- 1Department of Nutrition and Food Sciences, University of Vermont, Burlington, VT, United States

- 2Food Systems Program, University of Vermont, Burlington, VT, United States

In many low-income nations agriculture is used as the primary source of income, which in the face of a changing climate, is known to be at considerable risk for the smallholder farmers that rely on it. Financial resources may enable smallholder farmers to implement adaptation practices and diversify income and investments, which has the potential to affect household income and food security. Here we explore relationships between access to different types of financial resources among male and female-headed households and women vs. men, use of financial resources, and its relationship to food security. We use data from the CGIAR Climate Change, Agriculture, and Food Security (CCAFS) program from four sites including Nyando (Western Kenya) and Wote (Eastern Kenya), Rakai (Uganda) and Kaffrine (Senegal), to represent major farming systems and agro-ecological zones across Africa. We find that male and female-headed households do not attempt to borrow financial resources in significantly different quantities; however, female-headed households are less likely to have access to financial resources if they wanted them. We find that men and male-headed households are more likely to access formal loans. As well, we find that male and female-headed households spend their financial resources differently with female-headed households most likely to use their credit for food, medical expenses and education and male-headed households most likely to use it on food, agriculture/ livestock inputs and education. Formals loans were more frequently associated with credit spent on agriculture/livestock inputs while informal loans were more likely to be utilized for buying food and medical care. In the context of food security we find that all households and sexes that attempted to borrow money in the past 12 months were less likely to borrow food or other goods, but that female-headed households were more than twice as likely to borrow food or other goods overall. These results add nuance to the relationship of financial resources to food security, suggesting that for many smallholders, especially women, credit is often used to obtain food and other health outcomes as compared to on-farm investment. The use of financial resources for these varying purposes likely has different short-term vs. long-term returns and tradeoffs, which could influence smallholder farmer capacity for climate change adaptation.

Introduction

Access to financial resources is a key part of rural development; helping individuals to save and borrow eventually expands other economic opportunities available to these individuals (Fletschner, 2009). Limited access to financial resources in low-income countries presents many potential challenges for low-income countries, as access to financial resources is critically important for achieving sustainable development goals (UN General Assembly, 2015), including targets in food security and investment in education (De la Torre et al., 2007). In low-income countries, a large percent of the demographic makeup is smallholder farmers, who typically have less than five acres of land, yet provide more than half of the food produced in low-income countries (Lowder et al., 2014). Globally, there are estimated to be more than two billion smallholder farmers (International Fund for Agricultural Development, 2013), demonstrating their significant importance in our global food system and making them an important topic of study.

Given this importance, here we focus on smallholder farmers and financial resources in the context of food security and gender. Evidence suggests that financial resources can help smallholder farmers by improving agricultural productivity to better handle risks associated with climate change, and allow smallholders to participate in non-farm activities (Khandker and Koolwal, 2014). Use of financial resources for agricultural production may be particularly important in Africa. The agricultural production per capita has remained fairly stagnant in recent decades (Godfray et al., 2010) and this area is facing a heightened threat of climate change, reducing food security within the household (Morton, 2007; Niles and Brown, 2017). Despite this, Sub-Saharan Africa shows great potential to close “yield gaps” (Mueller et al., 2012). Access to credit can offer multiple avenues for improving agricultural production through access to inputs, but also by alleviating some technical barriers including access to extension services (Khandker and Koolwal, 2014). For many proposed “climate smart” agricultural practices, additional financial resources may further assist farmers in adoption. For example, a recent study of smallholder farmers across multiple continents and countries finds that those with income from other sources were more likely to be food secure and adopting climate-smart agricultural practices (Thornton et al., 2018).

Within the context of smallholder farmers, there has been a growing focus on female-headed households, which may be more likely to be food insecure (Niles and Brown, 2017; Niles and Salerno, 2018). Further, additional evidence indicates that the least food secure households, particularly female-headed households, are less likely to adopt new agricultural technologies due to factors including lower income and lack of access to financial resources (Jost et al., 2016). Furthermore, formal institutions more often directly allocate money to property owners; however, many rural women lack property rights due to inheritance laws favoring men in the family line.

This study explores financial resource access and use among male and female-headed households across four regions in Africa. We contribute to a growing body of research examining financial resources and their ability to improve smallholder farmer livelihoods, particularly through the explicit exploration of food security. We contribute novelty to the existing research by using data across multiple places, and among data collected separately between the men and women at the household level. Below we provide additional detail about the role of financial resources for food security in the context of gender, then present our hypotheses, methods, results, discussion and conclusion.

Background

Financial Resources

Existing research suggests that the type of credit and lending source (formal or informal) have differing effects on agricultural outputs and food security (Sacerdoti, 2005). Formal financial institutions often include banks and credit unions, while informal lenders can include friends, family, landlords, non-governmental organizations, and microfinance institutions (Ghate, 2000). Formal lenders more often attract wealthier clients, which could enable greater economic advancement at a regional or country level (Ghate, 2000). Contrarily, smaller, more informal institutions are associated with lower access to external financing options including leasing and credit access (Beck and Demirguc-Kunt, 2006). Nevertheless, small, informal loan sources have become an important source of financing for millions of people. Despite the ability of financial resources to improve livelihoods, evidence suggests in Africa only 21% of farms have a line of credit and only 16.5% of households indicate that they have an account with a formal financial institution (Zins and Weill, 2016). In some places, these numbers may be even less, such as Malawi where only a reported 2% of households have access to formal credit, despite evidence that access to such credit can help to increase the efficiency of food markets and reduce post-harvest losses (Edelman et al., 2014).

Formal credit use may be limited in low-income countries where people often rely on informal sources of credit including family, friends, and informal lenders (De la Torre et al., 2007). Such informal sources may confer many benefits, including reduced transaction costs and capacity for small loans in a timely manner (Yami and van Asten, 2018). Historically, there has been a consistent failure and inability of formal loan sources to maintain a presence within rural farming (Faruqee and Khandker, 2001), which has influenced many low-income individuals to rely on informal credit to alleviate financial constraints (Boucher et al., 2008). Maintaining rural financial institutions is costly due to the limited network of rural financial institutions (Tsai, 2004) and stark differences in costs of accessing types of lenders. One analysis found that formal institutions can, on average, cost about 30 USD to access due to transactions and transportation fees while the cost to access informal institutions were negligible (Brune et al., 2011). With exclusionary and costly mechanisms within formal institutions, low-income countries have seen a rise in informal institutions, particularly micro-financing institutions. Microcredit has shown one of the widest effects on improving outcomes for households in both rural and urban areas, including factors such as crop income and hours spent working on the farm (Khandker and Koolwal, 2014). In Mali, evidence shows that using microfinance for agricultural loans when compared to cash grants increased purchasing of agricultural products, showing a higher return to capital (Beaman et al., 2014). Although positive effects and an increase in micro-financing has been seen in the past 40 years (Koubâa, 2014), micro-financing institutions still have many limitations.

Smallholder Farmers, Climate Change, and Food Security

Financial resources are widely discussed as a potential strategy for ensuring agricultural production through climate-smart agriculture in the face of a changing climate (CGIAR, 2013). As the climate changes, food security will continue to be a major concern, which comes on top of the already 815 million individuals classified as malnourished in 2016 (FAO et al., 2017). Integration of credit may allow households to protect themselves against vulnerabilities including shocks and loss/damage of crops (Khandker and Koolwal, 2014). Evidence further suggests that outside financial resources can enable smallholders to “step up” to utilize strategies such as investments in agricultural assets that enable expansion in the scale or productivity of existing assets and activities (Thornton et al., 2018). Resilience to climate change is crucial, as it makes households more equipped to deal with surprising and unexpected environmental stressors (Perez et al., 2015). Additionally, access to information and financial markets enables longer-term saving and borrowing and increases the ability of households to obtain insurance (Zins and Weill, 2016). This study further explores the relationship of financial resources and food security among smallholder farmers utilizing research conducted within the context of climate change and adaptation strategies.

