- 1School of Economics, Qufu Normal University, Rizhao, China

- 2School of Economics and Management, WeiFang University, Shandong, China

- 3School of Economics and Management, Northwest Agriculture and Forestry University, Yangling, China

Since the 21st century, overseas farmland investment has gradually become the focus of research in the field of transnational agricultural investment. Under the background of China’s “going out” strategy, exploring the spatial distribution pattern and influencing factors of China’s overseas farmland investment activities in different regions of the world and reducing domestic food supply pressure through effective use of overseas farmland resources has become an important path for China to ensure food security. Based on the case data of China’s overseas cultivated Land investment in the Land Matrix database, this paper sorted out the utilization status of China’s global cultivated land resources, and analyzed the spatial distribution and influencing factors by using spatial analysis method and grey correlation analysis method. The results show that: (1) At present, the host countries of China’s overseas cultivated land investment have obvious spatial aggregation, showing the spatial characteristics of “small agglomeration and large dispersion,” and have the characteristics of distribution along the border and river; (2) China’s overseas farmland investment is affected by geo-economy, resource base, geo-culture and geopolitics, and the degree of impact is weakened in turn. Among them, the average annual import and export value, total water resources and other indicators have a significant impact on the investment choice of Chinese enterprises. Based on this, on the basis of identifying the spatial distribution pattern of China’s global overseas farmland investment and development and analyzing its key driving factors, this study proposed the path that overseas farmland investment and development can help improve the resilience of food system with the goal of ensuring the food security of sustainable agricultural system. It provides a theoretical basis for the country to formulate food security strategy based on overseas farmland investment and guide enterprises to invest overseas farmland.

1 Introduction

Food security is a national priority. Ensuring national food security is an important foundation for ensuring economic development, social stability and national security (Sun et al., 2017). The problem of population-land mismatch, that is, the imbalance between population distribution and arable land resources, is one of the key issues facing food security. It means that densely populated areas often lack sufficient arable land resources to ensure food self-sufficiency. Therefore, against the background of rapid global population growth, the food security situation is becoming increasingly severe. Solving the global “people-land mismatch” problem through transnational agricultural investment has become an important development feature of the agricultural field in the process of economic globalization (Zoomers et al., 2017). Making full use of overseas cultivated land resources has gradually become an important means for some countries and international organizations to increase the global supply of agricultural products and ensure their own food security (Jing et al., 2021). According to the 2024 Global Food Crisis Report, in 2023, nearly 282 million people in 59 countries and regions will experience sudden severe hunger, 24 million more than in 2022. The report shows that since 2017, global food insecurity has continued to increase and has become a worrying trend. External factors such as political conflicts, climate change and global economic fluctuations, as well as internal factors such as the level of economic development, natural endowments, scientific and technological levels, and social environment restrict food security. It is impossible for a government to meet the food needs of its people in a short period of time by relying entirely on its own food production (Lu et al., 2018). With the acceleration of global population growth, the contradiction between supply and demand of land and water resources has become increasingly prominent, further intensifying the contradiction between food supply and demand. According to the Food and Agriculture Organization of the United Nations, under the current consumption level to meet the needs of population growth and economic development in 2050, the global demand for arable land will increase from 1.567 billion hm2 in 2012 to 1.732 billion hm2. Increasing investment in land and water resources in developing areas is the key to breaking the above constraints on agricultural growth (FAO, 2018). In this context, countries with high food dependence on foreign countries, poor domestic agricultural resource endowment, and scarce arable land, as well as countries with prominent population, resource and environmental conflicts such as India and China, in addition to strengthening domestic agricultural development and improving land productivity to increase food supply, through the investment and utilization of transnational cultivated land, Transferring food crop production activities abroad is an inevitable choice to achieve domestic food supply (Han et al., 2018). Therefore, focusing on countries and regions with good resource endowment and stable investment environment, using their cultivated land resources to alleviate domestic agricultural resource constraints has gradually become a viable option to ensure the stability of domestic grain and important agricultural products and consolidate the foundation of food security (Cheng et al., 2018).

As a populous country with scarce cultivated land and the world’s largest food importing country, China has always attached great importance to the issue of cultivated land security and food security by successive governments (Andong et al., 2023; Hules and Singh, 2017). With the development of domestic economy and the improvement of people’s dietary structure, the contradiction between supply and demand of agricultural products and resource guarantee has become increasingly acute in China. The use of overseas cultivated land resources to alleviate the constraint of domestic agricultural resources has gradually become a feasible option to ensure China’s food security. China’s overseas farmland investment began in the early 21st century. Early investments were concentrated in Africa and Southeast Asia, mainly to obtain land use rights, develop agricultural infrastructure and modern planting technology. Subsequently, China gradually expanded its farmland investment in South America, Eastern Europe and other places, covering the planting and production of major agricultural products such as soybeans and corn. In recent years, China has further deepened its agricultural cooperation in countries along the “Belt and Road” and promoted local agricultural development through joint ventures, leasing and other forms, while meeting domestic demand. Overall, China’s overseas farmland investment strategy is moving towards diversification and sustainable development.

At present, the distribution of China’s overseas farmland investment is mainly concentrated in Africa, Southeast Asia, South America and other countries (Tang et al., 2017; Giovannetti and Ticci, 2016). Due to the limited strategic understanding of cultivated land investment in Africa, Southeast Asia, South America and other countries, foreign investors have strict access rules for cultivated land investment, and Chinese enterprises are at a disadvantage in competition with other countries due to their late start and lack of corresponding supporting facilities (He et al., 2024). Therefore, countries with relatively rich cultivated land resources, relatively high natural resource endowment for grain production, relatively stable national political situation, and relatively perfect policies and regulations have become an important strategic direction for China’s overseas farmland investment (Lu et al., 2020). However, what is the spatial distribution pattern of China’s overseas farmland investment projects? What factors will affect the choice of host country for China’s overseas farmland investment? What are the decisive factors? This series of problems need objective quantitative research and scientific evaluation.

As a matter of fact, investment in overseas cultivated land has been widely debated since it was proposed, involving many aspects such as food sovereignty, civic governance and agricultural structure of host countries (Renqu et al., 2020). As the world’s largest developing country and traditional agricultural power, China’s food security situation and food security strategy have attracted worldwide attention. The research on China’s overseas farmland investment has always been the focus of academic attention (Linyan et al., 2022). Many scholars have discussed the formation mechanism, basic connotation, implementation mode and risk control of China’s overseas farmland investment (Linyan et al., 2022). Lu et al. (2020) believes that the distribution of China’s overseas farmland investment is obviously unbalanced, and the correlation results show that the factors affecting overseas farmland investment are political stability and interest pursuit and the correlation analysis result shows the trends of overseas farmland investment with political stability and benefits seeking.

Lu et al. (2020) believes that China’s overseas farmland investment is noticeably imbalanced, and the current distribution is suboptimal. The most suitable host countries for investment are concentrated in Southeast Asia, as well as along the equator in Africa and Latin America, indicating a need for strategic adjustments. Using panel threshold technology, Renqu et al. (2020) found that the increase of host country resource endowment promoted China’s investment in overseas farmland, but the correlation gradually weakened as the level increased. Chen et al. (2017) used Landmatrix data to compare the scale, geographical distribution, utilization and investment mode of China’s overseas land investment and pointed out that China’s main investment fields are concentrated in non-food crops, and the investment tends to be in countries with low “transparency index.”

An in-depth understanding of the current situation of China’s overseas cultivated land investment and a macro grasp of the current distribution of global cultivated land resources are important issues for China to consider in formulating food strategies and promoting the construction of a “new development pattern with domestic and foreign cycles as the main body and domestic and foreign dual cycles promoting each other” (Yu and Cao, 2015). However, most of the existing literatures stay in the macroscopic level of analysis and description, and lack of spatial investigation. In the study of overseas farmland investment, the spatial analysis is very important. By studying the spatial distribution pattern, we can identify the concentration area of investment and the potential problem of unequal allocation of resources. Based on this, this paper analyzes the spatial distribution pattern of overseas cultivated land investment and its influencing factors including geoeconomy, resource base, geo-culture and geopolitics, which plays an important role in enriching the research content of this topic. Different from the existing literature, this paper uses the case data of China’s overseas farmland investment to analyze the spatial characteristics of China’s overseas farmland investment from a relatively micro level and explore the relevant factors affecting China’s overseas farmland investment. The research in this paper can not only enable Chinese “going global” enterprises to accurately grasp the development direction of farmland investment layout in the process of overseas farmland investment, but also provide references for Chinese enterprises to improve the stability of overseas farmland investment projects and reduce risks. It also has important practical value for Chinese enterprises to scientifically carry out overseas farmland investment and safeguard regional food security.

