- Institute of Agricultural Economics and Development, Chinese Academy of Agricultural Sciences, Beijing, China

Introduction: In the pursuit of agricultural sustainability and food security, the stability of livestock production under large-scale operations plays a pivotal role.

Methods: Based on panel data from 26 provinces in China spanning the years 2007 to 2020, this study employs a two-way panel fixed effects model to examine the stabilizing effect of scale breeding on swine production volatility in China. Additionally, it utilizes the moderating effect model to examine the moderating effect of epidemic risk and policy intervention, and uses the threshold effect model to test the threshold effect of marketization level.

Results: Empirical evidence indicates that moderate-scale breeding exerts a stabilizing effect on swine production volatility, with this effect displaying regional disparities. From the external situation, the higher the risk of epidemic disease, the stronger the stable effect of scale breeding on the fluctuation of swine production, while the enhancement of policy intervention cannot promote the stability of scale breeding on swine production volatility. There is a single threshold effect on the impact of scale breeding on swine production volatility. When the degree of marketization reaches a certain level, the stabilizing effect of scale breeding on swine production volatility is enhanced.

Discussion: Therefore, it is recommended to promote the moderately scaled swine breeding, enhance epidemic monitoring and information disclosure systems, reduce excessive policy intervention, and fully leverage the self-regulating role of the market.

1 Introduction

In 2015, the United Nations Sustainable Development Summit adopted the “Transforming our World: The 2030 Agenda for Sustainable Development,” which established the Global Sustainable Development Goals (SDGs). Among these, Sustainable Development Goal 2 is to end hunger, achieve food security and improved nutrition, and promote sustainable agriculture. This objective requires enhancing the agricultural production capacity of developing countries, ensuring the proper functioning of food commodity markets and their derivatives, and limiting extreme fluctuations in food prices. However, in recent years, factors such as the COVID-19 pandemic (Nugroho et al., 2022; Kornher et al., 2024), social conflicts (Ameyaw et al., 2021), rade policy disruptions (Lee et al., 2024), geopolitical tensions (Mulyo et al., 2023; Goyal et al., 2024), and climate change (Renaudeau and Dourmad, 2022) have exacerbated global food insecurity, extreme price volatility, and income disparities between small-scale and large-scale food producers. These issues pose significant threats not only to sustainable agricultural development but also to the livelihoods of vulnerable populations and broader economic stability (Grofova and Srnec, 2012; McEwan et al., 2020; Xu et al., 2024). As the largest developing country, China faces considerable pressure to enhance the stability and sustainability of its food supply, particularly in its rapidly expanding livestock sector (Bai et al., 2019).

The livestock industry is a crucial component of food systems that ensures food security and nutritional balance. Pork, as one of the most consumed meats worldwide, plays a significant role in this context. Pig farming not only drives economic growth but also serves as a key contributor to the global supply of animal protein, making it a crucial industry for safeguarding food security (Adesehinwa et al., 2024). In recent years, heightened global uncertainties have had profound impacts on the pig industry, with the outbreak of African Swine Fever (ASF) standing out as a critical event that has severely disrupted global supply chains. Visetnoi and Nelles (2023) noted that from 2017 to 2021, global pork production declined partly due to the ASF outbreak, which affected many pig farmers, especially in China and Southeast Asia. For instance, the outbreak of ASF in Vietnam led to a sharp decline in the pig population around 2018 (Kim et al., 2024). Additionally, geopolitical tensions, such as the US-China trade war, introduced further uncertainties, directly influencing pig farming and market conditions in China (Li and Bao, 2020). China, as the world’s largest producer and consumer of pork, accounted for 48.44% of global pork production and 50.73% of global pork consumption in 2022. Pork is also the most significant component of meat consumption among Chinese residents, with per capita pork consumption making up 77.75% of total meat consumption in 2022 (Ji et al., 2019; Qiao et al., 2016; Zhang et al., 2021). Thus, the stable development of China’s pig industry is of paramount importance to food security, economic development, and social stability both domestically and globally. However, the industry has been plagued by significant cyclical fluctuations in production and prices (Zhu et al., 2022; Zhuo et al., 2021). Since the emergence of the “pig cycle” in the early 21st century, China’s pig industry has undergone five complete cyclical fluctuations, occurring roughly every 4 years: 2003–2006, 2006–2010, 2010–2014, 2014–2018, and 2018–2021. Besides external shocks, many scholars argue that low levels of industrialization are a key reason for the significant fluctuations in China’s pig production (Zhao, 2017). In recent years, China has seen a marked increase in the industrialization and concentration levels of pig farming. According to “China Livestock and Veterinary Statistics,” the proportion of large-scale farms, those with an annual output of over 500 pigs, rose from 34.5% in 2010 to 65.1% in 2022. Given the emphasis on food security within the Sustainable Development Goals and the increasing external uncertainties, it is imperative to explore whether scaling up can enhance supply stability and to determine how to optimize its impact.

However, there is some controversy in the academic community regarding whether scaling up can stabilize swine production volatility. Some scholars argue that small-sized farms are more adaptable in adjusting their supply and production capacity following market fluctuations, leading to a situation of “follow the herd,” exacerbating later market volatility (Li et al., 2012). Moreover, small-scale pig farmers are often more susceptible to inadequate biosecurity measures due to cognitive and financial limitations, which exacerbates the impact of external shocks, such as disease outbreaks, on the industry (Schembri et al., 2015). Consequently, it is proposed that in order to eliminate significant cyclic fluctuations in the swine market, it is necessary to change the situation of dispersed and extensive farming and expedite the development of large-scale swine farming (Weng, 2013). However, other scholars contend that in the event of severe epidemics and policy shocks, large-scale farms may experience “big inflows and outflows,” with their demonstration effect potentially triggering sharp, short-term market volatility (Li and Wang, 2020). Conversely, free-range farmers, due to their minimal fixed inputs, can swiftly enter the market to supplement production capacity in the context of declining pig production, thus playing a necessary role in the structure of pig farming scale (Huang et al., 2021). The U.S. swine market exhibits relative stability, and in the face of disruptions caused by the COVID-19 pandemic, the American pork supply chain has demonstrated considerable resilience (Ramsey et al., 2021). Bai et al. (2023) suggest that a significant factor contributing to this resilience is the promotion of large-scale farming through the contract production model. Conversely, Guo and Lin (2020) argue that scale alone cannot eliminate cyclical volatility or narrow the amplitude of fluctuations in the pork market; instead, it serves to elongate the market’s fluctuation cycle, rendering it irregular. In addition to theoretical and empirical analyses, some scholars have further conducted empirical tests based on data. These studies almost unanimously conclude that the scale expansion of pig farming can stabilize fluctuations in pig production, or do so under certain conditions. However, the stabilizing effects exhibit significant variations when facing positive and negative shocks (Zhou et al., 2015), price increases and decreases (Shen and Qiao, 2019), and across different regions (Wang G. Y. et al., 2018).

Existing literature has explored whether the scale expansion of pig farming stabilizes production fluctuations, as well as the conditions and mechanisms under which this stabilizing effect operates. These studies provide a solid foundation for this paper. However, several aspects still require further advancement. Firstly, empirical studies to date have utilized pre-African swine fever outbreak data; however, the outbreak of African swine fever in China from 2018 onwards and the series of relevant policies implemented by the government to restore pig production have had a profound impact on China’s pig industry. Both the external aspects, such as scale, structure, and farming methods, and the internal aspect of farmers’ confidence in pig breeding have undergone significant changes. In this “great reshuffle” scenario, it is necessary to reevaluate the stabilizing effect of scale breeding on swine production volatility. Secondly, existing research has not delved into exploring how, under the trend of scaling, external conditions should be created to make the stabilizing effect of scale breeding on swine production volatility more significant if it can indeed stabilize such volatility. In the face of external shocks, should we opt for “visible hands” (policy interventions) or “invisible hands” (market regulation)? This paper utilizes panel data from China spanning 2007 to 2020 to empirically examine the stabilizing effect of scale breeding on swine production volatility, the moderating role of policy interventions and epidemic risks in the relationship between scale breeding and swine production volatility, and the threshold effect of marketization on the impact of scale breeding on swine production volatility. These results can provide a reference basis for effectively leveraging the advantages of scale breeding to stabilize swine production volatility and contribute to achieving global food security goal.

2 Theoretical analysis and research hypotheses

2.1 The impact of scale breeding on swine production volatility

Compared to free-range breeders, entities engaged in scale breeding exhibit significant advantages in terms of capital, technology, and organizational capabilities (Xu et al., 2023; Zhou et al., 2023), thus often possessing stronger resilience against market risks. Moreover, under asset constraints, the likelihood of scale farms suspending or shifting production during periods of depressed prices is relatively lower. In the face of market fluctuations, scale breeding primarily stabilizes swine production volatility through the following pathways.

Firstly, scale farms are more adept at withstanding the risk of declining pig prices due to their financial advantages. Supply theory indicates that the most significant determinant for producers to adjust output is the fluctuation in product prices. Under market economy conditions, when pig prices rise or operate at high levels, breeding operations see increased profits, leading pig breeders to expand their scale to increase the overall supply. Conversely, when prices fall or operate at low levels, breeding profits decrease or even result in losses, prompting breeders to reduce scale or exit the industry. According to the cobweb model theory, the absolute value of pork supply price elasticity exceeds that of demand price elasticity. Therefore, the key to reducing the “pig cycle” lies in maintaining supply–demand balance by ensuring supply when prices are low (Song, 2016). Free-range breeders, constrained by limited scale and capital, are more susceptible to exiting the breeding market when facing sustained low or declining pig prices. In contrast, scale breeders, with substantial financial resources, minimal loan and financing constraints, and strong capital turnover capabilities, can sustain production and operations for a considerable period even when market prices fall below cost levels (Iyai et al., 2021).

Secondly, scale breeding facilitates technological innovation and application, thus better addressing the fluctuations in the pig market. Scale breeding is often closely linked to modern animal medicines, feed, equipment, and production technologies (Xin et al., 2023). On the one hand, pig breeding enterprises of sufficient scale demonstrate strong technological innovation capabilities. On the other hand, even if smaller-scale breeding enterprises may lack innovation capabilities, they are still more receptive to and likely to adopt new technologies compared to scattered individual breeders (Hu et al., 2022). For example, the use of new animal medicines and vaccines can effectively enhance pigs’ disease resistance, reducing the impact of diseases on swine production. Advanced feed formulas and feeding techniques can enhance pigs’ growth and development capabilities, thereby increasing production efficiency. Additionally, intelligent equipment and automation technology can improve work efficiency and reduce the influence of human factors on production fluctuations.

In addition, scale breeding can mitigate market risks through increased organizational coordination. Industrial organization theory examines how market structures and firm behaviors influence market operations and fluctuations, emphasizing the importance of economies of scale to reduce costs and improve efficiency. Scale breeding often integrates resources across various sectors such as breeding farms, feed suppliers, animal medicine producers, and slaughter and processing enterprises, to foster collaborative industry chain and value chain synergies, aiming to optimize resource allocation and risk dispersion. Collaboration between farming operations and upstream/downstream enterprises can also establish long-term stable supply relationships, further reducing market fluctuation risks (Wang Z. Q. et al., 2023).

