- 1Department of Population Medicine and Diagnostic Services, Cornell University, Ithaca, NY, United States

- 2Department of Food and Resource Economics, University of Florida, Gainesville, FL, United States

Specialty crops are considered high-risk, high-reward, yet growers face differing, and relatively larger risk exposure when compared to traditional row crops. With traditional row crops, economies of scale and scope are key factors to increasing economic profitability. However, increasing economic profit for specialty crop operations present challenges which limit grower ability to easily take advantage of scale and scope economies. The authors discuss production, finance, regulatory, price, and human resource risks unique to U.S.-grown specialty crops. We apply our economic risk assessment framework to analyze U.S. edamame and present strategies to manage and mitigate risks faced by growers. We conclude that edamame may represent a profitable alternative crop in the U.S., and suggest future research topics are needed to optimize yields and meet market demand.

Introduction

Across the last two centuries, global farm operations have taken advantage of two economic principles—the economies of scale and scope. Combined with advances in research and grower adoption practices, scale, and scope economies allow growers to be more efficient while supplying food and fiber to meet consumer demand for product value and variety. However, specialty crop economics are fundamentally different than traditional row crops (i.e., corn, cotton, tobacco, grain soybeans, etc.) in many critical areas. Primarily, gains in specialty crop efficiencies and product diversity have larger opportunity costs—that is, the intrinsic value of the next best alternative is relatively greater—for specialty crops. We discuss these differences, and propose that increases in specialty crop profitability are driven by other economic factors that go beyond scale and scope.

The principle of scale economies is defined by the different types of production costs incurred, and a firm can cover those costs more efficiently by increasing the number of units produced. By reducing the marginal cost (cost per unit) of production, a firm can increase the amount of profit earned per unit (Stigler, 1958). An efficient producer aims to find ways to share fixed costs across additional units, or in the traditional row crop producer's case—acres (Heady and Ball, 1972). Fixed costs do not vary with output. For example, buildings/barns, planting and harvesting equipment, and land payments are costs that must be paid regardless of number of units produced. In contrast, variable costs are incurred once a decision is made to produce a unit/crop (Bressler, 1945). Examples of variable costs are seed, fertilizer, and irrigation/water expenses. Total costs are the sum of fixed and variable costs across all crops produced on the farm. Traditional row crops are typically annual crops, that follow a cycle of planting, maintaining, and harvesting every year, allowing for some flexibility in the timing of these variable and fixed costs over the lifetime of the farm operation. Moreover, most row crops are processed or fed to livestock rather than for direct human consumption.

For specialty crops, calculating total costs depends on several complicating factors. Many of the specialty crops require relatively higher costs to establish orchards, vineyards, and bushes (called perennial crops), and most are marketed for direct human consumption. So, a grower's ability to take advantage of scale economies is inherently more expensive as compared to row crops. In the perennial crop case, multi-year investments are required, which economists refer to as sunk costs, that are unrecoverable costs once expended (Sutton, 1991). Many annual specialty crops (i.e., strawberries, onions, lettuce, etc.) require more sophisticated irrigation systems, access to added labor in a narrow timeframe, and additional processing facilities, which are not needed for row crops. Therefore, any decision to expand production to achieve scale economies by harvesting additional acres results in more of a financial burden on growers.

Economies of scope is based on the principle that goods/crops are easily interchanged within the production process (Fernandez-Cornejo et al., 1992). In the case of traditional row crop production, this could mean changing between varieties of the same crop or changing to an entirely different crop. To a large extent, this is a relatively easy transition for growers to make from year to year. Many growers already rotate corn and soybean production or cotton and peanuts, among many other alternatives, to achieve scope economies. Within limits, this rotation between crops involves lower costs and are accepted practices adopted by most traditional row crop operations. Similarly, changing between varieties is relatively cost-effective, as varieties are predominately bred for genetic resistance to chemicals. For specialty crops, this decision to switch between alternate crops is much more convoluted. Changing to a new crop when perennial crops are established requires significant financial capital to remove existing crops, prepare planting sites, purchase new crops, learn optimal management techniques, and seek out new markets. This may even result in a loss of expected future returns, if this decision is made while existing orchards/vineyards/bushes are in the middle of prime production years. With annual and perennial specialty crops, the infrastructure to properly plant, irrigate, and harvest are highly specialized for each type of crop, further complicating and restricting the decision to switch between crops. Annual specialty crops substitution decisions hinge heavily on the demand side of a market, and growers are faced with determining whether any buyers exist for a different variety. As for production, they must know if the growing requirements are different, which may require extensive research or hiring someone with specific crop experience. These issues plague specialty crop growers far more than traditional row crop growers.

While it is well-known that specialty crops are considered high-value crop production, growers also face relatively greater risk exposures, and increased production costs. In the next section, the authors discuss why and how economic principles that affect specialty crop growers are fundamentally different than traditional row crop operations. The discussion is framed within the five types of agricultural risk: production, financial, human resources, marketing, and legal/regulatory. We present an application of our agricultural risk assessment framework to U.S. edamame production. Finally, we discuss key economic questions that still need to be answered to provide U.S. edamame growers, and the specialty crop industry, with profitable alternatives to management and mitigation of these risks.

