94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Sustain. Food Syst., 16 August 2021

Sec. Social Movements, Institutions and Governance

Volume 5 - 2021 | https://doi.org/10.3389/fsufs.2021.684181

This article is part of the Research TopicAchieving Food System Resilience & Equity in the Era of Global Environmental ChangeView all 21 articles

Recent years have seen the convergence of industries that focus on higher protein foods, such as meat processing firms expanding into plant-based substitutes and/or cellular meat production, and fisheries firms expanding into aquaculture. A driving force behind these changes is dominant firms seeking to increase their power relative to close competitors, including by extending beyond boundaries that pose constraints to growth. The broad banner of “protein” offers a promising space to achieve this goal, despite its nutritionally reductionist focus on a single macronutrient. Protein firm strategies to increase their dominance are likely to further diminish equity in food systems by exacerbating power asymmetries. In addition, the resilience of food systems has the potential to be weakened as these strategies tend to reduce organizational diversity, as well as the genetic diversity of livestock and crops. To better understand these changes, we visually characterize firms that are most dominant in higher protein food industries globally and their recent strategic moves. We discuss the likelihood for these trends to further jeopardize food system resilience and equity, and we make recommendations for avoiding these impacts.

Over the past decade, a significant restructuring has been underway across food systems. After a spate of mega-mergers sparked unprecedented consolidation in the seed, agrichemical, fertilizer, animal genetics, and farm machinery industries (IPES-Food, 2017), a similar convergence toward monopoly is occurring under the umbrella of protein. Nearly all of the largest meat and dairy processing firms, for example, have announced they are investing in or developing plant-based substitutes, and Unilever has set a target of €1 billion in annual sales of these foods by 2028 (Wood, 2021). In addition, the largest catch fisheries firms have expanded into aquaculture (Uzunca and Li, 2018), and dominant food processors are increasing their size and scope to offer numerous higher-protein foods—these include microbial proteins, insects and cellular (lab-grown or cultured) meat and fish (Mouat et al., 2019). This broader emphasis is highlighted in the language of several leading meat processors—Cargill and Maple Leaf Foods now describe themselves as “protein companies,” and Tyson Foods has gone so far as trademarking the phrase “The Protein Company.”

A growing body of research has analyzed the impacts of global livestock and fish production, particularly in regards to animal-source foods' effects on public health, the environment, and social and animal welfare (Pauly et al., 2002; Steinfeld et al., 2006; Worm et al., 2006; Rockström et al., 2009; HLPE, 2014; Bowles et al., 2019; Ryschawy et al., 2019; Willett et al., 2019; FAO, 2020b). Investor organizations have also sought to reduce their risks by analyzing the sustainability of animal source food industries. A notable example is FAIRR (Farm Animal Investment Risk and Return), a network of institutional investors currently representing US$29 trillion in assets. The organization has developed an extensive “protein producer index” that focuses on the 60 largest beef, dairy, pork, poultry/eggs, and farmed fish firms (FAIRR, 2019). This index scores firms by impacts on greenhouse gases, deforestation, water scarcity, waste and pollution, antibiotics, animal welfare, working conditions, and food safety.

While per-capita meat consumption is predicted to fall globally by nearly 3%, according to a recent report of the Food and Agriculture Organization of the United Nations (FAO, 2020a), sales of meat substitutes have been rising in many countries during the last year (Watson, 2020). This is partially a result of disruptions in the availability of meat products due to the COVID-19 pandemic, as well as the impacts of African swine fever on pork supplies in Asia and Europe. It also stems from a steady change in consumers' preferences and consumption patterns, especially in high-income countries. The meat substitute market is expected to reach annual sales of US$12 billion by 2025 and $17 billion by 2027, with an annual growth rate of 15–18% expected from 2020 to 2025 (Meticulous Research, 2020). This represents more than double the annual growth rate of the global processed poultry and meat market, estimated to increase at a rate of 7% during the same period and expected to reach $1.65 trillion annually by 2025 (Joseph et al., 2020; Research Markets, 2020). The popularity of meat analogs among consumers seeking protein alternatives and sustainable food is particularly high in Germany, France, the Netherlands, the United Kingdom, Italy, and Sweden (Kyriakopoulou et al., 2019). Europe is currently the largest market for these products and consumed the world's greatest share in 2017 (39%), but the Asian market is the fastest growing (Mordor Intelligence, 2020).

As the biggest players in the food industry are shifting their emphases from meat, dairy, and eggs to the macronutrient of protein, there is a need to understand who is changing, what is changing and how those changes will impact equity and resilience—questions that have yet to receive significant attention from food systems researchers. It is also crucial to understand the degree to which the industry convergence around higher-protein foods is a response to consumption and impact trends, and how much it is a catalyst of them. The answers to these questions have important implications for suggesting pathways to avoid negative impacts on food systems.

This paper analyzes how the convergence of investors and industry executives on protein may potentially exacerbate power asymmetries and increase the fragility of food systems. Below we first describe our theoretical perspectives, which suggest that these strategies may reduce organizational diversity, as well as the genetic diversity of livestock and crops. We then describe our methods, which visually characterize firms that are most dominant in higher protein food industries globally and their recent strategic moves. We conclude by discussing the likelihood for these trends to further jeopardize food system resilience and equity, and we make recommendations for avoiding these impacts.

To analyze drivers of changes involving higher protein food industries we use the perspective of Capital as Power (Nitzan and Bichler, 2009). To analyze the impacts of these changes on equity and resilience we complement this framework with perspectives from the political ecology of food literature. We also explore the interactions between drivers and impacts, which have the potential to reinforce negative outcomes, and decrease the opportunities for addressing them in the future.

Capital as Power is a framework that views capitalism not as a mode of production nor of consumption, but a mode of power. It seeks to connect changes in capitalists' quantitative, consensus estimates of power to the qualitative strategies of firm “owners and directors to shape and reshape politics, society, and culture (Di Muzio, 2013, p. 6). This approach, which views the accumulation of power as capitalists' ultimate goal, problematizes conventional dichotomies between politics and economics, as well as finance capital and material capital (Hager, 2013).

Market capitalization is viewed as measure of future expectations of power in current monetary valuations, while also adjusting for perceived risks. The theory emphasizes that top executives at large corporations are constantly trying to beat the average, as measured by benchmarks such as the S&P 500. Importantly, it suggests that capitalists are willing to strategically sabotage rapid growth—they will even accept negative growth rates, particularly if this leads to declining more slowly than other firms and results in a net differential increase in their power (Bichler and Nitzan, 2014).

There are numerous strategies that capitalists use to restructure society to increase their power relative to others. The market capitalization of Amazon (one of just five firms that exceeds $1 trillion), for example, is not based only on current economic performance, but also investor expectations of future success for its aggressive strategies—these include rapidly increasing spending on research and development, which is expected to lead to additional patent-protected monopolies (Watanabe et al., 2020). Although these strategies are constantly resisted, capitalists are quite flexible, which complicates the analysis of predominant approaches. One strategy that is typical for beating the average, however, is to “successively break its ‘envelopes,’ spreading from the industry, to the sector, to the national economy, and ultimately to the world as a whole” (Nitzan and Bichler, 2009, p. 332).

Although this might also occur via internal growth, it is easier and less risky to “bolt on” growth via acquisitions, particularly for firms that have the means to make buyout offers. Executives who fail to increase their firm's power relative than others may themselves become vulnerable to takeover. Regulations that previously hindered these strategies became less of a barrier beginning in the 1970s, due to the influence of “Chicago School” antitrust theories, and most notably the arguments of legal scholar Robert Bork (Lynn, 2010; Olson, 2014). Antitrust laws have been reinterpreted by judges and regulators to emphasize efficiency gains and lower prices that may potentially result from mergers and acquisitions (Aron et al., 1994), particularly in the United States and the European Union, which has enabled increasing concentration in numerous industries (Howard, 2016a). By 2012, for example, the US Department of Justice detailed abuses of power by dominant firms in food and agricultural industries, including bid rigging, market manipulation and one-sided contracts. The agency suggested that it could not address these issues, however, because they were outside of the scope of antitrust laws, due to precedents in recent decades (Khan, 2012; USDOJ, 2012).

Breaking ownership envelopes may proceed in multiple directions, as shown in Figure 1. Horizontal integration involves mergers or acquisitions with close competitors, such as a chicken processor acquiring another chicken processor in the same region. Another direction is to integrate vertically, or to acquire upstream suppliers or downstream customers. For this same chicken processor, for example, it might involve acquiring a poultry genetics firms upstream, or a distributor downstream. A third potential direction is to expand concentrically by acquiring firms in related industries, such as a pork processor or a pea protein processor. The fourth direction in which envelopes may be broken is geographic, such as expanding into new regions, nations or continents.

Geographic expansion is increasing in importance for food and agricultural firms, which are experiencing level or declining sales in high-income countries. One striking example is Nestlé's use of boats on the Amazon River tributaries in Brazil, as well as door to door sales via contractors in poor urban neighborhoods in this nation, to reach potential new consumers (Mulier and Dantas, 2010). Because the size of our stomachs is limited, there are significant barriers to increasing food and beverage sales in comparison to goods and services without such biological constraints. Per capita consumption of dairy, beef, and pork products in North America and Europe, for example, are high relative to many other parts of the world but have not increased in recent decades. Food firms have responded by shifting demand toward their products at the expense of other foods, or by encouraging the purchase of more highly processed and/or branded foods, which may command higher prices. These efforts have contributed to “meatification,” or increased consumption of animal source foods (including dairy) in areas where these products have traditionally been less central to diets, and particularly in households with rising incomes (Weis, 2013; Hoelle, 2017; Schneider, 2017; Clay and Yurco, 2020; Hansen and Jakobsen, 2020).

