95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

SYSTEMATIC REVIEW article

Front. Sustain. Food Syst. , 07 February 2023

Sec. Nutrition and Sustainable Diets

Volume 6 - 2022 | https://doi.org/10.3389/fsufs.2022.1053851

Background: Subsidy payments are used to support low-income groups and may improve income distribution and increase social welfare. The food subsidy programs and their long-term effects have been considered as major developmental issues in many developing countries. This review study aimed to examine the effects of subsidies on the food and nutritional status of Iranian people.

Methods: English and Persian language databases were searched using related keywords to discover studies on the effects of subsidies on food and nutritional status in Iran. A manual search was also conducted encompassing national and local research projects in Iran. In total, 12 articles were finally included out of an initial total of 70 studies.

Results: Subsidy payment affects many socio-economic variables. In Iran, subsidies are often paid for the basic goods and commodities that are a main part of the consumption patterns of most Iranian people. So, if the basic needs of the people are not well-understood, changes in economic structures may lead to a change in consumption patterns. In addition, physical payments for food may lead to an increase in the consumption of different groups, but cash payments do not necessarily lead to an increase in food intake.

Conclusion: The method of payment should be chosen correctly to improve the protection of vulnerable populations. The distribution of targeted subsidies for food security is inevitable due to limited resources available to support vulnerable populations.

Subsidy payment is a form of financial aid or support extended to producers from the government treasury. Subsidies can be categorized into a variety of areas, including production, imports, exports, consumption, and can be targeted/non-targeted subsidies (Heydari et al., 2004; Pajouyan, 2005; Ahmadvand and Eslamei, 2006; Hosseini, 2006).

Moreover, subsidies can be paid either direct payments of money and direct supplies of food or indirectly, through subsidy payments aimed at reducing prices and increasing access for people with low income to food (Farrar, 2000). Subsidies are government cash and non-cash grants that directly or indirectly increase consumer purchasing power, increase producer sales power, and improve equitable distribution of income, economic stability and support the effects of government policies to maintain or promote social welfare (FAO, 2001).

Iran, a country located in western Asia, has more than 85 million population according to statistics of 2021 and total life expectancy at birth reached 77 years in 2020. Iran's gross domestic product (GDP) per capita was US$ 2756 in 2020 and the annual inflation rate in Iran increased to 30.6 percent in 2020 (World Bank, 2022). Iran, as an oil-rich country, has spent a significant part of its wealth in the form of a variety of implicit and explicit subsidies on basic goods and services, which has been reported as an inefficient and ineffective policy in terms of both economic growth and income distribution (Heydari et al., 2004). For example, the implicit subsidy of oil and natural gas was more than 55 billion dollars in 2018 [Parliament (Majlis) Research Center, 2019]. The government spent more than 37850 billion rials (about US$ 909,855) in 2009 for the provision of wheat, flour, and bread according to the analysis of the net changes in the Iranian government's expenses [Parliament (Majlis) Research Center, 2019].

To achieve high economic growth, which ultimately improves income distribution and social welfare growth, modifying the prices of basic goods and services through government subsidies plays an important role, and accounts for a significant portion of the government budget each year. This issue, in addition to having an impact on the budget through increasing net income, should also reduce the wasteful consumption of these goods and services (Heydari et al., 2004). Subsidies impose many costs on governments, and if they are not exclusively designed for those in need (non-targeted), then non-indigent people also benefit from subsidies. These policies do not necessarily lead to a reduction in poverty by themselves, and require the government to commit to a permanent cost due to the dependence of poor people (Lustig, 1986; Richard, 1999; Farrar, 2000; FAO, 2001; Pajouyan, 2005).

Government direct aid to agriculture (e.g., wheat farmers) is a form of production subsidy through the purchase of wheat or other agricultural products at appropriate and guaranteed prices (Esmaeili and Shokoohi, 2011). The ratio of flour, bread and wheat in the total subsidy of basic goods in Iran was reported to be more than 50 percent (Karami et al., 2012; Report of the Company's Parent Company, 2014), and after that, sugar and milk are in the next ranks (Karami et al., 2012). Indirect government aid to support production can be funded in different ways, such as by subsidizing fertilizers, poison and seeds, or by allocating energy or fuel at lower prices (Esmaeili and Shokoohi, 2011). In Iran, more than 75 percent of the total cost of chemical fertilizers is paid through subsidies (Najafi and Farajzadeh, 2010). However, it should be noted that although the modest allocation of production subsidies to support the production and increase the supply of some goods and services can be effective in boosting economic growth and consequently, promoting people's welfare and purchasing power, paying this type of subsidy should be carried out in a cross-sectional and limited manner, taking into account economic considerations (Esmaeili and Shokoohi, 2011).

