- Department of Agriculture, Mediterranea University of Reggio Calabria, Reggio Calabria, Italy

The production of food with beneficial health effects is at the attention of consumer entrepreneurs and public decision-makers. Plants with established health benefits such as almonds, olives from which olive oil is made, and figs have always been cultivated in the Mediterranean basin. In the past, these three crops were widely cultivated in Italy, particularly in the southern part, where the best soil and climate conditions persisted. Today, however, almond and fig production is at an all-time low. The present study aims to assess the economic sustainability of investments in shell almond, olive, and fig farms by integrating Life Cycle Costing (LCC) methodology with specific economic indicators. In addition, a comparison between the three crops is made based on all economic results. The analysis allowed for the consideration of all costs over the entire life cycle of the investments, streamlining business decision-making for the choice between different alternatives. The results demonstrated greater economic profitability of investments in shelled almonds and dried figs and an adequate level of profitability. On the other hand, the results for olive trees were low. In this context, the production of almonds and figs could represent an important agribusiness chain, useful for the improvement of the rural economy.

1. Introduction

Among the food trends of recent years, particular consumers' sensitivity to the health benefits of foods is emerging (Di Fonzo and Liberati, 2020). To date, food consumption is not only related to physiological needs but also provides benefits beyond its intrinsic nutritional effects. Indeed, the consumption of specific foods such as fruits and vegetables, together with a healthy lifestyle, is one of the important prerogatives for the reduction of chronic diseases, including several types of cancer, diabetes, and cardiovascular diseases (Van Breda et al., 2019; Carpentieri et al., 2022). This trend results in a demand for specific agri-food products to which all actors in the food supply chain, including inevitably the agricultural sector, must adequately respond.

The production of foods with important functional characteristics is recognized in many global production areas, including the Mediterranean basin, the historical birthplace of the “Mediterranean Diet.” This is the result of centuries of eating habits based on the agricultural and rural traditions of each region. It is recognized by authoritative sources as one of the healthiest dietary patterns and is characterized by the intake of functional compounds such as antioxidants and polyphenols found in the high and balanced consumption of fruits and vegetables, nuts, cereals, fiber, and olive oil (De Luca et al., 2022). The availability of different foods in the Mediterranean diet is linked to various conditions, including climate and soil features, which allow the cultivation of many herbaceous and perennial crops, irrigated or dryland. Dryland cultivation on inaccessible slopes or plains, both in the past and now, includes drought-resistant trees composed of a mixture of multipurpose trees, particularly olive (Olea europeae L.), fig (Ficus carica L.), and almond (Prunus dulcis L.) (Correia et al., 2017).

As with spatial conditions, these three crops are characterized by similar conditions that threaten the competitiveness of farms.

They require medium to high inputs for cultivation, good technical specialization, and manual labor. From a structural point of view, in many areas of the Mediterranean, producing farms are characterized by fragmented production structures (small farm size), distributed in orographically difficult areas, and with low land mobility and poor crop renewal. With these objective conditions, some problems are more related to the organization and management capacity of farms, the delay in incorporating technological innovations, lack of investment, difficulty in accessing credit, lack of planning, medium to long-term strategic vision, and, many times, lack of awareness of the real costs of production during all phases of cultivation. Furthermore, specific variables related to climatic factors and, last but not least, the level of EU subsidies. These subsidies for many years have represented an important supplement to the income of some Mediterranean crops and, in some cases, completely distorted the concept of farm competitiveness, not allowing entrepreneurs to make correct investment choices and glimpse the best alternatives. With the gradual reduction of the same EU subsidies, these choices are proving to be unsuccessful and risky and do not allow for increased profitability both in the domestic and foreign markets, making these enterprises frequently uncompetitive.

On the contrary, high levels of firm profitability should be easily reached by three Mediterranean crops, such as olives, almonds, and figs, whose derived products fall into the category of products with positive health effects and have specific healthful properties of keen interest in consumers.

Indeed, almond fruits have antioxidant and anti-inflammatory properties, modulate glucose levels (Gervasi et al., 2021), and positively affect cognitive characteristics (Rakic et al., 2022). Extra virgin olive oil, obtained from the mechanical pressing of olives, is considered a key bioactive food due to its high nutritional qualities and concentration of monounsaturated fatty acids, as well as phenolic compounds such as oleuropein, which confer antioxidant, anti-inflammatory, antimicrobial, anti-aging, and neuroprotective properties (Pitsillou et al., 2022). Fig fruits are compounded by numerous antioxidant vitamins, sugars, dietary fiber, organic acids, phenolic compounds, organic acids, and carotenoids that can inhibit free radical formation (Arvaniti et al., 2019; Rezagholizadeh et al., 2022). Although they have a very short shelf-life, they are easily dried. Dried figs have historically assumed an important role in the daily diet in Mediterranean agricultural areas due to their ease of acquisition and the possibility of storing them for a long period without substantial quality changes.

In addition to the health aspects, another interesting feature of these three crops is that they can also be grown in arid and semi-arid Mediterranean environments under drought conditions and adaptations. Indeed, the almond tree is adapted to drought, thanks to appropriate characteristics in terms of variety and rootstock (Karimi et al., 2015); the olive tree is considered highly resistant to drought and aridity periods due to physiological adaptations such as reduction of leaf transpiration by stomatal closure (Proietti et al., 2013); and the same applies to the fig tree for its rapid growth and particular physiological mechanisms of the leaves (Medda et al., 2022).

These conditions are to be strictly considered at this historical moment when water resources become less available, compromising crop irrigation in further dry seasons (Cramer et al., 2018). Indeed, lately, in several olive-growing areas, the trend of converting crops such as olives from rainfed to irrigated areas and the increase in planting densities has increased pressure on water resources putting at risk aquifers and surface water bodies that are being overexploited (Gómez-Limón et al., 2012).

In this context, the evolution of the Italian domestic markets, especially related to the imported quantities of almonds and dried figs (INC, 2019), led to a greater interest in these crops, also manifested by specific investment support measures provided by the European Agricultural Fund for Rural Development (EAFRD) under the Rural Development Programs (RDPs) 2014/2020, such as in South Italy for Calabrian Region, the Measure 4 – Investments in tangible fixed assets – Interventions 4.1.1 and 4.1.3 “Fruit Nuit” for the annuity 2021 (Regione Calabria, 2021).

However, there is no greater area invested in almond and fig orchards, but rather a decrease, while that of olive trees is stationary.

Supporting investments in farms is necessary to provide information on the economic viability of the crops. The entrepreneur must be aware of everything that may affect his activities, taking into account all the cost factors of the investment projects incurred at each stage of the production process (Woodward, 1997). To this end, the life-cycle perspective can be functional for business strategy by analyzing, in a systematic way, the entire production process, including all stages from cradle to the grave of a product/process (De Luca et al., 2015). In this sense, the methodological tool of Life Cycle Costing (LCC) allows the incorporation of initial and operational costs incurred during the life cycle of a product or production system (Gluch and Baumann, 2004), from acquisition to final disposal (Dhillon, 1989), rationalizing long-term decision making when several investment alternatives are available. This approach, properly used for cost evaluation, enables optimal budget allocation over the product/process lifetime, as well as improving business performance (Huppes et al., 2004). As stated by Fuller and Petersen (1996, p. 17), LCC analysis “provides a significantly better assessment of the long-term cost-effectiveness of a project than alternative economic methods that focus only on first costs or operating related costs in the short run.” Several methods and standards (Dhillon, 1989; Ellram, 1993, 1994) for performing and harmonizing LCC were developed over time, but today again a standard LCC methodology does not occur; the most widespread approach is the discounting technique and cash flow models (Emblemsvåg, 2003). Specifically, conventional LCC analysis, an internationally recognized method, follows ISO standards (ISO, 2008), which provide guidelines on procedures for calculating and comparing costs and use the discounting technique through which all future costs and benefits are reduced to their present value (Woodward, 1997).

Almost all LCC applications to agri-food processes apply the so-called “Conventional LCC,” which assesses only internal costs along the life cycle of a product within the economic system. Until now, few studies have focused on assessing the economic feasibility of investments in almonds (De Leijster et al., 2020; Sottile et al., 2020), olives (Gennaro et al., 2012; Mohamad et al., 2014; Stillitano et al., 2016; De Luca et al., 2018; Iofrida et al., 2020), and figs orchards (Stillitano et al., 2017) by using the conventional LCC method.

In this context, the objective of this paper is to assess and compare different agricultural investments through the joint use of conventional LCC and economic and financial indicators. This evaluation was carried out by the analysis of average agricultural production scenarios from ordinary farms to produce almonds in shells, olives for oil, and dried figs in the same area with agricultural vocation located in Calabria, southern Italy.

To the best of our knowledge, this is the first study comparing the profitability of these three crops, thus representing a novelty in the literature of agricultural economics analyses for alternative production scenarios in the Mediterranean ecosystems' context.

The results of the analysis will have key elements identified along agricultural processes to optimize their economic performance for better farm management and will allow for comparison among the crops examined. In addition to the farmer, the results may support the public decision-maker in planning to fund rural development policies, also in line with the new objectives of Common Agricultural Policy (CAP) 2023–2027, which continue to include improving farm competitiveness by funding farm structural actions, such as planting orchards.

These determinations for the new CAP programming are also consequent to the good results achieved by the previous 2014–2020 program related to the second pillar, including structural measures, which have helped to increase and accelerate the modernization and restructuring of farms while improving their income (European Commission Joint Research Centre and Smeets Kristkova, 2017).

