- 1College of Marxism, Yunnan Agricultural University, Kunming, China

- 2School of Agricultural Economics and Rural Development, Renmin University of China, Beijing, China

- 3School of Finance and Business, Shanghai Normal University, Shanghai, China

Against the backdrop of growing attention being paid to both ecological compensation and the digital economy, this paper explores the impact of digital financial inclusion on green economic growth in counties within China’s National Key Ecological Functional Zones (NKEFZs) from 2014 to 2022, using panel data from 393 counties. Employing a two-way fixed-effects model, the study finds that digital financial inclusion promotes both traditional and green economic growth. The study results are robust, even after a series of robustness tests. The mechanisms identified include agricultural technology progress, industrial structure upgrading, and enterprise innovation and entrepreneurship. However, the effect is less significant in western and northeastern regions, as well as in windbreak and sand-fixing zones. The study highlights the potential of digital finance to help resource-rich, underdeveloped regions overcome the “resource curse” and foster sustainable economic growth.

1 Introduction

After undergoing rapid development in the past decades, the world economy has achieved tremendous economic growth (Bin Abu Sofian et al., 2024), but along with the rapid expansion of urbanization and the continuous increase in carbon emissions from industrial energy consumption, ecological and environmental problems such as resource depletion, global warming, soil erosion, atmospheric pollution, a sharp decline in biodiversity, and destruction of vegetation cover have been gradually exposed (Ghosh et al., 2021; Mardani et al., 2017; Wang et al., 2019). That is to say, behind the economic growth of countries around the world, economic growth and environmental protection are often separated and have not reached a state of coordinated development (Koseoglu et al., 2022). For this reason, in the face of the growing environmental crisis, countries around the world are endeavoring to provide sustainable solutions, but are constrained by a number of factors, such as insufficient technological innovation, insufficient market dynamism, and insufficient industrial transformation, to achieve green economic growth (Zhao et al., 2024); (Zhao et al., 2023). This model of crude economic development has also caused irreversible damage to the ecological environment in most countries where economic development is a priority, especially in developing countries. (Zhao et al., 2022) (Hu et al., 2021) (Ahmad et al., 2021). As the world’s largest developing country, China is exploring a new model of green economic growth in the form of the establishment of NKEFZs, in the hope of providing an experience for other developing countries. Digital finance inclusion, which has grown exponentially in the process, promotes “rapid development” for the green growth of the economy at the county level and indicates a new path for the green growth of the world economy and the realization of sustainable development goals.

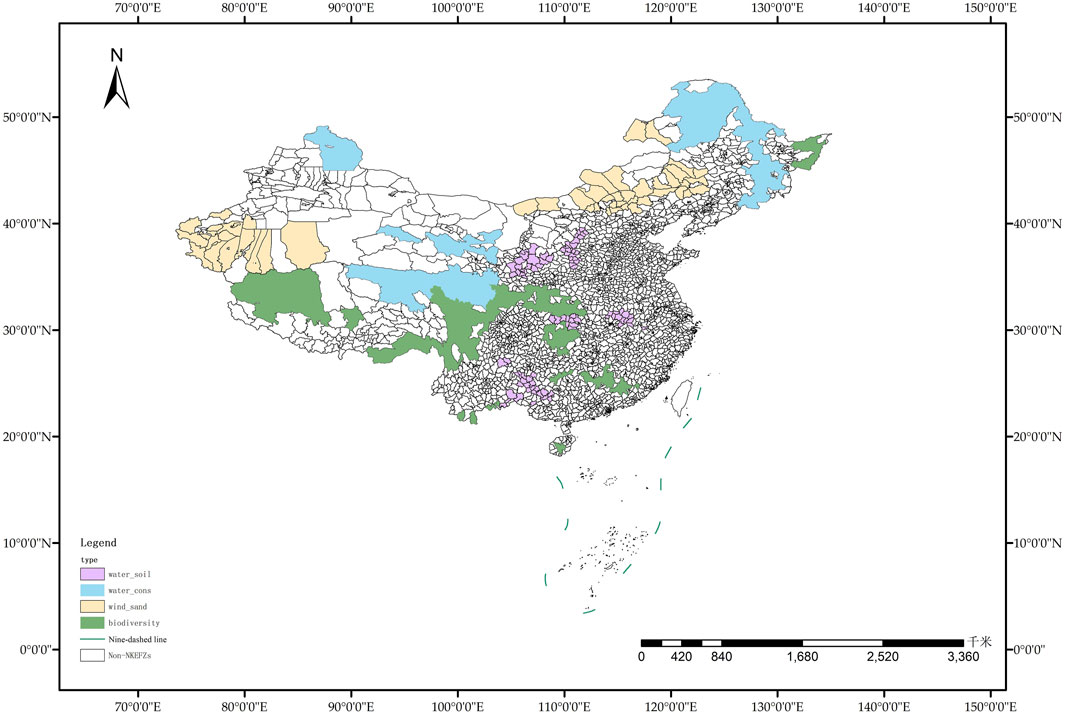

Payments for environmental services (PES) represent a pivotal approach adopted globally to safeguard ecosystems. Notable examples include the UK’s EU-guided Biodiversity Compensation Policy (CSWAPO Pilot); the U.S. Conservation Reserve Program (CRP), which prioritizes ecological fallowing; and similar initiatives in developing nations aimed at compensating for the use of natural resources like watersheds, forests, and wetlands. Among these, China’s NKEFZs policy is the largest PES program worldwide (Hu et al., 2024; Chen and Pan, 2019). This program is specifically designed to disrupt the detrimental cycle of poverty and environmental degradation. The Measures for the Transfer Payment of National Key Ecological Function Zones1 implemented in 2011 and 2012 stipulate the adoption of a new compensation mechanism, which not only compensates to a certain extent for the lost opportunity costs and economic costs of ecological protection due to the restriction and prohibition of development in the counties covered by the policy but also rewards ecological environment improvement within the counties covered by the policy. The construction of NKEFZs is the core driving force for China to strengthen economic growth momentum while promoting ecological civilization construction, and it is also a fundamental requirement for achieving high-quality economic development in China and has a clear direct impact on the achievement of SDGs. In December 2010, China introduced the China’s National Land Main Functional Zones Plan2, which provides strategic, fundamental, and binding planning for China’s territorial spatial development. The first batch of the plan delineated 25 national key ecological functional zones (436 counties), covering a total area of 3,436,000 square kilometers, or 35.8 per cent of the national territory, with the more important zones covering an area of 2,046,000 square kilometers, or 21.3 per cent of the national territory. This document further clarified that NKEFZs serve as ecological barriers and economic zones undertaking the functions of water conservation, soil conservation, wind and sand control, and biodiversity maintenance and that they have both ecological and economic effects, but it also means that they are facing the dual pressures of ecological environment improvement and high-quality economic development. NKEFZs are restricted from large-scale and high-intensity industrialization and urbanization development in order to improve the supply capacity of ecological products and maintain national ecological security. Therefore, when the environmentally friendly conditions in high-quality economic development are constrained in advance, it will be of great strategic importance to explore new driving models to promote green economic growth. The specific locations of the four types of NKEFZs are shown in Figure 1 (Ahmad et al., 2021; Hu et al., 2024).

Against the backdrop of a new round of technological revolution, the digital economy, as a new type of economic form arising and developing rapidly along with digital technology, contributes more than 70 per cent to the gross domestic product in most parts of the world (Ali et al., 2023). The digital economy is continuously integrating and coordinating development with agricultural production, enterprise innovation, residential life, and industrial change. As a more efficient and comprehensive financial model, it uses information technology to overcome the many drawbacks of the traditional financial model, such as high threshold of access to services, network of service institutions, and high requirements of customer groups and guides financial resources to support the development of the green economy based on the Internet platform to open up the “last kilometre” of financial services for the win–win situation of the “ecology” and the “economy.” Therefore, can regions with a relatively healthy natural ecological baseline achieve green economic growth? How can the development of digital financial inclusion empower this process? How can the issue of uncoordinated regional development during national land space development be addressed? Using evidence from China’s NKEFZs, we provide a theoretical basis and policy reference for formulating timely, targeted, and comprehensive strategies for the development of digital financial inclusion and green economic growth in resource-rich but economically underdeveloped areas in many developing countries.

In view of this, we explore the impact mechanism of digital financial inclusion on the economic green growth of counties and conduct heterogeneity analysis based on regions and types of NKEFZs, in order to find the optimal path for digital financial inclusion to empower the green growth of China’s NKEFZs. This aims to improve China’s “green-oriented” digital financial inclusion service system and leverage the positive role of new green financial instruments in promoting the green growth of NKEFZs, and it has important theoretical value and practical significance for promoting the sustainable economic and social development of the economy and society in NKEFZs around the world.

Compared to previous studies, the potential contributions of our study are as follows: first, our research broadens the theoretical framework of ecological civilization to construct a “policy-technology-economy” model, which analyzes the green transformation of economies within China’s NKEFZs, while incorporating international perspectives on digital financial inclusion as a crucial service factor. This model is proposed as a blueprint for similar initiatives in other developing countries striving for sustainable development. Second, it employs a two-way fixed-effects panel model to evaluate the impact of digital financial inclusion on both traditional and green economic growth across counties within the first NKEFZs, identifying agricultural technology progress, industrial upgrading, and entrepreneurial innovation as key mechanisms that could be replicated in other regions of the Global South. Lastly, it accounts for the heterogeneity in development levels and functional area positioning. This approach offers valuable insights for developing nations looking to balance economic growth with environmental sustainability.

The rest of this paper is organized as follows: Section 2 presents the literature review, Section 3 presents the theoretical analysis and research hypothesis, Section 4 presents the research design, Section 5 presents the reporting of the empirical analysis results, and Section 6 presents the conclusion and implications.

2 Literature review

Since China established the NKEFZs that restrict development and established a sound ecological protection transfer payment system, relevant studies have analyzed the impact of the establishment of NKEFZs on county-level development, mainly focusing on three aspects: first, some scholars have revealed the traditional economic growth effects brought by the establishment of NKEFZs from a macro perspective (Chen et al., 2024), indicating that the establishment of NKEFZs can improve the industrial structure in the long run in order to increase the financial strength of the counties; although the financial subsidies cannot completely offset the negative economic effects imposed by the restriction on development, with the advancement of time, the continuous accumulation of funds, and the transformation of the value of ecological products, the traditional economic growth effect brought about by the policy will gradually appear (Zhang et al., 2022). Second, some scholars have assessed the ecological service functions of different ecological function types of NKEFZs, providing direct empirical evidence for the significant positive effects of this policy in protecting regional ecological environments, restoring the quality of the ecological environment and improving the ecological pattern of counties, and at the same time, proving that the effects of the policy vary in different types of function zones, geographic spaces, and quartile levels (Yang et al., 2024). Third, some scholars have also taken into account the evolutionary characteristics of the coupled “ecological-economic-social” system in the NKEFZs, indicating that the current economic development of NKEFZs mainly depends on the improvement of the ecosystem and the creation of ecological and economic–social communities, which played an irreplaceable role, both in the ecological poverty alleviation in the past and in the current stage of ecological revitalization (Zeng et al., 2021).

