- 1College of Economics and Management, Northwest A&F University, Yangling, China

- 2College of Public Administration, Huazhong Agricultural University, Wuhan, China

Crop insurance, as a crucial tool for agricultural risk management, holds significant importance in increasing farmers’ income. This study analyzed the intrinsic relationship and mechanism between crop insurance, factor allocation, and pear farmers’ income. Using field survey data from 1,337 pear farmers in Xixian and Weixian counties in China, we employed OLS regression models and mediation effect models to empirically investigate the direct and indirect impacts of crop insurance on pear farmers’ income. Additionally, we examined the moderating role of agricultural cooperatives and group heterogeneity. The research findings revealed the following: (1) Although crop insurance increases agricultural expenses, it mitigates income losses due to disasters, ultimately leading to a net increase in pear farmers’ income. (2) Crop insurance enhances agricultural labor and machinery inputs, and encourages pear farmers to adopt green production techniques, thereby boosting their income. (3) The beneficial impact of crop insurance on pear farmers’ income is even more pronounced when farmers are members of cooperatives. (4) Heterogeneity analysis showed that for pear farmers who make individual decisions and have smaller land areas, crop insurance can increase their income, while its impact on farmers who make group decisions or have larger land areas is not significant. In conclusion, this study proposes to promote the development of crop insurance, deepen factor market-oriented reforms, support and guide the development of cooperatives, and pay attention to the heterogeneity among different groups of farmers.

1 Introduction

Farming is generally recognized as a risky endeavor due to uncertain weather, pests, and prices (DeLay et al., 2023). Especially against the backdrop of global climate change, agricultural production faces increasingly severe risk challenges, including floods, droughts, and frosts. These weather variations not only pose direct threats to crop growth and development, but also potentially cause significant disruptions to the continuity and stability of agricultural production. Farmers, faced with high natural risks, often lack effective risk management methods (Fang et al., 2021), resulting in unstable agricultural income. In theory, there is a wide array of risk management strategies that farmers can use in order to mitigate agricultural risks (Salazar et al., 2019). Crop insurance, as a crucial risk management tool, plays an increasingly vital role in addressing climate change and safeguarding farmers’ income. Agricultural insurance can participate in agricultural risk management, and effectively diversify, prevent and transfer various risks faced by agricultural production (Tan et al., 2022). It provides farmers with economic security, mitigating the impact of disaster losses on their income. By purchasing crop insurance, farmers can receive a certain level of economic compensation in the event of losses, thereby maintaining the continuity and stability of their production activities. In order to effectively reduce agricultural disaster losses, China formally implemented policy-based agricultural insurance in 2007 (Tang and Luo, 2021). The rapid development of crop insurance has effectively compensated rural households for economic losses and quickly restored crop production after disasters (Zhao et al., 2019). Within this context, analyzing the impact of crop insurance on farmers’ income growth and its underlying mechanisms holds both theoretical and practical significance for fully leveraging the role of crop insurance, addressing the challenges of climate change, and promoting farmers’ income enhancement.

Presently, there exists a wealth of research on the impact of crop insurance on agricultural production. These studies encompass the influence of crop insurance on farmers’ factor allocation, agricultural income, and production efficiency. Regarding the impact of crop insurance on factor allocation, it has been observed that crop insurance can alter agricultural investments by mitigating risks and offering subsidies (Yu and Sumner, 2018). Families covered by insurance policies tend to engage in adaptive behaviors, cultivating higher-yielding crops (Panda et al., 2013). Evidence from Shandong Province, China, indicates that crop insurance enhances farmers’ willingness to adopt environmentally friendly agricultural technologies from three dimensions: motivation, capability, and opportunity (Wei et al., 2021). Providing maize insurance leads to a shift in land usage from hayfields and pastures to maize, resulting in an overall increase in chemical usage (Wu, 1999). Research involving cotton farmers in Xinjiang, China, suggests heterogeneous effects of crop insurance on agrochemicals, with a stronger impact on the use of agrochemicals among large-scale farmers compared to small-scale ones (Mao et al., 2023). In terms of the impact of crop insurance on agricultural income, it has been observed that crop insurance can enhance farm income and reduce its volatility (Enjolras et al., 2014). The increase in crop insurance coverage and per capita indemnity significantly positively influences farmers’ income growth (Bhuiyan et al., 2022). Based on rural household survey data from five major sugarcane producing counties in the Guangxi Zhuang Autonomous Region in 2018, crop insurance has been shown to enhance farmers’ sugarcane production enthusiasm by elevating farm income and income expectations (Zhu and Yang, 2023). While policy-driven crop insurance generally benefits the augmentation of farmers’ income, it exhibits notable heterogeneity across different income groups of farmers. Moreover, its impact intensifies as farmers’ income levels rise (Li and Wang, 2022). Examining the impact mechanisms of crop insurance on income reveals that Total Cost Insurance (TCI) pilot initiatives have facilitated income augmentation for farmers through enhanced insurance coverage (Zhang et al., 2022). Additionally, subsidy policies for crop insurance have spurred increased farmer income by influencing the quantity of key productive fixed assets and per capita grain sowing areas (Gao et al., 2021). Assessing the impact of crop insurance on productivity, its expansion has shown promise in elevating the overall green total factor productivity in Chinese agriculture (Li et al., 2022a), a notion supported by studies originating from the United States as well (Ahmed et al., 2022). From the perspective of small-scale farmers, participation in weather-indexed crop insurance schemes improves the technical efficiency of peanut cultivation (Kumar and Babu, 2021). However, contrary evidence has been presented by scholars. Research evidence from wheat farms in six states of the U.S. western plains suggests that crop insurance has a negative impact on technical efficiency (Ji I. et al., 2023). Agbenyo et al. (2023) found that weather index insurance negatively influences cocoa output in Ghana due to inadequate information on insurance among farmers, lack of education, lack of awareness, and access to credit.

Considerable research exists on the impact of crop insurance on agricultural production. However, there remains a need for further investigation into the underlying mechanisms driving these effects. Based on this, this paper analyzes the impact of crop insurance on pear farmers’ income using microdata from pear farmers in Xixian and Weixian counties in China. In this paper, we use net agricultural income to investigate agricultural production for two reasons. Firstly, although agricultural output is the primary objective of agriculture, pear farmers engage in agricultural production with the core aim of producing more agricultural products and obtaining economic benefits through the sale of these products to maintain their livelihoods and improve their income levels. Secondly, compared to agricultural output, income provides a more comprehensive reflection of pear farmers’ economic status. Although agricultural output is also an important indicator for measuring the effectiveness of agricultural production, it primarily focuses on the material outcomes of the production process while neglecting the input costs of pear farmers, especially the expenses related to crop insurance. Therefore, by focusing on net agricultural income, we can gain a more comprehensive understanding of the impact of crop insurance on pear farmers’ economic well-being.

The main contributions of this research are reflected in the following four aspects: Firstly, in terms of theoretical innovation, we examine factor allocation as a crucial mechanism through which crop insurance affects farmers’ income, adopting a perspective that combines input and output. Farmers’ income is the outcome of a combination of various factors, yet it is primarily determined by the allocation of agricultural factors. This is mainly because factor allocation constitutes the input stage of agricultural production, while income represents the output stage. Secondly, regarding research data, we utilize micro-level data collected from pear farmers in China. Unlike grain crops, pears are high-value economic crops with capital-intensive characteristics and strong asset constraints. Pears also exhibit a relatively high income demand elasticity in target markets, indicating sufficient market competition. Therefore, studying pears can further enrich our understanding of the impact of crop insurance on high-value economic crops. Thirdly, compared with existing literature, our analysis of the impact of crop insurance on farmers’ income also takes into account the role of agricultural cooperatives. Agricultural cooperatives, as newly established business entities formed by farmers, play a pivotal role in agricultural development by providing farmers with agricultural information, technical guidance, and financial support. In our study, we incorporated agricultural cooperatives as a moderator variable to analyze whether they can complement crop insurance in jointly promoting farmers’ income growth. Additionally, regarding research methods, to mitigate potential endogeneity issues in the model, we employed the instrumental variable approach and conducted regressions using the two-stage least squares (2SLS) model. This approach enhances the reliability of our research conclusions.

2 Theoretical analysis and research hypotheses

China has achieved comprehensive poverty alleviation and is now entering a new phase that focuses on consolidating poverty alleviation efforts and seamlessly integrating rural revitalization. Increasing farmers’ income and realizing rural revitalization have become primary objectives in China’s agricultural and rural development initiatives. Consequently, the role of crop insurance has transcended its traditional function of safeguarding agricultural production, assuming a broader role aimed at augmenting farmers’ income and propelling agricultural modernization. Pear farmers, characterized by a lower level of diversification, allocate a greater proportion of labor toward agricultural production, thereby exhibiting a higher dependency on agricultural income. Pears, being economically sensitive due to inherent production risks, are susceptible to natural disasters such as floods, frost, pests (Li et al., 2022b), as well as market risks such as price fluctuations. To stabilize agricultural income and sustain household livelihoods, pear farmers opt to purchase crop insurance to mitigate the impact of production risks on income. Agricultural income stands as the primary source of household earnings for pear farmers, underscoring the multifaceted role of crop insurance not only in securing production but also in fostering increased income for farmers.

2.1 The direct impact of crop insurance on farmers’ income

Farmers’ participation of crop insurance refers to their proactive step in mitigating the impact of risks on agricultural production. It involves payment of premiums to crop insurance companies. In the event of agricultural production losses caused by risk occurrences, farmers receive compensation from insurance companies, thereby reducing their losses. To promote the development of crop insurance, the Chinese government has implemented a series of policy-oriented crop insurance schemes. Farmers receive governmental premium subsidies when paying insurance premiums. The impact of crop insurance on farmers’ income manifests across three dimensions: the premiums paid by farmers to insurance companies, the insurance subsidies acquired by farmers during enrollment, and the insurance compensations received by farmers in the event of losses.

Firstly, as an agricultural expenditure, crop insurance directly reduces farmers’ income following the payment of insurance premiums. Secondly, policy-based crop insurance stands as a significant subsidy mechanism aimed at assisting farmers in managing agricultural risks, thereby fostering agricultural development (Xu and Liao, 2014). The Chinese government, in accordance with a certain proportion of premiums, provides subsidies to farmers. Upon purchasing crop insurance products and furnishing the requisite documentation, farmers become eligible for government-subsidized crop insurance, a form of transfer payment that effectively reduces farmers’ production costs, subsequently bolstering their income. Thirdly, post the purchase of crop insurance, if risks materialize resulting in agricultural production losses, insurance companies compensate farmers based on their economic losses, thus augmenting farmers’ income.

In summary, crop insurance reduces farmers’ income through premium payments, but augments it through insurance subsidies and compensation. Looking at the landscape of crop insurance development in China, the substantial subsidization by the government, whether from central finances or other sources, typically exceeds 50%. Consequently, farmers incur relatively lower expenses when purchasing crop insurance, thereby minimizing the adverse impact on their income. In essence, the government’s subsidy of insurance premiums amplifies this offsetting effect, reinforcing the role of crop insurance in mitigating agricultural income volatility and potentially enhancing income (Zhao et al., 2016). The positive impact of premium subsidies and insurance compensation on income outweighs the negative impact of premium payments on income for farmers purchasing crop insurance. Based on this, the research hypothesis H1 is proposed:

H1: Crop insurance has a positive impact on farmers’ income.