Economic Drivers and Risk Management in Specialty Crop Production

While the principles of scale and scope economies are well-understood by specialty crop growers, other economic issues are equally important. Factors such as technology (including the efficiency of that technology), training to ensure proper field use of equipment, ability and capacity for on-farm storage/processing, produce form (fresh vs. frozen), timing and geography of harvest, etc., play interrelated roles in impacting the economic profitability of specialty crop growers. Moreover, these factors may affect the level of risk growers face at any given time within the production process. Most conversations related to agricultural-related risks are centered around financial details. However, financial risk is interwoven within all five risks, and as we have outlined in our introduction, our goal is to provide a more comprehensive understanding of the unique portfolio of risks facing specialty crop growers.

Production Risk

Production risk refers to the uncertainties affecting the natural process of crop growth. Weather, disease, weed competition, pest infestations, introduction of new technology (bio-tech, robots, processing, etc.) and crop damage are common risks within the production process (Traxler et al., 1995). Production risk increases year-to-year variability in harvest amounts which, in turn, affects profit potential. There are three ways for growers to reduce risk in this area: (1) control or minimize risk through irrigation practices, regular machinery maintenance, and close monitoring for pests/disease; (2) reduce production variability by diversifying farm enterprises, creating flexibility to evolving economic conditions, integrating multiple enterprises, improving technology, and/ preparing contingency plans; and (3) transfer the risk to someone else through contracting or insurance (Drollette, 2009b). Specialty crops are especially vulnerable to production risk as many are grown and marketed either fresh or minimally processed to end users. Any defects in the final product means economic losses as accountability for market quality is placed on individual growers and/or packing houses by retailers. While production risk can never be eliminated, it may be mitigated to enhance the probability of higher profits.

Financial Risk

As mentioned earlier, financial risk is the most referenced type of risk, largely due to the fact that all other types of risk are intimately related to farm finances. Finance risk primarily occurs when a farm business borrows money or, more generally, creates an obligation to repay some form of debt. This type of risk is primarily a function of the timing of cash flows, to meet the daily operational needs of the farm, and the capital-intensive nature of the business (Kay and Edwards, 1994). Specialty crops growers balance their need for capital and labor expenses as both are significant financial factors for production and harvesting. Moreover, local and global conditions play a large role in the amount of financial risk farms face. For example, the cost of capital (the interest rate on loans), availability of funds, land rents, and leasing agreements are predominately local concerns. On a global scale, worldwide supply and demand, trade conditions, and agricultural subsidies across all countries impact the extent of financial risks facing the farm business. Optimal management of financial risks requires a structured, well-documented financial tracking system to optimize the timing of cash needs, expenses, and revenues (Morgan et al., 2016).

