- Department of Agricultural, Food and Environmental Sciences, University of Perugia, Perugia, Italy

Introduction: Under an increasing demand from citizen and public institutions, agri-food supply chains are requested to comply with stringent environmental requirements. Moreover, new sources of uncertainty related to pandemic and geo-political turbulences put further pressures on economic agents, calling for proper and resilient governance mechanisms. Under the lens of the Neo Institutional Economics, we focus on production contracts and their clauses which, in turn, perform different functions and contribute to allocate property and decision rights, in the attempt to conciliate sustainability and food security.

Methods: In this framework, contract design assumes a key importance. Thus, we analyze farmers' preferences for different contractual clauses in the cereal sector. A choice experiment is carried out among durum wheat producers in Italy and mixed logit estimations assuming heterogeneous preferences are performed.

Results and discussion: Findings provide interesting indications, revealing a strong farmers' willingness to adhere production contracts in exchange for price stability and knowledge transfer offered by technical assistance services. However, producers are not available to limit their decisional autonomy in unilateral agreement with buyers and they reveal a certain indifference to costly production techniques aimed to improve environmental sustainability.

1. Introduction

In the last decades, greenhouse gas emissions from agri-food systems have increased of around 20%, accounting for about 30% of all emissions related to human activities in 2019 (FAO, 2022). Moreover, it is estimated that 85% of projected losses in biodiversity will be caused by agriculture and forestry (Vazquez-Brust et al., 2020). It follows that not only the agri-food sector negatively impacts on the environment but it also increasingly suffers from the main consequences of climate change, that could irremediably affect biodiversity, soil fertility, and last but not least, food security (Chandio et al., 2020). In order to push the transition toward global sustainable food systems and models, United Nations Member States approved the 2030 Agenda for Sustainable Development, revolving around the 17 Sustainable Development Goals (SDGs). Lately, the European Commission promoted the ecologic (or green) transition thanks to the European Green Deal and the Farm to Fork and Biodiversity strategies, all aimed to make agri-food system more sustainable (Dupraz, 2020; Schebesta and Candel, 2020). Such a transition mainly entails full decarbonisation and reduction of all GHG emissions down to a very low level (Prieve, 2022). As the general level of society's environmental consciousness increases, both consumers and downstream supply chain partners need to select eco-friendly products (Chu et al., 2017). Concerned with improving sustainability to enhance operational, economic, and social responsibility performance, many companies have begun therefore to incorporate cleaner technologies, and new organizational and logistical practices in the attempt to realize circular supply chains (González-Sánchez et al., 2020). For instance, food producers increasingly endorse and implement standards that establish criteria for sustainable production and sustainable management practices strongly relying on narrower collaboration with suppliers and customers for their implementation, with a growing interest for alternative food initiatives (Aggestam et al., 2017).

More recently, both the COVID-19 outbreak and the Russo-Ukrainian war had impacts on food security (Béné, 2020; Laborde et al., 2020; Mardones et al., 2020; Coopmans et al., 2021; Hassen and El Bilali, 2022; Hellegers, 2022). In this framework, there is an increasing need of progressively reconciling productivist and environmental standpoints, while addressing increasing technological, geopolitical, behavioral, and many other sources of uncertainty at stake. Such a situation calls into question coordinated, resilient, and responsive governance mechanisms regulating transactions in local and global agri-food supply chains. In more detail, both design and negotiation of contracts gain a key role (Li and Zhu, 2020). Companies requiring a consistent amount of agricultural raw materials have widely adopted contract farming (CF) to coordinate their supply chains (Abebe et al., 2013; Mugwagwa et al., 2020). According to Pinstrup-Andersen and Cheng (2009, p. 37), CF entails “agricultural production carried out according to a pre-planting agreement in which the farmer commits to producing a given product in a given manner and the buyer commits to purchasing it.” In this paper, we focus on production contracts, that is, a type of agreement between a buyer and its suppliers (either farmers or storage organizations) that frame the production and the transaction of a commodity (Bogetoft and Olesen, 2002). Compared to CF, production contracts refer more explicitly to the type of agreement in itself and its organizational dimension and not to the more global phenomenon of agricultural production under contract. Unlike traditional marketing contracts, which only specify basic clauses related to delivery modality, quantity and price, crop production contracts also contain also input and output specifications (Ricome et al., 2016). According to Cholez et al. (2020), therefore their main aim is to coordinate production, exchange and knowledge development among stakeholders. In doing so, they may play a relevant role in the field crop sector, because of their effect on reducing transaction costs.

Against this backdrop, the present paper aims to explore and analyze the role played by production contracts and their clauses (or terms) in matching farmers' preferences in the durum wheat sector. This is a strategic sector (particularly relevant in Italy, where the study was conducted) at the center of geopolitical turmoil for food security reasons, since the Russia-Ukraine conflict has started. The innovative contribution of this paper to the literature in the field of production contracts is two-fold. First, it proposes and test an original classification of contractual clauses and their function according to the NIE framework. Then, accordingly, using a discrete choice experiment and a mixed logit analysis, it analyzes the potential attractiveness of contractual clauses, including those related to the diffusion of sustainable production patterns in an uncertain context. To this purpose, in the following sections we first conceptualize the role of production contracts and their content, then, we elaborate research hypotheses looking at different functions and areas of intervention of contractual terms and at their likely acceptance from farmers. Methodology adopted is then described in detail, focusing on the characteristics of a discrete choice experiment conducted among Italian wheat producers and analyzed by means of mixed logit estimations. Lastly, results are described and discussed in the light of the existing literature in this field, before final remarks and recommendations are provided.

2. Conceptual framework

2.1. The NIE approach to contracts

A relevant strand of the agribusiness literature has been mainly centered on CF solutions as a tool (or “treatment”) for rural poverty alleviation, evaluating their impacts on smallholder farmers' welfare (in terms of employment, credits, farm incomes) in the least developed countries and across many crops (see Bellemare and Bloem, 2018 for an exhaustive review). Not without exceptions due to unfair practices and lack of transparency (Ruml and Qaim, 2020), CF clauses provide access to knowledge, better technologies (e.g., highly productive varieties), and credit, stimulating skill transfer and promotion of quality standards (Da Silva and Ranking, 2013; Mishra et al., 2018). However, under the concept of CF, there is a diversity of governance mechanisms that widely range from basic to more articulated contracts providing inputs and technical assistance.

The term “governance mechanism” is rooted in the Neo Institutional Economics (NIE) (Coase, 1988; Williamson, 1991, 1996). According to Williamson (1985), it is necessary to choose the mechanisms that minimize transaction costs, i.e., the ex-ante and ex-post costs of planning, adapting, and monitoring task completion of an agreement intrinsically related to different sources of asset specificity and uncertainty. Under the NIE view, contracts gain momentum as interesting governance solutions in response to coordination, safeguard and adaptations needs, so as to lower transaction burdens (Ménard, 2013; Martino and Polinori, 2019; Vazquez-Brust et al., 2020; Vicol et al., 2021).