Women and Financial Access

Considering gender as a critical component of access to financial resources is important to address challenges around accessibility, as evidence increasingly shows men and women have differing access to property, education, credit and extension services (Croppenstedt et al., 2013). While women make significant contributions to agriculture in low-income countries, women are still shown to have a lower output per unit of land and be less likely to participate in commercial farming when compared to men, which is linked to less access to financial resources and extension services (Croppenstedt et al., 2013). A major challenge for women is reliance on internal village groups, and also trying to overcome anti-women biases that make female headed households vulnerable to food insecurity (Perez et al., 2015). In some instances it is not acceptable for women to interact with men beyond their family members, and so this can make it difficult and often impossible to engage in informational sessions regarding financial institutions or markets (Fletschner, 2009). Importantly, these challenges can vary significantly by region and even village, as social norms may govern the traditional behaviors of a given place or the accessibility for women to credit and other resources.

The amount, type of credit, and who obtains credit all play an important role on the impact of the financial resource. Women however are more likely to be excluded from formal access to credit (Zins and Weill, 2016), leaving them to more often rely on family and friends for types of financial resources (Fletschner, 2009), and will more often begin businesses with fewer resources (Carter et al., 2003). These sources of lending can influence overall capacity for women. For example, women in India with lower incomes tended to have larger social networks, but which included other women with low incomes. Conversely men reported having smaller social networks, but their networks more often included wealthier men with access to agricultural resources (Magnan et al., 2013). In addition to having a social network that is more financially advantageous, men also value different organizations in the community (e.g., government agencies, community based organizations, and international organizations) when compared to women (e.g., community based organizations), which may affect utilization of certain types of financial resources (Cramer et al., 2016).

Women and Credit Allocation

Additional research has considered how gender may influence allocation of financial resources. Women's credit access is known to increase household and child food security (Lemke et al., 2003), while men's access to credit has shown fewer effects on nutrition and food-security for the family (Hazarika and Guha-Khasnobis, 2008). This may be because women tend to be in control of food preparation in the house including tasks but not limited to, collecting water, gathering wood and the physical cooking of the food (Hyder et al., 2005). Furthermore, there is a positive correlation between female empowerment and a higher dietary diversity for both women and children, which is linked to an increased body mass index (Malapit et al., 2013). This may be related to women more often spending their personal income on food, healthcare, and education for their children (Duflo and Udry, 2004; Malapit et al., 2013; Cramer et al., 2016). Spending patterns among women, however, relies on the fact that women must have direct access to financial resources and they cannot be mediated through their husbands (Fletschner, 2009). In many cases, women are required to hand over the received loan to their husband, or have little say in income spending, potentially eliminating positive benefits seen with women's access to financial capital (Start and Johnson, 2004). For example, 75% of women surveyed in Nyando, Kenya were able to decide on how to use crops, yet only 50% of the women reported that they were able to then make decisions on how the income from those crops was spent (Bernier et al., 2015). Thus, female empowerment, that enables women to work or access credit and allocate their earnings as they wish, or which enable women to be involved in household decision-making, may be an important strategy to improve household nutrition outcomes (Sraboni et al., 2014; Malapit and Quisumbing, 2015).

Materials and Methods

Research Questions and Hypotheses

The purpose of this study is to explore relationships between access to different types of financial resources among male and female-headed households and men and women within these households and communities and its effect on food security. Based on the existing research, we aim to explore the following research questions and hypotheses:

1. Do male and female-headed households and women have different access to kinds of financial resources? (H1: Male-headed households have greater access to loans and financial resources).

2. Are there gender differences in the kinds of financial resources that are sought by smallholder farmers? (H2: Male-headed households are more likely to utilize formal financial resources such as a bank or credit union, while female-headed households and women are more likely to access money from informal sources such as relatives or friends).

3. Are there gendered differences in how financial resources are spent? (H3: Loans and financial resources will be spent differently among male vs. female-headed households and women).

4. Is there a relationship between food borrowing and financial resources? (H4: Financial resource access is associated with higher rates of food security).

Site Locations

Our analysis utilized data from the CGIAR Climate Change, Agriculture, and Food Security (CCAFS) program from their gender survey. Four sites representing three countries (Kenya, Uganda, and Senegal) were chosen including Nyando (Western Kenya) and Wote (Eastern Kenya), Rakai (Uganda) and Kaffrine (Senegal) (Figure 1). A total of 2,245 responses were recorded from Nyando (426), Rakai (769), Senegal (565), and Wote (485). These sites were chosen by the CCAFS to represent major farming systems and agro-ecological zones across Africa (Bernier et al., 2015). The survey integrated an IMPACTLite methodology (Integrated Modeling Platform for Mixed Animal Crop System; Rufino et al., 2013), collecting data from only households participating in crop and other agricultural activities. Though our data analysis can explore the data relevant to the surveyed households, it should be noted that these data cannot be interpreted to be nationally nor regionally representative because of their purposeful selection by CCAFS (Bernier et al., 2015).

Figure 1. Location of Kaffrine, Rakai, Nyando, and Makueni (capital of Wote). Kenyan regions were derived from ke_district_boundaries.shp, available from https://www.wri.org/resources/data-sets/kenya-gis-data. The other two regions were derived from OpenStreetMap data (https://www.openstreetmap.org), and were converted to .shp files using the OsmToShape tool. The relevant .shp file is boundary_ply.shp, available from https://github.com/mgotovtsev/OsmToShape.

Senegal, located in West Africa, depends heavily on agriculture, which employs about 70% of the population (CCAFS, 2015). Only about 7% of the cultivated land in the country is irrigated, which makes the agriculture heavily dependent on the countries rainfall (CCAFS, 2015). The agricultural and ecological zone is classified as a transition zone from the Sahel toward Sudan Savannah (Perez et al., 2015). Women in Senegal report growing cereals (millet and maize), groundnuts, beans and sesame. In addition, women are responsible for free ranging livestock and for collecting firewood, all of which contribute to food security. Nyando and Wote, in Kenya, relies heavily on agriculture with a direct contribution of 25.4% of the national GDP. The agriculture primarily consists of crops, livestock and fishery subsectors (CCAFS, 2015). Nyando, Kenya has an agricultural ecological zone of a primarily mixed rainfed crop livestock, and a humid to sub-humid climate (Perez et al., 2015). Food security in specifically Nyando, Kenya can consist of hunger periods lasting up to 10 months, which often leads to dependence on food relief from family members working in Nairobi (Perez et al., 2015). Rakai, in Uganda located in East Africa, is also heavily agricultural, and agriculture contributes up to 40% of Uganda's GDP. More than two-thirds of the country is a plateau and up to 95% of the population participates in in rainfed mixed farming for both food and cash income (CCAFS, 2015). Uganda has an agricultural ecological zone defined as a steep rainfall gradient from highland agroforestry. It contains mid hill coffee/tea and a range of agricultural systems from small scale mixed farming/commercial to dryland small-scale agriculture (Perez et al., 2015).

