- 1Department of Management, Faculty of Economics, University of South Bohemia in České Budějovice, České Budějovice, Czechia

- 2Department of Economics, Faculty of Economics and Management, Czech University of Life Science in Prague, Prague, Czechia

Introduction: Sugar ranks among the most widely consumed, traded, sensitive, and protected commodities on the global and intra-regional stages. Recent developments in the sugar industry, inclusive of price distortions in the global sugar market, the liberalization of the European sugar sector, and the globalization of international agricultural trade, have amplified the need to comprehend the evolution of competitiveness in African sugar exports. Consequently, this study aims to provide a comprehensive analysis of the patterns, trends, and shifts in the inter- and intra-regional competitiveness of African sugar exports.

Methods: This paper employed the Normalized Revealed Comparative Advantage (NRCA) index and the Harris-Tzavalis panel-data unit-root test to assess the stability and structural changes in the competitive patterns of sugar exports for 34 African countries. The analysis is based on panel data spanning the period from 2001 to 2021.

Results and discussion: The NRCA indices unveil certain dynamics and shifts in the competitiveness of country-specific sugar exports. Overall, the number of countries exhibiting competitive sugar exports has marginally increased, rising from 14 in 2001 to 17 in 2021. However, only eight African countries, predominantly from the southern region, have consistently maintained competitiveness in both the global and intra-regional markets throughout the entire analysis period. A significant portion of sugar exports from African countries has remained non-competitive on the global market, with a select few oscillating between periods of comparative advantage and disadvantage. Notably, the North African nations of Morocco, Algeria, and Egypt have transitioned from a position of comparative disadvantage to one of comparative advantage. At the intra-regional level, the presence of tariff and non-tariff trade barriers, including tariff escalations and trade embargoes, has rendered sugar exports non-competitive. These barriers augment the challenges faced by producers in other African nations seeking to exploit economies of scale.

Conclusion: The sustained competitiveness of sugar exports from the Southern African region to other African regions underscores the significance and increasing impact of Foreign Direct Investment (FDI) in bolstering the competitiveness and development of the sugar industry.

1 Introduction

Sugar is one of the most consumed commodities in the world due to its widespread use in various industries and households. Its versatility extends beyond the culinary realm, as it is also utilized in the production of ethanol, pharmaceuticals, and even beauty products. The sugar industry is not only important in terms of its contribution to Gross Domestic Product of the producing countries, but also its immense potential to create employment opportunities along the agricultural and manufacturing value chains (Hassan, 2008). The main feedstock for sugar production globally is sugarcane accounting for an estimated 80% of total sugar production (Smutka et al., 2011; Macháček et al., 2017) of which 70% is consumed domestically while 30% is traded on the international market (Pulkrabek et al., 2011; Taylor, 2017). Sugar remains one of the most traded commodity both at international and intra-regional level (Bouët et al., 2022). The trade and competitiveness of sugar in Africa is likely to continue to evolve in the coming years. The demand for sugar is anticipated to rise as a result of the continent’s expanding population and rising incomes. While this might result in higher sugar imports, it might also give African nations the chance to grow their own sugar industries and boost their competitiveness on the world market (Helia, 2022).

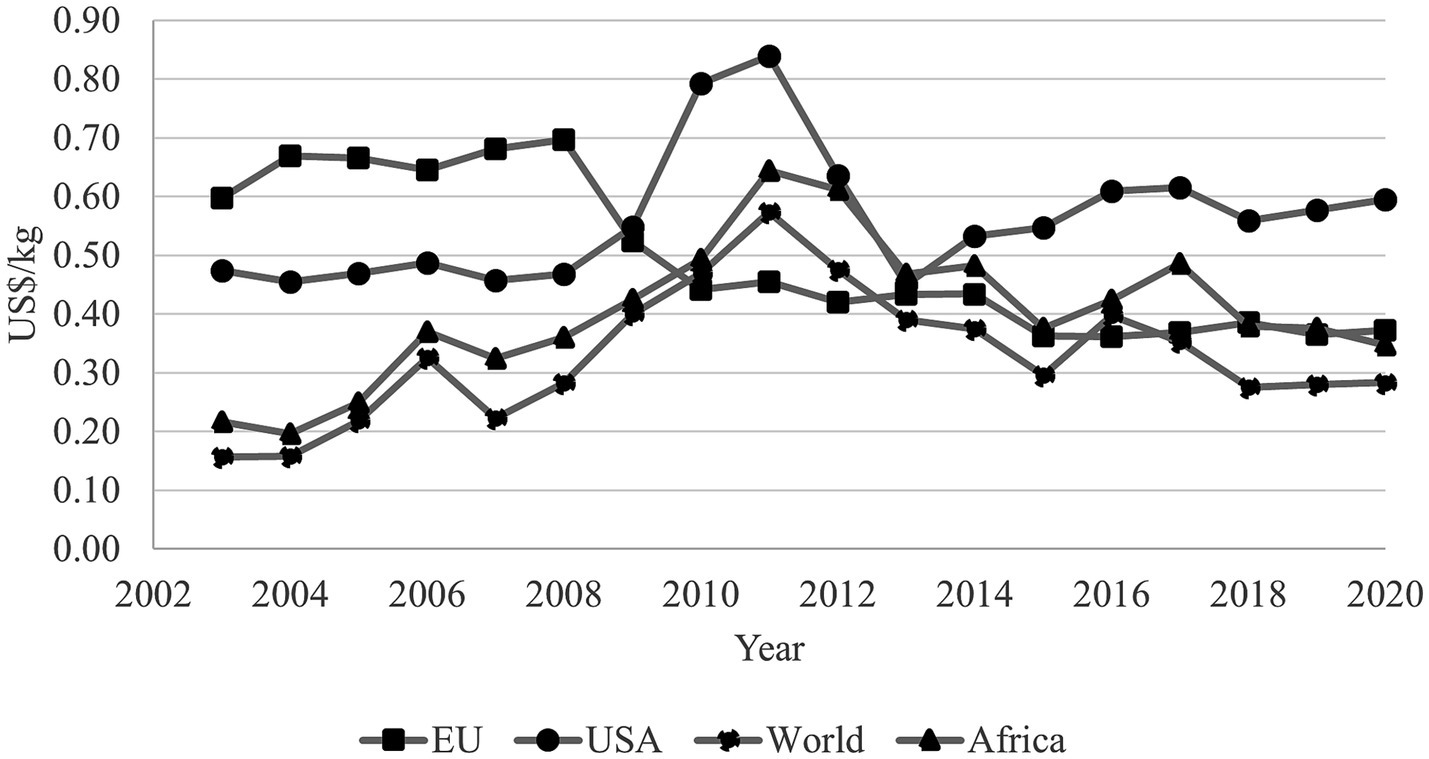

The development of the sugar industry on the global market has been shaped by key factors such as fluctuations in oil prices, geopolitical tensions, growth of alternative energy sources, significant economic growth of some Asian countries and emergence of Brazil as major sugar player on the international market (Pop et al., 2013; Galović and Bezić, 2019). The emergence of Brazil as a major sugar producing country and its trade-off between raw sugar production and biofuels has had ramifications on the global sugar supply and prices (FAO, 2005; Helia, 2022). The sugar market is one of the most distorted and heavily regulated markets worldwide (OECD, 2007; Das Nair et al., 2017; Anderson, 2023). The market for sugar is almost universally subject to some form of regulation and distortionary trade policies such as production quotas, subsidies, export quotas, export refunds and import restrictions (Paha et al., 2021). Some countries or regions, like the EU and Thailand, are in the process or have enacted legislation to deregulate the sugar industry (Helia, 2022). Sugar import prices in the EU have gradually been reducing and seem to be following the same trajectory as the prices on the African continent but still remain above the world prices as can be seen in Figure 1. Consumer prices for sugar in the EU have also since decreased to less than 10% above global market prices (Paha et al., 2021; OECD, 2022).

In view of the recent dynamics and developments in the sugar industry highlighted above over the last few decades, scholars have developed keen interest to understand the competitiveness of African sugar exports, especially given the current distortions of sugar prices on the world market, liberalization and globalization of international agricultural trade. This is particularly intriguing because, in contrast to developed nations that often maintain high levels of protectionism and subsidies for their own agricultural sectors, developing nations support the liberalization of the agricultural market and a reduction in protectionism to boost production and expand their market base (Nugroho and Lakner, 2022). At the same time, globalization and market liberalization has exposed African countries to a number of external shocks such as financial crises, the COVID-19 pandemic and the Ukraine-Russia war, which may affect the competitiveness of their sugar exports (Nugroho et al., 2022). It is, therefore, imperative that African countries sustain their competitiveness to withstand external shocks, given the substantial prospects that the sugar industry plays in foreign exchange earnings, contribution to Gross Domestic Product (GDP) and the cascading positive effects such as food security, job creation, and poverty reduction, particularly in economically disadvantaged and isolated rural regions (Pawlak and Kołodziejczak, 2020). The sugar industry also possesses the capacity to generate environmentally- friendly energy for selling to the national power grids and produce ethanol for blending with gasoline, thereby reducing the need for foreign fuel imports, or increasing export earnings (Innes, 2010).

Several studies have been conducted to assess the competitiveness of Africa’s sugar competitiveness at a global scale, but the analysis was mainly done at country level making it difficult to assess cross country or intra-regional competitiveness. To the best of the authors’ knowledge, there is no comprehensive study that has been conducted to analyze the competitiveness of sugar exports for all African countries at regional or global level. Chisanga et al. (2014) found that preferential access to European markets distorts the possibility of intra-regional trade in sugar between nations like Zambia and South Africa, which are low cost net exporters of sugar. Chisanga et al. (2014) further notes that some of the large milling sugar companies have leveraged a favorable regulatory environment which has resulted in exerting some level of market power and maximizing returns for their global shareholders.

Das Nair et al. (2017) found that not only do some African countries, particularly South Africa and Zambia, have comparative advantage in sugar production, the countries in question also have competitive advantage in sugar trade on the international market. Recently, Seleka and Dlamini (2020) conducted a comprehensive analysis of ACP sugar exporters which included 11 African countries. The study found out that countries like Côte d’Ivoire, Kenya, Madagascar, Malawi, Tanzania, Uganda, and Zambia have marginally moved from a state of extreme comparative disadvantage between the early 1960s and 1970s to comparative advantage in the 2010s. Structural shifts in comparative advantage that took place after the Lomé Convention went into effect helped to drive the improved performance. On the other hand, countries like Congo, Mauritius, Eswatini, and Zimbabwe have experienced a slight deterioration in comparative advantage during the same period. Using aggregated agricultural exports, Odjo and Badiane (2018) found that while the majority of commodities saw increases in competitiveness on international markets during the reference period, the analysis of Africa’s competitiveness at the commodity level showed that some important products recorded significant losses.

Quantifying comparative advantages is a crucial aspect of trade policy (Costinot et al., 2012). A number of studies have used market share indices such as the Export Concentration Index and the Hirschman Herfindahl Index to measure competitiveness (Odjo and Badiane, 2018; Sheetal et al., 2020; Bouët et al., 2021). The use of market share does not give a true picture of shifts in competitive advantage because it only focuses on the relative size of a country within its industry. Therefore, relying solely on market share can lead to an incomplete understanding of the dynamics within a competitive landscape. Augmented and improved versions of Balassa’s (1965) index, despite its inherent weaknesses, remain a benchmark in empirical literature as they allow for cross country analysis, ordinal ranking of countries and shifts in comparative advantage overtime (Yu et al., 2009; Liu and Gao, 2019; Danna-Buitrago and Stellian, 2021; Stellian and Danna-Buitrago, 2022b).