Finally, scale breeding operations, due to their stronger asset specificity, incur higher costs for production cessation or conversion (Wang G. et al., 2023). Free-range breeders, with limited scale and investment, face relatively lower fixed asset losses when exiting pig farming or converting production in response to declining or prolonged low pig prices. Conversely, the equipment deployed in scale breeding operations is more advanced and automated, giving rise to significantly higher asset specificity once the operation is established and in production (Yang et al., 2024). Consequently, the suspension or conversion of production in scale breeding operations leads to substantial idle and depreciation of fixed assets. Therefore, during periods of depressed pig prices, large-scale producers are inclined to persist due to substantial sunk costs, thereby contributing to the stability of swine production. Based on the above analysis, hypothesis 1 is proposed.

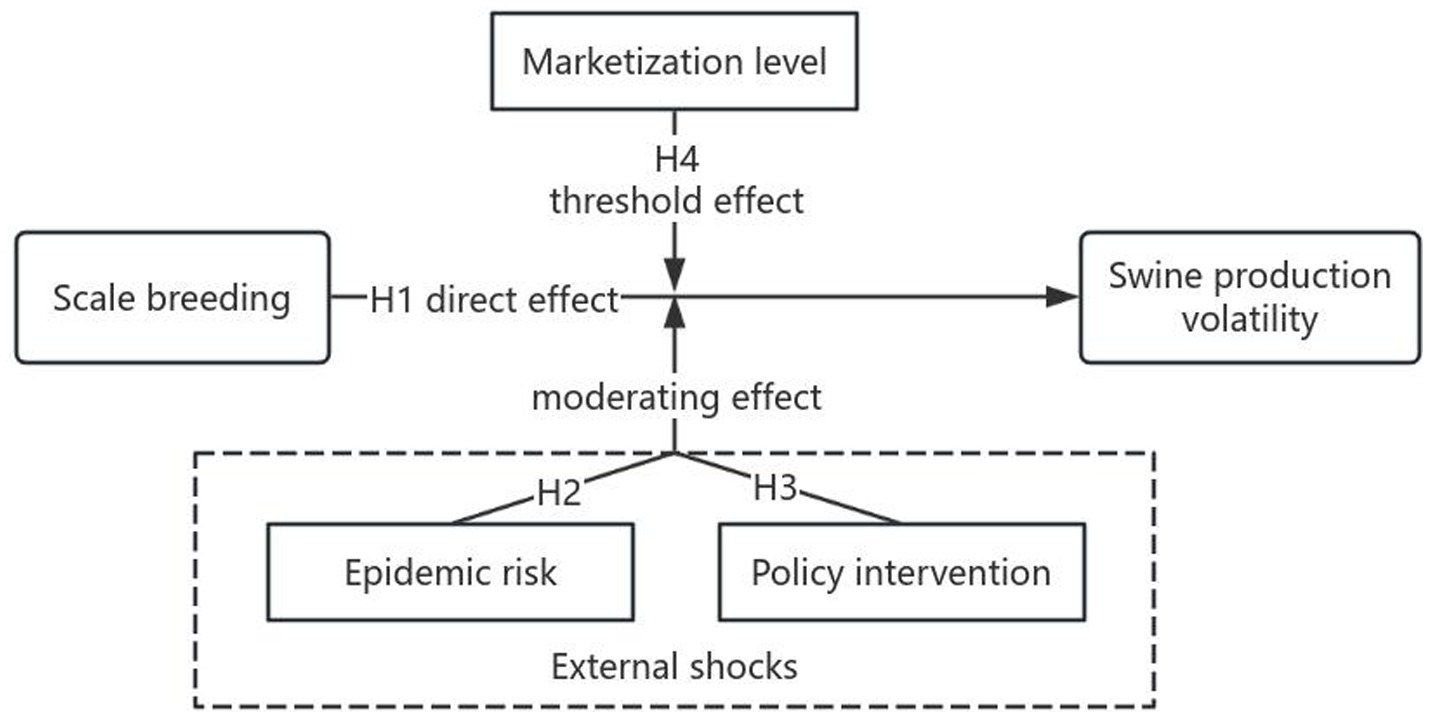

H1: Scale breeding has a stabilizing effect on swine production volatility.

2.2 The moderating role of epidemic risk in the impact of scale breeding on swine production volatility

Epidemic risk is recognized as a significant factor influencing fluctuations in swine production (Cheng and Ward, 2022). Since 2007, widespread outbreaks of highly pathogenic diseases such as blue ear disease, swine fever, viral diarrhea, and African swine fever in China have had a profound impact on the pig husbandry (Ma et al., 2021; Shi et al., 2023). Initially, pig diseases may lead to pig deaths and disease spread, thereby reducing the inventory of pigs (Liu et al., 2023; Niemi, 2020). Subsequently, these diseases may result in decreased production efficiency and increased disease prevention measures, consequently raising production costs and pork prices (Ma et al., 2023). Moreover, the effects of epidemics on transportation, logistics, and other aspects can possibly lead to changes in market supply and demand dynamics, thereby affecting swine production.

However, in environments with higher disease risk, the stabilizing role of scale breeding in swine production volatility may be more pronounced. From a biosafety management perspective, large-scale farms generally possess superior standardized production systems, which can mitigate disease risk through centralized management and production (Woonwong et al., 2020). On the one hand, the centralized management and facilities of scale farms aid in isolating disease sources, reducing the likelihood of disease transmission. Scale farms are also equipped to establish their own disinfection centers for enhanced disease prevention and control. On the other hand, scale farms typically implement stricter biosafety management measures, such as closed management, routine disease monitoring, and vaccination (Wang et al., 2022), and are supported by professional veterinary and management teams capable of promptly identifying, diagnosing, and addressing disease issues, effectively preventing and controlling the occurrence and spread of epidemics. In terms of risk resistance, scale farms often demonstrate higher capabilities in areas such as funding, technology, and market access. During disease outbreaks, scale farms are better positioned to swiftly resume production, thereby reducing industry-wide fluctuations. From a policy support perspective, the Chinese government’s assistance to pig farms often carries certain thresholds, requiring a certain scale of pig breeding to qualify for government subsidies (Liu and Zheng, 2024). Based on the above analysis, hypothesis 2 is proposed.

H2: Epidemic risk plays a positively moderating role in the stabilizing effect of scale breeding on swine production volatility.

2.3 The moderating effect of policy intervention intensity on the impact of scale breeding on swine production volatility

In academia and industry, there has long been significant debate over whether the government should intervene and how to intervene in response to the social welfare losses resulting from the malfunctioning of the pork market. Liberal economists argue that government intervention will only disrupt the normal functioning of the market, leading to misallocation of resources and inefficiency (Shang and McEwan, 2021). They believe that the market can automatically adjust prices through supply and demand dynamics, achieving optimal resource allocation. Market price fluctuations in the pork industry are seen as a result of self-regulation, and the government should not intervene in this process. Lu et al. (2020) argue that government intervention has dual-sided effects. Direct governmental interventions may potentially misguide entrepreneurs or lead to rent-seeking behaviors, thereby contributing to corruption and inequitable income distribution. Bai et al. (2017) observed a clear presence of information asymmetry in the Chinese pork market. In contrast, the pork market in the European Union, due to its minimal policy intervention, does not exhibit significant informational shock asymmetric effects. Therefore, it is recommended that relevant Chinese government departments reduce intervention and further enhance transparency in the pork market. However, in reality, the Chinese government’s intervention in the pork market is quite substantial. Based on the current national conditions and past experiences, there are three main reasons for the government’s intervention in the pork market: first, the incomplete development of futures markets for stabilizing pork production; second, the government’s strong short-term corrective capacity in the pork market compared to market regulation; and third, the successful experience of the Chinese grain reserve system in maintaining relatively stable long-term food prices (Lv et al., 2022). Yan et al. (2014) suggest that in response to the pork cycle, the government can select an appropriate combination of policies from subsidies, taxation, reserves, and price controls, along with a rational intervention strategy, to ensure price stability of pork, even with incomplete information.

Over the past 20 years, China has experienced uninterrupted “pork cycles,” all of which have involved government intervention. In the middle and later stages of the rising phase of the “pork cycle,” the government’s intensive introduction of support policies leads to excessive reactions from producers, resulting in excessive expansion of pork production. Subsequently, after a substantial increase, pork prices enter a significant decline phase. For example, from 2007 to 2008, a series of support policies such as subsidies for sow breeding and supporting the construction of large-scale breeding farms were successively introduced. From 2020 to 2021, an even greater series of support policies to restore pork production were implemented than those in 2007–2008. The price increases have led to an expansion in production scale, and the introduction of additional support policies at this time would inevitably further stimulate production, leading to severe oversupply after 18 months, causing prices to plummet significantly. Many producers went bankrupt or reduced sow breeding, thereby inducing the occurrence of the next “pork cycle.” When prices reach their lowest point, if combined with factors like epidemics (second, third, and fourth “pork cycles”) or production control policies related to “environmental protection” (fifth “pork cycle”), the next “pork cycle” becomes inevitable. It can be said that, apart from the impact of epidemics, inappropriate intervention policies may be the main cause of different degrees of fluctuation in the “pork cycle.” Therefore, excessive policy intervention may not necessarily play a promoting role in stabilizing the fluctuation of pork production in the context of scale breeding. Based on the above analysis, hypothesis 3 is proposed.

H3: Policy intervention intensity does not play a noticeably moderating role in the stabilizing effect of scale breeding on swine production volatility.

2.4 The threshold effect of marketization level on the impact of scale breeding on swine production volatility

The degree of marketization refers to the role and status of market mechanisms in resource allocation within a country or region’s economic activities. A higher degree of marketization signifies freer market supply and demand dynamics, more flexible resource allocation, greater independence for businesses, and a more regulatory and coordinating role for the government (Zhang et al., 2019). The influence of scale breeding on swine production volatility may vary due to different levels of marketization. Firstly, under conditions of higher marketization, scale farmers are more focused on acquiring and analyzing market information, enabling them to more accurately predict market trends and develop production and sales strategies based on market demand and trends, thereby mitigating the impact of market fluctuations on swine production. Secondly, in an environment with higher marketization, scale farmers are more willing to invest resources to improve production efficiency and quality, thereby alleviating production fluctuations through technological innovation and standardized management practices. This gives scale farmers an advantage in dealing with market fluctuations. Thirdly, in a context of higher marketization, scale breeding can better leverage economies of scale to reduce transaction costs, expand the scope of pig market transactions, mitigate imbalances in production and sales among different regions through a “unified large market,” and thereby alleviate the “pork cycle.” In summary, when marketization is higher, scale farmers have stronger competitive advantages in terms of market information acquisition and adaptation, production technology and management capabilities, cross-regional transactions, and are better equipped to cope with market fluctuations. Based on the above analysis, hypothesis 4 is proposed.

