94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Sustain. Food Syst., 24 February 2025

Sec. Land, Livelihoods and Food Security

Volume 9 - 2025 | https://doi.org/10.3389/fsufs.2025.1496902

The participation of smallholder farmers in agricultural production outsourcing through organizational means is of significant importance for enhancing agricultural production capacity and promoting agricultural modernization. Based on survey data from 648 households in the Guanzhong area of Shaanxi Province, this study analyzes the incentives for smallholder farmers to obtain credit guarantees provided by village collectives and grassroots supply and marketing cooperatives using a Logit model. It employs the Propensity Score Matching method to construct a counterfactual hypothesis, estimating the average treatment effect of credit guarantees on smallholder farmers’ organizational participation in agricultural production outsourcing. The study also uses regression adjustment methods to verify the mechanism through which credit guarantees affect smallholder farmers’ organizational participation in agricultural production outsourcing. The results show that: (1) Apart from the gender, education level, and number of plots of the household head, other characteristics of the household head and family, village, and market characteristics are important factors influencing smallholder farmers’ access to credit guarantees. (2) After obtaining credit guarantees, the participation of smallholder farmers in agricultural production outsourcing through organizational means significantly increases. (3) The pathways through which credit guarantees promote smallholder farmers’ organizational participation in agricultural production outsourcing, in order of contribution rate, are increasing agricultural income, reducing operational risks, and enhancing organizational trust. Therefore, support for village collectives and grassroots supply and marketing cooperatives should be increased, and organizational forms should be promoted to facilitate the integration of smallholder farmers with agricultural modernization.

For a long time, the fundamental aspect of agricultural operations in China has been composed of small-scale family operations by smallholder farmers. Against the backdrop of a “large country with small agriculture,” the scarcity of resources, the trend toward multiple occupations, and the aging of smallholder farmers have become increasingly prominent, making the questions of “who will farm and how to farm” increasingly severe (Zou et al., 2018). Organizing smallholder farmers to accept agricultural socialized services has become a new approach to solving the problem of effectively connecting smallholder farmers with agricultural modernization (Gao et al., 2021). In the face of the difficulty in achieving large-scale operations through land transfer, the report of the 20th National Congress of the Communist Party of China clearly stated, “Develop new types of agricultural business entities and agricultural socialized services.” To transform the agricultural business landscape and achieve agricultural modernization with Chinese characteristics, the “Guiding Opinions on Accelerating the Development of Agricultural Socialized Services” issued by the Ministry of Agriculture and Rural Affairs in 2021, as well as the Central Document No. 1 for the years 2022–2024, both emphasize the importance of various agricultural socialized service organizations and village collective economic organizations in organizing smallholder farmers to accept socialized services. However, in the context of fragmented land, organizing dispersed smallholder farmers to connect with agricultural socialized services still faces many challenges, such as: high difficulty in integrating smallholder land resources, declining coordination capabilities of village organizations, the difficulty for service organizations to balance private interests with public welfare services, and unstable interest linkages between different entities (Zhong et al., 2021; Du et al., 2021). In recent years, to effectively promote the organized participation of smallholder farmers in agricultural production outsourcing, there has been a phenomenon in rural areas where village collective economic organizations cooperate with new types of agricultural business entities such as grassroots supply and marketing cooperatives to provide agricultural services for farmers (Liu et al., 2024), which has strongly promoted the organized participation of smallholder farmers in agricultural production outsourcing. Therefore, exploring the impact of village collectives and supply cooperatives providing credit guarantees on the organized participation of smallholder farmers in agricultural production outsourcing and revealing the problems and obstacles therein, is of great theoretical and practical significance.

Regarding the issue of smallholder farmers’ organizational integration with agricultural socialized services, theoretical studies mainly focus on the following three aspects: Firstly, research on models of agricultural socialized service organizations driving smallholder farmers, which are specifically divided into three models: “Company + Smallholder Farmers,” “Cooperative + Smallholder Farmers,” and comprehensive agricultural associations. In the “Company + Smallholder Farmers” model, leading enterprises help smallholder farmers alleviate difficulties in selling through contract farming, but this model can easily lead to capital exploitation of smallholder farmers, resulting in their rights not being protected (Wan, 2008); in the “Cooperative + Smallholder Farmers” model, smallholder farmers spontaneously form professional cooperatives to provide services for members, generating economies of scale. However, due to the complex class and power structure in rural society, issues such as “big farmers exploiting small farmers” and “shell cooperatives” make it difficult for ordinary smallholder farmers to actually receive services provided by cooperatives (Chen et al., 2023); the comprehensive agricultural association model is to establish a three-dimensional comprehensive agricultural association system nationwide, relying on the government to integrate scattered smallholder farmers, a model of agricultural development that exists in Japan and South Korea but has not yet been practically implemented in China, with its effects not yet well presented (Yang, 2017). Secondly, research on the difficulties faced by agricultural socialized service organizations in driving smallholder farmers. The fragmentation of land and the aging of practitioners make smallholder farmers face difficulties such as a lack of cooperation in production processes, high market transaction costs, and difficulty in matching market supply and demand when participating in agricultural production outsourcing. In the process of reshaping the agricultural socialized service system, compared to large-scale farmers, the differentiation of smallholder farmers puts them at a clear disadvantage in terms of business methods, content, and volume of socialized service needs, which is not conducive to the small-scale family operations that lack organization (Qiu et al., 2021; Qiu and Luo, 2021; Qiu et al., 2022). Finally, research on village community organizations guiding smallholder farmers’ organizational integration with agricultural socialized services. Village collective economic organizations provide land consolidation, contact service organizations such as initiating the establishment of agricultural supply companies and agricultural machinery cooperatives, grassroots supply and marketing cooperatives or leading enterprises that provide agricultural inputs, agricultural technology, and agricultural machinery services uniformly, apply for agricultural government subsidies, or seek related agricultural financial organizations for financial support. As intermediaries, village collective economic organizations organize scattered smallholder farmers, promoting the matching of supply and demand for scaled services (Bagchi et al., 2022; Corsi et al., 2017; Hulke and Diez, 2020). From an empirical perspective, there are relatively few studies, and existing studies have focused on the impact of smallholder farmers’ organized participation in agricultural production outsourcing on agricultural production efficiency and household income from the perspective of implementation effects (Ofori et al., 2019; Yi and Gu, 2022), and some studies have explored the impact of migrant workers returning to farming households on the organized management of smallholder farmers from the perspective of formation background (Xiao and Luo, 2024).

Regarding the impact of credit guarantee on agricultural production, the academic community has conducted extensive explorations and achieved fruitful results. Related studies have found that agricultural credit guarantees not only increase the supply of agricultural credit but also promote the development of the agricultural economy. Agricultural credit guarantee loans are conducive to promoting the growth of family income for smallholder farmers at different income levels, driving diversification of non-agricultural income, and improving the consumption levels of rural households (Luan and Bauer, 2016). Ozdemir (2024) confirmed the long-term impact of agricultural credit on agricultural value-added from a global perspective. Twumasi et al. (2022) showed through analysis of survey data from four regions in Ghana that smallholder farmers who obtain credit are more likely to reduce the abandonment of farmland. Zhang et al. (2023) used Chinese county-level panel data to confirm that credit inputs can change the high-pollution production methods of agriculture and reduce agricultural carbon intensity. Mahmood et al. (2024) used 420 household survey data to confirm the role of digital electronic credit and institutional support in promoting the adoption of climate-smart agriculture (CSA) practices by smallholder farmers in Punjab, Pakistan. As an important tool for reducing risk losses and alleviating credit constraints, credit guarantees effectively connect smallholder farmers with financial institutions, playing an increasingly significant role in the modernization of agriculture and sustainable development.

Overall, existing literature widely recognizes that village collective economic organizations and cooperatives are significant sources of motivation for promoting the organized participation of smallholder farmers in agricultural production outsourcing during the new development stage. At the same time, it acknowledges that market risks and transaction costs may make it difficult for smallholder farmers to organize and engage with modern agricultural production outsourcing. Therefore, it proposes strengthening the village collective’s ability and motivation to coordinate farmers’ organizations and to enhance the connection between service entities and village collectives, promoting the large-scale development of agricultural services. However, most of the existing research on how village collectives promote farmers’ organized participation in agricultural production outsourcing remains at the level of theoretical inference or case studies. Research on credit guarantees also lacks exploration of their impact on agricultural production from the perspective of farmers’ organization. Few studies directly reveal the impact of credit guarantees provided through cooperation between village collectives and supply and marketing cooperatives on smallholder farmers’ organized participation in agricultural production outsourcing, and even fewer analyze the internal transmission paths of how credit guarantees affect smallholder farmers’ organized participation in agricultural production outsourcing. In view of this, this paper utilizes 648 pieces of farmer survey data from the Guanzhong area of Shaanxi Province, constructs a theoretical framework for the impact of credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing based on cooperative economic theory and the Stimulus-Organism-Response (S-O-R) theory, employs the Propensity Score Matching method for calculation, and decomposes the analysis of the effects of different driving factors in the impact of credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing, providing a directional reference for accelerating the guidance of smallholder farmers to connect with modern agricultural production.

