- 1School of Business and Management, Jilin University, Changchun, China

- 2Department of Business Administration, Cheng Shiu University, Kaohsiung, Taiwan

Objective: This paper explores the impact of media sentiment on stock prices on the Shanghai Stock Exchange Science and Technology Innovation Board (hereinafter the STAR market) from a behavioral finance perspective.

Methods: We collect Baidu News coverage of STAR-listed firms as the text, and measure text sentiment using a machine learning-based text analysis technique. We then empirically examine the impact of media sentiment on STAR market stock prices from two aspects: IPO pricing efficiency and IPO first-day stock performance.

Results: (1) Media sentiment has no significant impact on IPO pricing efficiency, thus suggesting that institutional investors participating in such offerings are generally not affected by media sentiment. (2) Optimistic media sentiment has a positive impact on IPO first-day returns, which indicates that individual investors are more easily influenced by media sentiment and therefore likely to abandon their rational judgment. (3) Media sentiment had a greater impact on IPO first-day returns during the COVID-19 pandemic than those before it, which suggests that individual investors are more influenced by media sentiment during pandemics.

Discussion: Our findings deepen the understanding of stock price formation on the STAR market, which provide a statistical basis for formulating policy directions and investment strategies.

Introduction

Extensive behavioral finance studies have shown that the information environment of the market has a significant impact on asset prices (Broadstock and Zhang, 2019; Duan et al., 2021; Du et al., 2022). Media coverage, which is far more pervasive than traditional analyst reports, has become the most important channel of information dissemination in financial markets (Bushee et al., 2010). The presence of media outlets reduces the cost of information and the information asymmetries that exist between firms and investors (Dyck et al., 2008). However, in order to gain attention—or due to its own editorial preferences—the media may report using language with a sentimental orientation or either exaggerate or ignore certain points of view, which may result in investors having cognitive biases and thus influence their investment decisions and behaviors (Hermida et al., 2012). Against this backdrop, it is important to consider the impact of media sentiment when examining asset prices and investor behaviors, especially in the initial public offering (IPO) market, which is characterized by highly asymmetric information and an absence of historical data for investors to reference in their decision-making processes (Guldiken et al., 2017).

This paper analyzes the impact of media sentiment on the stock prices of firms listed on the Shanghai Stock Exchange Science and Technology Innovation Board (hereinafter the STAR market). We choose the STAR market as the research object because its institutional background and market atmosphere provide a natural platform for us to test the impact of media sentiment on a securities market. The STAR market is a new market comprised of scientific and technologically innovative firms established by the China Securities Regulatory Commission on 13 June 2019. Its registration-based IPO system is regarded as a groundbreaking achievement that has reformed China’s stock issuance system by allowing for deep investor participation (i.e., the “invisible hand”) in new issuance pricing. More than a decade has passed since it was first proposed, during which time its planned launch was disrupted by the sudden stock market crash in 2015 and the downturn in the following years; it was not until 2019 that the registration-based IPO system was able to be successfully launched. It can be said that the registration system piloted by the STAR market is a long-awaited institutional arrangement, thus it has received unprecedented media coverage since its inception. The STAR market has made a wide range of institutional innovations such as listing requirements and trading rules, the most critical of which is the adoption of a market-based pricing mechanism that delegates pricing power to major market participants, which marked a significant break from the previous direct IPO pricing method in China. Therefore, research on STAR market stock prices can reflect the role of media sentiment in pricing more accurately than those on other stock boards in China.

In this paper, we explore the impact of media sentiment on STAR market stock prices from two aspects: the impact on IPO pricing efficiency and the impact on IPO first-day stock performance. These two aspects correspond to the primary and secondary stock markets, respectively. According to the regulations of the Shanghai Stock Exchange, although both institutional investors and retail investors are allowed to participate in IPOs, only seven types of professional institutional investors are permitted to participate in the process of IPO inquiry on the STAR market: securities companies, fund management companies, trust companies, finance companies, insurance companies, qualified foreign institutional investors and private equity fund managers that satisfy certain conditions. Therefore, the research on the impact of media sentiment on IPO pricing on the STAR market essentially explores the impact of media sentiment on the decision-making psychology and investment behaviors of professional institutional investors. In contrast to the primary market, the secondary market comprises both institutional and individual investors, most of which are individual investors (Dong and Huang, 2022). Therefore, research on the impact of media sentiment on the first-day stock performance of IPOs can broadly reflect the impact of media sentiment on the decision-making psychology and investment behaviors of individual investors.

We find an interesting phenomenon by direct observation of some STAR-listed firms. Investors in both the primary and secondary markets show sustained enthusiasm for STAR-listed firms. For example, in the first year after the STAR market debuted (i.e., from 22 July 2019 to 22 July 2020), a total of 140 firms successfully completed IPOs. Excluding nine firms that did not generate profits, the average IPO price was ¥31.94, and the average price-to-earnings ratio was 71.05 times, both of which set a record for China’s stock market, with the latter being much higher than the average IPO price-to-earnings ratio of firms on the Shenzhen Stock Exchange Growth Enterprise Board (hereinafter the GEM market) during the same period (i.e., 23 times). The IPO price-to-earnings ratios of certain STAR-listed firms are even higher than those of GEM-listed firms in the secondary market, especially those listed in the first few months after the STAR market debuted. For instance, the IPO price-to-earnings ratio of Bestechnic is 355.03 times, that of Chipscreen Biosciences is 467.51 times, that of Sansure Biotech is 536.3 times, and that of Farasis Energy has reached 1,737.49 times. Furthermore, by examining the first-day performance of new shares in the secondary market, we find that stock prices of most STAR-listed firms show a large increase relative to their IPO price. For example, the average of 140 STAR-listed firms rose 163.87% in their first day of trading, among which the largest increase was Quantumctek, which jumped by 923.91% (i.e., from ¥36.18 to ¥370.45 per share). This phenomenon may be related to the positive media sentiment. Media is more inclined to express positive views catering to the needs of listed firms, which influences investors’ trading behavior and then pushes up stock prices (Shen et al., 2022). However, in theory, the impact of media sentiment on stock prices in the primary and secondary markets should be different. Institutional investors have more information channels available to them, a higher degree of specialization, a stronger ability to screen information, and a proven ability to invest more rationally, so it is intuitive that they may be less affected by media sentiment. On the contrary, individual investors generally lack professional knowledge and investment experience and have limited access to information. In addition, IPO firms disclose less public information and data. Media coverage has naturally become an important channel through which individual investors obtain information relevant to IPO firms, so individual investors may be affected by media sentiment to a significant extent. For this reason, this paper investigates whether and how media sentiment affects stock prices in both the primary and secondary markets of STAR-listed firms, and seeks to determine whether the observable phenomenon is caused by media sentiment.

Unlike previous studies, we build a stochastic frontier model to measure the asset pricing efficiency of the primary market by exclusively using data from the IPO market. The existing literature generally uses the IPO underpricing rate as an indicator to measure IPO pricing efficiency (Cook et al., 2006) under the premise that the secondary market is efficient—that is, the price in the secondary market always reflects the fundamental value of the firm. However, it has been repeatedly shown in empirical studies that the price discovery and resource allocation functions of China’s secondary stock market are not efficient. Cao and Dong (2006) find that stock prices in the primary and secondary markets of China’s A-share market are all overpriced, but the price bubble in the secondary market is bigger. The empirical studies on IPO pricing on the A-share (Liu and Shen, 2011) and GEM (Guo and Wan, 2011) markets have reached similar conclusions. Therefore, the degree of IPO underpricing as a measure of the rationality of IPO pricing cannot be applied to China’s stock market. Furthermore, although we focus on the first-day performance of new shares when exploring the impact of media sentiment on secondary market pricing, we also use their first five-day performance for a robustness test. Although there are no limits placed on share movements of STAR-listed firms on their first five trading days, trading is typically most active on the first day of trading, when the turnover rate is extremely high. Therefore, IPO first-day stock performance is a more accurate reflection of how individual investors judge the pricing of new shares.

Our study makes four key contributions to the literature. First, we use a machine learning-based text analysis technique to analyze media sentiment. At present, most scholars still obtain and analyze media sentiment data by manually interpretating financial news reports (Tetlock, 2007; Suleman, 2012), and their assessment of media sentiment ignores the assessment of neutral sentiment. However, we believe that manually interpretating method may not be robust enough to accurately detect media sentiment because human psychology is more prone to be affected by their own emotions when making judgements. Fortunately, current advancements in artificial intelligence make it possible to realize sentiment analysis through machine learning. Our study retrains SnowNLP, a Python library, to obtain a sentiment analysis model by constructing positive and negative training sets suitable for the stock market, which improves the reliability of media sentiment data. Second, the literature on the impact of media sentiment on the STAR market from a behavioral finance perspective is surprisingly limited, and our research therefore addresses this research deficiency. Moreover, by exploring the impact of media sentiment on IPO pricing efficiency and first-day stock performance, respectively, we investigate the extent to which institutional and individual investors are influenced by media sentiment. Third, this paper comprehensively examines the key factors that affect the stock prices of STAR-listed firms. We include variables that reflect firm attributes related to science and innovation in the regressions and an indicator variable—the follow-up investment ratio—that measures the effect of the STAR market’s innovative sponsor system. Considering that the base date of SSE Science and Technology Innovation Board 50 Index is later than the start date of the sample interval, we use a circulating shares-weighted method to compile a STAR market index, which further enriches the available indicators with respect to the STAR market sentiment. Finally, our study extends the literature related to the impact of the COVID-19 pandemic on financial markets. By exploring the changes in the relationship between media sentiment and IPO first-day stock performance before and after the pandemic declaration, we are better able to understand the impact of pandemics on individual investors’ psychology.

