- Faculty of Agronomy and Veterinary Medicine, Universidade de Brasília, Brasília, Brazil

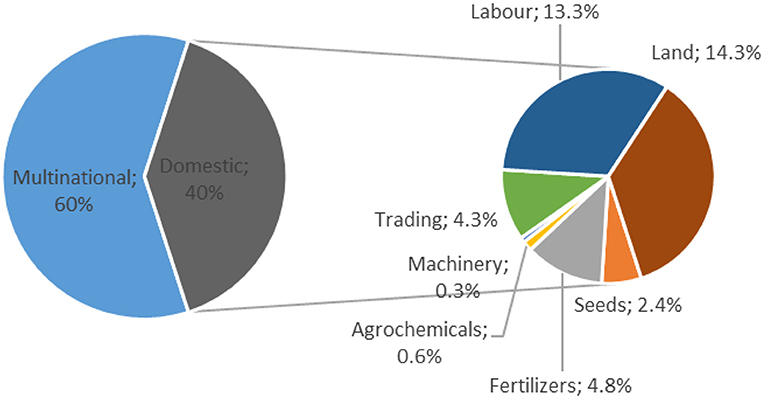

By understanding the economics of agribusiness, an important economic sector for developing countries, this article explores possibilities for a new development paradigm based on areas of opportunities created for local entrepreneurs. Based on a detailed study of the soybean market chain in Brazil, this paper illustrates that the current neoliberal economic approach has resulted in a business which is dependent on foreign multinationals. While foreign companies hold 60% of the soybean market share, Brazilian groups hold only 40% of the entire business, with the domestic market share concentrated in land (13.3%) and labor (14.3%). But the expansion of foreign investments in agribusiness in the country offers opportunities occupied by Brazilian companies, characterizing a situation of associated dependent development. Currently, 12.4% of the share held by Brazilian companies belongs to capital and technology intensive segments such as seed production (2.4%), fertilizers (4.8%), agrochemicals (0.6%), machinery (0.3%), and agro-industry trade (4.3%). The increase in the participation of Brazilian groups in agribusiness requires agricultural policies that can be inspired by a new development paradigm. Opportunities created by foreign investments can be used by domestic groups to increase their share in agro-industrial sectors. Lessons from the Brazilian case can help other developing countries to explore areas of opportunities for domestic investments in dynamic economic sectors such as agribusiness.

Introduction

Both Latin American and African developing countries are struggling with reduced market shares held by local companies in their industrial sectors as they have specialized in resource-based industries, simple processing and/or labor-intensive products with few prospects for upgrade (Di Meglio et al., 2018). There is an on-going effort led by scientists and policy makers to establish new development paradigms to allow these countries to engage with the global world based on more sophisticated economic sectors that can best remunerate capital and labor (Britto et al., 2019; Adamu and Haruna, 2020).

In some of these countries, agribusiness is one of the most dynamic economic sectors leading to debates on whether its expansion offers opportunities for local development, while overcoming the current simplified strategy of expansion into new agricultural frontiers with high social and environmental costs (Medina and Thomé, 2021).1 This is the case for countries such as Brazil, Argentina, and Paraguay, but it is also an issue for several African countries, particularly considering the enthusiasm the President of the African Development Bank has for importing the Brazilian agribusiness model based on foreign investments to Africa (Amanor and Chichava, 2016).

Brazil, a member of BRICS2 and one of the fastest-growing economies in the world, recently lost its economic vigor (Sauer et al., 2018). Brazil's gross domestic product (GDP) per capita increased by almost 150% from 1990 to 2017, and yet it has been steadily decreasing since 2014 (CEPAL, 2019). With industrial decline, agribusiness3 has become one of Brazil's main economic sectors and fundamental for trade balance (Nassif et al., 2017). In 2020, agribusiness as a whole was responsible for 26.7% of the Brazilian GDP, while the farming sector represented 7% of the national GDP (Cepea, 2020). Soybean production has been the leading commodity during this restructuring of Brazilian agriculture in recent decades (Soendergaard, 2018).

Until the 1980s, leading Brazilian companies dominated the industrial sectors linked to agribusiness. All of this suffered a setback in the 1990s when global players took control of the soybean production chain and other commodities, as well as their international trade (Wilkinson, 2010). With economic liberalization, the entry of international capital into the country boosted agribusiness and created a more competitive environment for domestic groups (Saes and Silveira, 2014). But long-run dynamic comparative advantages (Salerno, 2017)—that required the creation of improved technological capabilities—were disregarded (Di Meglio et al., 2018), leading to reduced market share hold by domestic groups in the industrial sectors of the agribusiness made in Brazil.

The current situation of a liberal and globalized business environment in which the country operates, results in the need for a new development paradigm based on opportunities created by dynamic economic sectors such as agribusiness. A crucial challenge is the consolidation of companies with domestic capital throughout the production chain of agribusiness done in Brazil, overcoming the increasing hegemony of multinationals in some agribusiness supply chains (Medina and dos Santos, 2017). Studies have shown that positive economic impacts caused by investments in the Brazilian national agribusiness sectors could have greater effects than those in any other Brazilian sector (Costa et al., 2014).

The changes introduced by the growing integration of the country into the global economy, growing foreign direct investments and the change in the form of government economic intervention required great effort to adapt the production sector and the Brazilian State (Santos and Glass, 2018; Green et al., 2019). Despite the importance of agribusiness done in the country, there are no integrated and sector-based projects to take advantage of the sector's expansion to strengthen either entrepreneurship or national agribusinesses. Knowledge of the production chain is vital in order to support the development of medium- and long-term agro-industrial policies (Szirmai, 2012; Aboah et al., 2019).

The expansion of domestic participation in sophisticated agribusiness sectors can be done by promoting win-win situations with foreign and domestic investments supporting the streamlining of supply chains, mutually benefiting domestic and international groups and increasing the productivity of the entire sector, and are thereby beneficial to the country in the short and long term (Cruz et al., in press). Brazilian entrepreneurs and farmers would benefit from a re-balance of market share between local economic groups and foreign multinational corporations. Wider economic benefits of a great domestic market share in agribusiness include: 1. Investments in segments that better remunerate domestic capital and labor, 2. Domestic technological development, 3. Profits and dividends invested in the country, and 4. Reduced production costs for local inputs (Medina et al., 2020).

The advances of agri-food production in Brazil offer areas of opportunities for Brazilian groups ranging from strengthening domestic seed-producing companies to the consolidation of regional trading companies (Corcioli et al., 2022). It is by investing in the agro-industrial sectors that will better remunerate capital and labor, and going beyond the current focus on the primary production of commodities, that developing countries will benefit from agri-food expansion for their development. Domestic economic groups can explore trade-offs between reducing farming expansion into new agricultural frontiers that have negative environmental externalities and increasing their market share throughout agroindustrial segments upstream and downstream of farms (Gardner et al., 2019; Medina and Thomé, 2021).

