95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Sustain. Food Syst. , 28 June 2023

Sec. Agro-Food Safety

Volume 7 - 2023 | https://doi.org/10.3389/fsufs.2023.1195218

This article is part of the Research Topic Ensuring the Quality and Safety of Livestock Products in Sustainable Food Systems View all 4 articles

Introduction: Agricultural insurance is crucial to reducing financial exposures and vulnerabilities, and managing the production risks of poultry farmers while also reducing hunger levels. Unfortunately, it has not been effective in developing countries, like Nigeria.

Methods: This study examined the outcome of agricultural insurance use on poultry egg output and efficiency in Oyo State, Nigeria. The multistage sampling technique was adopted to select 120 and 152 insured and uninsured poultry egg farmers, respectively. The data gathered, using a well-designed questionnaire, was analyzed by descriptive statistics, a logistic regression model, and a Stochastic Production Frontier.

Results and Discussion: Results showed that the majority (about 74% and 77%) of uninsured and insured poultry egg farmers, respectively, were small-scale farmers who operated on low capital investment, making it difficult to take insurance policy. Educational level, farming size, access to credit facilities, previous mortality rate, sales challenges, and net farm income were significant variables affecting the level of use of insurance. The result of the stochastic production frontier showed that the use of insurance is not statistically significant to the poultry egg farmers’ production inefficiency. This study highlights the importance of formulating policies that promote private sector involvement, ensure prompt indemnity payment, and encourage uninsured farmers to adopt insurance policies, ultimately aiding affected farmers, improving production scale, and mitigating farm risks.

If left unchecked, agricultural risks will remain draining holes in production that will impede efforts to eradicate global hunger, yet, mitigation of these risks is crucial for sustainable agricultural productivity. Meanwhile, the escalating trend of agricultural risk which disproportionately affects the poultry industry poses a global threat to sustainable agricultural production and food security. As an industry largely dependent on crop output, risks occasioned by climate change, global pandemics such as the most recent COVID-19 pandemic, and attendant competition between humans and poultry for staples such as maize, have greatly impacted poultry production. Yet, the sustainable development of the poultry industry is crucial to global food security (FAO, 2023). The demand for food (which is estimated to rise by 70% by 2050) due to the projected growth in income and global population, the high-risk characteristic of the agricultural sector, and the need to make the sector more resilient to such risks, place a much-to-be-desired need for investment in the agricultural sector. This investment is estimated at no less than $80 billion by 2050 (World Bank, 2022). The global average consumption of animal protein is projected to almost double by 2050 from 24.3 g/person/day (UNDP, 2008; FAO, 2011; Salvage, 2011) with poultry meat expected to represent the highest growth (41%) of all protein from meat sources by 2030. The poultry industry, being the leading meat producer on a global scale, and the most preferred animal protein source (OERC/FAO, 2021), is well placed in ending hunger in view of its bipedal repute. However, poultry production has been plagued by rising risks, leading to declining output and efficiency. Meanwhile, various agricultural enterprises have been seeking out ways to cushion the effects of these risks, of which agricultural insurance plays a cardinal role, by indemnifying poultry farmers who might be adversely affected. The extent to which these panaceas, particularly agricultural insurance, have helped to reduce the effects of these rising global poultry risks, is better assessed in terms of the output and efficiency levels of the poultry industry, in the shade of increased accessibility, availability, and affordability of poultry feed and feed ingredients for increased egg output levels, and farm performance.

The decline in poultry output in Nigeria appears to be more of an inadequate investment in the agricultural sector, particularly in mitigating risks inherent in the poultry industry, as opposed to just inadequate production. For instance, while global poultry egg production increased from 15 to 93 million tonnes between 1961 and 2020, Nigeria’s production only rose from 75 thousand tonnes to 14.4 million tonnes during the same period (Food and Agricultural Organization of the United Nations, 2022). China, the United States, and India are the largest producers of poultry eggs, accounting for half of global production in 2018 (FAO, 2020). Nigeria, despite being the largest producer of eggs in Africa, only meets 30% of the country’s egg demand. The poultry industry is crucial for addressing protein deficiency in developing countries like Nigeria (Anosike et al., 2018). Nigeria in 2018, still imported 359 million USD of egg and dairy products more than the 9 million USD of the same products it exported the same year, emphasizing the need for increased production to achieve food security (Zootecnica International, 2022; FAO, 2023). From the above statistics, reducing the 25 million people projected to face hunger between June and August 2023 in Nigeria may only be achieved if policy actions for reinvestment are underway to improve and sustain production (FICHE, 2022). In addition, poultry egg production is principally vulnerable to the risk of inadequate feed intake, unavailability of inputs such as feed and feed ingredients, disease cum mortality rates, price changes, unstable government policies, and new changes in technology. Farmers often cannot predict or manage these risks alone, necessitating risk-sharing strategies. That said, the adoption of risk-mitigating strategies varies among poultry egg farmers, depending on their risk perception and desired output and efficiency levels.