Increasing food sales is also a challenge in regions where more people are directly engaged in agriculture and have the capacity to produce or process their own food. These constraints may be overcome by reducing this capacity, such as supporting policies that lead to depeasantization (Araghi, 1995) and deskilling for those still engaged in farming (Stone, 2007). Deskilling leads farmers to become more dependent on corporations in upstream segments, such as animal genetics, or downstream segments, such as meat processing, and may be reinforced by regulations—food safety requirements for meat and dairy processing, for example, have created significant barriers to market access for smaller-scale producers (GRAIN, 2012).

Deskilling is also an important strategy that is applied to consumers (Jaffe and Gertler, 2006). Marketing by dominant firms has become more sophisticated and more effective in reducing knowledge and abilities with respect to food preparation. Hormel, for example, hired a corporate anthropologist who helped develop a ready to eat sandwich aimed at teenagers, with a goal of enabling them to consume it with one hand on their smartphone. This product has a 70-day shelf life, and it has been one of the most successful recent introductions in the food industry (Stock, 2016).

Dominant food firm marketing strategies increasingly promote the consumption of “protein.” This reductionist focus on a single macronutrient (Clapp and Scrinis, 2017) is not justified by nutritional requirements, as the majority of adults in high-income countries currently exceed the recommended daily protein intake (Mittendorfer et al., 2020). Even in low-income countries, where dietary diversity is generally low, interventions to reduce hunger that focused heavily on protein have been ineffective (Waterlow and Payne, 1975). This marketing emphasis, however, is used to convince consumers to replace animal source foods with highly processed and proprietary substitutes—frequently with the promise of comparable protein levels—rather than toward more diverse, less processed and less profitable foods (Clay et al., 2020; Santo et al., 2020).

A Capital as Power perspective views decreasing equity and self-reliance as an intended outcome, and the result of capitalists' influence on the redistribution of income and assets. It is not surprising that dominant firms increase prices for consumers (even going so far as price signaling or price-fixing) or drive down prices for sellers, and wages for workers. Protein-focused firms have been prominent in recent cases of alleged price-fixing, including tuna, beef, pork, chicken, turkeys, and peanuts (Demetrakakes, 2021). COVID-19 increased awareness of the vulnerability of low paid workers employed by dominant meat and seafood processors, many of whom were at greater risk of infection due to long working hours, and inadequate access to safety protections and health care (Middleton et al., 2020). Processors such as Tyson and JBS are also extending their contract model, which drastically reduced incomes and decision-making power for chicken growers in the southern US, to other regions, and to more species of livestock (Constance, 2008; Leonard, 2014; Stull, 2019). From an equity standpoint, concentration in food systems has made farmers increasingly reliant on a handful of suppliers and buyers, further squeezing their incomes and eroding their ability to choose what to grow, how to grow it, and for whom (IPES-Food, 2017; Hendrickson et al., 2019).

Many additional negative consequences of these trends could be viewed as collateral damage from a Capital as Power framework—they are unintended impacts of the strategies used to increase dominance (Cochrane, 2010). Most ecological impacts fall into this category, and political ecologists are prominent among researchers detailing these impacts empirically. These are typically described as “externalities” by economists, reducing costs for firms by displacing them onto society or the environment. Because firms that operate in the same political economic context frequently behave in ways that are similar to each other, these cost cutting strategies may be replicated throughout an industry (Nitzan and Bichler, 2009).

The growth of firms converging under the banner of protein (meat, dairy, and animal feed processors) has contributed to what political ecologists describe as an increasingly global “grain-oilseed-livestock complex.” This complex is characterized by “oceans of monocultures” of coarse grains (mostly maize) and oilseeds (mostly soybeans), and islands of concentrated animal production (mostly chickens, pigs and cows) (Weis, 2013). The growing intensification and separation of crop and livestock production results in a much heavier ecological footprint (or “hoofprint”) for these products, as well as the loss of multiple functions of livestock in more integrated contexts (e.g., labor, transport, hides, wool, fertilizer, fuel). Impacts such as pollution and soil damage are typically addressed with short-term technological fixes in an attempt to override them, but in the longer-term these approaches further undermine sustainability (Weis, 2010).

Breeding efforts have focused on an increasingly narrow range of crops and livestock, as noted above, which has contributed to the extinction of nearly one in six livestock breeds within a 100-year period (Tisdell, 2003). Genetic diversity within these species has also been reduced by focusing on a small set of traits (Khoury et al., 2014; IPES-Food, 2016). This leads to what a Tanzanian botanist described as a “monoculture within monoculture” (Thompson, 2007, p. 563). Industry consolidation is an important factor in these trends (Neo and Emel, 2017), such as the elimination of all North American turkey breeding stock after an acquisition made by a European firm, EW Group in 2004 (Walker, 2009). This firm, along with Hendrix Genetics, accounts for ~99% of the global breeding stock for turkeys, and 94% for laying hens (ETC Group, 2013). The seed industry has also experienced declining diversity in conjunction with dramatically increased concentration—four firms control more than half of commercial sales globally (Howard, 2020).

Reduced genetic and species diversity hampers the capacity of farming systems to mitigate risks related to shocks and stresses (IPES-Food, 2016). Highly concentrated monocultures of livestock, for example, remove “immune firebreaks” that would slow disease transmission in more diverse populations—particularly when (1) production conditions suppress immune systems, (2) life cycles are shorter and more uniform, (3) there is no on-site reproduction to evolve resistance, and (4) global trade increases the exchange of pathogens (Wallace, 2016, 2021). Intensive livestock production has demonstrated substantial vulnerability to epidemics such as those caused by avian influenza, PEDv, and numerous other pathogens. China, for example, lost 37% or more of its swine herd due to an outbreak of African swine fever in 2019 (FAO, 2019).

A key effort to counter these trends is agroecology, which has been demonstrated to be an important strategy to shift food systems in more resilient and equitable directions (IAASTD, 2009; Rosset et al., 2011; Altieri et al., 2015). Agroecology is the application of the science of ecology to sustainable food systems, integrated with practice and social movements. There is strong evidence of these systems' ability to deliver robust and stable outputs, based on maximizing biodiversity and minimizing external inputs (IPES-Food, 2018). In numerous contexts, the ability of diverse agroecological systems to maintain yields, reduce losses, and allow recovery in the face of environmental stresses and shocks has been noted (Holt-Giménez, 2002; Mijatovic et al., 2013; Wezel et al., 2020). Diversified systems, in particular, have shown the ability to boost production in areas where more food is urgently needed, addressing both resilience and equity goals.

Resilience is also being weakened, however, by changes in organizational diversity that accompany the rising power of dominant firms. An increasingly large-scale and centralized food system has reduced diversity in both scale and forms of organization, and has become more vulnerable to disruption, such as from natural disasters, pandemics, resource depletion, or social unrest (Hendrickson, 2015). With fewer smaller- and medium-scale organizations there is less flexibility and adaptability to respond to change, as well as less redundancy and a growing number of chokepoints (Bailey and Wellesley, 2017). COVID-19 dramatically illustrated the fragility of just-in-time supply chains, with so much food flowing through a very small number of processing plants—shutdowns resulting from outbreaks led to product shortages and forced farmers to euthanize their livestock (Hendrickson, 2020). In the US, for example, more than half of beef production is processed in just 13 plants (FAIRR, 2020). The demands of large firms for uniformity reinforce these trends by shutting out more participants, as “only the big can serve the big” (Hannaford, 2007, p. 30).

Interactions between the drivers and impacts described above are also resulting in feedbacks that further threaten equity and resilience. The disruption of fragile supply chains, for example, leads to firms charging higher prices to cover increased costs, and in concentrated industries, prices are “sticky”—they tend to decline more slowly and only partially when supply chains recover (Shields, 2010). Another interaction occurs when alternative food initiatives form in response to the social and ecological impacts of dominant firms—examples include organic and fair trade labeling schemes—but the most successful of these may be co-opted and redirected as new growth opportunities for dominant firms (Jaffee and Howard, 2010; Bichler and Nitzan, 2020).

Our analytic method focuses on visualization, which aids in cognition and reduces burdens on short-term memory, particularly for complex data sets (Card et al., 1999). This approach frequently improves understanding and recall in comparison to text or tables alone (Mayer, 2014). Visualization is especially useful for studying complex, industry-wide changes that are the collective result of the decisions of numerous specific firms. We collected information from secondary data sources to determine the largest firms involved in industries considered to be protein-focused, and to analyze the strategies they are employing to increase their dominance.

The data we selected included annual sales, ownership changes (primarily acquisitions and joint ventures), and market capitalization figures for the most recent 10-year period, 2011–2020. In addition, we collected data on investments in cellular meat and seafood startups to analyze actors involved in attempts to commercialize these products. Finally, we collected more detailed data on ownership changes (dates, locations, sale prices, and brands controlled) for one firm, JBS. We selected this firm as a case study due to its rapid growth via acquisitions to become the world's largest meat processor, as well as the more recent public disclosure of the illegal strategies that contributed to this dominance (Freitas et al., 2017; Wasley et al., 2019).