2 Current situation of China’s overseas farmland investment

2.1 Spatial distribution of China’s overseas farmland investment projects

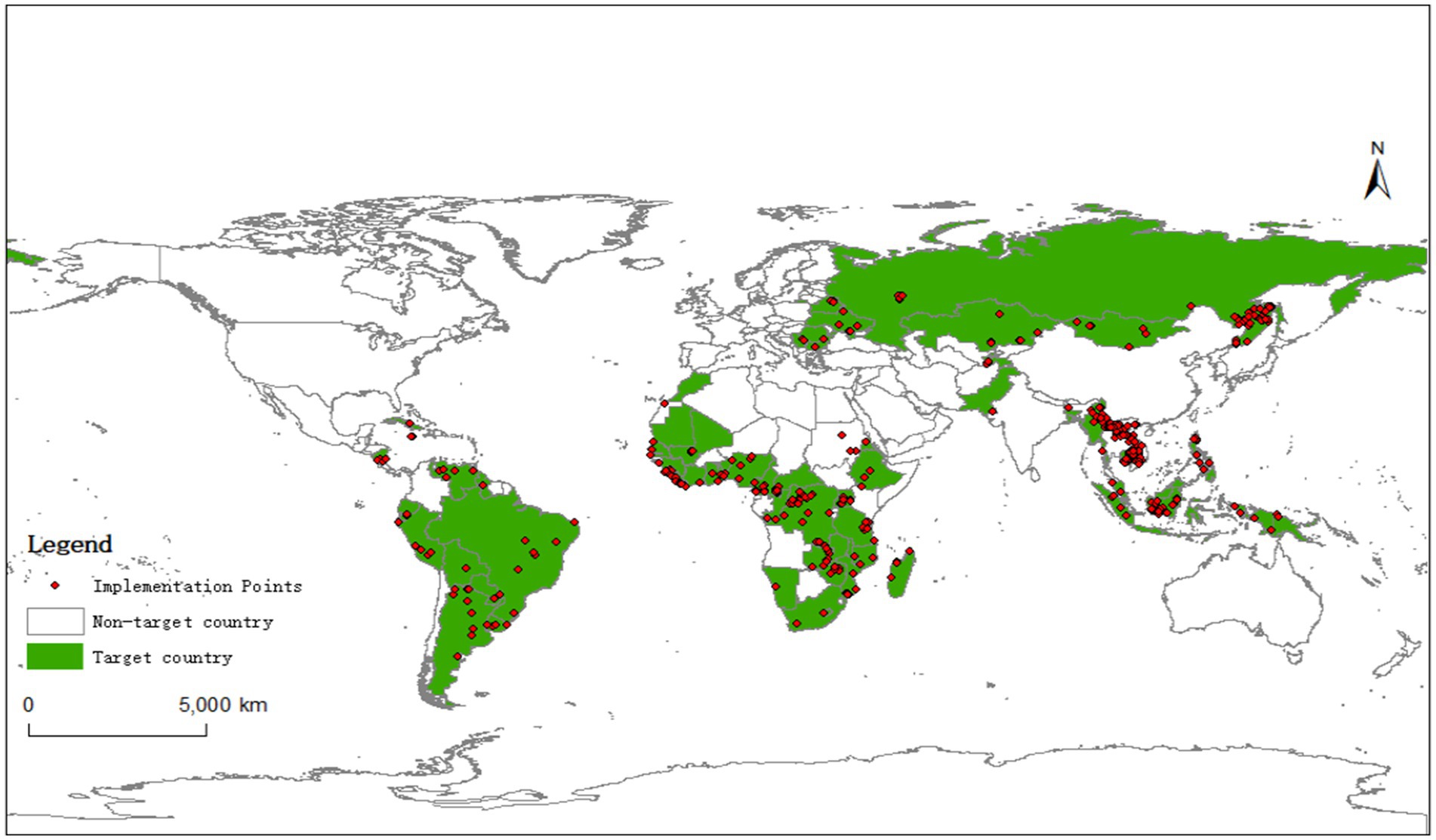

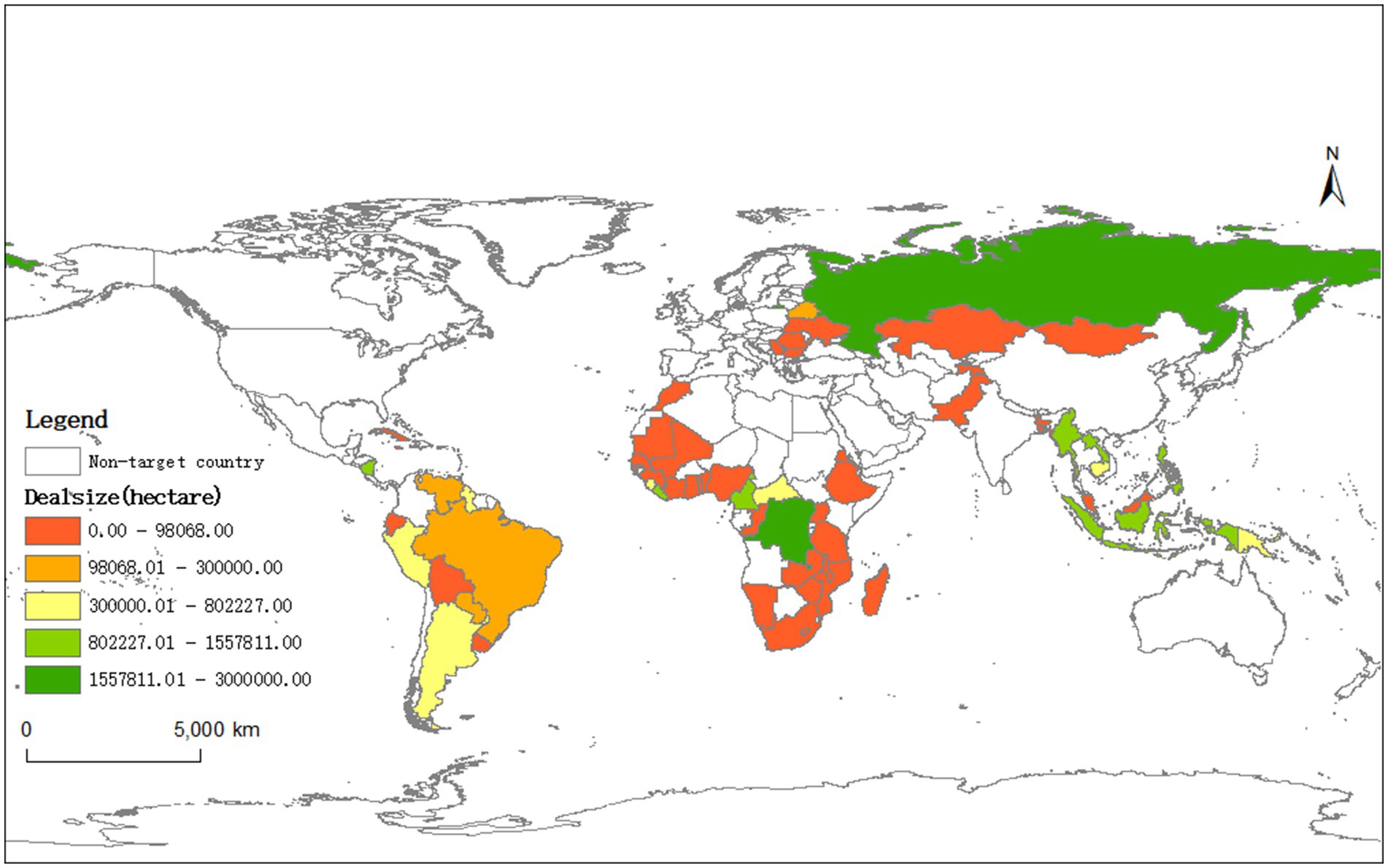

According to the data of the global Land transaction database Land Matrix, as of September 2024, China has carried out a total of 530 cultivated land investment projects in the world, involving 19.7658 million hectares of cultivated land, of which 61 countries are involved in overseas farmland investment. This paper uses Arcgis to draw the distribution map of China’s farmland investment projects in overseas countries (Figure 1) and uses the natural breakpoint method to divide the contracted area and draw the spatial distribution map of China’s farmland investment area in overseas countries (Figure 2).

Figure 2. Distribution map of contracted area of China’s investment in cultivated land in various countries.

From the perspective of project distribution, investment projects are mainly distributed in Africa, Asia and South America, of which Africa is mainly concentrated in West Africa and South Africa, and Asia is mainly concentrated in Southeast Asia. Investment projects in South America have slightly more investment projects than North America and Oceania, and are mainly distributed in Argentina and Uruguay. European investment projects are mainly distributed in the regions of Russia near the three Eastern provinces, with the least investment projects in North America and Oceania. From the perspective of contracted area, the natural breakpoint method divides the area into five categories. The first category is the country with the largest investment scale, covering 1,557,800 hectares and above, which represents only Russia and the Democratic Republic of the Congo, indicating that Russia and the Democratic Republic of the Congo are currently the key countries for China’s investment. The second category is the contracting area of larger countries, its area between 802,200 hectares to 1,557,800 hectares, representing Indonesia, Cambodia and other countries in Southeast Asia; The third group of countries are countries with average contract area, between 300,000 hectares and 802,200 hectares, representing Guyana, Peru and Argentina in South America; The fourth category is for countries with low contracted area, ranging from 98,100 hectares to 300,000 hectares, representing Brazil and Venezuela in South America; The fifth category is countries with low positive signatories, with an area between 0.004 million hectares and 981,000 hectares, representing Ethiopia, Guinea, Benin, Ghana and other countries in Africa. On the whole, Russia is the country with the largest number of projects and the most contracted area in Europe. The number and contracted area of Southeast Asia projects are larger; There are more investment projects in Africa.

