- 1School of Economics and Management, Fujian Agriculture and Forestry University, Fuzhou, China

- 2Postdoctoral Research Center of Business Administration, Chongqing University, Chongqing, China

- 3School of Economics and Business Administration, Chongqing University, Chongqing, China

- 4College of Architecture and Urban Planning, Fujian University of Technology, Fuzhou, China

With frequent occurrences of global public events, the prices of national grains continue to soar. As one of the countries with the largest populations globally, China has always regarded food security as a fundamental cornerstone of its development. However, with the continuous emergence of factors such as urbanization, scarcity of land resources, and climate change, China’s food security faces unprecedented challenges. Hence, this study empirically examines the impact of digital inclusive finance on multi-dimensional food security based on panel data from 30 provinces in China from 2011–2020. The research found that China’s multi-dimensional food security level from 2011–2020 showed a stable yet rising trend, with the spatial pattern of each location generally consistent with the overall trend. The Theil index for China’s multi-dimensional food security showed an upward trend from 2011–2020. Digital inclusive finance can promote multi-dimensional food security. The breadth of coverage and depth of use of digital inclusive finance have a significant promoting effect on safeguarding multi-dimensional food security, while the degree of digitization has not played a promoting role. Digital inclusive finance mainly ensures multi-dimensional food security through two pathways: promoting urbanization levels and enhancing marketization levels.

Introduction

Since 2020, the world has been confronted by the challenges of the COVID-19 pandemic, international political instability, and climate change, all of which have impacted the global food system and threatened food security. The ‘2020 State of Food Security and Nutrition in the World’ report indicates that it is estimated nearly 690 million people globally, or 8.9% of the world’s population, are facing hunger. The ‘2022 Global Food Crises Report’ reveals that in 2021, about 193 million individuals in 53 countries and regions experienced severe or even more critical food insecurity (IPC/CH Phase 3–5). This is an increase of nearly 40 million compared to the record numbers in 2020. In 2022, the escalating conflict between Russia and Ukraine significantly disrupted the international food supply chain, once again jeopardizing global food security. As leading global producers and exporters of food, Russia and Ukraine play a pivotal role in the global food supply and food security systems. Data from the United Nations Food and Agriculture Organization in 2020 show that the productions of sunflower seeds, wheat, barley, and corn by Russia and Ukraine account for 63%, 29%, 27%, and 20% of global output, respectively. Since the outbreak of the conflict between these two nations, declining food production efficiency and levels, coupled with a deteriorating export situation, have caused imbalances in global food supply and demand and intensified price fluctuations in international food markets. This has variably impacted food supply, access, utilization, and stability among countries (Mingming and Changhong, 2019). According to the FAO’s ‘Food Outlook—An Annual Report on Global Food Markets’, it is projected that the global grain output (including wheat, corn, rice, barley, and other coarse grains) for 2022–2023 will be 2.785 billion metric tons, a decrease of 0.58% from 2021–2022 and the first decline in four years. Global food security requires a concerted effort on the international stage. The United Nations, in its ‘2030 Agenda for Sustainable Development’, has set Sustainable Development Goal 2 (SDG2), which commits to eliminating hunger, achieving food security, improving nutrition, and promoting sustainable agriculture by 2030, also known as the ‘Zero Hunger’ target. However, due to various challenges, including the spread of COVID-19, the goals of ending food insecurity and all forms of malnutrition remain distant (Jennifer and Moseley, 2020).

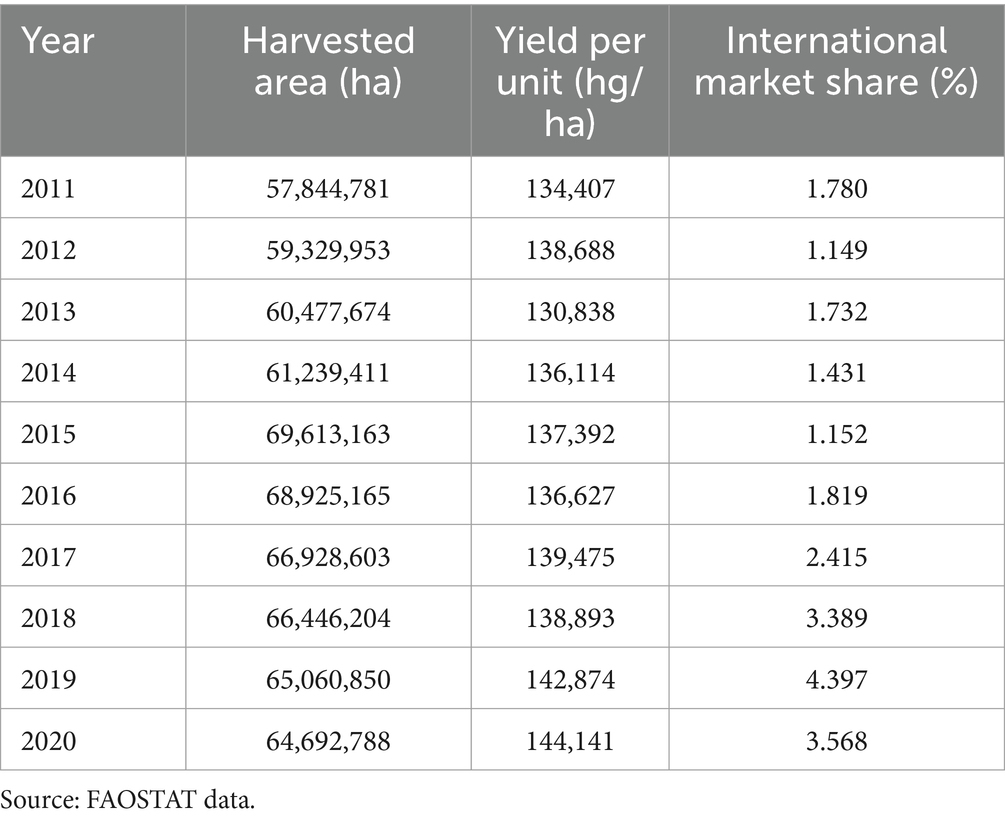

In recent years, China’s agricultural structure has been continually optimized, its regional layout has become more rational, and grain production has seen consecutive bountiful harvests. Using only 7% of the world’s arable land, China has addressed the food needs of 22% of the global population (Wang et al., 2023), setting an exemplary role in facing the challenges of food security. However, with the acceleration of China’s economic growth and urbanization, the demand for food has further increased, leading to issues such as rising grain prices and an imbalance between supply and demand. The situation regarding food security remains severe. As shown in Table 1, the development trend of China’s harvested area from 2011 to 2020 can be broadly divided into two phases: from 2011 to 2015, it gradually rose to a peak of 69,613,163 hectares, and from 2016 to 2020, it declined annually to 64,692,788 hectares. Between 2011 and 2020, China’s grain yield per unit showed a fluctuating upward trend, reaching its highest value of 144,141 hg/ha in 2020, an increase of 11.8% compared to 2011. From 2015 to 2019, China’s share in the international grain market increased annually, rising to 4.40% in 2019, but dropped to 3.57% in 2020. It’s evident that both China’s harvested area and its share in the international market were affected by the COVID-19 pandemic in 2020. Coupled with the challenging international trade situation, and as the world’s leading grain importer and consumer, disruptions in China’s grain logistics, instability in the grain market, and changes in the supply and demand structure inevitably impact the safeguarding of China’s food security. With the introduction of the “macro food perspective,” striking a balance between the sustainable development of agriculture, ecological protection, and the balanced advancement of agricultural modernization, while ensuring food security, holds significant practical importance.

However, addressing food security requires substantial financial support, necessitating not only government fiscal inputs but also active participation from social capital. In recent years, with the rise of digital technology, China’s digital inclusive finance has emerged as a new financial development model, demonstrating remarkable progress. Firstly, compared to traditional finance, digital inclusive finance offers consumers a more convenient channel for accessing funds. Leveraging automation technology, digital inclusive finance can swiftly process a vast number of loan applications and transaction requests. Unlike traditional finance, which might require days or even longer to process, digital inclusive finance can expedite intermediate and final processing, offering faster access to funds. Relying on digital technology and internet platforms, it streamlines financial transactions, eliminating some of the complexities and time costs inherent in traditional finance, thus providing consumers with a more accessible means of obtaining funds. Secondly, the barriers to entry for digital inclusive finance are lower than those of traditional financial institutions like banks. Digital financial products and services tailored for rural areas are also constantly expanding. This is because digital inclusive finance trusts advanced technologies and risk assessment methods, enabling a more detailed evaluation of an individual’s credit risk. The combination of small-loan models and trusted risk assessment approaches provides more people with loan opportunities, achieving the characteristic of low interest rates. Moreover, major financial institutions have successively launched services like “HuiNong e-Pay,” “YiNong Loan,” “KaiXin Loan,” “NongFa Loan,” and “YiLong Loan” to cater to the borrowing needs of rural residents. This boosts residents’ investments in grain production, further ensuring food supply safety. Thirdly, digital inclusive finance offers residents the convenience of transaction methods. Traditional finance usually requires consumers to visit physical banks or financial institutions for services, such as loans or deposits. In contrast, digital inclusive finance, through internet platforms and mobile applications, enables consumers to conduct financial transactions anytime and anywhere, free from time and location constraints. The ongoing development of digital inclusive finance has spurred the rapid proliferation of e-commerce, increasing employment opportunities for residents (Acemoglu and Restrepo, 2018; Hjort and Poulsen, 2019), reducing market frictions (Dana and Orlov, 2014), and raising residents’ income. This, in turn, enhances the availability of food (Ahmed and Lorica, 2002), effectively improving food security.

