- 1School of Management Science and Engineering, Shandong University of Finance and Economics, Jinan, China

- 2School of Finance, Shandong University of Finance and Economics, Jinan, China

- 3School of Business, Shandong Normal University, Jinan, China

- 4School of Management, Shandong University of Traditional Chinese Medicine, Jinan, China

Introduction: Environmental taxation is an essential regulatory tool for governments seeking to optimize agricultural production, enhance the environment, and guarantee food safety. Concerns exist, however, regarding the imposition of environmental taxes on agriculture, as this could be detrimental to the interests of agricultural producers and consumers. To address these challenges, it is essential to integrate agricultural production, environmental protection, and economic development, which can better comprehend the effects of agricultural environmental taxes on production decisions, the environment, the economy, and society.

Methods: To better comprehend the effects of agricultural environmental taxes on production decisions, the environment, the economy, and society, this paper constructs a mathematical model and analyzes optimal outcomes from a welfare perspective. The study examines the structure of consumer groups, classifying them as either green or non-green.

Results and discussion: First, when both consumer groups coexist on the market, imposing environmental taxes on non-green agricultural producers does not always result in a reduction in social welfare. Within a specific tax range, it is possible to accomplish a tripling of social welfare, agricultural producer welfare, and environmental benefits. Second, as the tax rate rises, the environment progressively improves while consumer surplus diminishes. Within a particular tax range, producer surplus and social welfare both increase. Third, as the proportion of green consumers in the market and ordinary consumers’ awareness of green agricultural foods increases, the positive impact of taxation on the environment decreases, while its positive impact on producer surplus and consumer surplus increases. Taxation can also have a positive effect on the social welfare under certain conditions.

Contributions: First, we comprehensively investigate the feasibility of agricultural environmental taxation from a welfare perspective, considering market competition and segmentation, which fills a gap in previous studies. Second, we establish a reasonable range for taxation that simultaneously enhances social welfare, producer welfare, and environmental benefits. Third, we explore the relationship between market segmentation structure, ordinary consumers’ awareness of green agricultural foods, and welfare, providing insights into the different attitudes of countries and regions toward agricultural environmental taxation.

1. Introduction

Agriculture plays a crucial role in every country as it is responsible for ensuring food security and economic stability (Kang, 2019). However, traditional agricultural practices often lead to environmental pollution due to excessive use of pesticides and fertilizers, resulting in carbon dioxide emissions, soil and groundwater pollution, and compromised food safety (Milošević et al., 2018). Over the past 30 years, the amount of greenhouse gases produced by agriculture and food production has increased by 17% globally. As of 2019, anthropogenic emissions total 54 billion tons of carbon dioxide equivalent (CO2 eq), of which 17 billion tons of CO2 eq, or 31%, come from agri-food systems (Tubiello et al., 2022). Only 44% of surface water in Europe is maintained in a good or highly ecological state, with nitrogen and phosphorus losses from agriculture contributing significantly to water pollution (EEA, 2020). In addition, the results of China’s State Administration of Market Supervision’s food safety supervision and sampling for the first half of 2020 show that 36.42% of sampled food products failed to meet the standards due to excessive pesticide residue levels (Ministry of Ecology and Environment, PRC, 2020).

To address these challenges, it is essential to integrate agricultural production, environmental protection, and economic development, which has become a key concern for governments worldwide. In this context, the Common Agricultural Policy (CAP) of the European Union is an excellent example of how to promote ecological security in agriculture via subsidy and incentive programs for farmers’ financial well-being. However, the policy would put further strain on public budgets since the CAP accounts for 38% of the EU’s yearly budget (Scown et al., 2020). In addition, environmental taxation is also as a possible policy tool to guide agricultural producers toward sustainable development. Implementing environmental taxes, agricultural producers can be incentivized to adopt more eco-friendly measures (Milošević et al., 2020). For instance, an environmental tax on the overuse of pesticides and fertilizers can increase production costs, prompting farmers to explore greener alternatives that reduce pollutant emissions and excessive use of resources.

At present, some developed countries have begun or are preparing to implement agricultural environmental taxes. Sweden, known for its pioneering environmental taxation, has implemented an agricultural emissions tax, encompassing taxes on fertilizers, chemical pesticides, and livestock farming emissions, among others (Hellsten et al., 2019). The UK government has also shown support for green agriculture through tax policies, introducing new taxes to incentivize energy conservation and the development of sustainable farming practices (Borel-Saladin and Turok, 2013). France has imposed taxes on nitrogen and phosphorus pollution from agricultural activities, encouraging farmers to adopt measures that reduce fertilizer and pesticide usage, thereby improving water and soil quality (Chabé-Ferret and Subervie, 2013). In contrast, developing countries such as India, Pakistan, and Bangladesh do not have nationwide uniform environmental taxation. Why does this interesting phenomenon occur? There is no denying that policy implementation in developing nations lags behind that in developed nations. For instance, although India’s fertilizer and irrigation subsidies have benefited farmers, only 48% of farmers surveyed for the Indian Soil Health Card (SHC), which was introduced in 2015, applied the recommended amount of fertilizer (Reddy, 2019). But from the policy itself, cannot the agricultural environmental taxes actually make the agricultural ecological environment better? Will consumers’ and producers’ interests be substantially harmed by agricultural environmental taxes? Are agricultural environmental levies’ effects inconsistent across various nations or regions?

Several studies on whether the agricultural environmental tax should be imposed are now being conducted from the perspectives of environmental advantages, agricultural sustainability, social economics, etc. Despite reasonably rich findings being obtained, the conclusions are debatable. To shed light on this issue, our analysis focuses on welfare considerations, providing a macroeconomic decision-making basis for government implementation of environmental taxes. Additionally, we categorize consumers into high-income and low-income groups to depict the market consumer structure accurately. The high-income group, known as green consumers, values the ecological aspects of agricultural foods, while the low-income group, ordinary consumers, prioritize price and basic product functions over ecological value. Our model is based on the Mussa-Rosen model (Mussa and Rosen, 1978), which we have modified to suit the study’s objectives. This improved model offers two key advantages: distinguishing between consumer groups and capturing their varying preferences for health and ecological value in green agricultural foods.

This paper aims to address several important questions. Firstly, is it reasonable to impose environmental taxes on non-green agricultural producers when both green and ordinary consumers exist in the market? Can such taxation improve the environment and increase social welfare? Secondly, if environmental taxation proves beneficial, what should be the appropriate tax range? Lastly, how does social welfare change with varying environmental tax amounts, market consumption structure, and general consumers’ awareness of green agri-foods?

The main contributions and innovations of this paper are as follows: Firstly, we comprehensively investigate the feasibility of agricultural environmental taxation from a welfare perspective, considering market competition and segmentation, which fills a gap in previous studies. Secondly, we establish a reasonable range for taxation that simultaneously enhances social welfare, producer welfare, and environmental benefits. Thirdly, we explore the relationship between market segmentation structure, ordinary consumers’ awareness of green agri-foods, and welfare, providing insights into the different attitudes of countries and regions toward agricultural environmental taxation.

The remainder of the paper is organized as follows: Section 2 reviews relevant literature, Section 3 describes the problem, constructs the model, and solves it. Section 4 analyzes the equilibrium results derived from the model, while Section 5 presents a numerical simulation analysis of the model’s findings. Finally, Section 6 concludes the study. Additionally, all proofs are provided in Appendix A.

2. Literature review

The research for this paper mainly focuses on two areas: the effects of environmental taxes on environmental and agricultural production, as well as the connection between environmental taxes and social welfare.