The food subsidy programs and their long-term effects have been considered as a major developmental issue in many developing countries. The programs might increase social welfare to individuals but they pose both an unnecessary burden on the public budget and are economically inefficient because their benefits are often not received by the poor (Karami et al., 2012). However, Food subsidies can make a significant contribution to the nutrition status and supply of the energy and nutrients needed by individuals in the community (Laraki, 1989; Pradhan, 2009). So, this review study aimed to investigate the effects of food subsidies in Iran.

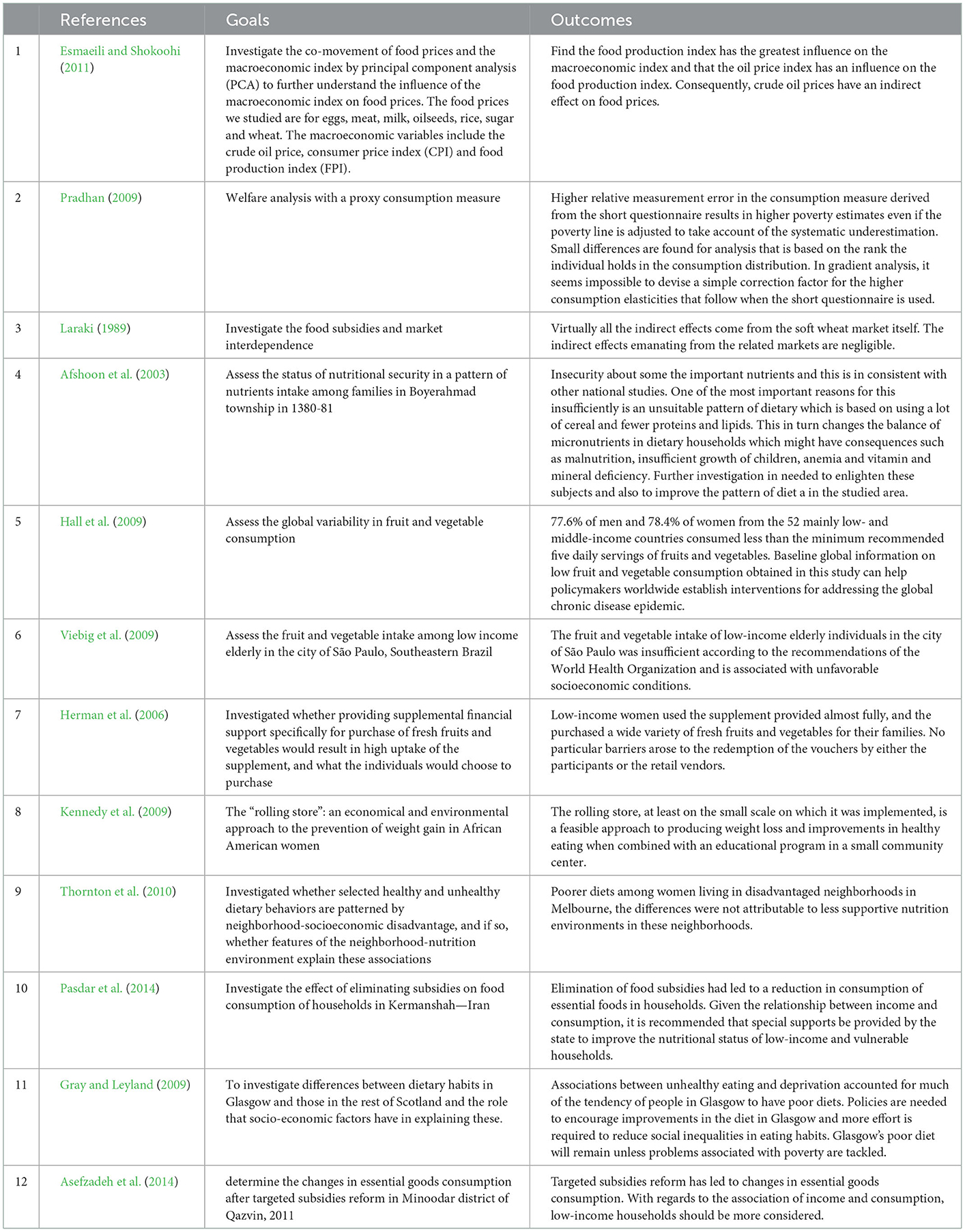

In this review study, online scientific databases including PubMed, Embase, Science direct, Scopus, Google Scholar, IranMedex, SID, Irandoc, and Magiran were searched for relevant papers published in English or Persian from 2000 to 2020. The reference lists of the included studies were also searched. A comprehensive search was performed using the combinations of the related keywords including “subsidy and/or targeting and/or food basket and/or Iran and/or the world.” This strategy recovered 70 articles. The inclusion criteria selected only articles that were clearly related to food subsidies in Iran. Finally, 12 papers were included after the elimination of duplicates or irrelevant papers. The search strategy is presented in Figure 1. In this paper, the pattern of consumption of three strategic commodities including bread, sugar and milk was investigated. The reason for choosing the mentioned goods was the amount of subsidy that is allocated to them in Iran (Karami et al., 2012; Report of the Company's Parent Company, 2014; Mosavi and Bagheri, 2016; Abolhassani et al., 2018). Also, the extracted articles had paid more attention to these items (Table 1).

Table 1. Summary of studies included in a review of field experiments on the effects of subsidies on food in Iran and its role on individual nutritional status.

Descriptive information for the included studies in this narrative review article are presented in Table 1. The main purpose of the provision of subsidies for some basic goods in Iran is to ensure that the minimum nutritional requirements are received by all groups of society, especially low-income groups. However, for various reasons including the inefficiency of the distribution system, the economic problems of low-income groups, and people's desire for liquidity (thus selling coupons), the most vulnerable sectors of society may not in fact receive the predicted minimum of subsidized items (Esmaeili and Shokoohi, 2011). Subsidy payment is not exclusive to Iran and developing countries, but the subsidy payment domain in developed countries is much wider and accounts for a larger share of their budgets (Laraki, 1989; Pradhan, 2009). Food subsidies can be effective at stabilizing food prices, transferring income to poor people, and maintaining political and social stability (Gutner, 2002). These subsidies are often effective in improving the nutritional status of people in the community, but proper targeting to specific foods, geographical areas or special populations needs to be considered (Afshoon et al., 2003).

