- Agribusiness Management Department, Central University, Accra, Ghana

Many developing countries have embraced policies to attract foreign direct investment into their respective economies including the agricultural sector to enhance technology transfer, employment, and trade among other benefits. On the other hand, foreign direct investment into the agricultural sector has been associated with competition with local agricultural produce from imported raw and processed products and land grabbing that has deprived farmers of land for cultivation. These could have implications for the investment and employment of indigenes in the agricultural sector and consequently welfare. This raises the question, does agricultural foreign direct investment promote or discourage welfare? In this paper, we assessed the welfare effects of agricultural foreign direct investment in developing countries. Using an unbalanced panel data of 51 developing countries from 1990 to 2019 with a fixed-effects estimator, we found that agricultural foreign direct investment promotes welfare in developing countries. Openness to trade, population growth, human capital, and infrastructure enhanced welfare. Whilst government expenditure did not promote welfare, inflation did not affect welfare. Whilst promoting foreign direct investment into agriculture, governments in developing countries must improve human capital, develop infrastructure, and pursue trade openness policies. Final government expenditure on goods and services needs to be redirected into funding projects and programmes that improve the health, education, and income of citizens, especially the poor.

Introduction

Agriculture provides food and nutrition for humans and raw materials for industry (Djokoto, 2021a). In 2018, the agricultural sector represented 4 per cent of global gross domestic product (GDP) and in some developing countries, agriculture contributed more than 25% of GDP (World Bank, 2021). The agricultural sector's growth is up to two and four times more effective in increasing wealth among the poorest compared to other sectors (Djokoto, 2021a,b; World Bank, 2021). In 2016, 65% of poor working adults made a living through agriculture (Djokoto, 2021a,b; World Bank, 2021). Thus, developing agriculture is one of the most potent tools for ending extreme poverty, enhancing shared prosperity and feeding a projected 9.7 billion people by 2050 (Djokoto, 2021a,b; World Bank, 2021). To develop agriculture through investment accumulation, technology transfer and job creation (De Mello Jr, 1997; Kosova, 2010; Farla et al., 2016), developing countries have pursued policies to attract foreign direct investment into their respective economies including the agricultural sector. These have been possible through granting of fiscal incentives that have been costly to the economies. The resources could have been channeled into increasing the social services budget and supporting domestic producers. Foreign direct investment in agriculture has also resulted in land grabs in developing countries (Deming, 2011; Escresa, 2014; Häberli, 2014; Byerlee et al., 2015; Fraser, 2019). Aside from the deprivation farmers suffer, the entry of foreigners to the land market has implications for increasing rent to levels those indigenous farmers may be unable to afford their desired acreages. Considering the benefits and the costs, does foreign direct investment into agriculture in developing countries promote welfare?

People are the ultimate of any economy. Thus, the people and their capabilities are crucial in determining welfare. A broader measure of welfare the Human Development Index (HDI) is a summary measure of average achievement in key dimensions of human development; namely, a long and healthy life, knowledge and having a decent standard of living. The HDI is the geometric mean of normalized indices for each of the three dimensions (UNDP, 2021).

Djokoto et al. (2022) studied the effect of food manufacturing foreign direct investment on welfare and found a positive influence on human development. Hossain et al. (2019) and Reiter and Steensma (2010) also studied the effect of foreign direct investment on welfare. Using the human development index as the welfare indicator, they found that foreign direct investment had a positive effect on welfare in developing countries. Whilst these studies focused on developing countries, the data related to the total economy, except Djokoto (2022) used food manufacturing foreign direct investment. Given the importance of agriculture alluded to earlier, this paper contributes to the literature by focusing on the welfare effect of agricultural foreign direct investment in developing countries which to the best of our knowledge has not been studied.

As most of the poor make a living from agriculture which ironically holds the key to lifting them out of poverty (Djokoto, 2021a,b; World Bank, 2021), the role of financing agriculture through foreign direct investment on welfare should be relevant. The outcome regarding the control variables would add to the existing body of knowledge on the role of macroeconomic indicators on welfare. Among others, these should be useful for meta-analysis, a secondary analysis, which has gained prominence in recent times (Glass, 1976; Poot, 2012; Djokoto et al., 2020).

The next section presents the theoretical and empirical literature on foreign direct investment and welfare. This is followed by the data and modeling. In section 4, the results of the analysis are presented and discussed. Conclusions and recommendations constitute section 5.

Literature Review

Theoretical Review

The theoretical review addresses the theoretical foundations of foreign direct investment as well as the effect of foreign direct investment on welfare. Dunning (2001) “….have frequently asserted that no single theory can be expected to satisfactorily encompass all kinds of foreign-owned value-added activity simply because the motivations for, and expectations from, such production vary a great deal” (Page 176). Thus, some theories explain the inflow of foreign direct investment (Vernon, 1966; Knickerbocker, 1973; Hymer, 1976; Dunning, 1988, 2001; Djokoto, 2021b). The theory of internationalization notes the consideration of foreign direct investment and exporting over franchising as a pathway for entering an external market (Hymer, 1976; Djokoto, 2021b). This consideration of foreign direct investment and exporting has been informed by a drawback. Some of the knowledge used by multinational firms cannot be licensed whilst, doing so in other cases would mean loss of control.

The second perspective is founded on oligopolistic theory (Knickerbocker, 1973). In oligopolistic theory, there is interdependence among major players in an industry. The interdependence stretches into the imitation of each other's foreign direct investment strategy (Djokoto, 2021b). Thus, a follower firm would imitate a leader firm that invests abroad. Vernon (1966) explained foreign direct investment inflow within the product life cycle framework. Firms enter a foreign market at stages in the life cycle of the product they developed (Vernon, 1966; Djokoto, 2012, 2021b). Having developed the product in the developed country, they invest in other advanced countries when local demand in those countries grows large enough to support local production (Djokoto, 2012, 2021b). When product standardization sets in and market saturation crystalise, these would give rise to price competition and cost pressures. As a response, production will be moved to developing countries. This is because investment in developing countries is seen as the best way to reduce costs (Djokoto, 2012, 2021b).