According to the theory of cooperative economy, cooperative economy is defined as a form of economic activity where individual producers or consumers voluntarily join together to engage in production and business activities at a certain stage of social and economic development (Su et al., 2021). In this form of economy, workers, in order to protect their own interests and seek more benefits, adhere to the principle of voluntary mutual benefit, implement democratic management, and join cooperative economic organizations through various means. Currently, in China, the effective supply of rural finance has been chronically insufficient, and the borrowing needs of smallholder farmers cannot be effectively met, generally facing issues such as “collateral, guarantee, and loan difficulties” (Han and Jin, 2014). In rural society, influenced by price competition and personal relationships, farmers tend to operate independently in the acquisition of agricultural inputs and the sale of grain. Village collectives and grassroots supply and marketing cooperatives provide credit guarantees for farmers to purchase agricultural inputs, and farmers participate in organized purchasing of agricultural production outsourcing services supplied by grassroots supply and marketing cooperatives and village collectives, which is a form of cooperative economy where producers and consumers seek more benefits. Specific forms of credit guarantees include commercial credit guarantees, monetary credit guarantees, and mixed credit guarantees. Commercial credit guarantees refer to credit sales and purchases, where smallholder farmers do not pay for the required raw materials, materials, and services at the time of acquisition, but instead repay the previous debts after the harvest and sale of grain. Monetary credit guarantees refer to the establishment of mutual aid organizations for funds, where village collectives and grassroots cooperatives provide small loans or act as guarantors for farmers to traditional financial institutions to meet the short-term financial borrowing needs of smallholder farmers. Mixed credit guarantees combine commercial and monetary credit guarantees (Tan and Han, 2020). This credit community with membership characteristics, established based on geographical and professional social networks, improves farmers’ credit ratings through collective credit, cooperative credit, and organizational credit, and through this method locks in the cooperative relationship between the service supply entity and farmers. This not only alleviates the credit constraints of smallholder farmers, reduces the operational risks of farmers, but also ensures the capital recovery of the service supply entity, achieving dual organization of the supply and demand sides. Based on this, this paper proposes the first research hypothesis.

H1: Village collectives and grassroots supply and marketing cooperatives cooperating to provide credit guarantees for farmers can directly promote smallholder farmers’ participation in organized acquisition of agricultural production outsourcing.

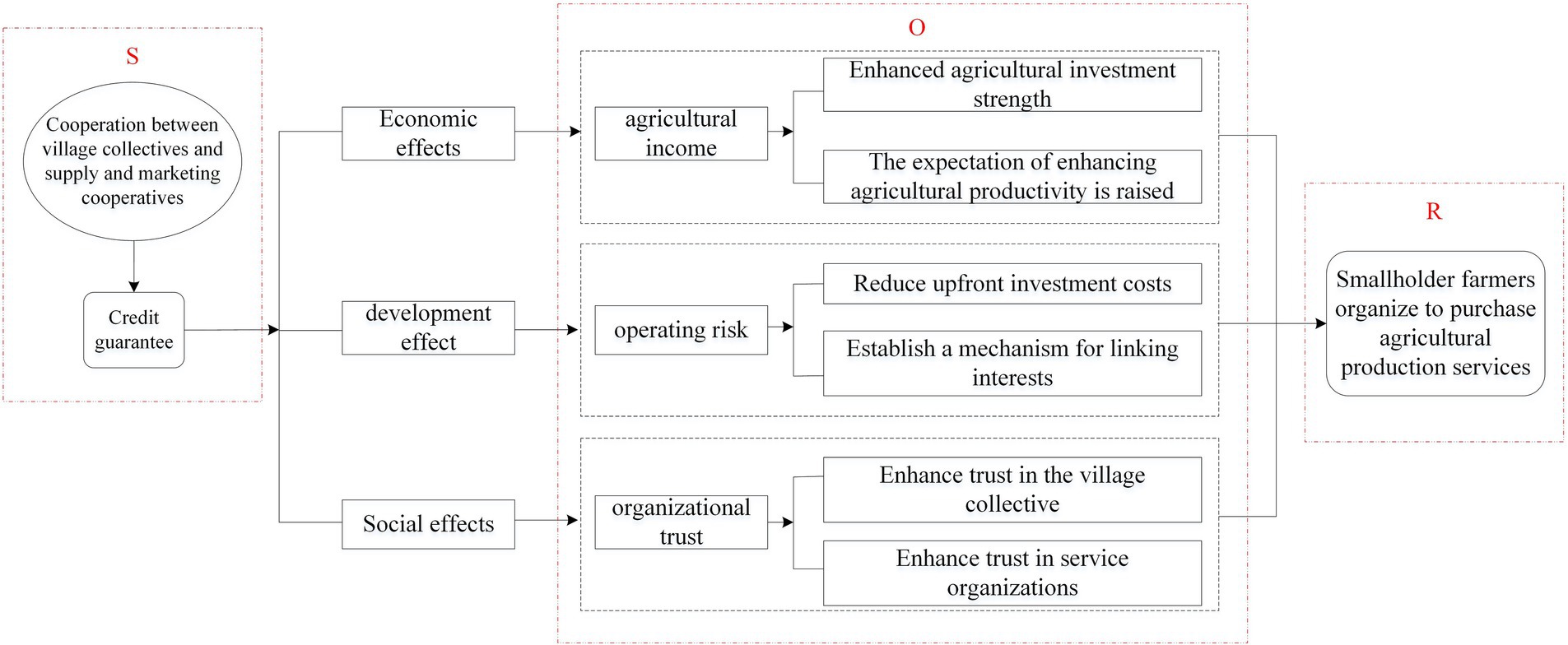

The S-O-R theory consists of Stimulus factors (S), Organism changes (O), and Response (R), and is used to explain how individuals react behaviorally to certain characteristics of their external environment based on their own cognition and emotions (Jiang et al., 2010). In traditional acquaintance social environments, smallholder farmers prefer to seek service providers within their own social networks. Village collective economic organizations and grassroots supply and marketing cooperatives, in order to consolidate the market, lock in the service cooperation relationship between smallholder farmers and grassroots supply and marketing cooperatives by providing agricultural credit guarantee services. Under the influence of this external stimulus (S), smallholder farmers and village collectives and grassroots supply and marketing cooperatives have reached a cooperative economic form (O), changing the previous decentralized purchasing behavior of smallholder farmers for agricultural production outsourcing services, thereby promoting the organized participation of smallholder farmers in agricultural production outsourcing (R). Agricultural income, operational risk, and organizational trust are important factors in explaining the decision-making behavior of smallholder farmers’ organized participation in agricultural production outsourcing. Based on existing research, this article analyzes the role of credit guarantees in smallholder farmers’ organized participation in agricultural production outsourcing from the perspectives of economic, developmental, and social effects.

From an economic effect perspective, credit guarantees may promote smallholder farmers’ organized participation in agricultural production outsourcing by increasing agricultural income. On one hand, credit guarantees can lead to a certain degree of growth in agricultural income, which enhances smallholder farmers’ ability to reallocate agricultural inputs to increase income. The provision of credit guarantees meets the borrowing needs of smallholder farmers for agricultural production investments, which is beneficial for improving their income levels and living conditions (Ozdemir, 2024). This means that the strength of smallholder farmers’ investment in agricultural production increases, thereby participating in the organized participation in agricultural production outsourcing. On the other hand, as agricultural income increases, smallholder farmers’ expectations for improving agricultural productivity also grow. The credit guarantees provided by village collectives and grassroots supply and marketing cooperatives increase agricultural income, and the increased confidence in agricultural production encourages smallholder farmers to raise their expectations for improving agricultural productivity. Agricultural production outsourcing can provide advanced agricultural technical guidance and mechanized production, which helps to improve agricultural production conditions and increase agricultural productivity (Wang and Huan, 2023), thereby attracting smallholder farmers to participate in the organized participation in agricultural production outsourcing. Based on this, this article proposes the second research hypothesis.

H2: Credit guarantees promote smallholder farmers’ organized participation in agricultural production outsourcing by increasing agricultural income.

From the perspective of development effects, credit guarantees may promote smallholder farmers’ organized participation in agricultural production outsourcing by reducing operational risks. On one hand, providing credit guarantees to smallholder farmers can reduce their initial investment costs for agricultural production, which is another form of increasing liquid assets, and can enhance their ability to cope with natural and market risks. With the continuous rise in the cost of agricultural inputs, the demand for agricultural funds among smallholder farmers is growing daily. However, due to the high risks involved in agricultural production and operation, and the lack of effective collateral, the borrowing needs of smallholder farmers cannot be effectively met (Rabbany et al., 2022). The credit guarantees provided through cooperation between village collectives and grassroots supply and marketing cooperatives expand the sources of funding for smallholder farmers, reducing their agricultural operational risks. With relatively more abundant funds, smallholder farmers’ participation in organized agricultural production outsourcing becomes more pronounced. On the other hand, the cooperation between village collectives and grassroots supply and marketing cooperatives in providing credit guarantees also offers a layer of security for smallholder farmers to fulfill their obligations under agricultural production outsourcing contracts. Providing credit guarantees to smallholder farmers means that the village collective, grassroots supply and marketing cooperatives, and smallholder farmers have established a linkage mechanism of “risk sharing and benefit sharing” (He and Xu, 2023). Smallholder farmers are only able to repay the loans for agricultural inputs after they have harvested their crops. Therefore, service entities such as grassroots supply and marketing cooperatives must provide agricultural production services on time to ensure the recovery of the loans. This approach further reduces the risk of default by service entities, thereby promoting smallholder farmers’ participation in organized agricultural production outsourcing. Based on this, this paper proposes the third research hypothesis.

H3: Credit guarantees promote smallholder farmers’ organized participation in agricultural production outsourcing by reducing operational risks.

From the perspective of social effects, credit guarantees may promote smallholder farmers’ organized participation in agricultural production outsourcing by enhancing organizational trust. On one hand, providing credit guarantees to smallholder farmers demonstrates the village collective’s confidence and ability to serve them, which can increase smallholder farmers’ organizational trust in the village collective, bringing prestige to the collective. In agricultural production practice, the behavior of village officials avoiding risks and shirking responsibilities, as well as collusion with service organizations to infringe upon the interests of smallholder farmers, has greatly damaged the farmers’ trust in the village collective (Mbeche and Dorward, 2014). However, the cooperation between the village collective and grassroots supply and marketing cooperatives to provide credit guarantees for smallholder farmers has allowed them to gain tangible benefits, leading to a deeper and more intuitive understanding of the village collective, which in turn strengthens organizational trust in the collective, thus actively responding to the collective’s call and participating in organized agricultural production outsourcing. On the other hand, credit guarantees have strengthened the interest connection between smallholder farmers and grassroots supply and marketing cooperatives and other service organizations, increasing smallholder farmers’ trust in the quality of services provided by these organizations. Agricultural production outsourcing involves multiple processes, long cycles, and requires phased acceptance, which necessitates a significant investment of human, material, and financial resources for the supervision of service organization quality. The principal-agent theory suggests that service organizations, as agents, may infringe upon the interests of farmers, as principals, and the quality of services cannot be guaranteed, potentially leading to irresponsible phenomena such as service organizations “running away with unfinished work,” continuously reducing smallholder farmers’ trust in service organizations (Wu et al., 2021). However, the cooperation between grassroots supply and marketing cooperatives and village collectives to provide credit guarantees for smallholder farmers links agricultural production quality to the service organizations’ benefits, ensuring that service organizations complete their work on time and in the required quantity. Consequently, smallholder farmers’ organizational trust in the service entities also increases, motivating them to participate in organized agricultural production outsourcing. Based on this, this paper proposes the fourth research hypothesis (Figure 1).