In Iran, the basket of subsidized goods, both in terms of type and quantity, is not provided for the purpose of overall nutritional health, and mainly provides energy and partial protein supplies. Some studies reported that direct food subsidies add about 350 calories per day to the table of all households, while half of the country's population does not need extra calories (Laraki, 1989; Gutner, 2002). The results of food basket studies, in the form of the MABA plan (planning and implementation pattern studies) indicated that despite the subsidy payment, about one-fifth of households experience insufficient energy and protein intake. In addition, the insufficient intake of 7 micronutrients was a major problem in Iranian population. About 80% of the households in Iran do not get enough vitamin B2 in their daily diet. Also, there was an insufficient intake of vitamins A (51%) and calcium (40%) in households across the country (Ghassemi et al., 2002; World Health Organization, 2003; Hall et al., 2009; Viebig et al., 2009; Pasdar et al., 2014).

Out of the 21 food items examined, in which some items such as bread, sugar, and vegetable oil, which had inclusive subsidies, while cheese, milk and imported rice, which had a limited subsidy. In general, the subsidy support system of essential food items has been evaluated as being successful in achieving the goal of reducing the inequality of consumption of some important items in the consumer basket of urban and rural households (Esmaeili and Shokoohi, 2011). Much evidence suggests that staple foods subsidies are effective in improving the nutritional status of the community. Of course, this positive effect on health is likely to be more noticeable if consumption increases in groups of people who need more energy and nutrients (Herman et al., 2006).

Columbian researchers found that allocating subsidies for some cereals at a minimum cost could increase the margin of the energy intake of poor people, although black market forces may also increase the costs (Kennedy et al., 2009). Rice subsidies in the Philippines resulted in an increase of 7 and 4–6 percent of daily calorific intake in adults and preschool children, respectively. Also, a weight increase of 0.12–0.14 kg in preschool children was also observed (Metcoff et al., 1985). Participants in the Special Supplemental Nutrition Program for Women, Infants and Children in the United States saw a significant increase in fruit and vegetable consumption after 6 months follow-up compared to the baseline (Pehrsson et al., 2001). Economic studies found the effectiveness of government costs on the more fruit and vegetable consumption in preventing disease and mortality in low-income groups (Rush et al., 1988a). In contrast, in China, consumer subsidies did not have an impact on improving the nutritional status of poor people, and even in some households even reduced energy and nutrient intakes by pushing the household consumption patterns toward low nutritional value foods (Rush et al., 1988b). In most of these studies, the subsidy was allocated to a particular region or group of society, and its effects were compared with a control group without subsidies, or with before the allocation of subsidies. The targeting of subsidies for vulnerable populations and the correct selection of subsidized food items in Indonesia (Rush et al., 1988c), India (Rush et al., 1988d), Egypt (Gutner, 2002), and Sudan (Herman et al., 2006; Hall et al., 2009; Viebig et al., 2009) whose support systems are similar to Iran which has changed from generalized wheat subsidies to targeted systems was associated with the least cost and maximum effectiveness.