3 Materials and methods

3.1 Estimation of nuclear density

Kernel density estimation is a method to study the spatial distribution characteristics of sample points in a regular region based on their data, and the results can be used to show the agglomeration and dispersion characteristics of sample data sets in a certain region with maps (Derek, 2020). Its calculation formula is as follows:

Where: f(x) is the estimated nuclear density; h is the bandwidth, that is, the radius of the circle (m); K is the kernel function; x-xi represents the distance (m) from the estimate point to the output grid. In this paper, the locations of different types of overseas farmland investment projects are abstracted as point elements, and the kernel density values of each project type are calculated with the area of different types of projects as the weight. Finally, the kernel density map is made with ArcMap component. The level of kernel density values reflects the level of certain attributes of overseas farmland investment projects in a certain region.

3.2 Grey correlation analysis

Grey theory is a systematic scientific theory initiated and developed by Professor Deng Julong in the 1980s. Grey correlation analysis is a quantitative analysis method based on grey theory to study the correlation degree of various factors within the system. The principle of this method is to identify the correlation degree of elements according to the curve proximity degree reflected in the image of each element series. Grey correlation analysis method has low requirement on data sample size, and can better analyze the “small sample” and “poor information” uncertainty system with “part of information known and part of information unknown.” Because of its special investment object, the investment sensitivity of overseas cultivated land investment is large, and the influence of political, economic, cultural, geographical and other factors is prominent, and the above factors have obvious unclear characteristics.

The core idea is to calculate the correlation between different sequences in order to discover the intrinsic relationship between the sequences. The specific steps are as follows:

1. Data standardization (dimensionless processing)

Since the dimensions of different data may be different, there will be deviations when directly compared. In order to make the data comparable, the data must first be standardized. The purpose of standardization is to convert the data into the same order of magnitude. Common standardization methods include maximum standardization and minimum standardization. After dimensionless processing, each sequence will be converted to the same numerical range, making it suitable for subsequent analysis.

1. Calculate the difference sequence and gray correlation coefficient

In this stage, the difference between the reference sequence and each comparison sequence is calculated to determine their similarity.

Difference sequence: The difference between the reference sequence and each comparison sequence at the corresponding moment is calculated, which is called the difference sequence.

Gray correlation coefficient: According to the difference sequence, the correlation coefficient of each moment is calculated using the following formula:

Among them, and are the minimum and maximum differences in all difference sequences respectively, ζ is the resolution coefficient, which is usually taken as 0.5.

1. Calculate the gray correlation

Finally, the gray correlation coefficients of each moment are averaged to obtain the final gray correlation. The correlation degree indicates the overall correlation degree between the reference sequence and the comparison sequence. The formula is:

The greater the correlation , the stronger the correlation between the reference sequence and the comparison sequence, and vice versa.

This paper takes China’s overseas host countries as the research area. Although the number of projects involved is large, the number of host countries is small, and the data has obvious “small sample” characteristics. Therefore, this paper regards overseas farmland investment activities as a grey system, and analyzes the influence degree of different factors on overseas farmland investment scale by constructing a grey correlation model between the scale series of overseas farmland investment of host countries and the index series of influencing factors in overseas regions, and calculating the grey relative correlation degree. The idea of grey relative correlation degree is to characterize the relationship between different data series groups by the relative change rate between the starting points. The closer the change rate between two data series is, the greater the grey relative correlation degree will be, and the smaller the grey relative correlation degree will be. Since this method is more conventional, the process of solving grey relative correlation degree will not be described here.

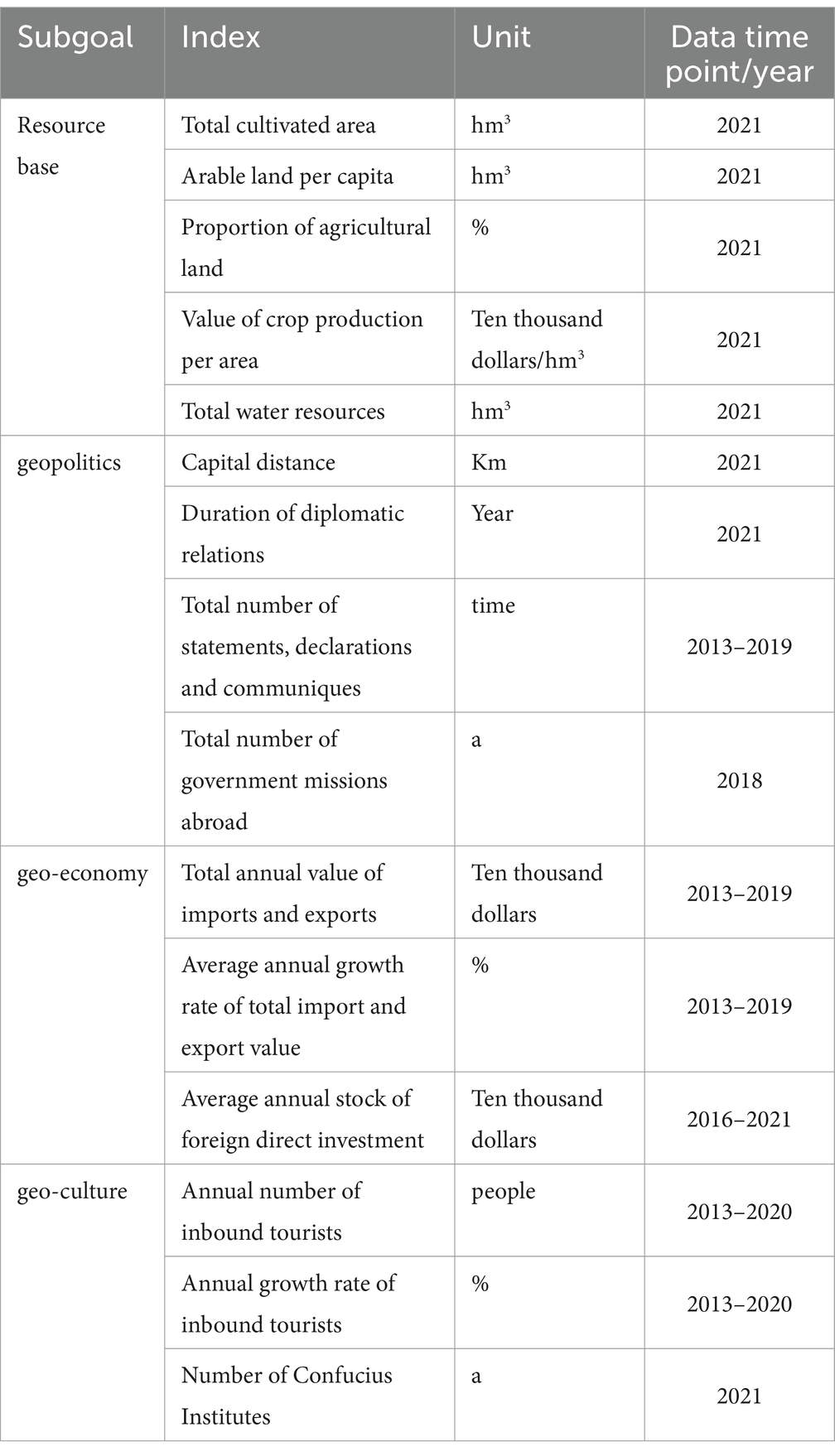

3.3 Data source and index selection

As a transnational natural resource utilization and control issue arising from traditional agricultural investment abroad, overseas farmland investment is influenced by not only resource endowment but also the geographical relationship between the investor country and the host country in the current international political background (Meng et al., 2022). Geographical relationship usually refers to the relationship caused by geographical location, distance, etc. It is a special social relationship between man and land based on the premise of geographical elements (Van den Broeck and Maertens, 2016). The modern state-scale geopolitical relations mainly refer to the geopolitical, geo-economic and geo-cultural relations between countries based on geographical factors such as the geographical weight of countries, the geographical distance between countries and the geographical flow, which has been widely recognized in the academic community (Tabeau et al., 2017). Geopolitics refers to the political interaction between countries due to geographical conditions or geographical factors, and the political relations formed therefrom. Geo-economy is based on the premise of geopolitics to emphasize the interregional relations (mainly refers to the spatial economic relations between regions), its final performance is regional economic integration (Acevedo et al., 2018); Geo-culture refers to the cultural relations between countries formed on the basis of special historical and geographical causes and the development law of ethnic relations (Yun and Yi, 2020). In the study of overseas farmland investment, the four dimensions of resource base, geopolitics, geo-economy and geo-culture are selected as the indicators of grey correlation analysis based on the profound impact of these factors on investment decisions. First, the resource base directly affects the agricultural production potential of the host country, which is an important consideration for the feasibility of investment. Second, geopolitical relations affect the political interaction and stability of countries and determine the security and sustainability of the investment environment (Cotula, 2012). Geo-economy reflects the economic ties and cooperation potential between countries, which is an important guarantee for investment returns and market expansion. Finally, geo-cultural relations affect the cultural adaptability and social acceptance of transnational cooperation and determine the long-term success of investment projects. Through the comprehensive analysis of these four dimensions, we can comprehensively evaluate the investment environment of the host country, and provide scientific basis and strategic guidance for China’s overseas farmland investment. Based on the above cognition and the currently available inter-country statistical indicators, and according to the data requirements of grey correlation analysis, this paper takes China’s intended project area in each host country as the initial reference sequence, and constructs grey correlation analysis sequence indicators from four dimensions: resource base, geopolitics, geo-economy and geo-culture (Table 1).

