- 1School of Management Science and Engineering, Shandong University of Finance and Economics, Jinan, China

- 2School of Management, Shandong University, Jinan, China

Introduction: Green finance plays a crucial role in driving sustainable development and has the potential to effectively reduce pollution emissions, thereby positively impacting the environment. However, in the agricultural sector, China, unlike developed countries, primarily relies on a small-peasant economy, and the green financial system is not well-developed. As a result, the specific emission reduction effects and mechanisms of green finance on agricultural non-point source pollution (ANSP) remain unclear. The objective of our research is to explore the internal mechanisms through which green finance influences ANSP, with the aim of providing valuable policy insights to the government and promoting the green transformation of agriculture for enhanced food security.

Methods: This study employs an empirical analysis of green finance on ANSP using provincial panel data from China spanning the years 2005 to 2020. By utilizing robust data and applying empirical analysis, we can derive scientifically credible conclusions. We introduce a relative indicator to assess the trend of ANSP and investigate the pathways through which green finance operates using heterogeneity analysis, intermediary effect evaluation, and threshold effect analysis.

Results and Discussion: The empirical findings reveal the following insights: (1) While green finance demonstrates a significant reduction effect on ANSP, this effect varies across different regions. Specifically, the impact of green finance on ANSP reduction is more pronounced in areas characterized by strong comprehensive agricultural strength, high levels of economic development, and predominantly focused on plantation agriculture. (2) From a mechanistic standpoint, green finance substantially diminishes ANSP by facilitating agricultural scaling and promoting the adoption of green technologies. (3) The threshold effect analysis demonstrates that the mitigation effect of green finance on ANSP exhibits non-linear characteristics, with a double threshold effect observed. As the level of green finance development increases, the mitigation effect is further enhanced.

Conclusion: In conclusion, the appropriate implementation of green finance can effectively enhance the agricultural environment and ensure food security. Considering the heterogeneity of the role of green finance and the presence of threshold values, it is crucial for the government to tailor green finance policies according to local conditions. This research not only expands on previous studies but also offers valuable insights for the government in formulating green finance policies. Furthermore, it provides a viable pathway for reducing ANSP while serving as a reference for other developing countries aiming to establish green agriculture and sustain food system security.

1. Introduction

After World War II, the global population increased. Food demand and resource exploitation also expanded. Therefore, agricultural non-point source pollution (ANSP) caused by the development of agricultural production and unreasonable exploitation of resources increases annually. The U.S. EPA survey shows that ANSP is the main source of water quality impacts in surveyed rivers and lakes, the second largest source of wetland impairment, and the main cause of estuarine and groundwater pollution (EPA, 2005, https://nepis.epa.gov/Exe/ZyPDF.cgi/P10039OH.PDF?Dockey=P10039OH.PDF). Meanwhile, eutrophication due to agriculture nutrient losses is another large-scale problem, especially in the Baltic and Black Seas (EEA, 2019, https://www.eea.europa.eu/publications/nutrient-enrichment-and-eutrophication-in). In China, ANSP is also can not be ignored. As the world’s largest developing country, China supplies 22% of the world’s population with 7% of the world’s arable land and uses more than 30% of the world’s agrochemicals. Although ANSP prevention and control work has risen to the national will, and its prevention and control has achieved initial results, but the pattern that ANSP emissions account for “half of the total emissions” has not changed (Jin and Xing, 2018; Hu et al., 2021). Recently, agricultural surface pollution has become one of the main factors affecting the sustainable improvement of China’s water environment quality. About 1/4 of the nitrogen and phosphorus pollutants in agricultural surface pollution come from plantation pollution, which mainly migrates to receiving water bodies through runoff, side seepage and infiltration (Ren et al., 2023). At the same time, excessive use of chemical fertilizer has seriously polluted the water quality (Xu et al., 2022). Excessive agricultural activities have severely polluted groundwater and put far more pressure on resources and the environment than in any other country. The “China Ecological Environment Status Bulletin 2020” pointed out that in shallow groundwater quality monitoring, only 22.7 percent of all monitoring sites have good water quality (Ministry of Ecology and Environment PRC, 2020).

Currently, under the main theme of coping with environmental pollution and developing a green economy, both prevention and treatment require large amounts of funds (Shen and Lu, 2022), and the effect of relying solely on government policies to promote pollution control is very limited (Tian and Lin, 2019). In contrast, green finance can promote environmental protection and sustainable economic and social development. Its service scope is mainly oriented to projects or economic activities that support environmental improvement, climate change response and efficient resource conservation and utilization (Sharif and Vijay, 2018; Muganyi et al., 2021). Therefore, green finance is gradually favored by governments and markets.

Green finance is currently well-developed in developed Western countries and has achieved remarkable results in both industrial emission reduction and agricultural pollution reduction, which is mainly due to its large farm system and the perfect green financial system in developed countries. Unlike developed countries, China is mostly a small-peasant economy, and the main agricultural producers are individual farmers, with the characteristics of very small cultivation area per capita, low literacy, little collateral and poor credit (Liang, 2023). So it’s difficult for individual farmers to obtain green financial support. In addition, there are significant characteristics such as low returns, high risk and long cycles to carry out green agriculture in China, and there are problems such as insufficient innovation and unsound relevant policies in green finance in the agricultural field (Ma et al., 2021). Although the central government strongly encourages the development of green financial services for rural revitalization, in order to maximize benefits, local governments, under the dual pressure of economic incentives and performance evaluation, tend to concentrate financial resources on production areas with higher economic benefits, but pay insufficient attention to agricultural environmental protection, leading to the intensification of agricultural non-point source pollution (Dong, 2020). In China, therefore, the relationship between green finance and ANSP is not clear. Then, can green finance reduce ANSP in China? Is the effect of green finance in reducing pollution in agriculture consistent in different regions? What is the internal mechanism by which green finance reduces ANSP? Is there a threshold effect between green finance and ANSP?

The results on green finance and environmental improvement in the current research are remarkable, but most of them focus on industrial and overall environmental improvement, with few studies focusing on green finance and agricultural environmental improvement. In order to study and explore the above issues, this paper conducts an empirical analysis of the impact of green finance on ANSP using provincial panel data of China from 2005 to 2020. And the mechanism of the role of green finance is explored in depth through the mediating effect model, heterogeneity analysis and threshold effect model in order to provide theoretical support for the government’s governance of ANSP.

The four key contributions that this paper offers in comparison to previous literature can be summarized as follows. First, our research fills a gap in the literature. Based on a review of previous literature, our paper is the first to examine the pollution-reducing effects of green finance from an agricultural perspective, which can raise awareness of the importance of green finance and its application in agriculture. Our paper provides micro-level empirical evidence for research in this area, thus enriching the research on the impact of green finance on ANSP. Second, We innovatively consider the heterogeneity of the role of green finance in three different dimensions. We find that green finance did not significantly reduce ANSP in all areas. Its pollution reduction effect was more effective only in agricultural provinces, economically developed provinces, and areas with developed plantations. Third, we explore the impact mechanism between green finance and ANSP. Green finance takes environmental protection as the landing point and gradually connects with ANSP management, but the current literature only covers its theoretical level, and there is no in-depth study on the mechanism of green finance’s effect on ANSP management. By conducting mechanism analysis, this paper finds that green finance can significantly reduce agricultural surface-source pollution by enhancing agricultural scale and green technology. Fourth, we find two threshold points of green finance. Our research verifies that the emission reduction effect of green finance on ANSP is non-linear, and its pollution reduction effect on ANSP will increase as the development level of green finance increases. The results of the above empirical study provide directions for the orderly promotion and precise implementation of future pilot policies. And it also provides reference significance for other developing countries in the world.

The remainder of this paper is structured as follows: the second part is a review of the relevant literature; the third part provides a theoretical analysis and research hypothesis; the fourth part outlines data sources, variable selection, and model construction; the fifth part gives relevant empirical analysis; and the sixth part outlines the empirical conclusions and policy implications.

2. Literature review and research hypothesis

2.1. Literature review

Theoretically, crop residue burning, livestock stocking, agricultural machinery, grain production and other crop production generate large amounts of ANSP and increase CO2 emissions, which seriously affect the ecological environment, and the destruction of the ecological environment will inevitably affect the agro-ecosystem in turn (Arif et al., 2018; Abbas et al., 2020a,b; Basit et al., 2021). So the government must reconsider its policies related to agricultural and livestock production and adopt environment-friendly practices in the agriculture sector that may reduce the ANSP in the long run (Abbas et al., 2020a,b). Based on these, green finance can coordinate the relationship between ecology and finance under a reasonable market mechanism, achieve effective management of environmental risks and optimal allocation of environmental resources (Wang and Zhi, 2016), and achieve a win-win situation of green economic development and environmental improvement by promoting the development of green technology (Zhou et al., 2020). In recent years, research on green finance in maintaining sustainable environmental development has achieved fruitful results. For example, using municipal-level data and a semi-parametric difference-in-difference approach, Muganyi et al. (2021) empirically found that green finance can lead to a significant reduction in overall industrial pollution (Muganyi et al., 2021). Using 15 years of data from South Asia, Southeast Asia, China, Middle Eastern countries, and Europe, Khan et al. (2022) found that green financing for renewable energy minimizes global CO2 emissions (Khan et al., 2022). Peng et al. (2022) found that green finance forms a complementary and mutually reinforcing relationship with environmental governance through interaction with green industries (Peng et al., 2022). He et al. (2022) found that green finance reduced the CER performance of polluting firms by increasing financing constraints, reducing environmental investments, and reducing technological innovation and thus improving the environment (He et al., 2022). Liu and Wang (2023) used a multiplicative approach to study the amount of green patents in a financial innovation pilot zone; they demonstrated that green finance promotes green patent output through intensive R&D investment and sustainable development goals and that it provides a feasible path to achieve the goal of “carbon peaking and carbon neutrality”(Liu and Wang, 2023). Gu et al. (2023) found, through empirical analysis, that green finance improves the energy consumption structure by providing financial support for green development, thereby reducing carbon emissions (Gu et al., 2023). Guo et al. (2022) found that green finance reduces carbon emissions by reducing the amount of fertilizer applied (Guo et al., 2022). Using 2004–2019 Chinese provincial panel data, Sun et al. (2022) found that green finance development has a significant inhibitory effect on local and surrounding carbon emissions (Sun et al., 2022). However, looking at the literature, it can be observed that studies on green finance and pollution abatement are mainly considered from the perspective of carbon abatement and industrial pollution abatement, with few studies conducted from the perspective of ANSP abatement.