Data sources were diverse, and included annual reports, company websites, press releases, trade journals, business articles, and non-profit and trade association reports. A key source of data for annual sales was the Food Engineering Top 100 Food and Beverage Companies (2020), but four additional firms were added based on figures from their annual reports (CP Foods, Tönnies, Mowi, and Thai Union). All data points except for the Food Engineering annual sales figures were corroborated with at least one additional document, unless they were announced directly by the firm that was involved.

We applied five types of visualizations to best represent the data we analyzed, guided by our theoretical framework. These included a treemap, a multi-variable plot, a timeline, a network diagram and a cartographic map (Howard, 2009). All of these visualizations were produced with OmniGraffle (The Omni Group, Seattle, WA), although initial layouts of the treemap and multi-variable plot were first produced with RAW Graphs (Mauri et al., 2017), and then revised with OmniGraffle. Data were encoded with color, form, and spatial position to take advantage of “pre-attentive” processing, or the capacity of the sense of vision to take in large amounts of information faster than possible when paying conscious attention (Tidwell, 2010).

In this section we present the results of our analysis, which includes visualizations of the current scope and recent changes in “protein” industries. We also discuss what they reveal about protein industry strategies to increase power, and the likelihood of these trends continuing in the near future.

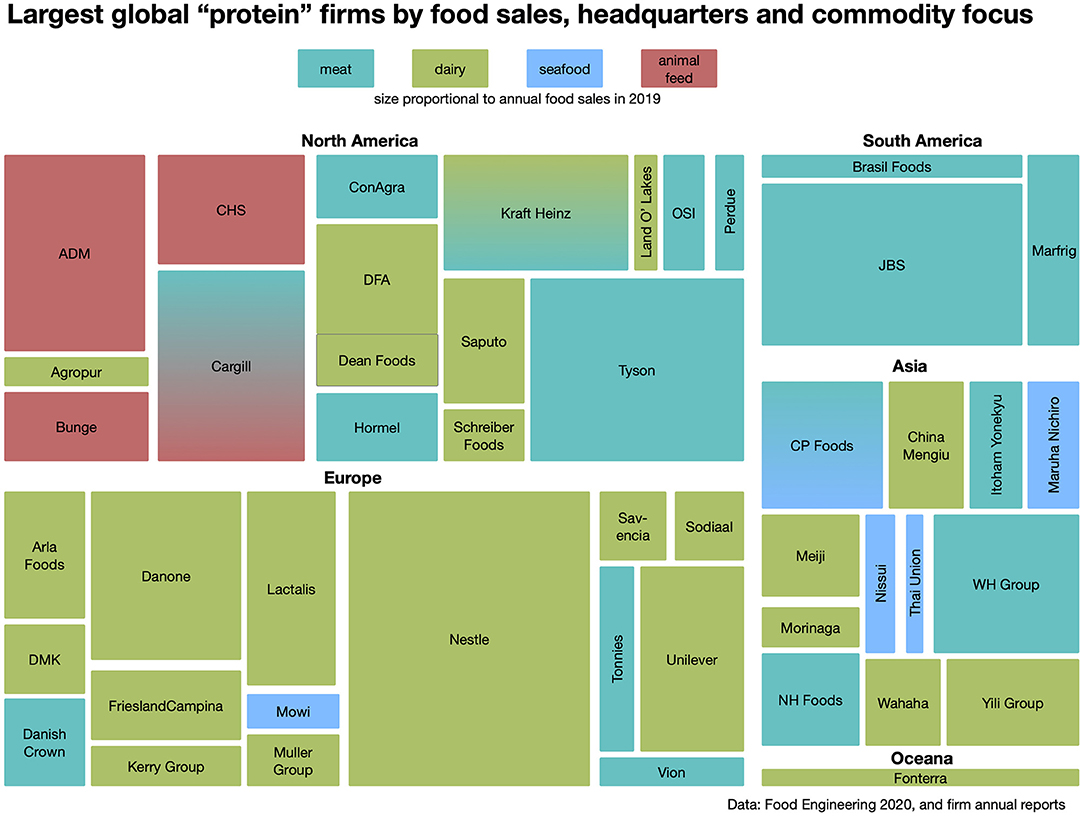

The largest protein firms by sales, focus, and headquarters are shown in Figure 2. The rectangle sizes are proportional to 2019 food sales—Nestlé was highest at US$76.8 billion and the lowest shown is Land O'Lakes with $4.0 billion. Rectangles are also colored by the firm's primary commodity focus, although some firms increasingly emphasize multiple higher protein commodities as the boundaries between them become more blurred. As a result, a gradient of two colors is used to represent Cargill's focus on both meat and animal feed, Kraft Heinz's focus on meat and dairy, and Charoen Pokphand (CP) Food's focus on seafood and meat.

Figure 2. Treemap of largest global “protein” firms by food sales, headquarters and commodity focus, with size proportional to annual food sales in 2019.

This figure indicates that dominant protein firms globally are most likely to focus on dairy, followed by those focusing on meat and animal feed. Although four firms focused on seafood are shown, their food sales are smaller relative to the other sectors. This figure should be interpreted with some caution, because it is based on total food sales, and some firms are selling foods in categories that are broader than “protein.” Nestlé, for example, is not only a dairy processor, but dominant in other commodities such as coffee, candy, and bottled water, as well as pet food and pharmaceuticals—dairy sales account for less than one-third of the food sales represented in Figure 2 (Ledman and van Battum, 2020). Also note that in 2020 most of the assets of Dean Foods were acquired by Dairy Farmers of America (DFA) in a bankruptcy sale, therefore the division between these firms for 2019 food sales is portrayed as less distinct than others.

Some geographic differences are evident, with meat firms concentrated in North America and South America, dairy firms concentrated in Europe, animal feed firms concentrated in North America, and seafood firms concentrated in Asia. The reasons for these differences are complex, but include cultural, ecological and historical factors, as well as government supports for dominant firms—examples include government-backed financing for meat firms headquartered in Brazil, and subsidies for animal feed crops in the United States (Howard, 2019).

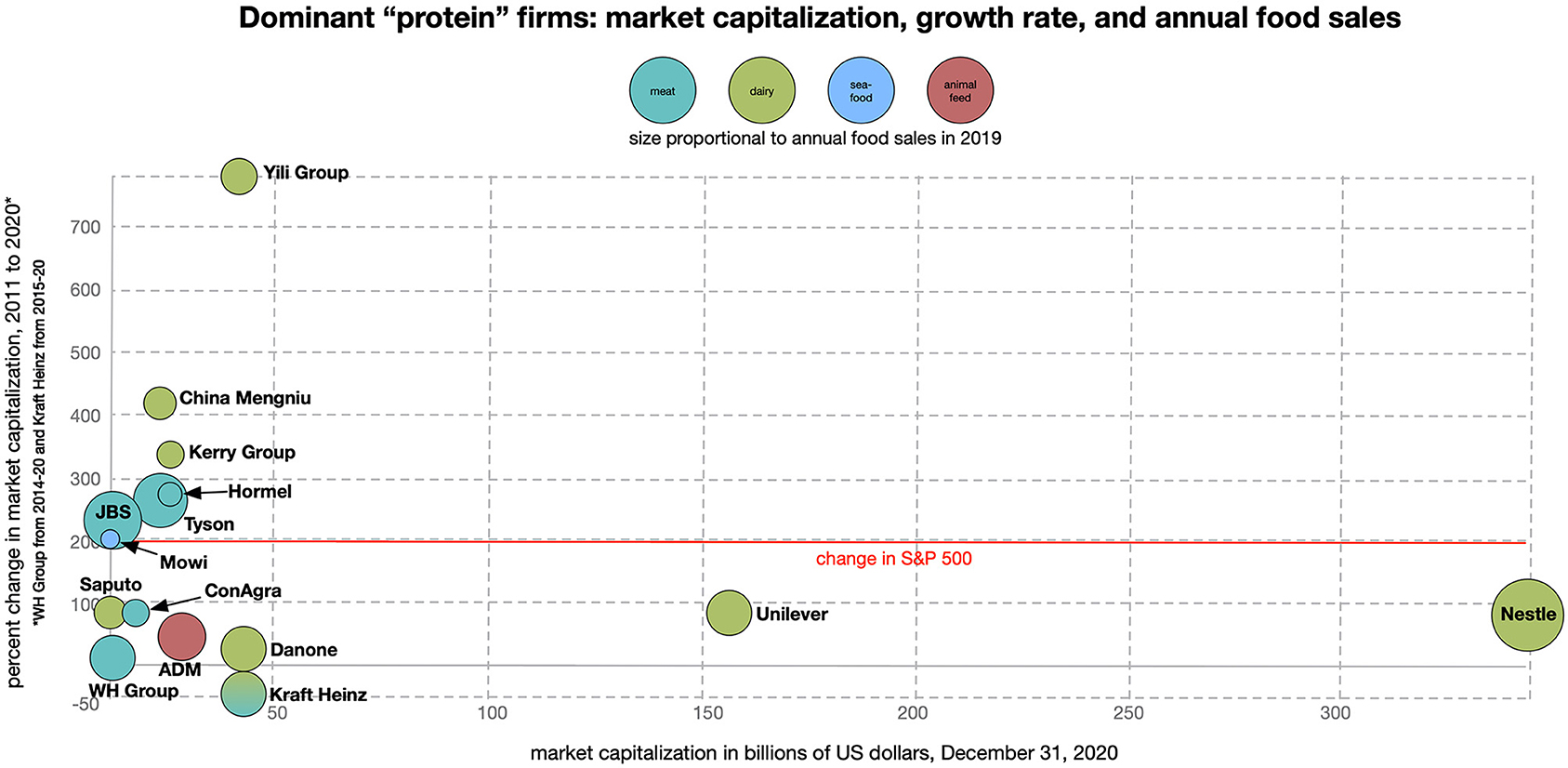

Next we selected a subset of the firms shown in Figure 2, with a focus on the largest publicly traded firms. This resulted in excluding privately held (e.g., Cargill) and cooperatively held (e.g., FrieslandCampina) firms, for which market capitalization figures are not available. We then plotted 15 firms with a market capitalization of more than US$10 billion as of December 31, 2020 by their percentage change in market capitalization since December 31, 2010, with size proportional to annual sales in 2019. The results are shown in Figure 3, with the change in the S&P 500 during the same 10-year period (199%) included as a point of reference—as mentioned above, this is a benchmark that top executives frequently seek to exceed.