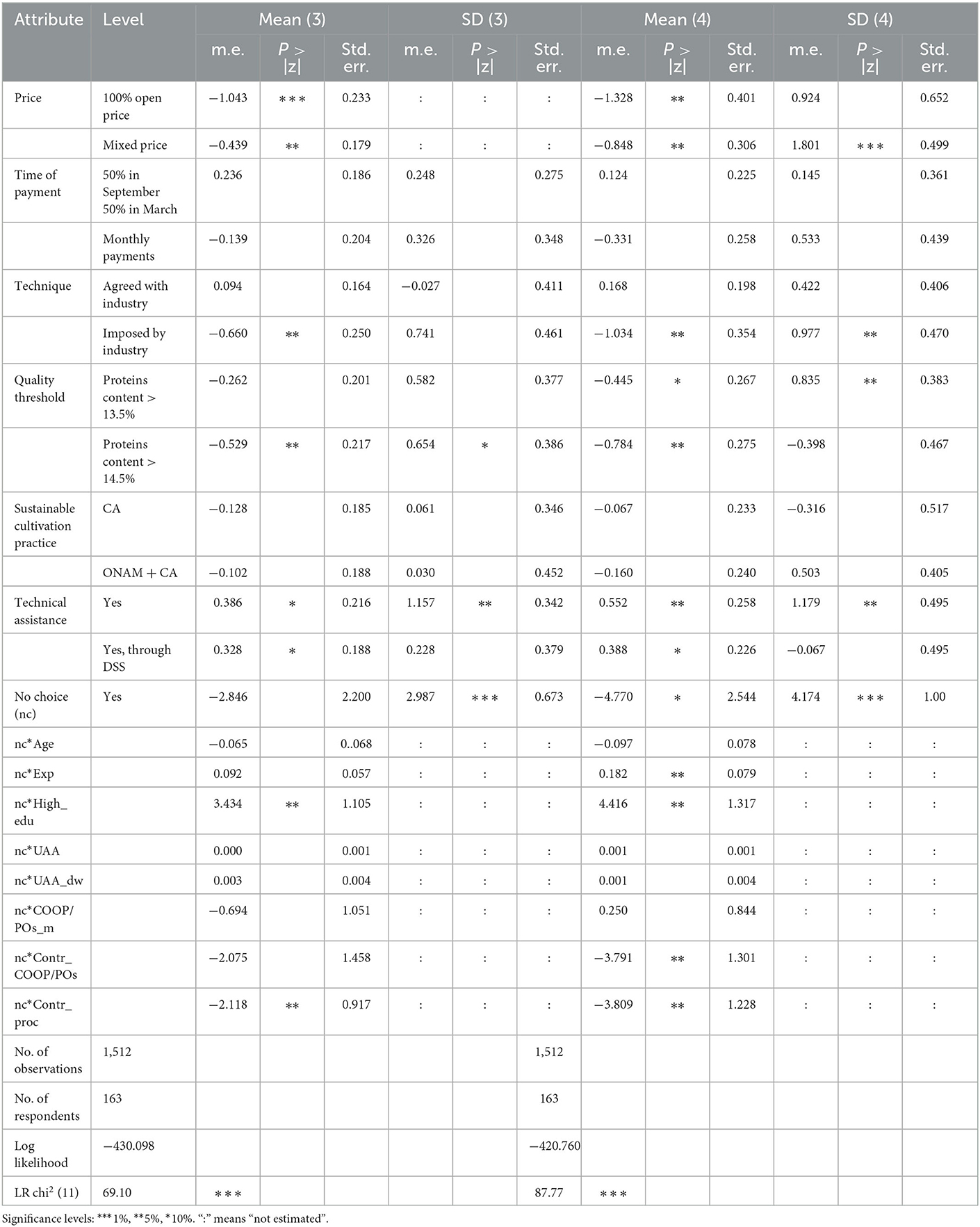

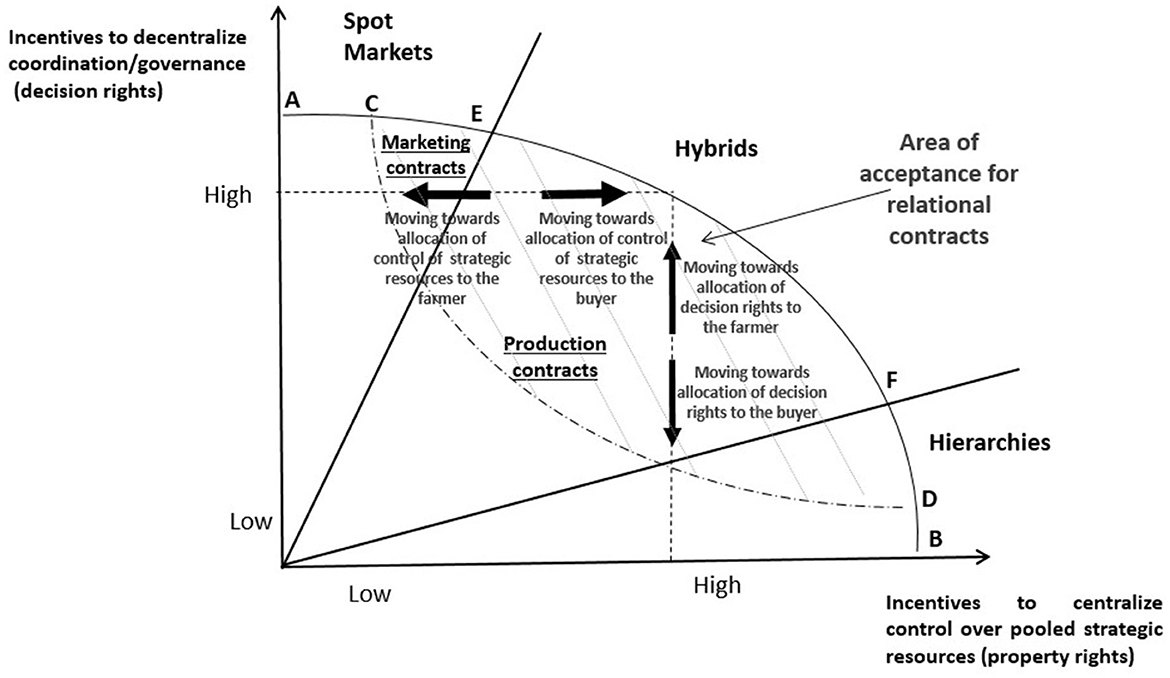

In this paper, we adopt the Ménard (2022) representation (Figure 1) in order to conceptualize the role of contractual mechanisms which are able to provide monetary and non-monetary incentives aimed to stimulate a process of joined centralization/decentralization of both property rights (that is, control over strategic investments) and decision rights (that, is governance). In turn, such a combination of incentives (to centralize/decentralize decision rights and/or the control over strategic investments) established by contractual clauses is able to shape organizational solutions aimed to minimize both production and transaction costs due to asset specificity and uncertainty.

Figure 1. Setting the research problem under the NIE lens: linking property and decision rights, transactional attributes, and organizational arrangements. Source: Our elaboration based on Ménard (2017, 2018, 2022).

Going into details, the curve from A to B (or external frontier) in Figure 1, that is concave to the origin, defines the optimal alternatives that could be reached with respect to the degree of control and coordination required. The curve from C to D (or internal frontier), that is convex to the origin, designates more formal agreements, with no room for relational adjustment. The intersection between these two curves delimitates the area under which misalignments between decision and property rights tend to make the organization of transaction costs hardly feasible, with the only exceptions of “spot markets” (segment from A to C) and “command firm” (segment from B to D). All other arrangements involve relational contracting with varying degree of efficiency and are located in the lens-shaped area covering markets (segment C-E), hierarchies (segment F-D) and, mainly, hybrids (segment E-F). This latter is the zone where commonly production contracts flourish, develop, and operate offering incentives for pooling strategic resources and governance decisions among the parties. Moreover, the figure reveals that, within the area of acceptance of relational contracts, the more partners expect to gain from pooling strategic assets, the more motivated they are to sacrifice their autonomous control over property rights. Symmetrically, the more they expect to gain from coordination over co-specialized investments, the more motivation they have to endorse centralized decision-making (Ménard, 2022).

Focusing on the topic under analysis, in response to the increasing interest of consumers and public authority for environment protection, agri-food production contracts engage multiple area of farming activities, spanning from technology definition and implementation, to quality strategies, and environmental resources. Multiple sources of uncertainty then affect the decision making process of farmers and processors, facing the necessity of combining private good provisioning and environmental services and protection. This fact has two implications, since economic agents seek to combine the contractual arrangements economizing on both transaction and production costs (Martino and Polinori, 2019). First, production contracts tend to become more complex requiring the specification and the alignment of multiple contractual terms. Second, because of the uncertainty surrounding transactions parties may face the need to adapt the contractual arrangement during its life and design further mechanisms to cope with the issues raised by non-contractible elements emerging after that the contract has been signed by the parties.

2.2. The role of contractual clauses

Following Martino and Polinori (2019) and Oliveira et al. (2021), a production contract is seen as the combination of specific clauses/terms (henceforth also named “attributes”) that encompass both governance and production costs. As a consequence, the profit of the farmer i (i = 1, 2, 3 . . . N) for each contract c (c = 1, 2, 3. . .) is:

where πic is the profit, Vic is the value of the final product obtained from the contract under the form of revenue, Cic represents production costs and Tic represents the transaction costs (that are function of the type of rights at stake and their negotiation).

In line with Williamson (1985) and Ménard (2017, 2018, 2022), we adopt a comparative approach that considers the alternative combinations (of property and decision) rights that are derived from different contractual attributes, entailing different values and costs. For instance, all other things being equal, insertion/removal of a contractual clause affects both value and (production and transaction) costs involved, as follows.

where Rijk represents an index for the alternative j from a choice situation k of contractual attribute which are included in a contract by the ith farmer, and β represents the unit monetary value of each term.

In our case, each contractual term brings its own value (that we assume constant for simplicity) as well as production and transaction costs. In practical terms, because we assume that the value V is given and therefore independent of the contract chosen, the farmer maximizes profit π by choosing, among alternatives, a contract c including combinations of contractual attributes j that minimize the expected variations of both production and transaction costs.

Hereafter, further elaborating on Williamson (1979), Mellewigt et al. (2012), and Ménard (2022), we conjecture connections among transactional attributes and functions of contractual clauses in allocating decision and property rights, which are able to affect preferences under scrutiny. Moreover, based on previous empirical evidences in the agri-food sector, we assume that widely adopted contractual clauses operate in some of the following areas of intervention: production, exchange and knowledge transfer. Accordingly, we develop research hypotheses on farmers' preferences, separately looking at contractual clauses based on their main areas of intervention and their functions.

2.2.1. Exchange clauses

Irrespective of the degree of centralization of decision and property rights, one of the fundamental elements of (more or less elaborated) contracts is represented by exchange clauses. This category encompasses a group of contractual clauses that parties adopt to regulate prices, methods and time of payment, and modality of delivery.

