- School of Business, Chengdu University, Chengdu, China

Facing increasingly pressing environmental issues, driving green transformation through innovation has become a necessary path for the future development of companies. Empirical analysis based on the sample of listed companies in the transportation sector in China from 2011 to 2021 reveals that digital transformation in transportation companies can promote green innovation. Furthermore, the impact of digital transformation on green innovation is sustained, with the lagged effect of digital transformation having a greater influence on green innovation than the current effect. The study also discovers the presence of a mediating effect of financing constraints between digital transformation and green innovation. Further research, using the promulgation of the Digital Transportation Development Plan Outline in 2017 as a quasi-natural experiment, employs the difference-in-differences method to verify the impact of the policy on green innovation in transportation companies before and after its implementation. The results demonstrate the introduction of digital policies contributes to promoting green innovation in companies. Economic consequences research suggests that green innovation can effectively reduce carbon emissions intensity. With the goal of the “carbon peaking and carbon neutrality” strategy, actively promoting the integration of digitalization and green innovation is crucial for enhancing the sustainable development of transportation companies.

1 Introduction

China’s economy is experiencing rapid development, yet our environmental conditions are facing serious challenges. Creating a sustainable development environment is a significant test we face in the future. With the advent of a new wave of technological revolution and industrial transformation, green innovation technology has become the motivation companies to transform their economic development methods and achieve sustainability.

Building a country with a strong transportation network is a pioneer field in building a modernized economic system. As a key foundational sector for economic and social prosperity and stability, the transportation industry plays a vital role in China’s economic development. However, with population growth and the process of industrialization, the transportation sector has become one of the four major carbon-emitting industries in our country, exerting significant pressure on carbon emissions (Uhere et al., 2010). China has explicitly proposed the goal of “carbon peaking” by 2030 and “carbon neutrality” by 2060, and it is the long-term responsibility of companies to achieve the “dual carbon” goals. At present, carbon emissions from transportation remain on a growing trend, technological level and energy structure of transportation development have not been fundamentally transformed, so the situation of carbon emission reduction in the transportation field is grim. “Green and low-carbon transportation actions” has been listed as a separate chapter in the Notice on the Action Plan for Peaking Carbon Emissions Before 2030 that issued by the State Council. The Green Transportation Development Plan for the 14th Five-Year Period issued by the Ministry of Transport clearly mentioned that continuously promoting green science and technology innovation, accelerating technological research and development and its application promotion, and forming a new pattern of green transportation development. It can be seen that the green transformation of transportation companies is the key to future development.

With the development momentum of global digitalization, digital economy has grown rapidly in recent years, the average score of Digital Economy Development Index (TIMG) increased by 26% from 45.33 in 2013 to 57.01 in 2021. It is increasingly evident that major countries catch-up with each other in digital economy, the median of global TIMG Index has begun to exceed the global average level and shows an accelerating upward trend. In particular, score of China’s Digital Economy Development Index (TIMG) increased by 28% from 63.43 in 2013 to 81.42 in 2021, the digital economy is gradually becoming an important driving force of China’s high-quality economic and social development. The rapid development of the digital economy has become crucial for enhancing the core competitiveness of businesses. With the successive release of documents such as the China Digital Economy Development White Paper, the Notice on Accelerating the Digital Transformation of State-Owned companies, and the 14th Five-Year Plan for Digital Transportation, it has become an inevitable trend for the transportation industry to transform its operations through digitalization, aiming to improve efficiency, reduce costs, enhance customer experiences, and innovate business models. Simultaneously, the deep integration of digital technology and transportation companies facilitates the achievement of comprehensive, environmentally-friendly, and low-carbon transportation development. Therefore, clarifying the impact of digital transformation on green innovation in transportation companies can provide theoretical guidance for their sustainable development.

The advent of digital technology has brought about changes in the overall business environment. Existing literatures analyze the antecedents, outcomes, and other aspects of digital transformation (Henfridsson et al., 2014), where the outcomes of digital transformation contain new company products, company performances, company innovations and many other dimensions. By discussing companies improve the operational quality and efficiency of companies through digitalization, scholars opined that digital transformation can bring companies with new products, services, and skills, and then summarized that the digitalization of companies boosting the competitiveness of companies, improving the innovation of companies, etc. (Mergel et al., 2019). Scholars have also explored the impact of different digital technologies such as big data (Ghasemaghaei and Calic, 2020) and the Internet (Glavas and Mathews, 2014) on companies’ technological innovation, the outcomes of the studies find that digital technologies can promote innovation level of companies. With the enhancement of company digital transformation and severe environmental issues, the impact of digital transformation on companies’ green innovation has gradually become a hot topic of academic attention.

Scholars have discussed the impact of digital technology on green transformation in companies and have identified new opportunities that arise from its emergence (Ahmad et al., 2022; Zhu et al., 2023). Studies conducted by Mubarak et al. (2021) and Luo et al. (2022) all acknowledge that digital technology can propel green transformation in companies, but the mechanisms through which this impact is achieved differ. The former suggests that digital technology enhances information dissemination and knowledge accumulation, thereby promoting green innovation activities within companies. On the other hand, the latter argues that the openness, inclusivity, and mobility inherent in digital technology can effectively address the cost and technological challenges faced during green transformation. However, some scholars also highlight the heterogeneity in the role of digitization in driving green transformation across industries and regions (Li and Shen, 2021; Gao et al., 2023). Peng et al. (2022) stated that the impact of digitalization on company green transformation shows “inhibitory effect” first, then “facilitate”. Thus, a consensus has yet to be reached regarding the magnitude and mechanisms through which digital transformation influences green innovation in companies. Consequently, what is the relationship between the digital transformation of transportation companies and green innovation? How does digital transformation drive green innovation in these companies?

The present study focuses on the sustainable development of transportation companies, specifically examining the green innovation pathways driven by digital transformation in the transportation industry. Recognizing that funding is vital to the survival of companies, transportation companies face significant pressure in securing diverse sources of capital. Attracting social capital investment has been a persistent challenge for these entities. In light of these considerations, this study explores the following aspects in conjunction with the unique characteristics of transportation companies: firstly, it analyzes the static and dynamic impacts of digital transformation on green innovation in transportation companies; secondly, it investigates how digital transformation can drive green transformation from perspective of financial constraint; thirdly, it reveals the influence of digital policies on green innovation in companies and the economic consequences resulting from green innovation in transportation companies. This research provides a theoretical foundation for the green transformation of transportation companies and contributes to the exploration of digital policies that can further facilitate environmentally-friendly development by offering insights for establishing a supportive framework for digital reforms.