Regulatory/Legal Risk

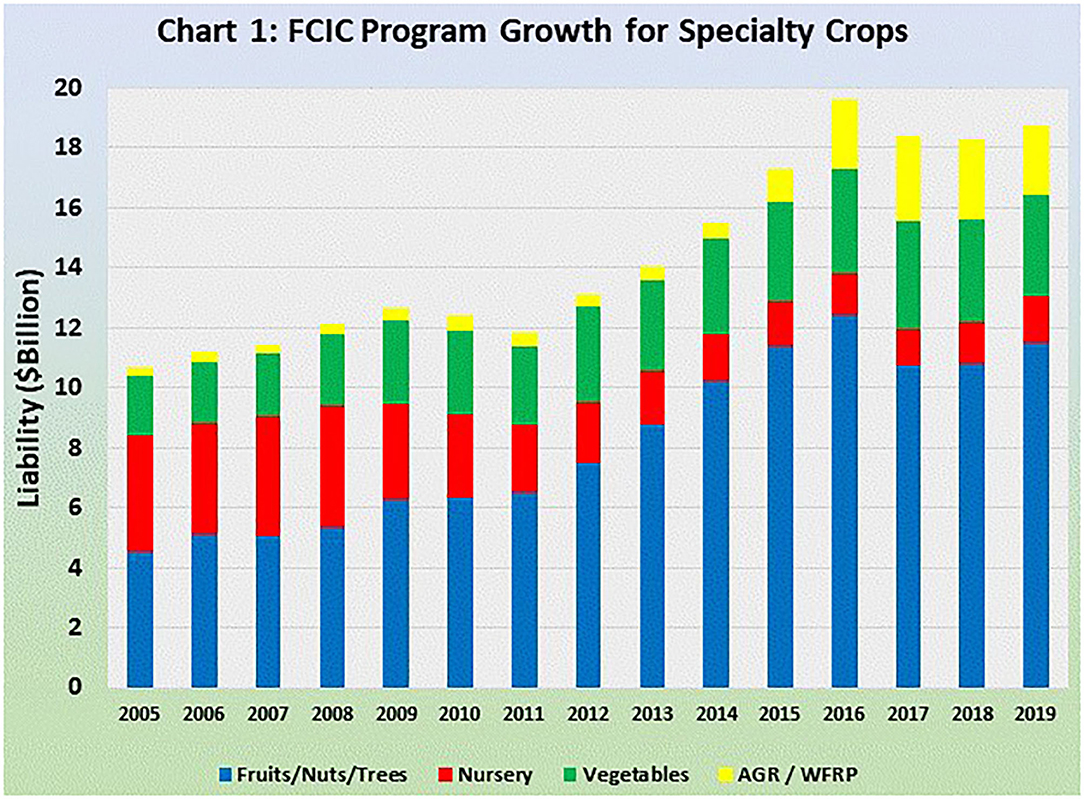

Uncertainty that deals with governmental actions or legal rights and regulations is referred to as regulatory or legal risk. This type of risk involves topics ranging from business structures to insurance standards to tort liability (property and personal injury) to environmental legislation specific to resource use. Growers may successfully mitigate regulatory risk by implementing and following the practice of “due diligence,” a technique that refers to taking reasonable actions to obtain all pertinent information (Harl, 2005). In choosing a business structure, consulting with a certified public accountant and a tax lawyer may ensure growers personal and farm business assets are identified accurately and legally secured. Growers may contact a local environmental regulatory agency to confirm that farm operational procedures are meeting, or exceeding, all current environmental standards and best management practices. Growers may research the latest legal rules and regulations specific to the geographic location of the farm operation, in conjunction with appropriate expert consultation, to discover ways and means to minimize legal risk. In 2019, the Federal Crop Insurance Coverage available for specialty crops exceeded $18 billion (USDA, 2020), yet the majority of specialty crops are not covered by the program and depend on the particular crop, the product form, and the production region (The National Agricultural Law Center, 2020).

Market/Price Risk

Market risk exposure depends on the type of agricultural commodity produced, but is focused on uncertainties about prices received for products and/or price of inputs. For most farm commodities, prices are dictated by national, or global market demands trends. An individual grower is a “price-taker” and cannot set product prices, instead receiving the price offered by the market on that day. In order to mitigate grower exposure to relatively lower market prices for homogenous products, many use hedging or storage to offset low prices (Drollette, 2009a; Broll et al., 2013).

Growers may decide to sell direct-to-consumers or retail outlets which gives an individual power over the market price through differentiation of the product offering (Nartea and Morgan, 2015). These “price-setters” manage price risks related to ever-changing market demand by connecting with individual customers. Direct customer tastes and preferences define the connections forged with individual growers and products, yet these are subject to variation over time. To mitigate price risk unique to direct market outlets, growers invest time and resources in a marketing plan, to include analysis of sales and market data, and create and cultivate market awareness of their unique product offerings. Growers who act as price-setters may mitigate financial risks by setting their prices above total costs of operations (Holdren, 1965) and earning marginal gains in profit relative to competitors. There are risks to both and it is up to the grower to decide which option best suits the short- and long-term goals of the farm operation.