Although a number of countries across the globe have made significant progress in the use of risk mitigants like agricultural insurance over the past decades (FAO, 2013; Yan-yuan et al., 2019), declining poultry output, even the closure of several poultry egg enterprises due to increasing and uncontrollably high levels of risk, remains prevalent in Africa. Crop insurance schemes, implemented in both developed and developing countries, have proven costly and have limited outreach. In Nigeria, risk-mitigating approaches include cooperative participation, reduction in household expenditure, enterprise diversification, stoppage of business expansion plans, and formal and informal insurance. Nevertheless, there is still a significant insurance gap, and only a small percentage of economic losses from natural disasters are covered by insurance (FAO, 2013).

Extant studies have shown that high costs of poultry feed and feed ingredients, lack of access to credit facilities, insecurity, and poor infrastructure, are serious challenges affecting poultry egg production (FAO, 2013; Otunaiya et al., 2015; Ayojimi et al., 2020; Maganga et al., 2021) opined that insurance and other risk mitigants can be features of a well-ordered adaptation method and can assist vulnerable nations to better cope with the new risks. Insurance can give a financial guarantee to the economic effects of natural risks and be more cost-effective than certain preventive measures. Similarly, adequate financing, access to credit, and government support are crucial for risk mitigation, and the sector’s growth. Farmers’ willingness to adopt insurance depends on factors such as premium prices (Nelson and Loehman, 1987; Battese and Coelli, 1995; Awotide, 2007; Farayola et al., 2013; Adeyonu, 2016; Ali et al., 2021; Maganga et al., 2021; Bannor et al., 2023).

Various organizations and governments have developed poultry breeding programs and invested in agriculture in developing countries. The Agricultural Insurance Program was established in Nigeria to change farmers’ attitudes toward risk and improve food supply (Coelli et al., 2005). The Nigerian government incentivized investment in the agricultural sector with tax exemption. Similarly, the Bank of Industry was established by the federal government in order to financially empower agriprenuers. However, the country’s policies have focused more on exportation than local production, posing challenges to food security.

This study builds on the agricultural insurance theory as propounded by the Asian economists (Syed et al., 1982), and the American Agricultural economists (Nelson and Loehman, 1987) as well as the Lancaster theory used by (Bannor et al., 2023). The agricultural insurance theory emphasizes pooling individual risks through Pareto-optimality states, enabling farmers to undertake risky activities by shifting these risks through insurance. Syed et al. (1982) found that a marginal increase in premium rates reduces resource use and expected agricultural output in risky farming. Conversely, (Nelson and Loehman, 1987) argued that although agricultural insurance is theoretically an efficient risk-sharing mechanism, it can be costly for transferring risks from farmers to the government or insurance agencies. The study supports the Lancaster theory’s proposition that farmers’ willingness to adopt insurance as a risk-mitigating instrument is influenced by attributes of the insurance product, such as premium price (Syed et al., 1982; Nelson and Loehman, 1987; Bannor et al., 2023).

Back home, agricultural insurance in Nigeria, particularly poultry insurance, is underdeveloped therefore, poultry (egg) producers in Nigeria are less equipped to mitigate production-related risks. The risk-bearing capacity of poultry farmers is low, and worse still, there are no existing mechanisms as poultry insurance, that indemnifies poultry egg farmers against the effects of these risks. Needless to say, poultry insurance has the potential to serve as an effective tool to deepen rural financial markets and thus boost small-scale poultry production yet, it is not established in Nigeria. Moreover, one of the pivotal roles financial institutions should play aside from savings and credit, is insurance services, yet to what extent do they provide this service? There is therefore the need to deepen financial services in rural areas, particularly in mitigating risks via the opportunities that agricultural (poultry) insurance presents. To ensure food security and sustainable poultry egg production, financial institutions should provide agricultural insurance services to support risk mitigation and small-scale poultry production. It is against this backdrop that this study which has a cardinal aim of ascertaining the agricultural insurance use effects on poultry egg output and efficiency in Oyo State of Nigeria now seeks to determine the factors affecting the choice of poultry insurance in the study area examine the factors that affect the level of use of poultry insurance, and analyze the effects of insurance on the efficiency of poultry egg farms.