The expansion of subsidies in Iran has different effects on economic and social structures. Before the revolution, the subsidy was used as a mechanism to control inflation and price increases, but for technical, economic and social reasons, the intended consequences were not obtained. Subsequently, the basic goods rationing plan and subsidy payments were started. After the revolution, subsidies were implemented as a mechanism for social justice and income redistribution. Although production subsidies are prevalent in developing countries, the role of consumption subsidies in social and economic structures in these countries is even more important. Developing countries pay subsidies for food due to the lack of equitable income distribution, and the existence of poor- and low-income groups, as well as to raise social welfare levels (Joshipura et al., 2001; Crowe et al., 2011).

Food subsidies in most societies are allocated for goods that play an important role in consumption patterns. However, consumption patterns have an interactive relationship with economic, social and cultural factors. Many goods in Iran are subsidized and rationed, being basic commodities and components of the consumption patterns of most people, meaning that price changes certainly change consumption patterns when no suitable alternatives are provided through economic development. Thus, by securing the minimum basic needs of the people, even if the vulnerable group is not properly understood, the economic transformation will lead to changes in consumption patterns, which will definitely bring about a major shock to cultural-economic patterns (Rush et al., 1988e; Brug et al., 2008).

Subsidies in different countries may have different results in food consumption. For example, in Canada, the consumption pattern in this country has not improved using the Nutrition North Canada Program and the access to healthy and nutritious foods and also fairly and equitably prevision of foods across regions and communities was not guaranteed (Galloway, 2017). On the other hand, Herman et al. found that allocating subsidies to a group of low-income American women increased the consumption of fruits and vegetables in this group (Herman et al., 2008). In addition, a study in South Africa indicated that the payment of subsidies increased the consumption of healthy foods and decreases the consumption of unhealthy foods (An et al., 2013).

Given that bread is a staple food, wheat is, therefore, a fundamental, strategic commodity whose demand overwhelms shortages or price fluctuations, thus creating many economic issues. On the other hand, since domestic production cannot meet the necessary supply, as the population grows, the gap between supply and demand deepens. Establishing subsidies for wheat in order to stabilize the price of bread is more in favor of consumer protection, especially for low-income urban groups (Thornton et al., 2010). Nematullahi et al. (2015) reported that the targeted subsidies and price correcting of wheat and flour, reduced the purchasing power of Iranian households. Consequently, the demand for wheat, flour and bread, and food security decreased (Nematullahi et al., 2015).

Sugar is another subsidized good. The relative cost of this commodity rises from the lower classes of the society to the upper classes. Whenever sugar subsidies are eliminated for rural households, the trend of change from lower classes to middle classes and then upper classes is downward. Considering the economic effects of sugar subsidies on urban and rural households, and the consequences of cutting it for household expenses, it should be noted that current eliminating the sugar subsidy will inflict the most damage on low-income groups (Newby and Tucker, 2004; Eyles and Mhurchu, 2009). Based on Khoshdel and Abbasi (2016), in Iran, sugar consumption reduced among the poor and middle-income households after paying cash subsidies (Khoshdel and Abbasi, 2016).

It can be proposed that by eliminating milk subsidy, low-income groups may reduce their consumption of this product. However, considering the importance of milk in feeding patterns, it is necessary to ensure different economic classes have access to milk. Milk subsidies could be crucial for infants, mothers and elderly people, in nurseries, kindergartens and hospitals (Smithers et al., 2011). In Iran, the main fiscal intervention during 2000–2020 on food was targeted subsides. As a result of the implementation of this plan, the consumption pattern of Iranian households changed (Nematullahi et al., 2015; Khoshdel and Abbasi, 2016; Roustaee et al., 2021). According to Roustaee et al. (2021), the targeted subsidies in Iran caused milk price to increase four times from 2011 to 2015 and eventually milk consumption was declined (Roustaee et al., 2021).