Regarding the impact of environmental taxes on agricultural production and the environment, several studies have examined the effects of different types of environmental taxes. Chalak et al. (2008) analyzed the impact of a pesticide tax on agricultural production and found that it can effectively reduce pesticide usage, leading to improvements in environmental governance and consumer health. Bourne et al. (2012) studied the effects of various environmental regulations on agricultural CO2 emissions in Spain and found that taxation could result in a decrease in agricultural production, an increase in agri-food prices, and a decline in farmers’ income. Meng (2015) analyzed the introduction of a carbon tax in the Australian agricultural sector and found that while it significantly reduces emissions, the cost of the tax can spread to other sectors of the economy, resulting in reduced production, employment, and earnings. Edjabou and Smed (2013) designed food taxes targeting livestock emissions and environmentally friendly diets, aiming to control greenhouse gas (GHG) emissions. Säll and Gren (2015) evaluated the environmental impact of an environmental tax on meat and dairy consumption in Sweden and found significant reductions in GHG, nitrogen, ammonia, and phosphorus emissions from livestock. Mackenzie et al. (2017) examine the relationship between tax level and its effectiveness in reducing environmental impacts from pig systems. The study’s findings demonstrated the possibility of increasing system-level environmental effects in animal production by the imposition of fees that target specific emissions. Mardones and Lipski (2020) evaluated the implementation of a tax on agricultural CO2 eq emissions and concluded that while taxing agricultural emissions reduces the competitiveness and output of agriculture, it does not substantially reduce emissions. Inkábová et al. (2021) empirically demonstrated that an increase in agricultural taxes reduces total agricultural output. Fendrich et al. (2022) studied the role of environmental taxes in conserving natural vegetation in Brazil and found that tax revenue was limited, posing challenges in terms of inspection, productivity standards, and inherent environmental distortions. Jansson et al. (2023) uses CAPRI model to simulate five policy scenarios and analyze how a carbon tax on agriculture will affect greenhouse gas emissions. It has been discovered that implementing a carbon price can dramatically lower agricultural carbon emissions, but it will also jeopardize regional food security (Jansson et al., 2023).

In the realm of environmental taxes and social welfare, various studies have investigated the effects of environmental taxes on welfare. Wesseh et al. (2017) examined the effects of a carbon tax in different regions and found welfare gains in all regions except low-income countries, noting a significant reduction in environmental damage across the board. Oueslati (2015) considered the effects of environmental tax reform and public expenditure policies on economic growth and welfare, suggesting that tax reforms combined with changes in public spending structures can improve long-term growth and welfare. Wesseh and Lin (2018) incorporated abatement technologies into a general equilibrium model and found overall welfare gains from the introduction of a carbon tax, despite output declines in several sectors, including electricity. Rustico and Dimitrov (2022) employed game theory to determine tax policies that maximize social welfare under realistic circumstances, demonstrating that a regulator can achieve higher social welfare through a two-period commitment. Farajzadeh (2018) explored the impact of a carbon tax in Iran from a welfare perspective and found that it significantly reduces pollution emissions, leading to enhanced welfare. Khastar et al. (2020) studied how a carbon tax affects social welfare and emission reduction in Finland, finding that while the carbon tax policy successfully reduces CO2 emissions, it negatively impacts social welfare. They recommend setting an optimal carbon price level for future policy revisions (Khastar et al., 2020).

Based on the above studies, it is evident that the impact of environmental taxes on agricultural production and the environment has been extensively examined in terms of production, total output, environment, and carbon emissions. However, there is a lack of research on the impact of environmental taxes on consumers and social welfare in the agricultural sector. Additionally, most studies primarily focus on industry and energy, with only a few exploring the welfare impact of taxation in agriculture, and these studies often overlook market segmentation and competition factors. However, in the agricultural production process, many countries and regions employ both green and traditional production methods, resulting in competition among the produced agricultural products. To address these gaps, this paper takes into account market segmentation and competition factors and explores the feasibility of environmental taxation in the agricultural sector, which holds significant theoretical significance.

3. The model

3.1. Problem description and assumptions

The agri-foods in this paper are mainly food crops. According to the Food and Agriculture Organization of the United Nations (FAO) report on agricultural production statistics for the period 2000–2021, the production of major food crops has steadily increased during this period, achieving an increase of 54 percent. This shows that the production of food crops is relatively stable, in addition, these agri-foods also has the characteristics of storage resistance, low loss, and other characteristics.

Meanwhile, the focus of this paper is the market competition between green agri-foods and non-green agri-foods. In order to reflect the market competition of two types of agri-foods, it is necessary to portray two different production entities to carry out price game. Accordingly, we assume that there are two producers (MG and MB) in the market, producer MG who produces green agri-foods, and producer MB who produces non-green agri-foods, and the two producers make price decisions at the same time.

The production costs of green and non-green agri-foods are and respectively, considering that the production process of green agri-foods is higher than that of non-green agri-foods, both in terms of labor costs and farming costs (Delbridge et al., 2013), thus it is assumed that . can be regarded as the gap between the two types of cultivation technology level, and this is used to indicate the technology level of green agri-foods. The smaller is, the higher the technical level of green agri-foods; the market prices of the two types of agri-foods are and without loss of generality, and it is assumed that This ensures that there are is an incentive for producers to participate in the production of green agri-foods.

The production process of non-green agri-foods involves the use of harmful agricultural materials, leading to negative environmental impact. The damage to the environment per unit of non-green agri-foods is assumed to be while the impact per unit of green agri-foods is smaller and represented by . The total damage effect on the environment caused by the two producers is To simplify the calculation, let and the product environmental impact is a linear function of output (Levi and Nault, 2004). Thus, the total environmental damage effect is

In the consumer market, there are two groups: green consumers and ordinary consumers. The total market size is 1, with a proportion of α, α∈(0,1) for green consumers and for ordinary consumers. Each consumer purchases only one unit of food. Considering the main characteristic of agricultural foods to wrap the belly, it may be assumed that the underlying functional value of both green and non-green agri-foods is the same, denoted as ( ), representing their basic functional value. is large enough to ensure that each consumer must purchase agri-foods.

Green consumers derive additional utility, denoted as , from purchasing green agri-foods due to the health and ecological attributes. But for the health and ecological attributes of agri-foods, all types of consumers feel differently. Let green consumers buy green agri-foods, in addition to the basic value, they can also obtain additional utility ( ), representing the level of health and ecological value of green agri-foods; while ordinary consumers in the purchase of green agri-foods, compared with green consumers, their perceived health and ecological value of ecological agri-foods is relatively low, ms, where ( ) represents the level of awareness of green agri-foods by ordinary consumers, and the larger the is the higher the level of awareness of green agri-foods by ordinary consumers.

It is thus assumed that the utility obtained by green consumers purchasing green agri-foods is and the utility obtained by purchasing non-green agri-foods is the utility obtained by ordinary consumers purchasing green agri-foods is and the utility obtained by purchasing non-green agri-foods is

For green consumers, there exists a taste parameter that equalizes the utility obtained from purchasing green and non-green agri-foods, given by The quantity of green agri-foods purchased by green consumers is and the quantity of non-green agri-foods purchased is Similarly, for ordinary consumers, there exists a taste parameter that makes no difference between purchasing green and non-green agri-foods, given by The quantity of green agri-foods purchased by ordinary consumers is and The quantity of non-green agri-foods purchased by ordinary consumers is (Table 1).