There are two main types of policy instruments for realizing green economic growth worldwide: a forcing mechanism with environmental regulation as the main component (Yang et al., 2024; Zeng et al., 2021) and an inducing mechanism with financial infrastructure services as the main component (Liu et al., 2023). In the NKEFZs, the resource constraints and restrictions on development brought about by policies and the resource allocation and efficiency change utility played by digital financial inclusion interact to serve local economic green growth. In this process, the digital economy is considered to be the main economic form that promotes the NKEFZs to enter in the process of realizing high-quality development of the economy by using their own basic advantages (Ren et al., 2022), while the development of digital financial inclusion is an important tool to cover the counties to break down the traditional financial barriers under the influence of the policy, to expand the coverage of the financial services, to improve the efficiency of financial resource allocation, and to inject a new vitality into the green growth of the economy (Nwani, 2022). First, digital financial inclusion has a targeted nature, which can effectively solve the problem of bias and factor distortion in the process of resource input, guide the allocation of various types of financial resources to the development of green industries, and better promote the greening of industries, the greening of the economy, and the greening transformation of enterprises in key ecological functional zones of the country in the NKEFZs of the country (Jin and Han, 2018). Second, digital financial inclusion is technological in nature and can effectively increase the level of technological innovation, which is favorable in enhancing local green total factor productivity, thus indirectly contributing to the green growth of the economy (Deng et al., 2023). Third, digital financial inclusion is inclusive, emphasizing its focus on agriculture, enterprises, and rural zones, coupled with a series of investment and incentives adopted by the state in recent years for the green development of rural zones and the clean innovation of enterprises (Perkins, 1994): this kind of inclusive finance led by “policy finance” can effectively deal with the “financial exclusion” problem of traditional finance (Rahman et al., 2020) and continuously provide financial services for the prosperity of rural industries, green transformation of enterprises, and the common prosperity of farmers. This kind of “policy finance”-led inclusive finance can effectively address the problem of “financial exclusion” that occurs in traditional finance and continuously provide financial services for the prosperity of rural industries, the green transformation of enterprises, and the common prosperity of farmers. In view of this, digital financial inclusion covering the county area improves the reach of inclusive finance in enterprises, solves the outstanding problems of difficult and expensive financing in rural industries, and promotes the return of rural labor, capital, and technology to the countryside in farmers’ production and life and significantly contributes to empowering the revitalization of the rural ecology and the realization of green economic growth (Huguet Ferran et al., 2018; Lin et al., 2023; Bennani-Taylor and Meer, 2024).

In summary, although the relationship between digital financial inclusion and economic growth as well as the ecological environment has been explained and confirmed in the literature (Liu et al., 2021), there is still a lack of literature on the combined impacts of digital inclusion, and in particular, studies exploring the impact of digital inclusion on the green growth of the economy are not yet available. Considering that the main content of China’s NKEFZs policy is development restriction and ecological compensation, most industrial enterprises have been relocated due to policy impacts. Therefore, the agricultural industry is mainly targeted by digital financial inclusion in the policy-covered counties, the main service targets are enterprises, and the main purpose is in the upgrading of the industrial structure. In response to the reality, this paper, based on the panel data of 393 covered counties in the first batch of China’s NKEFZs from 2014 to 2022 (excluding some samples with a high number of outliers and missing values among the 436 counties covered in total of the policy), intends to explore the impact of digital financial inclusion on the economic green growth of the economy within the covered counties and its mechanism of action, as well as to analyze the role of digital financial inclusion in different geographic locations, and the role of heterogeneity between the economic green growth of ecological functional zones with different functional positions is analyzed. This research can deepen the comprehensive understanding of the mechanism of digital financial inclusion in economic green growth, and at the same time, it can also provide theoretical guidance and practical support for the local governments in the counties covered by the NKEFZs to better leverage digital financial inclusion and promote economic green growth in combination with their own basic advantages and local conditions.

3 Theoretical analyses and research hypotheses

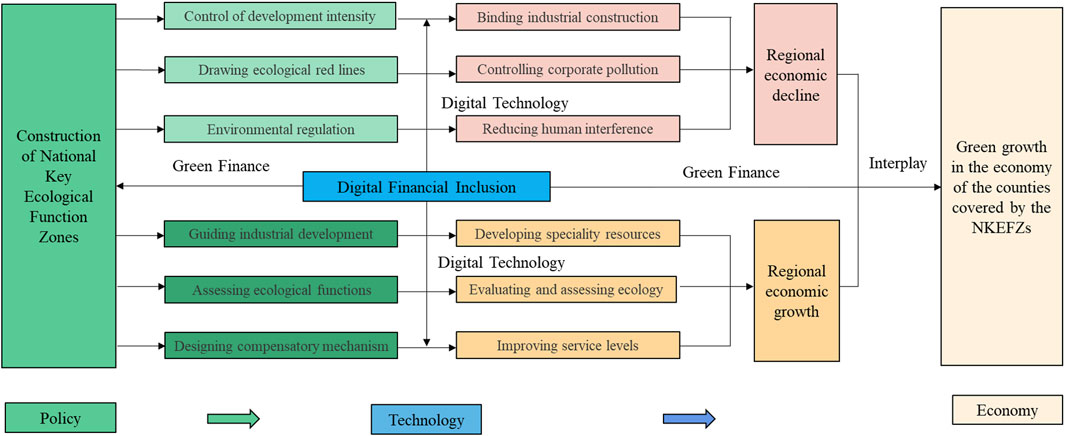

3.1 Theoretical analysis of economic green growth in counties within National Ecological Key Function Zones

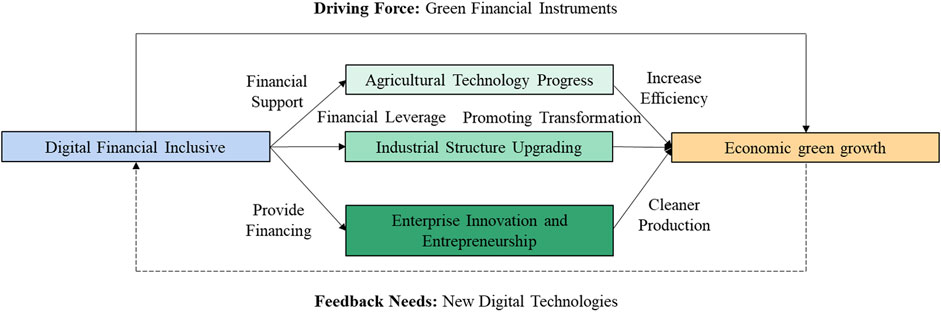

Combining the “policy-technology-economy” analytical framework (Liu et al., 2019; Ahmed, 2023), in the context of the NKEFZs, the technological development brought about by digital financial inclusion is more reflected in the improvement of agricultural mechanization, the innovation of green finance instruments, and the application of green inventions and patents in enterprises. Based on this, in terms of policy implementation, the NKEFZ policy mainly covers six aspects; all of them are effectively implemented with the services of digital financial inclusion. The control of development intensity refers to the strict control of all kinds of development activities in NKEFZs, thereby constraining industrial construction. However, digital financial inclusion can provide green financial support for existing industrial development zones, thus encouraging them to be gradually transformed into “low-consumption, recyclable, low-emission and zero-pollution” eco-friendly (c) industrial parks. Drawing the ecological red line refers to the formulation of the ecological red line control requirements and environmental and economic policies by means of digital financial inclusion tools to provide green loans and financial support for enterprises in the counties covered by the NKEFZs prone to ecological damage so as to prompt them to implement closure or relocation to non-ecologically sensitive zones as soon as possible. Eco-environmental control, on the other hand, requires a sound system of accountability for eco-environmental protection and an increase in economic penalties for man-made disturbances, which are mainly multiple developmental constraints on the covered counties, limiting their regional economic growth to a certain extent.

Correspondingly, industrial development guidance refers to the need to support the counties covered to combine their basic advantages with specialized resources and to encourage financial institutions to provide innovative green financial products and services for green, eco-friendly, and suitable industries (Fan et al., 2021). Ecological function assessment means that the construction of ecological civilization together with the quality of socio-economic development should be incorporated into the assessment system covering counties, and the ecological environment should be monetized and accounted for through the big data support of digital financial inclusion, and the results could provide the basis for the allocation of funds for ecological compensation transfers. The eco-compensation mechanism refers to the adoption of various forms of compensation, such as financial subsidies, targeted assistance, and counterpart support, for environmental protection and the improvement of public service levels in the covered counties, which is combined with the “universality” of digital financial inclusion to form a new model of green finance to jointly promote the common prosperity of the residents within the NKEFZs. These three components mainly support and subsidize the counties covered and promote their regional economic growth to a certain extent. The theoretical analysis framework of the green change of the economy of the covered counties in the NKEFZs is shown in Figure 2.

Figure 2. A theoretical analytical framework for economic green growth in counties covered by National Key Ecological Functional Zones.

Based on the above analysis, we propose the following research hypotheses:

Hypothesis 1. The development of digital financial inclusion can significantly promote the economic green growth of the counties covered by the NKEFZs.

Overall, the six components involved in the policy have an impact on the regional economy in different directions, as well as affecting the direction of change in the green growth of the county’s economy. Within the NKEFZs, the financial support provided by digital financial inclusion will be used for green technology innovation (Luo et al., 2021), green industry development, and the establishment of green enterprises. Specifically, digital financial inclusion may both guide the promotion of green industry consumption, provide financial support for local green development and enterprise green transformation to promote economic green growth (Lin and Pan, 2024), and may, due to its own uncertainty, also inhibit economic green growth, which leads to increased difficulty in regulating the financial market in the region, the emergence of financial mismatch problems, and its own quasi-public inhibition (Wang and Zhang, 2022). Therefore, the direction of the NKEFZ policy on the change of green growth of the county economy is still controversial in the academic community, but this paper argues that the development of green finance brought about by digital financial inclusion will inject a new impetus into the green growth of the county economy, alleviate the inhibitory effects of the policy of the NKEFZs on the green growth of the county economy, and improve the economic role of the policy so as to realize the green growth of the economy that covers the county area.

Based on the above analysis, we propose the following research hypothesis:

Hypothesis 2. The development of digital financial inclusion can significantly promote the economic green growth of the counties covered by the NKEFZs.

3.2 Analysis of the mechanism by which digital financial inclusion affects economic green growth

On the basis of financial inclusion, we introduce digital information technology to give play to the characteristics of high transparency and high efficiency of digital information, to better promote financial inclusion, reduce the cost and risk of financial services at the same time, and to promote financial services to low-income and small- and medium-sized micro-enterprises, in order to meet the needs of different geographic regions, different social strata, and different functional positioning of financial services (Xu et al., 2024). Against the backdrop of increasingly prominent environmental degradation and resource scarcity, especially within the NKEFZs, the development of digital financial inclusion is more reflected in the development of green finance, which has led to the emergence of a new type of green financial instruments with inclusive nature that can effectively serve the green growth of the county’s economy (Ma et al., 2019). In addition, in view of the NKEFZs of digital financial inclusion, with green industry focus support, high-priority green projects, and strict environmental risk management and other characteristics, it has become the core means to cover the county’s economic green growth drive, and economic green growth can also be obtained through the market signal to feedback the real demand for changes in the situation, for the indication of the digital financial inclusion to point to the direction of the next step in the development of digital financial inclusion.