The distinctive features and contribution of this study to literature are three-fold. First, there is a dearth of empirical evidence on product-specific competitiveness as most studies have focused on overall trade competitiveness of a country or a specific sector (Odjo and Badiane, 2018; Bouët et al., 2021). Sugar is one of the most consumed, sensitive, volatile and protected commodity in international trade (SADC, 2011; Viljoen, 2014; Sandrey et al., 2018; Mpapalika, 2019). Second, we recognize that this research area has been thoroughly examined at the regional level. Past research has focused on effects of EU sugar reforms on development in Africa (Gotor and Tsigas, 2011; Chisanga et al., 2014; Paha et al., 2021) and competitiveness of African sugar exporting countries that are members of regional trade agreements with the EU, USA and other developed countries (Innes, 2010; Seleka and Dlamini, 2020; Simelane, 2021). The novelty of this study is that it assesses the competitiveness of all sugar exporting countries from the African continent, including intra-regional competitiveness. Third, this study also analyses how competitiveness of the sugar exports has evolved over time, including the shifts in competitiveness across different countries using the NRCA index, which addresses the drawbacks of Balassa’s index. Against this backdrop, the objective of this paper is to assess the patterns, trends and changes in inter and intra-regional competitiveness of African sugar exports.

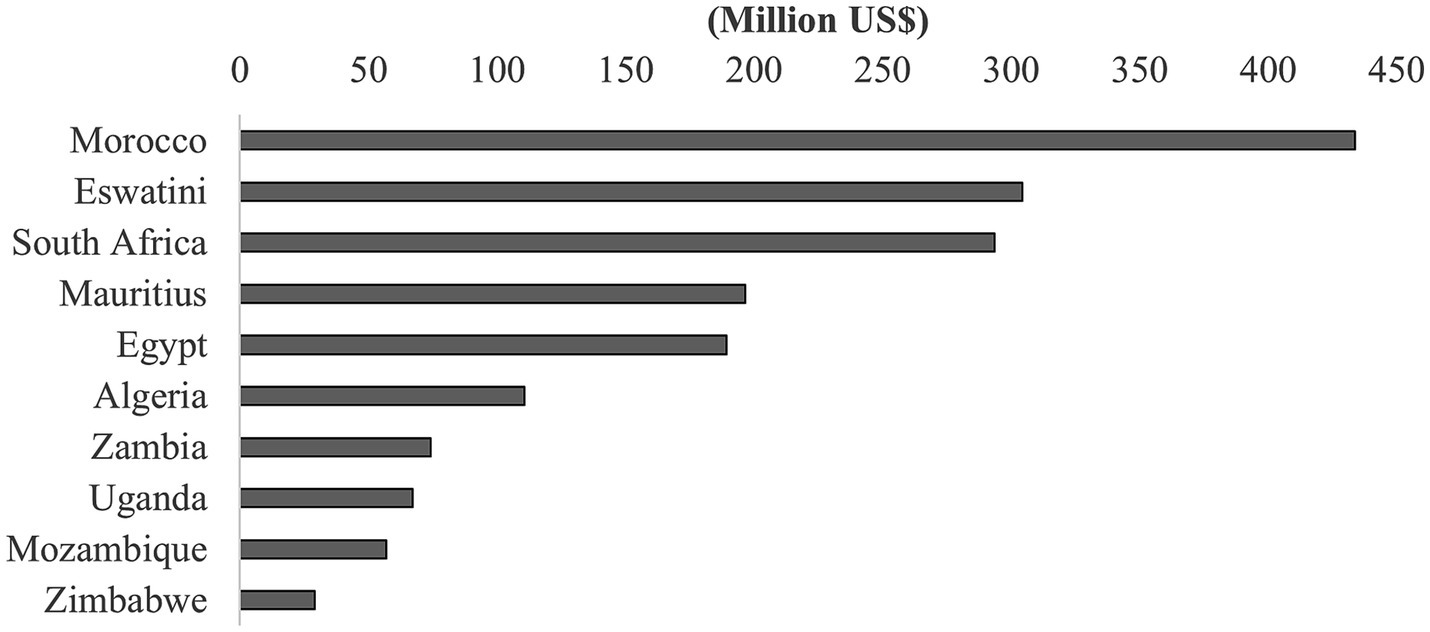

2 Overview of Africa’s sugar exports

Africa has experienced growth in sugar production, with several nations becoming major players on the world sugar market. The continent’s tropical and sub-tropical climatic conditions coupled with availability of arable land make it ideal for growing sugar cane and sugar beet. Several African countries are actively engaged in sugar exports, seeking to capitalize on the international demand for this essential commodity. Some of the major sugar-exporting nations in Africa in 2022 were Morocco, Eswatini, South Africa, Mauritius and Egypt. Figure 2 shows Africa’s top ten leading sugar exporting countries in 2022 by export value.

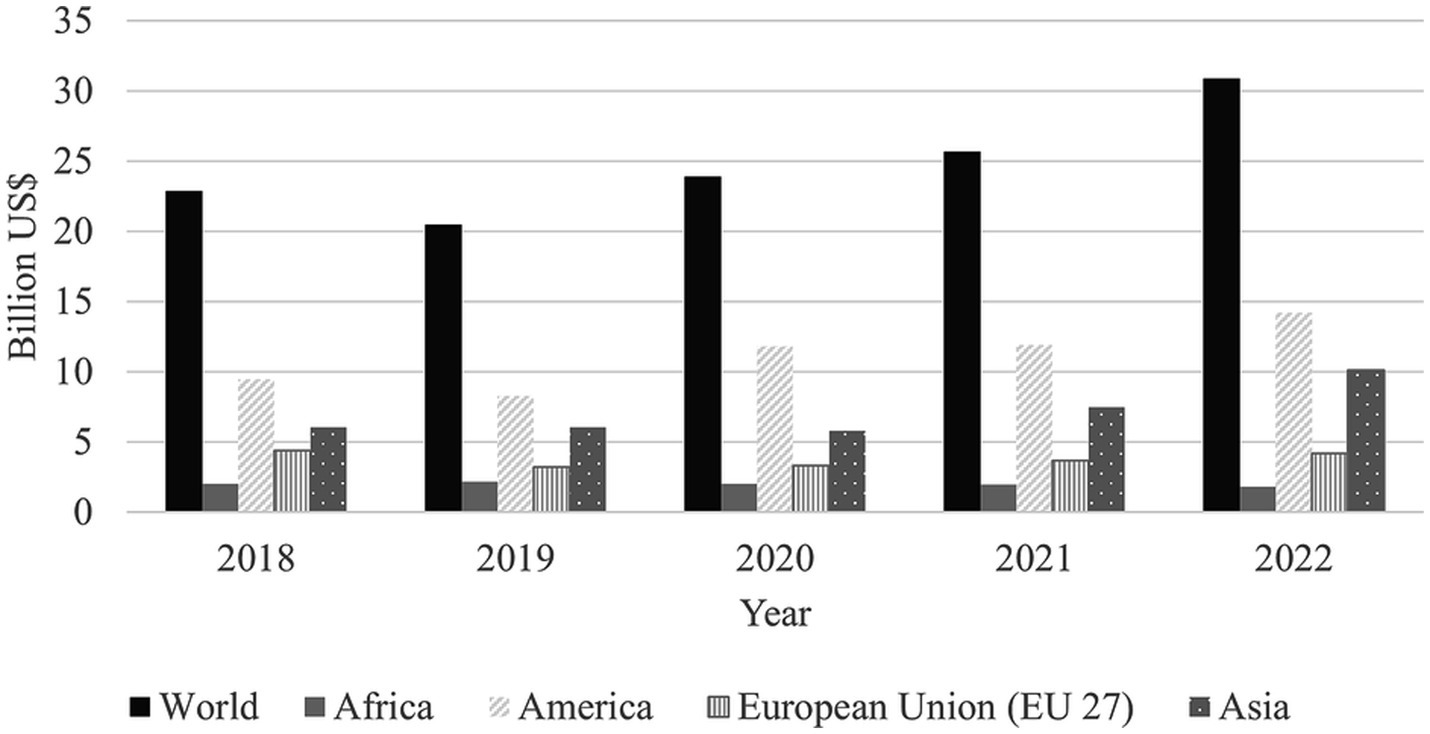

Sugarcane production is highly correlated with sugar exports. Countries that produce more sugarcane tend to export more. Countries with high sugarcane production have a surplus of sugar, leading to increased exports in order to meet global demand. Major sugarcane producing regions such as the Americas and Asia consistently stand out as leading sugar exporters on the world market. While Africa’s share of global sugarcane production has averaged about 5% (Mabeta and Smutka, 2023; Thibane et al., 2023), its contribution to global sugar exports has been slightly higher. Between 2018 and 2022, Africa accounted for about 8% of global sugar exports, the lowest among the four regions (Figure 3). However, Africa has the potential to increase its global share of sugar exports under existing various trade agreements, particularly with the EU.

Historically, the European Union has been the primary export market for African sugar, providing favorable conditions for sugar exports. These trade relationships were largely influenced by the former colonial ties that existed between European and African nations. African sugar exporters were beneficiaries of the protected sugar industry in the EU through the African, the Caribbean, and the Pacific Group (ACP)-EU partnership which allowed even the less efficient and uncompetitive African countries to realize gains from their exports (Seleka and Dlamini, 2020). After decades of heavy producer subsidies and price support that culminated in domestic prices that were well above the world price (FAO, 2005), the EU has since liberalized the sugar industry in a process that commenced in 2006 and was finalized in 2017 (Seleka and Dlamini, 2020; Paha et al., 2021). The EU sugar reforms resulted in increased supply of EU sugar on the world market, reduced imports from Africa and a decline in sugar prices within the EU (Seleka and Dlamini, 2020; Paha et al., 2021; OECD, 2022). Sugar production in the EU increased by approximately 21% in 2017 (FAOSTAT FAO, 2023), although it took a downturn in the subsequent years owing to unfavorable weather conditions and the impact of the COVID-19 pandemic (European Commission, 2019). The EU reforms coincided with a decline in African sugar exports to the EU in 2018. However, the share increased in subsequent years, albeit fluctuating and ranging between 13 and 17% between 2019 and 2022.

Nevertheless, shifting global dynamics and preferences have prompted African sugar exporters to look into alternative markets and expand beyond traditional markets to embrace new opportunities in diverse regions around the world. This diversification strategy has proved successful, opening up new markets in different parts of the world. For instance, Asian countries are emerging to be significant importers of African sugar. African sugar imports from countries like India, Indonesia, and Pakistan have surged recently. African exporters now have a lucrative market owing to Asian countries’ growing incomes, populations and changing dietary preferences (Pingali, 2007; Pradhananga and Naval, 2021). Between 2018 and 2022, the share of African sugar exports to Asian countries has averaged 22%, surpassing exports to the EU (Figure 4).