The main structure of this paper is organized as follows. The “Literature Review and Hypothesis Development” section reviews the literature and develops the research hypothesis. The “Research Design” section describes the sample selection, data sources, variable definitions and empirical models. The “Empirical Results and Analysis” section presents the research findings. The “Conclusion and Discussion” section discusses the conclusions, implications, limitations, and future research directions.

Literature review and hypothesis development

Financial asset pricing methods are at the core of modern financial theory and have attracted the attention of a variety of academic circles (Mossin, 1966; Merton, 1973; Lakonishok et al., 1994). Traditional asset pricing theory is based on the neoclassical economic framework and takes the efficient market hypothesis as its basis. The neoclassicists believe that market participants have no cognitive bias and that all relevant information is fully reflected in stock prices, so investors have no incentive to obtain additional information (Sharpe, 1964; Fama, 1970; Roll, 1977). However, scholars have gradually begun to realize that the traditional asset pricing theory cannot explain certain anomalies that are observed in financial markets, such as the new issues puzzle and the small firm effect, thus its continued use has become controversial. Since the 1980s, the rise of behavioral finance has expanded traditional theory and gradually incorporated realistic constraint conditions and human psychological behaviors into asset pricing models. In terms of realistic constraints, there are certain costs associated with collecting and sorting information. When the benefits of obtaining information fail to cover the costs of doing so, investors will prefer “rational ignorance”—that is, only choosing easily accessible information and remaining rationally ignorant of all other information—which is a rational behavior in the presence of limited knowledge and information constraints. Therefore, information asymmetries are common in financial markets. Nevertheless, as an intermediary responsible for information transmission, the media can help investors overcome their rational ignorance.

By selecting, screening, repackaging and reporting relevant information, the media can enhance financial market transparency and thus lower acquisition costs (Zuckerman, 1999). Dyck and Zingales (2003) find that media coverage significantly reduces the costs and increases the efficiency of acquiring information, which in turn increases the number of informed investors in the market. Tetlock et al. (2008) argue that the media can capture unquantifiable fundamental information relevant to listed companies. Investors integrate the information reported by the media with relevant information provided by companies, then assess the value of the companies accordingly. However, because investors are not completely rational, their psychological tendencies should also be taken into account in terms of how it affects asset pricing. Investors are always willing to preprocess information according to their own experiences or reasoning, which often results in cognitive bias. Accordingly, when investors make decisions relating to asset pricing, they typically rely on their personal preferences, which supports the prospect theory proposed by Kahneman and Tversky (1979). In addition, investor sentiment also impacts asset pricing: optimistic investors usually set high prices and vice versa (De Bondt, 1993; Baker and Wurgler, 2006). Under the shock of unprecedented exogenous events, investor negative sentiment also impacts stock prices (Huynh et al., 2021).

Earlier studies on the impact of media coverage on asset pricing mostly focus on the amount of information reported and regard the media as a completely neutral information intermediary. Media coverage provides effective incremental information to investors and reduces information asymmetries, thereby affecting asset prices (Niederhoffer, 1971; Johnson et al., 2005; Bushee et al., 2010). However, the media cannot be completely neutral in a technological and commercialized society. Due to the existence of realistic factors such as differences in ownership concentration (Djankov et al., 2003), acceptance (Mullainathan and Shleifer, 2005) and financial temptation (Rinallo and Basuroy, 2009), the media will form a viewpoint that deviates from truth and objectivity to pursue its own interests, which accounts for a certain degree of subjectivity and creates a unique media sentiment. In financial markets, market participants are not completely rational. Under the influence of external information, investors’ cognition and preferences are more likely to change, and their irrationality may be exacerbated. In other words, the tone or sentiment of media coverage can affect investors’ judgment and, ultimately, asset pricing. Further, the relationship between media sentiment and prices will be strengthened in times of larger uncertainty concerning external information (Koch et al., 2022).

In recent years, scholars have begun to pay attention to the impact of media sentiment on asset pricing (Sadique et al., 2008; Tetlock et al., 2008; Loughran and McDonald, 2011; Yang et al., 2022). Some of these scholars choose to conduct media sentiment analysis by a dictionary-based approach. Tetlock (2007) explores the effect of media pessimism on market prices using data from the Wall Street Journal. He first conducts a text analysis of specific categories of words in the General Inquirer’s Harvard IV-4 psychosocial dictionary to create a pessimism index, and then uses the VAR model to establish the intertemporal connection between media pessimism and stock market fluctuations. His final analysis shows that media pessimism causes markets to decline, while extreme media sentiment leads to abnormally high trading volumes. Subsequently, Tetlock et al. (2008) continue the previous research and pay special attention to the impact of the proportion of negative words in financial coverage on a company’s profitability. The research documents that the more pessimistic the media sentiment, the worse its profitability is, which shows that the use of negative words in media coverage is not groundless and that media sentiment can capture fundamental information that is not easily quantified. Nevertheless, Loughran and McDonald (2011) point out that lexical sentiment in a financial context differs from that in other contexts. Most of the words identified as negative by the Harvard dictionary are typically not negative in a financial context, so they rescreen the negative words to more accurately measure media sentiment and note that it does in fact affect asset prices. Ferguson et al. (2015) and Bajo and Raimondo (2017) reach a similar conclusion. Other scholars try to understand the relationship between media sentiment and asset pricing by the use of machine learning techniques, among which Naïve Bayes algorithm is most frequently used. Antweiler and Frank (2004) is the first to apply Naïve Bayes algorithm for text analysis in the financial field. They use Naïve Bayes algorithm to extract textual sentiment information from internet stock message boards, and find that media sentiment is positively associated with stock returns. Further, Khedr et al. (2017) analyze financial news sentiment using Naïve Bayes algorithm, and construct a model to predict future stock prices based on news polarities. The model can achieve prediction accuracy results ranging from 72.73 to 86.21%. It is worth noting that machine-learning methods offer more reliable measures of disclosure sentiment than dictionary-based methods, which has been confirmed by Frankel et al. (2021). They compare the ability of dictionary-based and machine-learning methods to capture disclosure sentiment, and find that measures based on machine learning offer a significant improvement in explanatory power over dictionary-based measures. This is why we use machine learning techniques for sentiment analysis in this paper.

Considering the comparative youth of China’s stock market, there are only a few studies on the impact of media sentiment on asset pricing in the Chinese context. You and Wu (2012) first discuss asset pricing from the perspective of media sentiment. Drawing on “the spiral of silence” theory of communication, they believe that the media, as an opinion leader, can easily spread sentiment among investors, form a strong “opinion environment,” and ultimately affect the efficiency of asset pricing. As media sentiment fluctuates, asset prices gradually deviate from their underlying fundamental values. In a subsequent study, You and Zheng (2013) further find that the more optimistic the media sentiment is, the greater the tendency to underprice IPO shares will be. Wang and Wu (2015) conclude that compared with positive tone in media, negative tone is more persuasive in explaining IPO underpricing, and the more pessimistic the media sentiment is, the lower the IPO underpricing rate will be. Unlike other Chinese stock boards, the STAR market IPO system, which adopts a market-oriented inquiry mechanism and allows seven types of professional institutional investors to participate in setting the issue price, seeks to exploit the professional abilities of institutional investors in pricing assets. Compared with individual investors, institutional investors have more professional knowledge, richer investment experience, and more private information about IPOs (Funaoka and Nishimura, 2019) and are thus able to make a more comprehensive assessment of firms’ underlying value while not being easily influenced by media sentiment. Therefore, we propose:

Hypotheses1: The impact of media sentiment on the pricing efficiency of new issues on the STAR market is not significant.

Individual investors can only obtain valuable information concerning IPO firms before their listing through third-party intermediaries such as the media. Furthermore, there is a relatively high proportion of individual investors and a large number of noise traders in the Chinese secondary stock market, most of whom make investment judgments based on sentiment instead of rational expectations (De Long et al., 1990; Chen et al., 2013). Therefore, such traders may be more vulnerable to media sentiment. Accordingly, we assert:

Hypotheses2: Media sentiment has a significant impact on the first-day stock performance of IPO shares on the STAR market.