First, digital financial inclusion provides easy access to finance for agricultural technology advancement. On one hand, compared with traditional inclusive finance, agricultural enterprises and farmers in the covered counties can obtain financial support for purchasing advanced agricultural equipment and investing in the research and development of new and high agricultural technologies more quickly based on (Xu et al., 2020). On the other hand, for the agricultural industry with long cycle and strong seasonality, the development of digital financial inclusion may require financial tools and means, combine big data and information technology to build a digital platform, integrate agricultural production data, help farmers carry out refined management, and guide farmers to adjust the planting structure and reduce the use of chemical fertilizers and pesticides so as to improve the production efficiency of agriculture and satisfy the requirements of the assessment of the NKEFZs, for achieving economic and ecological development.

Based on the above analysis, we propose the following research hypothesis:

Hypothesis 3. The development of digital financial inclusion can significantly promote the agriculture technological progress in the counties covered by the NKEFZs and thereby promote economic green growth.

Second, digital financial inclusion points to a low-carbon and environmentally friendly direction for industrial structural upgrading. On one hand, digital financial inclusion can effectively guide financial resources to lean more on the development of green industries such as clean, environmental protection and renewable energy, prompting industrial polluting enterprises in the covered counties to increase their investment in green technology research and development and application and gradually transform into low-carbon green enterprises. On the other hand, with the continuous development of digital financial inclusion, the risk of financial investment by enterprises in the covered counties has been reduced, and at the same time, the demand for capital needed for upgrading the industrial structure has been met, promoting the upgrading of the industrial structure in a more sustainable direction (Tian et al., 2024).

Based on the above analysis, we propose the following research hypothesis:

Hypothesis 4. The development of digital financial inclusion can significantly promote the industrial structure upgrading in the counties covered by the NKEFZs and thereby promote economic green growth.

Third, digital financial inclusion has created a digital platform for business innovation and entrepreneurship. On one hand, digital financial inclusion can directly provide financing support to start-up enterprises that meet environmental protection standards in the covered counties, especially for the research and development of environmental protection and eco-products, so as to promote the promotion and transformation of green innovative products. On the other hand, digital financial inclusion can break the channel obstruction and market barriers faced in the transformation process of eco-products, improve consumer acceptance of green products, and effectively promote the green growth of the county economy (Li et al., 2016).

Based on the above analysis, we propose the following research hypothesis:

Hypothesis 5. The development of digital financial inclusion can significantly promote enterprise innovation and entrepreneurship in the counties covered by the NKEFZs and thereby promote economic green growth.

The mechanism of how digital financial inclusion influences economic green growth is shown in Figure 3.

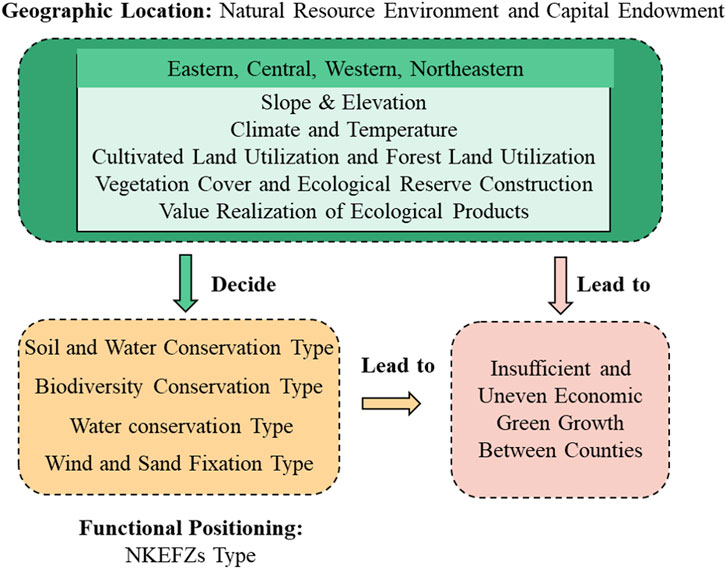

3.3 Heterogeneity analysis of county-level geographical location and functional position

In 1989, the British economist Pearce first put forward the concept of a “green economy,” arguing that regional economic growth must be accompanied by attention to the natural environment and the acceptability of human beings themselves. The “greening of the economy” is somewhat different from the “green economy,” but both share the same ultimate goal of synergizing economic growth with ecological protection (Huang, 2023). Most domestic definitions of “economic greenness” focus on the accounting of “green GDP” (Song et al., 2020). This paper defines economic greenness as the traditional GDP minus environmental protection costs and pollution control expenditures. In recent years, existing studies have argued against the reality of China’s overall low level of economic green growth, underdevelopment, and imbalance between regions, i.e., existing studies generally agree that there are significant regional differences in the level of economic green growth and that the efficiency of economic green growth in the east–central region is much higher than that in the western and northeastern regions. Then, does this phenomenon also exist within the NKEFZs?

Based on the above analysis, we propose the following research hypothesis:

Hypothesis 6. There is heterogeneity in the impact of digital financial inclusion development on the economic green growth of the counties covered by the NKEFZs across different regions.

The national main functional area plan is based on the ecological background of the NKEFZs, taking into full consideration the local ecological and human environment and combining the basic advantages and resource conditions to divide the covered counties into four types of ecological functional zones with different functional positions, namely, soil and water conservation, biodiversity preservation, water-source containment and windbreaks, and sand-fixing, so as to realize the dual goals of economic development and ecological protection in the region. (Zhang et al., 2021). Given the differences in the ecological background and functional positioning of the NKEFZs, the effectiveness of digital financial inclusion is essential in catalyzing green growth in the economy.

Based on the above analysis, we propose the following research hypothesis:

Hypothesis 7. There is heterogeneity in the impact of digital financial inclusion development on the economic green growth of the counties covered by the NKEFZs across different types of NKEFZs.

The theoretical analysis of the unbalanced economic green growth across different regions is shown in Figure 4.

4 Research design

4.1 Modeling design

The green growth of county economy belongs to the current period process, and its correlation with the green growth of economy in the previous period is not strong (Song et al., 2019). The two-way fixed-effects analysis is one of the commonly used strategies for identifying causal mechanisms and is based on two key assumptions: (1) the linearity assumption, which assumes that the intervention effect varies at a constant rate over the study period and (2) the no time-varying confounders assumption, which assumes that there are no time-varying unobserved factors associated with both the intervention outcome and the potential outcome that change over time. The model takes full account of area fixed effects and time fixed effects and can eliminate the potential impact of these factors on the results. Therefore, in order to empirically test the impact of digital financial inclusion on economic green growth, this paper sets up a two-way fixed-effects panel data model as follows:

In Equation 1,

4.2 Variable selection

4.2.1 Dependent variable

The explanatory variables in this paper are county green GDP; green GDP refers to a region in the calculation of gross domestic product considering the impact of economic development on the environment, mainly referring to the environmental costs, that is, taking into account the negative impacts of economic development on human beings and nature, in the accounting time to get a “net value.” Following the research of previous scholars (Li and Li, 2017), the specific calculation formula is given as follows:

In Equation 2,

Due to the limitation of data availability at the county level, this paper adopts the proportion of county-level wastewater, exhaust gas, and solid waste (three wastes) emissions to provincial-level three-waste emissions as the coefficient of the pollution factor and multiplies the pollution coefficient with provincial-level environmental protection expenditures and pollution control costs to approximate the county-level environmental protection expenditures and pollution control costs. Subsequently, based on Equation 2, the traditional GDP of counties is subtracted from the county-level environmental protection expenditures and pollution control costs to approximate the green GDP of the counties. After that, according to Equation 2, county traditional GDP is subtracted from county environmental protection expenditure and pollution control cost to approximate county green GDP.

4.2.2 Explanatory variable

The core explanatory variable of this paper is the level of development of digital financial inclusion development, which adopts the fourth phase of the China County Digital Financial Inclusion Index published by the Digital Finance Research Center of Peking University, which adopts the fourth issue of China’s county3. This set of indices includes three first-level dimensions, namely, the breadth of coverage, depth of use, and degree of digitization of digital financial inclusion, and at the same time is subdivided into 33 specific indicators, which comprehensively and objectively reflect the level of development of digital financial inclusion in each county in China.

4.2.3 Mediating variables

The mediating variables adopted in this paper are agricultural technological progress, industrial structure upgrading, and enterprise innovation and entrepreneurship. On agricultural technological progress, it is measured by the total power of agricultural machinery to reflect that digital financial inclusion provides funds for agricultural technological progress, which improves the degree of agricultural mechanization and agricultural production efficiency and then promotes the green growth of the county economy. For agricultural technology progress, it is measured by the total power of agricultural machinery, reflecting how digital financial inclusion provides funding for agricultural technology progress, improves the level of agricultural mechanization and production efficiency, and thus promotes the economic green growth of the counties. In terms of industrial structure upgrading, the degree of industrial advancement is used as a measure to reflect the fact that digital financial inclusion achieves green economic growth by promoting industrial structure upgrading, and the specific calculation formula is as follows:

In Equation 3,

4.2.4 Instrumental variables

The selection of instrumental variables needs to satisfy both correlation and exogenous properties. On one hand, the distance to the prefecture-level city (capital city) is chosen as an instrumental variable, which determines the transmission efficiency of digital financial inclusion and does not have a significant correlation with economic green growth, satisfying the exogenous condition. The topographic relief within the county is chosen as another instrumental variable, which also satisfies the correlation and exogeneity conditions, as topographic relief affects the installation and commissioning of digital infrastructure and is not significantly correlated with economic green growth.

4.2.5 Control variables

Referring to the existing research (Chen and Bian, 2023; Hou et al., 2021; Yin and Xu, 2022), the control variables in this paper are six indicators, which are as follows: general budget revenue of local finance, total population at the end of the year, total industrial output value above the large-scale industry, carbon emissions, average annual temperature, and average annual precipitation. The night lighting data (from the SNPP-VIIRS data4) are also selected to measure the degree of urbanization as an additional control variable.

4.3 Data sources

In view of the fact that the China Digital Financial Inclusion Index compiled by the Digital Finance Research Center of Peking University and Ant Financial Group has been counting data at the county level since 2014 at the earliest and after excluding samples with too many missing values and outliers5, this paper selects 393 counties under the coverage of the first batch of national key eco-functional zones from 2014 to 2022 as the samples and uses the data mainly for the digital financial inclusion development and economic development level of the counties. The data used are mainly related to the development of financial inclusion and the level of economic development of each county, and the raw data are mainly derived from the China County Economic Statistical Yearbook; China City Statistical Yearbook; provincial, municipal, and county statistical yearbooks; as well as the statistical bulletins of the counties. The raw data used are statistically collated from the National Bureau of Statistics of China6. Missing data are supplemented by the interpolation method. Additionally, to attenuate the effect of heteroskedasticity, all variables were logarithmized, except for the core explanatory variables, instrumental variables, structure, light, temperature, and precipitation, and all variables were reduced by 1% before and after to avoid the effect of extreme values.