From the different consumer utilities, demand functions for green and non-green agri-foods, respectively, are:

Profit functions for producer MG and producer MB, respectively, are:

To improve the environment and reduce the pollution problem in agricultural production, the government implement environmental taxes on producer MB, with the total taxation as:

Producer’s surplus is the sum of the profit functions of producer MG and producer MB, that is:

Consumer surplus consists of the sum of the surplus obtained from the purchase of green and non-green products by two groups of consumers (Bansal and Gangopadhyay, 2003), that is the collation gives:

Referring to Krass’s research (Krass et al., 2013), let the social welfare function consist of government revenue, consumer surplus, producer surplus, and environmental benefits, that is which leads to the social welfare:

3.2. Model and solution

3.2.1. Scenario of untaxed

In this scenario, the government does not impose environmental taxes, that is t = 0. Producer MG and producer MB make price decisions at the same time, and the game model as:

From the profit maximization first-order condition, the equilibrium solution of both producers can be found by further associating the optimal response functions of both producers, respectively, are:

Where

Based on the equilibrium price, we can further obtain the equilibrium output of both producers:

Again to ensure that the two equilibrium outputs are positive, it assumes that . Based on prices and outputs, we can obtain the profits of producer MG and producer MB:

Producer surplus:

Consumer surplus:

The environmental external costs:

The total social welfare:

3.2.2. Scenario of taxed

In this scenario, the government implementing taxes t on the producer MB. Producer MG and Producer MB make price decisions simultaneously, and the game model as:

From the first-order condition of profit maximization, the equilibrium solution of both Producers can be found by further associating the optimal response functions of both Producers:

From the equilibrium price, we can find the equilibrium output of both Producers:

The profits of MG and MB:

Producer surplus:

Consumer surplus:

Total taxation:

Environmental external costs:

In summary, social welfare in the case of government taxation can be obtained:

4. Analysis

In this section, we will begin by comparing the value of each welfare under both taxed and untaxed scenarios. Subsequently, we will influence relevant factors on the disparity of welfare before and after taxation.

Proposition 1. Through a comparison of the optimal decision regarding price and output in the scenarios with and without taxation, we have identified the following findings:

(1) , ;

(2) ;

According to Proposition 1, it is evident that following the imposition of the tax by the government, the market demand for producer MG increases, while the market demand for producer MB decreases. Additionally, the price of agri-foods for all producers is higher in the taxed scenario compared to the untaxed scenario, with non-green agricultural products experiencing a larger price increase than green agricultural products.

This can be primarily attributed to the increase in production costs for non-green agri-foods as s a result of the tax. Consequently, the non-green agri-foods prices are raised, leading ordinary consumers to shift toward becoming green consumers. Simultaneously, green consumers are more inclined to increase their proportion of purchasing green agri-foods. This dynamic expands the green consumer market and enhances the market share of green agri-foods. This outcome demonstrates that the imposition of environmental taxes by the government can impact the production, marketing, and pricing of agri-foods, thereby influencing the production behavior of agricultural producers.

As the government introduces the tax, resulting in changes in the price and sales of agricultural producers in the market, it inevitably affects producer surplus, consumer surplus, and overall social welfare. Therefore, we will now delve into the discussion of how welfare changes after the implementation of the tax.

Proposition 2. Through a comparison of each welfare in the scenarios with and without taxation, we have identified the following findings:

(1) ;

(2) if , ;where ;

(3)

(4)

(5) if ,

Proposition 2 indicates that after the government imposes the tax, the profits of green agri-food producers increase, and the profits of non-green agri-food producers decrease. Meanwhile, environmental external costs and consumer surplus decrease. Furthermore, under certain conditions, both producer surplus and social welfare experience an increase.

The primary reason behind these findings is that the government’s imposition of environmental taxes increases the costs for producer MB, resulting in a higher price for non-green agri-foods and a decrease in their market share. Meanwhile, the market price for producer MB grows at a relatively slower rate, causing an increase in the market share of green agri-foods. As a result, the profits of producer MB decline, while those of producer MG increase. Moreover, when the tax surpasses a certain threshold, the increase in profits for producer MG exceeds the decrease in profits for producer MB, resulting in a higher total producer surplus compared to the non-taxed scenario. This demonstrates that while taxation reduces the profits of producer MB, it enhances the profits of producer MB. Furthermore, a moderate increase in taxation also contributes to an overall increase in total producer surplus, which supports and promotes the development of green agriculture. This explains why some developed countries are willing to impose taxes, as it facilitates the overall advancement of green agriculture.

The government imposes environmental taxes to increase the cost of the producer MB, resulting in the price of non-green agri-foods increasing, the market share decreased, while the producer MB market price growth rate is relatively slow, green agri-foods market share increased, so there will be a decline in the profits of the producer MB, the producer MG’s profits increased. In addition, when the tax reaches above a certain threshold, the increase in the producer MG’s profits exceeds the decrease in the producer MB’s profits, so the total producer surplus will be higher than the producer surplus when the tax is not imposed. This result suggests that although taxation reduces the profits of the producer MB, it increases the profits of the producer MB, and a moderate increase in taxation also helps to increase the total producer surplus, which is beneficial for supporting and promoting the development of green agriculture. This is one of why some developed countries are willing to impose tax, as they can enhance the overall development of green agriculture by imposing environmental taxes.

The reduction in the environmental external cost primarily stems from the decrease in production scale for non-green agri-foods and the increase in production scale for green agri-foods after the tax is imposed. This reduction in scale mitigates the environmental damage associated with agricultural production. Thus, at the environmental level, the government can effectively mitigate the environmental impact of agricultural production by imposing taxes, which contributes to the improvement of the agro-ecological environment.

The decrease in total consumer surplus is attributed to the imposition of environmental taxes, which elevates the production cost of producer MB. Consequently, producer MB transfers this cost to market consumers through increased prices. Furthermore, even though the production cost of producer MG remains unchanged, due to competitive market dynamics, producer MB seizes the opportunity to raise prices and generate higher profits. As a result, the total consumer surplus declines. This demonstrates that the implementation of environmental taxes can hurt consumer welfare, particularly for ordinary consumers. It is the reason why the majority of development countries refrain from imposing environmental taxes in the agricultural sector.

The main reason why governments may not necessarily harm social welfare by imposing environmental taxes is that, despite the tax imposition, the total market demand remains intact while the prices of agri-foods rise. This price increase can be beneficial to the profitability of agricultural producers under certain conditions. Additionally, despite the decrease in consumer surplus, there is a corresponding increase in environmental benefits. Consequently, under specific circumstances, the imposition of environmental taxes can enhance total social welfare. Therefore, when governments impose environmental taxes on non-green agricultural producers, governments need to consider the overall interests of society and ensure that the tax burden falls within a reasonable range, allowing for a balance between environmental goals and social welfare. By doing so, governments can avoid jeopardizing the overall welfare of society resulting from the imposition of taxes.

Corollary 1. , .

Corollary 1 indicates that is positively correlated with the proportion of green consumers in market , while is inversely correlated with In other words, as the proportion of green consumers increases, the threshold increases and the threshold decreases. In other words, when there is a larger presence of green consumers in the market, the government would need to set a higher tax threshold to enhance producer surplus. While on the contrary, the government can achieve a lower tax threshold to enhance social welfare. This suggests that the government can more easily realize the enhancement of social welfare through environmental taxation when there is a higher proportion of green consumers in the market.

Corollary 2. when that is we can get and

Corollary 2 provides the tax interval, within which both social welfare and producer surplus increase after the imposition of environmental taxes. In this interval, the government’s imposition of environmental taxes is beneficial for enhancing both social welfare and producer surplus simultaneously. However, if this interval is surpassed, it becomes challenging to increase both social welfare and producer surplus simultaneously through the environmental tax. This finding serves as a valuable reference for the government when making optimal tax decisions, highlighting the importance of selecting a tax rate within the specified interval to achieve the desired outcomes of enhancing social welfare and producer surplus.

