- Department of Agro Socio-Economics, Faculty of Agriculture, Universitas Padjadjaran, Sumedang, Indonesia

Financial technology (fintech) offers farmers the prospect of getting other sources of finance apart from financial assistance from the established official funding institutions. Farmers of fresh agricultural products (FAP) in Indonesia received financial offers from various fintech platforms. However, several platforms have failed to maintain their operations, resulting in negative consequences for the farming activities. This study’s objective is to explore how fintech contributes to the sustainability of FAP by examining five key dimensions of sustainability: economic, social, environmental, technological, and institutional. Most extant literature primarily examines the determinants that impact an individual’s interest in fintech lending. However, the existing research needs to dedicate more attention to the sustainability of the platform and the enterprises it finances, with a particular emphasis on the FAP sector. A quantitative methodology was utilized to design the study, and a proportional stratified random sampling method was employed to select 269 FAP producers as respondents. The data were analyzed using the multidimensional scaling (MDS) approach in rap-Agrifin using factors specifically designed to assess fintech sustainability in agribusiness. Fintech in the FAP supply chain is classified as quite sustainable, according to this study’s multidimensional finding. Partially, the dimensions that acquire sufficiently sustainable value are the social, economic, and environmental dimensions, but the technological and institutional dimensions are less sustainable. This research demonstrates that the MDS approach in rap-Agrifin can effectively analyze sustainable finance in agriculture, highlighting the need for focused improvement on institutional and technological factors, particularly through the application of fintech.

1 Introduction

Capital is one of the productive factors in a business that will determine the performance of the business, including agricultural business. However, in developing countries, difficulties in obtaining capital to finance business are common for farmers, which limits their ability to invest in productive resources (Villalba et al., 2023). As is the case in the business of fresh products, farmers’ access to formal financial institutions, especially banks, is still low, and they have more access to informal financial institutions such as traders, the owner farmers’ shop, or family and neighbors (Barslund and Tarp, 2008; Sekabira et al., 2023). Access to financing is essential, especially for fresh agricultural products (FAP), including vegetables, fruits, dairy, meat, and herbs, because these products are highly perishable, require reliable supply chains, and have a faster production cycle, payback periods, and turnover, and these are the dominant micro-small and medium-sized enterprises (MSMEs) in the country.

The amount of agricultural credit from 2018 to 2022 has increased. Based on data from FAO, in 2018, the amount of agricultural credit was USD 45.24 million; in 2022, it reached USD 53.88 million. The annual agricultural credit amount has increased by 4.48% (Food and Agriculture Organization, 2022). As much as 53.64% of the world’s agricultural financing is used in Asia, dominated by developing countries. Indonesia uses agricultural credit as much as 1.49% of the total agricultural credit provided in the Asian Region (Food and Agriculture Organization, 2024). Based on data from the Indonesia Financial Services Authority (OJK) (2024), it was recorded that venture capital financing/placement based on the economic sector in Indonesia, the agriculture, forestry, and fisheries sectors only received venture capital of 4.94% of the total venture capital financing. This shows that financing for the agricultural sector with a dominance of small farmers is still given in small amounts compared to other economic sectors.

Accordingly, the actors involved along FAP supply chains face challenges in funding infrastructure to meet market demand and maintain product quality (Yan et al., 2020). Financial inclusion for rural populations and small FAP producers is essential for expanding businesses, creating jobs and reducing inequality in villages. In developing countries, access to finance remains a significant bottleneck for farmers and agribusinesses, hindering the productivity and global food security efforts. Improved financial access enables farmers to invest in high-quality inputs and equipment, ultimately enhancing productivity, contributing to economic growth, and alleviating poverty in rural areas (Perdana et al., 2023; Song and Appiah-Otoo, 2022; Yan et al., 2020).

Restricted access to capital will lead to a lack of access to technology and a reduction in productivity and farmers’ incomes. Although there have been notable advancements in developing countries’ FAP sector, attempts to enhance farmers’ access to formal financial services during the era of regional reform and autonomy, little progress has been made in this regard over the past two decades. Formal financial institutions often impose requirements, such as collateral and documentation that are difficult for farmers to meet (Barslund and Tarp, 2008; Sekabira et al., 2023). Farmers continue to rely on informal and non-formal sources of capital due to the ease of procedure, distance and social closeness, family bonds, and mutual trust (Tan et al., 2024).

With the rapid development of technology and the Internet, the financial industry is disrupted, so the concept of financial technology (fintech) has emerged as a transformative tool within the financial sector, disrupting traditional banking practices and making financial services more accessible (Anshari et al., 2019). The implication is that new financing sources will become available, which will be more accessible to the public by eliminating physical presence constraints and simplifying access procedures. The rapid expansion of fintech across various sectors is driven by technological innovations and increasing digitalization. Fintech provides mobile payments, digital lending platforms, blockchain, and cryptocurrency, emphasizing fintech’s potential to improve financial inclusion and disrupt the traditional financial system (Abad-Segura et al., 2020). This must be an exceptional circumstance, given that established formal financial institutions adhere to the well-known five C’s—character, capacity, capital, collateral, and economic condition—prudently. It has been difficult for farmers to access formal financial institutions, especially because it is difficult to qualify for collateral or guarantees.

As Barslund and Tarp (2008) found, formal credit institutions in Vietnam also demanded a condition of collateral. On the other hand, a number of studies provide evidence that fintech positively affects the operational outcomes of businesses. According to OJK (2024), the number of fintech companies in Indonesia is about 98. About 4.64% of fintech institutions distributed financing to the agricultural sector in 2024, and 2023 only 3.81% of them did. The absorption of agricultural financing through fintech needs special attention to help small farmers achieve FAP sustainability.

Qawi and Karuniasa (2020) explain that the presence of fintech can solve the problems of financing that arise in MSMEs. Research on fintech in some countries has been done, but it is more likely for the urban economic sector, focused on the Z-generation response, MSMEs, and retail (Aseng, 2020). Meanwhile, the use of fintech in the agricultural sector is still relatively new and underexplored. Some of the research already exists, focusing primarily on the determinants that affect farmers’ inclination to adopt fintech and the subsequent effects on their income. The utilization of digital financial services is anticipated to yield a favorable outcome, surpassing the influence exerted by conventional banks (Wang et al., 2021). Research findings suggest that the presence of fintech in China can reduce poverty (Song and Appiah-Otoo, 2022). In Korea, the fintech industry effectively makes the demand for intermediate products as high as the demand for final products (Shin and Choi, 2019). Fintech branding is easy access to financing that can empower small farmers to invest in better inputs, thereby enhancing productivity and economic resilience.

Fintech is evolving by adopting a multifaceted approach that integrates social, economic, and environmental dimensions to support the wellbeing of small farmers. Its utilization plays a crucial role in enhancing the resilience and efficiency of FAP supply chains, particularly for small farmers in developing nations. Fintech empowers small farmers by providing access to fair pricing and financial services, which improve their livelihoods and promote social equity (Carè et al., 2023; Rayhan et al., 2024; Song and Appiah-Otoo, 2022). Fintech supports small farmers to achieve better communication and market access by encouraging community engagement and support. Additionally, fintech enhances pre-production financing, enabling farmers to invest in essential resources and thereby improving their productivity and economic viability (Carè et al., 2023; Rayhan et al., 2024; Shin and Choi, 2019; Wang et al., 2021).

Previous studies linking fintech to sustainability were conducted by Mapanje et al. (2023) to review the role of fintech in the sustainability of agricultural financing. The study focused on economic outcomes to improve income and reduce poverty while neglecting broader sustainability dimensions (Mapanje et al., 2023). Other studies by Ningrat and Nurzaman (2019) explored the role of fintech in Islamic financing products to improve agricultural ecosystems. The study highlights the fintech’s role that emphasized transparency and accessibility rather than its environmental or social impact (Ningrat and Nurzaman, 2019). Other investigations showcased a digital marketplace model with fintech to support agricultural sustainability but did not address how fintech contributes to environmental or institutional sustainability (Anshari et al., 2019). Rayhan et al. (2024) explored how fintech has become a sustainable solution for improving small farmers’ economic situation by facilitating small farmers’ to access markets and addressing capital constraints.

It also supports sustainable agricultural practices, leading to more efficient resource use and reduced waste and environmental impact (Rayhan et al., 2024). Fintech has a role in promoting sustainable development through the case of Ant Forest, a digital platform in China to incentivize environmentally conscious behavior (Zhang et al., 2021). Moreover, fintech strengthens organizations by promoting sustainability to improve managerial and transparency (Rayhan et al., 2024). Fintech has a role in advancing the United Nations Sustainable Development Goals (SDGs) by promoting financial inclusion, reducing inequalities, and fostering economic growth (Carè et al., 2023; Rayhan et al., 2024; Song and Appiah-Otoo, 2022; Wang et al., 2021). It is considered that fintech platforms facilitate access to financial services for small farmers, thereby supporting several SDGs: Goal 1 (No Poverty), Goal 8 (Decent Work and Economic Growth), Goal 9 (Industry, Innovation, and Infrastructure), and Goal 13 (Climate Action) by promoting responsible investment practices and financing green projects (Carè et al., 2023; Rayhan et al., 2024; Saifi and Drake, 2008).

The technological advancements in fintech offer innovative solutions that enhance the overall sustainability of agricultural practices (Carè et al., 2023; Rayhan et al., 2024). Fintech provides significant opportunities for enhancing FAP sustainability; it also needs to consider potential challenges, such as the digital divide and access to technology, which may hinder the equitable distribution of benefits across different farmer demographics. Accordingly, it is essential to achieve comprehensive sustainability in FAP supply chains involving small farmers.

Given the uniqueness of the FAP sector, which is dominated by small farmers operating under seasonal cycle and the characteristics of its entrepreneur (Perdana et al., 2023), understanding the comprehensive impact of fintech is crucial (Carè et al., 2023). The funding of technology given to farmers has the uniqueness of providing market guarantees for their products and construction regarding their cultivation techniques (Barslund and Tarp, 2008; Qawi and Karuniasa, 2020; Rayhan et al., 2024). However, it is interesting to study the mechanism and sustainability of fintech in providing financing services to the FAP sector, especially in the pre-harvest phase to continuing agricultural activities.

Based on previous literature, the use of funding associated with the sustainability aspects of agriculture has not been studied from some dimensions other than the economic, social, and environmental dimensions. According to Saifi and Drake (2008), agricultural sustainability is not just about technical improvements and merely expertise. However, it is a process that needs to integrate social and environmental knowledge through policy, institutional, and behavioral changes. The study addresses unexpected aspects of fintech adoption in FAP supply chains as an area that requires fast turnover, reliable infrastructure, and market responsiveness. Moreover, this study also explores fintech’s potential beyond financial inclusion by investigating its impact on FAP supply chains and highlighting the digital divide challenge among small farmers, with a focus on how fintech can address both financing needs and promote sustainable FAP supply chains.

Therefore, the purpose of this research is to examine how fintech contributes to the sustainability (social, economic, environmental, technological, and institutional) of the FAP sector in developing countries, dominated by small farmers. The result of this study provides new insights into the role of fintech in fostering FAP sustainability, with a focus on pre-harvest financing in developing countries. This study will contribute to the literature by offering a multi-dimensional framework for assessing the sustainability of fintech applications in FAP supply chains. The structure of this article contains an introduction, literature review, research methods, results, explanations, and conclusions derived from research on fintech for farmers of fresh products in Indonesia.

2 Theory

2.1 Financial technology in fresh agricultural product supply chains

Fresh agricultural products (FAP) require special attention due to the involvement of micro, small, and medium enterprises (MSMEs). MSMEs face challenges in access to finance to maintain freshness and ensure quality. In developing countries, access to finance remains a significant bottleneck for farmers and other actors in FAP supply chains (Perdana et al., 2023). Improving access to finance allows farmers to spend money on high-quality supplies and machinery, eventually boosting output, promoting economic growth, and reducing poverty in rural regions (Yan et al., 2020).