The third perspective and perhaps the most celebrated theory of foreign direct investment is the ownership, location, and internalization (OLI) paradigm. Also known as the eclectic paradigm, it posits that ownership, location, and internalization explain the extent, spatial, and business composition of foreign manufacturing embarked on by a multinational corporation (MNE) (Dunning, 1988, 2001, 2015; Djokoto, 2021b). The ownership (O) relates to technology, know-how, resources, or some other form of income-generating asset(s). The natural capabilities or created endowments in the foreign country that can be used together with the ownership merits represent the location (L) merits. The internalization (I) portends possessing or having command over these value-adding activities (Dunning, 1988, 2001, 2015; Djokoto, 2021b). Although the underpinning theories of foreign direct investment take a microeconomic and business perspective, these are valuable in explaining macroeconomic (agriculture sector) behavior. Suffice it to state that it is the aggregation of (agricultural) firms that constitute the agricultural sector of the macroeconomy.

Regarding the effect of foreign direct investment on welfare, the early studies on welfare used incomes and commodities to assess a person's advantage, misery, and deprivation (Sen, 1987, 1992). However, other socioeconomic indicators are known to contribute to the general enhancement of the quality of life of persons (Sen, 1987, 1992, 1997, 1998). Thus, the focus has been shifted to dimensions people have reason to value intrinsically (Sen, 1987, 1992; Kaukab and Surwandono, 2021). These include good health and education.

Technological progress is the driving force for sustained economic growth (Solow, 1956; Sharma and Gani, 2004). As foreign direct investment encourages technological integration with local input, it promotes cooperation with local enterprises and helps human resources development. Given that foreign direct investment contributes to technology transfer, it is intrinsically linked to growth and development hence welfare. This is manifested through the creation of the enabling environment for a country with low technology with limited human and organizational resources to play catch up (Menon, 2013; Kaukab and Surwandono, 2021). Therefore, foreign direct investment effects on human, physical and employment resources will lead to human development (Mustafa et al., 2017; Kaukab and Surwandono, 2021). As noted earlier, foreign direct investment contributes to employment creation, skill development, income generation and technological improvements, thus, it would enhance the wellbeing of recipient countries.

Empirical Review

In the absence of empirical literature on the effect of agricultural foreign direct investment on welfare or human development, the review focuses on the foreign direct investment of the total economy on welfare. The pertinent literature on the effect of foreign direct investment on welfare, measured using the human development index has covered developing countries (Reiter and Steensma, 2010; Ngo, 2021; Djokoto et al., 2022), Africa (Gohou and Soumaré, 2012; Agbloyor, 2019; Atitianti and Dai, 2021), sub-Saharan Africa (Ganiyu, 2016; Aloui, 2019; Adegboye et al., 2021; Atitianti and Dai, 2021; Ranjkeshan, 2021), the Middle East and North Africa (MENA) (Kolster, 2015; Ganiyu, 2016) and specific countries; Cote d'Ivoire (Allou et al., 2020) and Nigeria (Evans and Kelikume, 2018). As expected, all the studies used panel data except Allou et al. (2020) and Evans and Kelikume (2018). The estimators for fitting the panel data included generalized least squares (Adegboye et al., 2021), Prais-Winsten GLS (Agbloyor, 2019), and the generalized method of moments (De Groot, 2014; Kolster, 2015; Ranjkeshan, 2021).

Foreign direct investment enhanced welfare in developing countries (Reiter and Steensma, 2010; Ngo, 2021; Djokoto et al., 2022), Africa (Gohou and Soumaré, 2012), sub-Saharan Africa (Ganiyu, 2016), Middle East and North Africa (Kolster, 2015; Hamdi and Hakimi, 2022), and Cote d'Ivoire (Allou et al., 2020). Allou et al. (2020) explained that investment in health, education, agriculture, infrastructures, and information and communications technology, have improved the human development index which, in aggregate, improved social welfare. Ganiyu (2016) observed that foreign investment creates more jobs, develops local skills, and stimulates technological progress, thereby improving welfare.

However, Ranjkeshan (2021) for sub-Saharan Africa and Adegboye et al. (2021) for western sub-Saharan Africa have shown that foreign direct investment does not promote welfare. They explained that the countries in sub-Saharan Africa do not have sufficient social capabilities to absorb the benefits of foreign direct investment. Also, high levels of corruption did not allow the effect of foreign direct investment to be transmitted to the poor.

Evans and Kelikume (2018), Aloui (2019), and Adegboye et al. (2021) have reported no effect of foreign direct investment on welfare, respectively for sub-Saharan Africa, central, eastern, and southern sub-Saharan Africa; and Nigeria, respectively. Agbloyor (2019) noted that the concentration of foreign direct investment in sectors such as oil that do not transit to the wider economy accounts for the no effect of foreign direct investment on welfare. Aloui (2019) attributed the non-effect to terrorism and militancy.

Hamdi and Hakimi (2022) and Agbloyor (2019) found a positive effect of trade on welfare. Agbloyor (2019) explained that an open economy allows countries to export what they have and import what they need. Evans and Kelikume (2018), Djokoto et al. (2022) and Ranjkeshan (2021) however, reported the neural effect of trade on welfare.

Inflation is known to reduce the purchasing power of consumers. Agbloyor et al. (2013) and Ganiyu (2016) found a negative effect of inflation on welfare in sub-Saharan African countries. Whilst Aloui (2019), Djokoto et al. (2022) and Hamdi and Hakimi (2022) found a positive effect in sub-Saharan Africa, developing countries and MENA respectively, Ranjkeshan (2021) and Gohou and Soumaré (2012) found a neutral effect for sub-Saharan Africa and Africa, respectively. It is worth noting that the data used by Ganiyu (2016) spanned 1990 to 2013 and was estimated by fixed effects whilst Aloui (2019) used data from 1996 to 2014 estimated with the general method of moments. The time series was wider for the data used by Ranjkeshan (2021) - 1990–2019 and shortest for Gohou and Soumaré (2012)−1990 to 2007.