Relevant case data are all from the Land Matrix database, and each index value is finally collected and summarized by the author. Considering the research theme of this paper, the main principles of data summary are as follows: (1) China’s overseas farmland investment project refers to the transnational land transaction project whose investment destination is outside China; (2) The number of the earliest years of receiving Chinese investment is calculated from the year of the earliest Chinese investment project known by statistics; (3) The relevant indicators of independent investment are summarized after excluding China’s overseas farmland investment projects with partners. The index data of the four dimensions of geographical relations are mainly from FAO database, CEPII database, China Foreign Affairs, China Trade and Foreign Economic Statistics Yearbook and the official website of Confucius Institute Headquarters. The selection of data time points and time period mainly takes into account the diplomatic characteristics of the new era after the establishment of the new Chinese government, the availability of statistical data and the connotation of indicators, and generally takes 2013–2021 as the main data collection period standard.

4 Results

4.1 Spatial agglomeration characteristics of China’s overseas farmland investment projects

4.1.1 Asian region

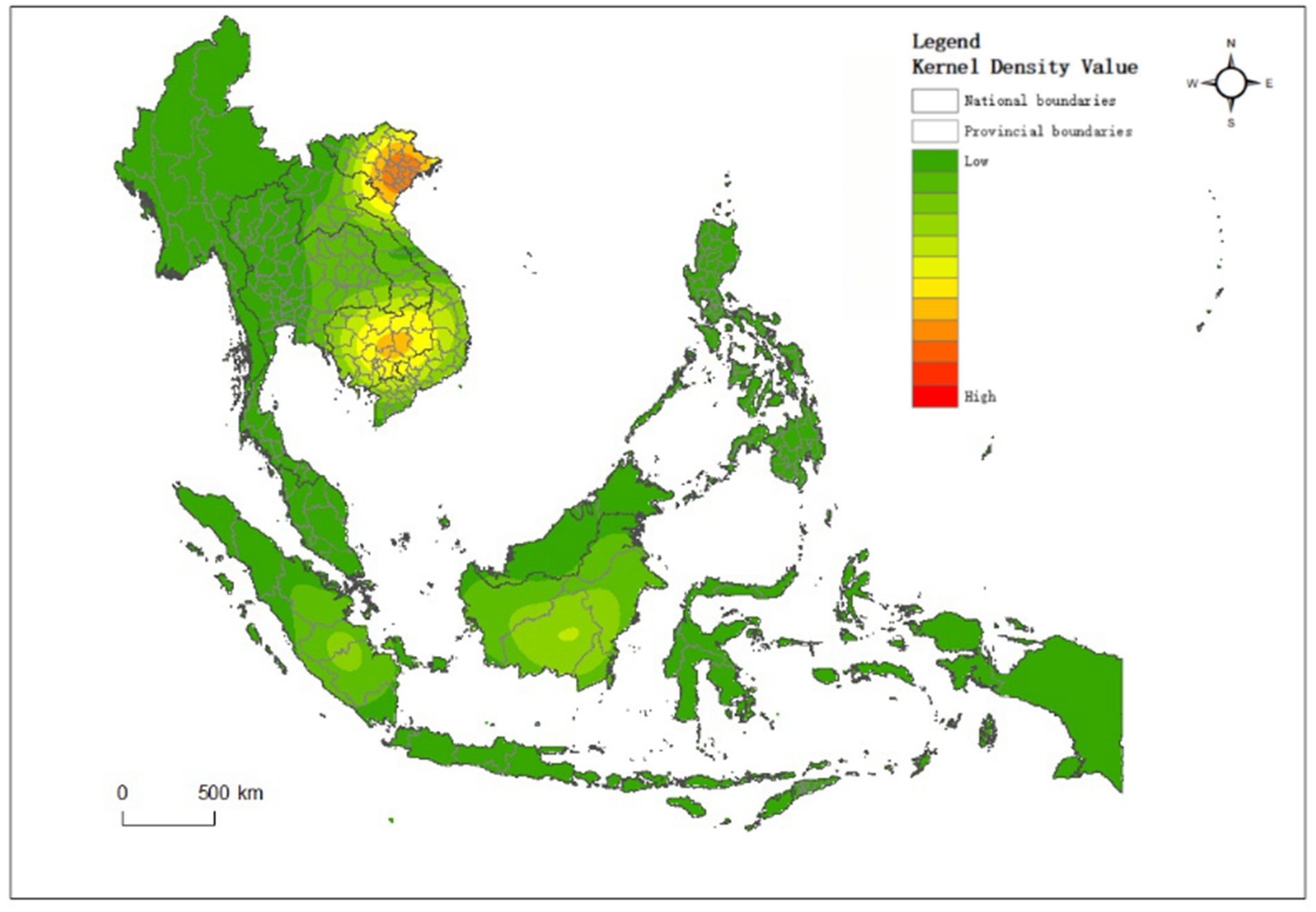

The cartographic results of the nuclear density estimation method show that the overall distribution of China’s overseas farmland investment contract projects in Asia is not balanced, showing a spatial feature of “small agglomeration and large dispersion.” From the perspective of agglomeration area, the contract projects of China’s overseas cultivated land are mainly concentrated in Vietnam, Cambodia, Malaysia and Indonesia. According to the level of nuclear density, the above concentration areas can be roughly divided into three levels: the first level is the project concentration area with the highest nuclear density, mainly located in Thanh Pho Ha Long, Hai Duong and Thanh Pho Ninh Bing in northern Vietnam; The second level is the project concentration area with high nuclear density, mainly Kampong Thum, Siemreab and Kracheh in central Cambodia. The third level is a project concentration area with average nuclear density values, consisting of two separate clusters, one at the junction of Jambi and Palembang in Sumatra, and the other at Kalimantan Capuas in Central Kalimantan, Indonesia. Investment in Asia is concentrated in Southeast Asia. The geographical proximity and close economic ties between the region and China make investment more convenient and economically beneficial. The rapid economic growth of Southeast Asian countries and close trade relations with China also provide a good market environment for investment. In addition, the promotion of the Belt and Road Initiative has further boosted Chinese investment in the region (Figure 3).

Figure 3. Nuclear density distribution of China’s overseas farmland investment contract projects in Asia.