Proposition 3 By deriving the differences in environmental external cost, consumer surplus, producer surplus, and social welfare after and before the taxation with respect to the parameter t, we have obtained the following results:

(1) , where

(2) , where

(3) if , ; if , ; where , ;

(4) if if ; where .

From Proposition 3, we observe the following trends as the government tax increases:

The difference in environmental external costs (∆EC) decreases, indicating a reduction in environmental harm due to the imposition of environmental taxes. The difference in consumer surplus (∆CS) decreases, suggesting a decline in consumer welfare after taxation. The difference in producer surplus (∆EC) initially decreases and then increases. This implies that the imposition of the tax initially reduces the producer surplus, but beyond a certain threshold, the producer surplus starts to increase due to specific market dynamics. The difference in total social welfare (∆sw) initially increases and then decreases. This indicates that, initially the tax leads to an improvement in social welfare. However, beyond a certain threshold, the decline in consumer welfare outweighs the positive effects on producer surplus, resulting in a decrease in overall social welfare.

These results can be attributed to several factors. With the increase in government tax, the price of non-green agri-foods rises at a faster rate compared to green agri-foods. This promotes the production and consumption of green agri-foods, which contributes to environmental improvement. However, the overall price of agri-foods increases due to the tax, resulting in a decrease in consumer surplus.

Regarding agri-food producers, the imposition of environmental taxes influences their production and marketing prices, thereby affecting their production behavior. Before reaching a certain tax threshold, producer MB retains a market advantage due to lower production costs. As the tax amount increases, MB’s profits decrease faster than MG’s profits increase, leading to a decline in producer surplus. However, beyond a certain threshold, the price of agri-foods produced by MG becomes more advantageous compared to MB, causing MG’s profits to increase more than MB’s profits decrease, resulting in an increase in producer surplus.

In terms of overall social welfare, before reaching a certain threshold, as the tax amount increases, the positive effects on environmental improvement become more prominent, leading to an increase in overall welfare. However, beyond a certain threshold, consumer welfare declines significantly while producer welfare does not improve significantly, resulting in a decline in overall social welfare.

Corollary 3.

(1) Government’s optimal level of taxation: ;

(2) , , 。

Corollary 3 provides the optimal tax amount, denoted as , as determined by the government. According to this system, the optimal tax amount is positively correlated with the market share of green consumers, the level of awareness among general consumers regarding green agri-foods, and the level of ecological planting technology. This implies that as the size of green consumers increases, the impact of green agri-foods on the environment becomes more significant, the level of ecological planting technology rises, and the ecological health value of green agri-foods increases, the government is more inclined to impose a higher environmental tax amount.

Proposition 4. After deriving the differences in environmental external cost, consumer surplus, producer surplus, and social welfare after and before taxation with respect to parameters and m, we have obtained the following results:

(1) , ;

(2) , ;

(2) , ;

(4) if , and .

From Proposition 4, we observe the following trends after the government imposes environmental taxes:

The differences in environmental external cost, consumer surplus, and producer surplus after and before the taxation all increase as the proportion of the green consumer market expands and the awareness of green agri-foods among ordinary consumers improves. ∆SW also increases when the level of ecological planting technology meets certain conditions. As the proportion of green consumers increases and ordinary consumers become more aware of the health and ecological value of green agri-foods, the consumer surplus and producer surplus after taxation show an increasing trend. Additionally, the difference in environmental external costs also increases. However, it is crucial to note that the direction of change in social welfare depends on the level of green agricultural cultivation technology. Specifically, the difference in social welfare increases only when the level of green agricultural cultivation technology meets certain conditions.

This is because as the scale of green consumers expands and the awareness of ecological agri-foods among ordinary consumers grows, the demand for green agri-foods increases. The imposition of environmental taxes does not lead to a further increase in the demand for green agri-foods, resulting in a decrease in the incremental production of green agri-foods. Consequently, the difference in environmental external costs increases after taxation.

For consumers, the increase in the number of consumers purchasing green agri-foods due to the imposition of environmental taxes leads to a rise in the total utility obtained by green consumers, thereby increasing the difference in consumer surplus after and before taxation.

Regarding agricultural producers, the gradual increase in the proportion of green consumers and the awareness of green agri-foods among ordinary consumers results in the market of producer MG expanding while that of producer MB decreases. Producer MB has to bear an increasing burden of environmental taxes. This leads to a faster increase in the profits of producer MB and a slower decrease in the profits of producer MB, ultimately contributing to an increase in the value of producer surplus as the proportion of green consumers rises.

However, when considering the total producer surplus, the changes in environmental benefits may not align with the direction of changes in producer surplus and consumer surplus. As a result, the increase in social welfare depends on meeting certain conditions.

These findings highlight that from the perspectives of producer surplus and consumer surplus, a larger proportion of green consumers and a higher awareness of ecological agri-foods among ordinary consumers make environmental taxation more favorable in the agricultural sector. However, from the viewpoint of total social welfare, the effectiveness of imposing environmental taxes requires specific conditions to be met. Thus, not all countries are suitable for environmental tax implementation. This also explains why environmental taxes are more commonly imposed in developed countries compared to developing countries. Developed countries tend to have a higher proportion of green consumers, and consumers exhibit greater concern for the health and ecological value of green food. In contrast, developing countries have a lower proportion of green consumers, and consumers have less awareness of the ecological value of ecological agri-foods. As a result, governments in developing countries cannot jeopardize the interests of the majority of ordinary consumers for the sake of the interests of a small number of green consumers.

5. Numerical simulation

To further validate the conclusions, this paper conducts a numerical analysis of the differences in different welfare after and before taxation.

