95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Sustain. Food Syst. , 10 February 2023

Sec. Land, Livelihoods and Food Security

Volume 7 - 2023 | https://doi.org/10.3389/fsufs.2023.1102189

This article is part of the Research Topic Land, Livelihood and Food Security in A Just Energy Transition View all 13 articles

Financial vulnerability is an important issue in livelihood resilience research domain. In the context of the Farmland Property Rights Reform in rural China and the promotion of farmland circulation, this study aims to explore whether and how household financial vulnerability is affected by farmland circulation and whether its impact shows heterogeneous characteristics depending on differences in farm household characteristics and regional characteristics. To answer these questions, a theoretical and empirical study was conducted based on the latest available Chinese household survey data (N = 9,822) from 2015 to 2019, using a chain mediating effects model and group regressions. The findings showed that farmland circulation could significantly reduce household financial vulnerability (Coef.=−0.167, p<0.01) while labor transfer and financial literacy played a mediating role. That is to say, farmland circulation could indirectly reduce household financial vulnerability by affecting labor transfer and financial literacy. The heterogeneity analysis showed that farmland circulation had a stronger mitigating effect on the financial vulnerability of older “first-generation farmer” households (with heads born before the 1980's) and households in the eastern regions with higher levels of economic development, suggesting that despite the “better late than never” advantage of farmland circulation, it can lead to greater regional inequality. These findings not only advance our understanding of how farmland circulation is associated with financial vulnerability but also provide some implications for the government's continuous optimization of the Farmland Property Rights Reform to ensure the financial security of farming households.

In classical economics, land is viewed as the basis of wealth and is essential to the growth of local economies (Besley and Burgess, 2000; Guo and Liu, 2021). For one thing, land not only offers the material foundation and geographical carrier for human life and progress, but also restricts the depth and breadth of human activity through its carrying capacity (Siciliano, 2012; Guo et al., 2018). For another, land is a key component of human activity, and its spatial heterogeneity contributes significantly to regional economic differentiation (Bromley, 1989; Liu et al., 2014). As a result, the land system has become the most important arrangement of production relations in a country and the most prominent basis of all systems (George and Samuel, 2005; Zhou et al., 2020; Tang, 2021). In particular for China, the key to the country's rapid economic rise from the 1970's to today has been the successful implementation of a land system reform in line with national conditions (Wang and Shen, 2022). China is a populous country with a predominantly agricultural but insufficient area of farmland (Zhou et al., 2020; Yuan and Wang, 2022). At present, important constraints on its rural revitalization are the small average area of farmland per household (each household owns only 0.5 hectares of farmland) (Ministry of Agriculture Rural Affairs of the People's Republic of China, 2022), serious fragmentation, and immature development of the circulation market (Yi, 2014; Xie and Lu, 2017; Song et al., 2021; Tian et al., 2021). Therefore, carrying out property rights reform of farmland to promote farmland circulation is the core task of China's rural land system reform at current stage (Han, 2020; Peng et al., 2020).

Property rights reform of farmland refers to the separation of ownership, contract rights, and operation rights based on the principles of collective ownership, stable tenure, and conversion of operation rights. In contrast, land circulation is circulating farmland operation rights from farmers who have contracted to manage farmland to other farmers or organizations (Tian et al., 2022). According to data from a survey conducted by the Ministry of Agriculture and Rural Affairs of the People's Republic of China, farmland circulation markets and farmland circulation service centers have been established in 1,474 counties (cities and districts) and 22,000 townships, respectively, which constitutes a national farmland circulation area of over 532 million hectares (Ministry of Agriculture Rural Affairs of the People's Republic of China, 2022). Nowadays, more and more farmers are circulating their farmlands by renting/leasing, subcontracting, and swapping them (this study refers to farmland outflow) or owning them in the form of equities. Farmland-circulation behavior is a self-selection process by farmers (He et al., 2022). They choose to circulate their farmlands for the improvement of their current situation (Xu et al., 2020).

According to the sustainable livelihoods framework proposed by the Department for International Development (DFID, 2022), farmland circulation is also a livelihood strategy for farmers that has an impact on their household livelihood outcomes. Numerous studies have discussed the impact of farmland circulation on the livelihood outcomes of households from different perspectives, such as income (Peng et al., 2020; Yang et al., 2020; Huo and Chen, 2021), consumption (Lei and Zhu, 2021; Zeng et al., 2022), quality of life (Zhang et al., 2018; He et al., 2022), and subjective wellbeing (Qiu et al., 2021), providing the basis for further research. It is worth noting that vulnerability is also a core indicator of livelihood outcomes in the sustainable livelihoods analysis framework and that reducing vulnerability or strengthening resistance to vulnerability is intrinsic to securing the livelihoods of farm households (Guo and Wang, 2021; DFID, 2022), with financial vulnerability being an important research perspective for analyzing the wellbeing of farm households, financial risks, and vulnerability levels. Particularly, in the context of the rapidly developing market economy and financial market openness in China and the world, every farmer is inevitably caught up in the whirlwind of the financial market. Hence, the issue of the financial vulnerability of farmers should be given more attention. Some scholars have found that there are multiple factors affecting household financial vulnerability. In addition to education (Anderloni et al., 2012; Ali et al., 2020), financial shock (Ramli et al., 2022), financial literacy (Liu et al., 2020; Chhatwani and Mishra, 2021; Seldal and Nyhus, 2022), the use of digital payment technologies (Seldal and Nyhus, 2022), household assets, and the way they are allocated are also key factors influencing household financial vulnerability (Yusof et al., 2015; Consumer Financial Protection Bureau, 2022). As important assets owned by farming households (Li et al., 2022), farmland, as well as the livelihood strategies for its circulation, inevitably has important implications for the livelihood outcome of household financial vulnerability. Unfortunately, there are few discussions about the relationship between farmland circulation and household financial vulnerability.

This study aims to examine whether and how farmland circulation affects household financial vulnerability and whether the impact varies by the characteristics of households and regions. Accordingly, we run the chain mediation model and group regressions, utilizing representative survey data of China (N = 9,822). The possible contributions of this study are as follows. Firstly, numerous studies have examined the impact of farmland circulation on income, consumption, and quality of life in farm household livelihood outcomes, but few studies, especially quantitative ones, have explored the relationship between farmland circulation and the financial vulnerability of farmers. The present study offers a new perspective on financial vulnerability for research on farmland circulation and supports it with representative data in China. Secondly, this study introduces labor transfer and financial literacy as mediating mechanisms to explain this relationship, thus furthering the understanding of how farmland circulation is connected to farmers' financial vulnerability. Then, this study covers a range of heterogeneity analyses to capture the different impacts of farmland circulation on financial vulnerability by combining the characteristics of different households and regions. Lastly, compared to the existing studies that use a single threshold to classify financial vulnerability into discrete variables (Zhang et al., 2020), this study constructs a system of evaluation indicators from multiple dimensions, such as survival security, basic social security, and debt burden, to comprehensively measure the financial vulnerability of households from the short term to the long term and unexpected periods when they are exposed to external risk shocks. This study can not only fill the gap of insufficient existing research but also provide a reference for the government to continuously optimize and improve the reform plan of farmland and ensure the financial security of farm households. The research framework is provided in Figure 1.

The remainder of this study proceeds as follows: The next section displays the theoretical framework and research hypothesis of the research. Section 3 describes the materials and methods of this study. Section 4 is the estimated results of the model and discussed in Section 5. Conclusions and policy implications are given in the last section.

The Sustainable Livelihoods Analysis Framework proposed by DFID (2022) aims to explore which livelihood outcomes can be achieved by different combinations of livelihood capital and livelihood strategies for the poor livelihood context. In the framework of sustainable livelihood analysis, household livelihood capital includes human, social, natural, physical, and financial capital, while livelihood strategies refer to the behavioral strategies employed by households to achieve sustainable livelihoods such as farmland circulation and crop diversification. Besides, livelihood outcomes mainly include multiple dimensions, such as increased income, poverty alleviation, welfare enhancement, and reduced vulnerability. The core of the sustainable livelihood analysis framework is to assess the influence of household livelihood capital and livelihood strategies on livelihood outcomes. The framework can be applied to different research subjects, such as individuals, households, villages, and even countries (Sun, 2020; Natarajan et al., 2022; Sun et al., 2022), thus serving as a good theoretical analysis tool for this paper to understand and assess the impact of farmland circulation on the financial vulnerability of farm households (Figure 2).