2.2 The indirect impact of crop insurance on farmers’ income

Crop insurance in China exhibits characteristics of “broad coverage and low protection.” This denotes that while the coverage of crop insurance in China is extensive, the level of risk protection is comparatively low. Consequently, it fails to exert a significant impact on agricultural income, further constraining its effectiveness in enhancing revenue through crop insurance. The role of insurance subsidies and compensation in stimulating increased income for farmers is minimal at best. Presently, the Chinese government advocates for an effective alignment between the advancement of smallholder farmers and modern agricultural development. This convergence aims to achieve agricultural modernization by employing contemporary production factors and optimizing their allocation. Consequently, the achievement of increased farmer incomes and sustained agricultural development relies significantly on harnessing the role of crop insurance to refine agricultural factor allocation and enhance the intrinsic developmental momentum of agricultural production. Nevertheless, within agricultural production, various risks and uncertainties stemming from production, markets, financing, technology, policies, and climatic conditions exist (Uçar et al., 2023), hindering farmers’ ability to allocate resources effectively. Hence, harnessing the role of crop insurance to mitigate production risks becomes imperative for optimizing resource allocation in agriculture, enhancing the intrinsic developmental momentum of agricultural production, and ultimately achieving sustained development in farmers’ income and the agricultural sector. In the case of purchasing agricultural insurance, farmers will adjust their agricultural production methods and change the input of production factors to maximize the expected benefits (Tang and Luo, 2021). Based on the preceding analysis, this paper will explore the indirect impact of crop insurance on farmers’ income through the lens of factor allocation.

To begin with, crop insurance engages in agricultural risk management, effectively mitigating, preventing, and transferring various risks inherent in agricultural production (Tan et al., 2022). By indemnifying agricultural losses, crop insurance mitigates the risks associated with farmers’ factor allocation, stabilizes income expectations, and thereby incentivizes increased factor allocation among farmers, consequently leading to an augmentation in farmers’ income. Furthermore, crop insurance serves the role of providing scientific guidance and risk management. Upon purchasing crop insurance, farmers receive scientifically-backed agricultural production information and risk management guidance from insurance companies. This provision aims to reduce erroneous practices in agricultural production among farmers, enhancing their capacity to withstand risks and, consequently, incentivizing farmers to optimize input allocation. Additionally, crop insurance can alter the transmission pathways of agricultural risks by substituting collateral, thereby elevating the anticipated returns of agricultural credit (Ai et al., 2023). Crop insurance serves as a form of credit guarantee for farmers, alleviating their financing constraints. Resource allocation, being an investment endeavor, necessitates significant capital input. However, smaller-scale farmers often face limitations due to financial constraints, impeding their ability to engage in resource allocation. Crop insurance has the effect of mortgage credit, that is, after farmers obtain crop insurance, they use the insurance to go to banks for loan financing (Fang et al., 2021). This approach effectively mitigates their financing constraints, thereby facilitating their resource allocation. This study posits that crop insurance plays a multifaceted role encompassing risk mitigation, informed guidance, and credit assurance. These aspects collectively encourage farmers to augment their resource allocation. By applying more of the risk-increasing, but also very productive input, feed, than the less-insured famers, they increase both their production and production risk, thereby increasing farmers’ income (Roll, 2019).

The agricultural production system in China has undergone a transition from labor-intensive practices to a reliance on agricultural chemicals such as fertilizers. With the continuous advancements in Chinese science and technology, technology has emerged as a pivotal factor in agricultural production. The substantial improvement in agricultural production efficiency in China is attributed to the reliance on technological advancements. Presently, China advocates for green agricultural development, where green production technologies are deemed essential components within agricultural factors. Thus, this study aims to analyze the impact mechanisms of crop insurance on farmers’ income augmentation from the perspectives of labor, capital, and green technologies.

Pear farmers engage in agricultural production that involves both family labor and hired labor. Pears, being economically intensive crops, necessitate considerable manual labor. Various stages in pear cultivation, such as pruning, bagging, fertilizer application, pesticide spraying, and harvesting, demand labor-intensive efforts. Particularly, bagging and harvesting are tasks that require substantial labor input. However, the availability of family labor is limited, making it challenging to meet the labor demands inherent in pear cultivation. Hiring labor becomes an advantageous option in this context. For pear farmers, employing a substantial labor force necessitates significant financial investment, constituting a high-risk endeavor. The pear cultivation process, laden with uncertainty, often compels farmers to adopt a conservative approach to labor input, restricting it to family labor while shunning hired labor. While this mitigates agricultural input risks, insufficient labor input adversely impacts yield. Crop insurance serves as a risk mitigator for pear farmers, offering income stability prospects, thereby encouraging the employment of labor and increasing pear yield, ultimately fostering increased income for farmers. Based on this, this study posits the following research hypotheses H2:

H2: Crop insurance increases farmers’ income by increasing labor input.

Within agricultural production, farm machinery is commonly considered a representative of capital. Subsequently, we will examine the influence of crop insurance specifically on capital, using machinery as a case study. Farm machinery, emblematic of advanced productive forces, can supplant labor inputs in pear cultivation, thereby enhancing agricultural production efficiency. While labor remains essential in tasks such as bagging and harvesting, mechanization progressively substitutes for activities like weeding, irrigation, pesticide application, and transportation. Despite its heightened productivity, machinery procurement costs often surpass the financial capacity of farmers. Crop insurance, on one hand, functions as a safeguard, bolstering the resilience of agricultural production against risks, consequently reducing the risk associated with farmers’ machinery investments. On the other hand, serving as collateral for loans, crop insurance enhances farmers’ access to credit, prompting alterations in their production decisions (Li et al., 2022b). Therefore, crop insurance can alleviate financial constraints, augmenting investments in farm machinery, thereby elevating production efficiency and subsequently, farmers’ income. Based on this, the research hypothesis H3 is proposed:

H3: Crop insurance increases farmers’ income by increasing machinery input.

Green technology refers to agricultural production techniques that not only aim to increase crop yield but also protect the environment, fostering sustainable agricultural development. China’s historical reliance on excessive application of agricultural chemicals, such as fertilizers, has led to severe non-point source pollution in agriculture. This practice has not only deteriorated the quality of arable land and affected crop yields but has also adversely impacted the ecological environment, hindering sustainable development. Despite the environmental friendliness of green technology, it is not without risks. Components of green technology encompass methods for pest and disease control, employing biopesticides among other techniques, which have specific technical thresholds for application. Improper utilization of these techniques by pear farmers could result in yield losses, thereby implying inherent risks associated with adopting green technology. Agricultural insurance affects the expected income of agricultural production and then affects the green development of agriculture (Hou and Wang, 2022). Crop insurance serves to mitigate these risks, encouraging farmers to adopt green technologies, thereby augmenting their income. Based on the above analysis, proposing the research hypothesis H4:

H4: Crop insurance increases farmers’ income by increasing green technology input.

3 Methodology

3.1 Data source

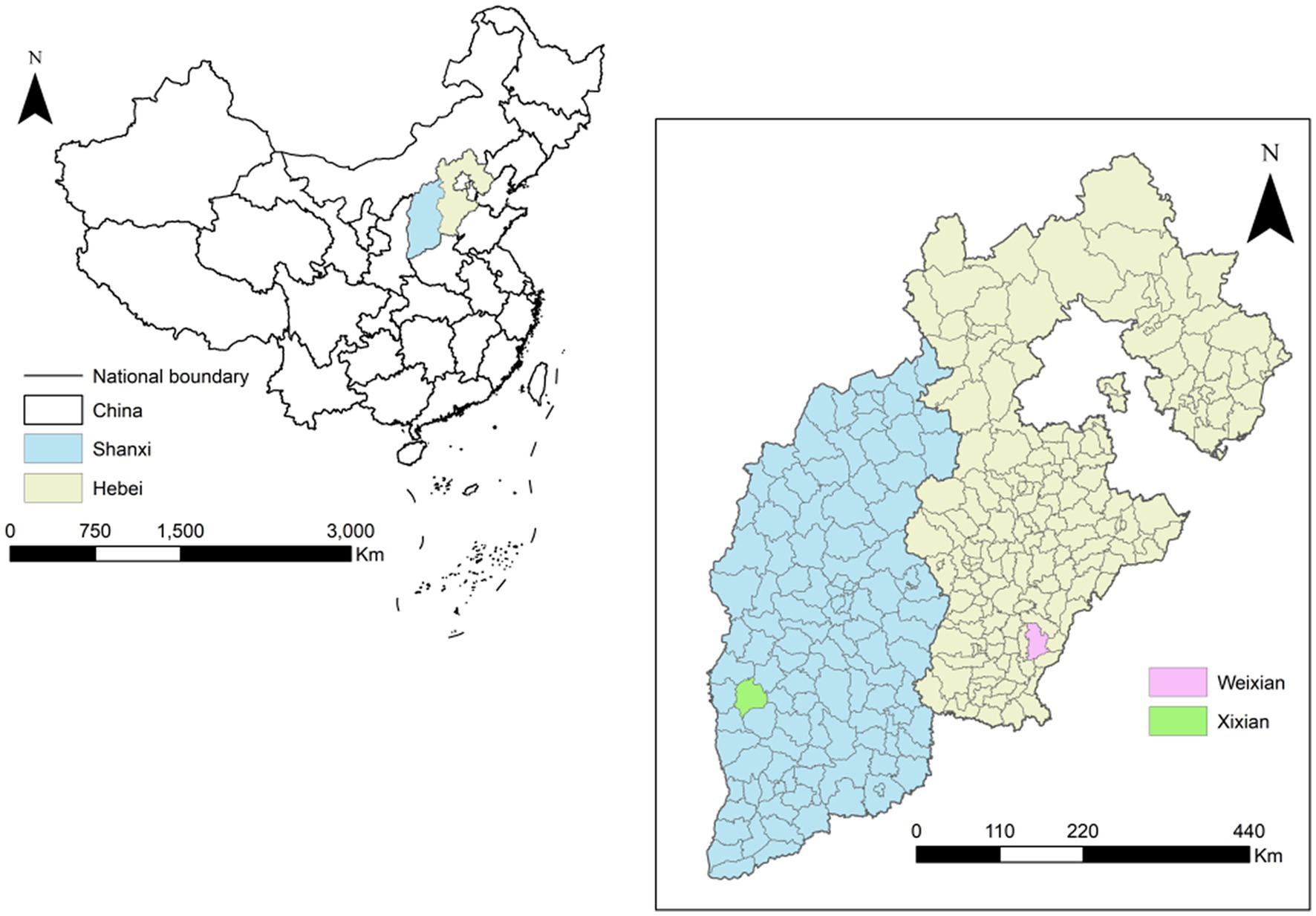

The research subjects of this study are pear farmers located in Xixian, Shanxi Province, and Weixian, Hebei Province, China. The selection of these subjects is founded upon two primary considerations. Firstly, Xixian and Weixian counties serve as principal production centers for pears in China. Pears face a multitude of natural risks such as frost, flooding, pests, alongside market risks like price fluctuations. To counter agricultural risks and stabilize income in agriculture, crop insurance is considered a viable choice. Secondly, in comparison to other industries, the income derived from agricultural activities for farmers is relatively lower. Particularly for pear farmers, who heavily rely on agriculture and derive a significant portion of their income from it, enhancing agricultural income stands as a crucial avenue for increasing their earnings and sustaining their livelihoods.

