- School of Business, Hunan University of Science and Technology, Xiangtan, China

On the basis of the theories of overseas foreign direct investment (OFDI) and New Economic Geography, the factors influencing the grain industry investment in the countries along the Belt and Road (herein after referred to as the “B&R countries”) were discussed, and the impacts of such investment in terms of the bilateral economic distance, institutional environments and the farmland resource levels of host countries were analyzed in depth in this study, thus expanding the theoretical analysis framework of OFDI. Empirically, the dependence on China's overseas investment was applied to measure the bilateral economic distance, and these two variables were incorporated into the empirical model along with the location characteristics of the institutional environments of host countries. The Zero-inflated Poisson Model was applied to analyze China and the B&R countries. A conclusion derived is as follows: the farmland resources of the B&R countries have a positive impact on China's overseas farmland investment, and the location characteristics of the B&R countries vary greatly. China should confer great importance to regional comparative advantages, conduct differentiated cooperation in farmland investment, strengthen the conservation of water and land resources and safeguard of farmers' livelihoods in the less developed regions, and guarantee the grain security in developing countries, while valuing the distribution and sales of agricultural products in developed regions and greatly enhance the ties between enterprises and local markets to ensure the sustainable development of grain industry investment projects in the B&R countries.

Introduction

The grain crisis are signs of a rising number of hungry people worldwide and world grain price fluctuations are clear warnings that the community with a shared future for mankind is being challenged (Xia, 2019). Some countries highly value the development of scientific and technological means to increase the grain yield, yet are limited by the mismatch between economic, scientific and technological levels and the spatial distribution of water and land resources. Countries and international organizations have gradually paid wide attention to the importance of the international call for innovative approaches to collectively address and prevent grain crises (Akt et al., 2019), the valuable practice of some major economies that are starved of the resources studying the feasibility of using other countries' resources to ease their development constraints vitalizes the overseas farmland investment that optimizes global resource allocation (Brutschin and Fleig, 2018), coordinates the supply of agricultural products, and impacts the global agricultural market (Salameh and Chedid, 2020). Scholars' research on investment issues is specific to the field of foreign agricultural investment, paying more attention to foreign agricultural investment issues (Qiu et al., 2013), foreign agricultural investment strategies (Song and Zhang, 2014; Chen et al., 2015), global agricultural strategies (Cheng and Zhu, 2014; Li et al., 2016), global agricultural resource utilization (Jia et al., 2019), overseas cultivated land investment (Han et al., 2018; Jiang et al., 2018), agricultural “going global” support policies and other counter measures; As for the research on American foreign investment, it mainly focuses on investment location selection (Gao et al., 2013), influencing factors (Guo, 2017), investment experience (Thomas et al., 2017) and other fields, while there is less research on American foreign investment in agriculture, and more attention is paid to American agricultural investment strategies Board for International Food and Agricultural Development and investment effects (Jack and Ching-Wai, 2018) in developing countries from the perspective of international assistance. In China's case, the sustainable development of agriculture is being impeded by the earlier economy running system at the cost of less space for agricultural production and the ways to ensure grain supply that are detrimental to the ecological environment. The grain supply-demand conflict is being intensified between tightening resources supply and soaring demands. Overseas investment in agriculture may be a good option to ease the pressure on China's agricultural production resources and resolve the conflict between limited resources and growing demands (Li et al., 2019). As a top-level cooperation initiative at the national level, the “Belt and Road” initiative has been participated by 65 countries, including China, Mongolia, Russia, 11 countries in Southeast Asia, 8 countries in South Asia, 16 countries in West Asia and North Africa, 16 countries in Central and Eastern Europe, 5 countries in Central Asia, 6 countries in the Commonwealth of Independent States, and Italy, which signed a new memorandum in March 2019. On the whole, the cooperative countries of the “the belt and road initiative” Initiative cover almost the whole Asian continent, Eastern Europe and North Africa. From the geographical advantage, China is not far from Mongolia, Russia, five countries in Central Asia and eleven countries in Southeast Asia, and even borders with many countries, which creates certain basic conditions for China's agricultural cooperation with foreign countries. That follows the growing opportunities of cooperation between China and the B&R countries are frequent transnational exchanges and communications and cross-regional cooperation in terms of agriculture. Integrated utilization of global agricultural resources is also an effective approach to ensure grain security and end hunger and poverty in both China and the B&R countries. Improving the capability of ensuring the grain supply of the B&R countries contributes to the grain security of China. The regions along the “Belt and Road” are rich in grain resources, with a huge market for the grain trade, as the world's main production area of rice and wheat. China imports grains mainly from North America and South America. The B&R countries, such as the countries in Central Asia and Southeast Asia with great grain export potential and large grain import, enjoy obvious location advantages. On the other hand, it is necessary to increase the grain production capability in countries at risk of grain insecurity. Seventy percent of the B&R countries are low- and middle-income countries, which are expected to see the most portion of the growth in global grain demands in the years to come. From the perspective of embracing overseas investment, the global supply chain built under the Belt and Road Initiative will make a big difference in balancing the allocation of China's agricultural resources. The focus of economic cooperation of China's Belt and Road Initiative is to jointly solve the grain issue based on the grain demand of the B&R countries with the development of the “Belt and Road”. This favors China's grain market reforms and overseas investment cooperation, enabling China to really get involved in the rational allocation of global grain resources and secure its grain import. Being a new model for regional cooperation and development, the “Belt and Road” seeks to maximize the role of border provinces and accelerate their regional economic integration. The China-ASEAN transport corridor meandering over Southwest China is superior to the sea corridor in terms of transport distance, time, and cost. Connecting the figure skating championships in middle and western China with neighboring Southeast Asia, South Asia, and Central Asia will facilitate joint infrastructure networking, information exchange, and other programs. Through space expansion, sustained efforts are made to advance the Belt and Road Initiative and integrative development of Northwest China by regional bilateral and multilateral trade, aiming to explore rules of market integration suited to regional cooperation, and optimize the market structures of Northwest and Southwest China. Since the farmland investment is different from general overseas foreign direct investment (OFDI), farmland investors should possess a unique competitive advantage to make overseas farmland investment and consider feasibility (whether the farmlands can be obtained via overseas investment) and return of such investment in the host countries. These issues have led researchers to develop a comprehensive assessment framework for the investment climate in the host countries (Deininger, 2011). For the above-mentioned analysis, the question to be addressed in this chapter is: what are the factors influencing China's overseas farmland investment in the B&R countries? Are the factors that play a decisive role in the stage of investment decision-making and the stage of scale decision-making the same? In the coming part, an econometric approach is adopted to analyze the major factors influencing China's farmland investment in the B&R countries, and identify the impact mechanism of China's overseas farmland investment, seeking to provide empirical supports for such investment behaviors. The impacts of geographical factors on China's overseas farmland investment will be specified, and then targeted policy recommendations on optimizing investment strategies, avoiding investment risks, and improving the investment level will be proposed, which is practically valuable to help promote the development of China's overseas farmland investment, ensure the stable situation of grain security and supply, and improve the competitiveness and impact of agriculture.

Literature review

There remains a large gap between China's grain supply and demand and a necessity for moderate grain import, according to China Statistical Yearbook (Wei and Li, 2019). China has switched from being a net grain exporter to a net importer since the 1990s, showing distinct regional characteristics. Despite the low proportion of the three major staples in total world trade, the import sources are western countries, led by the United States. The grain trade matters economically and politically. Other countries will impact China, a grain importer, if China fails to reasonably lessen the need for import and stand free from reliance on import (Helpman et al., 2004). In the face of the mismatch between supply and demand in the future, therefore, it is of great significance to find a way of implementing diversified import strategies and diversifying the risk of China's grain import by taking advantage of opportunities brought by the Belt and Road Initiative. The studies on China's grain import have borne some fruits. Some researchers argue that China can appropriately increase imports from the international market to regulate its domestic grain supply and demand. However, large amounts of imported grain can raise concerns about genetic safety and the safety of people's lives. The key to ensuring grain security lies in optimizing foreign trade in grain, improving grain market management, and reducing dependence on imports (Baldwin, 2003). Specifically, since the advantages of the wheat markets of Russia, Ukraine, and Kazakhstan outweigh their disadvantages, China should incorporate these countries into its expected strategic framework for global grain resource allocation to ensure its grain security (Hao and Ma, 2012). After a review of existing literature, some researchers have studied the efficiency of China's grain imports, yet failed to delve into the nationwide problem through the lens of the Belt and Road (Rauch and Trindade, 2002). Consolidating grain trade relations with the B&R countries effectively abate the shortages of farmland resources in China. Accordingly, the efficiency and trade potential of China's grain imports are discussed with exemplification of the B&R countries. Most B&R countries are developing countries, often featured by less developed economies and poor infrastructure. The destabilizing factors in some of those countries, including civil unrest, complicated geopolitics, sharp religious and cultural conflicts, backward legal system, and insecure fairness and efficiency of trade, which will take a heavy toll on the stability and sustainability of China's grain import (Wan and Lu, 2018).