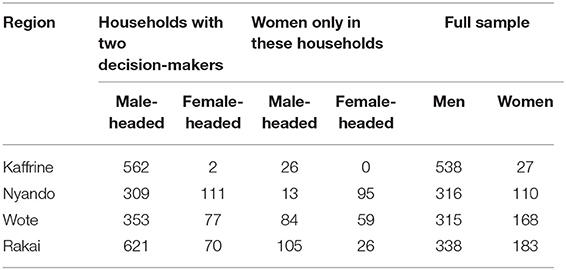

Statistical Analysis

We employ three measures to explore women and household type in the dataset: (1) female (households where a woman is head of household but there are two primary decision-makers (e.g., a male adult son, uncle) compared with households with male headed/dual-headed households with two primary decision-makers, for simplicity we refer to these as “female-headed households”); (2) female2 (women within female households with two primary decision-makers vs. women in male/dual headed households with two primary decision-makers, for simplicity we refer to these people as “women in female-headed households” vs. “women in male-headed households”); (3) sex (women vs. men regardless of household type). Table 1 shows the distribution of these types across the four regions.

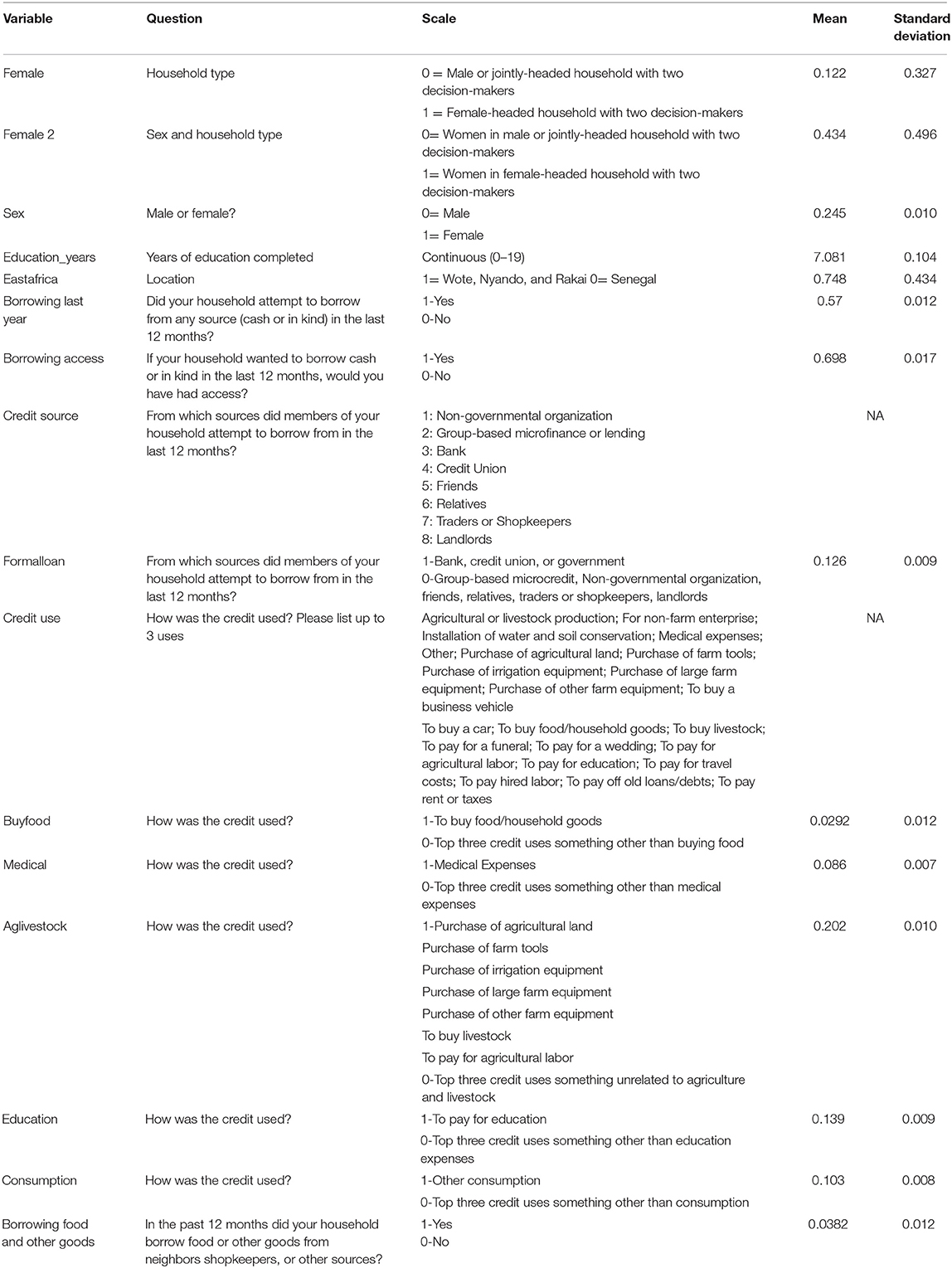

While there is no explicit question about food security within the survey, we utilize data related to food borrowing borrow food or other goods, which measures borrowing food or other goods within the past 12 months (Table 2). We note that food access is only one of the four pillars of food security (the others being availability, utilization, and stability), and that there is also a growing focus not just on food availability and access but nutritional security as well. Additional research could better explore these other components of food and nutritional security in these contexts. To compare male and female-headed households borrowing frequency allows us to understand how frequently households are borrowing food and other goods.

We explore how many and what types of households are attempting to borrow (borrowing last year) and have access to borrowing (borrowing access) while credit source represents the source of household credit (formal and informal). Formaloan captures participants that received loans from a bank, credit union, or the government, while a 0 indicates an informal loan source including group-based microcredit, non-governmental organization, friends, relatives, traders or shopkeepers and landlords. To understand where participants are most often spending credit we created sub-category variables from the variable credit use, which asked respondents to list their top three uses of credit. We aggregated credit uses across all possible uses and created binary variables for the top five outcomes including, buying food (buyfood), for purchasing agricultural or livestock inputs (aglivestock), for other consumption (consumption), for education (education), or for medical expenses (medical). Food borrowing (borrowing food and other goods) indicates whether or not they borrowed food or other goods in the past 12 months.

Data was analyzed in Stata 15 (StataCorp, 2017) using chi square tests and analysis of variance to test for the key differences between household and sex types among the four core hypotheses. We also utilize a two separate logistic regression models to explore food borrowing/food security in the context of loan access, household type and sex, and socio-demographic factors. The first explores food borrowing/security among all households and its relationship to borrowing attempts, while the second explores only households that did borrow and its relationship to loan type, how credit was spent, household type and sex, and socio-demographic factors. In both of these models we use an interaction term of sex and female to explore the relationship of household type and sex outcomes. The baseline outcome for this interaction term is men in male-headed households with two decision-makers, meaning the interaction terms are compared to this type of person and household. As reported below, we present data results along with p values for statistical significance.

Results

Access to Loans and Financial Resources

We predicted that male-headed households would have greater access to loans and financial resources compared with female-headed households and women (H1). Overall we find no statistically significant differences in female-headed and male-headed households with two decision-makers in attempting to borrow money (57.1% to 56.6%, p = 0.898). We also find no statistically significant differences between borrowing attempts of women in female-headed households compared to women in male-headed households (54.7% to 73.3%, p = 0.165), or of women overall, regardless of household type (59.1% to 56.6%, p = 0.480).

In terms of potential access to loans should individuals wanted to borrow, we find that female-headed compared to male-headed households with two decision-makers were statistically less likely to have loan access (53.9% to 70.9%, p = 0.003). We find no statistically significant difference of women in female-headed households compared to women in male-headed households with regards to access to loans (54.2% to 75%, p = 0.423) or of women overall compared to men in access to loans (62.7% to 70.9%, p = 0.109). In summary, we find no statistically significant differences between any of our three household and sex type measurements and attempting to borrow money. However, we do find that female-headed households were statistically less likely to have had access to loans if they wanted to borrow.

