- 1Department of Wine and Beverage Business Research, Hochschule Geisenheim University, Geisenheim, Germany

- 2Fraunhofer Institute for Solar Energy Systems ISE, Group Agrivoltaics, Freiburg, Germany

- 3Department of Economics, University of Freiburg, Freiburg, Germany

- 4Department of General and Organic Viticulture, Hochschule Geisenheim University, Geisenheim, Germany

- 5Department of Applied Ecology, Hochschule Geisenheim University, Geisenheim, Germany

Introduction: This paper introduces a framework for assessing the economic performance of agrivoltaic systems (AVS) in vineyards. The study aims to classify factors influencing the profitability of integrating photovoltaic (PV) systems with viticultural practices, emphasizing potential synergistic benefits. Focused on the geographic and climatic conditions of Geisenheim, Germany—home to the first AVS installation in viticulture in Germany—the framework highlights the need to explore economic and operational parameters to assess AVS feasibility.

Methods: The study operationalized its framework by simulating various scenarios based on key variables such as capital expenditures (CAPEX), operational expenditures (OPEX), and revenue streams from grape and energy production. Key factors considered included solar radiation, panel transparency, and regulatory impacts. Scenarios evaluated included: i) Configurations with fully opaque and semi-transparent PV modules. Ii) Adjustments for full mechanization of viticulture practices. Iii) Self-consumption of the produced energy. The framework employed these simulations to evaluate economic outcomes and identify profitability determinants under different conditions.

Results: Findings indicate that under current conditions in Germany, AVS systems are not economically viable for widespread adoption. Key results include: Economic Outcomes: High initial costs (CAPEX) and insufficient revenue from combined grape and energy production lead to negative net present values over a 20-year period across all simulated scenarios. Profitability Determinants: CAPEX and energy prices emerged as critical factors, while viticulture-related costs and revenues had a minor impact on overall profitability. Potential Improvements: Scenarios incorporating multiple positive changes—such as premium wine pricing, higher feed-in tariffs, and increased self-consumption of energy—demonstrated potential for economic feasibility.

Discussion: The study underscores that high CAPEX and low revenues from grape and energy production are the main barriers to AVS profitability. For AVS systems to achieve economic sustainability, substantial reductions in installation costs, increases in energy prices, or technological advances in efficiency are required. Promising configurations combining multiple favorable changes suggest a pathway toward economic feasibility but highlight the need for further development and innovation. The framework provides valuable guidance for future research and investment strategies, emphasizing the importance of: i) Long-term Trials: To evaluate viticultural impacts and synergistic benefits. Ii) Dynamic Models: Incorporating evolving revenue streams, cost structures, and regulatory impacts. iii) Broad Assessments: Exploring the environmental and social benefits of AVS alongside economic performance. Continuous updates to the framework will ensure its relevance, reflecting advancements in PV technology, viticultural practices, and policy environments. This approach will help bridge the gap between renewable energy and sustainable agriculture.

1 Introduction

The wine sector is increasingly adopting sustainability initiatives that address the three pillars of sustainability: environmental, economic, and social. However, in the context of global wine oversupply and intense price competition among producers, economic sustainability has emerged as the most pressing challenge (Loose and Pabst, 2019; Del Rey and Loose, 2023; Bennett and Loose, 2023).

The long-term viability of wine producers is contingent upon rising costs associated with energy (Eurostat, 2023), raw materials (Eurostat, 2024a), and labor (Eurostat, 2024b), along with increasing interest rates on capital (ECB, 2024). Concurrently, global wine consumption is on the decline (OIV, 2024; IWSR, 2024), exacerbating overproduction and resulting in a significant decline in wine prices.

From an environmental perspective, the impacts of climate change are becoming increasingly prominent (IPCC, 2023). The rising frequency of heatwaves, droughts, heavy rainfall, spring frost event and hail poses a substantial threat to 49% to 70% of current wine-growing regions, with projections indicating a severe risk of extinction for many by the end of the century (van Leeuwen et al., 2024). These dire forecasts highlight the urgent need to transition from fossil fuels to renewable energy sources and implement carbon dioxide removal solutions (Smith et al., 2024). Photovoltaics (PV) present a viable avenue to achieve this shift.

In addressing the trade-offs between the various pillars of sustainability, wine producers should be able to prioritize investments that bolster environmental sustainability without compromising their economic viability. Ideally, such investments should generate synergies that enhance economic sustainability by providing additional revenue streams for producers (Padilla et al., 2022). For businesses to adopt innovations and invest in new technologies such as agrivoltaic systems (AVS), these technologies must be economically viable. From the perspective of individual businesses operating in a highly competitive market environment, long-term investments in ecological innovations must at least cover costs. Therefore, it is essential to investigate the determinants of profitability within the application of AVS in viticulture.

1.1 Agrivoltaics in viticulture

PV represent the most cost-effective renewable energy technology currently available. Between 2010 and 2020, the prices of PV modules experienced a remarkable decline of 90% (Wirth, 2022). In light of escalating energy prices over the past two years, the economic attractiveness of these systems has significantly increased (Hörnle et al., 2021). However, ground-mounted photovoltaics (PV-GM) are characterized by substantial land requirements, posing challenges in terms of land use (Fritsche et al., 2017).

AVS provide a viable solution by allowing simultaneous food and energy production on the same land area (Götzberger and Zastrow, 1982; Weselek et al., 2019; Schindele et al., 2020; Trommsdorff et al., 2022a, 2022), thereby mitigating conflicts associated with land use (Schindele et al., 2020). These systems may not only offer alternative sources of income but also facilitate the transition to carbon-neutral energy production through decarbonization. Additionally, AVS can provide adaptation measures for viticulture, including protection against radiation, frost, and hail damage, as well as enhancements in rainwater harvesting and water management.

The utilization of AVS for non-permanent crop production has been established since the early 2000s (Weselek et al., 2019). The first agrivoltaic system in viticulture was implemented in 2009 in Puglia, Italy, while the inaugural AVS connected to the grid in Germany was constructed at Hochschule Geisenheim University (HGU) between winter 2022 and spring 2023 (Garstka et al., 2023).

The infrastructural compatibility of PV and viticulture is noteworthy, as both systems share similar life expectancies when installed concurrently (Hörnle et al., 2021). Moreover, the machinery used in viticulture tends to remain consistent over extended periods, in contrast to the equipment used in arable farming (Schindele et al., 2020), which aids in the structural planning of PV components. The training of vines in rows aligns with the establishment of AVS, where solar modules above may provide shade and protection to the underlying canopy.

AVS effectively combines solar energy production with the protection of grapevines, yet it also poses a challenge, as both the vines and the solar panels compete for sunlight. For this integration to be economically viable, specific conditions must be met, which will be further elaborated upon later in this study.

1.2 Objective and research question

Given that AVS are a relatively recent development in viticulture, with the inaugural systems currently being subjected to scientific trials, comprehensive evaluations of the critical variables influencing AVS in viticulture and their economic sustainability remain poorly investigated. This study aims to establish an initial, comprehensive framework that categorizes all pertinent factors affecting the profitability of both the PV and viticultural systems, including potential synergistic effects.

Subsequently, this framework will be operationalized through various scenarios to ascertain the relative significance of these key variables and to evaluate profitability within the specific context of Geisenheim, Germany, considering its unique location and regulatory conditions.

The medium-term objective is to identify the optimal balance or ‘golden ratio’ of economic co-benefits for both viticulture and electricity generation. Consequently, it is crucial to determine the economic impact of the key variables associated with AVS in viticulture. Identifying these variables will guide the collection of critical data from initial experimental sites, such as the ‘VitiVoltaic’ facility at HGU.