The research was conducted in Oyo State, which is a major hub for poultry egg production in Nigeria. Oyo State has an average annual rainfall between 1,050 mm and 1,350 mm (Samuel Ogallah et al., 2017), and is situated within the southwest geopolitical zone of Nigeria.

To realize the study’s main goal, interviews with two main groups of respondents were conducted in order to acquire the data required for the analysis. A multistage sampling technique as propounded by (Deming and Stephan, 1940) was adopted to sample two hundred and seventy-two poultry egg-producing farmers. The sampling frame was poultry egg farmers in Oyo State. The area of research which is Oyo State is covered by Oyo State Agricultural Development Program (OYSADEP). The state under OYSADEP has four agricultural zones viz. Shaki, Ogbomoso, Oyo, and Ibadan/Ibarapa have 28 blocks all together for ease of administration. The ADP zones are Ibadan/Ibarapa (9 blocks), Saki (9 blocks), Oyo (5 blocks), and Ogbomoso (5 blocks) with each block comprising eight cells.

At the base, the number of insured poultry egg farmers located and sampled was determined as the corresponding number of uninsured poultry egg farmers sampled. This is because the latter was easy to locate due to its higher frequency than the former.

At the first stage, four ADP Zones were purposively selected in order to reduce the possibility of biases. More so, poultry egg farmers of varying production scales are greatly concentrated in each zone. Although the population of poultry egg farmers, flock size, and availability of market for poultry products are more concentrated in Ibadan/Ibarapa and Oyo Agricultural zones, in order to ensure a holistic approach, 70% of all blocks in all four ADP Zones were randomly selected, i.e., six from Ibadan/Ibarapa and Saki apiece, and four from Ogbomoso and Oyo apiece.

At the second stage, 50% of each of the earlier selected blocks was chosen using a simple random technique. Thus, 24 cells were randomly selected from Ibadan/Ibarapa, 16 cells from Oyo, 24 cells from Saki, and 16 cells from Ogbomoso. A further random selection of 82 poultry egg farmers from Ibadan/Ibarapa, 48 poultry egg farmers from Oyo, 77 poultry egg farmers from Saki, and 65 poultry egg farmers from Ogbomoso. This process enabled the drawing of 272 poultry egg farmers across the state’s four agricultural zones. Thus, a total number of 152 and 120 uninsured and insured poultry egg farmers, respectively, were sampled, bringing it to a total of 272 poultry egg farmers in all.

A composition of analytical tools was engaged for achieving the study’s objectives. These include descriptive statistics, the Tobit regression model, and the Stochastic Production Frontier.

The Tobit regression model was used to analyze the effect of choice in terms of the extent of the use of agricultural insurance on egg output in the study area. The Tobit regression model analyzes censored or truncated dependent variables, where the outcome of interest is limited or restricted in some way. It is a scientifically justified approach to analyze this objective in that agricultural insurance adoption and usage data often exhibit censoring, as some poultry farmers may choose not to participate or may only partially utilize the insurance coverage. Therefore, the Tobit model enables the investigation of both the choice to adopt agricultural insurance and the extent of usage (Greene, 2012).

The model is as expressed:

Where:

= Insurance Premium Paid (N).

q1 = Age of Poultry egg farmers (Years).

q2 = Educational level of poultry egg farmers (years of schooling).

q3 = Household Size (number of persons).

q4 = Flock size (No of birds).

q5 = Main occupation (1 = Farming, 0 = Otherwise).

q6 = Egg Production experience (years).

q7 = Access to credit facility (1 = loan; 0 = otherwise).

q8 = Farming system (1 = Poultry egg enterprise alone, 0 = otherwise).

q9 = Agricultural information (No visits of extension agent).

q10 = previous mortality rate (no of dead birds/total no of birds).

q11 = Availability of Insurance Agent (No of Visits).

q12 = Farm structure ownership (1 = owned, 0 = otherwise).

Q13 = Sales challenge (No of eggs sold/no of eggs produced).

q14 = Farm labor (No).

q15 = Net Farm Income (N).