Human Resources/Labor Risk

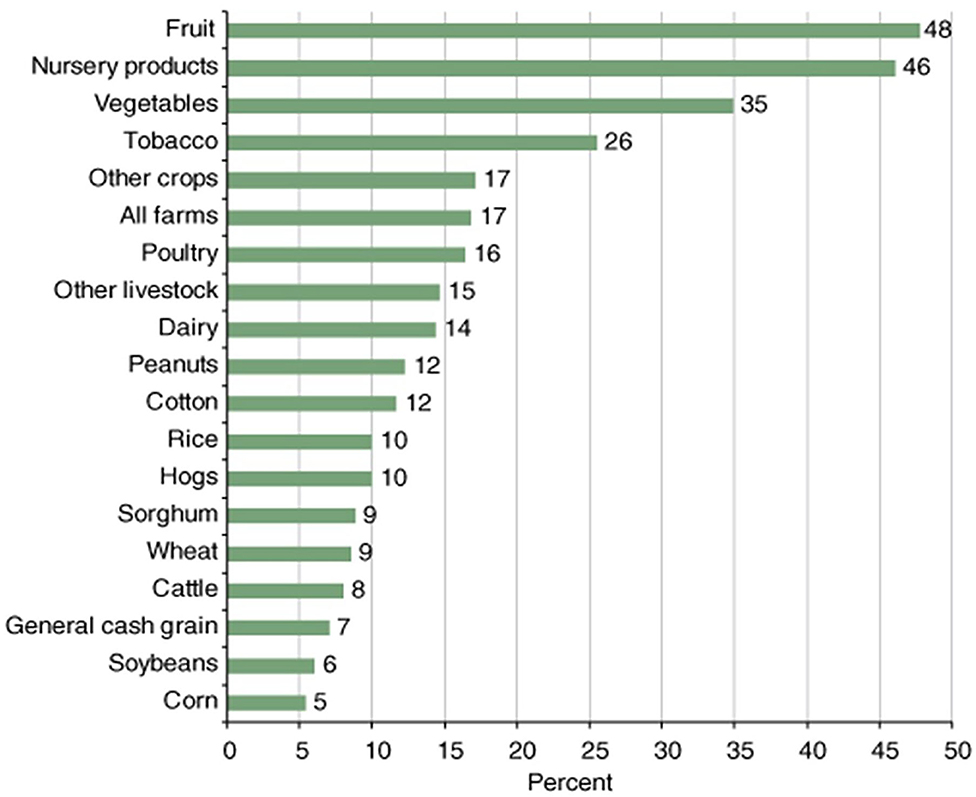

Every agricultural operation needs people in order to be successful. However, some agricultural operations require a larger labor force than others—i.e., specialty crop production. The share of variable costs attributed to labor for specialty crops is 2–3 times greater than many traditional row crops (Figure 1). As mentioned earlier, production risk is of utmost importance for specialty crop growers as the majority of these crops are intended for direct human consumption. In order to maintain integrity, many specialty crop operations employ a large labor force to maintain and harvest the crops. Machine harvesting of specialty crops often damages the product and increases losses to growers along the supply chain. Specialty crop growers are exposed to a relatively greater amount of labor risk exposure when compared to traditional row crops because it is heavily dependent on hand-harvesting the final product within a limited timeframe.

Labor risk also refers to the human health, personal relationship, and labor availability problems that directly affect the farm business (Billikopf, 2003). From family relationships to personnel management to health and communication, labor risk management requires development, and implementation of a plan to ensure access to a healthy and efficient workforce. Nearly all specialty crop growers rely on access to migrant laborers, whose availability is subject to the ever-changing political environment and extensive regulatory and legal paperwork (Mapes, 2010). With continued advances in agricultural mechanization, required numbers of hand laborers has reduced over time, particularly for specialty crops sold into processed or frozen product forms. However, hand harvesting is required for most fresh marketed fruits and vegetables, which earn greater market prices and improve overall grower profitability.

Economic Risk Assessment of U.S. Edamame Production

Applying our risk assessment framework, we examined edamame, a relatively new U.S. specialty crop, to demonstrate the economic factors that distinguish specialty crop production. Edamame is harvested from the same plant as conventional grain soybeans, though there are some varietal differences. By harvesting beans/pods at an earlier growth stage (R6 and R7), edamame is bright green and has a higher moisture content. Edamame also has a larger seed size and higher simple sugar content that lends itself to a sweeter taste and improved digestibility. More importantly, edamame is classified as a specialty crop by the United States Department of Agriculture (USDA), while grain soybeans—harvested at a later growth stage of the same plant—is a traditional row crop.

Consumer demand for edamame has been growing at an estimated rate of 12–15% annually (Bernick, 2009; Edamame Production Facts, 2012). This growth in demand is largely driven from consumer desires for healthier, plant-based protein alternatives. Edamame is known for its high protein and essential amino acids content. In addition, it is a rich source of dietary fiber, minerals, and vitamins (Zhang et al., 2013). In recent times, edamame has become the second largest soyfood consumed in the U.S. at 25,000–30,000 tons annually (Soyfoods, 2015). All of these demand factors have influenced the heightened interest in domestic edamame production and influced the potential profitably of such an enterprise. As will be pointed out below, the keys to sustaninable production of edamame production to meet this growing demand are predominately around minimizing production costs and developing a clear market for fresh edamame.

The production risks associated with edamame that differ from conventional grain soybeans are predominately due to the lack of genetically modified edamame varieties available to growers, and edamame is marketed for direct human consumption. There are few approved herbicides for fresh market edamame post-emergence, resulting in increased need for hand labor to control for weeds which increases the financial risk to the farm business. The planting of non-genetically modified edamame requires that pest and weed resistance are bred through traditional plant breeding techniques. At the same time, a non-genetically modified edamame production has benefits to environmental sustainability of production that could mitigate this financial risk. Fresh market edamame is harvested when the beans have a much higher moisture content, which requires precise timing for harvest and staggered harvesting to avoid overwhelming harvest laborers. Moreover, traditional soybean harvesters cannot be used as they damage the edamame beans, thus modified equipment or hand harvesting must be employed. Once harvested, edamame must be cooled to maintain edible quality of the beans.

Mitigating each of these production risks requires additional equipment and storage facilities. Thus, these additional costs incurred when switching from traditional grain soybeans to edamame introduce financial risk. Additional equipment or buildings are capital investments that create financial obligations in the long term. With a potential increase in labor cost, edamame growers must consider how a change in cost allocation will affect economic profitability. Under a purely hand-harvested operation, labor costs would encompass over 62% of the operations expenses (Garber et al., 2019). Mechanical harvesting is an option as it could reduce labor costs to as low as 25% of total expenses. However, this increases equipment costs and maintenance while also increasing pod damage. Under current market varieties this increase in damage would lower potential revenue. If harvest damage can remain lower than 20% of total yield, then mechanical harvest is potentially profitable (Garber et al., 2019).