2 Literature review

2.1 Research on green innovation

Environmental issues generated in the process of economic development, such as environmental pollution, scarcity of resources have gradually become significant influencing factors that restrain economic development of China (Bai et al., 2015). Therefore, the shift to resource conservation and improve resource utilization efficiency is a must for sustainable economic development (Bai et al., 2014). However, green transformation of economy need to put micro companies into practice, the development of green innovation in companies is a key factor to achieve green transformation economy or not. James (1997) defined green innovation as the introduction of new processes or products that significantly reduce environmental impact while adding value to individuals or businesses. In comparison to conventional technological innovation, green innovation not only retains characteristics such as long innovation cycles, large investment scale, high risks, strong uncertainty, and substantial adjustment costs, but also requires improving the efficiency of resource and energy usage and reducing the environmental costs associated with raw material consumption (Chen, 2008; Takalo and Tooranloo, 2021). Factors that affecting the green transformation of companies have also gradually become the focus of scholars’ attention.

In terms of internal influencing factors of companies, green product innovations can help to promote the image and reputation of companies, it can also help companies to improve overall competitiveness (Liao, 2018a). Meanwhile, green innovation help companies to reduce polluting production methods, bring company environmentally friendly production technology, promote the utilization efficiency of resources, and thus improve business operation efficiency (Jansson, 2013; Liang et al., 2020). From the view of external influencing factors of companies, firstly, government supervision and stringent environmental laws and regulations are the important driving forces of companies’ green transformation (Johnstone, 2010), which enforce companies on improving standards of green innovation. Secondly, in order to evade environmental risk, banks make loan decisions based on companies’ environmental information, and reduce the amount of loans to companies with poor environmental performance, therefore, companies promote their levels of green innovation to access green credits from banks (Thompson and Cowton, 2004; Liu et al., 2010; Nandy and Lodh, 2012). Lastly, clients, investors, and other stakeholders will impact the green transformation of companies as well, companies obtain more competitive advantages through green innovation, and media evaluation will also have a certain supervision effect on the green development of companies (Jiguang and Zhiqun, 2010; Huang et al., 2016; Liao, 2018b; Abbas and Sağsan, 2019).

Obviously, there are many factors affect green innovation of companies, and it is different from traditional innovation, which has higher requirements on knowledge spillover rate, capital demand, sustainability, and how to improve efficiency of resource acquisition and allocation is the key to companies’ green innovation.

2.2 Research on digital transformation

Digital transformation is an application of new technology to companies, such as Artificial Intelligence, Big Data, and cloud computing, use these new information technologies to empower overall management and production of companies. The goal of digital transformation is to enhance companies’ core competitiveness, and change the way of value creation to achieve value growth, improve the quality of information supply and conduction efficiency through higher efficient flow of information, reorganize and optimize resources of production to achieve major business improvements (Kuusisto, 2017; Dornberger, 2018).

Existing research confirms that digital transformation can improve efficiency of company resources allocation, promote input-output efficiency of companies (Graetz and Michaels, 2018; Levine and Warusawitharana, 2021). Digital transformation can also help to improve companies’ ability to obtain external resources and information research capabilities, which help companies deliver positive signals to the outside world while reducing the level of information asymmetry between internal and external investors. As the study progressed, scholars explore influences of digital transformation on companies’ operational models, financing cost, level of company governance and innovation, etc. In the context of green transformation strategy, the question of whether digital transformation affects the green innovation of companies has also gradually become the focus of academic attention.

3 Research hypotheses

3.1 Digital transformation and corporate green innovation

Compared to traditional innovation activities, green innovation combines dual attributes of both environmental protection and innovation. The innovation investment of companies requires a large amount of resources, how to obtain and coordinate a large amount of external resources effectively is the key to the innovation investment of companies. By leveraging digital technology, companies can enhance their ability to acquire resources and integrate internal and external knowledge (Gobble, 2018). They can also use low-cost digital transactions to broaden the knowledge supply required for technological innovation (Björkdahl, 2020; Wen et al., 2022; Maretto et al., 2023), thus enhancing their advantages in technological innovation. At the same time, digital transformation can accelerate the penetration of knowledge information, effectively reduce the trial-and-error costs of innovation, and reduce the huge costs associated with innovation. Therefore, both in terms of knowledge spillovers and costs, digital transformation can enhance corporate innovation. From perspective of environmental protection, digital transformation enhances companies’ ability to acquire and allocate resources efficiently, which help company to grasp the development trend, concept and technology of green innovation, and providing support (Strambach, 2017; Arias-Pérez et al., 2021). Furthermore, digital transformation also promotes the iteration and renewal of digital technologies, enabling the synergy between foundational digital technologies and specific technologies, thereby generating technological spill-over effects that promote corporate green innovation (Yang et al., 2022; Wang and Yan, 2023).

Transportation companies sustain significant environmental, market competition, and safety risks. Continuously enhancing technological advancement is an essential requirement for these companies to adapt to socioeconomic development. Based on social responsibility, digital transformation is essentially mathematical thinking that involves openness, co-creative and sharing, it strengthen the willingness of companies to fulfill social responsibilities by including more community of shared interest in decision-making. Transportation companies achieve carbon reduction, pollution reduction, and improve energy utilization efficiency through green innovation, which is a vital pathway to fulfill companies’ social responsibility, it can be seen that digital transformation can help to boost motivation of companies green innovation. Drawing upon institutional theory, transportation companies face regulatory pressures from governments and competitors (Okereke and Russel, 2010). The application of new technologies can help reduce energy consumption and address noise and dust issues (German et al., 2023).

Therefore, transportation companies need to continuously improve their level of green innovation. Through the information transmission and knowledge integration facilitated by digital transformation, companies can promote green innovation. Moreover, digital transformation is a comprehensive endeavor and a long-term task. Similarly, green innovation is a continuous and gradually accumulated process. Hence, both the current and lagged digital transformations of companies have an impact on green innovation. Based on this point of view, this study proposes the following hypotheses:

H1a:. There is a positive correlation between digital transformation of transportation companies and their current level of green innovation.

H1b:. There is a positive correlation between digital transformation of transportation companies and their future level of green innovation.