We conducted a sampling survey to acquire research data, aiming to gain a deep understanding of the production status of pear farmers in China, particularly with regard to factor allocation related to crop insurance. Firstly, based on an overview of pear planting in China, we selected Xixian and Weixian county as our survey regions. Subsequently, considering our survey area and objectives, we determined the content of the survey, which encompassed data collection on pear farmers’ individual characteristics, household features, factor inputs, crop insurance purchase status, and agricultural output. With these objectives in mind, we designed a comprehensive questionnaire to ensure the comprehensive and accurate acquisition of the required information.

To ensure the representativeness and accuracy of our sample, we employed a combination of stratified sampling and random sampling. Initially, we stratified the overall population based on factors such as geographical distribution, economic level, and pear industry development status across townships and villages in Xixian and Weixian county. Within each stratum, we then used random sampling to select a certain number of townships and villages as our sample units. Ultimately, we selected 20 townships and 50 villages as our survey samples, randomly choosing 20–30 pear farmers from each village as survey participants.

During the survey, we organized graduate students majoring in agricultural economics to serve as surveyors, conducting one-on-one questionnaire interviews with pear farmers. This approach ensured the quality of questionnaire completion and facilitated deep exchanges with pear farmers, enabling us to understand their true thoughts and actual situations. The surveyors explained each question in the questionnaire to the pear farmers, ensuring their accurate understanding and responses. They also patiently addressed any questions or concerns raised by the farmers, ensuring a smooth questionnaire completion process.

After the questionnaire interviews, we carefully collated and checked the collected raw data, obtaining 1,350 original questionnaires. We excluded questionnaires with missing or unreasonable data to ensure data integrity and accuracy. Ultimately, we obtained 1,337 valid questionnaires. The study area of the sample is illustrated in Figure 1.

3.2 Variable description

3.2.1 Dependent variable

The dependent variable in this study is the income of pear farmers, represented by the net profit derived from pear cultivation, calculated as total revenue minus total costs. Previous studies (Bhuiyan et al., 2022; Li and Wang, 2022; Tan et al., 2022; Zhang et al., 2022) have typically represented household income using indicators such as operating income, disposable income, or total agricultural income, without accounting for the input costs incurred by farmers in agricultural production. On one hand, crop insurance increases expenditure such as premium payments and input costs. On the other hand, it enhances income through premium subsidies and insurance compensation. Thus, representing income in terms of net profit better reflects changes in the cost–benefit scenario for pear farmers. Additionally, we utilized per-mu net profits from pear cultivation by farmers as an income indicator, facilitating robustness testing. Logarithmic transformations were applied to both net profits and per-mu net profits for our analysis.

3.2.2 Independent variable

The independent variable in this study is crop insurance, which refers to a risk management tool purchased by pear farmers from insurance companies to mitigate operational risks and obtain compensation in the event of disaster-related losses. We use the insurance purchase and insurance cost by pear farmers as indicators of crop insurance. Insurance purchase is determined by whether pear farmers buy crop insurance. A value of 1 indicates expenditure on crop insurance, signifying its purchase, whereas a value of 0 denotes no expenditure, indicating non-purchase. However, a binary variable cannot capture changes in the proportion of land covered by insurance or reflect variations in the average level of coverage chosen (Möhring et al., 2020). Therefore, we analyze insurance costs. The amount spent by pear farmers on purchasing crop insurance represents insurance costs, and we take the logarithm of these costs for analysis.

3.2.3 Mediator variable

To delve deeper into the pathways through which crop insurance affects pear farmers’ income, we conducted a mechanism analysis. In line with our research hypothesis, we selected factor allocation as the mediating variable, encompassing labor, machinery, and green technology input. Labor input was proxied by the costs incurred by pear farmers in hiring labor. Machinery input was represented by the expenses associated with pear farmers’ machinery purchases. Green technology input were gauged by the costs borne by farmers in adopting environmentally friendly production techniques. All these variables were logarithmically transformed for analysis purposes.

3.2.4 Control variable

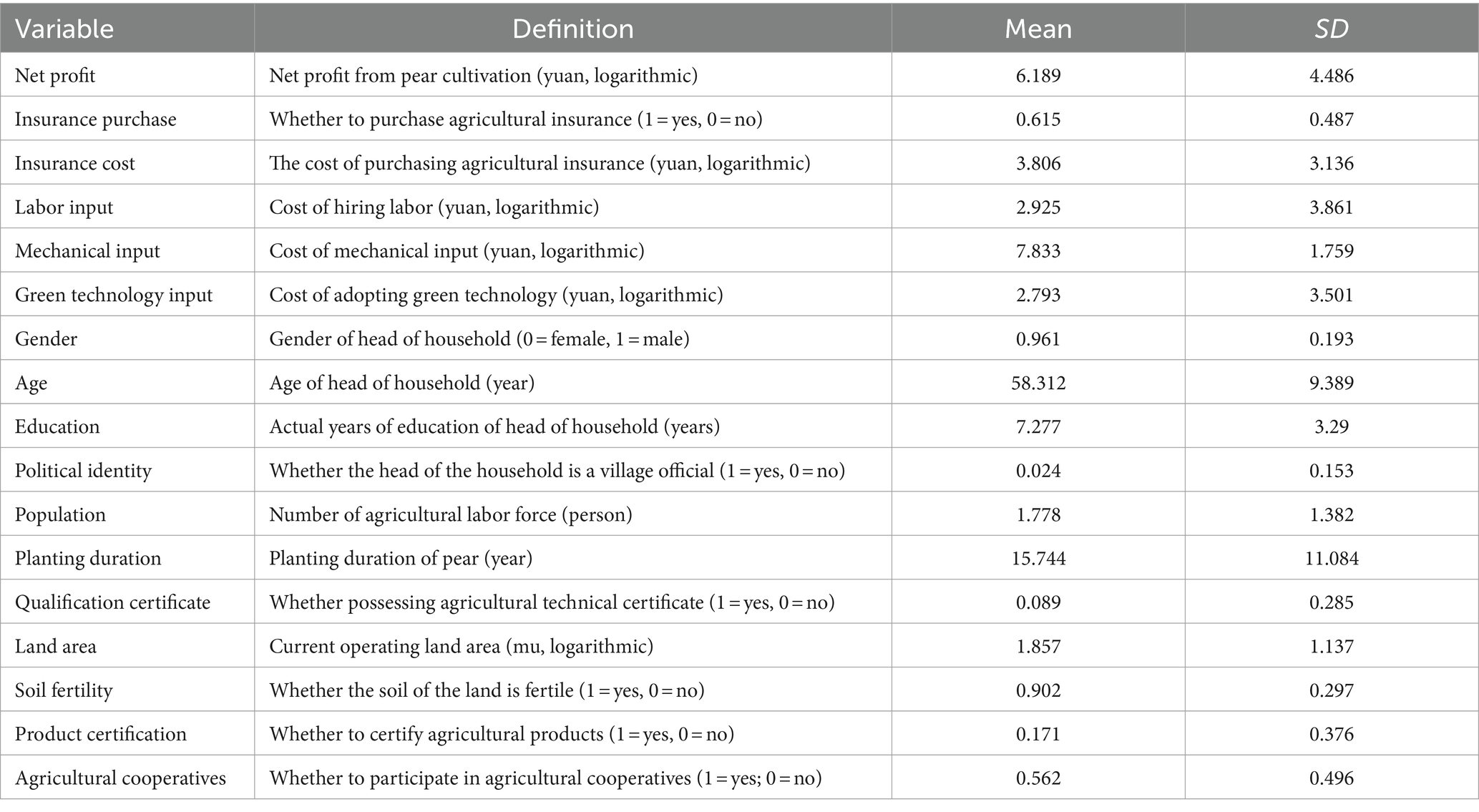

We introduces the following four types of control variables to avoid model estimation bias caused by missing variables. Firstly, household head characteristics, encompassing gender, age, education, and political identity. Secondly, family features, including the number of laborers involved in pear cultivation within the household, the duration of pear tree cultivation, and whether family members possess agricultural professional qualifications. Thirdly, farmland characteristics, comprising land area and soil fertility. Regarding soil fertility, we made judgments by inquiring pear farmers about the fertility of the soil on their cultivated land. Using farmer interviews as a means to assess soil fertility is a simple and practical approach. Although this method may carry a certain degree of subjectivity, farmers, as those who have long cultivated the land, typically have a relatively intuitive understanding of the fertility status of their own land. Fourthly, product certification, indicating whether pear farmers obtained green, organic, or pollution-free certifications for their agricultural products. Lastly, agricultural cooperatives, signifying the participation of pear farmers in professional agricultural cooperatives. The definitions and descriptive statistics of the variables are shown in Table 1.

3.3 Econometric model

3.3.1 Baseline model

The dependent variable investigated in this study is the net profit of pear farmers, which constitutes a continuous variable. The OLS model is chosen for empirical analysis in this study. The OLS model, also known as the ordinary least squares regression model, is a data modeling technique based on a linear prediction model. Its core principle involves minimizing the sum of squared errors between the true values of observations and their predicted values to obtain the best-fitting linear model. The OLS model is particularly suitable for this study as it excels in handling linear relationships between dependent and independent variables. By minimizing the sum of squared residuals, it can effectively identify the optimal parameter values. The basic form of the model is as follows:

In Equation (1), Yi is the dependent variable, which means that the net profit of pear farmers. Xi is the core independent variable, examining whether pear farmers engage in insurance purchase and the associated insurance costs. Controli is the control variable, including household head characteristics, family characteristics, farmland characteristic, product certification and agricultural cooperatives. is a constant term; , are the regression coefficients of each variable respectively; is a random disturbance term.

3.3.2 Mechanism analysis model

The primary aim of this study is to examine the impact of crop insurance on the pear farmers’ income and explore the underlying mechanisms of factor allocation. Consequently, we need to estimate a mediation model in which crop insurance influences factor allocation, which in turn affects pear farmers’ income. This study draws upon the research conducted by Zhang et al. (2023) and develops the following models:

In Equation (2), represents a mediating variable encompassing labor, machinery, and green technology inputs. The meanings of other variables are the same as those of Equation (1). Given that the mediating variables in Equation (2) are continuous, we continue to employ the OLS model.

4 Results

4.1 Baseline results

In the current study, Stata15.0 software is used to estimate the impact of crop insurance on farmers’ income. Stata 15.0, a robust statistical analysis software, is particularly adept at handling and analyzing diverse and intricate datasets. It offers a comprehensive suite of statistical methods and tools that cater to the complex analytical requirements of our study, including regression analysis and tests for multicollinearity. Multicollinearity test is carried out for all regressions. The variance inflation factor (VIF) is a crucial statistic used to diagnose multicollinearity in multiple linear regression models. It quantifies the extent to which the variance of regression coefficient estimates is inflated due to correlations among the predictor variables. The VIF is all lower than 2.0, indicating that the degree of correlation between the variables is within a reasonable range, and there exists no serious collinearity problem.