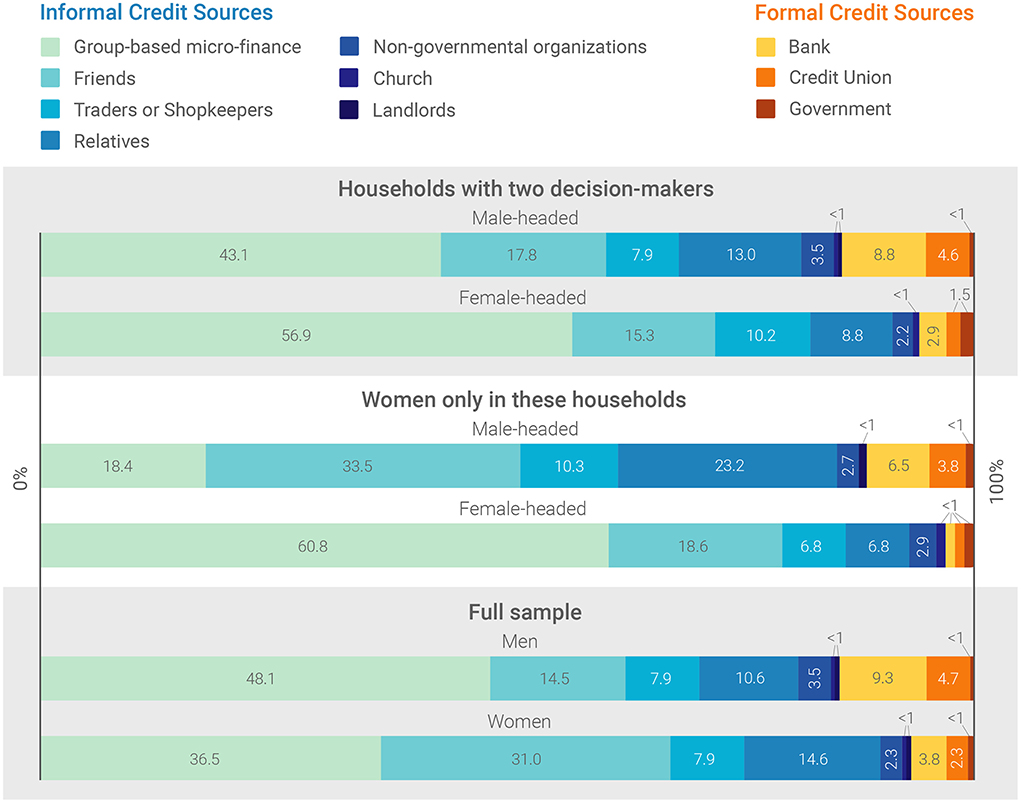

Formal and Informal Loan Sources

We predicted that male-headed households would be more likely to utilize formal loan sources (bank, credit union or government), while female-headed households would be more likely to access money from informal sources such as group-based micro-finance, relatives or friends (H2). We confirm this hypothesis, finding that male-headed households are more likely to access formal loans compared to female-headed households (14.2% compared to 5.8%, p = 0.007). We also find that women in female-headed households vs. women in male-headed households were also statistically less likely to utilize formal loans (2.9% to 10.9%, p = 0.018). Finally, we find that women overall compared to men are less likely to utilize formal loans (6.7% to 15.0%, p < 0.001) (Figure 2 and Table 3). However, overall, group-based microfinance is the most common source of lending, with 43.0% of male and 56.9% of female-headed households utilizing this source. In summary, we find consistent evidence that female-headed households, women in either household type, and women overall are less likely to utilize formal loans.

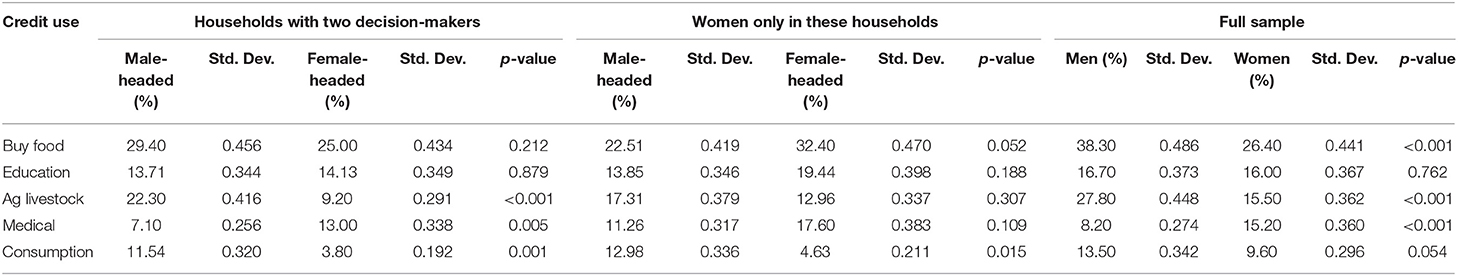

Spending Loans and Financial Resources

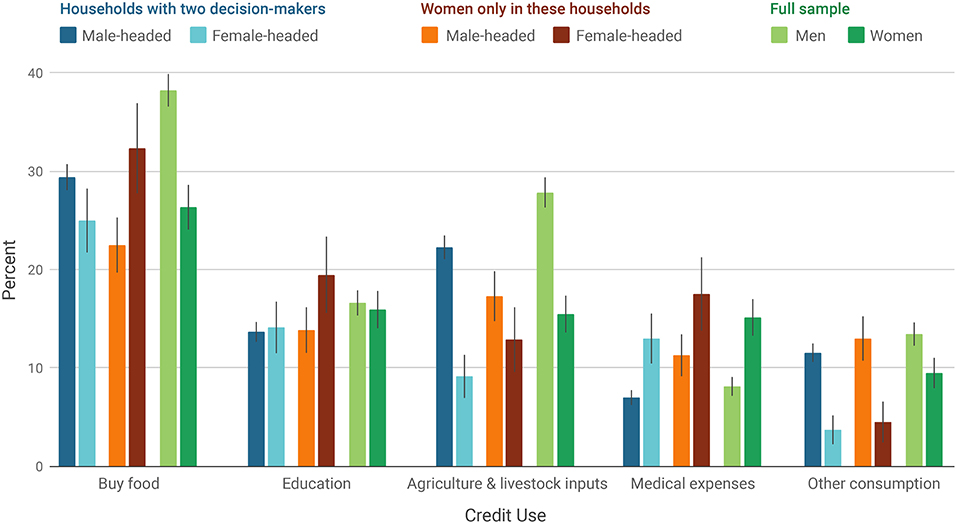

We predicted that loans and financial resources would be spent differently among male vs. female-headed households (H3), which we confirm (Figure 3 and Table 3). While buying food was the most common use of credit overall, we find no significant difference between female-headed and male-headed households (29.4% to 25.0%, p = 0.434). However, we do find that women in female-headed households vs. women in male-headed households (32.4% to 22.5%, p = 0.052) were more likely to spend their credit on food. Overall however, we find that men are more likely than women to spend credit on food (38.3% to 26.4%, p < 0.001). We find no significant differences in credit spending on education between any of our three groups of interest. For agriculture and livestock inputs we find that male-headed households are more than twice as likely as female-headed households (22.3% to 9.2%, p < 0.001) and men vs. women overall (27.8% to 15.5%, p < 0.001) to spend credit in this way. Female-headed households vs. male-headed households (13.0% to 7.1%, p = 0.005) and women overall (15.2% to 8.1%, p < 0.001) were more likely spend credit on medical expenses. Finally, we find that male-headed households vs. female-headed households (11.5% to 3.8%, p = 0.001), women in male-headed households vs. women in female-headed households (13.0% to 4.6%, p = 0.015), and men overall compared to women (13.5% to 9.6%, p = 0.054) were more likely to spend their credit on other consumption. In summary, we find evidence that women in female-headed households are more likely to spend their credit on food, while male-headed households and men overall are significantly more likely to spend credit on agriculture and livestock inputs and other consumption. Female-headed households and men overall are more likely to spend credit on medical expenses.