2. Contextual issues

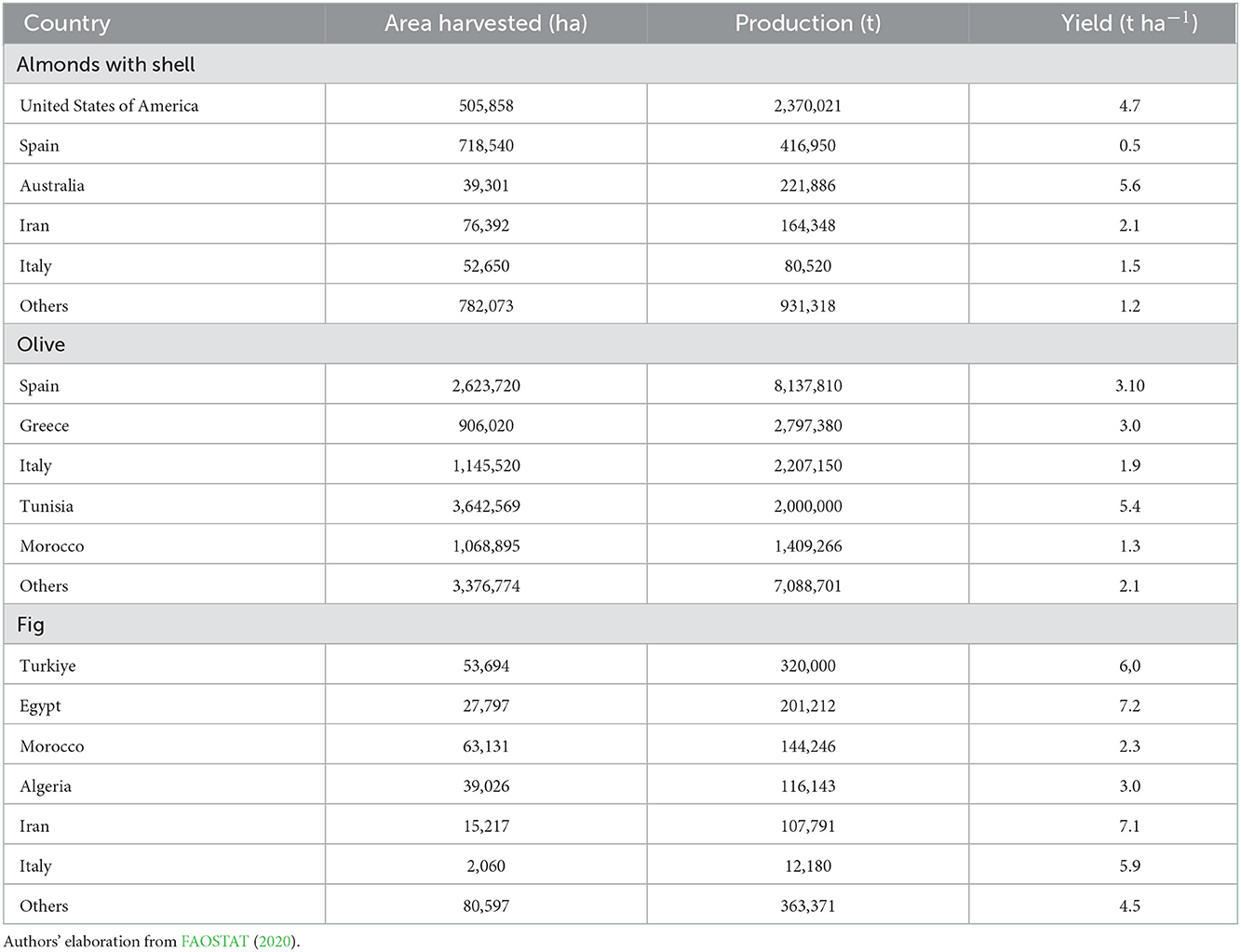

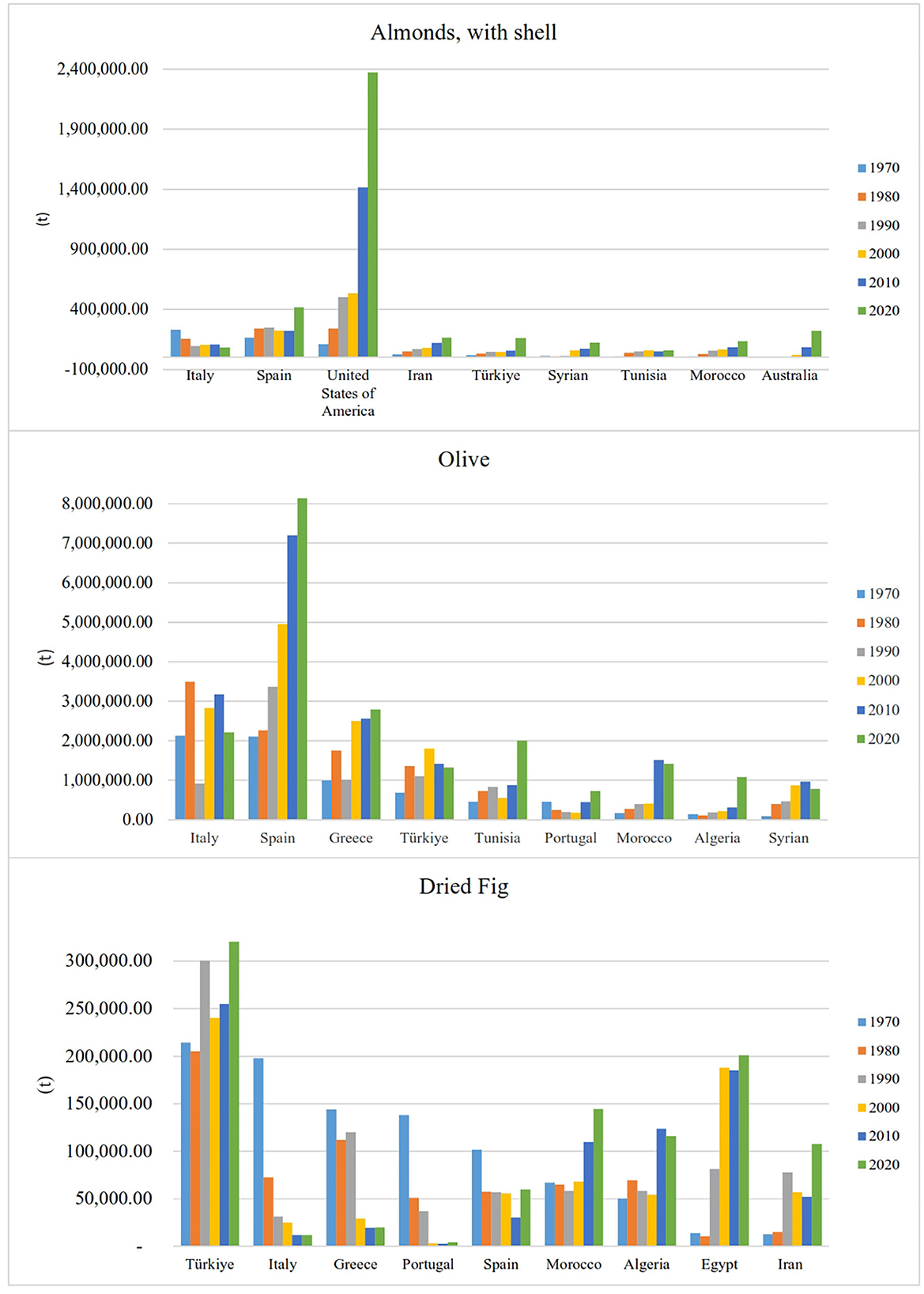

According to statistics from the Food and Agriculture Organization of the United Nations (FAOSTAT, 2020), world production of in-shell almonds in 2020 was about 4.1 million tons in an area of about 2.1 million hectares. The main producing country was the United States with about 2.4 million tons (51%), followed by Spain with 417 thousand tons (10%), Australia with 221 thousand tons (5%), and Iran with 164 thousand tons (4%). Italy, with 80 thousand tons produced, ranks eighth on the world scale (2%). The production of olives in 2020 was registered as 23.6 million tons of product in an area of about 12.7 million hectares. The leadership was maintained by Spain with 8.1 million tons (34%), followed by Greece with 2.7 million tons (11%), Italy with 2.2 million tons (9%), Tunisia with 2 million tons (8%), and Morocco with 1.4 million tons (6%). The production of figs in 2020 was 1.2 million tons in an area of about 281 thousand hectares. The leading country for fig production was Turkey with 320 thousand tons (25%), followed by Egypt with 200 thousand tons (16%), Morocco with 144 thousand tons (11%), and Algeria with 116 thousand tons (9%). Italy, with 12 thousand tonnes of in-shell almonds produced, ranks 11th worldwide (1%) (Table 1).

An analysis of the time series of the countries producing mainly almonds, olives, and figs shows a significant role of Italy over the period from 1970 to 1990 (Figure 1). A comparison with the production recorded in 2020, in contrast to 1970, shows in Italy a 65.8% reduction in the quantity of almonds produced, confirmed by a decrease in the area invested from 296,000 hectares in 1970 to 52,650 hectares in 2020. United States of America and Morocco had, respectively, a 20-fold increase in the quantity produced and a 10-fold increase. Regarding olive production, there has been little change over the years. There appears to be a large difference in production over the years mainly due to intrinsic conditions such as alternating production and pest attacks. The difference in olives produced between 1970 and 2020 shows an increase of 5%; in the years 1980 and 2010, the increase in production was 164 and 149%, respectively. The area has remained unchanged with a slight reduction in the last four decades of 12%, but with an increase in yield per hectare. In the international scenario, on the other hand, some countries have had a large increase in production such as Spain with +287.51%, which remains the leader in oil production, but also new olive-growing countries such as Tunisia with + 339.9%, and Morocco and Algeria which, although still playing a secondary role, report a production increase of 780 and 684%, respectively (FAOSTAT, 2020). As with the almond tree, a 93.85% reduction in production can be observed between 1970 and 2020 for the fig orchards. This also affected the area invested, which decreased from 39,000 hectares in 1970 to 2,060 hectares in 2020. Turkey maintains the leader in the production of figs with an increase of 40% from 1970 to 2020. Significant growth is then observed particularly for Egypt at +1,337% and Iran at +729.16% (FAOSTAT, 2020).

The reduction in production has inevitably led to having to import products from other countries. As far as almonds are concerned, in 2019, Italy imported about 54,454 tons of unshelled almonds and 2,340 tons of shelled almonds (FAOSTAT, 2020). Considering a yield of the shelled fruit of 33%, the total imported corresponds to 93,278 tons, compared with a total of 25,239 tons exported, corresponding to a balance between imports and exports equal to 118% of the number of almonds produced in Italy in 2020. As for olives, imports directly concern olive oil; Italy imported 564,378 tons of oil, compared to a production of 336,581 tons and an export of 303,819 tons. Regarding figs, Italy imported about 21,419 tons of dried figs and 904 tons of “fresh” figs. Considering a drying yield of 67%, a total of 36,673 tons were imported against 2,131 tons of figs exported (FAOSTAT, 2020). Considering the balance between imports and export, imports accounted for 283% of the amount produced in 2020. The drastic decrease in the production of figs and the surfaces are linked to the abandonment of the marginal areas where they were traditionally cultivated and to the lack of knowledge of the morphological, agronomic, chemical and conservation characteristics of the vegetable matter and fruits, which have caused little interest in cultivation. Therefore figs were not subjected to intensive breeding programs like other domestic crops (Ferrara et al., 2016). In Apulia, for example, before the Second World War, the agricultural area dedicated to the cultivation of figs was about 30,000 ha, but today it is less than 500 ha. This decline in fig cultivation is also a consequence of the expansion of the cultivation of other fruit tree species such as table grapes, sweet cherries, peaches, etc. (Ferrara et al., 2016).