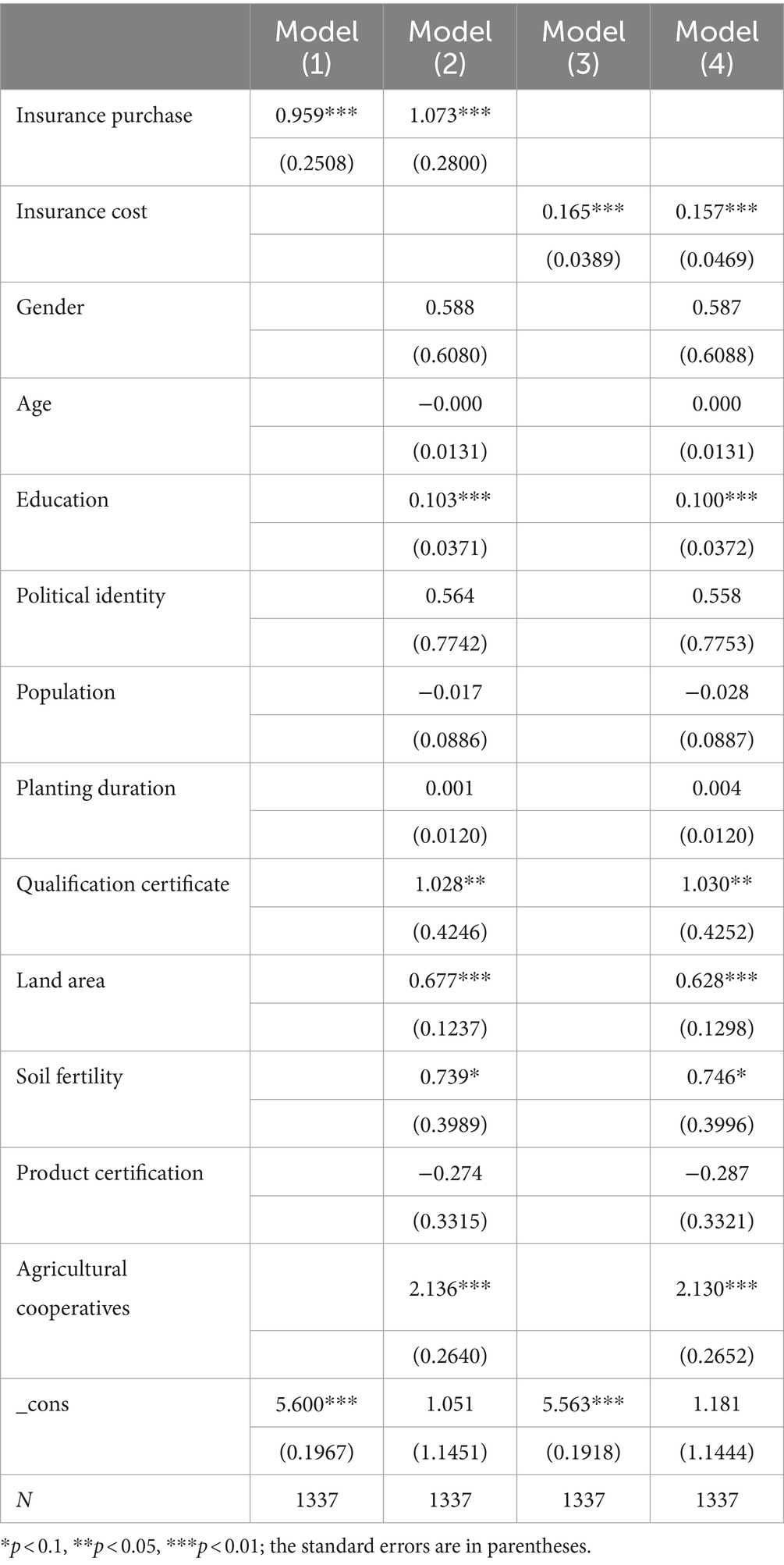

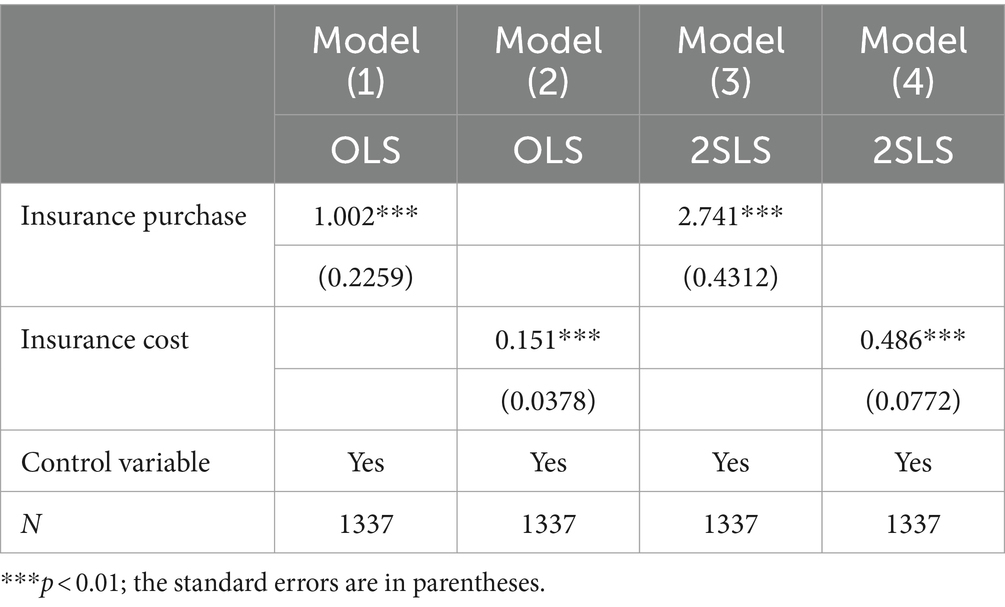

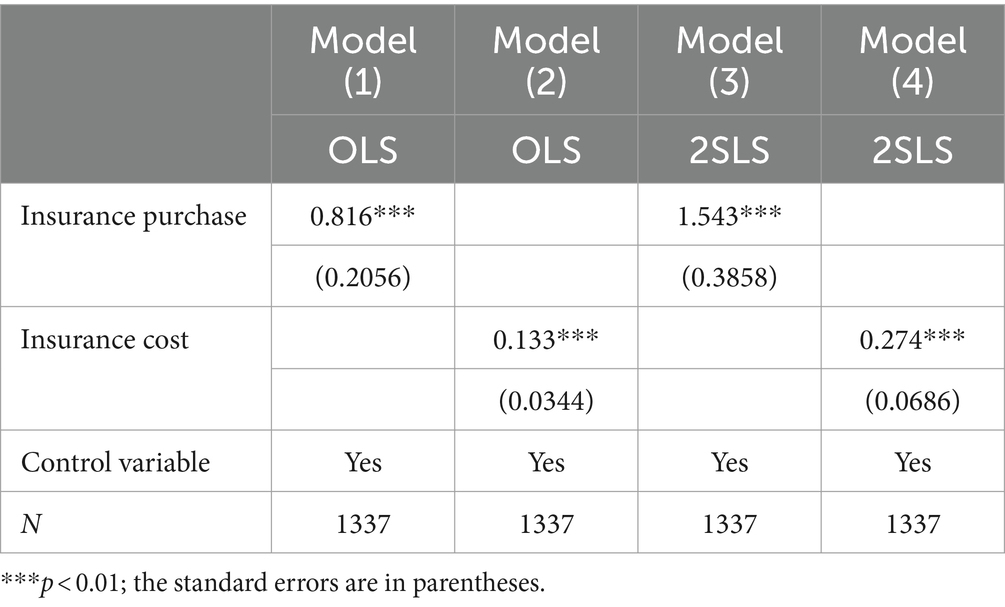

Table 2 shows the baseline regression results of the impact of crop insurance on pear farmers’ income. Model (1) and Model (2) demonstrate the effect of insurance purchase on pear farmers’ income after progressively introducing control variables. The results from Models (1) and (2) indicate a significant positive impact of insurance purchase on pear farmers’ income at the 1% significance level. This suggests that acquiring crop insurance substantially increases pear farmers’ income. The results from Models (3) and (4) indicate that insurance cost is positive and significant at 1% significance level. Specifically, as crop insurance costs increase, the income of pear farmers also increases.

4.2 Endogeneity discussion

There might be endogeneity concerns between crop insurance and pear farmers’ income. Firstly, self-selection bias serves as a significant source of endogeneity issues. When pear farmers purchase crop insurance, they may engage in self-selection based on their anticipated risks, economic conditions, or other personal factors. This self-selection process is not random but influenced by the farmers’ own characteristics and preferences. Consequently, the observed behavior of purchasing crop insurance may not be solely determined by external factors but rather a result of the farmers’ self-selection. Such self-selection bias can lead to a misestimation of the relationship between crop insurance and pear farmers’ income, thereby generating endogeneity problems. Secondly, reverse causality is another crucial aspect of endogeneity issues. Pear farmers with higher incomes may be more willing to purchase crop insurance to further stabilize their agricultural income. This reverse causality implies an interaction between crop insurance and pear farmers’ income, rather than a unidirectional causal relationship. Therefore, simply estimating the impact of crop insurance on pear farmers’ income using a regression model may produce biased results due to the neglect of this reverse causality. Furthermore, limitations in research design can also contribute to endogeneity issues. For instance, there may be variables that simultaneously influence both pear farmers’ decisions to purchase crop insurance and their income, such as natural disasters. These variables may not be fully considered or measured in the model, leading to endogeneity problems. Omitting these crucial variables can result in inaccurate estimation results, unable to truthfully reflect the relationship between crop insurance and pear farmers’ income.

To mitigate endogeneity issues, the instrumental variable (IV) approach is a commonly used method. An instrumental variable is a variable that is correlated with the explanatory variable but uncorrelated with the error term, enabling us to isolate the true impact of the explanatory variable on the explained variable. In the study of crop insurance and pear farmers’ income, if a suitable instrumental variable can be found, it can be used to replace the purchase behavior of crop insurance, thereby providing a more accurate estimation of the impact of crop insurance on pear farmers’ income. Based on relevant research (Chang and Mishra, 2012; Li et al., 2022b), this paper selects the average value of agricultural insurance purchased by other peasant households in the village except the respondents as the instrumental variable. On one hand, the theory of peer effects and imitation suggests that individuals are often influenced by the behaviors of those around them when making decisions. In rural villages, if a majority of farmers choose to purchase agricultural insurance, other farmers may perceive this as a generally accepted and beneficial practice, thereby following the trend and purchasing insurance as well. Consequently, the behavior of other farmers in the village purchasing crop insurance can influence the decision-making of individual farmers regarding their own purchases. On the other hand, the village-level behavior of purchasing crop insurance does not affect the income of individual farmers. This is because farmers’ income is a direct outcome of their individual economic activities. Farmers obtain household income through the allocation of productive factors such as land, labor, capital, and technology. The village-level behavior of purchasing insurance is a macro-level indicator reflecting the risk management level of the entire village, and it does not directly alter the production and operation status of individual farmers.