Figure 3. Multi-variable plot of dominant publicly traded “protein” firms: market capitalization, growth rate relative to the S&P 500 from 2011 to 2020, and annual food sales in 2019.

Two dairy-focused firms, Nestlé and Unilever, stand out as having the highest market capitalization figures ($343.7 billion and $156.6 billion, respectively), which suggests strong expectations from investors that these firms will be profitable in the future. Both firms, however, are diversified into other products—Nestlé's diversity is noted above, and Unilever is dominant in personal care and home care products.

Another cluster of firms is identified by growth rates that equaled or exceeded the S&P 500 over the previous 10 years. These are led by two dairy firms headquartered in China, Yili Group and China Mengniu (growth rates of 783 and 414%, respectively), followed by the more diversified Ireland-headquartered dairy firm Kerry Group (334%). In late 2020, Kerry Group reportedly hired advisors to consider selling its consumer food units, in order to fund acquisitions in food ingredients and flavors—a market in which it is more dominant (Nair et al., 2020). As Yili Group and China Mengniu have increased their sales and market share, encouraged by government policies, China has transformed from a nation that once shunned dairy as a “barbarian” food to the third-largest dairy producer in the world (Böhme, 2021). Milk suppliers have increased in size, as well as expanded their use of more genetically uniform foreign breeds of cattle—there are now more than 40 farms in China with herds of 10,000+ cows (Sharma and Rou, 2014).

The high growth group also includes three meat processors, Hormel, Tyson, and JBS, as well as one seafood/aquaculture firm, Mowi. Hormel, Tyson, and JBS, along with WH Group and other dominant firms in the US have faced multiple accusations of anti-competitive behavior, facilitated by sharing data with the firm AgriStats. This includes driving up prices for distributors, retailers, and consumers, and driving down wages for workers and the prices paid to contract farmers. Although Tyson and JBS have paid hundreds of millions of dollars in fines or settlements for some of these claims, a number of legal actions are still ongoing, including federal indictments of 10 poultry firm executives—five from JBS subsidiary Pilgrim's Pride, and one from Tyson (Secard, 2020).

Mowi is notable for its high market capitalization relative to annual food sales of just $4.6 billion, which is substantially lower than the other firms shown in Figure 3—this indicates investor expectations of strong future growth. Mowi is positioned to increasingly dominate the rapidly growing industrial aquaculture sector—although catch and consumption of wild caught seafood has been stagnant for decades (Pauly, 2019), aquaculture has reported growth rates exceeding 5% annually since the year 2000 (Edwards et al., 2019). Approximately half of fish consumed by humans is now derived from aquaculture (Rousseau et al., 2019). Mowi is vertically integrated into fish breeding, relying on the same strain of Atlantic salmon since 1964. The firm's growth is not only increasing genetic uniformity for farmed salmon, but may also threaten wild salmon populations when introgression occurs with escaped fish (Glover et al., 2017).

Even higher expectations of growth are evident for the plant-based meat alternative firm Beyond Meat. This firm had a market capitalization of $7.8 billion at the end of 2020, which was not high enough to reach the threshold for inclusion in Figure 3. Although its food sales totaled just $298 million in 2019, this valuation indicates investors are confident that future sales are likely to eventually exceed most other close competitors. Just a month later, for example, the market capitalization briefly reached $12 billion. Early investors included Tyson, which sold its 6.5% stake before Beyond Meat's initial public offering in 2019, followed by introducing its own “plant-based protein” brand, Raised & Rooted. The packing and marketing of both of these firms' products prominently display their high protein content. Beyond Meat also emphasizes this macronutrient to the exclusion of all others by stating, “part of our vision is to re-imagine the meat section as the Protein Section of the store,” and trademarking the phrase “The Future of Protein” (Beyond Meat, 2021).

A third cluster of firms, with growth rates below that of the S&P 500 and a market capitalization of $43 billion or less, includes the animal feed firm ADM, as well as other meat and dairy firms. ADM recently agreed to pay $45 million to settle a civil lawsuit, which alleged price-fixing with other peanut processors (Bunge, 2021). Kraft Heinz recorded the lowest growth among firms in Figure 3—its market capitalization declined 52% since two namesake firms merged in 2015, and the resulting entity has since attempted to simplify the strategic focus. In addition to selling a peanut division, as mentioned below, Kraft Heinz sold part of its cheese division to Lactalis in late 2020 for $3.2 billion.

We selected a subset of nine firms in Figure 3 to visualize acquisitions and joint ventures from 2011 to 2020, focusing on the largest and fastest growing firms by market capitalization. The results are shown in Figure 4. The colors represent the commodity focus, and they indicate that all firms were making horizontal acquisitions during this time period. Mengniu, for example, paid ~$1 billion to acquire Bellamy, an organic infant formula firm in Australia, with a goal of expanding to more international markets with this premium brand (Ferreira, 2019). The firm also formed a joint venture with Coca-Cola named “KeNiuLe” in 2020 to leverage the latter's brand influence and increase chilled milk sales in China—an analyst suggested this product “was purchased by just 29 percent of Chinese families and hence has huge growth potential” (Yan, 2020).

Four of the nine firms have also concentrically acquired plant-based protein firms: Nestle acquired Sweet Earth, Unilever acquired The Vegetarian Butcher, Kerry Group acquired a majority stake in Ojah, and Hormel acquired two peanut firms, Skippy and Justin's. In addition, shortly after the end of the study period, Hormel acquired the Planters peanut brand from Kraft Heinz for $3.35 billion.

Nestlé also integrated vertically by acquiring the prepared meal delivery firm Freshly, while Tyson acquired the multi-ingredient (and branded) frozen food firm Bosco's. Not shown in the figure is Marine Harvest's vertical integration into aquaculture shipping vessels via a joint venture in 2016—the firm was renamed Mowi in 2020, the same year that it divested this joint venture, with a net gain of ~$65 million (McDonagh, 2020). The name change was motivated by an increasing emphasis on branding—the firm has hired a former Coca-Cola executive to lead a €35 billion effort to “establish loyalty and habits” for a product that was previously an unbranded commodity (Berge, 2018). If successful, this will create more barriers to entry for smaller firms in this industry.

The meat processor JBS has been most active of the firms in Figure 4, as measured by number of acquisitions. JBS took a 64% stake in Pilgrim's Pride in 2009, and then increased the amount of equity to 75% in 2012 (it has since increased to 78%). When JBS was forced to sell Moy Park in 2017 to pay a $3.2 billion corruption fine, the sale was made to the Pilgrim's Pride subsidiary.

Figure 4 also indicates the reduction in organizational diversity that occurs with industry consolidation. Although it focuses on just a subset of firms in this study, it illustrates the declining number of firms that account for an increasing proportion of sales. This results in larger and more centralized organizations, with decision-making concentrated in fewer hands. It also leads to the loss of more diverse forms of organization, such as smaller firms and cooperatives, either through acquisitions or exiting these industries.

Figure 5 shows the investments in cellular meat and fish startups by key actors through the end of the study period, December 31, 2020. These firms are developing cellular technologies to produce meat or fish via stem or satellite cells from an organism's muscle, and growing them with the aid of nutrients, hormones and growth factors in an appropriate culture medium (Warner, 2019; Chriki and Hocquette, 2020; Guan et al., 2021). One firm, Eat Just, recently received regulatory approval to sell a cell-cultured chicken product to consumers in Singapore, although the high costs of production make it likely that entry to retail outlets will be slow (Scipioni, 2020). The convergence of firms with a focus on protein is evident, with investments made by meat firms, including Tyson and Cargill, as well as seafood, dairy and plant-based protein firms (Pulmuone controls the tofu brands Nasoya, Pulmuone and Wildwood). In addition to the investments made during the study period, in early 2021, BlueNalu announced an investment from Thai Union, Aleph Farms announced a partnership with Brasil Foods, and Future Meat Technologies announced investments from ADM, Rich's and Müller Group. Additional investors (not shown) include venture capitalists, who seek to beat the average rate of return by wide margins, typically with an exit strategy of an acquisition by a dominant firm. Investments in this sector have exceeded $350 million since 2014 (Khan, 2020), even though most of these firms are likely years away from commercialization.

These trends raise concerns that cellular meat and fish will be quickly monopolized by dominant firms, thus maintaining or even increasing power asymmetries in food systems (Santo et al., 2020). An emphasis on providing cellular alternatives may actually increase consumption of the non-cellular meat and seafood products sold by these firms, due to reinforcing the belief that such foods should be a central part of diets (Lonkila and Kaljonen, 2021). The utopian promises of new technologies frequently lead to overestimates of their potential impacts (Chiles, 2013), but substantial growth in this sector may threaten the livelihoods of livestock producers and harm rural communities. Such critiques are raised infrequently in mainstream media coverage, because these outlets rely heavily on industry sources and present overwhelmingly positive perspectives (Painter et al., 2020).