Research design

Sample selection and data sources

In this study, our initial sample consists of all firms that completed an IPO on the STAR market from 22 July 2019 to 30 April 2021. After excluding the observations for which there are missing values for key variables such as IPO pricing efficiency, this paper takes 238 firms as the final sample. We obtain the data from several sources. The financial and market transaction data are obtained from the WIND and CSMAR databases. Data on initial inquiries are manually collected from the announcements of the preliminary offline allotment results for the initial public offering of shares on science and technology innovation board. For data on media sentiment, we follow Zhang and Wu (2021) and crawl listed firms’ news coverage from Baidu News1 using Python software and process the news headlines to calculate the media sentiment score using Snow natural language processing (Snow NLP).

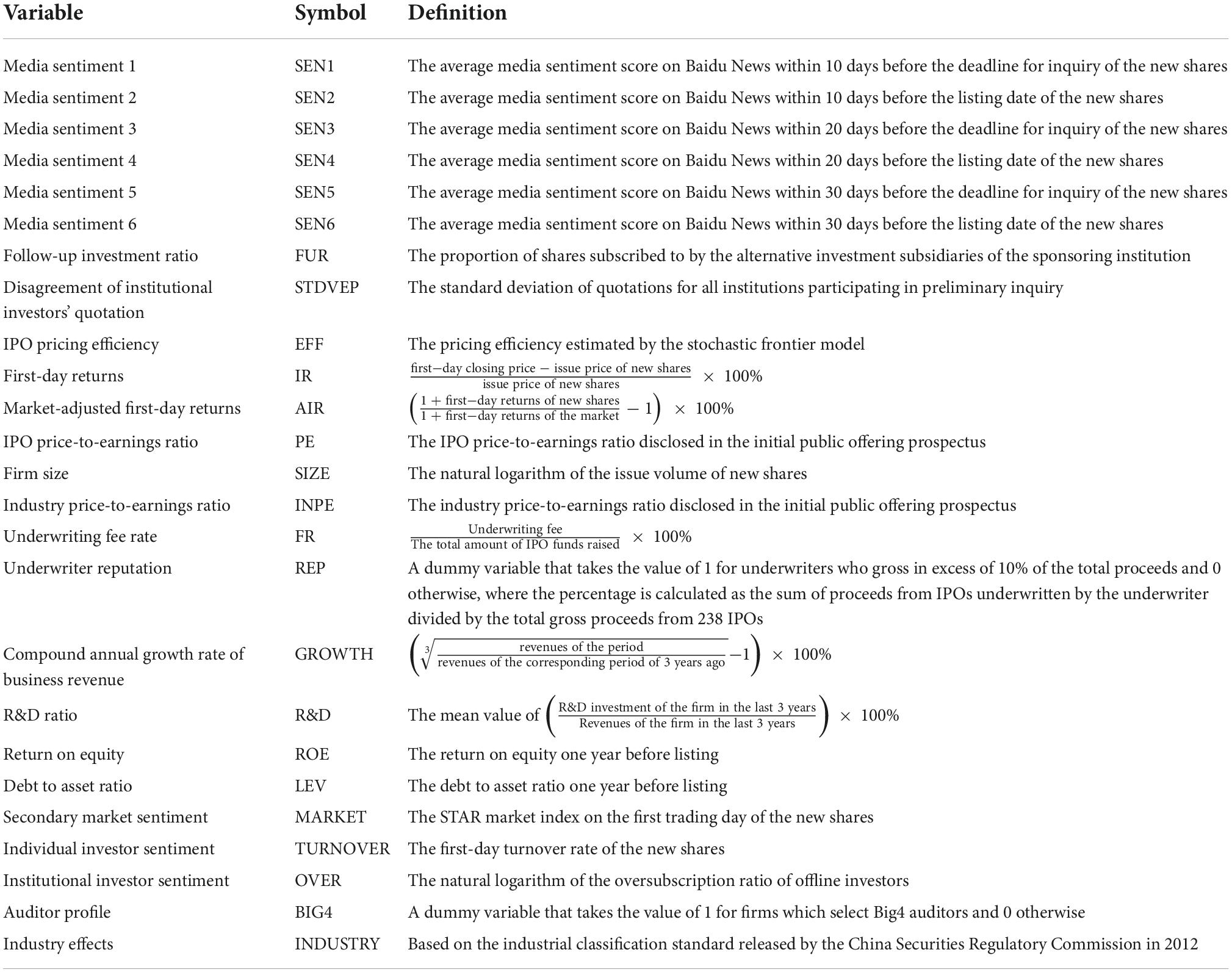

Variables

Media sentiment

Following Zhang and Wu (2021), we calculate the media sentiment score (SEN) through the following process. First, using the abbreviations of the company names as keywords, we crawl coverage of sample firms from Baidu News using Python software and separately set the time windows to 10 days before the deadlines for inquiry of new shares and 10 days before the listing dates. Further, to test the robustness of the empirical results, we expand the time windows to use 20 and 30 days before the deadlines for inquiry of new shares and 20 and 30 days before the listing dates, respectively, which is a processing method similar to that used for lagging explanatory variables by one or two periods. A total of 43,557 media reports for IPO firms are obtained. Second, we analyze the sentiment of news headlines2 and calculate a sentiment orientation score for each title using SnowNLP. The closer the score is to zero, the more negative the media sentiment is; the closer the score is to one, the more positive the media sentiment is. Finally, as we calculate the media sentiment orientation scores for each IPO firm according to each time window, we obtain a mean for each time period, which is used as the main explanatory variable in this paper. However, it must be said that although SnowNLP provides a sentiment analysis model, it is constructed using data obtained from product reviews. Zhang (2021) points out that directly using models trained in other domains for text sentiment analysis will lead to the poor adaptability problem. Therefore, we retrain a new sentiment analysis model that is more suitable for the stock market by using SnowNLP through the following process. To begin with, by randomly selecting media coverage data obtained by crawling, manually identifying, and interpreting the sentimental orientation of the coverage, we collect 1000 positive and 1000 negative samples as positive and negative training sets. Next, SnowNLP walks through the training sets and tags each news headline. Then it predicts the category and probability of the text by calling the classification method of Bayes Classifier. And then, the model calculates the loss value between the prediction results and the real tag, and engages the proper gradient descent algorithm to recurrently update the model’s parameters until the loss value converges to a satisfying value. Finally, the sentiment analysis model for the stock market is well-trained. The new sentiment analysis model can calculate the probability of being positive for each news headline, which is the sentiment orientation score for each title.

Follow-up investment ratio

The mandatory follow-up investment system, an innovative new sponsor system used by the STAR market, mandates that relevant subsidiaries of the sponsoring institutions participate in the strategic allotment of new shares with a follow-up investment ratio of 2–5% and a 24-month lock-in period. The system is intended to align the interests of intermediaries with information advantages with those of individual investors without such advantages to distribute risk more evenly among investors while promoting rational IPO pricing and strengthening the responsibility of securities companies for follow-up supervision. The higher the follow-up investment ratio (FUR) is, the more money securities companies pay and the greater their alignment with the interests of individual investors is likely to be.

Disagreement of institutional investors’ quotation

To measure the disagreement of institutional investors’ quotations (STDVEP), we follow Diether et al. (2002) and manually collect and collate detailed quotation data from the IPO announcement and calculate the standard deviation for each. The higher the standard deviation, the bigger the divergence between quotations and disagreement among institutional investors are.

Initial public offering pricing efficiency

Unlike other studies that use the IPO underpricing rate to measure IPO pricing efficiency, we construct a stochastic frontier model to calculate the frontiers of optimal prices of new shares to measure IPO pricing efficiency (EFF). We assume that the premise of the first-day transaction price serves as the proxy of the firm’s value is that the efficient market hypothesis is valid in the secondary market. However, there is low efficiency with regard to resource allocation in China’s stock market (Luo and Ouyang, 2014), so this price may not be meaningful or represent the firm’s true value. Therefore, we choose to use the stochastic frontier model to calculate the IPO pricing efficiency, for which the required data are from the primary market and only include those provided by prospectuses and underwriters during valuation rounds. This method is comparatively more scientific and effective, and the frontier obtained is closer to the fundamental value of the firm, so we calculate the IPO pricing efficiency by calculating the degree to which the IPO price deviates from the effective frontier (Wang Z. et al., 2022).

Initial public offering first-day returns

Due to IPO firms’ relatively low exposure to investors, investors in the secondary market can simply obtain information through third-party intermediaries and IPO announcements. As the most influential information intermediary, the media can use its own channels to provide investors with information about publicly traded firms (Chen et al., 2013). Moreover, considering that there are no historical market quotations for new shares, investors’ decisions on the first day of trading will be more dependent on media sentiment. Therefore, we choose IPO first-day stock performance as the explained variable to examine the role of media sentiment in the secondary market. IPO first-day returns (IR), which describes the increase of stock price in the secondary market relative to the issue price, is the closest proxy for IPO first-day stock performance. In addition, as a robustness check, we replace the explained variable (IR) with the market-adjusted first-day returns (AIR) for verification.