For ANSP reduction, a small number of scholars have considered the important role played by finance in the process of ANSP management and have conducted relevant studies. From the theoretical basis, it has been found that there is an inverted U-shaped relationship between financial technology development and ANSP, so that ANSP can be reduced more effectively by improving the level of financial technology as a main focus (Jiang et al., 2019). At the same time, reasonable ecological compensation standards are also key to solving farmland surface source pollution, and fiscal compensation can effectively stimulate farmers’ willingness to control surface source pollution and reduce ANSP (Lu et al., 2021). Based on these, Jiang et al. (2020) established a panel-smoothed transformation regression model and concluded that the increase in ANSP due to agricultural economic growth is largely related to the level of financial development and that increasing the level of finance to a medium-high threshold will suppress ANSP (Jiang et al., 2020). Lin et al. (2022) empirically tested the mitigation effect of digital financial inclusion on ANSP by constructing a fixed-effects model based on provincial data in China. Some scholars have also found that with the improvement of the development level of digital inclusive finance, the effect of pollution mitigation is enhanced (Lin et al., 2022). Ewa et al., 2020 showed that transferring financial support to large-scale restoration programs in rivers and riverside wetlands is cost-effective and can significantly reduce agricultural losses of nitrogen and phosphorus to surface waters and reduce the environmental risks of ANSP (Ewa et al., 2020). Although the above mentioned literature has studied the role of finance in ANSP emission reduction and provides a reference for this paper, these studies do not have content on green finance and lack research on green finance and ANSP emission reduction. Based on this, this paper conducts an empirical analysis of green finance and ANSP emission reduction to explore the mechanism of green finance in promoting ANSP emission reduction, which enriches the existing research.

2.2. Research hypothesis

2.2.1. Green finance and ANSP

Green finance is conducive to ANSP reduction. First, green finance promotes the construction of rural ecological, environmental management facilities and ecological recycling agriculture development by intervening in green projects to realize the role of ANSP emission reduction (Dong, 2020). Second, green finance can optimize resource allocation. It promotes the overall management level and technological innovation capacity of ecological agriculture by providing financial resources for eco-friendly low energy consumption and low-pollution green projects. In addition, it provides advanced agricultural equipment and materials for the market such as organic fertilizers that are more ecologically friendly. And it also provides a guarantee for the sustainable development of ecological agriculture (Tian and Lin, 2019), which in turn reduces the generation of ANSP from the source. Finally, green finance alleviates the financing constraints of small and medium-sized ecological agriculture operators. Also providing funds for the development of ecological agriculture, further expanding the scale of ecological agriculture and realizing great ecological and social value (Gao et al., 2022). Based on this, this paper proposes hypothesis one:

H1: Green finance can reduce ANSP.

2.2.2. Green finance, agricultural scaling and ANSP

Green finance promotes the enhancement of agricultural scale. First, green finance targets rural green resources and green industrial structures. It integrates and guides financial resources to be mobilized in the field of rural green industries, which is conducive to the enhancement of green or ecological agriculture scale (Ge and Zhou, 2011). Second, small-scale planting and breeding are uneconomical, expanding large-scale production can lead to a certain scale effect. Green finance can alleviate the financing constraints of ecological agricultural operators and prompt them to realize large-scale operations (Y, 2022). Once again, green finance has a guiding role in the development of eco-agriculture. By providing funds for eco-agricultural operators, green finance will guide the transformation of traditional agricultural operators, and thus will further enhance the scale of eco-agriculture (Ye et al., 2022). Finally, financial institutions tend to support agricultural operators that have already attained a scale due to risk factors and their interests (Ge and Zhou, 2011).

The increase in agricultural scale contributes to the reduction in ANSP. First, agricultural scale increases the long-term investments of agricultural operators (Zhang and Yue, 2019). For the sake of maximizing their interests, agricultural operators become more forward-looking and include the sustainable development of ecological resources such as land in the consideration of production. This contributes to the management of ANSP. Second, the development of agricultural mechanization, as the key to agricultural scale management, has realized the core mechanism of “machinery replacing labor” (Zhang, 2023). Moreover, agricultural mechanization infrastructure will replace individual agricultural practices with high pollution emissions such as diffuse irrigation, further reducing ANSP. Furthermore, the increase in agricultural scale contributes to the standardization of ecological agriculture. It helps reduce the number of agrochemical inputs per unit area and thus reduces ANSP (Zhu et al., 2017). In summary, hypothesis two is proposed in this paper:

H2: Green finance promotes the reduction of ANSP by enhancing the scale of agriculture.

2.2.3. Green finance, green technology level and ANSP

Green finance promotes the improvement of the green technology level. First, unlike the traditional financial sector, green finance plays a resource allocation role in the market by restricting projects with high pollution, high energy consumption and high emissions (Muganyi et al., 2021). Financial support is given to green innovation-oriented projects or enterprises (Shu et al., 2016). As a result, technologies and projects related to green or eco-agricultural technologies in agriculture will receive the pro-grandfathering of green finance. It enhances the overall level of eco-agricultural technologies. Second, green finance can encourage enterprises to carry out green technology development (Tao, 2021). It encourages agriculture-related enterprises to promote the progress of agricultural technology through technological innovation in agricultural machinery, planting and breeding. This further promotes the development of agriculture toward efficiency, modernization and sustainability. Finally, green finance contributes to the popularization and application of green technology. It can enhance the promotion and application of modern agricultural machinery and equipment. In addition, it enhances ecological agricultural technology and further promotes the level of green technology by alleviating the financing constraints of agricultural operators, agricultural equipment operators, farmers and other business entities.

The increase in the level of green technology contributes to the reduction of ANSP. The green technology level can be further subdivided into green technology efficiency change and green technology progress change (Guo and Liu, 2020). In terms of efficiency, the improvement in the level of green technology has advanced the high-quality development of agriculture. It also can facilitates the promotion of agricultural mechanization and digital production technology. All of these can effectively improve the efficiency of agricultural production, and reduce pollution and damage to the ecological environment caused by agricultural production (Dong, 2020). In terms of technological advances, first, green technological advances promote the development of more eco-friendly agricultural products (Wang and Zhi, 2016), reducing pollution by replacing or reducing resource consumption, such as replacing traditional high-pollution chemical fertilizers with low-pollution organic fertilizers to reduce ANSP at the source. Second, specialized pollution control technology provides an effective way to solve environmental problems, and farmers can improve the use of resources after mastering the technology (Tao et al., 2023). Therefore, the improvement in the level of green technology contributes to the reduction of ANSP by both improving technical efficiency and promoting technological progress. In summary, this paper proposes hypothesis three:

H3: Green finance promotes the reduction of ANSP by promoting the improvement of the green technology level.

3. Research design

3.1. Data source

We choose 2005–2020 as the research period to reflect the latest trends in the research results. The data for green finance calculations are obtained from the websites of authoritative institutions such as the Bureau of Statistics, the Ministry of Science and Technology and the People’s Bank of China. In addition, national sources are used to collect data, including provincial and municipal statistical yearbooks, environmental status bulletins and some professional statistical yearbooks, such as the China Science and Technology Statistical Yearbook, China Energy Statistical Yearbook, China Financial Yearbook, China Agricultural Statistical Yearbook, China Industrial Statistical Yearbook, and China Tertiary Industry Statistical Yearbook. The data on ANSP come from the National Bureau of Statistics, China Rural Statistical Yearbook and China Statistical Yearbook.

3.2. Indicator construction

3.2.1. Dependent variable

The dependent variable in this study is ANSP. Combining the measurement ideas of Chen et al. (2006), we used the non-point source pollution emissions from farming and planting to express the total ANSP. Considering the expansion of agricultural production, we choose the ratio of total ANSP to the value-added of agriculture, forestry, animal husbandry and fishery as a relative indicator to objectively reflect the emission trend of ANSP. The calculation formula of ANSP is as follows:

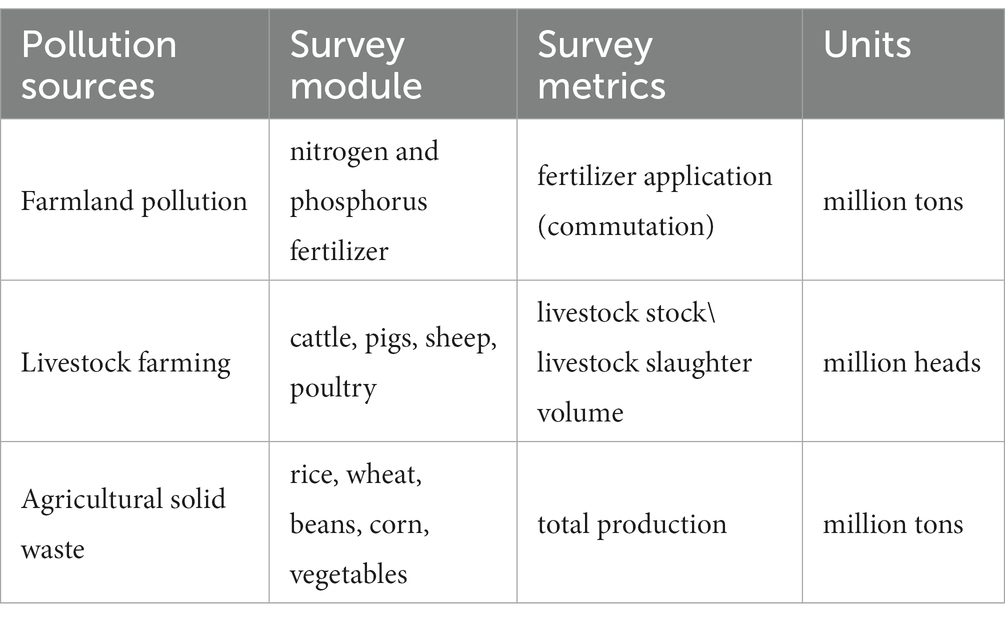

is the amount of emissions from pollutant source j in province i in year t. is the value added of agriculture, forestry, animal husbandry and fishery in province i in year t. is the statistics of pollution source j in province i in year t. is the discharge coefficients of unit j pollution source. The emission coefficients refer to the empirical data summarized by Lai et al. (2004). The accounting units are shown in Table 1.