By understanding the economics of agribusiness, this paper aims to explore possibilities for a new development paradigm that takes advantage of the opportunities created by the expansion of dynamic economic sectors in the economies of developing countries like Brazil. This paradigm seeks to expand national participation in sophisticated economic sectors that better remunerate labor and capital. Lessons on the Brazilian case may help other developing countries evaluate the possibilities and limitations of a new development paradigm. More specifically, this paper intends to:

1. Evaluate the market share held by Brazilian companies in the soybean supply chain established in the country;

2. Identify the opportunities created by the expansion of agribusiness in order to increase the market share of domestic companies;

3. Analyze the importance of agricultural and industrial policies in supporting the strengthening of domestic entrepreneurs in the agro-industrial segments.

Theoretical Framework

Development has always been conceived in terms of national or collective projects of structural and social transformation in the contexts of lagging and subordination within globalizing capitalism (Fischer, 2019). Even with the traditional predominance of Anglo-Saxon academia in economic studies (Madrueño and Tezanos, 2018), scientists from developing countries have played a key role in developing, testing and adjusting developmental theories. These are the cases for developmental economics (Furtado, 1961), for the theory of associated dependent development (Cardoso and Faletto, 1979), and for new paradigms such as new developmentalism (Bresser-Pereira, 2018).

These theories build on classical and neoclassical economics as they differ from the role played by the state in promoting development. Classical economics conceive economic growth based on free markets (the invisible hand theory), competitive advantages, and no governmental intervention (Smith, 1776). A diverging voice among classical economists was Friedrich List, whom believed protection can be important until countries could compete on equal terms (Peet and Hartwik, 1999). Classical economics have influenced neoliberal programs and the theory of associated dependent development (Cardoso and Faletto, 1979).

For neoclassical economists, states can influence the efficient allocation of resources through adjusting interest rates, carrying out investments, and promoting policies to maintain full employment (Keynes, 1936). Keynesians recognize the importance of government-led development approaches, which include both agricultural and industrial policies as discussed in this paper. Neoclassical theory has influenced both development economics and new developmentalism (Bresser-Pereira, 2018).

Development economics focused on the development of the economic periphery based on strong protections for domestic industry that would enable the industrialization model based on import substitution. As Raul Prebisch outlined, peripheries are conditioned by the propagation of technical progress that establishes the outward-directed, externally propelled development of peripheries (Peet and Hartwik, 1999). Development economics emerged in the United Kingdom in the 1940s and, in Latin America, it gained the name of “Latin American structuralism” because it defined economic development as “structural change”. It was the dominant theory of economic development in Brazil from the 1940s to 1960s, influencing development until the 1980s.

Classical developmentalism advocated for strong protection for national industry as a means to promote industrialization based on import substitution. State intervention was used as a means to favor local products through import tariffs and also to mobilize domestic investments based on both public and private resources (Peet and Hartwik, 1999). The crisis of development economics began in the late 1960s with the emergence of the dependency theory (Frank, 1971; Hirschman, 1981). As an alternative, associated dependent development theory was developed from the idea that developing nations, by associating with already developed nations, could take advantage of this relationship and its opportunities created in order to further develop. Since Brazil needed foreign financing for technology and investment at this time, there was a clear transition to a dependent-associated model due to the possibility of further development in the economic periphery (Cardoso and Faletto, 1979). This theory assumes a conciliation of both internal and external interests and a link between both development and external dependence, and thus became very influential to the Brazilian economy from 1980 onwards. A greater opening to imported goods is also a landmark of the military dictatorship that ruled Brazil from 1964 to 1985.

Associated dependent development assumes that opening up to international markets is a way of attracting foreign capital and forcing increased competition within national industry which was previously protected. This concept is well explored by the vast literature on foreign direct investments (Stosberg, 2018) and its potential positive influence on the performance of subsidiaries of multinational firms installed in developing countries (Thomé et al., 2017) as well as on productivity increases among domestic firms of emerging markets (Zhang et al., 2010).4

In Brazil, specifically since the 1990s, the neoliberal economic perspective has been promoted by the federal government through relaxed economic regulation and privatization policies (Mueller and Mueller, 2016). Neoliberals propose a refrain from government intervention and fiscal discipline, as promoted by the Chicago School of thought. Excessive government spending and waves of inflation led to the understanding that imperfect market is better than imperfect planning as a means to promote economic health. As a consequence, liberalism and fiscal discipline became prevalent economic approaches in countries such as Brazil, Indonesia and Malaysia (Peet and Hartwik, 1999).

In the early 2000s, high unemployment rates and stagnated economic growth in Brazil led to new developmentalism ideals (Bresser-Pereira et al., 2020). New developmentalism comes from the inspiration of a strong Keynesian State (Bresser-Pereira, 2018). New-developmental economists defend a model based on the exportation of manufactured goods supported by an exchange rate of competitive industrial equilibrium; in other words, they defend the competitive international integration of developing countries, instead of subordinate integration (Bresser-Pereira, 2018). It is argued that structural change toward a more sophisticated industrial base is a sine qua non condition for an emerging economy to converge from developed ones (Nassif et al., 2017). Therefore, new developmentalism includes creating opportunities for national groups to increase their share in industrial sectors based on long-term policies such as industrial and technological policies (Nassif et al., 2017).

Policy actions are needed to address the development work in moving countries from vicious circles to virtuous circles of development (CEPAL, 2019). On the one hand, the role of government should be to help entrepreneurs find innovative activities with the highest potential for success and return, as well as solve the problems of credit rationing. On the other hand, government's focus should be on activities with high potential to increase productivity and generate positive economic externalities (Nassif et al., 2017). Learning what one nation is good at producing is an important determinant of structural change and government policies have a role in helping the private sector find new and profitable production opportunities (Hausmann and Rodrik, 2002).

In recent history, developing economies have narrowed the gap with the “richer” more-developed ones to the extent that they have managed to achieve similar levels of technological knowledge and skilled workforces, without the selling of assets to foreign capital (Pikety, 2014). Therefore, development is directly related to the construction of a legitimate and effective government with long-term policies favoring national entrepreneurs.

Methodology

The research on the investment of Brazilian capital in the domestically produced soybean production chain was based on the identification of the most popular inputs used for each production stage, their suppliers, and the country of origin of the companies involved. This was done through interviews with specialists who work in the primary stages of the supply chain, a review of area-specific literature, and the consultation of institutional material from companies.

Based on the information gathered on the market size, the participation (market share) of companies with domestic capital was estimated. For each production stage, the amount of inputs sold in Brazil was identified (example: number of soybean combine harvesters sold in 2019). Then, the production of the main companies operating in each stage was estimated based on official sources (example: John Deere sold 2,269 combines in 2019 in Brazil) (Anfavea, 2020). In all cases, the sources were cited throughout the work.