2 Development of a framework for economic assessment of AVS

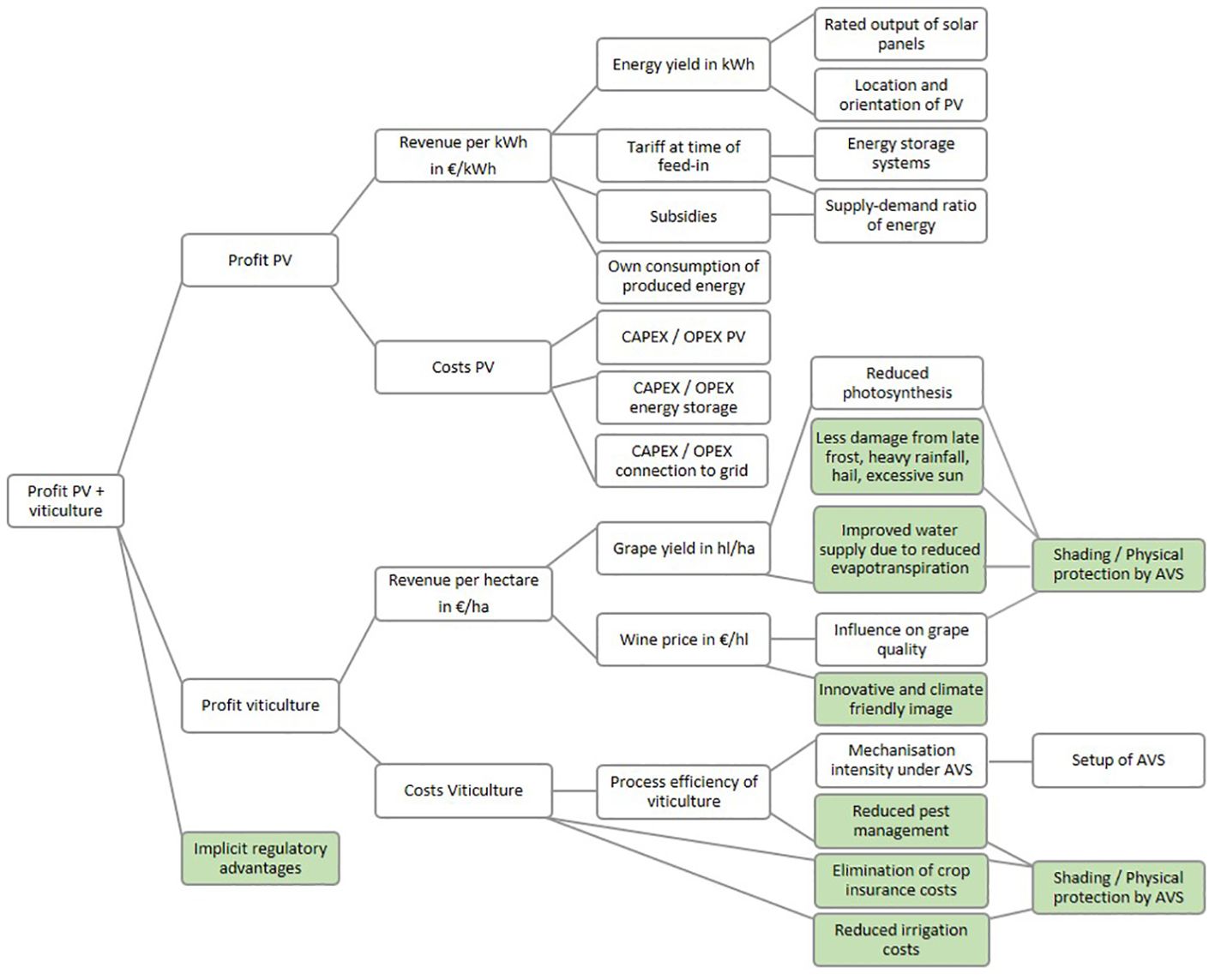

The development of a holistic framework must incorporate the primary factors influencing the profitability of both PV systems (section 2.1) and viticulture under PV systems (section 2.2), as well as potential regulatory effects (section 2.3). This framework should include input and output variables such as capital expenditures (CAPEX), operational expenditures (OPEX), and revenues generated from the marketing of grapes and energy. Additionally, it should account for the synergistic benefits associated with PV systems installed over grapevines.

2.1 Influencing factors on PV profit

The profitability of PV systems in viticulture is impacted by a variety of factors, influencing both revenue and cost aspects (upper part of Figure 1). On the revenue side, the energy yield from solar panels is primarily dependent on their rated power and the intensity of solar radiation, which is influenced by geographical location, panel orientation (Cura et al., 2022) and the transparency of the PV modules. Higher transparency modules allow more light to reach the ground, benefiting the underlying vines, but result in lower energy production (Wittke, 2023).

Figure 1. Variables in the profit generation of AVS (PV + viticulture) and their influencing factors (Source: own illustration); Notes: Positive synergy effects are marked in green. PV, Photovoltaics; AVS, Agrivoltaic system; CAPEX, Capital Expenditure; OPEX, Operational Expenditure.

The revenue per kilowatt-hour (kWh) of energy is influenced by the applicable price, which can vary based on the energy’s usage. Specifically, feeding-in tariffs are relevant when energy is fed into the public grid, whereas opportunity costs are considered when the energy is used onsite in the wine producer’s operations, such as for cooling tanks.

When energy is fed into the public grid, country-specific regulations and tariffs dictate the price per kWh, which may vary depending on the installation’s capacity. In Germany, for instance, the Renewable Energy Sources Act (EEG) subsidizes feed-in tariffs when market prices fall below a certain threshold. However, during peak periods, such as sunny public holidays when supply exceeds demand, market prices can fall below €0, resulting in negative figures. Under these circumstances, the EEG suspends subsidies for solar installations exceeding 100 kW, resulting in negative revenue. Future advancements in energy storage systems are anticipated to balance supply and demand, thereby stabilizing feed-in tariffs (Al-Ghussain et al., 2020). Though current energy storage solutions are costly, new developments in decentralized storage are expected to reduce these costs in the future (Hannan et al., 2021).

Energy generated by AVS can be utilized for onsite energy consumption, which may include recharging electric vehicles, agricultural equipment such as electric tractors or self-propelled robots, and powering cellar cooling systems or others. Depending on country-specific regulations and the cost of purchasing electricity from the grid, onsite usage may offer greater economic benefits than feed-in tariffs, as suggested by Trommsdorff et al. (2022a).

The costs associated with the overall PV system are primarily driven by CAPEX and OPEX, which include both the PV system itself and its connection to the grid. Due to significantly higher installation costs for the mounting system, the cost of electricity produced from AVS is currently estimated to be approximately 38% higher than that from conventional PV-GM (Schindele et al., 2020; Khan et al., 2021; Trommsdorff et al., 2022b). Additional CAPEX and OPEX considerations apply if energy storage systems are incorporated into the PV setup.

2.2 Influencing factors on profit of viticulture under PV

PV systems influence both revenues and costs in viticulture (branch “Profit viticulture” in Figure 1).

2.2.1 Revenue of viticulture

Revenue per hectare in viticulture is determined by the grape yield per hectare (expressed in hectoliters per hectare) and the price of the produced grapes or wine. Both grape yield and wine price can be affected by the presence of PV systems through shading effects on yield and synergistic effects due to the protective impact of the PV structures on the vines. All the effects mentioned can be both positive and negative, although the wine industry lacks figures specifically from AVS trials.

2.2.1.1 Effect of shading on grape yield

PV systems and vines compete for sunlight. Initial experimental trials with lettuce and vine indicate that shading from solar panels reduce photosynthesis and thus impact yields (Elamri et al., 2018; Valle et al., 2017; Ferrara et al., 2023). Research from other wine-growing regions utilizing shade cloth has demonstrated varied responses in grape yield and quality due to shading, influenced by grape variety, duration, and timing of shading activities (Abeysinghe et al., 2016; Pallotti et al., 2023). However, the effects of partial, but continuous shading, as imposed by PV modules, on grapevine yield and wine quality remain underexplored due to variations in growing conditions, different grapevine varieties (Weselek et al., 2019; Al Mamun et al., 2022; Tiffon-Terrade et al., 2022), as well as the ability of grapevines to adapt to lower light conditions by increasing foliage area and enhancing the production of pigments and RuBisCo (Cartechini and Palliotti, 1995).

Production for market segments of premium and ultra-premium wine, which often aim to reduce yields, might benefit from these shading effects. If yield-reducing measures are already in place, the shading effect from PV systems could potentially substitute for these measures. However, the overall influence of shading on grape and wine quality remains insufficiently researched and warrants further investigation.