3.2.2. Independent variable

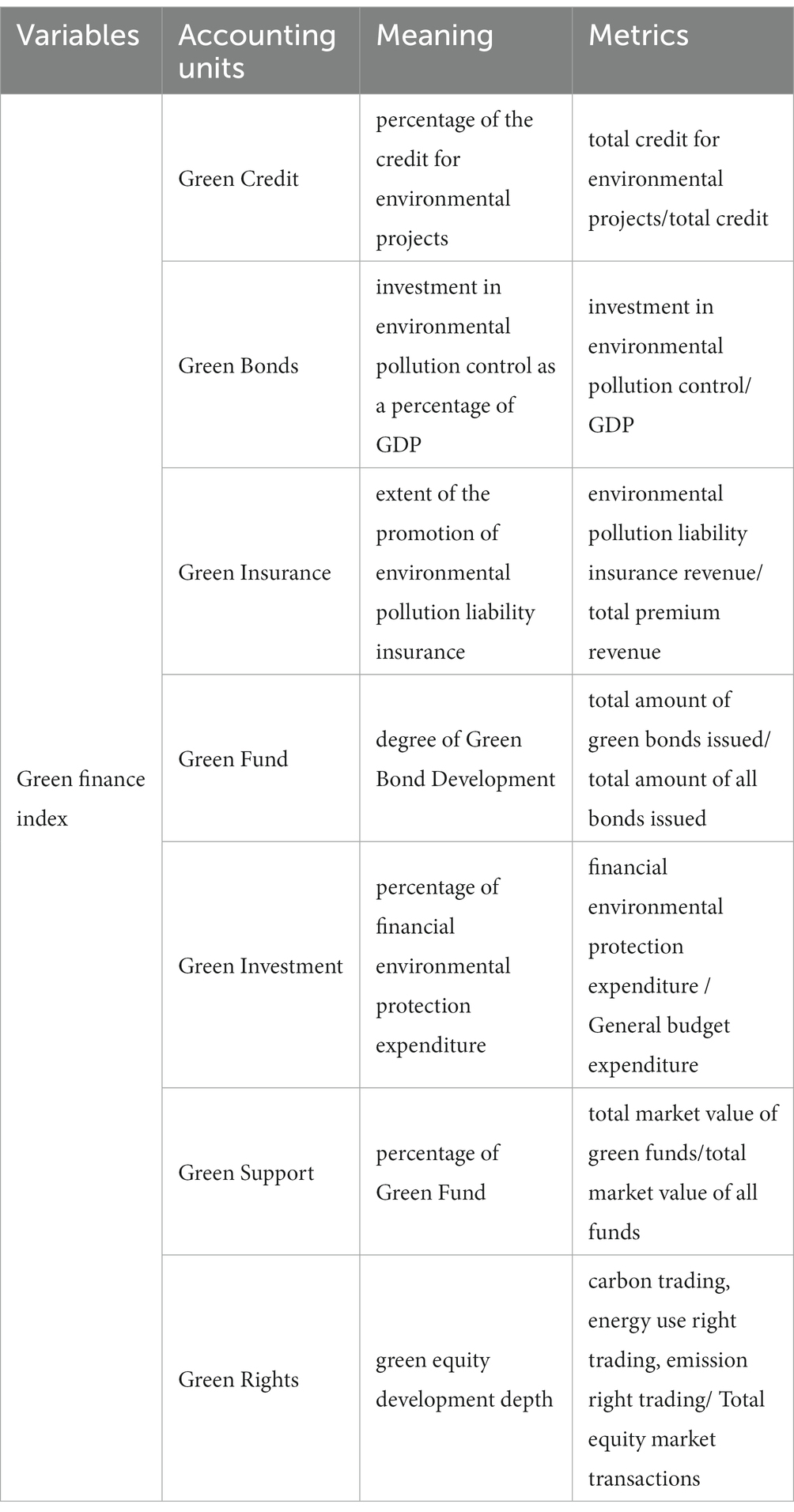

Based on the definition of green finance in The Guidance on Building Green Financial System and related studies on financial development and green finance measurement (Zhang et al., 2022), we select green credit, green bonds, green insurance, green funds, green investment, green support, and green equity as variables. We use the entropy method to measure the green finance index. The calculation results of the entropy value method have higher accuracy and credibility. The meanings of each variable selection are listed in Table 2.

3.2.3. Control variables

The following control variables were selected for this paper.

3.2.3.1. Population size

Measured by the total population size of the region. Population size is related to the amount of energy, soil and production materials used, all of which can be considered components of the sources of ANSP emissions.

3.2.3.2. Agriculture level

Measured by the ratio of the value added of agriculture, forestry, livestock, and fishery to the total value of agricultural production. An increase in agricultural production leads to an increase in ANSP emissions.

3.2.3.3. Arable land size

Measured by the total area of crops sown. The size of arable land is closely related to ANSP emissions.

3.2.3.4. Economic level

Measured by gross regional product per capita. The regional economic level affects agricultural production behavior, which in turn affects ANSP emissions.

Financial Support to Agriculture: measured by the ratio of government expenditure on agriculture, forestry, and water to government financial expenditure. Each country has adopted certain policies to support agricultural development, with financial support for agriculture being the most critical measure. Financial investment can improve farmland water conservancy projects, rural electricity, disaster prevention projects, agricultural science, technology and other infrastructure, improve the efficiency of agricultural production, improve production conditions, and thus influence ANSP reduction.

3.2.3.5. Secondary Industry Structure

Measured by the ratio of secondary industry value added to regional GDP. Changes in the structure of the secondary industry will affect the share of the agricultural industry to a certain extent, which in turn affects pollution emissions.

Tertiary Industry Structure: measured by the ratio of the added value of the tertiary industry to the regional GDP. Changes in the structure of the tertiary industry affect, to some extent, the share of the agricultural industry and thus pollution emissions.

3.2.4. Mediating variables

The following two mediating variables are set in this paper.

3.2.4.1. Agricultural scale-up

It’s the rate of land transfer, measured by the ratio of family contracted land transfer area to family contracted land area. Green finance, through its capital investment and green credit, improves agricultural operators’ agricultural investment capacity. It’s also a way to expand their operation scale. The increase in scale, in turn, contributes to the efficiency of agricultural mechanization operations (Shu et al., 2016) and to the realization of scale benefits.

3.2.4.2. Green technology level

In this paper, green total factor productivity is used to measure the level of green technology. Green total factor productivity reflects the degree of application of green technology in a region. The improved level of green technology promotes the development of more eco-friendly agricultural products (Tao et al., 2023), thereby reducing the high pollution behavior in agricultural production activities and thus reducing ANSP. The calculation method of green total factor productivity refers to the idea of Guo and Liu (2020), in which the input indicators include the number of people employed in agriculture, forestry, animal husbandry, and fishery, land input area, total agricultural machinery power, agricultural chemical fertilizer application, organic fertilizer application, pesticide use, agricultural film use, agricultural electricity consumption, and total agricultural water consumption. Output indicators include total agricultural output value and ANSP emissions.

3.3. Analysis of descriptive results

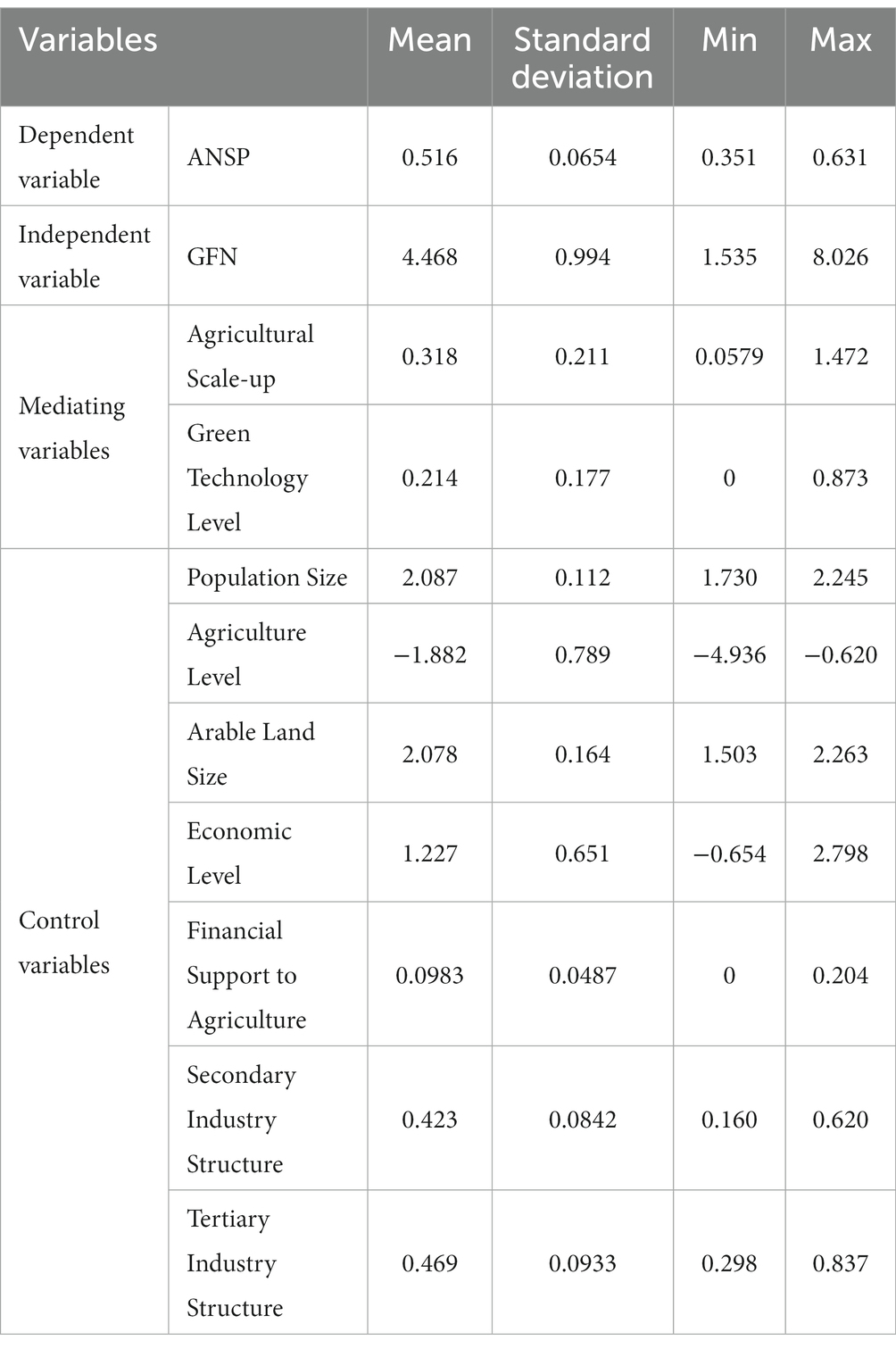

The results of descriptive statistics for the main variables in this paper are shown in Table 3. The independent variable green finance (GFN) has a maximum value of 8.026 and a minimum value of 1.535, with significant variability; the dependent variable ANSP has a maximum value of 0.631 and a minimum value of 0.351, with a mean value of 0.516 and reasonable data.

