- 1Department of Biological Sciences, University of Arkansas, Fayetteville, AR, United States

- 2Environmental Defense Fund, New York, NY, United States

The dramatic increase in greenhouse gas (GHG) emissions by humans over the past century and a half has created an urgency for monitoring, reporting, and verifying GHG emissions as a first step toward mitigating the effects of climate change. Fifteen percent of global GHG emissions come from agriculture, and companies in the food and beverage industry are starting to set climate goals. We examined the GHG emissions reporting practices and climate goals of the top 100 global food and beverage companies (as ranked by Food Engineering) and determined whether their goals are aligned with the science of keeping climate warming well below a 2°C increase. Using publicly disclosed data in CDP Climate reports and company sustainability reports, we found that about two thirds of the top 100 global food and beverage companies disclose at least part of their total company emissions and set some sort of climate goal that includes scope 1 and 2 emissions. However, only about half have measured, disclosed, and set goals for scope 3 emissions, which often encompass about 88% of a company's emissions across the entire value chain on average. We also determined that companies, despite setting scope 1, 2, and 3 emission goals, may be missing the mark on whether their goals are significantly reducing global emissions. Our results present the current disclosure and emission goals of the top 100 global food and beverage companies and highlight an urgent need to begin and continue to set truly ambitious, science-aligned climate goals.

Introduction

Since the start of the first Industrial Revolution around 1760, greenhouse gases (GHGs) emitted from human activities have exceeded emissions from natural sources. The rise in GHG concentration in the atmosphere over the years has steadily warmed the planet, leading to a rise in the global surface temperature (IPCC, 2021). One such shift in the global climate in the 1980s drew the concern of scientists and the public to the increasing atmospheric GHGs (Reid et al., 2016). In 1990, a report by the Stockholm Environmental Institute declared an increase of 2°C above pre-industrial times to be the global temperature limit, and going beyond that limit may result in “grave damage to ecosystems” (Rijsberman and Swart, 1990). Twenty-five years later, 196 countries signed the Paris Climate Agreement to limit global warming to well below 2°C, preferably below 1.5°C. This is a difficult task, however, as it calls for a massive shift in the way we currently do things and will require aggressive climate action from large emitters.

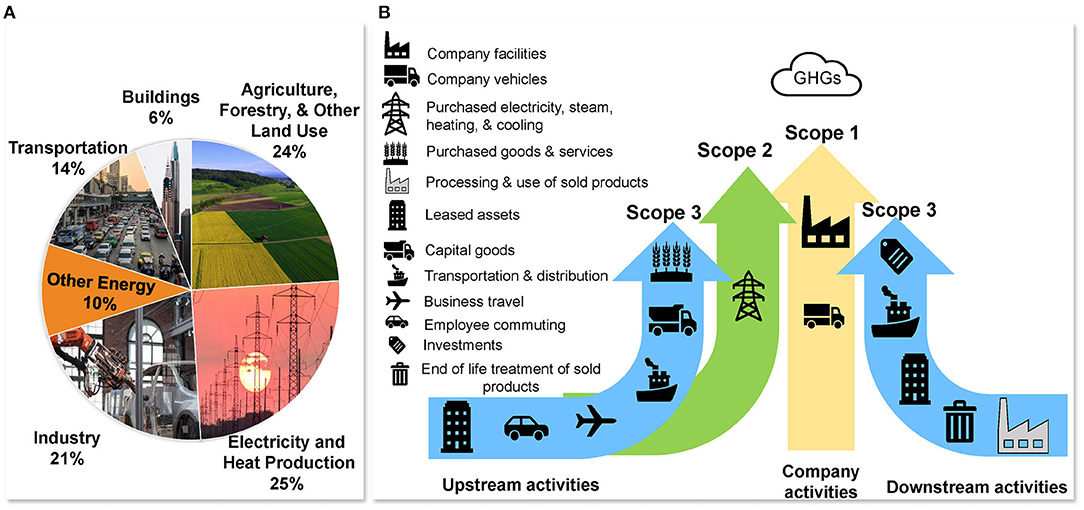

The global food and beverage sector is one significant source of GHG emissions. Food production accounts for roughly a quarter (Figure 1A) of the anthropogenic GHGs emitted annually across the globe (Ritchie, 2019) and the sector as a whole accounts for roughly a third of global emissions (Crippa et al., 2021). Significant reductions in global GHG emissions are not possible without reductions from the food and beverage industry (Kobayashi and Richards, 2021). The majority of emissions come from the supply chains of food and beverage companies, so setting climate goals to reduce the emissions within a company's value chain is of the utmost importance (Kobayashi and Richards, 2021).

Figure 1. (A) Breakdown of different anthropogenic greenhouse gas (GHG) emission sources [2010 emissions sources data from IPCC (2014)]; and (B) conceptual map of different activities included in scope 1 (yellow arrow), 2 (green arrow) and 3 (blue arrows) greenhouse gas (GHG) emissions.

Climate goals that align with the goals of the Paris Climate Agreement and a net-zero future are considered science-based (SBTi, 2021b). The Science Based Targets initiative (https://sciencebasedtargets.org/) is a framework that helps companies set science-based goals. As scientists (Ripple et al., 2019), consumers (Lai and Schiano, 2021), and employees (Sax, 2020) are increasingly calling for more direct and aggressive climate action from large corporations, more companies are getting on board (Winston, 2017; NewClimate Institute Data-Driven EnvironLab, 2020). In 2016, 119 companies had set goals with the Science Based Targets initiative (SBTi) (Faria, 2016), and currently, over 1,700 companies have committed or set climate goals with SBTi (SBTi, 2021a). However, previous studies have shown that while climate policy has improved over the years, and more countries and individual companies have set emission reduction goals, there has been no significant decrease in global emissions (Haffar and Searcy, 2018; Christensen and Olhoff, 2019).