Figure 1. The role of credit guarantee in influencing smallholder farmers’ organized participation in agricultural production outsourcing.

H4: Credit guarantees promote smallholder farmers’ organized participation in agricultural production outsourcing by enhancing organizational trust.

The data used in this study comes from field research conducted by the research group in July 2023 in the Guanzhong area of Shaanxi Province, including Xi’an Yanliang, Xianyang Yangling, and Wugong, as well as Lintai and Dali in Weinan. This paper focuses on the Guanzhong area of Shaanxi Province for the following three reasons: First, as an important economic and industrial belt and densely populated area of human activities in Shaanxi, the Guanzhong region plays a significant role in the province’s main agricultural production base and as a major commodity grain base in the country, ensuring food security and supplying high-quality specialty agricultural products, thus possessing significant regional representation. Second, as of 2024, the number of agricultural socialization service organizations in the Guanzhong area of Shaanxi Province is approximately 35,000. The research area has developed a certain scale of agricultural production outsourcing service market, facilitating the identification and evaluation of the development effects of agricultural production outsourcing. In particular, Lintai District and Dali County are both major grain-producing counties at the central level and the pilot areas for agricultural production outsourcing in the province. The promotion of agricultural production outsourcing can address the issue of rural labor force loss and achieve large-scale operations. Third, the Guanzhong Plain is the main grain-producing area of Shaanxi Province, where the grain purchasing and selling industry is thriving and there is a strong demand for funds. Loan guarantees are a major issue faced by farmers when applying for loans. To meet the financial needs of various agricultural service entities throughout the entire chain of grain purchase, storage, processing, circulation, and related fields such as agricultural machinery and tools, and socialized services, local financial service institutions and organizations have explored new approaches to financial support for the grain purchase and sale industry. Combining the feasibility of the survey, the research group selected 2 to 4 towns with different levels of grain production and economic development in each of the 5 sample counties and districts, adopting a stratified random sampling method. In the selected towns, 2 to 4 administrative villages were randomly selected, and then 10 to 30 smallholder farmers were randomly selected in each administrative village based on the village population and land trusteeship situation. The survey method involved one-on-one interviews with the village head (or accountant), the first secretary, the cooperative president, and ordinary smallholder farmers in the villages by students, mainly to understand the basic characteristics of the village, basic information of smallholder families, external incentives from the government and market, smallholder farmers’ risk perception, willingness, and behavior level regarding organized participation in agricultural production outsourcing. A total of 700 questionnaires were distributed, and 680 were ultimately collected. After excluding invalid samples with missing key information and contradictions, 648 valid questionnaires were obtained, with an effective rate of 96.73%.

This article employs the Propensity Score Matching (PSM) method to explore the impact of credit guarantee on smallholder farmers’ participation in agricultural production outsourcing. To obtain a treatment variable that is approximately randomly assigned, a counterfactual control group similar to the treatment group is constructed, making the farmers’ acquisition of credit guarantee behavior approximately random. The choice of this method is based on three considerations: First, although the cooperation between village collectives and grassroots supply and marketing cooperatives to provide credit guarantees is an objective situation, the behavior of smallholder farmers choosing to apply for credit guarantees is spontaneous and voluntarily decided by the farmers, leading to a sample self-selection problem. Second, due to the different endowments of smallholder farmers, there is a selective bias in the impact of credit guarantees on their participation in organized agricultural production outsourcing, and this method can assume scenarios before and after smallholder farmers obtain credit guarantees to test whether the participation behavior without credit guarantees is consistent with that after obtaining credit guarantees. Lastly, since in empirical economics it is impossible to obtain data on smallholder farmers who have obtained credit guarantees under the condition of not having credit guarantees, directly comparing data differences would result in endogeneity. PSM is a common method for dealing with sample self-selection problems. It can select or construct a smallholder farmer who has not obtained credit guarantees for each smallholder farmer who has obtained credit guarantees, making the two smallholder farmers similar in all other characteristics except for the behavior of participating in organized agricultural production outsourcing. Therefore, the difference in the outcome variables of the two different experiments for the same smallholder farmer can be obtained, and the difference in the outcome variables is the net effect of obtaining credit guarantees. However, there may be endogeneity issues due to omitted explanatory variables and reverse causality in the baseline regression. To address this, this article selects the degree of understanding of credit guarantees by smallholder farmers as an instrumental variable. The degree of understanding of credit guarantees by smallholder farmers affects their willingness to apply for credit guarantees, but whether they understand credit guarantees does not directly affect their participation in organized agricultural production outsourcing, making this instrumental variable reasonably justified.

This article will match the treatment group (farmers who obtained credit guarantees) with the control group (farmers who did not obtain credit guarantees) to explore the impact of obtaining credit guarantees on smallholder farmers’ participation in agricultural production outsourcing under the condition that external conditions are the same, and the analysis steps are as follows.

First, this article constructs a Logit model to estimate the conditional probability fitting value of small farmers obtaining credit guarantees, and the expression for the propensity score value is as follows:

In Equation 1, represents the propensity score value, A denotes the behavior of obtaining credit guarantees, where when , it indicates that smallholder farmers have obtained credit guarantees provided by village collectives and grassroots cooperatives, and when , it indicates that smallholder farmers have not obtained credit guarantees provided by village collectives and grassroots cooperatives. represents a series of observable control variables.

Secondly, match the treatment group with the control group. To verify the robustness of the model matching results, this paper selects four matching methods: K-nearest neighbor matching (K = 4), caliper K-nearest neighbor matching, kernel matching, and local linear matching, and conducts common support domain tests and balance tests. The common support domain is to determine whether there is local overlap between the treatment group and the control group in the range of propensity score intervals; the balance test is to compare whether there are significant differences between the treatment group and the control group on explanatory variables to assess the quality of matching.

Finally, calculate the average treatment effect on the treated (ATT) for smallholder farmers to obtain credit guarantees. By measuring the difference between the actual outcome and the counterfactual outcome for smallholder farmers under the condition of obtaining credit guarantees, the difference between the treatment group and the control group participating in organized participation in agricultural production outsourcing is obtained, which reflects the impact of obtaining credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing. The expression of ATT is shown as follows:

In Equation 2, ATT represents the average treatment effect of smallholder farmers obtaining credit guarantees, is the organizational participation in agricultural production outsourcing behavior of the treatment group that obtained credit guarantees, is the organizational participation in agricultural production outsourcing behavior of the control group that did not obtain credit guarantees, represents the average treatment effect of the observable credit guarantee-obtaining smallholder farmers, while represents the counterfactual outcome that cannot be directly observed. This paper constructs corresponding alternative indicators through the Propensity Score Matching method.

(1) The dependent variable. The organizational participation of smallholder farmers in agricultural production outsourcing is the dependent variable of this paper. The cooperation between village collectives and grassroots supply and marketing cooperatives in providing agricultural services is an important model that promotes the organizational participation of smallholder farmers in agricultural production outsourcing, and it is also the research topic of this paper. Therefore, this paper assigns the value of 1 to smallholder farmers who participate in agricultural production outsourcing through organizational purchasing of agricultural production outsourcing provided by village collectives and grassroots supply and marketing cooperatives, and assigns the value of 0 to those who participate through decentralized means.

(2) The core explanatory variable. The core explanatory variable of this paper is the access of smallholder farmers to credit guarantees provided by village collectives and grassroots supply and marketing cooperatives. If farmers have obtained credit guarantees such as deferred payment for agricultural materials or loans provided by cooperation between village collectives and grassroots supply and marketing cooperatives, they are assigned the value of 1, otherwise, they are assigned the value of 0. This paper surveyed a total of 648 smallholder farmers, of which 221 obtained credit guarantees, accounting for 34.18%, and 427 did not obtain credit guarantees, accounting for 65.90%.

(3) Control variables. This paper comprehensively considers the influence of internal characteristics and external environment, and selects control variables with the orientation of matching effects. In order to analyze the incentives for smallholder farmers to obtain credit guarantees, and to further measure the impact of credit guarantees on the organizational participation of smallholder farmers in agricultural production outsourcing, in combination with existing research, this paper ultimately selects household head characteristics (gender, age, education level), household characteristics (number of laborers, land size, number of plots, social capital), village characteristics (farmland infrastructure, village collective publicity), and market characteristics (market service prices and quality) as control variables.

(4) Instrumental variable. Obtaining credit guarantees is the result of smallholder farmers’ autonomous choice, which has a certain degree of endogeneity. Therefore, this paper adopts “the extent of understanding of credit guarantees” as an instrumental variable to address the endogeneity issue, measured through a Likert five-point scale, with the specific measurement question in the survey being “How well do you understand credit guarantees?”

(5) Mechanism variable. According to the analysis above, obtaining credit guarantees may promote smallholder farmers’ organized participation in agricultural production outsourcing through three pathways: increasing agricultural income, reducing operational risks, and enhancing social trust. For the economic effect factors, this paper uses the smallholder’s “annual household agricultural income” to measure; for the development effect factors, this paper uses the smallholder’s “ability to cope with operational risks,” with the specific measurement question in the survey being “How is your ability to cope with potential natural and market risks during the operation process?” For the social effect factors, this paper uses the smallholder’s “trust in service entities.” All the above variables are measured using a Likert five-point scale, with the specific measurement question in the survey being “How much do you trust the outsourcing service organization?”