For the almond orchards, on the other hand, the phenomenon of reduction can be generalized to the whole of Europe where, for many years, the cultivation has remained linked to ancient models that are not very specialized with low planting densities and very few uses of machinery. In this context, almond producers have never been able to resist world economic competition and have increasingly limited their production to marginal rural conditions (Sottile et al., 2020).

3. Materials and methods

3.1. Sample and data collection

In the Italian context, rural territories with a great agricultural vocation and historical–cultural tradition in the production of almonds, olives, and figs are located prevalently in the southern regions, such as Calabria which, for that reason, is the area of interest for the present study.

Analysis of data from the 6th Census of Agriculture (ISTAT, 2010) shows that almond cultivation in Calabria accounts for about 209 ha, and 361 farms conduct this agricultural production; olive cultivation covers an area of 185,914 ha for 113,907 farms, and fig cultivation accounts 1,076 ha spread out in 3,228 farms. As for extra virgin olive oil, there are three Protected Designations of Origin (PDOs): “Lametia,” “Alto Crotonese,” and “Bruzio,” and the Protected Geographical Indication (PGI) “Olio di Calabria”; there is also a PDO quality certification “Fichi di Cosenza” for figs. While the olive-growing area is well established and may have limited room for expansion, almond and fig farming could have great growth potential, both in terms of area and new farms.

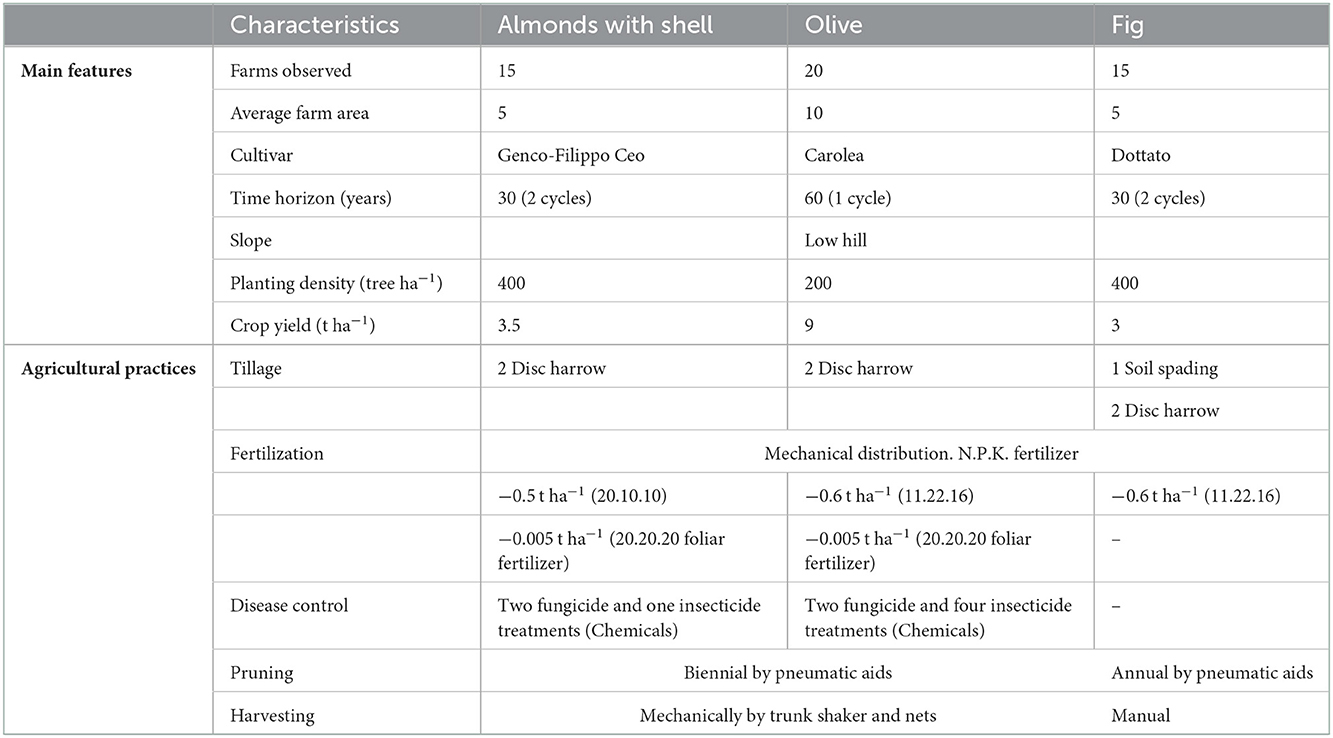

In the regional context, Catanzaro's province (Figure 2), with particular reference to the Ionian slope, lends itself well to representing a production area in which all three crops (almond, olive, and fig), currently, are widespread, albeit with different dimensions in terms of number and size of farms, especially for olive, which retains the largest share of diffusion, as in all of Calabria and generally in Mediterranean environments. Despite this, our analysis was based on the selection of farms that adequately represent the ordinary management of those agricultural production processes. All three crops are cultivated in dryland and by adopting modern and rational cultivation techniques. These techniques include mechanized harvesting for olive and almond trees, rational plant density per hectare (about 400 trees) for almond and fig trees, and high crop yields per hectare for all three crops. Farms' sample has been set up through a procedure of non-probability sampling with reasoned choice (Fraire and Rizzi, 1993) and allocation in stratified sampling (Bailley, 1994; Girone, 2001). Based on the information acquired through statistics, secondary sources, and face-to-face interviews with privileged stakeholders (agronomists, farmers, and trade associations), it was possible to define three different production scenarios related to “in-shell almonds production,” “olives production,” and “dried figs production”. The scenarios have the same orographic characteristics (hills) and the same cropping system (conventional). The medium clay soils of the hilly areas, with a dry and warm climate, allow the crops under consideration to grow and bear fruit with excellent results. All three scenarios are represented by rationally managed plants under rainfed conditions, mechanizing all possible operations. Soil management is done through surface tillage to reduce trophic competition with weeds and make the soil accumulate rainwater. The useful life of the three scenarios corresponds to 30 years for almond and figs, and 60 years for olives. To compare these scenarios, one hectare (ha) area was used as The functional unit (FU) and a cradle-to-gate analysis was performed as system boundaries. To perform the economic analysis, technical–economic data of the three scenarios were collected by means of customized questionnaires from farmers and technicians, in order to conduct a thorough data collection process.

Table 2 shows the main general characteristics, life cycle stages, and agronomic techniques of the three scenarios analyzed. As for the almond tree, the planting pattern is 4 × 6 with a density per hectare of 400 plants. Several self-fertile cultivars are present such as “Genco” and “Filippo Ceo.” The rootstock is GF 677. The training form is the classic vase and the yield per hectare was 3.5 tons of shelled almonds. Harvesting is done mechanically with a trunk shaker and inverted umbrella in the early stages of life, and the umbrella is replaced with interceptor nets when the size of the canopies does not allow its use.

In the olive groves, the planting layout is 7 × 7 with about 200 trees per hectare. The variety grown is Carolea, self-adopted from cuttings. The form of farming is the vase, and the yield per hectare of olives is eight tons biennial on average due to alternating production. Harvesting is done in the same way as the almond tree, with a trunk shaker.

The fig orchard has a 5 × 5 planting sixth with a density of 400 plants per hectare. The variety grown is Dottato, which lends itself well to drying. The form of cultivation is the pot. The yield per hectare of dried figs is three tons. Harvesting is done manually in the period from August to September with 5–6 operations. Figs were found to be already semi-wilted completely drying on racks placed in tunnels or open air.

3.2. Conventional Life Cycle Costing implementation

To identify the economic insights, a conventional LCC (Ciroth et al., 2016) based on the cash flows model (ISO, 2008) was applied. This approach allows for the rationalization of the long-term decision-making process when different investment alternatives are available.

Traditional approaches to investment appraisal may exclude some phases of the project's life, not allowing for a complete project appraisal (Gluch and Baumann, 2004).

The LCC approach, on the contrary, takes into account all costs of operations associated with the investment life cycle (acquisition, operation, and disposal; Dhillon, 1989), allowing a detailed analysis of the profitability of the investmentproject.

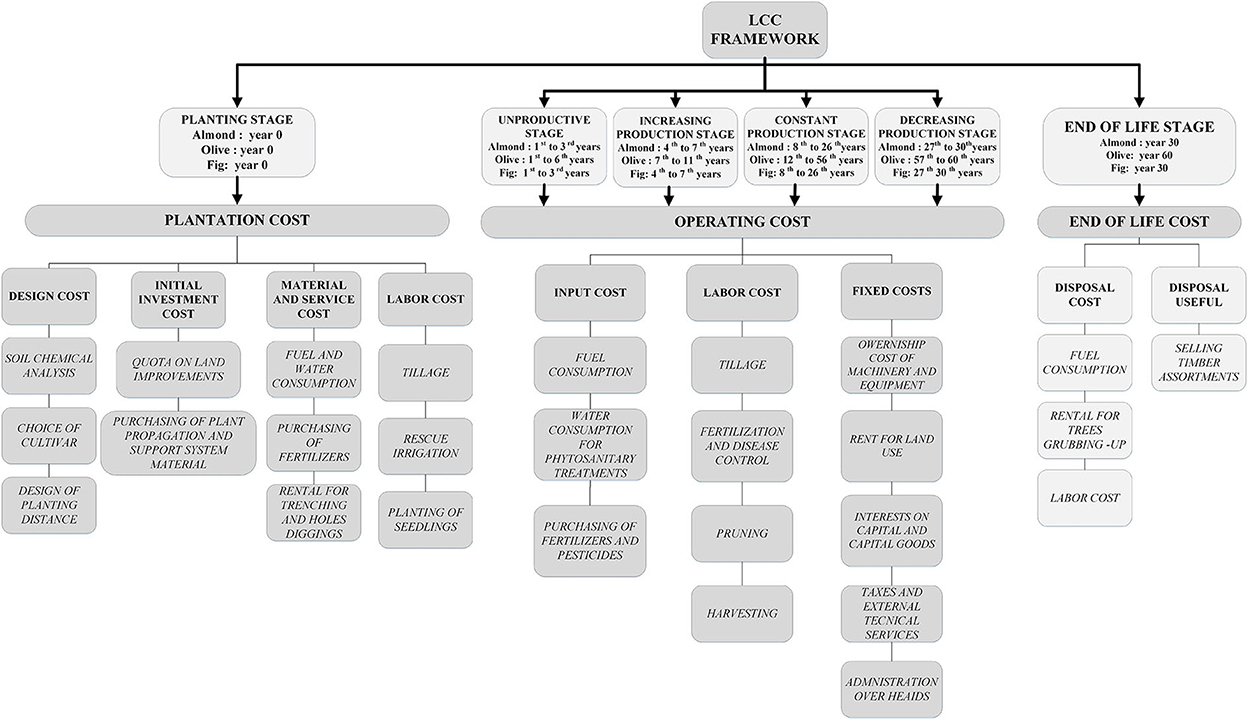

Because the study followed a farm perspective, only the real money ?ows were considered (Swarr et al., 2011). For the purpose of this study, the entire life cycle of each crop was divided into six main stages: (1) planting stage, (2) unproductive stage, (3) increasing production stage, (4) constant production stage, (5) decreasing production stage, and (6) end-of-life stage (Figure 3).