The shareholding structure of the companies was also identified. As companies with shares on stock markets keep their shareholding structure available on their websites, it was possible to identify whether the control of companies is done by Brazilian or multinational groups. Brazilian family companies which are not listed on stock markets usually indicate on their websites that they are 100% Brazilian groups as a marketing strategy. Since the data sources come from the own industries' unions and associations, they might embed some biases and some limited input data capacity. However, since there are not other sources for this information, the data sources used in this study are the best possible today.

Opportunities for domestic companies were identified based on the literature review and consultations with experts from our open interviews. Interviews were conducted with the executive director of the association of soy processing agro-industries, the purchasing director of a fertilizer company with inter-regional operations, and a researcher specializing in fertilizers and pesticides.

The soy sector was chosen because soybean is the main crop in Brazil, both in scale and in value. Soybean is also the main crop leading to agricultural frontier expansion in Brazil (Rajão et al., 2020). In the 1990s, soybean advanced from the south toward the central area of Brazil, and in the 2000s, it expanded farther to the north. Soybean monoculture is now expanding toward new agricultural frontiers such as parts of the Amazon and the Matopiba, which are in the north and northeast of Brazil, respectively.

Results

Market Share Held by Brazilian Companies

Seeds

In 2019, 91.8% of the soybean cultivated in Brazil was transgenic, a segment that has grown significantly since 2005 with the approval of the national Biosafety Law for the regulation of transgenic products. The transgenic market is currently controlled by five multinational companies, the so-called Genegiants (Monsanto/Bayer, Syngenta/ChemChina, Novartis, BASF, and Dupont), which control 66% of the world transgenic soybean seeds market and 84% of the trait patents. In Brazil, Monsanto has recently increased its participation in the seed market, controlling 90% of today's market share (Santos and Glass, 2018).

Although Brazil has companies that dominate soy genetics, transgenics are controlled by multinationals that receive royalties from Brazilian companies licensed to use their technology in seed production. National seed producers who have created their own germplasm improvement programs and pay royalties for the use of transgenics include the Tropical Melhoramento and Genética (TMG), created in 2001.

Studies show that multinationals which own the characteristics transferred to local germplasm make about 67% of the profit from the final price of soybeans, while the other 33% of the profit is shared between germplasm developers and seed multipliers (Marin and Stubrin, 2015). In practical terms, for each hectare of soybeans planted with transgenic seeds licensed by Monsanto in Brazil, the company receives about USD 37 in royalty.

From the 33% share held by germoplasm developers and seed multipliers, it is estimated that half of it will stay with the national seed companies and the other half with the multinationals that produce and sell their own seeds (Medina et al., 2016). The estimate of 50% of multinational capital in seed production was based on the projection of GDM and Monsoy (a company of the Monsanto group), which occupies 67% of the area planted in Brazil in 2019. Thus, in the segment of the chain related to the production of seeds, national capital would be equivalent to only 16.5% (50 of 33%) (Table 1).

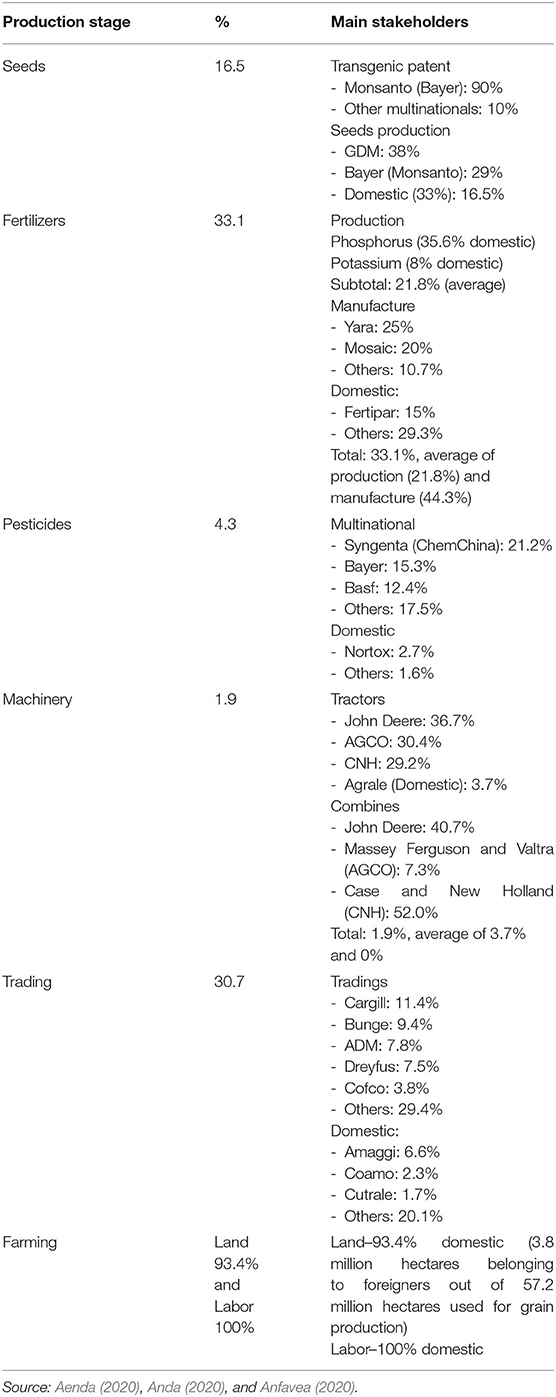

Table 1. Market share hold by domestic groups in the main production stages of the soybeans production chain in Brazil for the agricultural year of 2018/2019.

Fertilizers

Two types of companies operate in the fertilizer segment: those that produce raw materials and intermediate products (or simple fertilizers) and those that manufacture formulated fertilizers. Most of the raw material for the fertilizers used in Brazil is imported. In the case of soybeans, phosphorus (64.4% of total consumption in the country is imported) and potassium (92% of total consumption in the country is imported) are the most commonly used macronutrients, since soybeans do not require nitrogen fertilization and there is little use of micronutrient fertilization (Anda, 2020). In Brazil, the Vale Company, founded in 1942 and controlled by Brazilian groups, is the largest producer of phosphorus and the only producer of potassium. Thus, it is estimated that 21.8% of the investment in the production of raw materials of fertilizers consumed in Brazil is national (35.6% of the phosphorus and 8% of the potassium) (Anda, 2020).

In relation to fertilizer manufacturers, the market in Brazil has a strong share of the multinational Yara, with national groups holding 44.3% of the market (Table 1). The Fertipar Group (created in 1980) and Heringer (created in 1968, today with 56% of national capital) are the Brazilian companies with the largest participation in the manufacturing of fertilizers in Brazil. The rest of the market is serviced by domestic companies of regional nature and by multinational groups. Considering a 21.8% national share in the production of raw materials and a 44.3% share in the production of fertilizer, it is estimated that Brazilian participation in the fertilizer market is an average of 33.1%.