Based on this, our study embarks from the perspective of digital inclusive finance, using multidimensional food security as the entry point. Utilizing panel data from 30 provinces in China from 2011 to 2020 (excluding Tibet and the Hong Kong, Macao, and Taiwan regions), we empirically test the impact of digital inclusive finance on multidimensional food security. The aim is to provide a feasible digital path for achieving sustainable agricultural development. The potential marginal contributions of this paper are: firstly, this research is the first to integrate digital inclusive finance with multidimensional food security within the same research framework, exploring the influence of digital inclusive finance on multidimensional food security. This provides a reference basis for constructing a sound digital inclusive financial system to ensure multidimensional food security. Secondly, taking into full account the rural development situation in China, we construct a multidimensional food security index system from three dimensions: supply side, sustainability, and liquidity. This not only extends the prevailing research on food security but also aligns with the ecological goals of the “big food view” – effectively assessing ecological protection and sustainable agricultural development. This approach encourages a better practice of the “big food view,” offers a comprehensive evaluation of food security from multiple dimensions, and establishes a more comprehensive food security assessment system. This system closely aligns with the actual food security situation in our country. Additionally, we employ the Theil index to analyze the regional disparities in China’s multidimensional food security. Thirdly, our research discovers that digital inclusive finance can ensure multidimensional food security. This security can be further safeguarded by promoting urbanization levels and enhancing marketization levels. Fourthly, the study reveals the heterogeneous impact of digital inclusive finance on multidimensional food security from three dimensions: coverage breadth, usage depth, and the degree of digitization.

Literature review and research hypothesis

Literature review and brief commentary

With the development of urbanization in China, a large number of rural laborers have migrated to cities from the countryside, significantly impacting food production and further intensifying the pressing situation of food security in the country. However, the nation is founded on its people, and for the people, food is paramount. Thus, paying attention to the multidimensional food security of residents becomes especially significant. Scholars have extensively discussed related issues, and the literature relevant to this study mainly encompasses multidimensional food security and digital inclusive finance.

Multidimensional food security, evaluation systems and influencing factors

With the continuous improvement of production capabilities and human living standards, the concept of multidimensional food security has been continually enriched and deepened. In 1974, during the outbreak of the world food crisis, the Food and Agriculture Organization (hereinafter referred to as FAO) first introduced the concept of ‘food security’, which means ‘ensuring that everyone has access to the sufficient food required for survival and health at all times’. This definition emphasized the need to ensure food security mainly from the perspective of food supply by developing production and increasing reserves. In 1983, with the rapid development of the world economy, the FAO redefined food security as: ‘ensuring that everyone can buy and afford the basic food they need at all times’. This definition incorporated the consumer’s purchasing power into the analytical framework of food security, expanding from merely being able to buy to affording to buy. In 1996, the FAO once again revised the concept of food security to ‘ensure that all people have physical and economic access to sufficient, safe, and nutritious food at all times to meet their dietary needs and food preferences for an active and healthy life’. This concept introduced safety, nutrition, and other elements, reflecting the new demands arising from improved living conditions, raising the threshold for food security, and becoming a widely recognized and applied normative concept of food security. In 2001, the FAO emphasized the quantity, quality, and ecological safety of food in its definition of food security. As times evolved, global food security governance shifted its focus from merely production to sustainable production, consumption, and development. It moved from solely concentrating on food security to integrating food safety with nutrition. Consequently, food security has been endowed with more attributes and roles (Kejing and Xingyu, 2023).

The increasingly diversified concept of multidimensional food security has led to varying assessment systems. Firstly, in 1974, the FAO introduced the global food security coefficient. This index states that grain reserves should be greater than or equal to 17–18% of the annual consumption, and this value was set as the threshold for food security. However, since FAO’s evaluation standard only pertains to global food supply, it cannot comprehensively and scientifically reflect the global food security situation. As a result, Godfray et al. (2010) approached it from the perspectives of global food consumption, health, and effects, using seven metrics: ‘per capita dietary energy supply, prevalence of undernourishment, mortality rate of children under five, underweight rate, and the ratio of cereals and tubers in the dietary energy supply’ as evaluation standards. However, different regions might have varying food distribution situations, so this food security index system is not tailored to specific local needs. Secondly, Hannah et al. (2018), focusing on three key nutritional categories – “calories”, “digestible protein”, and “fats” – initially mapped India’s food system from crop production to household level, conducting scenario simulations for India’s food security status in 2030 and 2050. Thirdly, Yousaf et al. (2018) used the Dietary Intake Assessment (DIA), Household Food Insecurity Access Scale (HFIAS), and Household Dietary Diversity Score (HDDS) to investigate the food security status of both farming and non-farming families in Pakistan. The results indicated that farming families have better food security than non-farming families. The multidimensional food security mentioned in this article is based on the ecological objectives of the ‘big food’ perspective. It emphasizes not only ensuring the nutritional health of the public but also adheres to the ecological concept that ‘green mountains and clear water are as valuable as gold and silver’. It also stresses the balanced development of agricultural modernization and ecological protection (Zhigang and Meng, 2023). Drawing from the research findings of Yanlei et al. (2019), Jianli and Yongkuo (2014), and Yuanhong et al. (2015), the comprehensive evaluation system for multidimensional food security is constructed from specific indicators such as grain yield/permanent population, grain sown area/crop sown area, provincial agricultural fertilizer use, provincial plastic film usage, provincial pesticide usage, provincial grain price index, and total road mileage/regional area.

To safeguard multidimensional food security, it’s crucial to understand the factors that impact its development. From the perspective of developed countries, the U.S. believes that food rights can restrict and hinder the growth of national food security (Anderson, 2013), and achieving food security requires engaging in international trade (Mooney, 2022). For areas like Alaska, a range of climatic and socio-economic factors have disrupted the ability to achieve food security using locally available food resources (Loring and Gerlach, 2008). In contrast, in less developed countries like India, it’s believed that a lower socio-economic status and indebtedness are the primary risk factors for food insecurity (Dharmaraju et al., 2018). For developing countries, the main factors affecting household food security include family size, monthly income, food prices, medical expenses, and debt, as well as market accessibility factors (distance to roads and transportation costs) (Ijaz et al., 2017).

Digital inclusive finance

Digital inclusive finance is an extension and expansion of inclusive finance combined with internet technology. In 2016, the “G20 High-Level Principles for Digital Financial Inclusion” defined digital inclusive finance as “broadly referring to all actions that promote inclusive finance through the use of digital financial services, including the application of digital technologies to provide a range of formal financial services for groups that are unserved or underserved by financial services. The financial services provided can meet their needs, are delivered in a responsible and affordable manner, and are sustainable for the providers.” In 2016, a report by the GPFI released at the G20 summit elaborated on this and called on countries to devise digital inclusive finance development strategies in line with their national conditions, leveraging its digital convenience to enhance service levels and promote comprehensive economic development. Digital inclusive finance, by harnessing the advantages of big data and artificial intelligence, broadens its service coverage and elevates the service level (Nevvi et al., 2018), effectively reducing transaction costs and barriers to access diverse financial services, thereby accentuating the “universal” and “beneficial” aspects of inclusive finance (Guo et al., 2016). With the strong backing of digital technology, digital inclusive finance enables groups previously excluded from traditional financial services to access required products and services more conveniently through digital means, allowing low-income populations to obtain credit services at a lower cost (Schmied and Marr, 2016). This creates opportunities for increased wealth and welfare gains, helping to improve income levels, alleviate poverty (Mohammed et al., 2017), and mitigate regional development imbalances (Sehrawat and Giri, 2016). The “G20 High-Level Principles for Digital Financial Inclusion” definition of digital inclusive finance has been widely adopted and recognized by scholars. This article, when exploring the impact of digital inclusive finance on multidimensional food security, also employs the aforementioned definition and uses the “Peking University Digital Inclusive Finance Index (2011–2020)” compiled by the Digital Finance Research Center’s task force at Peking University. This index measures the 30 provinces (excluding Hong Kong, Macao, Taiwan, and Tibet) based on three sub-indicators: “coverage breadth,” “usage depth,” and “digitalization level.”