3.2 Digital transformation, financing constraints and green innovation

The process of green innovation cannot be achieved without adequate financial support. Previous research has highlighted that financial constraints remain a significant factor limiting innovation activities in businesses (Czarnitzki and Hottenrott, 2010; Milani and Neumann, 2022). As representatives of cyclical industries, transportation companies are particularly vulnerable to economic fluctuations (Drobetz et al., 2016). Under the influence of COVID-19 pandemic, global economic issue has further exacerbated the financial constraints faced by transportation companies. Additionally, as capital-intensive industries, transportation companies heavily rely on substantial investments in transportation equipment, roadways, air and sea routes, and railway lines. Consequently, a decrease in transportation volume has a significant impact on their revenue (Ngo, 2019). Thus, the financial challenges confronted by transportation companies during the process of green innovation not only involve securing external financing but also internal cash flow vulnerability, which is susceptible to operational conditions. Therefore, addressing the issue of stable financial constraints and ensuring sufficient funding is crucial to facilitating green innovation in these companies.

Digital transformation can alleviate financing constraints for companies in two aspects. Firstly, the processes of information transmission, data collection, and analysis in digital transformation enable companies to leverage vast amounts of information at lower costs. By utilizing information technology tools to filter market information, companies can address the issue of information asymmetry between fund suppliers and demanders, thus mitigating financing constraints (Peng and Tao, 2022; Chen and Xu, 2023). Secondly, digital transformation accelerates the transmission and integration of information among different organizational units within the company. This facilitates communication, effective supervision, and feedback regarding the utilization and allocation of internal funds, thereby reducing the risks associated with imbalanced internal capital allocation and promoting green innovation (Behera, 2021; Kostakis and Kargas, 2021).

In conclusion, digital transformation helps companies reduce financing costs, enhance internal information analysis, mitigate risk expectations, and alleviate financing constraints. This, in turn, prevents reductions in green innovation investments caused by insufficient funds. Based on these points, the following hypothesis is proposed in this study:

H2:. Digital transformation stimulates green innovation in transportation companies by alleviating financing constraints.

4 Research design

4.1 Data source and sample selection

Due to the significant impact of the COVID-19 pandemic on domestic transportation industry in 2022, the operational revenue and net profit of transportation companies have been greatly affected. To mitigate the influence of the pandemic, this study focused on the Shanghai and Shenzhen listed transportation companies from 2011 to 2021. All continuous variables were subjected to a winsorization technique, trimming the extreme values at the upper and lower 1% tails. Additionally, samples that were classified as ST, *ST, and those with missing key variables were excluded, resulting in a final dataset comprising 769 annual observations.

4.2 Variable definitions

4.2.1 Dependent variable: green technological innovation (GREEN)

The patent types include invention, utility model, and design patents. Following the approach of Song et al. (2022), this study adopted the IPC codes identified in the Green Patent Inventory published by the World Intellectual Property Organization (WIPO) to define green innovation, including both invention and utility model patents. To avoid the influence of zero values, the level of green innovation in companies (PTI) was measured by taking the logarithm of the sum of green invention patents and utility model patents, with an additional 1 added. For robustness checks, the proportion of green patent applications by companies (EPR) was also utilized, which represents the ratio of green patent applications to total patent applications in a given year.

4.2.2 Independent variable: digital transformation (DCG)

This study utilized Python web scraping techniques to extract textual information from the annual reports of transportation listed companies. Based on predefined keywords, the texts were searched, matched, and word frequencies were counted. The frequencies were then categorized, aggregated, and digitally processed to derive relevant indicators of corporate digital transformation. The keywords include artificial intelligence technology, big data technology, cloud computing technology, blockchain technology, and digital application technology.

4.2.3 Mediating variable: financial constraints (KZ)

Building upon the research of Kaplan and Zingales (1997), this study constructed a financial constraint index based on various financial indicators such as operating net cash flow, dividends, cash holdings, leverage ratio, and Tobin’s Q. The specific steps include: (1) categorizing the operating net cash flow/previous total assets (

Estimating the regression coefficients of the variables by establishing a regression model

Utilizing the results from the regression model, the KZ index can be calculated. A higher KZ value indicates a higher level of financial constraints for the company.

The WW and SA index is also used as a proxy variable for financing constraints for robustness test (Whited and Wu, 2006; Hadlock and Pierce, 2010).

Where CF is the ratio of cash flow to total assets; DIVPOS is a dummy variable for dividend payment; TLTD is the ratio of long-term liabilities to assets; SIZE is the natural logarithm of total assets; IGROWTH represents the growth rate of revenue in the industry where the company is located; and GROWTH is the growth rate of the company’s revenue. The WW index varies in the same direction as the corporate financing constraint, for instance, the larger the value of WW, the higher degree of the company financing constrained.

Where SIZE is the natural logarithm of total assets; AGE represents the company age.

4.2.4 Control variables

This study controlled for the following variables: company size (SIZE), leverage ratio (LEV), ownership concentration of the largest shareholder (EQUITY), revenue growth rate (GROWTH), proportion of fixed assets (PPE), company age (AGE), and annual variables (YEAR). Additionally, considering the influence of regional economy on company digitization, the companies were categorized into Eastern, Western, and Central regions, and dummy variables (AREA) were introduced to account for the regional effect. Furthermore, taking into account the temporal nature of company’s green innovation activities, the control variables were lagged by one period.

4.3 Model specification

To test the hypotheses of this study, models (7) and (8) were constructed to examine the impact of digital transformation on company’s green innovation and its underlying mechanisms.

5 Empirical testing and analysis

5.1 Descriptive statistics

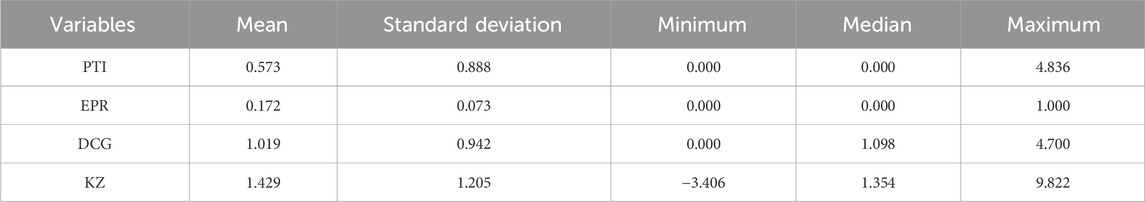

Table 1 presents the descriptive statistics of the main variables. The results indicate that the mean value of the dependent variable, green innovation (PTI), is 0.573, with a maximum value of 4.836 and a minimum value of 0.000. As for EPR, the mean value is 0.172, with a maximum of 1.000 and a minimum of 0. These values suggest a relatively low level of participation in green innovation activities among the transportation companies. The mean value of the explanatory variable, digital transformation (DCG), is 1.019, with a maximum value of 4.700 and a minimum value of 0, indicating a significant variation in the degree of digital transformation among transportation companies. Furthermore, the maximum value of the mediating variable, financial constraint (KZ), is 9.822, with a mean value of 1.429, indicating that transportation companies face severe financial constraints.