= Vector of unknown parameters.

Coefficients of stimulus variables.

The Stochastic Production Frontier (SPF) Model was employed to assess the effect of agricultural insurance on the efficiency of the Poultry egg business. Thus, following (Battese and Coelli, 1995; Awotide, 2007), the effect of agricultural insurance use on the production and technical efficiency of poultry egg farms was analyzed. The SPF model allows for the assessment of technical efficiency, which quantifies the extent to which a firm or industry utilizes its resources to produce outputs. It captures the productive efficiency of the poultry egg business and provides insights into the impact of agricultural insurance on its efficiency (Coelli et al., 2005).

The explicit form for the stochastic function is given as:

Where:

In = logarithm to base e.

Subscript ij refers to the jth observation of the ith poultry egg farmer.

Q = Number of eggs produced.

X1 = Feed (Kg).

X2 = Labor (Man/day).

X3 = Cost of Drug (N).

X4 = Cost of Veterinary (N).

X5 = Flock size (Number of birds).

Parameters to be estimated.

The technical inefficiencies are defined as:

Where:

Ui = Inefficiency effects δ0 = Intercept

Z1 = Household Size (number of persons).

Z2 = Climate information access (1 = Yes, 0 = No).

Z3 = Credit access (1 = Access, 0 = otherwise).

Z4 = Layer’s production in previous year (1 = Yes, 0 = No).

Z5 = Flock size (No of birds).

Z6 = access to extension agent.

Z7 = Loss in previous year (1 = Yes, 0 = No).

Z8 = Age (Years).

Z9 = Education (Years of schooling).

Z10 = Insurance (1 = insured, 0 = uninsured).

Z11 = Farming Experience (Years).

Z12 = Farm ownership status (1 = owned, 0 = otherwise).

γ = evaluates the total output variation at the frontier that may be linked to technical inefficiency.

From Table 1, the mean age of both insured and uninsured are 52 and 51 years respectively, and agrees with Koné et al. (2018), who said that 86.8% of farmers are adults. This is because most of the youth have their attention shifted from farming to other sources of livelihood. Similarly, the mean educational level of 3.62 and 3.64 is an indication that both categories of farmers averagely have a tertiary level of education. This also indicates their willingness to pay for insurance as opined by Battese and Coelli (1995) and Bannor et al. (2023) that an increase in farmer’s age and educational level increases their readiness to insure their farms. The Table also shows that insured poultry egg farmers have a slightly above mean farm experience of 7.1 over uninsured farmers (6.95). It may be implied that farmers with more experience would be expected to run a more efficient and profitable enterprise. In addition, the majority (80 and 72%) of the insured and uninsured poultry egg farmers, respectively, recorded mortality in the previous year therefore, a good knowledge of the frequency of mortality in previous poultry production year can influence farmers’ decision to take poultry insurance the subsequent year perhaps as a panacea to cushion the effect recorded in production loss. This is in consonance with Ellis (2017), BalmaIssaka et al. (2016), and Bannor et al. (2023) who underscored that farming experience has a significantly positive relationship with their decision to adopt insurance. Furthermore, the majority (about 74%) of the insured farmers practiced poultry as a sole farming system while only about 35% of the uninsured farmers practiced a farming system that is solely poultry. This may be unconnected to the fact that taking an insurance cover was seen as a panacea to cushion the effect of engaging in poultry as a sole business. On the other hand, the uninsured farmers might have adopted mixed farming as a risk-mitigating strategy as opposed to taking insurance.

The Tobit regression model was used to analyze the factors affecting the level of use of poultry insurance. This was achieved by running the amount of insurance premium paid by each farm (the dependent variable) against other independent variables like access to credit facilities, access to insurance agents, et cetera. This section explores the factors likely to affect the level of use of poultry insurance. Hence, only the insured poultry farms were included in this analysis. Thus, Table 2 shows the parameter estimates and diagnostic statistics of the Tobit regression model of all insured poultry farms.