Population growth was negatively and significantly related to welfare suggesting that an increase in population would lead to a reduction in welfare (Agbloyor, 2019; Djokoto et al., 2022). This was attributed to competition for the limited resources in resource-poor Africa.

Human capital enhanced welfare (Ganiyu, 2016; Agbloyor, 2019; Djokoto et al., 2022). Ganiyu (2016) explained that the higher a country's quality of human capital, the more likely the country would attract resource seeking (human resource) investors, and the more the spillover effect for better welfare. Agbloyor (2019) added that policies that promote education, health and income positively impact welfare.

The government's final expenditure on goods and services on welfare was found to be negative (Aloui, 2019) whilst Kolster (2015) reported a positive sign. Djokoto et al. (2022) and Gohou and Soumaré (2012) however, reported a neutral effect on welfare.

Gohou and Soumaré (2012), Kolster (2015), and Djokoto et al. (2022) found a positive effect of infrastructure on welfare. The former was measured as the number of kilometers of paved roads per 100 inhabitants whilst the latter measured infrastructure as the number of fixed and mobile phone subscriptions per 100 inhabitants. New infrastructure improves the standard of living and contributes to the overall sense of wellbeing (Gohou and Soumaré, 2012; Kolster, 2015).

Foreign resources have been invested in land acquisition, irrigation facilities, machinery, technology deployment and recurrent expenditure. As noted in the introduction, the effects of these investments are reflected in employment, increase in resources deployment. For agriculture, the availability of food as well as increased foreign exchange from export of the products are relevant. FDI in agriculture has been found to impact measures such as food security (Slimane et al., 2016), agricultural real GDP (Chaudhuri and Banerjee, 2010; Epaphra and Mwakalasya, 2017), agricultural real GDP growth (Awunyo-Vitor and Sackey, 2018) and employment (Ablo and Boadu, 2020).

The empirical literature shows that the effect of control variables on welfare such as inflation, human capital, government expenditure, and trade is mixed. So is the welfare effect of foreign direct investment. This evidence, however, relates to the total economy and not agriculture. Those that relate to agriculture used measures of welfare that are less inclusive. The use of the inclusive measure of welfare human development index, for agriculture in developing countries is unknown. This study fills the void.

Data and Methods

Data

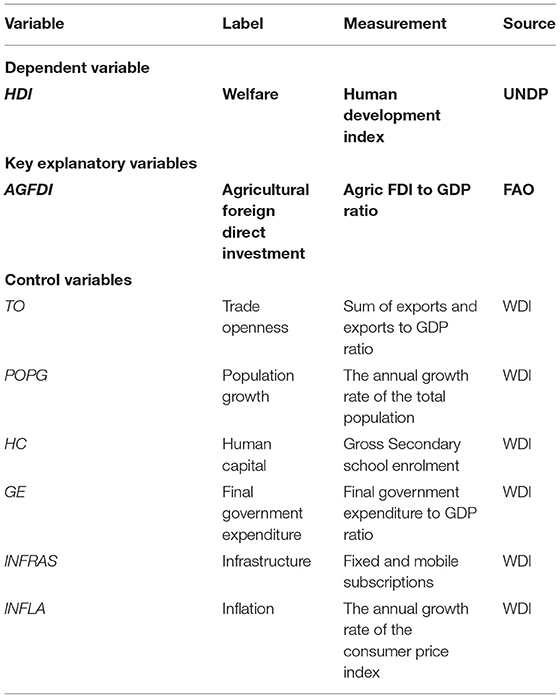

The data used in the study is an unbalanced panel of 51 developing countries from 1990 to 2019. Some reasons account for the unbalanced panel. First, we used the unbalanced panel because data availability did not permit a balanced panel. Second, the data is unbalanced because not all countries included in the data reported agricultural foreign direct investment data over the 1990–2019 period. Indeed, the reporting of agricultural foreign direct investment data by FAOSTAT is a recent development. Thirdly, where the agricultural foreign direct investment data was available, the absence of data on any control variable resulted in dropping all data for that year. Finally, regarding secondary data, the availability depends on the level of reporting by countries. This is not only hampered by conflict situations, but also by logistic concerns. As the exclusion of some years (causing the unbalanced panel) is not consistent, the unbalanced character of the data is not problematic (Kastratović, 2019). Nevertheless, the use of the unbalanced panel in the developing country international agricultural economics literature (Kastratović, 2019; Wardhani and Haryanto, 2020; Djokoto, 2021a,b) and welfare literature (Jarvis, 1988; Wiksadana and Sihaloho, 2021) are not uncommon. The developing countries are listed in the Appendix. The data originated from three sources: the Food and Agricultural Organization (FAO), United Nations Development Programme (UNDP) and World Development Indicators (WDI) of the World Bank (Table 1).

Model

Following the study objectives and existing literature (Reiter and Steensma, 2010; Gohou and Soumaré, 2012; De Groot, 2014; Kolster, 2015; Ganiyu, 2016; Aloui, 2019; Allou et al., 2020; Adegboye et al., 2021; Atitianti and Dai, 2021; Ngo, 2021; Ranjkeshan, 2021; Djokoto et al., 2022; Hamdi and Hakimi, 2022),

Equation 1 can be specified as

Where αk are parameters to be estimated, i is the number of countries and t is the time in years. The variables are defined in Table 1. Among the control variables, only TO has an agricultural parallel. The agricultural TO was not used because all the control variables ought to match the HDI in scope. Equation 2 is a general specification of the models to be estimated.