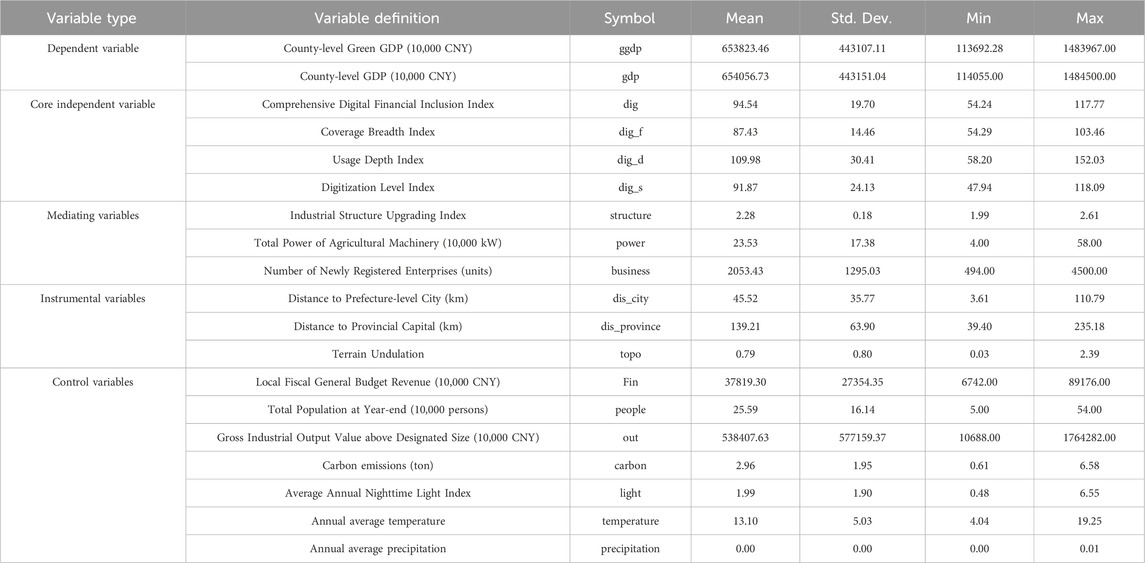

The descriptive statistics of the variables are shown in Table 1.

Table 1. Variable definitions and descriptive statistics of counties covered by National Key Ecological Function Zones.

5 Empirical results and analysis

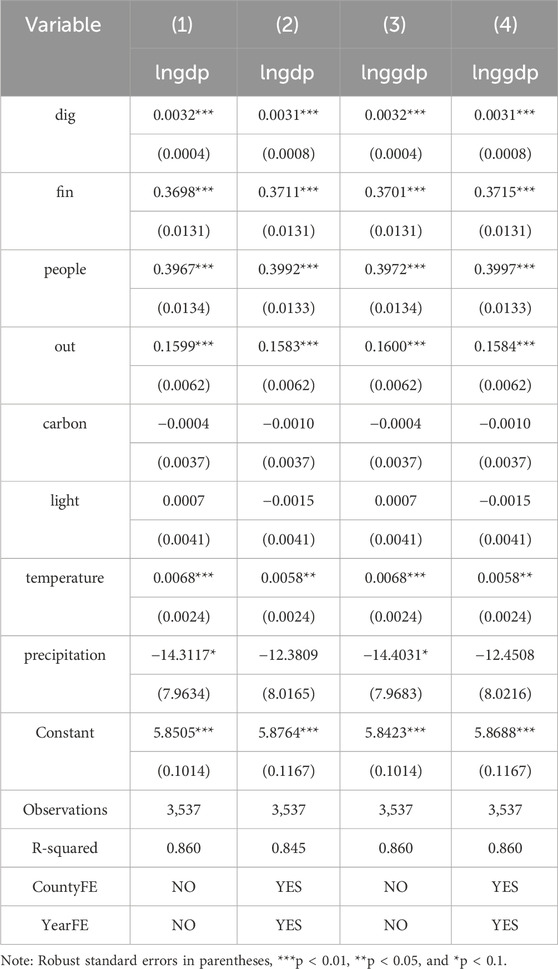

5.1 Baseline regression results and analysis

Prior to empirical evidence, we test for multicollinearity by means of variance inflation factors, and the largest VIF value of all variables is 3.96, and the mean VIF value is 2.48, indicating that there is no significant multicollinearity. The explanatory variables of models (1) and (2) in Table 2 are county economic growth levels (lngdp), where model (1) does not fix the county and year and model (2) demonstrates the results of regressing the economic growth levels of the counties covered by the NKEFZs (lngdp) through the bidirectional fixed-effects panel model, which illustrates that digital financial inclusion has a positive impact on the traditional economic growth at the 1 per cent level of significance, indicating that the higher the level of digital financial inclusion development, the more favorable it is to traditional economic growth, and this result is more robust. Models (3) and (4) show the results of regression using economic green growth (lnggdp) as an explanatory variable, using the two methods of unfixed counties and years and fixed counties and years, respectively, which indicate that digital financial inclusion has both a positive impact on the economic green growth of the NKEFZs at 1% significance level and also verifies the robustness of the model.

Table 2. Regression results of the impact of digital financial inclusion on county economic growth and economic green growth.

Based on the above, research hypotheses Hypothesis 1 and Hypothesis 2 are supported.

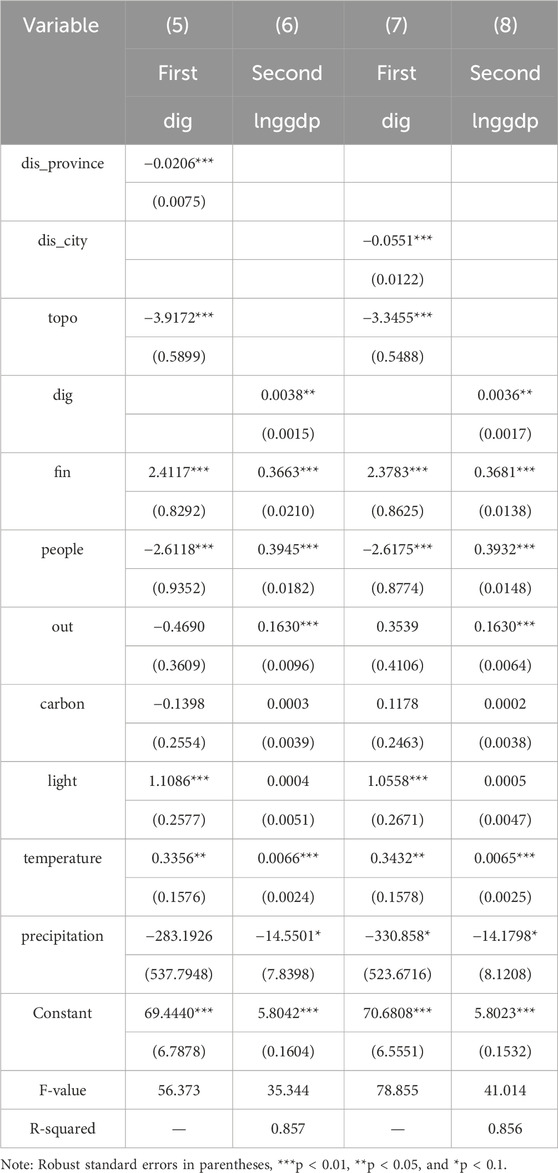

5.2 Treatment of the endogeneity of digital financial inclusion

This paper mainly adopts the instrumental variable method in mitigating the endogeneity problem caused by omitted variables, respectively, adopting two different combinations of instrumental variables representing geographic location, namely, the distance from the seat to the capital city of the province to which it belongs with the degree of geographic ups and downs and the distance from the seat to the prefectural city to which it belongs with the degree of geographic ups and downs and adopting the estimation method of the two-phase least squares of the panel data, with the explanatory variable being the level of green economic development of the counties.

Table 3 mainly shows the regression results of the impact of digital financial inclusion on the green growth of the county economy obtained based on the instrumental variable method, which according to model (5) and model (7) shows that the instrumental variables are significantly negatively correlated with the growth of digital financial inclusion, which is in line with the reality and expectations. Model (6) and model (8) show that digital financial inclusion has a positive impact on the green growth of county economy at 1% significance level. The results of the instrumental variable method study are consistent with the direction and significance level of the empirical results in the previous paper, which better mitigate the endogeneity.

Table 3. Regression results of the impact of digital financial inclusion on the green growth of county economies (instrumental variables approach).

5.3 Robustness checks

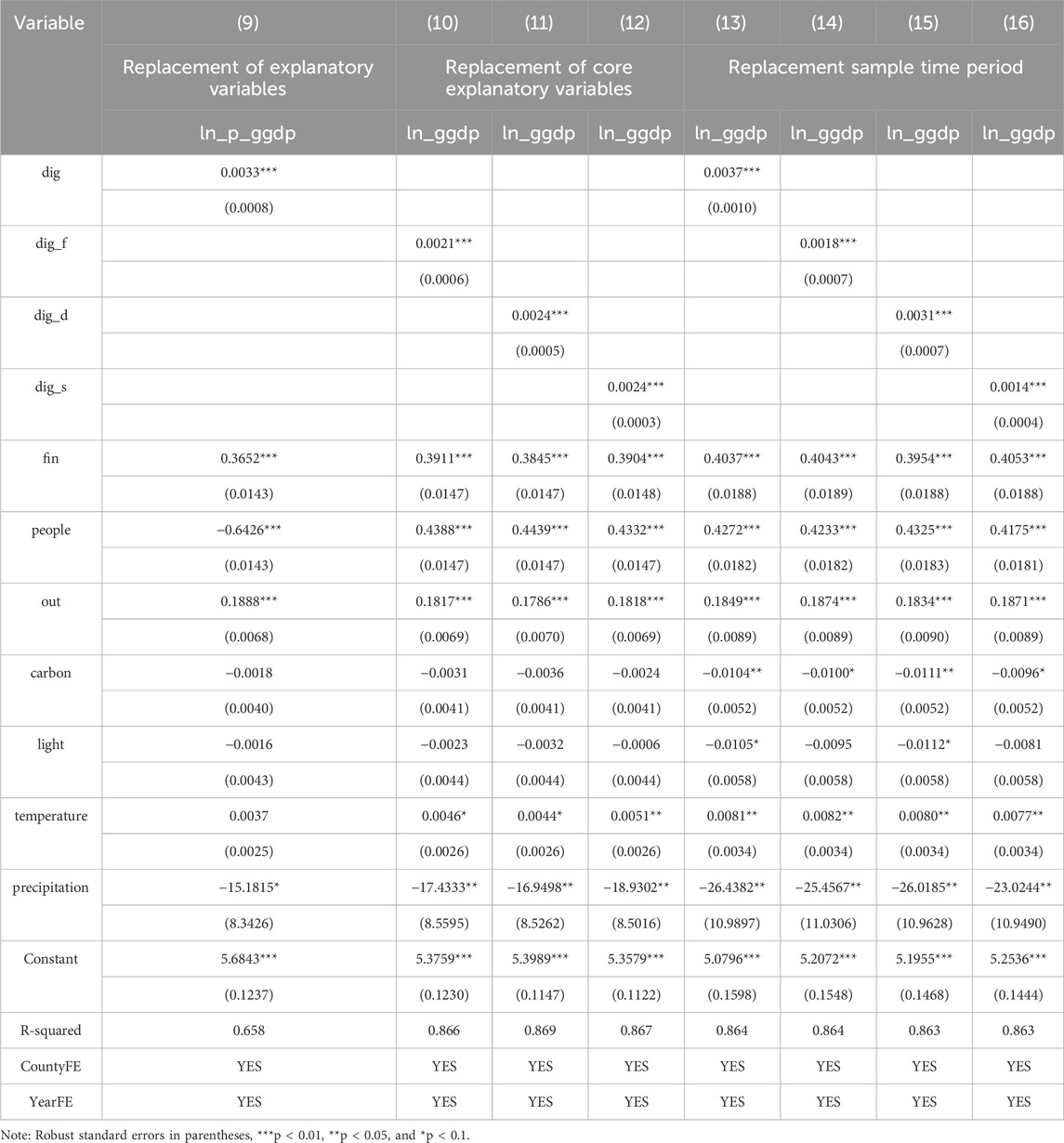

In order to verify the robustness of the empirical results and the scientific nature of the conclusions obtained, this paper first adopts the method of replacing the explanatory variables, the economic green growth (ggdp) compared with the total population at the end of the year, to get the per capita traditional economic growth per capita economic green growth after taking the logarithm of the (ln_p_ggdp) and then substituting it into the model as an explanatory variable to carry out the bidirectional fixed-effects panel model regression. The empirical results are shown in Table 4. Model (9) in Table 4 shows that after substituting the explanatory variables, digital financial inclusion still has a positive effect on the green growth of the county economy at the 1% significance level, that is, the model has good robustness.