According to the sustainable livelihoods analysis framework, livelihood strategies can significantly affect livelihood outcomes (Dey and Haloi, 2019; Eshun et al., 2019; Sun, 2020; Chowdhury, 2021; Natarajan et al., 2022). Specifically, this study suggests that the livelihood strategy of farmland circulation can have an impact on the financial vulnerability of farm households' livelihood outcomes. In general, household financial vulnerability mainly includes aspects such as over-indebtedness and emergency savings, and its specific measures are mostly related to income, liabilities, and assets (Fuenzalida and Ruiz-Tagle, 2011; Loke, 2017; Noerhidajati et al., 2021). Previous studies have shown that the farmland property rights reform and transfer in rural China can not only effectively improve the income level of farm households (Peng et al., 2020; Yang et al., 2020; Huo and Chen, 2021), but also explore the transformation of the financial value of farmland (Liu and Li, 2015; Jiang et al., 2017). The transformation of the financial value of farmland can further increase the liquidity of household capital, improve the efficiency of household asset allocation, and strengthen the ability of farms to cope with various uncertain risks. In addition, farmland circulation can increase income and improve the efficiency of asset allocation while alleviating or even eliminating household indebtedness to a certain extent. Based on the above analysis, the study proposes the following hypothesis:

H1: Farmland circulation can reduce household financial vulnerability.

In the context of the rapid development of urbanization and industrialization in China, a great deal of rural labor has chosen to seek employment opportunities by moving from the agricultural sector to the non-agricultural sector (Deng et al., 2020; Zhang et al., 2021). In process of transferring rural labor, there are certain costs and expenses, which are known as “economic threshold” (Chen and Wang, 2017). Under the theoretical assumption of “the rational peasant” (Schultz, 1964; Popkin, 1979), rural labor will choose to transfer if the benefits are greater than the “economic threshold.” However, when farmland cannot be reasonably transferred, potential farmland circulation (i.e., farmers who are willing to transfer their farmlands) cannot receive its rental income and even has to bear the costs of searching for contractors in the market, especially during the crop ripening season when farmers who have already worked in cities have to pay additional travel and labor costs in order to return home to harvest their crops (Ren and Kong, 2016). These costs and expenses are the “economic threshold” that currently limits the smooth transfer of rural labor to the non-farm sector.

With the continuous improvement of the rural farmland circulation market, more and more potential farmers can successfully transfer their farmlands, thereby reaping the benefits of farmland circulation and lowering their “economic threshold” for transferring to the non-farm sector (Chen and Wang, 2017). The lowering of the “economic threshold” will further accelerate the transfer of rural labor to the non-agricultural sector. Therefore, farmland circulation can facilitate the transfer of rural labor, which has been confirmed by some scholars using micro-survey data (Yao et al., 2010; Zhao et al., 2016; Han et al., 2019). In the context of the imbalance between China's urban and rural dual economy, the transfer of rural labor has obvious “income effects” and “Internet effects.” In other words, labor transfer helps to promote the increase in household income and the popularization of Internet use among farm households (Liao et al., 2020; Guo and Wang, 2021; Zhou and Chen, 2022). Among other things, the use of the Internet can alleviate objective constraints on farmers' participation in financial markets, increase the availability of household finance, and improve the way farmers allocate their financial assets (Bogan, 2008). Since the measures of household financial vulnerability mainly include income, liabilities, and assets (Fuenzalida and Ruiz-Tagle, 2011; Loke, 2017; Noerhidajati et al., 2021), the “income effect” and “internet effect” of labor transfer can improve the financial vulnerability of households. Based on the analysis, the second hypothesis is as follows:

H2: Farmland Circulation can reduce household financial vulnerability by facilitating labor transfer.

For farmlands with financial attributes, farmland circulation is a financial act of farmers (Jiang et al., 2017). At the same time, according to the sustainability analysis framework, farmland circulation is a livelihood strategy for farmers (Tian et al., 2022). Rational farmers who seek to maximize their benefits will weigh the possible costs and benefits before making any financial decision or livelihood strategies adjustment (Schultz, 1964; Popkin, 1979). Therefore, before decision-making on farmland circulation, rational farmers will actively collect and understand market price information through various channels to make themselves financially literate and thus achieve their livelihood goal of maximizing household income. In addition, the increase in income from farmland circulation provides an incentive for farmers to improve their financial literacy in order to allocate their capital more efficiently. Thus, both before and after the transfer, the financial decision and livelihood strategies of farmland circulation are conducive to the financial literacy of farm households.

Financial literacy refers to the combination of knowledge, awareness, attitudes, and skills necessary for a person to understand basic financial concepts and make the right financial decisions (Atkinson and Messy, 2011; Chhatwani and Mishra, 2021; Hamid and Loke, 2021; Hsu et al., 2021). Most studies have used “financial knowledge” and “financial literacy” interchangeably (Ansari et al., 2022). Increased levels of financial literacy are favorable for households' maintenance of healthy long-term savings and investments (Sivaramakrishnan et al., 2017; Kitamura and Nakashima, 2021). At the same time, according to behavioral finance, consumers are prone to heuristic bias, which leads to sub-optimal financial decisions (Chen et al., 2007; De Bondt et al., 2008; Barber and Odean, 2013). Financial literacy, with its moderating and controlling effects, can reduce the probability of making poor financial decisions, thereby minimizing the adverse effects of behavioral biases (Grohmann, 2018). In general, households with higher levels of financial literacy are more likely to make the right savings and investment decisions but less likely to be affected by behavioral biases and investment errors, avoiding falling into a debt crisis and suffering from financial vulnerability. Therefore, financial literacy can reduce household financial vulnerability, and some scholars have confirmed this finding using micro-survey data (Liu et al., 2020; Chhatwani and Mishra, 2021; Seldal and Nyhus, 2022). Based on the above discussion, the third hypothesis is as follows:

H3: Farmland circulation can reduce household financial vulnerability by increasing the financial literacy levels of farm households.

Broadly speaking, labor transfer can affect the financial literacy of farm households through the “social network effect.” The transfer of rural labor from the agricultural sector to the non-agricultural sector can broaden the radius of work and life and the scope of social interaction compared with that in a relatively closed village. That is to say, labor transfer can enable farm households to have a wider social network (Bai and Yuan, 2014). Enlarging the size of social networks has an information-sharing effect, making it easier for different groups to communicate, share, and receive more open and diverse market information and financial knowledge (Ma and Yang, 2011), thus contributing to the improvement of financial literacy. At the same time, according to the SLF, vulnerable smallholder farmers are susceptible to a variety of external risks (DFID, 2022). When labor transfer enters a broad social network, the probability of households falling into financial vulnerability can be reduced through financial assistance from other social network members, even if the farm household suffers an external risk shock or fails in its financial decisions.

Based on the above discussion and research hypotheses H2-H3, it can be inferred that labor transfer can influence household financial vulnerability by promoting the financial literacy levels of farm households. In other words, the two variables of labor transfer and financial literacy can act successively as indirect mechanisms through which farmland circulation affects the financial vulnerability of farm households. Therefore, the following research hypothesis is proposed in this study:

H4: Labor transfer and financial literacy act as a chain of intermediaries between farmland circulation and farm household financial vulnerability.

The heterogeneity of the impact of farmland circulation on household financial vulnerability may also result from the fact that households are different in terms of generation and region. For example, in the process of urbanization in China, the different upbringing of “first-generation farmers” (generally born before the 1980's) and “second-generation farmers” (generally born after the 1980's) has led to significant differences in their willingness to return to their hometowns and their perceptions of income, consumption, and savings (Liu and Wang, 2020), and hence in their degrees of financial vulnerability. Compared with “first-generation farmers,” younger “second-generation farmers” are more inclined to live in the city and can integrate smoothly into new social networks. This, coupled with a higher level of acceptance of financial management and the digital economy, has enabled “second-generation farmers” to reallocate their assets more rationally and effectively after receiving income from farmland circulation. In addition, uneven and inadequate development is the main contradiction in Chinese society, and the “uneven development” is mainly reflected in the uneven level of economic development between regions (Liu et al., 2022). Based on the above discussion, we have the fifth hypothesis is as follows:

H5: The impact of farmland circulation on farm household financial vulnerability can vary according to households and regional characteristics.