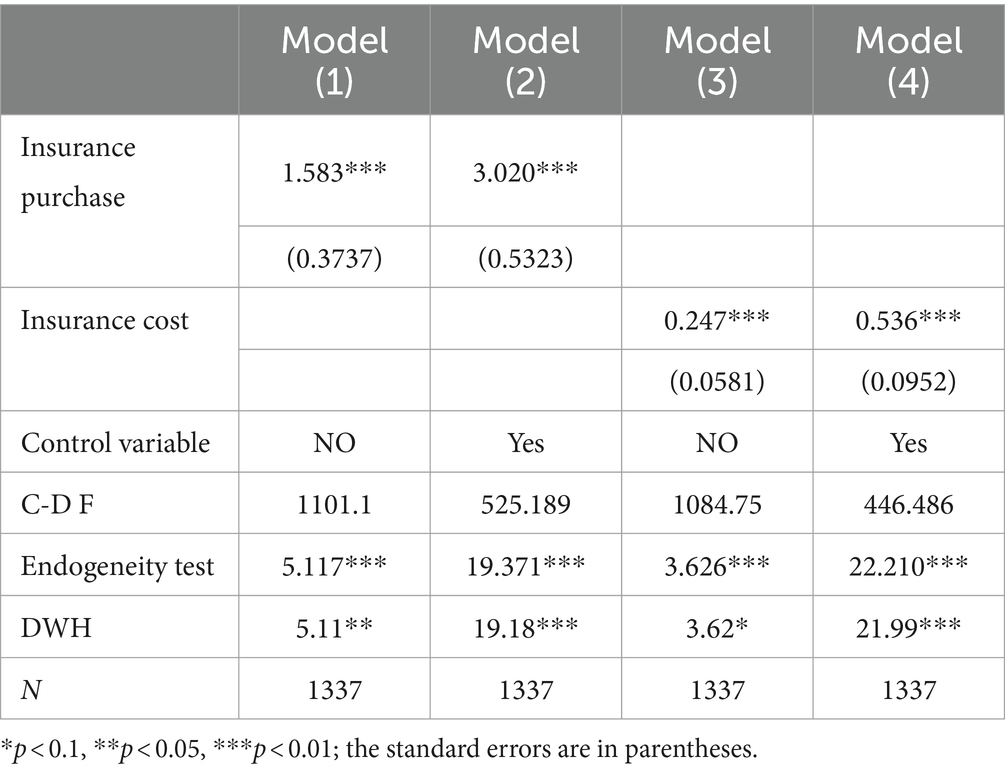

Regression (1)–(4) in Table 3 are a series of test results of 2SLS in which control variables are gradually added. p-value of endogeneity results is less than 0.01, which reject the hypothesis of no endogeneity. Meanwhile, DWH test significantly passed the exogenous test. Therefore, the core variable of crop insurance purchase and crop insurance cost can be considered as an endogenous explanatory variable. In addition, the C-D F statistic of the first stage is greater than 10, thus rejecting the null hypothesis of “existence of weak instrumental variables.” After introducing instrumental variables to solve the potential endogeneity, the regression (2) and regression (4) results show that the estimated coefficients of crop insurance purchase and crop insurance costs are positive at the 1% significance level, and research hypothesis H1 is supported.

4.3 Robustness test

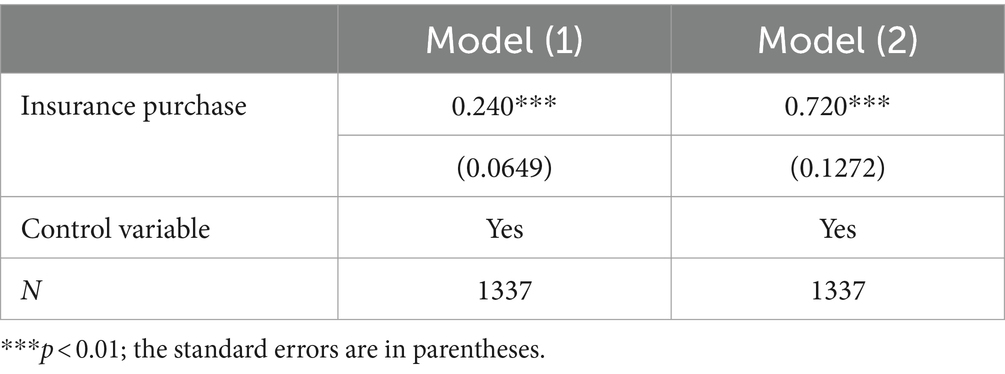

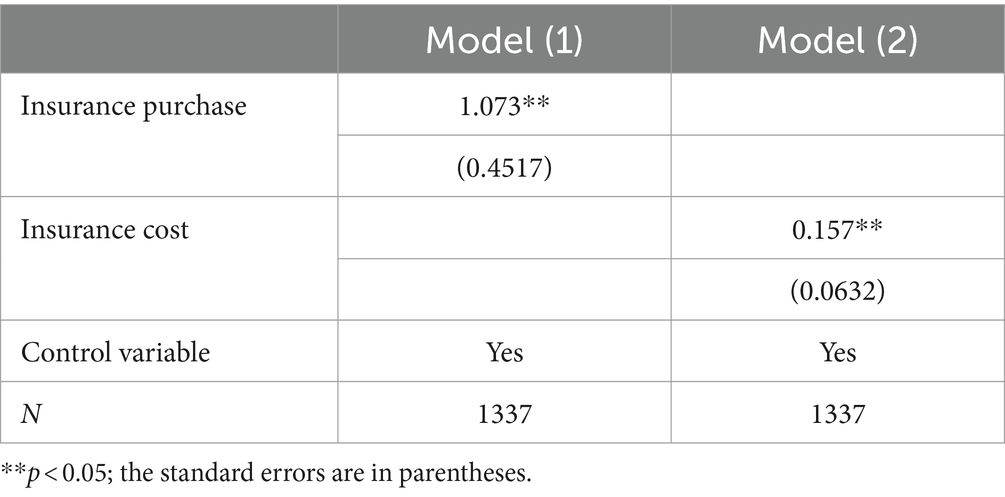

In order to verify the reliability of the above analysis results, this paper conducted robustness tests by changing the measurement method of core dependent variable. Specifically, the income was represented using the net profit per acre of land devoted to pear cultivation by pear farmers, and the final results are estimated as shown in Table 4. Models (1) and (2) in Table 4 present the results of OLS regressions, while models (3) and (4) exhibit the outcomes of 2SLS regressions. The findings show that crop insurance, namely the insurance purchase and the insurance costs, significantly impact pear farmers’ income. Thus, it can be shown that the results obtained by the study are robust.

Secondly, we conducted a robustness check by altering the explanatory variable. Specifically, we used the average insurance investment cost per mu of pear farmers as the explanatory variable in the regression analysis, and the results are presented in Table 5. Model (1) in Table 5 shows the results of the ordinary least squares (OLS) regression, while Model (2) displays the outcomes of the two-stage least squares (2SLS) regression. The findings indicate that even after changing the explanatory variable, purchasing crop insurance by farmers still has a positive impact on their income. It can be shown that the results obtained by the study are robust.

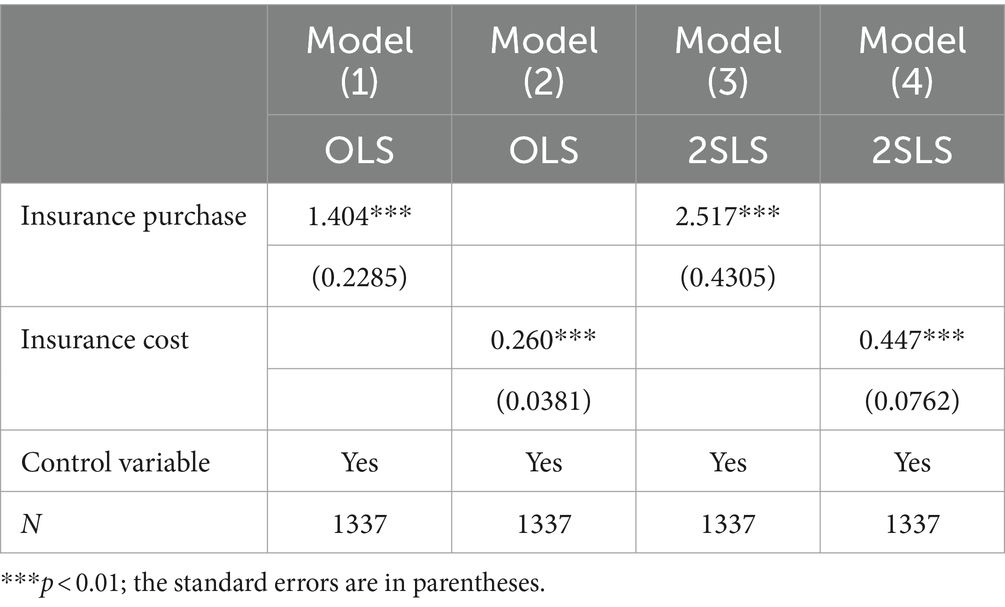

Thirdly, we employed a random sampling approach for the study samples. Specifically, we randomly selected 90% of the research samples and conducted regression analysis, with the results presented in Table 6. Models (1) and (2) in Table 6 show the outcomes of the OLS regression, while Models (3) and (4) represent the results of the 2SLS regression. The findings indicate that even after randomly sampling the samples, the conclusion that crop insurance can increase the income of pear farmers remains robust.

Furthermore, to enhance the robustness of the validity check, we included cluster-robust standard errors at the village level in our model, as depicted in Table 7. The findings indicate that even after controlling for cluster-robust standard errors, the key independent variables remain statistically significant. This underscores the reliability of our research outcomes.

Table 7. Regression results after controlling for the cluster-robust standard errors at the village level.

4.4 Influence mechanism analysis

Based on the research hypothesis of the article, the production factors allocation is an important pathway for crop insurance to affect the income of pear farmers. Next, we will further verify our research hypothesis. In our research process, we not only employed the OLS model for estimation but also utilized the 2SLS model as a comparison. This approach helps to better demonstrate the reliability of our study.

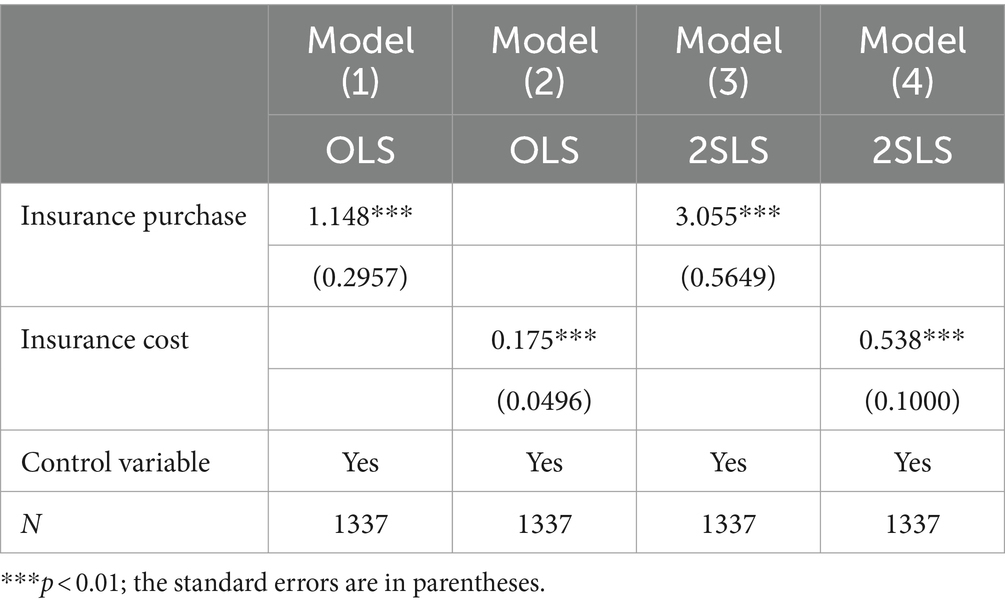

Firstly, we examine the impact of crop insurance on pear farmers’ labor input, as demonstrated in Table 8. Models (1) and (2) present the OLS regression outcomes for insurance purchase and insurance cost on labor input, respectively. Meanwhile, Models (3) and (4) depict the 2SLS regression results for insurance purchase and insurance cost on labor input. The results of the study show that the regression coefficients of insurance purchase and insurance cost are significantly positive at the 1% level. This suggests that the acquisition of crop insurance by pear farmers increases labor input, and as insurance premiums rise, there is a corresponding escalation in labor input among pear farmers. The employment of labor helps effectively alleviate the labor shortage issues faced by pear farmers during bagging and harvesting stages, ultimately enhancing pear yield and consequently augmenting pear farmers’ income, thus validating research hypothesis H2. The primary function of crop insurance is to transfer and disperse risks in agricultural production. When pear farmers purchase crop insurance, they are able to receive financial compensation in the event of natural disasters or other risk events, thereby reducing economic losses. Generally, higher insurance premiums often indicate a broader coverage or a higher degree of protection purchased by pear farmers, which provides them with greater security in the face of risks and incentivizes them to increase expenditures on hired labor. This finding not only reflects the direct impact of crop insurance on pear farmers’ production decisions but also reveals how pear farmers respond to risks and achieve income growth by adjusting their input of production factors.