Table 4. Robustness test results of the impact of digital financial inclusion on green growth of county economies.

Second, this paper comprehensively considers the different impacts of the three dimensions of digital financial inclusion on traditional economic growth and economic green growth and takes the index of breadth of coverage, the index of depth of use, and the index of digitization as the explanatory variables and uses the method of replacing the core explanatory variables to carry out the robustness test. The results are shown in Table 4. Model (10) in Table 4 shows the regression results with the index of breadth of coverage as the core explanatory variable, model (11) shows the regression results with the index of depth of use as the core explanatory variable, and model (12) shows the regression results with the index of digitization as the core explanatory variable, and the combined regression results of all the models show that, after replacing the core explanatory variables, digital financial inclusion facilitates economic green growth at the 1% level of significance.

Finally, in order to avoid being affected by the impact of the second batch of NKEFZs announced in September 2016 on the traditional and green economy of the first batch of covered counties, this paper adopts the method of shrinking the sample period to the first half of the year (2014–2017) to carry out the robustness test considering three dimensions of digital financial inclusion, and the results are shown in Table 4. Models (13)–(16) show the regression results of digital financial inclusion and its three different dimensions after narrowing the sample period, indicating that digital financial inclusion still has a significant positive contribution to the green growth of the county economy, as observed in the results of 2014–2016, confirming the robustness of the regression results.

5.4 Mechanisms for testing the impact of digital financial inclusion on economic green growth

Based on the previous theoretical analysis, digital financial inclusion can influence the green growth of the county economy through three pathways: agricultural technology progress, industrial structure upgrading, and enterprise innovation and entrepreneurship. Therefore, this paper refers to the two-step method (Jiang, 2022), by placing these three mediating variables as explanatory variables in the model for regression, although the core explanatory variable is still digital financial inclusion; meanwhile, in order to test the robustness of the model, this paper substitutes each of the three dimensions of digital financial inclusion with the total index of digital financial inclusion, aiming to provide empirical evidence.

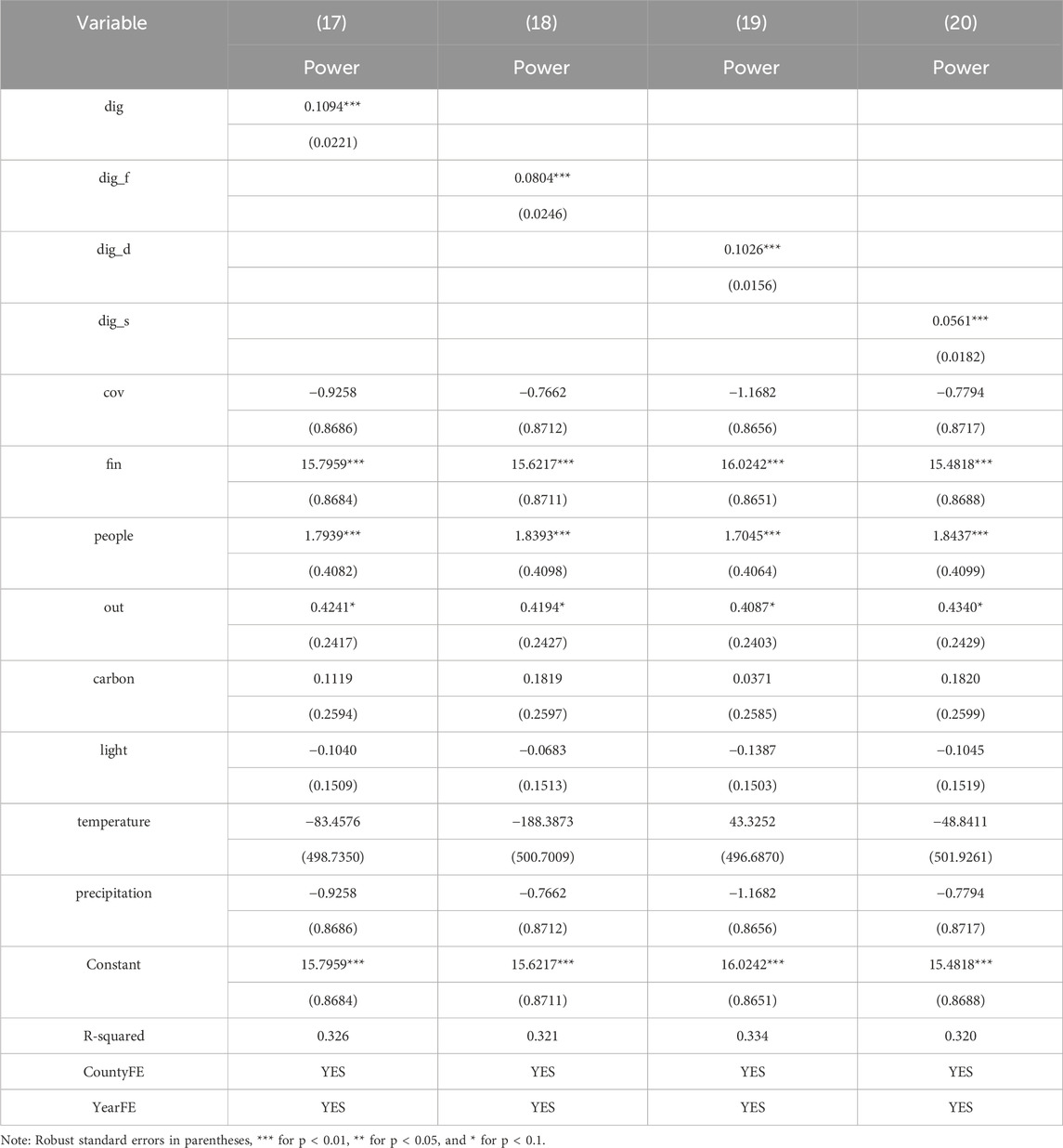

Table 5 shows the results of the mediation effect test of county agricultural technological progress and models (17)–(20) all show that digital financial inclusion and its three dimensions can significantly promote county agricultural technological progress at 1% significance level, with regression coefficients of 0.1094, 0.0804, 0.1026, and 0.0561, respectively. It shows that the development of digital financial inclusion can promote green growth of the county economy by improving the level of agricultural technology in the county, so there is a mediating effect of agricultural technology progress in the impact of digital financial inclusion on the green growth of the county economy.

Table 5. Mediating effects of the impact of digital financial inclusion on green growth in county economies (agricultural technology progress).

Based on the above, research hypothesis Hypothesis 3 is supported.

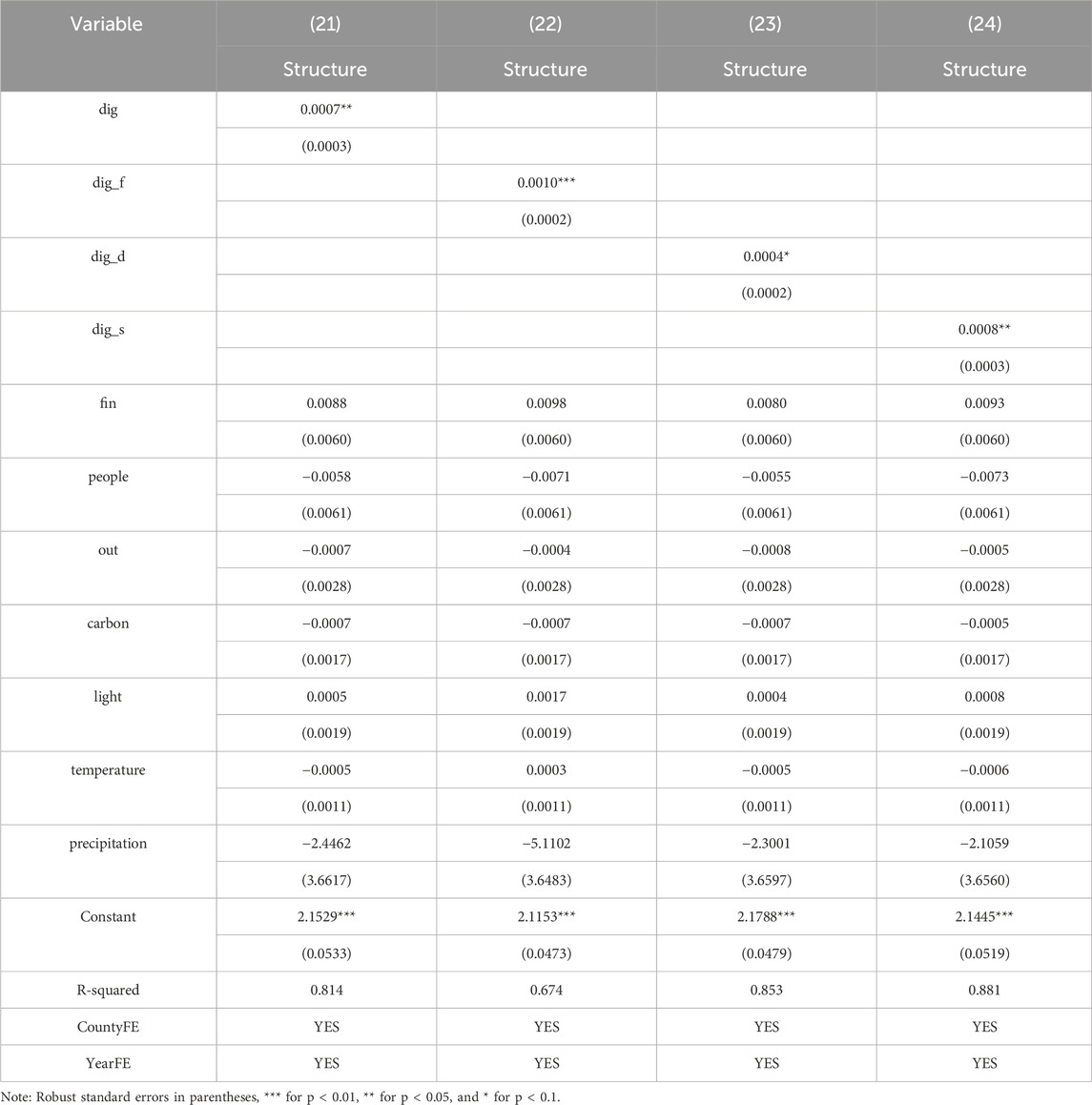

Table 6 shows the results of the mediation effect test of county industrial structure upgrading, and the models (21)–(24) show that digital financial inclusion and its three dimensions can significantly promote county industrial structure upgrading, with the regression coefficients of 0.0007, 0.0010, 0.0004, and 0.0008, respectively. It shows that the development of digital financial inclusion can promote the green growth of the county economy by promoting the upgrading of the county industrial structure, so there is a mediating effect of industrial structure upgrading in the impact of digital financial inclusion on the green growth of the county economy.