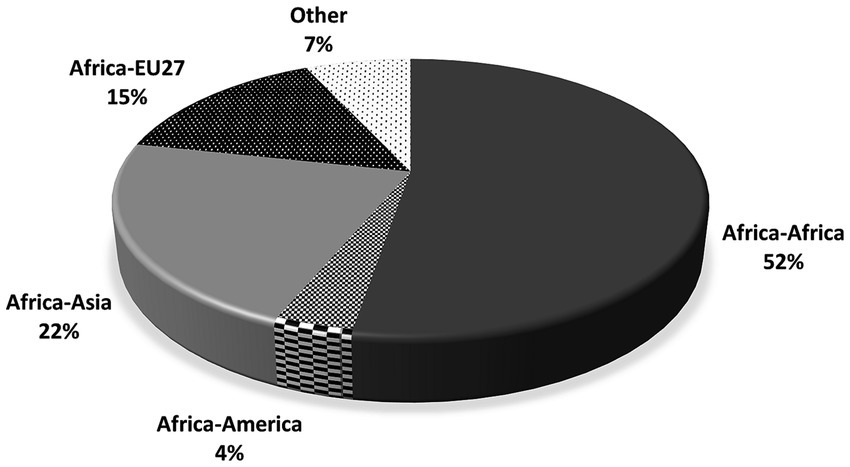

The emergence of intra-regional trade is one of the notable trends in African sugar exports. As urbanization and population growth continue to drive consumption, the continent has witnessed an increase in sugar demand within its own nations (Masters et al., 2013; Staatz and Hollinger, 2016). As a result, regional trade agreements and economic groups like the Southern African Development Community (SADC), East African Community (EAC), Economic Community of West African States (ECOWAS) and the Common Market for Eastern and Southern Africa (COMESA) have been instrumental in fostering this expansion of intra-regional sugar trade. The lion’s share of African sugar exports is traded intra-regionally (Figure 4), albeit within the regional trading blocs while trade across various regions is low to prohibitively high tariff and nontariff barriers. These barriers impede the growth of inter-regional sugar trade in Africa. Nevertheless, ongoing efforts are aimed at reducing these barriers and minimize unit costs via economies of scale to foster greater trade integration among African nations through the African Continental Free Trade Area (AfCFTA). The AfCFTA has the potential to enhance FDI in Africa through the reduction of trade barriers, the harmonization of regulatory requirements, and the creation of new investment avenues spanning various sectors to take advantage of an expanded market (Gunasekera et al., 2015; Morgan, 2022). The ongoing transition towards higher-value consumer goods in intra-African agricultural trade offers opportunities for investors to meet the burgeoning demand within Africa. AfCFTA is projected to increase food exports by a $2.5 billion, thereby fostering the deepening of agri-food value chains and contributing to the improvement of agricultural trade (Morgan, 2022).

3 Theory and literature review

Competitiveness of commodities on the international market is a multifaceted and multidimensional concept that is widely studied in economics, international trade, and business. While the definition of this concept is clear as it relates to a company, there is no universally accepted definition as it applies to a nation (OECD, 2010). Competitiveness is usually confused with comparative advantage and in most cases, the two are used interchangeably. However, the two terms are inextricably linked, particularly in international trade. Comparative advantage in international trade can be defined in terms of a country having lower equilibrium factor prices than an international competitor regardless of the source of cost advantage such as abundance of inputs (Heckscher-Ohlin Theory) and availability of technology (Ricardo’s Theory) (Siggel, 2006). This implies that nations exhibit relative competitiveness in the production of goods and services for which they possess a cost advantage. Bojnec and Fertő (2012) posit that relative comparative trade advantage encapsulates the enduring structural characteristics of both the sector and the economy, emphasizing long-term stability by centering on product-specific disparities within a country and being subject to macroeconomic variables. In contrast, competitive advantage experiences short-term fluctuations influenced by sector-specific factors, macroeconomic forces, and market and policy distortions. However, in the context of agro-food trade, trade advantage and trade competitiveness measures are interconnected and complementary, playing crucial roles in shaping a country’s position in the global agricultural and food markets. They work together to provide global market access by ensuring that products meet the standards and preferences of international consumers.

The notion of competitive advantage has been defined differently by various authors. One of the widely used modern definitions can be traced from the seminal work of Porter (1990). According to Porter’s Diamond Model, competitive advantage is a company’s ability to produce goods or services faster, more efficiently, or more affordably than its competitors. Porter’s idea of competitive advantage emphasizes the significance of recognizing and utilizing distinctive strengths and resources that differentiate a company from its rivals. Companies can do this to develop a long-lasting competitive advantage that propels profitability and market success. The importance of elements like innovation, technology, branding, customer loyalty, and operational efficiency in achieving long-term business growth is underscored by this understanding. This definition, however, only holds at company level.

Porter (1990) argues, using empirical analysis of selected developed and industrialized countries, that competitive advantage is much more than having a favorable macroeconomic environment in terms of exchange rates, interest rates, cheap and abundant labor or in terms of deliberate government policies that protect the local industries and provide subsidies. At a country level, Porter (1990) posits that productivity serves as the main determinant of international competitiveness and that raising it through constantly upgrading and innovation could consequently raise citizens’ standards of living. This is because producers can create more goods and services using the same amount of resources, increasing output and fostering economic prosperity. A country’s competitiveness in the global market can be further boosted by innovation and technological advancements, which can result in increased productivity. Porter’s view is supported by the Ricardian model which predicts that nations should produce and export proportionally more in sectors where they are more productive (Costinot et al., 2012).

Subsequent definitions have underpinnings on Porter’s theory. The Global Competitiveness Report (2020) of the World Economic Forum (WEF) reaffirms Porter’s definition by describing competitiveness in terms of a broad range of factors that raise productivity such as technological developments, among others. Similarly, Lundvall (2010) argues that a nation’s capacity for innovation and the creation of interactive learning systems is directly related to its level of competitiveness. Sugar, as a globally traded commodity, is fueled by production volumes (economy of scale) and low unit costs by profitably converting inputs to outputs (Simelane, 2021). In this regard, several studies in agricultural economic literature have described competitiveness as the capacity of an industry to attract investment and other limited resources by selling goods on the global market, while determined to earn opportunity cost of resources, in an effort to draw in choice and opportunity, while striving to offset the opportunity cost of resources (Esterhuizen et al., 2008; Van Rooyen and Esterhuizen, 2012; Boonzaaier, 2015).

From the various definitions highlighted above, it can be deduced that the concept of competitiveness of commodities on the international market entails a country’s ability to successfully sell and export their goods to foreign markets while maintaining an advantage over other competitors. It is an essential component of international trade as it has a direct impact on the economic growth, employment creation, and general prosperity of a nation. It involves a wide range of factors that influence a commodity’s marketability and attractiveness on a global scale. Competitiveness is crucial for countries looking to export their products and achieve favorable trade balances. It’s important to note that competitiveness is not static and can change over time. The competitiveness of commodities can be impacted by variables like shifts in global demand, improvements in infrastructure and technology, shifts in consumer preferences, movements in exchange rates (Siggel, 2006; Delgado et al., 2012), processing costs (Onyango et al., 2018) and low wages of African countries compared to developed countries (Wamboye and Fayissa, 2022). Srivastava et al. (2006) and Ndlangamandla (2016) found that the exchange rate, particularly the depreciation of domestic currencies significantly affect the competitiveness of the sugar industries of South Africa and Swaziland, respectively. Further, differences in climate, the availability of arable agricultural land and population may all play a role in comparative advantage in the production of agricultural commodities (FAO, 2010). Together, these elements play a significant role in determining trade flows across nations and regions. For instance, most African countries have a potential to enhance their competitiveness on the international market given their favorable climatic conditions for growing sugar and availability of land and other natural resources (Hess et al., 2016).

Additionally, trade barriers, changes in government policies and regulations that enhance productivity can also significantly affect the competitiveness of commodities on the international market (Srivastava et al., 2006; Nyanzunda, 2012; Bouët et al., 2021). These factors can create opportunities or challenges for industries and countries to maintain or improve their comparative advantage in the global market. These factors can lead to changes in the comparative advantage of countries and affect their trade patterns. Access to modern agricultural technologies, irrigation systems, and mechanization can enhance productivity and reduce production costs, thereby contributing to comparative advantage (Peng et al., 2022; Daum, 2023). Empirical evidence suggests that such technological spillovers are a commonplace for countries that attract FDI and may improve export performance (Ayenew, 2022; Chih et al., 2022). This explains why several African countries have formulated policies to attract foreign direct investment and stimulate their exports. Some of the policy measures include provision of fiscal incentives and establishment of special economic zones (SEZs) (Malikane and Chitambara, 2017; UNCTAD, 2021).

The increase in FDI due to deliberate policy interventions has coincided with a positive and upward trajectory in the performance of the agriculture sector, including sugar production. As noted by Ngcobo and Jewitt (2017), this can be attributed to inflows of FDI and its role in technological spillovers, increased investment in infrastructure and adoption of efficient methods of production, which in turn can enhance a country’s competitiveness in the sugar export market. This observation is also supported by Nyanzunda (2012) who further opines that that technological advancements that come with FDI increase productivity, enhance access to markets with high returns and play a pivotal role in determining the competitiveness of the sugar industry. Sugar production is a capital-intensive business venture that needs investments to maintain a given level of competitiveness (Galović and Bezić, 2019). Therefore, due to the high capital requirements involved, investments are necessary to modernize equipment, improve infrastructure, and implement advanced technologies that can enhance productivity and efficiency in the industry. Based on the perceived critical role of FDI in the growth and competitiveness of the sugar industry, it is, therefore, expected that countries that have attracted higher FDI inflows are more competitive in sugar exports compared to those countries with low FDI inflows in the sugar industry. By analyzing the relationship between FDI inflows and sugar exports, we can gain insights into the potential impact of foreign investment on a country’s sugar industry.

4 Methodology

4.1 Methods of analysis

The method used to measure competitiveness in a given country is contingent on whether it is done at the product, firm, sector, or overall economic level. The variety of the competitiveness term has led to a wide range of economics measurements being used by various studies. Multiple techniques and indices have been used to investigate competitive advantages as a result of the various ways in which authors have defined the term to guide the findings of their research as enunciated in section 2 above. Some of the widely used indices include the Revealed Comparative Advantage (RCA) Indexes, the Hirschman–Herfindahl Index and the Domestic Resource Cost (DRC), among others. Since Balassa’s seminal paper in 1965, RCA indexes have typically been used to measure competitive advantages. The Balassa’s Index can be expressed as:

Where shows exports of commodity j for country i, represents world exports of commodity j, indicates the total exports of all commodities from country, represents the export of all goods by all countries (Yu et al., 2009; Seleka and Dlamini, 2020). The Balassa’s index in Eq. 1 expresses a country’s market share in the export market for a commodity with its market share in the world market. If is such that (1, ], then country i has a comparative advantage in commodity j while if [0, 1) then country i has a comparative disadvantage in the commodity in question. On the other hand, a value equal to 1 shows that country i neither has comparative advantage nor comparative disadvantage in that particular commodity (Stellian and Danna-Buitrago, 2022b).

However, Balassa’s RCA Index has inherent weaknesses that have been advanced by several studies (Yu et al., 2009; Seleka and Dlamini, 2020; Stellian and Danna-Buitrago, 2022a,b). First, the index is asymmetric given that the lower bound [0, 1) and upper bound (1, ] are not of the same length. Second, the index suffers from small country bias such that a nation may display high values of the index despite having a relatively small share of total exports. Third, the index is not additive across products and countries, which may affect the measurement of comparative advantages. Due to these drawbacks, it is difficult to compare RCA values directly between various products or industries, as the scale and size of industries can vary significantly.

