94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Sustain. Food Syst., 01 June 2022

Sec. Social Movements, Institutions and Governance

Volume 6 - 2022 | https://doi.org/10.3389/fsufs.2022.821330

This article is part of the Research TopicLaw, Policy and the Governance of Sustainable Food SystemsView all 8 articles

Imam Mujahidin Fahmid1

Imam Mujahidin Fahmid1 Wahyudi2

Wahyudi2 Darmawan Salman1

Darmawan Salman1 I Ketut Kariyasa2

I Ketut Kariyasa2 Mirah Midadan Fahmid3

Mirah Midadan Fahmid3 Adang Agustian4

Adang Agustian4 Resty Puspa Perdana5*

Resty Puspa Perdana5* Benny Rachman5

Benny Rachman5 Valeriana Darwis4

Valeriana Darwis4 Sudi Mardianto5

Sudi Mardianto5Indonesia is one of the cocoa producing countries, where most of it is exported to foreign countries and the rest is marketed domestically. Indonesia cocoa export performance in the world market certainly opens up many opportunities. It is necessary to optimize the potency and competitiveness of its cocoa if Indonesia would make the cocoa exports as the driving of national economy. The objectives of this paper are to (1) analyze Indonesian cocoa performance in the global market compared to its competitors and (2) analyze the competitiveness and market position of Indonesian cocoa in global market and analyze the potency to develop market in 10 main trading partners. The data analysis methods used are the Revealed Comparative Advantage (RCA), Trade Specialization Index (TSI) and Export Product Dynamics (EDP). The result shows that the comparative competitiveness of Indonesian cocoa beans and processed cocoa is lower than that of other producing countries. However, Indonesia still has the potency to develop market for its cocoa products in several countries such as the United States, China, India, Canada, Mexico and Estonia. Some efforts to improve the competitiveness of Indonesian cocoa beans may be through the replanting for estates rejuvenation and the improvement of fermentation to improve the quality of cocoa beans. In addition, to enhance the export performance of cocoa base products in general, it is necessary to also improve the development of downstream line and processing industries.

Cocoa is one of the plantation commodities that has a role in economic activity in Indonesia. In addition, cocoa is also a foreign exchange earner apart from oil and gas. Indonesia is the major cocoa producer in the world. Most of Indonesia's cocoa production is exported abroad and the rest is marketed domestically. The main share of Indonesian cocoa exports is to the Asian continent, besides that it is also exported to America, Europe, Africa and Australia (UN Comtrade, 2020).

In 2019, the top five importing countries for Indonesian cocoa were Malaysia, America, India, China and the Netherlands. The total volume of cocoa exports reached 358.48 thousand tons with a total value of US $ 1.20 billion. There was a decrease in export volume from 2018 which reached 380.83 thousand tons with a total value of US $ 1.25 billion ([BPS] Central Bureau of Statistics., 2019).

Indonesia's cocoa production decreased from 0.77 million tons in 2018 to 0.74 million tons in 2020, while Côte d'Ivoire as a major producer of cocoa, the cocoa production reach 2.2 million tons in 2020. Total exports of Indonesia cocoa products including cocoa beans, cocoa butter, cocoa paste and cocoa powder and cake reach 0.52 tons. Exports of cocoa products showed an increase of 48.5% during 2018–2020. Meanwhile, total exports of cocoa products in Ghana in 2020 reached 2.12 million tons. During this period, imports of Indonesia cocoa products decreased by 15.5% (FAO, 2020). This shows that Indonesia's cocoa export performance has good prospects. However, efforts are needed to increase cocoa production so that it can further support the improvement of Indonesia's cocoa performance.

According to Nauly et al. (2014), before the export duty policy was applied, Indonesia's cocoa exports were dominated by cocoa beans. Furthermore, with the implementation of export duties in 2010 changed the composition of cocoa in Indonesia from dominant cocoa beans to processed cocoa. The implementation of export duties succeeded in reducing cocoa bean exports and increasing processed cocoa, but as a result of the implementation of these export duties, the volume of Indonesian cocoa exports also decreased. The results of the study of Andini et al. (2016) show that overall processed cocoa products in Indonesia, namely pasta (HS 1803), fat (HS 1804), flour, cocoa beans and also chocolate have comparative advantages. The result of calculating the RCA value is that only cocoa beans, fat, and cocoa powder have export competitiveness with an average of 4.23. The same thing is also known from the results of research by Buana et al. (2017) which revealed that in 1995–2015, Indonesia's competitive position was very good as shown by the results of the analysis with an average RCA value below 1 which was 1.25. Another study was also conducted by Maulana and Kartiasih (2017) which showed that the RCA value of Indonesian processed cocoa in 2010 was above one, while in previous years the RCA value of Indonesia was still below one (poor). With this information, it means that Indonesian cocoa in the German market after 2010, has good competitiveness.

The performance of cocoa exports in the world market certainly opens up many opportunities. Export proceeds will directly increase foreign exchange reserves and strengthen Indonesia's position in international transactions. In addition, through export activities, domestic producers have a wide market to market their products and ultimately increase people's income.

With existing natural resources, Indonesia's potential to boost the performance of export-based cocoa commodities is actually very large. Based on land cover area data from the Ministry of Environment and Forestry (KLHK), Indonesia's plantation area continues to increase every year and in 2018 the plantation area reached 15.11 million hectares. More than that, the tropical climate causes Indonesia's soil to become fertile. The availability of large and fertile agricultural lands has the potential for Indonesia to become a key player for a number of strategic plantation commodities, including cocoa which has the potential to be developed in a sustainable manner.

Seeing the huge potential of cocoa in Indonesia, it is important to identify the performance of Indonesian cocoa. In addition to getting a comprehensive picture of the condition of cocoa commodities, this can also be useful in seeing its potential. Thus, Indonesia's relative position for export-based cocoa at a global level can be well-mapped and at the same time the potential to become a key player in the global market can be found.

In addition, information on the competitiveness of cocoa commodities at the international level as well as market position and development potential is also useful in formulating strategies to improve the export performance of Indonesian plantation commodities in the global market. This is in line with the targets in the National Medium Term Development Plan (RPJMN) 2020–2024, namely increasing added value, employment, investment, exports and competitiveness in order to strengthen economic resilience for quality growth. If the competitiveness and potential of Indonesian cocoa can be optimized, the export of cocoa commodities can become the engine of driving the nation's economy.

In this backdrop, the objectives of this paper are: (1) identifying the performance of cocoa commodity in the global market compared to competing countries and (2) analyzing the competitiveness of cocoa commodity in the global market and the market position and potential for development in 10 trading partners main.

This study was conducted in 2020. The data used in the analysis is the 2018 period because UN Comtrade as the main data source in this study has not published data after 2018. Secondary data used in this study such as production data, land area, productivity, export-import of cocoa commodities and other information. Secondary data and information used are sourced from the Central Statistics Agency (BPS), the Ministry of Agriculture, the UN Comtrade Database, the Food and Agriculture Organization of the United Nations (FAO), and institutions/agencies, scientific journals, and other relevant literature sources.