4. Results and analyses

4.1. Baseline regression

To explore the relationship between green finance and ANSP and to assess the effect of green finance on ANSP, a regression model was constructed, as shown in Equation (1). The use of this model enables the estimation of the causal relationships of variables in panel data. Both time fixed effect and province fixed effect are taken into account to avoid omitting variable bias and exogeneity problems.

Equation (1): i represents province, t represents year, is a province fixed effect, is a time fixed effect, is a control variable, ε is an error term. is the dependent variable, which denotes the total ANSP emissions in province i in yeart. is the independent variable, which denotes the green finance index of province i in yeart. It is the regression coefficient, which response to the total effect of green finance on ANSP reduction. To facilitate the interpretation of statistical implications and to smooth data fluctuations, the two variables above are logarithmically treated.

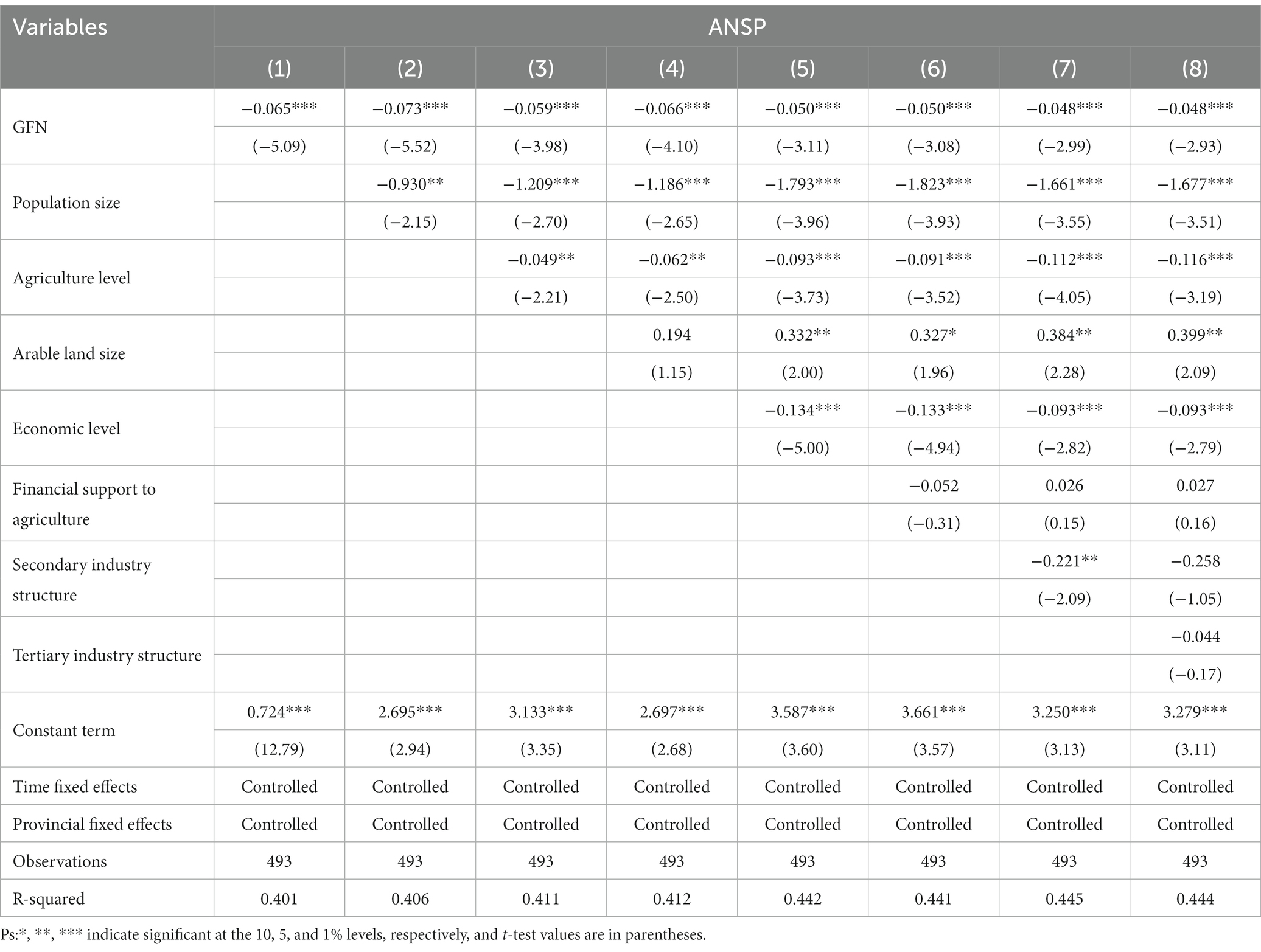

The estimation results of green finance on ANSP are presented in Table 4 through the regression of Model (1). Among them, only time and province fixed effects are added in Column (1), and all control variables are added sequentially and progressively in Columns (2)–(8). The coefficient of GFN is always negative, indicating that green finance can directly reduce ANSP.

In Table 4: Column (1), without adding any control variables, the estimated coefficient of total ANSP emissions is −0.065, and the result is significant at the 1% level, which indicates a negative impact of green finance on ANSP. Columns (2) to (8) include all control variables in turn based on Column (1), and as the control variables increase one by one, it is seen that the coefficient of the GFN row is always negative and significant at the 1% level, indicating that green finance can directly reduce ANSP. It can be calculated from the coefficients in Column (8) of Table 4, on average, every 1% increase in the green finance index reduces total ANSP by 0. 048%. Thus, green finance can effectively promote the reduction in ANSP. In summary, Hypothesis One is proven, suggesting that green finance is an effective means of reducing ANSP.

4.2. Robustness test

4.2.1. Endogenous problems handing

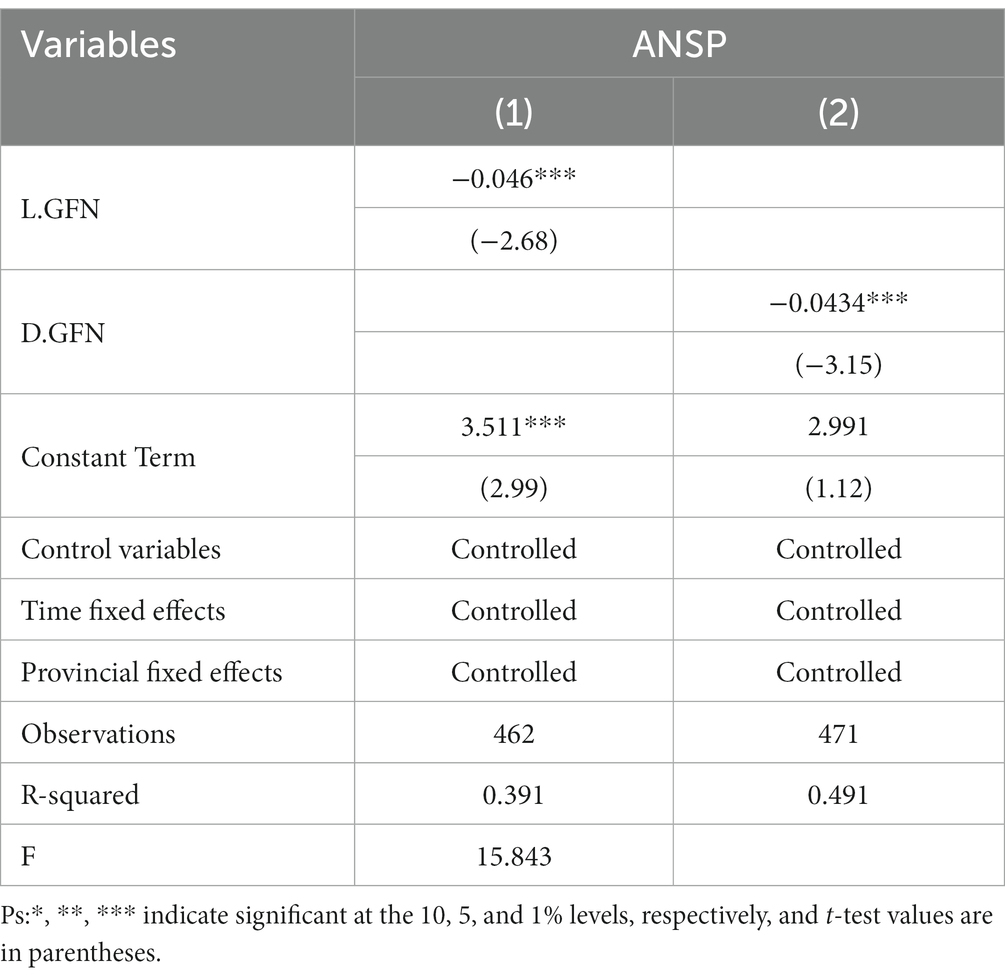

The baseline regression results show that green finance effectively reduces ANSP. To ensure the “consistency” of parameter estimates and the authenticity and reliability of the regression results, endogeneity tests are conducted. In the above baseline regression, control variables are added, the fixed effects of time and region are controlled so that the endogeneity problems of omitted variables and selection bias are better addressed. On this basis, L. GFN is defined as the independent variable lagged by one period. It is selected as the independent variable to be regressed again as a way to exclude the interaction between the 2 years. It can effectively alleviate the endogeneity problem of reverse causality.

The regression is performed by lagging the independent variable by one period, and the results are shown in Column (1) of Table 5: the coefficient of L. GFN is negative and significant at the 1% level. So there is still a significant abatement effect of green finance on ANSP after the endogeneity problem of reverse causality is fully taken into account.

4.2.2. Mitigation of outlier effects

To exclude the influence of data beyond the plausibility range on the regression results and ensure the reliability of the empirical test results, this paper conducts a robustness test excluding outliers to determine whether the empirical results are influenced by extreme values. Defining D. GFN as the variable obtained by excluding 5% extreme values from the original independent variables. Selecting it as the independent variable for regression again to exclude the influence of extreme values on the regression results.

