, 90–103. doi: 10.13502/j.cnki.issn1000-7636.2019.08.007

Zhang, L., and Feng, K. (2016). Analysis of the impact of rural land transfer on farmers’ income: a case study of farmers in Zaozhuang City. Asian Agric. Res. 12:4. Available at: https://doi.org/CNKI:SUN:AAGR.0.2016-12-018

Zhang, L., Feng, S., Heerink, N., Qu, F., and Kuyvenhoven, A. (2018). How do land rental markets affect household income? Evidence from rural Jiangsu, P.R. China. Land Use Policy 74, 151–165. doi: 10.1016/j.landusepol.2017.09.005

Zhang, H., Xu, Z., Wu, K., Zhou, D., and Wei, G. (2019). Multi-dimensional poverty measurement for photovoltaic poverty alleviation areas: evidence from pilot counties in China. J. Clean. Prod. 241:118382. doi: 10.1016/j.jclepro.2019.118382

Zhao, J. Z., and Lu, M. (2010). The contribution of relationships to rural income gap and its regional differences – a regression-based decomposition analysis. Economics (Quarterly) 9, 363–390. doi: 10.13821/j.cnki.ceq.2010.01.011

Zhen, S. P., and Ling, C. (2017). The impact of rural labor mobility on rural income and income gap – a perspective based on labor heterogeneity. Economics (Quarterly) 16, 1073–1096. doi: 10.13821/j.cnki.ceq.2017.02.11

Keywords: land transfer, income disparity, non-farm sector business, quantile regression model, propensity score matching

Citation: Wang B, Shao X, Yang X and Xu H (2023) How does land transfer impact rural household income disparity? An empirical analysis based on the micro-perspective of farmers in China. Front. Sustain. Food Syst. 7:1224152. doi: 10.3389/fsufs.2023.1224152

Received: 17 May 2023; Accepted: 09 October 2023;

Published: 19 October 2023.

Edited by:

Dingde Xu, Sichuan Agricultural University, ChinaReviewed by:

Peng Jiquan, Jiangxi University of Finance and Economics, ChinaCopyright © 2023 Wang, Shao, Yang and Xu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xuyang Shao, c2hhb3h1eWFuZzE5OTBAZm94bWFpbC5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.