Agrochemicals

In Brazil, 94% of total agrochemical sales refers to three classes of products, defined by their purpose: insecticides (33%), herbicides (32%), and fungicides (29%). Soybean farming is the main consumer of agrochemicals in Brazil, accounting for 50% of sales according to the National Union of the Plant Defense Products Industry (Sindiveg, 2020). There are two business segments: products with patents that require innovation, dominated by multinational groups today, and generic products, authorized after patent exclusivity periods end, in which the industry with domestic capital still has a stake.

In the segment of products with patents, there is ample competition, but few companies have a significant market share. In Brazil, the foreign multinationals control 95.7% of sales, specifically Syngenta (21.2%), Bayer (15.3%), and Basf (12.4%) and other multinational groups with smaller slices make up the remaining 46.8%. Part of this foreign control in the agrochemical sector can be explained by a synergy between the agro-chemical and seed sectors. For example, companies selling glyphosate are also selling glyphosate resistant seeds in some cases. Companies with domestic capital only makes up 4.3% of the total of commercial agrochemicals traded in the country (Sindiveg, 2020). This percentage is made up of domestic companies such as Nortox, the largest Brazilian agrochemical company founded in 1954, and a group of small- and micro-businesses.

Machinery

This sector is a worldwide oligopoly as a result of mergers and acquisitions headed by major international groups. Three companies are highlighted as the most important in the world: John Deere, CNH (Case and New Holland), and Agco (Massey Ferguson and Valtra), respectively, with 19, 11, and 7% of the international market share. In Brazil, the three together control 96.3% of tractor sales and 100% of combine harvester sales (Anfavea, 2020). The national capital share was estimated at 1.9% when including the Brazilian company Agrale (founded in 1962), which produces tractors rarely used for soybean due to their relatively small size (Anfavea, 2020).

There is a greater market share of companies with national capital in the case of agricultural implements, such as plows, scarifiers, limestone spreaders and cultivators, even though precise data on market share is not available. Some cases can be highlighted as successes with growth opportunities, as is the case of Stara, a Brazilian company founded in 1960, as well as Jumil (created in 1936), Marchezan (created in 1946), and Jacto (created in 1948). A characteristic of this market is the low barrier of entry, since many companies have open access to the technology necessary for the production of implements, making the market very competitive.

Trade

The large multinational export companies such as ADM, Bunge, Cargill and Dreyfus (known as the ABCD group) have oligopolised the governance of the soybean chain. After consolidating their control over a significant portion of the market, these companies began to invest in the expansion of their existing units and in the construction of projects in the Midwestern region of Brazil. Simultaneously, the migration of the meat agro-industries (chicken and pork) to the Midwest stimulated the increase in soy processing for the manufacturing of animal feed.

ABCD multinationals control 63.9% of Brazilian soybean sales and half of the country's crushing capacity. It is estimated that domestic capital controls about 30.7% of the commercial soybean market in the country (Table 1). National groups include Coamo (a cooperative founded in 1970), Amaggi (a company founded in 1977), Bianchini (a company founded in 1960), Granol (a company founded in 1965), Caramuru (a company founded in 1964), and Comigo (a cooperative founded in 1975). Recently, China celebrated the purchase of Noble Agri (trade) by China National Cereals, Oils and Foodstuffs Corporation (COFCO) as a way to ensure their presence in 21 countries, including Brazil and Argentina, its two largest soy suppliers.

Land and Labor

Brazil has been experiencing changes in the profile of the soybean grower. The private producer is now competing with large national groups and multinational companies such as Los Grobo, which leases land and manages crops, and Agrinvest, which purchases land. In Brazil, there are 33,200 registered properties belonging to foreigners, occupying 3.8 million hectares (Hage et al., 2012). The area used for grains in Brazil is around 57.2 million hectares and it has been estimated that 93.4% of this area belongs to national capital. The labor involved in the work has been estimated to be 100% national.

Production Chain

The national capital share has been estimated according to each segment of the soybean production chain: seeds 16.5%; fertilizers 33.1%, agrochemicals 4.3%, machinery 1.9%, trade 30.7%, land 93.4%, and labor 100%. National capital has 40% of all soy agribusiness done in Brazil when considering all segments, in contrast to the 60% belonging to multinational groups.

The 40% of national capital is concentrated mainly in land (13.3%) and labor (14.3%), with lesser participation in the agro-industrial segments of the production chain that are upstream and downstream from the farms (12.4%). The 12.4% of the share held by Brazilian companies in capital and technology intensive segments are distributed as follows: seed production (2.4%), fertilizers (4.8%), agrochemicals (0.6%), machinery (0.3%), and agro-industry trade (4.3%) (Figure 1).

Figure 1. Share of Brazilian capital in the production chain of soybeans produced in Brazil (in %). Source: This study.

Areas of Opportunities for Increasing the Market Share of Domestic Groups

Seeds

The growth of the seed market and the need to adapt to the country's diverse soil and climatic conditions creates opportunities for the consolidation of domestic seed-producing companies in different sectors such as:

• Seed production—Seed producers can consolidate themselves in the market through programs to improve their own germplasm by paying royalties for the use of transgenics controlled by multinationals. There are also opportunities in marketing non-transgenic seeds despite the dominance of transgenic seeds.

• Transgenic technology—The Brazilian company Embrapa, in partnership with Basf, managed to produce the first genetically modified soy fully developed in Brazil. Despite the gene patent belonging to BASF, the Brazilian company developed the method that allowed its introduction into the soybean genome. However, the country will still have to wait a few more years for a more precise evaluation on the viability of Brazilian companies being able to compete in soy transgenics.

Entrepreneurs from countries such as Brazil and Argentina have taken advantage of the opportunities to establish themselves as seed producers, leveraging their long history of crossbreeding varieties (Marin and Stubrin, 2015). TMG, founded from a cooperative of rural producers in the Brazilian state of Mato Grosso, gained a foothold in working on genetic improvement and even paying royalties for the production of transgenics. Today its soybean cultivars are the most planted in the state of Mato Grosso which is the Brazilian state with the most production.

Fertilizers

Opportunities in the area of fertilizers include the use of biological agents, mineral fertilization as an alternative, and strengthening the national fertilizer chain:

• Biological agents—The development of cultivars with greater efficiency in biological nitrogen fixation and further research involving other types of bacteria that promote biological fixation is essential;

• Mineral fertilization—It is possible to partially replace the conventional soluble sources of NPK granulated formulas with agrominerals applied in dust form. Rock fertilization is the addition of certain types of rock to the soil, which facilitates the recomposition of macro and micronutrients;

• National fertilizer chain—In the production of raw materials, necessary billion-dollar investments have been partially suspended by Vale in the short-term, although they could potentially return in the medium-term. In the manufacturing of fertilizers, national groups have taken advantage of the space left by Bunge's departure from the sector in order to expand their own market share.