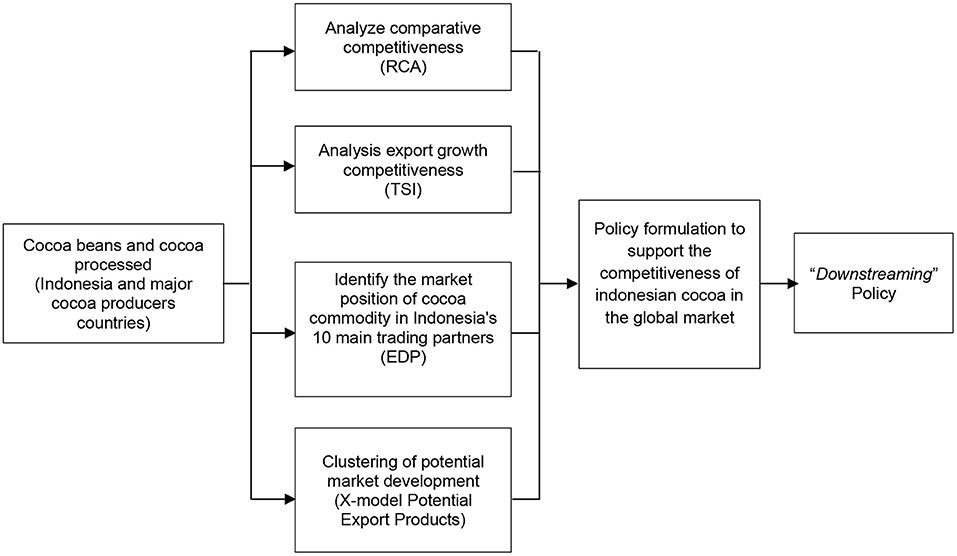

The analytical method used in this study is quantitative analysis to identify the performance of cocoa commodities relative to other supply countries. Meanwhile, to analyze comparative competitiveness, the Revealed Comparative Advantage (RCA) method was used and the export growth competitiveness uses the Trade Specialization Index (TSI) method. Export Product Dynamics (EDP) analysis and clustering of potential market development with the X-model Potential Export Products were also used to identify the market position of cocoa commodity in Indonesia's 10 main trading partners. The method of analysis show in Figure 1.

Figure 1. Method of analysis policy formulation to support the competitiveness of Indonesian cocoa in the global market.

Mathematically, RCA is formulated as follows:

Xij = export value of product i from country j

Xiw = world export value of product i

Xw = total value of world exports

The TSI value can be formulated as follows:

The formula to find out the market position based on the EDP matrix is as follows.

Xijk = export value of product i from country j to country k

Xiwk = export value of product i from the world to country k

Xwk = total value of world exports to country k

t = year t

t−1 = previous year

T = number of years of analysis

The X Model Potential Export Products method is a method that combines bilateral RCA results with Export Product Dinamics (EPD) results to produce a clustering of potential export products to certain countries. The following is the Clustering of X-Model Potential Export Products (Table 1):

Description:

a. Rising star indicates that a country that has this position gains market share (demand) for cocoa commodity that are growing rapidly.

b. Lost opportunity indicates there is a decrease in market share for cocoa commodity while the export market share of destination countries has increased.

c. Falling star shows that market share continues to increase despite a decline in cocoa commodity movement in the global market.

d. Retreat can be interpreted as a decline from cocoa commodity which means the product is no longer desired by the market share because of the dynamic and uncompetitive movement of the product in the market.

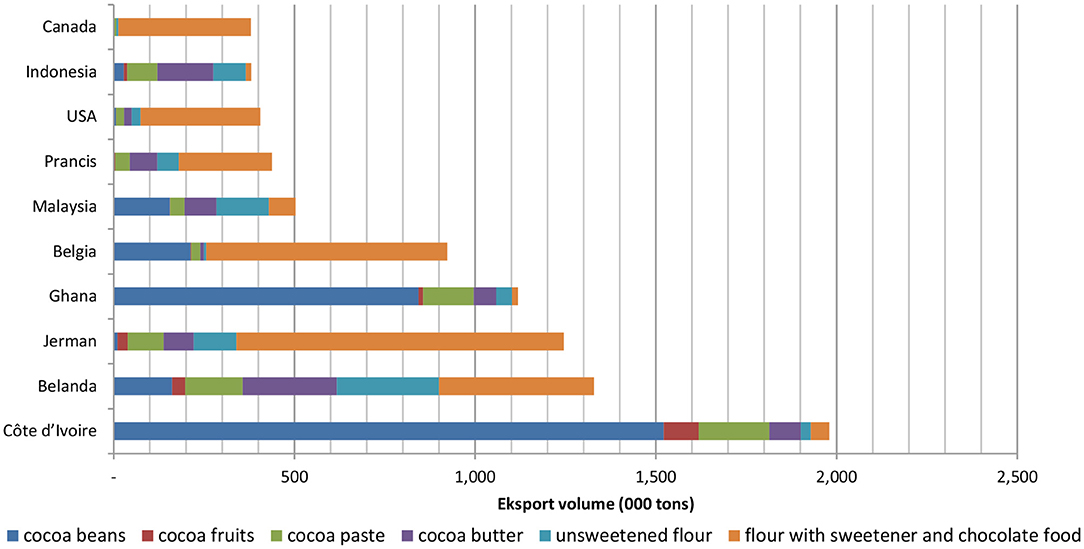

In terms of the volume of cocoa exports traded in the global market, it can be seen that European and American countries with processed cocoa products have begun to dominate the market, defeating several cocoa producing countries in Africa and Latin America (Figure 2).

Figure 2. Volume of cocoa exports by major exporting countries by type of cocoa, 2018. Source: (UN Comtrade, 2020) (data processed).

Indonesia's position in dominating the cocoa export market is quite weak considering that Indonesia is actually one of the largest cocoa producers after Côte d'Ivoire and Ghana. In 2018, Indonesia was only able to be in the 9th position as a cocoa exporter. The decline in exports of Indonesian cocoa beans is thought to be caused by lower demand from importing countries. This is because the cocoa beans come from Indonesia is a complementary cocoa bean to better quality cocoa beans such as cocoa beans from Ghana and is only used as a mixture due to its low quality (Rifin, 2013). However, if it is viewed from the production side, the cocoa production of Côte d'Ivoire and Ghana was more fluctuating compared to Indonesia even though their productivity is lower. This is partly due to bad weather conditions such as high rainfall and the condition of cocoa trees which are no longer productive and need replanting (Kolavalli and Vigneri, 2011).

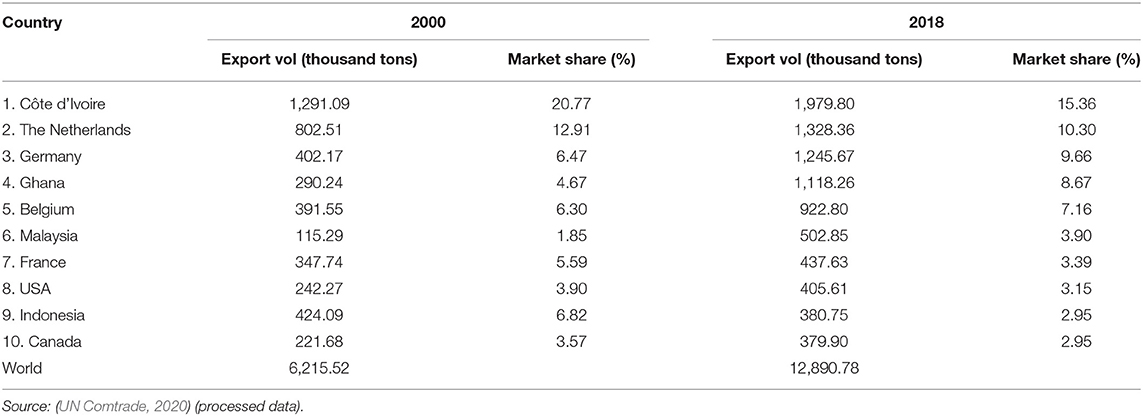

The performance of Indonesia's cocoa exports throughout the year was stagnant with a downward trend, as evidenced by the decline in cocoa exports from 424.09 thousand tons in 2000 to 380.75 thousand tons in 2018 and a decrease in market share from 6.8% to below 3%. In terms of product types, the majority of products exported by Indonesia were cocoa butter (40.72%), followed by unsweetened cocoa flour (23.59%), cocoa paste (21.9%), and cocoa beans and pods as much as 10%. Exports of sweetened cocoa flour and other chocolate foods are very small, <4% of the total trade. This indicates that the development of the downstream chocolate product industry in Indonesia is still minimal.