Figure 6 shows a global map of acquisitions and brands controlled by JBS. The time period selected is slightly extended in comparison to Figure 4, and instead begins in 2005—this was the first year that JBS expanded internationally by acquiring the firm Swift-Armor in Argentina. Not only has this firm been more active than other “protein” giants in terms of acquisitions, its strategy has received significant support from the government of Brazil, where it is headquartered. Other dominant meat firms based in this country, Marfrig and Brasil Foods, also had access to state-backed financing for foreign acquisitions but did not receive as preferential treatment as JBS. In 2017 a government investigation uncovered that the firm had bribed nearly 2,000 politicians, spending nearly $250 million (Wasley et al., 2019). Two brothers who controlled the firm admitted to these crimes as part of a plea bargain, and later served prison sentences for insider trading. One of them, Joesley Batista, said that without these bribes, “It wouldn't have worked. It wouldn't have been so fast” (Freitas et al., 2017).

JBS has made acquisitions throughout South America, North America, Australia, and Europe, and currently sells in more than 150 countries. Although the firm does not yet have a presence in Asia via acquisitions or joint ventures, it does have alliances in China to sell its branded meat products. These include agreements with e-commerce giant Alibaba, and the government-owned meat processor and grain trader COFCO.

The center of the figure names nearly 100 brands controlled by JBS globally. This is not unusual—Dean Foods offered more than 40 brands of milk in the US before its bankruptcy, for example (Howard, 2016a), and ConAgra has more than 70 highly recognized brands for meat and other processed foods. For all products, Unilever owns more than 400 brands and Nestle owns more than 2,000 brands (Wood, 2021). These ownership patterns are not transparent to consumers, however, which presents an illusion of greater organizational diversity. JBS, for instance, now offers brands in the categories of organic (Acres Organic, Spring Crossing, Just BARE), grass fed (Grass Run Farms, Little Joe), and plant-based substitutes (OZO). After acquisitions, dominant firms typically maintain profitable and fast-growing brands, and discontinue less successful brands. The numerous consumer options that do remain, however, may obscure the much lower diversity embodied in their ingredients, as well as in the breeds and seeds used to produce these ingredients (Howard, 2016b).

There has been very little response by governments to slow or prevent the types of acquisitions described above—JBS has continued to make acquisitions after receiving financial penalties, and due to the dominance established relative to smaller competitors, will likely continue to do so. Regulators in the US allowed JBS to acquire a lamb processing facility, from the cooperative Mountain States Rosen, at a bankruptcy auction in 2020. JBS, which imports all of its lamb products in the US, immediately announced it was converting the plant to beef processing. This action removed one of the few remaining processors for sheep producers in Colorado and surrounding states, and is expected to drive many of them out of business (Campbell, 2020). Such an impact would increase inequity and reduce farm organization diversity, and potentially reduce breed diversity.

Another meat processor headquartered in Brazil, Marfrig, was allowed to acquire ~82% equity in the US firm National Beef in 2018, moving it into the second ranked position globally for beef processing. Then, in early 2021, Marfrig became the largest shareholder in Brasil Foods by acquiring 31.66% of its shares. Although calls for more aggressive antitrust enforcement are becoming more common, particularly with respect to dominant technology firms (e.g., Amazon, Alphabet/Google, Apple, Facebook), this has not yet translated to significant actions in food and agricultural industries.

The convergence of previously separate industries under the umbrella of “protein” is contributing to increasing market capitalization values for the world's most dominant meat, dairy, animal feed, and seafood processors, as well as removing more of the remaining boundaries between them. Investors are therefore demonstrating confidence that these firms will continue to increase their power relative to other members of society. Some of these firms have used illegal tactics to decrease equity by driving up prices for customers, driving down prices for suppliers, and suppressing wages for workers. Even legal strategies to achieve these goals, however, have been quite successful over the past decade, and have contributed to increasing inequality. Vertical, horizontal, concentric and geographic growth strategies have also reduced the number of firms and their organizational diversity, resulting in less adaptability to respond to disruptions. Furthermore, the actions of these firms are contributing to declining species and genetic diversity, such as in dairy cattle and farmed Atlantic salmon, which amplifies the risks of pandemics.

The strategy of breaking ownership envelopes to achieve growth is also giving these firms control over what may appear to be alternatives to their products, such as plant-based substitutes and organic brands. These alternatives are frequently promoted as solutions to sustainability problems, but their rapid absorption by the most dominant firms indicate they pose little threat to business as usual and may actually reinforce their power. In addition, the strategic focus of dominant firms on “protein” has contributed to inflating the nutritional importance of this macronutrient, as well as to deflecting attention from the high degree of processing for many of their products.

The continued ability of dominant firms to restructure society and amass power suggests that efforts to improve equity and resilience will not be successful in the long term unless they also address the drivers of power concentration, which underlie and reinforce numerous other lock-ins of unsustainable, industrial food systems (IPES-Food, 2016). Government inaction to slow consolidation results in a vicious circle of increasing firm size, which leads to a greater ability of these firms to influence policy. One recommendation is therefore to redefine anti-competitive practices and extend the scope of antitrust rules—this should be accompanied by measures to fundamentally realign incentives in food systems and allow for transnational oversight (IPES-Food, 2017), while also implementing stronger enforcement of national competition laws to avoid unfair trading practices (Kelly, 2018). More broadly there is a need to strengthen food sovereignty, allowing individuals and communities more agency to define their own food and agriculture systems. Achieving this goal will involve the challenging tasks of mobilizing social movements and forming more diverse coalitions (Sharma and Daugbjerg, 2020).

A transition toward sustainable, healthy and fair food systems could also be achieved through greater support for both agroecology and increased organizational diversity (Hendrickson et al., 2020). This would require public governance reform through integrated food policies (IPES-Food, 2019) that allow for a level playing field for agroecology, and for shorter and more redundant supply chains to emerge and develop (HLPE, 2019). Public governance reform should also guarantee a shift in subsidies and investments from industrial production systems and powerful companies to instead support agroecological practices and research (Miles et al., 2017), and re-localized food systems. Some initial measures might include public procurement (de Schutter, 2014; Chandler et al., 2015), incentivizing innovative distribution and exchange models (Berti and Mulligan, 2016), and increasing land access and tenure (Peterson-Rockney et al., 2021). Moreover, agricultural subsidies could also be shifted to privilege sustainable food systems indicators that go beyond yields per hectare or productivity per worker and include price premiums for managing multi-functional landscapes with a continuum of wild and cultivated species (IPES-Food, 2016). Such practices could encourage increased species and genetic diversity of crops and livestock, as well as on-site reproduction to evolve greater resistance to pathogens (Wallace, 2021).

Lastly, more research could be conducted on the convergence of meat, dairy, animal feed, seafood, and plant-based alternatives industries, particularly from a food systems perspective. Such research could better characterize the social and ecological impacts of the growing power of these firms in specific contexts, and potentially inform more place-specific policy recommendations. As one example, the marketing efforts that have accompanied these trends frequently promote one-size-fits all or “neoliberal diets,” which may homogenize previously diverse food cultures, as well as increase consumption of less nutritious, ultra-processed products (Winson, 2013; Otero, 2018). In conjunction with multilateral trade agreements that favor dominant firms (Wood et al., 2021), such changes contribute to loss of domestic producers and increases in the prices that consumers pay for less processed domestic foods (Werner et al., 2019). A better understanding of the constraints on individuals and households to make dietary choices that reflect their values, and the role of dominant firms in structuring food access and availability to enact such constraints, is needed (Hendrickson and James, 2016).

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

PH wrote the first draft of the manuscript and led the analysis and the production of visualizations. FA and MY wrote sections of the manuscript. AC conducted a systematic search of academic databases. All authors reviewed and contributed to manuscript drafts and approved the submitted version.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The authors wish to thank three reviewers for their helpful suggestions. We also wish to thank members of the International Panel of Experts on Sustainable Food Systems and the organization's secretariat for discussions that informed the development of this manuscript.

Altieri, M. A., Nicholls, C. I., Henao, A., and Lana, M. A. (2015). Agroecology and the design of climate change-resilient farming systems. Agron. Sustain. Dev. 35, 869–890. doi: 10.1007/s13593-015-0285-2

Araghi, F. A. (1995). Global depeasantization, 1945–1990. Sociol. Q. 36, 337–368. doi: 10.1111/j.1533-8525.1995.tb00443.x

Aron, N., Moulton, B., and Owens, C. (1994). Judicial seminars: economics, academia, and corporate money in America. Antitrust Law Econ. Rev. 25, 33–50.