H4: There exists a threshold effect in the influence of scale breeding on swine production volatility, whereby the stabilizing effect of scale breeding on swine production volatility becomes more apparent when the level of marketization reaches a certain high point.

The relationship between the variables and the corresponding hypotheses can be seen in Figure 1.

3 Materials and methods

3.1 Data source

The data selected for this study comprises annual data from 26 provinces in China (excluding Hong Kong, Macao, Taiwan, Tibet, as well as the four municipalities of Beijing, Tianjin, Shanghai, and Chongqing) for the years 2007 to 2020. The data on swine production, urban residents’ disposable income are sourced from the “China Statistical Yearbook,” while the proportion of large-scale farm swine production comes from the “China Livestock and Veterinary Statistics.” The pig industry policies are derived from the Peking University Law Information Database, while data on swine disease mortality and culling are obtained from the “Veterinary Bulletin.” The marketization index is sourced from the China Marketization Index Database developed by scholars such as Fan & Wang. Prices of pork, chicken, beef, soybean meal, and corn are extracted from the “China Livestock and Veterinary Yearbook,” and CPI data is from the National Bureau of Statistics. Interpolation is utilized to fill in missing price data based on the national average price trend and neighboring period data with missing values.

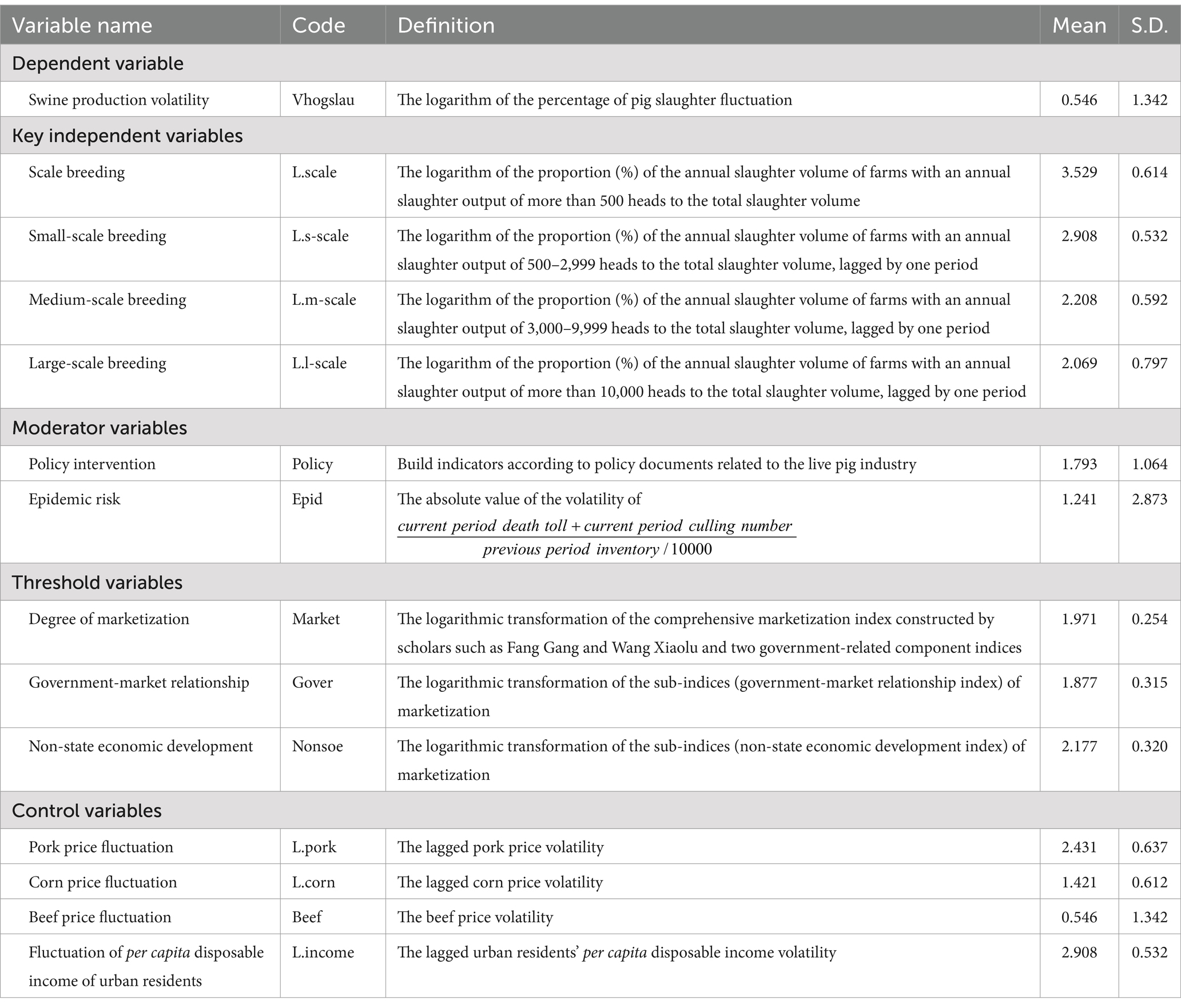

3.2 Variables selection

3.2.1 Dependent variable

The dependent variable in this paper is the volatility of swine production, with the logarithm of the percentage of pig slaughter fluctuation serving as a proxy for swine production volatility. The time series data includes three components: long-term trend elements, seasonal variation elements, and fluctuation elements. As pig slaughter volume is annual data and does not require seasonal adjustment, only the Hodrick-Prescott filter method is utilized to separate the long-term trend component, preserving the fluctuation component. This study focuses on the degree of swine production volatility and the stabilizing effect of scale breeding on swine production volatility, without regard to direction. Hence, the absolute value of the extracted fluctuation component yields the swine production volatility.

3.2.2 Core independent variable

Based on the standards of scale pig farming in “China Livestock and Veterinary Statistics,” the degree of pig scale breeding is measured by the logarithm of the proportion (%) of the annual slaughter volume of farms with an annual slaughter output of more than 500 heads to the total slaughter volume. In order to further distinguish the impact of different levels of pig farming scale on swine production fluctuations, this study divides the level of pig farming scale into small-scale, medium-scale, and large-scale, with annual slaughtering of 500–2,999 heads, 3,000–9,999 heads, and over 10,000 heads, respectively. The logarithm of the proportion (%) of slaughtering output of different scale breeding to the total slaughtering output is used to measure the level of pig farming scale at different scales. From the time when breeders make production plans to the pigs being slaughtered, there is approximately a one-year period during which the level of pig farming scale does not affect the situation of pig slaughtering. Therefore, a lagged treatment of the level of pig farming scale is required (Yang and Wang, 2022).

3.2.3 Moderator variables

(1) Policy intervention: The announcement and implementation of pig farming policies may influence breeders’ production and slaughtering decisions, and the extent of this impact may vary among breeders of different scales. To study the moderating effect of policy intervention on the impact of pig farming scale on swine production fluctuations, this paper constructs a policy intervention index as a moderating variable. The construction of the index refers to relevant studies (Pan et al., 2019; Shi and Hu, 2023). By searching for the title keywords “pig” in the Peking University Law Information Database, 2,775 pig industry-related policy documents from 2007 to 2020 were obtained. The effectiveness level of policy documents was quantified, and combined with the number of documents issued by each province to construct a pig farming policy intervention index, which was then log-transformed. The specific assignment criteria are as follows: local regulations are assigned a value of 4, local government regulations are assigned a value of 3, local normative documents are assigned a value of 2, and local working documents are assigned a value of 1.

(2) Epidemic risk: The occurrence and uncertainty of diseases can greatly impact breeders’ confidence and expectations in swine production and breeding. Breeders of different scales have varying capacities to withstand disease risks. To study the moderating effect of disease risk on the impact of pig farming scale on swine production fluctuations, this paper constructs a disease risk index as a moderating variable. This index is calculated by obtaining the absolute value of the volatility of , with volatility extracted using the HP filter method. This study considers major swine diseases such as African Swine Fever, Classical Swine Fever, Porcine Reproductive and Respiratory Syndrome (PRRS, also known as Blue Ear Disease), cysticercosis, swine pneumonia, and swine erysipelas.

3.2.4 Threshold variables

Degree of marketization: The most widely used comprehensive marketization index constructed by scholars such as Fan & Wang’s team, as well as two government-related sub-indices (government-market relationship index and non-state economic development index) under the comprehensive marketization index, are subjected to logarithmic transformation (Fan et al., 2011). Specifically, the government-market relationship index comprises three sub-indices: “proportion of market allocation of economic resources,” “reduction of government intervention in enterprises,” and “reduction of government size.” The non-state economic development index consists of three sub-indices: “proportion of non-state economy in the main business revenue of industrial enterprises,” “proportion of non-state economy in the total fixed asset investment of the whole society,” and “proportion of urban non-state economy employment to the total urban employment.”

3.2.5 Control variables

To ensure the accuracy and rationality of the results, a set of control variables affecting fluctuations in swine production was made, informed by the studies of Chen et al. (2016), Wang and Wei (2021), Wang et al. (2022) and Yang and Wang (2022), focusing primarily on the following three considerations: (1) Fluctuations in product and substitute product prices: The fluctuation of previous period product prices directly impacts producer decisions; thus, it is necessary to control for the lagged pork price volatility. Meanwhile, current substitute product prices also influence consumer choices, thereby affecting breeders’ production and marketing intentions. Beef is one of the main substitutes for pork consumption among residents. Therefore, beef price volatility will be considered as a control variable. (2) Fluctuations in production factor prices: According to the “Compilation of National Agricultural Cost–Benefit Data 2023″, feed costs account for approximately 50–70% of pig farming costs, representing the primary cost in pig farming. Hence, fluctuations in feed prices directly affect pig production costs and subsequently impact pig production (Wang G. et al., 2018). Corn is a major component of pig feed. As there is a lag between breeders’ determination of input factors and the pigs being marketed, the lagged corn price volatility will be taken into account as a control variable. (3) Fluctuations in consumer purchasing power: Fluctuations in consumer purchasing power affect pig demand, which in turn influences swine production. Consumers typically base their next year’s consumption on the previous year’s income level. Therefore, the lagged urban residents’ per capita disposable income volatility will be selected as a control variable.

To eliminate the influence of price factors, the Consumer Price Index (CPI) with the base year of 2006 will be used to adjust pork prices, beef prices, corn prices, and urban residents’ per capita disposable income. Since pork prices, beef prices, and corn prices are all monthly data, the CensusX12 seasonal adjustment method will be applied to the adjusted price series to remove seasonal fluctuations. Then, the HP filtering method will be used to extract the volatility term, followed by taking the absolute value and calculating the arithmetic mean to obtain the average volatility within the year, and finally, a natural logarithm transformation will be applied. Urban residents’ per capita disposable income is annual data and does not require seasonal adjustment. Only the HP filtering method will be used to extract the volatility term, followed by taking the absolute value and applying a natural logarithm transformation.

Definition of variables and descriptive statistics can be seen in Table 1.