Price is probably the most common attribute in empirical studies dealing with contracts (Tuyen et al., 2022). Scholars report several different solutions, spanning from “open” price following market volatility to fixed price, under the form of minimum guaranteed price, passing through mixed alternatives where market price is used as a reference point for complex design of contract price (Bogetoft and Olesen, 2002).

Other exchange clauses refer to the schedule, modalities, location, and methods of payment and delivery (Ochieng et al., 2017). Solutions mainly encompass immediate, anticipated or postponed payment, taken the delivery as reference point. Under the NIE lens, the rationale of these categories of contractual clauses is to offer monetary incentives and coordinate decisions about exchange and payment with the aim to both safeguard parties against opportunistic behavior and offer a protection against uncertainty in output market. As a consequence, a first set of research hypotheses that explicitly refer to exchange clauses is elaborated.

Hypothesis 1a. Contractual clauses centralizing coordination of decision rights on price significantly affect farmers' preferences, protecting them from market uncertainty.

Hypothesis 1b. Contractual clauses centralizing coordination of decision rights on the modality of payment significantly affect farmers' preferences, protecting them from behavioral uncertainty.

2.2.2. Production clauses

This category encompasses a wide variety of contractual clauses providing incentives to concentrate decisions rights over production, so as to enhance coordination among parties. In more details, these clauses intervene to regulate production techniques and, increasingly in the last decades, quality and sustainability requirements.

2.2.2.1. Technique and production rules

This type of contractual clauses refers to production decisions and rules for the use of specific technical inputs that are sometimes also provided by the buyer with specific arrangements (Lemeilleur et al., 2020). Clauses may also include the way the final product must be delivered to the buyers, with or without storage, additional treatments or first processing (Blandon et al., 2010). To sum up, contractual clauses allocate among the parties involved in the contract the right to decide the rules of production. In doing so, they incentivize coordination and offer safeguard to specific investments, against potential negative consequences of opportunistic behaviors related to the wrong use of technology in the production process. Thus, the following research hypothesis comes out as a consequence.

Hypothesis 2a. Contractual clauses centralizing both coordination of decisional rights on production techniques and control over pooled strategic resources significantly affect farmers' preferences, offering safeguard for specific investments and protection from technological uncertainty.

2.2.2.2. Quality

Increasing importance of credence attributes leads to a growing need for coordination along the agro-food supply chain, so as to avoid deleterious consequences in terms of legal liability, reputational damage and consumer confidence (Ménard and Valceschini, 2005; Martino and Perugini, 2006). Contractual clauses introducing quality requirements provide incentives to centralize decision over the use of technology, since this can have direct consequences on the use of input and dedicated investments to achieve certain quality threshold (Frascarelli et al., 2021). As a consequence, a new research hypothesis is elaborated, as follows.

Hypothesis 2b. Contractual clauses centralizing both the coordination of decision rights on quality requirements and control over pooled strategic resources significantly affect farmers ‘preferences, since they safeguard dedicated investments and protect them from technological and behavioral uncertainty.

2.2.2.3. Sustainability practices

The concept of jointness of production is a key characteristic of so-called nature-related transactions costs that have been often overlooked in literature, even if with some important exceptions in the NIE field (Hagedorn et al., 2002; Vatn, 2002; Hagedorn, 2008). Following Hagedorn (2008), for example, buying and applying fertilizers and pesticides on a crop might result in higher yields with farm income increases as a consequence. While such a transaction is intended and expected, a fraction of the applied chemical inputs might end up in the groundwater or in a nearby river imposing additional costs on actors using this water for drinking purposes. According to the seminal work of Coase on social costs (Coase, 1960), in the real world the attempt to allocate property rights in order to establish who is in charge of compensating whom for some environmental damage is not costless, because of the existence of transaction costs.

This fact explains why when formal laws or environmental standards are absent or not well-enforced and implemented, sources of technological, and behavioral uncertainty around the outcomes of nature-related transactions increase: to cope with them, economic agents react developing governance mechanisms and organizational structures (Ménard, 2017). Such a situation paves the road for the increasing diffusion of contractual clauses that refer to environmental sustainability. Even if these contractual terms are intrinsically related (and somehow similar) to production rules and quality specifications, they have gained importance because of the increasing collective demand for developing and adopting sustainable innovations techniques from both consumers and public authorities (Stanco et al., 2020). Accordingly, we formulate another research hypothesis.

Hypothesis 2c. Contractual clauses centralizing both coordination of decision rights on sustainable cultivation techniques and control over pooled strategic resources significantly affect farmers' preferences, since they safeguard dedicated investments and protect them from technological and behavioral uncertainty.

2.3. Knowledge transfer clauses

Another area where production contracts increasingly intervene is related to knowledge and innovation (Martino and Polinori, 2019). Under a NIE perspective, economic rationale of knowledge transmission thanks to clauses referred to the provision of technical assistance is at least three-fold (Ciliberti et al., 2019). First, these contractual ensure terms a continuous monitoring of production processes and coordination of decisions, possibly reducing risks of opportunistic behavior and information misalignment. Second, in doing so they indirectly allow to safeguard specific investments in key inputs, monitoring and controlling their use so as to enhance quality of productions. Last but not least, to a certain extent, it introduces a flexible and dynamic mechanism to adapt the use of key inputs, techniques and production to exogenous and incontrollable factors that in turn represent sources of technological uncertainty. As a consequence, we are able to formulate the following research hypotheses.

Hypothesis 3. Contractual clauses centralizing both coordination of decision rights and control over strategic resources by means of a technical assistance services significantly affect farmers' preferences, since they safeguard key investments as well as coordinate and adapt production choices in presence of behavioral and technological uncertainty.

3. Material and methods

3.1. Experimental design and contract attributes

Choice experiments are a standard tool to evaluate the preferences of respondents with respect to hypothetical goods or services and are widely used in consumer research and environmental economics (Hensher et al., 2005; Louviere et al., 2010). Recently, choice experiments have also gained popularity in the agricultural economics field. The choice model on which this study is based deepen its roots in random utility approach (Louviere et al., 2010).

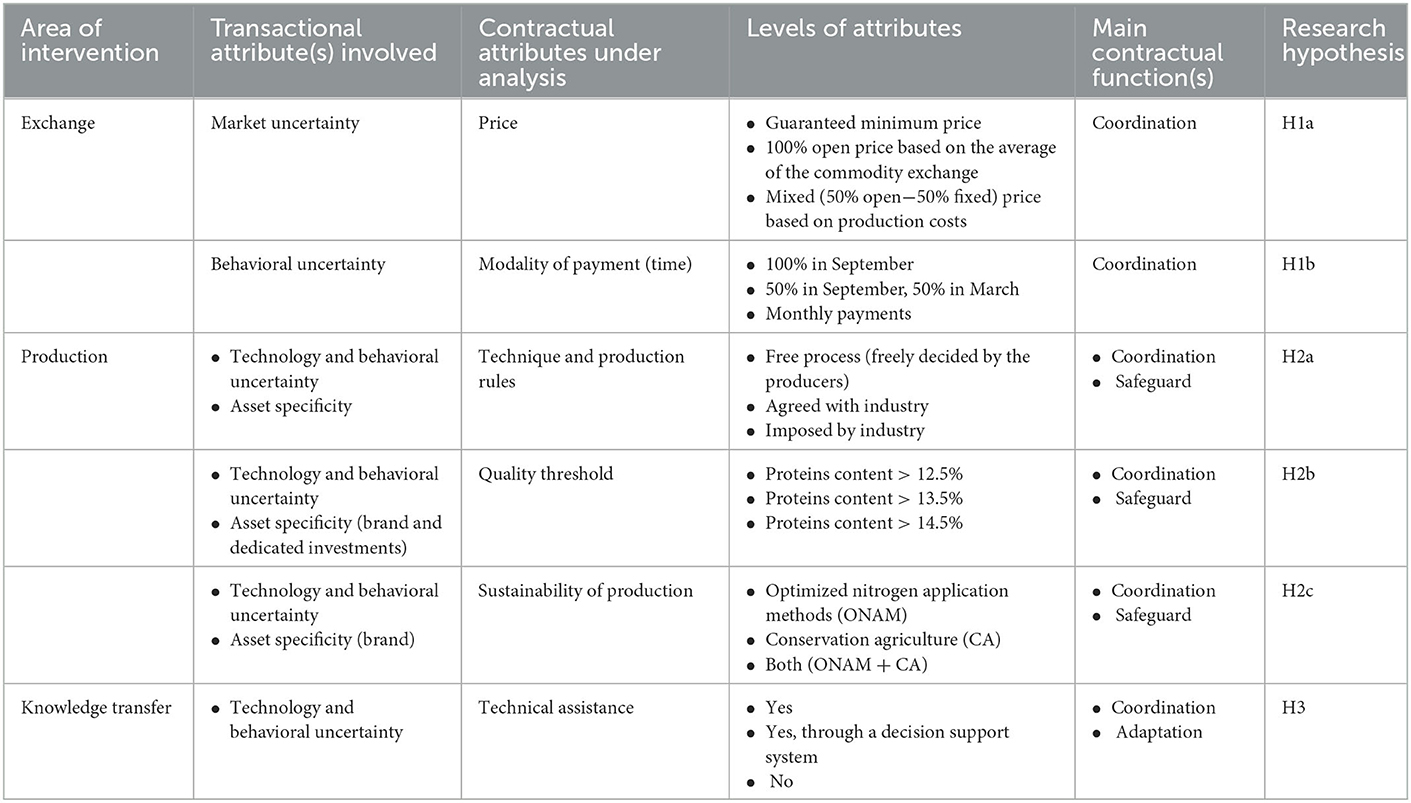

The starting point in designing a choice experiment is selecting relevant attributes and their corresponding levels (Hensher et al., 2005). Attributes (i.e., contractual clauses in our case) and levels were based on previous analyses and direct observations of the most representative contracts used in the durum wheat supply chain in Italy. Moreover, attributes and their levels were selected and tested with key stakeholders directly involved in designing and negotiating contracts, to validate the experimental design and enhance its robustness and reliability. Table 1 reports the list of attributes and levels considered for this work, building a bridge between the conceptual framework and the analytical framework.