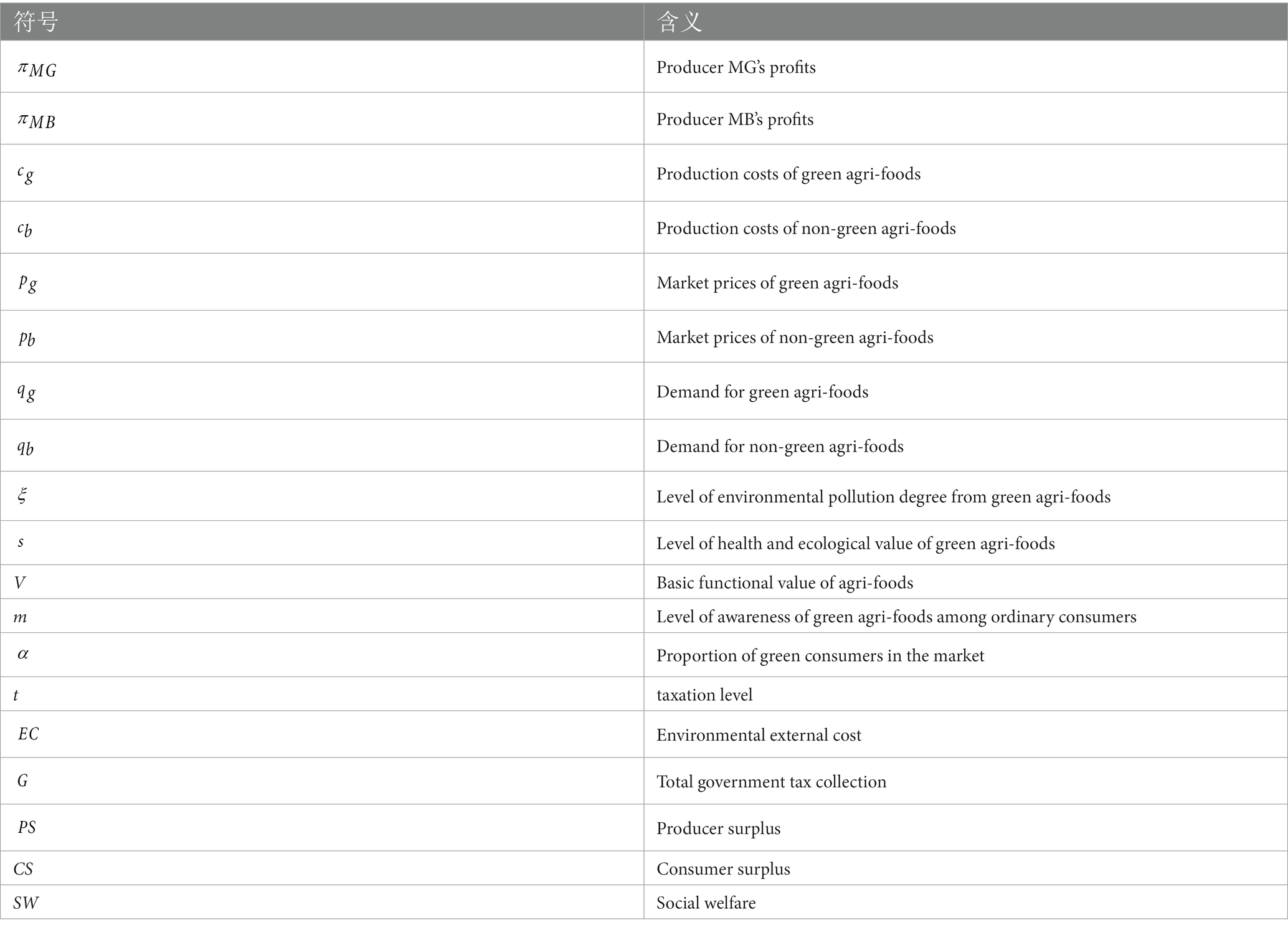

Firstly, we verify the effects of the proportion of green consumers (α) on the thresholds of social welfare ( ) and producer welfare after and before taxation. Under the condition of satisfying the solution validity, The analysis is conducted using MATLAB simulation with the following parameter values: , , , , , . The parameter α is varied between 0.1 and 0.8, and the results of the MATLAB simulation are depicted in Figure 1.

From Figure 1, we can see that (1) as the proportion of green consumers (α) increases, the critical value of producer surplus before and after the taxation decreases, and the critical value of social welfare increases. (2) The area where social welfare is favorable after the tax is below the critical line and the area where producer surplus is favorable after the tax is above the critical line. (3) There exists a taxing area TP where both the post-tax producer surplus and social welfare prevail. This corresponds to Proposition 2, Corollary 1 and Corollary 2. This suggests that it is possible for the government to contribute to the improvement of social welfare by imposing a certain amount of agri-environmental tax. This corresponds to Proposition 2, Corollary 1 and Corollary 2. They suggest that the government can play a role in enhancing social welfare by implementing an appropriate level of agri-environmental tax.

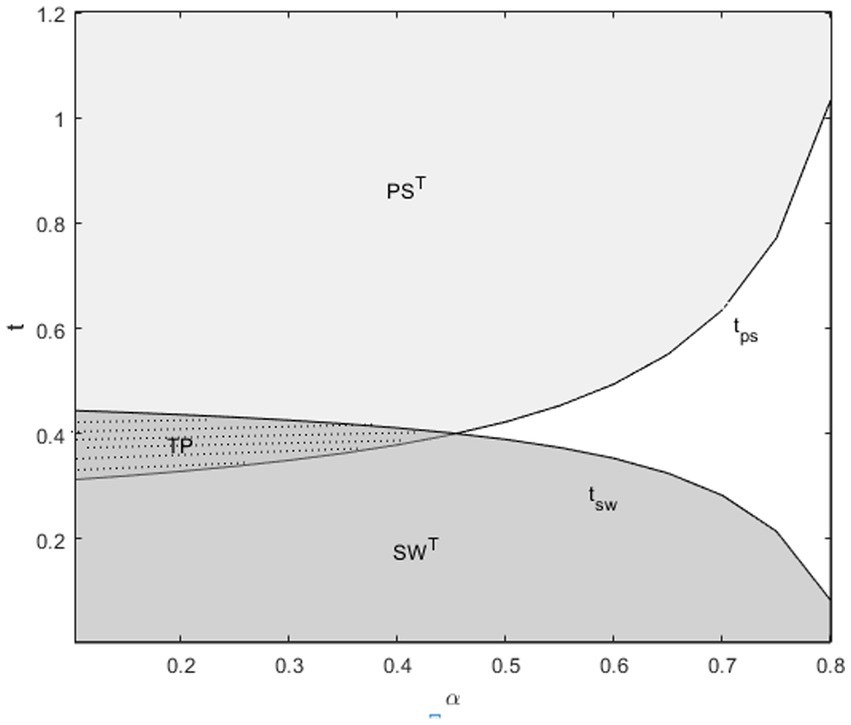

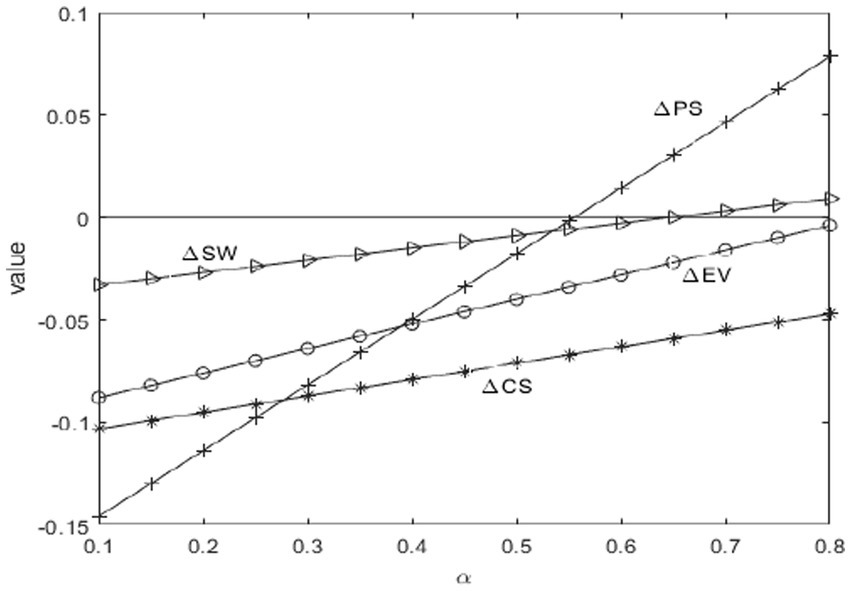

Secondly, we investigate the effects of the taxation level (t) on the difference in social welfare (ΔSW), the difference in producer surplus (ΔPS), the difference in consumer surplus (ΔCS), and the difference in environmental external cost (ΔEC) after and before the taxation. Under the condition of satisfying the uniqueness of the solution, the analysis is conducted using MATLAB simulation with the following parameter values: , , , , , , , and t ranging from 0 ~ 0.8, The results of the MATLAB simulation can be observed in Figure 2.

From Figure 2 we can see that as the taxation t increases, (1) the increase in the value of producer surplus after taxation initially decreases and then increases; (2) the increase in the value of social welfare after taxation increases and then decreases, this indicates that there exists an optimal level of taxation that maximizes the improvement in social welfare; (3) the differences in environmental external cost and consumer surplus gradually decrease. This corresponds to Proposition 3.