Arising from the weaknesses of Balassa’s Index, several RCAs have emerged to address some inherent weaknesses of Balassa’s index. However, there is still no universally accepted or superior index to measure comparative advantage (Liu and Gao, 2019; Stellian and Danna-Buitrago, 2022b). Stellian and Danna-Buitrago (2022a,b) argue that any RCA index despite being robust and having no weaknesses, is not a one-size-fits-all measure of comparative advantage and may yield incongruent outcomes depending on the countries, time periods and products it is applied on. This study adopts the Normalized Revealed Comparative Advantage (NRCA) index following Yu et al. (2009) and Seleka and Dlamini (2020). The computation of other types of indices is beyond the ambits of this study. The NRCA is a better indicator of comparative advantage by measuring the degree to which a country’s actual exports deviates from its comparative-advantage-neutral level in terms of its relative scale with respect to the global export market (Yu et al., 2009). The comparative-advantage-neutral level is defined as:

Eq. 2 shows that country i’s ratio of its sugar exports ( ) to total world sugar exports must equal country i’s ratio of total agricultural exports ( ) to the world’s total agricultural exports ( ). By making the subject in (2), the deviation of country i from its comparative-advantage-neutral level of exports would be given by:

Multiplying the comparative-advantage-neutral exports ( ) by the reciprocal of the world’s total agricultural exports ( ) would yield the NRCA index for country i’s sugar exports given by:

While the distribution of the NRCA index remains highly non-Gaussian (Deb and Sengupta, 2017; Liu and Gao, 2019) show that the derived NRCA index ranges is now symmetrical and ranges from −0.25 to +0.25, has a stable mean of 0 but is nonzero even if exports are naught. This implies that the summation of the NRCA score for a commodity and across all nations is zero as shown in Eqs 5, 6 below respectively:

The desirable properties of the NRCA index as encapsulated in Eqs 5, 6 entail that there is a trade-off in comparative advantage over a commodity and across countries. If one country gains a comparative advantage in a given good, then some other countries must lose a similar advantage in that same good (Yu et al., 2009). The converse is also true. The derived NRCA also has an additive property unlike the Balassa’s index. This means a region’s comparative advantage in producing a commodity can simply be measured by aggregating the individual member countries’ comparative advantage in producing the same commodity. These properties also allow for comparability of the NRCA indices over time within and across different countries to determine changes or shifts in comparative advantage (Yu et al., 2009). Positive NRCA values signify a state of comparative advantage, while negative values indicate comparative disadvantage.

It is imperative to test how the computed indices evolve over time. In this regard, trend stationarity analysis of the NRCA is carried out to test stability and structural changes in the competitive patterns of sugar exports. Trend stationarity describes how these indices behave over time in terms of stability of the mean and variance. A time series of the NRCA index is said to be trend stationary if it displays a steady and predictable pattern over time (Stellian and Danna-Buitrago, 2022a). To assess the changes in comparative advantage overtime, we estimate a model proposed by Dalum et al. (1998) and Danna-Buitrago and Stellian (2021). The model tests for stationarity using Harris-Tzavalis panel-data unit-root test and is specified as follows:

Where is the value of the RCA index corresponding to country i at time t, is the intercept unique to each country and is the error term. If | | is less than 1, then the null hypothesis of non-stationarity is rejected and therefore the NRCA index does exhibit short term deviations and finite variance around the time-invariant mean (Danna-Buitrago and Stellian, 2021). The Harris-Tzavalis panel-data unit-root test described above does not tell us the extent of time stationarity. We, therefore, compute the standard deviation to determine the magnitude of time stationarity of the country-specific NRCA indices.

4.2 Data

Different sources of data are used in this study. Data on sugar exports were extracted from the International Trade Centre (ITC) and United Nations’ Comtrade (UN COMTRADE) database statistics at the four-digit levels of the Harmonized System (HS) nomenclature in order to compare various sugar economies. Data at the four-digit HS 1701 (Cane or beet sugar and chemically pure sucrose, in solid form) aggregates the following subgroups; 170,111- Raw cane sugar (excluding added flavoring or coloring), 170,112-Raw beet sugar (excluding added flavoring or coloring), 170,113- Raw cane sugar (in solid form, not containing added flavoring or coloring matter, obtained without centrifugation, with sucrose content 69° to 93°, containing only natural anhedral microcrystals, 170,114- Cane sugar, raw, in solid form, other than as specified under 170,113, 170,191-Refined cane or beet sugar, containing added flavoring or coloring, in solid form, 170,199-Sucrose, chemically pure, in solid form, not containing added flavoring or coloring matter (UN Comtrade, 2023). Due to non-availability of data for some African countries, the NRCA indices are only computed for 34 African countries for each year from 2001 to 2021, five of which feature among the World’s top 20 major sugar exporters. These are Morocco, Eswatini, South Africa, Mauritius and Egypt. Country level, regional and world agricultural exports data are taken from the Food and Agriculture Organization (FAO) of the UN. The analysis also covers 10 major sugar exporting countries to gauge how African countries fare against these competitors on the world market. Based on 2022 UN Comtrade database, these countries include Brazil, India, Thailand, France, Germany, Mexico, Guatemala, Netherlands, Belgium and Poland. The regional analysis is based on the United Nations M49 classification widely used by FAO.

5 Results and discussion

5.1 Results

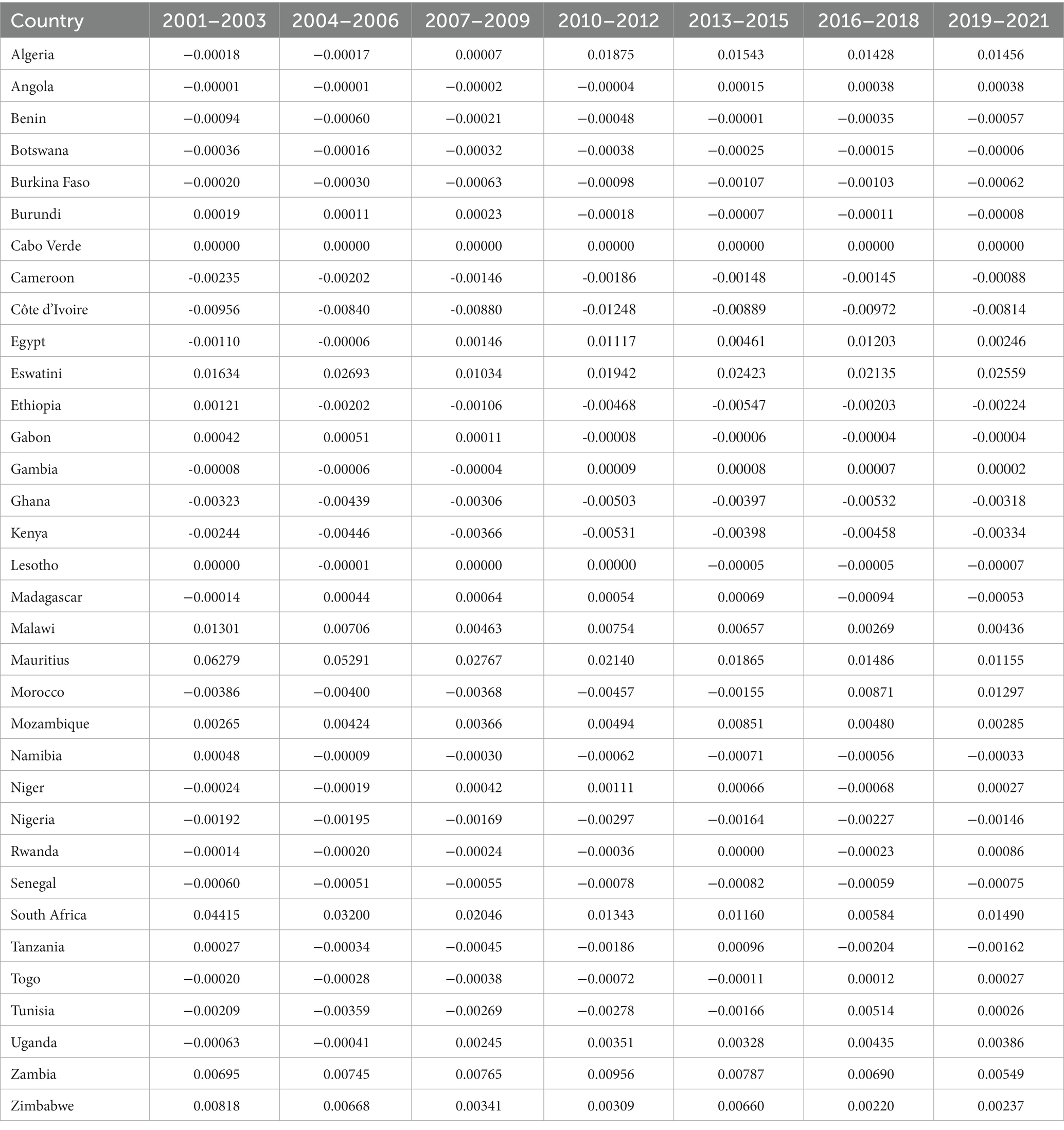

5.1.1 Patterns and trends in sugar exports

We, similarly to Seleka and Dlamini (2020) and Sheetal et al. (2020), use three-year averages for ease of interpretation and to smooth out random fluctuations making it easier to identify trends and patterns in the data. The three-year averages of NRCA indices between 2001 and 2021 are summarized in Table 1. Based on the positive NRCA indices, at the beginning of 2001, only 14 African countries had comparative advantage in sugar exports. These include Mauritius, South Africa, Eswatini, Malawi, Zimbabwe, Zambia, Mozambique, Ethiopia, Namibia, Gabon, Tanzania, Burundi, Cabo Verde and Lesotho. By the end of 2021, the number of sugar-exporting African countries with comparative advantage increased to 17. This expansion in the number of African countries with a competitive edge in sugar exports demonstrates the growing potential and competitiveness of the sugar industry across the continent. Almost 50% of the countries with competitive advantage are from the Southern Africa region, led by the traditional major exporters; Eswatini and South Africa. These countries have established strong industries and infrastructure, allowing them to efficiently produce and export goods. Additionally, their strategic geographical location provides easy access to international markets, further enhancing their competitive advantage.

While a number of African countries have experienced a positive trajectory in sugar production, changing climate patterns have continued to pose threats to the reliable supply of sugar, particularly for nations whose agriculture is dependent on rainfall. Sugarcane and sugar production in Africa has been interspersed with protracted droughts as several countries and regions have grappled with effects of climate change in the recent past (Masih et al., 2014). These droughts not only affect the quantity and quality of water available for irrigation, but also lead to reduced yields and crop failure, impacting the livelihoods of small-scale farmers that produce sugarcane under outgrower schemes (von Maltitz et al., 2019) and poses a significant risk to the overall competitiveness of African sugar exports. Hence, irrigation is indispensable to sugar producing African countries to ensure the sustainability of yields, and land productivity to minimize the effects of climate change (Nugroho et al., 2022).

In the context of the Harris-Tzavalis unit-root test, Rho represents the coefficient of the lagged level term (the lagged value of the dependent variable). A value of Rho close to 1 indicates a strong unit root effect, suggesting that the panel dataset is non-stationary. In this case, a positive value of Rho indicates a stochastic trend, while a negative value would imply a decreasing trend. On the other hand, Z statistic is a measure of how many standard deviations the estimated 𝜌 value deviates from the hypothesized null value. These test statistics are used to assess the significance of the unit-root test by comparing against critical values. The null hypothesis of a unit root is rejected by the negative value of the Z statistic, which indicates that Rho is significantly different from zero.