Other variables

When examining the impact of media sentiment on the pricing efficiency of the primary market, we follow prior studies (Wang and Wu, 2015; Tutuncu, 2022a) and control the regression analysis to consider several aspects of underwriters and issuers, including underwriter reputation (REP), underwriting fee rate (FR), firm size (SIZE), auditor profile (BIG4), and return on equity (ROE). Furthermore, taking into account the unique scientific and innovative characteristics of STAR-listed firms, variables such as the compound annual growth rate of business revenue (GROWTH) and the R&D ratio (R&D) are added. When examining the effect of media sentiment on the first-day performance of the shares in the secondary market, we add the variables of investor sentiment and the secondary market sentiment on the issue date (MARKET). Among them, individual investor sentiment (TURNOVER) is measured by the turnover rate of new shares on the first day of trading, and institutional investor sentiment (OVER) is measured by the offline oversubscription ratio. The base date of the SSE Science and Technology Innovation Board 50 Index is 31 December 2019, which implies that it does not report market data prior to 30 December 2019. Therefore, we use the circulating shares-weighted method to compile the STAR market index, which selects the top 50 STAR-listed firms as constituents and sets the base date to 22 July 2019 and the base index to 1000. The specific calculation is as follows.

Table 1 reports the specific definition of each variable used in this study.

Models

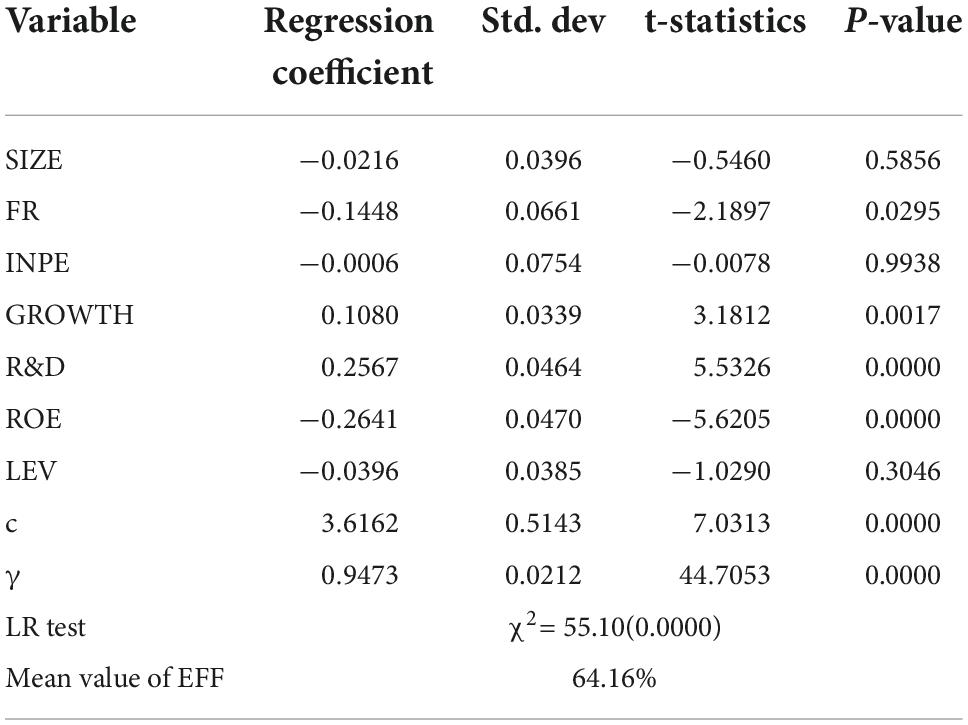

Initial public offering pricing plays a pivotal role in the primary market, because the reasonableness of pricing, for which IPO pricing efficiency is the closest proxy, directly affects the efficiency of resource allocation in the stock market in general. Following Guo and Wan (2011) and Dong et al. (2020), we measure the IPO pricing efficiency in the STAR market through a reverse-engineered process and calculate the fundamental value of the IPO firm to estimate its deviation from the IPO price—that is, the IPO pricing efficiency. To do so, we construct the following specific stochastic frontier cost model:

where μi is the systematic error term, , εi is the random error term, , and μi and εi are independent. The definitions of all other variables in this model are shown in Table 1.

Further, to test the impact of media sentiment on IPO pricing efficiency, we construct the following model:

where SENi takes the values of SEN1i, SEN3i, and SEN5i, respectively.

To test the impact of media sentiment on the first-day returns of IPO shares in the secondary market, we construct the following model:

where SENi takes the values of SEN2i, SEN4i, and SEN6i, respectively.

Empirical results and analysis

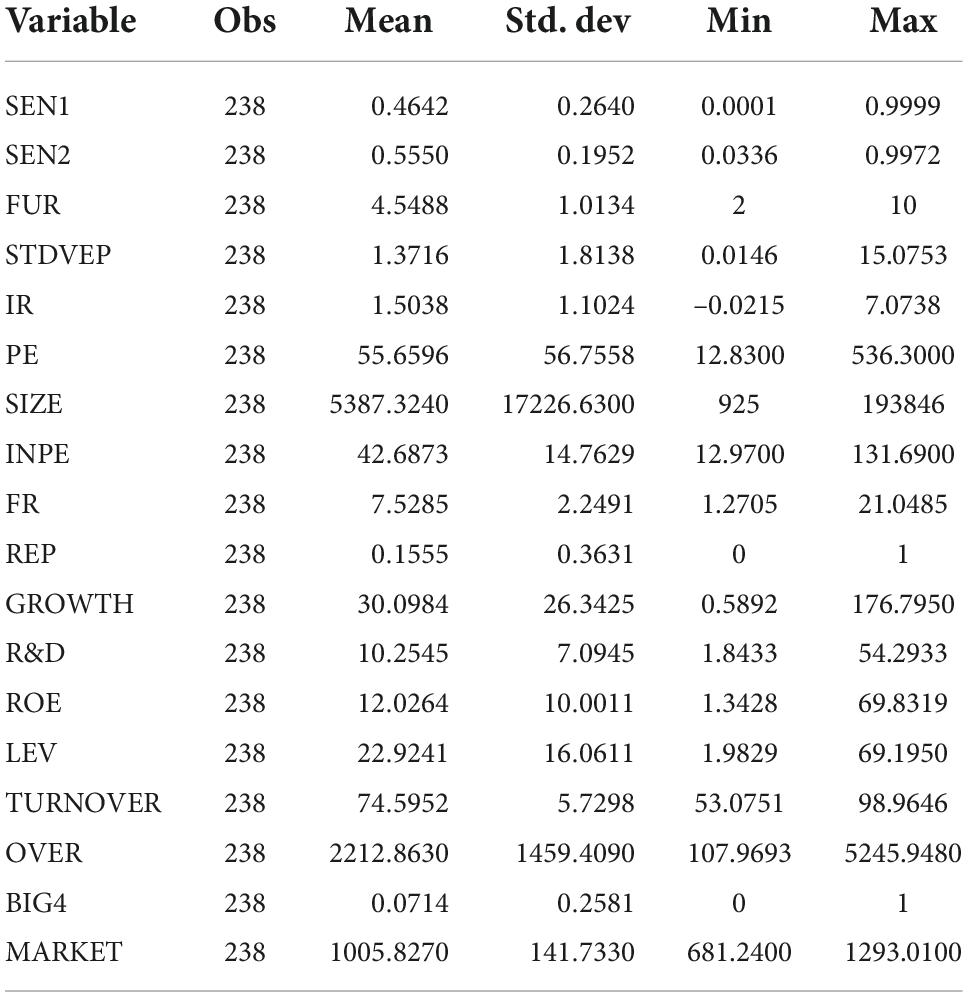

Descriptive statistics

Table 2 reports the descriptive statistics for the main variables in this paper. First, by observing the average values of SEN1 and SEN2, it can be seen that the average value of SEN2 is greater than 0.5000, thus indicating that media coverage of a company before its listing is more inclined to be skewed positively, which confirms the findings of Cook et al. (2006) and Gurun and Butler (2012). Second, the average PE of sample firms is 55.6596, which is significantly higher than the average INPE in the same industry (42.6873), and thus confirms the abnormally high pricing of new shares on the STAR market. Third, the average GROWTH of the sample firms over the past three years is 30.0984% and the average R&D is 10.2545%, both of which meet the requirements for scientific and innovative attributes of STAR-listed firms. In addition, there are great differences in the profitability of the sample firms, as the standard deviation of ROE is 10.0011, which shows that listing requirements on the STAR market have grown more inclusive in nature and are no longer singularly concerned with profitability. Fourth, with regard to underwriters, the average REP is 0.1555, which illustrates that less than 16% of listed firms choose high-reputation underwriters to issue new shares. The minimum of FUR is 2%, while the minimum of FR is only 1.2705%, which indicates that the underwriters’ follow-up investments may exceed the sponsors’ income. By including a long lock-in period for follow-up investments, underwriters are able to participate in the market risk associated with firms underwritten, so the follow-up investment system may in practice have a restrictive function. In addition, we note that the FUR of two sponsors reaches its maximum value (i.e., 10%) in cases of co-sponsorship. Fifth, STAR-listed firms have little demand for high-quality external audits, as the average of BIG4 is 0.0714. Finally, the averages of TURNOVER and OVER are 74.5952 and 2212.8630, respectively, which reflects that both individual and institutional investors have high enthusiasm for new share listings on the STAR market.