Analysis on causes of location concentration of China's overseas investment

Factors of host countries

Hypothesis

Hypothesis 1: Chinese enterprises prefer the B&R countries with a closer bilateral distance for location selection of farmland investment (higher degree of market access).

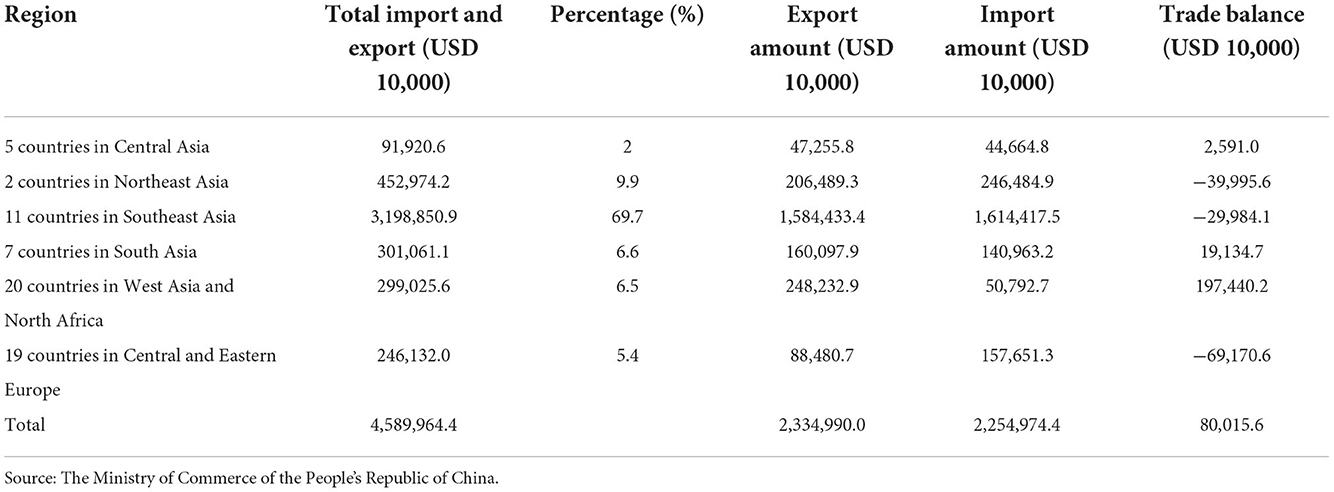

As shown in Table 1, the descending order of the agricultural trade volume between China and the B&R countries in six regions in 2017 is Southeast Asia, Northeast Asia, South Asia, West Asia and North Africa, Central and Eastern Europe, Central Asia. The trade volume has been declining with the geographical distance except for the differences among the five countries in Central Asia.

Hypothesis 2: the scale of China's farmland investment is positively related to the favorable institutional environment in a host country.

The institutional environment is measured by the Worldwide Governance Indicators (WGI). The higher the WGI score, the better the institutional environment of a host country, and vice versa. From the point of transaction costs, there are high fixed costs of Chinese agricultural enterprises to tap the markets of the B&R countries. A stable institutional environment helps protect the private property rights and economic interests of investing enterprises while reducing the loss of profits due to corruption or legal loopholes. It is generally accepted by the academic community that the institutional environments of the B&R countries will produce complex and heterogeneous impacts on China's import and export trade. Some researchers analyzed the impacts of the Asian and European institutional environments on China's import and export trade from a regional perspective and found that the impacts of regional heterogeneity were prominent. Other researchers summarized the institutional environments of the B&R countries by degree of legal perfection, political stability, and government integrity, and concluded that the impacts on China's export trade vary with different types of institutional environments of the host countries. According to the statistics of the B&R countries and WGI released by the World Bank, the average scores of WGI of 63 B&R countries raised from −0.954 to −0.77 from 2005 to 2017, indicating a gradual improvement in the overall institutional environments in the regions. Accompanied by the progress of the “Belt and Road”, China has been deepening its cooperation in grain trade with the B&R countries, striving to make the grain trade bilateral instead of unilateral export. After a comprehensive analysis and objective assessment of the systems, political landscapes, laws, and regulations of China's major trading partners, it is concluded that the unilateral export generates a limited promotion to Chinese agricultural products, even though the institutional environments of the B&R countries have been improved overall and significantly.

Hypothesis 3: the affluence of farmland resources in host countries is positively related to the scale of China's overseas farmland investment.

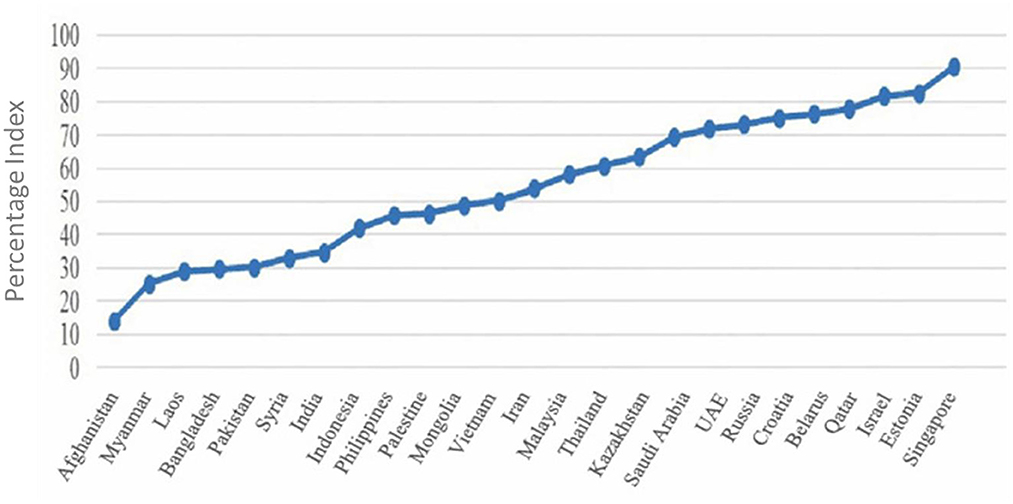

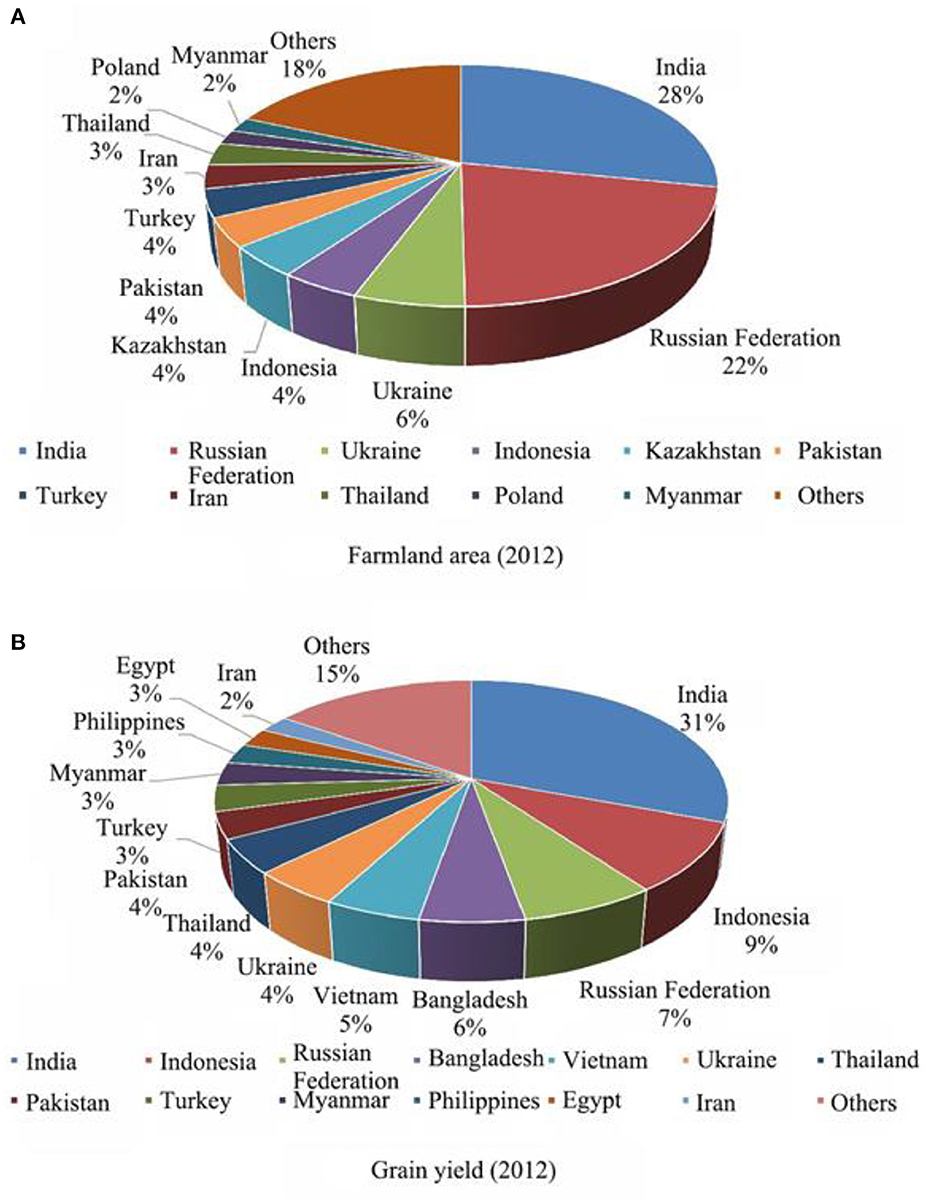

Figure 1 shows development level indexes of B&R countries. Figure 2 shows spatial distribution of agricultural resource elements in B&R countries. The analysis of the Belt and Road—Information Development Index (B&R-IDI) and the number of resident-selected patent applications shows an imbalance among the B&R countries in terms of the level of scientific and technological development. The countries in Central and Eastern Europe often gained higher B&R-IDI scores than the countries in South Asia and Southeast Asia, and Afghanistan gained a low score at 14.08.