The Netherlands and Germany have shown a very high performance to become the biggest cocoa exporters after Côte d'Ivoire. In 2018 the Netherlands re-exported 1.33 million tons of cocoa and captured more than 10% of the world market for cocoa while Germany controlled 9.66% of the market. The Netherlands was able to become the second largest exporter in the world by relying on imports of raw materials from cocoa producing countries, especially from Africa, such as Ghana, Côte d'Ivoire, Cameroon and Nigeria. In 2018 the Netherlands was the largest importer of cocoa in the world. After processing, the majority of Dutch cocoa products are re-marketed to other European countries. Meanwhile, in 2018 Belgium was ranked as the 5th largest exporter of chocolate with an export capacity of 922 thousand tons, but also at the same time the second largest importer of cocoa beans, the largest being supplied from Côte d'Ivoire (55%), Nigeria (10%), and Ghana (10%).

The main market share for Indonesian cocoa products is the United States which covers 28% of all cocoa sales, followed by Malaysia (15%), the Netherlands (9%), China (7%), and India (5%). The majority of the product types that are traded in the United States and the Netherlands are cocoa paste and cocoa butter which are used as raw materials for the chocolate processing industry. Slightly different, imports by China and India are dominated by cocoa flour, while Malaysian demand is more varied in raw and semi-finished products. According to Idris et al. (2011), Malaysia has a comparative advantage in producing cocoa butter and cocoa powder, but not cocoa beans and cocoa paste. On the other hand, the majority of cocoa products produced by African countries such as Côte d'Ivoire and Ghana are used to meet the demands of European countries and the United States which of course require huge quantities of raw materials to support their chocolate food production. Meanwhile, countries in Europe become suppliers to each other to encourage the processing of their chocolate.

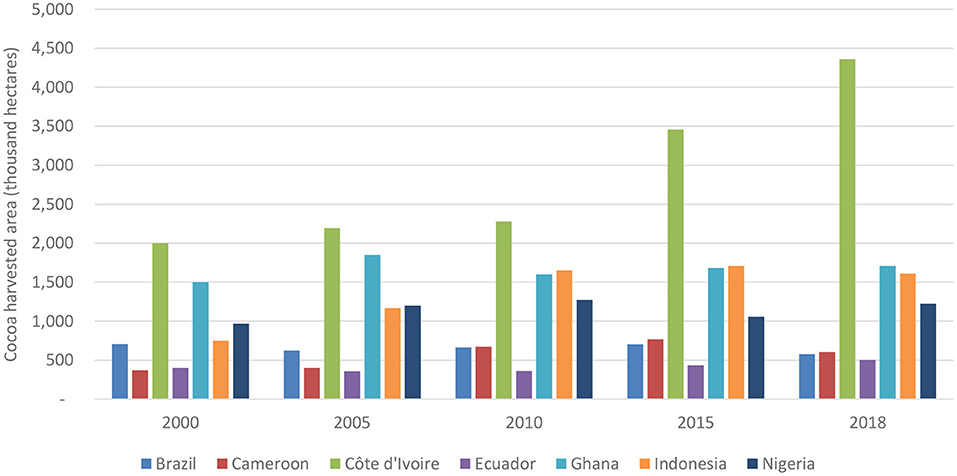

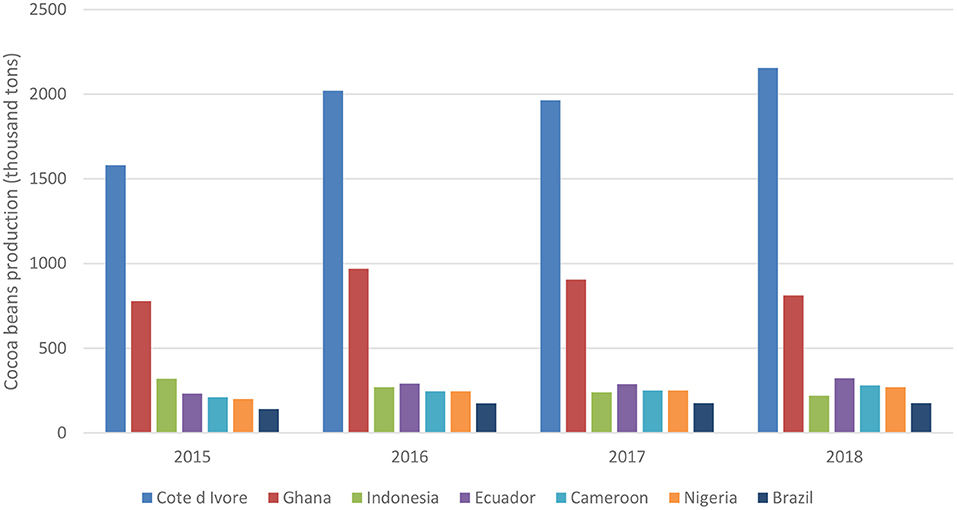

The majority of cocoa producing countries are scattered in West Africa, Southeast Asia, and Latin America which have a tropical climate where the habitat for cocoa plants grows because cocoa plants need high rainfall throughout the year to grow properly. Côte d'Ivoire is in the first position as the main cocoa producer, followed by Ghana, Indonesia, Nigeria, Cameroon, Brazil and Ecuador (Figure 4).

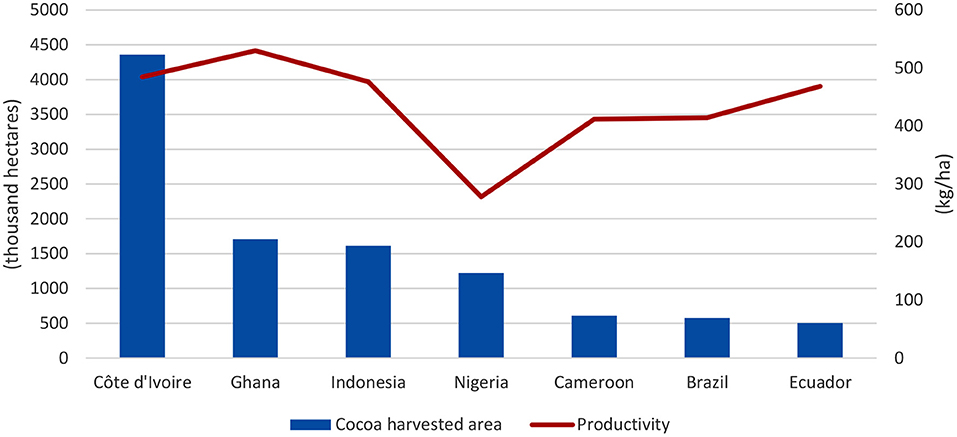

Côte d'Ivoire's cocoa acreage is the largest in the world and has a tendency to continue to grow. The expansion of this area will continue to encourage Côte d'Ivoire production to support export activities and make Côte d'Ivoire's position tend to be strong. In 2018, Côte d'Ivoire's cocoa harvest area was recorded at 4.39 million hectares with production reaching 2.15 million tons of cocoa beans or 45% of world cocoa bean production (Figure 3).