5.2 Analysis of benchmark regression results

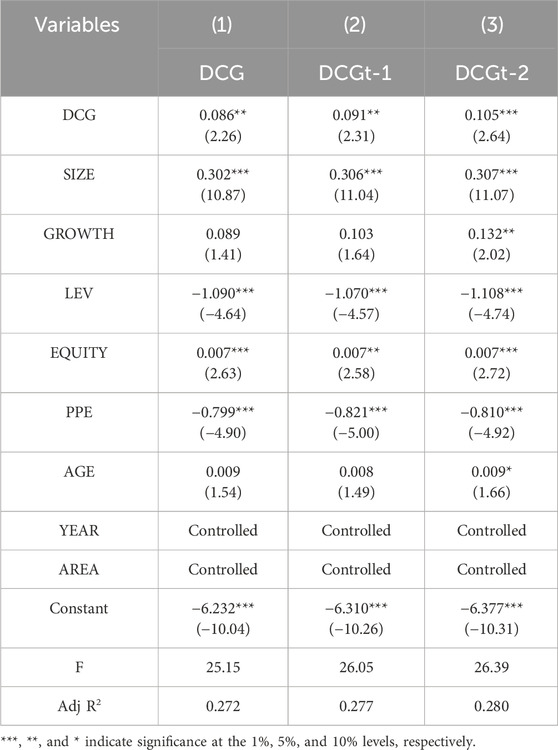

A multiple regression analysis was performed using Model (7) to examine the relationship between digital transformation and green innovation in transportation companies. The results, presented in Table 2, column (1), reveal a significant positive correlation between DCG and PTI, indicating that digital transformation in transportation companies contributes to the enhancement of their green technological innovation level. Economically speaking, for each increase of one standard deviation in digital transformation, green innovation in companies will increase by 0.091 standard deviations. Thus, hypothesis H1a is validated.

Analysis of the benchmark regression model considered the timeliness of green innovation in companies. To further examine the dynamic effects of digital transformation, DCG was lagged by one period and two periods respectively, and the validation was conducted again using Model (7), as shown in Table 2, columns (2) and (3). The results reveal that DCGt-1 and DCGt-2 are both significantly positively correlated with PTI, and the coefficients of the lagged periods are larger than the current period coefficient. Hence, hypothesis H1b is validated. Economically speaking, for each increase of one standard deviation in digital transformation, green innovation in companies increases by 0.097 and 0.111 respectively. It is evident that the impact of digital transformation on green innovation has timeliness, with the lagged periods of digital transformation having a more significant influence. This study suggests that digital transformation is not a short-term project that can be achieved instantaneously. Instead, it is a long-term process that requires gradual and sequential changes. Throughout this process, it is crucial to continuously improve efficiency, reduce costs, and enhance the company’s ability to acquire resources. Additionally, the integration of knowledge required for innovation also needs to be constantly accumulated. Therefore, there is a corresponding lag in the impact of digital transformation on green innovation.

6 Mechanism testing

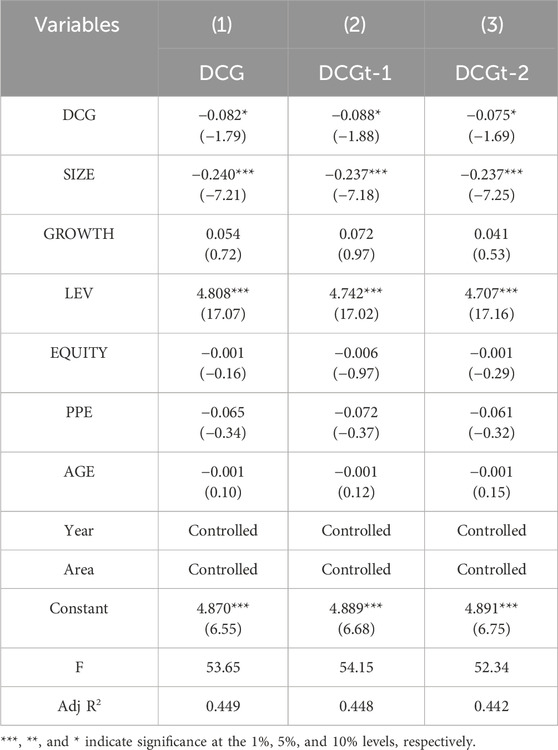

Model (8) was used to test the mediating effect of financing constraints. The coefficients of DCG in columns (1), (2), and (3) of Table 3 are significantly negative. In economic terms, the impact of digital transformation on financing constraints varies in different years. Specifically, for each standard deviation increase in digital transformation in the current period, financing constraints decrease by 0.064 standard deviations. Lagging digital transformation by one period leads to a decrease in financing constraints by 0.069 standard deviations, while lagging it by two periods only results in a decrease of 0.059 standard deviations in financing constraints. It can be observed that the impact of digital transformation on financing constraints is most significant when lagged by one period and least significant when lagged by two periods. This indicates that digital transformation effectively addresses information transmission issues and helps businesses access internal and external information. The impact of digital transformation on financing constraints is relatively “timely”. Showing that digital transformation reduces the companies’ financing constraints, facilitates their green innovation investments.

7 Robustness testing

7.1 Substitution variables

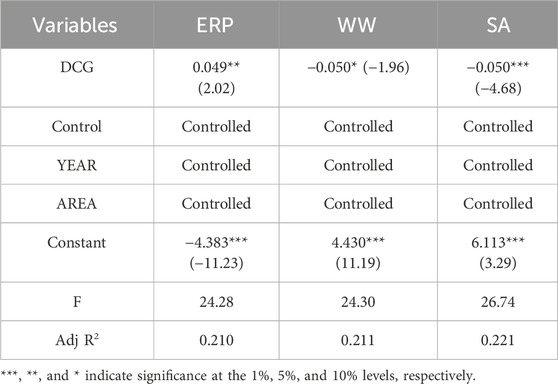

To test the robustness of the mediating effect of funding constraints on the relationship between the digital transformation and the green innovation and enhance the credibility of this study we conduct the following robustness test. The research replaces the variable of company technological innovation and the variable of funding constraints into the proportion of green patent applications (EPR)、 WW index and SA index. The results, as shown in Table 4, continue to support the previous conclusions.