In this study, data were collected from a large-scale nationwide household tracking survey conducted by the Survey and Research Center for China Household Finance from 2015 to 2019. The survey is carried out every 2 years and includes community (village), household, and individual questionnaires, covering household assets and liabilities, insurance and protection, income and consumption, demographic characteristics, employment, and other micro-level financial information. Thus, it can provide strong data support for this paper to explore the impact of farmland circulation on the financial vulnerability of farm households from a micro perspective. In accordance with the needs of the study, those farmlands owned by individuals were selected as the sample for this study. By matching and cleaning 2015, 2017, and 2019 data (mainly by eliminating outliers and missing values and shrinking the tails of income, consumption, and asset variables), 9,822 valid samples were finally obtained while ensuring that the balanced panel was satisfied.

Most existing studies have measured household financial vulnerability based on the dimensions of “over-indebtedness” and “emergency savings” (Zhang et al., 2020), which were assigned through correlation thresholds to reflect the financial vulnerability of the sample households in a discontinuous discrete variable. While the assignment of thresholds in two and simple summation can determine whether a household is vulnerable by exceeding a threshold, it is impossible to determine the extent of vulnerability beyond the threshold, which is a shortcoming that can be overcome by using continuous variables to measure household financial vulnerability. Therefore, drawing on existing research (Noerhidajati et al., 2021; He and Zhou, 2022), this paper selected indicators to characterize household financial vulnerability in terms of survival security, social competence, debt burden, and unexpected shocks (Table 1). Then, through the standardization of the data and the entropy method of weighting and summing, the Financial Vulnerability Index (FVI) can be obtained. The smaller the value of the index is, the lower the financial vulnerability of the household will be, that is, the household is financially safer.

As the core independent variables of this paper, farmland and farmland circulation refer to plowland for farmers and the outflow of farmland, respectively. The specific measurement is based on the question “Has the right to operate your farmland been transferred to another person or institution?” This question was measured by assigning a value of 1 to “yes” and 0 to “no” i.e., a dummy variable for farmland circulation. In addition, specific values for the area of farmland circulation were also calculated and used to replace the binary dummy variable when robustness testing of the model was carried out.

In the analysis of the mechanism of the effect of farmland circulation on household financial vulnerability, labor transfer (LT) and financial literacy (FL) were chosen as mediating variables. Labor transfer refers to the proportion of non-farm workers (excluding students) in the household. In this paper, the measurement of financial literacy is based on the World Bank's financial capability measurement framework (The World Bank, 2022) and existing studies (Atkinson and Messy, 2011; Liu et al., 2020; Zhang et al., 2020), conducted in three dimensions: financial knowledge, financial attitudes, and financial behaviors, as shown in Table 1.

This study chooses control variables from the characteristics of the head of households and households to reduce estimation bias and improve the accuracy of the model, taking into account that household financial vulnerability is also influenced by factors such as household characteristics, asset status, and geographic location (Ali et al., 2020). At the household level, life satisfaction, population size, the presence of a car, and the child and old age dependency ratios, which characterize the burden on the population, are selected; and finally, regional characteristics are also controlled for. More specifically, the control variables at the household head level primarily include the gender of the household head, age, education level, health status, and social security such as health and old age. The above variables and their descriptive statistics are shown in Table 2.

To test whether farmland circulation reduces household financial vulnerability, the following underlying econometric model was constructed.

Where, i represents the individual farm household; t represents the year; FVIit represent i household financial vulnerability of the farm household t year; FCit is the independent variable farmland circulation; Xit represents the control variables, including the characteristics of the household head, household characteristics, etc.; α is the constant term; εit is the random error term. In regard to the choice of panel data in the fixed-effects model and the random-effects model, firstly, although the research sample of this study is at the national level, it was obtained from a random sample of farm households across the country, which is more suitable for the random-effects model, and secondly, the test results are found to accept the original hypothesis through the Hausman test, therefore, the random-effects model was chosen in this study to test the impact of land transfer on financial vulnerability.

Whether or not farmland is diverted is the result of self-selection by households (He et al., 2022), but this selection is not random due to individual, household, and other factors. The selectivity bias caused by the “self-selection” of the sample could seriously confound the estimation results. The post-transfer financial vulnerability of households that have transferred farmland could be observed, whereas the level of financial vulnerability of households that have not transferred farmland could not be determined. And the post-transfer financial changes of households that have not transferred farmland were unknown, which was a “missing data” problem and could bias the estimates. To address this problem, Rosenbaum et al. proposed the use of Propensity Score Matching (PSM) to find a counterfactual control group similar to the treatment group based on a counterfactual framework (Rosenbaum and Rubin, 1983). Existing studies have shown that this method can effectively overcome the selection bias and biased estimation caused by the sample's “self-selection.”

Based on the idea of propensity score matching, firstly, factors affecting household financial vulnerability and farmland circulation were included in the model as much as possible. Specifically, variables, such as household head characteristics, household characteristics, and regional characteristics described above were considered to satisfy the negligibility assumption and reduce bias. Secondly, a decision model for farmland circulation was constructed to estimate its Propensity Score (PSi). In this paper, the logit model was chosen for estimation.

Where, i represents different households, FCi= 1 indicates households with farmland circulation, FCi= 0 indicates households with land not transferred, and Xi indicates covariates. Regarding the choice of matching methods, there is no clear indication in the existing relevant studies as to which matching method is the most effective. To ensure the robustness of matching, four commonly used matching methods were used in this study, namely k-nearest neighbor matching, caliper matching, kernel matching and local linear regression matching. Where k-nearest neighbor matching was based on the recommendations of Abadie et al. (2004), k = 4 was chosen to keep the mean square error to a minimum, caliper matching was calculated with r = 0.009, and both kernel matching and local linear regression matching use the default broadband of 0.06 and 0.08, respectively. Finally, the impact of farmland circulations on household financial vulnerability was estimated using the average treatment effect (ATT):

where, Y1irepresents the financial vulnerability of households with farmland circulations, E(Y1i|FCi = 1) is directly observable, Y0irepresents the financial vulnerability of households in the counterfactual control group, i.e., without farmland circulations, E(Y0i|FCi = 1) is not directly observable.

The study assumes that “farmland circulation or not” is strictly exogenous, but in fact it is not a random exogenous event. Although the control variables are selected from multiple dimensions in the model setting, it is undeniable that there are still some influencing factors that cannot be covered by the control variables. In addition, when farmers make farmland circulation decisions, they may also be affected by household financial vulnerability. When the household debt burden is too heavy or suffers from unexpected shocks, farmers are more likely to carry out farmland circulation behaviors, resulting in endogenous problems caused by missing variables or mutual causation. In order to effectively avoid the endogeneity problem, this paper refers to the instrumental variable method in existing studies (Yi et al., 2017), and selects the proportion of farmland circulation households in the village (community) where the farmer resides as the instrumental variable of “whether there is farmland circulation.” Theoretically, whether farmers circulation their land is related to the circulation of other farmers in the village (community), and the circulation of other farmers' farmland has no impact on the financial vulnerability of the farmers. Therefore, this instrumental variable meets the requirements of correlation and exogeneity, and can be used to deal with the endogenous problem.

According to the previous hypotheses, farmland circulation can alleviate household financial vulnerability by promoting labor transfer and improving financial literacy. Considering the impact of labor transfer on household financial literacy, a chain mediating effect model was applied in this study to reveal the mechanism of the effect of farmland circulation on household financial vulnerability. Drawing on the stepwise regression method proposed by Baron and Kenny (1986) and the study by Allen and Griffeth (2001), the following chain mediating effect model was developed.