Agrochemicals

Considering that the Brazilian chemical industry is relatively underdeveloped, the development of more technologically advanced products will probably be restricted to the current world leading companies that already operate in Brazil. Alternative opportunities include:

• Integrated Pest Management (IPM)—IPM is the use of integrated pest management techniques that consider interactions between plants, pests, soils and biological control with predators or sterile insects. Soy IPM is the main tool for rationing the use of insecticides with reduced production costs and without risks to productivity;

• Biological control—There are opportunities for companies to create parasitoid laboratories for the main pests of soybean cultivation. The parasitoids biologically control the caterpillars that attack soybean. In recent years, different biological control companies have been founded in Brazil.

Machinery

Considering the oligopoly and the technological advancement of multinationals in the manufacturing of machines with greater embedded technology, opportunities for national groups exist in segments of simpler technology. Examples include:

• Production of implements—National groups can increase their participation in the implements market. For example, the Brazilian company Baldan produces animal traction plows since 1928 and today is recognized for the diversification of its products;

• Niche market services—Production of implements for crops that have particular needs, such as those for steep or lowland areas.

Trade

Given the importance of agro-industry in the governance of the production chain, this is a strategic sector for greater participation of national capital. Opportunities identified were:

• The consolidation of domestic groups that have managed to establish themselves in the market—Although they hold the smallest share of the market, national groups have been able to expand their operations, with most companies recently opening new plants;

• Differentiation—The growing demands of the market offer opportunities for smaller companies to differentiate themselves from the larger trading companies.

Brazilian Agro-Industrial Policy

In Brazil, major agricultural policy efforts have focused on offering subsidized credit to rural producers. From the 2000s on, there was a growing increase in the supply of rural credit, with an emphasis on the amount allocated as funding credit (working credit) that serves for rural producers to pay using the following year's crop to purchase materials such as seeds and fertilizers for this year.

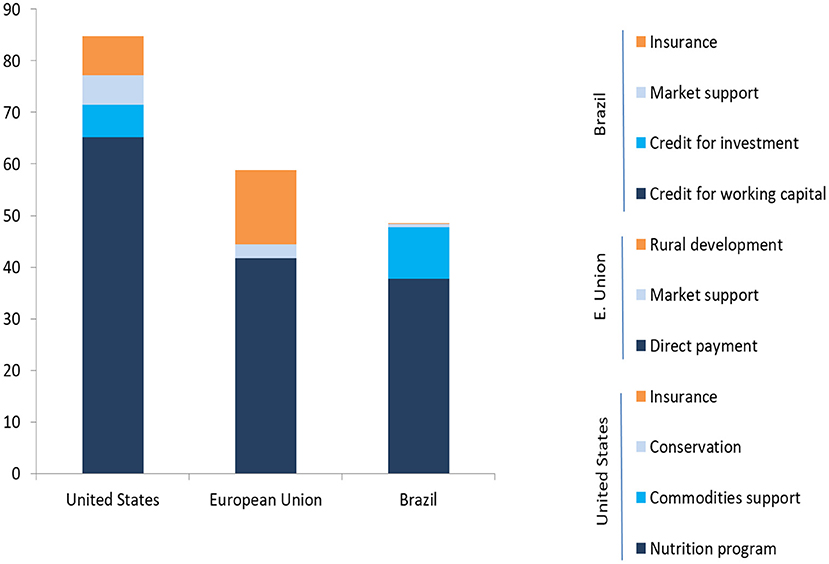

Brazilian agricultural policy is currently regulated by the Ministry of Agriculture, Livestock and Supply (MAPA). Of the USD 48.5 billion in the 2019/20 Agricultural and Livestock Plan (PAP) budget, which is aimed at medium and large rural producers,5 USD 47.7 billion was earmarked for credit, of which USD 37.7 billion for funding and USD 10 billion for investment, while marketing support received USD 0.65 billion and the rural insurance subsidy received USD 0.15 billion (MAPA, 2019).

It is worth noting that ~10% of the USD 47.7 billion earmarked for rural credit is public resources intended to subsidize interest rates and the rest of the budget is private capital from banks that is lent to producers (OECD, 2020). While Brazil has maintained its tradition of devoting itself to subsidized credit, the United States and the European Union have begun to experiment with a new generation of agricultural policies supporting agribusiness (Figure 2).

Figure 2. Budget for principal agricultural policy programmes in 2020 (in USD). Source: MAPA (2019) and OECD (2020).

Discussion

The study of the soy production chain in Brazil reveals that the current neoliberal economic approach has resulted in a business controlled by multinationals. However, the expansion of agribusiness often promoted by foreign direct investments generates areas of opportunities that have enabled the participation of domestic groups, characterizing a situation of associated dependent development. Increasing the market share of the Brazilian groups in agribusiness domestically requires an agro-industrial policy in favor of domestic groups that may be inspired by the new development paradigm.

Participation of Domestic Capital in a Neoliberal Environment

Based on a detailed study of the soybean market chain in Brazil, this study reveals that the current neoliberal economic approach has resulted in a business dependent on foreign multinational companies. While international companies hold 60% of the market share, Brazilian companies hold only 40%, with the national share concentrated in land (13.3%) and labor (14.3%). Most of the national capital is concentrated in basic resources such as land and labor, while technology and business governance are mainly controlled by multinational groups.

The key links in the current soy production chain include the multinationals of: Monsanto in seed production; Yara in fertilizer manufacturing, Syngenta and Bayer in pesticide production; John Deere, CNH, and AGCO in machine production; and the ABCD group in trade. These are characteristically technology- and capital-intensive sectors whose investments are largely based on securing the intellectual property of their patents. Multinational control characterizes a situation of dependence by Brazilian groups that have little autonomy over the entire production chain.

Given this data, it is necessary to question whether there is actual Brazilian agribusiness or whether it is more accurate to talk about agribusiness done in Brazil by foreign groups that control the technology and management of the production chains. Other studies reveal that other key agribusiness chains in Brazil, such as sugarcane and chicken, also have large-scale foreign technological dependence (Bassi et al., 2013; Garcia et al., 2015; Medina et al., 2020).

In fact, with economic liberalization, the entry of international capital into the country has boosted agribusiness (Saes and Silveira, 2014). But it has also resulted in a growing loss of market share for the domestic groups due to the growing hegemony of multinationals (Medina and Thomé, 2021). This situation of dependence leads one to wonder if there are opportunities generated by the recent expansion of agribusiness in the country that could be leveraged by the Brazilian groups.

Areas of Opportunities Created by an Associated Dependent Development Paradigm

Despite the multinationals' oligopoly over all the stages of the soybean chain, the advances of agribusiness in Brazil offers more spaces that can be occupied by Brazilian companies, characterized by a situation of associated dependent development. Today, 12.4% of the soybean market share is held by Brazilian companies belonging to capital and technology intensive sectors such as seed production (2.4%), fertilizers (4.8%), agrochemicals (0.6%), machinery (0.3%), and agro-industry trade (4.3%) (Figure 1). Market liberalization leading to recent expansion of agribusiness throughout the country has created new business opportunities throughout the production chains. But it has also led to greater competition for Brazilian companies that continues in the market.