Once we decided on the final attributes and levels specification, we designed the choice sets that would be presented to respondents. In more detail, combining the six attributes according to their three levels, a full factorial design would consist of 36 = 729. However, such a number of contracts is too complex to manage for a respondent. Therefore, we reduced the design to a D-efficient DCE where attributes and their levels were randomly distributed into 18 choice sets, each one with three possible contracts. As a result, 54 different contracts were involved in the end, representative of 729 possible contracts.

Moreover, choice sets were arranged into six blocks (each one with three choice sets) and each farmer was submitted to one of these blocks. Then, for each choice set, three choice situations came out in which the farmer was allowed to specify his preference toward one out of three contracts; as an alternative, he could also decide to select the opt-out (no-choice), opting for “none of the previous contract.” As a result, different contracts were proposed to farmers, characterized by six attributes (each one with three levels), reflecting different types of transactional attributes, contractual functions, and incentives to centralize property and decision rights.

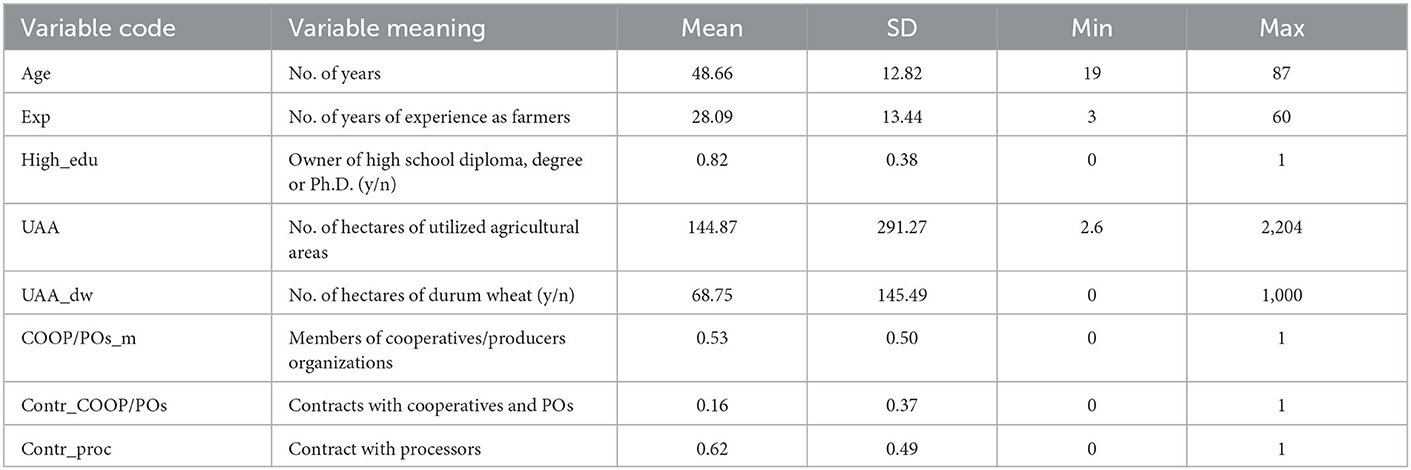

In order to test the research hypotheses a purposive sampling strategy was adopted to get insights from our study population, consisting of Italian farmers producing durum wheat. This crop covers 40% of the Italian cereal production, with around 150,000 farms cultivating an area of 1.3 million hectares, for an average production of around 4 million tons and a total value of 2 billion euro (Council for Agricultural Research Economics, 2021). Face-to-face interviews were conducted by trained and experienced interviewers, based on their own judgment when choosing potential respondents attending technical workshops and seminars all around Italy, between late 2019 and early 2020. As a consequence, inclusion in the sample mainly depended on farmers' participation to these workshops, their willing and interest to participate in the survey and their ability of correctly answering. To gather information, we used a structured questionnaire including a choice experiment to investigate farmers' preferences over contractual terms, details of which are provided later on. Characteristics of the sample, made of 163 farmers, are displayed in Table 2.

3.2. Econometric analysis

From a statistical point of view, the standard choice model, the multinomial logit (McFadden, 1974), assumes that substitution patterns are defined by the Independence of Irrelevant Alternatives (IIA) restriction. It implies that relative probabilities of two alternatives are unaffected by other alternatives, so that preferences for attributes of different alternatives are assumed to be homogeneous across individuals (Kanninen, 2007). Over the past years alternative modeling approaches have been developed that relax the IIA restriction, such as the mixed logit model also known as a mixed multinomial logit model or random-parameter logit model, which uses random coefficients to model the correlation of choices across alternatives. Mixed logit or random parameter logit is used in many empirical applications to capture more realistic substitution patterns than traditional conditional logit. The random parameters are usually assumed to follow a normal distribution, and the resulting model is fit through simulated maximum likelihood.

In doing so, it accounts for preference heterogeneity among respondents and repeated choices (McFadden and Train, 2000; Train, 2009). To account for such a heterogeneity, the random utility approach describes the utility Uijk consisting of a systematic (observable) component and an error (unobservable) component εijk. In more detail the latter component is represented by a vector of random coefficients of the attributes X of individual i for choosing alternative j and choice situation k can be included in equation.

The utility coefficients β vary according to individual (hence βi) with density function of the random parameters f (β). This density can be a function of any set of parameters, and represents in this case the mean and covariance of β in the sample population.

The mixed logit choice probability of choosing alternative j in a choice situation k is therefore given by

where Yijk is the choice variable of individual i for alternative j in choice situation k.