2.2.1.2 Synergistic benefits of AVS in viticulture

Beyond the primary objective of utilizing AVS for energy production, there are additional synergistic benefits relevant to viticulture (highlighted in green in Figure 1). Notably, from a viticultural perspective, solar panels can mitigate the impacts of extreme weather events, which are increasing in frequency due to climate change (Gömann et al., 2015).

Solar panels can shield against excessive solar radiation that in combination with higher temperature can lead to sunburn on grapes and leaves, elevate sugar levels, and consequently increase alcohol concentration, altering the aromatic profile of wines (van Leeuwen and Darriet, 2016; Gambetta et al., 2020). To some extend and particularly beneficial are these effects on young vineyards, as they are in the early stages of developing root systems needed for water absorption and are therefore especially susceptible to dry conditions and intense solar radiation. The shade provided by solar panels also reduces evaporation rates, thus enhancing water availability (Elamri et al., 2018; Ferrara et al., 2023).

Moreover, solar panels may offer protection against other climatic adversities such as heavy rain, hail, and frost, thereby reducing or preventing damage to grape crops (Hannah et al., 2013; Weselek et al., 2019). Initial findings from the Geisenheim AVS trial indicate that AVS can positively influence phytosanitary conditions, leading to improved grape quality and reduced losses from fungal infections (Garstka et al., 2023; Gambetta et al., 2020; Garstka et al., 2024) potentially offsetting the shading effects of the panels. The economic value of these benefits, however, depends significantly on the market segment being targeted.

For the niche market of premium wine production, higher quality grapes can command better prices. In this segment, where storytelling and the promotion of additional benefits are critical, adopting innovative solutions like AVS can serve as a compelling marketing message to enhance the company’s image as innovative, climate- and emission-conscious, and environmentally committed. Conversely, in the dominant market segment for grape and bulk wine production - estimated to constitute 75% of production in Germany (Loose and Pabst, 2018) - only yield and a basic level of grape quality is economically pertinent for producers.

The quantified value of these synergistic effects has a positive impact on the overall profitability of AVS. However, the relevant components and their magnitude are specific to the site and the producer. Currently, there is a scarcity of empirical data available to comprehensively evaluate these joint effects.

2.2.2 Costs of viticulture

2.2.2.1 Process efficiency and its impact on viticultural cost in AVS

In viticulture, process efficiency is a primary determinant of operational costs. The degree of mechanization, which inversely correlates with labor intensity, serves as a significant driver for efficient vineyard management and associated cost reductions (Strub et al., 2021).

The support structure for the initial AVS in viticulture in Germany, designed for research purposes, is integrated within the vineyard’s trellis system. This arrangement allows tractors to traverse the rows. However, certain viticultural operations, such as trimming, spraying (depending on the type of sprayer used), and harvesting with a mechanical harvester, necessitate over-the-row mechanization. The support structure of the PV system precludes the use of over-the-row machinery in these rows, dictating manual execution of these tasks, which consequently leads to higher labor hours and increased labor costs. Thus, positioning the PV support structure within the vine rows can negatively impact management costs.

An alternative approach for commercial viticulture involves not planting vines in the rows where the PV support structures are installed. This configuration ensures full mechanization but may decrease potential yield due to the lower vine density per unit area.

Future technological advancements in viticulture, particularly the development of autonomous robotic systems, may offer solutions that replace the need for over-the-row machinery (OIV, 2021). These innovations could allow the PV support structures to be installed within the vine rows without compromising mechanization. Experts predict that such technological solutions will become viable in the long term, particularly in the context of further labor shortages and a stabilized profitability of the wine sector within a new market equilibrium (Burch, 2021).

2.2.2.2 Elimination of additional costs

The physical protection provided by PV systems may potentially eliminate the need for ancillary costs, such as hail or frost insurance. Additionally, by reducing evaporation, PV systems have been found to lower irrigation requirements by up to 20% (Elamri et al., 2018). These factors collectively contribute to decreasing the overall costs of viticulture. Enhanced yield consistency - resulting from greater resilience to extreme weather events and their associated effects - improved spraying regimes, and better contributions to worker health and safety represent additional potential benefits. However, these aspects are site-specific and remain challenging to quantify in monetary terms at present.

2.2.3 Implicit regulatory effects

A comprehensive analysis of the economic sustainability of AVS must also incorporate country-specific regulations, including tax and inheritance implications. In Germany, AVS offers distinct valuation benefits compared to standard solar parks. Agricultural land is assessed at a lower value than commercial land, leading to reduced inheritance taxes. Fields equipped with elevated PV systems over crops are classified as agricultural land, provided the yield level remains at least 66% of a reference average yield without PV installation (DIN 91434, 2021). In contrast, solar parks with PV-GM are classified as commercial areas, resulting in higher inheritance taxes. Similar country-specific regulatory effects could exist elsewhere and should be accounted for in the overall assessment.

3 Materials and methods for simulation of AVS scenarios

To provide an initial assessment of the profitability of AVS in viticulture, the costs and revenues of the PV system, as well as those of viticulture beneath the PV installation, are simulated according to the framework developed in Section 2, as outlined by Equations 1 and 2.

This section outlines the methodology for the economic assessment and specifies the primary simulation parameters employed. These parameters are derived from considerations of Fraunhofer ISE research projects, interviews with industry experts, and assumptions based on other documented field trials (Müller et al., 2016; Becker and Dietrich, 2017; Strub and Loose, 2021; Mengel, 2022; Abeysinghe et al., 2016; Jäger et al., 2022; Schindele et al., 2020; Trommsdorff et al., 2022b), as data from the new experimental installation at HGU in Germany are not yet available. It is important to underscore that this analysis assumes all parameters remain constant throughout the economic lifespan of the AVS. Specifically, annual revenues and costs associated with both the PV and viticulture systems are presumed to remain unchanged over time.

Section four utilizes this methodology and these key parameters to evaluate various scenarios, aiming to elucidate the relative impact of different factors on the profitability of AVS in viticulture.