Further, we additionally analyzed the relationship of loan source to credit use. We find that buying food is significantly more common among informal loan recipients (38.8% compared to 24.0%, p < 0.001). Conversely, purchasing agricultural or livestock inputs was significantly associated with formal loans (39.0%) compared with 23.7% of households using informal loans (p < 0.001). The use of informal loans was positively associated with spending credit on medical expenses (12.0% of informal loans compared to 3.9% of informal loans, p = 0.003).

Food Security and Loan Access

Finally, we expected that access to financial resources would be associated with higher rates of food security (e.g., less food borrowing) (H4), a hypothesis we confirm. We find that overall those that had attempted to borrow in the last year were statistically less likely to borrow food or other goods (33.2% to 44.9%, p ≤ 0.001). We find no evidence that male or female-headed households that had access to loans borrowed food at different rates (36.6% to 34.4%, p = 0.654). Similarly, women in either of these male or female-headed households didn't borrow food or other goods at significantly different rates (36.7% to 45.5%, p = 0.581) and women vs. men overall who had access to loans (29.4% to 33.9%, p = 0.307), didn't borrow food or other goods at significantly different rates.

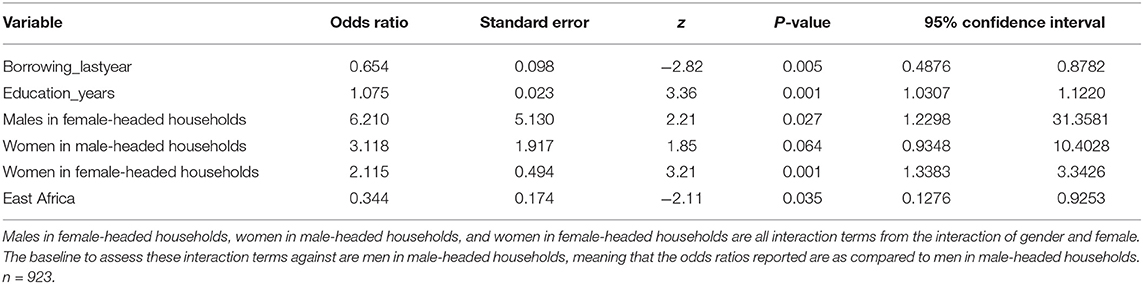

Logistic regression models explore food security outcomes among all households compared with households that accessed loans and financial resources of any type. Table 4 shows the results reported in odds ratios among food security for all households. We find that households that borrowed had a 65% reduced odds (or = 0.654, p = 0.005) of food borrowing. Higher years of education was associated with slightly higher rates of food borrowing (or = 1.075, p = 0.001). Exploring the relationship of household type and sex through interaction terms, we find that compared with men in male-headed households with two decision-makers, males in female-headed households with two decision-makers are more than six times as likely to borrow food or other goods (or = 6.210, p = 0.027), women in male-headed households were three times as likely to borrow food or other goods (or = 3.118, p = 0.064), and women in female-headed households were more than two times as likely to borrow food or other goods (or = 2.115, p = 0.001). Households in East Africa were much less likely to borrow food compared to the Senegalese households in West Africa (or = 0.344, p = 0.035).

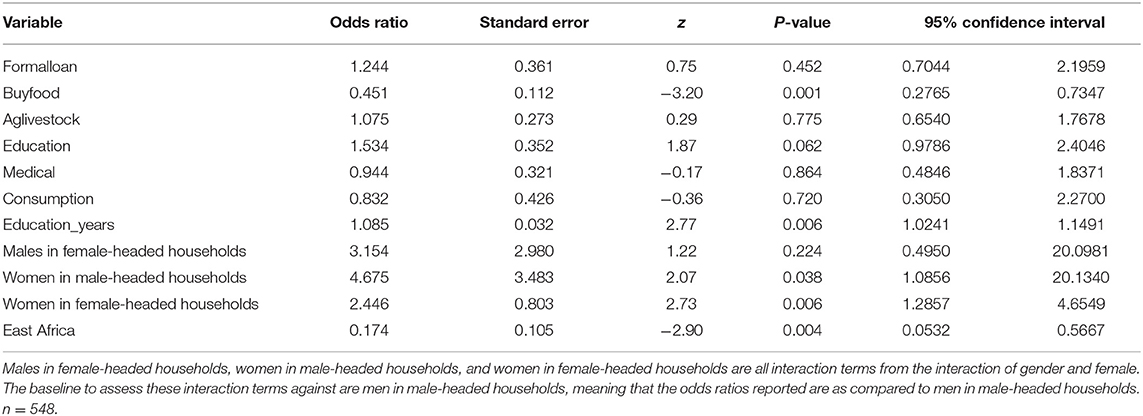

Among households that did have access to a loan, Table 5 examines the relationship of loan access and other key variables on food borrowing. We find several significant relationships. Households that utilized their loan to purchase food were less than half as likely to borrow food or other goods (or = 0.451, p = 0.001) compared to those that didn't purchase food with loans. Similar to all households in the previous model, we also find that higher levels of education is associated with slight increased odds of food borrowing (or = 1.085, p = 0.006). Finally, when exploring household type and sex through interaction terms, we find that compared with men in male-headed households with two decision-makers, women in male-headed households were more than four times as likely to borrow food or other goods (or = 4.675, p = 0.038) and female-headed households with two decision-makers were 2.4 times as likely to borrow food or other goods (or = 2.446, p = 0.006). Households in East Africa were much less likely to borrow food (or = 0.174, p = 0.004).

Table 5. Multivariate logistic regression exploring food borrowing among the sub-set of households that accessed loans.

Discussion

Gender Access to Financial Resources

This study explored the relationship of sex and household types to access of varying financial resources and credit uses and its implications on food security. We find that there are no statistically significant differences between borrowing attempts among household type or sex, but that female-headed households were less likely to have access to loans if they wanted to borrow. This is consistent with evidence from other African communities using broader CCAFS data, in which women were found to have less access to cash compared to males (Perez et al., 2015). However, we do find that male-headed households and men overall regardless of household type are more likely to access formal loans compared to female-headed households and women. This work is consistent with Zins and Weill (2016), who also find that women are more likely to be excluded from formal credit. This finding is critical since evidence suggests that female-headed households in these smallholder contexts are more likely to be food insecure (Niles and Brown, 2017; Niles and Salerno, 2018), and that formal financial resources can increase food security among smallholder farmers (Khandker and Koolwal, 2014) and increase rates of economic development across all households (Beck and Demirguc-Kunt, 2006). Importantly, access to formal financial resources has also been linked to greater financial stability among women in particular (Zins and Weill, 2016). Our work confirms existing findings that show female-headed households may have less access to such development opportunities with the decreased access to formal financial resources.