Table 6. Mediating effect of the impact of digital financial inclusion on the green growth of county economies (industrial structure upgrading).

Based on the above, research hypothesis Hypothesis 4 is supported.

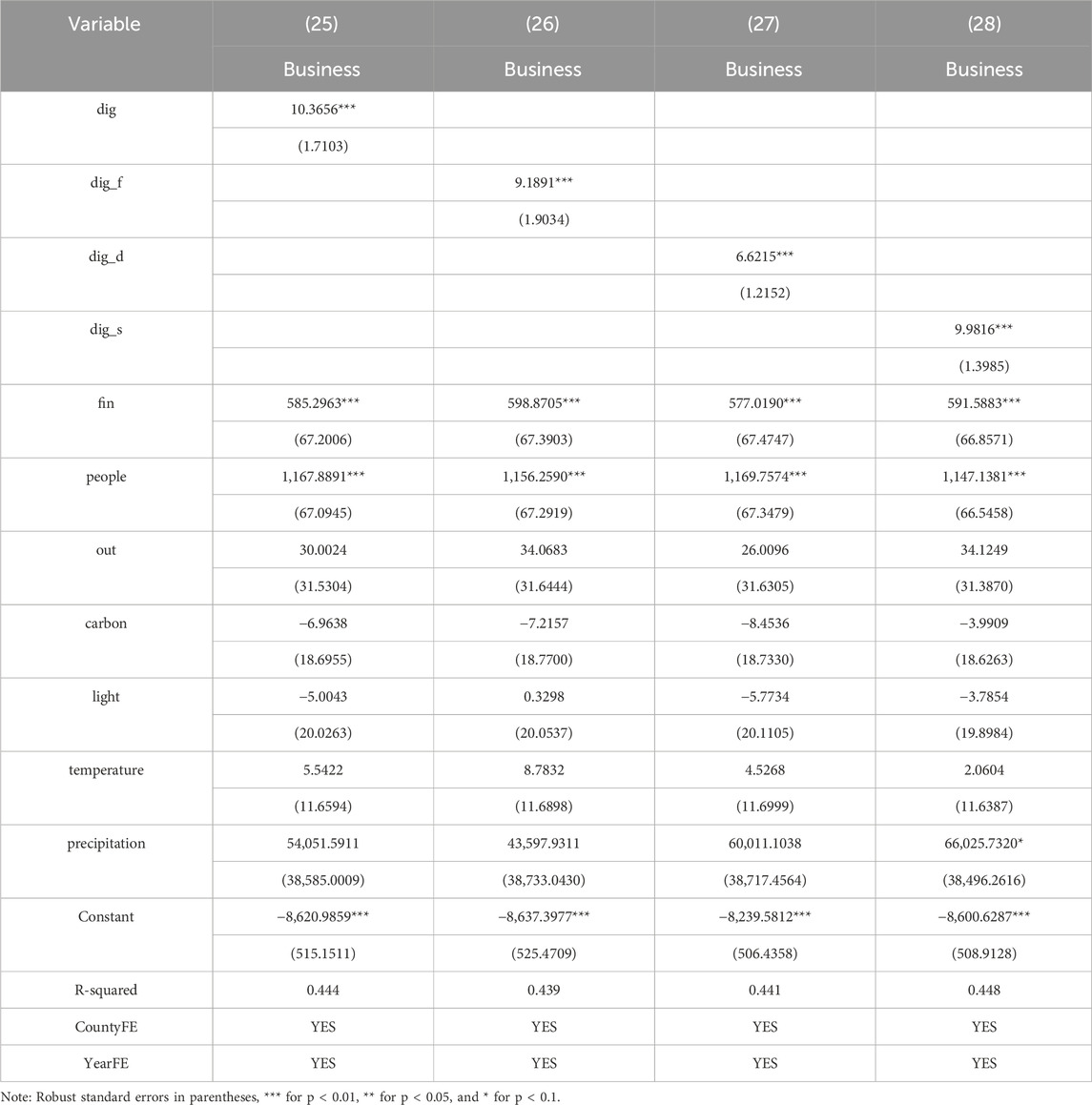

Table 7 shows the results of the mediation effect test of innovation and entrepreneurship of county enterprises, models (25)–(28) show that digital financial inclusion and its three dimensions can significantly promote innovation and entrepreneurship of county enterprises at 1% significance level, with regression coefficients of 10.3656, 9.1891, 6.6215, and 9.9816, respectively, can promote the green growth of the county economy by promoting the innovation and entrepreneurship of the county enterprises, so there is a mediating effect of the innovation and entrepreneurship of the enterprises in the impact of digital financial inclusion on the green growth of the county economy.

Table 7. Mediating effects of the impact of digital financial inclusion on green growth in county economies (enterprise innovation and entrepreneurship).

Based on the above, research hypothesis Hypothesis 5 is supported.

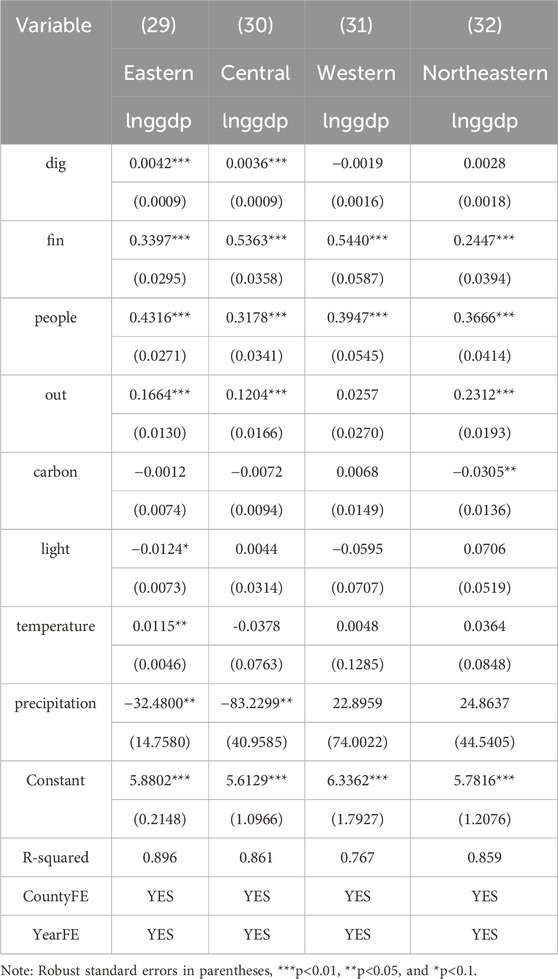

5.5 Heterogeneity analysis

Considering that the economic development foundation and resource endowment conditions of counties covered by NKEFZs can lead to differentiated impacts of digital financial inclusion on the green growth of county economies under the effect of different geographic location conditions , this paper refers to the studies by Feng et al. (2019) and divides the counties covered by China’s NKEFZs into four regions: east, the central, the west, and the north-east by the criterion of economic geography and conducts empirical tests in groups, regions, grouped for empirical tests. The results are shown in Table 8. As can be seen from Table 8, model (29) and model (30) are panel model regressions for the samples from the eastern and central regions, respectively, and the results indicate that digital financial inclusion has a positive impact on the green growth of the county’s economy in both the eastern and central regions of China’s policy-covered counties at 1 per cent significance level. Although model (31) and model (32) are panel model regressions for the samples in the western and northeastern regions, respectively, the results indicate that the role of digital financial inclusion on the green growth of county economies is not significant in the eastern and central regions of China. This indicates that the impact of digital financial inclusion on the green growth of the county economy receives heterogeneity of different geographic location conditions and in the eastern and central regions, the policy support is stronger, the infrastructure conditions are good, the technological innovation system is perfect, and the channels for enterprise entrepreneurship are smooth, so the effect of digital financial inclusion promotion on the green growth of the county economy is obvious. However, in the western and northeastern regions, due to the imperfections in the financial market infrastructure, it is unable to effectively support digital financial inclusion to promote the green growth of the county economy. At the same time, the results also fully illustrate that in some policy-covered counties in the western and north-eastern regions, there may be a large “digital divide” due to insufficient Internet coverage and low penetration of digital technology. The relatively homogeneous industrial structure, weak economic fundamentals, imperfect policy environment, and insufficient financial regulation in these policy-covered counties have hindered the effective operation of digital financial inclusion, which in turn has limited the role of digital financial inclusion in promoting the green growth of the county’s economy.

Table 8. Heterogeneity test of regional types for the impact of digital financial inclusion on economy green growth in counties.

Based on the above, research hypothesis Hypothesis 6 is supported.