7.2 Instrumental variable method

Instrumental variables were selected appropriately for the core explanatory variables to address endogeneity issues. Total volume of post and telecommunication operations are used as the instrumental variable, to analyses using two stage least square, Table 5 states the results. As shown in Table 5, after consideration of endogeneity, the effect of digital transformation on improving green innovation in companies holds still, results were significant at 1% level.

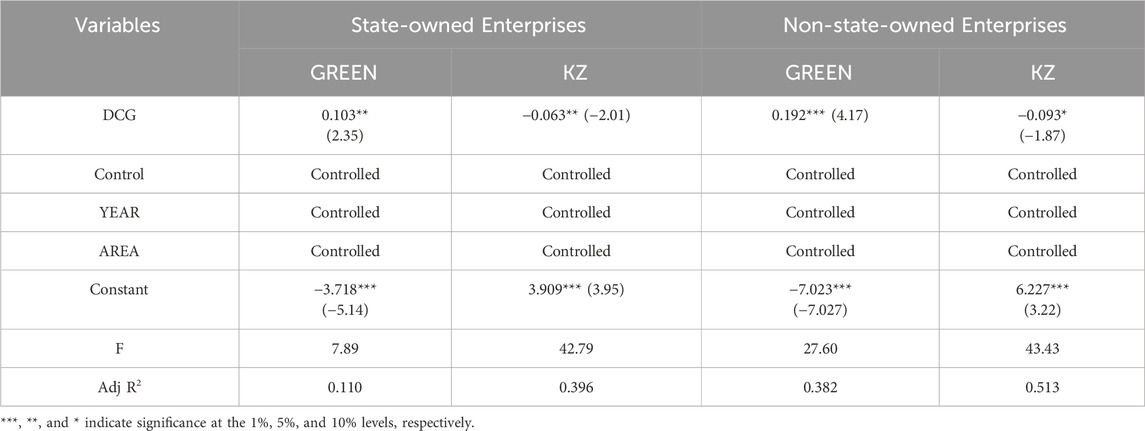

7.3 Company ownership heterogeneity analysis

The previous empirical analysis has controlled for region, year, and to further verify the reliability of the results, companies were categorized according to the nature of their ownership, the results shown in Table 6, the results still support the previous conclusions, moreover, compared to state-owned enterprises, the digital transformation of non-state-owned enterprises promote the level of green innovation more effectively.

8 Further analysis

8.1 Study on the role of policy promotion

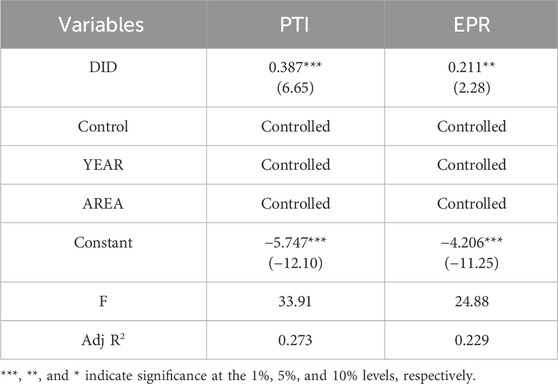

With the issuance of the Outline of the Construction of a Strong Transportation Country and the Outline of the National Comprehensive Stereoscopic Transportation Network Plan, the construction of an integrated, digitalized, and green modern comprehensive transportation system has become the goal of the transportation industry’s development. In 2017, the Ministry of Transport issued the Outline of the Development Plan for Digital Transportation, which emphasizes the development of digital transportation as a goal, supports the construction of a strong transportation country, and proposes “multi-channel fundraising and exploration of government and social capital cooperation models”. The purpose of this outline is to facilitate innovation as the primary motivation for transport development, to promote the deep integration of advanced information technology and transportation, take “data chain” as a main line to build digital collection system, networked transmission system and intelligent application system, accelerating transformation to digitization, networking, intelligence. The outline specifically indicates that digital collection system and networking transmission system of the transportation industry need to be substantially formed and deeply integrated with the electronics, communications, Internet and other industries by 2025. The Ministry of Transport also issued the Action Plan for the Development of Comprehensive Transportation Big Data (2020-2025), which clearly defines the specific content of the digital development of the transportation industry, points out the need to guide the opening and innovation of big data, promote enterprise integration and innovation, and proposes the utilization of social capital for innovative applications of big data to promote the development of the industry’s big data market. The digital transformation policy, which utilizes digital technology to break through key technologies and empower green development (Genzorova et al., 2019), undoubtedly promotes the digital transformation and development of transportation companies. However, what impact does policy have on the green innovation capabilities of these companies? Based on this, this study adopted the Difference-in-Differences (DID) method to further explore the impact of digitalization policies on the green innovation of transportation companies.

The transportation companies involved in digital transformation were categorized into two groups using PSM propensity score matching: the experimental group, which participated in digital transformation (denoted as TREAT = 1), and the control group, which was not involved in digital transformation (denoted as TREAT = 0). Additionally, a time dummy variable POST was set, with POST = 1 representing the period after the policy was implemented and POST = 0 representing the period before the policy was implemented. Furthermore, DID was defined as the product of POST and TREAT. Using these variables, a baseline difference-in-differences model was constructed.

The regression results, as shown in Table 7, indicate that regardless of the selected proxy variables for green innovation, the focus of this study, the coefficients of the DID regression are consistently positive and statistically significant. This suggests that the digital policy has a significant promoting effect on green innovation in transportation companies. It is evident that the digital policy plays a crucial role in driving the integration of digitalization and green transformation in the transportation industry, thereby facilitating its high-quality development.