The result of the Tobit regression reveals only six of the 16 variables used in the model to be statistically significant. The coefficient (0.0650) of educational level is positive and significant at 10% level. The marginal effect shows that an increase in the educational level of the insured poultry farmers will increase the premium paid by N36. Interestingly, the coefficient (0.0784) of the farmers’ access to credit positively and significantly affects their level of premium paid. This resonates with past findings that poultry farmers’ educational level, past mortality experience, access to credit, and flock size increased the level of use of insurance (Farayola et al., 2013; Adeyonu, 2016; Okeke Agulu and Salihu, 2019; Bannor et al., 2023). The marginal effect further reveals that an additional increase in the access to credit of the insured poultry farmers will increase their premium by N155. In addition, the previous mortality rate, which is a measure of the rate of the number of dead birds to the total number of birds, was found to be significant and positive. This is in tandem with (Akinola, 2014) that poultry farmers’ adoption of agricultural insurance will increase based on past experience with risk. The marginal effect (0.210) reveals that an insured poultry farmer is likely to pay an additional premium of N21 to further mitigate the effect of loss arising from bird mortality.

Furthermore, the marginal effect (1267.7) of the sales challenge encountered with respect to the rate of eggs sold to eggs produced reveals that the poultry farmer will pay more premium of about N12,670 to insure the rate of egg sales. Lastly, the coefficient of the Net Farm Income of poultry egg farmers is significant but negative at the 10 % level. The marginal effect further reveals that the increase in farm income will reduce the insurance premiums paid by farmers.