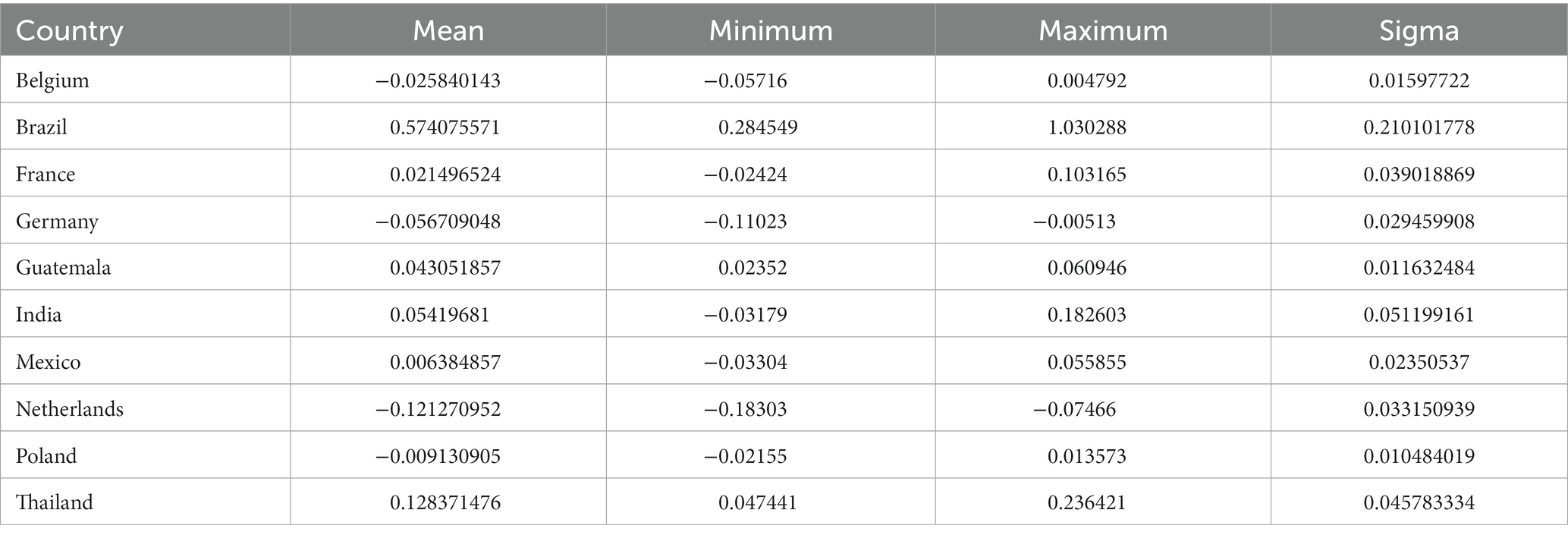

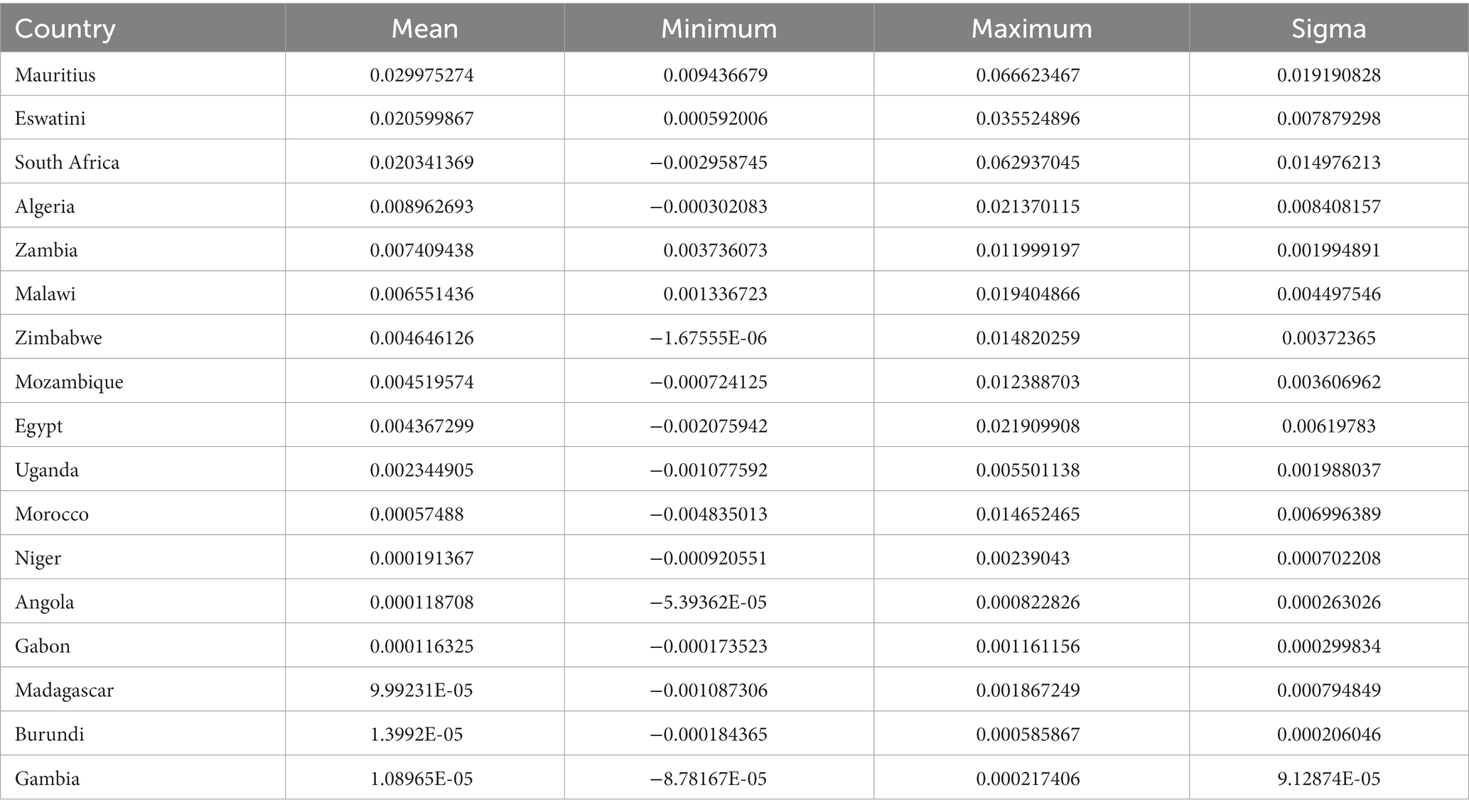

The Harris-Tzavalis panel unit root estimation of Eq. 6 yields a Rho (𝜌) value of 0.6952 and a Z statistic of −6.9458. These results indicate that overall, there has been a stable trend in competitiveness of sugar exports of African countries. The estimated results suggest that the null hypothesis is rejected in favor of the alternative hypothesis providing strong evidence against the presence of a unit root and therefore the NRCA index converges toward its long-term value. Summary statistics for the African countries with competitive advantage in sugar exports presented in Table 2 corroborate the Harris-Tzavalis panel unit root estimation results that indeed the NRCA indices are trend stationary. The low standard deviations confirm the low variability of the NRCA indices among the African countries. The descriptive statistics for the other African countries with uncompetitive sugar exports on the world market are shown in Appendix Table A1.

Table 2. Descriptive statistical analysis of NRCA indices for the most competitive African sugar exporters from 2001 to 2021.

When compared to the major sugar exporters on the world market, Table 3 shows that some African sugar exporting countries are more competitive than Belgium, Germany, Netherlands, and Poland whose exports have remained uncompetitive on average between 2001 and 2021. Among the top 10 sugar exporters on the world market from the EU, only France has competitive advantage in sugar exports. Asia’s leading sugar exporting countries (Thailand and India) and the Americas’ top exporters (Guatemala, Mexico, and Brazil) remain competitive on the world market. The detailed trends in the mean NRCA scores for the world’s top 10 sugar exporting countries are shown in Appendix Table A2.

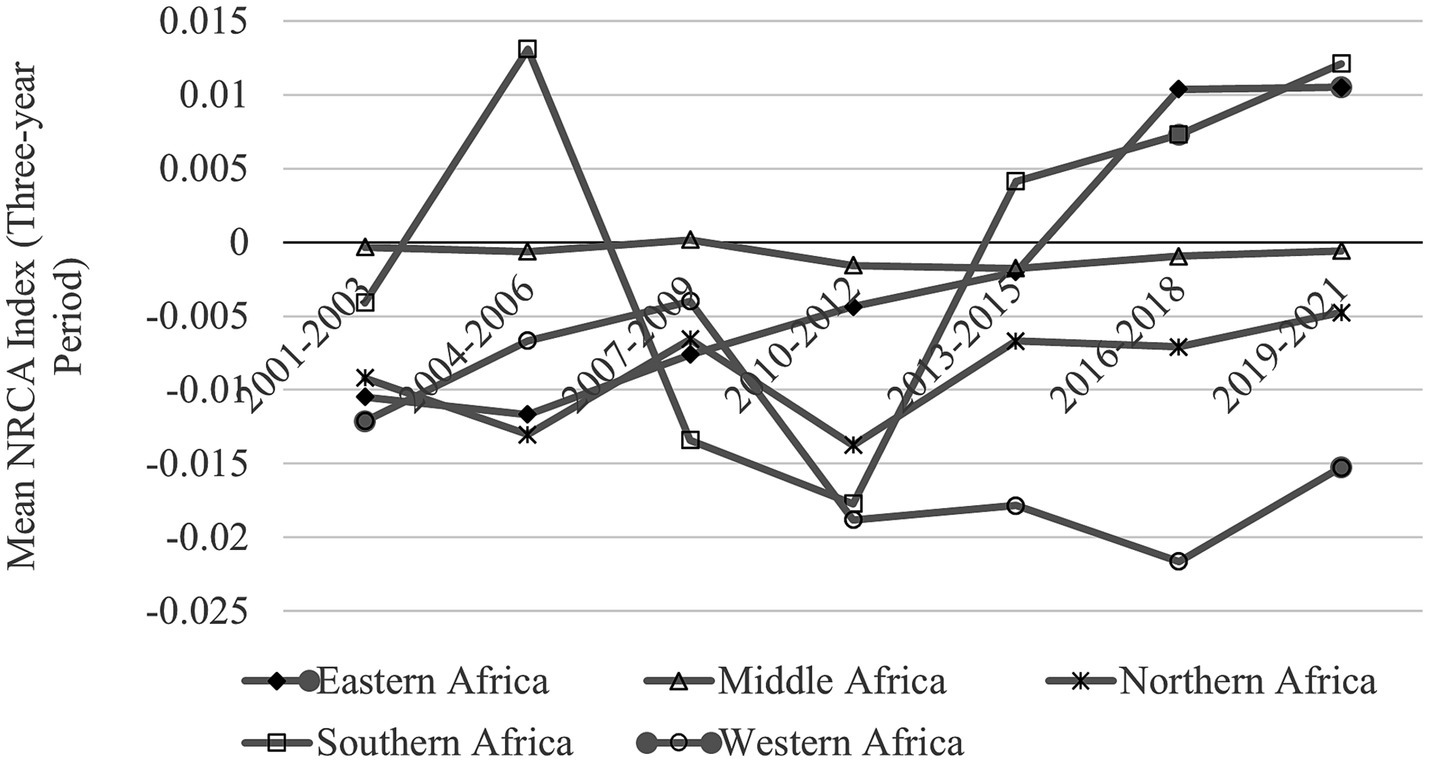

Intra-regional sugar export competitiveness

As pointed out earlier, one of the NRCA index’s strong point lies in its ability to enable a comparative analysis of competitiveness across commodities, nations, and time. In this regard, the NRCA index offers an effective tool for quantitative regional analysis, particularly for research on comparative advantage at regional level. Generally, sugar exports from the southern and eastern African regions have been more competitive compared to other regions, which largely remained uncompetitive between 2001 and 2021 (Figure 5). However, between 2006 and 2015, intra-regional exports from eastern and southern Africa regions dipped and became uncompetitive, like the other three regions. After 2015, exports from the eastern and southern Africa regions did rebound from their uncompetitive positions and have continued to exhibit an upward trajectory in their competitiveness.