A third of the global anthropogenic GHG emissions come from food and beverage company activities, and with a growing human population−10 billion by 2050— demand for food will only increase (Gerber et al., 2013), resulting in greater GHG emissions (Searchinger et al., 2019). As large emitters (GRAIN, 2018), setting climate goals is important for food and beverage companies and requires them to inventory their emissions. However, emissions across the entire value chain must be accounted for and included in emission goals. The current literature lacks studies and methods to evaluate how many large food and beverage companies are setting climate goals to reduce their total value chain emissions and how significant their current and potential reductions may be on global atmospheric GHG concentrations. There are several reports that examine climate targets or emission disclosure from large companies in all sectors (Crawford and Seidel, 2013; OECD and CDSB, 2015; CDP, 2016; Trucost, 2019), but few that address the progress of food and beverage companies specifically.

Here, we evaluate the GHG emissions reporting practices of the top 100 food and beverage companies ranked by Food Engineering (Food Engineering, 2020). We aim to (1) investigate the extent of publicly disclosed GHG emissions and climate goals, and (2) identify areas for improvement in publicly disclosed GHG emissions and climate goals to continue making significant progress toward reducing global GHG emissions and warming.

Methods

Food and Beverage Company Selection

To study the GHG emissions and goals across the food and beverage industry, we selected the top 100 global food and beverage companies as ranked by Food Engineering (Food Engineering, 2020). The food sales of these 100 companies make up roughly 15% of the food and agriculture industry worldwide (Plunkett Research Ltd., 2021). Company size was based on revenue generated from food sales only, not overall revenue. For example, Cargill (ranked 9th on the list) has a greater overall yearly revenue than Nestle (ranked 1st on the list), but Cargill's revenue from food sales alone was less than Nestle's because Cargill sells other agricultural products besides food, thus their lower ranking. The selected companies operate all over the world and consist of both food and beverage (alcoholic and nonalcoholic) processors and manufacturers. The companies, their industry, and headquarters are summarized in Supplementary Table S1.

Data Collection

We primarily use resources from the Science Based Target Initiative (SBTi) and CDP (formerly Carbon Disclosure Project), two organizations that guide companies toward greater climate action. The SBTi is a collaboration between CDP, the United Nations Global Compact, the World Resources Institute, and WWF (World Wildlife Fund). They aim to fight climate change by providing companies with technical assistance and resources to set climate goals aligned with science. Science-based targets are goals aligned with keeping global temperature rise to well below 2°C above pre-industrial levels. Companies set climate goals, and approval is based on rigorous SBTi criteria. We recorded the goals of the companies that had SBTi-approved climate goals.

CDP (https://www.cdp.net/en) is a global non-profit organization that works to make environmental reporting the norm by helping companies, cities, and states measure, report, and manage risk in areas of climate, water security, and deforestation. CDP provides scores for companies and cities based on their level of disclosure and their environmental leadership. We only reviewed the Climate reports that were submitted for 2020, which means data are from 2019. We recorded the CDP scores for each company and pulled out specific pieces of information about each company, including active climate goals from 2019 (both absolute and intensity goals), baseline emissions data for those goals, and emissions for all three scopes from 2019. When SBTi and CDP data were not available, we used company corporate sustainability reports (CSRs). When no information was publicly available about company GHG emissions or goals, we were unable to evaluate them further.

Understanding Emissions and Goals

Emissions can be categorized as scope 1, scope 2, and scope 3 (Figure 1B). Scope 1 emissions are those that a company is directly responsible for, such as those released from their owned and operated plants and factories. Scope 2 emissions are indirectly produced by the company, such as the emissions generated by the purchased electricity, heating, and cooling required by the company's own plants and factories. These types of emissions are most easily accounted for and managed. Scope 3 emissions are all other emissions, most often associated with the company's value chain, such as the upstream emissions from growing crops for the product and downstream emissions produced when customers use the product. For food and beverage companies with upstream value chains in agriculture, scope 3 emissions make up most of their total emissions (Tidy et al., 2016) (Figure 1B). However, companies have historically had less visibility and influence over the operations producing their scope 3 emissions, so measuring and managing them can be challenging. Here, we evaluate the top 100 global food and beverage companies' GHG reporting practices for these three scopes.

Analyzing Emissions and Climate Goals

For this research, we compared company goals to two science-aligned standards that aim to keep global temperatures from warming more than 2°C: the 3% Solution and the SBTi. While the 3% Solution requires a reduction of all emissions produced by the company, the SBTi standards focus on scope 1 and 2 emissions. To evaluate company goals, we calculated the linear emission reductions over the lifespan of the target for total reported emissions and for reported scope 1 and 2 emissions only and compared them to the 3% Solution and SBTi emission scenarios.

The 3% Solution Analysis

The 3% Solution is a report, produced by WWF and CDP in 2013, that calculated how U.S. businesses could reach 25% of the IPCC's 2°C goal by reducing GHG emissions 3% each year between 2010 and 2020 (Tcholak-Antitch et al., 2013). After reaching that target in 2020, a 4.3% annual reduction in emissions would be required each year until 2050 to meet 100% of that goal. To align with this standard, companies must set goals that reduce emissions at least 4.3% each year over the life of the goal. To calculate whether companies were in line with this standard, we used a percent decline function given below.

where, base year emission (BE), target year emission (TE), and duration of target in years (Time) were obtained from CDP reports.

The SBTi Analysis

The SBTi has two emission scenarios by which companies can set goals: well below 2°C where emissions must decrease at least 2.5% each year, and 1.5°C where emissions must decrease at least 4.2% per year (setting a target aligned with the 2°C emission scenario, which called for at least 1.23% annual decrease, is no longer allowed for scope 1 and 2 emissions, but is allowed for scope 3 emission goals) (SBTi, 2021b). Alignment with the standard was calculated using Equation 1.