Bailey, R., and Wellesley, L. (2017). Chokepoints and Vulnerabilities in Global Food Trade. London: Chatham House. Available online at: https://www.chathamhouse.org/2017/06/chokepoints-and-vulnerabilities-global-food-trade

Berge, A. (2018, November 14). The coca cola of salmon: mowi brand aims to provide a billion euros in annual turnover by 2025. SalmonBusiness. Available online at: https://salmonbusiness.com/the-coca-cola-of-salmon-mowi-brand-aims-to-provide-a-billion-euros-in-annual-turnover-by-2025/

Berti, G., and Mulligan, C. (2016). Competitiveness of small farms and innovative food supply chains: the role of food hubs in creating sustainable regional and local food systems. Sustainability 8:616. doi: 10.3390/su8070616

Beyond Meat (2021). Beyond Burger 2021. Available online at: https://www.beyondmeat.com/products/the-beyond-burger/

Bichler, S., and Nitzan, J. (2020). Growing through sabotage: energizing hierarchical power. Rev. Capital Power 1, 1–78. Available online at: https://capitalaspower.com/2020/09/growing-through-sabotage/

Bichler, S., and Nitzan, J. (2014). How capitalists learned to stop worrying and love the crisis. Real World Econ. Rev. 66, 65–73. Available online at: http://www.paecon.net/PAEReview/issue66/whole66.pdf

Böhme, M. (2021). ‘Milk from the purest place on earth’: examining chinese investments in the australian dairy sector. Agric. Human Values 38, 327–338. doi: 10.1007/s10460-020-10153-2

Bowles, N., Alexander, S., and Hadjikakou, M. (2019). The livestock sector and planetary boundaries: a ‘limits to growth’ perspective with dietary implications. Ecol. Econ. 160, 128–136. doi: 10.1016/j.ecolecon.2019.01.033

Bunge, J. (2021, March 12). ADM to pay $45 million to settle peanut farmers' price-fixing claims. Wall Street Journal. Available online at: https://www.wsj.com/articles/adm-to-pay-45-million-to-settle-peanut-farmers-price-fixing-claims-11615568604

Campbell, L. (2020, August 8). JBS plant takeover leaves uncertainty for western sheep farmers. Modern Farmer. Available online at: https://modernfarmer.com/2020/08/jbs-plant-takeover-leaves-uncertainty-for-western-sheep-farmers/

Card, S. K., Mackinlay, J. D., and Shneiderman, B. (1999). Readings in Information Visualization: Using Vision to Think. San Diego, CA: Morgan Kaufmann.

Chandler, C., Franklin, A., Ochoa, A., and Clement, S. (2015). Sustainable Public Procurement of School Catering Services. A Good Practice Report. Freiburg: INNOCAT. Available online at: https://sustainable-catering.eu/fileadmin/user_upload/InnocatReportFINAL_interactive.pdf

Chiles, R. M. (2013). If they come, we will build it: in vitro meat and the discursive struggle over future agrofood expectations. Agric. Human Values 30, 511–523. doi: 10.1007/s10460-013-9427-9

Chriki, S., and Hocquette, J.-F. (2020). The myth of cultured meat: a review. Front. Nutr. 7:7. doi: 10.3389/fnut.2020.00007

Clapp, J., and Scrinis, G. (2017). Big food, nutritionism, and corporate power. Globalizations 14, 578–595. doi: 10.1080/14747731.2016.1239806

Clay, N., Sexton, A. E., Garnett, T., and Lorimer, J. (2020). Palatable disruption: the politics of plant milk. Agric. Human Values 37, 945–962. doi: 10.1007/s10460-020-10022-y

Clay, N., and Yurco, K. (2020). Political ecology of milk: contested futures of a lively food. Geogr. Compass 14:e12497. doi: 10.1111/gec3.12497

Cochrane, D. T. (2010). Review of Nitzan and Bichler's ‘capital as power: a study of order and creorder.’ Theory Action 3, 110–116. doi: 10.3798/tia.1937-0237.10020

Constance, D. H. (2008). The southern model of broiler production and its global implications. Cult. Agric. 30, 17–31. doi: 10.1111/j.1556-486X.2008.00004.x

de Schutter, O. (2014). The Power of Procurement: Public Purchasing in the Service of Realizing the Right to Food. Briefing Note 08. UN Special Rapporteur on the Right to Food. Available online at: http://www.srfood.org/images/stories/pdf/otherdocuments/20140514_procurement_en.pdf

Demetrakakes, P. (2021, February 25). The food industry's market concentration problem. Food Processing. Available online at: https://www.foodprocessing.com/articles/2021/market-concentration/

Di Muzio, T. (2013). The Capitalist Mode of Power: Critical Engagements With the Power Theory of Value. New York, NY: Routledge.

Edwards, P., Zhang, W., Belton, B., and Little, D. C. (2019). Misunderstandings, myths and mantras in aquaculture: its contribution to world food supplies has been systematically over reported. Marine Policy 106:103547. doi: 10.1016/j.marpol.2019.103547

ETC Group (2013). Putting the Cartel before the Horse…and Farm, Seeds, Soil, Peasants, Etc. Communique No. 111. Ottawa, ON.

FAIRR (2019). Protein Producer Index 2019. Farm Animal Investment Risk and Return. Available online at: https://www.fairr.org/index/

FAIRR (2020). An Industry Infected: Animal Agiculture in a Post-COVID World. Farm Animal Investment Risk and Return. Available online at: https://www.fairr.org/article/industry-infected/

FAO (2019). ASF Situation in Asia Update. Food and Agriculture Organization of the United Nations. Available online at: http://www.fao.org/ag/againfo/programmes/en/empres/ASF/2019/Situation_update_2019_09_26.html

FAO (2020a). Food Outlook - Biannual Report on Global Food Markets: June 2020. Rome: Food and Agriculture Organization of the United Nations.

FAO (2020b). The State of World Fisheries and Aquaculture 2020. Sustainability in Action. Rome: Food and Agriculture Organization of the United Nations.

Ferreira, L. (2019, September 17). China Mengniu moves on Australian organic baby formula company Bellamy's. CGTN. Available online at: https://news.cgtn.com/news/2019-09-17/China-Mengniu-moves-on-organic-baby-formula-company-Bellamy-s-K3K9vXigiA/index.html

Freitas, G., Freitas, T. Jr., and Wilson, J. (2017, May 26). Dirty family secret is behind JBS's $20 billion buying spree. Bloomberg. Available online at: https://www.bloomberg.com/news/articles/2017-05-26/the-dirty-family-secret-behind-jbs-s-20-billion-buying-spree

Glover, K. A., Solberg, M. F., McGinnity, P., Hindar, K., Verspoor, E., Coulson, M. W., et al. (2017). Half a century of genetic interaction between farmed and wild atlantic salmon: status of knowledge and unanswered questions. Fish Fisheries 18, 890–927. doi: 10.1111/faf.12214

GRAIN (2012). The Great Food Robbery: How Corporations Control Food, Grab Land and Destroy the Climate. Barcelona: GRAIN.

Guan, X., Lei, Q., Yan, Q., Li, X., Zhou, J., Du, G., et al. (2021). Trends and ideas in technology, regulation and public acceptance of cultured meat. Future Foods 3:100032. doi: 10.1016/j.fufo.2021.100032

Hager, S. B. (2013). “The power of investment banks: surplus absorption or differential capitalization?” in The Capitalist Mode of Power: Critical Engagements With the Power Theory of Value, ed T. Di Muzio (New York, NY: Routledge), 39–58.

Hannaford, S. (2007). Market Domination!: The Impact of Industry Consolidation on Competition, Innovation, and Consumer Choice. Westport, CT: Greenwood Publishing Group.

Hansen, A., and Jakobsen, J. (2020). Meatification and everyday geographies of consumption in Vietnam and China. Geografiska Annaler Ser. B Human Geogr. 102, 21–39. doi: 10.1080/04353684.2019.1709217

Hendrickson, M. K. (2020). Covid lays bare the brittleness of a concentrated and consolidated food system. Agric. Human Values. 37, 579–580. doi: 10.1007/s10460-020-10092-y

Hendrickson, M. K., Howard, P. H., and Constance, D. H. (2019). “Power, food and agriculture: implications for farmers, consumers, and communities,” in In Defense of Farmers: The Future of Agriculture in the Shadow of Corporate Power, eds J. Gibson and S. Alexander (Lincoln, NE: University of Nebraska Press), 13–61.

Hendrickson, M. K. (2015). Resilience in a concentrated and consolidated food system. J. Environ. Stud. Sci. 5, 418–431. doi: 10.1007/s13412-015-0292-2

Hendrickson, M. K., Howard, P. H., Miller, E. M., and Constance, D. H. (2020). The Food System: Concentration and Its Impacts. Family Farm Action Alliance. Available online at: https://farmactionalliance.org/wp-content/uploads/2020/11/Hendrickson-et-al.-2020.-Concentration-and-Its-Impacts-FINAL.pdf

Hendrickson, M. K., and James, H. S. Jr. (2016). Power, fairness and constrained choice in agricultural markets: a synthesizing framework. J. Agric. Environ. Ethics 29, 945–967. doi: 10.1007/s10806-016-9641-8

HLPE (2014). Sustainable Fisheries and Aquaculture for Food Security and Nutrition. Rome: High Level Panel of Experts on Food Security and Nutrition of the Committee on World Food Security.

HLPE (2019). Agroecological and other innovative approaches for sustainable agriculture and food systems that enhance food security and nutrition. Rome: High Level Panel of Experts on Food Security and Nutrition of the Committee on World Food Security.

Hoelle, J. (2017). Jungle beef: consumption, production and destruction, and the development process in the Brazilian Amazon. J. Political Ecol. 24, 743–762. doi: 10.2458/v24i1.20964

Holt-Giménez, E. (2002). Measuring farmers' agroecological resistance after Hurricane Mitch in nicaragua: a case study in participatory, sustainable land management impact monitoring. Agric. Ecosyst. Environ. 93, 87–105. doi: 10.1016/S0167-8809(02)00006-3

Howard, P. H. (2009). Visualizing food system concentration and consolidation. Southern Rural Sociol. 24, 87–110. Available online at: https://egrove.olemiss.edu/jrss/vol24/iss2/5

Howard, P. H. (2019). “Corporate concentration in global meat processing: the role of feed and finance subsidies,” in Global Meat: Social and Environmental Consequences of the Expanding Meat Industry, eds B. Winders and E. Ransom (Cambridge, MA: MIT Press), 31–53.