3.1 Technical simulation parameters

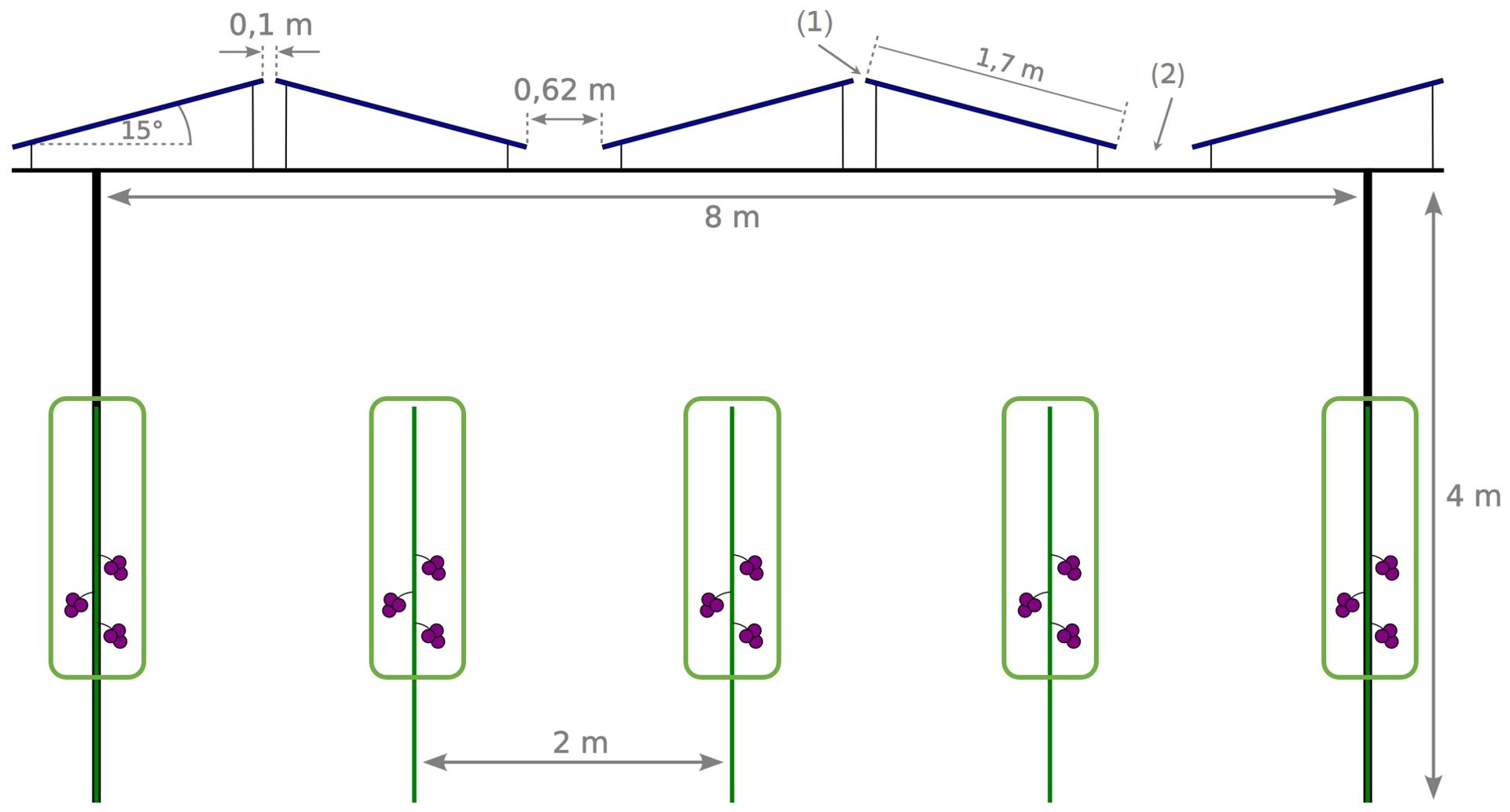

The location of the AVS in Geisenheim (coordinates: 49.986810°, 7.947557°) was selected as the starting point for the parameter survey. The system deployed at HGU represents the first AVS installation in viticulture in Germany, and consequently, most system parameters are derived from this site. However, the static system used in this study slightly deviates from the existing AVS at HGU, embodying further optimizations. In consultation with yield simulation experts at Fraunhofer ISE, an east-west orientation for the solar panels was selected here to optimize PV yield at varying shading intensities.

The technical specifications of the simulated PV system are detailed in Figure 2. Generally, reducing the ‘gable spacing’ (1) and increasing the distance between the PV modules at the bottom edge (2) minimizes self-shading among the PV modules. Half of the rows are oriented east, while the other half face west.

Figure 2. Illustration of the simulated AVS (Source: own illustration); (1) Gable spacing of AVS; (2) distance between modules on bottom module edge.

There are two primary approaches to mitigate the shading effect of PV modules on the underlying vines. One approach is to decrease the PV density above the vines (Dupraz et al., 2011). The alternative approach involves using semi-transparent PV modules with a radiation transmittance of 50% or more (Wong et al., 2008). The VitiVoltaic facility at Geisenheim University features a calculated transmittance of 70%. A similar concept to illustrate transmittance is opacity. Modules with lower (higher) opacity exhibit higher (lower) transmittance. For instance, a transmittance of 70% equates to an opacity of 30%. The degree of transmittance and opacity directly impacts both grape yields and energy yields. Higher opacity prioritizes energy production and is likely to reduce grape yields, whereas lower opacity prioritizes grape production, resulting in lower energy yields.

3.2 Economic simulation parameters

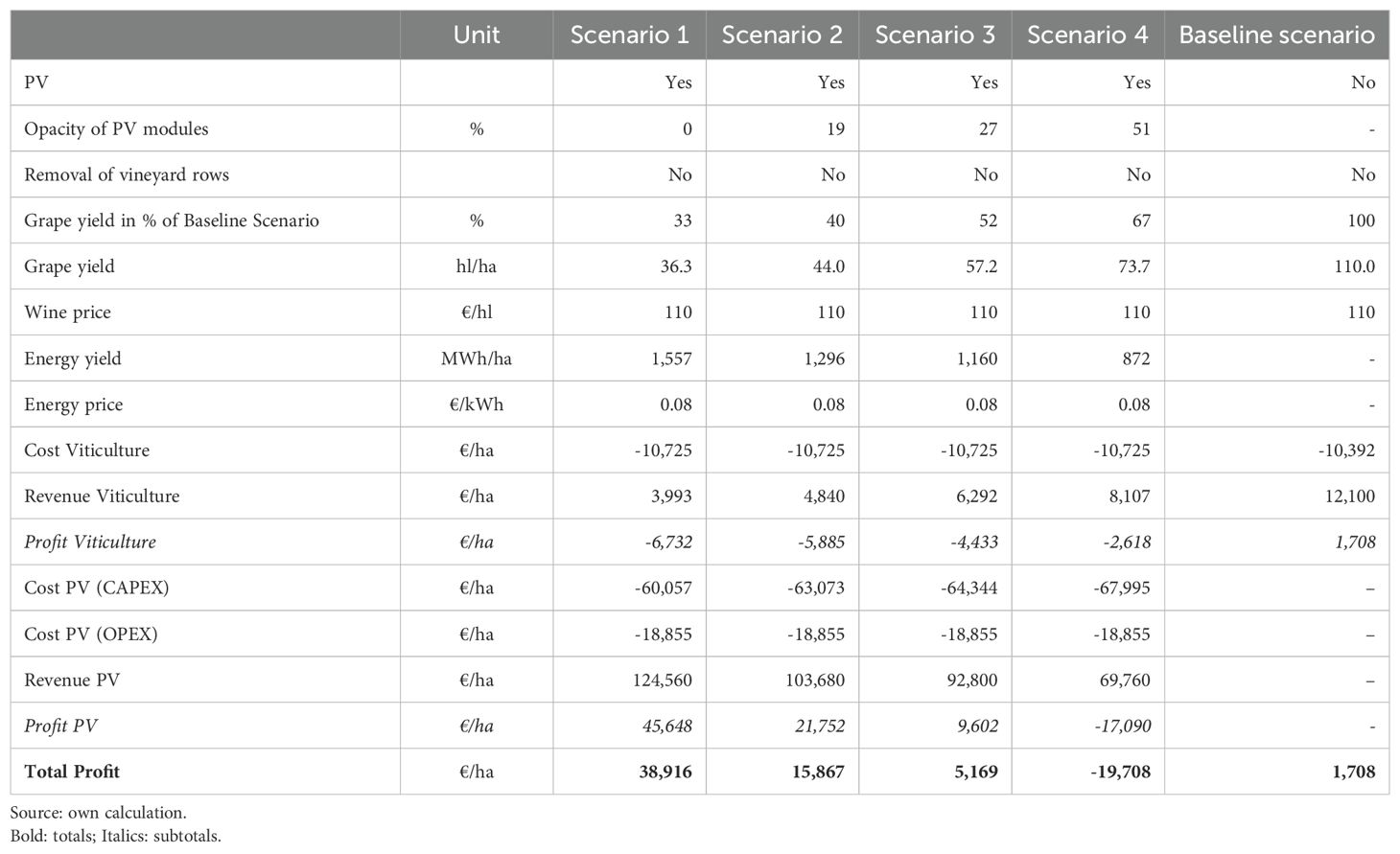

The economic assessment is based on annual costs, revenues, and profits for both the PV system and the viticultural system. The total annual profit of the AVS is then derived. The net present value (NPV), representing the discounted sum of annual profits against the total investment over the AVS’s economic life, is also calculated. Various AVS scenarios are compared to a baseline scenario of standard viticulture without PV. All simulation results are standardized to a one-hectare area.

The economic parameters presented herein reflect current conditions and assumptions. In Chapter 4, these assumptions are varied ceteris paribus to assess the relative leverage effects of different cost and revenue drivers on overall economic profitability.