Financial impact on food security

Finance has a close relationship with global food security. Finance not only involves the flow of funds but also encompasses international trade, supply chain management, and market stability, all of which impact global food security. Firstly, finance offers capital and financial instruments, supporting the transnational circulation of food, which is a vital means to ensure a balance in food supply and demand across regions (Irwin and Thierfelder, 2007). Secondly, international financial policies, tariffs, and trade duties influence food imports and exports. High tariffs might restrict certain regions from accessing the food they need, while trade liberalization could foster food supply. Developing countries often need to import food from the international market, making trade finance crucial for their food security (Ingco and Nash, 2004). Furthermore, finance can provide the necessary funds and credit to support these countries’ procurement and assurance of food supplies (Laborde Debucquet and Martin, 2017). Lastly, financial technological innovations like blockchain and digital payments, when applied in the realm of trade finance, can enhance the processes of trade finance by increasing efficiency and transparency, thereby promoting food trade and global food security (Nivievskyi and Falkowski, 2018).

Literature review

After reviewing and summarizing relevant literature, it was found that existing research primarily focuses on the connotations of multi-dimensional food security, its grading system, and its influencing factors, with less attention paid to the role of finance in safeguarding multi-dimensional food security. Among the scattered studies, Erokhin et al. (2014) argue that since farmers’ incomes are lower than urban residents, the best way to increase farmers’ income is to establish a diversified financial system. This would allow them to utilize the natural advantages of rural areas, develop rural tourism, and boost farmers’ earnings. Narayanan (2016) used India as a case study and explored the relationship between agricultural credit and agricultural GDP through a mediating analysis framework. The research found that investments in agricultural credit positively impact the growth of agricultural GDP. Castro and Teixeira, 2012 based on a theoretical study, analyzed the effect of agricultural credit on agricultural yield in Brazil, with results indicating that the level of agricultural credit can significantly enhance agricultural output, thereby ensuring food security. Clearly, the aforementioned studies generally discuss the role of traditional finance in multi-dimensional food security. With the development of digital inclusive finance, safeguarding multi-dimensional food security by utilizing digital inclusive finance could be a significant entry point. Regrettably, there is a dearth of studies directly exploring the impact of digital inclusive finance on multi-dimensional food security. Hence, this research constructs a multi-dimensional food security system, investigates the influence mechanism of digital inclusive finance on multi-dimensional food security, and is committed to providing a robust basis for ensuring food security and achieving sustainable agricultural development.

Theoretical analyses and research hypotheses

Analysis of direct channels for digital financial inclusion to guarantee multidimensional food security

In today’s era, digital inclusive finance has become an essential tool for promoting agricultural and rural economic development, with a particularly notable direct impact on multi-dimensional food security. It transcends the limitations of traditional financial services, allowing groups previously marginalized within the traditional financial system—especially small-scale farmers in rural areas and those in remote regions—access to financing. This grants them easy access to funds, providing substantial economic support, enabling them to purchase advanced agricultural technology, seeds, and other essential resources, thereby boosting agricultural productivity and enhancing crop yield and quality. Moreover, digital inclusive finance offers farmers more flexible risk management tools, such as agricultural insurance, mitigating their losses from extreme weather, pests, and other unforeseen factors, ensuring a stable food supply. Furthermore, it provides farmers with real-time market information, enabling them to make more precise planting and selling decisions, optimize their product structure, thereby yielding higher profits and ensuring their economic interests and food accessibility. Digital inclusive finance also promotes transparency in the agricultural supply chain; every stage from planting and harvesting to sales can be traced and managed, guaranteeing food quality and safety, and bolstering consumer confidence. Lastly, it offers farmers a platform for information sharing, learning, and mutual assistance, helping them continuously enhance their agricultural knowledge and skills, further strengthening their ability to address complex and ever-changing food security challenges. In summary, digital inclusive finance provides comprehensive support to farmers in areas like financial service penetration, productivity enhancement, risk management, market transparency, and education and training. All these factors directly contribute to the continuous and robust development of multi-dimensional food security, offering new perspectives and tools for achieving global food security. Thus, we propose Hypothesis 1:

H1: Digital inclusive finance facilitates the promotion of multi-dimensional food security

Analysis of indirect channels for digital financial inclusion to guarantee multidimensional food security

Firstly, the mediating role of urbanization level. With the deepening advancement of financial aid for rural revitalization, digital inclusive finance, with its advantages of inclusivity and convenience, plays a role in achieving comprehensive rural revitalization and coordinated urban–rural development. This is the essence of the development of digital inclusive finance (Mingwang and Jiaping, 2019). The fusion of inclusive finance and digital technology gives rise to digital inclusive finance, which, while exhibiting its inclusive characteristics, leverages its advantages in coverage and digitization to optimize urban–rural financial resource allocation. This narrows the income gap between urban and rural residents, achieves coordinated regional development, and enhances the construction of the rural financial system and the financial service environment. It plays a vital role in upgrading the industrial structure, promoting the domestic macro cycle, and coordinating urban–rural development, further consolidating and advancing new urbanization development. The growth of digital inclusive finance aids in the mobility of production factors across industries and regions, significantly driving urbanization (Jianjun et al., 2022). On one hand, urbanization aids in refining the market economy system, increasing residents’ income and improving living standards, thereby continuously raising the demand for food and increasing investment in food production capital. On the other hand, with urbanization’s progression, the growth of digital inclusive finance spurs the fintech industry, creating more job opportunities, especially in rural areas. This helps raise rural residents’ incomes, enhancing their ability to purchase food and other essentials. It also offers opportunities for residents to enhance their capabilities and learn about new agricultural technologies. Only with continuous advancement in agricultural production techniques can land output, resource conversion, and the economic benefits of agricultural production be effectively improved, ultimately promoting food security. Based on the above analysis, we propose Hypothesis 2:

H2: Digital inclusive finance can promote multi-dimensional food security by elevating the level of urbanization.

Secondly, the mediating role of marketization level. Digital inclusive finance can refine and enhance information quality through information technology and internet technology, thus mitigating issues arising from information asymmetry, more efficiently allocating financial resources, and forming a large-scale market. As market conditions continually improve, farmers get more opportunities to increase their income, solidifying the foundation for capital accumulation. From a developmental perspective, there’s an inverted U-shaped relationship between digital inclusive finance and marketization level. The early ‘wild growth’ development approach somewhat disrupted existing market rules and order, but later began promoting a higher level of marketization (Jizeng and Hao, 2022). From a financial function perspective, digital inclusive finance, through new technology, empowers the financial market and intermediaries. It effectively reduces market friction, alleviates information asymmetry in market operations, promotes financial marketization, and facilitates the efficient allocation of financial resources (Jiang, 2022). A higher marketization level indicates more innovative resources in that area (Chunjuan and Yang, 2020). For instance, establishing new agricultural e-commerce platforms supported by technologies like the internet, IoT, etc., can, through smart warehousing and blockchain technologies, enhance the efficiency and safety of agricultural product circulation (Junshan and Wenyu, 2022), improve financial infrastructure in rural areas, and expand financial service coverage. This connects agricultural products to broader markets, increasing farmers’ sales channels and food sales income, ultimately ensuring national food security and building a strong food industry (Baoming et al., 2018). Digital inclusive finance also increases the financial inclusion of rural residents, making it easier for them to participate in market transactions, which aids in improving the circulation and sale of agricultural products, promoting market supply–demand balance, and stabilizing food prices. The higher the marketization level, the more standardized the product circulation, factor mobility, and information transmission, making it easier to prevent risks in the food market (Gai, 2013). Taking European countries as an example, comparing multi-market research on food regulation’s impact on food prices between the UK and Australia shows that the higher the marketization level, the more stable the food prices (Ghosh, 2016). Based on the above analysis, we propose Hypothesis 3:

H3: Digital inclusive finance can promote multi-dimensional food security by elevating the level of marketization.

Measurement of multidimensional food security levels and analysis of their evolutionary trends and regional differences

Construction of a comprehensive multidimensional food security evaluation indicator system

The construction of a multi-dimensional food security index system not only needs to be based on the global implications of multi-dimensional food security but also needs to be in line with China’s national conditions and grain situation and keep pace with the times, reflecting the United Nations’ Sustainable Development Goals at a higher level. Therefore, drawing on the research findings of Yanlei et al. (2019), Jianli and Yongkuo (2014), and Yuanhong et al. (2015), this article establishes a comprehensive evaluation system for multi-dimensional food security, comprising three secondary indices: supply side, sustainability, and circulation, and seven specific indices such as per capita grain output, the proportion of grain sown area, and the application amount of agricultural fertilizers, as shown in Table 2.