We collected data on climate goals and scope 1, 2, and 3 emissions from the SBTi website, CDP climate reports, and annual CSRs for each company (when CDP and SBTi reports were not available). We use the latest available data (2019 data from 2020 CDP and corporate reports) from each company to identify presence, type, and extent of climate goals. Companies could have two types of goals: absolute and intensity. Absolute goals aim to reduce overall emissions over a period (e.g., reduce absolute scope 1 and 2 emissions 20% by 2030 from a 2015 baseline). Intensity goals reduce the emissions required to produce some unit of a product (e.g., reduce scope 3 GHG emissions 20% per ton of product by 2030 from a 2015 baseline). Some companies may be hesitant to set absolute goals, seeing them as potentially limiting future business growth, gravitating instead toward only intensity goals. However, both absolute and intensity goals are useful in different ways (SBTi, 2021b). Absolute goals are often ambitious and aim to reduce the total GHGs entering the atmosphere. Intensity goals can reflect efficiency improvements and allow for comparison among peers. Having and meeting both types of goals ensures that overall emissions go down and production efficiency goes up. Some companies had climate goals that ended in 2020, we only included 2020 goals when any other (intensity or absolute) future target is not available. For example, when evaluating a company with an absolute target with a 2030 end date and an intensity target with a 2020 end date, we only evaluate the company on its 2030 goal, not 2020 goal.

We compared a company's baseline emission data to its current emissions to understand whether the company is on track toward reaching the proposed goals or, at the minimum, has reduced its current emissions compared to the baseline (in CDP reports, companies are asked to disclose both market- and location-based scope 2 emissions. If the company specifies which scope 2 emissions they are tracking for their emissions goals, we used the specified scope 2 emissions for calculations. For companies that did not specify market or location, we used location-based scope 2 emissions. When calculating average scope 1, 2, and 3 emissions across all companies, we did not include companies that did not have full emission disclosure across all 3 scopes.) Over time, companies more accurately calculate and measure their emissions, which changes the scope of the emissions included under the baseline emissions. This makes comparing current total emissions to the baseline difficult if the company has measured additional aspects of their total emissions. Actual current emissions data was often much greater than the current emissions reported if not all emission categories were included in the goal or if new areas of emission have since emerged and been measured that were not part of the original goal's range. For this research, we compared only the emission categories included in both the baseline and current emissions, since that is how the companies are measuring their progress on the goal. We note that this standard is imperfect and may not portray an entirely true picture of the state of things. Companies need to be clear about what goals they are claiming to meet and what portion of their total emissions they are addressing and reducing.

As mentioned previously, we compared company goals to the metrics of the 3% Solution and SBTi, but this is only possible for companies with absolute goals. We could not evaluate intensity goals because production numbers to go along with the intensity are not provided with emission data, another limitation of the data. Only 17 companies had absolute goals and baseline data for all scopes, while 27 others had absolute goals and baseline data for scope 1 and 2 only.

Results

Extent of Publicly Disclosed GHG Emissions and Climate Goals

Publicly Disclosed GHG Emissions

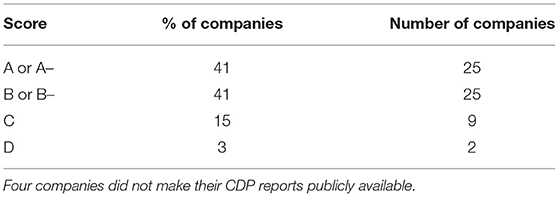

Of the 100 companies evaluated, 71 disclosed current scope 1 and 2 emissions data while 29 did not publicly disclose any of their emissions. Sixty-one companies disclosed at least partial scope 3 emissions, where they had measured some aspects of their value chain but had not mapped it entirely. Only 51 out of 100 companies measured and reported their scope 3 emissions across their entire value chain. Companies disclosed their GHG emissions primarily through CDP reports. Sixty-seven companies submitted climate reports to CDP in 2020, and only 61 companies had publicly accessible Climate reports (Figure 2). The six other unavailable reports were submitted to CDP but not accessible because the companies had chosen not to disclose their report publicly (CDP staff, personal communication, April 14, 2021). Six companies with submitted reports were not scored by CDP for unknown reasons. Companies earn points for their level of detail on disclosed information related to company climate policy, goals, and emissions and their display of understanding of climate change issues and progress made and planned toward climate change action. A summary of the breakdown of CDP scores can be found in Table 1.