Differences in Allocation of Financial Resources

This analysis explored not only the type of financial resources being accessed, but also the differences in spending among male and female-headed households and sex. While buying food was the most common use of credit for any kind of household, women in female-headed households are more likely to spend credit on food buying. Male-headed households are significantly more likely to spend financial resources on improving agricultural systems, including the purchase of inputs and livestock, and on other consumption, as compared to female-headed households. Conversely, the top three credit uses among female-headed households address basic needs through buying food, education, and medical expenses. Furthermore, we find additional evidence that formal loans are significantly more likely to be used for agricultural and livestock inputs, whereas informal loans are more likely to be spent on food and medical care. That women are less likely than men to spend their credit on agricultural resources may also be related to complex land control and tenure in many of the regions. Perez et al. found that women across their regions in Africa controlled less land than male-headed households and land tenure was insecure. Notably, the study also found that the land women do access is often of poorer quality, further demonstrating the potential benefit that integration of agricultural inputs may have. Although men are spending money on buying food, their allocation of financial resources for agricultural production may generate more income in the short-term if such inputs result in greater yield. These results are consistent with Jost et al. (2016), who found that women are less likely to adopt new agricultural technologies due to several factors, including lowered income and lack of access to financial resources. However, Twyman et al. (2014) found that in East Africa, women were just as likely to have adopted climate-smart agriculture practices, particularly if they had access to information.

These varying allocation of resources has myriad implications. First, it suggests that credit are still being utilized by all households to meet basic needs including food purchasing. Beyond this, the results suggest that the short-term vs. long-term returns on investment may be quite different in male vs. female-headed households and men vs. women in the same households, and that this may be in part due to the access to formal vs. informal loans. Investing in agriculture can provide resilience to shocks long-term (Dercon, 2004). Since formal loans often provide more financial resources, it is possible that this additional income is a driving force for the capacity to purchase inputs and invest in other capital investments necessary for agricultural development. That women, and those utilizing informal loans, are much less likely to invest in agriculture and livestock has clear implications for climate change adaptation in agriculture, and suggests that women may be even more vulnerable to future impacts than previously suggested. While financial resources may be a strategy to ensure agricultural production in the face of climate change (CGIAR, 2013), women may face adaptation challenges due to allocating spending toward basic household needs (Cramer et al., 2016). This is critical since investment in climate-smart agricultural practices and technologies help farmers respond to climate variability, reducing the number of households eating one or no meals each day (Gilbert, 2015). Additionally, investing in agriculture has been integrated into the Paris Agreement, with the knowledge that climate-smart agriculture is a way to transform the agricultural system in a way that supports food security, increases agricultural productivity, incomes, and adaptation to climate change (Braimoh, 2018). This potential progress however may be hindered by the fact that female-headed households, at least within these communities, are not investing financial resources in agricultural production at the same rate as male-headed households, and rather prioritizing basic needs and educational mobility. While not all climate-smart practices have significant capital investments, recent evidence from Thornton et al. (2018) suggest that financial resources have a role to play in agricultural input use. The discrepancies found and supported here need to be considered when thinking about adaptive capacity in the context of climate change (Cramer et al., 2016).

Similarly, the prioritization of female-headed households toward basic needs and longer-term opportunities for financial mobility is worth considering. As other previous research suggests, this allocation of funding may have significant nutritional benefits for children and the household overall (Hazarika and Guha-Khasnobis, 2008). Further, previous work also suggests that children's health and schooling are often closely related to their mother's education and empowerment status (Schultz, 2002). While education is a longer-term investment and doesn't offer immediate food security relief or climate change resilience, countries with higher enrollment in schooling are associated with faster and greater GDP per capita (Bils and Klenow, 2000), suggesting that investing in education shows positive long-term effects. Similarly, the role and effectiveness of investing in medical expenses are critical to understanding the effectiveness of financial resources. The health-poverty trap is perpetuated on the basis that low income households are more likely to be in poor health (Casasnovas et al., 2005), which then contributes to a lower income due to lack of participating in economically productive activities. Thus, investment in medical expenses is likely both a short-term and a longer-term economic strategy, enabling work, and schooling in the short-term, with potential long-term benefits. However, it is important to note that female-headed households using credit for education may be the case that their basic income is not sufficient to cover schooling fees.

The Relationship of Financial Resources to Food Borrowing

Notably, our results do suggest that access to financial resources result in less food borrowing overall among all household types and sexes. However, we find that women in all household types and men in female-headed households with two decision-makers are much more likely to borrow food or other goods. Similarly, among those with access to loans, we find that those with loans are much less likely to borrow food or other goods, but this is likely confounded by the fact that many households are using their credit to purchase food, especially women in female-headed households. Furthermore, among those with loans, women in female-headed households were still more likely to borrow food or other goods compared to men in male-headed households. This suggests that the relationship of financial resources to food security is much more complicated than a single question. Unpacking financial resources, household spending, and food access may involve multiple questions to fully understand a household's given situation for meeting their food needs. For example, if this survey had simply asked about food borrowing, it would have overlooked the financial credit access necessary for many to obtain basic needs including food.

Implications and Future Research

This study can inform future policy work around types and priorities of financial resources among smallholder farmers. Our findings suggest that financial resources are related to food security via multiple pathways, and that credit use is complex and appears to have implications for short-term and long-term development goals.

This analysis opens a space for continued research around female-headed households and women's access to financial resources and how this affects food security. It's worth noting that men living within female-headed households may also be an important overlooked demographic, as our results suggest that compared to men in male-headed households they are significantly more likely to borrow food or other goods. While some previous work has suggested that financial resources can provide better food security outcomes and potentially help households adapt to a changing climate, this may be more nuanced if that borrowing is to purchase food, which may prevent investment in agricultural or livestock investments. Additional future research is necessary to better assess the relationship of financial resources and food borrowing, as this analysis utilizes a single-question linear approach. Understanding the longer-term implications of financial resource allocation across multiple priorities can inform climate adaptation and other development goals for smallholder farmers.

Limitations

While the findings and the implications of this study are critical in the context of policy and development, it is important to understand the limitations within this research. While four sites representing three countries (Kenya, Uganda, and Senegal) were chosen by the CGIAR to represent major farming systems and agro-ecological zones across Africa (Bernier et al., 2015) these responses and findings are not nationally representative. Furthermore, given the multiple household types and sex analysis we conducted, we did not break out analysis further by individual region, as small sample sizes would have prevented analysis with appropriate statistical power. Further, while this analysis aims to understand the nuances in the access and implications of financial resources among female-headed households and women, there is no consideration to how things such as religion can affect this relationship. For example, individuals practicing a strong Muslim religion are required to follow regimented standards of conduct called Sharia, which includes beliefs and limitations around borrowing money. As credit was first widely being introduced, many Muslims in order to adhere to the proper guidelines would largely use cash, checks or debit cards. Cultural and religious factors clearly have a role in determining the type of credit that an individual can access, which may affect loan access (O'Neill, 2016). Furthermore, Muslim and other cultures often have traditions of wealth sharing, especially with vulnerable people, which may influence the informal lending sources available in a given region. This study does not consider cultural and religious relationships to credit, even though the three countries in which we work have significant Muslim populations, which have been shown to supplement explanations among various economic outcomes (Guiso et al., 2006).

This study as noted in the introduction evaluates food security in the context of food borrowing, which can be understood through a common food security indicator of access. As mentioned previously, access to food is one pillar in evaluating food security and this approach does not consider an important and growing focus on nutritional security. Indeed, food access is only one of the four pillars of food security (the others being availability, utilization, and stability). Other components such as quality, safety, and culturally appropriate food must be evaluated to gather a true understanding of food security for a specific region (Leroy et al., 2015). Furthermore, the question, as utilized in this survey, also asked about borrowing food or other goods, so it is possible that respondents were not borrowing food, but instead borrowing other goods. Given this limitation, there is great potential to further evaluate these relationships with other future surveys. Using experience based indicators including the Household Food Security Survey Module, the Household Food Insecurity Access Scale, and the Food Insecurity Experience Scale (Cafiero et al., 2014), to understand a households access to diet diversity, focusing on micronutrient adequacy, would be a useful next step to evaluate food security in the context of financial resources (Leroy et al., 2015). In response to both the Millennial Development Goals and the Sustainable Development Goals, food security is being measured in a number of ways, pushing beyond just measuring food security on the national level. While this study utilizes population surveys, it does not utilize more than one dimension of food security, which may contribute to a lowered validity (Cafiero et al., 2014).