Data sources

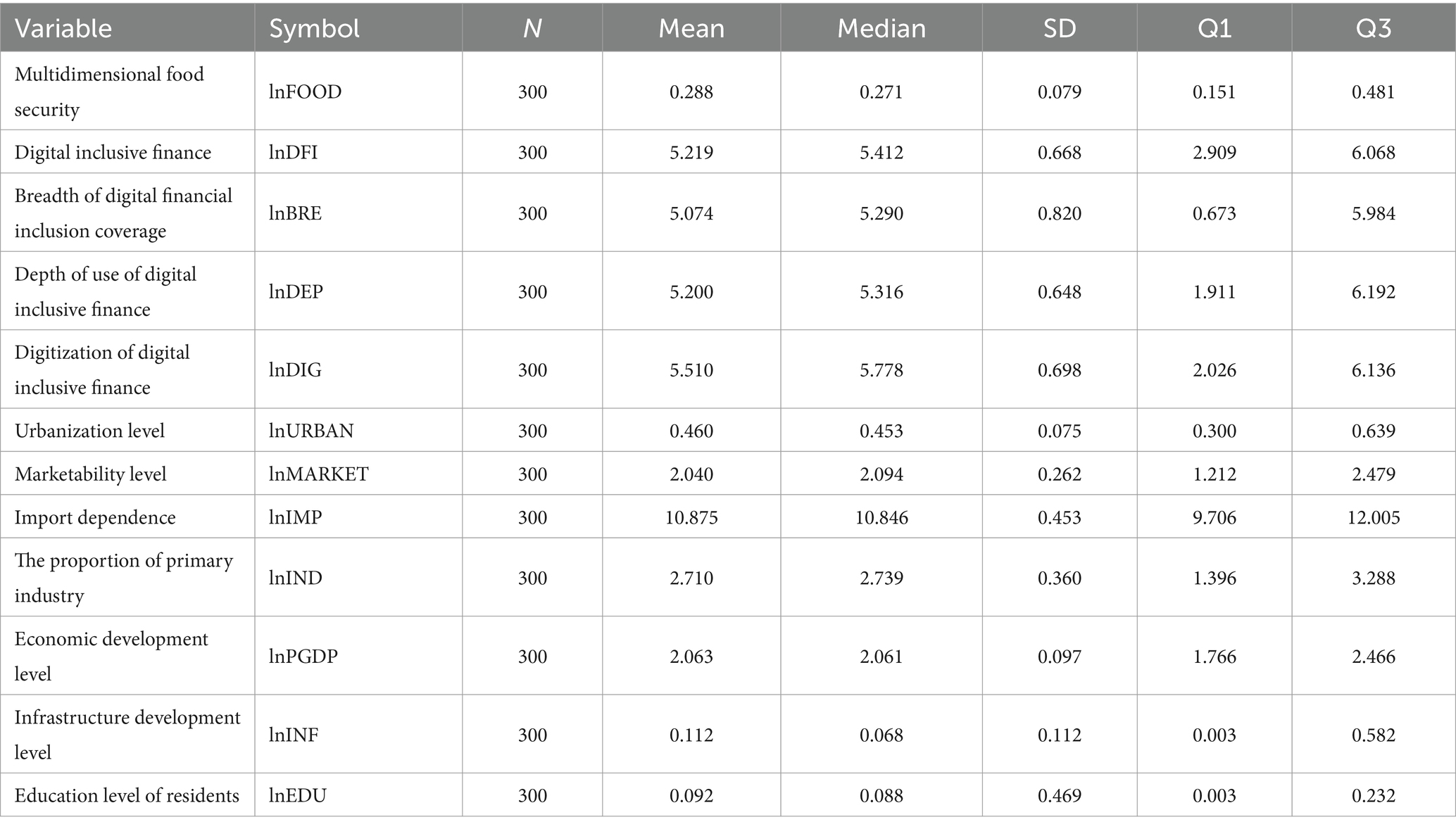

This study conducts an empirical test on the relationship between digital inclusive finance and multi-dimensional food security based on panel data from 30 provinces in China from 2011 to 2020 (excluding Tibet and the Hong Kong, Macau, and Taiwan regions). The data on digital inclusive finance comes from the Digital Financial Inclusion Index compiled by the Digital Finance Research Center of Peking University for the years 2011–2020. The rest of the data primarily originates from the “China Statistical Yearbook” for 2012–2021, “China Rural Statistical Yearbook,” “China Household Survey Yearbook,” and the statistical yearbooks of various provinces over the years.

Results of the multidimensional food security index measurements and their evolutionary trends

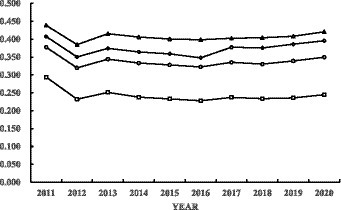

This study employs the entropy method to calculate the multi-dimensional food security index for 30 provinces in China. Although provinces in our country are categorized based on grain supply and demand into main grain-producing areas, primary grain-selling areas, and balanced production-sales areas, China’s vast territory means there are significant differences in regional resource endowments, levels of economic development, social living conditions, and digital infrastructure. The eastern, central, and western regions vary in economic development and digital infrastructure, which in turn exerts certain impacts on food security. Consequently, this paper focuses on the degree of regional disparities within China and further decomposes the overall difference in multi-dimensional food security into intra- and inter-regional differences for comparison across the eastern, central, and western regions. A higher multi-dimensional food security index signifies a greater level of food security in China. Figure 1 illustrates the trend in the multi-dimensional food security index for China overall and for the eastern, central, and western regions from 2011 to 2020. Specifically, from 2011 to 2012, China’s multi-dimensional food security level experienced a decline, with the index dropping from 0.3772 to 0.3196, a decrease of 15.27%. In the eastern, central, and western regions, the declines were 20.99, 14.37, and 12.27%, respectively. From 2012 to 2020, China’s multi-dimensional food security level showed a gradual improvement, with the index rising from 0.3196 to 0.3494, an increase of 9.32%. The eastern, central, and western regions saw increases of 5.42, 12.90, and 9.30% respectively, with the central region experiencing the highest growth rate in its multi-dimensional food security index, and the gap in food security levels between the central and western regions gradually diminishing.

Analysis of regional differences in multidimensional food security

The Theil index was used to measure the degree of regional variation in China’s multidimensional food security and to further decompose the overall variation in China’s multidimensional food security into intra- and inter-regional variation within the three major regions of the East, the Middle East, and the West in order to study the degree of regional variation in China’s multidimensional food security and its associated contribution. The formula for measuring the Theil index is as follows:

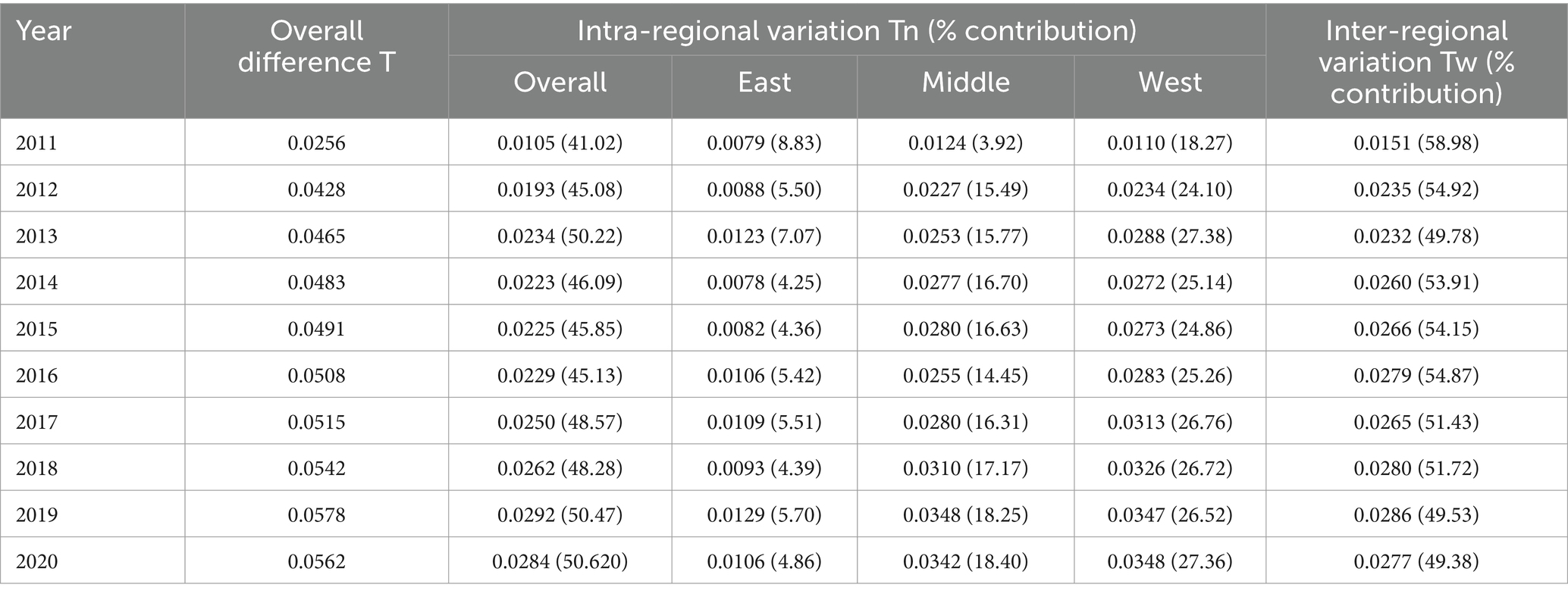

In Eq. (1), T is the overall difference Theil index of China’s multidimensional food security, and its value is located in [0, 1], the smaller the Theil index is, the smaller the overall difference of China’s multidimensional food security is; b is the province, a is the number of provinces, Kb is the multidimensional food security level of the province b, and it is the average value of China’s multidimensional food security. In Eq. (2), Tr is the overall difference Theil index of region r, ar is the number of provinces in region r, is the multidimensional food security level of province b in region r, and is the average value of multidimensional food security in region r. In Eq. (3), the overall difference Theil index of multidimensional food security can be further decomposed into the intra-region difference Theil index Tn and the inter-region difference Theil index Tw. As can be seen in Table 2, from the perspective of the overall difference, China’s multidimensional food security Theil index shows an upward trend from 2011 to 2020, from 0.0256 in 2011 to 0.0562 in 2020, indicating that the differences in the level of multidimensional food security in China are gradually expanding. In terms of regional differences, the contribution rate of interregional differences was generally higher than that of intra-regional differences from 2011 to 2018, indicating that the overall differences in China’s multidimensional food security mainly originated from inter-regional differences. However, from 2019 onwards, the contribution rate of intra-regional differences is higher than that of inter-regional differences, so it is necessary to continue to pay attention to the trend of China’s multidimensional food security in the future (see Tables 3, 4).