4.1.2 European region

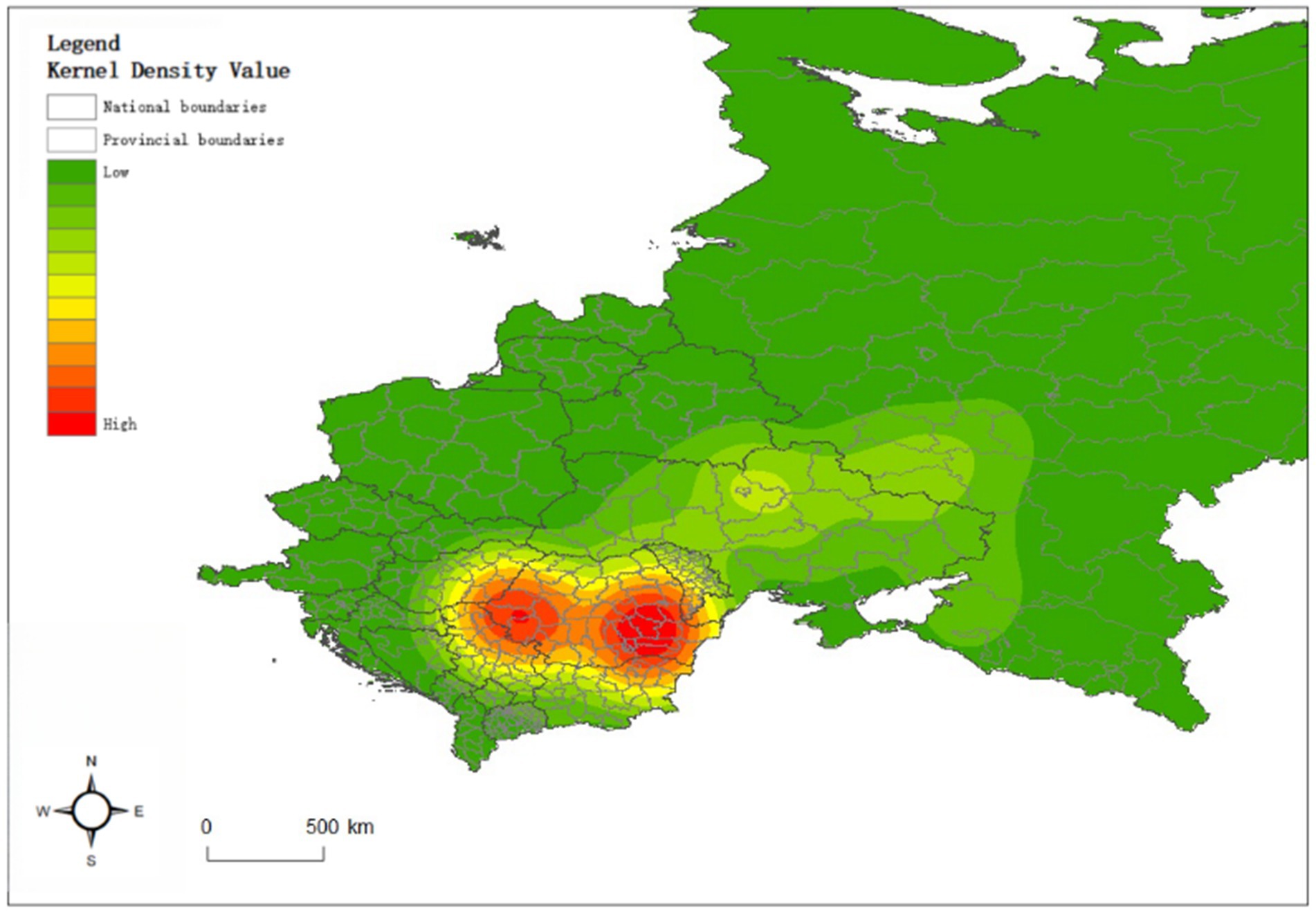

The nuclear density distribution map of China’s overseas farmland investment contract projects in Europe shows that there are two obvious clusters and one less obvious cluster in the region, the former one is located in the border of Hungary, Serbia and Romania, and the other one is located in the eastern region of Romania. The latter is in the northern part of Ukraine. In terms of the high and low levels of nuclear density, the above three clusters can be divided into two levels: the first level is the highest concentration of projects, forming two clusters in Romania, mainly located in the Timisoara and Arad regions in the west of the country and Bucuresti, Constanta and Buzau regions in the east; The second level is a project concentration area with average nuclear density values, consisting of an independent cluster, mainly located in the Kiev region of Ukraine. Investment in Europe is concentrated in places such as Russia and Romania. Russia’s vast land and rich resources make it one of the key countries for Chinese investment. Eastern European countries such as Romania have also attracted Chinese investment due to their lower land costs and higher agricultural production potential. In addition, Europe’s political stability and mature market environment provide security for investment (Figure 4).

Figure 4. Nuclear density distribution of China’s overseas farmland investment contract projects in Europe.

4.1.3 South America

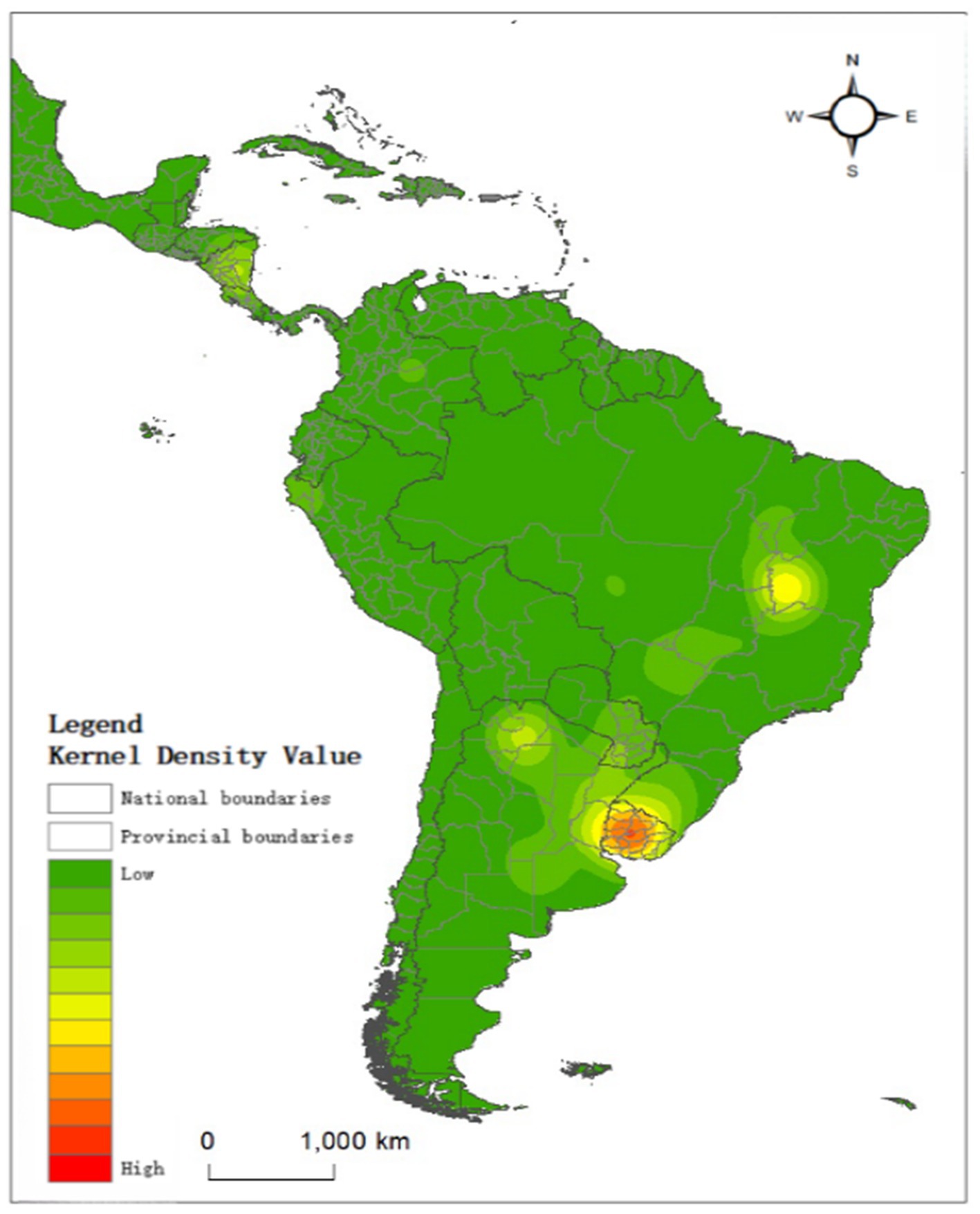

A map of the nuclear density distribution of China’s overseas farmland investment contracts in South America shows that there is one distinct cluster in the region and three less distinct clusters, the former in Uruguay, the latter in central Brazil, northern Argentina and Costa Rica. From the perspective of high and low nuclear density values, the above four clusters can be divided into three levels: the first level is the project concentration area with the highest nuclear density value, located in the Paso de los Toros region in central Uruguay; The second is the region with high nuclear density values, located in the Barreiras region in eastern Brazil and the San Salvador de Jujuy region in northern Argentina. The project concentration area with average Grade third nuclear density values is located in the Nueva Guinea region of Nicaragua. In addition, the Talara region in northern Peru, along the Meta River in northern Colombia, and the paranaiba region in central Brazil have also shown signs of agglomeration, but this agglomeration is not yet obvious. In South America, Chinese investment projects are mainly distributed in countries such as Argentina and Uruguay. These countries have abundant agricultural resources and relatively stable political environments, making them ideal targets for attracting investment. South America’s economic development potential and trade links with China also support investment (Figure 5).

Figure 5. Nuclear density distribution of China’s overseas farmland investment contract projects in South America.

4.1.4 African region

A map of the nuclear density of China’s overseas farmland investment and production projects in Africa shows four distinct clusters in Sierra Leone, Liberia, Ghana, Zambia and the western Democratic Republic of Congo, and five less distinct clusters in Senegal, Ethiopia, Uganda and Mozambique. From the perspective of the high and low levels of the nuclear density value, the above three clusters can be divided into three levels: The first is located on the border of Kenema in eastern Sierra Leone with Guinea and Liberia, the second in Kumasi in Ghana, the third in Bandundu in western Republic of the Congo, and the fourth in Kabew in central Zambia. The second category consists of high concentrations of projects, with the first in the Mboro region on the western coast of Senegal, the second in the Adama region of central Ethiopia, the third in Kampala region of Uganda along the northern shore of Lake Victoria, and the fourth in the Mocuba region of eastern Mozambique. The fifth is located in the Bumba region of the north-western Democratic Republic of the Congo; Level 3 is a cluster of projects with average nuclear density values, located in Souk-EI-Arba-Du-Rharb in central Morocco, Wad Madani in central Sudan, and Douala in central Cameroon. Investment in the African region is concentrated in West Africa and South Africa. This distribution is related to Africa’s abundant natural resource endowments, especially arable land available for development. In addition, political instability and low levels of social governance in some African countries make the need for foreign investment more urgent. China’s investment in these areas is not only to acquire resources, but also to expand its influence on the international stage (Figure 6).

Figure 6. Nuclear density distribution of China’s overseas farmland investment contract projects in Africa.