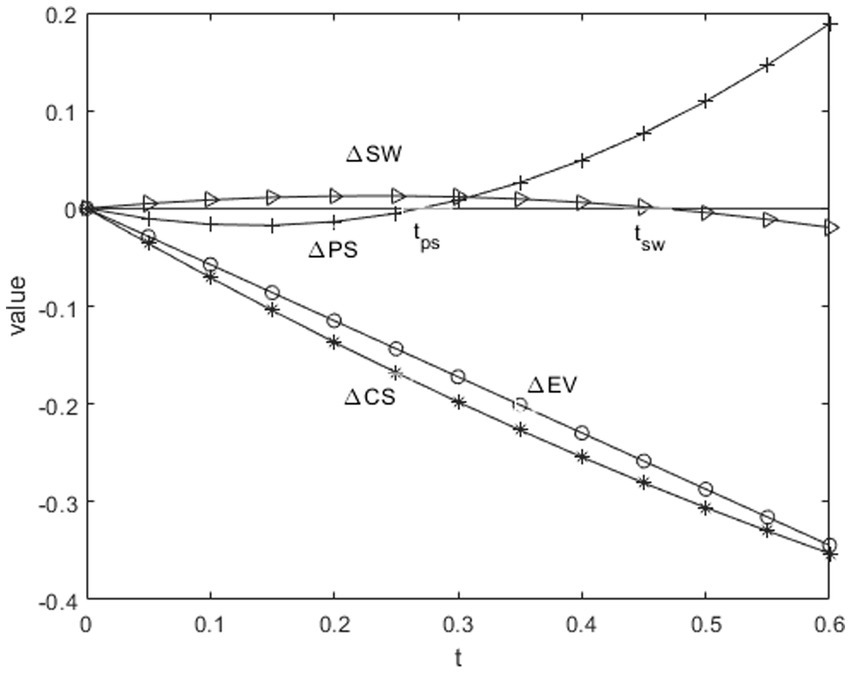

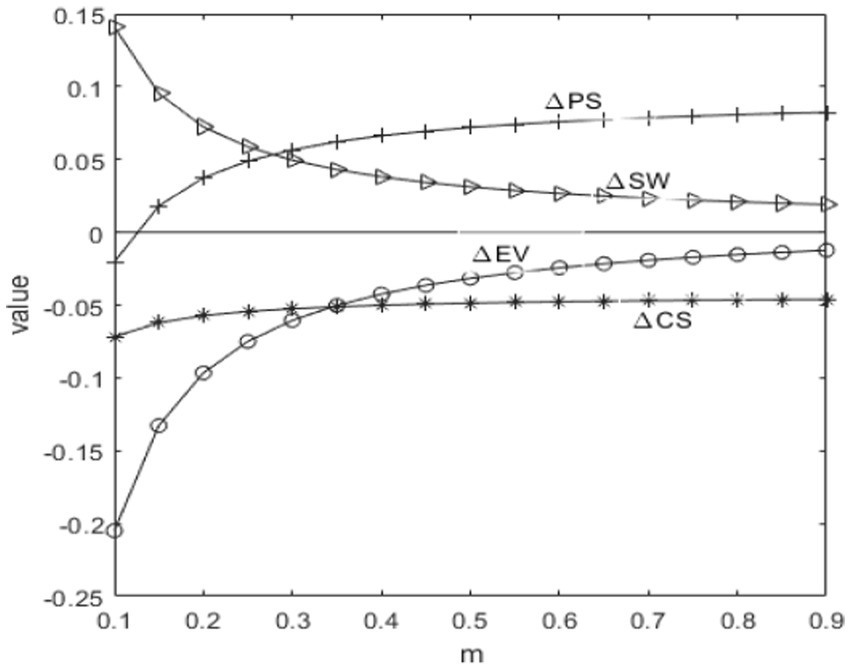

Thirdly, we simulate the effects of the proportion of green consumers (α) on the difference in social welfare (ΔSW), the difference in producer surplus (ΔPS), the difference in consumer surplus (ΔCS), and the difference in environmental external cost (ΔEC) after and before the taxation. Under the condition of satisfying the uniqueness of the solution, while satisfying , the analysis is conducted using MATLAB simulation with the following parameter values: , , , , , , and α is varied between of 0.1 ~ 0.8, The MATLAB simulation results are presented in Figure 3.

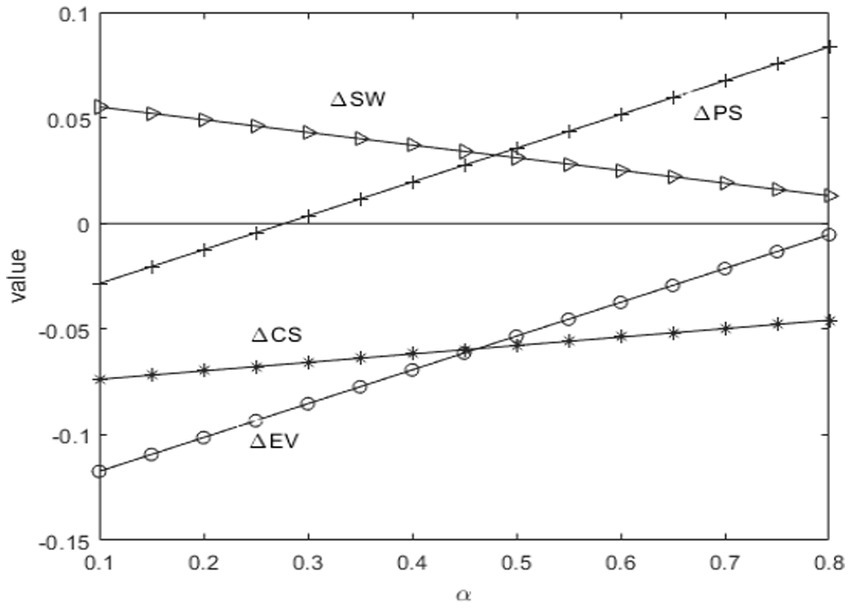

Based on the above, given the parameter values , , , , , , and the condition is satisfied, α also is in the range of 0.1 ~ 0.8, the MATLAB simulation can be obtained as in Figure 4.

From Figures 3, 4, the following observations can be made: As the proportion of green consumer market (α) increases, the differences in consumer surplus, negative environmental externality, and producer surplus all increase. The value added of social welfare after taxation shows an increasing trend when . Conversely, when , the value added of social welfare after taxation decreases. These observations align with the findings of Proposition 4.

5.1. Relationship between m and welfare

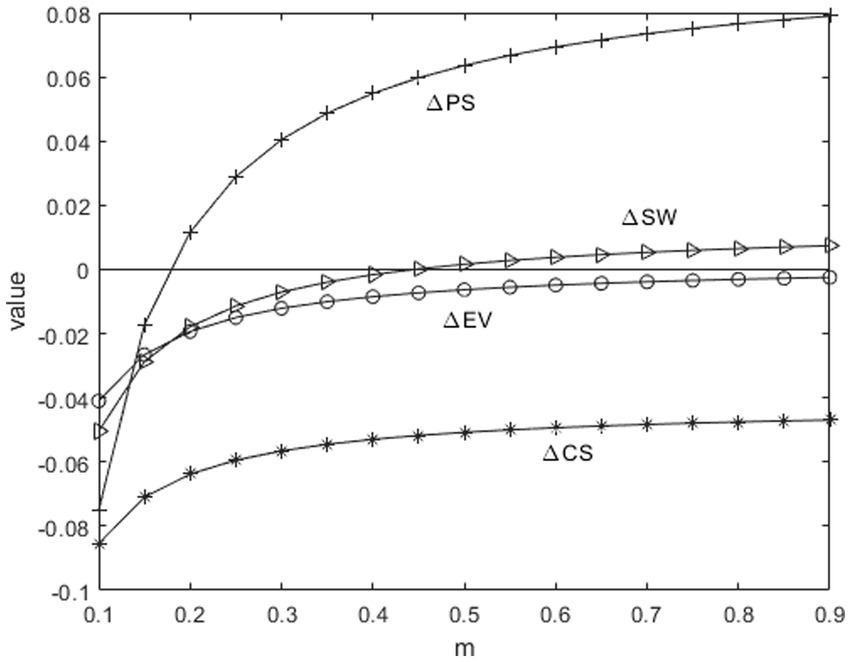

Fourth, we simulate the effects of the level of awareness of green agri-foods among ordinary consumers (m) on the difference in social welfare (ΔSW), the difference in producer surplus (ΔPS), the difference in consumer surplus (ΔCS), and the difference in environmental external cost (ΔEV) after and before taxation. While satisfying , the analysis is conducted using MATLAB simulation with the following parameter values: parameters , , , , , . The parameter is varied between 0.1 and 0.9, The MATLAB simulation results are presented in Figure 5.