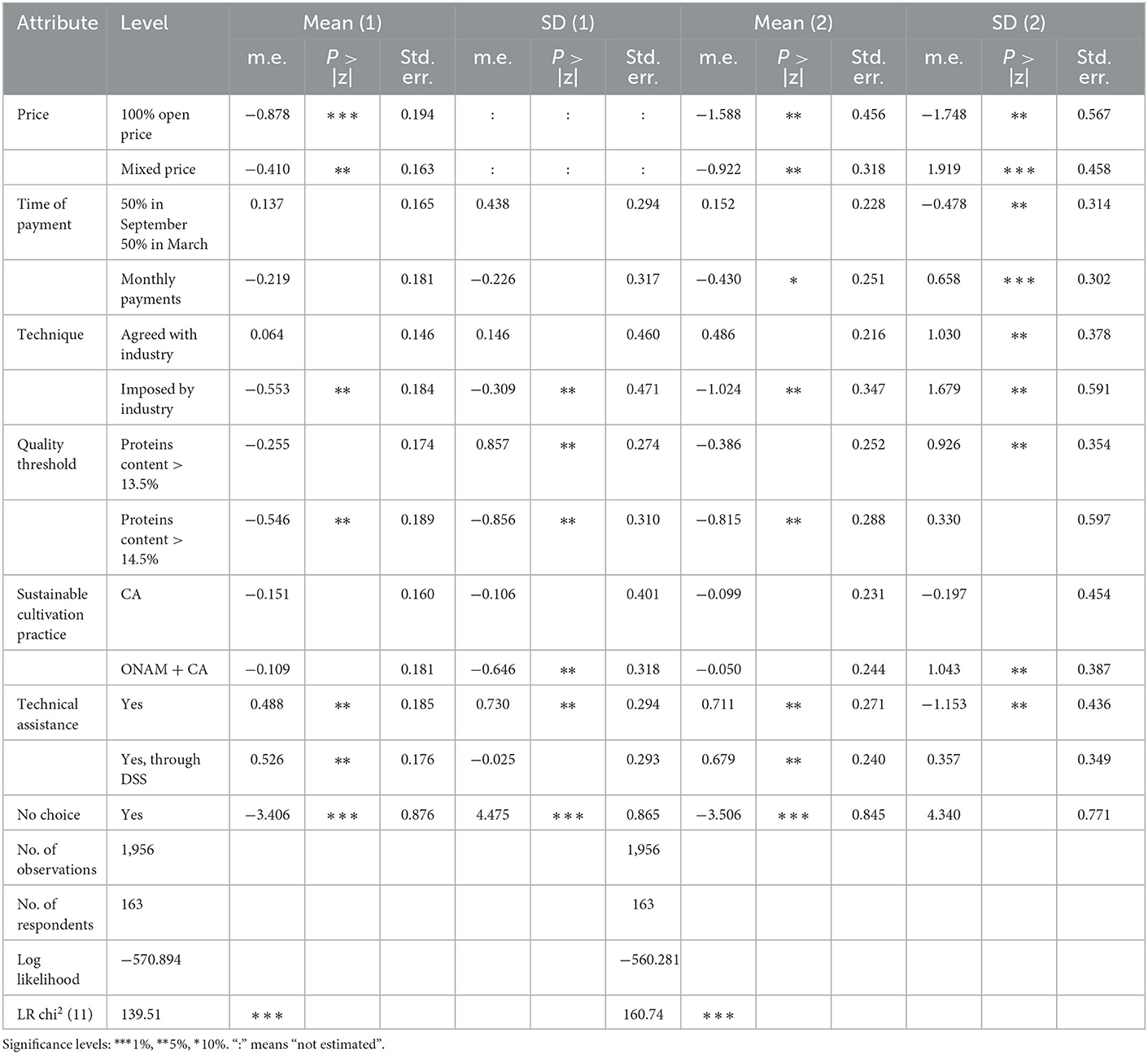

For this paper, we ran four mixed logit estimates. In model 1 the price coefficient is fixed, since we assume homogenous preferences of farmers for high prices, following a common approach in similar studies (Schipmann and Qaim, 2011; Ochieng et al., 2017). Then, being in presence of modalities of pricing options rather than price levels, we also considered price as random in model 2, allowing for heterogeneous preferences among farmers. Both models include an alternative specific constant (ASC) to account for the fact that the choice sets include a status quo (“none of the proposed contract”) option. Lastly, since contract preferences may be correlated with socioeconomic characteristics, we run two additional models (models 3 and 4) with the same specification of model 1 and 2 and interaction terms between ASC and control variables (related to farmers and farm characteristics) already described in Table 2.

Econometric analyses are run using the software Stata 14.2 and, in particular, packages based on Train (2003) and Hole (2007) for mixed logit with usual optimization methods for maximum likelihood estimation.

4. Results

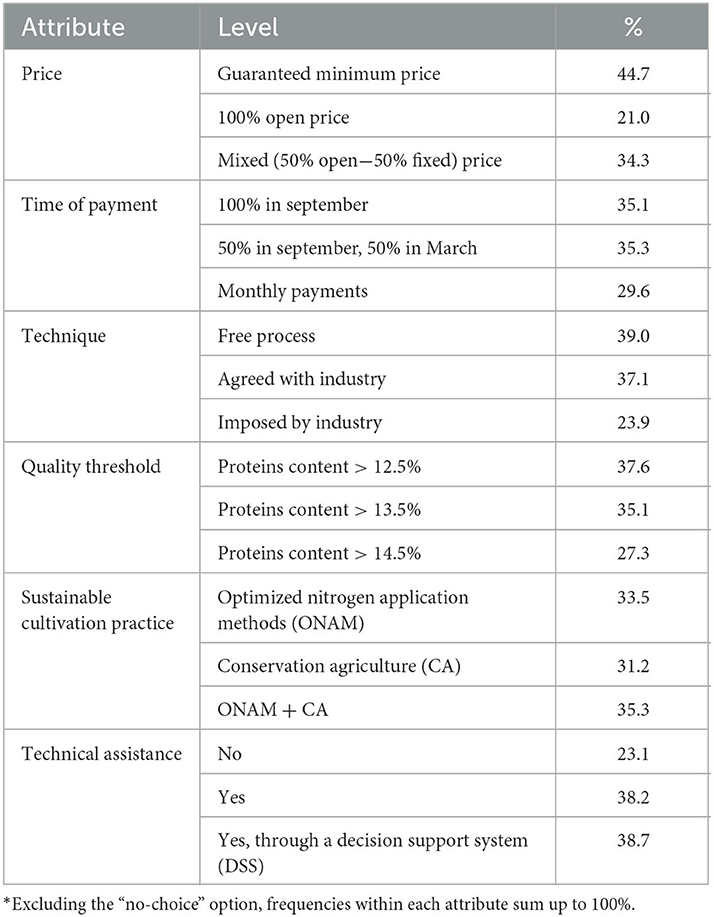

Results are obtained on a final sample of 163 completed questionnaires, filled in by durum wheat producers. Since each producer faced three choice situations, 489 choice set were available. However, 105 times (equivalent to 21.3% of the choice set), respondents opted for the “no-choice” alternative. Table 3 shows the raw choice frequency (%) for each attribute level, excluding the case where the “no-choice” option is selected. What emerges is that choices were almost equally spread over the three levels of each attribute, with some interesting exceptions for the price, technique and technical assistances attributes. Going into details, the “guaranteed minimum price” and the “100% open price” were selected in 44.7 and 21.0% of the choices, respectively. Moreover, only in <1 choice out of four, farmers opted for contracts were production techniques were imposed by the industry. Lastly, producers showed a larger acceptance for technical assistance (77% of the choices), combined or not with decision support systems.

Overall, the sample resulted quite heterogeneous with respect to respondent characteristics. On average, farmers are 48 years old (sd = 12.82), with 28 years of experience in the field (sd = 13.43). About one-fifth of the respondents own a degree, while about 18% has low or no education at all; the remaining 60 % took a high-school diploma. Farmers manage on average 144.87 hectares (sd = 291.27), of which on average 68.75 hectares (sd = 145.5) are cultivated with durum wheat. While 12.7% of respondents are associated with producers' organizations (POs) and 40.5% with cooperatives, the remaining respondents (46.8%) are not. Contracts with POs are used by 16.1% of respondents, while those with processors in 62.1% of the cases. Moreover, almost 42% of those contracting with POs also use contract with processors. However, almost one-third of the respondents do not use any type of contracts at all.

As far as the mixed models estimation are concerned, Tables 4, 5 report the marginal effects of the estimated models to facilitate the interpretation of the results.

Results reveal that some preferences toward attributes are significant and relevant.

First of all, the “no-choice” option has a negative and significant coefficient (m.e. are −3.406 in model 1 and −3.500 in model 2), indicating that farmers strongly prefer the contracting alternative over maintaining the status quo. This result is remarkable, given that not all the sampled farmers used to adopt contracts, suggesting a potential relevant interest for such a governance tool.

As for the price, in both mixed models farmers significantly prefer a guaranteed minimum price solution (the reference clause) in spite of open price solutions (m.e. are −0.878 in model 1 and −1.588 in model 2) or mixed price alternatives (m.e. are −0.410 in model 1 and −0.922 in model 2).

With regard to technique, results highlight a significant farmers' reluctance to rules unilaterally imposed by the processing industry purchasing durum wheat (m.e. are −0.533 in model 1 and −1.024 in model 2) compared to the possibility for a free production process (the reference clause).

Very interestingly, producers do not show significant preferences toward contractual attributes referred to the adoption of sustainable practices. At the same time, durum wheat producers are strongly and significantly attracted by the opportunity to benefit from technical assistance and decision support systems provided by buyers (m.e. are +0.488 in model 1 and +0.711 in model 2 for traditional support only, and +0.526 in model 1 and +0.679 in model 2 for modern technical assistance by means of decision support systems).

As far as the quality threshold and related duties are concerned, empirical evidences highlight clear and significant farmers' preferences toward lower level of commitment (and related production costs), that is a protein content of 12.5% rather 14.5% (m.e. are −0.546 and −0.815, respectively, in models 1 and 2).

Time of payment do not significantly affect farmers' preferences, with the only exceptions of mixed model 2 where estimates reveal a slight opposition to monthly payments compared to full payment after harvesting (m.e. = −0.430).

Lastly, models 3 and 4, introducing interaction terms between the “no-choice” option and control variables, substantially confirm previous results revealing also a significant role played by high education in fostering farmers participation to contracts. Interestingly, previous contracting experiences with cooperatives, producers' organizations and processors significantly decrease farmers' willingness to join production contracts.

5. Discussion

Empirical results allow to confirm the majority of the hypotheses under analysis, even if with some relevant exceptions. Henceforth, findings are therefore properly discussed in the lights of the existing literature in the field, following the order of presentation of the hypotheses in the conceptual framework.

The first group of hypotheses refers to clauses that affect exchanges.