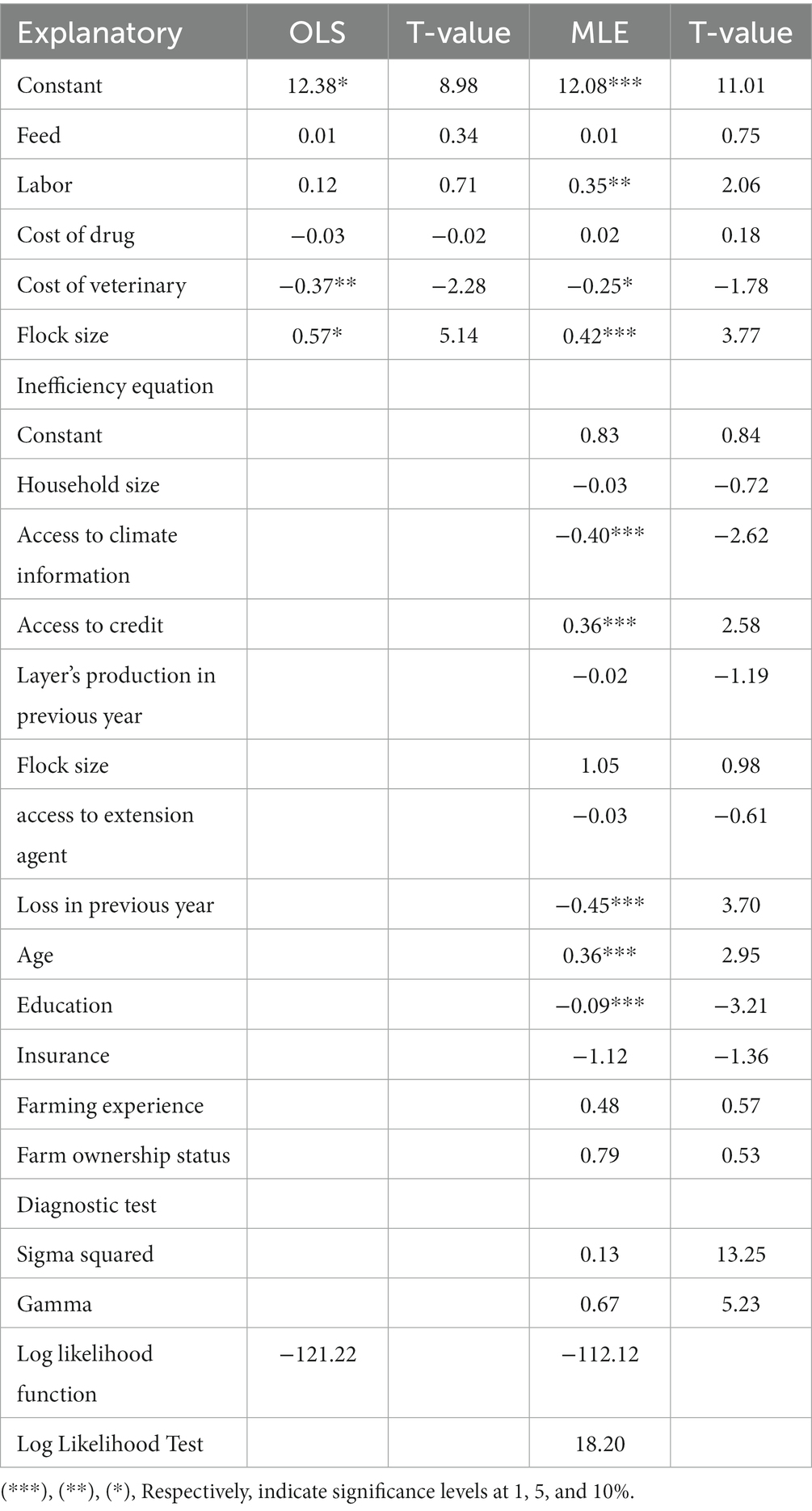

The Stochastic Production Frontier (SPF) Model was used to analyze the effect of poultry insurance on the efficiency of egg output. The egg farmers’ technical efficiency in the research area was estimated. Table 3 shows the effect of poultry insurance on the efficiency of egg output. Table 3 presents the results of the joint Maximum Likelihood Estimation (MLE) of the output frontier and inefficiency equation, as well as the Ordinary Least Square (OLS) version of the output frontier and the associated diagnostic statistics for all poultry egg farmers.

Table 3. Maximum likelihood estimate, ordinary least square, and inefficiency function of poultry production egg production.

A generalized likelihood ratio test of the significance of the one-sided error term fails to accept the null hypothesis that the one-sided error term is zero against an alternative that it is greater than zero. This shows that significant technical inefficiency exists among poultry farms in the sample.

The coefficient of sigma square in the MLE equation (0.13) is significant at p < 0.01. This connotes a good fit and correctness of the specified assumption of the composite error term. The coefficient of variance ratio (gamma) was found to be 0.67 and significant at p < 0.01. This shows that technical efficiency accounts for about 67.0% of the variation in egg output in the study area. Moreover, 5 out of 12 parameters in the inefficiency model are significant.

As shown in Table 4, the technical efficiency index for each term was calculated. The average technical efficiency for the sample is 0.75, with a minimum value of 0.1 and a maximum of 0.89. The Modal TE class for the sample is 0.10–0.19, showing that most poultry farmers in the sample (i.e., about 18%) can raise their revenue many folds if the militating factors are mitigated.

The coefficient of variables in the inefficiency equation and their corresponding t-ratios are shown in the lower half of Table 4. It shows that the coefficients for access to climate information, access to credit loss in the previous years, age, and education were significant at 1 %. Specifically, the coefficient of access to information on insurance is negative and significant (p < 0.1), which means that more access to information on insurance by poultry farmers can lower the inefficiency in the poultry business and egg output production activities in the study area.

Examining the other elements in the inefficiency model, the results in Table 4, show that the access to credit coefficient was positive and significant at the 1% level. This shows that an increase in loan access by egg-producing farmers can increase the inefficiency in production performance. The result with respect to loss in the previous year indicated a positively significant (p < 0.01) coefficient of −0.45. This implies having a loss experience in the previous year will reduce the inefficiency in the production performance. This result shows that egg producers learn from their previous losses experienced, hence, reducing their inefficiency. Furthermore, the coefficient (0.36) of age is positive and significant at the 1% level. Thus, as poultry egg farmers get older, their level of inefficiency increases. This may not be unconnected with the fact that there is a likely tendency for diminishing returns to set in arising from aging factors. The coefficient (−0.09) of education is an indication of the fact that as the farmers’ schooling level increases, their level of inefficiency reduces.

The adoption of agricultural insurance will improve the narrative for sustainable poultry production. Moreover, on account of production performance variability due to losses arising from the adoption of poultry insurance to mitigate the risk from previous year mortality, the insured farmers are supposed to generate better production performance and greater net profit as a result of taking insurance in order to reduce risk. Unfortunately, it did not. It should be noted that the majority of insured farmers decline to purchase an insurance policy to mitigate losses but as a precondition to secure financial support from a finance company. This clearly accentuates that the majority of poultry egg producers rarely have direct access to their insurers. There has been no proof of adequate and prompt insurance indemnity payment for any losses suffered by the insured farmers in the research area arising from poultry production. Moreover, this research revealed that farmers who are more informed either formally or through extension agents have a higher probability of using insurance as a risk mitigant. Therefore, although agricultural insurance remains evolving and is yet to be fully established in several developing countries, poultry insurance is however advocated for in order to adequately address the peculiarities in the poultry industry.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Adeyonu, Abigail Gbemisola. (2016). “Determinants of Poultry Farmers’ Willingness to Participate in National Agricultural Insurance Scheme in Oyo State, Nigeria.” Available at: https://www.semanticscholar.org/paper/Determinants-of-Poultry-Farmers%E2%80%99-Willingness-to-in-Adeyonu/2a8753c3a01e00a0ef5fd72fe854b1a319774f8c