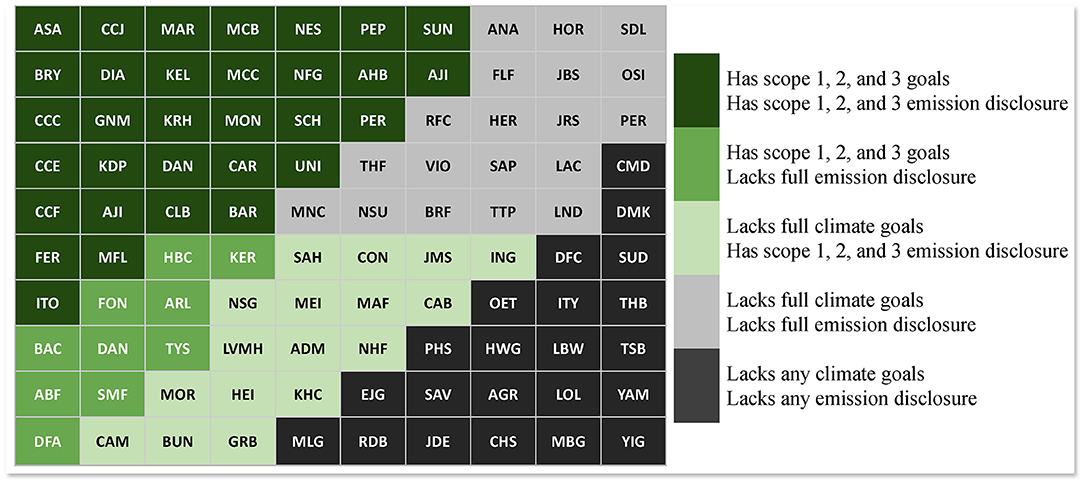

Figure 2. Heat map showing the current status of climate goals and greenhouse gas emission disclosure of top 100 global food and beverage companies as ranked by Food Engineering (Food Engineering, 2020). The data were taken from 2020 CDP or corporate reports. Each box contains an abbreviation for one company, company abbreviations can be found in Supplementary Table S1.

Companies participate in CDP reporting for various reasons including corporate stewardship or pressure from customers, retailers, and/or investors. Of the companies without submitted CDP reports, 16 were either not asked by investors or customers to participate in CDP reporting or did not volunteer to do so themselves (CDP staff, personal communication, April 4, 2021). Seventeen others were asked to submit reports by stakeholders, but they either declined or did not respond to the request. Eleven companies without CDP reports instead listed climate goals on their websites or corporate sustainability reports, and four of those companies' goals were approved by the SBTi. Only two companies disclosed all emission scopes without a CDP report. A CDP report is therefore not a required part of disclosing emissions or setting climate goals, but few large companies appear to do so otherwise.

Publicly Disclosed Climate Goals

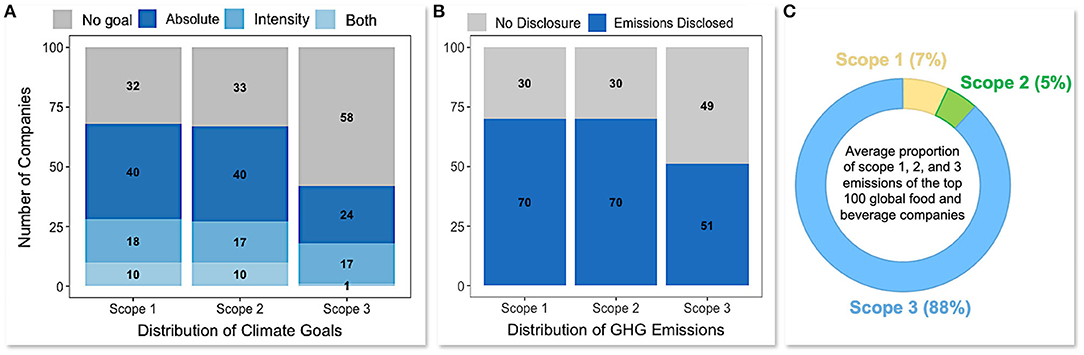

We found that 68 companies had some sort of climate goal in one or more scopes that extended beyond a 2020 end date (Figure 3A). Forty of these had scope 1 and 2 absolute targets, 18 had scope 1 intensity targets, 17 had scope 2 intensity targets, and 10 had both absolute and intensity targets for scopes 1 and 2 (Figure 3A). Forty-two companies had targets that included all three emission scopes. As noted previously, 51 companies fully disclosed emissions for all three scopes. However, not all companies with scope 3 goals disclosed all of their scope 3 emissions, and some companies that did fully disclose their emissions did not have scope 3 goals.

Figure 3. Distribution of top 100 global food and beverage companies (as ranked by Food Engineering (Food Engineering, 2020)) for (A) absolute and intensity climate goals across scope 1, 2, and 3 emissions; (B) emission disclosure across scope 1, 2 and 3 emissions, and (C) average proportion of scope 1, 2 and 3 emissions, when emission disclosure data were available. Data show the number of goals active in 2020 reports, data from 2019.

Limitations and Challenges

After reviewing the publicly available climate data of these companies, we identified three improvement areas in the way companies are currently disclosing their emissions and setting and monitoring climate goals: (1) limited GHG emission disclosure, (2) difficulty in tracking progress toward goals, and (3) lack of science-aligned goals.

Limited GHG Disclosure

As noted previously, we found that 49 companies aren't disclosing their scope 3 emissions (Figure 3B). Lack of disclosure from almost half of the largest food and beverage companies in the world shows the grim state of current monitoring and reporting practices in this industry, particularly since scope 3 emissions often make up most of a company's GHG emissions (Figure 3C). Our analysis of the reported GHG emissions shows that scope 3 emissions contribute about 88% of the total emissions on average (Figure 3C) and can be as high as 99% (e.g., Nisshin Seifun Group, Constellation Brands, and Saputo). Scope 1 emissions made up an average of 7% and scope 2 emissions were about 5% of a company's total emissions (Figure 3C).