Even surrounding these fundamental links of the production chain controlled by multinational groups, there are opportunities for the consolidation of domestic groups. The opportunities identified in the soy production chain include: (i) the strengthening of national seed-producing companies; (ii) the adoption of alternative fertilization practices with biological agents and mineral fertilization; (iii) integrated pest management as a way to reduce production costs; (iv) participation in the market for agricultural implements; and (v) the consolidation of national trade companies acting in regional chains focused on the domestic market.

These are less capital- and technology-intensive productive segments, since more technological sectors (transgenic seeds, tractor and harvester production, and governance of international chains) require a volume of investment above the capacity of most domestic companies. Nevertheless, there are examples in Brazil of a more aggressive commercial strategies such as the creation in 2009 of the Brazilian giant BRF (Bassi et al., 2013).

Interviews on areas of opportunities for increasing the market share of domestic groups provided relevant policy recommendations that are in line with the views of most progressive actors working on the soy supply chain in Brazil (Aboah et al., 2019). For example, there is opportunity to expand integrated pest management (IPM) techniques and biological control in Brazil and elsewhere. Biological control and IPM are leverage points for the development of Brazilian companies, therefore, public policies should be designed and implemented to foster this infant industry.

The associated dependent development assumes a link between local development and external dependence (Cardoso and Faletto, 1979). Therefore, it is essential to discuss to what extent opportunities generated in dynamic globalized chains allow for developing countries to evolve from their current situation of associated dependence to a new development paradigm, with a greater participation from domestic groups. The expansion of domestic participation could be promoted by strategic sector-based agro-industrial policies. Studies show that the positive economic impacts caused by investments in agribusiness sectors are greater than those of other industrial sectors (Costa et al., 2014).

Agro-Industrial Policy Inspired by New Developmentalism

The future of Brazilian agribusiness involves the creation of a vertical integration strategy of domestic capital throughout the agro-industrial sectors established upstream and downstream of agricultural production. The most profitable agribusiness done in Brazil are from the industrial and technological sectors. The new development paradigm can inspire agricultural and industrial policies that expand the participation of Brazilian groups in the current market.

To this end, agricultural policy needs to evolve from the current mainly exclusive focus on subsidized credit (mainly funding or “working” credit) for rural producers to more comprehensive investments that can bring longer-term returns to the agribusiness sector as a whole. Industrial policy needs to focus on learning what domestic companies are good at producing as an important determinant of structural change (Hausmann and Rodrik, 2002). Equally important is the construction of agro-industrial policy to support the agricultural and industrial segments of the production chains as a whole.

The agribusiness sector's future depends on increasing the share of local capital in business done domestically, while avoiding the current simplified strategy of expansion into new agricultural frontiers with high social and environmental costs (Medina and dos Santos, 2017). The current strategy to regain competitiveness in Brazilian industry has been restricted to reducing the cost of labor through labor reforms. However, sustained growth in competition of the industry and of agriculture and ranching needs to be built from the strategic management of enterprises, from innovation, from the coordination of production chains, and from searching for new foreign markets (Batalha, 2009).

Recent experiences with new developmentalism in Brazil illustrates the potential of a state with industrial policies and without the need to break from neoliberal macroeconomic policies (Morais and Saad-filho, 2011). The government can help entrepreneurs find new innovative activities and also focus on activities with high potential of generating positive economic externalities (Nassif et al., 2017). In recent history, developing economies have narrowed the gap between themselves and the richest economies by achieving similar levels of technological knowledge (Pikety, 2014).

Such an approach considers that foreign investments can play a role in promoting dynamic economic sectors in developing countries, such is the case for agribusiness, as revealed by the associated dependent development paradigm (Cardoso and Faletto, 1979). But it adds on that by suggesting that governments can promote local entrepreneurs to take part in the segments of these dynamic sectors producing goods that better remunerate capital and labor, as suggested by the new development paradigm (Bresser-Pereira et al., 2020). By engaging in global markets based on a strategic approach to development, developing countries can explore opportunities for domestic groups to increase their share in agro-industrial sectors (Szirmai, 2012). This investment in agro-industrial sectors involves both the expansion of domestic production capacity for currently imported agricultural inputs and the possibility of processing and aggregating raw material produced in the country, as is the case of meat production derived from soy meal.

Opportunities in soy agribusiness refer precisely to the most sophisticated manufacturing activities associated with the machinery, chemistry industries, and R&D, biotechnology, genetics, etc., activities that are dominated, in fact, by multinationals. That is, technological improvements that boost productivity in the primary and even tertiary sectors end up being those developed mainly in the secondary sector, in which the leading companies are mostly based in developed countries. Brazilian agro-industrial policy must address these issues.

This article touches upon a relevant topic both for the governance of commodity supply chains, including governing social-environmental aspects, and for the dialogue with current discourses and narratives permeating the debates about how to regulate agricultural commodities land use, expansion and international trade (Rajão et al., 2020). This study demonstrates that the only parts of the soy supply chain totally controlled by Brazilian companies are land and labor, all the others are already dominated by multinational companies and capital.

In the context of market regulation proposals for the imports of forest-risk commodities (Gardner et al., 2019) this study reveal that the soy supply chain already has a new-colonialist or, at least, unequal trade and supply chain structural setting. This adds to on-going debate on the fields of land use, international trade and sustainability and sheds light on anti-colonialism and anti-environmentalist discourses and narratives. It is important to discuss to what extent large-scale soy farmers and the current state of the soy supply chain can themselves be seen as part of a neo-colonialism process. For example, large-sale soybean farmers supported the approval of a growing number of agrochemicals in Brazil to the main benefit of foreign agrochemical multinationals and to de detriment of local population and local environment.

Conclusion

This study reveals that the current neoliberal economic approach adopted in Brazil has resulted in an agribusiness dependent on multinationals in the case of the soybean supply chain. Despite this, the expansion of foreign direct investments in agribusiness creates opportunity that enable the participation of national groups. However, the consolidation and expansion of Brazilian agribusiness groups domestically is reliant on strategic agricultural and industrial policies. The opportunities created by dynamic economic sectors can be used by domestic companies to increase their share in agro-industrial sectors.

In this way, Brazil can evolve from the current situation of associated dependent development to a new development paradigm. This paradigm seeks to expand domestic participation in sophisticated economic sectors that better remunerate labor and capital. Otherwise, the country runs the risk of remaining in a situation of external dependence with low participation in agribusiness segments that innovate the most and pay the best for the factors of production. This presupposes a policy of support for domestic groups, particularly in the agro-industrial sector upstream and downstream of farms, which can be inspired by new developmentalism.