On the basis of the above, given the parameter values , , , , , , such that it satisfies , m also is in the range of 0.1 ~ 0.9, the MATLAB simulation can be obtained as in Figure 4.

From Figures 5, 6, we can see that: the differences in consumer surplus, environmental external cost, and producer surplus after and before the taxation all increase with the increase as the level of awareness of green agri-foods among ordinary consumers rises; the value added of social welfare after taxation shows an increasing trend when . Conversely, when , the value added of social welfare after taxation decreases. These findings are consistent with Proposition 4.

6. Conclusion

This paper explores the feasibility of implementing environmental taxes on agriculture from a welfare perspective. The research takes into account the competitive behavior among agricultural producers and the variations among consumer groups. Market segmentation is applied using the Mussa-Rosen model, dividing consumers into green and non-green groups. Through game analysis, several interesting conclusions are drawn.

(1) The environmental tax seems to pin only the non-green agricultural production bodies, but it can transfer the cost to all consumers through the pricing mechanism, resulting in a reduction of consumer welfare. However, environmental taxes are beneficial for the environment. Regarding producers and social welfare, environmental taxes are not always detrimental. By controlling the tax amount within a certain range, it is possible to increase producer surplus, environmental benefits, and social welfare. Therefore, when implementing environmental taxes on agriculture, it is crucial to strike a balance between economic benefits, environmental benefits, and overall welfare, in order to achieve the multiple goals of environmental protection, sustainable agricultural development, and social welfare improvement. On this basis, in order to reduce the negative impact of agricultural taxation, policymakers can offer financial subsidies, agricultural insurance, market support, and agricultural transition support to lighten the burden of agricultural tax on agricultural producers and promote the sustainable development of agriculture.

(2) As the taxation increases, the environment gradually improves, consumer surplus decreases, and the surplus and social welfare of agricultural producers increase within a given tax amount. There exists an optimal tax amount that maximizes social welfare, and it is positively related to the market share of green consumers, general consumers’ awareness of ecological agri-foods, and the level of ecological planting technology. According to this conclusion, it becomes evident that when implementing environmental tax, the government should design the corresponding tax policy according to the situation of each country or region, so as to achieve the goal of improving the overall level of social welfare. Specifically speaking, first of all, market structure considerations are crucial. The structure of agricultural markets varies from country to country or region, the government should determine the appropriate tax policy according to the characteristics of the market structure. Secondly, the consideration of education level is also an important factor. The improvement of education level can improve people’s awareness of environmental protection, and then promote the development of green agriculture. Therefore, the government can enhance the environmental awareness of farmers and consumers by strengthening environmental education and promoting green agricultural knowledge and technology. Finally, the adaptability of agricultural technology also needs to be considered. There are differences in the level of agricultural technology in different countries or regions, and the government should formulate tax policies according to the development of agricultural technology.

(3) The higher the market shares of green consumers and ordinary consumers’ awareness of green agri-foods, result in increased total benefits for agricultural producers after the tax is imposed. The negative impact on consumer welfare gradually decreases, and the role of environmental improvement diminishes. Total social welfare increases under certain conditions. This implies that increasing national income and enhancing the promotion and education of green food can enhance the effectiveness of government environmental taxes in agriculture. In light of these findings, it is imperative for governments to emphasize the promotion of green agri-foods and consumer education to expand awareness of environmentally friendly food options. Firstly, governments can elevate public awareness and understanding of green agri-food through targeted publicity and promotion activities. These initiatives aim to capture public attention, pique interest in green agri-food, and foster informed choices among consumers. Public campaigns, advertisements, and educational programs can be instrumental in achieving this goal. Secondly, governments can play a proactive role in encouraging agricultural producers to transition to green agricultural production through preferential policies and incentive mechanisms. These incentives might encompass subsidies for eco-friendly farming practices, grants for sustainable agricultural innovations, or access to low-interest loans for investments in green technologies. By offering tangible benefits to producers who adopt environmentally sound practices, governments can stimulate the shift toward greener agriculture on a broader scale. Lastly, to facilitate consumer trust and choice in environmentally friendly foods, governments can strengthen the oversight of food labeling and certification systems. This involves rigorous monitoring to ensure the accurate labeling and identification of green agri-food. Clear and standardized eco-labels, such as organic or environmentally certified marks, can aid consumers in identifying sustainable choices more easily when making food purchases. Such transparency instills confidence in consumers and encourages greater participation in the green agri-food market. It is important to acknowledge certain limitations in this study. The analysis only considers two agricultural production subjects and examines the impact of agricultural environmental taxes on overall welfare under stable production conditions. However, further research is needed to explore the conclusions in situations where agricultural production processes are uncertain and involve multiple competing producers in external market environments. Understanding the linkages and differences between conclusions drawn in various situations will require additional exploration in future studies.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

ZZ: Conceptualization, Formal Analysis, Methodology, Project administration, Software, Supervision, Validation, Writing – original draft, Writing – review & editing. GW: Project administration, Writing – original draft. YG: Formal Analysis, Funding acquisition, Methodology, Project administration, Supervision, Writing – review & editing. XZ: Conceptualization, Formal Analysis, Methodology, Project administration, Supervision, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that National Natural Science Foundation of China (72104131) financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bansal, S., and Gangopadhyay, S. (2003). Tax/subsidy policies in the presence of environmentally aware consumers. J. Environ. Econ. Manag. 45, 333–355. doi: 10.1016/S0095-0696(02)00061-X

Borel-Saladin, J. M., and Turok, I. N. (2013). The green economy: incremental change or transformation? Environ. Policy Gov. 23, 209–220. doi: 10.1002/eet.1614

Bourne, M., Childs, J., Philippidis, G., and Feijoo, M. (2012). Controlling greenhouse gas emissions in Spain: what are the costs for agricultural sectors? Span. J. Agric. Res. 10, 567–582. doi: 10.5424/sjar/2012103-564-11

Chabé-Ferret, S., and Subervie, J. (2013). How much green for the Buck? Estimating additional and windfall effects of French agro-environmental schemes by DID-matching. J. Environ. Econ. Manag. 65, 12–27. doi: 10.1016/j.jeem.2012.09.003

Chalak, A., Balcombe, K., Bailey, A., and Fraser, L. (2008). Pesticides, preference heterogeneity and environmental taxes. J. Agric. Econ. 59, 537–554. doi: 10.1111/j.1477-9552.2008.00163.x

Delbridge, T. A., Fernholz, C., King, R. P., and Lazarus, W. (2013). A whole-farm profitability analysis of organic and conventional cropping systems. Agric. Syst. 122, 1–10. doi: 10.1016/j.agsy.2013.07.007

Edjabou, L. D., and Smed, S. (2013). The effect of using consumption taxes on foods to promote climate friendly diets–the case of Denmark. Food Policy 39, 84–96. doi: 10.1016/j.foodpol.2012.12.004

EEA. (2020). Ensuring clean waters for people and nature. Available at: https://www.eea.europa.eu/signals/signals-2020/articles/ensuring-clean-waters-for-people (Accessed on 15 October 2020).