Figure 2. Spatial distribution of agricultural resource elements in B&R countries. (A) Farmland area. (B) Grain yield.

Empirical analysis of factors of host countries and location selection of China's OFDI

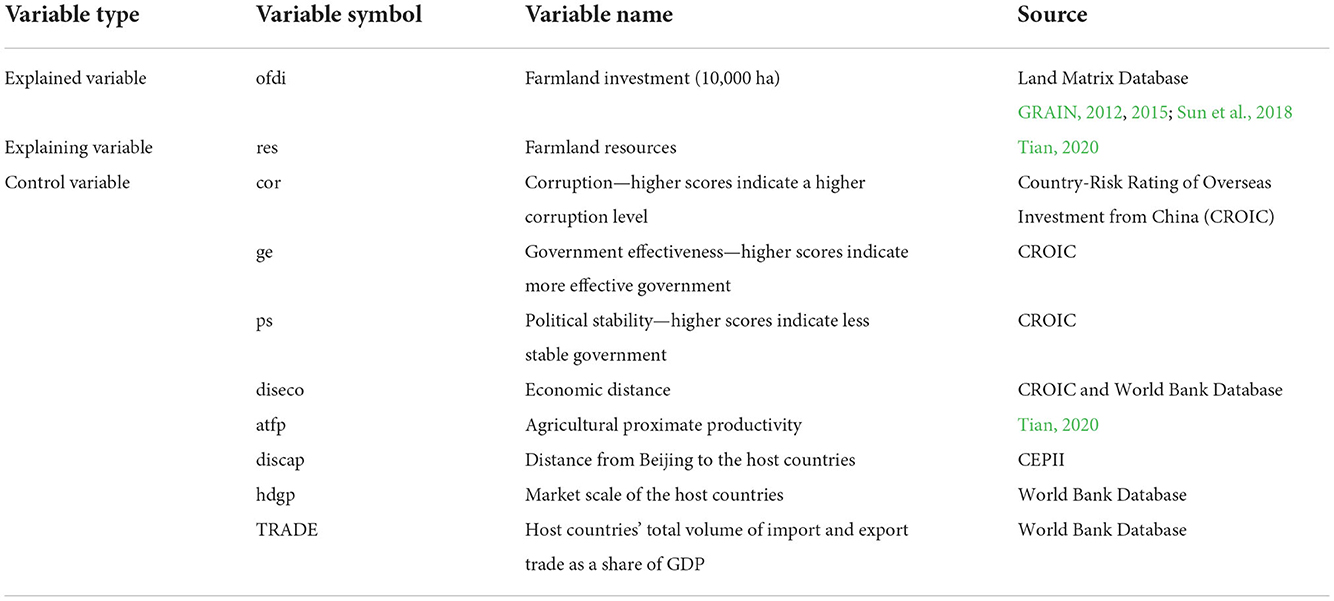

Selection of variables

(1) Explained variable

Since the host countries, politically sensitive to the farmland investments from other countries, may involve in backstage operation in investment projects, and the specific information on the amounts of foreign farmland investment by countries is not yet available from internationally public authoritative databases. Therefore, referring to the method of selecting dependent variables for overseas farmland investment in empirical studies by Wan and Lu (2018), the scale of farmland investment in the B&R countries was determined as a dependent variable to describe the trend of investment location selection made by Chinese enterprises and determine the trend of farmland investment in the B&R countries.

(2) Explaining variable

The farmland resource was taken as the main explaining variable in this study. The rapid growth of China's population and economy over the past 40 years has contributed to a climbing demand for grain, while putting pressure on the carrying capacity of its farmland resources, compounded by the ever-increasing demand for grain. The limited areas and uneven regional distribution of farmland make it highly geographical. The land and the freshwater resource factors, which constitute the farmland resources, would be unlikely to change much over a period, according to the results of the previous study herein. Consequently, regardless of the inconsistency between previous empirical findings on the attractiveness of natural resources for China's OFDI, the level of farmland resources in the host countries will play a part in the sustainable business development of transnational enterprises, given the long cycle of overseas farmland investment. Based on this, it is assumed that the farmland resources (res) in host countries are positively related to the scale of China's overseas farmland investment. The data of farmland resources in this study were attained by directly referring to the results of the study by Tian (2020).

(3) Control variables

Bilateral distance. In the Country-risk Rating of Overseas Investment, the relationship between the host countries and China is used as a measure of policy resistance and political friendship between the two sides. The indicator encompasses six sub-indicators, including whether the parties have signed an investment agreement (bit), whether the investment agreement is in force, the degree of investment resistance, bilateral political relations, trade dependence, investment dependence, and visa exemption. Considering the availability of data and the comparative analysis that follows, the investment dependence of the host countries in the Kronecker system was determined as an indicator measuring the bilateral economic distance in this study.

Institutional environments of host countries. To date, the WGI annually released by the World Bank, and the International Country Risk Guide (ICRG) published by the U.S. PRS Group are in a better position to assess the national institutions and investment risks. The ICRG has been described as “authoritative” and “highly predictive” in terms of risk rating. As approaches measuring institutional environment indicators vary across international rating agencies, the overseas investment risk assessment system adopted in this study is the same as that of CROIC, which measures the institutional environments of the host countries by the corruption level, government effectiveness, and political stability. The corruption level (cor) measures the degree of corruption in the political system. Government effectiveness (ge) measures the quality of public services, the efficiency of policy formation and implementation. In addition, political stability (ps) measures the frequency of regime change and government capability to implement introduced policies.

Agricultural total factor productivity (TFP) of host countries. Most of the existing studies measure and judge the regional TFP from a rather macroscopic perspective. Methods calculating the industrial TFP include the C-D production function, the L-P method, and the DEA-Malmquist index method among others. Subject to the availability of agricultural data outside China, an approximate TFP index was taken as a substitute variable and the study results of Tian (2020) were used.

Scales of markets of host countries. A larger market scale, an important factor in attracting foreign investment, is expected to bring more effective economies of scale and scope, maximize the benefits of the development and output of farmland in the invested country, which mirrors a country's economic performance and economic environment. The market scale of a host country is expected to be positively correlated with the scale of Chinese investment in the country's farmland expressed by the gross national product (hgdp) in this study.

Geographical distance. The First Law of Geography, according to Tobler (1970), is “everything is related to everything else, but near things are more related than distant things.” The geographical distance between countries was expressed by the bilateral distance between capitals (discap) in this study.

Degrees of trade openness of host countries. The degree of trade openness (trade) of a host country was measured by the sum of the host country's export and import divided by GDP. For the sake of consistency in the magnitudes, algorithmization was done to the GDP of host countries and geographic distance indicators (Table 2). The impacts of the selected indicators on China's farmland investment in the B&R countries were measured objectively.

Model building

(1) Major limitations on empirical study

The driving factors of China's OFDI (or foreign trade) are often tested empirically by the gravity model (Kolstad and Wiig, 2012; Wei and Li, 2019). In terms of foreign trade, the trade flow is used as the explained variable in some gravity models. However, Helpman et al. (2004) pointed out that there is no bilateral trade or only unilateral trade between most countries in transnational business activities. By analyzing the foreign trade data of different industries in the United States in 2005, Baldwin (2003) found that there is no trade in more than 90% of the data. The same is true with OFDI. Chinese enterprises make no investment in many countries (regions) in a certain year.