3.3 Empirical models

3.3.1 Benchmark model

This study investigates the stabilizing effect of scale breeding on pigs production fluctuations. It conducts econometric analysis using panel data across provinces from 2007 to 2020 and establishes the following panel model:

In Equation 1, i refers to the region, and t refers to time. Vhogslauit refers to swine production volatility, measured in terms of the volatility of swine slaughter quantity. L.Scaleit-1 refers to the lagged swine scale breeding. Policyit refers to policy intervention, Epidit refers to epidemic risk. CVit refers to a group of control variables, including Porkit-1, Cornit-1, Beefit, Incomeit-1, Policyit, Epidit. refers to the individual heterogeneity that affects the fluctuation of swine production, refers to the stochastic disturbances that vary over time and across individuals.

3.3.2 Moderating effect model

To further explore the moderating effects of policy interventions and epidemic risk on the relationship between scale breeding and pigs production fluctuations, the following models are established:

In Equation 2, Policyit*L.Scaleit-1 denotes the interaction term between scale breeding and policy interventions. In Equation 3, Epidit*L.Scaleit-1 denotes the interaction term between scale breeding and epidemic risk.

3.3.3 Threshold effect model

To investigate the threshold effect of marketization level on the influence of scale breeding on swine production fluctuations, this study incorporates a threshold variable into the regression based on the aforementioned models, thus expanding the model to a threshold effect model:

In Equation 4, I(·) is a characteristic function, the threshold variable is Market (and two sub-indices—Gover and Nonsoe).

4 Results and discussion

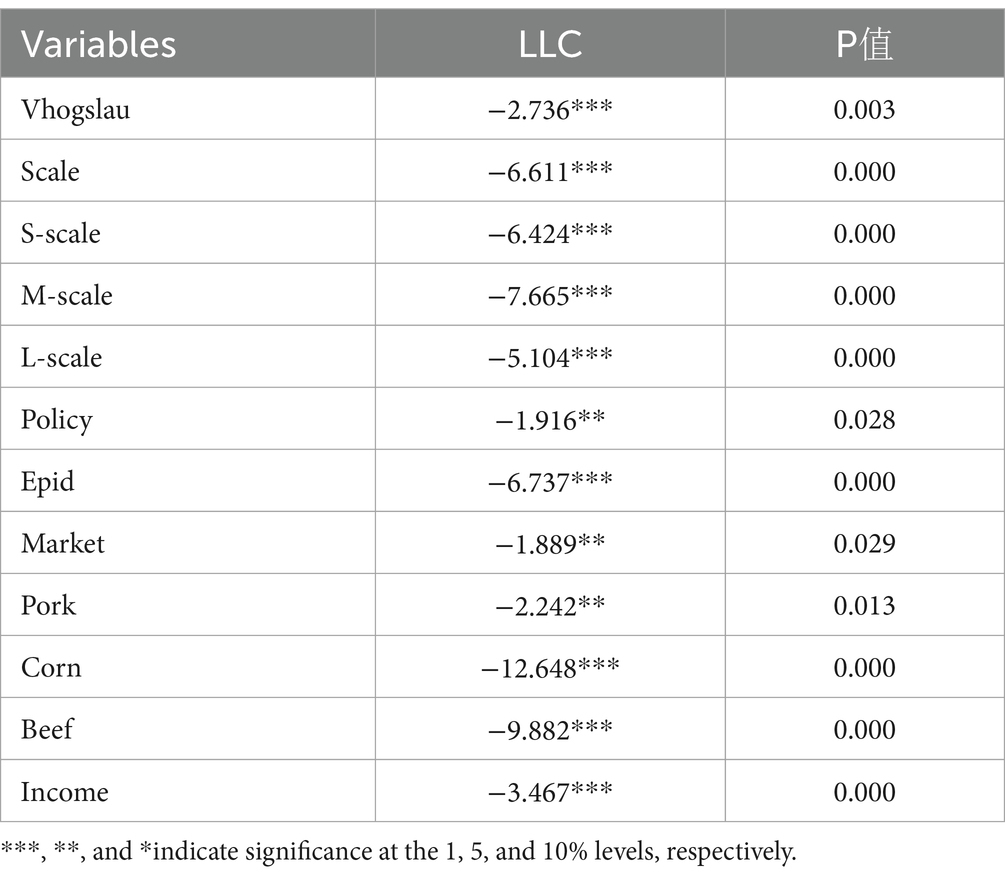

4.1 Unit root test

To avoid spurious regression, panel data is subjected to a unit root test prior to empirical analysis. The LLC test is employed in this study, and the results in Table 2 indicate that all variables pass the significance test and exhibit no unit roots. Based on these findings, empirical testing can be conducted.

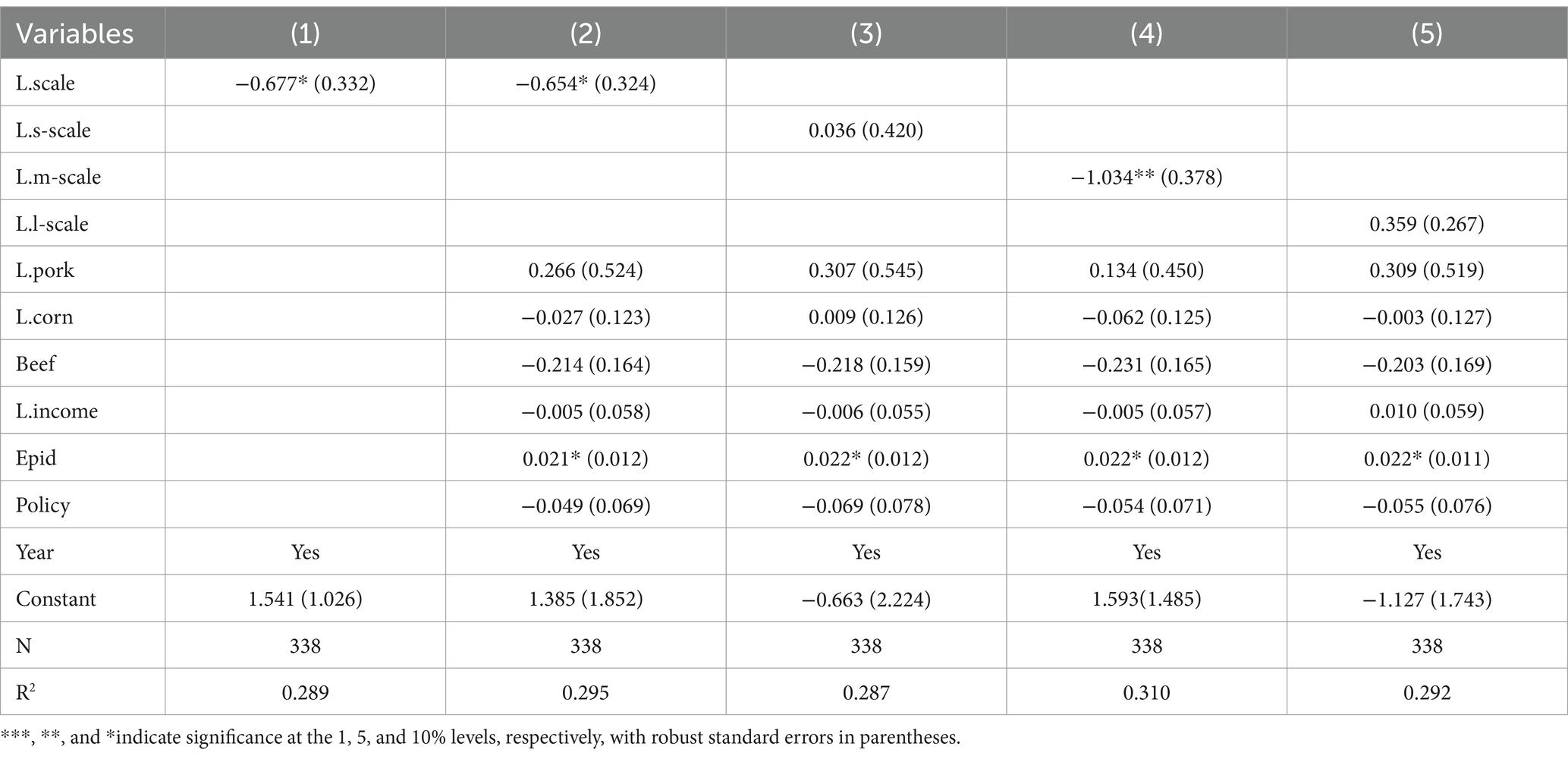

4.2 Baseline regression analysis

Utilizing a two-way panel fixed effects model, this study examines the stabilizing effect of scale breeding on swine production volatility. Columns (1) to (2) in Table 3 present the regression results of the impact of scale breeding on swine production volatility without and with control variables, respectively. The estimated coefficients of scale breeding are significantly negative at the 10% level in both cases, indicating that scale breeding reduces the fluctuations in swine production, thus confirming Hypothesis 1. Furthermore, the results of the control variables indicate that epidemic risk significantly increases fluctuations in swine production.

To further distinguish the impacts of different scale level on the volatility of swine production, the scale level was divided into small-scale, medium-scale, and large-scale levels (defined, respectively, by annual slaughter numbers of 500–2,999, 3,000–9,999, and over 10,000 heads, as a proportion of total slaughter numbers, with logarithmic transformation applied). The results of regression are presented in columns (3) to (5) of Table 3. Only the coefficient of swine medium-scale breeding is significantly negative, indicating that only moderate scale can stabilize swine production volatility. Therefore, in subsequent analysis, swine medium-scale breeding will be used as the primary explanatory variable. One possible reason is that it is only after reaching a certain scale that transaction costs can be reduced, leading to economies of scale. Moreover, only when reaching a certain scale will breeders have the motivation to invest in more sophisticated facilities and equipment, thereby stabilizing production. While compared to medium-scale breeding, the number of large-scale breeding farms is relatively small, decision-making is more centralized, and individual slaughter volumes are larger. Once production plans are adjusted, there is a risk of “big gains and big losses,” which may also exert a strong “demonstration effect” on other breeders, thereby weakening the stabilizing effect of scale breeding on swine production volatility.