Eliminating subsidies for all classes of society due to limited resources can have serious social effects (Smithers et al., 2011). The poor people will unintentionally react to removing Subsidies by emigration, changing consumption patterns, youth/child employment, and other social harms, even if they do not respond violently. However, the complete elimination of subsidies is not recommended in this form. Therefore, the change in payment method should be considered (Smithers et al., 2011).

A food-coupon program will take precedence over a cash subsidy program, as long as consumers are allowed to choose from a wide range of products. If nutritional outcomes are the main goal of the program, cash subsidies can be beneficial with their impact on increasing food intake (U. S. General Accounting Office, 1992).

When the subsidy is offered to the public at a low price, the demand for that commodity increases. Some of this commodity is actually consumed, some of it is wasted without consumption (like bread), some of it is exported (like fuel). If the same commodity is offered at a marginal cost to the people, its loss or smuggling will disappear due to the cost. On the other hand, if the price difference before and after the removal of the subsidy is paid out to people, then people will choose their own type of consumption, and will avoid the misuse or waste of the desired goods. Regarding the subsidy reform plan, including law enforcement in the agricultural sector, it should be pointed out that the implementation of this law in the early years caused a negative impact on the agricultural sector. Increasing the price of various productions, the imbalance between the purchasing price of products with their production cost, the increase of intermediaries, and consequently the excessive purchase price of products, caused a great shock in the production and consumption sectors. This led many farmers in the agricultural sectors to reduce production in order to reduce economic losses, and on the other hand, due to rising prices for food products, the ability of urban citizens to buy was reduced. Therefore, these two issues have led to a decrease in the food security index of households in the middle and vulnerable groups of Iran. One of the reasons for this negative effect is the fact that the agricultural sector of Iran has not yet reached a stage in terms of growth and development that would allow it to continue to operate without the help and support of the government (Esmaeili et al., 2011; Asefzadeh et al., 2014). It is quite possible that households with lower socioeconomic status reduce their food expenses as much as possible by using more subsidized food items (Vakili et al., 2008).

Bread is distributed in subsidized form throughout the country, and therefore there is no difference between different households (Asefzadeh et al., 2014). Bread plays an important role in the carbohydrate intake in Iranian dietary patterns. This portion is slightly higher in villages than in cities, and in both is reduced with the improvement of socio-economic status. This reduction process is probably due to the increase in other groups (especially simple sugars, rice, fruits and vegetables) as part of the carbohydrate supply. However, in the case of oil, the situation is completely different (Vakili et al., 2008; Chun et al., 2010; Asefzadeh et al., 2014). It is noteworthy that the consumption of oil decreases significantly with the improvement of the socio-economic situation, which reflects the greater reliance of low-income households on energy intake through vegetable oils. In sum, low-income households consume more solid vegetable oil, while their proportion of liquid-oil consumption is very low. The portion of energy received from vegetable oil in the city and the village is not significantly different. The only significant difference is the role of vegetable oil (without subsidy) in providing energy, which is greater in the countryside than in the city. In the case of sugar and rice, no differences were observed in terms of consumer energy supply in urban and rural households, or between socio-economic tertiles (Vakili et al., 2008; Gray and Leyland, 2009; Chun et al., 2010; Karami et al., 2012; Asefzadeh et al., 2014). Summary of studies included in this review on the effects of subsidies on food intake in Iran are presented in Table 1.

Although, the results of this review indicated that subsidy payment affects socio-economic status of Iranian population, it also addressed the lack of evidence available from Iran on fiscal interventions on food. In Iran, subsidies are often paid for those basic goods and commodities that are part of the consumption patterns of majority of the society. So, if the basic needs of the people are not well-understood, changes in subsidy payment structures may lead to a change in consumption patterns. On the other hand, paying subsidies on some of the basic commodities, such as bread, sugar and milk, with the aim of protecting vulnerable populations, includes all income groups. In general, according to various studies, physical payments for food lead to an increase in the consumption of different groups, but cash payments do not necessarily lead to an increase in food intake. The complete elimination of subsidies is not recommended, and the method of payment should be changed to improve the protection of vulnerable populations. Further longitudinal studies are warranted to confirm these findings and to discover the underlying mechanisms of the effects of subsidies on foods in Iran.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abolhassani, L. E., Shahnoushi, N. A., Dourandish, A. R., Taherpour, H., and Mansouri, H. O. (2018). An investigation on outcomes and consequences of subsidies-reform law in wheat, flour and bread sectors. Agric. Econ. Dev. 26, 145–164. doi: 10.30490/AEAD.2018.73555

Afshoon, E., Malekzadeh, J. M., and Poormahmoodi, A. (2003). Nutritional security in pattern of daily nutrients intake among households in boyerahmad township in 2001-2002. Armaghan Danesh J. 8, 59–69.