In general, fintech denotes the provision of financial solutions through the application of technology (Arner et al., 2016; Barslund and Tarp, 2008; Qawi and Karuniasa, 2020). More precisely, fintech is characterized as a digital technology that aids in financial intermediation (Aaron et al., 2017; Carè et al., 2023). According to Dhar and Stein (2017), financial technology is an advancement within the financial industry that entails the integration of technology into a business model and can provide facilities to eliminate intermediaries. The financial technology industry can be said to be a more flexible industry compared to conventional financial businesses.

The constraints on the conventional system exist in the form of complex and limited regulations, especially those related to the submission of loan applications, which have to go through a variety of complicated administrative processes. This is different from the financing technology, which requires less documentation and can be done online (Abad-Segura et al., 2020; Cai et al., 2024). Financial technology offers a new ecosystem in the financial industry by providing low-cost services while still maintaining quality. The fintech ecosystem comprises traditional financial institutions, governments, financial customers, fintech startups, and technological development. This digital financing service, or fintech, has already contributed to the development of the agricultural sector. The service provides facilities for key actors and entrepreneurs in the agricultural sector to obtain funding (Qawi and Karuniasa, 2020). The application of financial technology provides new opportunities in market targeting, credit pricing, risk sharing, and the use of information technology aimed at improving financial management in the agricultural sector (McIntosh and Mansini, 2018; Rayhan et al., 2024; Wang et al., 2021). Furthermore, this technology can be a link between urban areas that can provide financial access to rural areas so that it can improve the economy in agricultural areas (Cai et al., 2024; Carè et al., 2023; McIntosh and Mansini, 2018; Rayhan et al., 2024). Technology can also help with data collection, thereby strengthening data analysis related to finance (Khan et al., 2022).

In addition to financing services, there are also payment services and marketing of products generated to facilitate access to all services (Bajunaied et al., 2022; Shin and Choi, 2019; Song and Appiah-Otoo, 2022). However, this service requires supporting equipment that must be well available, such as an Internet connection, smartphone, internet data plan, and the ability to use such devices. The constraints related to fintech in the agricultural sector support the development of rural areas by emphasizing infrastructure and digital literacy (Pant and Odame, 2017). Urban areas typically have better access to digital infrastructure than rural areas and the adoption of digital financial services is also higher in these areas (Mhlanga and Ndhlovu, 2023; Pant and Odame, 2017).

The FAP sector in rural areas is dominated by small farmers that rarely use or have smartphones and other digital devices, which restricts small farmers’ ability to access financial services (Mhlanga and Ndhlovu, 2023). Small farmers lack the necessary digital skills to utilize online financial services effectively, which hinders their participation in the digital economy (Zhang et al., 2024). Limited offering of fintech for small farmers creates a disadvantage for them in rural areas as they have limited access to digital financial services (Yang et al., 2024). Accordingly, in rural areas, small farmers need the revitalization of digital finance for better a sustainable FAP.

2.2 Sustainability theory

The theory of sustainability was initially introduced in 1987 in the Brundtland Report, also referred to as “Our Common Future.” The United Nations World Commission on Environment and Development defines sustainable development as predicated on the notion that current requirements ought to be fulfilled while safeguarding the capacity of future generations to do so (United Nations, 1987). John Elkington introduced the notion of three-dimensional sustainability in his 1997 book Cannibals with Forks: The Triple Bottom Line of 21st Century Business as a means of quantifying sustainability. It stresses the importance of considering three interrelated aspects of business activity, namely, the economic, social, and environmental aspects (Elkington, 1997). The economic aspects relate to financial performance, while the social aspects include the social impact of business activities, and the environmental aspect relates to environmental impact. The three domains are incorporated into sustainability: the economic, the social, and the environmental (Munasinghe, 2009; Papilo et al., 2018). In the context of agricultural production systems, sustainability is intrinsically linked to the sum of the values of these three factors (Sydorovych and Wossink, 2008).

A change in organizational emphasis from short-term financial objectives to long-term social, environmental, and economic repercussions is implied by Elkington (Amos and Uniamikogbo, 2016). The approach used to evaluate sustainable development does not only see development from three dimensions (economic, ecological, and socio-cultural), but also can grow even wider (Clayton and Bass, 2011) and evaluates sustainability through economic, environmental, social, cultural, institutional, political, and security sustainability. Several other studies also incorporate five dimensions into sustainability assessment, including economic, socio-cultural, environmental, technological, and legal and institutional (Clayton and Bass, 2011; Ebrahimi and Rahmani, 2019; Hellyward et al., 2019).

Developing sustainability in fintech for the FAP sector integrates financial inclusion, social equity, and environmental responsibility to support smallholder farmers. Access to capital is a critical bottleneck for farmers in developing countries, limiting investment in productive resources (Villalba et al., 2023). Small farmers rarely take loans from formal financial institutions because of rigid requirements (Barslund and Tarp, 2008; Sekabira et al., 2023). Fintech is designed as a transformative solution by simplifying financial processes, offering mobile payments, and facilitating digital lending. The concept of fintech is making it easier for small farmers to obtain loans that support improved sustainable FAP business (Abad-Segura et al., 2020; Anshari et al., 2019). The availability of fintech services supports sustainable agricultural practices by promoting better market access, enhancing productivity, and reducing environmental impacts (Rayhan et al., 2024).

Furthermore, fintech platforms contribute to achieving several UN Sustainable Development Goals (SDGs), such as poverty reduction, economic growth, and climate action, by financing green projects and encouraging responsible investments (Carè et al., 2023). However, achieving comprehensive sustainability requires addressing challenges like the digital divide and ensuring equitable technology access for all farmers (Perdana et al., 2023). As fintech continues to evolve, its role in fostering sustainability in FAP supply chains becomes increasingly vital, offering new opportunities for resilient farming practices and improved livelihoods (Rayhan et al., 2024).

3 Methods

The research was designed with a quantitative design and using survey methods involving theory and empirical facts. The study was conducted with participants from a population using questionnaire as a data collection tool (Creswell and Creswell, 2018).

3.1 Sample and data collection

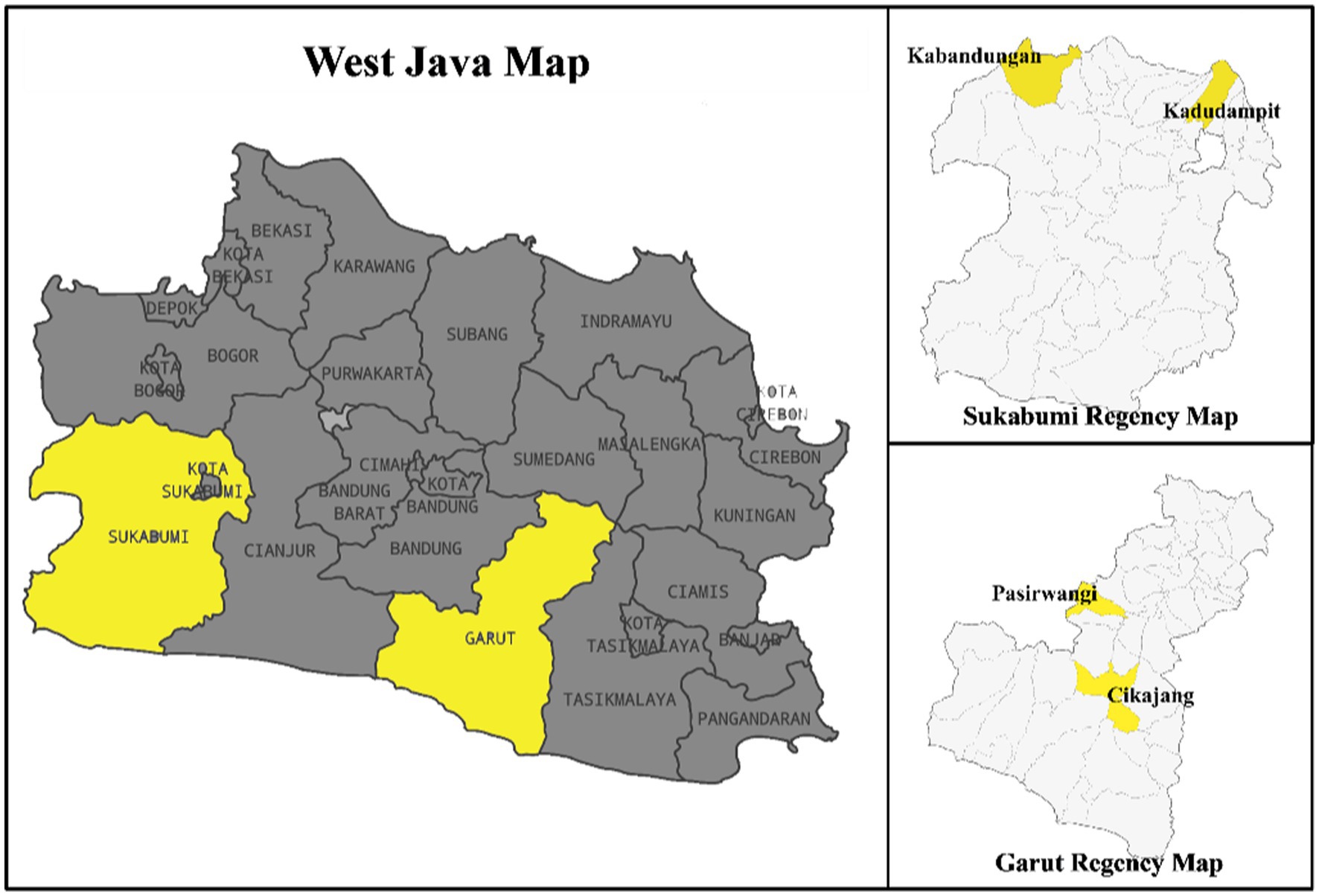

Vegetable farmers in the region of the vegetable production center in West Java, Indonesia, form the target population of this study. West Java Province is one of the largest producers of FAP in Indonesia, which accounts for 18% of total fresh vegetables production.1 In this study, sampling was carried out using stratified random sampling. Sukabumi and Garut Regencies were selected, which are the central areas for vegetable production and there are already companies in these regions that distribute fintech products. Next, from each selected regency, two sub-districts were randomly selected (Figure 1).

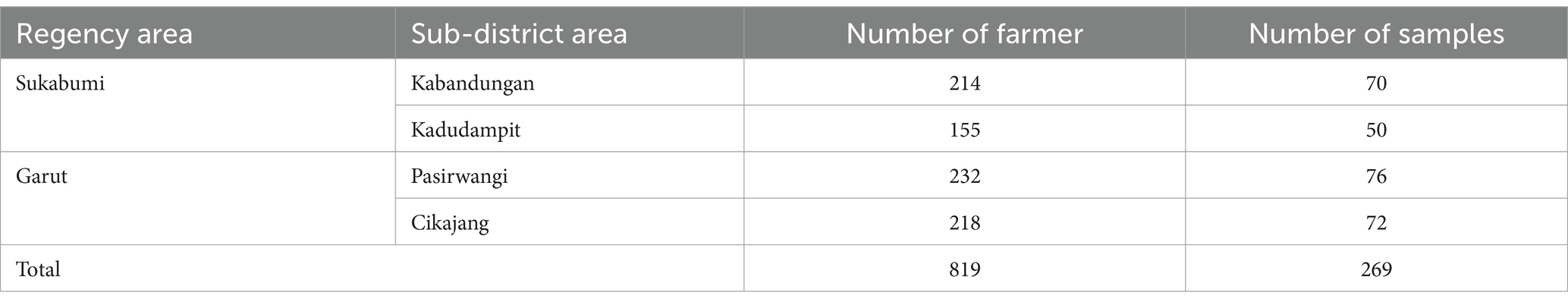

The target population in this study were vegetable farmers who accessed fintech and non-fintech solutions for their financial needs. Based on data from the snowball sampling technique survey at the field location, the number of active farmers in farmer groups in the two districts was 819 farmers. Furthermore, sampling was carried out using the Slovin formula. Based on this formula at an applied error rate of 5%, a sample size of 269 farmers was obtained from a population size of 819 farmers. The next stage of proportional sample selection is carried out using simple random sampling, where all farmers in the population have the same probability of being selected (Noor and Tajik, 2022) (Table 1).