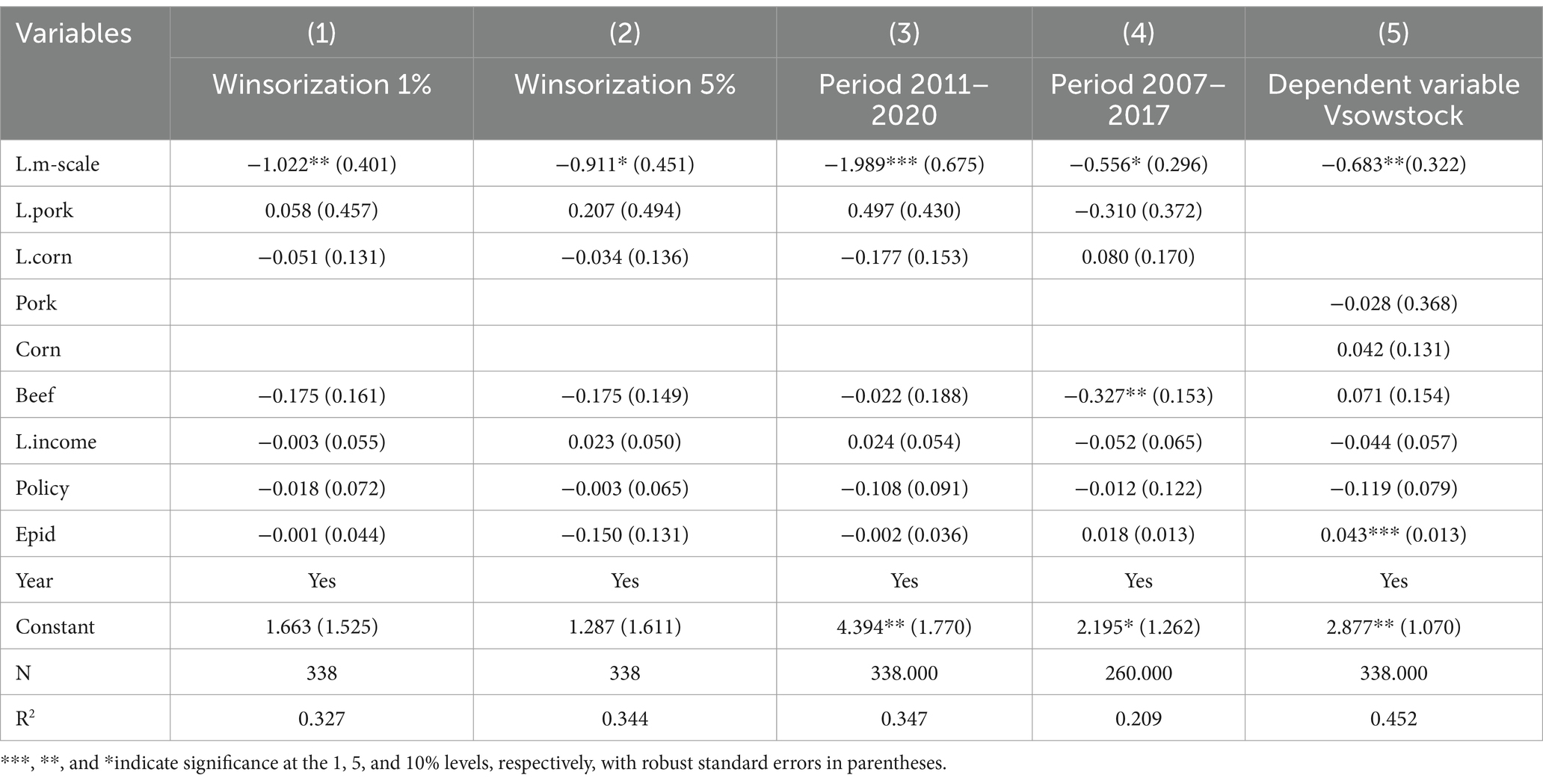

4.3 The robustness test

In order to ensure the reliability of the empirical research findings previously presented, this study conducted the following robustness checks.

4.3.1 Winsorization

Outliers in the regression sample may bias the estimation results. Therefore, this paper applies winsorization to all continuous variables in the baseline regression at the 1 and 5% quantiles, replacing outliers beyond the 98 and 90% intervals, respectively, before re-estimating the regressions. The results in columns (1) and (2) of Table 4 indicate that after winsorization, the impact of pig farming scale on production volatility remains significantly negative, consistent with the baseline regression findings.

4.3.2 Changing the regression period

The regression period from 2007 to 2020 in the baseline regression was replaced by a shorter period in this robustness test, specifically from 2011 to 2020 and from 2007 to 2017. The results, as shown in columns (3) and (4) of Table 4, indicate that the coefficient for pig farming scale remains significantly negative, consistent with the baseline regression results. The absolute value of the coefficient for pig farming scale during the period from 2011 to 2020 is greater than that in the baseline regression, while the absolute value of the coefficient during the period from 2007 to 2017 is smaller than that in the baseline regression. This suggests that the stabilizing effect of farming scale on swine production volatility has become more pronounced in recent years.

4.3.3 Replacing the dependent variable

In the baseline regression, the dependent variable, swine production volatility, was represented by the logarithm of the fluctuation rate of swine slaughter. The “Implementation Plan for Capacity Regulation of Swine Production (Interim)” issued by the Ministry of Agriculture and Rural Affairs of the People’s Republic of China in 2021 identified the change rate of sow stock as the core regulatory indicator for swine production capacity. The fluctuation rate of swine slaughter can directly measure changes in production supply, while the change rate of sow stock (the sow stock of the previous year being the underlying cause of the current year’s swine production) better reflects the principle of “early warning, regulatory guarantees, timely intervention, and precise policy implementation.” Therefore, in the robustness test, the dependent variable was replaced by the logarithm of the fluctuation rate of sow stock to measure swine production volatility. Consequently, the pork and corn price fluctuations included in the control variables were no longer lagged. Column (5) in Table 4 presents the regression result with the fluctuation of sow stock as the dependent variable, where the coefficient for the scale of swine farming remains significantly negative, consistent with the baseline regression results. Furthermore, in this robustness test, the absolute value of the coefficient for swine scale breeding is slightly smaller than that observed in the baseline regression, affirming the appropriateness and accuracy of the variable selection in the baseline regression. In conclusion, these results confirm the reliability of the main findings of this study and affirm the stability and credibility of the reported results.

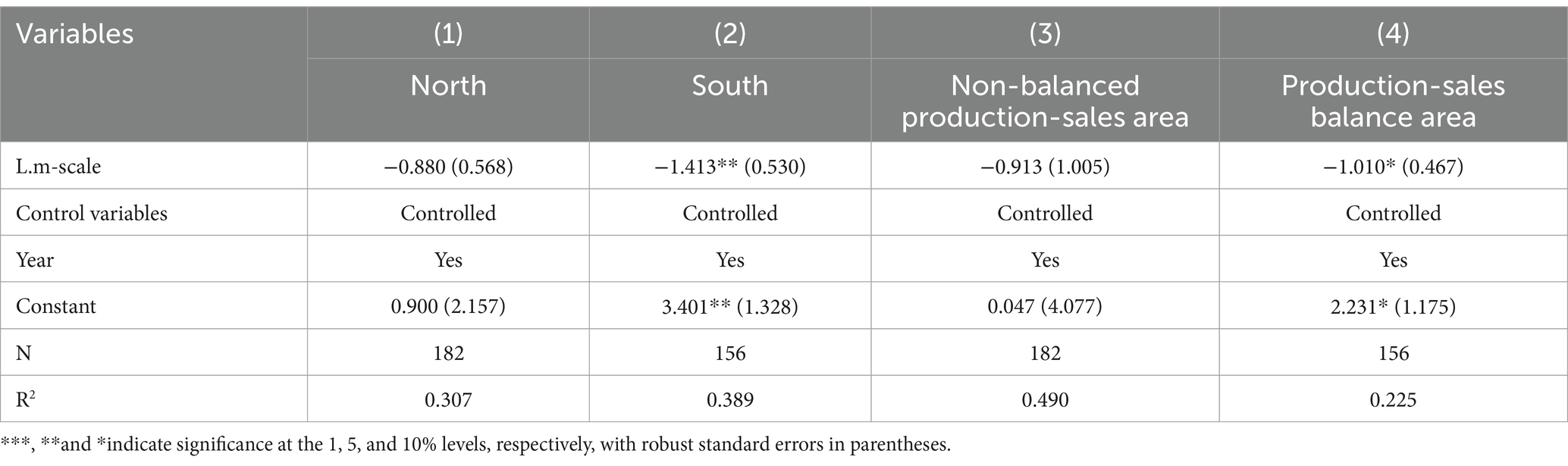

4.4 Regional heterogeneity analysis

Dividing 26 provinces into northern and southern provinces, with the Qinling-Huaihe River as the boundary (Northern provinces include Inner Mongolia, Xinjiang, Hebei, Gansu, Ningxia, Shanxi, Shaanxi, Qinghai, Shandong, Henan, Anhui, Liaoning, Jilin, Heilongjiang, and southern provinces include Jiangsu, Zhejiang, Hubei, Hunan, Sichuan, Guizhou, Yunnan, Guangxi, Jiangxi, Fujian, Guangdong, Hainan), separate regressions were conducted for the two regions, and the regression results are shown in columns (1) and (2) of Table 5. The results indicate that the stabilizing effect of scale breeding on swine production volatility is significant in the southern region but not in the northern region. This may be due to the fact that the northern region is relatively colder than the southern region, which imposes higher requirements on swine farming facilities and equipment, leading to higher construction costs for scale breeding and thus relatively lower levels of pig farming scale. In contrast, the climate in the southern region is more suitable, the population is denser, and there is relatively greater market demand. Additionally, influenced by factors such as dense water networks and greater environmental pressures, independent or cooperative moderate-scale breeding is more prevalent and mature (Data shows that in the southern and northern regions, the annual slaughter volume in pig farms with a scale of 3,000–9,999 heads accounted for 11.01 and 8.94% of the total slaughter volume, respectively). Furthermore, the northern region is an important area for feed raw materials, while the cost of pig farming feed is relatively higher in the southern region. Therefore, in the southern region, the “economies of scale” of moderate-scale breeding can be leveraged to reduce production costs and stabilize swine production volatility.

In the “14th Five-Year Plan” for the national animal husbandry and veterinary industry development, the national swine farming industry is divided into sending-out areas, main sales areas, and production-sales balance areas based on factors such as economic and social development level, resource and environmental carrying capacity, and market consumption demand (Sending-out areas include Hubei, Hunan, Henan, Guangxi, Liaoning, Jilin, Heilongjiang, Hebei, Anhui, Shandong, Jiangxi, main sales areas include Guangdong, Zhejiang, Jiangsu, Beijing, Tianjin, Shanghai, and production-sales balance areas include Inner Mongolia, Shanxi, Hainan, Sichuan, Chongqing, Yunnan, Guizhou, Fujian, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang). This study categorizes sending-out areas and main sales areas as non-balanced production-sales areas and conducts separate regressions for the non-balanced production-sales areas and production-sales balance areas, with the regression results presented in columns (3) and (4) of Table 5. The results indicate that the stabilizing effect of scale breeding on swine production volatility is significant in the production-sales balance areas but not in the non-balanced production-sales areas. This may be due to the frequent product trading between provinces in non-balanced production-sales areas, leading to greater market supply–demand fluctuations. Moreover, under uncontrollable factors such as diseases, product circulation between regions may be hindered (Yan et al., 2023; Yao et al., 2022), thus weakening the stabilizing effect of scale breeding on swine production volatility. In contrast, production-sales balance areas can basically achieve self-sufficiency, and the relatively stable market supply–demand relationship allows moderate-scale breeding to better stabilize production.