Ahmadvand, M., and Eslamei, S. (2006). Review on the government subsidies payment (2003-2006). Commerc. Surv. 13, 38–42.

An, R., Patel, D., Segal, D., and Sturm, R. (2013). Eating better for less: a national discount program for healthy food purchases in South Africa. Am. J. Health Behav. 37, 56–61. doi: 10.5993/AJHB.37.1.6

Asefzadeh, S., Gholamalipoor, S., and Alijanzadeh, M. (2014). Changes in essential goods consumption after targeted subsidies reform in Minoodar district of Qazvin 2011. J. Qazvin Univ. Med. Sci.18, 75–82.

Brug, J., Kremers, S. P., Van Lenthe, F., Ball, K., and Crawford, D. (2008). Environmental determinants of healthy eating: in need of theory and evidence: symposium on ‘Behavioural nutrition and energy balance in the young'. Proc. Nutr. Soc. 67, 307–316. doi: 10.1017/S0029665108008616

Chun, O. K., Floegel, A., Chung, S.-J., Chung, C. E., Song, W. O., Koo, S. I., et al. (2010). Estimation of antioxidant intakes from diet and supplements in U.S. Adults. J. Nutr. 140, 317–324. doi: 10.3945/jn.109.114413

Crowe, F. L., Roddam, A. W., Key, T. J., Appleby, P. N., Overvad, K., Jakobsen, M. U., et al. (2011). Fruit and vegetable intake and mortality from ischaemic heart disease: results from the European Perspective Investigation into Cancer and Nutrition (EPIC)-Heart study. Eur. Heart J. 32, 1235–1243. doi: 10.1093/eurheartj/ehq465

Esmaeili, A., Baghestani, A. A., and Sherafatmand, H. (2011). “Assessing the effect of targeting subsidies on meat consumption,” in Regional Conference on Economic Jihad Approaches and Strategies, Iran (Tehran).

Esmaeili, A., and Shokoohi, Z. (2011). Assessing the effect of oil price on world food prices: application of principal component analysis. Energy Policy 39, 1022–1025. doi: 10.1016/j.enpol.2010.11.004

Eyles, H. C., and Mhurchu, C. N. (2009). Does tailoring make a difference? A systematic review of the long-term effectiveness of tailored nutrition education for adults. Nutr. Rev. 67, 464–480. doi: 10.1111/j.1753-4887.2009.00219.x

FAO (2001). Targeting for Nutrition Improvement. Rome: Nutrition Planning, Assessment and Evaluation Service, Food and Nutrition Division, Food and Agriculture Organization of the United Nations.

Farrar, C. (2000). A Review of Food Subsidy Research at IFPRI. Food consumption and nutrition division. International Food Policy Research Institute.

Galloway, T. (2017). Canada's northern food subsidy Nutrition North Canada: a comprehensive program evaluation. Int. J. Circumpolar Health. 76, 1279451. doi: 10.1080/22423982.2017.1279451

Ghassemi, H., Harrison, G., and Mohammad, K. (2002). An accelerated nutrition transition in Iran. Public Health Nutr. 5, 149–155. doi: 10.1079/PHN2001287

Gray, L., and Leyland, A. H. (2009). A multilevel analysis of diet and socio-economic status in Scotland: investigating the 'Glasgow effect'. Public Health Nutr. 12, 1351–1358. doi: 10.1017/S1368980008004047

Gutner, T. (2002). The political economy of food subsidy reform: the case of Egypt. Food Policy 27, 455–476. doi: 10.1016/S0306-9192(02)00049-0

Hall, J. N., Moore, S., Harper, S. B., and Lynch, J. W. (2009). Global variability in fruit and vegetable consumption. Am. J. Prev. Med. 36, 402–409. doi: 10.1016/j.amepre.2009.01.029

Herman, D. R., Harrison, G. G., Afifi, A. A., and Jenks, E. (2008). Effect of a targeted subsidy on intake of fruits and vegetables among low-income women in the special supplemental nutrition program for women, infants, and children. Am. J. Public Health 98, 98–105. doi: 10.2105/AJPH.2005.079418

Herman, D. R., Harrison, G. G., and Jenks, E. (2006). Choices made by low-income women provided with an economic supplement for fresh fruit and vegetable purchase. J. Am. Diet. Assoc. 106, 740–744. doi: 10.1016/j.jada.2006.02.004

Heydari, K., Permeh, Z., Cheraghi, D., Gholami, S., and Rasti, M. (2004). Reforming Subsidy Payment System of Essential Commodities in Iran With Emphasis on Targeting, 1st Edn. Tehran: Institute for Trade Studies andResearch.