Figure 3. Development of harvested areas for cocoa in major producing countries, 2000, 2005, 2010, 2015, and 2018. Source: (FAO, 2020) (processed data).

Meanwhile, Ghana's cocoa area is the second largest after Côte d'Ivoire, but with a less significant increase. Although the land tends to be stagnant, Ghana's cocoa bean production has increased quite rapidly, from 437 thousand tons in 2000 to 812 thousand tons in 2018, indicating high productivity gains. Ghana is able to produce 530 kg/ha of cocoa beans in a year. Productivity grew as a result of implementing the “Cocoa High-Tech” program launched by the government in 2002/2003, which required the provision of fertilizer for cocoa producers (Kolavalli and Vigneri, 2011). In addition, in 2011 Ghana also carried out a program of rehabilitation and replacement of plants with hybrid varieties (Aneani et al., 2017). The rejuvenation of cocoa plants will maintain the sustainability of the cocoa plant, which means maintaining future production. This is in accordance with the statement of Ndubuto et al. (2015), to increase cocoa production in Nigeria, it is necessary to rehabilitate plantations and rejuvenate cocoa plants. Boansi (2013) also revealed that Ghana's performance in cocoa production and exports is supported by efforts to reduce agricultural taxes, increase farmers' share in export prices, bonuses in cash and in kind and intensification of competition in the domestic market through partial liberalization of internal marketing.

In 2018, Indonesia is the seventh largest producer of cocoa beans in the world with production reaching 220 thousand tons in 2018. Indonesia's cocoa bean production has decreased from 2015 to 2018 reaching 31.25%. In 2015, Indonesia was the third largest producer of cocoa beans in the world, reaching 320 tons. To support its production, expansion continues by expanding the cocoa area from 749 thousand hectares to 1.68 million hectares, in the period of 2019 and beyond. However, in recent years production has experienced a sharp decline mainly due to the rapid spread of the cocoa pod borer (Conopomorpha cramerella) (Kozicka et al., 2018). In addition, the aging of the plant also limits Indonesia's cocoa production. Furthermore, Fahmid et al. (2018) revealed that the low productivity of cocoa in Indonesia is due to the management that is still done traditionally by the majority of farmers.

FAO data shows that Indonesia's productivity is still lower than some other producing countries. In 2018 Indonesia was only able to produce 476 kg of cocoa beans in 1 hectares, while Ghana can reach 530 kg/ha (Figure 5). The majority of Indonesian plantations are managed by the community (98%), and the rest are carried out by private and national companies. In practice, farmers in rural areas experience problems with the lack of access to market information and knowledge due to the lack of institutional roles in the field (Hidayat and Echdar, 2018).

Another problem that must be faced in the development of Indonesian cocoa is the low quality of the product. Ministry of Industry (2007) mentioned, in the world market, especially Europe, the quality of Indonesian cocoa is considered low because it contains high acidity, low flavor precursor compounds / flavor forming compounds, and low levels of fat contained in cocoa. This has resulted in the relatively low price of Indonesian cocoa compared to other producers.

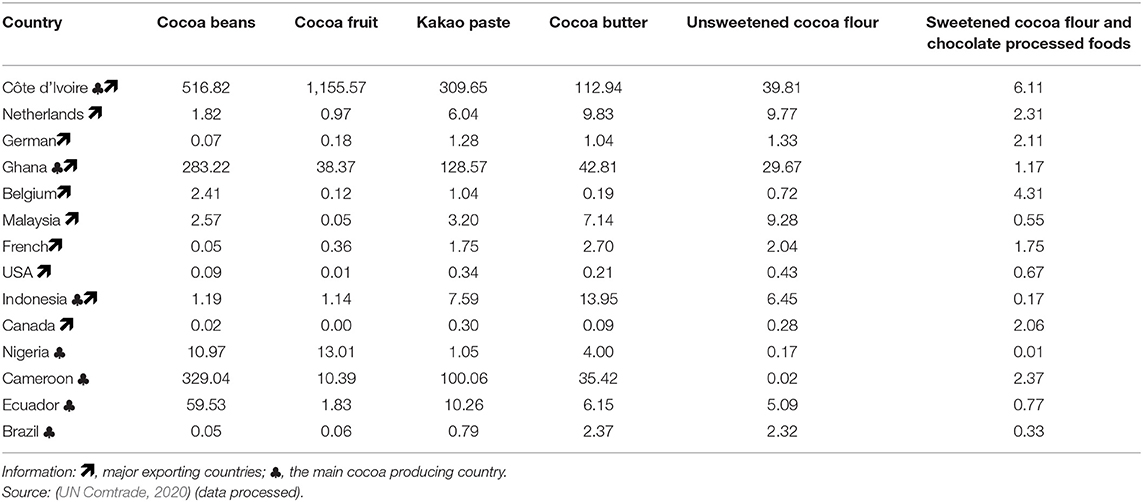

In the cocoa bean trade, countries in Africa tend to have the highest comparative advantage. such as Côte d'Ivoire with the highest RCA, namely 516.82, Ghana: 283.22, Cameroon: 329.04, and Nigeria: 10.97. This is because these countries are the main producers of cocoa beans and export cocoa in the form of very high beans. As expressed by Jambor et al. (2017), cocoa producers such as Côte d'Ivoire or Ghana have the greatest export competitiveness for cocoa raw materials. On the other hand, distributor countries (Netherlands, Belgium or UK) generally do not have high competitiveness or do not have a comparative advantage as producers, even though their markets are better positioned. According to Arifin (2013), a country that has a comparative advantage in producing certain commodities over other countries means that this country produces products with lower opportunity costs than other countries. Meanwhile, the RCA for Indonesia's cocoa bean export value of 1.19 shows that the competitiveness of cocoa beans exports is weak, even weaker than non-producing countries such as Belgium (2.41) and the Netherlands (1.82). Likewise, the results study conducted by Wahyudi (2016), Indonesia's cocoa commodity has a strong since its RCA index value is >1 (RCA > 1) in the export markets of Malaysia and Singapore. However, the upward trend in cocoa commodity prices in the international market was not accompanied by an increase in the value of export products. Similar to cocoa bean products, Indonesia's competitiveness is also far below that of these African countries. In line with what Fahmid et al. (2018) namely that cocoa commodities in Indonesia generally do not have comparative competitiveness, but do have competitive competitiveness.

Based on the results of the study Hasibuan et al. (2012a), in 2001 to 2010, Indonesia had the highest comparative advantage for cocoa bean trade while the lowest comparative advantage was for cocoa butter trade. The results of his study using the constant market share calculation results show that Indonesian cocoa beans have low competitiveness because Indonesian cocoa bean products have low quality so that only used as a mixture.