In the first step of the analysis, all costs throughout the life cycle of each scenario were inventoried. All costs have been accounted for and organized into plantation costs, operating costs during the production stages, and end-of-life costs. Within the plantation costs, the design cost (i.e., soil chemical analysis, choice of cultivar, and design of planting distance) and initial investment cost (i.e., the quota on land improvements, purchasing of plant propagation material, the rental cost of machinery for trenching, holes diggings and tree grubbing up), as well as the material and service cost, and human labor cost were considered. To evaluate operating costs, all cost items linked to agricultural operations performed in each crop were analyzed. The total cost was accounted for by its variable and fixed components. Within variable costs, input costs, i.e., fertilizers, pesticides, fuel, and lubricants consumption of machinery ownership were accounted for, as well as the human labor cost for field operations and the interests on advance capital. Fixed costs comprised ownership costs of machinery and equipment (i.e., depreciation, insurance, repairs, and maintenance), rent for land use, interests on capital goods, taxes and external technical services, and administration overheads. To calculate each cost item the following assumptions were adopted:

- Input costs such as fertilizers, herbicides, pesticides, and fuel were calculated taking into account the quantity effectively used by farms and the current market prices (i.e., in 2021);

- For specific operations such as trenching, hole diggings, and tree grubbing up were considered as provided by third parties and, therefore as rental costs of mechanical means;

- Family labor cost was evaluated in terms of opportunity cost and was equalized to the employment of casual workers for manual and mechanical operations by assuming the current wage;

- Interests on advance capital and capital goods evaluated by applying a rate equal to 4.5 and 2%, respectively;

- The rental cost for land use was deduced from the average local rental prices;

- The administrative overheads were estimated to be 5% of the gross production value, which corresponds to the annual total revenues.

Within the end-of-life costs, disposal costs (i.e., fuel consumption, rental cost for tree grubbing up, and labor cost) and disposal of useful material (i.e., sale of timber assortments) arising from the plant removal were taken into account.

Based on the life cycle of each scenario under study, the LCC approach adopted can be expressed through Eqs. (1, 2):

Where,

TLCC = total life cycle costing;

j = 0, …, n represents years of lifetime (30 years for both almond and fig, 60 for olive);

r = discount rate;

PC0 = Plantation Costs in the “Planting stage”;

OCUPstage = Operating Costs in the “Unproductive stage”;

OCIPstage = Operating Costs in the “Increasing Production stage”;

OCCPstage = Operating Costs in the “Constant Production stage”;

OCDPstage = Operating Costs in the “Decreasing Production stage”;

ELC = difference between disposal useful and disposal cost in the “End-of-Life Stage.”

Finally, the total revenues for the entire life cycle of each scenario were evaluated by multiplying the crop yield by its market price, which is referred to as the average of 2019/2020, 2020/2021, and 2021/2022 harvesting seasons, including EU Agricultural Policy direct subsidies. In particular, the crop selling prices were provided by:

- The Italian Services Institute for the Agri-food Market (ISMEA) for almonds, with an average price equal to 2.10 € kg−1;

- The investigated farmers for olive and fig, with an average price of 0.50 € kg−1 and 3.50 € kg−1 respectively, which reflect the market prices in the province of Catanzaro.

3.3. Economic indicators

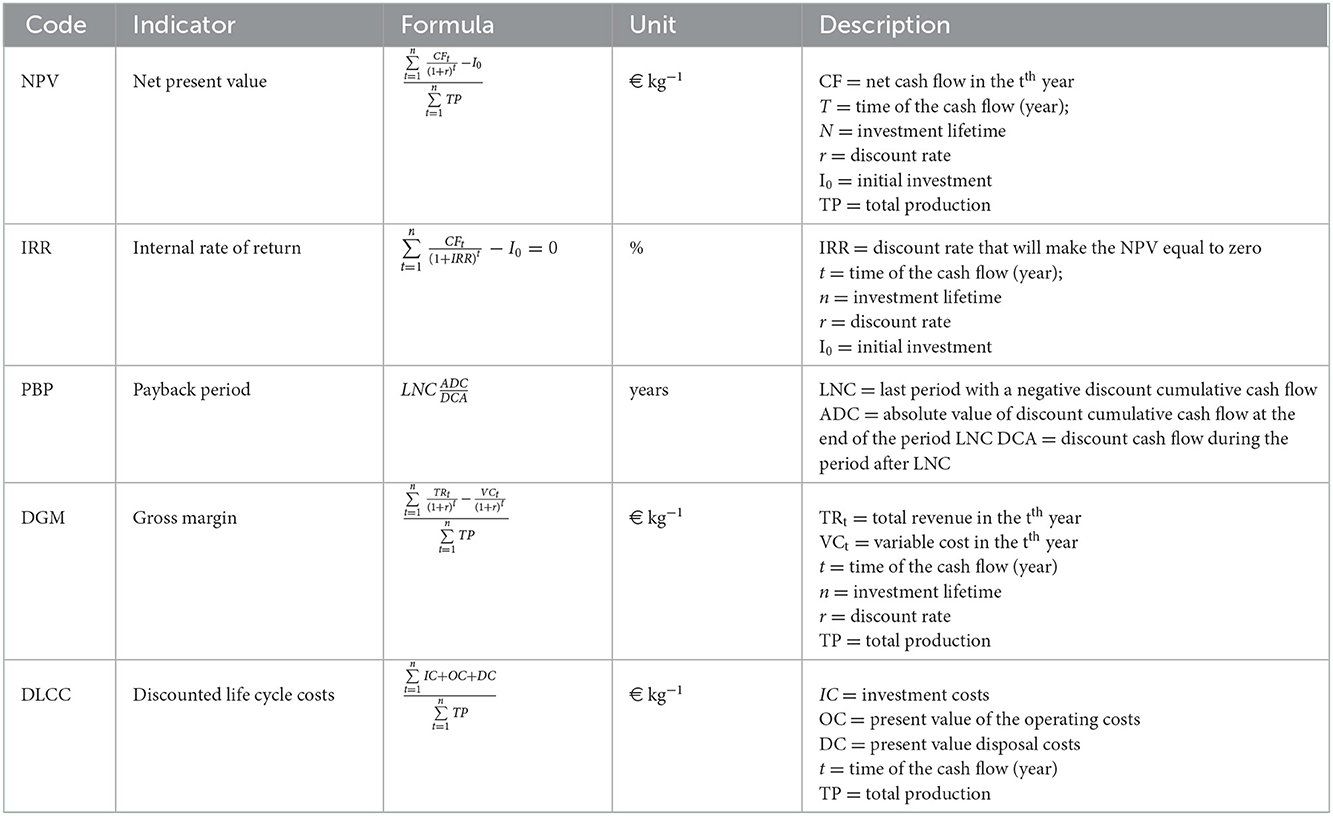

As the next step in the analysis, an investment analysis was carried out by calculating specific indicators, i.e., net present value (NPV), internal rate of return (IRR), payback period (PBP), discounted gross margin (DGM), and discounted life cycle costs (DLCC; Table 3). The selected indicators were able to assess the primary economic hotspots during the entire life of the systems analyzed, and therefore, they provided information on more effective management strategies for long-term sustainability (De Luca et al., 2018).

To perform the profitability analysis of the scenarios under study, the following assumptions were made:

- All of the costs and revenues were discounted for the entire life cycle of 60 years for the olive scenario and 30 years for the almond and fig scenarios;

- To select a discount rate, the opportunity cost approach in terms of alternative investments with similar risks and times was used (De Luca et al., 2018). Here, a discount rate set to 2% was assumed, which was similar to the average return rate of Italian government bonds in 2019;

- During the life cycle, constant prices by excluding adjustments for inflation were taken into account (Hussain et al., 2005).

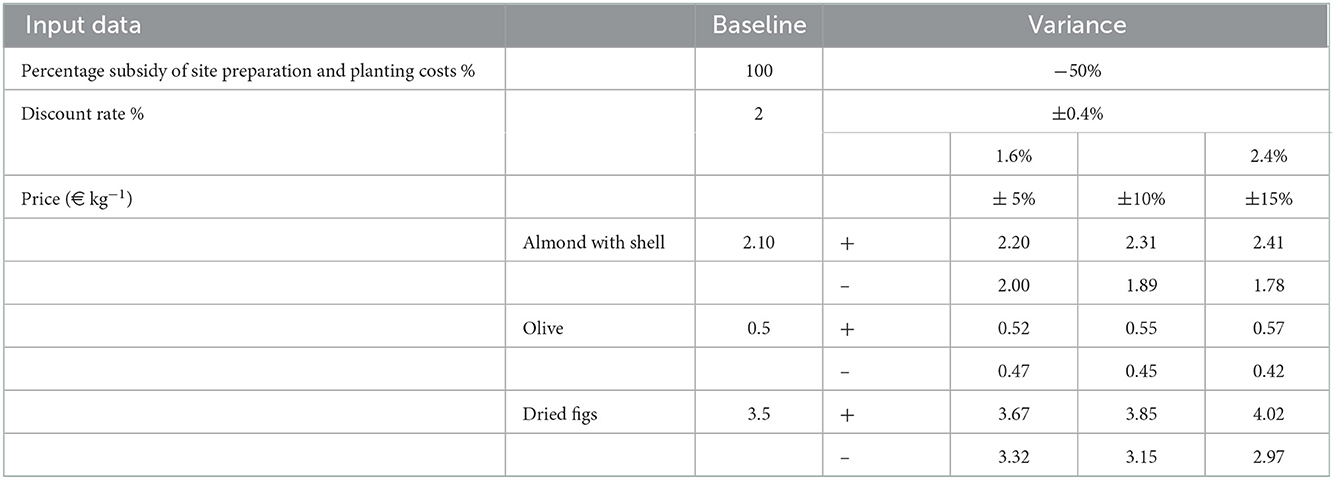

3.4. Sensitivity analysis

As a final step of the study, sensitivity analyses were performed by excluding EU Agricultural Policy direct subsidies and by including the subsidy of plantation costs according to the Rural Development Plan (RDP) measures, as well as by changing the crop selling prices, the total cost per stage, and the discount rate, to demonstrate how the economic results are related to these variables. The sensitivity analysis of the results about the inclusion of site preparation and planting costs subsidy (Pra and Pettenella, 2019) was conducted assuming an average subsidy percentage of 50% according to Measure 4 “Investments in tangible fixed assets” under the Calabria RDP 2014–2020. To explore the effect on the economic indicators from the discount rate fluctuations, a range of ±0.4 percentage points (p.p.) was used.