6 Discussion

The computed NRCA indices and the Harris-Tzavalis panel unit root estimation reveal salient features about sugar trade and its competitiveness. Overall, the competitiveness of African sugar exports has exhibited a stable trajectory. Of the 34 African countries that formed part of the analysis in this study, 17 were found to be competitive on the world market by the end of 2021. However, the findings of this study reveal contrasting trends and shifts in comparative advantage among the African sugar exporters. African countries have experienced various degrees of competitiveness in sugar exports over the past few decades.

The North African countries of Morocco, Algeria and Egypt have emerged from a position of comparative disadvantage between 2001 and 2003 to being competitive by the end of 2021 owing to government subsidies, pricing strategy and heavy investments in the sugar industry, including establishment of some of the world’s largest sugar factories (Sandrey et al., 2018; Arezki et al., 2019). In this regard, FDI inflows have contributed to the gain in comparative advantage of North African countries. The United Arab Emirates (UAE) has accounted for the largest share of FDI inflows with over $2 billion invested in the sugar industry between 2016 and 2020 (Morgan, 2022). However, domestic production is still unable to meet consumption demand (Hassan, 2008). Exports of North African countries are mainly driven by importing raw sugar and re-exporting on the world market and to other African countries (Sandrey et al., 2018). Therefore, these countries, despite gaining competitive advantage, turn out not to be as competitive as the rest of the other African countries. Other African countries that have experienced a similar path as North African countries in sugar export competitiveness include Uganda, Angola and Gambia. On the contrary, countries such as Lesotho, Namibia, and Tanzania have regressed from an initial competitive to a non-competitive state. On the other hand, another set of countries, while having attained competitiveness by the end of 2021, they have alternated between periods of comparative advantage and comparative disadvantage. These countries include Gabon and Burundi.

The computed NRCA indices reveal that majority of southern African countries have sustained comparative advantage over the entire period considered in this study, consistent with the findings of Bouët et al. (2022). The southern Africa region alone accounts for over 50% of raw sugar production in sub-Saharan Africa (Mabeta and Smutka, 2023) and the majority of the countries are surplus producers compared to other African regions (Johnson and Seebaluck, 2013). It is no coincidence that the Southern African region is the most competitive compared to the other African regions. Of the 8 countries that sustained competitive advantage between 2001 and 2021, 7 are from the southern Africa region (Eswatini, South Africa, Mauritius, Zambia, Malawi, Mozambique, and Zimbabwe). Cabo Verde is the only country outside the southern Africa region to have a sustained competitive advantage in sugar exports over the same period.

The southern African countries have not only competitive on the global market but also in terms of intra-regional exports. Dubb et al. (2017) and Das Nair et al. (2017) attribute this to low production costs and high yields under the existing institutional and production arrangements, particularly the outgrower schemes. Critical to the development and competitiveness of the sugar industry for the majority of southern African countries is the role of FDI. The sugar industry in southern Africa is one characterized by large-scale commercial investments, both from inside and outside the region, which has contributed to significant increases in sugar production (Dubb et al., 2017; Dunne and Masiyandima, 2017; Chudasama, 2021; Simelane, 2021). According to Ngcobo and Jewitt (2017) and Viljoen (2014), expansion and intensification of sugar production in southern Africa can be attributed to substantial FDI, especially new investments in sugar mills, improved seed varieties of sugarcane and supply chain infrastructure. The southern African region, along with Northern Africa, have traditionally accounted for the largest share of FDI inflows (Morgan, 2022). Africa’s largest sugar producer, Illovo Sugar Africa, a wholly owned subsidiary of Associated British Foods plc (ABF) has invested in 6 African countries, all of which are from southern Africa. These are Malawi, South Africa, Tanzania, Mozambique, Eswatini and Zambia. Three of these countries (South Africa Eswatini and Zambia) are top intra-regional exporters of sugar on the African continent (Sandrey and Moobi, 2015). These countries have also sustained their competitiveness by consistently maintaining low production costs (Sandrey and Vink, 2007; Gro Intelligence, 2015; SASA, 2023) and yields within the expected range of 70 to 100 tons per hectare (Mabeta and Smutka, 2023).

Chisanga et al. (2014) argues that better terms of trade and the potential to trade with more profitable markets like the EU appears to be the driving force behind increased investment in the sugar industry by Illovo and other multinational firms in the region such as Tongaat Hulett Group. The EPA between the EU and the SADC member states has lowered the impediments to the free flow of sugar exports from southern African countries and consolidated their competitiveness on the world market (Paha et al., 2021). The situation is quite different with the rest of the African countries whose sugar exports to the EU are subject to various market access issues such tariff and non-tariff barriers (Torres and van Seters, 2016). Coulibaly (2017) also notes that while preferential trade agreements such as the African Growth Opportunity Act (AGOA) and EBA, appear to have boosted Sub-Saharan Africa’s exports, the benefits have been considerably skewed towards certain regions as other regions, especially countries from West Africa, face restrictive rules of origin and narrow range of exportable products.

The findings of this study also reveal that several African countries have consistently been uncompetitive on the world market between 2001 and 2021. This set of countries largely comprises western Africa states of Benin, Burkina Faso, Senegal, Cameroon, Nigeria, Ghana, and Côte d’Ivoire. Other countries in this bracket include Tunisia, Botswana and Kenya. The political economy of a number of these countries has contributed to the uncompetitiveness of their sugar exports. Countries like Kenya and Nigeria are net importers of sugar despite several reforms that have been implemented in their sugar industries (Sandrey and Moobi, 2015). Heavy government intervention and monopolization of the sugar industry riddled with inefficiencies and mismanagement of the sugar industry through ineffective extension systems and delayed payments to farmers, high production costs, high post-harvest losses, corruption and trade barriers have impeded the competitiveness of sugar exports of some of these countries (Busari, 2004; Government of Kenya, 2010; Onyango et al., 2018; Bomett et al., 2020). State intervention and high entry barriers in the sugar industry have distorted competitive outcomes and created production inefficiencies (Chisanga et al., 2014; Onyango et al., 2018). For instance, of the 12 active milling companies in Kenya, the government currently owns five, three of which are under receivership due to inherent inefficiencies in the management of production arrangements for sugar (Bomett et al., 2020). Further, inadequate investment and limited access to credit has affected infrastructure development and adoption of technologies that can increase sugarcane productivity and recoverable sugar yields (Chisanga et al., 2014; Onyango et al., 2018).

Intraregional competitiveness has eluded most African countries. Sugar exports from the eastern Africa, Northern Africa, Middle Africa and Western Africa to other African regions remained uncompetitive throughout the entire analysis period. However, the southern Africa region’s sugar exports to other African regions have been the most competitive. As indicated earlier, the majority of FDI inflows in Africa’s sugar industry are invested in the southern Africa region. The southern Africa region boasts effective institutional and production arrangements, use of irrigation in sugarcane production, adoption of early maturing cane varieties, better processing facilities and contemporary post-harvest management techniques (Hess et al., 2016; Ngcobo and Jewitt, 2017; Onyango et al., 2018). In addition, SADC has a deliberate policy and framework to facilitate FDI in order to encourage growth of the sugar industry among member states.

Intra-regional competitiveness of sugar exports has continued to be hampered by tariff and non-tariff barriers within the African continent, including tariff escalations and trade embargoes (Coulibaly, 2017; Bouët et al., 2022; Odjo et al., 2023). The majority of sugar exports from the southern and northern African regions are directed within their respective regions or exported to the east African region due to preferential tariffs under SADC and COMESA (Bouët et al., 2022). The share of intra-regional trade of the west African and middle African regions is low due to prohibitive import tariffs and discriminatory policies to import sugar from outside the African region, especially for countries like Nigeria (Sandrey and Moobi, 2015; Bouët et al., 2022). Import tariffs make it more challenging for producers in other African nations to take advantage of economies of scale by prohibiting the import of sugar from other African regions (Paha et al., 2021). Intra-regional import duties can be as high as 100% as most of the regions in Africa consider sugar to be a sensitive commodity which needs to be shielded from external competition (Sandrey et al., 2018). Chisanga et al. (2014) argues that these protectionist measures may not necessarily be inappropriate in the context of modern industrial policy, but they risk being undermined if domestic producers are not provided with the right environment and support mechanisms to boost their competitiveness through innovation and efficiency. Non-tariff barriers such as inefficient customs, infrastructural and transactions costs are even more harmful than tariffs in impeding intra-regional trade (Sandrey et al., 2018). African countries need to address them so that they facilitate trade rather than impede it.

Although most African countries are uncompetitive on the world market, some African countries outcompete some of the world’s largest sugar exporters. On the global front, some of the leading sugar exporting countries like Germany, Belgium, Mexico and the Netherlands have been uncompetitive. This highlights the complex dynamics of the global sugar trade. This suggests that a country’s export volume alone does not determine its overall competitiveness in the sugar industry, as factors such as production costs and domestic consumption also play significant roles. While some of EU are grappling with competitiveness of their sugar exports on the international market, emerging sugar exporting countries like Brazil, Thailand, and India have gained a significant advantage with their lower production costs and higher sugar yields, further intensifying the competition for these traditional exporters. This has led to a decline in market share for the EU sugar industry, as importing countries are increasingly turning to these emerging countries for their sugar needs. Like other studies have already established (Seleka and Dlamini, 2020; Sheetal et al., 2020), this study confirms that sugar exports from Brazil, India and Thailand remain the most competitive on the world market.

7 Conclusion and recommendations

The novel contribution of this research lies in its comprehensive analysis and exploration of some of the nuances often overlooked in conventional econometric analysis. Such analysis, specifically focusing on available sugar data across a wide spectrum of sugar-exporting African countries, has been overlooked in empirical literature. Most studies tend to concentrate on the overall trade competitiveness of a country’s exports or a particular industry, neglecting sugar despite its status as one of the most consumed and traded commodities. The study further analyzed the intra-regional relations and competitiveness of sugar that have not been adequately investigated in empirical literature, and extends the analysis to cover inter-regional competitiveness, a subject widely explored in recent studies. The overarching objective of this paper was, therefore, to analyze the patterns, trends, and changes in the inter and intra-regional competitiveness of sugar exports for 34 African countries, including those that are not party to or signatories to RTAs. The study employed the augmented NRCA index designed to address the limitations of the conventional Balassa’s index. We also provide insights into possible key drivers that have either enhanced or inhibited the competitiveness of African sugar exports.