3.2 Research instrument

The questionnaire was developed based on five sustainability dimensions: social, economic, environmental, technological, and institutional. Every dimension was transformed into a set of variables regarding sustainability of the FAP supply chain. The responses of each question were measured using 1–3 ordinal scale (1 = bad, 2 = average, 3 = good). The implementation of a 1–3 ordinal scale in the questionnaire was motivated by the necessity for simplicity and clarity in farmers’ responses (Dolnicar, 2003). This restricted scale facilitates interpretation and diminishes cognitive burden on responders, hence improving data quality (Hedeker et al., 2017). Furthermore, the questionnaire was given to 30 respondents to evaluate the validity and reliability of the questionnaire.

3.3 Data analysis

The Fisheries Center at the University of British Columbia has created a multidimensional scaling (MDS) analysis to assess the sustainability of fintech as a funding source. The dimensions assessed comprise the economic, social, environmental, technological, and institutional dimensions. These dimensions are determined through the utilization of fintech indicators and coordination methodologies implemented by the Rapid Appraisal Technique for Fisheries (Rapfish) program (Kavanagh and Pitcher, 2004). We then modified the Rapfish method into Rapid Appraisal for Agribusiness Finance (Rap-Agrifin). Modification was done by changing the attributes on each dimension and adapted to the agribusiness coverage. Each dimension contains attributes that have been specifically created for agriculture finance. The use of MDS in Rapfish has the advantage of being a simple but comprehensive sustainability evaluation analysis.

In terms of finance applications, Rapfish is compatible with Rap-Agrifin. This is possible because the concept of sustainable development has gained traction across all disciplines. Therefore, as submitted by Jimenez et al. (2021), the five stages undertaken in the Rapfish procedure can be applied to Rap-Agrifin as follows: (1) evaluation of attributes across multiple categories and score; (2) determination and classification of attributes; (3) using scoring to establish benchmarks for good and bad; (4) organization in multiple dimensions for each attribute; (5) Monte Carlo analysis; (6) leverage analysis; and (7) sustainability analysis. MDS is a statistical methodology that endeavors to execute transformations from higher dimensions to lower ones (Puspitasari et al., 2023). In detail, the analysis procedure with the Rap-Agrifin technique will go through several stages, as follows:

1. Gathering information regarding the condition of the research site.

2. Interviews with vegetable farmers in the province of West Java regarding research search results and indicator data.

3. Assessing sustainability factors.

4. Conduct multidimensional scaling analysis (MDS) using the Alternative Least Squares Optimal Scaling (ALSCAL) algorithm to determine orders and stress values using an Excel template.

5. Employ rotation to determine whether fintech is a favorable or unfavorable source of financing for vegetable farmers. Subsequently, in order to mitigate uncertainty, one should integrate leverage analysis and Monte Carlo simulation.

Multidimensional scaling analysis produces outcomes that are more consistent when compared to alternative methodologies employed in multivariate analysis. MDS involves the mapping of two identical points or objects to a single neighboring point. On the contrary, distinct objects or points are designated as distant points. The equation for the ordination technique or distance determination within MDS, which is based on the Euclidean distance in dimensional space (Puspitasari et al., 2023), and the equation is as follows:

The process of approximating the ordering of these items or points involves the utilization of the point of origin (δij) to regress the Euclidean direction (dij) from point i to point j. The following outlines the similarities:

Utilize the ALSCAL method, which is a least squares approach predicated on the Euclidean root distance (square distance), to regress the given equation. The squared distance (dijklm) is optimized in relation to the squared data (origin point = Oijklm) using this method. S-Stress is the five-dimensional (ijklm) representation of the following equation:

The square distance is the Euclidean distance according to the equation:

The goodness of fit is assessed by measuring the distance between the presumed point and the original point subsequent to the execution of the ordination. The magnitude of the S-stress value of R-squared is indicative of the goodness-of-fit value. According to Herdiansyah et al. (2014), a model is considered to be valid when the S-stress value is below 0.5 (S < 0.25) and R-squared approaches 1 (100%). The determination coefficient (R-squared) and stress value establish whether an additional variable is required to verify that the variable utilized accurately represents the attributes of the object being compared.

Leverage analysis and Monte Carlo analysis are utilized to demonstrate the horizontal and vertical axes that represent the location of the sustainability point in MDS analysis. The purpose of leverage analysis is to find sustainability-affecting indicators that are sensitive. According to Puspitasari et al. (2023), the purpose of leverage analysis in MDS is to ascertain critical indicators. The leverage outcome as measured by the root mean square (RMS) ordination change along the X-axis provides the essential indicator. The greater the variation in the RMS, the more responsive the indicator is to changes in the sustainability status.

Monte Carlo analysis, on the other hand, refers to the examination of uncertainty. Monte Carlo analysis is a method utilized to forecast with a confidence level of 95% the impact that random errors will have on the analytical process. Monte Carlo analysis is utilized in this instance as a simulation technique to assess the effect of random mistakes on the entire dimension. Monte Carlo technique is employed in this study to generate scatter plots that illustrate the ordinances associated with each dimension.

The value assigned to each indication for each criterion is determined by the scorer’s scientific judgment. Indicator conditions determine the range of possible scores from 1 (poor) to 5 (excellent). By performing a multidimensional analysis of the score values of each indicator, one or more points that represent the sustainable position in the five researched dimensions relative to two reference points—the good point and the bad point—are determined. Rapfish was utilized to assess the sustainability status of the scores (Geria et al., 2023).

4 Results

4.1 Validation and reliability

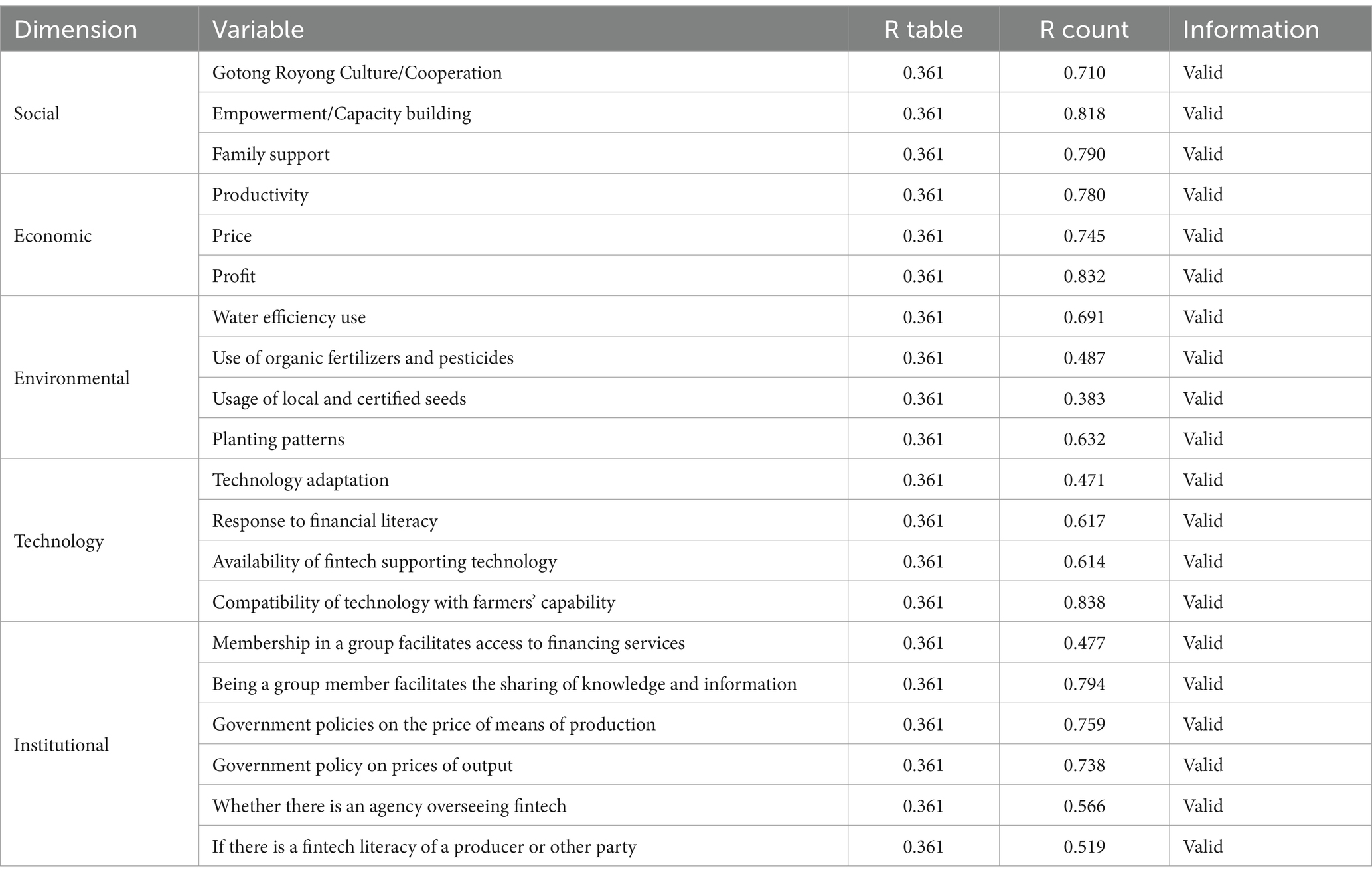

The validity and reliability of the questionnaire as a research instrument were tested using SPSS statistics software. Validity assesses the accuracy and appropriateness of the questionnaire in measuring the intended concept. Table 2 provides the validation result of the questionnaire. All variables have a calculated R value greater than the R table, indicating validity.

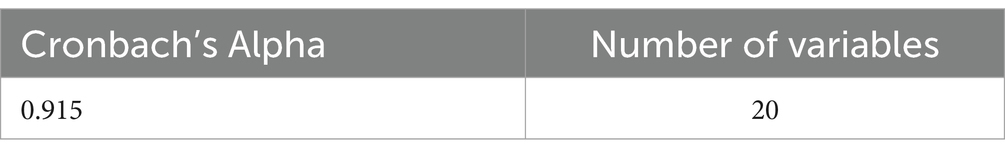

Moreover, reliability testing was carried out to measure the consistency of the questionnaire over time. The indicator used in reliability testing is Cronbach’s alpha. The rule of thumb is that Cronbach’s alpha is greater than 0.60 (Khan F. Z. A. et al., 2021). Table 3 shows that the reliability result of Cronbach’ alpha is 0.915, which indicates reliability of the questionnaire.