Finally, the sensitivity analysis concerning the crop price change was performed by assuming a range of ±5, 10, and 15% compared to the baseline scenario to reflect the market price dynamics in a free market (Stillitano et al., 2016). A decrease of the total cost per life cycle stage floated with ±5, 10, and 15% was assumed to investigate changes in the farm's internal factors (Table 4).

4. Results and discussion

4.1. Conventional LCC results

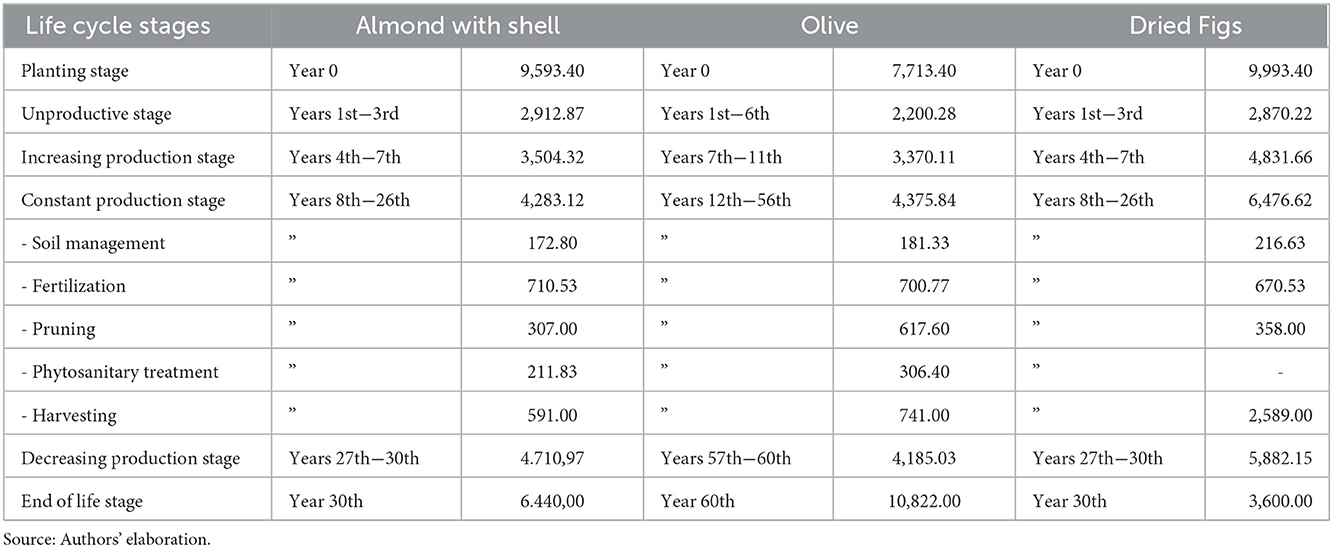

In line with the proposed methodology, average operating costs for each life cycle stage and per crop scenario under study were quantified as shown in Table 5. For all three scenarios, the “planting stage” was the most expensive of the entire life cycle due to the large initial investment costs, which include the quota on land improvements, the purchase of plant propagation material, and the cost of renting machinery for digging trenches, holes, and tree grubbing up. Among the scenarios analyzed, the highest planting cost was achieved by the fig orchard with a value of 9,993.40 € ha−1, followed by the almond orchard with 9,593.40 € ha−1. The lowest plantation cost was found in the olive grove with 7,713.40 € ha−1, as detected by Iofrida et al. (2020). This variance is directly related to the number of trees planted, i.e., 400 for the fig and almond orchards, and 200 for the olive grove.

In the “unproductive stage,” the cost analysis showed that the average plantation cost is the highest for the almond tree crop at 2,912.87 € ha−1, followed by the fig tree with 2,870.22 € ha−1 and olive tree at 2,200.28 € ha−1. These results are related to the increased need for farming practices due to breeding pruning, which is carried out to set and strengthen the plant.

In the “increasing production stage,” it is possible to notice an increase in orchard management costs related to harvesting and pruning operations that are carried out from this stage for the three crops considered. The crop with the highest operating cost was fig with 4,831.66 € ha−1, followed by almond with 3,504.32 € ha−1 and olive with 3,370.11 € ha−1. The highest management cost found for fig cultivation is related to the expenses incurred for harvesting, which is done manually and several times due to scalar ripening. In fact, as the study by Bernardi et al. (2018, 2021) argues, the mechanization of crop operations such as harvesting is key to improving the profitability of the agricultural sector by increasing labor productivity and reducing production costs.

In the “constant production stage,” there is a general increase in costs compared to the previous stages in all three crops. The highest value is found in fig orchards with 6,476.62 € ha−1, while the olive groves and almond orchards have values of 4,375.84 and 4,283.12 € ha−1, respectively. The increase in management costs found in the fig orchard is related to the increased use of waged labor for harvesting against higher production. With regard to the almond orchard and olive grove scenario, while recording higher production, the costs related to management are lower due to the complete mechanization of the harvesting that is carried out through trunk shakers and interceptor nets. Pruning also affects a lot among the other cost items. The almond tree has the lowest expenditure, even compared to the olive tree, as argued in the study by Cardone et al. (2021).

The “disposal stage” is the most expensive in the olive grove with 10,822.00 € ha−1, followed by the almond tree with 6,440.00 € ha−1 and finally the fig tree with 3,600.00 € ha−1. In all the scenarios examined, the greatest incidence of the total cost item is represented by the rental of the mechanical means necessary for the uprooting of plants (including roots).

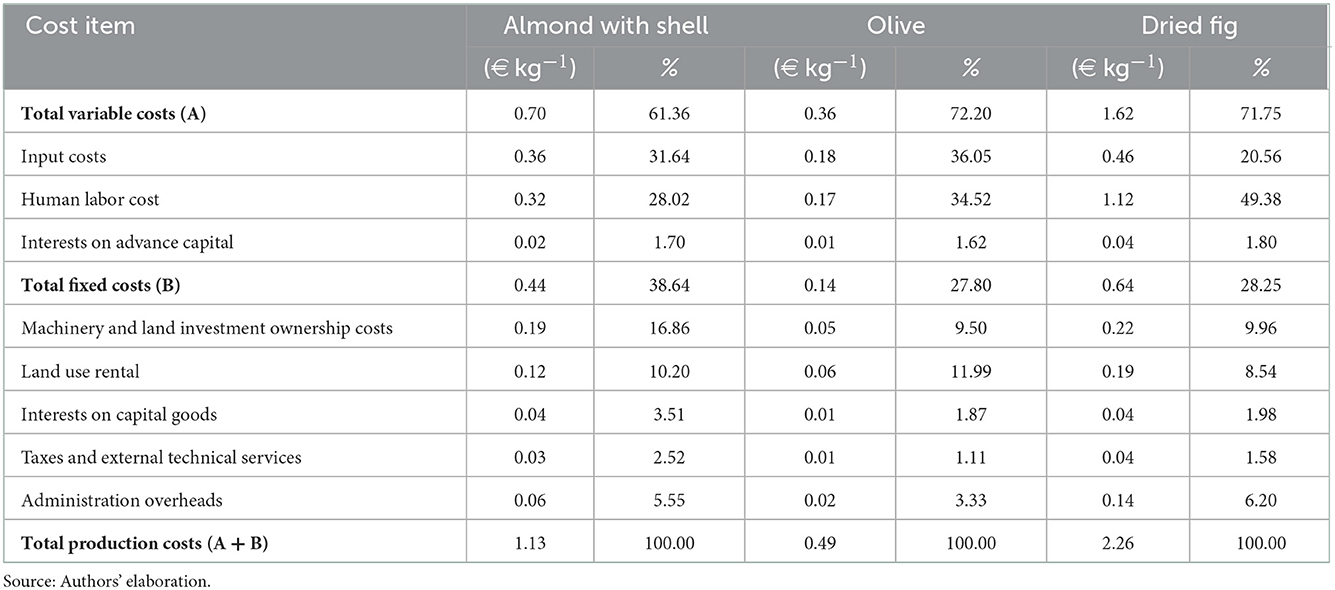

In Table 6, the fixed and variable costs are reported for every kilogram of the product obtained. The analysis shows that variable costs exceed fixed costs in all three scenarios. The highest incidence is in olive with 72.2%, followed by fig with 71.7% and almond with 61.4%. In terms of cost items, input costs have the highest incidence in the olive 36% scenario and the almond scenario 31.6%. Fig has the lowest percentage of incidence with the 20.5%. This ranking is related to the higher number of inputs such as fertilizers and pesticides used in the first two crops. In terms of labor costs, fig has the highest incidence percentage at 49.4% as the harvesting operations are all done manually. Olive and almond have a lower incidence rate equal to 34.5 and 28.08%, respectively, due to the use of trunk shaker machines.

Regarding fixed costs, the highest incidence is in the almond scenario with 38.64%, followed by fig tree at 28.25% and olive tree at 27.8%. Among the cost items with the highest incidence are machinery ownership and investment land costs (i.e., depreciation, insurance, repairs, and maintenance). The almond tree has the highest incidence compared to the other two crops due to the presence of several agricultural machines, including those for almond hull removal.