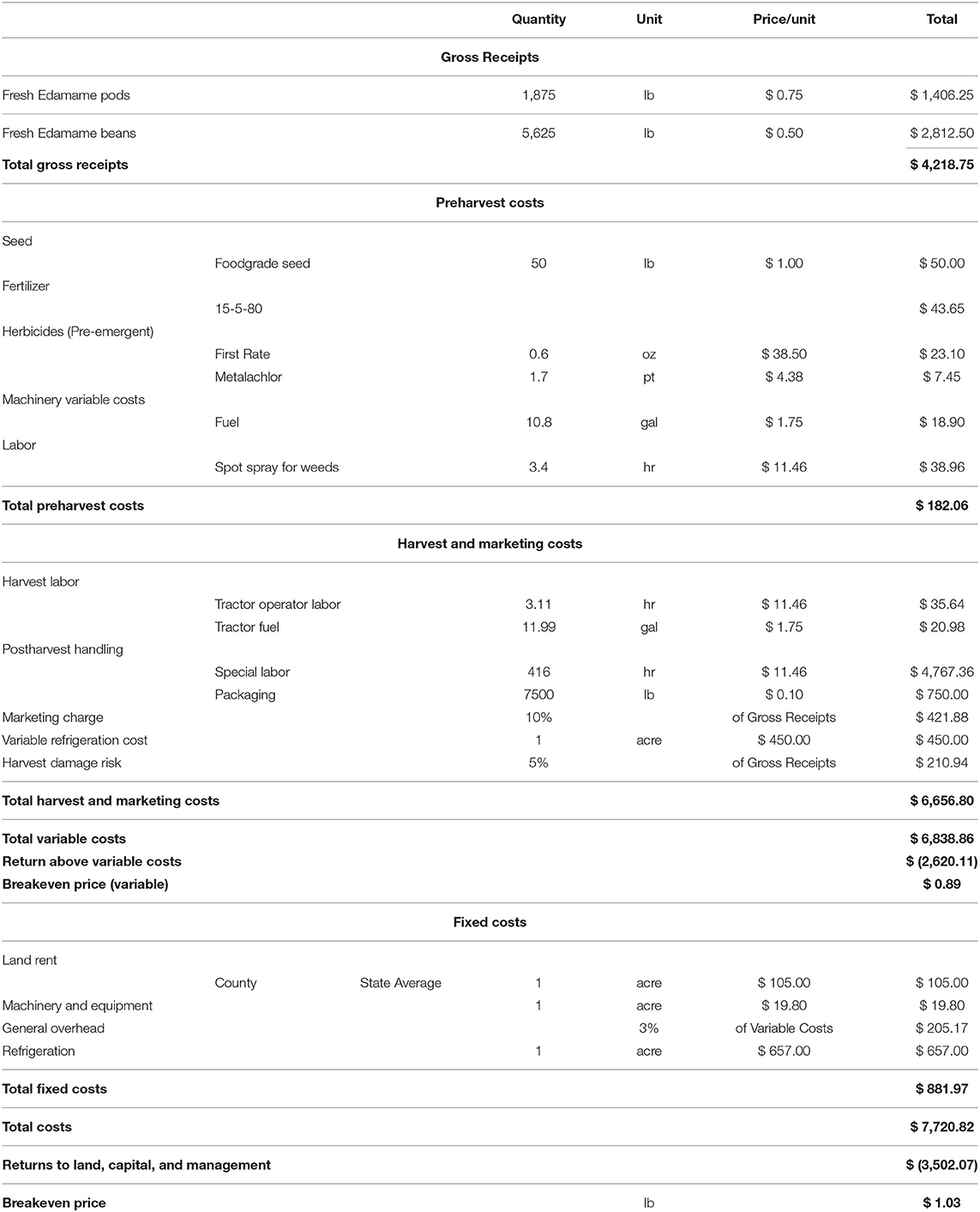

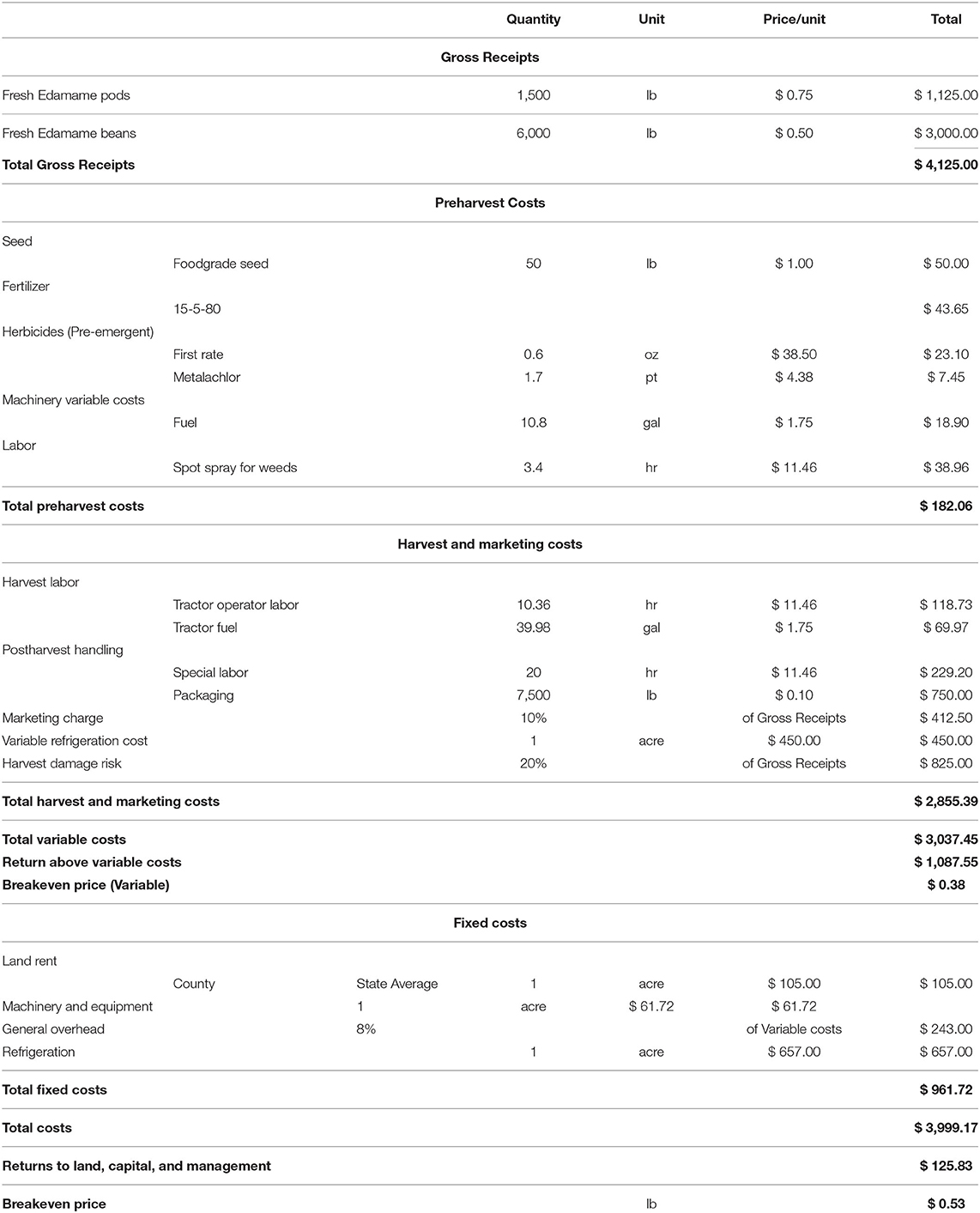

Enterprise budget analysis is a useful tool to estimate the potential profitability of various enterprises and variations within enterprises. A one-acre edamame operation in Virginia, with several assumptions about average inputs, that employs hand harvesting is presented in Table 1. Lord et al. (2019) found that hand harvesting is not profitable, and any potential revenue is not enough to cover variable costs. Moreover, the breakeven price received by the grower to cover total costs is $1.03 per pound, which exceeds current fresh market edamame market prices. We investigated machine harvesting of edamame pods, and found the operation is potentially profitable with a breakeven grower price of $0.53/pound, which is more realistic based on current market demand (Table 2). Enterprise budgets provide growers with the ability to understand the opportunity cost of choosing to grow one crop relative to the next best alternative use of available time and resources. This type of tool is a powerful planning tool for growers interested in edamame as a potential crop in their operation, and may be adjusted to capture the specific farm characteristics (Morgan et al., 2016).

Table 1. Enterprise Budget for Average Farm in Virginia—Edamame, hand-harvested (Source: Garber et al., 2019).

Table 2. Enterprise budget for average farm in Virginia – Edamame, Machine-Harvested (Source: Garber et al., 2019).

The edamame example demonstrates the unique financial risks facing all specialty crop growers. The issue is exacerbated because of the additional regulatory constraints and the lack of a government safety net. Regulatory risk for specialty crop growers arises as products are typically used in human consumption, which requires growers and processors meet strict food safety guidelines both on and off farm. Following rules set out by legislation such as the Food Safety Modernization Act and Good Agricultural Practices are critical for market access and may significantly increase the cost of producing specialty crops. Traditional row crop growers have a more robust safety net from crop insurance subsidized by the federal government. While crop insurance coverage has grown over the last decade (see Figure 2), many specialty crops have little to no subsidization of insurance coverage for a specific crop in a specific geographic location. In many cases, the only option is Whole Farm Revue Protection, which may provide insufficient coverage or is too expensive for smaller operations. This lack of a safety net increases the risk exposure of every specialty crop producer when unexpected weather, disease, and pest pressures occur. Since edamame is a relatively new crop for domestic production, there is a long way to go before targeted insurance products may be available. Management and mitigation of these production risks unique to specialty crops requires relatively larger cash reserves to prevent long-term financial losses.

Figure 2. Federal Crop Insurance Coverage Program Growth for specialty crops (Sources USDA -Risk Management Agencvy, 2020).