This article uses Stata 15.1 software to analyze the mean differences between the experimental and control groups of farmers on various indicators through independent sample t-tests. The results are shown in Table 1. Specifically, smallholder organizations that received credit guarantees had a higher participation in agricultural production outsourcing by 0.8 compared to those that did not, and this result is statistically significant at the 1% level. In terms of matching variables, smallholders who received credit guarantees showed significant differences from those who did not in terms of household head age, number of laborers, frequency of communication of agricultural knowledge with villagers, agricultural infrastructure, village collective promotion, market service prices, and land size. Smallholders who received credit guarantees tended to be older, have more laborers, communicate agricultural knowledge with villagers more frequently, have better agricultural infrastructure, have more proactive village collective promotion, and perceive higher market prices for decentralized agricultural services, while smallholders who did not receive credit guarantees had larger land sizes compared to those who did. There were no significant differences between the treatment and control groups in terms of household head gender, education level, number of plots, total expenditure on social interactions, and the quality of services for decentralized agricultural services.

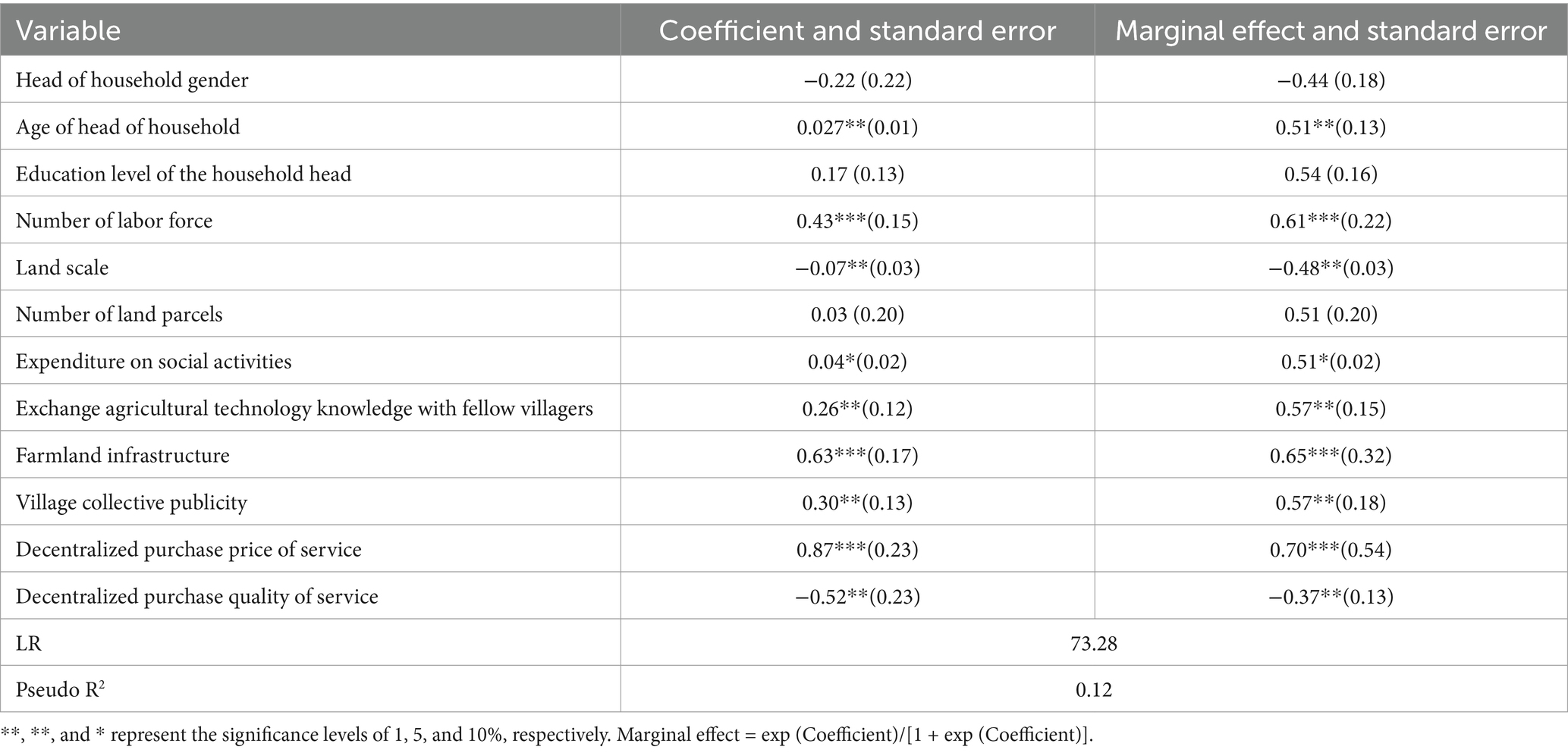

The estimated results of the conditional probability fitting values for smallholder farmers to obtain credit guarantees based on the Logit model are shown in Table 2, from which the influencing factors of smallholder farmers obtaining credit guarantees can be analyzed. According to the Pearson test for the correlation between independent variables, it can be determined that there is no multicollinearity among the variables.

Table 2. The estimation results of the equation for the antecedent factors of smallholder farmers’ organized participation in agricultural production outsourcing, namely obtaining credit guarantees.

As can be seen from Table 2, the results are consistent with those of Li et al. (2022) and Men et al. (2024). Differentiated characteristics of household heads, family characteristics, village characteristics, and market characteristics are factors influencing whether smallholder farmers obtain credit guarantees. The age of the household head, the number of laborers, expenditures on social interactions, communication of agricultural knowledge with fellow villagers, agricultural infrastructure, village collective promotion, and the price of decentralized purchasing services have a significantly positive impact on smallholder farmers’ access to credit guarantees. Notably, first of all, land size and the quality of decentralized purchasing services have a significantly negative impact. That is, for every unit increase in the size of land and the quality of decentralized purchase services, the probability of farmers obtaining credit guarantees decreases by an average of 48 and 37%, respectively. A possible explanation is that agricultural machinery is more convenient for larger-scale land operations, hence larger landholding farmers can obtain cheaper prices for decentralized purchasing services. The motivation to apply for credit guarantees through village collectives and supply and marketing cooperatives to obtain organized agricultural production outsourcing is therefore lower. The more satisfied farmers are with the service quality of decentralized participation in agricultural production outsourcing, the lower their demand for organized participation in agricultural production outsourcing to reduce the risk of default and ensure the production, Considering the implicit additional conditions of credit guarantees provided by village collectives and supply and marketing cooperatives, which include participating in organized agricultural production outsourcing, and since farmers generally prefer independent operations, this reduces the probability of obtaining credit guarantees. Secondly, agricultural infrastructure and the price of decentralized purchasing services have a significantly positive impact on smallholder farmers’ access to credit guarantees, That is, The probability of farmers obtaining credit guarantees increases by an average of 65 and 70%, respectively, when the prices of farmland infrastructure and decentralized purchase services increase by one unit, proving that the more perfect the farmland infrastructure such as road irrigation facilities is, the price of outsourced services purchased by farmers in decentralized form is higher than that in organized form, the more inclined small farmers are to obtain credit guarantees provided by village collectives and cooperatives. Finally, the education level of the head of household has no significant impact on Farmers’ access to credit guarantee. The possible explanation is that farmers’ access to credit guarantee mainly depends on village collectives and grass-roots supply and marketing cooperatives. The factors that affect farmers’ access to credit guarantee are more the advantages of farmers’ family conditions and organization than decentralized access to outsourced services. Therefore, the education level of farmers plays a relatively small role in it.