4.2. Investment results

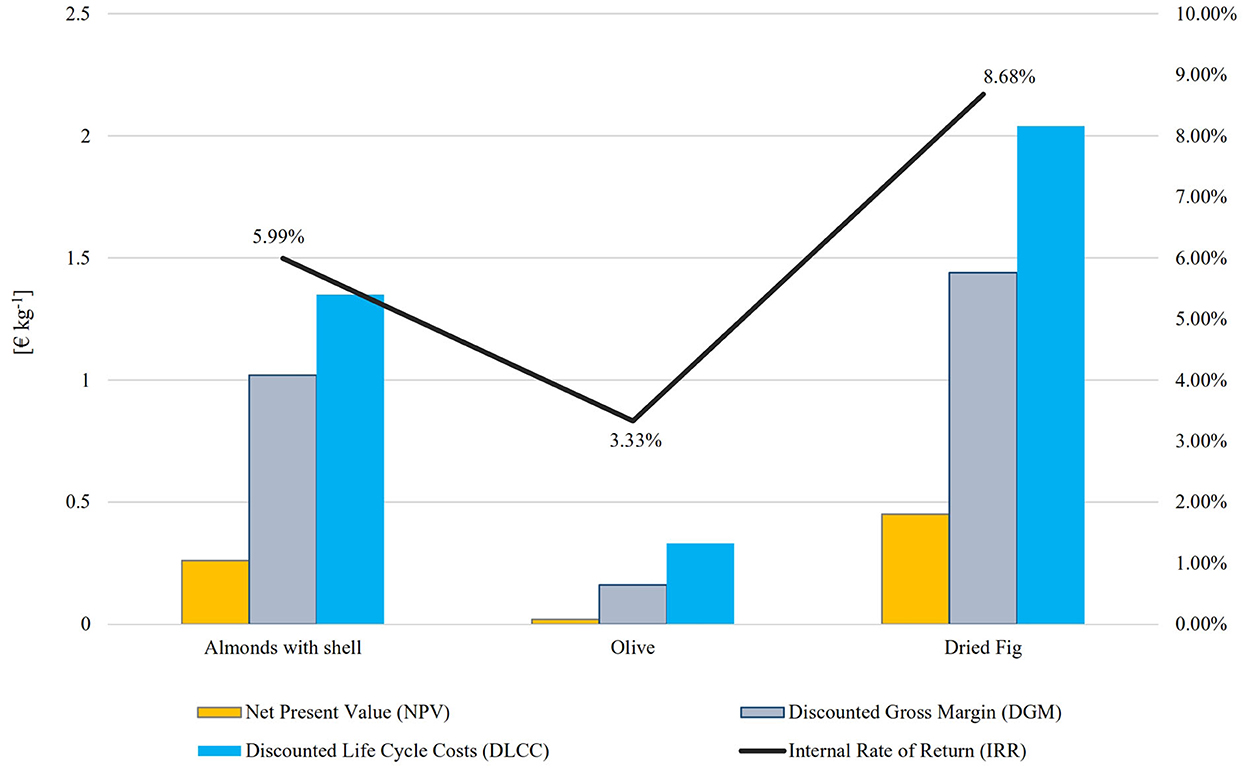

The results of the financial analysis (Figure 4) allow for a positive favorability rating for all three scenarios. The best performance is obtained by the fig tree, followed by the almond and olive tree.

For the almond tree, the positive financial results are consistent with those stated by De Leijster et al. (2020) and Sottile et al. (2020), which report for traditional almond trees similar to the one analyzed an NPV corresponding to € 0.63 per kg. The IRR was higher than the discount rate with an assay corresponding to + 6% consistent with that developed by De Leijster et al. (2020) on almond trees, equal to 13.5%. The DGM corresponds to 1.02 kg−1, the DPP to 19.21 years, and the DLCC to 1.35 € kg−1.

The NPV of the olive grove is 0.02 per kg, also observed by Mohamad et al. (2014) and Stillitano et al. (2016). The IRR is also positive and equal to 3.33%, very similar to that of Mohamad et al. (2014) which is equal to 3.37%. The DGM corresponds to 0.16 € kg−1, DPP to 40.4 years, and DLCC to 0.33 € kg−1.

The fig tree obtained the best performance with an NPV of 0.45 € kg−1, and also in this case the value is positive like that of Stillitano et al. (2017), equal to about 0.32 € kg−1. The IRR has a value of 8.68%, and also in this case the value is positive, like that of Stillitano et al. (2017), equal to 6%. The DGM corresponds to 1.44 kg−1, the DPP to 14.4 years, and the DLCC to 2.04 € kg−1.

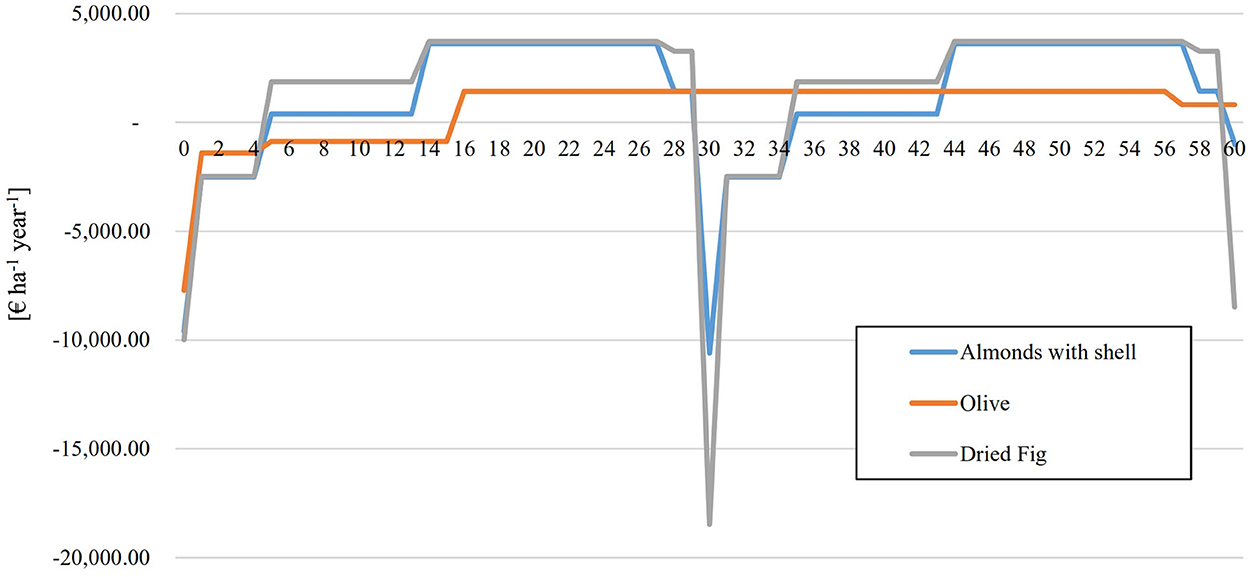

Figure 5 shows the net cash flows for the three scenarios examined. From the analysis of these results, it is possible to delineate in the long run the different performances of the scenarios. As previously described, the period considered in the analysis is related to the useful life of the orchard: for the olive tree, it is equal to 60 years, while for the almond and fig tree it is equal to 30 years. As can be seen from the graph, the results show that compared with the ordinary management period, the scenarios in which the break-even point between costs and revenues is reached in the shortest time are for the fig and almond orchards (10th year), followed by the olive grove (15th year). For the unproductive stage in all scenarios, there are negative profits as the EU aid to support production does not zero out the high costs incurred.

For the increasing production phase (Figure 5), there are negative values for olive trees of −870.00 € ha−1 while for the almond tree and fig tree positive values, accounting for 395.68 € ha−1 and 1,868.34 € ha−1, respectively. Regarding the profits obtained, it emerges that in the constant production phase, positive values are recorded for all three crops. Fig and almond orchard for the period from the 14th to the 26th year show average values of 3.723.38 € ha−1 and 3.616.88 € ha−1, respectively, and the olive orchard for the period from the 16th to the 56th year shows a profit of 1.424.16 € ha−1.

In the decreasing production phase, the fig grove and almond grove show a profit of 3,267.85 and 1,439.03 € ha−1 respectively for the period from the 27th to the 30th year, the olive grove a profit of 814.97 € ha−1 from the 57th to the 60th year. Concerning the end-of-life stage, corresponding to the 30th year for almonds and figs and the 60th for olives, the highest profit is found in the olive crops of 814.97 € ha−1. This is followed by almond and fig with a negative profit of −1,004.97 € ha−1 and −8,482.15, € ha−1, respectively.