Modeling and Estimation

With 622 observations and 51 developing countries, the average number of years is 12. This makes the cross-section (N) greater than the time series (T). Following this, time-series effects such as unit roots and cointegration were not anticipated to be a challenge to address. Rather, the focus was on the cross-section dimension of the data. Consequently, panel fixed effect and random effect estimators were applied to the data. The choice between the fixed effects and random effects was accomplished using the Hausman test (Durbin, 1954; Wu, 1973; Hausman, 1978). Tests for some violations of the classical regression assumptions; homoscedasticity (Greene, 2000; Baum, 2001), non-serial correlation (Wooldridge, 2002; Drukker, 2003), non-correlated covariates (Hsiao, 2014; Baltagi, 2021) and specification (Ramsey, 1969; Asteriou and Hall, 2015) were performed.

Results and Discussions

Background of the Data

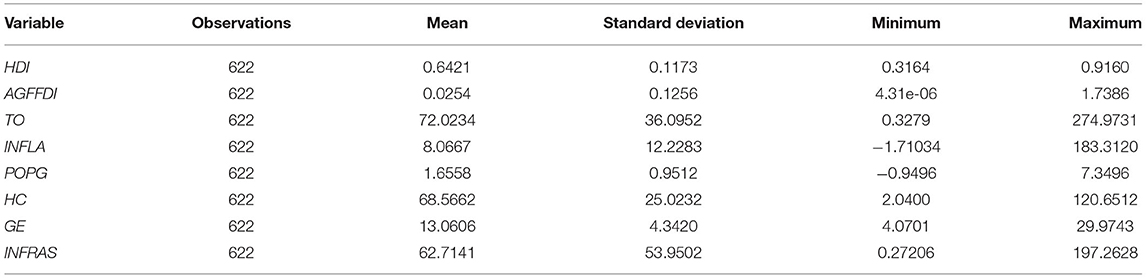

The HDI range from a low of 0.3164–0.9160, averaging at 0.6421 (Table 2). The low standard deviation suggests a low spread of the observations around the mean. Thus, the size and statistical significance of the coefficients would depend largely on the variations in the explanatory variables. The size of the standard deviation of AGFDI, 0.1256, is higher than that of the mean, 0.0254. This is indicative of the overdispersion of AGFDI. The statistics of INFLA are similar. The means of TO, POPG, HC GE and INFRAS exceed their respective standard deviations.

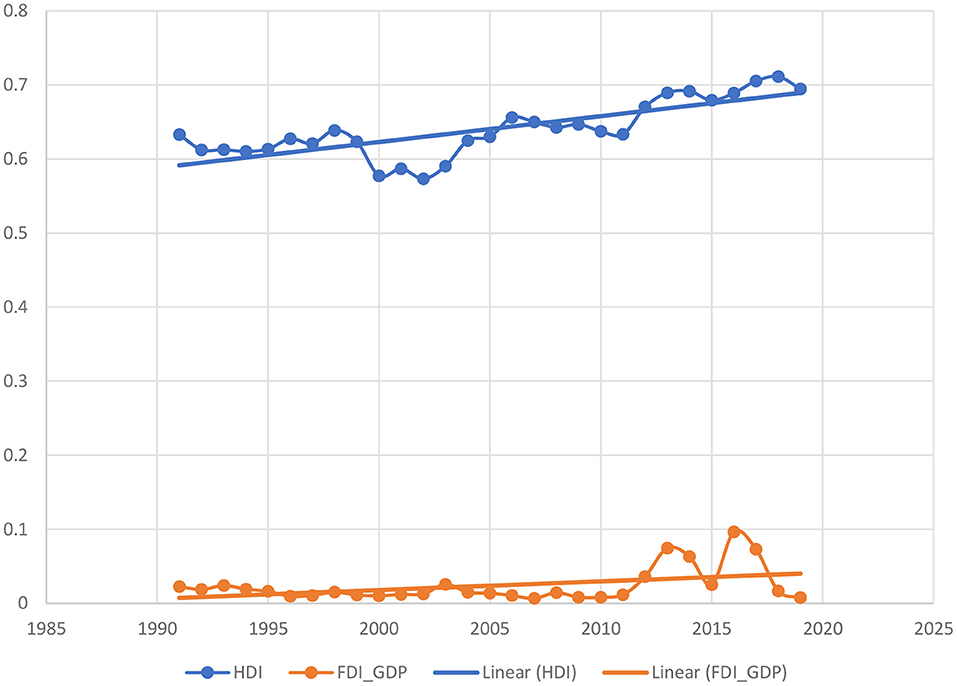

A time-path of HDI and agricultural foreign direct investment shows that HDI remained largely within the 0.6 and 0.7 bands, except drops below the 0.6 level in 2000–2003 and above 0.7 in 2017–2018 (Figure 1). Whilst the 0.6 – 0.7 band fall within the medium human development category (UNDP, 2021; Djokoto, 2022), 0.7 and above is within the high human development. The trend is rising over time. The FDI_GDP has been closer to the zero mark than 0.1 over the period 1992–2011, however, there were marked gyrations between 2012 and 2019. The FDI_GDP also show a rising trend. The rising trend of both the HDI and GDI_GDP is an indication of the joint movement of the two variables over time.

Results

For the Hausman tests, null hypotheses that states that the ‘difference in coefficients not systematic' was rejected for models 1–2, 4–6 and 8. This implied the difference between the fixed effects and the estimates of the random effects was systematic, hence the use of the fixed effects estimator (Durbin, 1954; Wu, 1973; Hausman, 1978). Regarding models 3 and 8, the null hypotheses that state that the ‘difference in coefficients not systematic' could not be rejected. Therefore, the random-effects model was appropriate. In the case of the Wooldridge serial correlation test, the null hypothesis that there is no first-order autocorrelation was rejected for each of the models. This implied that the errors were serially correlated at least in the first order (Hsiao, 2014; Baltagi, 2021). We employed a modified Wald test for the groupwise heteroskedasticity in the fixed effect regression models. And an alternative test for the RE models. The null hypothesis that the variances are the same for all the cross-sections was rejected. Thus, there was heteroscedasticity in all the models (Greene, 2000; Baum, 2001). The serial correlation was corrected using the pooled ordinary least squares whilst the heteroscedasticity was resolved using Driscoll-Kraay standard errors (Driscoll and Kraay, 1998; Hoechle, 2007) for the FE models. In the case of the RE models, we used the Prais-Wisten regression that can account for the stated violations in the RE models.