Difficulty in Tracking Progress Toward Climate Goals

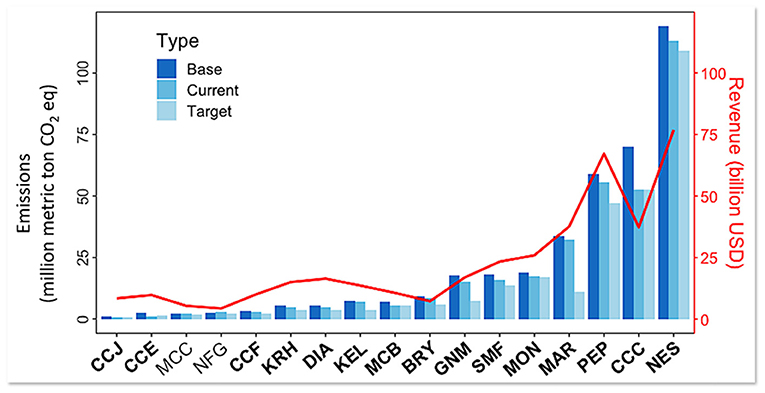

Three things were necessary to calculate whether a company is making progress toward its target: base year emissions, current (2019, in this study) emissions, and absolute goals for all scopes. Seventeen companies out of 100 had available data to match these criteria (Figure 4). Fifteen of these 17 companies have lower current emissions than their base emissions, according to their reported emissions (companies noted in bold on the x-axis of Figure 4). The two other companies (companies not in bold on the x-axis of Figure 4) have increased their emissions from their baseline, making no progress on their goals. No mention of increasing their emissions was made in the reports of those two companies. In this set of 17 companies, eight companies had increased their emissions compared with their baselines when looking at their actual current emissions rather than reported ones, though in fact only two companies reported an increase.

Figure 4. Distribution of base year emissions, current (2020 report) emissions, and target year emissions for seventeen companies with absolute goals and emissions data for scopes 1, 2, and 3. Red line and y-axis correspond to 2020 food sales revenue for each company in billions of USD. Acronyms left to right with base and target dates: Coca-Cola Bottlers Japan (CCJ: 2015–2030), Coca-Cola European Partners (CCE:2019–2030), McCormick Corporation (MCC; 2015–2025), Nissin Foods Group (NFG: 2018–2060), Coca-Cola Femsa (CCF: 2015–2030), Kirin Holdings (KRH: 2015–2030), Diageo (DIA: 2007–2020), Kellogg Company (KEL: 2015–2050), Molson Coors Brewing Co. (MCB: 2016–2025), Barry Callebaut (BRY: 2018–2025), General Mills (GNM: 2010–2050), Smithfield (SMF: 2010–2025), Mondelez International (MON), Mars (MAR: 2015–2025), PepsiCo (PEP: 2015–2030), The Coca-Cola Company (CCC: 2015–2030), Nestle (NES: 2014–2020). Company names in bold have reduced their emissions compared to baseline. Emissions data are acquired from 2020 CDP Climate reports submitted by each company, and revenue data are taken from Food Engineering's 2020 list of top 100 food and beverage companies.

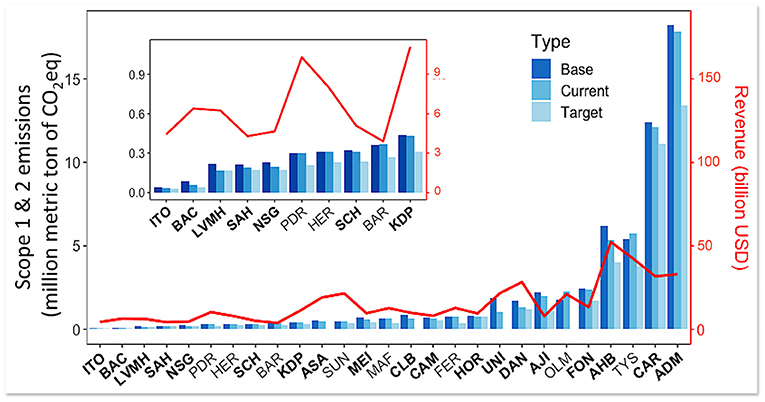

Since only 17 companies had absolute goals and baseline and current emission data for all three scopes, we expanded our criteria to include those without scope 3 goals or emission data. There are 27 companies with scope 1 and 2 data and absolute scope 1 and 2 goals (Figure 5). Of these, 19 companies have reduced their emissions from their baselines (companies noted in bold on the x-axis of Figure 5) while eight companies have increased their emissions (non-bolded companies on the x-axis of Figure 5). As with the companies in Figure 4, reported emissions are often smaller than their actual emissions, meaning that while a company may be appearing to move toward their goals, actual emissions from the company are increasing.

Figure 5. Distribution of base year emissions, current (2020 report) emissions, and target year emissions for 27 companies with absolute goals and emissions data for scopes 1 and 2. Red line and y-axis correspond to 2020 revenue for each company in billions of USD. Smaller graph within is zoomed in on the smallest 10 companies. Acronyms left to right with base and target years: Ito En (ITO: 2018–2030), Bacardi (BAC: 2015–2025), LVMH (2013:2020), Sapporo Holdings (SAH: 2013–2030), Nisshin Seifun Group (NSG: 2013–2030), Pernod Ricard (PDR: 2018–2025), The Hershey Company (HER: 2015–2025), Schreiber Foods (SCH: 2017–2030), Barilla (BAR: 2017–2030), Keurig Dr. Pepper (KDP: 2018–2030), Asahi (ASA: 2015–2030), Suntory (SUN: 2015–2030), Meiji Holdings (MEI: 2015–2030), Marfrig Group (MAF: 2019–2035), Carlsberg Group (CLB: 2015–2030), Campbell Soup Company (CAM: 2017–2025), Ferrero (FER: 2018–2030), Hormel Foods Corporation (HOR: 2011–2020), Unilever (UNI: 2015–2030), Danone (DAN: 2015–2030), Ajinomoto (AJI: 2018–2030), Olam (OLM: 2017–2030), Fonterra (FON: 2018–2030), Anheuser-Busch (AHB: 2017–2025), Tyson (TYS: 2016–2030), Cargill (CAR: 2017–2025), Archer Daniel Midland (ADM: 2019–2035). Company names in bold have reduced their emissions from their baseline. Emissions data are acquired from 2020 CDP Climate reports submitted by each company, and revenue data are taken from Food Engineering's 2020 list of top 100 food and beverage companies.