3.2.1 Annual cost and revenues for PV system

Revenues from PV yields are based on yield simulations for different degrees of opacity (Table 1) and are calculated assuming the full marketing of energy at a feed-in tariff of 8 ct/kWh. This feed-in tariff includes the market price plus a technology premium under the German Renewable Energy Sources Act. The simulation does not account for the degradation of PV modules and the corresponding decrease in energy yield, to emphasize differences due to varying opacity levels. Estimates of annual degradation range between 0.2% and 2% (Jampole and Chaudhary, 2023; Olczak, 2023; Atia et al., 2023). Further research is required to obtain reliable estimates for inclusion in the economic assessment.

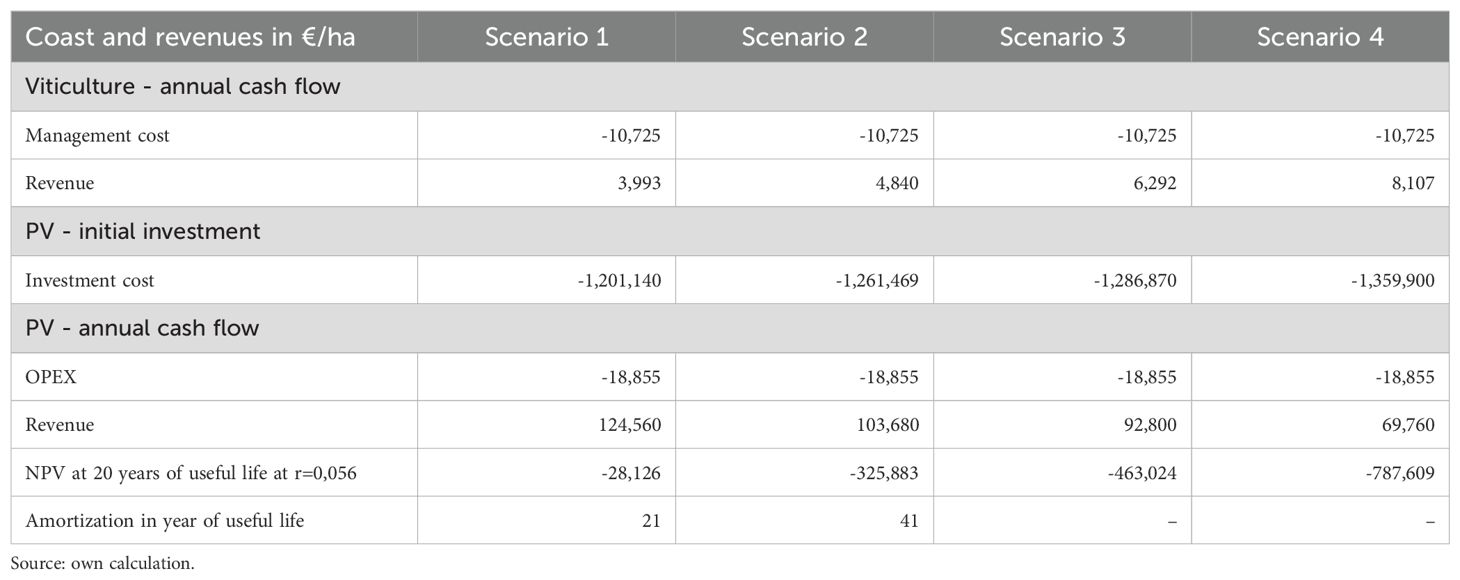

Table 1. Results of the cost and revenue analysis of PV and viticulture for different degrees of opacity, based on a cultivated area of one hectare (annual costs and revenues).

CAPEX includes costs for modules, inverters, substructures, installation, and planning. Opaque modules are less expensive than transparent ones. The cost of connecting the system to the electricity grid’s feed-in point is excluded from these scenarios, as it is primarily determined by the individual distance to the feed-in point, and including it would hinder the universal applicability of the figures to different circumstances. OPEX encompasses costs for land lease, area maintenance, monitoring, repair and maintenance, surveillance, commercial management, and other expenses. The assumed OPEX costs used in this analysis are derived from guidelines provided by Fraunhofer ISE (2024), as there are currently no robust empirical cost data available from practical applications. Relative to the costs associated with traditional viticultural management, these OPEX figures appear relatively high. At the assumed level, they have a significant impact on the overall profitability of the AVS system. Consequently, actual cost values from recently established AVS sites are eagerly anticipated. The profit from PV is calculated as annual revenue minus the annual cost of the PV system.

3.2.2 Annual cost and revenues for viticulture

Viticultural costs were determined based on an analysis of viticultural management costs (Strub et al., 2021) and cost accounting in viticulture (Mengel, 2022). Expert interviews with viticultural economists from Geisenheim University provided estimates of changes in costs and revenues in viticulture due to the introduction of AVS. An optimal AVS system in viticulture would involve the simultaneous installation of the PV system and the planting of the vineyard. However, the simulation maintains constant viticultural management costs throughout the useful life of the vineyard, neglecting the differences in management practices of a young and an established vineyard, to enhance the clarity of the calculations.

The empirical results from Abeysinghe et al. (2016) in New South Wales, Australia - assigned to the same climate zone as Germany - were used for viticultural yield simulations under different degrees of opacity. The corresponding yield responses are detailed in Table 1.

The price for wine was assumed to match the long-term average price for quality bulk wine in the Rheingau area, approximately 110 €/hl. This figure is based on monthly publications of bulk wine prices for Riesling, the most important grape variety in the Rheingau. Due to a global oversupply in 2024, bulk wine prices are considerably lower at around 80 €/hl. Viticultural revenue was calculated by multiplying yield by price. Again, the yield level is simulated to remain constant over the lifespan of the system, even though full yields are not expected before the third year of the vineyard. The profit from viticulture is derived as annual revenue minus the annual cost of viticulture.

3.2.3 Net present value of profits

The total annual profit of the AVS is derived as the aggregate of profits generated from PV operations and viticulture. Employing the NPV method, the discounted stream of total annual profits over the economic lifespan of the AVS is subtracted from initial investment costs. The useful life of the AVS is projected to be 20 years, to align the useful life with the maximum duration of external financing through a bank loan.

The discount rate, reflecting the risk associated with an investment, is set at 5.6%, based on wine estate-specific estimates (Strub and Loose, 2023). This rate incorporates both sectoral and individual winery risks based on leverage. However, this discount rate does not yet account for significant economic risks associated with climate change (van Leeuwen et al., 2024) and fundamental shifts in wine demand (Loose and Del Rey, 2024). A significantly higher discount rate would be required to reflect these unsystematic risks, which would substantially reduce the NPV of the AVS.

4 Results – economic assessment of simulated scenarios

The assumptions specified in Chapter 3 are first applied to four scenarios with different degrees of opacity that are compared to the baseline scenario of viticulture without PV. The scenario with lowest opacity is then adapted to reflect varying revenue and cost assumptions. To permit full mechanization and reduce OPEX of viticulture one scenario is analyzed where every fourth row is removed. The impact of reduced CAPEX of the PV due to economies of scale in the production of AVS is assessed in two scenarios. Scenarios considering the self-consumption of a share of the produced energy are also examined. Furthermore, the production of higher-value premium and ultra-premium grapes is analyzed in distinct scenarios. Another scenario explores the condition where grape yields are not adversely affected by PV shading. The analysis concludes with a final scenario that combines a total of six positive changes, including an increase in the feed-in tariff for energy.

4.1 Scenarios for different degrees of opacity

The scenarios outlined in Table 1 differ in their degree of opacity, resulting in varying shading intensities and grape yields when compared to the baseline scenario of viticulture without PV. Scenario 1, featuring opaque modules, achieves the highest energy yield. With increasing module transparency from Scenario 2 to Scenario 4, energy yield priority diminishes.

The viticultural costs under the AVS for Scenarios 1 to 4 reflect significantly higher shares of manual labor due to the inability of over-the-row machinery to navigate rows with PV system support structures. The Baseline scenario, representing viticulture alone, shows a modest profit of €1,708 per hectare per year. As shading intensity increases from Scenarios 1 to 4, viticultural losses also rise, with Scenario 1 incurring the highest loss at €6,732 per hectare per year. Only Scenario 4, which utilizes the most transparent PV modules, achieves the minimum required grape yield of 66% to qualify as an AVS under German regulation (section 2.2.3). Scenarios with higher opacity fail to meet this minimum requirement. Therefore, Scenario 4 serves as the basis for adaptation in subsequent scenarios.