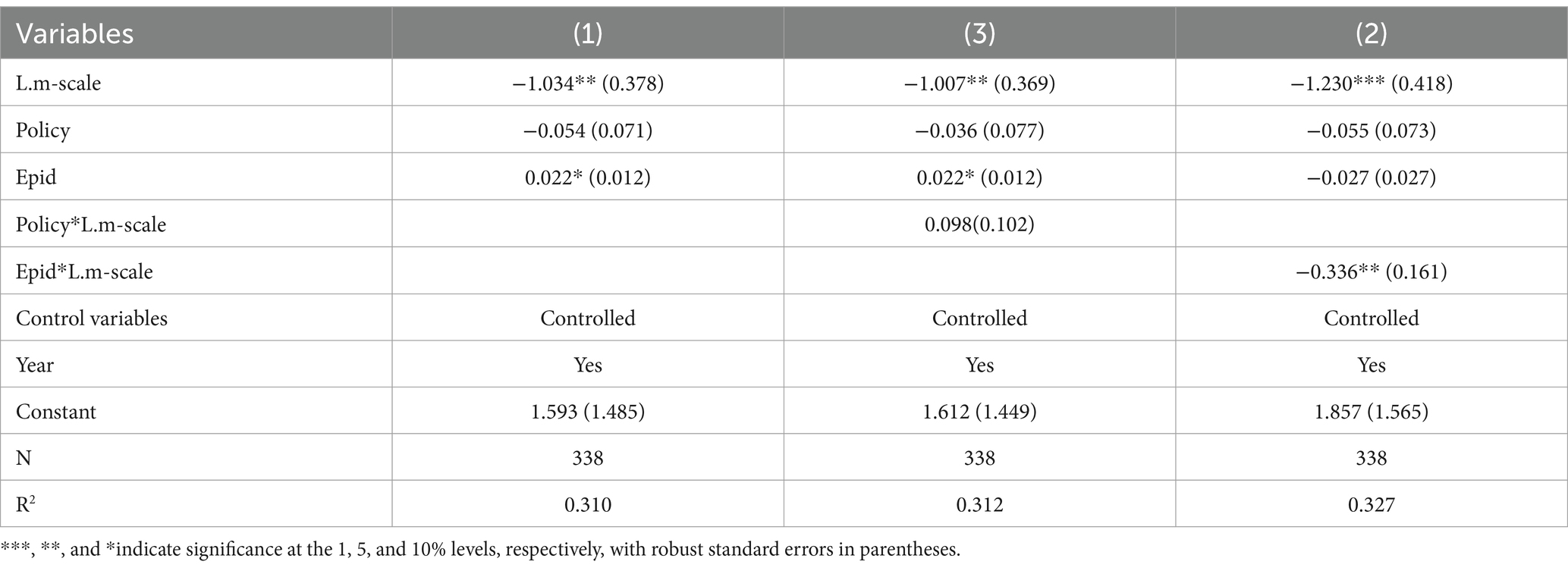

4.5 The moderating role of policy intervention and epidemic risk

To examine whether policy intervention and epidemic risk play a moderating role in the impact of scale breeding on pig production volatility, interaction terms of epidemic risk and policy intervention intensity with scale breeding were separately included in the regression. To mitigate the high collinearity between the interaction terms and the explanatory and moderating variables, the explanatory and moderating variables were centralized before the interaction. The regression results are presented in columns (1) to (3) of Table 6. In column (2), the coefficient of the interaction term between epidemic risk and scale breeding is significantly negative at the 5% level, confirming that while an increase in epidemic risk exacerbates pig production volatility, the stabilizing effect of scale breeding on pig production volatility becomes more pronounced during heightened disease fluctuations. This suggests that scale farming operations maintain more stable production in the face of epidemic risk, and that epidemic risk does not significantly impact the production plans of scale farming operations. Hypothesis 2 is validated. In column (3), the coefficient of the interaction term between policy intervention intensity and scale breeding is not significant, indicating that excessive policy intervention does not promote the stabilizing effect of scale breeding on pig production volatility. This may be due to the lack of foresight and precision in China’s current policy interventions in the pig industry, with a tendency for more pro-cyclical regulation and less counter-cyclical regulation in response to pig production fluctuations (Xin et al., 2023), thus resulting in an insignificant effect of policy intervention in promoting stable production through scale breeding. Hypothesis 3 is validated.

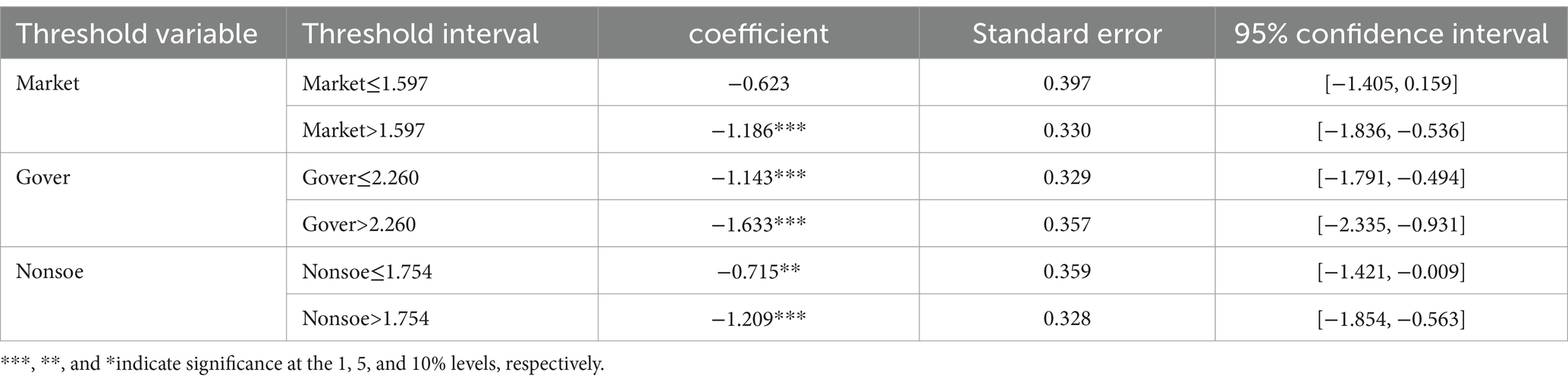

4.6 The threshold effect of marketization level

To further investigate the potential non-linear relationship between scale breeding and the volatility of pig production, and to verify the roles of the market’s “invisible hand” and the government’s “visible hand,” this study introduces a panel threshold model. Utilizing the bootstrap resampling method, the study examines the threshold characteristics of the marketization index and its component indices. Single-threshold, double-threshold, and triple-threshold tests are successively conducted. The results of the threshold effect tests and the estimated threshold values are presented in Table 7. The comprehensive marketization index, the government-market relationship index, and the non-state economic development index all pass the single-threshold test at a significance level of 10%, with threshold values of 1.597, 2.260, and 1.754, respectively.

The regression results of the threshold model in Table 8 indicate that when the comprehensive marketization index is less than or equal to 1.597, the stabilizing effect of scale farming on pig production volatility is not significant. However, when the comprehensive marketization index exceeds 1.597, the stabilizing effect of scale farming on pig production volatility becomes significant at the 1% level, with a coefficient of −1.186. This suggests the presence of a threshold effect of marketization on the influence of scale farming on pig production volatility. Stable production in scale farming requires a favorable external market environment, and only when the degree of marketization reaches a certain level will scale farming have a stabilizing effect on pig production volatility. This may be attributed to the fact that only when the degree of marketization reaches a certain level are information transparency, predictability of market demand, coordinated and stable supply chains achieved, enabling scale farms to gain technological and cost advantages through standardized production processes and economies of scale. Moreover, under favorable development conditions, they receive stable policy support, have more stable expectations, and consequently reduce production volatility. Hypothesis 4 is essentially confirmed.

Furthermore, focusing on two government-related aspects indexes under the comprehensive marketization index, the threshold model regression results indicate that when the government-market relationship index is below the threshold value (2.260), the coefficient for scale farming is −1.143. Once the government-market relationship index surpasses the threshold value, the coefficient for scale farming becomes −1.633, both coefficients are significant at the 1% level. This demonstrates that as the proportion of market allocation of economic resources increases and government intervention decreases, the stabilizing effect of scale farming on pig production significantly improves. This can be attributed to the fact that market mechanisms help optimize resource allocation, allowing scale farms to utilize resources more fully, enhance overall production efficiency, and improve their resilience to risks. Therefore, as the role of the market’s “invisible hand” rises and the role of the government’s “visible hand” declines, scale farms are better able to contribute to stable production. Additionally, when the non-state economic development index is below the threshold value (1.754), the coefficient for large-scale farming is −0.715. Upon crossing the threshold value, the coefficient for scale farming becomes −1.209, further strengthening its stabilizing effect on pig production volatility. The aforementioned coefficients are significant at the 5 and 1% levels, respectively. This indicates that non-state economic development helps stimulate the vitality of micro-subjects and mobilize social resources, thereby continuously reinforcing the stabilizing effect of scale farming on pig production volatility. The threshold regression results of marketization aspects indexes further validate the preceding conclusions.

5 Conclusions and policy implications

The panel data from 26 provinces in China from 2007 to 2020 is utilized in this study to empirically analyze the stabilizing effect of scale farming on the fluctuation of swine production, the moderating effect of epidemic risk and policy intervention on the relationship between scale farming and swine production fluctuation, as well as the threshold effect of marketization level on the impact of scale farming on swine production fluctuation. The study’s findings are as follows: First, moderately scaled farming (annual slaughter of 3,000–9,999 pigs) has a stabilizing effect on swine production fluctuation. This effect is significant in the southern region but not significant in the northern region; it is significant in balanced production and consumption areas, but not significant in unbalanced production and consumption areas. Second, the stronger the disease risk, the stronger the stabilizing effect of moderately scaled farming on swine production fluctuation. Third, the moderating effect of policy intervention on the stabilizing effect of scale farming on swine production fluctuation is not significant. Fourth, there exists a threshold for the stabilizing effect of scale farming on swine production fluctuation. When the comprehensive level of marketization reaches the threshold value, scale farming has a stable effect on swine production fluctuation. From the aspect index, when government-market relationship index, and non-state economic development index reach the threshold value, the stabilizing effect of scale farming on pig production becomes significantly enhanced.

Overall, this study provides a novel theoretical perspective and empirical evidence, making significant contributions to the existing literature, particularly regarding the relationship between breeding scale and swine production volatility. Firstly, the paper employs data that includes the post-African Swine Fever outbreak period, offering a reassessment of whether scale farming still plays a stabilizing role in swine production amidst the “great reshuffle.” By revealing regional heterogeneity, it deepens the discussion on how region-specific factors influence the effectiveness of agricultural economies of scale in stabilizing production. Furthermore, the study incorporates the moderating effects of external shocks, such as disease outbreaks (e.g., African Swine Fever) and government policy interventions, while also emphasizing the threshold effect of marketization. This enriches the understanding of how both “visible hands” (policy interventions) and “invisible hands” (market forces) can foster breeding scale development to stabilize swine production in an era of increasing global uncertainty.