The F and the Wald statistics showed that the explanatory variables jointly explained the variation in the human development index for all the models. The R squared was high for most of the models. The highest variance inflation factors were below 5. This was way below the conservative 10.00 (Belsley et al., 1980; Greene, 1993; O'brien, 2007; Wooldridge, 2009).

The Ramsey RESET test seeks to show whether the appropriate specification of the model has been estimated. This test is tantamount to an omitted variable test. Consequently, the test uses the powers of the fitted values of the dependent variable, the human development index in this case. Specifically, the null hypothesis that each of the models has no omitted variables is rejected. Thus, the models were mis-specified except model 7. The resolution of the misspecification required including powers of the prediction of the dependent variable as additional explanatory variables as shown in Table 3. The statistical significance of the coefficients of the powers of the prediction of the dependent variable indicated the misspecification had indeed been accounted for.

It must be noted that the fixed effect in Table 3 is the country fixed effect. The pooled ordinary least squares account for the correction for serial correlation as shown in Table 3. All the models corrected for the violations tested are presented in Table 3. The size of the observations and the number of explanatory variables show that the hypothesis test of the statistical significance of the estimates of the coefficients has a high degree of freedom. Thus, these estimates must be sufficiently efficient.

Irrespective of the control variable used for the robustness checks, the coefficient of AGFDI is positive and statistically significant. The coefficients of the control variables were also similar across models in respect of magnitude and statistical significance. These suggest the consistency and robustness of the estimates across models. All the coefficients were positive except that for GE and INFLA. All the coefficients were also statistically significant except that of INFLA.

Discussions

Model 7 was chosen for discussion as this model contained all the control variables identified in our empirical review. The t-test statistic of AGFDI in model 7 in Table 3 shows the null hypothesis that the coefficient of AGFDI for developing countries is statistically indistinguishable from zero is rejected. Coupled with the positive sign of the coefficient, agricultural foreign direct investment has a positive effect on welfare. A one US dollar increase in agricultural foreign direct investment would induce a 0.1400 unit increase in the human development index. Agriculture is a source of food and nutrition for households and provides raw materials for industry. Other industries provide services to agriculture from the input end through production to the output end of the value chain. Indeed, agriculture contributes significantly to the economies of developing countries. More than 4 per cent of global gross domestic product is accounted for by agriculture whilst representing more than 25% of the gross domestic product in some developing countries (Djokoto, 2021a,b; World Bank, 2021). Foreign direct investment into the agricultural sector is expected to contribute to investment in the domestic economies, create more jobs, develop local skills, and stimulate technological progress thereby contributing to increased food production. World Bank (2021) and Djokoto (2021a,b) noted that agriculture is up to four times more effective in increasing wealth among the poor, unlike other sectors.

Increased food production could reduce food prices and curtail food price inflation. These would improve the human development index which, in aggregate, improves social welfare. Gohou and Soumaré (2012) and Ranjkeshan (2021) noted that foreign direct investment has a greater impact on poverty reduction the poorer and the less developed the country is although richer countries benefit more in absolute terms. Kennedy et al. (2012) noted that foreign direct investment influences spillovers that increase the threshold of human capital thereby accentuating an improved standard of living. The empirical evidence of Reiter and Steensma (2010); Gohou and Soumaré (2012); Kolster (2015); Aloui (2019); Allou et al. (2020); Atitianti and Dai (2021); Ngo (2021), and Djokoto et al. (2022) are consistent with the result of this study. The negative effect of foreign direct investment on welfare (Ranjkeshan, 2021) and neutral effects (Agbloyor, 2019; Aloui, 2019) are inconsistent with the outcome of this study.

Trade provides the opportunity for countries to export what they have and import what they need thereby improving welfare (Agbloyor, 2019). Developing countries are large exporters of primary products, especially agricultural products. And they import machinery to support their agricultural sectors among other sectors. These make trade important to these countries. These explain the statistically significant positive coefficient for the openness to trade variable, TO. The finding of the current study is consistent with empirical evidence from Agbloyor (2019), Adegboye et al. (2021), and Hamdi and Hakimi (2022). Our finding is inconsistent with the prior evidence of Evans and Kelikume (2018), Ranjkeshan (2021), and Djokoto et al. (2022).

The coefficient of population growth (POPG) is also statistically significantly positive. This is inconsistent with the conclusions of Agbloyor (2019) and Djokoto et al. (2022) who explained that an increase in population would lead to competition for limited resources which would lead to a reduction in welfare.

Human capital (HC) was used as a proxy for education. The null hypothesis that the coefficient of HC is statistically indistinguishable from zero was rejected. Thus, the coefficient of HC is statistically significantly different from zero. The statistically significant and positive coefficient is unsurprising as education is part of the HDI. Education provides the opportunity for citizens to access information in general including those on disease prevention and cure. Also, education, both formal and informal provides knowledge and skills that are necessary for employment. Indeed, technology adoption is known to be positively correlated with education (Tovignan and Nuppenau, 2004; Genius et al., 2006; Kassie et al., 2009; Mzoughi, 2011; Latruffe and Nauges, 2014). Educated persons are thus able to access technology that can enhance livelihoods and hence welfare. Our finding is consistent with the conclusions of Ganiyu (2016), Agbloyor (2019), Adegboye et al. (2021), and Djokoto et al. (2022).

The coefficient of the final government expenditure on welfare is negative. This is in line with the pertinent literature (Aloui, 2019). Government expenditure may not have been adequately directed to projects and programmes that would improve health, education, and livelihood (income), the components of the HDI. Kolster (2015) however, found a positive effect. Gohou and Soumaré (2012), Ganiyu (2016), and Djokoto et al. (2022). reported a neutral effect of GE on welfare.