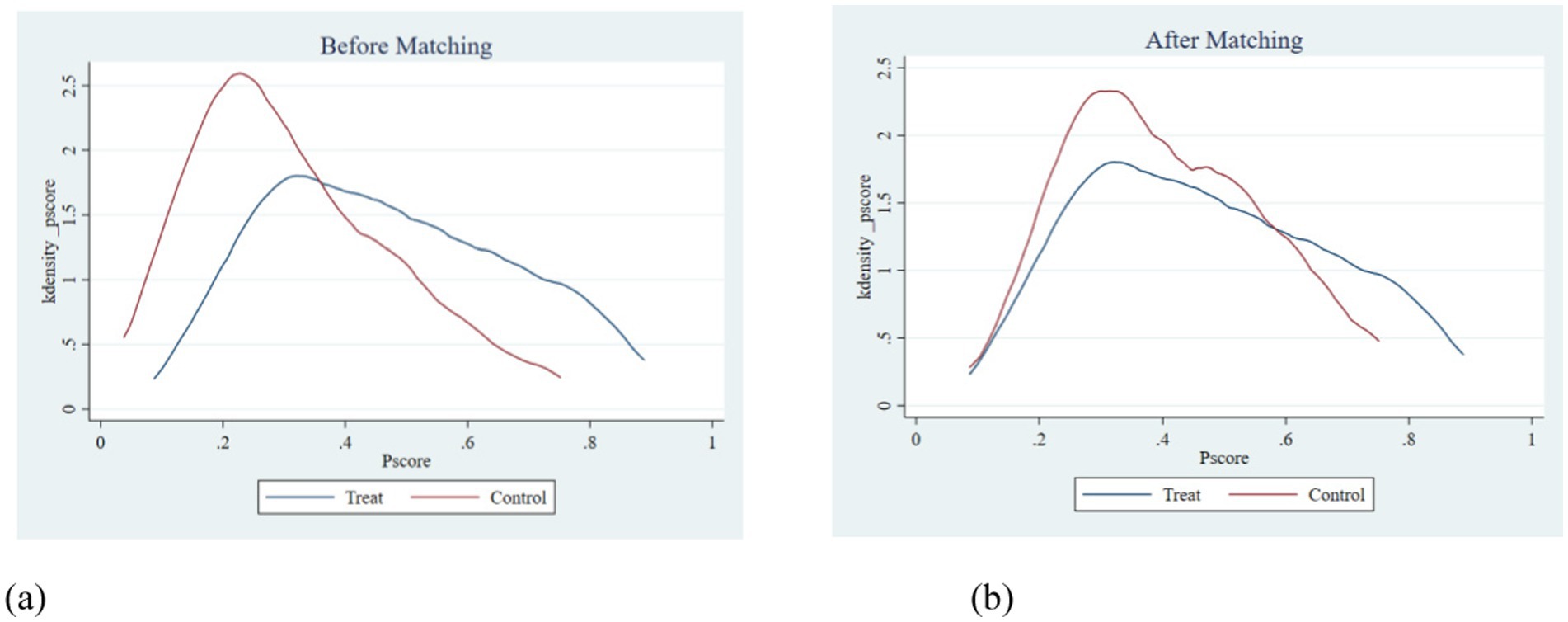

To ensure the quality of matching for sample farmers, after obtaining the propensity scores for smallholder farmers to access credit guarantees, this paper discusses the common support domain of matching by plotting the kernel density function graph to analyze the quality of matching. Figure 2 shows the kernel density curve of the propensity scores for smallholder farmers after matching. The overlapping interval of the propensity scores for farmers who have obtained credit guarantees and those who have not is referred to as the common support domain. The larger the range of the common support domain, the smaller the possibility of sample loss during the matching process. As can be seen from Figure 2, after matching, the propensity score intervals for farmers who have obtained credit guarantees and those who have not overlap over a large range, indicating a good degree of matching for the sample farmers. In addition, this paper uses four different matching methods: K-nearest neighbor matching, caliper K-nearest neighbor matching, kernel matching, and local linear matching, to obtain the maximum loss results for the sample. The maximum cumulative loss sample number for the treatment group and the control group after matching is 32, indicating a small number of sample losses, thus ensuring the validity of the sample estimation.

Figure 2. Comparison of kernel density curves before and after propensity score matching for obtaining credit guarantees. (A) Common support domain before matching. (B) Common support domain after matching.

The main purpose of propensity score estimation is to balance the distribution of explanatory variables between the treatment and control groups of farmers, while the common support domain test can only judge the quality of matching and cannot accurately measure the probability of small farmers obtaining credit guarantees. Therefore, after matching the farmer samples, this article further examines the significance of the differences in explanatory variables between the treatment and control groups. The results of the balance test are shown in Table 3. The results indicate that after propensity score matching, the standard deviation of explanatory variables has significantly decreased, and there is no significant difference between the explanatory variables of the treatment and control groups of farmers after matching. At the same time, the pseudo R2 value decreased from 0.121 before matching to 0.002 ~ 0.006 after matching, and the LR statistic decreased from 73.51 before matching to 0.69 ~ 2.24 after matching. According to the joint significance test, there has been a significant change in the significance level of the explanatory variables. In addition, the mean deviation and median deviation of the explanatory variables have significantly decreased, from 19.5 and 16.5% before matching to 2.4% ~ 3.5 and 2.0% ~ 4.3% after matching, and the total bias has been greatly reduced. It can be seen that PSM significantly reduces the differences in explanatory variables between the treatment and control groups, and after matching, the other characteristics of farmers who obtained credit guarantees are basically the same as those who did not obtain credit guarantees.

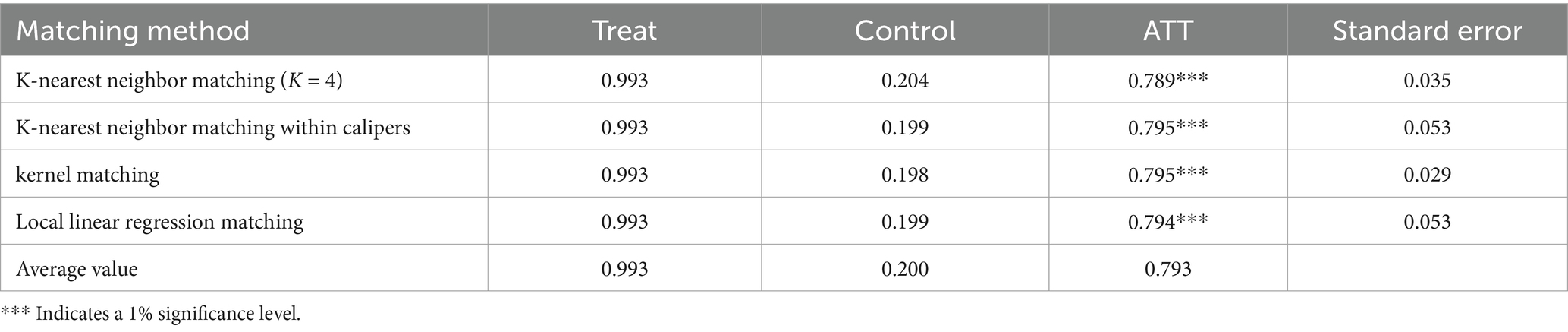

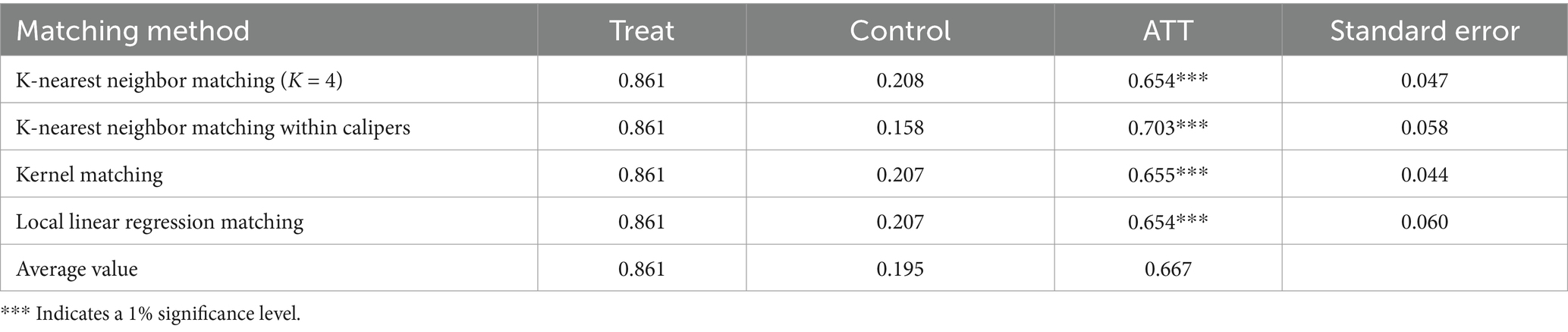

The impact of credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing is shown in Table 4. The matching results from the four matching methods adopted in this paper are very similar, and the ATT values are significant at the 1% statistical level, indicating that the matching results are robust. Similar to the impact of credit access on farmers’ agricultural production proven by Nguyen et al. (2023), this paper confirms that credit guarantees can effectively promote smallholder farmers’ organized participation in agricultural production outsourcing, with differentiated outcomes. If farmers do not obtain credit guarantees, their organized participation in agricultural production outsourcing is 0.2, but if farmers obtain credit guarantees, their organized participation increases to 0.993. The empirical results confirm the promoting effect of credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing, and hypothesis H1 is established. Theoretically, the cooperation between village collectives and grassroots supply and marketing cooperatives to provide credit guarantees for smallholder farmers not only helps to alleviate the credit constraints of smallholder farmers but also benefits the capital recovery of service providers. This approach locks in the cooperative relationship between service providers and farmers, effectively promoting the behavior of smallholder farmers’ organized participation in agricultural production outsourcing.

Table 4. The average treatment effect of obtaining credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing.

Although the PSM method can effectively avoid the selection bias problem caused by sample self-selection, it cannot overcome the endogeneity problem caused by omitted variables or bidirectional causality, which may lead to an overestimation of the benchmark regression results. Therefore, this paper adopts the instrumental variable method for analysis, and the estimation results are shown in Table 5. The first-stage instrumental variable for understanding the level of credit guarantee and the second-stage obtaining credit guarantee are both significant at the 1% statistical level. This indicates that the instrumental variable meets the relevance principle and that after addressing the endogeneity problem, obtaining credit guarantee still has a significant positive impact on smallholder farmers’ organized participation in agricultural production outsourcing. In addition, the F-statistic is 18.19, significant at the 1% statistical level, and the Wald test statistic is 230.82, greater than the critical value of 16.38 at the 10% level for the weak instrument variable test, indicating that the understanding level of credit guarantee selected as the instrumental variable in this paper has a certain degree of reliability.