Where LT is the first mediating variable labor transfer; FC is the independent variable farmland circulation and FL is the second mediating variable financial literacy, Equations (4–6) are regression analyses using mixed OLS. If the estimation results of Equations (4) and (5) are significant, it indicates that there are multiple mediators in the model, and if Equation (6) is significant, it indicates that there are multiple chain mediators. In addition, the non-parametric Bootstrap method of mediating effects was further tested to ensure the reliability of the test results of mediating effects in this study.

Through Stata 17.0 analysis, Table 3 shows the impact of farmland circulation on household financial vulnerability estimated mainly by a random effects model, with possible heteroskedasticity addressed by clustering robust standard errors. The columns (1–3) in Table 3 were estimated by sequentially adding household head characteristics and household characteristics to the core independent variable farmland circulation. The estimation results demonstrated that the effect of farmland circulation on household financial vulnerability remained significantly negative as the control variables were added in turn. When all control variables were added, the value of the coefficient of farmland circulation was −0.167, p < 0.01 [with a coefficient of −0.167 (p < 0.01)] indicating that farmland circulation can mitigate household financial vulnerability, which initially validated hypothesis H1.

Other control variables were also found to be significantly related to household financial vulnerability. Firstly, household head characteristics, such as higher education, good health, and retirement security all reduced household financial vulnerability, with education affecting household financial vulnerability by reducing the probability of debt burden and stabilizing income (Zhang et al., 2020), while better health made households less vulnerable as these households were less exposed to diseases and less likely to suffer unexpected shocks such as medical expenses, which were reduced by with good medical coverage. Secondly, at the household characteristics level, the population size was negatively related to household financial vulnerability, whereas the child dependency ratio and the old dependency ratio significantly increased the probability of a household being financially vulnerable. The positive effect of the child dependency ratio on household financial vulnerability was nearly three times that of the old dependency ratio. The possible reason for this is that households with larger populations have more members in the labor force and thus higher income that dampens financial vulnerability, but a higher proportion of children implies higher developmental consumption such as education, which leads to a high household burden that significantly aggravates financial vulnerability.

To ensure the robustness of the above estimation results, robustness tests were conducted using, among others, replacement models and variable measures. Estimation was first carried out through the propensity score matching method, and then common support domain and balance tests were performed. Table 4 shows the average treatment effects of farmland circulation on household financial vulnerability obtained using the four matching methods. Overall, the values of similar average treatment effects obtained through different methods were relatively close, indicating the robustness of the analysis. More importantly, the data results demonstrate that farmland circulation has a significant mitigating effect on household financial vulnerability. For the purpose of this analysis, mean values were used for characterization. Specifically, after PSM counterfactual estimation, farmland circulation was found to significantly mitigate financial vulnerability, with a mean treatment effect of −0.155, indicating that farmland circulation reduces household financial vulnerability by 15.5% after addressing sample selection bias.

In addition to robustness testing through propensity score matching, this study also used the method of replacing the independence variable with the dependence variable for further testing. The financial vulnerability index was first classified as a discrete variable by mean, with values from 0 to 2, representing low, medium and high vulnerability, respectively and then empirically tested using a panel multi-valued logit model, and the results were shown in column (1) in Table 5. As the estimated coefficients of the logit model are not directly comparable in a statistically significant way, the values reported in the table are marginal coefficients. It can be found that after replacing the measure and estimation method of financial vulnerability, farmland circulation still has a negative impact on financial vulnerability. Specifically, with low vulnerability as the benchmark group, the effect of farmland circulation on high financial vulnerability was much higher than that of low vulnerability, indicating that farmland circulation can better mitigate high household financial vulnerability. In terms of control variables, the health status and medical coverage of the household head always have a negative effect on financial vulnerability; the marginal effect of the child dependency ratio on high vulnerability was higher than that of medium vulnerability, and the old dependency ratio has a decreasing effect on the probability of households falling into medium financial vulnerability but increases the probability of households falling into high financial vulnerability, indicating that an excessive demographic dependency burden was more likely to put households into high financial vulnerability status. In addition, column (2) in Table 5 was the estimated result of replacing the independence variables, and we replaced whether farmland is diverted with the area of farmland diverted for the regression, which was still found to have a mitigating effect on financial vulnerability. Even after FVI was decomposed into five specific time-level indicators, namely short-term, short to medium term, medium to long term, long-term and accident period, the impact of farmland circulation on household financial vulnerability in different periods was examined by using the truncated regression model successively (see Appendix A for the results), the results remained unchanged.

In addition, considering the endogeneity problem caused by the possible omission of variables in the baseline regression, instrumental variables were introduced into the model. The estimated results are shown in column (3) in Table 5, where the relationship between farmland circulation and financial vulnerability remained negative and significant at the 1% statistical level after using instrumental variables, proving that farmland circulation effectively reduces financial vulnerability. Research hypothesis H1 was further verified, and again, the direction of influence of the control variables remained consistent with the baseline regression results, also indicating that the findings of this study remain robust after overcoming endogeneity.

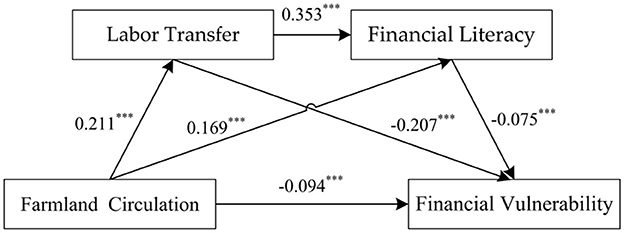

The estimation results of models (4–6) are shown in Table 6. According to column (1) in Table 6, the coefficient of farmland circulation was 0.211 and significantly positive at the 1% level, indicating that farmland circulation can promote labor transfer. Column (2) shows that the regression coefficients of farmland circulation and labor transfer on financial literacy were 0.169 and 0.353, respectively, indicating that both farmland circulation and labor transfer can significantly increase financial literacy. Column (3) shows that the estimated coefficients of farmland circulation, labor transfer, and financial literacy were all significantly negative, with the coefficient of farmland circulation being −0.094, using the financial vulnerability index as the independent variable. The results of the above three columns suggest that farmland circulation can indirectly reduce household financial vulnerability by promoting labor transfer or improving financial literacy in one direction or through the chain mechanism of “promoting labor transfer → improving financial literacy.”

Table 7 reports the results of the Bootstrap method test for the chain multiple mediating effects under the OLS model, and it can be found that the farmland circulation → labor transfer → financial vulnerability path has the highest effect value, with a coefficient of −0.044, which does not contain 0, indicating that the mediating effect was significant and H2 holds. Farmland circulation → financial literacy → financial vulnerability with a coefficient of −0.013, does not contain 0, indicating that the mediation effect was significant and H3 holds. Farmland circulation → labor transfer → financial literacy → financial vulnerability with a coefficient of −0.006, does not contain 0, indicating a significant mediating effect, H4 holds. This implies that there was a significant continuous mediation effect from labor transfer to financial literacy, i.e., farmland circulation can mitigate financial vulnerability through the chain mediation pathway of “promoting labor transfer → enhancing financial literacy.”

In summary, the hypotheses H1–H4 of this paper were tested and passed, thus obtaining a chain mediation model of the impact of farmland circulation on financial vulnerability. According to the estimation results in Table 6, the relationship between the variables and the coefficient of influence were shown in Figure 3, and the direct effect of farmland circulation on financial vulnerability is −0.094. Further analysis in conjunction with Table 7 reveals that the total mediation effect of farmland circulation on financial vulnerability is −0.063 and the direct effect is −0.094, so the total effect is −0.157. This gives a total mediating effect as a proportion of the total effect of 40.13%. Among the different types of mediation effects, the independent mediation effect of labor transfer is the largest, with an effect value of −0.044, accounting for 28% of the total effect, the independent mediation effect of financial literacy is the second largest (effect value of −0.013) and the impact effect of chain mediation is the lowest (effect value of −0.006), indicating that the pathway of farmland circulation is the most significant in mitigating household financial vulnerability by promoting labor transfer, and is the most important mechanism through which farmland circulation mitigates household financial vulnerability.

Figure 3. Modeling the impact of farmland circulation on financial vulnerability. *** indicate significant at the 1% levels.