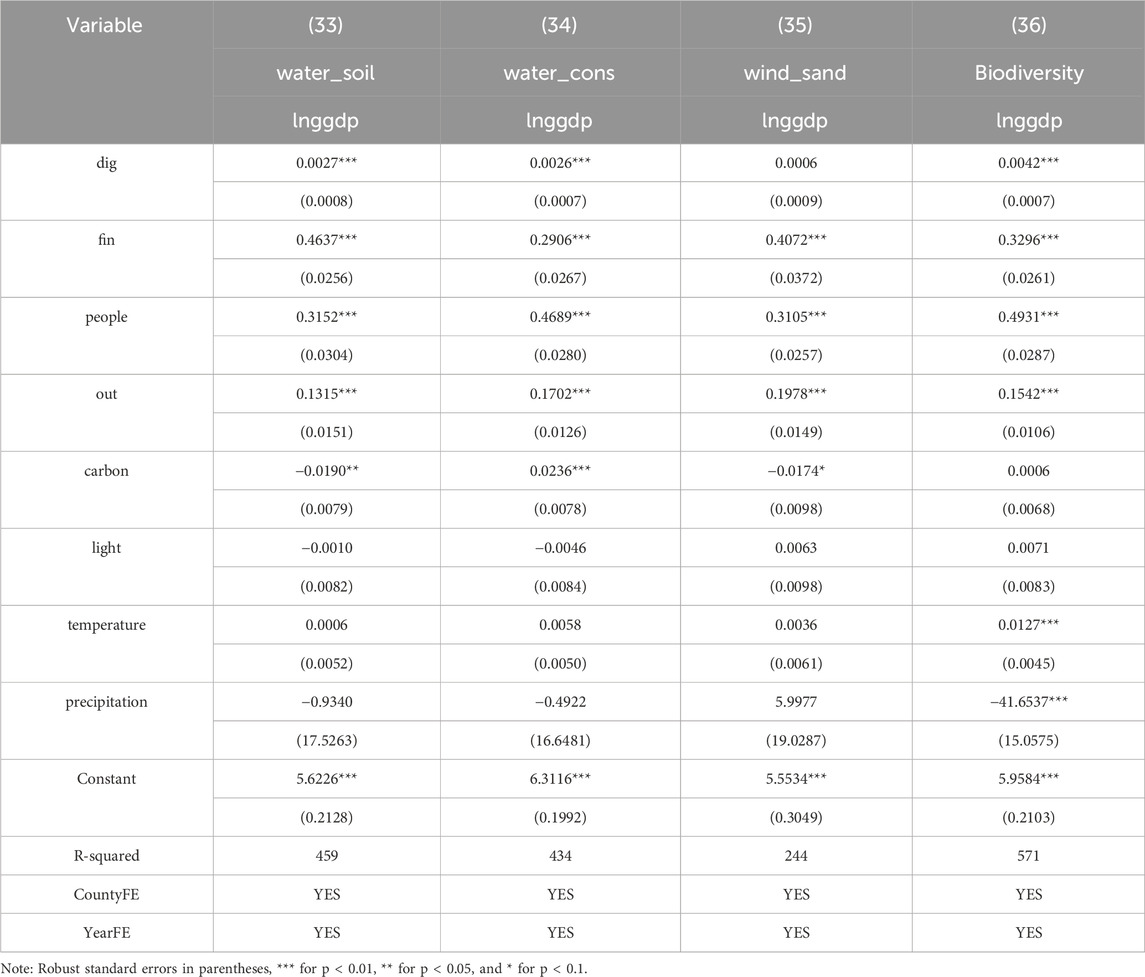

Considering that under the functional positioning of different ecological functional area types, the natural ecological background and goal-oriented positioning of the counties covered by NKEFZs will lead to the differential impact of digital financial inclusion on the green growth of the county economy, this paper refers to the study of Lin and Zhou (2022) and divides the counties covered by China’s NKEFZs. According to the policy document requirements, the counties covered by China’s NKEFZs are classified into the soil and water conservation type; according to the requirements of policy documents, windbreak and sand-fixing type and biodiversity maintenance type are types of ecological functional zones with different functional positioning, grouped for regression, and the results are shown in Table 9. Model (33), model (34), and model (36) in Table 9 show that digital financial inclusion has a positive effect on the green growth of the county’s economy at 1% significance level in counties covered by soil and water conservation, water conservation, and biodiversity maintenance policies. In model (35), digital financial inclusion is positively but not statistically significant on economic green growth in counties covered by wind and sand conservation-type ecological functional zones. One possible explanation for this is that the direction of investment in digital financial inclusion in the wind and sand defense ecological function zones is limited. Within this type of covered county, the rural economy is likely to be dominant and the industrial structure of rural zones relies mainly on agriculture that is highly related to wind and sand control, and the funds from digital financial inclusion are more often applied to the development of traditional industries, and most of the projects supported have stricter environmental standards and application thresholds due to policy impacts, which increases the investment costs of startups and limits the economy of the county in which they are located Green Growth.

Table 9. Heterogeneity test of NKEFZ types for the impact of digital financial inclusion on economic green growth of counties.

Based on the above, research hypothesis Hypothesis 7 is supported.

6 Conclusion and implications

6.1 Conclusion

Compared with non-policy-covered counties, digital financial inclusion is more effective in promoting the green growth of county economies in those covered by NKEFZs, achieving a win–win situation between the economy and the ecology. The main conclusions are as follows.

First, digital financial inclusion has a significant positive contribution to both traditional economic growth and economic green growth, which is consistent with the findings by Yang et al. (2023). Meanwhile, this conclusion still holds after endogeneity treatment using instrumental variables approach, robustness test by means of substitution of explanatory variables, and substitution of core explanatory variables with a reduced sample period.

Second, digital financial inclusion promotes economic green growth through three paths: agricultural technological progress, industrial structure upgrading, and enterprise innovation and entrepreneurship and all three paths pass the mediation effect test. This indicates that there is an intermediary effect of agricultural technology progress, industrial structure upgrading, and enterprise innovation and entrepreneurship in the promotion of green growth of the county’s economy by digital financial inclusion in the NKEFZs.

Third, within the NKEFZs, there is variability in geographic location and functional positioning in the promotion of digital financial inclusion for green growth in county economies. In the four regions, digital financial inclusion has a significant effect on green growth of county economies only in the eastern and central regions, while the effect is not significant in the western and northeastern regions. In terms of the types of ecological functional zones, digital financial inclusion has a significant effect on the green growth of county economies only in soil and water conservation, water conservation, and biodiversity zones, but not in wind and sand control zones.

6.2 Implications

In response to the findings of the study, in order to avoid the distorting effect of the NKEFZ policy in the process of implementation and a more universal extension to other similar ecological functional zones in the world to break the “resource curse” to achieve the economy green growth with the support of the digital inclusive financial infrastructure services, this paper puts forward the policy suggestions from the following aspects.

First, accelerating the development of digital financial inclusion. Since the establishment of China’s NKEFZs, digital financial inclusion has been relatively recent, and certain gaps remain in policy and market regulation. To facilitate green economic growth in these regions and similar areas in developing countries, it is crucial to integrate information technology with traditional finance. By leveraging the digital economy, financial resources can be allocated more efficiently to eco-friendly sectors, promoting innovation in green finance. This approach supports the green transformation of small- and medium-sized enterprises, easing financing barriers for zero-pollution startups. Additionally, expanding green credit coverage and establishing a diverse support system can help avoid market distortions and enhance the role of digital financial inclusion in sustainable economic growth.

Second, improving digital financial inclusion infrastructure in remote areas. Empirical evidence shows that digital financial inclusion’s impact on green economic growth in NKEFZs is uneven. In some remote, resource-rich regions, weak internet penetration and limited consumer capacity hinder its development. However, the current policy does not yet focus on these remote areas. Therefore, priority should be given to enhancing infrastructure in the western and northeastern regions of China and similar areas in other countries. Improving internet and telecommunications infrastructure and building data centers can increase the reach of digital financial services. This will accelerate information flow, reduce the “digital divide,” and improve the efficiency of digital financial inclusion in promoting green growth by channeling resources into clean, high-tech industries.

Third, adopting tailored digital financial inclusion strategies for different ecological zones. Given that digital financial inclusion develops unevenly across counties with different functional roles, a tailored approach is necessary. In soil and water conservation areas, for example, digital financial inclusion may not promote green economic growth effectively. Thus, strategies should be adapted to each region’s ecological context. In other zones, digital financial inclusion can enhance green technology transformation. In windbreak and sand-fixation zones, for example, it can provide low-interest loans and subsidies to encourage eco-friendly agricultural practices and the production of high-value-added crops, such as green foods or medicinal herbs. Moreover, eco-tourism, leveraging unique local resources, can further promote balanced green growth. Overall, digital financial inclusion should play a key role in global environmental protection and sustainable development, especially in ecologically sensitive regions.

6.3 Future prospects

Although this paper explores the impact of digital financial inclusion on economic green growth in a more comprehensive way using a two-way fixed-effects panel data model, there may still be the following directions that could be investigated in more depth: for one thing, due to the limitation of the data of China’s Digital Financial Inclusion Index compiled by Peking University, this paper only adopts the panel data of the 9 years from 2014 to 2022 for the study, and it lacks the capture of the effect of digital financial inclusion on the promotion of economic green growth in the NKEFZs prior to 2014, and a future study must be considered to analyze by textual analysis and to make a reasonable statistics and transformation into the county digital financial inclusion index from the county annual report of the related word frequencies and reasonable statistics and transformed into county digital financial inclusion index, in order to fill in the changes in the specific effects of digital financial inclusion on the green growth of the economy in the covered counties before and after the implementation of the policy in 2010. Second, due to the data limitation of the county statistical yearbook, this paper adopts the method of discounting the provincial environmental protection expenditure and pollution control cost to obtain the relevant data of the county when defining and dealing with the explanatory variables of green GDP, which may have errors to a certain extent and can be tested by calculating green GDP by means of ecological service value accounting in the subsequent research. Third, we have only used evidence from China for our tests, hoping to shed some light on developing countries in general, but comparative analyses of their countries in quantitative terms remain a topic worthy of additional research in the future.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

LM: resources, writing–original draft, and writing–review and editing. SC: formal analysis, resources, writing–original draft, and writing–review and editing. SW: methodology, software, writing–original draft, and writing–review and editing. CL: conceptualization, methodology, validation, and writing–review and editing. YM: conceptualization, methodology, validation, and writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was funded by the Chinese Academy of Engineering Strategic Research and Consultancy Project (2023-PP-03), Yunnan Agricultural University Student Science and Technology Innovation and Entrepreneurship Action Fund (2024N1566), Scientific Research Fund Project of Yunnan Provincial Education Department (2025Y0515) and 2024 Student Scientific Research and Training Program of School of Agriculture and Rural Development in Renmin University of China fund supporting project (2024A01).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1For details, please see: https://www.gov.cn/gzdt/2011-07/28/content_1915488.htm

2https://www.gov.cn/zwgk/2011-06/08/content_1879180.htm

3For details, please see: https://idf.pku.edu.cn/docs/20210421101507614920.pdf

4For details, please see: https://oceandata.sci.gsfc.nasa.gov/

5For details, please see: https://en.idf.pku.edu.cn/achievements/seriesofdigitafinanceindexes/490847.htm

6For details, please see: https://www.stats.gov.cn/

References

Ahmad, M., Jabeen, G., and Wu, Y. (2021). Heterogeneity of pollution haven/halo hypothesis and environmental kuznets curve hypothesis across development levels of Chinese provinces. J. Clean. Prod. 285, 124898. doi:10.1016/j.jclepro.2020.124898

Ahmed, K. (2023). Perspective on China’s commitment to carbon neutrality under the innovation-energy-emissions nexus. J. Clean. Prod. 390, 136202. doi:10.1016/j.jclepro.2023.136202

Ali, K., Jianguo, D., Kirikkaleli, D., Mentel, G., and Altuntaş, M. (2023). Testing the role of digital financial inclusion in energy transition and diversification towards COP26 targets and sustainable development goals. Gondwana Res. 121, 293–306. doi:10.1016/j.gr.2023.05.006

Bennani-Taylor, S., and Meer, N. (2024). Processing payments, enacting alterity: financial technology in the everyday lives of asylum seekers. J. Ethn. Migr. Stud. 50, 2384–2402. doi:10.1080/1369183X.2024.2312249

Bin Abu Sofian, A. D. A., Lim, H. R., Siti Halimatul Munawaroh, H., Ma, Z., Chew, K. W., and Show, P. L. (2024). Machine learning and the renewable energy revolution: exploring solar and wind energy solutions for a sustainable future including innovations in energy storage. Sustain. Dev. 32, 3953–3978. doi:10.1002/sd.2885

Chen, C., Li, W., Zheng, L., and Guan, C. (2024). Exploring the impacts of spatial regulation on environmentally sustainable development: a new perspective of quasi–experimental evaluation based on the national key ecological function zones in China. Sustain. Dev. 32, 404–424. doi:10.1002/sd.2667

Chen, C., and Pan, J. (2019). The effect of the health poverty alleviation project on financial risk protection for rural residents: evidence from chishui city, China. Int. J. Equity Health 18, 79. doi:10.1186/s12939-019-0982-6