The results are shown in Column (2) of Table 5: the sign of D. GFN is negative and significant at the 1% level, indicating that there is always an abatement effect of green finance on ANSP, and it is not affected by extreme values.

5. Additional analyses

5.1. Heterogeneity analyses

Reviewing the previous studies, we found that most of the studies on the geographical differences of ANSP were based on objective geographical location as the division. That is, the study of ANSP in the east and west of China (Ma and Yue, 2021). To further investigate the performance of ANSP in different regions, we divided the regions in a more diverse and detailed way in this section of the heterogeneity study.

5.1.1. Heterogeneity of developed agricultural provinces

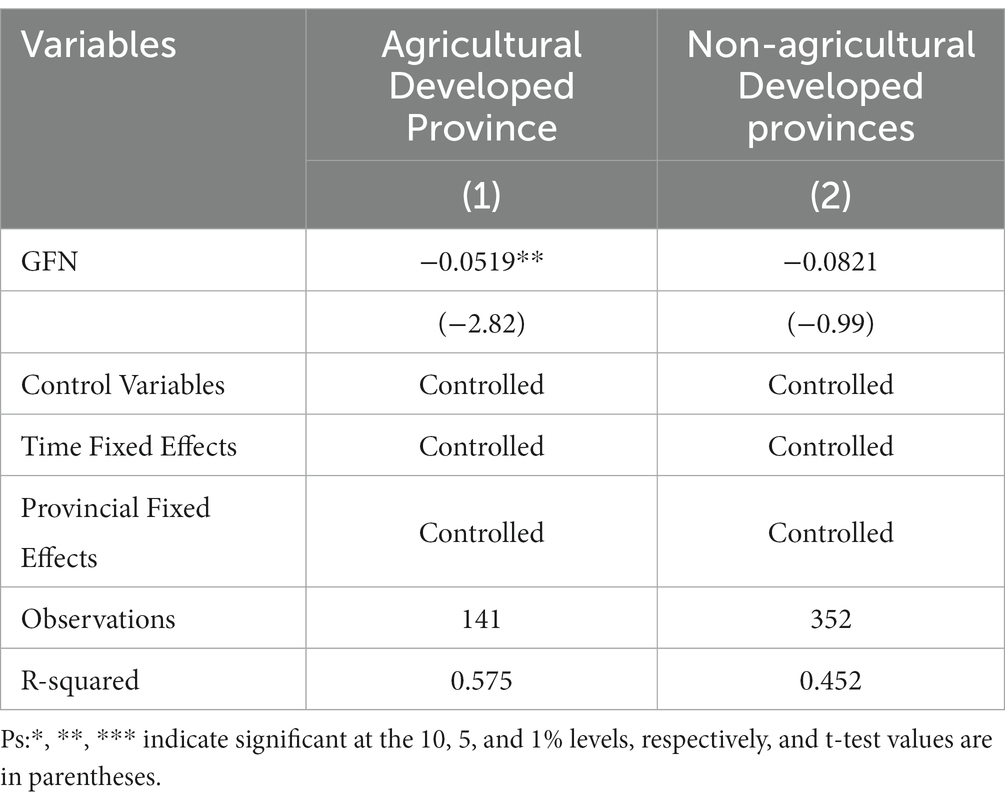

Developed agricultural provinces are those provinces that have reached a higher level of quality and a level of agricultural development. Those provinces have a higher level of agricultural modernization, agricultural production efficiency, agricultural industrialization, agricultural market competitiveness, and farmers’ income, based on a larger scale of production and operation and a higher overall production capacity (Gu, 2022). The sample was divided into agricultural developed provinces and non-agricultural developed provinces (cities), mainly to investigate whether green finance can play a significant role in reducing ANSP in non-agricultural developed provinces (cities), which have more room for green finance development. Based on the data from the National Bureau of Statistics, ten provinces, Henan, Shandong, Sichuan, Jiangsu, Heilongjiang, Guangdong, Hebei, Hubei, Guangxi, and Hunan, were classified as developed agricultural provinces by calculating the average value of total agricultural output in the last five years as a measure.

In Table 6, Column (1) is the agricultural developed province, showing that the effect of green finance on ANSP is negative and significant at the 5% level; Column (2) is the non-agricultural developed province, showing that the effect of green finance on ANSP is negative but does not pass the significance test. This indicates that the effect of green finance on ANSP reduction is greater in agricultural developed provinces.

The reasons for this result may be twofold: on the one hand, the agricultural developed provinces have a high level of agricultural modernization, a strong agricultural foundation, and advanced agricultural technology. The financial sector is willing to support the development of green agriculture by the operators, with higher financial support and a more prominent role of green finance. On the other hand, in agricultural developed provinces, agriculture is the pillar industry. So the government attaches more importance to the sustainable development of agriculture, the corresponding government support is strong, the corresponding supporting enterprises are complete, more projects support the green development of agriculture. And the financial sector’s financial support for these projects is high, and the role of green finance in ANSP reduction is significant.

In contrast, the agricultural base in non-agricultural developed provinces is weaker, and the role of green finance in supporting ecological agricultural development is not outstanding compared with that in developed provinces. Therefore, it is necessary to mobilize the production motivation of agricultural operators in non-agricultural developed provinces and strengthen the agricultural foundation. It is also necessary to increase the number of eco-agriculture demonstration projects and strengthen the introduction of advanced agricultural technologies. Continuously improve the eco-agriculture industry chain in order to promote the landing of green finance and ultimately promote the reduction of ANSP.

5.1.2. Heterogeneity of economic development level

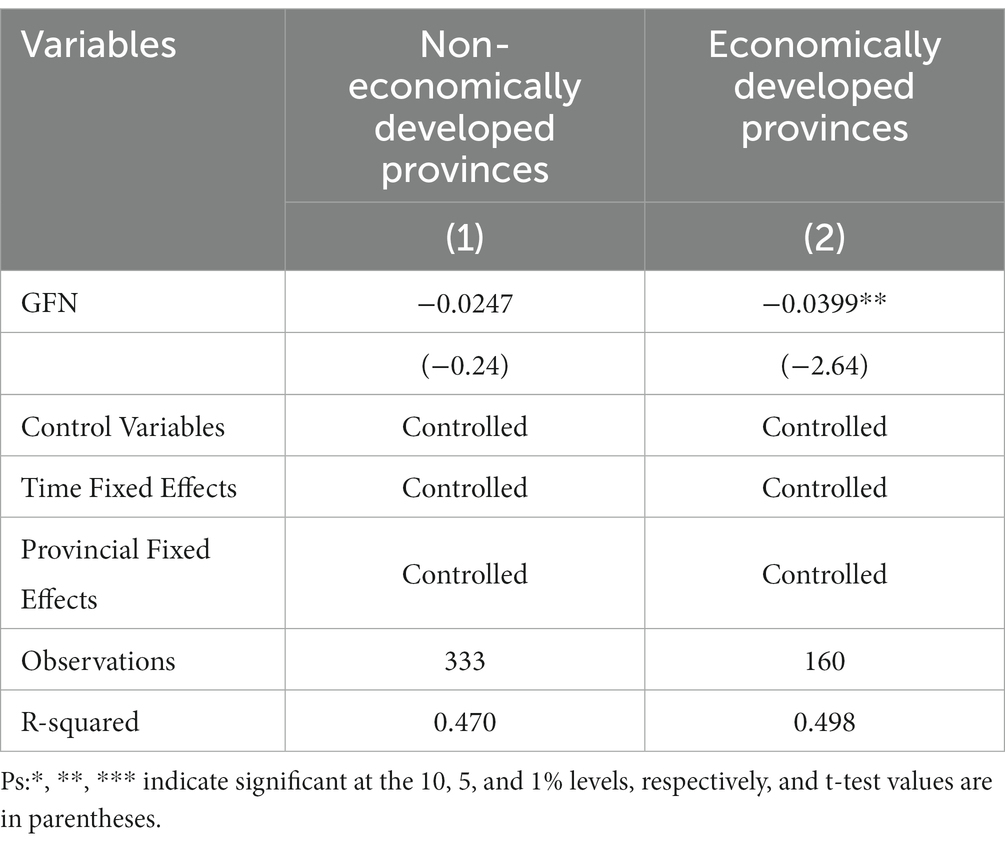

The level of economic development impacts the development of green finance. The sample was divided into economically developed provinces and non-economically developed provinces to explore the differences in green finance for ANSP reduction in provinces with different economic development bases. Based on the data published by the National Bureau of Statistics, the top ten provinces (cities) among 31 Chinese provinces in terms of regional GDP were classified as economically developed provinces (cities) by calculating the average value of the regional GDP of each province in the last five years as a measure: Chongqing, Zhejiang, Guangdong, Jiangsu, Shandong, Henan, Sichuan, Hubei, Fujian, and Hunan.

In Table 7, Column (1) is distributed in non-economically developed provinces, showing that the effect of green finance on ANSP is not significant; Column (2) is economically developed provinces (cities), showing that the effect of green finance on ANSP is negative and significant at the 5% level, indicating that green finance can significantly reduce ANSP. This indicates that the green ANSP reduction effect is greater in economically developed provinces (cities).

Possible reasons for this result include three main aspects. First, compared to less economically developed regions, economically developed provinces have stronger financial strength, better financial systems, and more innovative financial products. So it can provide diverse financial support to local green or ecological agricultural operators. This reduces their financing constraints and encourages operators to practice ecological agriculture, thus contributing to the reduction of ANSP. Second, agricultural operators in economically developed provinces are more educated and have a deeper understanding of green finance. That makes it easier for them to receive high-quality green financial services in the production and operation of ecological agriculture, thus reducing ANSP. Finally, economically developed provinces are relatively rich in material life for urban and rural residents. They have higher requirements for the safety of agricultural products and living environment. So the government will promote the investment of green finance in ecological agriculture to meet the needs of residents, thus promoting the development of ecological agriculture and environmental improvement.

Therefore, for non-economically developed provinces, we should accelerate economic development, improve the construction of the financial system, innovate green financial services, and accelerate the construction of a green, fair, and efficient green financial market system.