Still with the dominance of African producing countries, chocolate industrial countries such as the Netherlands, Germany, and France, began to show comparative advantages in cocoa paste and cocoa butter products as these countries began processing cocoa beans and imported cocoa pods into intermediates material. However, in this product, Indonesia's competitiveness position is still higher than those of the cocoa processing industrial countries.

On unsweetened cocoa flour products, the dominance of African countries such as Nigeria and Cameroon is starting to disappear, both of them no longer have a comparative advantage, leaving Côte d'Ivoire and Ghana with a still strong position. In this product, Indonesia's competitiveness is below Côte d'Ivoire, Ghana, the Netherlands and Malaysia.

RCA value of for sweetened cocoa flour and processed chocolate foods show that Indonesia lacks competitiveness. This indicates that the downstream industry for processing cocoa products into ready-to-consume products in Indonesia is not optimal. Côte d'Ivoire has the highest competitiveness, followed by chocolate processing industry countries such as Belgium, the Netherlands, Germany, Canada, and France in the confectionary product trade. According to Maulana and Kartiasih (2017), efforts to increase the competitiveness of Indonesian processed cocoa exports to the main export destination countries need to be done so that Indonesian processed cocoa will be more attractive to consumers. It will increase demand for processed cocoa by export destination countries. Furthermore, the result study conducted by Putra (2020) show that Indonesia cocoa products and its derivatives have a competitive advantage except for cocoa beans. However, it is lagging far behind other cocoa-producing countries. Furthermore, Indonesian cocoa products and derivatives continue to experience declining competitiveness in the European market. In general, Indonesia cocoa and derivative products in the European market are not able to take the region's market share.

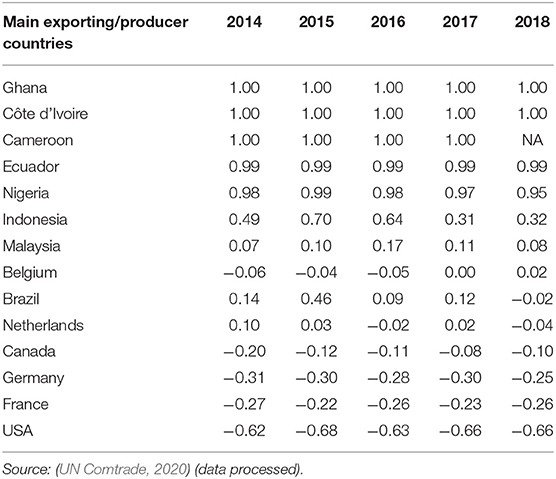

TSI results show that Indonesia specializes as an exporter of cocoa commodities. However, the small TSI value indicates that there are still many chocolate products from abroad circulating in the domestic market, while the TSI value which tends to decline from 0.70 in 2015 to 0.32 in 2018 shows that imports were on the increase (Table 4). It also shows that Indonesia's cocoa exports are in a growth stage. In this position, Indonesia's cocoa trade balance is weaker than that of Ghana, Côte d'Ivoire, Cameroon, Equador, and Nigeria, which are at the stage of export maturity because their domestic market can be fulfilled by the domestic production.

The implementation of a cocoa bean export tax will affect the volume of cocoa beans exported. Based on the Minister of Finance Regulation Number 67/PMK.011/2010 concerning Stipulation of Exported Goods Subject to Export Duties and Export Duties, it is stated that cocoa bean exports are subject to export duties, starting in April 2010. When the price of cocoa beans on the world market is less than US$ $ 2,000/ton, the export of cocoa beans is not subject to export duty. When the price of cocoa beans is US$ 2,000-US$ 2,750 per ton, an export duty of 5 percent will be imposed, and an export duty of 10 percent will be imposed when the price of cocoa beans is US$ 2,750-US$ 3,500. Then a 15 percent export duty rate will be imposed if the cocoa price on the world market is above US$ 3,500 per ton. The imposition of the export tax caused the volume of exports to decline in the following year, for example in 2018 (Table 2).

Table 2. Export volume and market share of cocoa exports for major exporting countries, 2000 and 2018.

The imposition of an export tax on cocoa beans is an effort to keep the raw material needs of the domestic cocoa processing industry available. This is in view of the declining condition of domestic cocoa production (Figure 4) due to the attack of the cocoa pod borer. With the constant demand for raw materials for the cocoa processing industry, the import of cocoa beans has also increased. Therefore, to ensure the availability of raw materials for the cocoa processing industry, an export tax is applied, so that imports will decrease. In this condition, the position of the value of imports and exports of cocoa beans will be relatively balanced, and the TSI value is close to zero.

Figure 4. Development of cocoa bean production in major producing countries, 2015–2018 (thousand tons). Source: (ICCO, 2018, 2019, 2020) (processed data).

Figure 5. Cocoa harvested area and productivity of major producing countries, 2018. Source: (FAO, 2020) (processed data).

Meanwhile, the chocolate industrial countries in Europe and America are more likely to be cocoa importers because these countries have to import raw materials for processing their factories. With the large amount of imports carried out, the exports carried out by Belgium, Brazil, the Netherlands, Canada, Germany, and France are at the import substitution stage, while the United States is at the earliest stage, namely the introduction stage because of the much larger composition of exports.

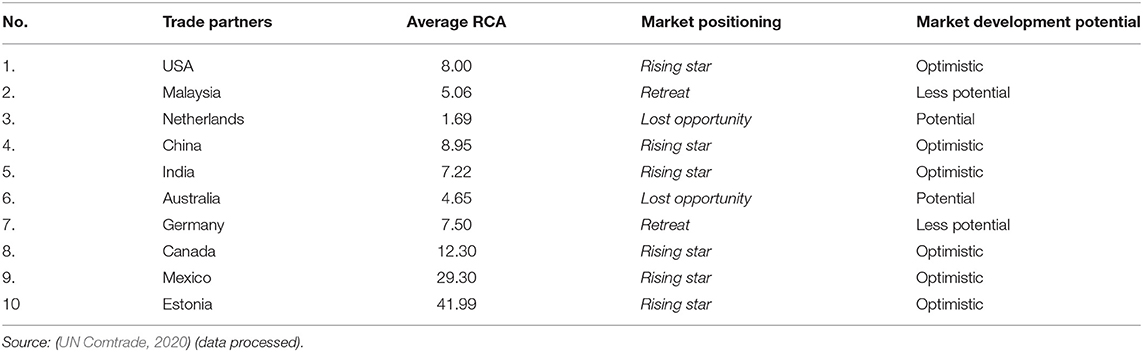

Even though it ranks ninth as the largest exporter of cocoa, the position of the Indonesian cocoa market in its main trading partners is quite strong. The Indonesian market in highly populated countries such as the United States, China and India is in a rising star position, meaning that Indonesia's market share in these countries is getting bigger and Indonesian cocoa products are increasingly accepted. The same thing happened to other American markets, namely Canada and Mexico, and Estonia in Europe. In addition to the rising market position, Indonesian cocoa in these markets is supported by its comparative competitiveness, making the potential for developing the cocoa market optimistic (Table 5).