Chen, K., and Bian, R. (2023). Green financing and renewable resources for China’s sustainable growth: assessing macroeconomic industry impact. Resour. Policy 85, 103927. doi:10.1016/j.resourpol.2023.103927

Deng, H., Zheng, W., Shen, Z., and Štreimikienė, D. (2023). Does fiscal expenditure promote green agricultural productivity gains: an investigation on corn production. Appl. Energy 334, 120666. doi:10.1016/j.apenergy.2023.120666

Fan, W., Wang, S., Gu, X., Zhou, Z., Zhao, Y., and Huo, W. (2021). Evolutionary game analysis on industrial pollution control of local government in China. J. Environ. Manag. 298, 113499. doi:10.1016/j.jenvman.2021.113499

Feng, W., Liu, Y., and Qu, L. (2019). Effect of land-centered urbanization on rural development: a regional analysis in China. Land Use Policy 87, 104072. doi:10.1016/j.landusepol.2019.104072

Ghosh, S., Das Chatterjee, N., and Dinda, S. (2021). Urban ecological security assessment and forecasting using integrated DEMATEL-ANP and CA-markov models: a case study on Kolkata metropolitan area, India. Sustain. Cities Soc. 68, 102773. doi:10.1016/j.scs.2021.102773

Hou, S., Song, L., Wang, J., and Ali, S. (2021). How land finance affects green economic growth in Chinese cities. Land 10, 819. doi:10.3390/land10080819

Hu, F., Zhang, S., Gao, J., Tang, Z., Chen, X., Qiu, L., et al. (2024). Digitalization empowerment for green economic growth: the impact of green complexity. Environ. Eng. Manag. J. 23, 519–536. doi:10.30638/eemj.2024.040

Hu, X., Ma, C., Huang, P., and Guo, X. (2021). Ecological vulnerability assessment based on AHP-PSR method and analysis of its single parameter sensitivity and spatial autocorrelation for ecological protection – a case of weifang city, China. Ecol. Indic. 125, 107464. doi:10.1016/j.ecolind.2021.107464

Huang, F. (2023). How does trade and fiscal decentralization leads to green growth; role of renewable energy development. Renew. Energy 214, 334–341. doi:10.1016/j.renene.2023.05.116

Huguet Ferran, P., Heijungs, R., and Vogtländer, J. G. (2018). Critical analysis of methods for integrating economic and environmental indicators. Ecol. Econ. 146, 549–559. doi:10.1016/j.ecolecon.2017.11.030

Jiang, T. (2022). Mediation and moderation effects in causal inference empirical research. China Ind. Econ. 05, 100–120. (in Chinese). doi:10.19581/j.cnki.ciejournal.2022.05.005

Jin, J., and Han, L. (2018). Assessment of Chinese green funds: performance and industry allocation. J. Clean. Prod. 171, 1084–1093. doi:10.1016/j.jclepro.2017.09.211

Koseoglu, A., Yucel, A. G., and Ulucak, R. (2022). Green innovation and ecological footprint relationship for a sustainable development: evidence from top 20 green innovator countries. Sustain. Dev. 30, 976–988. doi:10.1002/sd.2294

Li, C., and Li, X. (2017). Empirical analysis of the development of green GDP in China. Stat. Decis. 22, 143–146. (in Chinese). doi:10.13546/j.cnki.tjyjc.2017.22.033

Li, Y., Lu, Y., Zhang, X., Liu, L., Wang, M., and Jiang, X. (2016). Propensity of green consumption behaviors in representative cities in China. J. Clean. Prod. 133, 1328–1336. doi:10.1016/j.jclepro.2016.06.012

Lin, B., and Pan, T. (2024). The impact of green credit on green transformation of heavily polluting enterprises: reverse forcing or forward pushing? Energy Policy 184, 113901. doi:10.1016/j.enpol.2023.113901

Lin, B., and Zhou, Y. (2022). Measuring the green economic growth in China: influencing factors and policy perspectives. Energy 241, 122518. doi:10.1016/j.energy.2021.122518

Lin, S., Long, X., Huang, J., and Gao, R. (2023). Green technology diversification, technology vertical spillovers, and energy intensity in Chinese cities. Energy Sustain. Dev. 76, 101281. doi:10.1016/j.esd.2023.101281

Liu, C., Wang, S., Liu, H., and Zhu, W. (2019). Reprint of: why did the 1980s’ reform of collective forestland tenure in southern China fail? For. Policy Econ. 98, 8–18. doi:10.1016/j.forpol.2017.12.009

Liu, H., Liu, Z., Zhang, C., and Li, T. (2023). Transformational insurance and green credit incentive policies as financial mechanisms for green energy transitions and low-carbon economic development. Energy Econ. 126, 107016. doi:10.1016/j.eneco.2023.107016

Liu, Y., Luan, L., Wu, W., Zhang, Z., and Hsu, Y. (2021). Can digital financial inclusion promote China’s economic growth? Int. Rev. Financial Analysis 78, 101889. doi:10.1016/j.irfa.2021.101889

Luo, Y., Salman, M., and Lu, Z. (2021). Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci. Total Environ. 759, 143744. doi:10.1016/j.scitotenv.2020.143744

Ma, L., Long, H., Chen, K., Tu, S., Zhang, Y., and Liao, L. (2019). Green growth efficiency of Chinese cities and its spatio-temporal pattern. Resour. Conservation Recycl. 146, 441–451. doi:10.1016/j.resconrec.2019.03.049

Mardani, A., Zavadskas, E. K., Khalifah, Z., Zakuan, N., Jusoh, A., Nor, K. M., et al. (2017). A review of multi-criteria decision-making applications to solve energy management problems: two decades from 1995 to 2015. Renew. Sustain. Energy Rev. 71, 216–256. doi:10.1016/j.rser.2016.12.053

Nwani, C. (2022). Financing low-carbon growth in africa: policy path for strengthening the links between financial intermediation, resource allocation and environmental sustainability. Clean. Environ. Syst. 6, 100082. doi:10.1016/j.cesys.2022.100082

Perkins, D. (1994). Completing China’s move to the market. J. Econ. Perspect. 8, 23–46. doi:10.1257/jep.8.2.23

Rahman, M., Aziz, S., and Hughes, M. (2020). The product-market performance benefits of environmental policy: why customer awareness and firm innovativeness matter. Bus. Strat. Env. 29, 2001–2018. doi:10.1002/bse.2484

Ren, S., Li, L., Han, Y., Hao, Y., and Wu, H. (2022). The emerging driving force of inclusive green growth: does digital economy agglomeration work? Bus. Strat. Env. 31, 1656–1678. doi:10.1002/bse.2975

Song, M., Zhu, S., Wang, J., and Zhao, J. (2020). Share green growth: regional evaluation of green output performance in China. Int. J. Prod. Econ. 219, 152–163. doi:10.1016/j.ijpe.2019.05.012

Song, X., Zhou, Y., and Jia, W. (2019). How do economic openness and R&D investment affect green economic growth? evidence from China. Resour. Conservation Recycl. 146, 405–415. doi:10.1016/j.resconrec.2019.03.050

Tian, H., Qin, J., Cheng, C., Javeed, S. A., and Chu, T. (2024). Towards low-carbon sustainable development under industry 4.0: the influence of industrial intelligence on China’s carbon mitigation. Sustain. Dev. 32, 455–480. doi:10.1002/sd.2664

Wang, J., and Zhang, X. (2022). Land-based urbanization in China: mismatched land development in the post-financial crisis era. Habitat Int. 125, 102598. doi:10.1016/j.habitatint.2022.102598

Wang, Z., Liang, L., Sun, Z., and Wang, X. (2019). Spatiotemporal differentiation and the factors influencing urbanization and ecological environment synergistic effects within the beijing-tianjin-hebei urban agglomeration. J. Environ. Manag. 243, 227–239. doi:10.1016/j.jenvman.2019.04.088

Xu, K., Wang, H., Wang, Z., and Mei, K. (2024). Distribution justice and regional equity of urban public transport services: evidence from China. Transp. Res. Part D Transp. Environ. 126, 104033. doi:10.1016/j.trd.2023.104033

Xu, X. L., Chen, H. H., and Zhang, R. R. (2020). The impact of intellectual capital efficiency on corporate sustainable growth-evidence from smart agriculture in China. Agriculture 10, 199. doi:10.3390/agriculture10060199

Yang, A., Yang, M., Zhang, F., Kassim, A. A. M., and Wang, P. (2024). Has digital financial inclusion curbed carbon emissions intensity? Considering technological innovation and green consumption in China. J. Knowl. Econ. doi:10.1007/s13132-024-01902-3

Yang, Z., Li, Q., and Xue, W. (2023). Impact of the establishment of national key ecological functional areas on the rural residents’ income: empirical analysis based on PSM-DID. Resour. Sci. 45, 144–157. (in Chinese). doi:10.18402/resci.2023.01.11

Yin, X., and Xu, Z. (2022). An empirical analysis of the coupling and coordinative development of China’s green finance and economic growth. Resour. Policy 75, 102476. doi:10.1016/j.resourpol.2021.102476

Zeng, P., Wu, S., Sun, Z., Zhu, Y., Chen, Y., Qiao, Z., et al. (2021). Does rural production–living–ecological spaces have a preference for regional endowments? A case of beijing-tianjin-hebei, China. Land 10, 1265. doi:10.3390/land10111265

Zhang, T., Hou, M., Chu, L., and Wang, L. (2022). Can the establishment of national key ecological function areas enhance vegetation carbon sink? A quasi-natural experiment evidence from China. IJERPH 19, 12215. doi:10.3390/ijerph191912215

Zhang, Z., Zhang, Y., Yu, X., Lei, L., Chen, Y., and Guo, X. (2021). Evaluating natural ecological land change in function-oriented planning regions using the national land use survey data from 2009 to 2018 in China. IJGI 10, 172. doi:10.3390/ijgi10030172

Zhao, S., Cao, Y., Feng, C., Guo, K., and Zhang, J. (2022). How do heterogeneous R&D investments affect China’s green productivity: revisiting the porter hypothesis. Sci. Total Environ. 825, 154090. doi:10.1016/j.scitotenv.2022.154090

Zhao, S., Guan, Y., Zhou, H., and Hu, F. (2024). Making digital technology innovation happen: the role of the CEO’s information technology backgrounds. Econ. Model. 140, 106866. doi:10.1016/j.econmod.2024.106866

Keywords: National Key Ecological Function Zones, digital financial inclusion, economic green growth, sustainable development, policy assessment

Citation: Mo L, Chen S, Wan S, Liang C and Ma Y (2025) Digital financial inclusion and economic green growth: evidence from counties covered by China’s national key ecological functional zones. Front. Environ. Sci. 13:1467542. doi: 10.3389/fenvs.2025.1467542

Received: 22 July 2024; Accepted: 15 January 2025;

Published: 10 February 2025.

Edited by:

Xiaolei Sun, Chinese Academy of Sciences (CAS), ChinaReviewed by:

Mohamed R. Abonazel, Cairo University, EgyptOlinga Taeed, Centre for Citizenship, Enterprise and Governance, United Kingdom

Copyright © 2025 Mo, Chen, Wan, Liang and Ma. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shenwei Wan, wanshenwei@ruc.edu.cn

Li Mo1

Li Mo1