5.1.3. Heterogenrity of pollution composition

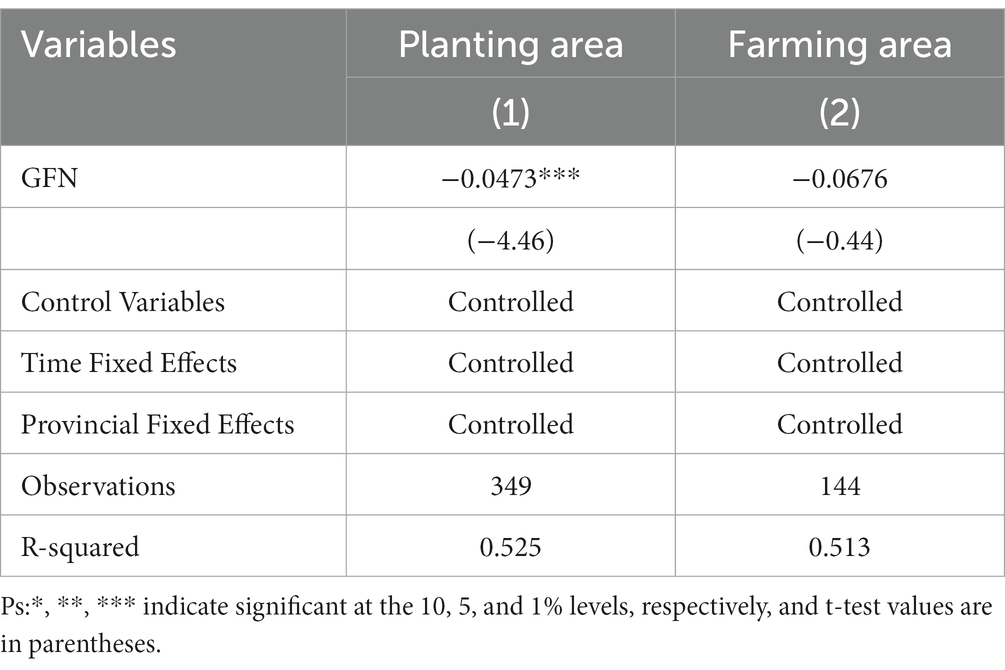

Since the production patterns of planting and farming are different, the demand for capital is different. Therefore, the sample is divided into planting and farming areas to exploring the differences in the role of green finance in promoting ANSP reduction. By calculating the proportion of pollution from farming and planting to total pollution in each province in the last five years, the provinces with more than 50% of pollution from farming were divided into farming zones: Sichuan, Guangdong, Guangxi, Jiangxi, Hainan, Fujian, Tibet, Qinghai, and Liaoning. The rest of the provinces are divided into planting areas.

In Table 8: (1) column is the province of planting area, which shows that the effect of green finance on ANSP is negative and significant at the 1% level, indicating that green finance can significantly reduce ANSP; (2) column is the farming area, which shows that the effect of green finance on ANSP is negative, but the effect of ANSP reduction is not significant. This indicates that in China, green finance promotes ANSP reduction mainly in the farming areas.

The main reasons are as follows: first, the pollution source of planting areas is clear and the pollution treatment program is clear. This leads to green financial policies for the planting areas, and faster pollution treatment effects. Thus green finance has more significant effect on emission reduction; second, in recent years, in the planting areas, green finance has invested in straw return technology, water-saving irrigation technology and other ecological technologies, and a large amount of funds have been spent on high-standard farmland and modernized facility agriculture. This has further promoted the reduction of pollution in the planting areas.

In contrast, in livestock and poultry farming, manure and gas emissions from livestock and poultry are important pollutants for agriculture, and the number is large and continuous. At present, many small and medium-sized farmers lack environmental awareness and corresponding pollution abatement supporting technology. So it is difficult for livestock and poultry farming to achieve pollution abatement. On the other hand, due to the greater risk of livestock and poultry farming, it is difficult for small and medium-sized farmers to obtain financing from financial institutions. Therefore, the role of green finance in pollution abatement in the farming areas is not significant.

Based on this, first, we should improve the regulatory system and its implementation to ensure that the land area is safe for consumption to obtain a farming permit. In order to achieve the return of livestock and poultry manure to the use of land, and thus promote emission reduction. Second, support for large standardized breeding enterprises should be expanded, and small and medium-sized farmers should be gradually replaced, which is also an important way to reduce emissions. Finally, we should innovate financial services to ensure that financial products can serve small and medium-sized livestock and poultry farmers.

5.2. Mechanism analysis

Although green finance can significantly reduce ANSP, its mechanism of action is not clear. To explore the mechanism of green finance’s role in reducing ANSP, a mediating effect model is constructed based on Equation (1) as follows:

Mk is the kth mediating variable, including the level of green technology and the degree of the agricultural scale. Equation (2) is used to test the effect of green finance on the mediating variables; under the condition that the estimated coefficients of the core dependent variables in Equation (2) are significant, Equation (3) can be used to test the mediating effect of green finance on ANSP.

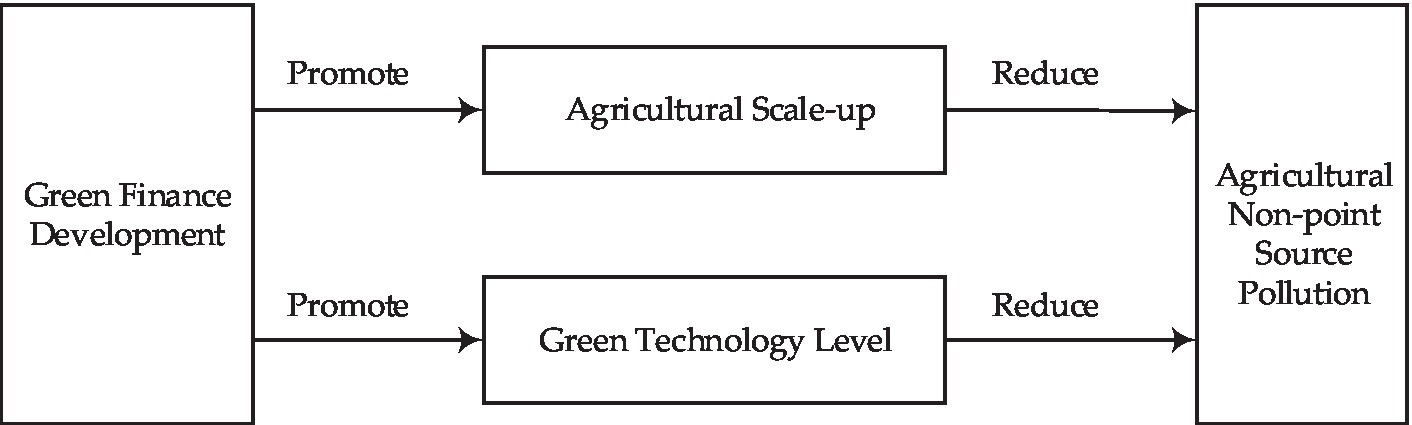

The model of mechanism analysis is shown in Figure 1.

To examine the mechanism of the impact of green finance on ANSP, the idea of sequential testing of mediating effects is applied. Equations (2) and (3) are regressed sequentially to determine the mediating factors. Firstly, the effects of green finance on technological progress and the degree of agricultural scale are analyzed, and the regression results are shown in Columns (1) (2) of Table 9. Secondly, the two mediating variables are added to the benchmark regressions separately to analyze the effect of mediating factors on total ANSP, and the regression results are shown in Columns (3) (4) of Table 9.

From Table 9, it can be observed that Columns (1) to (2) show a positive and significant effect of green finance on technological progress and the degree of agricultural scale, with the effect of the independent variables on the mediating variables is positive and significant at the 1% level. This suggests that green finance can promote technological progress and increase the degree of agricultural scale. Additionally, the coefficient of the degree of agricultural scale is negatively significant at the 1% level, indicating that green finance can reduce ANSP emissions through the increase in the degree of agricultural scale, thus proving hypothesis two. Furthermore, the coefficient of the green technology level column is negative and significant at the 1% level, indicating that green finance can reduce ANSP emissions through the path of technological progress, which proves hypothesis three.

The results show that, first, green finance can promote the development of the agricultural scale and then enhance the scale efficiency. The increase in the agricultural scale leads to a significant reduction in ANSP. This is related to the improvement of the quality and efficiency of agricultural production and the development of efficient agriculture. Second, green finance can improve the level of green technology in agriculture, and the improvement of green technology will lead to a significant reduction in ANSP. The improvement of the green technology level in agriculture promotes technological innovation and eco-friendly agricultural products, which promotes the green and sustainable development of agriculture and ultimately reduces ANSP emissions.

A review of the existing literature reveals that digital inclusive finance can promote technological innovation (Liang et al., 2023). Similarly, in this paper, our analysis of intermediary mechanisms reveals that green finance also promotes green technology innovation, which in turn reduces ANSP. This means that the government may be able to achieve twice the result with half the effort by aligning its policies on green finance and digital inclusive finance so that they complement each other.

5.3. Threshold effect

In addition to the negative linear relationship between green finance on ANSP verified by model (1), this study further considers whether there is a non-linear relationship between the effects of green finance on ANSP abatement considering that the effects of green financial on ANSP abatement may be different for different levels of development in the context of non-equilibrium development of green finance. A panel threshold model was constructed as follows:

In Equation (4), denotes the level of green financial development, which is the core independent variable of the model and also the threshold variable of the panel threshold model, denotes the threshold value to be estimated, I (·) denotes the exponential function, α denotes the correlation coefficient, and the other variables are consistent with the previous section.

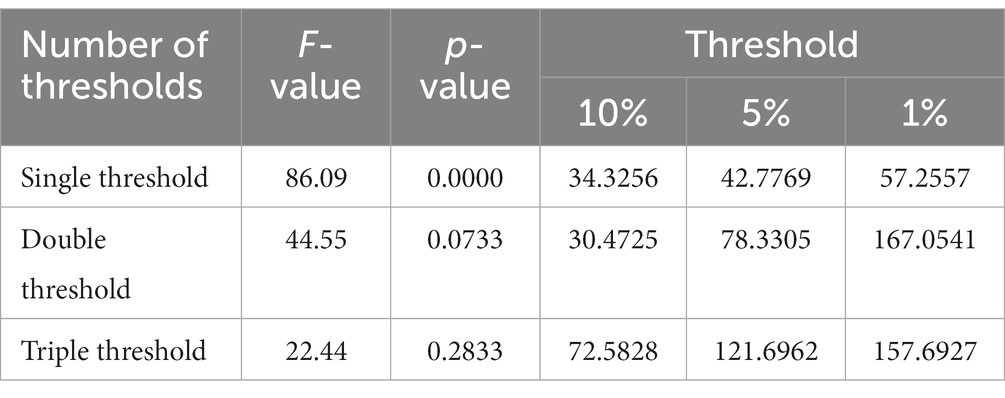

Before conducting the panel threshold regression, it is necessary to determine whether there is a threshold effect, and if there is a threshold effect, the number of thresholds needs to be determined. As can be seen from Table 10, the value of p for the single threshold is 0.000, which is significant at the 1% statistical level, the value of p for the double threshold is 0.0733, which is significant at the 10% statistical level, and the value of p for the triple threshold is not significant, so there is a double threshold.