Howard, P. H. (2020). “How corporations control our seeds,” in Bite Back: People Taking On Corporate Food and Winning, eds S. Jayaraman and K. De Master (Oakland, CA: University of California Press), 15–29.

Howard, P. H. (2016a). Concentration and Power in the Food System: Who Controls What We Eat? New York, NY: Bloomsbury Publishing.

Howard, P. H. (2016b). Decoding diversity in the food system: wheat and bread in North America. Agric. Human Values 33, 953–960. doi: 10.1007/s10460-016-9727-y

IAASTD (2009). International Assessment of Agricultural Knowledge, Science and Technology for Development: Executive Summary of the Synthesis Report. Washington, DC: Island Press. Available online at: http://www.sidalc.net/cgi-bin/wxis.exe/?IsisScript=orton.xis&method=post&formato=2&cantidad=1&expresion=mfn,=085587

IPES-Food (2016). From Uniformity to Diversity: A Paradigm Shift from Industrial Agriculture to Diversified Agroecological Systems. International Panel of Experts on Sustainable Food Systems. Available online at: http://www.ipes-food.org/images/Reports/UniformityToDiversity_FullReport.pdf

IPES-Food (2017). Too Big to Feed: Exploring the Impacts of Mega-Mergers, Consolidation, and Concentration of Power in the Food System. International Panel of Experts on Sustainable Food Systems. Available online at: http://www.ipes-food.org/images/Reports/Concentration_FullReport.pdf

IPES-Food (2018). Breaking Away From Industrial Food and Farming Systems: Seven Case Studies of Agroecological Transition. International Panel of Experts on Sustainable Food Systems. Available online at: http://www.ipes-food.org/_img/upload/files/CS2_web.pdf

IPES-Food (2019). Towards a Common Food Policy for the European Union. International Panel of Experts on Sustainable Food Systems. Available online at: http://www.ipes-food.org/_img/upload/files/CFP_FullReport.pdf.

Jaffe, J., and Gertler, M. (2006). Victual vicissitudes: consumer deskilling and the (gendered) transformation of food systems. Agric. Human Values 23, 143–162. doi: 10.1007/s10460-005-6098-1

Jaffee, D., and Howard, P. H. (2010). Corporate cooptation of organic and fair trade standards. Agric. Human Values 27, 387–399. doi: 10.1007/s10460-009-9231-8

Joseph, P., Searing, A., Watson, C., and McKeague, J. (2020). Alternative proteins: market research on consumer trends and emerging landscape. Meat Muscle Biol. 4, 1–11. doi: 10.22175/mmb.11225

Kelly, P. (2018). Unfair Trading Practices in the Food Supply Chain. Brussels: European Parliamentary Research Service.

Khan, A. (2020). The Cellular Agriculture Investment Report 2020. Available online at: https://www.cell.ag/reports

Khan, L. (2012). Obama's game of chicken. Washington Monthly. Available online at: https://washingtonmonthly.com/magazine/novdec-2012/obamas-game-of-chicken/

Khoury, C. K., Bjorkman, A. D., Dempewolf, H., Ramirez-Villegas, J., Guarino, L., Jarvis, A., et al. (2014). Increasing homogeneity in global food supplies and the implications for food security. Proc. Nat. Acad. Sci. 111, 4001–4006. doi: 10.1073/pnas.1313490111

Kyriakopoulou, K., Dekkers, B., and van der Goot, A. J. (2019). “Plant-based meat analogues,” in Sustainable Meat Production and Processing, ed C. M. Galanakis (London: Academic Press), 103–126.

Leonard, C. (2014). The Meat Racket: The Secret Takeover of America's Food Business. New York, NY: Simon and Schuster.

Lonkila, A., and Kaljonen, M. (2021). Promises of meat and milk alternatives: an integrative literature review on emergent research themes. Agric. Human Values. doi: 10.1007/s10460-020-10184-9

Lynn, B. C. (2010). Cornered: The New Monopoly Capitalism and the Economics of Destruction. New York, NY: John Wiley & Sons.

Mauri, M., Elli, T., Caviglia, G., Uboldi, G., and Azzi, M. (2017). “RAWGraphs: a visualisation platform to create open outputs,” in Proceedings of the 12th Biannual Conference on Italian SIGCHI Chapter, 1–5. CHItaly'17 (New York, NY: Association for Computing Machinery).

Mayer, R. E. (2014). “Introduction to multimedia learning,” in The Cambridge Handbook of Multimedia Learning, ed R. E. Mayer (Cambridge: Cambridge University Press), 1–24.

McDonagh, V. (2020, December 21). Mowi Offloads Its Stake in DESS Aquaculture. Fish Farmer Magazine. Available online at: https://www.fishfarmermagazine.com/news/mowi-offloads-its-stake-in-dess-aquaculture/

Meticulous Research (2020). Meat Substitute Market: Global Opportunity Analysis and Industry Forecast. Wakad. Available online at: https://www.meticulousresearch.com/product/meat-substitute-market-4969

Middleton, J., Reintjes, R., and Lopes, H. (2020). Meat plants—a new front line in the Covid-19 pandemic. BMJ 370:m2716. doi: 10.1136/bmj.m2716

Mijatovic, D., Van Oudenhoven, F., Eyzaguirre, P., and Hodgkin, T. (2013). The role of agricultural biodiversity in strengthening resilience to climate change: towards an analytical framework. Int. J. Agric. Sustainability 11, 95–107. doi: 10.1080/14735903.2012.691221

Miles, A., DeLonge, M. S., and Carlisle, L. (2017). Triggering a positive research and policy feedback cycle to support a transition to agroecology and sustainable food systems. Agroecol. Sustain. Food Syst. 41, 855–879. doi: 10.1080/21683565.2017.1331179

Mittendorfer, B., Klein, S., and Fontana, L. (2020). A word of caution against excessive protein intake. Nat. Rev. Endocrinol. 16, 59–66. doi: 10.1038/s41574-019-0274-7

Mordor Intelligence (2020). Meat Substitute Market - Growth, Trend and Forecast (2021 - 2026). Hyderabad. Available online at: https://www.mordorintelligence.com/industry-reports/meat-substitutes-market

Mouat, M. J., Prince, R., and Roche, M. M. (2019). Making value out of ethics: the emerging economic geography of lab-grown meat and other animal-free food products. Econ. Geogr. 95, 136–158. doi: 10.1080/00130095.2018.1508994

Mulier, T., and Dantas, L. (2010, June 17). Nestle to sail Amazon rivers to reach consumers. Bloomberg. Available online at: https://www.bloomberg.com/news/articles/2010-06-17/nestle-navigates-amazon-rivers-to-reach-cut-off-consumers-before-unilever

Nair, D., Balezou, M., and Noel, A. M. (2020, December 18). Kerry group is said to weigh options for consumer food unit. Bloomberg. Available online at: https://www.bloomberg.com/news/articles/2020-12-18/kerry-group-is-said-to-weigh-options-for-consumer-food-business

Neo, H., and Emel, J. (2017). Geographies of Meat: Politics, Economy and Culture. New York, NY: Taylor & Francis.

Nitzan, J., and Bichler, S. (2009). Capital as Power: A Study of Order and Creorder. New York, NY: Routledge.

Olson, R. D. (2014). “Lessons from the food system: borkian paradoxes, plutocracy, and the rise of Walmart's Buyer power,” in The Global Food System: Issues and Solutions, ed. W. D. Schanbacher (Santa Barbara, CA: ABC-CLIO), 83–114.

Otero, G. (2018). The Neoliberal Diet: Healthy Profits, Unhealthy People. Austin, TX: University of Texas Press.

Painter, J., Brennen, J. S., and Kristiansen, S. (2020). The coverage of cultured meat in the US and UK traditional media, 2013–2019: drivers, sources, and competing narratives. Climatic Change 162, 2379–2396. doi: 10.1007/s10584-020-02813-3

Pauly, D. (2019). Vanishing Fish: Shifting Baselines and the Future of Global Fisheries. Vancouver, BC: Greystone Books Ltd.