Next, we analyze the impact of crop insurance on machinery input, as depicted in Table 9. Similar to Table 8, we employ both OLS regression and 2SLS regression to address the endogeneity issues inherent in the model. The results indicate that both the insurance purchase and insurance cost pass a significant test at the 1% level. With positive coefficients, this signifies that pear farmers’ purchase of crop insurance encourages increased machinery input, with higher premium payments associated with greater expenses in machinery input. This validates research hypothesis H3. Mechanization represents advanced productivity, yet significant production risks and higher input costs stand as some reasons why farmers might be reluctant to adopt machinery. On one hand, crop insurance is considered an effective means to help small-scale farmers mitigate production risks (Tang et al., 2019). It encourages farmers to increase their investment in machinery. On the other hand, farmers who purchase crop insurance can access bank loans, thereby alleviating financial constraints. Augmenting machinery investment can enhance agricultural production efficiency, consequently augmenting pear farmers’ income. The impact of increased mechanical input on the income growth of pear farmers is primarily manifested in the following aspects: firstly, it enhances production efficiency. Machinery can replace human labor in performing heavy and repetitive tasks, thereby increasing labor productivity and enabling pear farmers to complete more production tasks within the same timeframe. Secondly, it reduces production costs. Although mechanical inputs incur certain costs, they can, in the long run, mitigate labor costs and decrease the production cost per unit of product. Thirdly, it improves product quality. Mechanized production methods allow for more precise control over the production process, enhancing product quality and thus strengthening their competitiveness in the market.

Finally, we analyze the impact of crop insurance on pear farmers’ adoption of green agricultural technologies, as indicated in Table 10. The findings exhibit statistical significance at the 1% level for both insurance purchase and insurance cost. The positive coefficients suggest that crop insurance facilitates farmers in adopting eco-friendly production techniques, with higher insurance costs correlating positively with increased expenditures on green production technologies among pear farmers. Correspondingly, Tang and Luo (2021) reached analogous conclusions, demonstrating an 8.2% increase in the likelihood of farmers applying bio-pesticides if they purchase crop insurance.

Economic crops, in comparison to grain crops, exhibit a heightened demand for agricultural chemicals such as fertilizers and pesticides, resulting in a greater adverse impact on the environment. Green technology stands as a favorable agricultural production method conducive to environmental sustainability, capable of both bolstering farmers’ income and fostering ecological advancement in agriculture. However, the adoption of green technology inherently carries risks. Mismanagement of these techniques by farmers could lead to agricultural losses. Consequently, embracing green technology not only encounters natural and market risks but also involves technological uncertainties. Crop insurance incentivizes risk-neutral behavior, encouraging active engagement in risk management, as it pertains to the adoption of green technologies (Turvey, 1992). Therefore, crop insurance can mitigate the technical risks faced by pear farmers, encouraging the adoption of advanced green technologies, consequently bolstering farmers’ income. Green technologies can assist pear farmers in enhancing production efficiency and reducing production costs, ultimately leading to increased income. For instance, the application of water-saving irrigation and precision fertilization techniques can minimize the waste of water and fertilizer resources, thereby enhancing the yield and quality of pear trees. Research hypothesis H4 stands validated.

The three major resources in agriculture are land, labor, and capital (van Vliet et al., 2015). Land is the most basic factor of production. In general, larger land scale tends to facilitate economies of scale, leading to increased agricultural output and enhanced income for farmers. This conclusion has been validated in the baseline regression. However, land scale has not been employed in this study as an mediator variable to analyze the impact mechanism of crop insurance on pear farmers’ income. Rural China operates under a land contract system where farming is conducted on a household basis, with a fixed land area allocated per family. Land transfer stands as a significant means for farmers to expand their operational size. However, pear trees, being perennial economic crops, exhibit a strong asset specificity. The extended maturation period of 3–5 years before pear trees bear fruit inhibits farmers from enlarging their pear cultivation area through land transfer.

Although studies have indicated an expansion in cultivated land area due to crop insurance (Kurdyś-Kujawska et al., 2021; Zou et al., 2022), this research posits a significant issue of endogeneity between the two. For instance, related studies suggest that farmers with substantial landholdings are more inclined to adopt crop insurance (Jin et al., 2016; Fahad et al., 2018).

4.5 Moderation effect analysis

In examining the impact of crop insurance on increasing pear farmers’ income, the role of agricultural cooperatives cannot be overlooked. Firstly, as an organizational form, cooperatives can provide pear farmers with various services, including technical guidance, financial support, market development, and brand building. By joining cooperatives, pear farmers can access these resources and services, which in turn enhance their production efficiency and market competitiveness, ultimately contributing to increased income. Secondly, cooperatives often facilitate cooperation and exchange among pear farmers, enabling them to share experiences and resources and jointly tackle risks. This collaborative mechanism may encourage pear farmers to be more rational and cautious when purchasing crop insurance, as they can leverage collective actions within the cooperative to disperse risks and reduce the pressure of individual risk-bearing. Crop insurance and agricultural cooperatives are two means for Chinese farmers to diversify risks. The relationship between cooperatives and crop insurance remains to be explored. This paper will further investigate the moderating effect of cooperatives in the relationship between crop insurance and increasing pear farmers’ income.

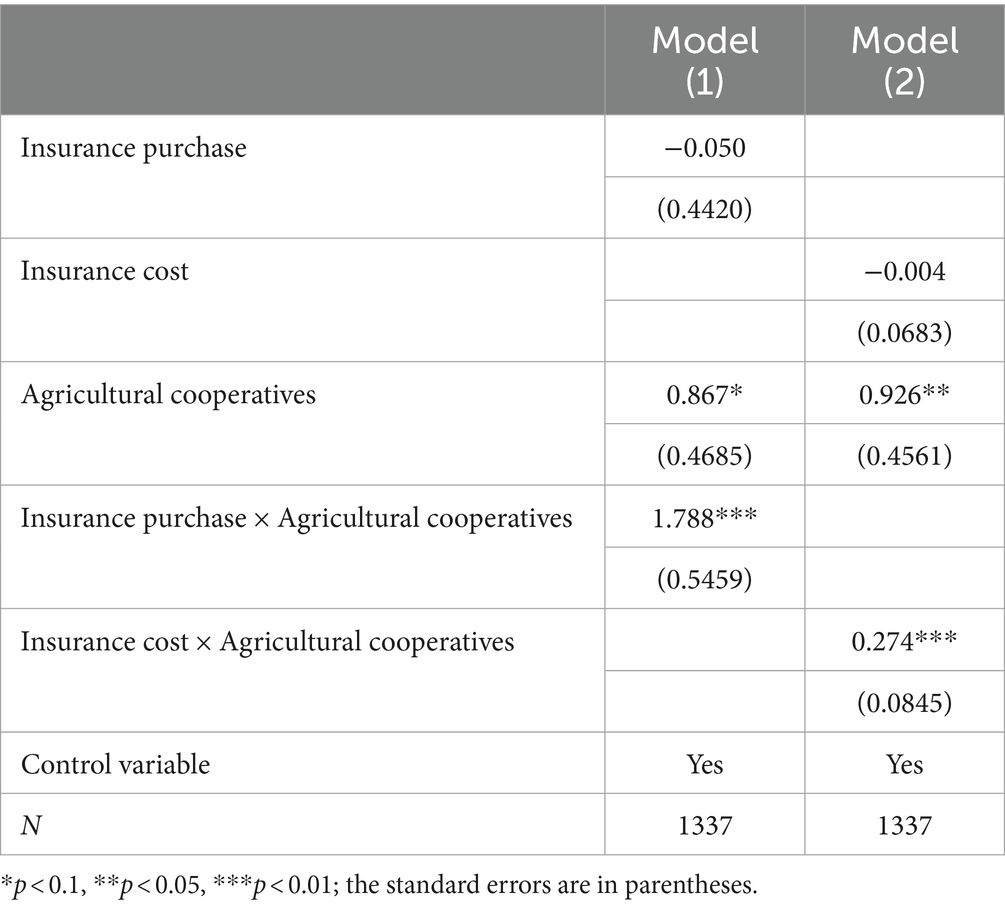

We used interaction terms between crop insurance and cooperatives to represent the moderating effect, and the test results are shown in Table 11. Models (1) and (2) represent the interaction terms between insurance purchase and cooperatives, and between insurance cost and cooperatives, respectively. The results indicate that the coefficients of the interaction terms passed the significance test at the 1% level and were positive, suggesting that crop insurance and cooperatives have a complementary relationship, and joining a cooperative can positively modulate the income-increasing effect of crop insurance on farmers. Crop insurance and cooperatives naturally complement each other in terms of risk management and income enhancement. Crop insurance aims to provide farmers with production risk protection through economic means, mitigating economic losses caused by uncontrollable factors such as natural disasters. On the other hand, cooperatives, through collective actions, provide farmers with services such as market information, technical support, collective purchasing, and sales, helping them to improve production efficiency and market competitiveness. By joining a cooperative, pear farmers can access more resources and support, improve production efficiency and quality, and receive guidance and support in risk management from the cooperative, enabling them to better utilize crop insurance as a risk management tool, effectively cope with risks, and maximize the benefits of crop insurance.

In addition, our empirical results also found that when adding the interaction term of cooperatives, the coefficients of insurance purchase and insurance cost were no longer significant, indicating that when considering the impact of cooperatives on increasing the income of pear farmers, relying solely on crop insurance’s role is no longer sufficient to promote income growth. It is necessary to leverage the complementary effect of crop insurance and cooperatives to further enhance income.

4.6 Heterogeneity analysis

Although the previous analysis has demonstrated that crop insurance can help pear farmers increase their income, this conclusion only applies to the average effect on the overall pear farmer population. Due to the different characteristics of pear farmers, it is necessary to further explore the heterogeneity of the impact of crop insurance on increasing pear farmers’ income. In this article, we conduct heterogeneity analysis from two aspects: pear farmers’ household decision-making characteristics and land endowment characteristics. We analyze this using grouped regression to obtain more in-depth research conclusions. To verify heterogeneity among different groups, a seemingly unrelated estimation test (Suest) was conducted.