4.3. Sensitivity analysis results

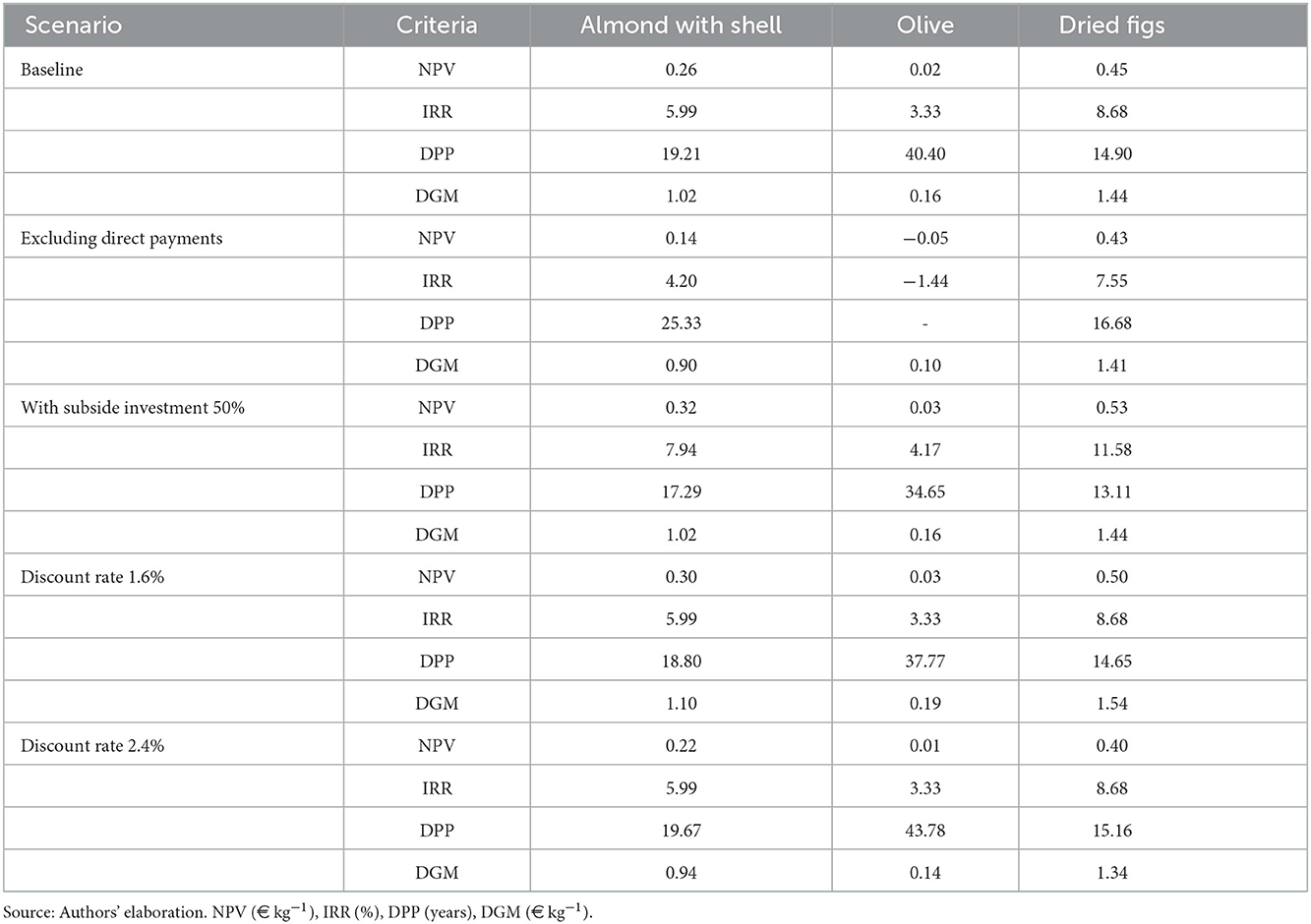

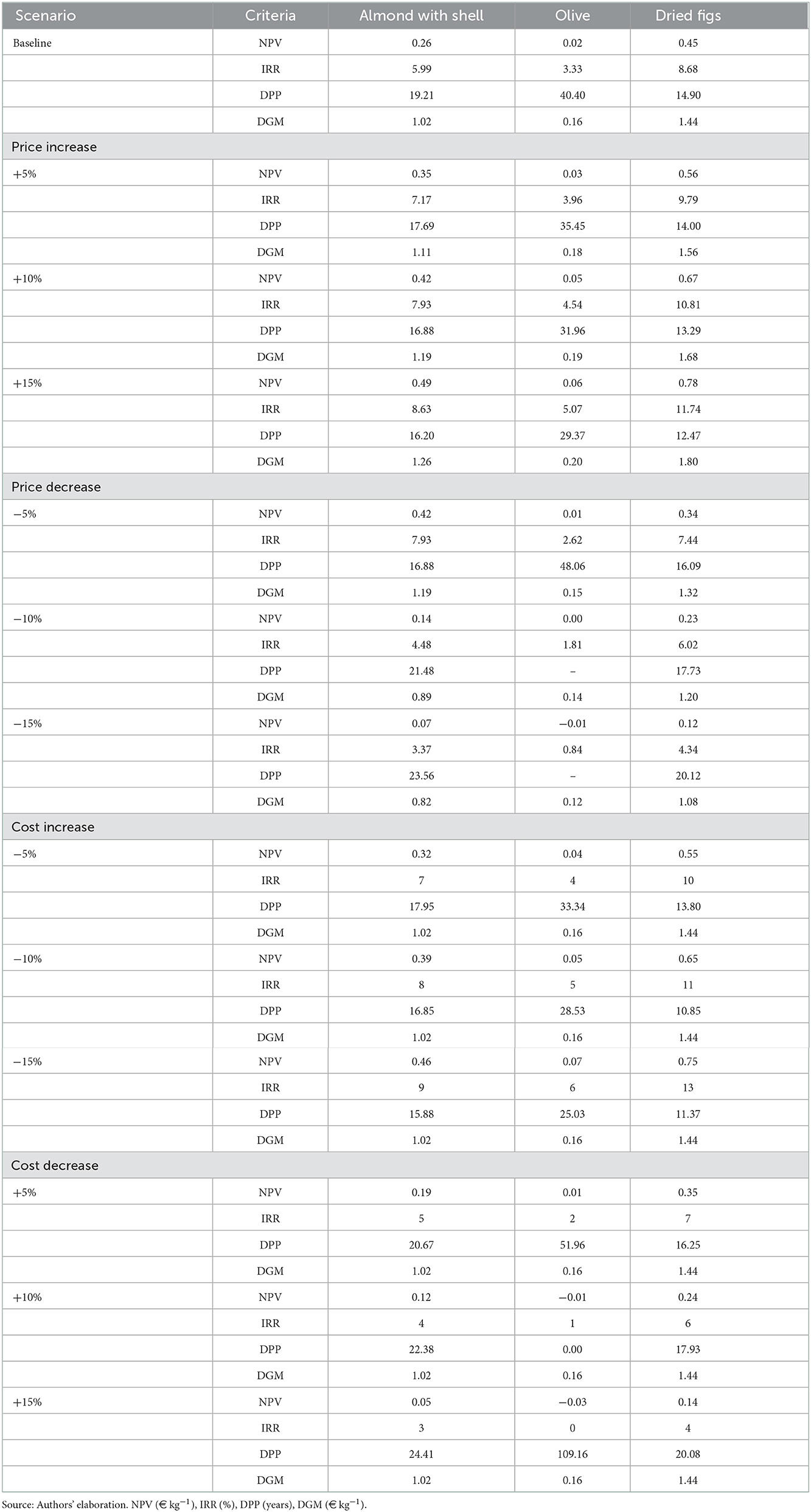

The results of the sensitivity analysis testing different hypotheses on the NPV, IRR, DPP, and DGM are presented in Tables 7, 8.

In the base scenario in which public subsidies (direct payments) are included, all criteria are positive for the three crops. Excluding public subsidies, olive cultivation reports negative values for NPV −0.05 € kg−1 and IRR −1.44%, in line with similar results obtained from Iofrida et al. (2020) and Stillitano et al. (2016). However, as argued by Cardone et al. (2021), an indicator of economic sustainability for farms is own associated with independence from external inputs such as government subsidies.

Almond and fig are less susceptible to variations with a reduction in NPV of 47 and 5%, respectively.

The introduction of a subsidy on initial investment equal to 50% of planting costs results in the largest increase in NPV in the olive grove with 50%, followed by the almond grove with +23% and the fig grove with +17%. IRR turns out to have an increase of 33.4% in the fig orchard, 32% in the almond orchard, and 25% in the olive grove.

Changes in discount rates relative to the baseline scenario show higher values for all the criteria analyzed with the discount rate of 1.6% and lower values with the discount rate of 2.4%. The criterion that varies the most in all scenarios is NPV, with the discount rate of 1.6% registering +50% in olive groves, +15% in almond groves, and +11% in fig groves. With a discount rate of 2.4% for all scenarios, there is a reduction in NPV, respectively −50% in the olive grove, −15% in the almond grove, and −11% in the fig grove.

Regarding “positive variances,” the simulations were carried out in terms of price increases and cost reductions. These variations as argued by Strano et al. (2015) should be taken into account due to the volatility of prices and inputs that could happen in the market depending on the current economic conditions. From the elaborations, it is possible to note, as was obvious, that in all the scenarios, the criteria considered remain positive for the hypothesized scenarios. However, from the analysis of the deviations, it emerges that, ceteris paribus, the change in price considering an increase of 5% has a more significant impact on the almond and fig scenario with a deviation from the base scenario of 34 and 24%, respectively, while 50% on the olive tree, while the 5% cost reduction shows a 24% difference for the almond tree, 22% for the fig, and 90% for the olive tree. Similar results are recorded by analyzing the profitability of the investment in terms of IRR. However, as discussed by Strano et al. (2015), the hypothesis of an increase in prices does not take into account either the actual feedback on the market or any higher costs associated with the promotion of the product, making it, therefore, less certain. On the other hand, with the reduction of costs, albeit less performance, we only act on the internal factors of the company, through a better organization and management of the resources that enter both the plant management process and the transformation process. The results thus obtained are therefore less subject to uncertainty.

5. Conclusion

To the best of our knowledge, this is the first study to analyze the comparison of economic costs, benefits, and profitability of three Mediterranean tree crops such as almond, olive, and fig. The production of shelled almonds, olives for oil, and dried figs is found to be profitable in the study area, partly due to the modern and rational cultivation techniques adopted. Among the three crops, olive, despite being more rooted in the Calabrian area and better known to farmers, has the lowest profitability, which cancels out becoming negative in the absence of public subsidies, in contrast to the other two crops that remain equally profitable. Considering that with the new program of the Common Agricultural Policy 2023–2027, there will be a reduction in direct payments allocated to the olive crop, it is necessary to promote the conditions for such a crop to become profitable even in the absence of public contribution. Moreover, the analysis conducted in this paper, in addition to verifying the economic viability of almond, olive, and fig trees, also returned indications in terms of the investments needed, with a special focus also related to labor requirements. Therefore, the results of the research could guide the decisions of policy-makers and farmers in planning farm development strategies. Further research is underway with a 2-fold objective.

First is to complete the life cycle boundaries by including in the assessment the entire processing stage of almonds in shell and dried figs to obtain different products for the confectionery industry, and olives to obtain bottled olive oil. Further developments will be the quantification of environmental and social sustainability by integrating LCC analysis with life cycle assessment (LCA) and social life cycle assessment (sLCA).

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

Conceptualization: ES, TS, GG, and AID. Formal analysis and writing—original draft: ES, TS, NI, GF, and AID. Methodology: ES, TS, and AID. Data curation: ES and TS. Project administration, supervision, and funding acquisition: AID. Validation: ES, TS, GG, NI, and GF. Writing—review and editing: TS, NI, GF, and AID. All authors have read and agreed to the published version of the manuscript

Funding

This research is part of DRASTIC PRIN 2017 research project, project code: 2017JYRZFF, funded by the Italian Ministry of Education, University, and Research (MIUR).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Arvaniti, O. S., Samara, Y., Gatidou, G., Thomaidis, N. S., and Stasinakis, A. S. (2019). Review on fresh and dried figs: chemical analysis and occurrence of phytochemical compounds, antioxidant capacity and health effects. Food Res. Int. 119, 244–267. doi: 10.1016/j.foodres.2019.01.055

Bernardi, B., Falcone, G., Stillitano, T., Benalia, S., Bacenetti, J., Luca, D., et al. (2021). Harvesting system sustainability in mediterranean olive cultivation: other principal cultivar. Sci. Total Environ. 766, 142508. doi: 10.1016/j.scitotenv.2020.142508

Bernardi, B., Falcone, G., Stillitano, T., Benalia, S., Strano, A., Bacenetti, J., et al. (2018). Harvesting system sustainability in mediterranean olive cultivation. Sci. Total Environ. 625, 1446–1458. doi: 10.1016/j.scitotenv.2018.01.005

Cardone, G., Bottalico, F., and Prebibaj, M. (2021). Assessment of the economic sustainability of an organic olive oil farm in Puglia region (Italy) under the voluntary regional quality scheme. New Medit 20, 114. doi: 10.30682/nm2101h

Carpentieri, S., Larrea-Wachtendorff, D., Dons,ì, F., and Ferrari, G. (2022). Functionalization of pasta through the incorporation of bioactive compounds from agri-food by-products: Fundamentals, opportunities, and drawbacks. Trend Food Sci. Technol. 122, 49–65. doi: 10.1016/j.tifs.2022.02.011

Ciroth, A., Hildenbrand, J., and Steen, B. (2016). “Life cycle costing,” in Sustainability Assessment of Renewables-Based Products: Methods and Case Studies, eds J. Dewulf, S. De Meester, R. A. F. Alvarenga (Hoboken: John Wiley and Sons), 215–228.