Farajzadeh, Z. (2018). Emissions tax in Iran: incorporating pollution disutility in a welfare analysis. J. Clean. Prod. 186, 618–631. doi: 10.1016/j.jclepro.2018.03.093

Fendrich, A. N., Barretto, A., Sparovek, G., Gianetti, G. W., da Luz Ferreira, J., de Souza Filho, C. F. M., et al. (2022). Taxation aiming environmental protection: the case of Brazilian rural land tax. Land Use Policy 119:106164. doi: 10.1016/j.landusepol.2022.106164

Hellsten, S., Dalgaard, T., Rankinen, K., Tørseth, K., Bakken, L., Bechmann, M., et al. (2019). Abating N in Nordic agriculture-policy, measures and way forward. J. Environ. Manag. 236, 674–686. doi: 10.1016/j.jenvman.2018.11.143

Inkábová, M., Andrejovská, A., and Glova, J. (2021). The impact of environmental taxes on agriculture—the case of Slovakia. Pol. J. Environ. Stud. 30, 3085–3097. doi: 10.15244/pjoes/130729

Jansson, T., Malmström, N., Johansson, H., and Choi, H. (2023). Carbon taxes and agriculture: the benefit of a multilateral agreement. Clim. Pol. 2023, 1–13. doi: 10.1080/14693062.2023.2171355

Kang, Y. (2019). Food safety governance in China: change and continuity. Food Control 106:106752. doi: 10.1016/j.foodcont.2019.106752

Khastar, M., Aslani, A., and Nejati, M. (2020). How does carbon tax affect social welfare and emission reduction in Finland? Energy Rep. 6, 736–744. doi: 10.1016/j.egyr.2020.03.001

Krass, D., Nedorezov, T., and Ovchinnikov, A. (2013). Environmental taxes and the choice of green technology. Prod. Oper. Manag. 22, 1035–1055. doi: 10.1111/poms.12023

Levi, M. D., and Nault, B. R. (2004). Converting technology to mitigate environmental damage. Manag. Sci. 50, 1015–1030. doi: 10.1287/mnsc.1040.0238

Mackenzie, S. G., Wallace, M., and Kyriazakis, I. (2017). How effective can environmental taxes be in reducing the environmental impact of pig farming systems? Agric. Syst. 152, 131–144. doi: 10.1016/j.agsy.2016.12.012

Mardones, C., and Lipski, M. (2020). A carbon tax on agriculture? A CGE analysis for Chile. Econ. Syst. Res. 32, 262–277. doi: 10.1080/09535314.2019.1676701

Meng, S. (2015). Is the agricultural industry spared from the influence of the Australian carbon tax? Agric. Econ. Blackwell 46, 1–13. doi: 10.1111/agec.12145

Milošević, G., Kulić, M., Đurić, Z., and Đurić, O. (2020). The taxation of agriculture in the republic of Serbia as a factor of development of organic agriculture. Sustain. Basel 12:3261. doi: 10.3390/su12083261

Milošević, G., Vuković, M., and Jovanović, D. (2018). Taxation of farmers by the income tax in Serbia. Econ. Agric. 65, 683–696. doi: 10.5937/ekoPolj1802683M

Ministry of Ecology and Environment, PRC (2020). China ecological environment status bulletin. Available at: https://www.mee.gov.cn/hjzl/sthjzk/zghjzkgb/202105/P020210526572756184785.pdf (Accessed on 24 May 2021).

Mussa, M., and Rosen, S. (1978). Monopoly and product quality. J. Econ. Theory 18, 301–317. doi: 10.1016/0022-0531(78)90085-6

Oueslati, W. (2015). Growth and welfare effects of environmental tax reform and public spending policy. Econ. Model. 45, 1–13. doi: 10.1016/j.econmod.2014.10.040

Reddy, A. A. (2019). The soil health card scheme in India: lessons learned and challenges for replication in other developing countries. J. Nat. Resour. Policy Res. 9, 124–156. doi: 10.5325/naturesopolirese.9.2.0124

Rustico, E., and Dimitrov, S. (2022). Environmental taxation: the impact of carbon tax policy commitment on technology choice and social welfare. Int. J. Prod. Econ. 243:108328. doi: 10.1016/j.ijpe.2021.108328

Säll, S., and Gren, M. (2015). Effects of an environmental tax on meat and dairy consumption in Sweden. Food Policy 55, 41–53. doi: 10.1016/j.foodpol.2015.05.008

Scown, M. W., Brady, M. V., and Nicholas, K. A. (2020). Billions in misspent EU agricultural subsidies could support the sustainable development goals. One Earth 3, 237–250. doi: 10.1016/j.oneear.2020.07.011

Tubiello, F. N., Karl, K., Flammini, A., Gütschow, J., Obli-Laryea, G., Conchedda, G., et al. (2022). Pre-and post-production processes increasingly dominate greenhouse gas emissions from agri-food systems. Earth Syst. Sci. Data 14, 1795–1809. doi: 10.5281/zenodo.5615082

Wesseh, P. K. Jr., and Lin, B. (2018). Optimal carbon taxes for China and implications for power generation, welfare, and the environment. Energy Policy 118, 1–8. doi: 10.1016/j.enpol.2018.03.031

Wesseh, P. K. Jr., Lin, B., and Atsagli, P. (2017). Carbon taxes, industrial production, welfare and the environment. Energy 123, 305–313. doi: 10.1016/j.energy.2017.01.139

Appendix

Proof of Proposition 1

Since , , ; Similarly it can be proved that , , . The proof is completed.

Proof of Proposition 2

Since and , , So it can get , . Similarly, it can be proved that , . While , when , that is, when , where , . Similarly, it can be proved that when , where . The proof is completed.

Proof of Corollary 1

From the value of and , we can get . The proof is completed.

Proof of Corollary 2

Based on the value of and , when , there is , that is, when , we can get and . The proof is completed.

Proof of Proposition 3

Based on the equilibrium solution obtained, we can get that Based on them, ; while , when , that is when , , when , . Similarly, it can be proved that when , ; when , ; among them . The proof is completed.

Proof of Corollary 3

Because of and , there exists a maximum value for and , Thus making gives .

According to , we can easily get that , , . The proof is completed.

Proof of Proposition 4

Based on proof of Proposition 3, proposition 4 can be easily obtained.

Keywords: agricultural environmental, social welfare, market segmentation, game theory, agricultural foods

Citation: Zhang Z, Wu G, Guo Y and Zhang X (2023) Should environmental taxes be imposed on agriculture? Analysis from the welfare perspective. Front. Sustain. Food Syst. 7:1269943. doi: 10.3389/fsufs.2023.1269943

Edited by:

Yari Vecchio, University of Bologna, ItalyReviewed by:

Marcello De Rosa, University of Cassino, ItalyA. Amarender Reddy, National Institute of Biotic Stress Management, India

Copyright © 2023 Zhang, Wu, Guo and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaran Zhang, emhhbmd4aWFyYW5AMTI2LmNvbQ==

Zheng Zhang

Zheng Zhang Guangpu Wu2

Guangpu Wu2 Xiaran Zhang

Xiaran Zhang