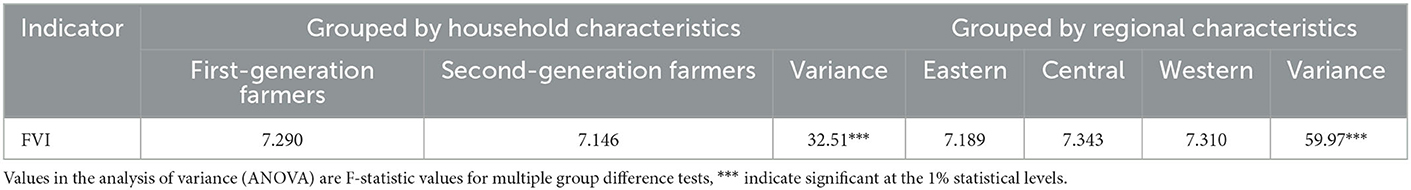

To capture the differences in the impact of farmland circulation on financial vulnerability, this section presents a heterogeneity analysis from two dimensions: household and regional characteristics. Table 8 presents the results of the financial vulnerability measurement for different household and regional characteristics of farmers, which show that there are significant differences in the levels of financial vulnerability of farmers by household and regional characteristics. In particular, the level of financial vulnerability of young “second-generation farmers” (with heads born after the 1980's) was significantly lower than that of “first-generation farmers” (with heads born before the 1980's), F = 32.51, p < 0.01. The level of financial vulnerability of households in the eastern region, which is characterized by a higher level of economic development than the central and western regions, was also significantly lower than that in the central and western regions, F = 59.97, p < 0.01.

Table 8. Levels of financial vulnerability of farm households with different household characteristics and regional characteristics.

Further results of the regression model were shown in Table 9. Specifically, the regression coefficient of farmland circulation on the financial vulnerability of households in the “first-generation farmers” is −0.119, which was statistically significant at the 1% level, indicating that the farmland circulation behavior of households in the “first-generation farmers” can significantly reduce household financial vulnerability. The estimated coefficient is −0.1 but was not statistically significant when the sample is the “second-generation farmers.” At the regional level, farmland circulation had a mitigating effect on household financial vulnerability in the eastern, western and central regions, with the largest effect in the east.

In this study, a new area of research, the potential relationship between farmland circulation and the financial vulnerability of households, was introduced to enrich existing literature. This study not only analyzed the direct relationship between farmland circulation and financial vulnerability but also explored the indirect impact mechanisms involved using the chain mediation model, by using the latest available Chinese household survey data containing 9,822 households for the period 2015–2019. This study showed that farmland circulation was negatively correlated with household financial vulnerability with a coefficient of −0.167 (p < 0.01), indicating that farmland circulation, as a self-selected behavior of farmers (He et al., 2022), can achieve the purpose of safeguarding household financial security and improving the current situation (Xu et al., 2020), which supports the classical theoretical assumption that “farmer are rational” (Schultz, 1964; Popkin, 1979), as well as the idea that “livelihood strategies influence livelihood outcomes” in the sustainable livelihoods analysis framework is also applicable in the Chinese context. At the same time, promoting farmland circulation is the core task of China's rural land system reform at the present stage (Peng et al., 2020). As a result, this finding may also provide micro-level evidence for formulating relevant policies and measures.

In terms of the indirect effects of farmland circulation on the financial vulnerability of farmers, this study shows that farmland circulation can indirectly reduce household financial vulnerability by affecting labor transfer and financial literacy. Specifically, the independent mediation effect of labor transfer was the largest, with an effect value of −0.044, accounting for 28% of the total effect, followed by the independent mediation effect of financial literacy (−0.013) and the lowest effect of chain mediation (−0.006). This confirms that the “asset allocation effect” of farmland circulation can facilitate labor transfer (Yao et al., 2010; Zhao et al., 2016; Han et al., 2019), the “social network effect” of labor transfer can enhance the financial literacy of farmers, and financial literacy can reduce the financial vulnerability of farmers (Liu et al., 2020; Chhatwani and Mishra, 2021; Seldal and Nyhus, 2022). Therefore, in order to give greater play to the role of farmland circulation in alleviating household financial vulnerability, the government should pay attention to labor transfer and financial literacy in the process of promoting farmland circulation.

To capture the differences in the impact of farmland circulation on financial vulnerability, this study discussed the differences in household and regional characteristics of farmers in groups. The results of the financial vulnerability measurement showed that older “first-generation farmers” households had significantly higher levels of financial vulnerability than younger “first-generation farmers” households (F = 32.51, p < 0.01). In this study and previous studies (Fuenzalida and Ruiz-Tagle, 2011; Loke, 2017; Noerhidajati et al., 2021), financial vulnerability was measured mainly by income, consumption, and other indicators. According to the household life cycle theory, the household life cycle has an impact on these indicators (Martins et al., 2011; Liu and Wang, 2020). Therefore, there are differences in the level of financial vulnerability across household life cycles. Further model regression results showed that farmland circulation significantly reduced the financial vulnerability of “first-generation farmers” households (coefficient = −0.149, p < 0.01), but the estimated coefficient for the “first-generation farmers” was −0.1 and not significant. The possible reason is that younger “second-generation farmers” households are less likely to engage in agricultural production, and whether or not farmland is circulation does not have a significant impact on their livelihood outcomes. By contrast, older “first-generation farmers” often miss out on the opportunity to work in urban areas by transferring labor because they cannot afford to give up agricultural production. As a result, the financial vulnerability of first-generation farmers is more significantly affected when farmland circulation takes place. This also suggests that it is “better late than never” for farm households to transfer their farmlands.

In terms of regional groupings, the level of financial vulnerability of households in the eastern region, which is at a higher level of economic development, was significantly lower than that in the central and western regions (F = 59.97, p < 0.01), and the mitigating effect of farmland circulation on the financial vulnerability of households in the eastern region was also the largest (coefficient = −0.149, p < 0.01). This difference may be explained by the fact that the eastern region has been leading the development of financial markets nationwide, with urban expansion contributing to greater market demand for farmland circulation, as well as the fact that farmers in the eastern region have greater access to employment opportunities and financial information when they move to cities, which has led to a significant increase in their levels of financial literacy. As a result, farmers in the eastern region have been able to increase their income through farmland circulation, thus allocating their assets more efficiently to reduce their household financial vulnerability. The estimated coefficients of labor transfer (coefficient = −0.222, p < 0.01) and financial literacy (coefficient = −0.101, p < 0.01) on financial vulnerability in the eastern region in the regression results in Table 9 also support this judgment from the side, with the coefficients in the eastern region being significantly higher than those in the central and western regions. In the context of China's commitment to addressing regional development inequalities (Guo et al., 2020; Qi et al., 2022), the findings of this study are of great reference value for government departments to take effective measures to avoid the consequences of further widening the regional development gap brought about by farmland circulation.

The strengths of this study include the use of large data, a representative sample, a wide range of socio-economic variables, and the examination of whether and how farmland circulation affects household financial vulnerability and whether their effects are heterogeneous according to differences in household and regional characteristics of farmers. However, this study is not free from limitations. Firstly, farmland circulation includes two types, namely, inflow and outflow. This paper only focused on farmland outflow. However, what is the impact of farmland inflow on the financial vulnerability of households? Will it get better or worse? This is an important issue that needs further study. Secondly, in this study, financial vulnerability indicators were constructed in terms of household survival and security, social capacity, debt burden, and unexpected shocks, whereas there is no space for a detailed discussion about the impact of farmland circulation on these dimensions. Therefore, further research could consider systematically analyzing the impact of farmland circulation on different dimensions of financial vulnerability of farm households. Thirdly, although stepwise regression and Bootstrap methods were used in this study to test the mediating effects of labor transfer and financial literacy on the relationship between farmland circulation and financial vulnerability, it cannot be denied that there may also be moderating effects of labor transfer and financial literacy or endogeneity problems due to reverse causality (Jia et al., 2020; Kim et al., 2022). This is also a direction for future research and discussion.