Correia, P. J., Guerreiro, J. F., Pestana, M., and Martins-Loução, M. A. (2017). Management of carob tree orchards in mediterranean ecosystems: strategies for a carbon economy implementation. Agroforest Syst. 91, 295–306. doi: 10.1007/s10457-016-9929-8

Cramer, W., Guiot, J., Fader, M., Garrabou, J., Gattuso, J. P., Iglesias, A., et al. (2018). Climate change and interconnected risks to sustainable development in the Mediterranean. Nat. Clim. Change 8, 972–980. doi: 10.1038/s41558-018-0299-2

De Leijster, D., Verburg, V., Santos, R. W., Wassen, M. J. M. J., Martínez-Mena, M., Vente, J., et al. (2020). Almond farm profitability under agroecological management in south-eastern Spain: accounting for externalities and opportunity costs. Agric. Syst. 183, 102878. doi: 10.1016/j.agsy.2020.102878

De Luca, A, Di Cristo, I., Valentino, F., Peluso, A., Di Salle, G., Calarco, A., et al. (2022). Food-derived bioactive molecules from mediterranean diet: nanotechnological approaches and waste valorization as strategies to improve human wellness. Polymers 14, 1726. doi: 10.3390/polym14091726

De Luca, A. I., Molari, G., Seddaiu, G., Toscano, A., Bombino, G., Ledda, L., et al. (2015). Multidisciplinary and innovative methodologies for sustainable management in agricultural systems. Environ. Eng. Manag. J. 14, 1571–1581. doi: 10.30638/EEMJ.2015.169

De Luca, G., Falcone, A. I., Stillitano, G., Iofrida, T., Strano, N., Gulisano, A., et al. (2018). Evaluation of sustainable innovations in olive growing systems: a life cycle sustainability assessment case study in southern Italy. J. Clean. Prod. 171, 1187–1202. doi: 10.1016/j.jclepro.2017.10.119

Dhillon, B. S. (1989). Life Cycle Costing: Techniques, Models, and Applications. New York, NY: Gordon and Breach Science Publishers.

Di Fonzo, A., and Liberati, A. C. (2020). Consumers are unaware about European legislation on communication of the health benefits conveyed by claims. An empirical survey. Ital. Rev. Agric. Econ. 75, 51–59. doi: 10.13128/rea-11742

Ellram, L. M. (1993). A framework for total cost of ownership. Int. J. Log. Manage. 4, 49–60. doi: 10.1108/09574099310804984

Emblemsvåg, J. (2003). Life-Cycle Costing. Using Activity-Based Costing and Monte Carlo Methods to Manage Future Costs and Risks. Hoboken, NJ: John Wiley and Sons, Inc.

European Commission Joint Research Centre, Dudu, H., and Smeets Kristkova, Z. (2017). Impact of CAP Pillar II and Payments on Agricultural Productivity. Ispra: Publications Office

FAOSTAT (2020). Crops Production. Available online at: http://faostat3.fao.org/download/Q/QC/E (accessed June 15, 2022).

Ferrara, G., Mazzeo, A., Pacucci, C., Matarrese, A. M. S., Tarantino, A., Crisosto, C., et al. (2016). Characterization of edible fig germplasm from Puglia, southeastern Italy: is the distinction of three fig types (Smyrna, San Pedro and Common) still valid? Sci. Hortic. 205, 52–58. doi: 10.1016/j.scienta.2016.04.016

Fuller, S. K., and Petersen, S. R. (1996). Life Cycle Costing manual for the Energy Federal Management Program. Washington, DC: US Government Printing Office.

Gennaro, D. E., Notarnicola, B., Roselli, B. L., and Tassielli, G. (2012). Innovative olive-growing models: an environmental and economic assessment. J. Clean. Prod. 28, 70–80. doi: 10.1016/j.jclepro.2011.11.004

Gervasi, T., Barreca, D., Laganà, G., and Mandalari, G. (2021). Health benefits related to tree nut consumption and their bioactive compounds. Int. J. Mol. Sci. 22, 5960. doi: 10.3390/ijms22115960

Gluch, P., and Baumann, H. (2004). The life cycle costing (LCC) approach: a conceptual discussion of its usefulness for environmental decision-making. Build. Environ. 39, 571–580. doi: 10.1016/j.buildenv.2003.10.008

Gómez-Limón, J. A., Picazo-Tadeo, A. J., and Reig-Martínez, E. (2012). Eco-efficiency assessment of olive farms in Andalusia. Land Use Policy 29, 395–406. doi: 10.1016/j.landusepol.2011.08.004

Huppes, G., Van Rooijen, M., Kleijn, R., Heijungs, R., Konin, A., and Van Oers, L. (2004). Life Cycle Costing and the Environment. Report of a project commissioned by the Ministry of VROM-DGM for the RIVM Expertise CentreLCA.

Hussain, M., Mumma, G., and Saboor, A. (2005). Discount rate for investments: some basic considerations in selecting a discount rate. Pak. J. Life Soc. Sci 3, 1–5.

Iofrida, N., Stillitano, T., Falcone, G., Gulisano, G., Nicolò, F. B., Luca, D. E., et al. (2020). The socioeconomic impacts of organic and conventional olive growing in Italy. New Medit. 19, 117–131. doi: 10.30682/nm2001h

ISO (2008). Buildings and constructed assets. Service-Life Planning. Part 5: Life-Cycle Costing. Geneva: ISO.

ISTAT. (2010). IV Agricultural Census. Available online at: http://dati?censimentoagricoltura.istat.it/ (accessed July 8, 2022).

Karimi, S., Yadollahi, A., Arzani, K., Imani, A. E., and Aghaalikhani, M. (2015). Gas-exchange response of almond genotypes to water stress. Photosynthetica 53, 29–34. doi: 10.1007/s11099-015-0070-0

Medda, S., Fadda, A., and Mulas, M. (2022). Influence of climate change on metabolism and biological characteristics in perennial woody fruit crops in the mediterranean environment. Horticulturae. 8, 273. doi: 10.3390/horticulturae8040273

Mohamad, R. S., Verrastro, V., Cardone, G., Bteich, M. R., Favia, M., Moretti, M., et al. (2014).Optimization of organic and conventional olive agricultural practices from a life cycle assessment and life cycle costing perspectives. J. Clean. Prod. 70, 78–89. doi: 10.1016/j.jclepro.2014.02.033

Pitsillou, E., Liang, J. J., Beh, R. C., Prestedge, J., Catak, S., Hung, A., et al. (2022). Identification of novel bioactive compounds from Olea europaea by evaluation of chemical compounds in the OliveNet™ library: in silico bioactivity and molecular modelling, and in vitro validation of hERG activity. Comput. Biol. Med. 142, 105247. doi: 10.1016/j.compbiomed.2022.105247

Pra, A., and Pettenella, D. (2019). Investment returns from hybrid poplar plantations in northern Italy between 2001 and 2016: are we losing a biobased segment of the primary economy? Ital. Rev. Agric. Econ. 74, 49–71. doi: 10.13128/REA-25479

Proietti, P., Nasini, L., Del Buono, D., D'Amato, R., Tedeschini, E., Businelli, D., et al. (2013). Selenium protects olive (Olea europaea L.) from drought stress. Sci. Hortic. 164, 165–171. doi: 10.1016/j.scienta.2013.09.034

Rakic, J. M., Tanprasertsuk, J., Scott, T. M., Rasmussen, H. M., Mohn, E. S., Chen, C. Y. O., et al. (2022). Effects of daily almond consumption for six months on cognitive measures in healthy middle-aged to older adults: a randomized control trial. Nutr. Neurosci. 25, 1466–1476. doi: 10.1080/1028415X.2020.1868805

Regione Calabria (2021). Avviso pubblico – Misura 04 “Investimenti in immobilizzazioni materiali” per la concessione di sostegni inerenti interventi per promuovere investimenti di nuovi impianti e reimpianti arborei delle specie fruttifere a guscio, incluso l'ammodernamento degli impianti irrigui- Annualità 2021.

Rezagholizadeh, L., Aghamohammadian, M., Oloumi, M., Banaei, S.h., Mazani, M., and Ojarudi, M. (2022). Inhibitory effects of ficus carica and olea europaea on pro-inflammatory cytokines: a review. Iran. J. Basic Med. Sci. 25, 268–275. doi: 10.22038/IJBMS.2022.60954.13494

Sottile, F., Massaglia, S., and Peano, C. (2020). Ecological and economic indicators for the evaluation of almond (Prunus dulcis L.) orchard renewal in sicily. Agriculture 10, 301. doi: 10.3390/agriculture10070301

Stillitano, T., Falcone, G., Spada, E., Luca, D. E., Grillone, A. I., Strano, N., et al. (2017). An economic sustainability assessment of “Fichi di Cosenza” PDO production compared with other profitable permanent crops ISHS. Acta Horticulturae 1173, 395–400 doi: 10.17660/ActaHortic.2017.1173.68

Stillitano, T., Luca, D., Falcone, A. I., Spada, G., Gulisano, E., Strano, G., et al. (2016). Economic profitability assessment of Mediterranean olive growing systems. Bulg. J. Agric. Sci. 22, 517–526.

Strano, A., Stillitano, T., Luca, D. E., Falcone, A. I., and Gulisano, G. G. (2015). Profitability analysis of small-scale beekeeping firms by using life cycle costing (LCC) methodology. Am. J. Agric. Biol. Sci. 10, 116–127. doi: 10.3844/ajabssp.2015.116.127

Swarr, T. E., Hunkeler, D., Klopffer, W., Pesonen, H. L., Ciroth, A., Brent, A. C., et al. (2011). Environmental life cycle costing: a code of practice. Int. J. Life Cycle Assess.16, 389–391. doi: 10.1007/s11367-011-0287-5

Van Breda, S. G. J., Briedé, J. J., and De Kok, T. M. C. M. (2019). Improved preventive effects of combined bioactive compounds present in different blueberry varieties as compared to single phytochemicals. Nutrients 11, 61. doi: 10.3390/nu11010061

Keywords: Mediterranean crops, almond-olive-fig crops, long-term feasibility analysis, sensitivity analysis, Life Cycle Costing

Citation: Spada E, Stillitano T, Falcone G, Iofrida N, Gulisano G and De Luca AI (2022) Economic sustainability assessment of Mediterranean crops: A comparative Life Cycle Costing (LCC) analysis. Front. Sustain. Food Syst. 6:1004065. doi: 10.3389/fsufs.2022.1004065

Received: 26 July 2022; Accepted: 25 November 2022;

Published: 21 December 2022.

Edited by:

Samuel Ayofemi Olalekan Adeyeye, Hindustan University, IndiaReviewed by:

Wilfredo Guaita, University of Santiago de Cali, ColombiaRui Fragoso, University of Evora, Portugal

Copyright © 2022 Spada, Stillitano, Falcone, Iofrida, Gulisano and De Luca. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Emanuele Spada,  ZW1hbnVlbGUuc3BhZGFAdW5pcmMuaXQ=

ZW1hbnVlbGUuc3BhZGFAdW5pcmMuaXQ=

Emanuele Spada

Emanuele Spada Teodora Stillitano

Teodora Stillitano Giacomo Falcone

Giacomo Falcone Nathalie Iofrida

Nathalie Iofrida Anna Irene De Luca

Anna Irene De Luca