Based on the research conclusions, the following policy insights are proposed:

First, promote moderately scaled pig farming and choose appropriate farming models according to local conditions. On the one hand, collaboration models such as “company + farmers,” “company + base + farmers,” “company + cooperative + farmers,” “company + village collective + farmers” can be implemented to lower the technical and financial thresholds for small-scale farmers to expand their scale and drive them towards moderately scaled farming. On the other hand, establishing a risk protection mechanism to reduce the risks of scaled farming, such as increasing government subsidies to encourage full coverage of breeding sow and fattening pig farming insurance by scaled farmers, expanding the scope of fattening pig price insurance, and promoting “insurance + futures” and “insurance + credit” models to help scaled farmers withstand market and disease risks. At the same time, methods such as establishing a manure treatment system (e.g., biogas digester, sewage treatment facilities), producing organic fertilizer, biogas power generation, and collaborating with surrounding farmers for manure harmless treatment and resource utilization should be adopted to reduce environmental pollution from scaled farming.

Second, improve the monitoring and information disclosure system of diseases and increase the accuracy and transparency of disease information. Due to concerns that the announcement of epidemics may affect officials’ career development and the normal development of the local pig industry, and that it may be difficult to pay subsidies for culling infected pigs after full reporting of epidemic outbreaks, various regions commonly delay, conceal, or underreport pig disease outbreaks (Ma et al., 2024). This makes it difficult for farmers to accurately judge the real situation of surrounding diseases based on public information. To prevent passive infection, farmers can only increase the investment in disease prevention and control and reduce trading frequency. Combined with the empirical results of this study, improving disease monitoring and information disclosure systems can enable large-scale farmers to have more accurate disease information and more efficiently exert their stabilizing effect on production. First, regular inspections and sampling tests of farms should be carried out to ensure real-time monitoring of epidemic situations, and to regularly release pig disease monitoring results, early warning information, and response measures. Second, transportation, slaughtering, and quarantine processes should be strengthened to clarify the responsibilities of disease prevention at each stage and continuously improve the biological safety protection levels of each process.

Third, maintain policy stability and reduce excessive intervention of the “visible hand.” Policy intervention in the process of industrial development should be moderate. Frequent policy changes cannot stabilize pig production and may instead increase uncertainties for farmers, discouraging long-term investments. From a long-term perspective, stable and predictable support policies in finance, banking, land use, and environmental protection should be maintained to ensure the continuity of policies, avoiding creating confusion for farmers. In the current situation, efforts should be made to improve the countercyclical regulation mechanism for pig production and reduce pro-cyclical regulation to avoid amplifying market risks through policy intervention. Matters that can be adjusted by market should be given time to be regulated by the market itself, and only consider policy adjustments for issues that cannot be regulated by the market and have significant impacts.

Fourth, create a favorable market environment to fully leverage the self-regulating role of the market’s “invisible hand.” Firstly, it is important to establish and improve agricultural product market information release platforms, trading platforms, and market early warning mechanisms, in order to make agricultural supply and demand information transparent. This will enable farmers to timely understand market dynamics and adjust production decisions accordingly, preventing significant market fluctuations. It is recommended to integrate the data from the direct reporting system of the Ministry of Agriculture and Rural Affairs with the statistics and survey monitoring data from the National Bureau of Statistics, in order to establish uniform standards and ensure the accuracy of production and supply–demand data. Secondly, promote live collateral and whole-farm asset financing for scaled farms to address the financing difficulties faced by farmers. The construction of pig farms and the purchase of breeding equipment, as well as investment in pigs, require considerable capital. However, most farmers currently face challenges in using the aforementioned assets as collateral for loans, resulting in widespread financing difficulties. It is suggested to promote live collateral through digital transformation, advance the separate rights confirmation of land and buildings in aquaculture farms to facilitate comprehensive collateralization of entire aquaculture operations, enabling the “valuable assets” of farmers to be utilized as “effective assets” for financing. Furthermore, efforts should be made to encourage the development of agricultural intermediary organizations such as cooperatives and social service agencies to promote integrated cooperation in production, marketing, and credit. Additionally, in areas such as the utilization of organic waste resources, collaborative win-win partnerships can be achieved by bringing together suppliers and buyers to reduce transaction costs.

6 Research limitations and future direction

Due to the unavailability of more recent disease-related data in China, the article utilizes data from the period 2007–2020. Future research could employ simulation methods such as machine learning to establish predictive models for further analysis. Moreover, broader data collection from other countries can facilitate comparative studies.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found below: China Statistical Yearbook (https://www.stats.gov.cn/sj/ndsj/); China Livestock and Veterinary Statistics; Veterinary Bulletin (https://www.moa.gov.cn/gk/sygb/); China Livestock and Veterinary Yearbook (https://data.cnki.net/statisticalData/index?ky=%E4%B8%AD%E5%9B%BD%E7%89%B2%E7%95%9C%E5%85%BD%E5%8C%BB%E5%B9%B4%E9%89%B4); Peking University Law Information Database (https://pkulaw.com/law); the National Bureau of Statistics (https://www.stats.gov.cn/sj/).

Author contributions

HJ: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. MW: Conceptualization, Funding acquisition, Investigation, Project administration, Resources, Supervision, Writing – original draft, Writing – review & editing. ZY: Conceptualization, Formal analysis, Methodology, Writing – original draft, Writing – review & editing. YS: Conceptualization, Formal analysis, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This work was supported by the Key Project of National Natural Science Foundation of China (Grant No. 72033009); Chinese Academy of Agricultural Sciences Science and Technology Innovation Project (Grant No. 10-IAED-01-2024).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adesehinwa, A. O. K., Boladuro, B. A., Dunmade, A. S., Idowu, A. B., Moreki, J. C., Wachira, A. M., et al. (2024). Pig production in Africa: current status, challenges, prospects and opportunities. Anim Biosci. 37, 730–741. doi: 10.5713/ab.23.0342

Adhikari, B. B., Harsh, S. B., and Schwab, G. (2004). Regional competitive position of pork industry.

Ameyaw, G. A., Tsamenyi, M., McIlgorm, A., and Aheto, D. W. (2021). Challenges in the management of small-scale marine fisheries conflicts in Ghana. Ocean Coast. Manag. 211:105791. doi: 10.1016/j.ocecoaman.2021.105791

Bai, X. B., Hu, H., and Zhang, Y. (2023). The internal logic, practical effect and enlightenment of the development of hog contract production in the United States. Issues Agric. Econ. 7, 101–115. doi: 10.13246/j.cnki.iae.2023.07.004

Bai, H. Y., Tan, Y. W., and Zeng, H. S. (2017). Influence of market information on fluctuation of pork price in China and european union. J. Huazhong Agric. Univ. Sci. Ed. 70:78. doi: 10.13300/j.cnki.hnwkxb.2017.06.009

Bai, Z., Zhao, J., Wei, Z., Jin, X., and Ma, L. (2019). Socio-economic drivers of pig production and their effects on achieving sustainable development goals in China. J. Integr. Environ. Sci. 16, 141–155. doi: 10.1080/1943815X.2019.1671463

Chen, D., Abler, D., Zhou, D., Yu, X., and Thompson, W. (2016). A meta-analysis of food demand elasticities for China. Appl. Econ. Perspect. Policy 38, 50–72. doi: 10.1093/aepp/ppv006

Cheng, J., and Ward, M. P. (2022). Risk factors for the spread of african swine fever in china: a systematic review of chinese-language literature. Transbound Emerg. Dis. 69, E1289–E1298. doi: 10.1111/tbed.14573

Fan, G., Wang, X. L., and Ma, G. R. (2011). Contribution of marketization to china’s economic growth. Econ. Res. J. 46, 4–16. doi: CNKI:SUN:JJYJ.0.2011-09-002

Goyal, R., Mensah, E., and Steinbach, S. (2024). The interplay of geopolitics and agricultural commodity prices. Appl. Econ. Perspect. Policy 30:13481. doi: 10.1002/aepp.13481

Grofova, S., and Srnec, K. (2012). Food crisis, food production and poverty. Agric. Econ. 58, 119–126. doi: 10.17221/91/2011-AGRICECON

Guo, L. J., and Lin, Y. Z. (2020). Study on the power, path and influence of large-scale pig breeding in. Rural Econ. 8, 126–135.

Hu, H., Jiang, G. H., and Ge, Y. (2022). High-quality development of chinese pig breeding industry: realistic needs,connotation features and path selection. Issues Agric. Econ. 12, 32–44. doi: 10.13246/j.cnki.iae.2022.12.004

Huang, B. K., Geng, X. H., and Hu, H. (2021). Was the change of farm scale structure caused by hog industrial policy in China? An empirical analysis based on markov chain. China Rural Surv. 4, 123–144.

Iyai, D. A., Nurhayati, D., Arim, M., Saragih, D., Orisu, M., Djunaedi, M., et al. (2021). Analyses of interlinked actors in determining the potential business beneficiaries of small-scale pig farming systems in West Papua, Indonesia. Heliyon 7:e05911. doi: 10.1016/j.heliyon.2021.e05911

Ji, C., Jin, S. Q., Wang, H. T., and Ye, C. H. (2019). Estimating effects of cooperative membership on farmers' safe production behaviors: evidence from pig sector in China. Food Policy 83, 231–245. doi: 10.1016/j.foodpol.2019.01.007

Kim, S. W., Gormley, A., Jang, K. B., and Duarte, M. E. (2024). Current status of global pig production: an overview and research trends. Anim. Biosci. 37, 719–729. doi: 10.5713/ab.23.0367

Kornher, L., Balezentis, T., and Santeramo, F. G. (2024). Eu food price inflation amid global market turbulences during the covid-19 pandemic and the Russia–Ukraine war. Appl. Econ. Perspect. Policy 22:13483. doi: 10.1002/aepp.13483

Lee, S., Ohler, A., and Thompson, W. (2024). The impact of agricultural policy evolution on long-run grain market projection. Appl. Econ. Perspect. Policy 20:13474. doi: 10.1002/aepp.13474

Li, S., and Bao, Z. (2020). Research on characteristics and forecast of pork price volatility in China. Price Theory Pract. 6, 80–83+150. doi: 10.19851/j.cnki.cn11-1010/f.2020.06.198

Li, P. C., and Wang, M. L. (2020). How to recover pig production under the double attack of environmental protection and epidemic situation. Issues Agric. Econ. 6, 109–118. doi: 10.13246/j.cnki.iae.2020.06.010

Li, M., Yang, J., and Xu, Z. G. (2012). Impacts of feeding patterns on fluctuations and cycle of pork price: a comparison between China,the United States and Japan. Issues Agric. Econ. 33, 73–78. doi: 10.13246/j.cnki.iae.2012.12.013

Liu, H., Ren, Y., Wang, T., Shan, H., and Wong, K. W. (2023). Fuzzy model for quantitative assessment of the epidemic risk of african swine fever within Australia e. Prev. Vet. Med. 213:105884. doi: 10.1016/j.prevetmed.2023.105884