The findings revealed that Africa’s competitiveness in sugar exports has improved over the last two decades. Half of the countries considered in the analysis were competitive on the international market based on the computed indices. The results of this study, however, show divergent patterns and changes in comparative advantage across African sugar exporters. While only 8 countries, the majority of which are from southern Africa, have successfully sustained their competitiveness in the sugar industry, North African countries of Algeria, Egypt and Morocco have transitioned from a position of comparative disadvantage to comparative advantage. These divergent outcomes highlight the complex dynamics and varying strategies employed by African sugar exporters to enhance their comparative advantage in the global market. The findings highlight the importance and growing influence of FDI in enhancing the competitiveness and development of the sugar industries, particularly for North and Southern African countries. The substantial influx of FDI has not only boosted their sugar industries but also contributed to overall economic growth. By leveraging FDI, these countries have been able to modernize their production techniques through technology transfer, adopt improved sugarcane varieties, improve infrastructure, and develop a skilled workforce, further enhancing their competitive edge in the global sugar market. This has raised productivity and led to cost-efficiency, further strengthening their competitive edge in the global sugar market, which confirms Porter’s Diamond Model and its emphasis on the pivotal role of productivity improvements in enhancing competitiveness. The competitiveness of sugar exports of the rest of the African countries has continued to be hampered by mismanagement and inadequate investment in their sugar industries.

At intra-regional level, sugar trade remains low owing to high barriers to trade. Tariff and non-tariff trade have rendered intra-regional sugar exports uncompetitive as they make it more challenging for producers in other African nations to take advantage of economies of scale. However, sugar exports from the southern and part of the eastern African region to the rest of Africa have gained and sustained their competitiveness over the past 10 years. The southern African region has particularly invested in well-functioning agricultural systems and established strong industries and infrastructure, allowing them to efficiently produce and export sugar.

In light of the established patterns and trends of competitiveness in sugar exports, the findings of this study carry significant policy implications, given the importance of sugar to African countries in terms of substantial prospects for generating foreign exchange earnings, contributing to GDP, ensuring food security, creating jobs, and reducing poverty. This study recommends that non-competitive sugar exporting African countries should prioritize policy reforms that attract FDI to facilitate technology transfers that modernize sugar production, improve yields and lower production costs. This is particularly important in view of the projected increase in the African population, which is expected to significantly impact the demand for sugar. This surge in demand may further exacerbate the already existing deficits, creating a pressing need for strategic measures to address this issue. In this regard, the sugar industry in Africa presents a unique opportunity for sustainable investment and comprehensive growth across an expansive value chain.

African countries also need to address the prevailing impediments in their sugar industries, including trade barriers (tariff and non-tariff) and institutional and production arrangements to enhance intra-regional competitiveness. Trade liberalization can increase competition by eliminating trade obstacles that can prevent foreign companies from participating in African national markets. Strengthening regional integration efforts through the implementation of the AfCFTA would broaden the market for competitive African sugar producers and enhance intra-regional competitiveness. This, however, would require bold and ambitious reforms that require elimination of not only tariff barriers, but also non-tariff barriers to trade. This study highlights that some countries are both exporters and importers of sugar. In this regard, future studies should investigate competitiveness using indices that factor in both exports and imports such as Contribution-to-the-Trade-Balance (CTB) indexes at the six-digit level HS nomenclature to unmask the competitiveness at a disaggregated level. Further, it is imperative to carry out a comprehensive analysis of the determinants of sugar exports competitiveness, including an econometric analysis of the impact of FDI, and possible cross-country differences in competitiveness between countries that are signatories to regional trade agreements and those that are not.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JM: Data curation, Formal analysis, Investigation, Methodology, Writing – original draft, Writing – review & editing. LS: Conceptualization, Funding acquisition, Investigation, Resources, Supervision, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

The authors wish to thank the respective faculties of University of South Bohemia in České Budějovice and the Czech University of Life Sciences, Prague, Czech Republic for their valuable support.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsufs.2023.1304383/full#supplementary-material

References

Anderson, K. (2023). Loss of preferential access to the protected EU sugar market: Fiji’s response. Aust. J. Agric. Resour. Econ. 67, 480–499. doi: 10.1111/1467-8489.12526

Arezki, R., Barone, A., Decker, K., Detter, D., Fan, R. Y., Nguyen, H., et al. (2019). Reaching New Heights: Promoting fair competition in the Middle East and North Africa Washington, DC USA: World Bank.

Ayenew, B. B. (2022). The effect of foreign direct investment on the economic growth of sub-Saharan African countries: an empirical approach. Cogent Econ. Finance 10:2038862. doi: 10.1080/23322039.2022.2038862

Balassa, B. A. (1965). Trade liberalization and revealed comparative advantage. Manchester School Econ. Soc. Stud. 33, 99–123. doi: 10.1111/j.1467-9957.1965.tb00050.x

Bojnec, Š., and Fertő, I. (2012). Complementarities of trade advantage and trade competitiveness measures. Appl. Econ. 44, 399–408. doi: 10.1080/00036846.2010.508725

Bomett, M., Wambua, J., and Odhiambo, V. (2020). Sugar sub-sector profile. Kenya Association of Manufacturers Available at: https://kam.co.ke/bfd_download/kam-sugar-sub-sector-profile/ (Accessed February 20, 2023).

Boonzaaier, J. D. T. L. (2015). An Inquiry into the Competitiveness of the South African Stone Fruit Industry. Available at: https://core.ac.uk/download/pdf/37439968.pdf (Accessed July 20, 2023).

Bouët, A., Odjo, S. P., and Zaki, C. (Eds.) (2022). Africa Agriculture Trade Monitor. Kigali and Washington, DC: AKADEMIYA2063 and Int. Food Policy Res. Inst. doi: 10.54067/9781737916437

Bouët, A., Tadesse, G., and Zaki, C. (2021). Africa Agriculture Trade Monitor 2021. Kigali and Washington, DC: AKADEMIYA2063 and Int. Food Policy Res. Inst. doi: 10.54067/9781737916406

Busari, A. (2004). Sugar-cane and sugar industry in Nigeria: the bitter-sweet lessons. Ibadan: Spectrum Books Ltd.

Chih, Y.-Y., Kishan, R. P., and Ojede, A. (2022). Be good to thy Neighbours: a spatial analysis of foreign direct investment and economic growth in sub-Saharan Africa. World Econ. 45, 657–701. doi: 10.1111/twec.13167

Chisanga, B., Gathiaka, J., Nguruse, G., and Onyancha, S. (2014). “Competition in the regional sugar sector: the case of Kenya, South Africa, Tanzania and Zambia” in Fifth Meeting of the UNCTAD Research Partnership Platform on Competition and Consumer Protection (Geneva, Switzerland: United Nations Conference on Trade and Development), 48–60. Available at: https://unctad.org/meeting/fifth-meeting-research-partnership-platform-competition-and-consumer-protection

Chudasama, A. (2021). International sugar journal-world sugar yearbook 2021. London, United Kingdom: International Sugar Journal Available at: https://internationalsugarjournal.com/

Costinot, A., Donaldson, D., and Komunjer, I. (2012). What goods do countries trade? A quantitative exploration of Ricardo’s ideas. Rev. Econ. Stud. 79, 581–608. doi: 10.1093/restud/rdr033

Coulibaly, S. (2017). Differentiated impact of AGOA and EBA on west African countries. Washington, DC: World Bank.

Dalum, B., Laursen, K., and Villumsen, G. (1998). Structural change in OECD export specialisation patterns: de-specialisation and ‘stickiness. Int. Rev. Appl. Econ. 12, 423–443. doi: 10.1080/02692179800000017

Danna-Buitrago, J. P., and Stellian, R. (2021). A new class of revealed comparative advantage indexes. Open Econ. Rev. 33, 477–503. doi: 10.1007/s11079-021-09636-4

Das Nair, R., Nkhonjera, M., and Ziba, F. (2017). Growth and development in the sugar to confectionery value chain. Centre for Competition, regulation and economic development (CCRED) and the Zambia Institute for Policy Analysis and Research (ZIPAR) Available at: https://www.ssrn.com/abstract=3003804 (Accessed July 21, 2023).

Daum, T. (2023). Mechanization and sustainable Agri-food system transformation in the global south. A review. Agron. Sustain. Dev. 43:16. doi: 10.1007/s13593-023-00868-x

Deb, K., and Sengupta, B. (2017). On empirical distribution of RCA indices. IIM Kozhikode Society & Management Review 6, 23–41. doi: 10.1177/2277975216676125

Delgado, M., Ketels, C., Porter, M. E., and Stern, S. (2012). The determinants of National Competitiveness. Boston: National Bureau of Economic Research.

Dubb, A., Scoones, I., and Woodhouse, P. (2017). The political economy of sugar in southern Africa – introduction. J. South. Afr. Stud. 43, 447–470. doi: 10.1080/03057070.2016.1214020

Dunne, J. P., and Masiyandima, N. (2017). Bilateral FDI from South Africa and income convergence in SADC: bilateral FDI from South Africa. Afr. Dev. Rev. 29, 403–415. doi: 10.1111/1467-8268.12277

Esterhuizen, D., van Rooyen, J., and D’Haese, L. (2008). An evaluation of the competitiveness of the agribusiness sector in South Africa. Adv. Compet. Res. 16, 31–46.

European Commission (2019). EU agricultural outlook for markets and income 2019–2030. Brussels: Publications Office of the European Union.

FAO (2005). Sugar: the impact of reforms to sugar sector policies. A guide to contemporary analyses. Rome: Food and Agriculture Organisation.

FAO (2010). Trade of agricultural commodities 2005–2021. Rome Available at: https://www.fao.org/3/cc3750en/cc3750en.pdf

FAOSTAT FAO (2023). Food and agriculture Organization of the United Nations. Available at: https://www.fao.org/faostat/en/#data (Accessed July 14, 2023).

Galović, T., and Bezić, H. (2019). The competitiveness of the EU sugar industry. Zb. rad. Ekon. fak. Rij. 37, 173–189. doi: 10.18045/zbefri.2019.1.173

Gotor, E., and Tsigas, M. E. (2011). The impact of the EU sugar trade reform on poor households in developing countries: a general equilibrium analysis. J. Policy Model 33, 568–582. doi: 10.1016/j.jpolmod.2010.10.001

Government of Kenya (2010). Review of the policy, legal and regulatory framework for the sugar sub-sector in Kenya: A case study of governance controversies affecting the sub-sector. Nairobi: Kenya Anti-Corruption Commission.

Gro Intelligence (2015). Global Sugar Markets. Available at: https://gro-intelligence.com/insights/global-sugar-markets (Accessed February 17, 2023).

Gunasekera, D., Cai, Y., and Newth, D. (2015). Effects of foreign direct investment in African agriculture. China Agric. Econ. Rev. 7, 167–184. doi: 10.1108/CAER-08-2014-0080

Hassan, S. F. (2008). Development of sugar industry in Africa. Sugar Tech 10, 197–203. doi: 10.1007/s12355-008-0037-6

Helia, M.-R. (2022). OECD-FAO Agricultural Outlook 2022 – 2031. Organisation for Economic Co-operation and Development Available at: https://www.oecd-ilibrary.org/agriculture-and-food/oecd-fao-agricultural-outlook-2022-2031_f1b0b29c-en (Accessed July 5, 2023).