Finally, it is important to acknowledge that additional household dynamics may be at play in the dataset, which are not explicitly able to be explored in this analysis. While we examine the role of female-headed households and women as compared to male-headed households and men, it is possible that there are varying household dynamics within these households that could influence food security and credit outcomes, including the presence of other household members of earning age and multiple adults.

Conclusion

Understanding how financial resources, formal and informal, are accessed and utilized has important implications for sustainable development, particularly in the context of smallholder farmers and future climate changes. Financial resources have been identified as a potential strategy to maintain food security amongst a changing climate (Fletschner, 2009), however, this relationship demands that several other factors be considered. As found by this analysis, gender, type of financial resource, and allocation of that resource are key components that show potential in affecting long-term food security and economic development for smallholder farmers. In particular, our results indicate that there are key differences in short vs. long-term investments with financial resources. Future research could consider the other components of food security as it relates to financial resource access and analyze longer-term studies across time to understand how financial resources contribute to short-term and long-term outcomes at the household level.

Data Availability

Publicly available datasets were analyzed in this study. This data can be found here: https://dataverse.harvard.edu/dataverse/IFPRI/?q=gender.

Ethics Statement

This data was obtained by CCAFS and released publicly without identifying information and informed consent was sought from all participants by CCAFS prior to data collection.

Author Contributions

MC conceived the research, hypotheses, conducted literature review, and wrote the original manuscript. MN conceived the research, analyzed data, edited the manuscript, and provided project oversight.

Funding

This project was funded in part by USDA HATCH grant number VT-H02303 to MN.

Conflict of Interest Statement

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Acknowledgments

We thank Farryl Bertmann and Karen Nordstrom for their review and feedback of this paper. We are grateful for the research and statistical expertise from Christie Silkotch and Alan Howard. Additionally we would like to thank Quinn Bernier and Abigail Crocker for their assistance and guidance in data management. We thank Thomas Wentworth for his graphic design on Figures 2 and 3.

References

Beaman, L., Karlan, D., Thuysbaert, B., and Udry, C. (2014). Self-Selection Into Credit Markets: Evidence From Agriculture in Mali. National Bureau of Economic Research. Working Paper 20387. doi: 10.3386/w20387

Beck, T., and Demirguc-Kunt, A. (2006). Small and medium-size enterprises: access to finance as a growth constraint. J. Bank. Finan. 30, 2931–2943. doi: 10.1016/j.jbankfin.2006.05.009

Bernier, Q., Meinzen-Dick, R., Kristjanson, P., Haglund, E., Kovarik, C., Bryan, E., et al. (2015). Gender and Institutional Aspects of Climate-Smart Agricultural Practices: Evidence from Kenya. Climate Change, Agriculture, and Food Security Program (Copenhagen).

Bils, M., and Klenow, P. J. (2000). Does schooling cause growth? Am. Econ. Rev. 90, 1160–1183. doi: 10.1257/aer.90.5.1160

Boucher, S. R., Carter, M. R., and Guirkinger, C. (2008). Risk rationing and wealth effects in credit markets: theory and implications for agricultural development. Am. J. Agric. Econ. 90, 409–423. doi: 10.1111/j.1467-8276.2007.01116.x

Braimoh, A. (2018). Climate-Smart Agriculture: Lessons from Africa, for the World. The World Bank. Available online at: https://blogs.worldbank.org/nasikiliza/climate-smart-agriculture-lessons-from-africa-for-the-world

Brune, L., Gine, X., Goldberg, J., and Yang, D. (2011). Commitments to Save: A Field Experiment in Rural Malawi. Policy Research Working Paper 5748. doi: 10.1596/1813-9450-5748

Cafiero, C., Melgar-Quiñonez, H. R., Ballard, T. J., and Kepple, A. W. (2014). Validity and reliability of food security measures. Ann. N. Y. Acad. Sci. 1331, 230–248. doi: 10.1111/nyas.12594

Carter, N., Brush, C., Greene, P., Gatewood, E., and Hart, M. (2003). Women entrepreneurs who break through to equity financing: the influence of human, social and financial capital. Venture Cap. 5, 1–28. doi: 10.1080/1369106032000082586

Casasnovas, G. L., Rivera, B., and Currais, L. (eds.). (2005). Health And Economic Growth: Findings and Policy Implications. Cambridge: MIT Press.

CCAFS (2015). CCAFS Baseline Survey Indicators for Kaffrine, Senegal. CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS). Copenhagen. Available online at: www.ccafs.cgiar.org.

CGIAR (2013). Climate-Smart Agriculture is the Future for Smallholder Farmers in Africa. Retrieved from: https://ccafs.cgiar.org/about-us (accessed September 7, 2017).

Cramer, L., Förch, W., Mutie, I., and Thornton, P. K. (2016). Connecting women, connecting men: how communities and organizations interact to strengthen adaptive capacity and food security in the face of climate change. Gend. Technol. Dev. 20, 169–199. doi: 10.1177/0971852416639771

Croppenstedt, A., Goldstein, M., and Rosas, N. (2013). Gender and agriculture: inefficiencies, segregation, and low productivity traps. World Bank Res. Obs. 28, 79–109. doi: 10.1093/wbro/lks024

De la Torre, A., Gozzi, J. C., and Schmukler, S. L. (2007). Innovative Experiences in Access to Finance: Market Friendly Roles for the Visible Hand? World Bank Policy Research Working Paper No. 4326. doi: 10.1596/1813-9450-4326

Dercon, S. (2004). Growth and shocks: evidence from rural Ethiopia. J. Dev. Econ. 74, 309–329. doi: 10.1016/j.jdeveco.2004.01.001

Duflo, E., and Udry, C. (2004). Intrahousehold Resource Allocation in Cote d'Ivoire: Social Norms, Separate Accounts and Consumption Choices. Cambridge, MA: National Bureau of Economic Research. Working Paper No. w10498.

Edelman, B., Lee, H. L., Mabiso, A., and Pauw, K. (2014). Strengthening Storage, Credit, and Food Security Linkages: The Role and Potential Impact of Warehouse Receipt Systems in Malawi. Lilongwe: International Food Policy Research Institute. MaSSP Working Paper 14.

FAO, IFAD, UNICEF, WFP, and WHO (2017). The State of Food Security and Nutrition in the World 2017. Building Resilience for Peace and Food Security. Rome: FAO.

Faruqee, R. R., and Khandker, S. R. (2001). The Impact of Farm Credit in Pakistan. World Bank Working Papers in Agriculture: Land, Commodity Prices, Markets, 2653.

Fletschner, D. (2009). Rural women's access to credit: market imperfections an intrahousehold dynamics. World Dev. 37, 618–631. doi: 10.1016/j.worlddev.2008.08.005

Ghate, P. (2000). Linking formal finance with micro and informal finance. Bangladesh Dev. Stud. 26, 201–215. Available online at: www.jstor.org/stable/40795617

Gilbert, N. (2015). Climate adaptation effort cuts hunger in African villages. Nature. doi: 10.1038/nature.2015.17112

Godfray, H. C. J., Beddington, J. R., Crute, I. R., Haddad, L., Lawrence, D., Muir, J. F., et al. (2010). Food security: the challenge of feeding 9 billion people. Science 327, 812–818. doi: 10.1126/science.1185383

Guiso, L., Sapienza, P., and Zingales, L. (2006). Does culture affect economic outcomes? J. Econ. Perspect. 20, 23–48. doi: 10.1257/jep.20.2.23

Hazarika, G., and Guha-Khasnobis, B. (2008). Household Access to Microcredit and Children's Food Security in Rural Malawi: A Gender Perspective. IZA Discussion Paper No. 3793.