First, we analyze the heterogeneity of pear farmers’ household decision-making characteristics. The approach of farmers’ household decision-making directly impacts the organization and implementation of their production activities. Individual decision-making is typically based on factors such as the farmers’ own resource conditions, market information, and risk tolerance, whereas group decision-making may involve negotiation and cooperation among multiple farmers to share resources, disperse risks, or achieve other common goals. These two decision-making approaches may exhibit significant differences in resource allocation, risk management, and production efficiency, thereby affecting the impact of crop insurance on farmers’ income.

This article divides pear farmers’ household production decisions into individual decision-making and decision-making. When agricultural production is decided by a member of the family, we consider it to be an individual decision-making. When agricultural production decisions are made jointly by family members, we consider it to be a group decision-making. The heterogeneity analysis results of household decision-making are shown in Table 12. The research results indicate that Suest is significant at the 1% level, suggesting significant heterogeneity in pear farmers’ household decision-making. More specifically, when pear farmers make agricultural production decisions using individual decision-making, crop insurance can increase their income. However, when pear farmers adopt group decision-making, the regression coefficient of crop insurance on income is not significant. In group decision-making, pear farmers may make decisions more diffusely, which may lead to a smaller impact of agricultural production decisions on income, so the impact of crop insurance on income may not be significant. In individual decision-making, pear farmers can focus more on their own production and risk situation, and thus use crop insurance more effectively to increase income. Different household decision-making methods can also affect pear farmers’ risk preferences. In group decision-making, pear farmers may tend to choose decisions with less risk, which curtails the degree to which crop insurance affects factor allocation. In individual decision-making, pear farmers may tend to choose riskier decisions, enabling them to use crop insurance more effectively to promote factor allocation and thus increase income.

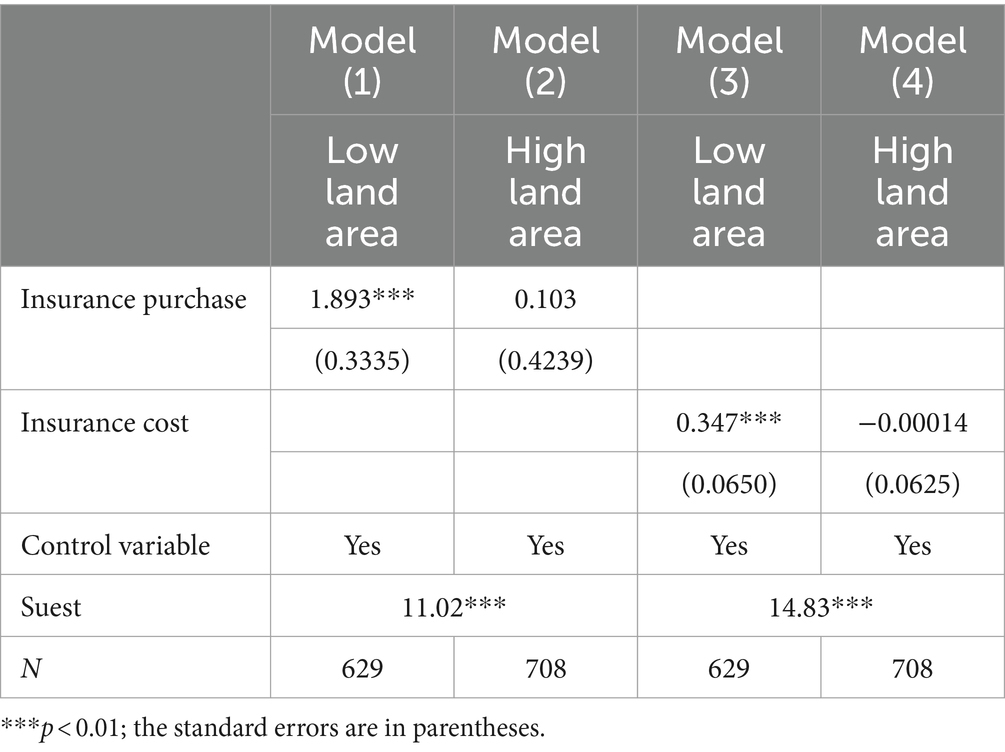

Next, we analyze the heterogeneity of land endowment characteristics. The area of pear tree cultivation serves as an important indicator reflecting farmers’ production scale and economic strength. Farmers with different cultivation areas may exhibit significant differences in resource investment, technology application, market positioning, and risk management. Farmers with low-land-areas may face greater resource constraints and technological limitations, while those with high-land-areas may possess more capital and technological support. In terms of production objectives, farmers with low-land-areas may be more concerned with the cost and coverage level of insurance, while those with high-land-areas may prioritize the stability and comprehensive coverage of insurance. Additionally, farmers with different cultivation areas have varying degrees of loss and risk tolerance in the face of risks, which influences their demand and expectations for crop insurance. Therefore, incorporating pear tree cultivation area as a variable in heterogeneity analysis can help reveal the differences in farmers’ responses and the effectiveness of crop insurance across different production scales.

We divided the sample according to the median pear land area, with those below the median considered low-land-areas and those above the median considered high-land-areas. The heterogeneity analysis results are shown in Table 13. The Suest is significant at the 1% level, indicating significant heterogeneity in land area. Specifically, crop insurance can increase the income of low-land-area pear farmers, but its impact on high-land-area pear farmers’ income is not significant. For high-land-area pear farmers, they pay more attention to risk management in agricultural production and adopt diversified risk management strategies, weakening the role of crop insurance as a risk management tool. For low-land-area pear farmers, they rely more on crop insurance as a risk management tool, so they fully leverage its insurance function to increase agricultural income.

5 Conclusion, discussion, and policy implications

5.1 Conclusion and discussion

Using survey data from pear farmers in Xixian and Weixian counties in China, this paper empirically analyzes the impact and pathway of crop insurance on pear farmers’ income. The conclusions of this study can be summarized as follows.

Firstly, insurance purchase and insurance costs increase the income of pear farmers. Although purchasing crop insurance means additional expenses for farmers, this measure effectively avoids risks in the agricultural production process, thereby enhancing agricultural output and ultimately increasing farmers’ net income. After rigorous endogenous treatment and robustness testing, our research conclusion remains solid and reliable. Our research conclusion is similar to that of Enjolras et al. (2014), which is that crop insurance can augment farmers’ income while decreasing income variability. However, evidence from Inner Mongolia, China, indicates that crop insurance does not significantly affect farmer income (Zhao et al., 2016). The reasons for this are closely related to the pear farmers who are the focus of this study. As a high-value economic crop, pear trees make pear farmers more inclined to utilize the protective function of crop insurance to optimize the allocation of production factors, thereby enhancing the development potential of agriculture itself and achieving income growth. This finding also suggests that crop insurance has a better effect on economic crops. This study not only enhances our understanding of the functions of agricultural insurance, but also further reveals its differentiated impacts on different agricultural crops.

Secondly, analysis of the mechanism of influence found that crop insurance mainly promotes pear farmers’ income increase through factor allocation, namely labor input, mechanical input, and green technology input. Specifically, crop insurance can increase expenditure on hired labor, promote the use of agricultural machinery by farmers, and encourage farmers to adopt green production techniques. Previous research has revealed that a broader scope of insurance coverage increases the labor supply for small-scale farm operators producing under $25,000 in output (Key et al., 2006). Given that this study focuses on small-scale farmers cultivating pears, whose operational scale and agricultural output are relatively modest, the findings from the aforementioned research align closely with the conclusions drawn in this study. Consistent with our research findings, Gao et al. (2021) similarly posit that crop insurance subsidy policies can foster an increase in farmers’ income by influencing primary productive fixed asset, which further validates the reliability of our findings. Our study reconfirms that farmers can achieve optimal economic benefits through reasonable allocation and utilization of various resources.

Thirdly, cooperatives positively moderate the impact of crop insurance on pear farmers’ income. Specifically, post-joining a cooperative, the favorable effect of crop insurance on pear farmers’ income increases. Crop insurance and agricultural cooperatives are two essential means for Chinese farmers to cope with risks. Agricultural cooperatives have a significant positive impact on the stability of farm income (Ji C. et al., 2023). A study conducted among Chinese pig farmers has shown that farmers’ decisions to use crop insurance and cooperatives are positively correlated (Zhang et al., 2019). Similarly, our research also finds that crop insurance and cooperatives are not substitutes but rather complementary to each other.

Finally, the analysis of subgroup regression results shows that there are significant heterogeneity in household decision-making and land area. Specifically, for pear farmers who make individual decisions and have low land areas, crop insurance can increase their income, while the impact of crop insurance on the income of pear farmers who make group decisions and have high land areas is not significant. This finding is conducive to guiding the formulation and adjustment of crop insurance policies, allowing crop insurance to play its role effectively among different groups of farmers.

However, it is worth noting that crop insurance mainly covers four types: cost insurance, yield insurance, price insurance, and revenue insurance. Our study did not distinguish between these different types of crop insurance, thus unable to fully reveal their individual effects. This will be an important direction for our future research. Additionally, as we conducted our study using cross-sectional data, it is difficult to comprehensively reflect the long-term impact of crop insurance on agricultural production, which is also an issue that needs further exploration in future research.

5.2 Policy implications

Under the impact of multiple risks such as natural risks and market risks, the importance of crop insurance is gradually increasing. Based on the conclusions of this study, the following policy implications can be derived.

Firstly, given the role of crop insurance in promoting farmers’ income growth, it is necessary to improve crop insurance policies and expand insurance coverage. On one hand, the government should continue to refine crop insurance policies and broaden the scope of coverage, particularly for specialty crops such as pears. Tailored insurance policies should be developed to ensure that farmers specializing in these crops, including pear farmers, can enjoy the protection and benefits provided by insurance. On the other hand, policy-based crop insurance should integrate agricultural subsidies with crop insurance. Farmers purchasing crop insurance should be provided with higher subsidies to reduce the cost of purchasing insurance.

Secondly, crop insurance can promote the allocation of various factors, thereby increasing farmers’ income. Therefore, it is necessary to further deepen the reform of factor marketization, reduce farmers’ transaction costs for purchasing production factors, optimize the allocation of agricultural production factors, and improve the efficiency of factor allocation. Additionally, insurance companies can collaborate with agricultural technology extension departments to jointly promote a model that combines crop insurance with factor allocation. By providing technical guidance and consulting services, they can guide farmers in scientifically allocating production factors and improving agricultural production efficiency.

Thirdly, the government should increase support for cooperatives and encourage pear farmers to join them, leveraging collective action to mitigate risks and enhance earnings. Cooperatives, in turn, can actively collaborate with insurance companies to negotiate more favorable insurance policies and higher compensation standards for pear farmers.