Hess, T. M., Sumberg, J., Biggs, T., Georgescu, M., Haro-Monteagudo, D., Jewitt, G., et al. (2016). A sweet deal? Sugarcane, water and agricultural transformation in sub-Saharan Africa. Glob. Environ. Chang. 39, 181–194. doi: 10.1016/j.gloenvcha.2016.05.003

Johnson, F. X., and Seebaluck, V. (2013). Bioenergy for sustainable development and international competitiveness: the role of sugar cane in Africa. New York: Routledge.

Ndlangamandla, K. Determinants of competitiveness of the Swaziland sugar industry (2016) University of Eswatini. doi: 10.22004/ag.econ.265677

Liu, B., and Gao, J. (2019). Understanding the non-Gaussian distribution of revealed comparative advantage index and its alternatives. Int. Econ. 158, 1–11. doi: 10.1016/j.inteco.2019.01.001

Lundvall, B.-Å. (2010). National Systems of innovation: Toward a theory of innovation and interactive learning. London: Anthem Press.

Mabeta, J., and Smutka, L. (2023). Historical and contemporary perspectives of the sugar industry in sub-Saharan Africa. Ukranian Food J. 12, 157–171. doi: 10.24263/2304-974X-2023-12-1-12

Macháček, J., Syrovátka, M., and Harmáček, J. (2017). Sugar production and trade in sub-Saharan Africa. Listy Cukrovarnické a Reparské 133, 258–261.

Malikane, C., and Chitambara, P. (2017). Foreign direct investment, democracy and economic growth in southern Africa. Afr. Dev. Rev. 29, 92–102. doi: 10.1111/1467-8268.12242

Masih, I., Maskey, S., Mussá, F. E. F., and Trambauer, P. (2014). A review of droughts on the African continent: a geospatial and long-term perspective. Hydrol. Earth Syst. Sci. 18, 3635–3649. doi: 10.5194/hess-18-3635-2014

Masters, W. A., Djurfeldt, A. A., De Haan, C., Hazell, P., Jayne, T., Jirström, M., et al. (2013). Urbanization and farm size in Asia and Africa: implications for food security and agricultural research. Glob. Food Sec. 2, 156–165. doi: 10.1016/j.gfs.2013.07.002

Morgan, S. (2022). Foreign direct Investment in Africa: Recent trends leading up to the African continental free trade area (AfCFTA).

Mpapalika, J. (2019). The regulation of sugar market Price in developing countries. Addis Ababa, Ethiopia: UN Economic Commission for Africa.

Ngcobo, S., and Jewitt, G. (2017). Multiscale drivers of sugarcane expansion and impacts on water resources in southern Africa. Environ. Dev. 24, 63–76. doi: 10.1016/j.envdev.2017.07.004

Nugroho, A. D., Istvan, F., Fekete-Farkas, M., and Lakner, Z. (2022). How to improve agricultural value-added in the MENA region? Implementation of diamond Porter’s theory in agriculture. Front. Sustain. Food Syst. 6:956701. doi: 10.3389/fsufs.2022.956701

Nugroho, A. D., and Lakner, Z. (2022). Impact of economic globalisation on agriculture in developing countries: a review. Agric. Econ. - Czech 68, 180–188. doi: 10.17221/401/2021-AGRICECON

Nyanzunda, T. (2012). Determinants and Indicators of Competitiveness in the South African Sugar Industry. Available at: http://hdl.handle.net/10539/12044 (Accessed August 23, 2023).

Odjo, S., and Badiane, O. (2018). “Competitiveness of African agricultural exports” in Africa Agriculture Trade Monitor 2018 (Washington, DC: International Food Policy Research Institute (IFPRI))

Odjo, S., Traoré, F., and Zaki, C. (2023). 2023 Africa Agriculture Trade Monitor. Washington, DC: International Food Policy Research Institute.

OECD (2007). Sugar policy reform in the European Union and in world sugar markets. Paris: Organisation for Economic Co-operation and Development.

OECD (2010). The OECD innovation strategy: Getting a head start on tomorrow. Paris: Organisation for Economic Co-operation and Development.

OECD (2022). OECD-FAO Agricultural Outlook. Washington, DC: Organisation for Economic Co-operation and Development.

Onyango, K., Njagi, T., Kirimi, L., and Balieiro, S. (2018). Policy options for revitalizing the ailing sugar industry in Kenya. Nairobi: Tegemeo Institute of Agricultural Policy and Development.

Paha, J., Sautter, T., and Schumacher, R. (2021). Some effects of EU sugar reforms on development in Africa. Intereconomics 56, 288–294. doi: 10.1007/s10272-021-1001-x

Pawlak, K., and Kołodziejczak, M. (2020). The role of agriculture in ensuring food security in developing countries: considerations in the context of the problem of sustainable food production. Sustainability 12:5488. doi: 10.3390/su12135488

Peng, J., Zhao, Z., and Liu, D. (2022). Impact of agricultural mechanization on agricultural production, income, and mechanism: evidence from Hubei Province, China. Front. Environ. Sci. 10:53. doi: 10.3389/fenvs.2022.838686

Pingali, P. (2007). Westernization of Asian diets and the transformation of food systems: implications for research and policy. Food Policy 32, 281–298. doi: 10.1016/j.foodpol.2006.08.001

Pop, L. N., Rovinaru, M., and Rovinaru, F. (2013). The challenges of sugar market: an assessment from the Price volatility perspective and its implications for Romania. Proc. Econ. Finance 5, 605–614. doi: 10.1016/S2212-5671(13)00071-3

Pradhananga, M., and Naval, D. (2021). Asia’s eating habits are changing and the environmental impact could be huge. Asian Development Blog: Straight Talk from Development Experts. Available at: https://blogs.adb.org/blog/asia-s-eating-habits-are-changing-and-environmental-impact-could-be-huge (Accessed July 26, 2023).

Pulkrabek, J., Smutka, L., Benesova, I., and Maitah, M. (2011). World trade in raw sugar - analysis competitiveness of regions. Listy Cukrovarnické a Řepařské 127, 374–378.

SADC (2011). SADC-Trade-protocol-Annex-VII-Concerning Trade in Sugar. Available at: https://www.tralac.org/files/2011/11/SADC-Trade-protocol-Annex-VII.pdf (Accessed August 24, 2023).

Sandrey, R., and Moobi, M. (2015). Sugar: Production, trade and policy profiles for South Africa and other selected African countries. Stellenbosch, South Africa: Tralac.

Sandrey, R., Viljoen, W., Ntshangase, T., Mugrefya, M., Potelwa, Y., Motsepe, T., et al. (2018). Agriculture and the AfCFTA. Stellenbosch: Trade Law Centre.

Sandrey, R., and Vink, N. (2007). Future prospects for African sugar: Sweet or sour? Stellenbosch, South Africa: Tralac.

SASA (2023). The sugar industry | the south African sugar Assocciation. SASA. Available at: https://sasa.org.za/the-sugar-industry/ (Accessed February 20, 2023).

Seleka, T. B., and Dlamini, T. S. (2020). Competitiveness of ACP sugar exporters in the global market. Int. Trade J. 34, 247–277. doi: 10.1080/08853908.2019.1691091

Sheetal, S., Kumar, R., and Shashi, S. (2020). Export competitiveness and concentration analysis of major sugar economies with special reference to India. JADEE 10, 687–715. doi: 10.1108/JADEE-07-2019-0096

Siggel, E. (2006). International competitiveness and comparative advantage: a survey and a proposal for measurement. J. Ind. Compet. Trade 6, 137–159. doi: 10.1007/s10842-006-8430-x

Smutka, L., Pokorna, I., and Pulkrábek, J. (2011). World production of sugar crops. Listy Cukrovarnicke a Reparske 127, 78–82.

Srivastava, D. K., Shah, H., and Talha, M. (2006). Determinants of competitiveness of south African agricultural export firms. Competitiveness Review: An International Business Journal incorporating Journal of Global Competitiveness 16, 223–232. doi: 10.1108/10595420610818848

Staatz, J., and Hollinger, F. (2016). West African food systems and changing consumer demands. Paris: Organisation for Economic Co-operation and Development.

Stellian, R., and Danna-Buitrago, J. P. (2022a). Revealed comparative advantage and contribution-to-the-trade-balance indexes. Int. Econ. 170, 129–155. doi: 10.1016/j.inteco.2022.02.007

Stellian, R., and Danna-Buitrago, J. P. (2022b). Which revealed comparative advantage index to choose? Theoretical and empirical considerations. CEPAL Rev. 2022, 45–66. doi: 10.18356/16840348-2022-138-3

Taylor, R. D. (2017). 2017 outlook of the U.S. and world sugar markets, 2016-2026. North Dakota: North Dakota State University, Department of Agribusiness and Applied Economics.

Thibane, Z., Soni, S., Phali, L., and Mdoda, L. (2023). Factors impacting sugarcane production by small-scale farmers in KwaZulu-Natal Province-South Africa. Heliyon 9:e13061. doi: 10.1016/j.heliyon.2023.e13061

Torres, C., and van Seters, J. (2016). Overview of trade and barriers to trade in West Africa. Maastricht, Netherlands: European Centre for Development Policy Management.

UN Comtrade (2023). UNSD — Classifications on Economic Statistics. Harmonized Commodity Description and Coding Systems (HS). Available at: https://unstats.un.org/unsd/classifications/Econ (Accessed August 4, 2023).

UNCTAD (2021). Handbook on special economic zones in Africa. Geneva, Switzerland: United Nations Conference on Trade and Development.

Van Rooyen, C. J., and Esterhuizen, D. (2012). Measurement and analysis of the trends in competitive performance: south African agribusiness during the 2000’s. J. Appl. Manag. Invest. 1, 426–434.

Viljoen, W. (2014). The End of the EU Sugar Quota and the Implication for African Producers. Available at: https://www.tralac.org/discussions/article/5684-the-end-of-the-eu-sugar-quota-and-the-implication-for-african-producers.html (Accessed February 19, 2023).

von Maltitz, G. P., Henley, G., Ogg, M., Samboko, P. C., Gasparatos, A., Read, M., et al. (2019). Institutional arrangements of outgrower sugarcane production in southern Africa. Dev. South. Afr. 36, 175–197. doi: 10.1080/0376835X.2018.1527215

Wamboye, E. F., and Fayissa, B. eds. (2022). The Palgrave handbook of Africa’s economic sectors. London, United Kingdom: Palgrave Macmillan UK.

Keywords: competitiveness, sugar exports, Africa, trade, Normalized Revealed Comparative Advantage index

Citation: Mabeta J and Smutka L (2023) Trade and competitiveness of African sugar exports. Front. Sustain. Food Syst. 7:1304383. doi: 10.3389/fsufs.2023.1304383

Edited by:

Marian Rizov, University of Lincoln, United KingdomReviewed by:

Agus Dwi Nugroho, Hungarian University of Agricultural and Life Sciences, HungaryŠtefan Bojnec, University of Primorska, Slovenia

Copyright © 2023 Mabeta and Smutka. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Luboš Smutka, c211dGthQHBlZi5jenUuY3o=

Joshua Mabeta

Joshua Mabeta Luboš Smutka

Luboš Smutka