Effects of media sentiment on pricing efficiency in the primary market

Table 3 reports the regression results of IPO pricing efficiency in the STAR market. It can be seen that γ rejects the null hypothesis at the 1% level and passes the likelihood ratio test with an χ2 of about 55.10, thus indicating that choosing the stochastic frontier cost model to measure IPO pricing efficiency is valid. IPO prices of sample firms are generally higher than their fundamental values, and the average IPO pricing efficiency is 64.16%. In addition, INPE supports the null hypothesis at the 10% level, thus suggesting that the IPO pricing of the sample firms differs significantly from that of other firms in the same industry. The regression coefficients of GROWTH, R&D and ROE are 0.1080, 0.2567 and –0.2641, respectively, and the corresponding concomitant probabilities are all less than 0.0100, thus illustrating that in terms of pricing, the STAR market is highly sensitive to listing firms’ science and technology capabilities instead of the profitability, which is consistent with its desired “hard technology” profile. With regard to underwriters, the higher the FR is, the lower the IPO price will be, because the underwriting fee rate is usually related to the degree of underwriting difficulty. Underwriters may therefore pursue a lower pricing strategy for firms with higher underwriting difficulty to reduce the risk of failing to realize the expected capital gains after listing (Jamaani and Ahmed, 2020).

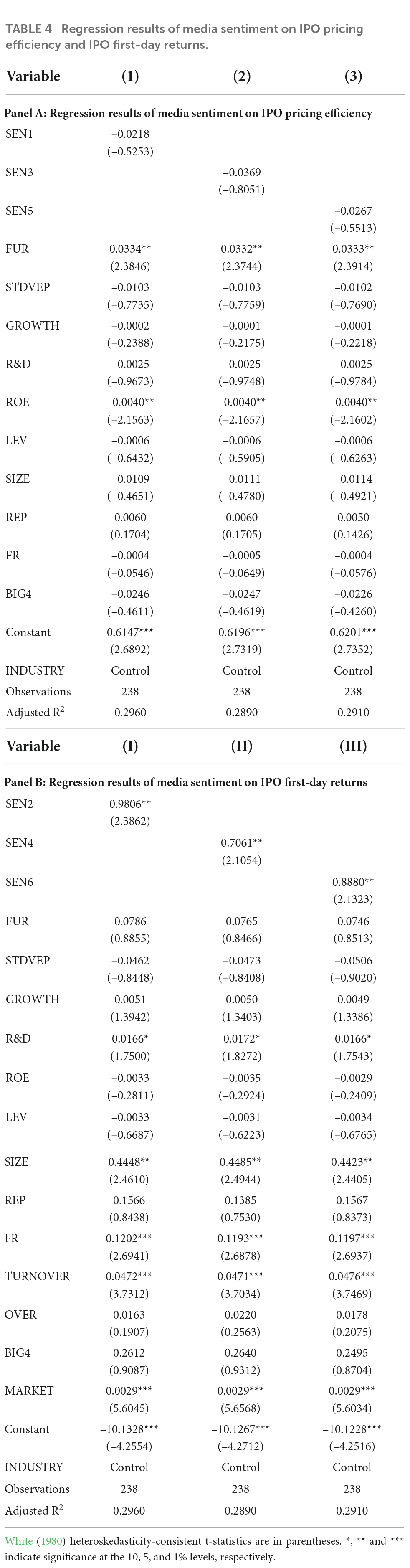

Panel A of Table 4 shows the OLS regression results of media sentiment on IPO pricing efficiency. The effect of media sentiment on IPO pricing efficiency—that is, the performance of the primary market—is not statistically significant at conventional levels as the concomitant probability greater than 0.0100, which confirms Hypothesis1. This is because the investors in the primary market are typically highly experienced institutional investors who have a better grasp of how to properly value firms and are better equipped to process and verify relevant information (Neupane et al., 2016). Hence, they are less influenced by media sentiment. The variable that has the most pronounced positive impact on IPO pricing efficiency is FUR, as its coefficients are all significantly positive at the 5% level in the three regression models. From the evidence above, we conclude that the mandatory follow-up investment system of the STAR market has played a key role in enhancing the efficiency of IPO pricing. Through this mechanism, securities companies actively engage in strengthening their own responsibilities and gradually become the true gatekeepers of the IPO market. The arrangement by which sponsors only recommend, but do not guarantee, the quality of listed firms no longer holds. Similarly, due to the restrictive two-year lock-in period, securities companies are forced to carefully judge the quality of IPO projects to ensure that their follow-up investment projects are profitable and promote pricing efficiency in the primary market.

Effects of media sentiment on IPO first-day returns in the secondary market

Panel B of Table 4 presents the OLS regression results of media sentiment on IPO first-day returns. The regression coefficients of SEN2i, SEN4i, and SEN6i are all significant at the 5% level, thus indicating that media sentiment has a significant and positive impact on the first-day returns of new shares—that is, the more positive the media sentiment is, the higher the IPO first-day returns will be. One possible explanation for this phenomenon, as suggested by Wang X. et al. (2022), is that many noise traders participate in the secondary market, especially on the first day of trading. Unlike professional institutional investors who are able to obtain private information, individual investors are at an information disadvantage and can only obtain actionable information through third-party intermediaries such as the media. Furthermore, individual investors’ relative inability to evaluate information makes them more vulnerable to media influence. These irrationality characteristics of individual investors eventually cause asset prices and to deviate from their underlying fundamental values. Chan and Fong (2004) argue that bullish media sentiment will lead to optimistic investor expectations, which will in turn inflate the prices of new shares. The findings of this paper also confirm this view. Thus, Hypothesis2 is supported.

Panel B of Table 4 shows that the regression coefficient of TURNOVER rejects the null hypothesis at the 1% level, thus suggesting that the more bullish the individual investor sentiment is, the higher the IPO first-day returns will be, which is consistent with the view of Cook et al. (2006). Interestingly, the regression coefficient of FUR supports the null hypothesis at the 10% level, which indicates that the impact of the follow-up investment system on IPO first-day returns is not significant and illustrates, to some degree, that its expected supervisory function has not been effective. Furthermore, due to the predominance of individual investors on the first day of trading and thus the prevalence of irrational investment behaviors, disagreement among institutional investors with regard to pricing new shares cannot change individual investors’ psychological states, which are characterized by blind optimism and overconfidence. Therefore, it is reasonable that the regression coefficient of STDVEP is not statistically significant. The regression coefficient of MARKET is significantly positive with a concomitant probability of less than 0.0100, which implies that the more active the market is, the higher the IPO first-day returns will be.

Additional analysis: Effects of the COVID-19 pandemic

Since the outbreak of the COVID-19 pandemic, a growing stream of literature has discussed the upheaval it caused in the financial markets and its impact on investors (Al-Awadhi et al., 2020; Schell et al., 2020; Bouri et al., 2021). Studies find that during the COVID-19 pandemic, individual investor participation increased (Tutuncu, 2022b), and their investing psychology became irrational and emotional (Silalahi et al., 2020), which may in turn influenced the relationship between media sentiment and stock prices in the secondary market.