4.2 Rap-Agrifin result

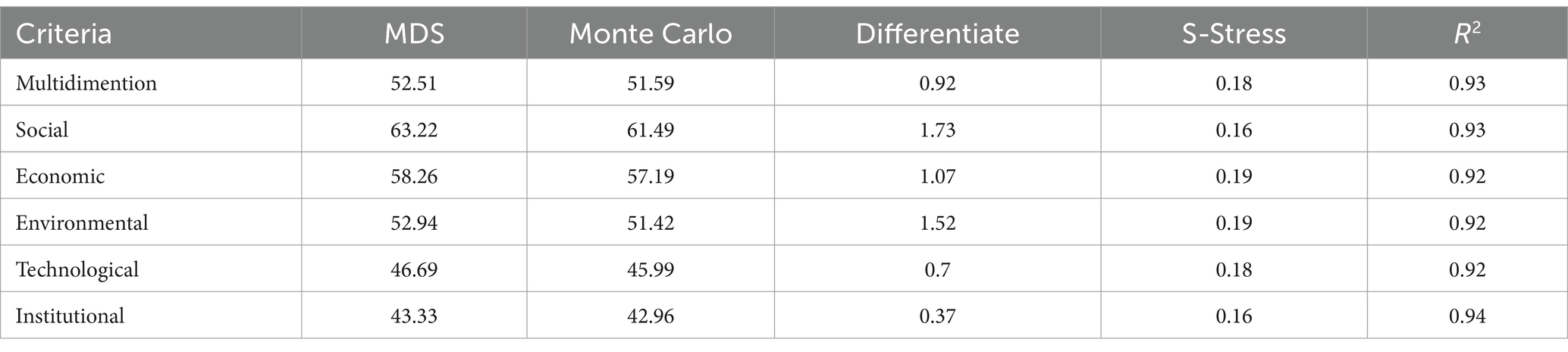

Financial sustainability of technology is one of the sources of financing based on established sustainability indicators. The assessment of the financial sustainability status of technology is analyzed using the Rap-Agrifin method in multidimensional terms and against the five sustainability dimensions: social, economic, environmental, technological, and institutional dimensions. The statistical parameters in this study consist of Monte Carlo analysis, S-stress values, and R-squared. Rap-Agrifin analysis showed goodness of fit values reflecting the magnitude of S-stress and R-squared values. The obtained S-Stress and R-squared values demonstrate that, in dimensional and multidimensional terms, each of the utilized and analyzed variables satisfies the statistical requirements and is suitable for describing sustainability.

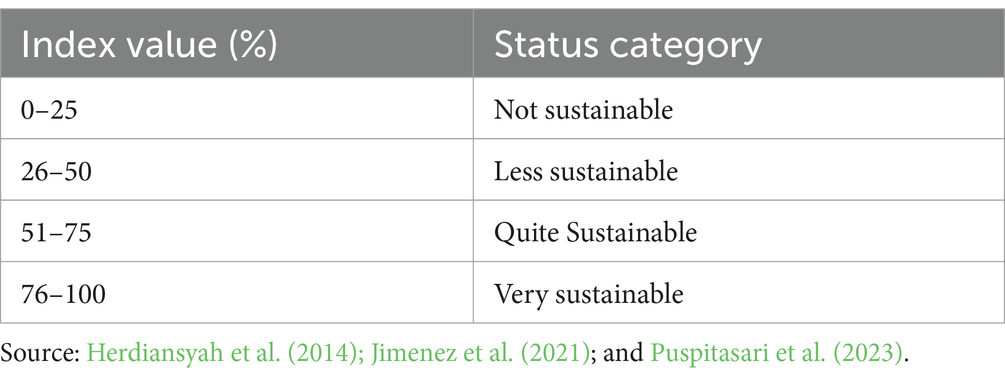

Table 4 shows that S-Stress value is between 0.16 and 0.19 and R-squared value is at 0.92–0.94 should be noted that the goodness value of fit on Rap-Agrifin analysis is already met. Value coefficient determination (R-squared) represents the attribute’s contribution to the sustainability system, which is analyzed, is achieved. If S-Stress is also achieved, then the attribute configuration could reflect the real data, which implies the indicator used is accurate and statistically accountable. The difference between MDS and Monte Carlo is <5%, the results of this MDS analysis are sufficient as predictors of the sustainability index (Table 5).

Table 5. Results (goodness of fit) of Rap-Agrifin analysis and financial sustainability status of technology as a source of financing in West Java Province.

4.3 Multidimensional fintech sustainability status in fresh product farming

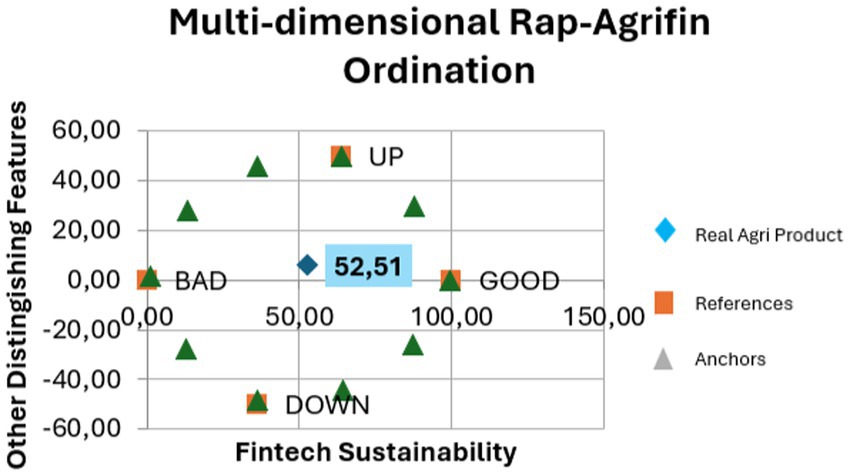

Multi-dimensional Rap-Agrifin analysis using MDS resulted in the fintech sustainability index as a source of financing of 52.51. This value belongs to the category “quite sustainable,” as seen on the following ordnance scale:

The determination of this value is contingent upon multidimensional analysis, which is the calculation of the combined evaluation of all dimensions (social, economic, environmental, technological, and institutional). The sustainability index values for the social, economic, and environmental dimensions indicate a relatively sustainable position for these dimensions. In contrast, the technical and institutional dimensions are classified as less sustainable. The features of each dimension serve as parameters for determining the sustainability of fintech as a financing source. The sustainability index’s value is determined through an evaluation of 20 sustainability attributes categorized by dimension, as elaborated in Figure 2.

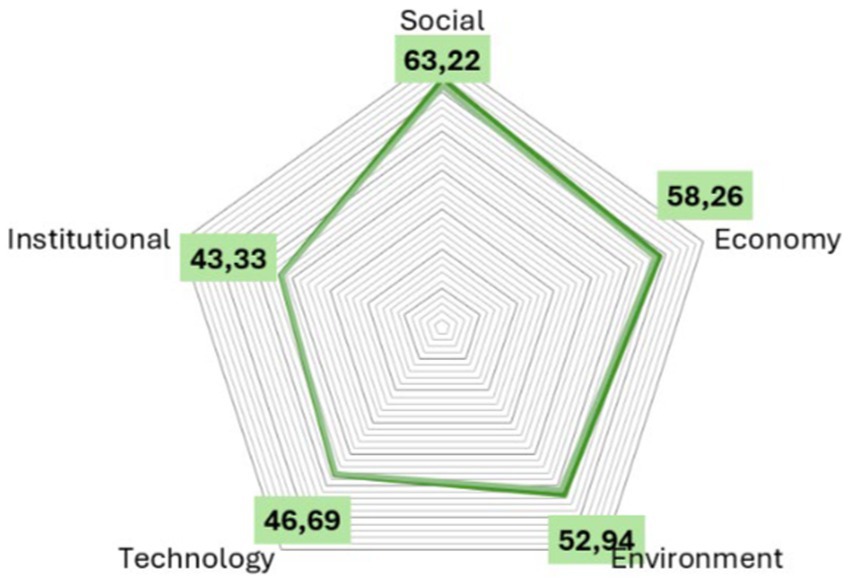

The sustainability index value for each dimension is depicted in the kite diagram (Figure 3), where a greater distance of the sustainability points from 0 indicates a higher sustainability value. According to Papilo et al. (2018), the diagrams are commonly known as “radar” diagrams, with the analysis distance being closer to the zero point, the less sustainable it is, and vice versa.

The graphic indicates that the technological dimensions have the lowest sustainability index value, followed by the institutional, environmental, and economic dimensions, with the social dimension having the greatest value. The fintech sustainability status as a source of funding that is integrated across the various criteria of sustainability can be depicted using a kite diagram.

4.4 Sustainability status based on each dimension

4.4.1 Social dimension

A crucial requirement for developing sustainable financial technology is its social impact. One of the foundations of sustainable development, the social component, can aid in rural development and the alleviation of poverty (Suárez Roldan et al., 2023). Three attributes are utilized in this study to assess the sustainability of the social dimension of financial technology as a financing source: (1) gotong royong culture/cooperation; (2) empowerment/capacity building; and (3) family support (Campagnaro and D’urzo, 2021; Hikmah et al., 2017; Suárez Roldan et al., 2023).

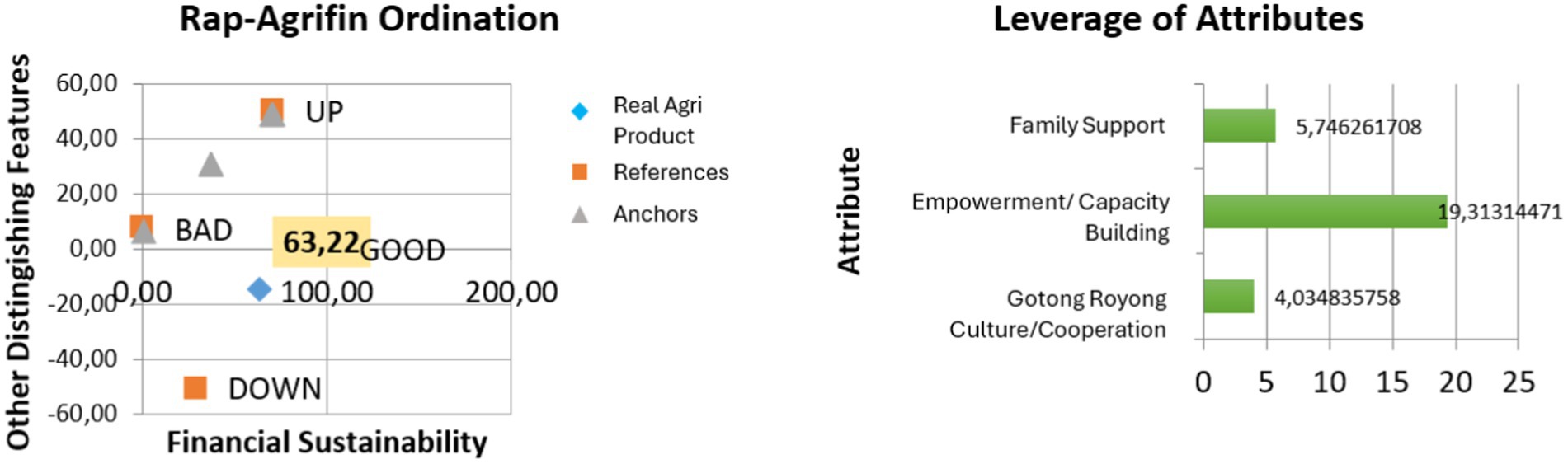

The Rap-Agrifin analysis with three social dimensions showed that technology as a source of financing has a financial sustainability index value of 63.22. The social dimension category is considered to be “quite sustainable,” even when looking at the sustainability position and sensitivity analysis of the social dimensions (Figure 4).

Figure 4. Sustainability status and sensitivity (Leverage) analysis of social dimension [Left Figure: the clustering points (blue) indicates the sustainability assessments and the spread of points refer to anchor in the evaluation].