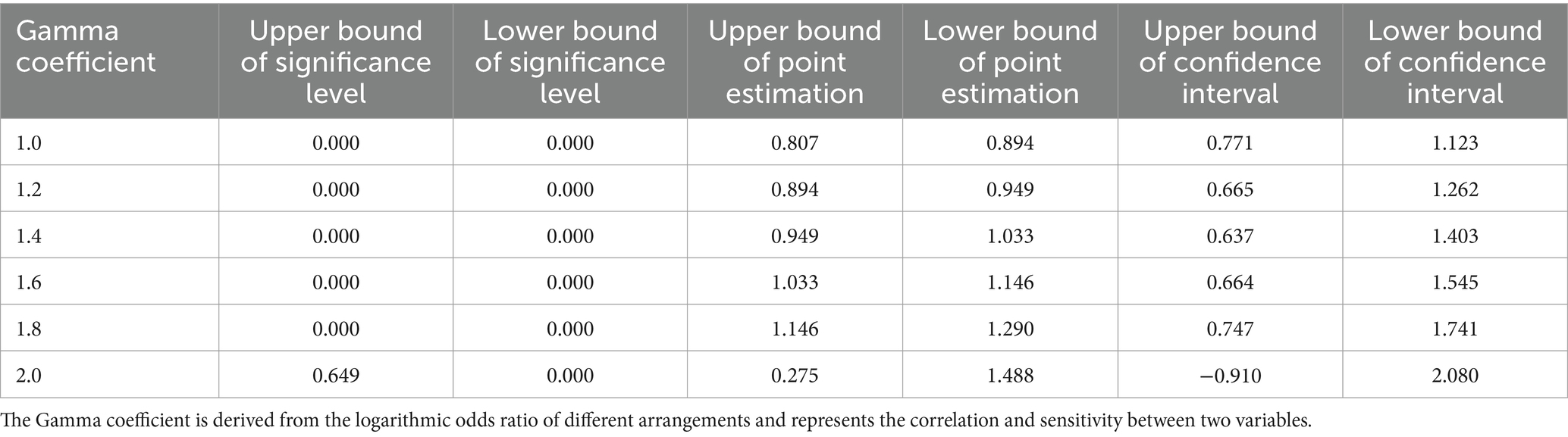

(1) Sensitivity analysis. The results of the sensitivity analysis for ATT are shown in Table 6. The Gamma coefficient is used to examine whether there are any unobserved factors that could affect the access to credit guarantees for smallholder farmers. If the Gamma coefficient, which represents the influence of neglected unobservable factors, is not significant when close to 1, it indicates that there is hidden bias in the model, and the PSM estimation results are not robust; if the Gamma coefficient has a larger value (usually close to 2), and the sensitivity analysis results are not significant, then the possibility of omitted variable selection bias in the model is small, and the PSM estimation results are more reliable (Rosenbaum and Rubin, 2023). From Table 6, it can be seen that the Gamma coefficient increases to 2.0 before the results become insignificant at the 10% level. Although unobservable factors may exist in the model, the analysis results suggest that the treatment effect is not sensitive to these potential factors, meaning that other factors are unlikely to cause significant bias in the PSM estimation results.

(2) Placebo test. Although the PSM baseline regression results passed the sensitivity analysis, they cannot rule out the randomness of the results and the potential impact of other unobservable factors. Based on this, referring to the study in Cai et al. (2016), this article uses the placebo test to randomly perform 500 repeated experiments, and determines the probability of the estimated coefficient of the impact of credit guarantees on the organizational participation of smallholder farmers in agricultural production outsourcing based on the false experimental group, thereby judging the reliability of the research results. The results of the placebo test are shown in Figure 3, and the estimated coefficients are distributed around 0, indicating that the model setting is reliable, thus proving that the previous results are relatively robust.

(3) Replace the core explanatory variable. This paper employs various matching methods to demonstrate the consistency of the conclusions, but there may be selection bias in farmers’ access to credit guarantee cooperatives, such as whether the village collective actively coordinates with service providers to offer credit guarantees. Unobservable variables may affect the research results. Therefore, to avoid the limitations of using the indicator of whether credit guarantees are obtained, the method of replacing the core explanatory variable is further adopted. Specifically, this paper uses the indicator of “whether the village collective cooperates with the supply and marketing cooperative to provide credit guarantees” to characterize whether farmers have priority access to credit guarantees, and the estimation results of replacing the core explanatory variable are detailed in Table 7. The results indicate that after replacing the core explanatory variable, the estimation results are consistent with the previous findings, suggesting that the research results of this paper are robust.

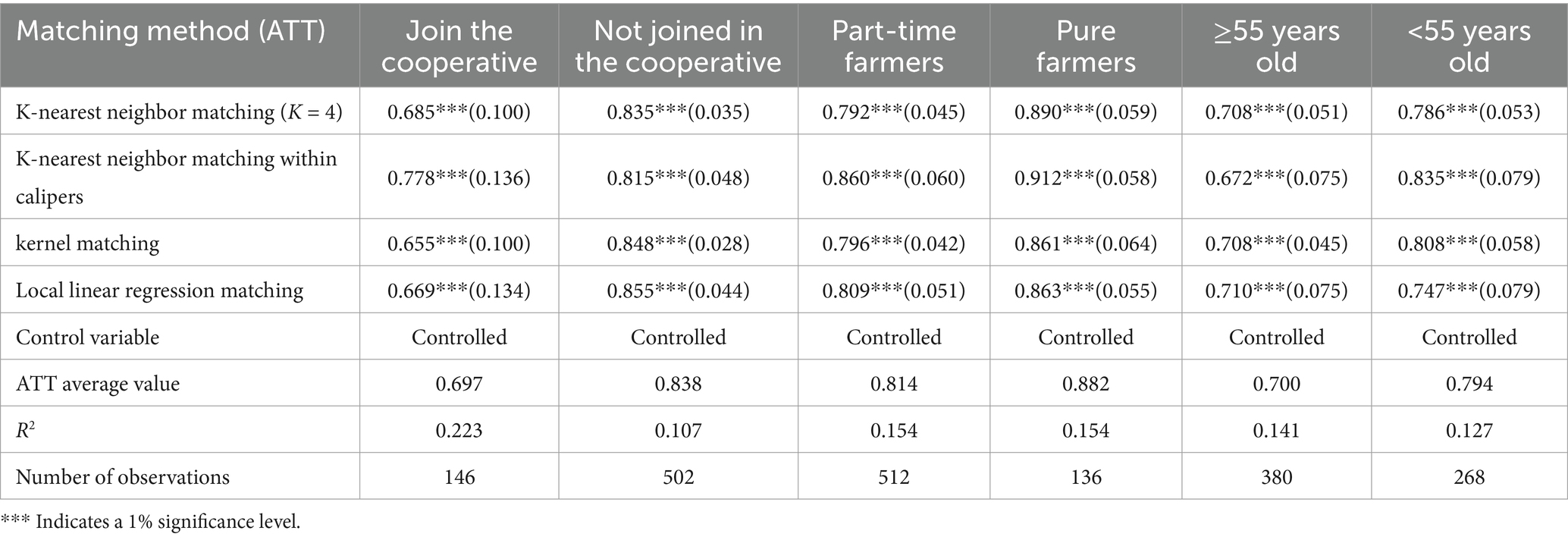

(4) Analyze by grouping individual characteristics. Due to the significant differences in resource endowments among farmers with different individual characteristics, their behavioral decisions will also vary. In terms of organized participation in agricultural production outsourcing, farmers who join cooperatives, those with multiple occupations, and elderly farmers may differ from those who do not join cooperatives, pure farmers, and middle-aged and young farmers in terms of agricultural resources and energy, potentially leading to different outcomes. Therefore, this article groups smallholder samples according to whether they join cooperatives, whether they have multiple occupations, and whether they are elderly (≥55 years old) to analyze the average treatment effect of credit guarantees on smallholders’ organized participation in agricultural production outsourcing. As can be seen from the calculation results in Table 8, after adopting four matching methods, the results obtained for different types of farmers are still very similar, and the ATT values are significant at the 1% statistical level, the same as the baseline regression results. This indicates that the research findings of this article are robust.

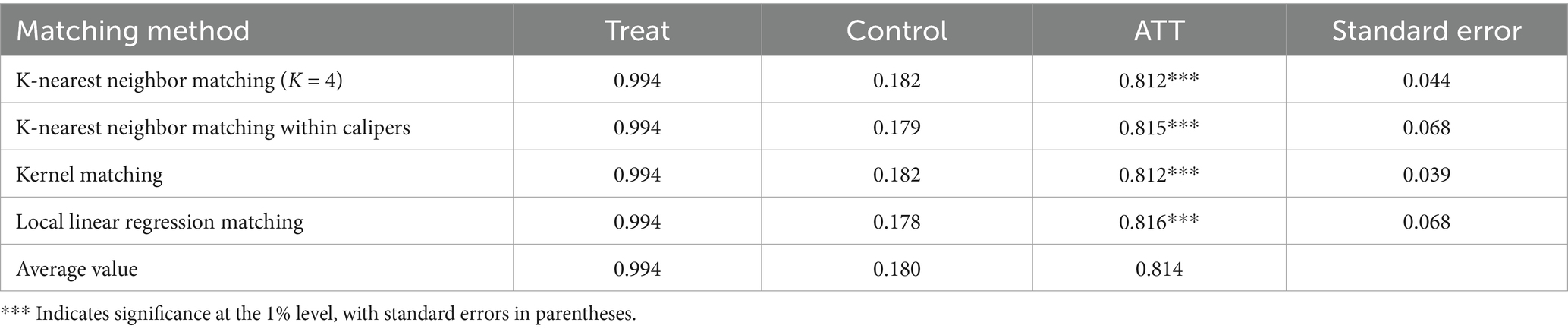

(5) Replace the empirical model analysis. To explore the robustness of empirical results, this paper uses the probit model to estimate the conditional probability fitting value and further estimate the average treatment effect. As shown in Table 9, under the counterfactual hypothesis, the average treatment effect of obtaining credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing is 0.814, significant at the 1% statistical level, which is basically consistent with the treatment results mentioned earlier. This proves that the effect of credit guarantees on enhancing smallholder farmers’ organized participation in agricultural production outsourcing is significant and robust.

Table 6. Sensitivity analysis of the impact of obtaining credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing.

Table 7. Average treatment effect of obtaining credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing (replacement of core explanatory variables).

Table 8. Estimated results of the impact of obtaining credit guarantees on the organized participation of different types of smallholder farmers in agricultural production outsourcing.

Table 9. Average treatment effect of obtaining credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing (Probit Model).

The aforementioned studies indicate that credit guarantees significantly promote smallholder farmers’ organized participation in agricultural production outsourcing. However, which factors change after obtaining credit guarantees stimulate farmers’ organized participation in agricultural production outsourcing? How much do these factors contribute to the increase in farmers’ organized participation in agricultural production outsourcing? These questions have not been clearly addressed yet. To verify the impact mechanism more intuitively and accurately, this paper, referring to the decomposition equation (Xue et al., 2024) and regression adjustment method (Rubin, 1997) from existing studies, further analyzes and verifies the impact mechanism of credit guarantees on promoting smallholder farmers’ organized participation in agricultural production outsourcing.