While major economies provide a growing market, in the Dutch and Australian markets, Indonesia is experiencing a loss of market share for its dynamic cocoa products. This is quite unfortunate especially with regard to the Australian market. Indonesia is the closest major country to Australia but has experienced a market decline. This means that many Australian products are imported from other countries that are further away from Indonesia. In this condition, the Netherlands and Australia still have a potential market to develop because the main problem is not the export performance of cocoa but with other Indonesian products in general.

Meanwhile, Indonesia's cocoa market share position in Malaysia was in fact a retreat. This indicates that the demand for Indonesian products in general and for cocoa in particular by Malaysia for the 2014–2018 period was not as high as in previous years. As the closest country, in 2014 Indonesia received 27.34% of the Malaysian cocoa market, but in 2018 it only received 17.61%. The Indonesian cocoa market in Malaysia has been displaced by cocoa products from African countries, namely Ghana and Côte d'Ivoire (Table 3).

Table 3. Average RCA value of cocoa commodity in major exporting / producing countries by 4-digit HS product type, 2014–2018.

Table 4. Development of Trade Spesialization Index (TSI) values in major cocoa exporting / producing countries, 2014–2018.

Table 5. Analysis results of the X-Model Potential Product of Indonesian cocoa to the 10 main trading partners in 2014–2018.

As the number three cocoa producer in the world, Indonesia is only able to be in the 9th position of the world's largest cocoa exporter, below the non-producing chocolate processing industry countries. This is because the ability to diversify Indonesia's cocoa products is still minimal. The majority of Indonesian cocoa products traded in the global market are semi-finished cocoa, namely in the form of butter which accounts for more than 40% and unsweetened cocoa flour which makes up 24% of Indonesia's cocoa exports. Meanwhile, exports of ready-to-use chocolate in the form of sweetened cocoa flour and chocolate food are very small, below 4%. This shows that the domestic chocolate food and beverage processing industry is not yet optimal.

Besides that, Sudjarmoko (2013) mentioned, there are still many cocoa that are processed without doing the first phase even though compulsory Indonesian National Standard (SNI) for Indonesian cocoa beans has been implemented, while the market prefers fermented cocoa. The cocoa fermentation process is one way to improve the taste and quality of cocoa. Fermented cocoa tends to be used as the main raw material while unfermented cocoa will only be a mixture. Rifin (2013) also stated that the majority of Indonesian cocoa is exported in non-fermented form, unlike cacao products from Côte d'Ivoire and Ghana, which are sold in a form that has been cemented. This certainly affects the competitiveness of Indonesian cocoa in the global market. Purnawijaya and Idris (2019) in their study found reasons why farmers are reluctant to carry out fermentation because it takes a long time and the price received by farmers who do fermentation and those who do not only differ slightly, not proportional to the time and energy spent. Besides that, according to Listyati et al. (2014), there is still a willingness in the export market to do soaccepting non-fermented cocoa beans also encourages farmers to be more reluctant to carry out fermentation even though the price is low.

The Indonesian government implements a resource-based industrial development policy to support the development of processed product exports. This is often referred to as downstreaming. These efforts are carried out with the aim of strengthening the structure of the agriculture, mining and oil-based chemical sector (Ministry of Industry, 2015). Furthermore, the (Ministry of Industry, 2016a) revealed that downstream aims to developing economic industries, increasing the spatial distribution of industries throughout Indonesia, and increasing the value of exports and local product. According to Patunru and Rahardja (2015), Indonesia's economic growth, especially the food processing industry, has a good potential to be developed but is less integrated with international trade networks, when compared to other Southeast Asian countries such as Malaysia, Thailand and Singapore.

Until now, cocoa exports are still dominated by raw cocoa and semi-finished products such as cocoa butter, unsweetened cocoa flour, and cocoa paste. Meanwhile, exports of cocoa in the form of products such as sweetened cocoa flour and chocolate food are still limited. Therefore, the Indonesian government has implemented a downstream policy or development of the cocoa processing industry to increase added value and competitiveness of processed cocoa products in the global market. Hadinata (2020) revealed that “downstreaming” policies provide several benefits, including a decrease in the volume of cocoa beans exports without a significant decrease in cocoa exports, a rise in cocoa processing companies, an increase in the utility of the cocoa processing industry, an increase in labor absorption, and an increase in processed cocoa production.

According to Harrington (2011), Indonesian cocoa has an advantage in terms of the level of hardness of cocoa (hard butter) so that it does not melt easily and has good color characteristics (light breaking effect), although in general the cocoa produced by farmers is not fermented. In addition, compared to Côte d'Ivoire, Haiti and Ecuador, Indonesian cocoa has the highest anti-oxidant content. This is one of the potentials of Indonesian cocoa to be developed into finished food products that have higher added value and are competitive in the global market.

On the other hand, the imposition of an export tax on Indonesian chocolate products has also succeeded in shifting Indonesia's chocolate exports from cocoa beans to processed chocolate. This shows that this policy can encourage the downstreaming of cocoa commodities into processed products that have added value. However, the competitiveness of Indonesian processed chocolate products has decreased which has resulted in the export growth of Indonesian chocolate products being lower than the rate of world demand (Rifin and Nauli, 2013). Putri et al. (2015) also revealed that Indonesian chocolate had lost its competitiveness compared to chocolate products from its competitors Côte d'Ivoire and Ghana. Further research results related to the impact of the export duty policy by conducting a model simulation up to 2025 to see the achievement of the export duty policy in the long term shows that the export duty policy for cocoa beans is able to increase the ability of the processing industry to absorb domestic cocoa bean production (Hasibuan et al., 2012b). This policy was also able to increase the share of the volume and value of processed cocoa exports. Syadullah (2012) also stated the same thing, namely the government implementing the export duty policy for cocoa beans resulted in an increase in the number of companies engaged in the cocoa processing industry. However, Hasibuan et al. (2012c) in fact revealed that the government needs to review the application of export duties for cocoa beans because it has a negative impact on cocoa farming.

The Ministry of Agriculture has made efforts to support post-harvest processing to increase added value and product competitiveness by building plantation processing facilities. In total, 135 plantation processing units spread across 23 provinces were built for rubber, coconut, coffee, essential oil, palm sugar, lemongrass, sago, including cocoa. Unfortunately, the utilization of this plantation product processing facility is constrained by the problem of optimizing the utilization of the facilities and farmer institutions which are still weak. In this case, institutional strengthening at the farmer level through farmer groups (poktan) and also farmer group associations (gapoktan) needs to be done. Poktan and Gapoktan have an important role, starting from providing input to the plantation business, providing capital, sharing agricultural information.

According to the (Ministry of Industry, 2016a) that the downstream development of the cocoa processing industry is directed to produce cocoa powder, cocoa butter, chocolate-based food and beverages, as well as cocoa-based functional foods and supplements. This downstream industry opportunity is supported by Indonesia's potential as the third largest cocoa bean producer in the world after Ivory Coast and Ghana. Currently, there are around 40 domestic cocoa processing companies with a total production capacity of up to 800 thousand tons per year. Under these conditions, the government encourages the downstreaming of cocoa-based industries through the establishment of processing units in cocoa bean centers that aim to grow small and medium-scale entrepreneurs. In order to support this policy, the government through the Ministry of Industry has provided assistance with machinery and equipment for cocoa processing in cocoa bean producing areas since 2012 such as in West Sumatra, Central Sulawesi, South Sulawesi and Southeast Sulawesi.