Liu, H., and Zheng, K. (2024). Analysis of the chinese government's subsidy programs to restore the pork supply chain: the case of african swine fever. Omega 124:102995. doi: 10.1016/j.omega.2023.102995

Lu, C. X., Fang, J. Q., and Fu, S. C. (2020). A new equilibrium strategy of supply and demand for the supply chain of pig cycle. Math. Probl. Eng. 2020, 1–13. doi: 10.1155/2020/2093593

Lv, X., Tu, G., and Li, H. (2022). Price volatility of hogs and tracing of the event in China: based on ceemdan method. Front Energy Res 10:902613. doi: 10.3389/fenrg.2022.902613

Ma, M., Delgado, M. S., and Wang, H. H. (2024). Risk, arbitrage, and spatial price relationships: insights from China's hog market under the african swine fever. J. Dev. Econ. 166:103200. doi: 10.1016/j.jdeveco.2023.103200

Ma, C., Tao, J., Tan, C., Liu, W., and Li, X. (2023). Negative media sentiment about the pig epidemic and pork price fluctuations: a study on spatial spillover effect and mechanism. Agriculture 13:658. doi: 10.3390/agriculture13030658

Ma, M., Wang, H. H., Hua, Y., Qin, F., and Yang, J. (2021). African swine fever in China: impacts, responses, and policy implications. Food Policy 102:102065. doi: 10.1016/j.foodpol.2021.102065

McEwan, K., Marchand, L., Shang, M., and Bucknell, D. (2020). Potential implications of covid-19 on the Canadian pork industry. Can. J. Agric. Econ. 68, 201–206. doi: 10.1111/cjag.12236

Mulyo, J. H., Prasada, I. Y., and Nugroho, A. D. (2023). Impact of political and security stability on food security in developing countries: case of africa, asia, latin america and the caribbean. Agric. Econ. 69, 375–384. doi: 10.17221/142/2023-AGRICECON

Niemi, J. K. (2020). Impacts of african swine fever on pigmeat markets in europe. Front. Vet. Sci. 7:634. doi: 10.3389/fvets.2020.00634

Nugroho, A. D., Tovar, J. P. C., Bopushev, S. T., Bozsik, N., Feher, I., and Lakner, Z. (2022). Effects of corruption control on the number of undernourished people in developing countries. Food Secur. 11:924. doi: 10.3390/foods11070924

Pan, D., Chen, H., and Kong, F. B. (2019). The evolution of forestry policies since 1949: an quantitative analysis based on 283 texts of forest-related normative policy documents. Chin. Rural Econ. 7, 89–108.

Qiao, F., Huang, J., Wang, D., Liu, H., and Lohmar, B. (2016). China's hog production: from backyard to large-scale. China Econ. Rev. 38, 199–208. doi: 10.1016/j.chieco.2016.02.003

Ramsey, A. F., Goodwin, B. K., Hahn, W. F., and Holt, M. T. (2021). Impacts of covid-19 and price transmission in us meat markets. Agric. Econ. 52, 441–458. doi: 10.1111/agec.12628

Renaudeau, D., and Dourmad, J. Y. (2022). Review: future consequences of climate change for european union pig production. Animal 16:100372. doi: 10.1016/j.animal.2021.100372

Schembri, N., Hernandez-Jover, M., Toribio, J. A. L. M., and Holyoake, P. K. (2015). On-farm characteristics and biosecurity protocols for small-scale swine producers in eastern Australia. Prev. Vet. Med. 118, 104–116. doi: 10.1016/j.prevetmed.2014.11.008

Shang, M. Z., and McEwan, K. (2021). The make-or-buy decision of feed on livestock farms: evidence from Ontario swine farms. Can. J. Agric. Econ.-Rev. Can. Agroecon. 69, 353–368. doi: 10.1111/cjag.12269

Shen, X. Q., and Qiao, J. (2019). Differences in opportunity selection behaviors of pig farms and households with different seales under price fluctuations: thoughts on mitigating the large fluctuation of pig prices. J. Huazhong Agric. Univ. Sci. Ed. 5, 54-62+167-168.doi: 10.13300/j.cnki.hnwkxb.2019.05.007

Shi, Z. Z., and Hu, X. D. (2023). Epidemic shock, policy regulation, and china’s hog market price volatility. Res. Agric. Mod. 44, 130–141. doi: 10.13872/j.1000-0275.2023.0016

Shi, Z. Z., Li, J. R., and Hu, X. D. (2023). Risk assessment and response strategy for pig epidemics in China. Vet. Sci. 10:485. doi: 10.3390/vetsci10080485

Visetnoi, S., and Nelles, W. (2023). Can organic pork help achieve sustainable development goals in Thailand? Agriculture 13:1822. doi: 10.3390/agriculture13091822

Wang, M. L., Li, P. C., and Ma, X. P. (2022). The influence of scale structure adjustment on the high-quality development of animal husbandry and its path optimization:an analysis from the perspective of pig breeding scale. Chin. Rural Econ. 3, 12–35.

Wang, G., Si, R., Li, C., Zhang, G., and Zhu, N. (2018). Asymmetric price transmission effect of corn on hog: evidence from China. Agric. Econ. 64, 186–196. doi: 10.17221/227/2016-AGRICECON

Wang, G., Wang, J., Chen, S., and Zhao, C. E. (2023). Vertical integration selection of chinese pig industry chain under african swine fever - from the perspective of stable pig supply. PLoS One 18:e280626. doi: 10.1371/journal.pone.0280626

Wang, G. Y., Wang, X. H., and Li, C. X. (2018). The stabilization effect of farming capitalization on hog price fluctuation: an empirical analysis based on China panel data. Chin. Rural Econ. 6, 55–66.

Wang, W., and Wei, L. (2021). Impacts of agricultural price support policy on price variability and welfare: evidence from china's soybean market. Agric. Econ. 52, 3–17. doi: 10.1111/agec.12603

Wang, Z. Q., Yang, K. F., Li, L. L., Liu, J., and Liu, Y. M. (2023). Effect of animal disease risk on application of digital intelligence technology in large-scale pig farms. Chin. J. Agric. Resour. Reg. Plan. 44, 65–72. doi: 10.7621/cjarrp.1005-9121.20230407

Weng, M. (2013). Analysis on the causes of large fluctuation of pig price in China: from the perspective of breeding scale and pig market. Rural Econ. 9, 31–33.

Woonwong, Y., Do, T. D., and Thanawongnuwech, R. (2020). The future of the pig industry after the introduction of african swine fever into asia. Anim. Front. 10, 30–37. doi: 10.1093/af/vfaa037

Xin, X. F., Wang, Z. L., Liu, C. Y., and Wang, J. M. (2023). Development situations, problems and countermeasuresof china’s hog industry in the new stage. Issues Agric. Econ. 8, 4–16. doi: 10.13246/j.cnki.iae.2023.08.004

Xu, F., Ni, X., Liu, K., Wang, M., Tan, K., and Hu, J. (2024). Analysis of pork price fluctuations during the special era when african swine fever and covid-19 epidemic coexisted: an empirical study in Macau, China. Front. Sustain. Food Syst. 8:1370726. doi: 10.3389/fsufs.2024.1370726

Xu, G., Tan, Y. F., Lu, Q., and Zhang, S. X. (2023). Zhang, exploration of path for farmers’production resilience to promote post-epidemic production recovery under impact of major epidemics–a research based on perspective of contract agriculture. Agric. Econ. Manag. 4, 112–126. doi: 10.3969/j.issn.1674-9189.2023.04.010

Yan, Z. X., Fei, F. Y., and Su, C. J. (2014). The pig cycle,the diversity of policy and government intervention. Issues Agric. Econ. 35, 16–24. doi: 10.13246/j.cnki.iae.2014.08.003

Yan, T., Zhang, T., and Zhu, Z. (2023). The environmental tax scheme in China's large-scale pig farming: balancing economic burden and responsibility. Agriculture. 8:1576. doi: 10.3390/agriculture13081576

Yang, Q., Qiao, S., and Ying, R. (2024). Agricultural industrial scale, price random fluctuation, and profitability levels: evidence from china's pig industry. Front. Sustain. Food Syst. 8:1291743. doi: 10.3389/fsufs.2024.1291743

Yang, S. H., and Wang, K. (2022). Study on stabilization effect of scale management on fluctuation of hog production in China:double test based on moderating effect and threshold effect models. Issues Agric. Econ. 7, 81–96. doi: 10.13246/j.cnki.iae.2022.07.008

Yao, H., Zang, C., Zuo, X., Xian, Y., Lu, Y., Huang, Y., et al. (2022). Tradeoff analysis of the pork supply and food security under the influence of african swine fever and the covid-19 outbreak in China. Geogr. Sustain. 3, 32–43. doi: 10.1016/j.geosus.2022.01.005

Zhang, J. K., Hou, Y. Z., Liu, P. L., He, J. W., and Zhuo, X. (2019). The goal requirements and strategic path for high-quality development. Manag. World 35, 1–7. doi: 10.3969/j.issn.1002-5502.2019.07.002

Zhang, S. Y., Jiang, H., Tong, D. J., and Jiang, J. Y. (2021). Environmental regulations, regional strategic interaction and hog production development: an empirical study based on the spatial econometric model. China Popul. Resour. Environ. 31, 167–176. doi: 10.12062/cpre.20201009

Zhao, Q. X. (2017). Causes and pathways for solution of hog cycle phenomenon in China. Pricetheory Pract. 4, 44–48. doi: 10.19851/j.cnki.cn11-1010/f.2017.04.012

Zhou, K., Wang, H., Wu, J., and Li, J. Q. (2023). Effect of digital economy on large-scale pig farming: an empirical study from China. Cogent Food Agric. 9:238985. doi: 10.1080/23311932.2023.2238985

Zhou, J., Zhang, K. J., and Ding, S. J. (2015). A study of the stabilizing effect of large-scale breeding on pig production fluctuation in China: an empirical analysis based on provincial panel data. J. Jiangxi Univ. Finance Econ. 1, 84–94. doi: 10.13676/j.cnki.cn36-1224/f.2015.01.009

Zhu, H. M., Xu, R., and Deng, H. Y. (2022). A novel stl-based hybrid model for forecasting hog price in China. Comput. Electron. Agric. 198:107068. doi: 10.1016/j.compag.2022.107068

Keywords: agricultural sustainability, food security, swine production volatility, scale breeding, epidemic risk, policy intervention

Citation: Jiang H, Wang M, Yan Z and Sun Y (2024) The stabilizing effect of scale breeding on swine production volatility-empirical evidence from China. Front. Sustain. Food Syst. 8:1457499. doi: 10.3389/fsufs.2024.1457499

Edited by:

Mohamed R. Abonazel, Cairo University, EgyptReviewed by:

Akanksha Roberts, Helmholtz Institute for RNA-based Infection Research (HIRI), GermanyPeng Jiquan, Jiangxi University of Finance and Economics, China

Copyright © 2024 Jiang, Wang, Yan and Sun. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mingli Wang, d2FuZ21pbmdsaUBjYWFzLmNu

Hui Jiang

Hui Jiang Mingli Wang*

Mingli Wang*