Infrastructure is the fulcrum around which economic activities revolve. Thus, it is not surprising that the coefficient of INFRAS is positive and statistically significantly distinguishable from zero. As Gohou and Soumaré (2012) and Kolster (2015) had explained, infrastructure improves the standard of living and contributes to the overall sense of wellbeing. The finding of a positive effect of infrastructure is also consistent with the findings of Adegboye et al. (2021) for central, eastern, and western sub-Saharan Africa and Djokoto et al. (2022) for developing countries.

The sign of the coefficient of INFLA is negative whilst the magnitude is statistically insignificant. This implies that inflation does reduce welfare, but the effect is not significant. The sign means that inflation reduces the purchasing power of consumers. This would have reduced how much education and health services could be consumed. Consequently, Ganiyu (2016) reported a negative effect of inflation on welfare in line with our findings. Whilst the findings of Gohou and Soumaré (2012), De Groot (2014), Kolster (2015), Agbloyor (2019), Ranjkeshan (2021), and Djokoto et al. (2022) found a negative and statistically significant effect of inflation of welfare, Aloui (2019) reported a positive effect of inflation on welfare.

Conclusions and Recommendation

Notwithstanding the positive role of foreign direct investment in general and in the agricultural sector, foreign direct investment into agriculture is known to have negative effects including land grabs. Also, there is limited evidence on the effect of agricultural foreign direct investment on welfare. In this paper, we assessed the welfare effects of agricultural foreign direct investment in developing countries. Using an unbalanced panel data of 51 developing countries from 1990 to 2019 with a fixed-effects estimator (with country and year effects), we found that agricultural foreign direct investment promotes welfare in developing countries. Openness to trade, population growth, human capital, and infrastructure enhanced welfare in developing countries. Whilst government expenditure does not promote welfare, inflation had no discernible effect on welfare in developing countries. Whilst promoting foreign direct investment into agriculture, governments in developing countries need to increase investment in infrastructure, and education and promote trade if they wish to promote the welfare of their citizens. Final government expenditure on goods and services should be invested in projects and programmes that promote health, education, and increased livelihoods (income).

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary materials, further inquiries can be directed to the corresponding author.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ablo, A. D., and Boadu, R. (2020). Assessing foreign direct investment (FDI) in agriculture and employment in rural Ghana. Ghana Soc. Sci. J. 17, 25.

Adegboye, F. B., Adesina, O. S., Olokoyo, F. O., Ojeka, S., and Akinjare, V. A. (2021). The impact of trade openness and foreign direct investment on economic welfare in sub-Saharan Africa. Int. J. Financ. Res. 12, 389–400. doi: 10.5430/ijfr.v12n2p389

Agbloyor, E. K. (2019). Foreign direct investment, political business cycles and welfare in Africa. J. Int. Dev. 31, 345–373. doi: 10.1002/jid.3408

Agbloyor, E. K., Abor, J., Adjasi, C. K. D., and Yawson, A. (2013). Exploring the causality links between financial markets and foreign direct investment in Africa. Res. Int. Bus. Finance 28, 118–134. doi: 10.1016/j.ribaf.2012.11.001

Allou, E. J., Adeleye, B. N., Cheng, J., and Abdul, R. (2020). Is there a nexus between China outward foreign direct investment and welfare in Côte d'Ivoire? Empirical evidence from the Toda–Yamamoto procedure. Afr. Dev. Rev. 32, 499–510. doi: 10.1111/1467-8268.12456

Aloui, Z. (2019). The Impact of Foreign Direct Investment and the Institutional Quality on Welfare in Latin America and Sub-saharan Africa. MPRA Paper No. 95484. Available online at: https://mpra.ub.uni-muenchen.de/95484/ (accessed May 30, 2021)

Asteriou, D., and Hall, S. G. (2015). Applied Econometrics. Macmillan International Higher Education.

Atitianti, P. A., and Dai, Q. (2021). Does Chinese Foreign Direct Investment Improve the Welfare of Africans? J. Afr. Bus. 1–20. doi: 10.1080/15228916.2021.1969192

Awunyo-Vitor, D., and Sackey, R. A. (2018). Agricultural sector foreign direct investment and economic growth in Ghana. J. Innov. Entrep. 7, 1–15. doi: 10.1186/s13731-018-0094-3

Baum, C. F. (2001). Residual diagnostics for cross-section time series regression models. Stata J. 1, 101–104. doi: 10.1177/1536867X0100100108

Belsley, D. A., Kuh, E., and Welsch, R. E. (1980). Regression Diagnostics: Identifying Influential Data and Sources of Collinearity. New York: Wiley.

Byerlee, D., Masters, W. A., and Robinson, D. (2015). “Investment in land development: An overlooked dimension of the land grab discourse on frontier agriculture,”. In Pre-Conference Workshop on Agro-holdings and Other Types of Mega-farming Operations at the 29th International Conference of Agricultural Economists. (Milan).

Chaudhuri, S., and Banerjee, D. (2010). FDI in agricultural land, welfare and unemployment in a developing economy. Res. Econ. 64, 229–239. doi: 10.1016/j.rie.2010.05.002

De Groot, O. J. (2014). Foreign Direct Investment and Welfare. United Nations Production Development Series.

De Mello Jr, L. R. (1997). Foreign direct investment in developing countries and growth: a selective survey. J. Dev. Stud. 34, 1–34. doi: 10.1080/00220389708422501

Deming, K. (2011). Food and the feminization of agriculture: Land grab practices and the future of food in Jordan. Washington University Senior Honors Thesis Abstracts (WUSHTA) 3, 92.

Djokoto, J. G. (2012). An investigation of the determinants of inward foreign direct investment flow into Ghana's agricultural Sector. Pentvars Bus. J. 6, 19–37.