4.2 Factors influencing the distribution of China’s overseas farmland investment projects

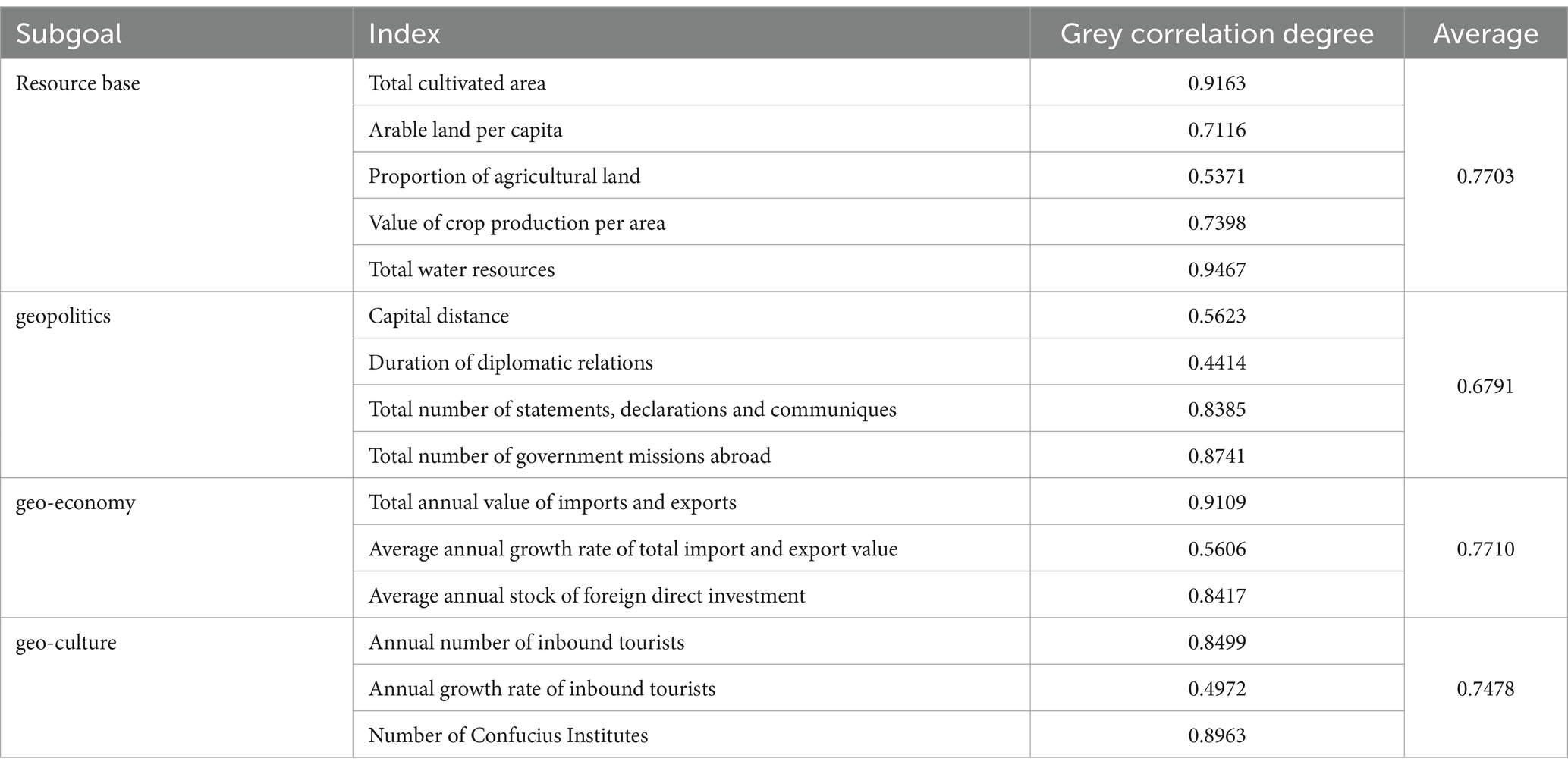

As shown in Table 2, the calculated results of the grey relative correlation degree show that the project area of China’s overseas farmland investment intention is closely related to the resource base, geopolitics, geo-economy and geo-culture of the host country. Among the 16 indicators selected in this paper, the grey relative correlation degree value of 11 indicators is above 0.70. The average grey relative correlation of the four dimensions is greater than 0.70, and the importance of the four dimensions is as follows: geoeconomy > resource base > Geoculture > geopolitics.

According to the results of gray correlation analysis, among the four dimensions of resource base, geopolitics, geoeconomy and geoculture, the importance of geoeconomy is the first, and the average gray relative correlation degree of high impact index is as high as 0.7668. China’s investment in overseas farmland is not only the investment of funds, but also the sharing of agricultural technology and management experience. This transfer of technology and knowledge can help improve the efficiency of agricultural production in host countries, while also giving Chinese companies a competitive advantage in local markets. The closeness of geo-economic ties determines the depth and breadth of such cooperation. Take Southeast Asia and the Belt and Road countries as an example. Since 2002, after China and ASEAN signed the Memorandum of Understanding between the Government of the People’s Republic of China and the Governments of the member States of the Association of Southeast Asian Nations on Food and Agriculture Cooperation and the Joint Statement on China-Asean Food Security Cooperation, Chinese enterprises have significantly increased their agricultural investment in Southeast Asia, and overseas farmland investment activities have also been rapidly developed. With the full launch of China-Asean Free Trade Area in 2010, the economic and trade ties between Southeast Asian countries and China have become closer, the market scale of China in Southeast Asian countries has been expanding, and the convenience of commodity trade has also been improving. All these have laid favorable conditions for Chinese enterprises to implement overseas farmland investment in Southeast Asia. At the same time, the Belt and Road cooperation between China and Latin America and the Caribbean has gradually deepened and made solid progress (Hufe and Heuermann, 2017). Twenty-two countries in Latin America and the Caribbean have signed cooperation documents on the Belt and Road cooperation with China (Yu et al., 2015). China and Latin America have continuously strengthened practical cooperation in agricultural infrastructure construction, cross-border e-commerce, logistics and transportation (Hanif, 2017; Robert and Phil, 2022). In recent years, relying on the opportunity of “Silk Road e-commerce,” more and more Latin American agricultural products have entered the Chinese market through cross-border e-commerce, opening up a new channel for Sino-Latin American agricultural trade (Haider, 2022). At the index level, the average annual import and export value and the average annual stock of China’s foreign direct investment have a high degree of influence, and the grey relative correlation value of these two indicators is above 0.83, indicating that good trade relations and investment basis have a strong influence on Chinese enterprises to choose the host country of overseas cultivated land investment.

The average grey relative correlation degree of resource base high impact degree index is 0.7703, ranking second. The abundance of natural resources directly affects the attractiveness of agricultural investment, such as abundant cultivated land resources and water resources, which can provide good growing conditions for crops. The population in Southeast Asia is relatively dense and the per capita cultivated land area is not high, but the region has more reserve cultivated land resources, good solar and thermal conditions, strong output capacity of cultivated land, and some agricultural products have strong complementarity with China. Under good trade conditions, a large number of Chinese enterprises have invested in rice, palm oil and natural rubber projects in the region (Mazzocchi et al., 2018; Azadi et al., 2012). Different from some regions with relatively scarce per capita resources, some countries in South America and Africa are outstanding in terms of per capita cultivated land area and cultivated land potential, especially in terms of arable reserve land and rich water resources (Yu et al., 2015). The photothermal conditions in these areas are good and suitable for the growth of a variety of crops, especially in agricultural products such as soybeans, coffee and fruits, which are highly complementary to the Chinese market (Miao et al., 2024; Suo and Bai, 2024). At the index level, the grey relative correlation values of the four indicators of per capita cultivated land area, total cultivated land area, crop production value per area and total water resources are above 0.70, among which the grey relative correlation values of total cultivated land area are 0.92 and the total water resources area is 0.94, indicating that in terms of resource base, Compared with the total amount of cultivated land, investors may pay more attention to the area of cultivated land and water resources in the selection process of host country.

The average grey relative correlation degree of the geo-cultural high impact degree index is 0.7478, ranking third. There is a long history of cultural interaction between China and many regions, especially in Africa and Latin America, where the Chinese government has actively expanded economic cooperation and cultural exchanges through its “Going out” strategy. In these regions, China has set up a number of Confucius institutes to promote the spread of language and culture, while increasing scholarship support for students from these countries. Such cultural exchanges not only enhance the trust and friendship between China and the host country, but also provide a good environment for Chinese enterprises to adapt and operate in the local market. Secondly, Southeast Asian countries have a traditional process of friendly exchanges in history. Especially after the reform and opening up, with the development of China’s economy, the Chinese government also put forward the policy of “good-neighborly, secure and prosperous neighbors” in its foreign relations with neighboring countries, established a number of Confucius institutes in Southeast Asian countries, and increased financial assistance to students from Southeast Asian countries studying in China. On the one hand, these cultural exchanges enhance mutual trust and friendship between the two sides, and also create conditions for investment enterprises to adapt to local environment and laws (Ji et al., 2023; Raimondi and Scoppola, 2018; Li, 2015). At the index level, among the four geo-cultural indicators selected in this paper, the grey relative correlation values of the average annual FDI stock, the average annual number of inbound tourists and the number of Confucius Institutes all exceed 0.80, and the grey relative correlation value of the number of Confucius Institutes exceeds 0.89. It reflects that good cultural exchanges and friendly exchanges between citizens have an important impact on the choice of host country for Chinese enterprises investing in overseas cultivated land.

Geopolitics has the least influence on overseas farmland investment, and its average grey relative correlation degree is 0.6791. In recent years, with the promotion of the Belt and Road Initiative, China’s diplomatic relations with many countries and regions have been significantly strengthened, especially in regions such as Africa, Latin America and Southeast Asia (Bureau and Swinnen, 2018). However, the political environment in these regions is complex and volatile, often with varying degrees of political risk, social unrest and policy uncertainty (Aha and Ayitey, 2017). These adverse risks will have a strong inhibitory effect on the investment activities of overseas cultivated land investment, which has high fixed cost and long recovery cycle (Chavas, 2017). In addition, geopolitics belongs to an extremely complex influence layer, and the influence of China’s overseas farmland investment cannot be ignored (Cotula et al., 2011; Fan and Brzeska, 2016). The “balanced diplomacy” policy formed by Latin American and Southeast Asian countries, as well as the strategic intervention of the United States and Japan, makes it difficult to generate a reasonable order in the region. In particular, some Southeast Asian countries have shown uncertainty in their policies toward China, making investment decisions more difficult and making geopolitical factors an obstacle to the development of China’s overseas farmland investment in the region. At the level of specific indicators, only the distance between the capital and the total number of declarations, declarations and communiques have grey relative correlation values greater than 0.80, and the values of other indicators are not high. This reflects the weak influence of political atmosphere on the choice of host country for Chinese enterprises to invest in overseas farmland. Despite the increasing number of cooperation mechanisms within the region, geopolitical factors remain an important obstacle to China’s investment in overseas farmland due to historical issues and competition between countries in the region.