For example, an enterprise has not decided to make an investment in view of its own strength or project feasibility, or may quit after investing in the project, so that a large amount of farmland investment is zero in certain duration in the land transaction database. If parameters are estimated by the ordinary least squares after log-linearization in the traditional gravity model, the regression results will be biased because the conditional expectation of the error term is no longer equal to zero due to the change of the probability density function of the dependent variable and the existence of heteroscedasticity. Based on the above analysis, there is a limitation on the feasibility of the empirical approach in the study on the factors influencing China's overseas farmland investment, which is mainly reflected in two aspects: limited dependent variables and sample selection bias. (1) Limited dependent variable. Only farmland transaction data larger than 200 hectares is available in the updated statistical database of Land Matrix due to statistical reasons. In reality, most enterprises have not invested in overseas farmland or have not reached the collection scale of Land Matrix Database after investment. Therefore, there is a “left truncation” in China's overseas farmland investment at 200 hectares. In addition, enterprises may continue to invest to recover costs and seek profits after they are familiar with and adapt to the investment environments of the host countries due to the long cycle of farmland investment and high initial investment so that the target host countries of China's long-term farmland investment are concentrated in only a few countries, showing a non-normal distribution. Based on the above analysis, the enterprise first selects whether to invest in overseas farmland and then decides the scale and mode of investment. The explained variables in such decision-making behavior are limited to a certain extent, and the method of ordinary least squares is not applicable.

(2) Sample selection bias

If a sample survey is adopted for analysis, the data cannot explore the true investment behaviors of enterprises when there are no farmland investment activities or the investment scale is less than 200 hectares in the selected samples, as it is impossible to estimate whether it is caused by factors such as the institutional environment or transportation costs. If the samples without farmland investment are ignored, and only the countries where China has invested in farmland are studied to infer the parameters of the equation, the actual state of the dependent variables cannot be fully reflected by such a processing method, and the estimated results may also be biased. Because some “zero investment” does not occur randomly, but may be related to the variables in the model, the loss of valid information may be caused if these samples are ignored (Hao and Ma, 2012). Rauch and Trindade (2002) believed that the method of ignoring countries without trade in international trade is only suitable for random sampling surveys among some individuals. If these samples (countries without trade) are not random, the estimated results may be biased. In this study, if the host countries where China has made no overseas farmland investment are more concentrated in the B&R countries with scarce farmland resources or long bilateral distances, the impacts of the farmland resources in host countries on China's overseas farmland investment will be underestimated when the samples of these countries are ignored, misjudging the determinants of the location selection of China's overseas farmland investment.

(3) Model selection

In the actual studies of social science data, many null values are found often in the number of observed events. For example, widespread attention from multidisciplinary fields has been paid to data on hospitalization, prisoners, birth, abortion, and other special discrete limited variables. Because there are too many null points in the atmospheric data, the same null points reflect different situations, and the atmospheric data often vary greatly. The zero-inflated negative binomial (ZINB) model is developed based on the denispoisson model and negative binomial model technology, in which the problem of excessive null points in count data is explained, making it possible to identify the true null point of dependent variables, obtaining reliable hypothesis testing and parameter estimation, and helping researchers to solve a series of practical problems that cannot be solved by traditional models.

(4) Model building

In the zero-inflated count model, the mixed probability distribution composed of zero count and non-zero count sets is:

In Formula (1), y represents the number of events in the sample data, i.e., the number of China's farmland investment in host countries; P represents the probability that there are too many “0”s in the data when the individual comes from the first process and follows the Bernoulli distribution; g(yi) means that the individual comes from the second process and follows Poisson distribution or negative binomial distribution, with the probability of 1-P. In terms of the copula function, the logit function was used in this analysis, and the final model obtained is as follows:

Where α0 is a constant term, α1-α2 are regression coefficients, and ε is a random error term.

Empirical analysis

(1) Descriptive and correlation analysis

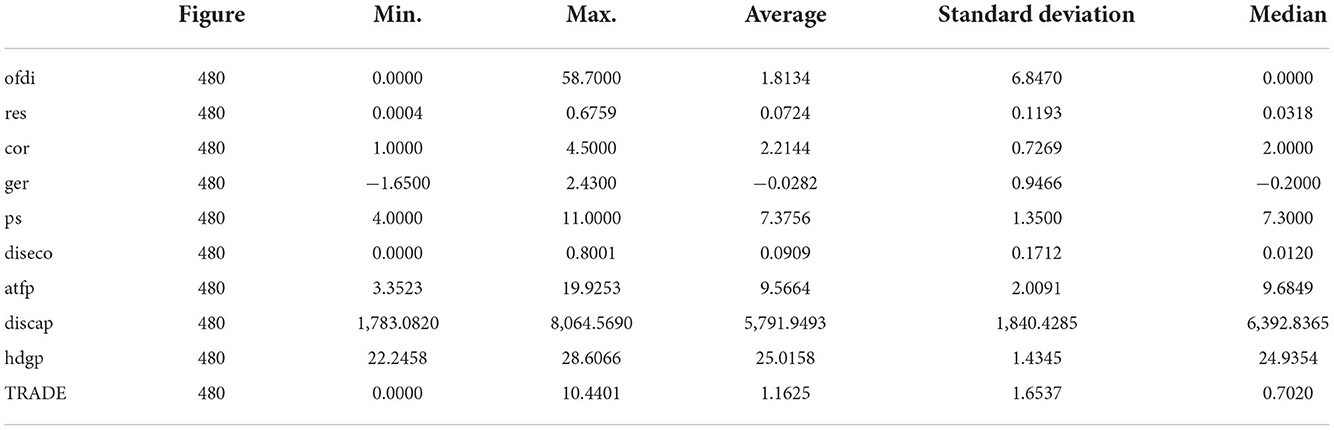

A descriptive analysis of the variables in this study was performed at first before the regression analysis, to list their basic statistical characteristics and perform correlation analysis.

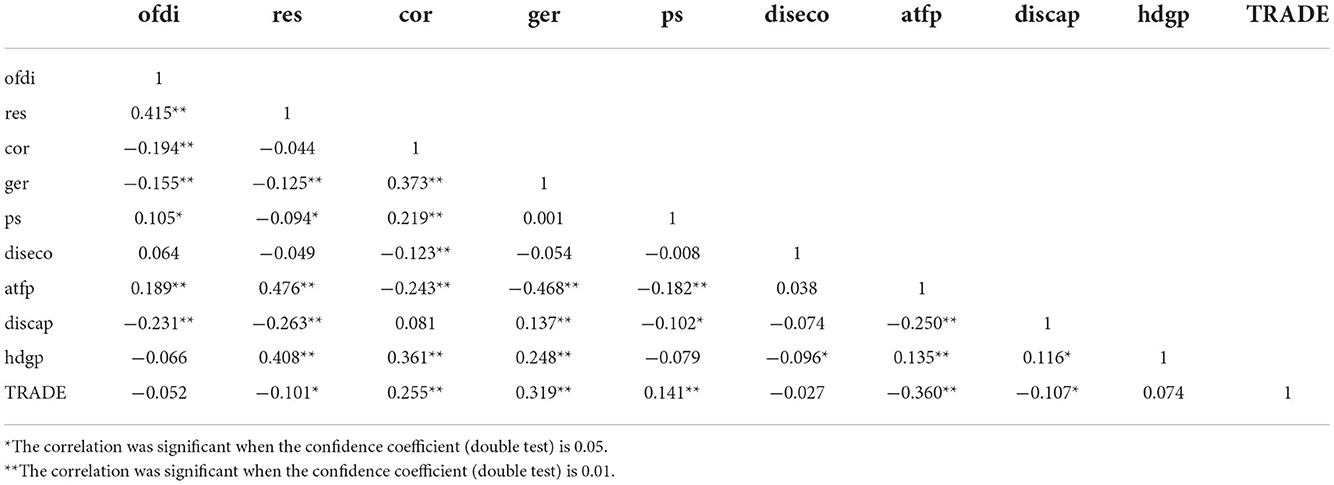

The descriptive analysis is shown in Table 3, in which the maximum, minimum, mean, standard deviation and median of each variable are listed.

The results of the correlation analysis are shown in Table 4. The Pearson correlation analysis method was adopted. According to the results of this study, farmland investment (ofdi) and farmland resources (res) were significantly positively correlated, with a correlation coefficient of 0.415, which was significant at the level of 1%. In terms of control variables, farmland investment (ofdi) was significantly negatively correlated with the degree of corruption (cor), government effectiveness (cor), and the distance from Beijing to the host country (discap). The farmland investment (ofdi) was significantly negatively correlated with political stability (PS), and agricultural approximate TFP (atfp) was significantly positively correlated. However, the correlation analysis is only the single-factor analysis, and the correlation between the final variables shall be determined by multiple linear regressions. In addition, collinearity also can be determined by the correlation analysis. Generally, it is believed that there is collinearity and the results of the regression model are biased if the correlation coefficients between the explaining variables, and between the explaining variable and the control variable are all more than 0.8. According to this result, the correlation coefficients were less than 0.8, indicating that there was no collinearity, and further regression analysis could be performed.

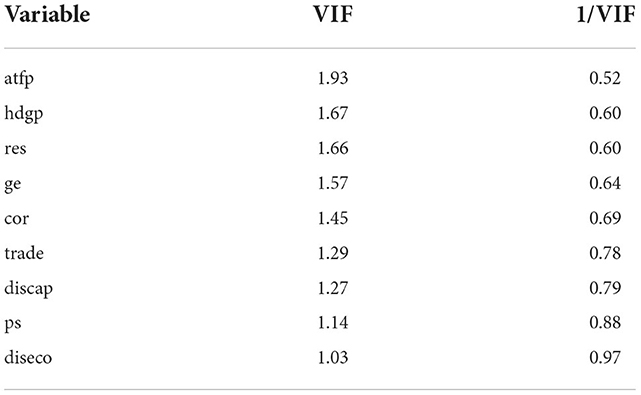

(2) Collinearity test

The Variance Inflation Factor (VIF) method was used herein to test whether there is multicollinearity among variables before the formal regression analysis was performed. The calculation results showed that the variance inflation factor of each variable was less than 10 (Table 5), indicating that there was no serious multicollinearity among these 9 variables, which can be used in the empirical test herein.