Djokoto, J. G. (2021a). Drivers of agricultural foreign divestment. Stud. Agric. Econ. 123, 43–51. doi: 10.7896/j.2114

Djokoto, J. G. (2021b). Foreign direct investment into agriculture: does it crowd-out domestic investment? Agrekon 60, 176–191. doi: 10.1080/03031853.2021.1920437

Djokoto, J. G. (2022). The investment development path and human development: is there a nexus?. Res. Glob. 4, 100079. doi: 10.1016/j.resglo.2021.100079

Djokoto, J. G., Gidiglo, F. K., Srofenyo, F. Y., and Agyeiwaa-Afrane, A. (2022). Human Development Effects of Food Manufacturing Foreign Direct Investment. Int. J. Food Agric. Econ. 10, 23–39. doi: 10.12688/f1000research.28681.2

Djokoto, J. G., Gidiglo, F. K., Srofenyoh, F. Y., Agyei-Henaku, K. A. A. O., Arthur, A. A. A., and Badu-Prah, C. (2020). Sectoral and spatiotemporal differentiation in technical efficiency: a meta-regression. Cogent Econ. Finance 8, 1773659. doi: 10.1080/23322039.2020.1773659

Driscoll, J. C., and Kraay, A. C. (1998). Consistent covariance matrix estimation with spatially dependent panel data. Rev. Econ. Stat. 80, 549–560. doi: 10.1162/003465398557825

Drukker, D. M. (2003). Testing for serial correlation in linear panel-data models. Stata J. 3, 168–177. doi: 10.1177/1536867X0300300206

Dunning, J. H. (1988). The eclectic paradigm of international production, a restatement and some possible extensions. J. Int. Bus. Stud. 24, 49–60. doi: 10.1057/palgrave.jibs.8490372

Dunning, J. H. (2001). The eclectic (OLI) paradigm of international production: past, present and future. Int. J. Econ. Bus. 8, 173–190. doi: 10.1080/13571510110051441

Dunning, J. H. (2015). The eclectic paradigm of international production: a restatement and some possible extensions. Eclect. Paradigm 50–84. doi: 10.1007/978-1-137-54471-1_3

Epaphra, M., and Mwakalasya, A. (2017). Analysis of foreign direct investment, agricultural sector and economic growth in Tanzania. Mod. Econ. 8, 111–140. doi: 10.4236/me.2017.81008

Escresa, L. (2014). Comment on Christian Häberli foreign direct investment in agriculture: land grab or food security improvement? Econ. Anal. Int. Law 305.

Evans, O., and Kelikume, I. (2018). The effects of foreign direct investment, trade, aid, remittances and tourism on welfare under terrorism and militancy. Int. J. Manag. Econ. Soc. Sci. 7, 206–232. doi: 10.32327/IJMESS.7.3.2018.14

Farla, K., De Crombrugghe, D., and Verspagen, B. (2016). Institutions, foreign direct investment, and domestic investment: crowding out or crowding in? World Dev. 88, 1–9. doi: 10.1016/j.worlddev.2014.04.008

Fraser, A. (2019). Land grab/data grab: precision agriculture and its new horizons. J. Peasant Stud. 46, 893–912. doi: 10.1080/03066150.2017.1415887

Ganiyu, I. A. (2016). Foreign Direct Investment and Welfare: Evidence from Sub-Saharan Africa (Doctoral dissertation, University of Ghana).

Genius, M., Pantzios, C. J., and Tzouvelekas, V. (2006). Information acquisition and adoption of organic farming practices. J. Agric. Resou. Econ. 31, 93–113.

Glass, G. V. (1976). Primary, secondary, and meta-analysis of research. Educ. Res. 5, 3–8. doi: 10.3102/0013189X005010003

Gohou, G., and Soumaré, I. (2012). Does foreign direct investment reduce poverty in Africa and are there regional differences? World Dev. 40, 75–95. doi: 10.1016/j.worlddev.2011.05.014

Häberli, C. (2014). Foreign direct investment in agriculture: Land grab or food security improvement. Econ. Anal. Int. Law 283–303.

Hamdi, H., and Hakimi, A. (2022). Trade openness, foreign direct investment, and human development: a panel cointegration analysis for MENA countries. Int. Trade J. 36, 219–238.

Hausman, J. A. (1978). Specification tests in econometrics. Econometrica 46, 1251–1271. doi: 10.2307/1913827

Hoechle, D. (2007). Robust standard errors for panel regressions with cross-sectional dependence. Stata J. 7, 281–312. doi: 10.1177/1536867X0700700301

Hossain, M. S., Kamal, M. S., Halim, M. R., and Zayed, N. M. (2019). Inward foreign direct investment and welfare nexus: the impact of foreign direct investment on welfare in developing countries. Int. J. Econ. Financ. Issues 9, 228. doi: 10.32479/ijefi.8465

Hymer, S. H. (1976). The International Operation of National Firms, A Study of Direct Foreign Investment. Cambridge, MA, MIT Press.

Jarvis, L. S. (1988). “The contribution of animal agriculture to economic welfare in developing countries,” in Animal Agriculture Symposium: Development Priorities Toward the Year 2000. Chantilly.

Kassie, M., Zikhali, P., Manjur, K., and Edwards, S. (2009). Adoption of organic farming techniques: Evidence from a semi-arid region of Ethiopia (Discussion Paper Series, EfD−09-01). Gothenburg: Environment for Development.

Kastratović, R. (2019). Impact of foreign direct investment on greenhouse gas emissions in agriculture of developing countries. Aust. J. Agric. Resour. Econ. 63, 620–642. doi: 10.1111/1467-8489.12309

Kaukab, M. E., and Surwandono, S. (2021). Convergence of human development Index: case study of foreign direct investment in ASEAN. Bus. Theory Pract. 22, 12–17. doi: 10.3846/btp.2021.12153

Kennedy, T. F., Bardy, R., and Rubens, A. (2012). Economic growth and welfare: How foreign direct investment contributes to improving social order in less developed countries. J. Org. Transform. Soc. Change 9, 185–205. doi: 10.1386/jots.9.2.185_1

Knickerbocker, F. (1973). Oligopolistic Reaction and Multinational Enterprise. Cambridge, MA, Harvard University Press.

Kolster, J. (2015). Does foreign direct investment improve welfare in North African countries? (No. 2162). AfDB Working Paper. North Africa Policy Series.