As for the hypothesis 1a, results reveal that farmers prefer clauses able to ensure a higher level of coordination leading to a centralization of decision rights on price in order to address market uncertainty. In our case farmers perceive a minimum guaranteed price as explicitly abler to play a stabilization role even better than a mixed price, that is however costlier to enforce and somehow exposed to price volatility. This result is in line with Minten et al. (2009), Miyata et al. (2009), and Blandon et al. (2010), confirming that fixed price options provide farmers insurance against downside price risks. However, evidences contrast with Wang et al. (2011) and Abebe et al. (2013) who reported smallholders' preference for a floating price, when the ex post spot market price is expected to exceed the price proposed in the contract.

For what concerns the other clause intervening on the exchange area, findings do not allow to confirm hypothesis 1b related to the modality of payment. Farmers do not see such a contractual attribute as a remedy able to offer coordination and mitigate potential behavioral uncertainty. This result contradicts other studies (Schipmann and Qaim, 2011; Gelaw et al., 2016; Anh et al., 2019), where delivery and payment mechanisms are of paramount importance for farmers. However, while Widadie et al. (2020) noticed a group of interviewed farmers neglecting this type of clauses, Oliveira et al. (2021) also found a similar pattern in a previous study in the durum wheat sector, where producers were not significantly interested to contractual terms establishing the modality of payment in advance.

The second group of hypotheses is referred to clauses regulating production and its features.

In this area of intervention, what emerges is that farmers prefer a higher degree of decentralization of decision rights on the production process rather than a quasi-hierarchical centralization imposed by the industry without negation. Interestingly, against the expectation that farmers rely on clauses that ensure coordination of decisions to both safeguard their specific investments and protect them from technology and behavioral uncertainty (as in Oliveira et al., 2021 and in Al Ruqishi et al., 2020), here what prevails is the decisional autonomy for a production cycle characterized by a low level of dedicated investments. However, this evidence is in line with Abebe et al. (2013) and Vaissiere et al. (2018), which showed that the probability of accepting a contract decreases with increasing levels of restrictions on management practices, since farmers place more value on the freedom to make autonomous decisions. All that said and considered, we must reject hypothesis 2a.

With regard to quality of durum wheat production, the hypothesis 2b is confirmed. In line with Goodhue (2011), farmers reveal a preference toward a contractual clause introducing a certain degree of coordination aimed to centralize decision rights on quality requirement, reducing technology and behavioral uncertainty and introducing safeguard for dedicated investments. In this regard, literature is plenty of examples of contractual clauses regulating stringent food safety and product quality standards or imposing quality specifications (Raynaud et al., 2005, 2009; Arouna et al., 2017). All these clauses refer to quality requirements, which have a large impact on farmers' acceptance because they not only define minimum quality levels but also payment of premium prices. In our case, the reluctance to accept costly obligations, such as an excessive quality threshold (e.g., 14% or even 13% of protein content for durum wheat), can be attributed to possible quality measurement problems in line with Abebe et al. (2013) and Oliveira et al. (2021).

Very interestingly, despite the potential of contractual arrangements in promoting environmental sustainability in the agri-food sector (Ren et al., 2021), empirical evidences do not allow to confirm hypothesis 2c, in line with Van den Broeck et al. (2017). Results highlight that farmers tend to not accept a clause centralizing decision rights on sustainable cultivation techniques, which could contribute to guarantee safeguard for dedicated investments and protection from technological and behavioral uncertainty. Possible explanations are at least two-fold. First, such a clause can be used to transfer liability of the environmental pollution from agribusiness firms to farmers (Huong et al., 2020). Second, producers are not particularly committed to more sustainable practices per se, so that they do not accept specific obligations, if not in exchange for incentives promoted by leading actors in the agri-food supply chains (Shi et al., 2020; Ciliberti et al., 2022). Looking outside, a decisive role certainly can be played on the one hand by the institutional environment, unable to provide sufficient incentives or disincentives (in terms of rewards and penalties) and on the other hand, by consumers and clients unwilling to pay more to compensate producers from extra costs due to the adoption of environmental-friendly practices.

The last hypothesis concerns clauses intervening on knowledge transfer.

In this case, results show that farmers see favorably a contractual term centralizing both coordination of decision rights and control over strategic resources by means of whatever form of technical assistance. What emerges is that durum wheat producers rely on this category of services, in order to better coordinate and adapt their production choices, reducing behavioral and technological uncertainty and benefitting from some form of safeguard for their key investments as well. In line with Anh et al. (2019) and Ihli et al. (2022), these evidences allow to confirm research hypothesis 3 revealing that extension and advisory services are largely accepted from farms, since they can help improving both their productivity and performance. Moreover, technical assistance may contribute to guiding farms in transitioning toward more sustainable and resilient practices (Labarthe and Laurent, 2013; Šumane et al., 2018).

6. Conclusions

In a scenario where continuing societal and institutional pressure for an ecological transition are imposing a shift toward eco-friendlier production process, the COVID-19 crisis and the Russian-Ukrainian conflict increasingly questioned the ability of the agricultural sector to ensure both food security and environmental sustainability. This fact calls for a necessary balance between two apparently contrasting goals, that in turn interrogates coordination mechanisms along the agri-food supply chain as an opportunity for reconciling food production and environmental protection.

Adopting a NIE perspective, our paper shed lights on production contracts as an interesting solution to govern transactions among economic agents, regulating not only modality of production but also exchange and knowledge transfer and directly impacting on both property and decision rights allocation. Looking at production contracts under this lens, we focused on contract design, that is a fundamental step where actors' preferences toward specific terms reflect the role played by transactional attributes, such as uncertainty and asset specificity, and the consequent need for safeguard, coordination or adaptation solutions.

In doing so, this paper contributed to unravel the complex interactions among contractual areas of interventions, contractual functions, and transactional attributes in the cereal sector, highly impacted by recent geo-political turmoil. Even if based on a small and not representative sample of Italian farmers that hinder whatever generalization of results, empirical evidences revealed a widespread interest for production contracts and offered other valuable indications.

What emerged was that farmers' preferences on contractual clauses were composite and not necessarily in line with previous evidences. Farmers did not accept unilateral and extremely stringent rules imposed by the industry, showing a certain degree of managerial autonomy which must be taken into account when negotiating contracts. In this regard, fixed prices and the provision of technical assistance were key terms in leading producers' choice to join a contract. These clauses have a role in safeguarding investments and protecting against uncertainty, while making the relationships more adaptive to unexpected events and new techniques. Likewise, quality thresholds also played an important function in coordinating and guiding production choice and protecting investments, but only if the request from industry was not extremely burdensome for farmers.

However, neither the condition of payments nor, more interestingly, the adoption of sustainable practices without specific rewards were of any interests for producers. Such a latter finding raised important questions on what could be useful monetary or non-monetary incentives able to stimulate sustainable commitments in the cereal sector.

In conclusion, matching production and sustainability targets in contractual arrangements brings implications that, in turn, call for both managerial and policy actions in a scenario of international crisis with direct and negative consequences on international trade and prices for fertilizers and energy.

Governing the ecological transition cannot ignore farmers needs for containing increasing input costs and adapting to potential sources of uncertainty, related to increasing market and geopolitical instability as well as to new technological pressure in emerging digital business ecosystems. Along this pathway, due to their organizational nature, contractual solutions should not be approached as one size fits all solutions, since they are not able to automatically ensure the achievement of whatsoever targets, even more when they are apparently conflicting such as sustainability and food security. Rather, recognizing different contractual functions, areas of intervention and effects on property and decision rights, managers and policymakers should invest in supporting more inclusive process of production contract design, based on fair and collaborative negotiation of contractual terms, so as to enhance their diffusion.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the participants was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

SC: conceptualization, methodology, formal analysis, software, and writing—original draft preparation. AF: investigation. SC and GM: writing—review and editing. GM and AF: validation and supervision. All authors contributed to the article and approved the submitted version.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abebe, G. K., Bijman, J., Kemp, R., Omta, O., and Tsegaye, A. (2013). Contract farming configuration: smallholders' preferences for contract design attributes. Food Policy 40, 14–24. doi: 10.1016/j.foodpol.2013.01.002

Aggestam, V., Fleiß, E., and Posch, A. (2017). Scaling-up short food supply chains? A survey study on the drivers behind the intention of food producers, J. Rural Stud. 51, 64–72. doi: 10.1016/j.jrurstud.2017.02.003

Al Ruqishi, B. H., Gibreel, T., Akaichi, F., Zaibet, L., and Zekri, S. (2020). Contractual agriculture: better partnerships between small farmers and the business sector in the sultanate of Oman. Asian J. Agric. Rural Dev. 10, 321–335. doi: 10.18488/journal.1005/2020.10.1/1005.1.321.335

Anh, N. H., Bokelmann, W., Thi Thuan, N., Thi Nga, D., and Van Minh, N. (2019). Smallholders' preferences for different contract farming models: empirical evidence from sustainable certified coffee production in Vietnam. Sustainability 11, 3799. doi: 10.3390/su11143799

Arouna, A., Adegbola, P., Zossou, R., Babatunde, R., and Diagne, A. (2017). Contract farming preferences of smallholder rice producers in benin: a stated choice model using mixed logit. Tropicultura 35, 179–191.