These lessons can also inspire other developing nations. Nevertheless, it is worth noting that a significant portion of South American and African developing countries do not have domestic entrepreneurs with conditions equivalent to the Brazilian groups that occupy market gaps. Thus, if in the Brazilian case the participation of national groups is already restricted to a small market share and concentrated in segments less intensive in capital and technology, it is likely that countries with smaller economies will be even more dependent on foreign multinationals.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

GM: formulation of overarching research goals and aims, management and coordination responsibility for the research activity planning and execution, and quantitative data of domestic market share.

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^Agricultural production growth in Brazil is due to two main developments, which are increase in productivity (Gasques et al., 2018) and expansion into new agricultural frontiers (Rada, 2013).

2. ^BRICS is the acronym for an association of five major emerging national economies: Brazil, Russia, India, China, and South Africa.

3. ^Agribusiness is the sum of all operations involved in manufacture and distribution of farm supplies, production operations on the farm, and the storage, processing, and distribution of farm commodities (Davis and Goldberg, 1957).

4. ^Theoretical arguments state that Foreign Direct Investments (FDI) contributes to economic growth both directly – through the accumulation of capital and technological know-how – and indirectly – through technology and knowledge spillovers to domestic firms in the host economy (Colen et al., 2008).

5. ^Brazil has a dedicated credit line for family farmers named Pronaf with an annual budget of US$ 7.5 billons (Medina et al., 2015).

References

Aboah, J., Wilson, M. M. J, Rich, K. M., and Lyne, M. C. (2019). Operationalising resilience in tropical agricultural value chains. Supp. Chain Manag. Int. J. 24, 271–300. doi: 10.1108/SCM-05-2018-0204

Adamu, A., and Haruna, J. (2020). Ownership structures and firm performance in Nigeria: a canonical correlation analysis. J. Res. Emerg. Mark. 2, 21–32. doi: 10.30585/jrems.v2i4.537

Aenda (2020). Associados da Associação Brasileira dos Defensivos Genéricos, Associação Brasileira dos Defensivos Genéricos (AENDA). Available online at: https://www.aenda.org.br/ (accessed December 20, 2020).

Amanor, K. S., and Chichava, S. (2016). South-South Cooperation, Agribusiness, and African agricultural development: Brazil and China in Ghana and Mozambique. World Dev. 81, 13–23. doi: 10.1016/j.worlddev.2015.11.021

Anda (2020). Anuário estatístico, eds A. N. para D. de Adubos. São Paulo: Associação Nacional para Difusão de Adubos. Available online at: http://anda.org.br/arquivos/ (accessed January 2, 2022).

Anfavea (2020). Anuario da indústria automobilística brasileira, 1st Edn São Paulo: Associação Nacional dos Fabricantes de Veículos Automotores.

Bassi, N. S. S., da Silva, C. L., and Santoyo, A. (2013). Inovação, pesquisa e desenvolvimento na agroindústria avícola brasileira. Estudos Soci. Agric. 21, 392–417.

Bresser-Pereira, L. C (2018). The Rise of a New Developmental Macroeconomics for Middle- Income Countries: From Classical to New Developmentalism. Berlin: Dialogue of Civilizations Research Institute gGmbH.

Bresser-Pereira, L. C., Araújo, E. C., and Costa Peres, S. (2020). An alternative to the middle-income trap. Struct. Change Econ. Dyn. 52, 294–312. doi: 10.1016/j.strueco.2019.11.007

Britto, G., Romero, J. P., and Freitas, E. (2019). La gran brecha: complejidad económica y trayectorias de desarrollo del Brasil y la República de Corea. Revista de la CEPAL. 127, 217–241. doi: 10.18356/dd7be737-es

Cardoso, F. H., and Faletto, E. (1979). Dependency and Development in Latin America, 1st Edn. Berkeley: University of California Press.: doi: 10.1525/9780520342118

CEPAL (2019). Latin American Economic Outlook 2019: Development in Transition. Brasília: Economic Commission for Latin America and the Caribbean (ECLAC). Available online at: https://repositorio.cepal.org/handle/11362/44515 (accessed January 2, 2022).

Cepea (2020). PIB do agronegócio - Dados de 1994 a 2019, Cepea. Available online at: https://www.cepea.esalq.usp.br/br/pib-do-agronegocio-brasileiro.aspx (accessed December 20, 2020).

Colen, L., Maertens, M., and Swinnen, J. (2008). Foreign Direct Investment as an Engine for Economic Growth and Human Development: A Review of the Arguments and Empirical Evidence. Leuven: Leuven Centre for Global Governance Studies.

Corcioli, G., Medina, G., and Arrais, C. A. (2022). Missing the target: Brazil's agricultural policy indirectly subsidizes foreign investments to the detriment of smallholder farmers and local agribusiness. Front. Sustain. Food Syst. 5, e796845. doi: 10.3389/fsufs.2021.796845

Costa, C., Guilhoto, J., and Imori, D. (2014). ‘Importância dos setores agroindustriais na geração de renda e emprego para a economia brasileira', RESR, 51(4), pp. 797–814. doi: 10.1590/S0103-20032013000400010

Cruz E. Medina G. Oliveira J. (in press). Brazil's Agribusiness Economic Miracle: Exploring Food Supply Chain Transformations for Promoting Win-Win Investments, Logistics.

Davis, J. H., and Goldberg, R. A. (1957). A concept of agribusiness. Am. J. Agric. Econ. 39, 1042–1045. doi: 10.2307/1234228

Di Meglio, G., Martínez-Alcocer, J. G., Sanchez, A. M., and Savonam, M. (2018). Services in developing economies: the deindustrialization debate in perspective, Dev. Change. 49, 1495–1525. doi: 10.1111/dech.12444

Fischer, A. M (2019). Bringing development back into development studies. Dev. Change. 50, 426–444. doi: 10.1111/dech.12490

Garcia, J. R., Lunas Lima, D. A. L., and Pinto Vieira, A. C. (2015). A nova configuração da estrutura produtiva do setor sucroenergético brasileiro: panorama e perspectivas. Revista Econ. Contemp. 19, 162–184. doi: 10.1590/198055271917

Gardner, T. A., Benzie, M., Borner, J., Dawkins, E., Fick, S., Garrett, R., et al. (2019). Transparency and sustainability in global commodity supply chains, World Dev. 121, 163–177. doi: 10.1016/j.worlddev.2018.05.025

Gasques, J. G., Bacchi, M. R. P., and Bastos, E. T. (2018). Crescimento e Produtividade da Agricultura Brasileira, Carta de Conjuntura. Brasília. Available online at: http://www.ipea.gov.br/cartadeconjuntura/index.php/2018/03/02/crescimento-e-produtividade-da-agricultura-brasileira-de-1975-a-2016/ (accessed January 2, 2022).