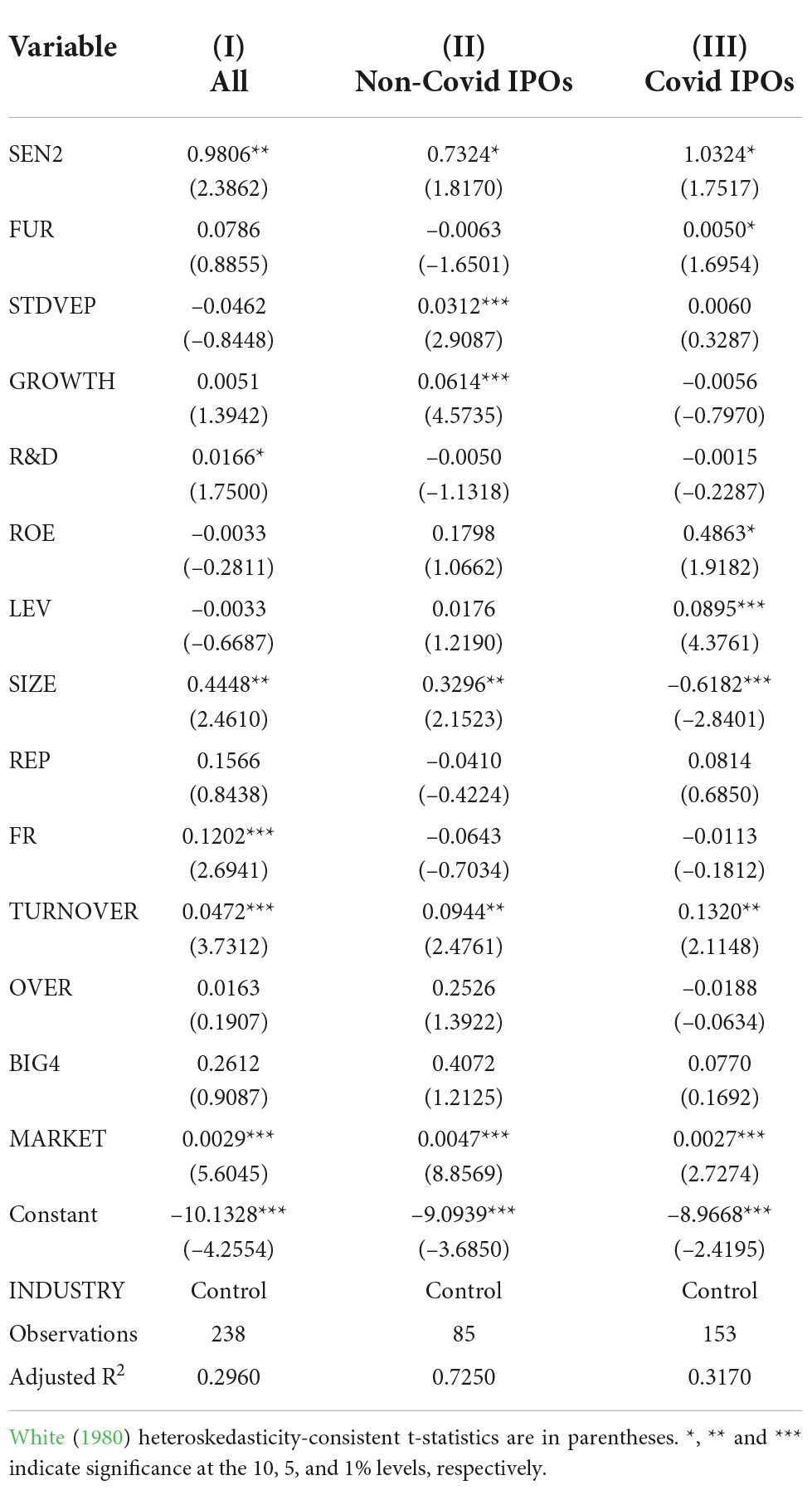

To examine the impact of the pandemic on the relationship between media sentiment and IPO first-day stock performance, we take 11 March 2020 (i.e., the date on which the World Health Organization declared COVID-19 a pandemic) as the time node and separate our research sample into IPOs after the pandemic declaration (hereinafter COVID IPOs) and those before it (hereinafter non-COVID IPOs), then test the impact of media sentiment on first-day returns of COVID IPOs and non-COVID IPOs, respectively. Table 5 reports the OLS regression results. The regression coefficient of media sentiment on COVID IPO first-day return (1.0324) is greater than that on non-COVID IPO first-day return (0.7324), and both are significant at the 10% level, which indicates that IPO first-day returns after the COVID-19 pandemic declaration are more significantly impacted by media sentiment. We argue that there are two reasons behind this phenomenon. One is that irrational individual investor participation increased with institutional investor decreasing during the pandemic (Tutuncu, 2022b), but the trading behavior of individual investors became more emotional. The other is that the outbreak of the COVID-19 pandemic created great uncertainty in the stock market, which influenced investors’ psychological and behavioral factors (Hoffmann et al., 2013; Nabil and Elalfy, 2022). Greater market uncertainty causes investors to search for more information (Bonsall et al., 2020), which makes media sentiment more likely to influence individual investors and in turn affect stock prices on the secondary market.

Table 5. Regression results of media sentiment on the first-day returns of COVID IPOs and non-COVID IPOs.

Robustness tests

To check for robustness, this study conducts three post-hoc tests. The results are presented in Table 6. First, we control for potential bias resulting from the selection of the sample period. The establishment of the STAR market attracted a great deal of investor attention, thus the market was quite lively and IPO firms became media “darlings” to a great extent. In order to report noteworthy coverage among the numerous news reports, the media will use more words that carry a sentimental orientation in its coverage and its sentiment will become more radical as a result. Therefore, we follow the robustness test method of that used in Zhang and Wu (2021) to eliminate the data of listed firms in the first three months after the STAR market debuted, then re-run the regression analysis. Columns (1), (2), (3), (I), (II) and (III) of Table 6 show the regression results after changing the sample period. There are no substantial changes from the previous tests, which confirms that the conclusions of this paper are robust. Furthermore, we control for potential bias due to the variable measurement methods. The measurement of IPO pricing efficiency is the basis of this research, so following Guo and Wan (2011), we substitute IPO price for IPO price-to-earnings ratio as the explained variable and re-fit the stochastic frontier cost model. Then, we take the new pricing efficiency obtained as the explained variable to test the impact of media sentiment on the pricing efficiency of the primary market. In addition, we replace first-day returns with market-adjusted first-day returns for further verification. Columns (4), (5), (6), (IV), (V) and (VI) of Table 6 present the regression results after replacing the explained variables, which confirm the robustness of our results. Finally, considering that the stock prices of STAR-listed firms on all of the first five trading days fully reflect individual investors’ involvement due share movements having no daily limits during this period, we further examine the effect of media sentiment on IPO first five-day returns to check the robustness of our results. We use IPO first five-day returns (IR5) and market-adjusted first five-day returns (AIR5) as proxies for stock performance in the secondary market as explained variables, respectively. The key explanatory variable is the average media sentiment score on Baidu News within five days of the listing date of the new shares (SEN7). Correspondingly, TURNOVER and MARKET, as control variables, are also adjusted to indicate observations that fall within five days of the listing date of the new shares. Leaving other control variables unchanged, we re-run the regression model. Panel C of Table 6 presents the regression results of media sentiment on IPO first five-day returns. It can be seen that media sentiment still has a significant impact on first five-day returns, which again confirms the results of this paper.

Conclusion and discussion

Conclusion

This paper analyzes 238 STAR-listed firms the perspective of behavioral finance for the period from 22 July 2019 to 30 April 2021 and systematically examines the impact of media sentiment on stock prices on the Shanghai Stock Exchange STAR market from two aspects: IPO pricing efficiency and IPO first-day stock performance, which also reflect the influence of media sentiment on institutional and individual investors. Furthermore, we investigate the impact of the COVID-19 pandemic on the relationship between media sentiment and IPO first-day stock performance on the STAR market. We obtain data for media coverage of STAR-listed firms by crawling Baidu News using Python software and measure media sentiment using a machine learning-based text analysis technique. The results suggest the following. (1) Media sentiment has no significant impact on IPO pricing efficiency on the STAR market. This implies that institutional investors that participate in the primary market are not influenced by media sentiment, which is a likely result of their analytical sophistication and investing experience. However, it remains true that IPO prices of STAR-listed firms are obviously overestimated, with an average IPO pricing efficiency of 64.16%. This phenomenon can be explained by Derrien (2005)—that is, rational institutional investors participating in the IPO process intentionally and opportunistically increase the prices of new shares after observing the hot market atmosphere. (2) The more optimistic the media sentiment is, the higher the IPO first-day returns will be, which indicates that the sentimental orientation of media reports significantly induces generally irrational individual investors to overbid for and thus drive up the prices of newly issued shares. In addition, the results remain robust after extending IPO first-day returns to IPO first five-day returns. (3) Media sentiment has a greater impact on IPO first-day returns after the COVID-19 pandemic declaration than before the declaration. This finding suggests that irrationality among individual investors intensifies during pandemics, which makes them more susceptible to media sentiment and thus strengthens the relationship between media sentiment and stock prices. The above conclusions still hold after a series of robustness tests through which we change the sample period and choose alternative variable measurements.

Implications

This study adds to emerging research on how media sentiment affects stock prices. By taking the perspective of behavior finance, we provide a novel explanation for the mechanisms that affect stock price formation on the STAR market. Our study also has implications for policy formulation and investment behavior based on the above findings. First, it is necessary to strengthen the regulations and guidance on media behaviors and encourage the media to play an active role in financial markets. Our empirical evidence suggests that media sentiment has a great impact on the judgment of individual investors, and we believe that such influence will increase along with the increasingly high development of information technology. Therefore, regulators should incentivize the media to report with objectivity and neutrality while punishing non-compliance and overt or self-interested biases. Second, the “gatekeeper” function of sponsors and lead underwriters should be fortified and the follow-up supervision responsibility of securities companies should be strengthened. Our results demonstrate that the mandatory sponsor follow-up investment system has improved the efficiency of stock pricing, but not the effectiveness of follow-up supervision. Hence, regulators should clarify the obligations of securities companies and provide institutional guarantees to ensure that they continue to safeguard the market after the IPO process is complete. Third, public health crisis events should be paid attention to, as they might induce market volatility as well as market disruption. We find that the COVID-19 pandemic declaration reinforced the positive impact of media sentiment on IPO first-day returns. Therefore, regulators need to reduce the market uncertainty caused by the pandemic by ensuring the authenticity and timeliness of information disclosure of listed firms, which in turn mitigates the adverse impact of media sentiment on the stock market during the pandemic. Finally, investors need to make value investment. The data show that most STAR stocks have high first-day returns in the secondary market, but our research has confirmed that STAR stock prices are already overvalued in the primary market, which indicates that the stock price bubble exists and investment risk is high. However, compared with mature capital markets, there is indeed a more speculative atmosphere characterized by irrational behavior in China’s stock market, which is also confirmed by our result that media sentiment affecting stock pricing in the secondary market is a function of the irrational behaviors of individual investors. Therefore, investors should be toward value investing and away from speculative short-term trading, especially during pandemics.