Lastly, insurance companies should develop diversified insurance products tailored to the characteristics of different pear farmer groups. For pear farmers who make individual decisions and have smaller land areas, insurance products with relatively low premiums and moderate coverage can be introduced. Conversely, for farmers who make group decisions and have larger land areas, more comprehensive insurance products with higher premiums can be designed to meet their diverse needs.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the (patients/participants OR patients/participants legal guardian/next of kin) was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

JC: Writing – review & editing, Writing – original draft, Software, Methodology, Conceptualization. YD: Writing – review & editing, Methodology, Formal analysis. SZ: Writing – original draft, Supervision, Funding acquisition, Data curation. FL: Writing – review & editing, Software, Formal analysis.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research paper was supported by the National Natural Science Foundation of China (71773093).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Agbenyo, W., Jiang, Y., Wang, J., Ntim-Amo, G., Dunya, R., and Frempong, L. N. (2023). Does weather index-based insurance adoption influence cocoa output? An endogenous swicth regression approach. Clim Dev 16, 1–10. doi: 10.1080/17565529.2023.2179868

Ahmed, N., Hamid, Z., Mahboob, F., Rehman, K. U., Ali, M. S. E., Senkus, P., et al. (2022). Causal linkage among agricultural insurance, air pollution, and agricultural green total factor productivity in United States: pairwise granger causality approach. Agriculture 12:1320. doi: 10.3390/agriculture12091320

Ai, T., Zhang, J., and Shao, J. (2023). Study on the coordinated poverty reduction effect of agricultural insurance and agricultural credit and its regional differences in China. Econ. Anal. Policy 78, 835–844. doi: 10.1016/j.eap.2023.04.027

Bhuiyan, M. A., Davit, M., XinBin, Z., and Zurong, Z. (2022). The impact of agricultural insurance on farmers’ income: Guangdong province (China) as an example. PLoS One 17:e274047. doi: 10.1371/journal.pone.0274047

Chang, H., and Mishra, A. K. (2012). Chemical usage in production agriculture: do crop insurance and off-farm work play a part? J. Environ. Manag. 105, 76–82. doi: 10.1016/j.jenvman.2012.03.038

DeLay, N. D., Brewer, B., Featherstone, A., and Boussios, D. (2023). The impact of crop insurance on farm financial outcomes. Appl. Econ. Perspect. P 45, 579–601. doi: 10.1002/aepp.13223

Enjolras, G., Capitanio, F., Aubert, M., and Adinolfi, F. (2014). Direct payments, crop insurance and the volatility of farm income. Some evidence in France and in Italy. New Medit 13, 31–40,

Fahad, S., Wang, J., Hu, G. Y., Wang, H., Yang, X. Y., Shah, A. A., et al. (2018). Empirical analysis of factors influencing farmers crop insurance decisions in Pakistan: evidence from khyber pakhtunkhwa province. Land Use Policy 75, 459–467. doi: 10.1016/j.landusepol.2018.04.016

Fang, L., Hu, R., Mao, H., and Chen, S. (2021). How crop insurance influences agricultural green total factor productivity: evidence from Chinese farmers. J. Clean. Prod. 321:128977. doi: 10.1016/j.jclepro.2021.128977

Gao, Y., Shu, Y., Cao, H., Zhou, S., and Shi, S. (2021). Fiscal policy dilemma in resolving agricultural risks: evidence from china's agricultural insurance subsidy pilot. Int. J. Env. Res. Pub. Health 18:7577. doi: 10.3390/ijerph18147577

Hou, D., and Wang, X. (2022). Inhibition or promotion?–the effect of agricultural insurance on agricultural green development. Front. Public Health 10:910534. doi: 10.3389/fpubh.2022.910534

Ji, I., Vitale, J. D., Vitale, P. P., and Adam, B. D. (2023). Technical efficiency of us western great plains wheat farms using stochastic frontier analysis. J. Appl. Econ. 26. doi: 10.1080/15140326.2023.2178798

Ji, C., Zhuo, N., and Jin, S. (2023). Does cooperative membership stabilize farm income volatility? Evidence from the pig sector in China. China Agr. Econ. Rev. 15, 623–641. doi: 10.1108/CAER-09-2022-0219

Jin, J., Wang, W., and Wang, X. (2016). Farmers' risk preferences and agricultural weather index insurance uptake in rural China. Int. J. Disast. Risk Sci. 7, 366–373. doi: 10.1007/s13753-016-0108-3

Key, N., Roberts, M. J., and O'Donoghue, E. (2006). Risk and farm operator labour supply. Appl. Econ. 38, 573–586. doi: 10.1080/00036840500369043

Kumar, K. N. R., and Babu, S. C. (2021). Can a weather-based crop insurance scheme increase the technical efficiency of smallholders? A case study of groundnut farmers in India. Sustainability-Basel 13:9327. doi: 10.3390/su13169327

Kurdyś-Kujawska, A., Sompolska-Rzechuła, A., Pawłowska-Tyszko, J., and Soliwoda, M. (2021). Crop insurance, land productivity and the environment: a way forward to a better understanding. Agriculture 11:1108. doi: 10.3390/agriculture11111108

Li, H., Tang, M., Cao, A., and Guo, L. (2022a). Assessing the relationship between air pollution, agricultural insurance, and agricultural green total factor productivity: evidence from China. Environ. Sci. Pollut. R. 29, 78381–78395. doi: 10.1007/s11356-022-21287-7

Li, Y., and Wang, Z. (2022). Analysis on the effect of farmer income of policy-based agricultural insurance. Acta Agric. Scand. Sec. B Soil Plant Sci. 72, 386–400. doi: 10.1080/09064710.2021.2005820

Li, H., Yuan, K., Cao, A., Zhao, X., and Guo, L. (2022b). The role of crop insurance in reducing pesticide use: evidence from rice farmers in China. J. Environ. Manag. 306:114456. doi: 10.1016/j.jenvman.2022.114456

Mao, H., Chen, S., Ying, R., and Fu, Y. (2023). How crop insurance influences agrochemical input use: evidence from cotton farmers in China. Aust. J. Agr. Resour. Ec. 67, 224–244. doi: 10.1111/1467-8489.12507

Möhring, N., Dalhaus, T., Enjolras, G., and Finger, R. (2020). Crop insurance and pesticide use in European agriculture. Agric. Syst. 184:102902. doi: 10.1016/j.agsy.2020.102902

Panda, A., Sharma, U., Ninan, K. N., and Patt, A. (2013). Adaptive capacity contributing to improved agricultural productivity at the household level: empirical findings highlighting the importance of crop insurance. Global Environ. Chang. 23, 782–790. doi: 10.1016/j.gloenvcha.2013.03.002

Roll, K. H. (2019). Moral hazard: the effect of insurance on risk and efficiency. Agr. Econ. Blackwell 50, 367–375. doi: 10.1111/agec.12490

Salazar, C., Jaime, M., Pinto, C., and Acuna, A. (2019). Interaction between crop insurance and technology adoption decisions: the case of wheat farmers in Chile. Aust. J. Agr. Resour. Ec. 63, 593–619. doi: 10.1111/1467-8489.12307

Tan, C., Tao, J., Yi, L., He, J., and Huang, Q. (2022). Dynamic relationship between agricultural technology progress, agricultural insurance and farmers’ income. Agriculture 12:1331. doi: 10.3390/agriculture12091331

Tang, L., and Luo, X. (2021). Can agricultural insurance encourage farmers to apply biological pesticides? Evidence from rural china. Food Policy 105:102174. doi: 10.1016/j.foodpol.2021.102174

Tang, Y., Yang, Y., Ge, J., and Chen, J. (2019). The impact of weather index insurance on agricultural technology adoption evidence from field economic experiment in China. China Agr. Econ. Rev. 11, 622–641. doi: 10.1108/CAER-05-2018-0107

Turvey, C. G. (1992). An economic analysis of alternative farm revenue insurance policies. Can. J. Agric. Econ. 40, 403–426. doi: 10.1111/j.1744-7976.1992.tb03704.x

Uçar, K., Marković, T., Nastić, L., Kokot, Ž., Engindeniz, S., and Meseldžija, M. (2023). Analysis of investment and insurance in orange production: a case study for Turkey. Erwerbs obstbau 65, 905–913. doi: 10.1007/s10341-022-00779-3

van Vliet, J. A., Schut, A. G. T., Reidsma, P., Descheemaeker, K., Slingerland, M., van de Ven, G. W. J., et al. (2015). De-mystifying family farming: features, diversity and trends across the globe. Glob. Food Secur. Agr. 5, 11–18. doi: 10.1016/j.gfs.2015.03.001

Wei, T., Liu, Y., Wang, K., and Zhang, Q. (2021). Can crop insurance encourage farmers to adopt environmentally friendly agricultural technology—the evidence from Shandong province in China. Sustainability 13:13843. doi: 10.3390/su132413843

Wu, J. J. (1999). Crop insurance, acreage decisions, and non-point-source pollution. Am. J. Agr. Econ. 81, 305–320. doi: 10.2307/1244583

Xu, J., and Liao, P. (2014). Crop insurance, premium subsidy and agricultural output. J. Integr. Agr. 13, 2537–2545. doi: 10.1016/S2095-3119(13)60674-7

Yu, J., and Sumner, D. A. (2018). Effects of subsidized crop insurance on crop choices. Agr. Econ. Blackwell 49, 533–545. doi: 10.1111/agec.12434

Zhang, Y. Y., Ju, G. W., and Zhan, J. T. (2019). Farmers using insurance and cooperatives to manage agricultural risks: a case study of the swine industry in China. J. Integr. Agr. 18, 2910–2918. doi: 10.1016/S2095-3119(19)62823-6

Zhang, Z., Xu, H., Shan, S., Liu, Q., and Lu, Y. (2022). Whether the agricultural insurance policy achieves green income growth—evidence from the implementation of china’s total cost insurance pilot program. Int. J. Env. Res. Pub. Health 19:852. doi: 10.3390/ijerph19020852

Zhao, Y., Chai, Z., Delgado, M. S., and Preckel, P. V. (2016). An empirical analysis of the effect of crop insurance on farmers' income results from Inner Mongolia in China. China Agr. Econ. Rev. 8, 299–313. doi: 10.1108/CAER-05-2014-0045

Zhang, X., Hu, L., and Yu, X. (2023). Farmland leasing, misallocation reduction, and agricultural total factor productivity: insights from rice production in china. Food Policy. 119:102518. doi: 10.1016/j.foodpol.2023.102518

Zhao, L., Shi, J., Kang, X., and Hong, H. (2019). Research on crop insurance and change in farmers’ welfare: evidence from china's Inner Mongolia. Int. Food Agribus. Man. 22, 519–533. doi: 10.22434/IFAMR2018.0083

Zhu, M., and Yang, R. (2023). The impact of agricultural insurance on farmers' enthusiasm for sugarcane production: evidence from Guangxi, China. Sustainability 15:4191. doi: 10.3390/su15054191

Keywords: crop insurance, farmers’ income, factor allocation, agricultural cooperatives, pear farmers

Citation: Cha J, Deng Y, Zheng S and Li F (2024) Crop insurance, factor allocation, and farmers’ income: evidence from Chinese pear farmers. Front. Sustain. Food Syst. 8:1378382. doi: 10.3389/fsufs.2024.1378382

Edited by:

Ademola Braimoh, World Bank Group, United StatesReviewed by:

Aravind B. R., Kalasalingam Academy of Research and Education, IndiaXin Wang, Longyan University, China

Copyright © 2024 Cha, Deng, Zheng and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shaofeng Zheng, bndhZnUyMDIyQG53YWZ1LmVkdS5jbg==

Jianping Cha1

Jianping Cha1 Shaofeng Zheng

Shaofeng Zheng