Hosseini, S. (2006). Method of subsidy payment, experiment of selective country and Iran. Commer. Surv. 13, 48–53.

Joshipura, K. J., Hu, F. B., Manson, J. E., Stampfer, M. J., Rimm, E. B., Speizer, F. E., et al. (2001). The effect of fruit and vegetable intake on risk for coronary heart disease. Ann. Intern. Med. 134, 1106–1114. doi: 10.7326/0003-4819-134-12-200106190-00010

Karami, A., Esmaeili, A., and Najafi, B. (2012). Assessing effects of alternative food subsidy reform in Iran. J. Policy Model. 34, 788–799. doi: 10.1016/j.jpolmod.2011.08.002

Kennedy, B. M., Champagne, C. M., Ryan, D., Newton, R., Conish, B. K., Harsha, D. W., et al. (2009). The “rolling store”. Ethn. Dis. 19, 7–12.

Khoshdel, A., and Abbasi, E. (2016). The comparison of the necessary goods consumption among the poor and middle-income households before and after paying cash subsidies. Econ. Res. 15, 217–243.

Laraki, K. (1989). Food Subsidies: A Case Study of Price Reform in Morocco. Washington, DC: World Bank.

Lustig, N. (1986). Food Subsidy Programs in Mexico. Washington, DC: CDC: International Food Policy Research Institute.

Metcoff, J., Costiloe, P., Crosby, W. M., Dutta, S., Sandstead, H. H., Milne, D., et al. (1985). Effect of food supplementation (WIC) during pregnancy on birth weight. Am. J. Clin. Nutr. 41, 933–947. doi: 10.1093/ajcn/41.5.933

Mosavi, S. H., and Bagheri, M. (2016). Welfare impacts of the subsidy reform policy on wheat, flour and bread market in Iran. Agric. Econ. Dev. 24, 245–271. doi: 10.30490/AEAD.2016.59040

Najafi, B., and Farajzadeh, Z. (2010). Welfare impacts of chemical fertilizer subsidy elimination on bread consumers. J. Agric. Econ. Res. 2, 1–3.

Nematullahi, Z., Shahnooshi Forushani, N., Hosseinzadeh, M., and Abolhasani, L. (2015). The effects of targeted subsidies, rising of exchange ratio and currency restrictions caused by sanctions on wheat, flour and bread. J. Agric. Econ. 10, 97–114.

Newby, P. K., and Tucker, K. L. (2004). Empirically derived eating patterns using factor or cluster analysis: a review. Nutr. Rev. 62, 177–203. doi: 10.1111/j.1753-4887.2004.tb00040.x

Pajouyan, J. (2005). Comprehensive Study on Nutritional Practice and Food Security of Iranian Households. Tehran: Commercial Studies and Researches Foundation.

Parliament (Majlis) Research Center (2019). About Energy Subsidy in Iran, Implicit Subsidy and Its Considerations. Tehran: Parliament (Majlis) Research Center. Available online at: http://sspp.iranjournals.ir/&url=http://sspp.iranjournals.ir/article_251123.html

Pasdar, Y., Rezaei, M., Darbandi, M., Mohamadi, N., and Niyazi, P. (2014). Dietary pattern and food consumption among kermanshah households, 2011. J. Kerman Univ. Med. Sci. 20, 25–36.

Pehrsson, P. R., Moser-Veillon, P. B., Sims, L. S., Suitor, C. W., and Russek-Cohen, E. (2001). Postpartum iron status in nonlactating participants and nonparticipants in the Special Supplemental Nutrition Program for Women, Infants, and Children. Am. J. Clin. Nutr. 73, 86–92. doi: 10.1093/ajcn/73.1.86

Pradhan, M. (2009). Welfare analysis with a proxy consumption measure: evidence from a repeated experiment in Indonesia. Fisc. Stud. 30, 391–417. doi: 10.1111/j.1475-5890.2009.00101.x

Report of the Company's Parent Company (2014). Iranian Business Corporation. Planning Deputy. Schedule Office.