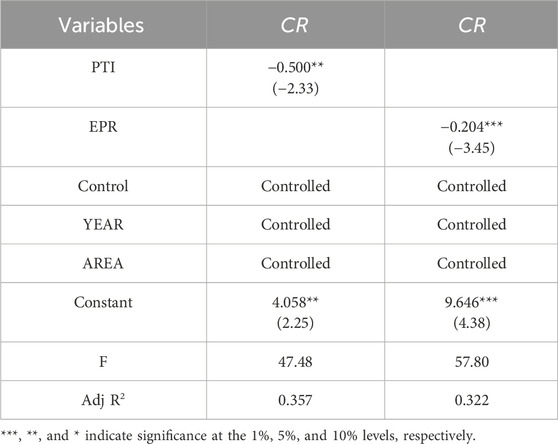

8.2 Study on economic consequences

With the implementation of the “carbon peaking and carbon neutrality” strategy, green innovation in companies serves as an emphasized approach to environmentally friendly innovation. It not only contributes to economic growth through conventional innovative technologies but also mitigates the dual pressures of environment and energy (Liu et al., 2022; Xie and Jamaani, 2022), thereby reducing carbon emissions intensity. It has been proved that green innovation is a key element of green development strategy, which improves environmental productivity, promote energy conservation and environmental optimization by investing in environmental technology and using green technology to reduce environmental pollution, energy and raw material consumption, in order to reduce carbon emissions significantly (Cai et al., 2021; Yuan et al., 2022; Chang et al., 2023). Therefore, this study further investigates economic consequences of digital transformation in promoting green innovation, specifically examining whether green innovation can reduce carbon emissions intensity and achieve the goal of sustainable development. This study used the ratio of provincial carbon dioxide emissions to gross domestic product as a measure of carbon emissions intensity (CR). The following model is established:

The results are presented in Table 8. Using two measures, PTI and EPR, to assess green innovation, both coefficients show significant negative effects on CR, indicating that green innovation contributes to reducing carbon emissions intensity. Therefore, it can be observed that promoting the development of green innovation technologies in companies is an effective approach for achieving green transformation, reducing carbon emissions, and realizing sustainable development.

9 Conclusion and recommendations

This study explores the mechanisms and pathways through which digital transformation alleviates financing constraints in environmental transportation companies and promotes green innovation. Empirical testing was conducted using data from listed transportation companies in the Shanghai and Shenzhen stock exchanges during the period of 2011–2021. The research findings are as follows: 1. Digital transformation can stimulate green innovation in transportation companies. 2. Financing constraints play a mediating role between digital transformation and green innovation in companies. 3. Further research revealed that digital policies contribute to promoting green innovation in companies. Additionally, economic consequences study demonstrated that green innovation helps to reduce carbon emissions intensity. The main contribution of this study are: firstly, it focuses on economic effects of digital transformation in transportation companies, enriches relevant studies on transportation companies. Secondly, based on the perspective of financing constraints, the relevant conclusion not only enriches the research on digital transformation of transportation companies, but also provide new perspectives on promoting the role of company in digital economic. Thirdly, this study further discusses the practical effects of green innovation in transportation company, which provide companies references for sustainable development.

Based on the above findings, this paper presented the following policy recommendations:

(1) Vigorously promoting the digital transformation of transport companies, boost digital economy transit to a new stage of deepening application and universal sharing, apply green governance as guide for future development. Strengthen the demonstration effect of digital transformation in large transportation companies, with target of green transformation, build a digital platform through comprehensive and systematic promotion of digital transformation, promote overall operation efficiency, achieve synergies, help transportation companies with sustainable development. The application of the Internet of Things and Big Data implement information exchange between vehicles, infrastructure and vehicles, in order to improve efficiency and safety of transportation system. It can also help transportation department to predict and optimize routes by using Big Data and to provide better customer service. In the meantime, ensuring data security, simplifying system processes, improving the accessibility and operational efficiency of the transportation system are also significant functions of using digital technology. Therefore, transportation company managers should combine the actual situation of the companies, choose an appropriate path of green transformation, accelerate construction of information network infrastructure, promote and upgrade smart infrastructure, introduce advanced information technology and management system, enhance transparency and efficacy of project management, reduce management costs, improve security and reliability of the system.

(2) Use digital technology to expand resources, alleviate companies’ financing constraints, facilitate the promotion of green innovation. Application of digital technology helps transportation to access various data resources with high dimensions, wide coverage and large volume in capital market, promote transparency and accuracy of information delivery. Facilitate the digital transformation progress of transportation companies, combine the companies with differentiated development patterns at different stages and in different modes, to build diversified green cooperation model, follow policies to maximize fiscal policy effect, make rational utilization of government subsidies to solve the financial issues of transportation companies. Use digital technology for full access to capital market information, standardize the data processing in financing procedural, expand the boundary of company governance from offline to online, enhance the communication between companies and markets, strengthen security risk assessment, and monitoring and early warning, cooperate with high quality partners to reduce financing risk.

(3) Complete the institutional system of digital and green development, construct a reasonable green innovation development policy for transportation companies. Apply government policies to guide transport companies towards green innovation, which help companies to enhance initiative to innovate, thus to achieve win-win situation of sustainable development and reduction of envinmental pollution. Meanwhile, use green development as policy guide, and build a new model of coordinated governance among companies, government and society, strengthen implementation and control of all aspects of companies’ green development, improve information transparency, and build a sharing mechanism for digital development.

The limitations of this study includes the following two main points: one is the limitation of defining digital transformation. This study follows the methods of existing literature, build relevant index of digital transformation by searching, matching and counting word frequencies on feature words, however, along with the development of digital technology, there are also limitations in feature words, which lead to potentially incomplete definition of digital transformation. The other one is that general applicability of the findings remains to be improved. This study only discusses the relationship between digital transformation and green innovation in transportation companies, which do not cover all industries. Therefore, future study should continue to develop the research, use diversified methods and data to explore the questions such as motivation, process, and consequences of companies’ green transformation in various industries comprehensively.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

XW: Writing–original draft.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by National Social Science Foundation Western Project(22XJY012) and Chengdu Green Low-Carbon Development Research Base Project (LD23YB16) of the Chengdu Philosophy and Social Science Research Base.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, J., and Sağsan, M. (2019). Impact of knowledge management practices on green innovation and corporate sustainable development: a structural analysis. J. Clean. Prod. 229, 611–620. doi:10.1016/j.jclepro.2019.05.024

Ahmad, M., Ahmed, Z., Bai, Y., Qiao, G., Popp, J. O., and Oláh, J. (2022). Financial inclusion, technological innovations, and environmental quality: analyzing the role of green openness. Front. Environ. Sci. 10, 851263. doi:10.3389/fenvs.2022.851263

Arias-Pérez, J., Velez-Ocampo, J., and Cepeda-Cardona, J. (2021). Strategic orientation toward digitalization to improve innovation capability: why knowledge acquisition and exploitation through external embeddedness matter. J. Knowl. Manag. 25, 1319–1335. doi:10.1108/JKM-03-2020-0231

Bai, C., Dhavale, D., and Sarkis, J. (2014). Integrating fuzzy C-means and TOPSIS for performance evaluation: an application and comparative analysis. Expert Syst. Appl. 41, 4186–4196. doi:10.1016/j.eswa.2013.12.037

Bai, C., Sarkis, J., and Dou, Y. (2015). Corporate sustainability development in China: review and analysis. Ind. Manage Data Syst. 115, 5–40. doi:10.1108/IMDS-09-2014-0258

Behera, J. K. (2021). Digital Transformation and Its Impact: An Analytical Study. Hoboken, NJ: Apple Academic Press, 27–49.