In terms of PV operations, Scenario 1 yields the highest profit at €45,648 per hectare per year, followed by Scenarios 2 and 3 with positive profits of €21,752 and €9,602 per hectare per year respectively. Scenario 4, however, records losses from PV operations.

Overall profitability is realized in Scenarios 1, 2 and 3, which post net profits of €38,916, €15,867 and €5,169 per hectare per year respectively. In these scenarios, the emphasis on electricity yield ensures PV profits surpass viticultural losses. Conversely, Scenario 4 which ensures the vineyard site to remain agricultural land results in overall losses, as combined revenues from PV and viticulture fail to cover costs.

The NPV calculations, detailed in Table 2, indicate that only Scenarios 1 and 2 approach paybacks at all. However, both scenarios fail payback within the planned useful life of 20 years, that would align with the duration of external financing.

For Scenarios 3 and 4, revenues are insufficient to recoup initial investments and annual costs. Given the current investment costs for PV systems, and the presumed yield levels for both energy and grapes, alongside assumed energy and wine price points, an investment in AVS is economically impractical. Therefore, such investments would necessitate cross-subsidization from other revenue streams within the wine business.

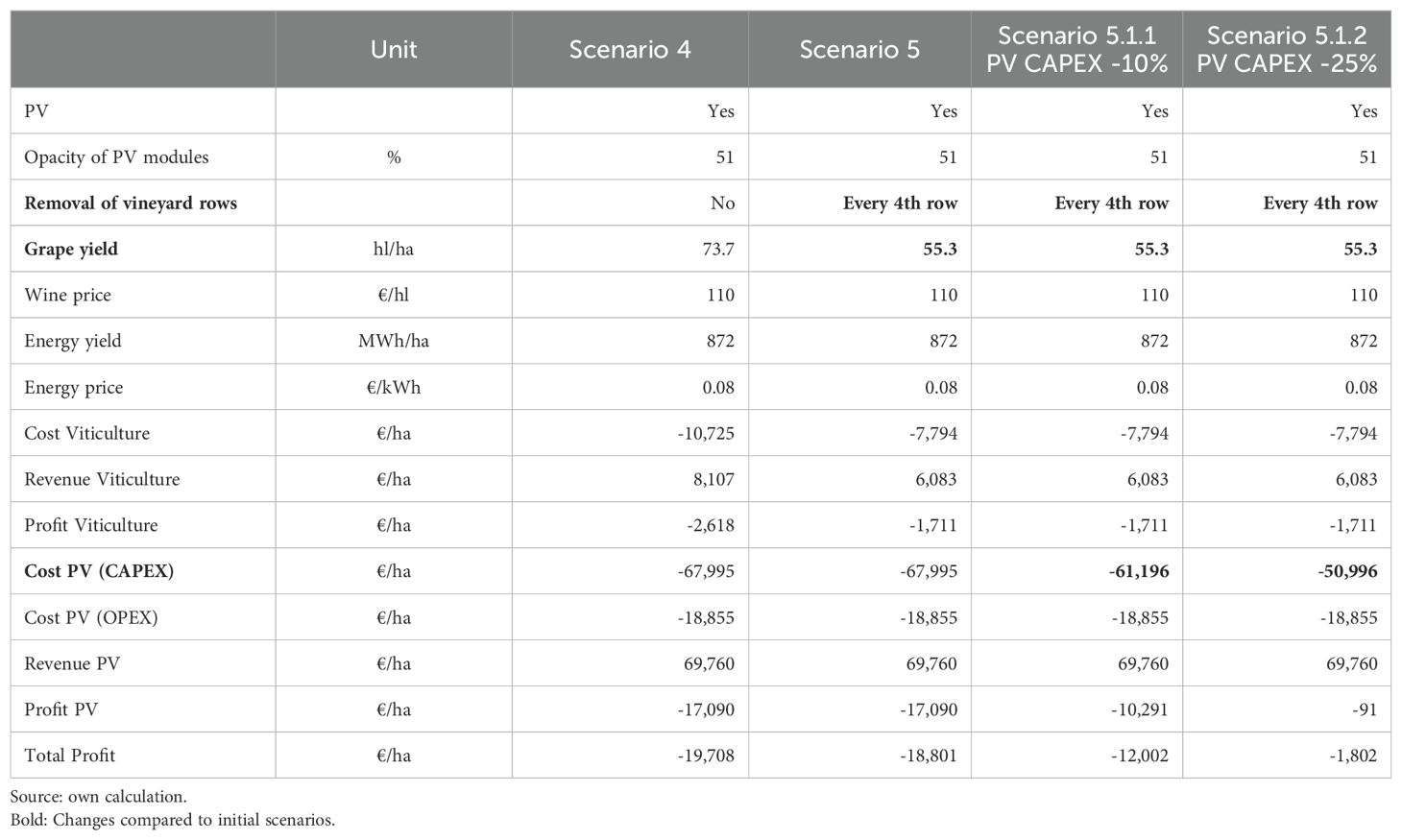

4.2 Scenario with fewer rows to permit full mechanization

To facilitate full mechanization using over-the-row technology, Scenario 5 simulates an adapted vineyard configuration in which every fourth row, containing support structures for the PV system, is removed. This adjustment results in a 25% reduction in both viticultural OPEX and grape yield compared to Scenario 4.

A comparison of the viticultural profit between Scenario 4 and Scenario 5, as presented in Table 3, reveals that the removal of vines in rows with support structures enhances economic outcomes. Although Scenario 5 experiences a reduction in grape yield relative to Scenario 4, this loss is more than offset by the lowered management costs due to full mechanization. Enabling efficient mechanization under PV is particularly crucial for bulk wine production, as assumed in this study. However, for premium wines (section 4.5), the yield reduction might offset the benefits of mechanization.

Table 3. Effect on profitability of every 4th row removed and reduced CAPEX for the PV system – Scenario 5 and two variations based on Scenario 4, based on a cultivated area of one hectare (annual costs and revenues).

4.3 Scenarios with reduced CAPEX for the PV system

Given the relative novelty of AVS in viticulture, current installations are predominantly custom-built solutions. It is anticipated that standardized, off-the-shelf systems will emerge as the technology gains broader acceptance, leading to a reduction in prices. Table 3 illustrates the impact of 10% and 25% reductions in CAPEX for the PV system on overall profitability. A 25% reduction in CAPEX comes close to achieving break-even for the PV part of operations. To achieve a break-even point for the whole AVS based solely on reduced system costs, the CAPEX would need to decrease by 29% relative to the values used in Scenario 4.