Kosova, R. (2010). Do foreign firms crowd out domestic firms? Evidence from the Czech Republic. Rev. Econ. Stat. 92, 861–881. doi: 10.1162/REST_a_00035

Latruffe, L., and Nauges, C. (2014). Technical efficiency and conversion to organic farming: The case of France. Eur. Rev. Agric. Econ. 41, 227–253. doi: 10.1093/erae/jbt024

Menon, J. (2013). Narrowing the development divide in ASEAN: the role of policy. Asian Pac. Econ. Lit. 27, 25–51. doi: 10.1111/apel.12025

Mustafa, G., Rizov, M., and Kernohan, D. (2017). Growth, human development, and trade: the Asian experience. Econ. Model. 61, 93–101. doi: 10.1016/j.econmod.2016.12.007

Mzoughi, N. (2011). Farmers' adoption of integrated crop protection and organic farming: Do moral and social concerns matter? Ecol. Econ. 70, 1536–1545. doi: 10.1016/j.ecolecon.2011.03.016

Ngo, N. Q. (2021). An empirical study of foreign direct investment, human development and endogenous growth. Glob. Bus. Econ. Rev. 24, 59–78. doi: 10.1504/GBER.2021.111987

O'brien, R. M. (2007). A caution regarding rules of thumb for variance inflation factors. Qual. Quan. 41, 673–690. doi: 10.1007/s11135-006-9018-6

Poot, J. (2012). Learning from the flood of findings: Meta-analysis in economics. National Institute of Demographic and Economic Analysis. The University of Waikato. Available online at: https://www.nzae.org.nz/wp-content/uploads/2012/09/NZAE-2012-Poot-meta-analysis.pdf (accessed April 20, 2015).

Ramsey, J. B. (1969). Tests for specification errors in classical linear least-squares regression analysis. J. Roy. Stat. Soc. B 31, 350–371. doi: 10.1111/j.2517-6161.1969.tb00796.x

Ranjkeshan, A. (2021). Foreign Direct Investment and Welfare: Is Sub-Saharan Africa Different? Lund University.

Reiter, S. L., and Steensma, H. K. (2010). Human development and foreign direct investment in developing countries: the influence of FDI policy and corruption. World Dev. 38, 1678–1691. doi: 10.1016/j.worlddev.2010.04.005

Sen, A. (1987). The Standard of Living: Lecture I, Concepts and Critiques. Cambridge: Tanner Lectures, Cambridge University Press.

Sen, A. (1997). Editorial: Human capital and human capability. World Dev. 25, 1959–1961. doi: 10.1016/S0305-750X(97)10014-6

Sen, A. (1998). Mortality as an indicator of economic success and failure. Econ. J. 108, 1–25. doi: 10.1111/1468-0297.00270

Sharma, B., and Gani, A. (2004). The effects of foreign direct investment on human development. Glob. Econ. J. 4, 1850025. doi: 10.2202/1524-5861.1049

Slimane, M. B., Huchet-Bourdon, M., and Zitouna, H. (2016). The role of sectoral FDI in promoting agricultural production and improving food security. Int. Econ. 145, 50–65. doi: 10.1016/j.inteco.2015.06.001

Solow, R. M. (1956). A contribution to the theory of economic growth. Q. J. Econ. 70,65–94. doi: 10.2307/1884513

Tovignan, D. S., and Nuppenau, E. A. (2004). “Adoption of organic cotton in Benin: Does gender play a role,” in Proceedings: Conference of Rural Poverty Reduction through Research for Development and Transformation. (Deutscher Tropentag, Berlin), 1e10.

UNDP (2021). Human Development Index (HDI). Available online at: http://hdr.undp.org/en/content/human-development-index-hdi (accessed June 20, 2021).

Vernon, R. (1966). International investment and international trade in the product cycle. Q. J. Econ. 80, 190–207. doi: 10.2307/1880689

Wardhani, F. S., and Haryanto, T. (2020). Foreign direct investment in agriculture and food security in developing countries. Contemp. Econ. 14, 510–521.

Wiksadana, W., and Sihaloho, E. D. (2021). Does government spending in health, education, and military improve welfare in Asian developing countries? J. Ekonomi Stud. Pembangunan 22, 59–74. doi: 10.18196/jesp.v22i1.9337

Wooldridge, J. M. (2002). Econometric Analysis of Cross Section and Panel Data. Cambridge, MA: MIT Press.

Wooldridge, J. M. (2009). Introductory Econometrics: A Modern Approach, 4. Ed., Mason, OH: South-Western.

World Bank (2021). Agriculture and Food. Available online at: https://www.worldbank.org/en/topic/agriculture/overview (Accessed January 5, 2021).

Wu, D. M. (1973). Alternative tests of independence between stochastic regressors and disturbances. Econometrica 41, 733–750. doi: 10.2307/1914093

Appendix

Keywords: agriculture, developing countries, fixed effects, foreign direct investment, welfare, human development index

Citation: Djokoto JG, Agyei-Henaku KAA-O and Badu-Prah C (2022) Welfare Effects of Agricultural Foreign Direct Investment in Developing Countries. Front. Sustain. Food Syst. 6:748796. doi: 10.3389/fsufs.2022.748796

Received: 28 July 2021; Accepted: 21 June 2022;

Published: 08 July 2022.

Edited by:

Joseph Agebase Awuni, University for Development Studies, GhanaReviewed by:

Viswanathan Pozhamkandath Karthiayani, Amrita Vishwa Vidyapeetham, IndiaNurul Mohammad Zayed, Daffodil International University, Bangladesh

Copyright © 2022 Djokoto, Agyei Henaku and Badu-Prah. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Justice Gameli Djokoto, ZGdhbWVsaTIwMDJAZ21haWwuY29t

†These authors have contributed equally to this work

Justice Gameli Djokoto

Justice Gameli Djokoto Kofi A. A-O Agyei Henaku

Kofi A. A-O Agyei Henaku Charlotte Badu-Prah†

Charlotte Badu-Prah†