On the other hand, the government has also issued an export duty policy through the Regulation of the Minister of Finance Number 67 of 2010 concerning Stipulation of Exported Goods Subject to Export Duties and Export Duty Tariffs. With this policy, the supply of cocoa for the domestic industry is getting bigger and it is hoped that in the future processed cocoa exports will continue to increase with better quality. The implementation of the export duty also supports the downstream program and has had a good impact on the decline in cocoa bean exports (Ministry of Industry, 2016b). In this case, the downstream cocoa-based industry program has succeeded in attracting foreign investors to invest in Indonesia by building a cocoa factory and encouraging the expansion of its production capacity. Besides that, it is also able to grow small and medium scale chocolate industry in several areas. The increase in the downstream cocoa sector needs to be balanced with an increase in domestic cocoa consumption.

According to Zulfiandri (2018) that the downstream cocoa agro-industry policy in Indonesia will also provide a multiplier effect on national economic development because of its ability to: (1) increase the added value of primary agricultural products, (2) expand the reach of marketing areas, (3) expanding job opportunities and opening up new business opportunities related to downstream agro-industry products such as transportation and marketing services, (4) increasing farmers' income as suppliers of primary agricultural products, (5) as equal partners to farmers, (6) diversifying food products and processed agricultural products both vertically and horizontally, (7) save foreign exchange (substitution materials) and it is possible to increase foreign exchange because processed MSME products can be exported (have comparative and competitive advantages), (8) foster entrepreneurship for stakeholders, (9) build food security and meeting the basic needs of the community, (10) increasing Indonesia's economic competitiveness through the production of food and processed agricultural products that have international quality standards.

To develop downstream agro-industry in the country, various preparations and strategies are needed to be used as guides and enrichment of the capacity of the organizers of the development. For this reason, institutions are needed both at the central and regional levels and even in universities. The creation of inter-sectoral integration carried out by departments at the central level to the regional level in the development of downstream agro-industry is very important and urgent to be implemented. Because with the integration between sectors such as the provision of transportation and communication facilities, communication, clean water facilities, waste handling and others, it can increase productivity, efficiency and quality assurance. Meanwhile, inter-regional integration can reduce the financing of infrastructure development such as roads, electricity distribution networks, telecommunications networks, and clean water distribution and others, and further efficiency will be obtained in their use. The development of downstream agro-industry is a bridge between the industrial sector which has high productivity and the agricultural sector which is the livelihood of most Indonesian people.

The comparative competitiveness of Indonesian cocoa beans is weak when compared to countries in Africa such as Côte d'Ivoire, Ghana, Cameroon and Nigeria. Likewise, the comparative competitiveness of processed cocoa products is still low because the downstream industry for processing cocoa products into ready-to-consume products in Indonesia is not optimal. Indonesia's cocoa trade balance is weaker than that of Ghana, Côte d'Ivoire, Cameroon, Equador, and Nigeria, which are at the stage of export maturity because their domestic market can be fulfilled by the production they produce. However, Indonesia still has a fairly strong market development potential for cocoa products in several countries such as the United States, China, India, Canada, Mexico and Estonia.

In order to increase the export of Indonesian processed cocoa, this can be done by limiting the export of raw cocoa beans while still imposing export duties on cocoa beans. However, to anticipate negative impacts on farmers' revenues, the export duty can be implemented while still providing competitive prices for farmers. According to Hütz-Adams et al. (2016), to strengthen the competitiveness of cocoa production and improving the income of cocoa producers needed: (a) a stable policy and legal framework and specific sector policies; (b) coordination of stakeholders, data collection and research; (c) farmer organizations; (d) good quality extension services; (e) access to high-quality inputs reaching farmers on time and in sufficient amount; and (f) transparency in price setting. In addition, to anticipate the decline in cocoa competitiveness, support is needed to maintain the stability of the export price of Indonesian processed cocoa, among others, by providing incentives or capital assistance and other facilities, especially for export-oriented small processing companies / industries. Meanwhile, to increase the competitiveness of Indonesian processed cocoa in the global market, it can be done by implementing a downstream policy or developing the Indonesian cocoa processing industry which is expected to increase competitiveness by improving product quality and quality. To support this, farmers need to be encouraged to carry out cocoa fermentation by providing incentives so that the quality of cocoa increases. In addition, support for the use of superior varieties of cocoa is also needed to increase productivity so that the continuity of the availability of raw materials for the cocoa processing industry is maintained.

The original contributions presented in the study are included in the article/supplementary materials, further inquiries can be directed to the corresponding author/s.

IF, Wahyudi, and IK contributed to conception and design of the study. AA, RP, and VD organized the database. BR and MMF performed the statistical analysis. IF wrote the first draft of the manuscript. DS, AA, Wahyudi, and RP wrote sections of the manuscript. All authors contributed to manuscript revision, read, and approved the submitted version.

We wish to express our profound gratitude to Ministry of Agriculture, Republic of Indonesia for the financial support in accomplishing this paper.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The authors gratefully acknowledge the Ministry of Agriculture, Republic of Indonesia for the financial support in this research.

Andini, D., Yulianto, E., and dan Fanani, D. (2016). Peningkatan Daya Saing Ekspor Produk Olahan Kakao Indonesia Di Pasar Internasional (Studi pada Ekspor Produk Olahan Kakao Indonesia tahun 2009-2014). Jurnal Administrasi Bisnis 38, 171–175.

Aneani, F., Adu-Acheampong, R., and Sakyi-Dawson, O. (2017). Exploring opportunities for enhancing innovation in agriculture: the case of cocoa (Theobroma cacao L.) production in Ghana. Sust. Agric. Res. 7, 33–53. doi: 10.5539/sar.v7n1p33

Arifin, B. (2013). On the competitiveness and sustainability of the Indonesian agriculture export commodities. ASEAN J. Econ. Manag. Account. 1, 81–100.

Boansi, D. (2013). Export Performance and Macro-Linkages: A Look at the Competitiveness and Determinants of Cocoa Exports, Production and Prices for Ghana. Budapest: Corvinus University of Budapest.

[BPS] Central Bureau of Statistics. (2019). Statistik kakao Indonesia. Jakarta: Central Bureau of Statistics.

Buana, S., and H., Malik, N. (2017). “Analisis Harga Internasional, Nilai Tukar, Dan Konsumsi Kako Amerika Terhadap Daya Saing ekspor Kakao Indonesia,” in Jurnal Ilmu Ekonomi. Cbi.eu. (2020). What Is the Demand for Cocoa on the European Market? Available online at: https://www.cbi.eu/marketinformation/cocoa/~trade-statistics (accessed January 25, 2021).

Fahmid, I. M., Harun, H., Fahmid, M. M., Saadah, and Bustanul, N. (2018). Competitiveness, production, and productivity of cocoa in Indonesia. IOP Conf. Ser. Earth Environ. Sci. 157, 1–6. doi: 10.1088/1755-1315/157/1/012067

FAO (2020). Food and Agriculture Data. Available online at: https://www.fao.org/faostat/en/#data

Hadinata, S. (2020). Analysis of the downstream impact of the cocoa industry in Indonesia. J. Accounting 12, 99–108. doi: 10.28932/jam.v12i1.2287

Harrington, W. L. (2011). The effects of roasting time and temperature on the antioxidant capacity of cocoa beans from Dominican Republic, Ecuador, Haiti, Indonesia, and Côte d'Ivoire (Thesis). University of Tennessee, Knoxville, USA.