An ordination analysis activated with twice iterations shows goodness of fit conditions in the category fair with a determination value (R-squared = 0.93), and the S-stress value is 0.16, or 16%. This result has met the statistical rules of multidimensional scaling (MDS) analysis. The sensitivity analysis (leverage) of three social dimension attributes shows that empowerment/capacity building has the maximum leverage amount, depicted in Figure 3. As you can see, this attribute has an RMS value of 19.31. Based on Monte Carlo’s analysis performed with twice iterations. The ordination point remains fixed and concentrated, and signifying the stability of the order.

4.4.2 Economic dimension

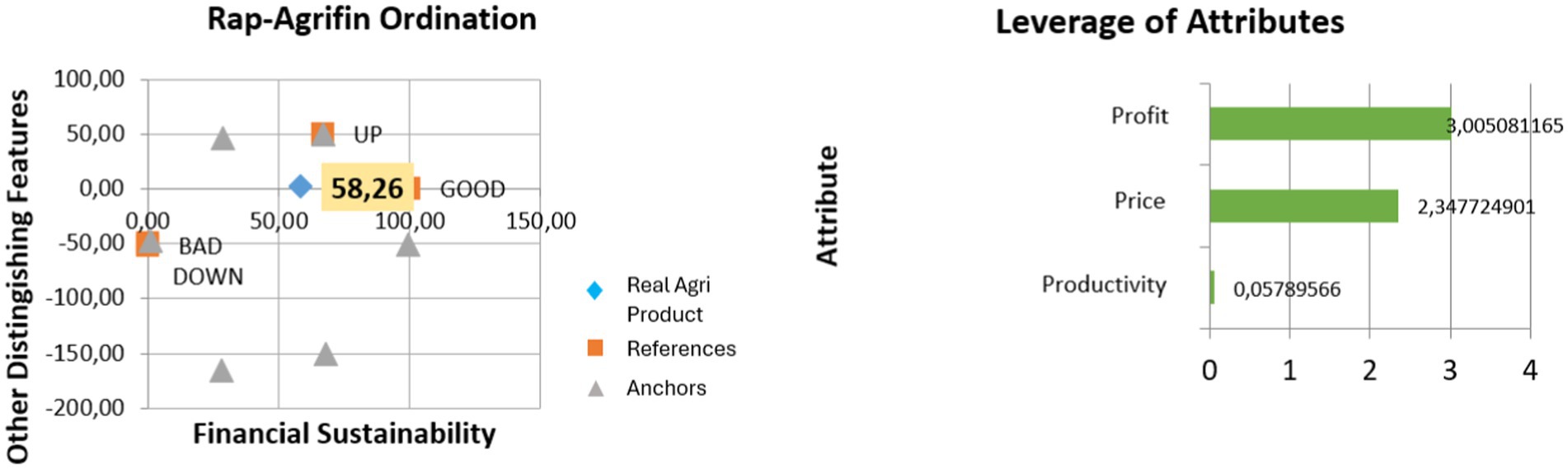

The economic aspect of fintech sustainability was analyzed using Rap-Agrifin and compared to the whole attribute. The value of the sustainability index for the economic aspect is 58.26, which is in the “quite sustainable” category.

Ordination analysis in the economic dimension with two iterations yields a value (R2 = 0.92) and the S-Stress value is 0.19, or 19%. The economic analysis in this study demonstrates goodness-of-fit conditions in the category sufficient (fair). Sensitivity analysis on economic dimensions using leverage analysis methods on Rap-Agrifin software showed the three attributes tested. Figure 5 displays two sensitive attributes that have the highest influence on the sustainability of fintech as a source of financing, namely, revenue/profit with a value of RMS 3.01 and price with RMS 2.35. According to Puspitasari et al. (2023), a higher leverage analysis number indicates a greater sensitivity of the feature to determining sustainability. Based on a previous survey, enhancing the sustainability status of the economic dimension necessitates careful consideration and analysis of the above-mentioned attributes.

Figure 5. Sustainability status and leverage analysis of economic dimension [Left Figure: the clustering points (blue) indicates the sustainability assessments and the spread of points refer to anchor in the evaluation].

The stability of the order is indicated by the fact that the ordination point remains unsplit, as demonstrated by the Monte Carlo simulation. The stability of ordination can represent sustainability well (Lloyd Chrispin et al., 2022).

4.4.3 Environmental dimension

In a sustainable natural resource management, it is essential to preserve the original function of natural resources while meeting eco-efficacy criteria, which ensures both economic and environmental efficiency (Dai and Chen, 2023; Yue et al., 2020). Environmental attributes are chosen to demonstrate the environmental impact of utilizing natural resources and the environment on sustainability (Khan I. et al., 2021). Measuring the sustainability of the financial environmental Agrifin analysis, among others: (a) water efficiency use; (b) use of organic fertilizers and pesticides; (c) usage of local and certified seeds; and (d) planting patterns (Dai and Chen, 2023; Khan I. et al., 2021).

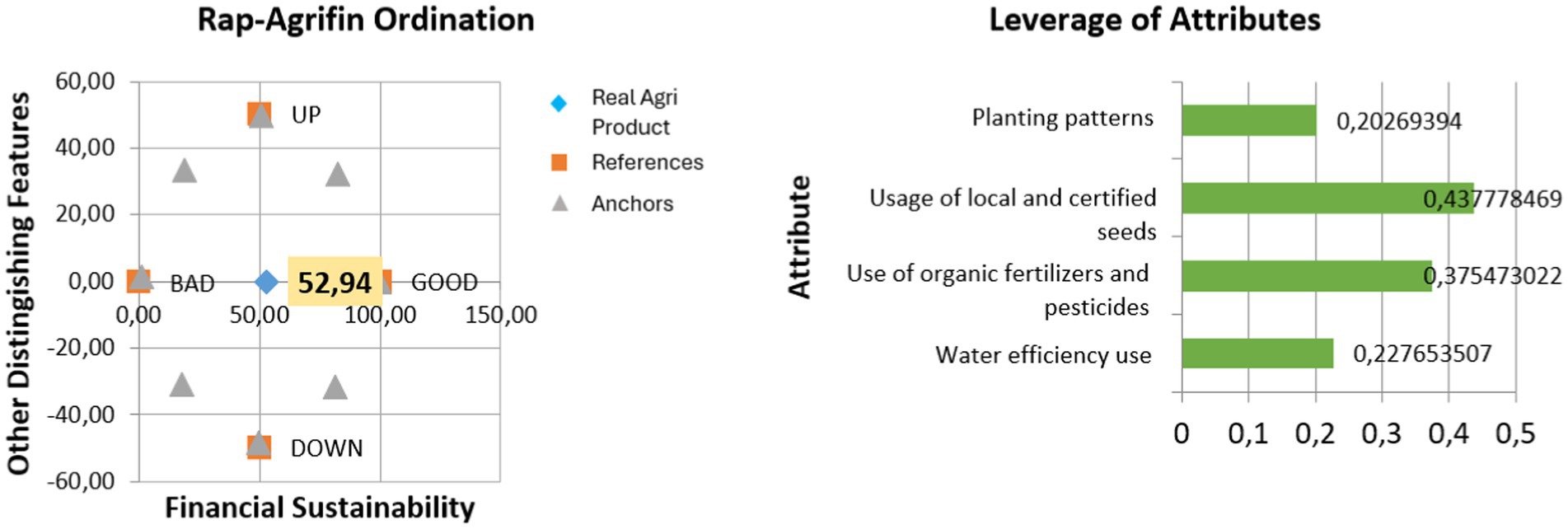

According to the findings of the Rap-Agrifin analysis, the value of the sustainability index of fintech on environment dimension as a source of financing was 52.94 and categorized as quite sustainable category, as shown in Figure 6. Farmers’ lack of understanding and concern for environmental sustainability is causing this issue, which is crucial for the sustainability of fresh produce.

Figure 6. Sustainability status and leverage analysis of environmental dimension [Left Figure: the clustering points (blue) indicates the sustainability assessments and the spread of points refer to anchor in the evaluation].

Ordination analysis on environmental dimensional sustainability performed with two iterations yields a value (R2 = 0.92) and S-stress value of 0.19 or 19%. Thus, environmental dimension sustainability analysis shows goodness of fit conditions in fair categories and has fulfilled the criteria of multidimensional scaling (MDS) analysis well. The results of the leverage analytics identify the two traits most susceptible to impacting environmental sustainability are the use of local and certified seeds with RMS value of 0.44 and the use of organic fertilizers and pesticides with RMS value of 0.38.

The ordinating point is not dispersed, as determined by the Monte Carlo simulation. This indicates that the ordinances are stable; therefore, the MDS analysis for the ambient dimensions is deemed to be in satisfactory condition.

4.4.4 Technological dimension

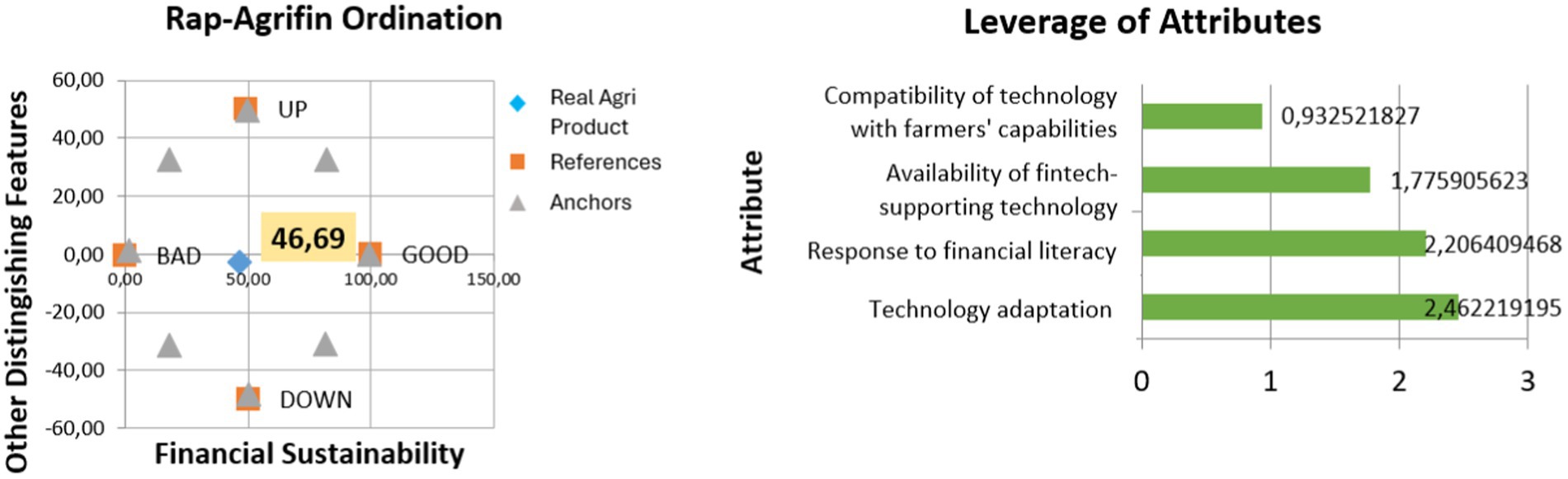

Measuring fintech sustainability on technology dimension as a source of financing using four measurement attributes: (a) technology adaptation, (b) response to financial literacy, (c) availability of fintech-supporting technology, and (d) compatibility of technology with farmers’ capabilities (Cai et al., 2024; McIntosh and Mansini, 2018; Pertiwi et al., 2017; Sands and Podmore, 2000).

Rap-Agrifin’s analysis of the technology dimension of fintech as a source of financing resulted in a sustainability index of 46.69 and falls into the category of less sustainable. The position of the ordination point can be seen in Figure 7. It shows that the utilization of technology by farmers is not yet at its peak. Rap-Agrifin analysis of the technology dimension leads to a value of R2 = 0.92 and an S-Stress value of 0.18, or 18%. The study’s investigation of technology dimensions revealed the goodness of fit as fair.