Akinola, B. D. (2014). Determinants of farmers’ adoption of agricultural insurance: the case of poultry farmers in Abeokuta Metropolis of Ogun state, Nigeria. Br. J. Poultry Sci. 3, 36–41. doi: 10.5829/idosi.bjps.2014.3.2.83216

Ali, W., Abdulai, A., Goetz, R., and Owusu, V. (2021). Risk, ambiguity and willingness to participate in crop insurance programs: evidence from a field experiment. Aust. J. Agric. Resour. Econ. 65, 679–703. doi: 10.1111/1467-8489.12434

Anosike, F. U., Rekwot, G. Z., Owoshagba, O. B., Ahmed, S., and Atiku, J. A. (2018). Challenges of poultry production in Nigeria: a review. Niger. J. Anim. Prod. 45, 252–258. doi: 10.51791/njap.v45i1.335

Awotide, D. O. (2007). “Conditional analysis of Paddy output and resource-use efficiency of farmers in Ogun state, Nigeria” in Pathways to sustainable agriculture and rural economic development in Nigeria. ed. O. O. Olubanjo (Ibada: St. Paul Publishing House), 73–85.

Ayojimi, W., Ajiboye, B. O., and Bamiro, O. M. (2020). Comparative economic analysis of poultry egg production under two feed management regimes in Ogun state, Nigeria. Int. J. Res. Sci. Innov. 7, 107–115.

BalmaIssaka, Y., Wumbei, B. L., Buckner, J., and Nartey, R. Y. (2016). Willingness to participate in the market for crop drought index insurance among farmers in Ghana. Afr. J. Agric. Res. 11, 1257–1265. doi: 10.5897/AJAR2015.10326

Bannor, R. K., Oppong-Kyeremeh, H., Amfo, B., Kuwornu, J. K. M., Kyire, S. K. C., and Amponsah, J. (2023). Agricultural insurance and risk management among poultry farmers in Ghana: an application of discrete choice experiment. J. Agric. Food Res. 11:100492. doi: 10.1016/j.jafr.2022.100492

Battese, G. E., and Coelli, T. J. (1995). A model for technical inefficiency effects on a stochastic frontier production function for panel data. Empir. Econ. 20, 325–332. doi: 10.1007/BF01205442

Coelli, T., Rao, D. S., and O'Donnell, C. J. (2005). An introduction to efficiency and productivity analysis. New York, NY: Springer Science & Business Media.

Deming, W. E., and Stephan, F. F. (1940). On a least squares adjustment of a sampled frequency table when the expected marginal totals are known. Ann. Math. Stat. 11, 427–444. doi: 10.1214/aoms/1177731829

Ellis, E. (2017). Farmers' willingness to pay for crop insurance: evidence from eastern Ghana. Int. J. Agric. Manag. Dev 7 2017, 447–463. doi: 10.22004/ag.econ.292508

FAO (2013). MANAGING RISK in farming by David Kahan. Available at: https://www.fao.org/uploads/media/3-ManagingRiskInternLores.pdf

FAO (2020). Sustainable Development Goals. Available at: http://www.fao.org/sustainable-development-goals/goals/goal-8/en/#:~:text=Agriculture%20is%20the%20single%20largest,private%20investors%20in%20primary%20agriculture [Accessed February 21, 2023].

FAO (2023). Gateway to poultry production and products. Available at: https://www.fao.org/poultry-production-products/en/ [Accessed February 24, 2023].

Farayola, C.O, Adedeji, I.A, Popoola, P. O, and Amao, S. A. (2013) Determinants of Participation of Small Scale Commercial Poultry Farmers in Agricultural Insurance Scheme in Kwara State. Available at: http://www.sciepub.com/wjar/abstract/735 [Accessed MArch 9, 2023].

FICHE (2022). Cadre Harmonisé for Identification of Food and Nutrition Insecurity Risk Areas and Vulnerable Populations in 26 States and Federal Capital Territory (FCT) of Nigeria. Available at: https://fscluster.org/sites/default/files/documents/fiche_nigeria_november_2022_final_pdf.pdf [Accessed January 28, 2023].