Hasibuan, A. M., Nurmalina, R., and Wahyudi, A. (2012a). Analisis kinerja dan daya saing perdagangan biji kakao dan produk kakao olahan Indonesia di pasar internasional. Jurnal Tanaman Industri Penyegar 3, 57–70. doi: 10.21082/jtidp.v3n1.2012.p57-70

Hasibuan, A. M., Nurmalina, R., and Wahyudi, A. (2012b). Pengaruh pencapaian kebijakan penerapan bea ekspor dan gernas kakao terhadap kinerja industri hilir dan penerimaan petani kakao (suatu pendekatan dinamika sistem). Buletin Riset Tanaman Rempah Aneka Tanaman Industri 3, 157–170. doi: 10.21082/jtidp.v3n2.2012.p157-170

Hasibuan, S. M., Nurmalita, R., and Wahyudi, A. (2012c). Analisis kebijakan pengembangan industri hilir kakao (Suatu pendekatan sistem dinamis). Informatika Pertanian 21, 59–67. doi: 10.21082/ip.v21n2.2012.p59-70

Hidayat, M., and Echdar, S. (2018). Tho influence of farmers' entrepreneurship and organizational competence on cacao productivity. Int. J. Sci. Dev. Res. 2, 40–44. doi: 10.31219/osf.io/q58nf

Hütz-Adams, F., Huber, C., Knoke, I., Morazan, P., and Mürlebach, M. (2016). Strengthening the Competitiveness of Cocoa Production and Improving the Income of Cocoa Producers in West and Central Africa. Bonn: SÜDWIND e.V.

ICCO (2018). Quarterly Bulletin of Cocoa Statistics 2017/2018. 44(4). Abidjan: ICCO. doi: 10.1787/int_trade-v2017-4-14-en

Idris, N., Hameed, A. A. A., Niti, M. A., and Arshad, F. M. (2011). Export performance and trade competitiveness of the Malaysian cocoa products. Afr. J. Bu. sManag. 5, 12291–12308. doi: 10.5897/AJBM11.537

Jambor, A., Toth, A. T., and Koroshegyi. (2017). The export competitiveness of global cocoa traders. Agris online Papers Econ. Inform. 9, 27–37. doi: 10.7160/aol.2017.090303

Kolavalli, S., and Vigneri, M. (2011). “Cocoa in Ghana: shaping the success of an economy,” in Yes, Africa Can: Success Stories From a Dynamic Continent, eds P. Chuhan- Pole and M. Angwafo (Washington, DC: World Bank), 201–217. Available online at: http://www.cocoaconnect.org/publication/cocoa-ghana-shaping-success-economy (accessed December 27, 2020).

Kozicka, M., Tacconi, F., Horna, D., and Gotor, E. (2018). Forecasting Cocoa Yields for (2050). Rome: Bioversity International.

Listyati, D., Herman, M., and Aunillah, A. (2014). Prospek dan potensi pengembangan industri kakao di Indonesia. SIRINOV 2, 35–46.

Maulana, A., and Kartiasih, F. (2017). Analisis ekspor kakao olahan indonesia ke sembilan negara tujuan tahun 2000–2014. Jurnal Ekonomi Pembangunan Indonesia 17, 103–117. doi: 10.21002/jepi.v17i2.664

Ministry of Industry (2015). Rencana strategis Kementerian Perindustrian 2015–2019. Available online at: http://www.kemenperin.go.id/download/15478/Rencana-Strategis-KementerianPerindustrian-2015-2019 (accessed December 27, 2020).

Ministry of Industry (2016b). Media Industri Edisi I. Available online at: http://www.kemenperin.go.id/download/11419 (accessed December 27, 2020).

Ministry of Industry. (2016a). Hilirisasi Industri Olahan Kakao Berbuah Manis. Available online at: https://www.kemenperin.go.id/artikel/16610/Hilirisasi-Industri-Olahan-Kakao-Berbuah-Manis (accessed December 27, 2020).

Nauly, D., Daris, E., and Nuhung, I. A. (2014). Daya Saing Ekspor Kakao Olahan Indonesia. Jurnal Agribisnis 8, 11–20. doi: 10.15408/aj.v8i1.5126

Ndubuto, I. N., Agwu, N., Nwaru, J., and Imonikhe, G. (2015). Competitiveness and determinants ff cocoa export from Nigeria. Rep. Opin. 2, 51–54.

Nurhayati, E., Hartoyo, S., and Mulatsih, S. (2019). Analisis pengembangan ekspor pala, lawang, dan kapulaga Indonesia. Jurnal Ekonomi Pembangunan Indonesia 19, 173–190. doi: 10.21002/jepi.v19i2.847

Patunru, A. A., and Rahardja, S. (2015). Trade Protectionism in Indonesia: Bad Times and Bad Policy. Sydney, NSW: The Lowy Institute. Available online at: http://hdl.handle.net/11540/6410 (accessed May 6, 2021).

Purnawijaya, D. C., and Idris, M. (2019). Penerapan SPO (Standar Prosedur Operasional) pasca panen kakao. Jurnal Pembangunan Agribisnis 2, 21–25.

Putra, E. U. (2020). Analysis of Indonesian cocoa product competitiveness in european market. ?????? 61, 207–228. doi: 10.24997/KJAE.2020.61.3.207

Putri, A. S., Sutopo, W., Prihawantara, S., and Matheos, R. C. (2015). “Value chain improvement for the cocoa industry in Indonesia by input-output analysis,” in International MultiConference of Engineers and Computer Scientists 2015, Vol. II (Hong Kong: IMECS).

Rifin, A. (2013). Competitiveness of Indonesia's cocoa beans export in the world market. Int. J. Trade Econ, Fin. 4, 279–281. doi: 10.7763/IJTEF.2013.V4.301

Rifin, A., and Nauli, D. (2013). “The effect of export tax on Indonesia's cocoa competitiveness,” in 57th AARES Annual Conference (Sydney, NSW: Australian Agricultural and Resource Economics Society).

Syadullah, M. (2012). Dampak kebijakan bea keluar terhadap ekspor dan industri pengolahan kakao. Bul Ilmiah Litbang Perdagang 6, 53–68.

UN Comtrade (2020). Cococa Trade Data. Available online at: https://comtrade.un.org/data/.

Keywords: cocoa, competitiveness, industry, downstream, Indonesia

Citation: Fahmid IM, Wahyudi, Salman D, Kariyasa IK, Fahmid MM, Agustian A, Perdana RP, Rachman B, Darwis V and Mardianto S (2022) “Downstreaming” Policy Supporting the Competitiveness of Indonesian Cocoa in the Global Market. Front. Sustain. Food Syst. 6:821330. doi: 10.3389/fsufs.2022.821330

Received: 24 November 2021; Accepted: 02 May 2022;

Published: 01 June 2022.

Edited by:

Rosalind Malcolm, University of Surrey, United KingdomReviewed by:

Viswanathan Pozhamkandath Karthiayani, Amrita Vishwa Vidyapeetham, IndiaCopyright © 2022 Fahmid, Wahyudi, Salman, Kariyasa, Fahmid, Agustian, Perdana, Rachman, Darwis and Mardianto. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Resty Puspa Perdana, cmVzdHlwdXNwYXBlcmRhbkBnbWFpbC5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.