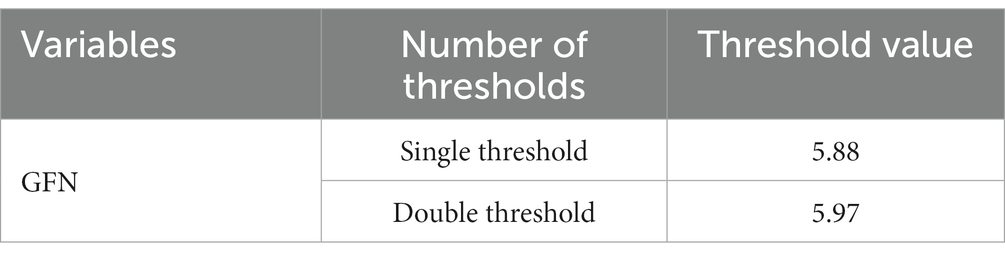

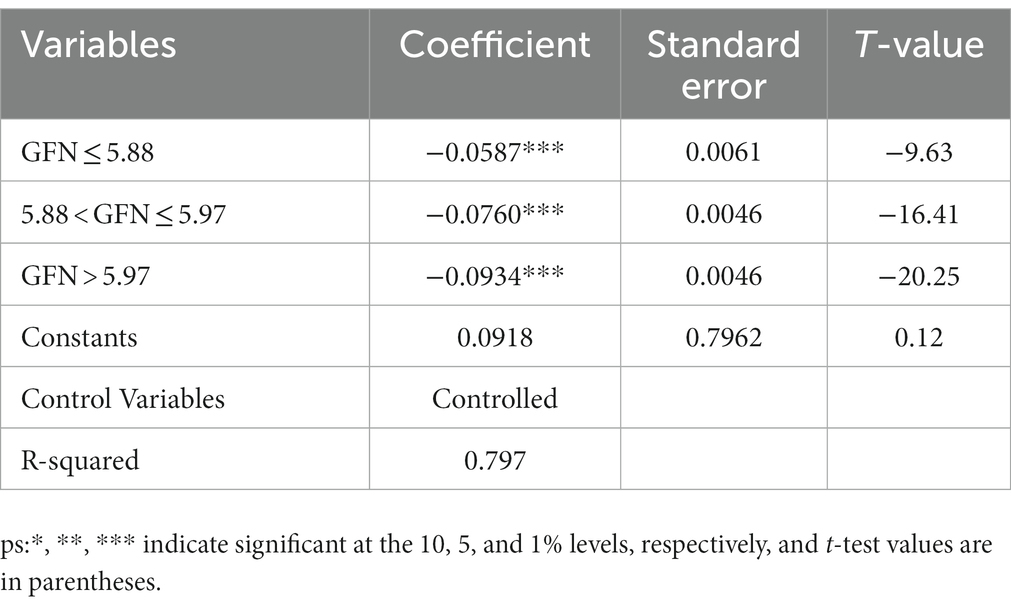

After determining the existence of a double threshold, this study tested the single and double thresholds, and the results are shown in Table 11. The threshold value for the single threshold was 5.88 and the threshold value for the dual threshold was 5.97.

When the level of green financial development is below the threshold (GFN ≤5.88), the emission reduction effect of green finance on ANSP is statistically significant at the 1% level with a coefficient of −0.0587. When the level of green financial development is between the threshold (5.88 < GFN ≤5.97), the emission reduction effect of green finance on ANSP is still statistically significant at the 1% level The coefficient is −0.076. When the level of green financial development is greater than the threshold (GFN >5.680), the abatement effect of green finance on ANSP is increased, with a coefficient of −0.0934. The results show that with the improvement of the development level of green finance, the effect of green finance on ANSP abatement will be gradually enhanced, and green finance is expected to become a new tool for ANSP abatement. The results are shown in Table 11.

Among the existing studies, Jiang, S. et al. argued that raising the level of finance to a medium-high threshold would inhibit ANSP (Jiang et al., 2020). To quantitatively analyze its specific connotation, this paper identifies the threshold point of the inhibitory effect of green finance on ANSP through a threshold model and provides more informative suggestions for government governance (see Table 12).

6. Conclusion

Green financial development has broken through the service boundaries of conventional finance and effectively connects with ANSP management. It has become an important driver of green agricultural development. This paper calculates the ANSP emissions and uses the entropy value method to measure green finance. We use China’s provincial panel data from 2005 to 2020 to systematically examine the impact of green finance on ANSP. Then, further analyses are conducted to explore the green finance’s role in the ANSP reduction process reduction. The main findings are as follows: (1) In general, Green finance development significantly reduces ANSP, (2) From the three different dimensions of subdivision, green finance can significantly reduce ANSP only in developed agricultural provinces, economically developed provinces and plantation-based areas. The estimated coefficients of ANSP emission were − 0.0519, −0.0399 and − 0.0473, (3) Green finance significantly reduces ANSP with estimated coefficients of −0.174 and − 0.735 by promoting the scale of agriculture and the improvement of green technology levels, and (4) The threshold effect test shows that the mitigation effect of green finance on ANSP has non-linear characteristics, the mitigation effect will be enhanced as the development level of green finance increases. With the threshold values about 5.88 and 5.97.

Based on the research findings, we provide the following policy inspirations. First, we recommend increasing green financial support in agriculture and rural areas. Rural financial institutions should deeply explore the economic development and natural resources of rural areas and design suitable green financial products based on the needs and difficulties of farmers. Given China’s small farmer economy, it is necessary to fully consider farmers’ weak links in production and operation and gradually improve green loan services to address individual farmers’ difficulties in obtaining loans due to guarantee issues. Second, green finance should be developed according to local conditions. In provinces with high comprehensive agricultural prominence, economic development, and a planting-oriented approach, green finance should be prioritized to further reduce agricultural surface source pollution through the integration of green finance and agriculture. In other provinces, green finance awareness should be raised around the needs of basic rural financial development to promote the organic integration of green finance and green agricultural development. Third, it is crucial to clarify the positioning of green finance and promote the development of agriculture toward technology and scale. Given the inadequate targeting of green financial services by Chinese rural financial institutions and the absence of agriculture-related features, rural financial institutions should actively innovate to link technological development with green agriculture. For instance, developing projects such as mortgage loans for special crops and harmless production waste would facilitate the main bodies’ green development efforts. Additionally, financial and technical support should be provided to promote large-scale operations in agriculture. The development of financial institutions and green financial products will continually enhance the endogenous power of green agricultural development, guiding rural agriculture toward a green and sustainable direction. Fourth, it is necessary to improve the green financial system and optimize policy tools in response to the inadequate green financial system in China and the lack of enthusiasm from relevant financial institutions. At the highest level, it is necessary to enhance green financial standards in the context of the current situation of Chinese agriculture and rural areas. Continuously strengthening environmental information disclosure, establishing incentive and restraint mechanisms, and optimizing product and market systems is key. Reasonable policies should be constructed to stimulate the development of green finance in rural areas. Rural financial institutions should be given incentives to carry out green finance by implementing differentiated regulatory policies, adjusting the weight of green finance assessment, and providing certain loan subsidies. These steps would stimulate the enthusiasm of rural financial institutions to carry out green finance.

There are also some limitations in this paper. Considering the proportion of pollution emissions and the availability of data, we used the pollution emissions from planting and livestock to reasonably estimate the total amount of ANSP. Those sources that account for a relatively small share of pollution are excluded from consideration. This may result in less accurate data, provided that the overall conclusion remains unchanged. In future studies, we will pay more attention to these pollution sources that are not taken into account, such as fisheries. On the basis of continuous data collection, we will select appropriate measurement indicators to improve the calculation of ANSP, so as to obtain more accurate results to provide a better reference for government administration.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

ZZ: conceptualization and methodology. ZZ and WL: formal analysis. WL: software, writing—original draft, and writing—review and editing. ZZ and XZ: supervision. All authors contributed to the article and approved the submitted version.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2023.1199417/full#supplementary-material

References

Abbas, A. C., Jiang, Y. S., Abdul, R., and Abdul, R. (2020a). Short and long-run impacts of climate change on agriculture: an empirical evidence from China. Int J Clim Chang Strateg Manag 12, 201–221. doi: 10.1108/IJCCSM-05-2019-0026

Abbas, A. C., Waqar, A., Fayyza, A., and Munir, A. (2020b). Dynamic relationship among agriculture-energy-forestry and carbon dioxide(CO2) emissions: empirical evidence from China. Environ. Sci. Pollut. Res. 27, 34078–34089. doi: 10.1007/s11356-020-09560-z

Arif, U., Dilawar, K., Imran, K., and Zheng, S. F. (2018). Dose agricultural ecosystem cause environmental pollution in Pakistan? Promise and menace. Environ. Sci. Pollut. Res. 25, 13938–13955. doi: 10.1007/s11356-018-1530-4

Basit, A., Arif, U., and Dilawar, K. (2021). Does the prevailing India agricultural ecosystem cause carbon dioxide emission? A consent towards risk reduction. Environ. Sci. Pollut. Res. 28, 4691–4703. doi: 10.1007/s11356-020-10848-3

Chen, M. P., Chen, J. N., and Lai, S. Y. (2006). Inventory analysis and spatial distribution of Chinese agricultural and rural pollution. China Environ. Sci. 6, 751–755. doi: 10.3321/j.issn:1000-6923.2006.06.025

Dong, N. (2020). Current situation and path analysis of developing green finance to promote rural revitalization. J. Fin. Dev. Res. 11, 86–89. doi: 10.19647/j.cnki.37-1462/f.2020.11.010

Ewa, J., Marta, W., Paweł, M., Mateusz, G., Craig, R. W., Dominik, Z., et al. (2020). Catchment-scale analysis reveals high cost-effectiveness of wetland buffer zones as a remedy to non-point nutrient pollution in north-eastern Poland. Water. 12:629. doi: 10.3390/w12030629