Green, J. M. H., Croft, S., Duran, A. P., Balmford, A. P., Burgess, N. D., Gardner, T. A., et al. (2019). Linking global drivers of agricultural trade to on-the-ground impacts on biodiversity. PNAS. 116, 201905618. doi: 10.1073/pnas.1905618116

Hage, F., Peixoto, M., and Vieira Filho, J. (2012). Aquisição de Terras por Estrangeiros no Brasil: Uma Avaliação Jurídica e Econômica. Brasilia, Brasil: Núcleo de Estudos e Pesquisas do Senado. Available online at: http://www.senado.gov.br/senado/conleg/textos_discussao/TD114-FabioHage-MarcusPeixoto-JoseEustaquio.pdf (accessed January 2, 2022).

Hausmann, R., and Rodrik, D. (2002). Economic development as self-discovery. J Dev Econ. 72, 603–633.

Hirschman, A (1981). The rise and decline of development economics. Ann. Econ. Soc. Civil. 36, 49–73.

Keynes, J. M (1936). General theory of employment, interest and money. Quart. J. Econ. 51, 87. doi: 10.2307/1882087

Madrueño, R., and Tezanos, S. (2018). The contemporary development discourse: analysing the influence of development studies' journals. World Dev. 109, 334–345. doi: 10.1016/j.worlddev.2018.05.005

MAPA. (2019). Plano agrícola e pecuário 2019/2020. Brasília: Ministério da Agricultura Pecuária e Abastecimento.

Marin, A., and Stubrin, L. (2015). Innovation in Natural Resources: New Opportunities and New Challenges The Case of the Argentinian Seed Industry, Innovation. Maastricht. Available online at: http://www.merit.unu.edu/publications/wppdf/2015/wp2015-015.pdf (accessed January 2, 2022).

Medina, G., Almeida, C., Novaes, E., Godar, J., and Pokorny, B. (2015). Development conditions for family farming: lessons from Brazil. World Dev. 74, 386–396. doi: 10.1016/j.worlddev.2015.05.023

Medina, G., Café, M., and Oliveira, J. (2020). Participação do capital brasileiro na cadeia produtiva do frango de corte: Estratégia para o desenvolvimento do agronegócio nacional. Agropampa. 3, 21–25.

Medina, G., and dos Santos, A. P. (2017). Curbing enthusiasm for Brazilian agribusiness: the use of actor-specific assessments to transform sustainable development on the ground. Appl. Geogr. 85, 101–112. doi: 10.1016/j.apgeog.2017.06.003

Medina, G., Ribeiro, G., and Brasil, E. (2016). Participação do capital brasileiro na cadeia produtiva da soja: lições para o futuro do agronegócio nacional. Revista Econ. Agro. 13, 1–38. doi: 10.25070/rea.v13i1,2,3.339

Medina, G., and Thomé, K. (2021). Transparency in global agribusiness: transforming Brazil's soybean supply chain based on companies' accountability. Logistics. 5, 58. doi: 10.3390/logistics5030058

Morais, L., and Saad-filho, A. (2011). Da economia política à política econômica: o novo-desenvolvimentismo e o governo Lula. Revista Econ. Polít. 31, 507–527. doi: 10.1590/S0101-31572011000400001

Mueller, B., and Mueller, C. (2016). The political economy of the Brazilian model of agricultural development: institutions versus sectoral policy. Quart. Rev. Econ. Fin. 62, 12–20. doi: 10.1016/j.qref.2016.07.012

Nassif, A., Bresser-Pereira, L. C., and Feijo, C. (2017). The case for reindustrialisation in developing countries: towards the connection between the macroeconomic regime and the industrial policy in Brazil. Cambridge J. Econ. (2017) 42, 355–381. doi: 10.1093/cje/bex028

Rada, N (2013). Assessing Brazil's Cerrado agricultural miracle: an update. Food Policy. 38, 146–155. doi: 10.1016/j.foodpol.2012.11.002

Rajão, R., Soares-Filho, B., Nunes, F., Börner, J., Machado, L., Assis, D., et al. (2020). The rotten apples of Brazil's agribusiness. Science. 369, 246–248. doi: 10.1126/science.aba6646

Saes, M. M., and Silveira, R. L. F. (2014). Novas formas de organização nas cadeias agropecuárias brasileiras: Tendências recentes. Estudos Soc. Agric. 22, 386–407.

Salerno, T (2017). Cargill's corporate growth in times of crises: how agro-commodity traders are increasing profits in the midst of volatility. Agric. Hum. Values. 34, 211–222. doi: 10.1007/s10460-016-9681-8

Santos, M., and Glass, V. (2018). Atlas do Agronegócio: Fatos e números sobre as corporações que controlam o que comemos. Rio de Janeiro: Fundação Heinrich Böll.

Sauer, S., Balestro, M. V., and Schneider, S. (2018). The ambiguous stance of Brazil as a regional power: piloting a course between commodity-based surpluses and national development. Globalizations. 15, 32–55. doi: 10.1080/14747731.2017.1400232

Sindiveg (2020). Associadas, Sindicato Nacional da Indústria de Produtos para Defesa Vegetal (Sindiveg). Available online at: https://sindiveg.org.br/associadas/ (accessed December 20, 2020).

Soendergaard, N (2018). Modern monoculture and periphery processes: a world systems analysis of the Brazilian soy expansion from 2000-2012. Revista Econ. Socol. Rural. 56, 69–90. doi: 10.1590/1234-56781806-94790560105

Stosberg, J (2018). Political Risk and the Institutional Environment for Foreign Direct Investment in Latin America. Frankfurt: Political Risk and the Institutional Environment for Foreign Direct Investment in Latin America.

Szirmai, A (2012). Industrialisation as an engine of growth in developing countries, 1950-2005. Struct. Change Econ. Dyn. 23, 406–420. doi: 10.1016/j.strueco.2011.01.005

Thomé, K., Medeiros, J., and Hearn, B. A. (2017). Institutional distance and the performance of foreign subsidiaries in Brazilian host market. Int. J. Emerg. Mark. 12, 279–295. doi: 10.1108/IJoEM-02-2015-0031

Wilkinson, J (2010). Transformações e perspectivas dos agronegócios brasileiros. Revista Brasil. Zoot. 39(Suppl. 1), 26–34. doi: 10.1590/S1516-35982010001300004

Keywords: foreign investments, neo-colonialism, development economics, associated dependent development, new developmentalism, agricultural policy

Citation: Medina GdS (2022) The Economics of Agribusiness in Developing Countries: Areas of Opportunities for a New Development Paradigm in the Soybean Supply Chain in Brazil. Front. Sustain. Food Syst. 6:842338. doi: 10.3389/fsufs.2022.842338

Received: 23 December 2021; Accepted: 21 February 2022;

Published: 18 March 2022.

Edited by:

Mairon G. Bastos Lima, Stockholm Environment Institute (SEI), SwedenReviewed by:

Tiago Reis, Catholic University of Louvain, BelgiumAndrew Ofstehage, Cornell University, United States

Copyright © 2022 Medina. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Gabriel da Silva Medina, Z2FicmllbC5tZWRpbmFAdW5iLmJy

Gabriel da Silva Medina

Gabriel da Silva Medina