Björkdahl, J. (2020). Strategies for digitalization in manufacturing firms. Calif. Manage Rev. 62, 17–36. doi:10.1177/0008125620920349

Cai, A., Zheng, S., Cai, L., Yang, H., and Comite, U. (2021). How does green technology innovation affect carbon emissions? a spatial econometric analysis of China’s provincial panel data. Front. Environ. Sci. 9, 813811. doi:10.3389/fenvs.2021.813811

Chang, K., Liu, L., Luo, D., and Xing, K. (2023). The impact of green technology innovation on carbon dioxide emissions: the role of local environmental regulations. J. Environ. Manage 340, 117990. doi:10.1016/j.jenvman.2023.117990

Chen, Y., and Xu, J. (2023). Digital transformation and firm cost stickiness: evidence from China. Financ. Res. Lett. 52, 103510. doi:10.1016/j.frl.2022.103510

Chen, Y. S. (2008). The driver of green innovation and green image-green core competence. J. Bus. Ethics 81, 531–543. doi:10.1007/s10551-007-9522-1

Czarnitzki, D., and Hottenrott, H. (2010). Financing constraints for industrial innovation: what do we know? Rev. Bus. Econ. 55, 346–362. doi:10.2139/ssrn.1621683

Dornberger, R., Inglese, T., Korkut, S., and Zhong, V. J. (2018). “Digitalization: yesterday, today and tomorrow,” in Business Information Systems and Technology 4.0: New Trends in the Age of Digital Change. Editor R. Dornberger (Cham: Springer), 1–11.

Drobetz, W., Menzel, C., and Schröder, H. (2016). Systematic risk behavior in cyclical industries: the case of shipping. Transp. Res. E Logist. Transp. Rev. 88, 129–145. doi:10.1016/j.tre.2016.01.008

Energy-Intensive, O., and Russel, D. (2010). Regulatory pressure and competitive dynamics: carbon management strategies of UK energy-intensive companies. Calif. Manage Rev. 52, 100–124. doi:10.1525/cmr.2010.52.4.100

Gao, S., Li, W., Meng, J., Shi, J., and Zhu, J. (2023). A study on the impact mechanism of digitalization on corporate green innovation. Sustainability 15, 6407. doi:10.3390/su15086407

Genzorova, T., Corejova, T., and Stalmasekova, N. (2019). How digital transformation can influence business model, case study for transport industry. Transp. Res. Procedia 40, 1053–1058. doi:10.1016/j.trpro.2019.07.147

German, J. D., Redi, AANP, Ong, A. K. S., and Liwanag, J. L. (2023). The impact of green innovation initiatives on competitiveness and financial performance of the land transport industry. Heliyon 9, e19130. doi:10.1016/j.heliyon.2023.e19130

Ghasemaghaei, M., and Calic, G. (2020). Assessing the impact of big data on firm innovation performance: big data is not always better data. J. Bus. Res. 108, 147–162. doi:10.1016/j.jbusres.2019.09.062jbusres.2019.09.062

Glavas, C., and Mathews, S. (2014). How international entrepreneurship characteristics influence Internet capabilities for the international business processes of the firm. Int. Bus. Rev. 23, 228–245. doi:10.1016/j.ibusrev.2013.04.001

Gobble, M. M. (2018). Digitalization, digitization, and innovation. Res. Technol. Manage. 61, 56–59. doi:10.1080/08956308.2018.1471280

Graetz, G., and Michaels, G. (2018). Robots at work. Rev. Econ. Stat. 100, 753–768. doi:10.1162/rest_a_00754

Hadlock, C. J., and Pierce, J. R. (2010). New evidence on measuring financial constraints: moving beyond the KZ index. Rev. Financ. Stud. 23, 1909–1940. doi:10.1093/rfs/hhq009

Henfridsson, O., Mathiassen, L., and Svahn, F. (2014). Managing technological change in the digital age: the role of architectural frames. J. Inf. Technol. 29, 27–43. doi:10.1057/jit.2013.30

Huang, X. X., Hu, Z. P., Liu, C. S., Yu, D. J., and Yu, L. F. (2016). The relationships between regulatory and customer pressure, green organizational responses, and green innovation performance. J. Clean. Prod. 112, 3423–3433. doi:10.1016/j.jclepro.2015.10.106

James, P. (1997). The sustainability circle: a new tool for product development and design. J. Sustain. Prod. Design. 2, 52–57.

Jansson, A. (2013). Reaching for a sustainable, resilient urban future using the lens of ecosystem services. Ecol. Econ. 86, 285–291. doi:10.1016/j.ecolecon.2012.06.013

Jiguang, L., and Zhiqun, S. (2011). Low carbon finance: present situation and future development in China. Energy Procedia 5, 214–218. doi:10.1016/j.egypro.2011.03.038

Johnstone, N., Haščič, I., and Popp, D. (2010). Renewable energy policies and technological innovation: evidence based on patent counts. Environ. Resour. Econ. 45, 133–155. doi:10.1007/s10640-009-9309-1

Kaplan, S. N., and Zingales, L. (1997). Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 112, 169–215. doi:10.1162/003355397555163

Kostakis, P., and Kargas, A. (2021). Big-data management: a driver for digital transformation? Information 12, 411. doi:10.3390/info12100411

Kuusisto, M. (2017). Organizational effects of digitalization: a literature review. Int. J. Organ Theory Behav. 20, 341–362. doi:10.1108/IJOTB-20-03-2017-B003

Levine, O., and Warusawitharana, M. (2021). Finance and productivity growth: firm-level evidence. J. Monet. Econ. 117, 91–107. doi:10.1016/j.jmoneco.2019.11.009

Li, D., and Shen, W. (2021). Can corporate digitalization promote green innovation? the moderating roles of internal control and institutional ownership. Sustainability 13, 13983. doi:10.3390/su132413983