This article constructs an analytical framework for the impact mechanism of credit guarantee on the organized participation of smallholder farmers in agricultural production outsourcing through three steps. First, this article calculates the difference-in-differences result between the treatment group and the control group for smallholder farmers’ organized participation in agricultural production outsourcing, denoted as . This result represents the net growth of smallholder farmers’ organized participation in agricultural production outsourcing after obtaining credit guarantees.

Second, this article calculates the difference-in-differences results for various driving factors, denoted as . These results are used to measure the changes in factors affecting smallholder farmers’ organized participation in agricultural production outsourcing due to obtaining credit guarantees. Since a sample in the treatment group and its matched control sample can be considered as the same farmer in two different experiments, from the perspective of the differences in driving factors, if neither the treatment group nor the control group is affected by obtaining credit guarantees, the difference in smallholder farmers’ organized participation in agricultural production outsourcing should be zero and statistically significant. However, for smallholder farmers affected by obtaining credit guarantees, the differences in driving factors for their organized participation in agricultural production outsourcing should not be zero and should be statistically significant.

Finally, to analyze the impact of each driving factor in on the net efficiency growth , this article establishes a regression equation of on , thereby calculating the contribution rate of each driving factor to smallholder farmers’ organized participation in agricultural production outsourcing. The following equation is constructed:

In Equation 3, represents the net growth of smallholder organizations participating in agricultural production outsourcing after obtaining credit guarantees, and is the parameter to be estimated, is the difference in agricultural income increase for smallholders after obtaining credit guarantees, is the difference in reducing operational risks, and is the difference in increasing organizational trust.

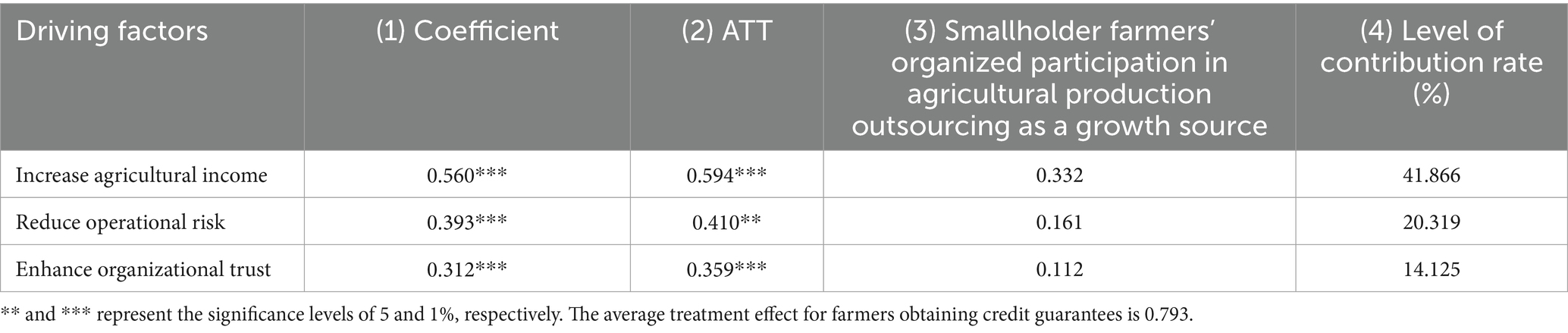

The decomposition results of the net growth of smallholder farmers’ organized participation in agricultural production outsourcing are shown in Table 10. (1) The column represents the driving factor coefficients of the weighted OLS estimation for Equation 3; (2) The column represents the average treatment effect on the treated (ATT) of the driving factors for smallholder farmers’ organized participation in agricultural production outsourcing calculated by the K-nearest neighbor matching method; (3) The column represents the source of net efficiency growth obtained by multiplying the ATT values of the driving factors for smallholder farmers’ organized participation in agricultural production outsourcing by the estimated coefficients of the driving factors; (4) The column represents the net efficiency contribution rate of the driving factors for smallholder farmers’ organized participation in agricultural production outsourcing to obtaining credit guarantees, that is, the ratio of (3) column to the average treatment effect of farmers obtaining credit guarantees. The ATT values of the driving factors for smallholder farmers’ organized participation in agricultural production outsourcing are significant at least at the 5% statistical level, indicating that the growth of smallholder farmers’ organized participation in agricultural production outsourcing brought about by obtaining credit guarantees is mainly achieved by increasing agricultural income, reducing operational risks, and improving organizational trust, thus verifying hypotheses H2, H3, and H4.

Table 10. Decomposition results of net growth in smallholder organizational participation in agricultural production outsourcing.

As can be seen from Table 10, firstly, the marginal effect of increasing agricultural income is 0.56, with the contribution rate to promoting smallholder farmers’ organized participation in agricultural production outsourcing reaching a maximum of 41.87%. This indicates that, as rational individuals, smallholder farmers’ transformation of agricultural production and operation methods largely depends on the incentive of agricultural income growth. Credit guarantees have brought about an increase in agricultural income, which not only strengthens farmers’ capacity to invest in agricultural production but also boosts their expectations to improve agricultural productivity. With the dual support of strength and expectations, their participation in organized agricultural production outsourcing becomes increasingly evident, confirming Hypothesis H2. Secondly, reducing operational risks contributes to promoting smallholder farmers’ organized participation in agricultural production outsourcing by 20.32%, indicating that credit guarantees on one hand reduce smallholder farmers’ initial investment costs and expand their sources of funding, and on the other hand facilitate the establishment of a benefit linkage mechanism between village collectives, grassroots supply and marketing cooperatives, and smallholder farmers. This effectively increases smallholder farmers’ ability to cope with natural and market risks, thereby attracting them to organize and participate in agricultural production outsourcing, confirming Hypothesis H3. Thirdly, enhancing organizational trust contributes to promoting smallholder farmers’ organized participation in agricultural production outsourcing by 14.13%, indicating that cooperation between village collectives and grassroots supply and marketing cooperatives in providing credit guarantees links the quality of agricultural production to the income of service organizations, allowing farmers to gain actual benefits and enhancing their trust in village collectives and grassroots supply and marketing cooperatives, thereby stimulating their organized participation in agricultural production outsourcing, confirming Hypothesis H4. From the perspectives of economic, developmental, and social effects, the economic effect has a greater contribution level to promoting smallholder farmers’ organized participation in agricultural production outsourcing than the developmental and social effects. A possible reason is that smallholder farmers are generally in a situation of scarce resource endowment and limited development levels, so compared to the incentive of direct income brought by the economic effect, the driving force of developmental and social effects is weaker, and the driving force of the economic effect is more conducive to smallholder farmers’ organized participation in agricultural production outsourcing.

This paper utilizes a sample of 648 farmer households from the Guanzhong area of Shaanxi Province, and based on Propensity Score Matching (PSM) to construct a counterfactual hypothesis, it estimates the average treatment effect of credit guarantees on smallholder farmers’ organized participation in agricultural production outsourcing using four matching methods: K-nearest neighbor matching, Caliper K-nearest neighbor matching, Kernel matching, and Local linear matching. It also decomposes the specific sources of how credit guarantees promote smallholder farmers’ organized participation in agricultural production outsourcing. The findings indicate that: Firstly, credit guarantees significantly promote smallholder farmers’ organized participation in agricultural production outsourcing. Secondly, differentiated characteristics of household heads, family characteristics, village characteristics, and market characteristics are important factors affecting smallholder farmers’ access to credit guarantees. Thirdly, the decomposition results of the mechanism through which credit guarantees affect smallholder farmers’ organized participation in agricultural production outsourcing show that the paths of credit guarantees’ role in promoting smallholder farmers’ organized participation in agricultural production outsourcing, in order of contribution rate, are increasing agricultural income, reducing agricultural business risks, and enhancing organizational trust. From the perspective of driving factors, economic effects are more effective than development and social effects in promoting smallholder farmers’ organized participation in agricultural production outsourcing. The Guanzhong area, as the main agricultural production base of Shaanxi Province and an important commercial grain base in China, is a typical representative of developing countries with smallholder agricultural conditions, and the research results have strong regional applicability.

Therefore, this article proposes the following policy implications: Firstly, further enhance the organizational level of smallholder farmers in accessing agricultural production outsourcing. In the process of developing smallholder farmer organization, the village collective, as the main body of the “unified and decentralized” management system, has the advantage of organizing and mobilizing within the village. It should play its role in overall coordination, such as integrated land management, providing farmland infrastructure for smallholder farmers, and activating village self-governance to achieve organization of smallholder farmers and further enhance the level of farmer organization. Secondly, strengthen the connection between service entities and village collectives. Having the village collective play the role of linking and coordinating between grassroots supply and marketing cooperatives and farmers is beneficial for reducing transaction costs and ensuring transaction completion rates. The organizational model of “smallholder farmers + village collective + grassroots supply and marketing cooperatives” provides comprehensive chain services for smallholder farmers, such as unified procurement of agricultural materials, shared agricultural machinery, unified technology, and scale sales, thereby continuously promoting the joint production and operation of smallholder farmers in breadth and depth. Thirdly, increase financial support for the supply of agricultural production outsourcing entities. Based on understanding the financial needs of rural industry revitalization and the credit cooperation practices of related service entities, summarize experiences and problems, accelerate the formulation of guiding opinions and related policies and measures, guide village collectives and grassroots supply and marketing cooperatives to provide diversified financial services for smallholder farmers, and at the same time, increase publicity efforts for credit guarantees provided by village collectives and grassroots supply and marketing cooperatives, enhance farmers’ awareness of credit guarantees, and promote the organizational connection between smallholder farmers and service entities, effectively leveraging the positive impact of individual, village, and market characteristics on farmers’ access to credit guarantees.