Pauly, D., Christensen, V., Guénette, S., Pitcher, T. J., Sumaila, U. R., Walters, C. J., et al. (2002). Towards sustainability in world fisheries. Nature 418, 689–695. doi: 10.1038/nature01017

Peterson-Rockney, M., Baur, P., Guzman, A., Bender, S. F., Calo, A., Castillo, F., et al. (2021). Narrow and brittle or broad and nimble? Comparing adaptive capacity in simplifying and diversifying farming systems. Front. Sustain. Food Syst. 5:564900. doi: 10.3389/fsufs.2021.564900

Research Markets (2020). Processed Poultry & Meat Market - Forecast (2020 - 2025). Dublin. Available online at: https://www.researchandmarkets.com/reports/3501462/processed-poultry-and-meat-market-forecast

Rockström, J., Steffen, W., Noone, K., Persson, Å., Chapin, F. S., Lambin, E., et al. (2009). Planetary boundaries: exploring the safe operating space for humanity. Ecol. Soc. 14:32. doi: 10.5751/ES-03180-140232

Rosset, P. M., Machín Sosa, B., Roque Jaime, A. M., and Ávila Lozano, D. R. (2011). The campesino-to-campesino agroecology movement of ANAP in cuba: social process methodology in the construction of sustainable peasant agriculture and food sovereignty. J. Peasant Stud. 38, 161–191. doi: 10.1080/03066150.2010.538584

Rousseau, Y., Watson, R. A., Blanchard, J. L., and Fulton, E. A. (2019). Defining global artisanal fisheries. Marine Policy 108:103634. doi: 10.1016/j.marpol.2019.103634

Ryschawy, J., Dumont, B., Therond, O., Donnars, C., Hendrickson, J., Benoit, M., et al. (2019). An integrated graphical tool for analysing impacts and services provided by livestock farming. Animal 13, 1760–1772. doi: 10.1017/S1751731119000351

Santo, R. E., Kim, B. F., Goldman, S. E., Dutkiewicz, J., Biehl, E. M. B., Bloem, M. W., et al. (2020). Considering plant-based meat substitutes and cell-based meats: a public health and food systems perspective. Front. Sustain. Food Syst. 4:134. doi: 10.3389/fsufs.2020.00134

Schneider, M. (2017). Wasting the rural: meat, manure, and the politics of agro-industrialization in contemporary China. Geoforum 78, 89–97. doi: 10.1016/j.geoforum.2015.12.001

Scipioni, J. (2020, December 18). This restaurant will be the first ever to serve lab-grown chicken (for $23). CNBC. Available online at: https://www.cnbc.com/2020/12/18/singapore-restaurant-first-ever-to-serve-eat-just-lab-grown-chicken.html

Secard, R. (2020, October 9). Justice department expands poultry price-fixing investigation, charges six more. IndustryWeek. Available online at: https://www.industryweek.com/operations/article/21144301/justice-department-expands-poultry-pricefixing-investigation-charges-six-more

Sharma, P., and Daugbjerg, C. (2020). Politicisation and coalition magnets in policy making: a comparative study of food sovereignty and agricultural reform in Nepal and Ecuador. J. Compar. Policy Anal. Res. Prac. 1–15. doi: 10.1080/13876988.2020.1760716

Sharma, S., and Rou, Z. (2014). China's Dairy Dilemma. Minneapolis, MN: Institute for Agriculture and Trade Policy. Available online at: https://www.iatp.org/sites/default/files/2017-05/2017_05_03_DairyReport_f_web.pdf

Shields, D. A. (2010). Consolidation and Concentration in the U.S. Dairy Industry. R41224. Washington, DC: Congressional Research Service.

Steinfeld, H., Gerber, P., Wassenaar, T., Castel, V., Rosales, M., and de Haan, C. (2006). Livestock's Long Shadow: Environmental Issues and Options. Rome: Food & Agriculture Organization of the United Nations.

Stock, K. (2016, August 15). Hormel is so much more than spam. Bloomberg. Available online at: https://www.bloomberg.com/features/2016-hormel-spam/

Stone, G. D. (2007). Agricultural deskilling and the spread of genetically modified cotton in Warangal. Curr. Anthropol. 48, 67–103. doi: 10.1086/508689

Stull, D. D. (2019). “Chickenizing american farmers,” in In Defense of Farmers: The Future of Agriculture in the Shadow of Corporate Power, eds J. Gibson and S. Alexander (Lincoln, NE: University of Nebraska Press), 63–97.

Thompson, C. B. (2007). Africa: green revolution or rainbow evolution? Rev. Afr. Polit. Econ. 34, 562–565. Available online at: https://www.jstor.org/stable/20406431

Tidwell, J. (2010). Designing Interfaces: Patterns for Effective Interaction Design. Sebastopol, CA: O'Reilly Media, Inc.

Tisdell, C. (2003). Socioeconomic causes of loss of animal genetic diversity: analysis and assessment. Ecolo. Econ. Valuing Animal Genetic Resour. 45, 365–376. doi: 10.1016/S0921-8009(03)00091-0

USDOJ (2012). Competition and Agriculture: Voices From the Workshops on Agriculture and Antitrust Enforcement in Our 21st Century Economy and Thoughts on the Way Forward. Washington, DC: United States Department of Justice. Available online at: https://www.justice.gov/sites/default/files/atr/legacy/2012/05/16/283291.pdf

Uzunca, B., and Li, S.-C. (2018). “How sustainable innovations win in the fish industry: theorizing incumbent-entrant dynamics across aquaculture and fisheries,” in Handbook of Knowledge Management for Sustainable Water Systems, ed M. Russ (Hoboken, NJ: John Wiley & Sons), 133–156.

Walker, R. (2009). Conserving Turkeys of Thanksgivings Past for the Future. Pittsboro, NC: The Livestock Conservancy. Available online at: https://livestockconservancy.org/images/uploads/docs/pressrelease_heritageturkeys_2.pdf

Wallace, R. (2016). Big Farms Make Big Flu: Dispatches on Influenza, Agribusiness, and the Nature of Science. New York, NY: NYU Press.

Wallace, R. (2021, January 8). Planet farm. New Internationalist. Available online at: https://newint.org/immersive/2021/01/06/planet-fjf-farm

Warner, R. D. (2019). Review: analysis of the process and drivers for cellular meat production. Animal 13, 3041–3058. doi: 10.1017/S1751731119001897

Wasley, A., Heal, A., Michaels, L., Phillips, D., Campos, A., and Junqueira, D. et al. (2019, July 2). JBS: the brazilian butchers who took over the world. The Bureau of Investigative Journalism. Available online at: https://www.thebureauinvestigates.com/stories/2019-07-02/jbs-brazilian-butchers-took-over-the-world

Watanabe, C., Tou, Y., and Neittaanmäki, P. (2020). Institutional systems inducing R&D in Amazon- the role of an investor surplus toward stakeholder capitalization. Technol. Soc. 63:101290. doi: 10.1016/j.techsoc.2020.101290

Waterlow, J. C., and Payne, P. R. (1975). The protein gap. Nature 258, 113–117. doi: 10.1038/258113a0

Watson, E. (2020, April 6). How is coronavirus impacting plant-based meat? Foodnavigator-USA.com. Available online at: https://www.foodnavigator-usa.com/Article/2020/04/06/How-is-coronavirus-impacting-plant-based-meat-Impossible-Foods-weighs-in

Weis, T. (2010). The accelerating biophysical contradictions of industrial capitalist agriculture. J. Agrarian Change 10, 315–341. doi: 10.1111/j.1471-0366.2010.00273.x

Weis, T. (2013). The Ecological Hoofprint: The Global Burden of Industrial Livestock. London: Zed Books, Limited.

Werner, M., Isa Contreras, P., Mui, Y., and Stokes-Ramos, H. (2019). International trade and the neoliberal diet in central america and the dominican republic: bringing social inequality to the center of analysis. Soc. Sci. Med. 239:112516. doi: 10.1016/j.socscimed.2019.112516

Wezel, A., Gemmill Herren, B., Bezner Kerr, R., Barrios, E., Rodrigues Gonçalves, A. L., and Sinclair, F. (2020). Agroecological principles and elements and their implications for transitioning to sustainable food systems. a review. Agronomy Sustain. Dev. 40:40. doi: 10.1007/s13593-020-00646-z

Willett, W., Rockström, J., Loken, B., Springmann, M., Lang, T., Vermeulen, S., et al. (2019). Food in the anthropocene: the EAT–lancet commission on healthy diets from sustainable food systems. Lancet 393, 447–492. doi: 10.1016/S0140-6736(18)31788-4

Winson, A. (2013). The Industrial Diet: The Degradation of Food and the Struggle for Healthy Eating. Vancouver, BC: UBC Press.

Wood, B., Williams, O., Baker, P., Nagarajan, V., and Sacks, G. (2021). The Influence of corporate market power on health: exploring the structure-conduct-performance model from a public health perspective. Globalization Health 17:41. doi: 10.1186/s12992-021-00688-2

Wood, Z. (2021, February 4). World is shifting to a more plant-based diet, says unilever chief. The Guardian. Available online at: https://www.theguardian.com/business/2021/feb/04/world-is-shifting-to-a-more-plant-based-diet-says-unilever-chief

Worm, B., Barbier, E. B., Beaumont, N., Duffy, J. E., Folke, C., Halpern, B. S., et al. (2006). Impacts of biodiversity loss on ocean ecosystem services. Science 314, 787–790. doi: 10.1126/science.1132294

Yan, L. (2020, May 13). Coca-Cola, Mengniu's JV to sell chilled milk. Ecns.cn. Available online at: http://www.ecns.cn/business/2020-05-13/detail-ifzwefvs2289437.shtml

Keywords: protein, consolidation, diversity, political ecology, visualization, equity, resilience

Citation: Howard PH, Ajena F, Yamaoka M and Clarke A (2021) “Protein” Industry Convergence and Its Implications for Resilient and Equitable Food Systems. Front. Sustain. Food Syst. 5:684181. doi: 10.3389/fsufs.2021.684181

Received: 22 March 2021; Accepted: 19 July 2021;

Published: 16 August 2021.

Edited by:

Jennifer Sowerwine, University of California, Berkeley, United StatesReviewed by:

Yiching Song, Chinese Academy of Sciences (CAS), ChinaCopyright © 2021 Howard, Ajena, Yamaoka and Clarke. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Philip H. Howard, aG93YXJkcEBtc3UuZWR1

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.