Liang, W., Wenpei, F., Chengyuan, W., and Shanyong, W. (2020). A literature review of enterprise green transformation from the perspective of complex social network and prospects. J. Univ. Sci. Technol. China 50, 1330. doi:10.3969/j.issn.0253-2778.2020.10.005

Liao, Z. (2018a). Environmental policy instruments, environmental innovation and the reputation of enterprises. J. Clean. Prod. 171, 1111–1117. doi:10.1016/j.jclepro.2017.10.126

Liao, Z. (2018b). Institutional pressure, knowledge acquisition and a firm’s environmental innovation. Bus. Strategy Environ. 27, 849–857. doi:10.1002/bse.2036

Liu, J., Duan, Y., and Zhong, S. (2022). Does green innovation suppress carbon emission intensity? new evidence from China. Environ. Sci. Pollut. Res. 29, 86722–86743. doi:10.1007/s11356-022-21621-z

Liu, X., Yu, Q., Fujitsuka, T., Liu, B., Bi, J., and Shishime, T. (2010). Functional mechanisms of mandatory corporate environmental disclosure: an empirical study in China. J. Clean. Prod. 18, 823–832. doi:10.1016/j.jclepro.2009.12.022

Luo, S., Yimamu, N., Li, Y., Wu, H., Irfan, M., and Hao, Y. (2023). Digitalization and sustainable development: how could digital economy development improve green innovation in China? Bus. Strategy Environ. 32, 1847–1871. doi:10.1002/bse.3223

Maretto, L., Faccio, M., Battini, D., and Granata, I. (2023). “Models for the cost-benefit analysis of digitalization and industry 4.0: a systematic literature review,” in Proceedings of the changeable, agile, reconfigurable and virtual production conference and the world mass customization and personalization conference (Cham: Springer International Publishing), 675–682.

Mergel, I., Edelmann, N., and Haug, N. (2019). Defining digital transformation: results from expert interviews. Gov. Inf. Q. 36, 101385. doi:10.1016/j.giq.2019.06.002

Milani, S., and Neumann, R. (2022). R&D, patents, and financing constraints of the top global innovative firms. J. Econ. Behav. Organ 196, 546–567. doi:10.1016/j.jebo.2022.02.016

Mubarak, M. F., Tiwari, S., Petraite, M., Mubarik, M., and Raja, M. R. R. Z. (2021). How Industry 4.0 technologies and open innovation can improve green innovation performance? Manage Environ. Qual. 32, 1007–1022. doi:10.1108/MEQ-11-2020-0266

Nandy, M., and Lodh, S. (2012). Do banks value the eco-friendliness of firms in their corporate lending decision? some empirical evidence. Int. Rev. Financ. Anal. 25, 83–93. doi:10.1016/j.irfa.2012.06.008

Ngo, N. S. (2019). Urban bus ridership, income, and extreme weather events. Transp. Res. D. Transp. Environ. 77, 464–475. doi:10.1016/j.trd.2019.03.009

Peng, C., Jia, X., and Zou, Y. (2022). Does digitalization drive corporate green transformation? Based on evidence from Chinese listed companies. Front. Environ. Sci. 10, 963878. doi:10.3389/fenvs.2022.963878

Peng, Y., and Tao, C. (2022). Can digital transformation promote enterprise performance? from the perspective of public policy and innovation. J. Innov. Knowl. 7, 100198. doi:10.1016/j.jik.2022.100198

Song, D., Zhu, W., and Ding, H. (2022). Can enterprise digitalization promote green technology innovation? based on the investigation of listed companies in heavy pollution industries. J. Financ. Econ. 48, 34–48. doi:10.16538/j.cnki.jfe.20211218.304

Strambach, S. (2017). Combining knowledge bases in transnational sustainability innovation: microdynamics and institutional change. Econ. Geogr. 93, 500–526. doi:10.1080/00130095.2017.13662682017.1366268

Takalo, S. K., Tooranloo, H. S., and Shahabaldini parizi, Z. (2021). Green innovation: a systematic literature review. J. Clean. Prod. 279, 122474. doi:10.1016/j.jclepro.2020.122474

Thompson, P., and Cowton, C. J. (2004). Bringing the environment into bank lending: implications for environmental reporting. Brit Acc. Rev. 36, 197–218. doi:10.1016/j.bar.2003.11.005

Uherek, E., Halenka, T., Borken-Kleefeld, J., Balkanski, Y., Berntsen, T., Borrego, C., et al. (2010). Transport impacts on atmosphere and climate: land transport. Atmos. Environ. 44, 4772–4816. doi:10.1016/j.atmosenv.2010.01.002

Wang, L., and Yan, J. (2023). Effect of digital transformation on innovation performance in China: corporate social responsibility as a moderator. Front. Environ. Sci. 11, 1215866. doi:10.3389/fenvs.2023.1215866

Wen, H., Zhong, Q., and Lee, C. C. (2022). Digitalization, competition strategy and corporate innovation: evidence from Chinese manufacturing listed companies. Int. Rev. Financ. Anal. 82, 102166. doi:10.1016/j.irfa.2022.102166

Whited, T. M., and Wu, G. (2006). Financial constraints risk. Rev. Financ. Stud. 19, 531–559. doi:10.1093/rfs/hhj012

Xie, P., and Jamaani, F. (2022). Does green innovation, energy productivity and environmental taxes limit carbon emissions in developed economies: implications for sustainable development. Struct. Chang. Econ. Dyn. 63, 66–78. doi:10.1016/j.strueco.2022.09.002

Yang, W., Chen, Q., Guo, Q., and Huang, X. (2022). Towards sustainable development: how digitalization, technological innovation, and green economic development interact with each other. Int. J. Environ. Res. Public Health 19, 12273. doi:10.3390/ijerph191912273

Yuan, B., Li, C., Yin, H., and Zeng, M. (2022). Green innovation and China’s CO2 emissions-the moderating effect of institutional quality. J. Environ. Plan. Manag. 65, 877–906. doi:10.1080/09640568.2021.1915260

Keywords: transportation, digital transformation, green innovation, financing constraints, carbon emissions

Citation: Xuqian W (2024) The digital transformation, funding constraints, and the green innovation of transportation companies. Front. Environ. Sci. 12:1332051. doi: 10.3389/fenvs.2024.1332051

Received: 02 November 2023; Accepted: 11 July 2024;

Published: 26 July 2024.

Edited by:

Wei Zhang, China University of Geosciences Wuhan, ChinaCopyright © 2024 Xuqian. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wen Xuqian, 394203303@qq.com

Wen Xuqian

Wen Xuqian