Financial vulnerability is an important research perspective for analyzing the wellbeing of farmers (Zhang et al., 2020; Ramli et al., 2022). In the context of the Chinese government's vigorous efforts to reform the farmland ownership system and promote farmland circulation, this paper has systematically investigated the direct and indirect effects of farmland circulation on the financial vulnerability of farmers. The results showed that farmland circulation was negatively associated with household financial vulnerability at the 1% statistical level, suggesting that farmland circulation helps to ensure the financial security of farmers. Moreover, farmland circulation was found to indirectly reduce household financial vulnerability by influencing labor transfer and financial literacy, with labor transfer having the largest independent mediating effect, accounting for 28% of the total effect. A range of further heterogeneity analyses and studies have also been performed to capture differences in estimates across groups, and the results showed that farmland circulation had a significant mitigating effect on the financial vulnerability of “first-generation farmers,” suggesting that it is “not too late” for farmers to engage in farmland circulation. At the same time, farmland circulation was found to have a stronger mitigating effect on the financial vulnerability of households in the more economically developed eastern regions than in the backward central and western regions, suggesting that from the perspective of household financial vulnerability, farmland circulation exacerbates regional development inequalities.

The findings of this study have some policy implications. Firstly, the government should promote multiple channels for potential farmers to transfer their farmlands, even if the potential household head is older. These channels include, but are not limited to, renting/leasing, subcontracting, shareholding, swaps, etc. Secondly, for those who have already transferred their farmlands, it is necessary to enable them to be employed close to their homes through the vigorous development of township and county industries, so as to achieve the transfer of family labor. Meanwhile, government and financial institutions should organize more financial literacy education and training activities (e.g., seminars and consultations) for farmland circulation households through new media such as WeChat. The universal content should include, but not be limited to, knowledge of the loan process, interest rates, loan terms, and the risks and benefits of family financial strategies. Thirdly, regional development inequality is an important constraint on the comprehensive revitalization of rural areas. Since farmland circulation will aggravate the inequality of financial vulnerability between regions, policy-makers ought to focus on the financial vulnerability of households in the central and western regions in the process of promoting farmland circulation. To be more specific, they should make greater efforts to promote labor transfer and improve the financial literacy of households in these regions, so as to make better use of farmland circulation to alleviate the financial vulnerability of households in these regions.

Publicly available datasets were analyzed in this study. This data can be found at: https://chfs.swufe.edu.cn/sjzx/sjsq.htm.

SC and YZ: conceptualization. FS and LW: formal analysis. SC and LW: data curation and writing–review and editing. SC and FS: methodology. SC: software. FS and YZ: writing–original draft. All authors have read and approved the final manuscript.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2023.1102189/full#supplementary-material

Abadie, A., Drukker, D. M., Herr, J. L., and Imbens, G. W. (2004). Implementing matching estimators for average treatment effects in stata. Stata J. 4, 290–311. doi: 10.1177/1536867X0400400307

Ali, L., Khan, M. K. N., Ahmad, H., and Maggino, F. (2020). Education of the head and financial vulnerability of households evidence from a households survey data in Pakistan. Soc. Indic. Res. 147, 439–463. doi: 10.1007/s11205-019-02164-2

Allen, D. G., and Griffeth, R. W. (2001). Test of a mediated performance-turnover relationship highlighting the moderating roles of visibility and reward contingency. J. Appl. Psychol. 86, 1014–1021. doi: 10.1037/0021-9010.86.5.1014

Anderloni, L., Bacchiocchi, E., and Vandone, D. (2012). Household financial vulnerability: an empirical analysis. Res. Econ. 66, 284–296. doi: 10.1016/j.rie.2012.03.001

Ansari, Y., Albarrak, M. S., Sherfudeen, N., and Aman, A. (2022). A study of financial literacy of investors—a bibliometric analysis. Int. J. Fin. Stud. 10, 36. doi: 10.3390/ijfs10020036

Atkinson, A., and Messy, F. A. (2011). Assessing financial literacy in 12 countries: an OECD/INFE international pilot exercise. J. Pension Econ. Finan. 10, 657–665. doi: 10.1017/S1474747211000539

Bai, M., and Yuan, P. (2014). Analysis of the present situation and influencing factors of farmer' social relations. China Rural Sur. 1, 41–49. Available online at: https://zncg.cbpt.cnki.net/WKB3/WebPublication/kbDownload.aspx?fn=ZNCG201401005

Barber, B. M., and Odean, T. (2013). “The behavior of individual investors,” in Handbook of the Economics of Finance, eds G. M. Harris, and R. M. Stulz (Elsevier: Amsterdam, Holland 3), 1533–1570.

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51, 1173–1182. doi: 10.1037/0022-3514.51.6.1173

Besley, T., and Burgess, R. (2000). Land reform, poverty reduction, and growth: evidence from India. Q. J. Econ. 115, 389–430. doi: 10.1162/003355300554809

Bogan, V. (2008). Stock market participation and the internet. J. Finan. Quan. Anal. 43, 191–212 doi: 10.1017/S0022109000002799

Bromley, D. W. (1989). Property relations and economic development: the other land reform. World Dev. 17, 867–877. doi: 10.1016/0305-750X(89)90008-9

Chen, G., Kim, K. A., Nofsinger, J. R., and Rui, O. M. (2007). Trading performance, disposition effect,overconfidence, representativeness bias, and experience of emerging market investors. J. Behav. Decis. Mak. 20, 425–451. doi: 10.1002/bdm.561

Chen, Y., and Wang, L. X. (2017). The mechanism, problems and countermeasures of land circulation to promote the transfer of rural labor forces. Rural Fin. Res. 10, 63–66. doi: 10.16127/j.cnki.issn1003-1812.2017.10.014

Chhatwani, M., and Mishra, S. K. (2021). Does financial literacy reduce financial fragility during COVID-19? the moderation effect of psychological, economic and social factors. Int. J. Bank Mark. 39, 1114–1133. doi: 10.1108/IJBM-11-2020-0536

Chowdhury, T. A. (2021). Applying and extending the sustainable livelihoods approach: identifying the livelihood capitals and well-being achievements of indigenous people in Bangladesh. J. Soc. Econ. Develop. 23, 302–320. doi: 10.1007/s40847-021-00163-z

Consumer Financial Protection Bureau (2022). Measuring Financial Well-being: A Guide to Using the CFPB Financial Well-being Scale. Available online at: https://www.consumerfinance.gov/data-research/research-reports/financial-well-being-scale (accessed January 29, 2022).

De Bondt, W. F., Muradoglu, Y. G., Shefrin, H., and Staikouras, S. K. (2008). Behavioral finance: quovadis?. J. Appl. Finan. 18, 7–21. Available online at: https://ssrn.com/abstract=2698614

Deng, W., Zhang, S. Y., Peng, Z., Li, P., and Wan, J. J. (2020). Spatiotemporal characteristics of rural labor transfer in China: evidence from the transfer stability under new-type urbanization. Chin. Geogr. Sci. 30, 749–764. doi: 10.1007/s11769-020-1147-7

Dey, S., and Haloi, R. (2019). Assets, rural livelihood strategies and welfare outcomes: a case study from South Assam, India. Ind. J. Labor Econ. 62, 595–620. doi: 10.1007/s41027-019-00192-7

DFID (2022). DFID Sustainable Livelihoods Guidance Sheets. Available online at: www.ennonline.net/dfidsustainableliving (accessed January 11, 2022).

Eshun, I., Golo, H. K., and Dankwa, S. (2019). Livelihood strategies and outcomes of fisher folks in selected rural coastal communities of Ghana. J. Cul. Soc. Develop. 48, 35–46. Available online at: https://iiste.org/Journals/index.php/JCSD/article/view/47803/49386

Fuenzalida, M., and Ruiz-Tagle, J. (2011). “Household financial vulnerability,” in Financial Stability, Monetary Policy, and Central Banking, ed R. Alfaro (Central Bank of Chile: Santiago, Republic of Chile), 299–326.