Study design and modelling

Model setup

Benchmark model

Based on the previous theoretical analysis, this study constructs a two-way fixed-effects model to test the impact of digital financial inclusion on multidimensional food security, with all variables in logarithmic form. The specific benchmark model is set as follows:

Eq. (4) where i denotes province (city, autonomous region), t denotes year, FOOD denotes multidimensional food security; DFI denotes digital financial inclusion; is the ensemble of control variables; is the parameter to be estimated, with an expected sign of negative; is a province fixed effect, is a time fixed effect, and is a random disturbance term.

Mediating effect model

To further explore the transmission mechanism of digital financial inclusion in affecting multidimensional food security, the following mediation effect model is constructed with reference to Zhonglin and Baojuan (2014):

Eq. (5) represents the model of the total effect of digital financial inclusion on multidimensional food security, Eq. (6) represents the model of the effect of digital financial inclusion on the mediating variables (including the level of urbanisation and the level of marketisation), and Eq. (7) represents the model of the effect of digital financial inclusion and the mediating variables together on multidimensional food security. Where A1 is the total effect of digital inclusive finance on multidimensional food security; B1 is the effect of digital inclusive finance on intermediary variables; and C1 is the effect of intermediary variables on multidimensional food security after controlling the effect of digital inclusive finance. If the regression coefficients A1, B1, and C1 in Eqs. (5)–(7) are significant then it indicates that there is a mediating effect, and the mediating effect is tested.

Variable data sources

Explanatory variable

Multidimensional food security (lnFOOD)

The multidimensional food security index for 30 Chinese provinces from 2011 to 2020 was obtained by the entropy method.

Core explanatory variable

Digital inclusive finance (lnDFI)

The lnDFI is used for 30 provinces of the Peking University Digital Inclusive Finance Index (2011–2020) (excluding Hong Kong, Macao, Taiwan and Tibet) compiled by the research group of Peking University Digital Finance Research Center, which contains the total indicators of the “Digital Inclusive Finance Index” and the sub-indicators of “breadth of coverage The index consists of the general index of “Digital Inclusive Finance Index” and sub-indicators of “breadth of coverage,” “depth of use” and “degree of digitization,” measuring the digital inclusive finance index from multiple dimensions and reflecting the development trend of digital inclusive finance in different regions of China in a more comprehensive manner.

Mediating variables

Level of urbanisation (lnURBAN) and level of marketisation (lnMARKET). (1) The level of urbanisation (lnURBAN) is expressed using the ratio of the resident urban population to the total resident population. (2) Marketisation level (lnMARKET) is used to measure the marketisation index by province in China as reported by Xiaolu et al. (2021).

Control variables

In order to comprehensively analyze the impact of digital inclusive finance on multidimensional food security and its mechanism of action, the following control variables were incorporated into the econometric model in this study with reference to previous scholars: (1) Import dependence (lnIMP): total import trade converted to RMB denominated at the current year’s exchange rate and divided by regional GDP; (2) Share of primary industry (lnIND). (3) Level of economic development (lnPGDP): real GDP; (4) Level of infrastructure development (lnINF): measured by the area of urban roads per capita; (5) Level of education of the population (lnEDU): the average number of years of education of the population, as follows: average number of years of education of the population = (primary school number of people × 6 + number of junior high school students × 9 + number of senior high school students × 12 + number of college students and above × 16)/total population aged 6 and above in the region.

Empirical findings and analyses

Benchmark regression results and analyses

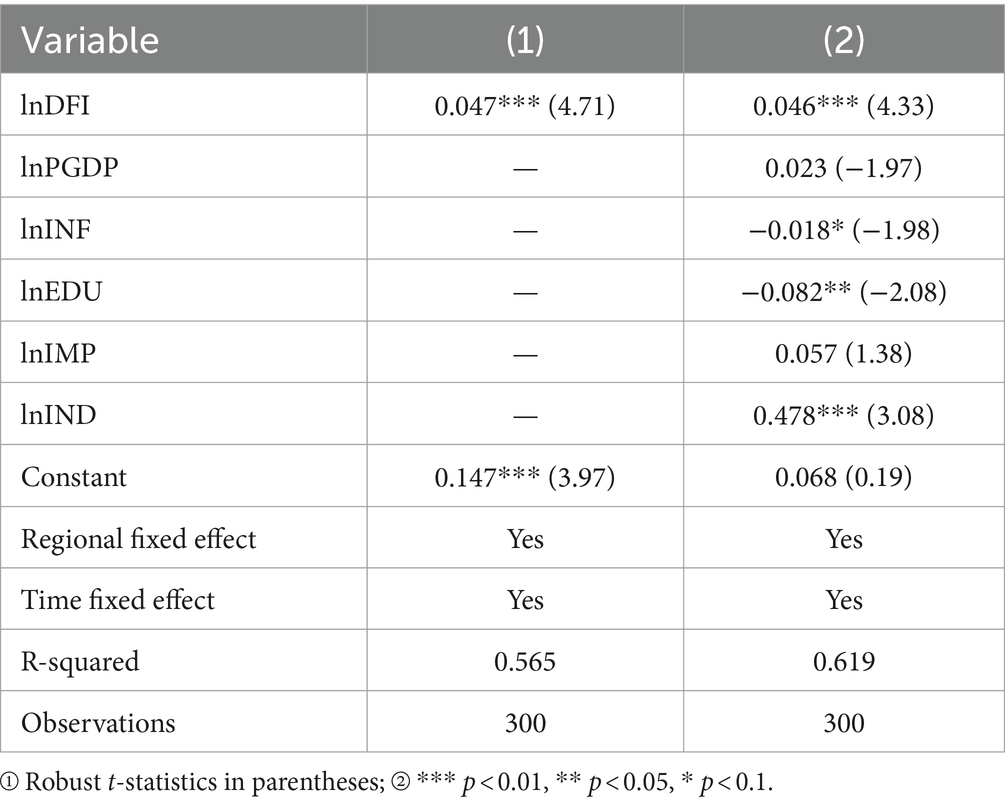

Before conducting the baseline regression, it is essential to determine whether there is multicollinearity among the variables. The results show that the VIF (Variance Inflation Factor) values of all variables are less than 10, with an average of 2.58, indicating that there is not severe multicollinearity, thus regression analysis can be performed. When testing for individual effects, the F-test value is 51.69, with a p-value of 0.000. Using the LSDV (Least Squares Dummy Variables) method, it’s found that the p-value is less than 0.05, indicating significant individual effects. Thus, the fixed effects model is preferable over the mixed regression model. Finally, based on the Hausman test results, the χ2(7) value is 59.25, with a p-value of 0.000, suggesting that the fixed effects model is superior to the random effects model. Table 5 presents the regression results of the impact of digital financial inclusion on multi-dimensional food security.

Column (1) indicates that, without considering control variables, digital financial inclusion has a significant positive effect on multi-dimensional food security. This preliminarily suggests that digital financial inclusion can help ensure multi-dimensional food security. As seen from column (2), even when considering control variables, digital financial inclusion continues to have a significant positive impact on multi-dimensional food security, further asserting that digital financial inclusion can promote and ensure multi-dimensional food security, validating hypothesis 1. Digital financial inclusion, characterized by its wide reach, convenience, and low cost, enables farmers to easily access financial resources, effectively increasing the income levels of low-income households. This aids in alleviating challenges like expensive financing and financing difficulties for agriculture, encourages farmers to optimize agricultural resource allocation, and subsequently increases regional agricultural productivity, thereby enhancing food supply levels and ensuring multi-dimensional food security.