Figure 7. Sustainability status and leverage analysis of technology dimension [Left Figure: the clustering points (blue) indicates the sustainability assessments and the spread of points refer to anchor in the evaluation].

The leverage analysis aimed to identify the critical attributes that have the greatest potential to affect the sustainability of the technology dimension. As illustrated in Figure 7, the outcome of the analysis of the four attributes indicates that technology adaptation has the greatest impact on the continuity of the technological dimension. Three most affecting attributes in technology dimension are the technology adaptation attribute with RMS value of 2.46, the response to financial literacy with a ratio of RMS 2.21, and the availability of fintech support technology with an RMS of 1.78. It shows that to enhance the sustainability of the technological aspect, it is crucial to focus on and take into account certain aspects.

The order’s stability is confirmed by the clustering of the ordination points in the Monte Carlo simulation, indicating that the MDS analysis for the sustainability of technological dimensions is considered adequate.

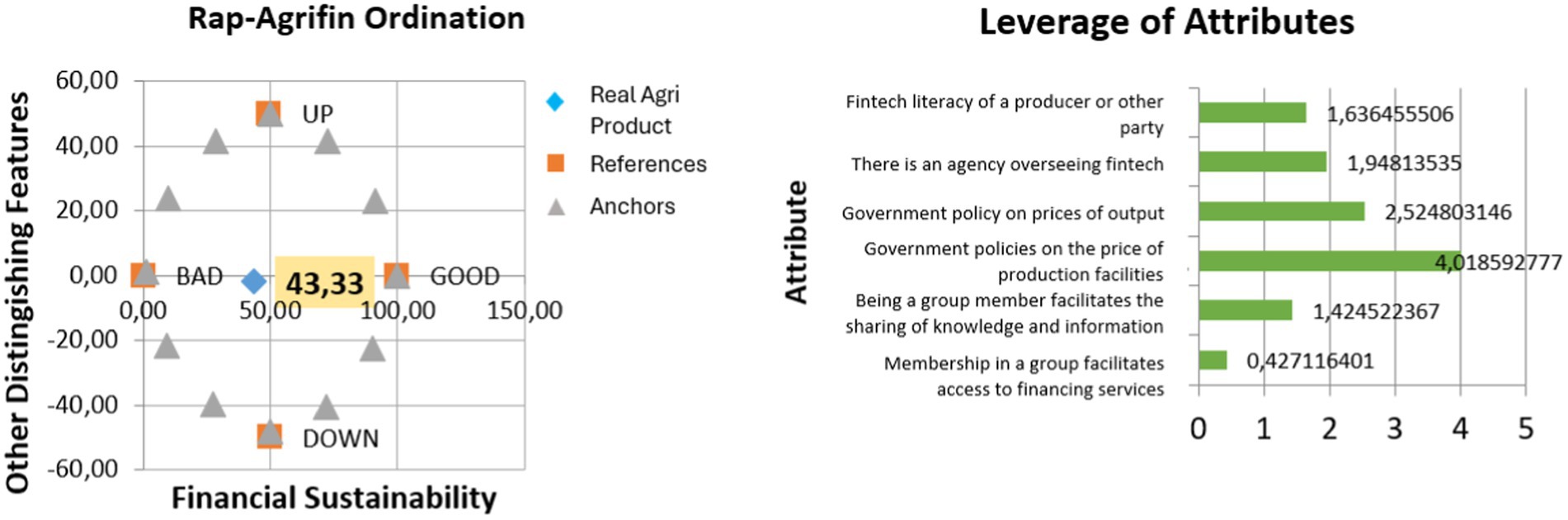

4.4.5 Institutional dimension

The institutional dimension is the part involved in measuring fintech sustainability as a source of financing. Institutional sustainability refers to a group or agency’s capacity to perform institutional duties that support business activity. Measuring the sustainability of institutional dimensions uses six measurement attributes: (a) membership in a group facilitates access to financing services; (b) being a group member facilitates the sharing of knowledge and information; (c) government policies on the price of means of production; (d) government policy on prices of output; (e) whether there is an agency overseeing fintech; and (f) if there is a fintech literacy of a producer or other party (Disemadi, 2021).

Based on Rap-Agrifin’s analysis of institutional dimension, it indicates that the sustainability index of the institutional dimension of fintech as a source of funding institutions is 43.33 and categorized as less sustainable. The position of the ordination point is presented in Figure 8. The results suggest that further refinement and development of the institutional function are necessary to progress.

Figure 8. Sustainability status and leverage analysis of institutional dimension [Left Figure: the clustering points (blue) indicates the sustainability assessments and the spread of points refer to anchor in the evaluation].

Rap-Agrifin analysis in institutional dimension is performed with two iterations and yields (R2 = 0, 94), and the S-Stress value is 0.16, or 16%. Then the value of goodness of fit in the institutional dimension sustainability analysis is in fair condition and has met the criteria of a good MDS analysis. A sensitivity analysis was performed, which highlighted Government policies on the price of production facilities as the critical attributes on institutional dimension.

5 Discussion

5.1 Social dimension

Vegetable farmers in production centers in West Java have long had “gotong royong” culture or cooperation as social capital, where farmers can learn, help, and strengthen each other through groups. Social capital is the values and norms shared by members of a group of society so that cooperation can take place within the group (Harutyunyan and Valadbigi, 2012). Furthermore, working together can develop a high level of thinking and communication skills and increase interest and confidence (Nahar et al., 2022).

The most influential attribute is empowerment and capacity building activities, mainly through the use of technology related to applications and cultivation. Empowerment is a form of increasing the knowledge and capacity of farmers, where it increases the value-added for products for both farmers and consumers (Hermiatin et al., 2022). The use of technology for farmers is not only on cultivation techniques, it is also linked to the use of smartphones as one of the facilities that farmers must understand to operate, although in the early stages, it was much assisted by guides. The urgency of smartphone ownership in farmers’ family is increasing due to the pandemic effect, where the smartphone supports all kinds of activities, such as learning for student and communication. Although farmers re empowered to use smartphone, access to fintech should be provided by fintech companies.

As regard the attribute of family support, as is the custom of farmers in the countryside, when making decisions they always involve their family, especially their wives, even though the decisions are fixed by the head of the family. Moreover, family support is necessary because farming is the primary source of income for the family. Empowerment is an important factor in influencing the sustainability of this fintech, which means it is important to socialize and educate farmers on fintech so that farmers are willing to join and use it. Farmers are basically not fully aware of fintech; therefore, training is needed to demonstrate how to operate smartphones, how to understand cash flow, and other details related to finance. Farmers have not known in detail about the benefits and risks arising from the use of fintech (Rufaidah et al., 2023). Farmers also have not understood the mechanisms of transactions using fintech and are not familiar with the fintech companies.

Being aware of the current condition, the fintech company that is implementing on chili farmers in West Java provides a facility called Responsive Aspirations of Farmers (ATAP). ATAP is a place where farmers can gather and consult with fintech providers about everything about online applications developed by fintech providers. In addition to the application, farmers can also consult on matters related to the cultivation of fresh products. In order to achieve this goal, fintech companies themselves need to communicate well with farmers, but communication can work well if supported by good competence anyway (Rufaidah et al., 2023).

5.2 Economic dimension

Economic factors play a crucial role in assessing the financial viability of technology as a funding source. The economic dimension refers to the capacity to fulfill farmers’ requirements in a sustainable manner (Zorn et al., 2018). The economic dimension is a key component of the notion of sustainable development outlined by Blackburn (2008), which states that economic success involves the prudent allocation of financial resources for the benefit of society. Farmers’ ability to access finance is a form of increasing farmers’ level of competence and adding value-added supply chains (Pothula, 2023). There are three attributes of measurement in the economic dimension analyzed by Rap-Agrifin analysis: (a) productivity, (b) price, and (c) income or profit.

The primary factor that has the most impact on fintech sustainability in the economic realm is money or profit. Income or profit is the most influential factor in driving the sustainability of financial technology among vegetable farmers in West Java. Income has become one of the factors that farmers pay great attention to in improving their wellbeing. Labor capital financing, investment, and consumption greatly help people increase their production and meet their consumer needs. There is an increase in production as a result of additional enterprise capital, which in the end can increase revenue.

The next most sensitive attribute is price. Prices are basically related to the income or profits that farmers will earn. The selling price of commodities produced by farmers is basically fluctuating, which also causes fluctuations in income. An arrangement between farmers and fintech companies to be off-takers of farmers’ products can help to mitigate these shifting situations. Fintech can cooperate with farmers in terms of capital provision and distribution of output so that price fluctuations can be overcome (Pothula, 2023).

5.3 Environmental dimension

Local and certified seeds are the primary factor influencing the sustainability of the environmental dimension. The majority of farmers have not yet used certified seeds and usually use self-developed seeds. As a result of the use of such non-certified seeds, the produce realized by farmers is less optimal. This eventually leads to low relative income for the farmers. This can be overcome by partnering with fintech, where there is a role in providing production needs, including certified seeds. Capital borrowed by fintech at the research site is in kind except to pay labor in money.

Another factor influencing the sustainability of the environmental dimension is the utilization of organic fertilizers and insecticides. Fertilizers and organic pesticides are important in humanitarian activities. Farmers rarely use organic fertilizers and organic pesticides because they are accustomed to using inorganic fertilizers and pesticides. This causes farmers to become heavily dependent on artificial chemical fertilizers and pesticides (Rahman and Zhang, 2018). Nevertheless, in this research, in-kind capital was given in the form of fertilizers and pesticides, the supply of which cooperated with the kiosks (sell production facilities) closest to the location of the farmer. Although only organic basic fertilizer was given, the supply of other inorganic fertilizers and pesticides are restricted according to their needs, so farmers are limited in their use of inorganic fertilizers and pesticides. This condition causes the sustainability index for the environmental dimension to be quite sustainable.

5.4 Technological dimension

The sensitive attribute that affects the technology dimension of fintech sustainability as a source of financing is technology adaptation. Technology is less familiar among farmers, so adaptation to technology tends to be difficult. Farmers are used to conventional methods and often do not want to adapt to something new, including fintech. Farmers do not have the ability to operate the features that exist in smartphones. Farmers only use smartphones for communication and feel it is going to be difficult if they have to run fintech (Septiani et al., 2020).

The responses of farmers to financial literacy is also sensitive to the technological dimension. Farmers’ financial literacy is relatively low, so farmers know less about fintech. Farmers consider that fintech is an illegal financing alternative and could cause losses to them. They have a negative view of fintech because of a lack of insight into legal fintech. Farmers need to be educated about it to get used to technology and access legal fintech.

5.5 Institutional dimension

The primary attribute most affecting the sustainability of the institutional dimension, with an RMS of 4.02, is government policy on the price of production facilities. The price of the production facilities and the sale price are related to the income that the farmer will earn. Various production inputs are hard to find and tend to have high prices, such as seeds, fertilizers, and pesticides. Subsidized fertilizers are difficult to obtain because of the various procedures that must be undertaken. Farmers sometimes choose to buy non-subsidized fertilizer, which is obviously more expensive. Then there is also a possibility that fertilizer will not be subsidized again and handed over to market mechanisms. It would make it harder for the farmer if the sale price did not match the cost he was charging. This can be overcome by partnering with fintech so that additional capital can be obtained and also a suitable sale price. Fintech has a role to play in providing markets for farmers (Anshari et al., 2019).