Bellemare, M., and Bloem, J. (2018). Does contract farming improve welfare a review. World Dev. 112, 259–271. doi: 10.1016/j.worlddev.2018.08.018

Béné, C. (2020). Resilience of local food systems and links to food security – a review of some important concepts in the context of COVID-19 and other shocks. Food Sec. 12, 805–822. doi: 10.1007/s12571-020-01076-1

Blandon, J., Henson, S., and Islam, T. (2010). The importance of assessing marketing preferences of small-scale farmers: a latent segment approach. Eur. J. Dev. Res. 22, 494–509. doi: 10.1057/ejdr.2010.26

Bogetoft, P., and Olesen, H. B. (2002). Ten rules of thumb in contract design: lessons from Danish agriculture. Eur. Rev. Agric. Econ. 29, 185–204. doi: 10.1093/eurrag/29.2.185

Chandio, A. A., Ozturk, I., Akram, W., et al. (2020). Empirical analysis of climate change factors affecting cereal yield: evidence from Turkey. Environ. Sci. Pollut. Res. 27, 11944–11957. doi: 10.1007/s11356-020-07739-y

Cholez, C., Magrini, M. B., and Galliano, D. (2020). Exploring inter-firm knowledge through contractual governance: a case study of production contracts for faba-bean procurement in France. J. Rural Stud. 73, 135–146. doi: 10.1016/j.jrurstud.2019.10.040

Chu, S., Yang, H., Lee, M., and Park, S. (2017). The impact of institutional pressures on green supply chain management and firm performance: top management roles and social capital. Sustainability 9, 764. doi: 10.3390/su9050764

Ciliberti, S., Martino, G., Frascarelli, A., and Chiodini, G. (2019). Contractual arrangements in the Italian durum wheat supply chain: the impacts of the ‘Fondo grano duro’. Econ. Agro Aliment. 21, 235–254. doi: 10.3280/ECAG2019-002004

Ciliberti, S., Stanco, M., Frascarelli, A., Marotta, G., Martino, G., and Nazzaro, C. (2022). Sustainability strategies and contractual arrangements in the italian pasta supply chain: an analysis under the neo institutional economics lens. Sustainability 14, 8542. doi: 10.3390/su14148542

Coopmans, I., Bijttebier, J., Marchand, F., Mathijs, E., Messely, L., Rogge, E., et al. (2021). COVID-19 impacts on flemish food supply chains and lessons for agri-food system resilience. Agric. Syst. 190, 103136. doi: 10.1016/j.agsy.2021.103136

Council for Agricultural Research Economics (2021). Annuario Dell'agricoltura Italiana 2021. Available online at: https://www.crea.gov.it/documents/68457/0/Annuario_CREA_2021_Volume_LXXV.pdf/49fc57e1-a325-50f4-22bb-d044d0f24dbe?t=1671527592245 (accessed January 10, 2023).

Da Silva, C. A., and Ranking, M. (2013). Contract Farming for Inclusive Market Access. Rome: Food and Agriculture Organization of the United Nations (FAO).

Dupraz, P. (2020). Policies for the ecological transition of agriculture: the livestock issue. Rev. Agric. Food Environ. Stud. 101, 529–538. doi: 10.1007/s41130-020-00135-7

FAO. (2022). Faostat. FAO. Available online at: www.fao.org/faostat/en/ (accessed November 23, 2022).

Frascarelli, A., Ciliberti, S., Magalhães de Oliveira, G., Chiodini, G., and Martino, G. (2021). Production contracts and food quality: a transaction cost analysis for the italian durum wheat sector. Sustainability 13, 2921. doi: 10.3390/su13052921

Gelaw, F., Speelman, S., and Van Huylenbroeck, G. (2016). Farmers' marketing preferences in local coffee markets: evidence from a choice experiment in Ethiopia. Food Policy 61, 92–102. doi: 10.1016/j.foodpol.2016.02.006

González-Sánchez, R., Settembre-Blundo, D., Ferrari, A. M., and García-Muiña, F. E. (2020). Main dimensions in the building of the circular supply chain: a literature review. Sustainability 12, 2459. doi: 10.3390/su12062459

Goodhue, R. E. (2011). Food quality: the design of incentive contracts. Ann. Rev. Resour. Econ. 3, 119–140. doi: 10.1146/annurev-resource-040709-135037

Hagedorn, K. (2008). Particular requirements for institutional analysis in nature-related sectors. Eur. Rev. Agric. Econ. 35, 357–384. doi: 10.1093/erae/jbn019

Hagedorn, K., Arzt, K., and Peters, U. (2002). “Institutional arrangements for environmental co-operatives: a conceptual framework,” in Environmental Co-operation and Institutional Change: Theories and Policies for European Agriculture, ed K. Hagedorn (Cheltenham: Edward Elgar), 3–25. doi: 10.4337/9781782543916.00009

Hassen, T. B., and El Bilali, H. (2022). Impacts of the Russia-Ukraine war on global food security: towards more sustainable and resilient food systems? Foods 11, 2301. doi: 10.3390/foods11152301

Hellegers, P. (2022). Food security vulnerability due to trade dependencies on Russia and Ukraine. Food Sec. 14, 1503–1510. doi: 10.1007/s12571-022-01306-8

Hensher, D. A., Rose, J. M., and Greene, W. H. (2005). Applied Choice Analysis: A Primer. Cambridge: Cambridge University Press. doi: 10.1017/CBO9780511610356

Hole, A. R. (2007). Fitting mixed logit models by using maximum simulated likelihood. Stata J. 7, 388–401. doi: 10.1177/1536867X0700700306

Huong, L. T. T., Takahashi, Y., Nomura, H., Son, C. T., Kusudo, T., and Yabe, M. (2020). Manure management and pollution levels of contract and non-contract livestock farming in Vietnam. Sci. Total Environ. 710, 136200. doi: 10.1016/j.scitotenv.2019.136200

Ihli, H., Seegers, R., Winter, E., Chiputwa, B., and Gassner, A. (2022). Preferences for tree fruit market attributes among smallholder farmers in Eastern Rwanda. Agric. Econ. 53, 5–21. doi: 10.1111/agec.12673

Kanninen, B. J. (2007). Valuing Environmental Amenities Using Stated Choice Studies; A Common Sense Approach to Theory and Practice. Dordrecht: Springer. doi: 10.1007/1-4020-5313-4

Labarthe, P., and Laurent, C. (2013). Privatization of agricultural extension services in the EU: towards a lack of adequate knowledge for small-scale farms? Food Policy 38, 240–252. doi: 10.1016/j.foodpol.2012.10.005

Laborde, D., Martin, W., Swinnen, J., and Vos, R. (2020). Covid-19 risks to global food security. Science 369, 500–502. doi: 10.1126/science.abc4765

Lemeilleur, S., Subervie, J., Presoto, A. E., Souza Piao, R., and Saes, M. S. M. (2020). Coffee farmers' incentives to comply with sustainability standards. J. Agribus. Dev. Emerg. Econ. 10, 365–383. doi: 10.1108/JADEE-04-2019-0051

Li, X., and Zhu, Q. (2020). Contract design for enhancing green food material production effort with asymmetric supply cost information. Sustainability 12, 2119. doi: 10.3390/su12052119

Louviere, J. J., Flynn, T. N., and Carson, R. T. (2010). Discrete choice experiments are not conjoint analysis. J. Choice Model. 3, 57–72. doi: 10.1016/S1755-5345(13)70014-9

Mardones, F. O., Rich, K. M., Boden, L. A., Moreno-Switt, A. I., Caipo, M. L., Zimin-Veselkoff, N., et al. (2020). The COVID-19 pandemic and global food security. Front. Vet. Sci. 7:578508. doi: 10.3389/fvets.2020.578508

Martino, G., and Perugini, C. (2006). “Hybrid forms in food supply”, in “International Agri-Food Chains and Networks: Management and Organizations”, eds J. Bijman, O., Omta, J., Trinekens, J., Wijnands, and E., Wubben (Wageningen: Wageningen Academic Publishers), 287–301.

Martino, G., and Polinori, P. (2019). An analysis of the farmers contractual preferences in process innovation implementation. Br. Food J. 121, 426–440. doi: 10.1108/BFJ-12-2017-0697

McFadden, D. (1974). Conditional Logit Analysis of Qualitative Choice Behavior. New York, NY: Academic Press.