Gao, Y., Yao, X., Bai, Y. X., and Wu, Z. L. (2022). Active “chain chief” empowers green and low-carbon agriculture industry chain:internal mechanism and realization path. Economist. 288, 116–124. doi: 10.16158/j.cnki.51-1312/f.2022.12.015

Ge, J. H., and Zhou, S. D. (2011). Analysis of economic influence factors of agricultural surface source pollution--based on the data of Jiangsu Province from 1978 to 2009. Chinese Rur. Eco. 317, 72–81. doi: CNKI:SUN:ZNJJ.0.2011-05-009

Gu, X. Y. (2022). Promoting high-quality agricultural development, and supporting construction of an agricultural powerful country by strong agricultural provinces. Agric. Econ. Mgt. 6, 4–7. doi: 10.3969/j.issn.1674-9189.2022.06.002

Gu, X., Qin, L. J., and Zhang, M. (2023). The impact of green finance on the transformation of energy consumption structure: evidence based on China. Front. Earth Sci. (Lausanne) 10:1097346. doi: 10.3389/feart.2022.1097346

Guo, H. H., and Liu, X. M. (2020). Time-space evolution of China’s agricultural green Total factor productivity. Chinese J. Mgt. Sci. 28, 66–75. doi: 10.16381/j.cnki.issn1003-207x.2020.09.007

Guo, L. L., Zhao, S., Song, Y. T., Meng, Q. T., and Li, H. J. (2022). Green finance, chemical fertilizer use and carbon emissions from agricultural production. Agriculture 12:313. doi: 10.3390/AGRICULTURE12030313

He, L., Zhong, T. Y., and Gan, S. D. (2022). Green finance and corporate environmental responsibility: evidence from heavily polluting listed Enterprises in China. Environ. Sci. Pollut. Res. 29, 74081–74069. doi: 10.1007/S11356-022-21065-5

Hu, Y., Lin, Y., and Jin, S. Q. (2021). The situation of agricultural non-point source pollution and the policy orientation of the 14th five-year plan: based on the comparative analysis of two pollution census bulletins. Environ. Prot. 49, 31–36. doi: 10.14026/j.cnki.0253-9705.2021.01.007

Jiang, S., Qiu, S., and Zhou, J. (2020). Re-examination of the relationship between agricultural economic growth and non-point source pollution in China: evidence from the threshold model of financial development. Water. 12:2609. doi: 10.3390/w12092609

Jiang, S., Qiu, S., Zhou, H., and Chen, M. L. (2019). Can FinTech development curb agricultural nonpoint source pollution? Intl J. Environ. Res. Pub. Health. 16:4340. doi: 10.3390/ijerph16224340

Jin, S. Q., and Xing, X. X. (2018). Trend analysis, police evaluation, and recommendations of agricultural non-point source pollution. Sci. Agric. Sin. 51, 593–600. doi: 10.3864/j.issn.0578-1752.2018.03.016

Khan, S., Akbar, A., Nasim, I., Hedvičáková, M., and Bashir, F. (2022). Green finance development and environmental sustainability: a panel data analysis. Front. Environ. Sci. 10:2134. doi: 10.3389/FENVS.2022.1039705

Lai, S. Y., Du, P. F., and Chen, J. N. (2004). Evaluation of non-point source pollution based on unit analysis. J. Tsinghua Univ. 44, 1184–1187. doi: 10.16511/j.cnki.qhdxxb.2004.09.009

Liang, W. (2023). Rational expansion of peasants and re-understanding of peasant economy. Modern Economic Research. 493, 114–122. doi: 10.13891/j.cnki.mer.2023.01.007

Liang, L. L., Li, Y., and Chen, S. (2023). The effect and mechanism test of digital inclusive finance promoting enterprise green technology innovation. Statistics and Decision. 39, 168–173. doi: 10.13546/j.cnki.tjyjc.2023.11.029

Lin, Q. H., Cheng, Q. W., Zhong, J. F., and Lin, W. H. (2022). Can digital financial inclusion help reduce ANSP?—an empirical analysis from China. Front. Environ. Sci. 10:2473. doi: 10.3389/FENVS.2022.1074992

Liu, S., and Wang, Y. K. (2023). Green innovation effect of pilot zones for green finance reform: evidence of quasi natural experiment. Technol. Forecast. Soc. 186:122079. doi: 10.1016/J.TECHFORE.2022.122079

Lu, S. B., Zhong, W. J., Li, W., and Taghizadeh, H. F. (2021). Regional non-point source pollution control method: a Design of Ecological Compensation Standards. Front. Environ. Sci. 9:724483. doi: 10.3389/FENVS.2021.724483

Ma, J., Meng, H. B., Shao, D. Q., and Zhu, Y. S. (2021). Green finance, inclusive finance and green agriculture development. Finance. Forum 26:3-8+20. doi: 10.16529/j.cnki.11-4613/f.2021.03.002

Ma, J. Q., and Yue, Z. (2021). The analysis of the spatial difference and its influencing factor of agricultural non-point source pollution in China 1,22. Res. Agric. Mod. 42, 1137–1145. doi: 10.13872/j.1000-0275.2021.0114

Ministry of Ecology and Environment PRC. China ecological environment status bulletin (2020). Available at: https://www.mee.gov.cn/hjzl/sthjzk/zghjzkgb/202105/P020210526572756184785.pdf. (accessed on 24 May 2021).

Muganyi, T., Yan, L. N., and Sun, H. P. (2021). Green finance, Fintech and environmental protection: evidence from China. ESE. 7:100107. doi: 10.1016/J.ESE.2021.100107

Peng, G., Wang, T. T., Ruan, L. J., Yang, X. S., and Tian, K. Y. (2022). Measurement and spatial-temporal analysis of coupling coordination development between green finance and environmental governance in China. Environ. Sci. Pollut. Res. 1-13. doi: 10.1007/S11356-022-24657-3

Ren, J. G., Fan, K., Chen, Q., Zhao, J., and Hua, X. J. (2023). Application status and Prospect of field ridge in agricultural non-point source pollution control. J. Environ. Eng. Tech. 3, 262–269. doi: 10.12153/j.issn.1674-991X.20210609

Sharif, M., and Vijay, K. K. (2018). Green finance:a step towards sustainable development. J. Fin. Acctg. 1, 22–31. doi: 10.17492/mudra.v5i01.13036

Shen, Y., and Lu, Y. (2022). Green finance enables farmers and rural areas to achieve common prosperity. Rur. Fin. Res. 11, 10–19. doi: 10.16127/j.cnki.issn1003-1812.2022.11.002

Shu, C. L., Zhou, K. Z., Xiao, Y. Z., and Gao, S. X. (2016). How green management influences product innovation in China: the role of institutional benefits. J. Bus. Ethics 133, 471–485. doi: 10.1007/s10551-014-2401-7

Sun, J., Zhai, N. N., Miao, J. C., and Sun, H. P. (2022). Can green finance effectively promote the carbon emission reduction in “local-neighborhood” areas?—empirical evidence from China. Agriculture 12:1550. doi: 10.3390/AGRICULTURE12101550

Tao, R. (2021). Research on the mechanism, practice and optimization of green technology innovation driven by green finance: from the perspective of coordinated development of “government, Enterprise, university and finance”. Fin. Theory Prac. 509, 62–72.

Tao, Y., Zhao, X. Y., and Liu, Q. Z. (2023). Can the environmental and economic effects of green agricultural technology be effective?—based on survey data of apple growers in Shandong Province. Chinese J. Agric. Res. Reg. Plan:1-11[2023-02-07]. Available at: http://kns.cnki.net/kcms/detail/11.3513.S.20221031.1034.010.html.

Tian, P., and Lin, B. Q. (2019). Impact of financing constraints on Firm’s environmental performance: evidence from China with survey data. J. Clean. Prod. 217, 432–439. doi: 10.1016/j.jclepro.2019.01.209

Wang, Y., and Zhi, Q. (2016). The role of green finance in environmental protection: two aspects of market mechanism and policies. Energy Procedia 104, 311–316. doi: 10.1016/j.egypro.2016.12.053

Xu, H. X., Tan, X. X., Liang, J., Cui, Y. H., and Gao, Q. (2022). Impact of ANSP on river water quality: evidence from China. Front. Ecol. Evol. 10. doi: 10.3389/fevo.2022.858822

Y, S. Q. (2022). Thought of pollution comprehensive prevention and control system of non-point sources based on National Food Security. SAS. 55, 3380–3394. doi: 10.3864/j.issn.0578-1752.2022.17.010

Ye, Y. H., Xiao, B., Feng, H. J., He, Y. L., Chen, P., Chen, X. Y., et al. (2022). Researches on the pattern and Poute of ecological product value realization from the perspective of rural revitalization. Eco. Environ. Sci. 31, 421–428. doi: 10.16258/j.cnki.1674-5906.2022.02.023

Zhang, J. L. (2023). The dynamics mechanism and inner dilemma of agricultural scale transformation in China-based on the perspective of Farmers’ family development. Open Times. 1, 189-204–9-10. doi: 10.3969/j.issn.1004-2938.2023.01.019

Zhang, T., Li, Z. H., and Cui, J. (2022). Green finance, environmental regulation and industrial structure optimization. J. Shanxi Univ. Fin. Econ. 44, 84–98. doi: 10.13781/j.cnki.1007-9556.2022.06.007

Zhang, X. H., and Yue, Q. F. (2019). Does land scale management promote agricultural productive investment? Based on panel data of thirty-one provinces(cities) across the county. J. Aud. Econ. 34, 87–93.

Zhou, X. G., Tang, X. M., and Zhang, R. (2020). Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ. Sci. Pollut. Res. 27, 19915–19932. doi: 10.1007/s11356-020-08383-2

Keywords: green finance, agricultural non-point source pollution, agricultural scale, green technology level, threshold effect

Citation: Lv W, Zhang Z and Zhang X (2023) The role of green finance in reducing agricultural non-point source pollution—an empirical analysis from China. Front. Sustain. Food Syst. 7:1199417. doi: 10.3389/fsufs.2023.1199417

Edited by:

Kaiqiang Zhang, Imperial College London, United KingdomReviewed by:

Dilawar Khan, Kohat University of Science & Technology, PakistanAbbas Ali Chandio, Sichuan Agricultural University, China

Copyright © 2023 Lv, Zhang and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaran Zhang, eGlhcmFuemhhbmdAbWFpbC5zZHUuZWR1LmNu

Wen Lv

Wen Lv Zheng Zhang

Zheng Zhang Xiaran Zhang

Xiaran Zhang