Market/Price risk is a key issue for all specialty crop growers. Edamame has only recently been produced in the United States for fresh markets. Traditionally, edamame was imported in the form of frozen product from Asian countries, where it originated, such as Taiwan and China (Born, 2006). Over the past 20 years, domestic U.S. production has been steadily increasing due to an increase in consumer demand for fresh edamame products (Lord et al., 2019). With the advent of fresh market opportunities comes the risk of increased price fluctuations. Early season edamame garners higher prices as there are fewer competitors in the market. As the season progresses, edamame market prices decrease at an increasing rate, and growers must decide to stop harvesting when the market price falls below their operational costs. To mitigate this financial risk exposure, growers may stagger production and consider early varieties/plantings to take advantage of the higher early-season prices. Additionally, the establishment of a local processing plant designed for edamame would alleviate the market risks. In Arkansas, a processing plant was established in 2012 which allowed for some growers to have access to a dedicated buyer which reduced the uncertainty of selling the product after harvest (CBS News, 2014).

While hand-harvesting is not generally a profitable way to produce edamame, there are likely situations that indicate when this is the best option for some growers. To determine the risks associated with hand harvesting, growers need answers to several key questions. Is there enough of a qualified labor force available that could be employed to harvest one's edamame crop? Are they available for the entire season? Can family labor be substituted for hired labor? One way to offset the issue of labor force availability is to pursue migrant/immigrant labor, but this creates another layer of risk. Constantly changing political climates apply pressure to the feasibility of migrant labor. In addition, migrant labor may not be cheaper than other alternatives. Small to medium sized edamame operations may benefit from hand-harvesting as the labor force needed is much smaller, but availability of labor fluctuates from year to year. Mitigating this risk requires adopting varieties that are more suited to mechanical harvesting or, hiring and training a smaller labor force that plays a more permanent role in an operation rather than seasonal/temporary workers. Training is the key to creating and maintaining a viable work force on farm, but those workers must be retained in order to be effective. Overall, labor risk will continue to be a critical issue in U.S. edamame production, as in all of specialty crop enterprises.

Discussion and Conclusions

We present an economic risk assessment framework and an application to U.S. edamame production. Overall, edamame is a interesting case study as the growing demand for the crop is driving the need to better understand risks associated with specialty crop production. Specifically, U.S. production of edamame can meet growing consumer preferences for fresh, healthy, plant-based protein alternatives. However, there are several limitations to sustainable domestic production. To assist in promoting sustainable production we identify five areas of agricultural risk based on underlying economic concepts, along with potential strategies to manage and mitigate risks behind and beyond the farm gate. What is apparent about U.S. edamame production is the many unknowns about the long-term viability of such an enterprise. As with all businesses, profitability of an enterprise is of utmost importance, but a lack of existing data on new enterprises is always a challenging issue. To better answer the numerous questions posed by our findings, we encourage improved data collection specific to each risk category to inform future research. This includes grower-informed surveys to better understand the key issues that limit expansion of U.S. edamame production, and public availability of market price trends within production regions.

Industry partnerships may provide an opportunity to enhance the data and knowledge of the potential profitability of edamame production. This requires industry to “buy-in” and provide needed transparency and information sharing. Creation of public-private partnerships is crucial to ensuring that specialty crops continue to be profitable to all supply chain participants. These partnerships would ensure that the research conducted within public institutions is grounded in application and focused on improving grower profitability and long-term business survival. Moreover, partnering provides better decision and management tools, which are especially relevant when considering farm enterprise diversification with new crops like edamame. As noted in the enterprise analysis, many assumptions are made about the production of edamame in Virginia. Any number of those assumptions may be incorrect and/or require adjustments as edamame production becomes more widespread. Industry partnerships would ensure that those assumptions are reduced so that potential edamame growers better predict the expected benefits of producing this crop on their farms. This is especially relevant for the small to medium sized growers with tighter operating budgets and limited access to human resources.

As mentioned in the regulatory risk assessment, there are no comprehensive government-supported or private insurance policies available to all specialty crop growers. This exposes most specialty crop growers to more risk as compared to traditional row crop growers. By coordinating efforts across different specialty crop grower associations, lobbying for more effective policies may be achieved. To reiterate, we encourage a collective lobbying effort to benefit all specialty crop growers. Without collective effort, new specialty crop growers—like U.S. edamame growers—will not have the economic incentives to explore these novel enterprises.

As we have shown, profitable specialty crop production goes far beyond the traditional thoughts about scale and scope economies. Edamame production in the U.S. has great potential, but incentivizing farmers to grow the crop requires a deep understanding of the added economic risks. Mitigating each of the risks presented in this analysis are vital to the success of U.S. grown edamame. By analyzing these issues in future research, we expect U.S. edamame production to represent a profitable enterprise for growers.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

Author Contributions

CN drafted the manuscript and edited based on co-author and reviewers' comments. All authors reviewed, edited, and approved draft and submitted versions of the manuscript.