George, C. S. L., and Samuel, P. S. H. (2005). The state, land system, and land development processes in contemporary China. Ann. Assoc. Am. Geograp. 95, 431–436. doi: 10.1111/j.1467-8306.2005.00467.x

Grohmann, A. (2018). Financial literacy and financial behavior: evidence from the emerging asian middle class. Pacific-Basin Fin. J. 48, 129–143. doi: 10.1016/j.pacfin.2018.01.007

Guo, Y., and Wang, J. (2021). Poverty alleviation through labor transfer in rural China: evidence from hualong county. Habitat Int. 116, 102402. doi: 10.1016/j.habitatint.2021.102402

Guo, Y. Z., and Liu, Y. S. (2021). Poverty alleviation through land assetization and its implications for rural revitalization in China. Land Use Policy 105, 105418. doi: 10.1016/j.landusepol.2021.105418

Guo, Y. Z., Zhou, Y., and Liu, Y. S. (2020). The inequality of educational resources and its countermeasures for rural revitalization in Southwest China. J. Mount. Sci. 17, 304–315. doi: 10.1007/s11629-019-5664-8

Guo, Z. Y., Yang, Z., and Cao, Z. (2018). Geographical patterns and anti-poverty targeting post-2020 in China. J. Geogr. Sci. 28, 1810–1824. doi: 10.1007/s11442-018-1580-z

Hamid, F. S., and Loke, Y. J. (2021). Financial literacy, money management skill and credit card repayments. Int. J. Consum. Stud. 45, 235–247. doi: 10.1111/ijcs.12614

Han, J. (2020). How to promote rural revitalization via introducing skilled labor, deepening land reform and facilitating investment?. China Agricul. Econ. Rev. 12, 577–582. doi: 10.1108/CAER-02-2020-0020

Han, J. B., Liu, S. Y., and Zhang, S. F. (2019). The land entitlement, farmland circulations and non-farm employment of the peasants:based on the incomplete contract theory. Northwest Popul. J. 40, 11–22. doi: 10.15884/j.cnki.issn.1007-0672.2019.03.002

He, L., and Zhou, S. (2022). Household financial vulnerability to income and medical expenditure shocks: measurement and determinants. Int. J. Environ. Res. Public Health 19, 4480. doi: 10.3390/ijerph19084480

He, Q., Deng, X., Li, C., Kong, F. X., and Qi, Y. B. (2022). Does farmland circulation improve farmer' quality of life? Evidence from Rural China. Land 11, 15. doi: 10.3390/land11010015

Hsu, Y. L., Chen, H. L., Huang, P. K., and Li, W. Y. (2021). Does financial literacy mitigate gender differences in investment behavioral bias? Finan. Res. Lett. 41, 101789. doi: 10.1016/j.frl.2020.101789

Huo, C. J., and Chen, L. M. (2021). Research on the impact of land circulation on the income gap of rural households: evidence from CHIP. Land 10, 781. doi: 10.3390/land10080781

Jia, G., Ge, S., and Sun, X. Q. (2020). Does labor transfer affect rural farmland circulation? Evidence from China. Land Use Policy 99, 105096. doi: 10.1016/j.landusepol.2020.105096

Jiang, M., Paudel, K., and Mi, Y. S. (2017). “Rural farmland circulation and financial impact: evidence from China,” in Annual Meeting of Alabama Southern Agricultural Economics Association, in Mobile, Alabama, U.S.A., February 4 2017.

Kim, K. T., Lee, J. M., and DeVaney, S. A. (2022). Financial knowledge and financial fragility: a consideration of the neighborhood effect. J. Finan. Counsel. Plann. 33, 268–279. doi: 10.1891/JFCP-2021-0042

Kitamura, T., and Nakashima, K. (2021). An investigation of policy incentives for delaying public pension benefit claims. Rev. Behav. Fin. 13, 109–124. doi: 10.1108/RBF-09-2019-0117

Lei, S., and Zhu, K. J. (2021). Can farmland circulation improve household consumption? Consum. Econ. 37, 47–56. Available online at: https://kns.cnki.net/kcms/detail/43.1022.F.20210623.1553.004.html

Li, Z. S., Yang, Q. Y., Yang, X. C., Ouyang, Z. T., Cai, X. M., and Qi, J. G. (2022). Assessing farmer' attitudes towards rural land circulation policy changes in the Pearl River Delta, China. Sustainability 14, 4297. doi: 10.3390/su14074297

Liao, W., Qiao, J., Xiang, D., Peng, T., and Kong, F. (2020). Can labor transfer reduce poverty? evidence from a rural area in China. J. Environ. Manag. 271, 110981. doi: 10.1016/j.jenvman.2020.110981

Liu, B., Wang, X. H., and Hu, Z. Y. (2020). Does financial literacy weaken household financial vulnerability? South China J. Econ. 10, 76–91. Available online at: https://kns.cnki.net/kcms/detail/44.1068.f.20201010.1827.005.html

Liu, J., and Li, B. J. (2015). Agricultural land finance: activating the economic value of management Rights. China Rural Fin. 4, 14–17. Available online at: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGNC201504006&DbName=CJFQ2015

Liu, S. Y., and Wang, B. J. (2020). The characteristics and evolution of smallholder farmer in China. Social Sci. Front 1, 63–78. Available online at: https://www.shkxzx.cn/?mod=datas&act=viewfulltext&id=2846

Liu, W., Liu, Z., Wang, L., Liu, H., and Wang, Y. (2022). Regional social development gap and regional coordinated development based on mixed-methods research: evidence from China. Front. Psychol. 13, 927011. doi: 10.3389/fpsyg.2022.927011

Liu, Y. S., Fang, F., and Liu, Y. H. (2014). Key issues of land use in China and implications for policy making. Land Use Policy 40, 6–12. doi: 10.1016/j.landusepol.2013.03.013

Loke, Y. J. (2017). Financial vulnerability of working adults in Malaysia. Contempor. Econ. 11, 205–218. doi: 10.5709/ce.1897-9254.237

Ma, G., and Yang, E. (2011). Social networks, informal finance and entrepreneurship. Econ. Res. J. 46, 83–94. Available online at: https://kns.cnki. net/kcms2/article/abstract?v=3uoqIhG8C46NmWw7YpEsKL-WhGHP2RH_EsfUP6uyp mhHNQUOgiHgr42zBYXW36Tw0_ZpTXg14BdDhknHQRwhcdZLJ8LIekqz&uniplatf orm=NZKPT

Martins, J. M., Yusuf, F., and Swanson, D. A. (2011). Life cycle: consumption, consumer income and savings. Cons. Demogr. Behav. 30, 83–98. doi: 10.1007/978-94-007-1855-5_6

Ministry of Agriculture Rural Affairs of the People's Republic of China (2022). Available online at: http://www.moa.gov.cn/govpublic/zcggs/202206/t20220622_6403117.htm (accessed June 26, 2022).

Natarajan, N., Newsham, A., Rigg, J., and Suhardiman, D. (2022). A sustainable livelihoods framework for the 21st century. World Dev. 155, 105898. doi: 10.1016/j.worlddev.2022.105898

Noerhidajati, S., Purwoko, A. B., Werdaningtyas, H., Kamil, A. I., and Dartanto, T. (2021). Household financial vulnerability in Indonesia: measurement and determinants. Econ. Model. 96, 433–444. doi: 10.1016/j.econmod.2020.03.028

Peng, K., Yang, C., and Chen, Y. (2020). Farmland circulation in rural China: incentives, influencing factors and income effects. Appl. Econ. 52, 5477–5490. doi: 10.1080/00036846.2020.1764484

Popkin, S. L. (1979). The Rational Peasant: The Political Economy of Rural Society in Vietnam. Berkeley: University of California Press, 1–5.

Qi, X. H., Ye, S. L., Xu, Y. C., and Chen, J. (2022). Uneven dynamics and regional disparity of multidimensional poverty in China. Soc. Indic. Res. 159, 169–189. doi: 10.1007/s11205-021-02744-1

Qiu, T. W., He, Q., and Luo, B. L. (2021). Does land renting-out increase farmer' subjective well-being? evidence from rural China. Appl. Econ. 53, 2080–2092. doi: 10.1080/00036846.2020.1855315

Ramli, Z., Anak Nyirop, H. B., and Md Sum, S. (2022). The impact of financial shock, behavior, and knowledge on the financial fragility of single youth. Sustainability 14, 4836. doi: 10.3390/su14084836

Ren, X. C., and Kong, M. (2016). Study on the effect of rural land circulation on labor transfer. Rural Fin. Res. 1, 70–76. doi: 10.16127/j.cnki.issn1003-1812.2016.01.016

Rosenbaum, P. R., and Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika 70, 41–55. doi: 10.1093/biomet/70.1.41

Schultz, T. W. (1964). Transforming Traditional Agriculture. New Haven: Yale University Press, 32–46.