As mentioned previously, we can only evaluate companies' absolute goals, as intensity goals are currently difficult to track because they require knowing the amount of product used in the metric, which isn't publicly available. Regardless of the metric of the goal, the number of units produced is required to measure progress toward the goal. In the CDP reports, baseline, current, and target intensity numbers are provided, so it is possible to see whether progress is occurring and estimated absolute reduction from the intensity goals is reported. However, we discovered a substantial number of errors and unverifiable numbers in the reports leading to questions about the reported numbers. Currently, CDP reports do not ask companies to submit data about production, so we cannot verify whether intensity goals are being met, but this may be a helpful aspect to include moving forward so that progress to reduce total GHG emissions is accurately monitored.

Many of these companies with absolute scope 1 and 2 goals also have intensity goals covering these scopes or have additional scope 3 intensity goals. Three of the companies with increased emissions (SUN, MAF, OLM; Figure 5) also claimed increased business growth in the CDP reports. As businesses grow, emissions often grow as well, making absolute goals more difficult to meet. All three of these companies, though, had met or were making progress toward meeting their intensity goals.

Lack of Science-Aligned Goals

In addition to examining how companies are progressing on their goals, we also evaluated their goals in comparison with the 3% Solution target estimation. Both the 3% Solution and the SBTi have standards for this annual emission reduction and multiple scenarios for reduction. We compared the company goals to five different scenarios by investigating if they are in line with: (1) a 4.3% annual reduction of total company emissions, (2) a 3% annual reduction of total company emissions, (3) a 4.2% annual reduction of scope 1 and 2 emissions, (4) a 2.5% annual reduction of scope 1 and 2 emissions, and (5) a 1.23% annual reduction of scope 1 and 2 emissions. The first two scenarios (1, 2) are based on the 3% Solution, where prior to 2020, annual reduction needed to be at least 3%, but after 2020, reduction must be at least 4.3%. The next three (3–5) scenarios follow the SBTi guidelines, which only include rules for scopes 1 and 2.

Only the 17 companies included in Figure 4 were evaluated on the 3% Solution scenarios since the rest did not have full baseline scopes to compare with. Of those 17, four companies (CCE, BRY, GNM, MAR) have goals that are equally or more than aligned with the 3% Solution. We included all companies from Figures 4, 5 when comparing with SBTi guidelines. Under the 4.2% annual scope 1 and 2 reduction scenario, 13 companies out of 44 are aligned. Twenty-six companies have goals aligned with a 2.5% annual scope 1 and 2 reduction scenario, and 37 are aligned with a 1.23% annual scope 1 and 2 reduction. Thirty-three of these companies have official science-based goals approved by the SBTi, meaning they must be aligned with at least one of these scenarios, though the 1.23% reduction scenario is no longer allowed. We found that two companies (MON, CAR) did not have goals that align with the SBTi guidelines, though it could have been that we were not able to make accurate calculations due to lack of data. MON target included all three emission scopes but did not provide separate scope 1 and 2 baseline emissions, and CAR had an intensity goal but no information on total number of units produced.

Discussion

Extent of Publicly Disclosed GHG Emissions and Climate Goals

Publicly Disclosed GHG Emissions

While only half (51) of the large food and beverage companies have disclosed their total emissions, this number also indicates a growing trend toward transparency in GHG emissions disclosure. A 2018 study of the top 50 food and beverage companies found that only 32% (17) of companies were disclosing their emissions fully across all three scopes (Ceres, 2019). This number more than doubled in our 2020 report data to 72% (36 of the top 50 companies). The fact that, in just 2 years, we see a 112% increase in the number of top 50 food and beverage companies reporting their entire scope 1, 2, and 3 emissions demonstrates a growing awareness and change in the industry. We believe an increase in measurement and disclosure of scope 3 GHG emission is necessary to understand the climate impact of food and beverage industry and to be able to effectively reduce overall emissions.

Climate Goals

We found that the number of companies setting scope 3 targets and science-based goals is on the rise. Twenty-two of the 37 science-based goals (which all include scope 3 emissions) were set by companies in 2019 or later. And from 2019 to 2020, the number of companies globally setting net-zero targets more than doubled (NewClimate Institute Data-Driven EnvironLab, 2020). The rise in scope 3 and net-zero targets, as with the rise in scope 3 emission disclosure, is a harbinger of an acceleration in the rate of companies taking aggressive climate action.

Limitations and Challenges

Limited GHG Emission Disclosure

While more companies are setting climate goals around scope 3 emissions, companies did not always disclose their scope 3 emissions. There are currently no global emission disclosure requirements for all emission scopes, though several countries have some requirements for corporations on scope 1 and 2 emission disclosure (OECD and CDSB, 2015). However, several studies have found that making emission disclosure a requirement results in reductions in absolute GHG emissions (Christensen and Olhoff, 2019; Jouvenot and Krueger, 2019). Without full GHG emission disclosure, it is difficult to verify the claims made by companies to meet or exceed their climate goals.

Difficulty in Tracking Progress Toward Goals

The discrepancies between actual and reported emissions make it difficult to accurately track reductions in overall company emissions. We noted previously that some companies were reporting reductions in GHG emissions when their actual emissions were increasing. There is no clear method or procedure of stating when changes occur in emission categories or standard metric to evaluate changes (World Economic Forum, 2020). Tracking progress is made additionally arduous by the inability to capture a company's goal and progress fully. Strong intensity goals can contribute to overall absolute emission reductions (SBTi, 2021b), but there is no way of tracking progress if companies do not disclose production volume data. Being unable to account for a company's progress on its intensity goals is a significant shortcoming to tracking company progress toward overall emission reduction.