Funding

This work was funded, in part, by USDA-NIFA, Grant No. 2018-51181-28384, Accession No. 1016465 and the Virginia Agricultural Experiment Station.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Acknowledgments

The authors thank USDA-NIFA and Virginia Agricultural Experiment Station for the financial support.

References

Bernick, K. (2009). Edamame Takes Root in U.S. Corn and Soybean Digest. Available online at: http://www.cornandsoybeandigest.com/edamame-takes-root-us (accessed on April 18, 2020).

Billikopf, G. E. (2003). Labor Management in Agriculture: Cultivating Personnel Productivity. University of California, Division of Agriculture and Natural Resources, Agricultural Issues Center.

Born, H. (2006). Edamame: Vegetable Soybean. National Sustainable Agriculture Information Service. Available online at: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.669.8757andrep=rep1andtype=pdf (accessed on April 18, 2020).

Bressler, R. G. (1945). Research determination of economies of scale. J. Farm Econom. 27, 526–539. doi: 10.2307/1232647

Broll, U., Welzel, P., and Wong, K., and Kit, P. (2013). Price risk and risk management in agriculture. Contempor. Econom. 7, 17–20.

CBS News (2014). Edamame Production Goes From Asia to Arkansas. Available online at: https://www.cbsnews.com/news/asias-edamame-business-is-coming-to-us-soil/ (accessed on November 30, 2020).

Drollette, S. (2009a). Managing Marketing Risk in Agriculture. Logan, UT: Department of Applied Economics Utah State University

Drollette, S. A. (2009b). Managing Production Risk in Agriculture. Logan, UT: Department of Applied Economics Utah State University.

Edamame Production Facts (2012). Available at: https://www.uaex.edu/farmranch/cropscommercial-horticulture/edamame/docs/EdamameFacts1.pdf (accessed on November 18, 2020).

Fernandez-Cornejo, J., Gempesaw, C. M., Elterich, J. G., and Stefanou, S. E. (1992). Dynamic measures of scope and scale economies: an application to German agriculture. Am. J. Agricult. Econom. 74, 329–342. doi: 10.2307/1242487

Garber, B., Neill, C., and Lord, N. (2019). Edamame: Costs, Revenues, and Profitability. Virginia Cooperative Extension AAEC-189P.

Heady, E. O., and Ball, A. G. (1972). Public Policy Means and Alternatives. Ball, A; Gordon Size, Structure, and Future of Farms.

Holdren, B. R. (1965). Competition in food retailing. J. Farm Econom. 47, 1323–1331. doi: 10.2307/1236390

Lord, N., Neill, C., and Zhang, B. (2019). Production and economic considerations for fresh market Edamame in Southwest Virginia. Virginia Cooperative Extension AAEC-188P.

Mapes, K. (2010). Sweet Tyranny: Migrant Labor, Industrial Agriculture, and Imperial Politics. Urbana, IL: University of Illinois Press.

Morgan, K. L., Callan, P. L., Mark, A., Niewolny, K., Nartea, T. J., Scott, K. H. (2016). Farm Financial Risk Management Series. Part I, Overview of Financial Systems for New and Beginning Farmers. Virginia Cooperative Extension AAEC-114P.

Soyfoods (2015). Soy Products Sales and Trends. Available online at: http://www.soyfoods.org/soyproducts/sales-and-trends (accessed on November 18, 2020).

Sutton, J. (1991). Sunk Costs and Market Structure: Price Competition, Advertising, and the Evolution of Concentration. MIT press.

The National Agricultural Law Center, N.A. Specialty Crops (2020). An Overview. University of Arkansas. Available online at: https://nationalaglawcenter.org/overview/specialty-crops/ (accessed on April 18, 2020).

Traxler, G., Falck-Zepeda, J., Ortiz-Monasterio R, J. I., and Sayre, K. (1995). Production risk and the evolution of varietal technology. Am. J. Agricult. Econom. 77, 1–7.

USDA, Risk Management Agency. (2020). Specialty Crops. Risk Management Agency Fact Sheet. Available online at: https://rma.usda.gov/en/Topics/Specialty-Crops.

Keywords: risk assessment, economics, edamame, enterprise analysis, profitability

Citation: Neill CL and Morgan KL (2021) Beyond Scale and Scope: Exploring Economic Drivers of U.S. Specialty Crop Production With an Application to Edamame. Front. Sustain. Food Syst. 4:582834. doi: 10.3389/fsufs.2020.582834

Received: 13 July 2020; Accepted: 04 December 2020;

Published: 11 January 2021.

Edited by:

Xujun Fu, Zhejiang Academy of Agricultural Sciences, ChinaReviewed by:

Maria Ewa Rembialkowska, Warsaw University of Life Sciences, PolandDavid Moseley, Louisiana State University Agricultural Center, United States

Copyright © 2021 Neill and Morgan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Clinton L. Neill, Y2xuNjRAY29ybmVsbC5lZHU=

Clinton L. Neill

Clinton L. Neill Kimberly L. Morgan2

Kimberly L. Morgan2