This study also has some limitations. Firstly, due to the constraints of data collection methods, the sample size is still relatively small and mainly comes from the Guanzhong area of Shaanxi, which may lead to certain sampling biases, meaning that the behavior patterns of smallholder farmer organization cannot be fully reflected across different regions; secondly, this is a cross-sectional survey study, and there has been no long-term tracking of the relationship changes between agricultural production outsourcing service organizations and smallholder farmer organization, so future research needs to combine longitudinal studies to further verify the statistical relationships between variables.

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

MQ: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Software, Validation, Writing – original draft, Writing – review & editing. JW: Funding acquisition, Investigation, Project administration, Supervision, Writing – review & editing. BW: Project administration, Resources, Supervision, Validation, Writing – review & editing.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by the National Natural Science Foundation of China (71873101).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2025.1496902/full#supplementary-material

Bagchi, N. S., Mishra, P., and Behera, B. B. (2022). Collectivization of smallholder farmers, strategic competition, and market performance: experiences from two selected villages of West Bengal, India. Agribusiness 38, 710–733. doi: 10.1002/agr.21742

Cai, X. Q., Lu, Y., Wu, M. Q., and Yu, L. H. (2016). Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J. Dev. Econ. 123, 73–85. doi: 10.1016/j.jdeveco.2016.08.003

Chen, F. F., Xu, Z. G., and Luo, Y. F. (2023). False prosperity: rethinking government support for farmers' cooperatives in China. Ann. Publicand Cooper. Econ. 94, 905–920. doi: 10.1111/apce.12420

Corsi, S., Marchisio, L. V., and Orsi, L. (2017). Connecting smallholder farmers to local markets: drivers of collective action, land tenure and food security in East Chad. Land Use Policy 68, 39–47. doi: 10.1016/j.landusepol.2017.07.025

Du, H. Y., Chen, J. H., and Li, Y. (2021). Agricultural production trusteeship organization and interest linkage mechanism to promote the organic connection between small farmers and modern agriculture. Rural Econ. 1, 31–38.

Gao, J. J., Gai, Q. G., Liu, B. B., and Shi, Q. H. (2021). Farm size and pesticide use: evidence from agricultural production in China. China Agric. Econ. Reg. 13, 912–929. doi: 10.1108/CAER-11-2020-0279

Han, X. P., and Jin, Y. (2014). Construction of rural financial credit guarantee system in China. Issues Agric. Econ. 3, 37–43.

He, H. L., and Xu, H. C. (2023). From "business cooperation", "co construction of two cooperatives" to "integration of two cooperatives" -- discussion on three modes of supply and marketing cooperatives promoting the development of village collective economy. Acad. Forum. 1, 27–36.

Hulke, C., and Diez, J. R. (2020). Building adaptive capacity to external risks through collective action - social learning mechanisms of smallholders in rural Vietnam. Int. J. Dis. Risk Reduction. 51:101829. doi: 10.1016/j.ijdrr.2020.101829

Jiang, Z. H., Chan, J., Tan, B. C. Y., and Chua, W. S. (2010). Effects of interactivity on website involvement and purchase intention. J. Assoc. Inf. Syst. 11, 34–59. doi: 10.17705/1jais.00218

Li, P., Song, X., and Li, J. Z. (2022). Research on farmers' households credit behavior and social capital acquisition. Front. Psychol. 13:961862. doi: 10.3389/fpsyg.2022.961862

Liu, L., Liu, C., and Wang, Y. H. (2024). Activating co-production of rural service delivery: examining the role of nonprofit organizations using a case study in China. Voluntas 35, 953–964. doi: 10.1007/s11266-024-00663-6

Luan, D. X., and Bauer, S. (2016). Does credit access affect household income homogeneously across different groups of credit recipients? Evidence from rural Vietnam. J. Rural. Stud. 47, 186–203. doi: 10.1016/j.jrurstud.2016.08.001

Mahmood, I., Qin, S. Z., Xia, C. P., Razzaq, A., and Bashir, A. (2024). Do E-credit and institutional support drive climate-smart, environmentally sustainable practices in Punjab’s agriculture? Pol. J. Environ. Stud. 33, 5805–5817. doi: 10.15244/pjoes/183640

Mbeche, R. M., and Dorward, P. (2014). Privatisation, empowerment and accountability: what are the policy implications for establishing effective farmer organisations? Land Use Policy 36, 285–295. doi: 10.1016/j.landusepol.2013.08.014

Men, P., Hok, L., Seeniang, P., Middendorf, B. J., and Dokmaithes, R. (2024). Identifying credit accessibility mechanisms for conservation agriculture farmers in Cambodia. Agriculture 14:947. doi: 10.3390/agriculture14060917

Nguyen, T. T., Nguyen, T. T., and Grote, U. (2023). Credit, shocks and production efficiency of rice farmers in Vietnam. Econ. Analysis Policy 77, 780–791. doi: 10.1016/j.eap.2022.12.018

Ofori, E., Sampson, G. S., and Vipham, J. (2019). The effects of agricultural cooperatives on smallholder livelihoods and agricultural performance in Cambodia. Nat. Res. Forum 43, 218–229. doi: 10.1111/1477-8947.12180

Ozdemir, D. (2024). Reconsidering agricultural credits and agricultural production nexus from a global perspective. Food Energy Security 13:1. doi: 10.1002/fes3.504

Qiu, T. W., Choy, S. T. B., and Luo, B. L. (2022). Is small beautiful? Links between agricultural mechanization services and the productivity of different-sized farms. Appl. Econ. 54, 430–442. doi: 10.1080/00036846.2021.1963411

Qiu, T. W., and Luo, B. L. (2021). Do small farms prefer agricultural mechanization services? Evidence from wheat production in China. Appl. Econ. 53, 2962–2973. doi: 10.1080/00036846.2020.1870656

Qiu, T. W., Shi, X. J., He, Q. Y., and Luo, B. L. (2021). The paradox of developing agricultural mechanization services in China: supporting or kicking out smallholder farmers? China Econ. Rev. 69:101680. doi: 10.1016/j.chieco.2021.101680

Rabbany, M. G., Mehmood, Y., Hoque, F., Sarker, T., Hossain, K. Z., Khan, A. A., et al. (2022). Do credit constraints affect the technical efficiency of Boro rice growers? Evidence from the district Pabna in Bangladesh. Environ. Sci. Pollut. Res. 29, 444–456. doi: 10.1007/s11356-021-15458-1

Rosenbaum, P. R., and Rubin, D. B. (2023). Propensity scores in the design of observational studies for causal effects. Biometrika 110, 1–13. doi: 10.1093/biomet/asac054

Rubin, D. B. (1997). Estimating causal effects from large data sets using propensity scores. Ann. Intern. Med. 127, 757–763. doi: 10.7326/0003-4819-127-8_Part_2-199710151-00064

Su, Z. H., He, H. L., and Xu, W. Z. (2021). The logical boundary, realistic misunderstanding and correlation path of rural collective economic organizations and farmers' professional cooperatives. Rural Econ. 8, 109–117.

Tan, Z. X., and Han, M. (2020). The effective path for farmers' professional cooperatives to carry out credit cooperation. Rural Fin. China 13, 37–39.

Twumasi, M. A., Jiang, Y. S., Ntiamoah, E. B., Akaba, S., Darfor, K. N., and Boateng, L. K. (2022). Access to credit and farmland abandonment nexus: the case of rural Ghana. Nat. Res. Forum 46, 3–20. doi: 10.1111/1477-8947.12233

Wan, J. Y. (2008). Quasi vertical integration, relationship governance and contract performance. Manag. World 12, 93–102.

Wang, Y. H., and Huan, M. L. (2023). The effects of socialized agricultural services on rural collective action in the irrigation commons: evidence from China. Agric. Water Manag. 289:108519. doi: 10.1016/j.agwat.2023.108519

Wu, S. C., Lu, X. J., and Huang, S. J. (2021). Why the agricultural production trusteeship project has achieved results -- based on the perspective of policy implementation. China Rural Surv. 5, 110–127.

Xiao, J., and Luo, B. L. (2024). How small farmers move towards agricultural organized management: evidence from migrant workers returning to farmers. J. Nanjing Agric. Univ. 24, 35–48.

Xue, Y. J., Xue, Y. J., and Zhang, Y. Y. (2024). Whether joining cooperatives can improve the green total factor productivity of family farms -- based on the survey data of 892 planting family farms in Jiangsu, Jiangxi and Shaanxi. China Rural Econ. 2, 67–89.

Yang, T. (2017). Comprehensive agricultural association: a breakthrough in the reform of agriculture, rural areas and farmers in China. J. Northwest Normal Univ. 3, 5–13.

Yi, Y. J., and Gu, C. (2022). Impact of structure and organization of smallholders on agricultural carbon emissions. Front. Environ. Sci. 10:1032863. doi: 10.3389/fenvs.2022.1032863

Zhang, Z., Tian, Y., and Chen, Y. H. (2023). Can agricultural credit subsidies affect county-level carbon intensity in China? Sustain. Prod. Consum. 38, 80–89. doi: 10.1016/j.spc.2023.03.028

Zhong, L. N., Wu, H. F., and Liang, D. (2021). Collective planning: an organized path for the organic connection between small farmers and modern agriculture. J. Nanjing Agric. Univ. 21, 126–135.

Keywords: credit guarantee, smallholder organization, agricultural production outsourcing, Propensity Score Matching method, regression adjustment method

Citation: Qiao M, Wang J and Wang B (2025) How does credit guarantee promote the organized participation of smallholder farmers in agricultural production outsourcing? Front. Sustain. Food Syst. 9:1496902. doi: 10.3389/fsufs.2025.1496902

Received: 15 September 2024; Accepted: 03 February 2025;

Published: 24 February 2025.

Edited by:

Muhammad Irshad Ahmad, Zhengzhou University, ChinaReviewed by:

Amar Razzaq, Huanggang Normal University, ChinaCopyright © 2025 Qiao, Wang and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jing Wang, d2o2Nnh5eEAxMjYuY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.