5 Discussions and conclusions

Based on the Land Matrix database, this paper studies the spatial distribution characteristics and influencing factors of global overseas cultivated land investment and development, and mainly draws the following conclusions: (1) From the perspective of regional distribution, Asia has the largest amount of cultivated land, about 579 million hectares, accounting for 39.94% of the total cultivated land in the world. Moreover, most of the projects are located in Indochina Peninsula countries, and have the characteristics of distribution along the border between China and the host country. Myanmar, Cambodia, Malaysia and the Philippines have a better concentration of overseas farmland investment projects; Laos and southern Vietnam are important areas for China’s overseas farmland investment; Indonesia’s Sumatra Island is the main area for China’s overseas farmland investment in the country. It is followed by Europe, which has 20.34% of the global total cultivated land, and Oceania, which has the least cultivated land, only 2.62% of the world’s total cultivated land. (2) From the nuclear density distribution map, China’s overseas farmland investment projects in countries along the “Belt and Road” show the characteristics of spatial agglomeration distribution, and the distribution of projects in Asia, Africa, Europe and other continents also shows the characteristics of agglomeration distribution, and the distribution of projects in Latin America and Oceania has the highest degree of agglomeration, while Africa has the lowest degree of agglomeration; From the perspective of signed area, the signed area of China to countries along the route tends to be evenly distributed. Specifically, the signed area of Asia, Africa and other continents is concentrated, and only Europe is evenly distributed. (3) In terms of influencing factors, this paper analyzes the influencing factors of China’s overseas farmland investment in Southeast Asia by using the grey correlation model and finds that Chinese enterprises’ overseas farmland investment activities are closely related to the resource base, geopolitics, geo-economy and geo-culture of the host country, and its significance is as follows: Geo-economy > Resource Base > Geo-Culture > Geopolitics. It can be seen that factors such as political relations between countries, policy stability and international strategic intervention caused by geopolitics have greatly affected the security and sustainability of China’s overseas farmland investment. (4) At the index level, the grey relative correlation degree between the average annual import and export value of China and the host country, the average annual stock of China’s foreign direct investment, the total amount of water resources, the index of cultivated land area of the host country and the area of China’s overseas cultivated land investment project is more than 0.84, that is, the above factors have a strong influence on Chinese enterprises to choose the host country for overseas cultivated land investment.

From the perspective of influencing factors, China’s overseas farmland investment strategy shows obvious heterogeneity, mainly in the four dimensions of geo-economics, resource base, geo-culture and geopolitics. In areas dominated by economic factors, China’s investment strategies are mainly concentrated in countries and regions with close economic and market connections, such as Southeast Asia and countries along the “Belt and Road.” China has strong economic and trade ties with these regions, and the establishment of free trade zones and convenient market conditions have created a good environment for agricultural investment. This type of strategy focuses on efficient investment in capital and technology and pursues rapid economic returns and market share. For regions with better resource endowments (such as South America and Africa), China tends to choose countries with abundant land resources and superior water resources to ensure high yields in crop cultivation. This type of strategy takes resource development as its core goal and emphasizes the full utilization of natural resources to produce agricultural products such as soybeans and palm oil that are in high demand in China to maximize the matching of production capacity and resources. In regions with strong cultural ties, especially Southeast Asia and Africa, China promotes relations with host countries by strengthening cultural exchanges and educational cooperation. Cultural programs such as Confucius Institutes and scholarships help build a foundation for mutual trust and cooperation. This strategy is particularly effective in areas with high cultural similarities, helping Chinese companies better adapt to local market demands and operating environments. In areas with unstable political environments (such as some African and Latin American countries), China’s investment strategy is more cautious. Due to the political risks in these areas, China will pay more attention to risk aversion when choosing investment projects, and may reduce capital investment or choose countries with relatively stable cooperative relations. In addition, China uses the “Belt and Road” cooperation mechanism to balance and strengthen political relations with host countries to enhance the security of agricultural investment. In general, China adjusts its investment strategy according to local conditions to achieve sustainable development of foreign agricultural investment.

Overseas investment in cultivated land is not only a new trend in the utilization and control of transnational agricultural resources, but also an important option for developing countries with weak agricultural foundation to solve the problem of poverty and ensure food security. Through transnational agricultural investment, China has effectively used overseas cultivated land resources and eased the restrictions of domestic agricultural resources. This kind of investment not only optimizes the allocation of land resources, but also promotes the rational distribution of food production on a global scale, thus solving the problem of “mismatch between people and land” to a certain extent and ensuring national food security. According to the distribution characteristics of the three nuclear density grade regions mentioned in the experimental results, we put forward the following suggestions. First, for high-density investment areas, it is recommended to strengthen resource integration and risk management. The government and enterprises should jointly develop detailed investment plans to ensure the efficient use of resources and the sustainability of investment. Second, in medium-density regions, policies should focus on attracting more investment through infrastructure development and policy incentives. The e government can provide tax incentives, financing support and other measures to encourage enterprises to expand investment in these areas. Third, for low-density areas, it is recommended to conduct in-depth market research and risk assessment to identify potential investment opportunities and challenges. And according to the different regions of the world involved in the experimental results, strategies adapted to local conditions can also be adopted, such as Southeast Asia, which offers strong economic ties with China, but fragmented land governance systems pose challenges. China could leverage regional frameworks like the ASEAN-China Free Trade Area to harmonize investment policies and establish dispute resolution mechanisms. Given environmental concerns in this region, investments should focus on crops that align with local ecological conditions and avoid deforestation or overuse of water resources. And China could Strengthen cultural exchanges, such as through Confucius Institutes or scholarships, building trust and facilitate smoother operations for Chinese enterprises. In European Region, Countries like Russia and Romania offer vast agricultural potential. Investments should target modernizing agricultural infrastructure and enhancing productivity while navigating EU regulations. And collaborating with European agricultural research institutions can facilitate knowledge exchange and improve yields in Chinese-operated farms. South America’s abundant arable land and water resources make it ideal for large-scale agricultural projects. Investments should focus on high-demand crops like soybeans and coffee that complement China’s market needs. To address global criticism of deforestation, especially in countries like Brazil, China should adopt sustainable farming practices and collaborate with international organizations to promote environmental conservation. And Strengthening trade ties through bilateral agreements or participation in regional trade blocs like MERCOSUR to improve market access for agricultural products. About African region, for addressing Geopolitical Risks, China could develop partnerships with local governments to enhance transparency and accountability in land deals, ensuring fair compensation and community benefits. Strengthening diplomatic ties and participating in regional organizations like the African Union can also help manage geopolitical risks. And investments should prioritize improving local infrastructure (e.g., irrigation systems, transportation networks) to support agricultural productivity and foster goodwill among local communities. Providing training in modern farming techniques to local farmers can promote sustainable practices and reduce resistance to foreign investments. Governments and enterprises should pay attention to the resource endowment and market potential of these regions and formulate flexible investment strategies. A comprehensive identification and quantitative measurement of the spatial pattern of China’s overseas farmland investment development in the world will not only provide an operational judgment basis for the sound development of China’s overseas farmland investment, but also help to scientifically analyze China’s investment activities and their rules in the region, optimize China’s overseas farmland investment, and formulate corresponding policies for relevant departments. In particular, the establishment of China’s overseas cultivated land investment development strategy and policy provides a practical basis, and further promotes resource coordination and cooperation between different countries and regions, and achieves win-win development for maintaining regional food security and agricultural sustainable development.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YW: Conceptualization, Funding acquisition, Writing – original draft. FZ: Data curation, Formal analysis, Writing – review & editing. LW: Supervision, Visualization, Writing – review & editing. HJ: Funding acquisition, Supervision, Writing – review & editing. ML: Formal analysis, Resources, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This work is supported by Humanities and Social Sciences Youth Foundation, Ministry of Education of the People’s Republic of China (24YJC630222), the Social Science Planning Project of Shandong Province (23DJJJ08), Rizhao Natural Science Foundation Youth Project (RZ2022ZR45), Shandong Provincial College Youth Innovation Team Development Plan (2024KJL001), Excellent Youth Innovation Team Project of Shandong University (2022RW041), and Natural Science Foundation of Shandong Province (ZR2021QG063).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acevedo, M. F., Harvey, D. R., and Palis, F. G. (2018). Food security and the environment: interdisciplinary research to increase productivity while exercising environmental conservation. Glob. Food Sec. 16, 127–132. doi: 10.1016/j.gfs.2018.01.001

Aha, B., and Ayitey, J. Z. (2017). Biofuels and the hazards of land grabbing: tenure (in) security and indigenous farmers’ investment decisions in Ghana. Land Use Policy 60, 48–59. doi: 10.1016/j.landusepol.2016.10.012