Richard, A. H. (1999). Self-Targeted Subsidies: The Distributional Impact of the Egyptian Food Subsidy System. The World Bank. doi: 10.1596/1813-9450-2322

Roustaee, R., Eini Zinab, H., and Mohammadi Nasrabadi, F. (2021). Policy proposals to increase milk and dairy consumption in Iran based on a scoping review. Iran. J. Nutr. Sci. Food Technol. 16, 123–141.

Rush, D., Alvir, J. M., Kenny, D. A., Johnson, S. S., and Horvitz, D. G. (1988a). The national WIC evaluation: evaluation of the special supplemental food program for women, infants, and children. III. Historical study of pregnancy outcomes. Am. J. Clin. Nutr. 48, 412–428. doi: 10.1093/ajcn/48.2.412

Rush, D., Horvitz, D. G., Seaver, W. B., Leighton, J., Sloan, N. L., Johnson, S. S., et al. (1988b). The national WIC evaluation: evaluation of the special supplemental food program for women, infants, and children. IV. Study methodology and sample characteristics in the longitudinal study of pregnant women, the study of children, and the food expenditures study. Am. J. Clin. Nutr. 48, 429–438. doi: 10.1093/ajcn/48.2.429

Rush, D., Kurzon, M. R., Seaver, W. B., and Shanklin, D. S. (1988c). VII. Study of food expenditures. Am. J. Clin. Nutr. 48, 512–519. doi: 10.1093/ajcn/48.2.512

Rush, D., Leighton, J., Sloan, N. L., Alvir, J. M., Horvitz, D. G., Seaver, W. B., et al. (1988e). The national WIC evaluation: evaluation of the special supplemental food program for women, infants, and children. VI. Study of infants and children. Am. J. Clin. Nutr. 48(2 Suppl.), 484–511. doi: 10.1093/ajcn/48.2.484

Rush, D., Sloan, N. L., Leighton, J., Alvir, J. M., Horvitz, D. G., Seaver, W. B., et al. (1988d). The national WIC evaluation: evaluation of the special supplemental food program for women, infants, and children. V. Longitudinal study of pregnant women. Am. J. Clin. Nutr. 48(2 Suppl.), 439–483. doi: 10.1093/ajcn/48.2.439

Smithers, L. G., Golley, R. K., Brazionis, L., and Lynch, J. W. (2011). Characterizing whole diets of young children from developed countries and the association between diet and health: a systematic review. Nutr. Rev. 69, 449–467. doi: 10.1111/j.1753-4887.2011.00407.x

Thornton, L. E., Crawford, D. A., and Ball, K. (2010). Neighborhood-socioeconomic variation in women's diet: the role of nutrition environments. Eur. J. Clin. Nutr. 64, 1423–1432. doi: 10.1038/ejcn.2010.174

U. S. General Accounting Office (1992). Early Intervention. Federal Investments Like WIC. Can Produce Savings. GAO/HRD 92-18.

Vakili, M., Baghiani-Moghadam, M. H., Pirzadeh, A., and Dehghani, M. (2008). Education on knowledge, attitude and practice of guidance school students about milk and dairy products. Knowl. Health 2, 38–43.

Viebig, R. F., Pastor-Valero, M., Scazufca, M., and Menezes, P. R. (2009). Fruit and vegetable intake among low income elderly in the city of São Paulo, Southeastern Brazil. Rev. Saúde Públ. 43, 806–813. doi: 10.1590/S0034-89102009005000048

World Bank (2022). Iran, Islamic rep. Available online at: Iran, Islamic Rep. | Data (worldbank.org) (accessed November 17, 2022).

Keywords: subsidy, food intake, nutritional status, vulnerable populations, food security, Iran

Citation: Saeediankia A, Majdzadeh R, Haghighian-Roudsari A and Pouraram H (2023) The effects of subsidies on foods in Iran: A narrative review. Front. Sustain. Food Syst. 6:1053851. doi: 10.3389/fsufs.2022.1053851

Received: 08 October 2022; Accepted: 30 December 2022;

Published: 07 February 2023.

Edited by:

Jasenka Gajdoš Kljusurić, University of Zagreb, CroatiaReviewed by:

Marina Mefleh, University of Bari Aldo Moro, ItalyCopyright © 2023 Saeediankia, Majdzadeh, Haghighian-Roudsari and Pouraram. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Arezoo Haghighian-Roudsari,  YWhhZ2hpZ2hpYW5AeWFob28uY29t; Hamed Pouraram,

YWhhZ2hpZ2hpYW5AeWFob28uY29t; Hamed Pouraram,  cG91cmFyYW0xODdAeWFob28uY29t

cG91cmFyYW0xODdAeWFob28uY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.