McFadden, D. L., and Train, K. E. (2000). Mixed MNL models for discrete response. J. Appl. Econ. 15, 447–470. doi: 10.1002/1099-1255(200009/10)15:5<447::AID-JAE570>3.0.CO;2-1

Mellewigt, T., Decker, C., and Eckhard, B. (2012). What drives contract design in alliances? Taking stock and how to proceed. J. Bus. Econ. Manag. 82, 839–864. doi: 10.1007/s11573-012-0591-y

Ménard, C. (2013). “Hybrid model of organization. alliance, joint ventures, networks, and other ‘strange’ animals,” in The Handbook of Organizational Economics, eds R. Gibbons, and J. Roberts (Princeton, NJ: Princeton University Press), 1066–1108. doi: 10.1515/9781400845354-028

Ménard, C. (2017). “Finding our way in the jungle: Insights from organization theory,” in It's a Jungle Out There—The Strange Animals of Economic Organization in Agri-Food Value Chains, eds G. Martino, K. Karantininis, S. Pascucci, L. K. Dries, J. M. Codron (Wageningen: Wageningen Academic Publishers), 124–139. doi: 10.3920/978-90-8686-844-5_1

Ménard, C. (2018). Organization and governance in the agrifood sector: how can we capture their variety? Agribusiness 34, 142–160. doi: 10.1002/agr.21539

Ménard, C. (2022). Hybrids: where are we? J. Inst. Econ. 18, 297–312. doi: 10.1017/S1744137421000230

Ménard, C., and Valceschini, E. (2005). New institutions for governing the agri-food industry. Eur. Rev. Agric. Econ. 32, 421–440. doi: 10.1093/eurrag/jbi013

Minten, B., Randrianarison, L., and Swinnen, J. F. M. (2009). Global retail chains and poor farmers: evidence from Madagascar. World Dev. 37, 1728–1741. doi: 10.1016/j.worlddev.2008.08.024

Mishra, A. K., Kumar, A., Joshi, P. K., and D'Souza, A. (2018). Impact of contract farming on yield, costs and profitability in low-value crop: evidence from a low-income country. Austral. J. Agric. Resourc. Econ. 62, 589–607. doi: 10.1111/1467-8489.12268

Miyata, S., Minot, N., and Hu, D. (2009). Impact of contract farming on income: linking small farmers, packers, and supermarkets in China. World Dev. 37, 1781–1790. doi: 10.1016/j.worlddev.2008.08.025

Mugwagwa, I., Bijman, J., and Trienekens, J. (2020). Typology of contract farming arrangements: a transaction cost perspective. Agrekon 59, 169–187. doi: 10.1080/03031853.2020.1731561

Ochieng, D. O., Veettil, P. C., and Qaim, M. (2017). Farmers' preferences for supermarket contracts in Kenya. Food Policy 68, 100–111. doi: 10.1016/j.foodpol.2017.01.008

Oliveira, G. M. d, Martino, G., Ciliberti, S., Frascarelli, A., and Chiodini, G. (2021). Farmer preferences regarding durum wheat contracts in Italy: a discrete choice experiment. Br. Food J. 123, 4017–4029. doi: 10.1108/BFJ-09-2020-0876

Pinstrup-Andersen, P., and Cheng, F. (2009). Case Studies in Food Policy for Developing Countries: Domestic Policies for Markets, Production, and Environment. Ithaca, NY: Cornell University Press.

Prieve, J. (2022). Growth in the ecological transition: green, zero or de-growth? Eur. J. Econ. Econ. Poli. Interv. 19, 19–40. doi: 10.4337/ejeep.2022.01.04

Raynaud, E., Sauvée, L., and Valceschini, E. (2005). Alignment between quality enforcement devices and governance structures in the agro-food vertical chains. J. Manag. Gov. 9, 47–77. doi: 10.1007/s10997-005-1571-1

Raynaud, E., Sauvée, L., and Valceschini, E. (2009). Aligning branding strategies and governance of vertical transactions in agri-food chains. Ind. Corp. Chang. 18, 835–868. doi: 10.1093/icc/dtp026

Ren, Y., Peng, Y., Campos, B. C., and Li, H. (2021). The effect of contract farming on the environmentally sustainable production of rice in China. Sustain. Product. Consum. 28, 1381–1395. doi: 10.1016/j.spc.2021.08.011

Ricome, A., Chaib, K., and Ridier, A. (2016). The role of marketing contracts in the adoption of low-input practices in the presence of income supports. J. Agric. Resourc. Econ. 41, 347–371.

Ruml, A., and Qaim, M. (2020). Smallholder farmers' dissatisfaction with contract schemes in spite of economic benefits issues of mistrust and lack of transparency. J. Dev. Stud. 57, 1106–1119. doi: 10.1080/00220388.2020.1850699

Schebesta, H., and Candel, J. J. L. (2020). Game-changing potential of the EU's farm to fork strategy. Nat. Food 1, 586–588. doi: 10.1038/s43016-020-00166-9

Schipmann, C., and Qaim, M. (2011). Supply chain differentiation, contract agriculture, and farmers' marketing preferences: the case of sweet pepper in Thailand. Food Policy 36, 667–677. doi: 10.1016/j.foodpol.2011.07.004

Shi, X., Chan, H.-L., and Dong, C. (2020). Value of bargaining contract in a supply chain system with sustainability investment: an incentive analysis. IEEE Trans. Syst. Man Cybernet. Syst. 50, 1622–1634. doi: 10.1109/TSMC.2018.2880795

Stanco, M., Nazzaro, C., Lerro, M., and Marotta, G. (2020). Sustainable collective innovation in the agri-food value chain: the case of the “aureo” wheat supply chain. Sustainability 12, 5642. doi: 10.3390/su12145642

Šumane, S., Kunda, I., Knickel, K., Strauss, A., Tisenkopfs, T., Des, I., et al. (2018). Local and farmers' knowledge matters! How integrating informal and formal knowledge enhances sustainable and resilient agriculture. J. Rural Stud. 59, 232–241. doi: 10.1016/j.jrurstud.2017.01.020

Train, K. E. (2003). Discrete Choice Methods With Simulation. Cambridge: Cambridge University Press.

Train, K. E. (2009). Discrete Choice Methods With Simulation, 2nd Edn. New York, NY: Cambridge University Press.

Tuyen, M. C., Sirisupluxana, P., Bunyasiri, I., and Hung, P. X. (2022). Stakeholders' preferences towards contract attributes: evidence from rice production in Vietnam. Sustainability 14, 3478. doi: 10.3390/su14063478

Vaissiere, A. C., Tardieu, L., Quetier, F., and Roussel, S. (2018), “Preferences for biodiversity offset contracts on arable land: a choice experiment study with farmers”. Eur. Rev. Agric. Econ. 45, 553–582. doi: 10.1093/erae/jby006

Van den Broeck, G., Vlaeminck, P., Raymaekers, K., Vande Velde, K., Vranken, L., and Maertens, M. (2017). Rice farmers' preferences for fairtrade contracting in Benin: evidence from a discrete choice experiment. J. Clean. Prod. 165, 846–854. doi: 10.1016/j.jclepro.2017.07.128

Vatn, A. (2002). Multifunctional agriculture: some consequences for international trade regimes. Eur. Rev. Agric. Econ. 29, 309–327. doi: 10.1093/eurrag/29.3.309

Vazquez-Brust, D., Souza Piao, R., de Sousa de Melo, M. F., Trotta Yaryd, R., and Carvalho, M. M. (2020). The governance of collaboration for sustainable development: exploring the “black box”. J. Clean. Prod. 256, 120260. doi: 10.1016/j.jclepro.2020.120260

Vicol, M., Fold, N., Hambloch, C., Narayanan, S., and Pérez Niño, H. (2021). Twenty-five years of living under contract: contract farming and agrarian change in the developing world. J. Agrar. Change 22, 3–18. doi: 10.1111/joac.12471

Widadie, F., Bijman, J, and Trienekens, J. (2020). Farmer preferences in contracting with modern retail in Indonesia: a choice experiment. Agribusiness 37, 371–392. doi: 10.1002/agr.21652

Williamson, O. E. (1979). Transaction-cost economics: the governance of contractual relations. J. Law Econ. 22, 233–262. doi: 10.1086/466942

Williamson, O. E. (1985). The economic institutions of capitalism. J. Econ. Issues 21, 528–530. doi: 10.1080/00213624.1987.11504638

Williamson, O. E. (1991). Comparative economic organization—the analysis of discrete structural alternatives. Admin. Sci. Q. 36, 269–296. doi: 10.2307/2393356

Keywords: contracts, sustainability, food security, NIE, transaction costs, uncertainty, choice experiment, Italy

Citation: Ciliberti S, Frascarelli A and Martino G (2023) Matching ecological transition and food security in the cereal sector: The role of farmers' preferences on production contracts. Front. Sustain. Food Syst. 7:1114590. doi: 10.3389/fsufs.2023.1114590

Received: 02 December 2022; Accepted: 19 January 2023;

Published: 07 February 2023.

Edited by:

Roberta Selvaggi, University of Catania, ItalyReviewed by:

Massimiliano Borrello, University of Naples Federico II, ItalyGumataw Kifle Abebe, Dalhousie University, Canada

Copyright © 2023 Ciliberti, Frascarelli and Martino. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Stefano Ciliberti,  c3RlZmFuby5jaWxpYmVydGlAdW5pcGcuaXQ=

c3RlZmFuby5jaWxpYmVydGlAdW5pcGcuaXQ=

Stefano Ciliberti

Stefano Ciliberti Angelo Frascarelli

Angelo Frascarelli