Andong, G., Wenze, Y., Jun, Y., Bing, X., Wu, X., Mengmeng, L., et al. (2023). Cropland abandonment in China: patterns, drivers, and implications for food security. J. Clean. Prod. 418:138154. doi: 10.1016/J.JCLEPRO.2023.138154

Azadi, H., Houshyar, E., Zarafshani, K., Hosseininia, G., and Witlox, F. (2012). Agricultural outsourcing: a two-headed coin? Glob. Planet. Chang. 100, 20–27. doi: 10.1016/j.gloplacha.2012.10.002

Bureau, J., and Swinnen, J. (2018). EU policies and global food security. Glob. Food Sec. 16, 106–115. doi: 10.1016/j.gfs.2017.12.001

Chavas, J. (2017). On food security and the economic valuation of food. Food Policy 69, 58–67. doi: 10.1016/j.foodpol.2017.03.008

Chen, Y., Li, X., Wang, L., and Wang, S. (2017). Is China different from other investors in global land acquisition? Some observations from existing deals in China’s going global strategy. Land Use Policy 60, 362–372. doi: 10.1016/j.landusepol.2016.10.045

Cheng, S. K., Li, Y. Y., Liu, X. J., Wang, L. E., Wu, l., Lu, C. X., et al. (2018). Thoughts on food security in China in the new period. J. Nat. Resour. 33, 911–926. doi: 10.31497/zrzyxb.20170527

Cotula, L. (2012). The international political economy of the global land rush: a critical appraisal of trends, scale, geography and drivers. J. Peasant Stud. 39, 649–680. doi: 10.1080/03066150.2012.674940

Cotula, L., Vermeulen, S., Mathieu, P., and Toulmin, C. (2011). Agricultural investment and international land deals: evidence from a multi-country study in Africa. Food Secur. 3, 99–113. doi: 10.1007/s12571-010-0096-x

Derek, H. (2020). Where is Japan in the land rush debate? Can. J. Dev. Stud. 41, 1–19. doi: 10.1080/02255189.2020.1678461

Fan, S., and Brzeska, J. (2016). Sustainable food security and nutrition: demystifying conventional beliefs. Glob. Food Sec. 11, 11–16. doi: 10.1016/j.gfs.2016.03.005

FAO (2018). The future of food and agriculture: Alternative pathways to 2050. Rome: Food and Agriculture Organization of the United Nations, 1–228.

Giovannetti, G., and Ticci, E. (2016). Determinants of biofuel-oriented land acquisitions in sub-Saharan Africa. Renew. Sust. Energ. Rev. 54, 678–687. doi: 10.1016/j.rser.2015.10.008

Haider, M. (2022). Trade, FDI, and CO2 emissions nexus in Latin America: the spatial analysis in testing the pollution haven and the EKC hypotheses. Environ. Sci. Pollut. Res. Int. 30, 14439–14454. doi: 10.1007/S11356-022-23154-X

Han, J., Yang, C., Ke, N., and Lu, X. (2018). Analysis of the spatial difference and impact factors of China and America's overseas farmland investment host country selections in Africa. China Land Sci. 32, 37–43. doi: 10.11994/ZGTDKX.20180723.142602

Hanif, I. (2017). Economics-energy-environment nexus in Latin America and the Caribbean. Energy 141, 170–178. doi: 10.1016/j.energy.2017.09.054

He, W., Luo, P., Lyu, Q., and Hu, J. (2024). How do the home country regulations promote the responsibility for overseas farmland investment? Land 13:981. doi: 10.3390/land13070981

Hufe, P., and Heuermann, D. F. (2017). The local impacts of large-scale land acquisitions: a review of case study evidence from sub-Saharan Africa. J. Contemp. Afr. Stud. 35, 168–189. doi: 10.1080/02589001.2017.1307505

Hules, M., and Singh, S. J. (2017). India’s land grab deals in Ethiopia: food security or global politics? Land Use Policy 60, 343–351. doi: 10.1016/j.landusepol.2016.10.035

Ji, M., Gao, X., and Liang, Y. (2023). Opportunities and challenges of cross-border E-commerce development cooperation between China and southeast Asian countries—based on the perspective of the entry into force of RCEP. Academic. J. Bus. Manag. 5:1319. doi: 10.25236/AJBM.2023.051319

Jing, H., Mengying, J., Xupeng, Z., and Xinhai, L. (2021). Knowledge mapping analysis of transnational agricultural land investment research. Land 10:1374. doi: 10.3390/LAND10121374

Li, T. M. (2015). Transnational farmland investment: a risky business. J. Agrar. Chang. 15, 560–568. doi: 10.1111/joac.12109

Linyan, M., Zichun, P., Yameng, W., and Feng, W. (2022). Spatial distribution characteristics and influencing factors of the success or failure of China’s overseas arable land investment projects—based on the countries along the “belt and road”. Land 11:2090. doi: 10.3390/LAND11112090

Lu, X. H., Ke, S. G., Cheng, T., and Chen, T. (2018). The impacts of large-scale OFI on grains import: empirical research with double difference method. Land Use Policy 76, 352–358. doi: 10.1016/j.landusepol.2018.05.023

Lu, X., Li, Y., and Ke, S. (2020). Spatial distribution pattern and its optimization strategy of China’s overseas farmland investments. Land Use Policy 91:104355. doi: 10.1016/j.landusepol.2019.104355

Mazzocchi, C., Salvan, M., Orsi, L., and Sali, G. (2018). The determinants of large-scale land acquisitions (LSLAs) in sub-Saharan Africa (SSA): a case study. Agriculture 8, 2–13. doi: 10.3390/agriculture8120194

Meng, L., Wen, Y., Wu, Y., Fangqu, N., Hanqin, l., and Duanmu, H. (2022). Spatio-temporal evolution and influencing factors of geopolitical relations among Arctic countries based on news big data. J. Geogr. Sci. 32, 2036–2052. doi: 10.1007/S11442-022-2035-0

Miao, T., Pastpipatkul, P., Liu, X., and Liu, J. (2024). The trade potential of grain crops in the countries along the belt and road: evidence from a stochastic frontier model. Front. Sustain. Food Syst. 8:1404232. doi: 10.3389/fsufs.2024.1404232

Raimondi, V., and Scoppola, M. (2018). Foreign land acquisitions and institutional distance. Land Econ. 94, 517–540. doi: 10.3368/le.94.4.517

Renqu, T., Zisheng, Y., and Qinglong, S. (2020). Effects of host country resource endowment and labor cost on China's investment in overseas cultivated land. Environ. Sci. Pollut. Res. Int. 27, 45282–45296. doi: 10.1007/s11356-020-10373-3

Robert, M., and Phil, M. (2022). A real-time mix-adjusted median property price index enabled by an efficient nearest neighbour approximation data structure. J. Bank. Financ. Technol. 6, 135–148. doi: 10.1007/S42786-022-00043-Y

Sun, F., Dai, Y., and Yu, X. (2017). Air pollution, food production and food security: a review from the perspective of food system. J. Integr. Agric. 16, 2945–2962. doi: 10.1016/S2095-3119(17)61814-8

Suo, R., and Bai, Y. (2024). Measurement and spatial-temporal evolution of industrial carbon emission efficiency in Western China. Sustain. For. 16:7318. doi: 10.3390/su16177318

Tabeau, A., van Meijl, H., Overmars, K. P., and Stehfest, E. (2017). REDD policy impacts on the Agri-food sector and food security. Food Policy 66, 73–87. doi: 10.1016/j.foodpol.2016.11.006

Tang, X., Pan, Y., and Liu, Y. (2017). Analysis and demonstration of investment implementation model and paths for China's cultivated land consolidation. Appl. Geogr. 82, 24–34. doi: 10.1016/j.apgeog.2017.03.002

Van den Broeck, G., and Maertens, M. (2016). Horticultural exports and food security in developing countries. Glob. Food Sec. 10, 11–20. doi: 10.1016/j.gfs.2016.07.007

Yu, W., and Cao, L. (2015). China's meat and grain imports during 2000–2012 and beyond: a comparative perspective. J. Integr. Agric. 14, 1101–1114. doi: 10.1016/S2095-3119(14)60993-X

Yu, W. S., Elleby, C., and Zobbe, H. (2015). Food security policies in India and China: implications for national and global food security. Food Secur. 7, 405–414. doi: 10.1007/s12571-015-0432-2

Yun, W., and Yi, L. (2020). Central Asian geo-relation networks: evolution and driving forces. J. Geogr. Sci. 30, 1739–1760. doi: 10.1007/S11442-020-1810-Z

Keywords: China, overseas farmland investment, spatial distribution, influencing factor, food security

Citation: Wang Y, Zou F, Wang L, Jin H and Ma L (2025) Spatial distribution and influencing factors of China’s overseas farmland investment projects under the background of food security. Front. Sustain. Food Syst. 8:1509360. doi: 10.3389/fsufs.2024.1509360

Edited by:

Catherine Keske, University of California, Merced, United StatesReviewed by:

Liqi Chu, Henan University of Economic and Law, ChinaTan Yongfeng, Ningxia University, China

Haiyu Yang, Guangdong Research Institute of Petrochemical and Fine Chemical Engineering, China

Copyright © 2025 Wang, Zou, Wang, Jin and Ma. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Linyan Ma, bWFsaW55YW5AbndhZnUuZWR1LmNu

Yameng Wang

Yameng Wang Fan Zou1

Fan Zou1 Linyan Ma

Linyan Ma