Lack of Science-Aligned Goals

The IPCC estimates that global emissions must fall by at least 45% by 2030 from a 2010 baseline to limit warming to 1.5°C (IPCC, 2018). Scope 1 and 2 emissions from food and beverage companies often make up <45% of their total emissions, so even goals that aim for zero emissions from scopes 1 and 2 fall short of this global goal if they do not include scope 3 emissions. Due to the difficulty of controlling some aspects of scope 3 emissions, making sure that suppliers and other actors in the value chain are included in measuring and reducing their emissions will be critical in reaching global climate goals (NewClimate Institute Data-Driven EnvironLab, 2020). Transparent communication around scope 3 emissions and goals is important for facilitating constructive dialogue around challenges and moving toward closing the gaps in action (NewClimate Institute Data-Driven EnvironLab, 2020).

Conclusion

Our results show the state of current disclosure and emission goals of the top 100 food and beverage companies and highlight an urgent need to begin and continue to set science-aligned climate goals. Overall, the number of companies setting goals and disclosing emissions is increasing, but we found that 31 of the largest companies in this sector still do not have any climate goals. Of the ones that do have goals, half are not measuring, reporting, or including scope 3 emissions. Since scope 3 emissions make up about 88% of these companies' total emissions on average, not monitoring or setting goals to reduce these emissions does little to reach the goal of keeping global warming to well below 2°C. There is an urgent need for standardization in GHG emission disclosure so companies can be evaluated on their performance to meet climate goals. Reaching the well below 2°C goal is only possible if companies are publicly disclosing their scope 1, 2, and 3 GHG emissions, monitoring and reporting both absolute and intensity goals, and setting science aligned climate goals.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

MR designed the study and analyzed the data with assistance of KN, JA, and JR. MR wrote the initial manuscript draft with contributions from KN, JA, and JR. All authors discussed, edited, revised, and approved the paper.

Funding

The NSF Intern Award (supplement to MCB-1716844) funded this study.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

We are thankful for the Environmental Defense Fund, Bentonville, AR for hosting MR as an Intern. We acknowledge support from the Open Access Publishing Fund administered through the University of Arkansas Libraries.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2021.789499/full#supplementary-material

References

CDP (2016). Out of the Starting Blocks: Tracking Progress on Corporate Climate Action. Available Online at: https://cdn.cdp.net/cdp-production/cms/reports/documents/000/001/228/original/CDP_Climate_Change_Report_2016.pdf?1485276095 (accessed December 6, 2021).

Ceres (2019). Top US Food and Beverage Companies Scope 3 Emissions Disclosure and Reductions. Engage the Chain. Available online at: https://engagethechain.org/top-us-food-and-beverage-companies-scope-3-emissions-disclosure-and-reductions (accessed February 12, 2021).

Christensen, J., and Olhoff, A. (2019). Lessons From a Decade of Emissions Gap Assessments. Nairobi: United Nations Environment Programme. Available online at: https://wedocs.unep.org/bitstream/handle/20.500.11822/30022/EGR10.pdf?sequence=1andisAllowed=y (accessed February 12, 2021).

Crawford, M., and Seidel, S. (2013). Weathering the Storm: Building Business Resilience to Climate Change. Center for Climate and Energy Solutions. Available Online at: https://www.c2es.org/document/weathering-the-storm-building-business-resilience-to-climate-change-2/ (accessed December 6, 2021).

Crippa, M., Solazzo, E., Guizzardi, D., Monforti-Ferrario, F., Tubiello, F. N., and Leip, A. (2021). Food systems are responsible for a third of global anthropogenic GHG emissions. Nat Food 2, 198–209. doi: 10.1038/s43016-021-00225-9

Faria, P (2016). The Evolution of Corporate Climate Targets. We Mean Business Coalition. Available online at: https://www.wemeanbusinesscoalition.org/blog/the-evolution-of-corporate-climate-targets/ (accessed February 12, 2021).

Food Engineering (2020). 2020 Top 100 Food and Beverage Companies | Food Engineering. Available online at: https://www.foodengineeringmag.com/2020-top-100-food-beverage-companies (accessed February 12, 2021).

Gerber, P. J., Steinfeld, H., Henderson, B., Mottet, A., Opio, C., Djikman, J., et al. (2013). Tackling Climate Change Through Livestock—A Global Assessment of Emissions and Mitigation Opportunities. Rome: Food and Agriculture Organization of the United Nations.

GRAIN (2018). Emissions Impossible: How Big Meat and Dairy are Heating Up the Planet. Available at: https://grain.org/article/entries/5976-emissions-impossible-how-big-meat-and-dairy-are-heating-up-the-planet (accessed April 21, 2021).

Haffar, M., and Searcy, C. (2018). Target-setting for ecological resilience: Are companies setting environmental sustainability targets in line with planetary thresholds? Bus. Strategy Environ. 27, 1079–1092. doi: 10.1002/bse.2053

IPCC (2014). “Climate change 2014: mitigation of climate change,” in Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change, eds O. Edenhofer, R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, et al. (Cambridge, New York: Cambridge University Press).

IPCC (2021). “Climate change 2021: the physical science basis,” in Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, eds V. Masson-Delmotte, P. Zhai, A. Pirani, S.L. Connors, C. Péan, S. Berger, et al. (Cambridge: Cambridge University Press). Available online at: https://www.ipcc.ch/report/ar6/wg1/#FullReport (accessed October 4, 2021).

IPCC (2018). Global warming of 1.5° C. An IPCC Special Report on the Impacts of Global Warming of 1.5° C Above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change. Available Online at: https://www.ipcc.ch/site/assets/uploads/sites/2/2019/05/SR15_SPM_version_report_LR.pdf (accessed June 4, 2021).