(3) Regression analysis

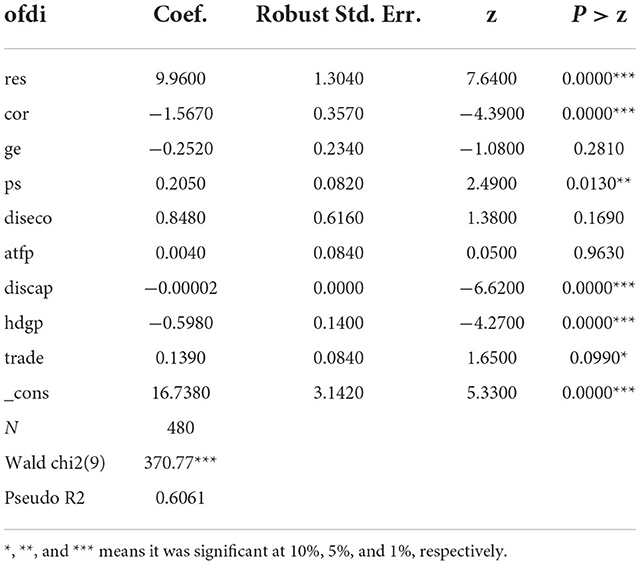

The above variables were substituted into the model in this section, and the zero-inflated Poisson model and Stata15.0 analysis software were used to perform empirical analysis on all samples.

The regression results are shown in Table 6. Pseudo r2 was used to judge that the model fits well, and the value range was 0–1. The closer it was to 1, the better the model fitted. Pseudo R2 was 0.6061 in this study, which indicated that the model fit well. The value of Wald chi2(9) was 370.77, and there was a significant difference at the level of 1%, indicating that the model fit.

The full-variable model was applied in this study to test the impacts of variables on the farmland investment scale in the B&R countries. The regression equation included explaining variables-farmland resources, three indicators to measure the institutional environment of host countries, bilateral economic distance variables, economic distance and institutional environment, agricultural approximate TFP of host countries, etc. According to the results, the regression coefficient of farmland resources (res) was 9.9600, which was significant at the level of 1%, indicating that farmland investment (ofdi) and farmland resources (res) were significantly positively correlated. China's farmland investment (ofdi) in host countries has increased with the increase of farmland resources (res) within a certain range. The regression coefficient of the degree of corruption (cor) was −1.5670, which was significant at the level of 1%, indicating the farmland investment (ofdi) and the degree of corruption (cor) were significantly negatively correlated. China's farmland investment in host countries has increased with the decrease of the degree of corruption (cor) of host countries within a certain range. The regression coefficient of political stability (PS) was 0.2050, indicating that farmland investment (ofdi) and political stability (PS) were significantly positively correlated. China's farmland investment in host countries has increased by 0.2050% as political stability (PS) of host countries increased by 1%. The distance from Beijing to the host countries (discap) and the farmland investment (ofdi) were significantly negatively correlated. The farther the distance from Beijing to the host countries, the less China's farmland investment in the host countries. The economic scale of the host countries (hdgp) and the farmland investment (ofdi) were significantly negatively correlated. The smaller the economic scale of host countries (hdgp), the less China invested directly in host countries. The proportion of the host countries' total trade to GDP (trade) was positively correlated with farmland investment (ofdi). The higher the proportion of the host countries' total import-export volume (trade) to GDP, the more China's farmland investment in the host countries.

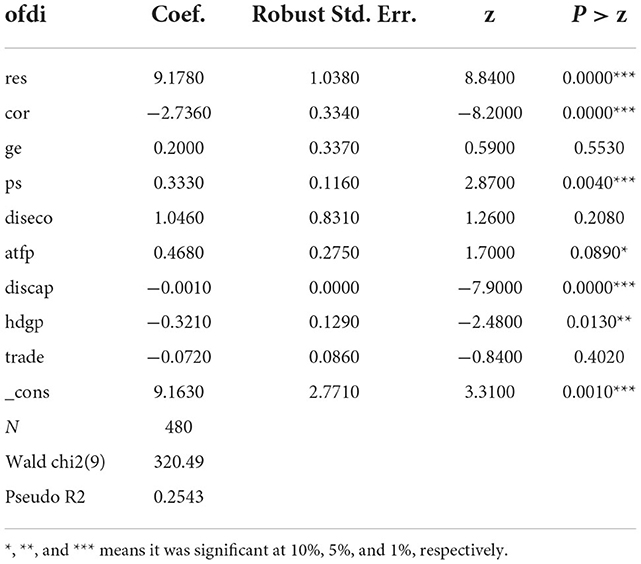

(4) Robustness analysis

The farmland resources herein were comprehensively calculated by several indicators related to the quantity and quality of farmland. As it was difficult to find effective instrumental variables and substitute variables, negative binomial Poisson regression was used for robustness analysis to further evaluate the effectiveness of the model regression. Currently, studies on the prediction of the incidence by the zero-inflated model mainly focus on population sociology, agricultural extension, and other fields. In the robustness test in Table 7, the impact direction and significance of all explaining variables almost maintained unchanged. This indicates that the regression results herein are reliable.

Conclusion

(1) Impact of variables in the investment scale model

According to the pragmatic results, the location selection of farmland investment is significantly impacted by the economic distance, corruption level, and geographical distance of host countries to China. According to the empirical results of the investment scale model, important factors that affect the scale of China's investment in the B&R countries include farmland resources, corruption level in host countries, the agricultural approximate TFP, and geographic distance.

The regression coefficient of the economic distance from host countries to China (diseco) passed the significance test. The probability of Chinese enterprises' overseas farmland investment will decrease by 0.00002 percentage when the economic distance from host countries to China increases by one percentage, which validates the hypothesis. Frequent and large-scale economic exchanges between countries contribute to form unique bilateral social relations, thereby reaching a consensus on economic issues, helping to reduce the disadvantages of Chinese enterprises' overseas farmland investment as foreigners, reducing transaction costs of enterprises, and ultimately increasing the probability of investment. At the stage of investment scale decision-making, multinational agricultural enterprises themselves have already benefited from a close economic distance, so economic distance has no significant impact on the scale of local investment by enterprises.

The coefficient of the corruption level (cor) of host countries has a negative impact in the model, which is significant at the significance level of 5%, so that the hypothesis is supported. With the establishment of China's modern enterprise system and the participation by more private enterprises, Chinese enterprises have paid more attention to market-oriented investment in overseas farmland, so that they tend to avoid risks in farmland investment. This result is consistent with the study conclusion of Wan and Lu (Gao et al., 2013), refuting the conclusion that Chinese enterprises prefer to select locations with a higher risk of corruption for their overseas investment pointed out by some international scholars. In view of the long process of farmland investment, the government of the host country manages the farmland transactions of multinational enterprises, so that the conflicts that may occur in the follow-up of farmland management projects can be mediated effectively. It is believed in this study that the host countries' institutional environments have always been an important factor influencing the investment scale in the long run.

The variable of farmland resources (res) of the B&R countries is positively correlated with the investment scale of enterprises, which is consistent with the intuitive results observed above that the countries with abundant farmland resources are associated with destinations of China's farmland investment. It is noted that farmland resources are attractive in terms of the location selection of China's farmland investment in the B&R countries to some extent, but it is not a determinant. The farmland resources are of greater importance for the investment scale decision-making, that is, enterprises pay more attention to the continuous supply of input elements required for grain production during the stage of scale decision-making. Therefore, farmland resources of host countries (including the quantity and quality of farmland) play a highly significant and positive role in promoting the scale of farmland investment, which supports the hypothesis.

Agricultural approximate TFP (aftp) has no significant impact on the stage of location selection of enterprises' farmland investment. This indicates that although the agricultural approximate TFP has little effect on the probability of China's farmland investment in the B&R countries, the post-investment scale of enterprises in host countries will be reduced by higher productivity. Upon cause analysis, the potential for future development of agriculture lies in the improvement of agricultural TFP under the condition of limited natural resources. Both the progress in agricultural technology and the optimal allocation of resources may play role in promoting the agricultural TFP (Li and Fan, 2013; Hao and Zhang, 2016). In terms of agricultural production, with cutting-edge technology and rich experience in management, Chinese enterprises prefer to expand the scale of farmland investment in countries with low productivity after deciding to invest, so as to give better play to their comparative advantages.