Regarding other control variables, infrastructure development, residents’ years of education, and the proportion of primary industry also significantly influence multi-dimensional food security. For instance, infrastructure development has a significant negative impact on multi-dimensional food security at the 10% significance level. This might be because large-scale infrastructure projects often require vast expanses of land, possibly leading to a reduction in farmland, environmental damage, and pollution. Additionally, such projects might result in land dispossession for local farmers, damaging their livelihoods and challenging the agricultural supply chain. Residents’ years of education have a significant negative impact on multi-dimensional food security at the 5% significance level, indicating a considerable rural population migration to cities, leading to a lack of young and middle-aged labor in rural areas, reducing food production capacity and lowering the level of multi-dimensional food security. A higher proportion of the primary industry significantly promotes multi-dimensional food security at the 1% level. When a country or region has a high proportion of the primary industry, it often implies a higher emphasis and investment in agriculture. Such investment can lead to the optimal allocation of technology, resources, and labor, thereby increasing agricultural productivity and yield, ensuring a steady food supply. Therefore, a higher primary industry proportion strengthens multi-dimensional food security, ensuring food’s availability, usability, and stability. However, economic development levels and import dependency did not significantly influence it.

Robustness tests and endogeneity discussion

To better test the robustness and reliability of the model, this study employs an alternative method for the core explanatory variable to conduct robustness checks, as shown in Table 6. On one hand, the lagged data of the explained variable, digital financial inclusion, is incorporated into the model for analysis. As seen from column (3), digital financial inclusion still significantly ensures multi-dimensional food security. Based on the results, for every 1% increase in the digital financial inclusion index, the level of multi-dimensional food security rises by 2.8%. On the other hand, as indicated in column (4), with other conditions unchanged, financial efficiency (lnEff) is used to replace the core explanatory variable for regression. This is because regions with higher financial efficiency might have better levels of digital financial inclusion development. The regression results show a significant positive impact on multi-dimensional food security at the 5% level.

Considering that the baseline regression model of digital financial inclusion on multi-dimensional food security in the study may have certain endogeneity issues: first, endogeneity problems caused by omitted variables, such as the degree of regional government participation, consumer perceptions, and other influences. These unquantifiable factors could introduce biases into the regression results. Second, reverse causality leads to endogeneity. In promoting sustainable agricultural development, there’s a need to enhance the level of multi-dimensional food security, which in turn requires considerable financial support, potentially further propelling the development of digital financial inclusion, resulting in endogeneity due to reverse causality. Therefore, this study employs the first-order lag of digital financial inclusion (lag1_lnDFI) and the level of financial development (lnm3) as instrumental variables. The level of financial development is directly related to the digital financial inclusion development level in a given city but does not directly influence the development level of multi-dimensional food security through other channels, thus satisfying both the relevance and exogeneity conditions of the instrumental variable. As shown in Table 6, column (5) reveals that after using the lagged first-order of digital financial inclusion as the instrumental variable, digital financial inclusion has a positive impact on multi-dimensional food security at the 1% level. As indicated in column (6), after using the financial development level as the instrumental variable, digital financial inclusion positively influences multi-dimensional food security at the 5% level.

Heterogeneity test

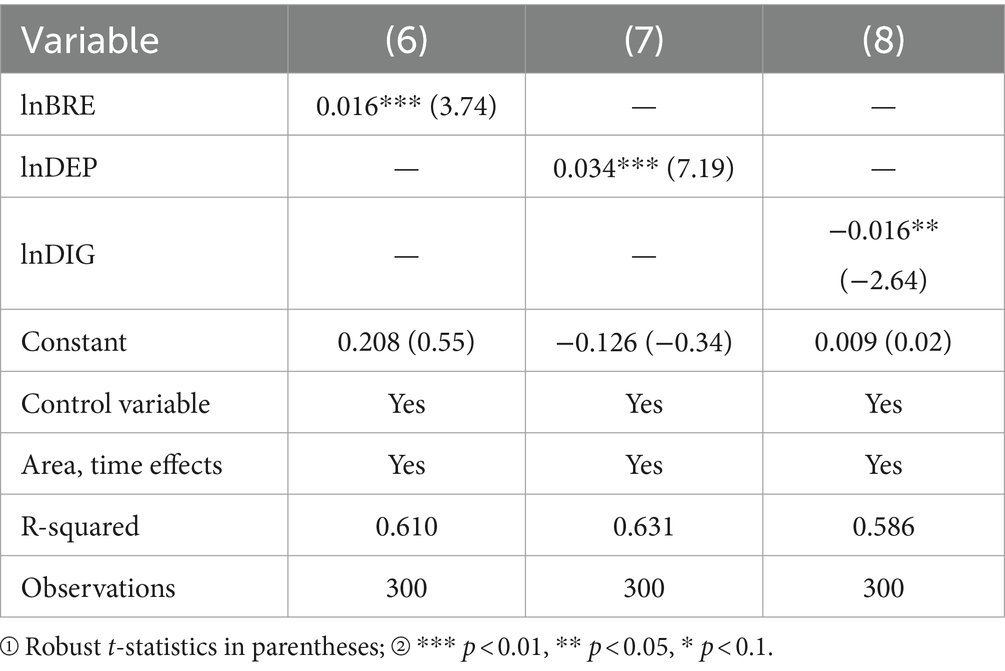

To explore the impact of digital financial inclusion in terms of breadth of coverage (lnBRE), depth of usage (lnDEP), and degree of digitization (lnDIG) on multi-dimensional food security, the results are presented in Table 7.

Table 7. Results of the impact of different dimensions of digital inclusive finance on energy poverty.

The findings indicate that different dimensions of digital financial inclusion development have distinct effects on multi-dimensional food security. As seen from Table 7, both the breadth of coverage index and depth of usage of digital financial inclusion have a significant positive impact on multi-dimensional food security at the 1% level. As digital financial inclusion develops, its service range expands, the number of financial service products increases, addressing the needs of more residents, enhancing residents’ access to financial services, significantly lowering the entry barriers to the loan market, and reducing the borrowing costs for residents. This enables them to channel borrowed funds into food production, thereby ensuring multi-dimensional food security. However, enhancing the degree of digitization has a constraining effect on the development of multi-dimensional food security. The potential reason could be that an over-reliance on digital technology might lead to the loss of traditional agricultural knowledge and skills. Furthermore, the introduction of digital technology might exacerbate the digital divide in rural areas, making it challenging for some farmers to adapt to the new technological environment. Additionally, data security concerns and reliance on a single technology platform could also increase the vulnerability of the food supply chain. Therefore, while digitization can bring about efficiency improvements, it may also introduce new challenges and uncertainties.

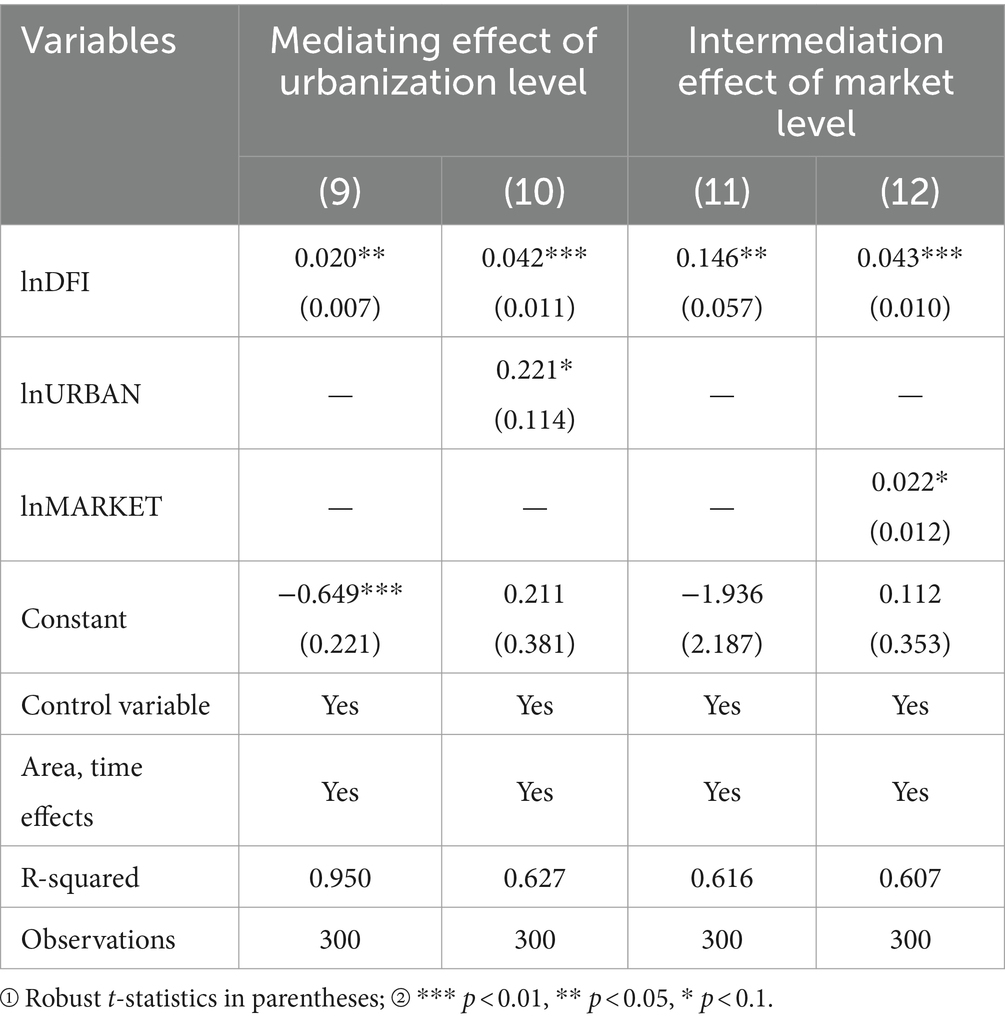

Further discussion: mediation effects tests

The previous sections have amply demonstrated the overall impact of digital financial inclusion on multi-dimensional food security. This section will further analyze the mediating effects of urbanization levels (lnURBAN) and marketization levels (lnMARKET) in the model and verify the existence of these mediating effects through Bootstrap testing. The results are presented in Table 8.