Jouvenot, V., and Krueger, P. (2019). Reduction in Corporate Greenhouse Gas Emissions Under Prescriptive Disclosure Requirements. SSRN Electronic Journal. doi: 10.2139/ssrn.3434490

Kobayashi, N., and Richards, M. (2021). Global Sector Strategies: Recommended Investor Expectations for Food and Beverage. Available online at: https://www.climateaction100.org/wp-content/uploads/2021/08/Global-Sector-Strategies-Food-and-Beverage-Ceres-PRI-August-2021.pdf (accessed September 14, 2021).

Lai, A., and Schiano, S. (2021). Empowered Consumers Go Green. Forrester. Available online at: https://www.forrester.com/report/Empowered+Consumers+Go+Green/-/E-RES163526?objectid=RES163526 (accessed February 12, 2021).

NewClimate Institute Data-Driven EnvironLab (2020). Navigating the Nuances of Net-Zero Targets. Available online at: https://newclimate.org/wp-content/uploads/2020/10/NewClimate_NetZeroReport_October2020.pdf (accessed June 4, 2021).

OECD CDSB (2015). Climate Change Disclosure in G20 Countries. Available Online at: https://www.oecd.org/daf/inv/mne/Report-on-Climate-change-disclosure-in-G20-countries.pdf (accessed December 6, 2021).

Plunkett Research Ltd. (2021). Plunkett's Food Industry Market Research. Food, Beverage and Grocery Overview. Available online at: https://www.plunkettresearch.com/industries/food-beverage-grocery-market-research/ (accessed May 10, 2021).

Reid, P. C., Hari, R. E., Beaugrand, G., Livingstone, D. M., Marty, C., Straile, D., et al. (2016). Global impacts of the 1980s regime shift. Glob. Change Biol. 22, 682–703. doi: 10.1111/gcb.13106

Rijsberman, F. R., and Swart, R. J. (1990). Targets and Indicators of Climatic Change. Stockholm: Stockholm Environment Institute.

Ripple, W. J., Wolf, C., Newsome, T. M., Barnard, P., and Moomaw, W. R. (2019). World Scientists' Warning of a Climate Emergency. BioScience 70, 8–12. doi: 10.1093/biosci/biz088

Ritchie, H (2019). Food production is responsible for one-quarter of the world's greenhouse gas emissions. Our World in Data. Available online at: https://ourworldindata.org/food-ghg-emissions (accessed February 12, 2021).

Sax, S (2020). Employees Are Fighting for a New Cause at Work: The Climate. EcoWatch. Available online at: https://www.ecowatch.com/employee-climate-activism-2645855023.html (accessed February 12, 2021).

SBTi (2021a). Companies Taking Action. Science Based Targets. Available online at: https://sciencebasedtargets.org/companies-taking-action (accessed February 12, 2021).

SBTi (2021b). SBTi Corporate Manual. SBTi. Available online at: file:https://Users/meganreavis/Downloads/SBTi-Corporate-Manual-v1.0-2.pdf (accessed February 12, 2021).

Searchinger, T., Waite, R., Hanson, C., and Ranganathan, J. (2019). Creating a Sustainable Food Future: A Menu of Solutions to Feed Nearly 10 Billion People by 2050. World Resources Institute. Available online at: https://research.wri.org/sites/default/files/2019-07/WRR_Food_Full_Report_0.pdf (accessed February 12, 2021).

Tcholak-Antitch, Z., Carnac, T., Harris, C., Baker, B., Banks, M., Gerholdt, R., et al (2013). The 3% Solution: Driving Profits Through Carbon Reduction. Available online at: https://c402277.ssl.cf1.rackcdn.com/publications/575/files/original/The_3_Percent_Solution_-_June_10.pdf?1371151781 (accessed February 12, 2021).

Tidy, M., Wang, X., and Hall, M. (2016). The role of Supplier Relationship Management in reducing Greenhouse Gas emissions from food supply chains: supplier engagement in the UK supermarket sector. J. Cleaner Prod. 112, 3294–3305. doi: 10.1016/j.jclepro.2015.10.065

Trucost (2019). Best Practices in Corporate Climate Disclosure. S&P Global. Available Online at: https://www.spglobal.com/_media/documents/trucost-carbon-disclosure-marketing-brief-05.pdf (accessed December 6, 2021).

Winston, A (2017). The Rise of Corporate Sustainability Goals: Some Hard Data. Sustainable Brands. Available online at: https://sustainablebrands.com/read/marketing-and-comms/the-rise-of-corporate-sustainability-goals-some-hard-data (accessed February 12, 2021).

World Economic Forum (2020). Measuring Statekholder Capitalism: Towards Common Metrics and Consistent Reporting of Sustainable Value Creation. Available Online at: https://www3.weforum.org/docs/WEF_IBC_Measuring_Stakeholder_Capitalism_Report_2020.pdf (accessed December 6, 2021).

Keywords: greenhouse gas emissions, food and beverage sector, climate goals, emission disclosure, science-based targets

Citation: Reavis M, Ahlen J, Rudek J and Naithani K (2022) Evaluating Greenhouse Gas Emissions and Climate Mitigation Goals of the Global Food and Beverage Sector. Front. Sustain. Food Syst. 5:789499. doi: 10.3389/fsufs.2021.789499

Received: 05 October 2021; Accepted: 10 December 2021;

Published: 12 January 2022.

Edited by:

Wayne Martindale, University of Lincoln, United KingdomReviewed by:

Elena Lioubimtseva, Grand Valley State University, United StatesGuobao Song, Dalian University of Technology, China

Copyright © 2022 Reavis, Ahlen, Rudek and Naithani. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kusum Naithani, a3VzdW1AdWFyay5lZHU=

Megan Reavis

Megan Reavis Jenny Ahlen2

Jenny Ahlen2 Joe Rudek

Joe Rudek Kusum Naithani

Kusum Naithani