The coefficient of the market scale of the host country (lnhgdp) is significantly negatively correlated in the model, which is different from the research conclusion of Hao and Zhang (2016), that is, with obvious market seeking characteristics of China's overseas farmland investment now, the scale of farmland investment is larger in host countries with a smaller economic scale.

The geographical distance (discap) variable is negatively correlated at the level of 1% in the location selection and investment decision-making model, and the significance of its impact is one of the most stable and obvious variables. This is consistent with the research results of other scholars, and also confirms that the long geographical distance is unfavorable to the operation and management of overseas farmland investment and the transportation of agricultural products so that this variable has a significant negative impact in each model.

The coefficient symbol of the trade openness (trade) is positive, which is significant at the level of 10%. One possible explanation is that some of the crops that China invests in and plants in host countries are exported by enterprises taking advantage of geography or more convenient policy environment in host countries, while some are directly sold locally. The trade openness of host countries has little effect on China's overseas farmland investment behavior based on the study samples and periods herein.

Driving factors of overseas investment

Markets seeking overseas investment

Firstly, sufficient services about information of the B&R countries are provided by China to Chinese enterprises, so that the enterprises willing to participate in OFDI can easily and freely access relevant information, thus greatly reducing the costs and difficulties in the production and operation of Chinese enterprises in the host countries, and improving their OFDI capabilities. Secondly, the return on investment of enterprises can be directly increased by tax incentives. Tax incentives are provided by the Chinese government to the OFDI enterprises of China, which can not only directly increase the net investment return of Chinese enterprises in the host countries, but also promote the OFDI of Chinese enterprises, so that such enterprises have more funds for daily turnover and reinvestment, and their investment capabilities are is further enhanced. Thirdly, strong financing support has been provided by China for its enterprises as OFDI requires large amounts of funds. The financing support refers to China's support for Chinese enterprises in raising funds for OFDI, including the raising and distribution of financing funds and subsidies for financing costs. Such financing support can satisfy the capital demand of Chinese enterprises, ensure that they have adequate capital for OFDI, reduce their financing costs, and improve their profitability and return on investment, thereby boosting their enthusiasm for OFDI. Financing is one of the “Five Connectivity” programs of the Belt and Road Initiative proposed by China, namely, China will lead the Silk Road Fund, the Asian Infrastructure Investment Bank, the China Development Bank, the Export-Import Bank of China (EIBC), and the four major Chinese banks (Bank of China, Industrial and Commercial Bank of China, Agricultural Bank of China, China Construction Bank) to provide adequate financial support for the Belt and Road Initiative and significantly enhance the investment capabilities of participating enterprises.

Technology seeking overseas investment

The knowledge spillover from the export trade created by China's OFDI in the B&R countries cannot be ignored. A value transfer mechanism exists in the global value chain. In the study of Pakistani enterprises, the technological levels of local suppliers are enhanced by embedding them into the global value chain. The embedding of the local innovation system into the global value chain marks a great opportunity for the technological advancement of relevant countries. Chinese enterprises generate a competition effect on downstream enterprises, namely, investment enterprises are willing to assist downstream enterprises in management training, marketing planning, and market exploration in order to increase their brand impact and market shares, and increase returns to scale (Kolstad and Wiig, 2012). The realization of technology spillover also requires certain absorption capabilities of the host countries. Among them, the strength of scientific and technological research and development is the primary prerequisite, and such strength of the B&R countries varies greatly, and the capabilities to absorb and expand technology spillover determines the realization of technology spillover and the scale of its effect (Li and Fan, 2013).

Factors of the value chain

Within the framework of cooperation under the Belt and Road Initiative, China will work even more closely with the B&R countries in scientific and technological cooperation to improve the level of cooperation in key fields with scientific and technological advantages and demands, and further establish scientific and technological cooperation mechanisms with the B&R countries, which is conducive not only to breaking technological discrimination and blockade in key scientific and technological fields but also enhancing China's voice and right to call in scientific and technological fields, escorting the economic, trade and cultural exchanges of the B&R countries. “Pulled” by the import demands of technically backward countries and “pushed” by China's industrial upgrading, the technology is transferred from the technological “highland” with China at the core to the technological “lowland” with emerging-market countries at the core along the “Belt and Road”. Since the Belt and Road Initiative was proposed, China's participation in the global industrial division and the creation of value systems has been furthering, and China's technology transfer to the emerging markets along the Belt and Road indicates that the traditional direction of technology diffusion has changed from “developed countries to emerging markets” to “developed countries and emerging markets to emerging markets”.

Impacts of concentration of overseas investment location selection

Concentration of overseas investment location selection and development of enterprises

In terms of natural resources, if the enterprises need to obtain resources from the B&R countries for their production and operation, they can internalize the resource transactions of the B&R countries through OFDI in order to avoid tariff barriers or exchange rate fluctuation risks, so as to reduce the production costs, maintain the stability of production and operation, and provide continuous financial support for research, development, and innovation. Therefore, Chinese enterprises are more likely to obtain reverse technology spillovers through the research and development cost sharing channels when making OFDI in said countries with rich natural resources. In terms of the national institutions, different institutional environments of the B&R countries may differently impact the relationship between OFDI and innovation of Chinese enterprises. On the one hand, the better the institutional environments in the B&R countries are, the lower the operating costs are and the more stable the operating profits of Chinese enterprises are, so the sharing methods of research and development costs can be utilized to promote technological innovation of Chinese enterprises. On the other hand, the worse the institutional environments in the B&R countries are, the more likely Chinese enterprises are to obtain implicit income through rent-seeking behaviors, so as to provide financial support for research and development of Chinese enterprises and improve their innovation capabilities. As for geographical location, the closer the geographical distances between China and the B&R countries are, the lower the transport costs, transaction costs, and fixed production costs of OFDI will be, which will effectively share the research, development, and production costs of Chinese enterprises (Hao and Zhang, 2016). Therefore, the OFDI in the B&R countries with relatively close geographical distances can promote innovation of Chinese enterprises through the research and development cost sharing channels. According to statistics, as for OFDI in the B&R countries, China mainly invests in close ones, such as Singapore, Kazakhstan, Indonesia, and Russia. Griliches pointed out that from the perspective of cultural distance, studies had shown that the role of the cultural distance of host countries in the relationship between OFDI and innovation of home country was uncertain, either as a catalyst or as a hindrance. However, the B&R countries are characterized by highly diversified religious cultures, including almost all types of religions. The B&R countries differ greatly in their economic development, scientific and technological levels, institutional environments, religious beliefs, cultural customs, and other characteristics, which provides opportunities for Chinese enterprises to participate in the scientific and technological innovation cooperation of Belt and Road, and may also bring about potential conflicts and risks.

Concentration of overseas investment location selection and development of industries

From the aspect of technology, China's direct investment in the B&R countries will generate a positive spillover effect on the recipient countries. The participation of the B&R countries in the global value chain is an important opportunity for them to realize technological upgrading, and the absorption of knowledge and technology spillovers will help them develop innovative technologies and increase industrial added values. The B&R countries are mainly developing economies, with large entry barriers in most of their advantageous industries. The entry of Chinese enterprises may change the original market structures of the host countries, thus intensifying industrial competition, forcing the enterprises of the host countries to increase research and development expenditure, cultivating the local industrial chains, combining the global industrial chain with the local industrial chains, and finally promoting the technological progress of the host countries to develop toward the direction of high-value-added industries.

Suggestions on location selection for China's OFDI

Selecting diversified overseas investment locations

The overseas investment locations of China are very concentrated geographically. It is necessary to consider the regional flow that spreads the overseas investment in order to decentralize the investment risks, promote the optimal allocation of resources, and increase the return on overseas investment. According to different investment objectives, regional strategies at different levels should be diversified for China's overseas investment. Since there is a huge market for China's products in developed countries, developed countries often implement strict trade protection measures and more investment policy restrictions. For China's overseas investment enterprises seeking markets, the ideal overseas investment path is to directly invest in the developing countries around the developed countries and then export their products to corresponding developed countries in such an indirect way. In this way, not only can the market shares of developed countries be effectively expanded, but also the low cost advantage of developing countries can be utilized to reduce production costs, but attention should be paid to the principle of origin adopted by developed countries. In addition, overseas investment enterprises with a certain foundation can directly invest in the target countries after accurately targeting the target market. For some weak enterprises with insufficient investment experience, if they excessively rely on the markets, they must comprehensively consider and analyze the geographical concentration of industrial investment in a detailed manner, avoid areas with fierce competition, take into account their actual conditions and directly invest in the regions with large market growth potential. The location selection of resource-based OFDI is relatively clear and the major investment targets should be countries and regions with abundant resources, low mining costs, and low access thresholds. Generally, the locations of such investment enterprises are relatively stable, but for new investment enterprises, full consideration should be given to the concentration of locations for seeking resource-based overseas investment, in order to avoid similar enterprises from competing for limited resources in the same region, and shall select target locations in countries and regions with abundant resources and few investment enterprises. These investments should be targeted at developed countries since these technologies, especially information technology, are largely concentrated in a few countries and regions, such as the United States, Japan, and the European Union. In terms of the specific arrangement of investment path, the focus of investment of Chinese enterprises should be placed on the technical research, development, and management of products, rather than the production and processing of products. Through direct investment, technology research centers and government sales management research centers will be established to give full play to the spillover and agglomeration effects of technology research and development in developed countries. The study-based overseas investment is mainly concentrated in the high-tech industries. Multinational enterprises in China can consider the location concentration of foreign investment, make use of the agglomeration effect within the industry, strengthen the cooperation and exchange between enterprises, and realize the maximum benefits of foreign investment.