Hyder, A. A., Maman, S., Nyoni, J. E., Khasiani, S. A., Teoh, N., Premji, Z., et al. (2005). The pervasive triad of food security, gender inequity and women's health: exploratory research from sub-Saharan Africa. Afr. Health Sci. 5, 328–334. doi: 10.5555/afhs.2005.5.4.328

International Fund for Agricultural Development (2013). Smallholders, Food Security and the Environment. Rome: International Fund for Agricultural Development.

Jost, C., Kyazze, F., Naab, J., Neelormi, S., Kinyangi, J., Zougmore, R., et al. (2016). Understanding gender dimensions of agriculture and climate change in smallholder farming communities. Clim. Dev. 8, 133–144. doi: 10.1080/17565529.2015.1050978

Khandker, S. R., and Koolwal, G. B. (2014). Does Institutional Finance Matter for Agriculture? Evidence Using Panel Data from Uganda. Washington, DC: The World Bank. Working Paper WPS6942. doi: 10.1596/1813-9450-6942

Koubâa, H. F. (2014). Start-Up Informal Finance and Formal Microfinance: The Role of Human Capital. Strat. Change 23, 415–423. doi: 10.1002/jsc.1986

Lemke, S., Vorster, H. H., van Rensburg, N. J., and Ziche, J. (2003). Empowered women, social networks and the contribution of qualitative research: broadening our understanding of underlying causes for food and nutrition insecurity. Pub. Health Nutr. 6, 759–764. doi: 10.1079/PHN2003491

Leroy, J. L., Ruel, M., Frongillo, E. A., Harris, J., and Ballard, T. J. (2015). Measuring the food access dimension of food security: a critical review and mapping of indicators. Food Nutr. Bull. 36, 167–195. doi: 10.1177/0379572115587274

Lowder, S. K., Skoet, J., and Singh, S. (2014). What Do We Really Know About the Number and Distribution of Farms and Family Farms in The World. Background paper for the State of Food and Agriculture, 14.

Magnan, N. D., Spielman, D. J., Gulati K., and Lybbert, T. J. (2013). Gender Dimensions of Social Networks and Technology Adoption: Evidence From a Field Experiment in Uttar Pradesh, India. Washington, DC: International Food Policy Research Institute. GAAP Note.

Malapit, H. J., Kadiyala, S., Quisumbing, A., Cunningham, K., and Tyagi, P. (2013). Women's Empowerment in Agriculture, Production Diversity, and Nutrition: Evidence from Nepal. International Food Policy Research Institute. Discussion Paper 01313. doi: 10.2139/ssrn.2405710

Malapit, H. J. L., and Quisumbing, A. R. (2015). What dimensions of women's empowerment in agriculture matter for nutrition in Ghana? Food Policy 52, 54–63. doi: 10.1016/j.foodpol.2015.02.003

Morton, J. F. (2007). The impact of climate change on smallholder and subsistence agriculture. Proc. Nat. Acad. Sci. U.S.A. 104, 19680–19685. doi: 10.1073/pnas.0701855104

Mueller, N. D., Gerber, J. S., Johnston, M., Ray, D. K., Ramankutty, N., and Foley, J. A. (2012). Closing yield gaps through nutrient and water management. Nature 490, 254. doi: 10.1038/nature11420

Niles, M. T., and Brown, M. E. (2017). A multi-country assessment of factors related to smallholder food security in varying rainfall conditions. Sci. Rep. 7, 16277. doi: 10.1038/s41598-017-16282-9

Niles, M. T., and Salerno, J. (2018). A cross country analysis of climate shocks on smallholder food insecurity. PLoS ONE 13:e0192928. doi: 10.1371/journal.pone.0192928

O'Neill, B. (2016). Cultural Differences in Handling Credit. EXtension, 4. Available online at: articles.extension.org/pages/25269/cultural-differences-in-handling-credit.

Perez, C. Jones, E. M., Kristjanson, P., Cramer, L., Thorntond, P. K., Förchd, W., et al. (2015). How resilient are farming households and communities to a changing climate in Africa? A gender-based perspective. Glob. Environ. Chang. 34, 95–107. doi: 10.1016/j.gloenvcha.2015.06.003

Rufino, M. C., Quiros, C., Boureima, M., Desta, S., Douxchamps, S., Herrero, M., et al. (2013). Developing Generic Tools for Characterizing Agricultural Systems for Climate and Global Change Studies (IMPACTlite-Phase 2). Climate Change, Agriculture, and Food Security Program.

Sacerdoti, M. E. (2005). Access to Bank Credit in Sub-Saharan Africa: Key Issues and Reform Strategies. International Monetary Fund. (No. 5–166). doi: 10.5089/9781451861853.001

Schultz, T. P. (2002). Why governments should invest more to educate girls. World Dev. 30, 207–225. doi: 10.1016/S0305-750X(01)00107-3

Sraboni, E., Malapit, H. J., Quisumbing, A. R., and Ahmed, A. U. (2014). Women's empowerment in agriculture: what role for food security in Bangladesh? World Dev. 61, 11–52 doi: 10.1016/j.worlddev.2014.03.025

Start, D., and Johnson, C. (2004). Livelihood Options? The Political Economy of Access, Opportunity and Diversification. London: Overseas Development Institute.

Thornton, P. K., Kristjanson, P., Förch, W., Barahona, C., Cramer, L., and Pradhan, S. (2018). Is agricultural adaptation to global change in lower-income countries on track to meet the future food production challenge? Glob. Environ. Chang. 52, 37–48. doi: 10.1016/j.gloenvcha.2018.06.003

Tsai, K. S. (2004). Imperfect substitutes: the local political economy of informal finance and microfinance in rural China and India. World Dev. 32, 1487–1507.

Twyman, J., Green, M., Bernier, Q., Kristjanson, P., Russo, S., Tall, A., et al. (2014). Adaptation Actions in Africa: Evidence that Gender Matters. Copenhagen, Denmark: CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS). CCAFS Working Paper no. 83.

UN General Assembly (2015). Transforming Our World: The 2030 Agenda for Sustainable Development. A/RES/70/1.

Yami, M., and van Asten, P. (2018). Relevance of informal institutions for achieving sustainable crop intensification in Uganda. Food Secur. 10, 141–150. doi: 10.1007/s12571-017-0754-3

Keywords: food security, climate change, financial resources, female-headed households, women

Citation: Carranza M and Niles MT (2019) Smallholder Farmers Spend Credit Primarily on Food: Gender Differences and Food Security Implications in a Changing Climate. Front. Sustain. Food Syst. 3:56. doi: 10.3389/fsufs.2019.00056

Received: 15 February 2019; Accepted: 03 July 2019;

Published: 25 July 2019.

Edited by:

Amy Ickowitz, Center for International Forestry Research, IndonesiaReviewed by:

Kikuko Shoyama, Institute for the Advanced Study of Sustainability (UNU-IAS), JapanYann le Polain de Waroux, McGill University, Canada

Marlène Elias, Bioversity International, Italy

Copyright © 2019 Carranza and Niles. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Meredith T. Niles, bXRuaWxlc0B1dm0uZWR1

Marissa Carranza1

Marissa Carranza1 Meredith T. Niles

Meredith T. Niles