Food and Agricultural Organization of the United Nations (2022). Available at: www.fao.org/faostat/en/#data/QA [Assessed on March 12, 2023].

Koné, G. A., Kouassi, G. F., Kouakou, N. D. V., and Kouba, M. (2018). Diagnostic of guinea fowl (Numida meleagris) farming in Ivory Coast. Poult. Sci. 97, 4272–4278. doi: 10.3382/ps/pey290

Maganga, A. M., Chiwaula, L. S., and Kambewa, P. (2021). Parametric and non=−prametric estimates of willingness to pay for weather index insurance in Malawi. Int. J. Disaster Risk Reduc. 62:102406. doi: 10.1016/j.ijdrr.2021.102406

Nelson, Carl H., and Loehman, Edna T. (1987). Further Towards a Theory of Agricultural Insurance. theory of agric insur 2.pdf. Available at: http://ajae.oxfordjournals.org/ [Accessed February 24, 2023].

OERC/FAO (2021). “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database). Available at: http://dx.doi.org/doi:10.1787/agr-outl-dataen.

Okeke Agulu, K. I., and Salihu, B. I. (2019). Poultry farmers’ participation in agricultural insurance in JOS Metropolis of plateau state, Nigeria. J. Agric. Vet. Sci. 12 Ser. II, 21–25.

Otunaiya, A. O., Adeyonu, A. G., and Bamiro, O. M. (2015). Technical efficiency of poultry egg production in Ibadan Metropolis, Oyo State, Nigeria. Economics 4, 50–56. doi: 10.11648/j.eco.20150403.12

Salvage, B. (2011): Global meat consumption to rise 73 percent by 2050: FAO. Available at: https://www.meatpoultry.com/articles/4395-global-meat-consumption-to-rise-73-percent-by-2050-fao [Accessed February 24, 2023].

Samuel Ogallah, S., Wandiga, S., Olago, D., and Silas, O. (2017). Impacts of climate variability and climate change on agricultural productivity of smallholder farmers in Southwest Nigeria. Int. J. Sci. Eng. Res. 8:ISSN 2229-5518.

Syed, M. Ahsan, Ali, Ali A. G., and Kurian, N. John (1982). Towards a Theory of Agricultural Insurance. theory of agric insur.pdf [Accessed February 24, 2023]

UNDP, (2008): Human Development Report 2007/2008: Fighting climate change: Human solidarity in a divided world. New York, USA. (15) (PDF) Livestock and Livestock products by 2050. Available at: https://www.researchgate.net/publication/344188926_Livestock_and_Livestock_products_by_2050 [Accessed February 25, 2023].

World Bank (2022). Agriculture Finance & Agricultural Insurance. Available at: https://www.worldbank.org/en/topic/financialsector/brief/agriculture-finance [Accessed February 12, 2023]

Yan-yuan, Z. H. A. N. G., Guang-wei, J. U., and Jin-tao, Z. H. A. N. (2019). Farmers using insurance and cooperatives to manage agricultural risks: a case study of the swine industry in China. J. Integr. Agric. 18, 2910–2918. doi: 10.1016/S2095-3119(19)62823-6

Zootecnica International (2022). Patterns and dynamics of egg trade: the global situation in 2020. https://zootecnicainternational.com/focus-on/market-trends/patterns-and-dynamics-of-egg-trade-the-global-situation-in-2020/ [Accessed February 12, 2023]

Keywords: insurance, poultry egg, risk, production, efficiency

Citation: Ayojimi W, Bamiro OM, Otunaiya AO, Shoyombo AJ and Matiluko OE (2023) Sustainability of poultry egg output and efficiency: a risk-mitigating perspective. Front. Sustain. Food Syst. 7:1195218. doi: 10.3389/fsufs.2023.1195218

Received: 28 March 2023; Accepted: 12 June 2023;

Published: 28 June 2023.

Edited by:

Li Min, Guangdong Academy of Agricultural Sciences (GDAAS), ChinaReviewed by:

Inoussa K. Y., Université Joseph Ki-ZERBO, Burkina FasoCopyright © 2023 Ayojimi, Bamiro, Otunaiya, Shoyombo and Matiluko. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wale Ayojimi, YXlvamltaS53YWxlQGxtdS5lZHUubmc=; d2F5b2ppbWlAZ21haWwuY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.