From columns (10) and (11), it is evident that digital financial inclusion has a significant positive impact on urbanization levels at a 5% significance level, with a coefficient of 0.020. This indicates that for every 1% increase in digital financial inclusion, the level of urbanization rises by 2.0%. Urbanization level has a significant positive effect on multi-dimensional food security at a 10% significance level, with a coefficient of 0.221, suggesting that for every 1% increase in urbanization, multi-dimensional food security improves by 22.1%. These empirical findings suggest that digital financial inclusion can ensure multi-dimensional food security by enhancing urbanization levels. This may be because digital financial inclusion provides more accessible financial services to a broad population, especially marginalized groups under the traditional financial system, promoting economic activity and entrepreneurial opportunities in rural areas. Such financial support can encourage rural-to-urban migration, accelerating urbanization. With the rise of urbanization, rural labor is released into more efficient modern agriculture, increasing food production and improving agricultural efficiency. Moreover, the expansion of cities drives the growth of the food processing and distribution industry, enhancing the stability and efficiency of the food supply chain, thereby helping secure multi-dimensional food security. Thus, Hypothesis 2 is verified.

From columns (12) and (13), it’s observed that digital financial inclusion significantly positively impacts marketization levels at a 5% significance level, with a coefficient of 0.146. This means that for every 1% increase in digital financial inclusion, the marketization level rises by 14.6%. Marketization level has a significant positive effect on multi-dimensional food security at a 10% significance level, with a coefficient of 0.022, indicating that for every 1% increase in marketization, multi-dimensional food security improves by 2.2%. These empirical findings suggest that digital financial inclusion can safeguard multi-dimensional food security by enhancing marketization levels. This might be because digital financial inclusion can offer more convenient and cost-effective financial services to a vast number of farmers and small enterprises, lowering the traditional financial barriers. It also stimulates agricultural market vitality, encouraging farmers and businesses to adopt advanced agricultural technologies and management models, thereby improving agricultural production efficiency. Digital financial inclusion further promotes market information transparency and circulation, allowing agricultural product prices to more accurately reflect market supply–demand relationships, further motivating producers to optimize resource allocation. Hence, by improving marketization levels, digital financial inclusion provides more robust economic and technical support for multi-dimensional food security. Hypothesis 3 is verified.

Research findings, policy recommendations and discussion

Research findings and policy recommendations

To systematically explore the impact of digital financial inclusion on the development of multi-dimensional food security and the potential innovative driving mechanisms, this study takes digital financial inclusion as the starting point. Based on panel data from 30 provinces nationwide from 2011 to 2020, we discuss the influence of digital financial inclusion on multi-dimensional food security from both theoretical and empirical perspectives, providing a foundation for ensuring multi-dimensional food security and sustainable agricultural development. The study finds: Firstly, from 2012 to 2020, China’s level of multi-dimensional food security has gradually increased, with the multi-dimensional food security index rising from 0.3196 to 0.3494, an increase of 9.32%. The growth rates of the multi-dimensional food security index in the eastern, central, and western regions were 5.42, 12.90, and 9.30%, respectively. The central region witnessed the highest growth, and the gap in food security levels between the central and western regions has gradually narrowed. Secondly, China’s multi-dimensional food security Theil Index showed an upward trend from 2011 to 2020. Thirdly, digital financial inclusion can significantly promote multi-dimensional food security. Fourthly, the breadth and depth of coverage of digital financial inclusion play a significant role in enhancing multi-dimensional food security, but the degree of digitization has not effectively safeguarded multi-dimensional food security. Fifthly, digital financial inclusion ensures multi-dimensional food security by promoting urbanization and enhancing marketization levels.

Based on these research conclusions, this study proposes the following policy recommendations: firstly, depending on the development status of digital financial inclusion in different regions, targeted promotion policies should be introduced. By increasing the coverage and depth of use of digital financial inclusion, the system can be further perfected, allowing rural residents to enjoy digital financial inclusion services more conveniently and with greater benefits. Secondly, the government can offer supportive policies, such as tax reductions or exemptions for equipment needed for production; continue to implement preferential policies concerning national grain railway freight rates; residents who contract land for grain on a large scale can enjoy certain land preferential policies. Thirdly, further urbanization should be promoted, market systems improved, and scaled-up production and intensive management developed. This approach genuinely enhances grain production profits, which is an effective way to ensure multi-dimensional food security.

Discussion

This study utilizes panel data from 30 provinces in China from 2011–2020 (excluding Tibet, Hong Kong, Macau, and Taiwan) to empirically examine the impact of digital financial inclusion on multi-dimensional food security. We have derived our research conclusions and, based on these findings and existing research results, the following discussion is presented:

For the first time, this study positions digital financial inclusion and multi-dimensional food security within the same research framework, aiming to understand the influence of digital financial inclusion on multi-dimensional food security. This provides a reference for building a rational digital financial inclusion system, thereby ensuring multi-dimensional food security. The research conclusions show that digital financial inclusion has a significantly positive impact on the development of multi-dimensional food security. Infrastructure development, the number of years residents receive education, and the proportion of primary industry also significantly influence the role of digital financial inclusion in ensuring multi-dimensional food security. However, the level of economic development and import dependence did not have a significant impact. The probable reasons are: While the level of economic development can provide a more robust infrastructure and policy environment for the financial system, the core of digital financial inclusion is to serve marginalized groups. Its impact is mainly reflected in financial inclusivity. Hence, economic growth may not directly lead to a significant expansion or optimization of digital financial inclusion. Multi-dimensional food security involves many factors, and relying solely on financial means may not produce a significant positive effect. Therefore, economic development might not have significantly propelled digital financial inclusion’s role in ensuring multi-dimensional food security. Import dependence reflects the degree to which a country or region relies on external supply chains. Digital financial inclusion primarily focuses on increasing the prevalence of financial services, especially for marginalized groups in the traditional financial system. Essentially, their focal points and objectives are not directly related. Although import dependence might affect a country’s macroeconomic stability and the stability of its food supply chain, it might not have a direct, significant influence on the promotion and application of digital financial inclusion and its effectiveness in ensuring multi-dimensional food security.

This study methodically examined the impact of digital financial inclusion development on multi-dimensional food security using theoretical analysis and empirical models. Regarding the research subjects and data research methods, there might be two areas for improvement or further investigation: Firstly, one of the subjects of this study is digital financial inclusion. However, this concept was only introduced in 2016, and the academic community lacks standard measurements for this indicator. The most credible currently is the digital financial inclusion index compiled by the Digital Finance Research Center of Peking University in China. However, this index spans a short time, covering only data from 2011–2020. As the pace of digital finance development accelerates and the digital finance database becomes more comprehensive, future research can extend the time span to further explore its correlation and effects, making the conclusions more convincing. Secondly, there’s a singularity in data acquisition. This study only chose to examine the impact of digital financial inclusion development on multi-dimensional food security using existing macro-level statistical data and did not collect micro-level data for analysis and verification. Future research could delve into micro-survey data, providing a direction for subsequent studies.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

YT: Writing – review & editing, Writing – original draft. QiuC: Writing – review & editing. XR: Writing – review & editing. XH: Data curation, Methodology, Supervision, Conceptualization, Formal analysis, Validation, Investigation, Visualization, Software, Writing – original draft. QinC: Writing – review & editing. QZ: Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. The Impact of Carbon Neutral Policies on Land Use Patterns of Abandoned Land and Assessment of the Effects (2021J01649); Mechanism and Optimisation Strategies for Realising the Value of Agricultural Land Asset Mortgage in the Context of Rural Revitalisation (2019R0030); Study on the Value of Ecological Public Forest Carbon Sinks Based on the Demand of Carbon Emission Reduction Enterprises (FJ2021C085).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., and Restrepo, P. (2018). The race between man and machine: implications of Technology for Growth, factor shares, and employment. Am. Econ. Rev. 108, 1488–1542. doi: 10.1257/aer.20160696

Ahmed, M., and Lorica, M. H. (2002). Improving developing country food security through aquaculture development—lessons from Asia. Food Policy 27, 125–141. doi: 10.1016/S0306-9192(02)00007-6

Anderson, M. D. (2013). Beyond food security to realizing food rights in the US. J. Rural. Stud. 29, 113–122. doi: 10.1016/j.jrurstud.2012.09.004