The second most critical factor influencing the sustainability of the institutional dimension is the government’s policy on the price of agricultural output, with RMS of 2.52. Governments tend not to make price interventions for fresh agricultural products, so often product prices fluctuate. When products are abundant, prices tend to be low, and vice versa when products have slightly higher prices. The fluctuating sales price can be overcome through a partnership with fintech. The role of fintech as a market provider could be exploited to ensure that farmers obtain fixed and agreed-upon prices (Septiani et al., 2020).

5.6 Fintech to leverage sustainable FAP supply chains

The success of collaboration FAP supply chains involving small farmers is related to the local social culture. Through collective spirit, farmers can easily share knowledge and mutual support, aligning with the concept of social capital as shared values that facilitate cooperation (Harutyunyan and Valadbigi, 2012). The social capital also influences farmers to develop the cognitive skills, communication abilities, and confidence to work together, bolstering their productivity and problem-solving capacity (Nahar et al., 2022). However, capacity-building efforts remain essential for sustainable integration of fintech, particularly around smartphone usage and financial technology (fintech). Fintech companies should train small farmers to leverage digitalization knowledge for financial transactions, fostering an environment where technological and financial literacy gradually enhance their operational capabilities.

The sustainable dimensions that give challenges and opportunities for farmers are economic, environmental, technological, and institutional. Economically, the potential for increased income and stable pricing through fintech partnerships is significant since fluctuating product prices impact farmers’ profits (Pothula, 2023; Zorn et al., 2018). Environmentally promoting certified seeds and organic fertilizers through fintech initiatives can improve sustainability, albeit with challenges, as many farmers are accustomed to conventional fertilizers (Carè et al., 2023; Rayhan et al., 2024). According to the technological perspective, comprehensive fintech literacy and technical training are necessary for small farmers to improve their adaptability to using fintech (Carè et al., 2023; Rayhan et al., 2024; Septiani et al., 2020). Fintech can help stabilize input and output prices, mitigating financial risks that arise from government price interventions and market dynamics (Anshari et al., 2019; Mapanje et al., 2023; Qawi and Karuniasa, 2020). Fintech is not just a funding source for small farmers but also has a role in aligning producers and markets, which has the potential to develop resilience and sustainability of the FAP supply chains involving small farmers.

6 Conclusion

This study sheds light on the sustainability index of financial technology (fintech) within the agriculture sector, focusing on fresh produce farming. It considers various dimensions, including social, economic, environmental, technological, and institutional factors. Implementing the Rap-Agrifin method, which demonstrates the efficiency, evaluates farmers’ perceptions of sustainability factors to understand the contribution of fintech in supporting sustainability in FAP supply chain.

The findings reveal that the overall sustainability index of fintech in agriculture as “quite sustainable.” It shows fintech contributions to developing sustainability in the FAP supply chain, particularly farmers. Fintech empowers farmers through capital and market access to improve their productivity to achieve optimum profit and increase farmers’ livelihood.

However, social, economic, and environmental factors reflect sustainability among the dimensions, which means fintech is proven to be supporting the sustainability of the FAP supply chain, especially in those three dimensions. However, fintech implementation in Indonesia still has weak support for technology and institutional factors.

Further investigation through leverage examination identifies critical variables impacting fintech sustainability, notably the social dimension of empowerment and capacity building, which is crucial for small farmers new to fintech usage.

Moreover, technological adaptations are stressed, necessitating capacity-building efforts to enhance farmers’ technology utilization. Government regulations regarding pricing also significantly impact fintech sustainability, affecting farmers’ profits and product pricing.

To develop justifiable technological and financial strategies, it is imperative to consider these factors comprehensively. While improvements are needed across all dimensions, particular attention should be given to enhancing technological sustainability, which remains a concern for farmers. By encouraging farmers to maximize smartphone usage alongside adopting sound cultivation practices, they can play a pivotal role in addressing this issue, feeling empowered and integral to the process.

In essence, by addressing the identified challenges and leveraging the strengths of each dimension, stakeholders can work toward enhancing the sustainability of fintech in the agriculture sector. This not only promotes socio-economic development and environmental conservation in the long term but also opens up new avenues for innovation and growth, instilling a sense of hope and motivation.

6.1 Limitation

The study focuses on the sustainability dimensions of financial technology (fintech) within the agriculture sector, specifically on FAP with the involvement of small farmers. This study may restrict the generalizability of the findings to other agricultural sub-sectors or regions. The sustainability dimensions is based on farmers’ perceptions of sustainability factors, which may vary based on individual experiences, knowledge, and biases. This subjectivity could introduce variability and skew the results. Illegal fintech (not officially registered with government financial institutions) influences bias in farmers’ perception and knowledge when conducting interviews. Thus, different commodities and regional characteristics may produce different results.

6.2 Future directions for further research

From this research, the multidimensional scaling (MDS) approach in Rap-Agrifin has proven to rapidly analyze the sustainability of finance in agriculture. It is an opportunity for future research in agriculture financing to use this method. Extending the analysis beyond fresh produce farming to include other agricultural sub-sectors would facilitate cross-sectoral comparisons and enrich our understanding of fintech sustainability across diverse agricultural contexts. This approach can identify sector-specific challenges and opportunities for fintech adoption and sustainability. Furthermore, future research should examine the impact of government policies and regulations on fintech to foster sustainability in the agriculture sector. Analyzing the role of regulatory frameworks in shaping farmers’ access to fintech, pricing mechanisms, and overall sustainability can inform policy recommendations to foster a supportive environment for fintech innovation.

In the long run, in order to improve sustainability in Indonesia’s agriculture, the government and other stakeholders need to give more attention to factors that are still weak, which are institutional and technological and involve building agricultural financing governance to accommodate knowledge transfer and practice on agriculture finance to farmers, especially applications of fintech.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

Written informed consent was obtained from the individual(s) for the publication of any potentially identifiable images or data included in this article.

Author contributions

TK: Writing – review & editing, Writing – original draft, Validation, Supervision, Methodology, Data curation, Conceptualization. TP: Writing – review & editing, Validation, Supervision, Funding acquisition. AS: Writing – original draft, Methodology, Investigation, Data curation. HU: Writing – review & editing, Resources, Project administration, Formal analysis, Data curation. ER: Writing – review & editing, Visualization, Software, Resources, Formal analysis.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research is supported by the Academic Leadership Grant (ALG) from Universitas Padjadjaran, providing funding for the publication of this journal article.

Acknowledgments

We gratefully acknowledge the financial support provided by Universitas Padjadjaran through the Academic Leadership Grant Number 1549/UN6.3.1/PT.00/2023, which has enabled the completion of this research and the publication of our findings in this journal. We would like to express our sincere gratitude to our research assistant, ALG, for their invaluable support and dedication throughout this study.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^https://www.bps.go.id/id/statistics-table/2/NjEjMg==/produksi-tanaman-sayuran.html (accessed in October 2024).

References

Aaron, M., Rivadeneyra, F., and Samantha, F. (2017). Fintech: is this time different? A framework for assessing risks and opportunities for central banks. Bank Can. Staff Discussion Paper 1, 283–312.

Abad-Segura, E., González-Zamar, M.-D., López-Meneses, E., and Vázquez-Cano, E. (2020). Financial technology: review of trends, approaches and management. Mathematics 8:951. doi: 10.3390/math8060951

Amos, O. A., and Uniamikogbo, E. (2016). Sustainability and triple bottom line: an overview of two interrelated concepts. Igbinedion Univ. J. Acc. 2, 1–40.

Anshari, M., Almunawar, M. N., Masri, M., and Hamdan, M. (2019). Digital marketplace and FinTech to support agriculture sustainability. Energy Procedia 156, 234–238. doi: 10.1016/j.egypro.2018.11.134

Arner, D. W., Barberis, J., Buckley, R. P., Nos Barberist, J., and Buckley, R. P. (2016). The evolution of FinTech: A new post-crisis paradigm. Georgetown J. Int. Law 47, 1271–1320.

Aseng, A. C. (2020). Factors influencing generation Z intention in using FinTech digital payment services. CogITo Smart J 6, 155–166. doi: 10.31154/cogito.v6i2.260.155-166

Bajunaied, K., Hussin, N., and Kamarudin, S. (2022). Behavioral intention to adopt FinTech services: an extension of unified theory of acceptance and use of technology. J. Open Innov.: Technol. Mark. Complex. 9, 1–2.

Barslund, M., and Tarp, F. (2008). Formal and informal rural credit in four provinces of Vietnam. J. Dev. Stud. 44, 485–503. doi: 10.1080/00220380801980798

Blackburn, W. (2008). The sustainability handbook, the complete management guide to achieving social, economic and environmental responsibility. London: Earthscan Publications Ltd.

Cai, Y., Huang, Z., and Zhang, X. (2024). FinTech adoption and rural economic development: evidence from China. 83(august 2023).

Campagnaro, C., and D’urzo, M. (2021). Social cooperation as a driver for a social and solidarity focused approach to the circular economy. Sustainability 13, 10145–10161. doi: 10.3390/su131810145

Carè, R., Boitan, I. A., and Fatima, R. (2023). How do FinTech companies contribute to the achievement of SDGs? Insights from case studies. Res. Int. Bus. Financ. 66:102072. doi: 10.1016/j.ribaf.2023.102072

Clayton, B. D., and Bass, S. (2011). Sustainable Development Strategies. London: Earthscan Publications Ltd.

Creswell, J. W., and Creswell, J. D. (2018). “Research design: qualitative, quantitative, and mixed methods approaches” in Research Defign: Qualitative, Quantitative, and Mixed Methods Approaches. ed. H. Salmon 5th ed. (Los Angeles: SAGE Publications Ltd).

Dai, Y., and Chen, X. (2023). Evaluating green financing mechanisms for natural resource management: implications for achieving sustainable development goals. Res. Policy 86:104160. doi: 10.1016/j.resourpol.2023.104160

Dhar, V., and Stein, R. M. (2017). FinTech platforms and strategy. Commun. ACM 60, 32–35. doi: 10.1145/3132726

Disemadi, H. S. (2021). Fenomena Predatory Lending: Suatu Kajian Penyelenggaraan Bisnis Fintech P2P Lending selama Pandemi COVID-19 di Indonesia. Pandecta Res. Law J. 16, 55–67.

Dolnicar, S. (2003). Simplifying three-way questionnaires—do the advantages of binary answer categories compensate for the loss of information? Simplifying Three-way Questionnaires—Do the Advantages of Binary Answer.

Ebrahimi, M., and Rahmani, D. (2019). A five-dimensional approach to sustainability for prioritizing energy production systems using a revised GRA method: A case study. Renew. Energy 135, 345–354. doi: 10.1016/j.renene.2018.12.008

Elkington, J. (1997). Cannibals With Forks: The Triple Bottom Line of 21st Century Business. Oxford: Capstone Publishing Limited.

Financial Services Authority (OJK). (2024). Statistik Fintech. https://ojk.go.id/id/kanal/iknb/data-dan-statistik/fintech/default.aspx# [Accessed 28 October, 2024].

Food and Agriculture Organization. (2022). FAOSTAT. https://www.fao.org/faostat/en/#data/IC [Accessed 28 October, 2024].

Food and Agriculture Organization. (2024). FAOSTAT. https://www.fao.org/faostat/en/#data/IC [Accessed 28 October, 2024].

Geria, I. M., Nastiti, T. S., Handini, R., Sujarwo, W., Dwijendra, A., Fauzi, M. R., et al. (2023). Built environment from the ancient Bali_ the Balinese heritage for sustainable water management. Heliyon 9:e21248. doi: 10.1016/j.heliyon.2023.e21248

Harutyunyan, B., and Valadbigi, A. (2012). Trust. The social virtues and creation of prosperity by Francis Fukuyama. Stud. Chang. Soc. 1, 80–95.