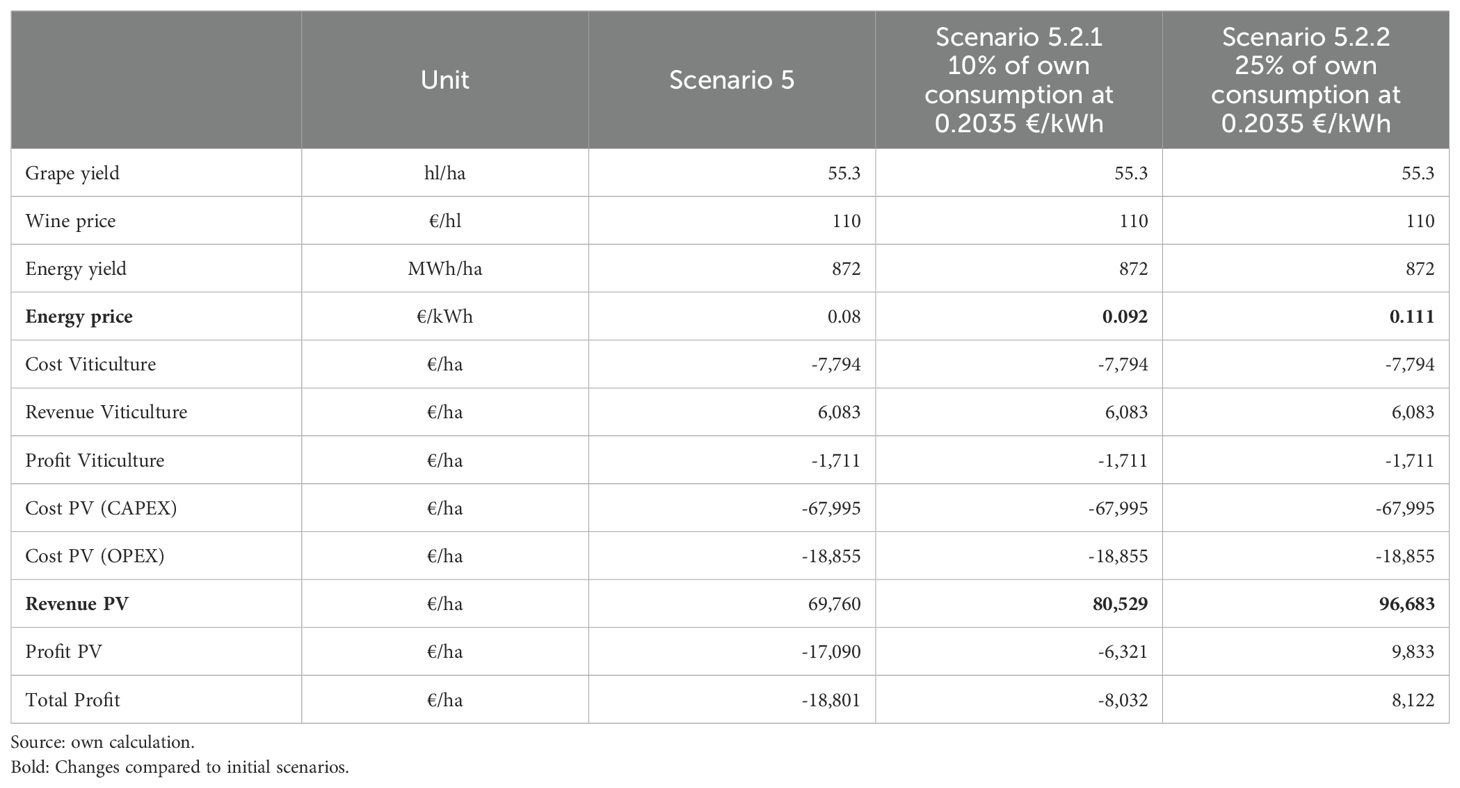

4.4 Scenarios with self-consumption of produced energy

Scenarios 1 to 4 are predicated on the assumption that all energy produced by the PV system is fed into the grid at a fixed market price. However, higher opportunity costs arise when the winery can utilize a portion of the produced energy for its internal processes. Self-consumption would be especially advantageous for wineries from spring to fall, during daylight hours when PV energy production is at its peak. During these periods, cooling systems - which are essential for many winery operation - operate predominantly in the hottest hours of the day, coinciding with maximum energy production and aligning production with consumption.

Even though many vehicles already allow relatively rapid charging up to a high level of battery power, it is critical to recognize that vehicles are typically used during the day when electricity production is highest, necessitating flexibility in charging schedules to decouple energy production from the charging process. In the future, innovations such as easily replaceable batteries, tools, or autonomous vehicles that operate at night and recharge during the day may enhance this flexibility, though they would entail additional investment costs.

To minimize connection costs, the AVS should be geographically proximate to the winery’s site. It is important to note that the self-consumption of energy has limits and cannot scale indefinitely with the expansion of vineyard areas under PV. Eventually, the demand for self-consumed energy will reach equilibrium, beyond which additional PV installations will result in decreasing percentages of self-consumption, thereby diminishing the average price effect. The actual proportion of self-consumption is highly contingent upon the size of the PV system and the winery’s specific energy demands and distribution patterns throughout the year.

Table 4 presents the outcomes when 10% and 25% of the winery’s electricity needs are assumed to be met by AVS-produced electricity at a rate of €0.2035 per kWh, which corresponds to the average electricity price for industrial users (non-households) (Destatis, 2024). Comparing these two levels of self-consumption, it becomes evident that the monetary value of self-consumed energy significantly enhances profitability. Specifically, 10% self-consumption at €0.2035 per kWh results in a 15% increase in value, while 25% self-consumption leads to a 39% increase in average value.

Table 4. Effect of self-consumption of produced energy on profitability – variations of Scenario 5, based on a cultivated area of one hectare (annual costs and revenues).

Similar positive effects are observed if the feed-in tariff increases, possibly due to a price premium for AVS-produced energy, or if energy yields improve due to more efficient PV modules or greater solar radiation - such as might be found in southern France or Spain. To achieve a break-even point, there would need to be a 27% increase in either the energy yield or the price, or a combination of both, relative to the assumptions used in Scenario 5. That said, Scenario 5.2.2 with a 39% increase of energy value leads to a profit of €8,122 per hectare and year for the AVS.