Limitations and future research

This paper is subject to certain limitations that may present avenues for further research. Zhang et al. (2022) find that in China’s bond market, investors’ reactions to good and bad news are asymmetric. In addition, the asymmetric effect of sentiment has been confirmed to exist in the stock market (Akhtar et al., 2013). Hence, we believe that positive and negative media sentiment should have different effects on STAR market stock prices. However, due to the relative youth of the STAR market, our research sample is small. If we were to classify the existing research samples by media sentiment to re-test our hypotheses, we would not be able to ensure the validity of the empirical results due to the small sample size. Therefore, we did not carry out this step and will continue to deepen our research when a larger sample is available. In addition, as we are limited by time and manpower, we did not further analyze the mechanism of impact of media sentiment on stock prices and plan to do so in future research efforts.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

XD conceived and supervised the study. SX conducted literature review and wrote the manuscript. JL contributed to the acquisition, analysis, and interpretation of data for the work. F-ST contributed to construct the model and write the manuscript. All authors contributed to the article and approved the submitted version.

Acknowledgments

The authors thank the editor and the reviewers for their helpful remarks and guidance.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

- ^ We choose Baidu News as the platform to observe the media coverage of IPO firms for three reasons. First, as the largest Chinese search engine, Baidu has more stable servers and the advantage of being a Chinese information search engine, so it ensures that data crawling is technically feasible. In addition, the news sources used in Baidu News include more than 500 authoritative websites, which ensures the comprehensiveness of the information we obtain. Finally, compared with Baidu Search, Baidu News filters more invalid information such as advertising information, thus improving our information processing efficiency.

- ^ We choose to conduct sentiment analysis on news headlines because investors will not read the contents of the coverage in detail considering their limited time and energy, but rather obtain information through reading news headlines only.

References

Akhtar, S., Faff, R., Oliver, B., and Subrahmanyam, A. (2013). Stock salience and the asymmetric market effect of consumer sentiment news. J. Bank. Finance 37, 4488–4500. doi: 10.1016/j.jbankfin.2012.07.019

Al-Awadhi, A. M., Alsaifi, K., Al-Awadhi, A., and Alhammadi, S. (2020). Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. J. Behav. Exp. Finance 30:100430. doi: 10.1016/j.jbef.2020.100326

Antweiler, W., and Frank, M. Z. (2004). Is all that talk just noise? The information content of internet stock message boards. J. Finance 59, 1259–1294. doi: 10.1111/j.1540-6261.2004.00662.x

Bajo, E., and Raimondo, C. (2017). Media sentiment and IPO underpricing. J. Corp. Finance 46, 139–153. doi: 10.1016/j.jcorpfin.2017.06.003

Baker, M., and Wurgler, J. (2006). Investor sentiment and the cross-section of stock returns. J. Finance 61, 1645–1680. doi: 10.1111/j.1540-6261.2006.00885.x

Bonsall, S. B. IV, Green, J., and Muller, K. A. III (2020). Market uncertainty and the importance of media coverage at earnings announcements. J. Account. Econ. 69:101264. doi: 10.1016/j.jacceco.2019.101264

Bouri, E., Demirer, R., Gupta, R., and Nel, J. (2021). COVID-19 pandemic and investor herding in international stock markets. Risks 9:168. doi: 10.3390/risks9090168

Broadstock, D. C., and Zhang, D. (2019). Social-media and intraday stock returns: The pricing power of sentiment. Finance Res. Lett. 30, 116–123. doi: 10.1016/j.frl.2019.03.030

Bushee, B. J., Core, J. E., Guay, W., and Hamm, S. J. W. (2010). The role of the business press as an information intermediary. J. Account. Res. 48, 1–19. doi: 10.1111/j.1475-679X.2009.00357.x

Cao, F., and Dong, X. (2006). An empirical study on the rationality of IPO pricing. J. Finance Econ. 32, 4–14. doi: 10.16538/j.cnki.jfe.2006.06.001

Chan, S. Y., and Fong, W. M. (2004). Individual investors’ sentiment and temporary stock price pressure. J. Bus. Finance Account. 31, 823–836. doi: 10.1111/j.0306-686X.2004.00558.x

Chen, C. W., Pantzalis, C., and Park, J. C. (2013). Press coverage and stock price deviation from fundamental value. J. Financ. Res. 36, 175–214. doi: 10.1111/j.1475-6803.2013.12007.x

Cook, D. O., Kieschnick, R., and Van Ness, R. A. (2006). On the marketing of IPOs. J. Financ. Econ. 82, 35–61. doi: 10.1016/j.jfineco.2005.08.005

De Bondt, W. P. (1993). Betting on trends: Intuitive forecasts of financial risk and return. Int. J. Forecast. 9, 355–371. doi: 10.1016/0169-2070(93)90030-Q

De Long, J. B., Shleifer, A., Summers, L. H., and Waldmann, R. J. (1990). Noise trader risk in financial markets. J. Polit. Econ. 98, 703–738. doi: 10.1086/261703

Derrien, F. (2005). IPO pricing in “hot” market conditions: Who leaves money on the table? J. Finance 60, 487–521. doi: 10.1111/j.1540-6261.2005.00736.x

Diether, K. B., Malloy, C. J., and Scherbina, A. (2002). Differences of opinion and the cross section of stock returns. J. Finance 57, 2113–2141. doi: 10.1111/0022-1082.00490

Djankov, S., McLiesh, C., Nenova, T., and Shleifer, A. (2003). Who owns the media? J. Law Econ. 46, 341–382. doi: 10.1086/377116

Dong, X., Liu, J., and Man, Y. (2020). Research on the reasonability of IPO pricing and the causes of high returns under the registration system of the STAR market. J. Shanghai Univ. Finance Econ. 22, 65–78. doi: 10.16538/j.cnki.jsufe.2020.06.005

Dong, Y., and Huang, J. (2022). Price limits, investor sentiment, and initial public offering underpricing: A quasi-natural experiment based on ChiNext. Emerg. Mark. Rev. 51:100893. doi: 10.1016/j.ememar.2022.100893

Du, H., Hao, J., He, F., and Xi, W. (2022). Media sentiment and cross-sectional stock returns in the Chinese stock market. Res. Int. Bus. Finance 60:101590. doi: 10.1016/j.ribaf.2021.101590

Duan, Y., Liu, L., and Wang, Z. (2021). COVID-19 sentiment and the Chinese stock market: Evidence from the Official news media and sina weibo. Res. Int. Bus. Finance 58:101432. doi: 10.1016/j.ribaf.2021.101432

Dyck, A., Volchkova, N., and Zingales, L. (2008). The corporate governance role of the media: Evidence from Russia. J. Finance 63, 1093–1135. doi: 10.1111/j.1540-6261.2008.01353.x

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. J. Finance 25, 383–417. doi: 10.1111/j.1540-6261.1970.tb00518.x

Ferguson, N. J., Philip, D., Lam, H. Y. T., and Guo, J. M. (2015). Media content and stock returns: The predictive power of press. Multinatl. Finance J. 19, 1–31.