Adjusting the location concentration of relevant industries

China's overseas investment involves a wide range of industries, with an increasingly obvious trend of diversified development. However, the distribution of overseas investment in the industries is still unreasonable. The location concentration of overseas investment in some industries is very high, which tends to lead to the homogeneity of investment in some industries. A necessary means to solve this problem is to adjust the location concentration of overseas investment in related industries. The location selection of overseas investment should be combined with industrial development, and the location strategy should be reasonably arranged according to the characteristics of industrial development and the current status of location distribution of overseas investment.

First, mature and applicable technology industries. The mature and applicable technology industries refer to the industries with the technology advantage of scale in China, but their investment profits decrease and their products face elimination in China's market. The investment location selection of these industries is relatively concentrated. In order to reduce the location concentration and in combination with the characteristics of industrial development, such investment can be located in markets with a higher demand but a lower level than China, such as developing countries around West Asia and in Southeast Asia, and countries with slightly higher economic levels in Latin America and Africa, so as to transfer “marginal industries” and upgrade domestic industries of China.

Second, the first processing and manufacturing industry with certain comparative advantages. This industry requires little overseas investment and has a short cycle and quick effect, so it is especially suitable for the development model of small and medium-sized enterprises (SMEs). For China's overseas investment, the labor-intensive industries should be gradually replaced by technology-intensive industries, but this change should be analyzed in combination with different regions. This industry is also one of the key investment industries of China. Firstly, there is an obvious feature of location concentration. It is necessary to appropriately reduce the concentration within the industry and reasonably select the locations. For the investments in developed countries, it is required to change the current pattern of labor-intensive industries and optimize and upgrade invested industries as soon as possible. However, for the investments in countries with low levels of economic development, it is required to gradually keep pace with the upgrading of the domestic industrial structure in China, and gradually transform from the development of traditional labor-intensive industries to the development of technology-intensive industries. Distinguishing the investment distribution of the above two regions can effectively reduce the location concentration of overseas investment in this industry.

Third, overseas investment in the high-tech industry. Developed countries own high-quality human resources, can produce high-quality products, improve the TFP, and show powerful location advantages in high-tech products or industries, so it is suitable for the development of high-tech industries. The investment of related enterprises in China is increasing gradually with the rapid development of China's high-tech industry. China possesses the ability to invest and operate in developed countries since the research achievements in microelectronics, bioengineering, materials industry, aerospace, and other industries are world-leading. The international operation can also promote the rapid development of domestic industries in China. However, generally, most enterprises of China are weak in transforming scientific and technological achievements into productive forces. Therefore, the Chinese government should offer certain policy support, encourage and protect the domestic enterprises to participate in the international market competition, and promote the optimization and upgrading of the domestic industrial structure. This type of investment generates a strong concentration effect. As China's investment in this industry is not large enough, it is necessary to give full play to the concentration effect of investment, appropriately increase the concentration of overseas investment in this industry, and urge relevant Chinese enterprises to invest abroad.

Fourth, overseas investment in the capital-intensive and technology-intensive manufacturing industry. China can make direct investment in industries in which China has potential competitive advantages in developed countries, bring its own industries closer to advanced technological resources, carry out production and operation in accordance with international practices, and participate in international competition at a higher level. Fifth, overseas investment in the resource and energy industry. The OFDI is concentrated in this industry since the geographic distribution of world resources is very clear. In order to realize the optimal allocation of resources, domestic enterprises in China should take the occupation of resource locations and markets as the baseline when they invest in the industry. Meanwhile, the government should also exert control so that the enterprises investing in the resource and energy industry are distributed in more reasonable regions to avoid the vicious competition of resources and energy development. In short, the industrial development must be combined with the location selection as for China's OFDI, so as to develop different industries for countries of different economic development levels and promote the rationalization of the location concentration of overseas investment.

Improving the location layout of the value chain

The value chain as a management analysis method is utilized to analyze various economic phenomena more and more in economics. In recent 2 years, from the perspective of overseas investment, China's overseas investment tends to shift to the value chain with high added values, but most enterprises still focus on processing trade, price competition, OEM, and low-end products, which determines their position at the lower end of the value chain. The technological development capability of Chinese enterprises is poor and the core technology and products are imported, which are the main causes of the weakness of the core competitiveness of Chinese enterprises. To improve the position of Chinese enterprises in the value chain, it is necessary to cultivate independent brands based on the improvement of product quality, fully utilize the foreign resources and advantages, make up for the deficiencies of some of their links in the value chain, and realize the integration of the global value chain According to the enterprise value chain, the location selection requires separating different links in the enterprises, utilizing the location advantages of host countries in each link, and arranging these links in the most suitable countries and regions for their development. This in fact puts forward a certain requirement to the conditions of the enterprises that the enterprises must be of a certain scale and can divide the production activities into different procedures and links. Few overseas investment enterprises of China can meet this requirement, but qualified enterprises can optimize their geographical distribution around the world according to the concept of the value chain and promote the development and growth of enterprises by optimizing and combining different production links and regional characteristics. The location arrangement of the enterprise value chain decentralizes the overseas investment in different regions of the world, reasonably allocates resources, and disperses management risks.

Exerting superiority of concentration to promote clustered overseas investment

China's overseas investment enterprises show a trend of centralized development in terms of location selection. Generally, this selection will bring about a positive effect of enterprise cluster. In practice, however, although Chinese enterprises are concentrated, they do not attach importance to the connection between groups and division of labor and cooperation, the effect of concentration is not brought into play, and the regional concentration does not bring the advantage of centralized development. In recent years, the overseas investment of China's SMEs has gradually developed, and the development model of cluster investment is conducive to enterprises to make full use of the advantages of regional concentration, effectively avoid unfavorable factors, and promote the healthy development of China's overseas investment. In order to promote the cluster overseas investment of SMEs, the government should first formulate corresponding public policies to provide convenience for the financing of SMEs, help investors deal with the daily financial business, and strengthen the financial support. In the process of promoting the cluster overseas investment of enterprises, the emphasis should be placed on cultivating core enterprises, promoting the common development of other enterprises within the group, promoting the formation of specialized division of labor, and improving the production efficiency of enterprises. Meanwhile, it is necessary to pay attention to technological innovation, avoid excessive competition due to the homogenization of enterprises, and make the enterprises in the group realize the differentiated common development of products and services through innovative technologies and concepts.

Conclusion

(1) The scope of land property rights in the definition of land property rights in the host countries is the decisive premise of transnational land transactions. There are many uncertainties in the current international situation, including the sustainability of rapid economic growth, increasing constraints on productive resources, land degradation, water consumption, increasing climate change, bilateral distance, etc. These uncertainties may potentially affect crop yield fluctuations, which may lead to changes in host countries' rules on foreign ownership and farmland contracting. Therefore, the transnational enterprises of farmland investment need to pay close attention to the land policies of the host countries.

(2) The stages of location selection and scale decision-making of China's farmland investment in major B&R countries are impacted by different factors. In the stage of location selection, enterprises should pay more attention to countries with a closer bilateral distance and a better institutional environment. The bilateral distance is vital for transnational enterprises. However, it is even more important for transnational enterprises that invest in farmland, since farmland investment involves large initial sunk costs and a high degree of uncertainty in the external environment. Therefore, to some extent, a closer bilateral distance means a more stable and predictable business environment. In the stage of scale decision-making, on the one hand, enterprises should continue to pay attention to the institutional environments of the host countries and natural resources are strategically, politically, and financially important for the host countries. Therefore, the governments strictly control the OFDI in natural resources, and enterprises have to deal with the governments of host countries continuously throughout the investment process. The empirical results of this study further highlight the importance of the host countries' institutional environments. Olivia (2003), Bbsse and Hefeker (2007), Quer et al. (2012), Guo et al. (2014) and other scholars have similar conclusions. In order to cope with the political risks of the host country, foreign agricultural direct investment enterprises should improve their ability to identify, warn and respond to the political risks of the host country, scientifically screen the information released by the outside world, do a good job in the investigation and political risk assessment before the project investment, as well as the dynamic monitoring and emergency plan of political risks during the project operation, so as to minimize the possible losses caused by political risks. On the other hand, the agricultural production technology in some countries is backward, there is great growth potential in the infrastructure markets, and the sharing of agricultural technology and the investment in engineering projects by Chinese enterprises have complementary advantages in investment cooperation for some countries that are in urgent need of developing agriculture. Therefore, the popularization of China's agricultural technology can promote the productivity of the host countries, thus improving the resource allocation efficiency of farmland exploitation, which is also one of the driving factors for Chinese enterprises to continue to operate and expand the investment scales in the host countries. Foreign investment in agriculture has become an inevitable choice to alleviate the contradiction between the shortage of agricultural resources and the structural shortage in various countries and build a community of interests and destiny. Countries should strengthen the strategic planning of agricultural foreign investment, and implement the strategy of agricultural science and technology first, agricultural investment and agricultural products trade simultaneously. Adopt a fair and inclusive investment model, take into account economic, social and environmental interests, promote poverty reduction and economic development through agricultural investment, and cooperate with relevant interest groups for win-win results.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JT and YL each wrote the section of the manuscript, contributed to data curation and analysis, and contributed to the manuscript revision. All authors contributed to the article and approved the submitted version.