Hedeker, D., Mermelstein, R. J., Demirtas, H., and Berbaum, M. L. (2017). A mixed-effects location-scale model for ordinal questionnaire data. Health Serv. Outcome Res. Methodol. 773, 1–20. doi: 10.1007/s10742-016-0145-9.A

Hellyward, J., Suyitman,, and Rachmat, A. (2019). The sustainability index of dairy cattle area in Padang Panjang City. IOP Conf. Ser. Earth Environ. Sci. 287:012038. doi: 10.1088/1755-1315/287/1/012038

Herdiansyah, H., Soepandji, B. S., Seda, F. S., and Dewi, O. (2014). Conflict Management of Renewable Natural Resources in the border of Indonesia-Malaysia: sustainable environmental approach. Procedia Environ. Sci. 20, 444–450. doi: 10.1016/j.proenv.2014.03.056

Hermiatin, F. R., Handayati, Y., Perdana, T., and Wardhana, D. (2022). Creating food value chain transformations through regional food hubs: a review article. Sustain. For. 14:8196. doi: 10.3390/su14138196

Hikmah, H., Yulisti, M., and Nasution, Z. (2017). Analisis Indeks Dan Status Keberlanjutan Peran Serta Wanita Dalam Pengembangan Usaha Pengolahan Hasil Perikanan. J. Sos. Ekon. Kelaut. Perikanan 6:103. doi: 10.15578/jsekp.v6i1.5758

Jimenez, É. A., Gonzalez, J. G., Amaral, M. T., and Lucena Frédou, F. (2021). Sustainability indicators for the integrated assessment of coastal small-scale fisheries in the Brazilian Amazon. Ecol. Econ. 181:106910. doi: 10.1016/j.ecolecon.2020.106910

Kavanagh, P., and Pitcher, T. J. (2004). Implementing Microsoft excel. Fish. Center Res. Rep. 12, 1–80.

Khan, I., Hou, F., and Le, H. P. (2021). The impact of natural resources, energy consumption, and population growth on environmental quality: fresh evidence from the United States of America. Sci. Total Environ. 754, 142222–142235. doi: 10.1016/j.scitotenv.2020.142222

Khan, F. Z. A., Manzoor, S. A., Akmal, M., Imran, M. U., Taqi, M., Manzoor, S. A., et al. (2021). Modeling pesticide use intention in Pakistani farmers using expanded versions of the theory of planned behavior. Hum. Ecol. Risk. Assess. 27, 687–707. doi: 10.1080/10807039.2020.1750345

Khan, N., Ray, R. L., Kassem, H. S., and Zhang, S. (2022). Mobile internet technology adoption for sustainable agriculture: evidence from wheat farmers. Appl. Sci. 12:4902. doi: 10.3390/app12104902

Lloyd Chrispin, C., Ananthan, P. S., Ramasubramanian, V., Sugunan, V. V., Panikkar, P., and Landge, A. T. (2022). Rapid reservoir fisheries appraisal (r-RAPFISH): Indicator based framework for sustainable fish production in Indian reservoirs. J. Clean. Prod. 379:134435. doi: 10.1016/j.jclepro.2022.134435

Mapanje, O., Karuaihe, S., Machethe, C., and Amis, M. (2023). Financing sustainable agriculture in sub-Saharan Africa: A review of the role of financial technologies. Sustainability 15, 4587–4607. doi: 10.3390/su15054587

McIntosh, C., and Mansini, C. S. (2018). The use of Financial Technology in the Agriculture Sector. Asian Development Bank Institute (issue 872).

Mhlanga, D., and Ndhlovu, E. (2023). Digital technology adoption in the agriculture sector: challenges and complexities in Africa. Hum. Behav. Emerg. Technol. 2023, 1–10. doi: 10.1155/2023/6951879

Munasinghe, M. (2009). Sustainable development in practice: Sustainomics methodology and applications. Sustain. Dev. Pract. 2009, 1–633. doi: 10.1017/CBO9780511626777

Nahar, S., Suhendri, S., and Hardivizon, H. (2022). Improving students’ collaboration thinking skill under the implementation of the quantum teaching model. Int. J. Instr. 15, 451–464. doi: 10.29333/iji.2022.15325a

Ningrat, R. G., and Nurzaman, M. S. (2019). Developing Fintech and Islamic finance products in agricultural value chain. J. Islamic Monet. Econom. Fin. 5, 491–516. doi: 10.21098/jimf.v5i3.1077

Noor, S., and Tajik, O. (2022). Defining simple random sampling in a scientific research. Int. J. Educ. Lang. Stud. 1, 78–82.

Pant, L. P., and Odame, H. H. (2017). Broadband for a sustainable digital future of rural communities: A reflexive interactive assessment. J. Rural. Stud. 54, 435–450. doi: 10.1016/j.jrurstud.2016.09.003

Papilo, P., Marimin, H. E., and Sitanggang, I. S. (2018). Sustainability index assessment of palm oil-based bioenergy in Indonesia. J. Clean. Prod. 196, 808–820. doi: 10.1016/j.jclepro.2018.06.072

Perdana, T., Tjahjono, B., Kusnandar, K., Sanjaya, S., Wardhana, D., and Hermiatin, F. R. (2023). Fresh agricultural product logistics network governance: insights from small-holder farms in a developing country. Int J Log Res Appl 26, 1761–1784. doi: 10.1080/13675567.2022.2107625

Pertiwi, I., Prajanti, S. D. W., and Juhadi, J. (2017). Strategi Adaptasi Petani Dalam Pengolahan Lahan Kering di Desa Dieng Kecamatan Kejajar Kabupaten Wonosobo. J. Educ. Soc. Stud. 6, 87–91.

Pothula, R. S. (2023). Review and analysis of FinTech approaches for smart agriculture in one place. J. Agric. Sci. Technol. 22, 60–69. doi: 10.4314/jagst.v22i1.6

Puspitasari, N., Hariyadi, R., and Agustian, A. (2023). Assessing the sustainability of garlic production for determining strategies in garlic sustainable development program. IOP Conf. Ser. Earth Environ. Sci. 1266:012040. doi: 10.1088/1755-1315/1266/1/012040

Qawi, M. R., and Karuniasa, M. (2020). Financial technology for supporting sustainable agriculture. Int. J. Innov. Technol. Explor. Eng. 9, 83–86. doi: 10.35940/ijitee.c1018.0193s20

Rahman, K. M. A., and Zhang, D. (2018). Effects of fertilizer broadcasting on the excessive use of inorganic fertilizers and environmental sustainability. Sustainability 10. doi: 10.3390/su10030759

Rayhan, M. J., Rahman, S. M. M., Mamun, A. Al, Saif, A. N. M., Islam, K. M. A., Alom, M. M., et al. (2024). FinTech solutions for sustainable agricultural value chains: A perspective from smallholder farmers. Bus. Strateg. Dev. 7,:e358. doi: 10.1002/bsd2.358

Rufaidah, F., Karyani, T., Wulandari, E., and Setiawan, I. (2023). A review of the implementation of financial technology (Fintech) in the Indonesian agricultural sector: issues, access, and challenges. Int. J. Fin. Stud. 11, 108–122. doi: 10.3390/ijfs11030108

Saifi, B., and Drake, L. (2008). A coevolutionary model for promoting agricultural sustainability. Ecol. Econ. 65, 24–34. doi: 10.1016/j.ecolecon.2007.11.008

Sands, G. R., and Podmore, T. H. (2000). A generalized environmental sustainability index for agricultural systems. Agric. Ecosyst. Environ. 79, 29–41. doi: 10.1016/S0167-8809(99)00147-4

Sekabira, H., Tepa-Yotto, G. T., Ahouandjinou, A. R. M., Thunes, K. H., Pittendrigh, B., Kaweesa, Y., et al. (2023). Are digital services the right solution for empowering smallholder farmers? A perspective enlightened by COVID-19 experiences to inform smart IPM. Front. Sustain. Food Syst. 7:983063. doi: 10.3389/fsufs.2023.983063

Septiani, H. L. D., Sumarwan, U., Yuliati, L. N., and Kirbrandoko, K. (2020). Understanding the factors driving farmers to adopt peer-to-peer lending sharing economy. Int. Rev. Manag. Mark. 10, 13–21. doi: 10.32479/irmm.10564

Shin, Y. J., and Choi, Y. (2019). Feasibility of the fintech industry as an innovation platform for sustainable economic growth in Korea. Sustainability 11, 5351–5372. doi: 10.3390/su11195351

Song, N., and Appiah-Otoo, I. (2022). The impact of Fintech on economic growth: evidence from China. Sustainability 14, 1–13. doi: 10.3390/su14106211

Suárez Roldan, C., Méndez Giraldo, G. A., and López Santana, E. (2023). Sustainable development in rural territories within the last decade: a review of the state of the art. Heliyon 9:e17555. doi: 10.1016/j.heliyon.2023.e17555

Sydorovych, O., and Wossink, A. (2008). The meaning of agricultural sustainability: evidence from a conjoint choice survey. Agric. Syst. 98, 10–20. doi: 10.1016/j.agsy.2008.03.001

Tan, Y., Cheng, Q., Ren, X., Huang, X., Chen, Q., and Zhang, Q. (2024). A study of the impact of digital financial inclusion on multidimensional food security in China. Front. Sustain. Food Syst. 8:1325898. doi: 10.3389/fsufs.2024.1325898

United Nations (1987). Report of the world commission on environment and development: our common future. United Nations.

Villalba, R., Venus, T. E., and Sauer, J. (2023). The ecosystem approach to agricultural value chain finance: A framework for rural credit. World Dev. 164:106177. doi: 10.1016/j.worlddev.2022.106177

Wang, Y., Xiuping, S., and Zhang, Q. (2021). Can fintech improve the efficiency of commercial banks? —an analysis based on big data. Res. Int. Bus. Financ. 55:101338. doi: 10.1016/j.ribaf.2020.101338

Yan, B., Liu, G., Zhang, Z., and Yan, C. (2020). Optimal financing and operation strategy of fresh agricultural supply chain. Aust. J. Agric. Resour. Econ. 64, 776–794. doi: 10.1111/1467-8489.12375

Yang, C., Ji, X., Cheng, C., Liao, S., Obuobi, B., and Zhang, Y. (2024). Digital economy empowers sustainable agriculture: implications for farmers’ adoption of ecological agricultural technologies. Ecol. Indic. 159:111723. doi: 10.1016/j.ecolind.2024.111723

Yue, B., Sheng, G., She, S., and Xu, J. (2020). Impact of consumer environmental responsibility on green consumption behavior in China: the role of environmental concern and price sensitivity. Sustainability 12, 1–16. doi: 10.3390/su12052074

Zhang, Y., Chen, J., Han, Y., Qian, M., Guo, X., Chen, R., et al. (2021). The contribution of Fintech to sustainable development in the digital age: ant forest and land restoration in China. Land Use Policy 103:105306. doi: 10.1016/j.landusepol.2021.105306

Zhang, C., Zhu, Y., and Zhang, L. (2024). Effect of digital inclusive finance on common prosperity and the underlying mechanisms. Int. Rev. Financ. Anal. 91:102940. doi: 10.1016/j.irfa.2023.102940

Keywords: sustainability, fintech, agricultural fresh products, supply chain, MDS

Citation: Karyani T, Perdana T, Sadeli AH, Utami HN and Renaldi E (2024) Leveraging financing technology for sustainable fresh agricultural products financing in Indonesia. Front. Sustain. Food Syst. 8:1438263. doi: 10.3389/fsufs.2024.1438263

Edited by:

Isabelle Piot-Lepetit, INRAE Occitanie Montpellier, FranceReviewed by:

Setyardi Pratika, IPB University, IndonesiaMehrdad Niknami, Islamic Azad University of Garmsar, Iran