Frankel, R., Jennings, J., and Lee, J. (2021). Disclosure sentiment: Machine learning vs. Dictionary methods. Manag. Sci. 68, 5514–5532. doi: 10.1287/mnsc.2021.4156

Funaoka, K., and Nishimura, Y. (2019). Private information, investor sentiment, and IPO pricing: Which institutional investors are better informed? Emerg. Mark. Finance Trade 55, 1722–1736. doi: 10.1080/1540496X.2018.1484355

Guldiken, O., Tupper, C., Nair, A., and Yu, H. (2017). The impact of media coverage on IPO stock performance. J. Bus. Res. 72, 24–32. doi: 10.1016/j.jbusres.2016.11.007

Guo, H., and Wan, D. (2011). Research on rationality of IPO issue prices in China’s growth enterprises. China Soft Sci. 9, 156–166. doi: 10.3969/j.issn.1002-9753.2011.09.016

Gurun, U. G., and Butler, A. W. (2012). Don’t believe the hype: Local media slant, local advertising, and firm value. J. Finance 67, 561–598. doi: 10.1111/j.1540-6261.2012.01725.x

Hermida, A., Fletcher, F., Korell, D., and Logan, D. (2012). Share, like, recommend. Journal. Stud. 13, 815–824. doi: 10.1080/1461670X.2012.664430

Hoffmann, A. O. I., Post, T., and Pennings, J. M. E. (2013). Individual investor perceptions and behavior during the financial crisis. J. Bank. Finance 37, 60–74. doi: 10.1016/j.jbankfin.2012.08.007

Huynh, T. L. D., Foglia, M., Nasir, M. A., and Angelini, E. (2021). Feverish sentiment and global equity markets during the COVID-19 pandemic. J. Econ. Behav. Organ. 188, 1088–1108. doi: 10.1016/j.jebo.2021.06.016

Jamaani, F., and Ahmed, A. D. (2020). Simultaneous effects of clustering and endogeneity on the underpricing difference of IPO firms: A global evidence. Res. Int. Bus. Finance 54:101250. doi: 10.1016/j.ribaf.2020.101250

Johnson, J. L., Ellstrand, A. E., Dalton, D. R., and Dalton, C. M. (2005). The influence of the financial press on stockholder wealth: The case of corporate governance. Strateg. Manag. J. 26, 461–471. doi: 10.1002/smj.457

Kahneman, D., and Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica 47, 263–292. doi: 10.2307/1914185

Khedr, A. E., Salama, S. E., and Yaseen, N. (2017). Predicting stock market behavior using data mining technique and news sentiment analysis. Int. J. Intell. Syst. Appl. 9, 22–30. doi: 10.5815/ijisa.2017.07.03

Koch, A., Huynh, T. L. D., and Wang, M. (2022). News sentiment and international equity markets during BREXIT period: A textual and connectedness analysis. Int. J. Finance Econ. 1–30. doi: 10.1002/ijfe.2635

Lakonishok, J., Shleifer, A., and Vishny, R. W. (1994). Contrarian investment, extrapolation, and risk. J. Finance 49, 1541–1578. doi: 10.2307/2329262

Liu, Y., and Shen, K. (2011). Primary market under-pricing or secondary market over-pricing?–An empirical analysis and explanation of IPO puzzles in the Chinese stock market. J. Financ. Res. 11, 183–196.

Loughran, T., and McDonald, B. (2011). When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks. J. Finance 66, 35–65. doi: 10.1111/j.1540-6261.2010.01625.x

Luo, C., and Ouyang, Z. (2014). Estimating IPO pricing efficiency by Bayesian stochastic frontier analysis: The ChiNext market case. Econ. Model. 40, 152–157. doi: 10.1016/j.econmod.2014.03.030

Merton, R. C. (1973). An intertemporal capital asset pricing model. Econometrica 41, 867–887. doi: 10.2307/1913811

Mossin, J. (1966). Equilibrimn in a capital asset market. Econometrica 34, 768–783. doi: 10.2307/1910098

Mullainathan, S., and Shleifer, A. (2005). The market for news. Am. Econ. Rev. 95, 1031–1053. doi: 10.2307/4132704

Nabil, M., and Elalfy, A. H. (2022). The effect of COVID-19 fear sentiment on banks’ performance in emerging markets. Int. Bus. Res. 15, 39–52. doi: 10.5539/ibr.v15n5p39

Neupane, S., Neupane, B., Paudyal, K., and Thapa, C. (2016). Domestic and foreign institutional investors’ investment in IPOs. Pac. Basin Finance J. 39, 197–210. doi: 10.1016/j.pacfin.2016.06.011

Niederhoffer, V. (1971). The analysis of world events and stock prices. J. Bus. 44, 193–219. doi: 10.2307/2351663

Rinallo, D., and Basuroy, S. (2009). Does advertising spending influence media coverage of the advertiser? J. Mark. 73, 33–46. doi: 10.2307/20619057

Roll, R. (1977). A critique of the asset pricing theory’s tests Part I: On past and potential testability of the theory. J. Financ. Econ. 4, 129–176. doi: 10.1016/0304-405X(77)90009-5

Sadique, S., In, F. H., and Veeraraghavan, M. (2008). The impact of spin and tone on stock returns and volatility: Evidence from firm-issued earnings announcements and the related press coverage. SSRN[Preprint]. Available online at: https://ssrn.com/abstract=1121231 or http://dx.doi.org/10.2139/ssrn.1121231 (accessed April 17, 2008).

Schell, D., Wang, M., and Huynha, T. L. D. (2020). This time is indeed different: A study on global market reactions to public health crisis. J. Behav. Exp. Finance 29:100439. doi: 10.1016/j.jbef.2020.100349

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. J. Finance 19, 425–442. doi: 10.2307/2977928

Shen, S., Xia, L., Shuai, Y., and Gao, D. (2022). Measuring news media sentiment using big data for Chinese stock markets. Pac. Basin Finance J. 74:101810. doi: 10.1016/j.pacfin.2022.101810

Silalahi, P. R., Hafizh, M., Nasution, S., and Sugianto, S. (2020). Psychology of muslim investors in stock market during COVID-19 pandemic. Tazkia Islamic Finance Bus. Rev. 14, 65–90. doi: 10.30993/tifbr.v14i1.223

Suleman, M. T. (2012). Stock market reaction to good and bad political news. Asian J. Finance Account. 4, 299–312. doi: 10.5296/ajfa.v4i1.1705

Tetlock, P. C. (2007). Giving content to investor sentiment: The role of media in the stock market. J. Finance 62, 1139–1168. doi: 10.1111/j.1540-6261.2007.01232.x

Tetlock, P. C., Saar-Tsechansky, M., and Macskassy, S. (2008). More than words: Quantifying language to measure firms’ fundamentals. J. Finance 63, 1437–1467. doi: 10.1111/j.1540-6261.2008.01362.x

Tutuncu, L. (2022a). Allocation discretion, price discounts and returns in Turkish initial public offerings. Int. J. Islam. Middle East. Finance Manag. 15, 623–645. doi: 10.1108/IMEFM-05-2020-0258

Tutuncu, L. (2022b). The changing investor demographics of an emerging IPO market during the COVID-19 pandemic. China finance review international[Preprint]. Available online at: doi: 10.1108/CFRI-07-2022-0111 (accessed October 9, 2022).

Wang, C., and Wu, J. (2015). Media tone, investor sentiment and IPO pricing. J. Financ. Res. 9, 174–189.

Wang, Z., Wang, X., Xu, Y., and Cheng, Q. (2022). Are green IPOs priced differently? Evidence from China. Res. Int. Bus. Finance 61:101628. doi: 10.1016/j.ribaf.2022.101628

Wang, X., Xiang, Z., Xu, W., and Yuan, P. (2022). The causal relationship between social media sentiment and stock return: Experimental evidence from an online message forum. Econ. Lett. 216:110598. doi: 10.1016/j.econlet.2022.110598

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48, 817–838. doi: 10.2307/1912934

Yang, M., Jiang, B., Wang, Y., Hao, T., and Liu, Y. (2022). News text mining-based business sentiment analysis and its significance in economy. Front. Psychol. 13:918447. doi: 10.3389/fpsyg.2022.918447

You, J., and Wu, J. (2012). Spiral of silence: Media sentiment and the asset mispricing. Econ. Res. J. 47, 141–152.

You, J., and Zheng, J. (2013). Media sentiment, framing dependence bias and IPO anomalies: Based on the perspective of agenda setting theory. Rev. Invest. Stud. 32, 68–84.

Zhang, S. (2021). Sentiment classification of news text data using intelligent model. Front. Psychol. 12:758967. doi: 10.3389/fpsyg.2021.758967

Zhang, W., Wang, J., and Tong, M. (2022). Research on bond participants’ emotion reactions toward the internet news in China’s bond market. Front. Psychol. 13:855063. doi: 10.3389/fpsyg.2022.855063

Zhang, Z., and Wu, Z. (2021). Media’s emotional contagion and analyst optimistic bias: Evidence based on the technique of machine learning. J. Manag. World 37, 170–185. doi: 10.19744/j.cnki.11-1235/f.2021.0011

Keywords: the STAR market, media sentiment, stock price, IPO pricing efficiency, IPO first-day stock performance, machine learning

Citation: Dong X, Xu S, Liu J and Tsai F-S (2022) Does media sentiment affect stock prices? Evidence from China’s STAR market. Front. Psychol. 13:1040171. doi: 10.3389/fpsyg.2022.1040171

Received: 09 September 2022; Accepted: 16 November 2022;

Published: 01 December 2022.

Edited by:

Mei Wang, WHU – Otto Beisheim School of Management, GermanyReviewed by:

Lokman Tütüncü, Zonguldak Bülent Ecevit University, TurkeyToan Luu Duc Huynh, University of Economics Ho Chi Minh City, Vietnam

Copyright © 2022 Dong, Xu, Liu and Tsai. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jianing Liu, bGpuMjBAbWFpbHMuamx1LmVkdS5jbg==; Fu-Sheng Tsai, ZnVzaGVuZ190c2FpQGhvdG1haWwuY29t

Xiuliang Dong

Xiuliang Dong Shiying Xu

Shiying Xu Jianing Liu

Jianing Liu Fu-Sheng Tsai

Fu-Sheng Tsai