Baoming, C., Ting, L., and Songbo, Y. (2018). Reform of China's grain circulation system: goals, path and restart. Agric. Econ. Issu. 12, 33–38. doi: 10.13246/j.cnki.iae.2018.12.004

Castro, E. R., and Teixeira, E. C. (2012). Rural credit and agricultural supply in Brazil. Agric. Econ. 43, 293–302. doi: 10.1111/j.1574-0862.2012.00583.x

Chunjuan, W., and Yang, L. (2020). Changes in agricultural product distribution channels: theory and modelling. Bus. Econ. Res. 7, 123–127. doi: 10.3969/j.issn.1002-5863.2020.07.033

Dana, J. , Orlov, E . Internet penetration and capacity utilization in the US airline industry, Am. Econ. J. Microeconomics, 6, 106–137. (2014). doi: 10.1257/mic.6.4.106

Dharmaraju, N., Mauleshbhai, S. S., Arulappan, N., Thomas, B., Marconi, D. S., Paul, S. S., et al. (2018). Household food security in an urban slum: determinants and trends. J. Fam. Med. Prim. Care 7, 819–822. doi: 10.4103/jfmpc.jfmpc_185_17

Erokhin, V., Heijman, W., and Ivolga, A. (2014). Sustainable rural development in Russia through diversification: the case of the Stavropol region. Visegrad J. Bioecon. Sustain. Dev. 3, 20–25. doi: 10.2478/vjbsd-2014-0004

Gai, P. Systemic risk: the dynamics of modern financial systems. Oxford: Oxford University Press, (2013).

Ghosh, D. (2016). Food safety regulations in Australia and New Zealand food standards. J. Sci. Grain Agric. 9, 3274–3275.

Godfray, H., Charles, J., Crute Ian, R., Lawrence, H., David, L., Muir James, F., et al. (2010). The future of the global food system. Philos. Trans. R. Soc. Lond. Ser. B Biol. Sci. 365:180. doi: 10.1098/rstb.2010.0180

Guo, F., Kong, S. T., and Wang, J. (2016). General patterns [10]and regional disparity of internet finance development in China: evidence from the Peking University internet finance development index. China Econ. J. 9, 253–271. doi: 10.1080/17538963.2016.1211383

Hannah, R., David, R., and Peter, H. (2018). Sustainable food security in India-domestic production and macronutrient availability. PLoS One 13:193766. doi: 10.1371/journal.pone.0193766

Hjort, J., and Poulsen, J. (2019). The arrival of fast internet and employment in Africa. Am. Econ. Rev. 109, 1032–1079. doi: 10.1257/aer.20161385

Ijaz, A. U., Liu, Y., Khalid, B. M., Muhammad, A., and Farhad, Z. (2017). Status and determinants of small farming households' food security and role of market access in enhancing food security in rural Pakistan. PLoS One 12. doi: 10.1371/journal.pone.0185466

Ingco, M. D., and Nash, J. D. (2004). Agricultural trade, policy reforms, and global food security. Washington, DC, USA: World Bank Publications.

Irwin, A., and Thierfelder, K. (2007). Trade and food security: conceptualizing the linkages. Food Policy 32, 175–190.

Jennifer, C., and Moseley, W. G. (2020). This food crisis is different: COVID-19 and the fragility of the neoliberal food security order. J. Peasant Stud. 47, 1393–1417. doi: 10.1080/03066150.2020.1823838

Jiang, L., and Lingyun, X. (2022). The historical mainline and theoretical basis of the construction of National Unified Market by the Communist Party of China. Financ. Sci. 11, 88–106. doi: 10.3969/j.issn.1000-8306.2022.11.015

Jianjun, T., Jiaowei, G., and Qinghua, S. (2022). Digital inclusive finance and agricultural total factor productivity—a perspective based on factor mobility and technology diffusion. China Rural Econ. 7, 81–102.

Jianli, Y., and Yongkuo, L. (2014). The construction, measurement and policy suggestions of China's food security evaluation index system. Rural Econ. 5, 23–27.

Jizeng, P., and Hao, Z. (2022). Digital economy, marketisation and income gap between urban and rural residents. Financ. Econ. 12, 67–76.

Junshan, D., and Wenyu, G. (2022). Research on the impact of digital financial development on enterprise total factor productivity. Contemp. Finan. Econ. 5, 51–62.

Kejing, C., and Xingyu, G. (2023). Analysis of the relationship between black land protection and national implementation of food security strategy. Heilongjiang Grain 237, 31–33.

Laborde Debucquet, D., and Martin, W. (2017). A global assessment of the economic effects of export taxes. Food Policy 66, 50–58. doi: 10.1111/twec.12072

Loring, P. A., and Gerlach, S. C. (2008). Food, culture, and human health in Alaska: an integrative health approach to food security. Environ. Sci. Policy 12, 466–478. doi: 10.1016/j.envsci.2008.10.006

Mingming, C., and Changhong, N. (2019). Research on the evolution of China's food security based on indicator evaluation system. Proc. Chin. Acad. Sci. 34, 910–919. doi: 10.16418/j.issn.1000-3045.2019.08.009

Mingwang, C., and Jiaping, Z. (2019). Internet penetration and urban-rural income gap: theory and empirical evidence. China Rural Econ. 2, 19–41.

Mohammed, J. I., Mensah, L., and Gyeke-Dako, A. (2017). Financial inclusion and poverty reduction in sub-Saharan Africa. Afric. Fin. J. 19, 1–22.

Mooney, P. H. (2022). Local governance of a field in transition: the food policy council movement. J. Rural. Stud. 89, 98–109. doi: 10.1016/j.jrurstud.2021.11.013

Narayanan, S. (2016). The productivity of agricultural credit in India. Agric. Econ. 47, 399–409. doi: 10.1111/agec.12239

Nevvi, W., Idqan, F., and Teguh, S. I. (2018). Factors affecting consumer acceptance of digital financial inclusion; an anecdotal Evidence from Bogor City. Int. J. Oper. Prod. Manag. 9, –1338. doi: 10.14807/ijmp.v9i4.824

Nivievskyi, O., and Falkowski, J. (2018). “International trade and food security: framework and policy implications” in Advances in production management systems. The path to intelligent, collaborative and sustainable manufacturing (Springer), 197–204.

Schmied, J., and Marr, A. (2016). Financial inclusion and poverty: the case of Peru. Reg. Sect. Econ. Stud. 16, 29–40.

Sehrawat, M., and Giri, A. K. (2016). Financial development, poverty and rural-urban income inequality: evidence from south Asian countries. Qual. Quant. 50, 577–590.

Wang, S., Li, J., and Yang, P. (2023). The theoretical sources, connotations and practical directions of xi Jinping's important exposition on the work of "three rural areas". J. Northwest Agric. Forest. Univ. 23, 1–8. doi: 10.13968/j.cnki.1009-9107.2023.04.01

Xiaolu, W., Lipeng, H., and Gang, F. Report on China’s marketisation index by province (2021). Beijing: Social Science Literature Press, (2021).

Yanlei, G., Zhengyan, Z., and Zhigang, W. (2019). Evaluation of food security based on entropy weight TOPSIS method: cutting in from the main grain producing areas. J. Agric. Forest. Econ. Manag. 18, 135–142. doi: 10.16195/j.cnki.cn36-1325/f.2019.02.16

Yousaf, H., Zafar, M. I., Anjum, F., and Adil, S. A. (2018). Food security status and its determinants: a case of farmer and non-farmer rural households of the Punjab, Pakistan. Pak. J. Agric. Sci. 55, 217–225. doi: 10.21162/PAKJAS/18.6766

Yuanhong, Z., Changquan, L. I. U., and Lulai, G. (2015). Evaluation of China's food security situation and strategic thinking. China Rural Observ. 1, 2-14+29+93.

Zhigang, C., and Meng, X. (2023). Synergistic development of low carbon emission reduction and food security under the leadership of the big food view: status quo, challenges and countermeasures. Agric. Econ. Iss. 522, 77–85. doi: 10.13246/j.cnki.iae.2023.06.007

Keywords: digital inclusive finance, multi-dimensional food security, Theil index, entropy method, mesomeric effect

Citation: Tan Y, Cheng Q, Ren X, Huang X, Chen Q and Zhang Q (2024) A study of the impact of digital financial inclusion on multidimensional food security in China. Front. Sustain. Food Syst. 8:1325898. doi: 10.3389/fsufs.2024.1325898

Edited by:

Enoch Kikulwe, Alliance Bioversity International and CIAT (Kenya), KenyaCopyright © 2024 Tan, Cheng, Ren, Huang, Chen and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiang Huang, ODc0MTIwNzM3QHFxLmNvbQ==; Qin Chen, MzIxMTQyOTAzNkBmYWZ1LmVkdS5jbg==; Qiuyi Zhang, emhhbmdxeUBmanV0LmVkdS5jbg==

Yunshu Tan

Yunshu Tan Qiuwang Cheng2,3

Qiuwang Cheng2,3 Qiuyi Zhang

Qiuyi Zhang