Seldal, M. M. N., and Nyhus, E. K. (2022). Financial vulnerability, financial literacy, and the use of digital payment technologies. J. Consum. Policy 45, 281–306. doi: 10.1007/s10603-022-09512-9

Siciliano, G. (2012). Urbanization strategies, rural development and land use changes in China: a multiple-level integrated assessment. Land Use Policy 29, 165–178. doi: 10.1016/j.landusepol.2011.06.003

Sivaramakrishnan, S., Srivastava, M., and Rastogi, A. (2017). Attitudinal factors, financial literacy, and stock market participation. Int. J. Bank Mark. 35, 818–841. doi: 10.1108/IJBM-01-2016-0012

Song, H. N., Jiang, H., Zhang, S. Y., and Luan, J. D. (2021). Land circulation, scale operation, and agricultural carbon reduction efficiency: evidence from China. Discret. Dynam. Nat. Soc. 2021, 928895. doi: 10.1155/2021/9288895

Sun, F. (2020). Study on the Impact of Specialization of Crop Planting on Rural Household' Livelihood (PhD Thesis) Zhongnan University of Economics and Law, Wuhan, China.

Sun, F., Qian, P., Cao, S. H., Chen, Y. P., and Feng, Z. Y. (2022). The impact of crop specialization on nutritional intake: evidence from farm households in China. PLoS ONE 17, e0272347. doi: 10.1371/journal.pone.0272347

Tang, R. J. (2021). Great causes during the past century, and the grand chapter on agriculture, rural areas, and farmer: the CPC's centennial achievements and historical experience in the field of agriculture, rural areas, and farmer. CPC Hist. Stud. 5, 5–18. Available online at: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGDS202105001&DbName=CJFQ2021

The World Bank (2022). Financial Capability Surveys Around the World: Why Financial Capability Is Important and How Surveys Can Help. Available online at: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/693871468340173654 (accessed February 15, 2022).

Tian, G. J., Duan, J. L., and Yang, L. (2021). Spatio-temporal pattern and driving mechanisms of cropland circulation in China. Land Use Policy 100, 105118. doi: 10.1016/j.landusepol.2020.105118

Tian, J., Cai, D., Han, K., and Zhou, K. (2022). Understanding peasant household's farmland circulation decision-making: a perspective of financial literacy. Land Use Policy 119, 106189. doi: 10.1016/j.landusepol.2022.106189

Wang, X. R., and Shen, H. (2022). In the spirit of radical liberalism: a historical review of land reforms in China from the 1970s to today. Cambridge J. Econ. 46, 511–530. doi: 10.1093/cje/beac007

Xie, H., and Lu, L. (2017). Impact of land fragmentation and non-agricultural labor supply on circulation of agricultural land management rights. Land Use Policy 68, 355–364. doi: 10.1016/j.landusepol.2017.07.053

Xu, D. D., Yong, Z. L., Deng, X., Zhuang, L. M., and Qing, C. (2020). Rural-urban transfer and its effect on farmland circulation in rural China. Land 9, 81. doi: 10.3390/land9030081

Yang, B. Q., Li, Y. L., and Jiang, Y. X. (2020). On farmland circulation, farmer' income and targeted poverty alleviation – based on the analysis of DID model. Francis Acad. Press 2, 109–128. Available online at: https://francis-press.com/papers/1553

Yao, S., Guo, Y., and Huo, X. (2010). An empirical analysis of the effects of china's land conversion program on farmer' income growth and labor transfer. Environ. Manage. 45, 502–512. doi: 10.1007/s00267-009-9376-7

Yi, C. (2014). Mismatch: Land reallocations, recovery land rental and land rental market development in Rural China. China Agric. Econ. Rev. 6, 229–247. doi: 10.1108/CAER-06-2012-0070

Yi, X. J., Mo, N., Zhou, C., and Yang, B. Y. (2017). The impact of consumer credit on household consumption: an empirical estimation based on micro-household data. J. Shandong Univ. 5, 93–100. Available online at: https://kns.cnki.net/kcms2/article/abstract?v=zHhSLvPVAV4BwV0whEpJk8-JvjATU8L4a7y4CYDxmt0gS_jxRSWxxrlalML9zkvIObAOlBYhNCg_PxYHAhA3h6kX0S_5A5Zi4QwM0npoouvTF08HdcbE1FJ3VZ74QndN&uniplatform=NZKPT

Yuan, S. C., and Wang, J. (2022). Involution effect: does China's rural farmland circulation market still have efficiency? Land 11, 704. doi: 10.3390/land11050704

Yusof, S., A; Rokis, R. A., and Jusoh, W. J. W. (2015). Financial fragility of urban households in Malaysia. J. Ekonomi Mal. 49, 15–24. doi: 10.17576/JEM-2015-4901-02

Zeng, Y. R., Hu, Y., and Zeng, W. Z. (2022). The impact of farmland circulation on Farmer' household consumption from the perspective of life cycle. J. Sich. Agric. Univ. 40, 292–300. doi: 10.16036/j.issn.1000-2650.202112035

Zhang, J., Yu, M. D., and Cao, Y. (2020). Financial literacy and household financial fragility. Jilin Univ. J. Soc. Sci. Edi. 60, 140–150. doi: 10.15939/j.jujsse.2020.04.jj3

Zhang, J. F., Zeng, K., and Zhong, L. X. (2018). Research on the effect of farmland circulation on peasants' life in the new period. J. Chuzhou Univ. 20, 19–23. Available online at: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=CZSB201806006&DbName=CJFQ2018

Zhang, T., Huang, X., Zhang, L., and Zhang, L. (2021). The evolution of China's rural labor market in the 21st century: an empirical study based on nationally representative survey data at the household level. Agric. Econ. Rev. 13, 349–366. doi: 10.1108/CAER-06-2020-0134

Zhao, Z., Zheng, X. G., and Li, D. M. (2016). Farmland circulation, non-agricultural employment and tendency of urbanization: evidence from agricultural transfer population in Sichuan. J. Nanjing Agricu. Univ. 16, 90–99. Available online at: https://kns.cnki.net/kcms2/article/abstract?v=3uoqIhG8C46NmWw7YpEsKMypi3qVj28L-63FDqW9F0hnqUVtDu_jKgJcyvgvWtlzWoznxim0doHwFbj5OfHs4SvHDuRekTRS&uniplatform=NZKPT

Zhou, Y., Li, X. H., and Liu, Y. S. (2020). Rural land system reforms in China: history, issues, measures and prospects. Land Use Policy 91, 104330. doi: 10.1016/j.landusepol.2019.104330

Keywords: farmland circulation, financial vulnerability, labor transfer, financial literacy, livelihood strategy

Citation: Sun F, Wang L, Cao S and Zhang Y (2023) How farmland circulation affects household financial vulnerability in China: The chain mediation effect of labor transfer and financial literacy. Front. Sustain. Food Syst. 7:1102189. doi: 10.3389/fsufs.2023.1102189

Received: 18 November 2022; Accepted: 26 January 2023;

Published: 10 February 2023.

Edited by:

Li Xu, University of Saskatchewan, CanadaReviewed by:

Baiding Hu, Lincoln University, New ZealandCopyright © 2023 Sun, Wang, Cao and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shouhui Cao,  Y2Fvc2gxMDZAc2luYS5jb20=; Yuan Zhang,

Y2Fvc2gxMDZAc2luYS5jb20=; Yuan Zhang,  emhhbmd5dWFuQHN0dS56dWVsLmVkdS5jbg==

emhhbmd5dWFuQHN0dS56dWVsLmVkdS5jbg==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.