Funding

This study was funded by Major Projects of the National Philosophy and Social Science Foundation of China (17ZDA046).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Akt, A., Dd, B., and Ad, C. (2019). Geopolitical risk, economic policy uncertainty and tourist arrivals: evidence from a developing country. Tourism Manage. 75, 323–327. doi: 10.1016/j.tourman.2019.06.002

Baldwin, R. (2003). The Spoke Trap: Hub and Spoke Bilateralism in East Asia. Korea Institute for International Economic Policy (KIEP). Working Paper.

Bbsse, M., and Hefeker, C. (2007). Political risk, institutions and foreign direct investment. Eur. J. Polit. Econ. 23, 397–415. doi: 10.1016/j.ejpoleco.2006.02.003

Board for International Food and Agricultural Development (2022). How the United States Benefit. International Food Policy Research Institute, Association of Public and Land-Grant Universities.

Brutschin, E., and Fleig, A. (2018). Geopolitically induced investments in biofuels. Energy Econ. 74, 721–732. doi: 10.1016/j.eneco.2018.06.013

Chen, Y. F., Li, X. D., and Wang, S. H. (2015). Research on the impact of the principle of responsible investment in agriculture and food system. Issues in Agric. Econ. 36, 35-41, 110–111. doi: 10.13246/j.cnki.iae.2015.001

Cheng, G. Q., and Zhu, M. D. (2014). The path-choosing and policy framework of agriculture implementing global strategy in China. Reform 27, 109–123.

Deininger, K. (2011). Challenges posed by the new wave of farmland investment. J. Peasant Stud. 38, 217–247. doi: 10.1080/03066150.2011.559007

Gao, L. F., Li, W. F., and Yu, Y. Q. (2013). Research on the relation between ODI and industrial upgrading in the United States. Econ. Survey 30, 72–76. doi: 10.15931/j.cnki.1006-1096.2013.06.010

Guo, J., Wang, G., and Tung, C. (2014). Do China's outward direct investors prefer countries with high political risk? An international and empirical comparison. China and World Economy22, 22–43. doi: 10.1111/cwe.12090

Guo, Z. M. (2017). The analysis of US and Japan foreign investment and its enlightenment to China: Based on the perspective of “The Belt and One Road Initiative”. Int. Trade 36, 42–47. doi: 10.14114/j.cnki.itrade.2017.06.010

Han, J., Yang, C., Ke, N., and Lu, X. (2018). Analysis of the differences and influencing factors between China and the United States in the choice of host countries for overseas cultivated land investment in Africa. China Land Sci. 32, 37–43.

Hao, G. S., and Zhang, W. W. (2016). Influencing factors, decomposition of influencing effects and regional differences of agricultural total factor productivity in China-GMM estimation based on provincial dynamic panel data. J. Liaoning Univ. (Phil. Soc. Sci. Edn.) 44, 79–88. doi: 10.16197/j.cnki.lnuspse

Hao, J. F., and Ma, H. (2012). New development of gravity model and its test to China's foreign trade. J. Quant. Tech. Econ. 53, 53–69.

Helpman, E., Melitz, M. J., and Yeaple, S. R. (2004). Export versus FDI with heterogeneous firms. Am. Econ. Rev. 94, 300–316. doi: 10.1257/000282804322970814

Jack, C. C. H., and Ching-Wai, C. (2018). How important are global geopolitical risks to emerging countries? Int. Econ. 156, 305–325. doi: 10.1016/j.inteco.2018.05.002

Jia, P. N., Liu, A. M., Cheng, S. K., Qiang, W. L., Liang, W. U., and Peng, L. I. (2019). Pattern changes of China's agricultural trade and countermeasures for the utilization of overseas agricultural resources. J. Nat. Resour. 34, 1357–1364. doi: 10.31497/zrzyxb.20190701

Jiang, X. Y., Chen, Y. F., and Wang, L. J. (2018). The location characteristics and influencing factors of China's overseas arable land investment: based on the 2000-2016 land matrix network data. Chinese J. Agric. Resour. Reg. Plann. 39, 46–53.

Kolstad, I., and Wiig, A. (2012). What determines Chinese outward FDI? J. World Bus. 47, 26–34. doi: 10.1016/j.jwb.2010.10.017

Li, F. J., Dong, S. C., Yuan, L. N., Cheng, H., Chen, F., Li, Y., et al. (2016). Study on agriculture patterns and strategy of the Belt and Road. Bull. Chinese Acad. Sci. 31, 678–688. doi: 10.16418/j.issn.1000-3045.2016.06.011

Li, G. C., and Fan, L. X. (2013). Total factor productivity growth in agriculture: re-estimation of productivity index based on a new window-type DEA. J. Agrotech. Econ. 32, 4–17. doi: 10.13246/j.cnki.jae.2013.05.002

Li, M., Wang, J., and Chen, Y. (2019). Evaluation and influencing factors of sustainable development capability of agriculture in countries along the Belt and Road Route. Sustainability 11, 2004. doi: 10.3390/su11072004

Olivia, G. (2003). The impact of regional integration on foreign direct investment: can closer economic cooperation among countries influence firms' location strategies? J. Econ. Comm. 17, 46–47.

Qiu, H. G., Chen, R. J., Liao, S. P., and Cai, Y. (2013). Current situation, problems and countermeasures of “going global” of agricultural enterprises in China. Issues in Agric. Econ. 34, 44–50. doi: 10.13246/j.cnki.iae.2011

Quer, D., Claver, E., and Rienda, L. (2012). Political risk, cultural distance, and outward foreign direct investment: empirical evidence from large Chinese firms. Asia Pacific J. Manage. 29, 1089–1104. doi: 10.1007/s10490-011-9247-7

Rauch, J. E., and Trindade, V. (2002). Ethnic Chinese networks in international trade. Rev. Econ. Stat. 84, 116–130. doi: 10.1162/003465302317331955

Salameh, R., and Chedid, R. (2020). Economic and geopolitical implications of natural gas export from the East Mediterranean: the case of Lebanon. Energy Policy 140, 111369. doi: 10.1016/j.enpol.2020.111369

Song, H. Y., and Zhang, H. K. (2014). Characteristics, obstacles and countermeasures of Chinese enterprises' foreign agricultural investment. Issues in Agric. Econ. 4–10, 110. doi: 10.13246/j.cnki.iae.2014.09.001

Sun, Z., Jia, S. F., and Lv, A. F. (2018). The status of China's overseas farmland investment. Resour. Sci. 40, 1495–1504. doi: 10.18402/resci.2018.08.01

Thomas, J., Chance, K., and Isaac, M. (2017). Enhancing United States Efforts to Develop Sustainable Agri-Food Systems in Africa. Farm Journal Foundation, 2017-02-01. Available online at: http://www.agweb.com/assets/1/6/enhancingusefforts_print.pdf (accessed January 10, 2022).

Tian, R. Q. (2020). Research on Cultivated Land Resource Evaluation and Influencing Factors of Investment in “One Belt and One Road”. Yunnan University of Finance and Economics.

Tobler, W. R. (1970). A computer movie simulating urban growth in the Detroit region. Econ. Geogr. 46, 234–240. doi: 10.2307/143141

Wan, K., and Lu, X. H. (2018). A Study on the influencing factors of China's overseas cultivated land investment host country choice-An empirical study ased on the Trade Gravity Model and the Stochastic Utility Model. China Land Sci. 75–81.

Wei, Y. G., and Li, H. (2019). The power of faith: Will the religious beliefs of the host country affect OFDI in China? South China J. Econ. 108–128. doi: 10.19592/j.cnki.scje.351319

Keywords: “Belt and Road”, grain industry, investment, empirical study, sustainability

Citation: Tian J and Liu Y (2022) A study on agricultural investment along the Belt and Road. Front. Sustain. Food Syst. 6:1036958. doi: 10.3389/fsufs.2022.1036958

Received: 05 September 2022; Accepted: 24 November 2022;

Published: 14 December 2022.

Edited by:

Gopal Shukla, Uttar Banga Krishi Viswavidyalaya, IndiaReviewed by:

Henry Jordaan, University of the Free State, South AfricaJahangeer A. Bhat, Fiji National University, Fiji

Copyright © 2022 Tian and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Youjin Liu, bGl1eW91amluQGhudXN0LmVkdS5jbg==

Jiajun Tian

Jiajun Tian Youjin Liu

Youjin Liu