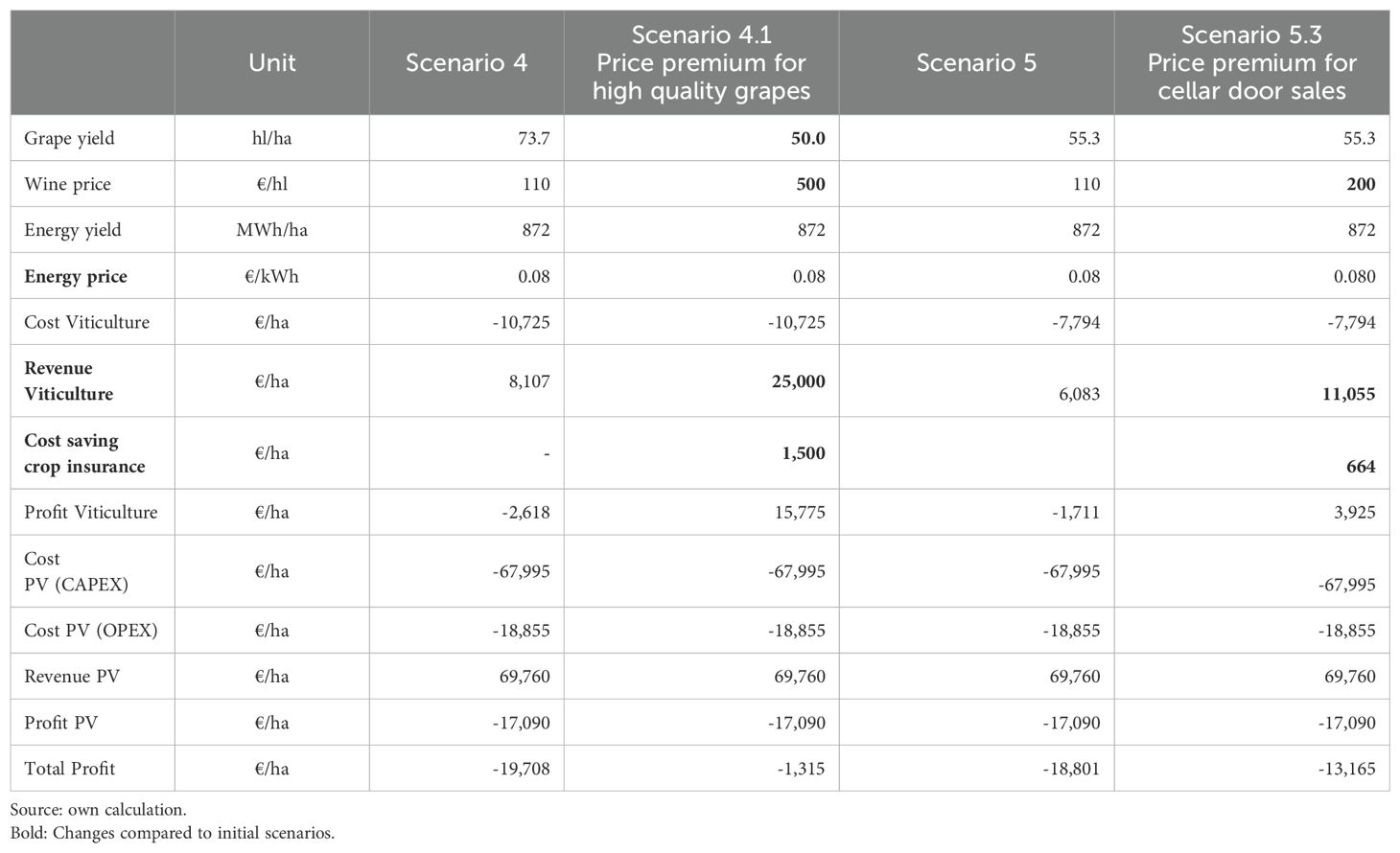

4.5 Scenarios for production of premium grapes with crop insurance

In addition to generating electricity, constructing PV systems over vineyards provides several supplementary benefits, particularly in terms of offering physical protection to plants and crops. However, the value of such protection is contingent upon the value of the crops themselves. Consequently, it is more rational to protect vineyards that produce premium grapes, such as those used in Verband der Deutschen Prädikatsweingüter (VDP) Große Gewächse (GG) wines in Germany or Grand Cru wines in France, rather than vineyards that produce lower-quality, bulk wine grapes.

In the context of premium and ultra-premium grape production, a reduction in yield is often desirable. For Scenario 4.1 in Table 5, the target yield is set at 50 hectoliters per hectare (hl/ha). Hence, the shading effect aligns with the targeted yield reduction, though the impact on grape quality remains to be thoroughly investigated.

Table 5. Effect of premium wine prices on profitability – variation of Scenarios 4 and 5, based on a cultivated area of one hectare (annual costs and revenues).

The grape price is assumed to be €500 per hectoliter, reflecting the current market price for Champagne grapes, a typical example for ultra-premium products. For comparative purposes, Scenario 4, which relies on manual labor, is chosen, as manual viticultural practices, including grape harvesting, are standard in premium wine production, particularly in plots that are not fully mechanized.

It is assumed that the winery maintains crop insurance, which would become redundant if the vines are adequately protected by the PV system. Comprehensive crop insurance costs approximately 6% of the insured sum (Unfiltriert Versicherungsmakler GmbH, 2024), translating to about €1,500 per hectare for the specified yield and grape price. These insurance savings are factored into the profit calculations. Such insurance typically covers losses only in the year the initial damage from frost or hail occurs and not in subsequent years due to damage to the shoot. Therefore, this represents a conservative estimate, as the value of AVS protection may be even greater if it effectively shields the vines from hail and frost.

In the case of premium wines, with the insurance cost waiver, the profitability of the viticultural activity increases to a positive outcome of €15,775 per hectare.

The implementation of an AVS may also support a sustainable marketing narrative. This marketing benefit is particularly potent in a direct-to-consumer sales context, forming the basis for Scenario 5.3. Here, the average wine price is set at €200 per hectoliter to reflect the enhanced value achieved through cellar door sales in bottles as opposed to bulk sales. The cost savings from foregoing crop insurance, again at 6% of the insured sum, amount to €664 per hectare. These assumptions yield a profit for the viticultural activity of €3,930 per hectare. Nevertheless, the viticultural profits in both scenarios remain insufficient to balance the losses from energy generation, resulting in overall negative total profits.

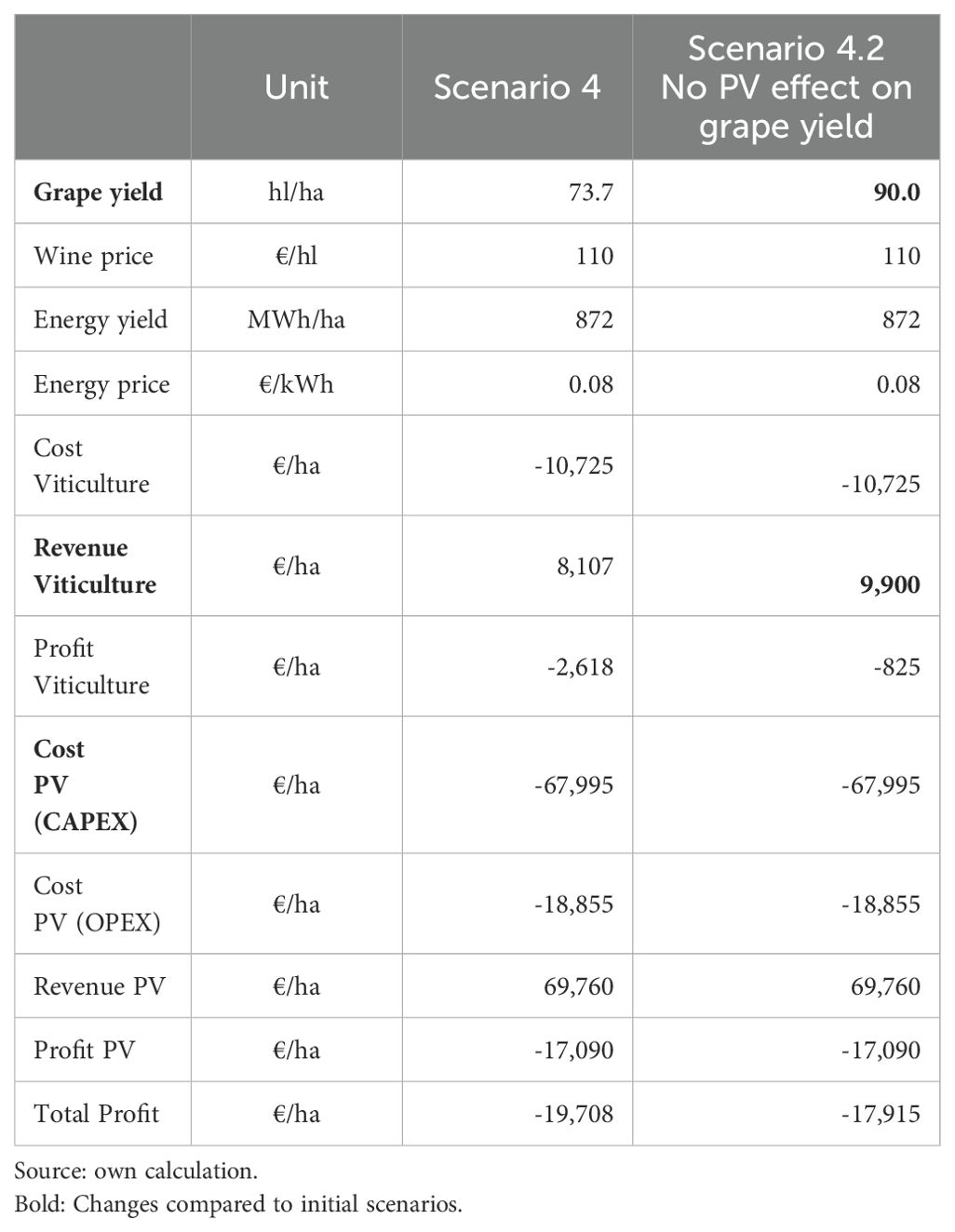

4.6 Scenario with grape yields unaffected by PV

Preliminary results from the research conducted at Geisenheim University suggest that the installation of PV systems above vines - resulting in a combination of reduced solar radiation and protective synergy effects - does not necessarily lead to diminished grape yields. However, these initial findings require long-term experimental validation. In Scenario 4.2, it is assumed that grape yields are not impacted by the presence of PV systems, and the scenario is therefore based on the average German grape yield of 90 hl/ha.

In Scenario 4.2, as outlined in Table 6, the number of vines and viticultural costs are assumed to be equivalent to those in Scenario 4. Consequently, manual labor is required for every fourth row where over-the-row technology cannot be utilized.

Table 6. Effect of unaffected grape yields on profitability, based on a cultivated area of one hectare (annual costs and revenues).

For this scenario, viticultural activities are slightly below the break-even point. With a yield of 90 hl/ha, the wine price required to achieve break-even is €119/hl. However, the losses from the PV component remain unmitigated and cannot be compensated by the viticultural profits.

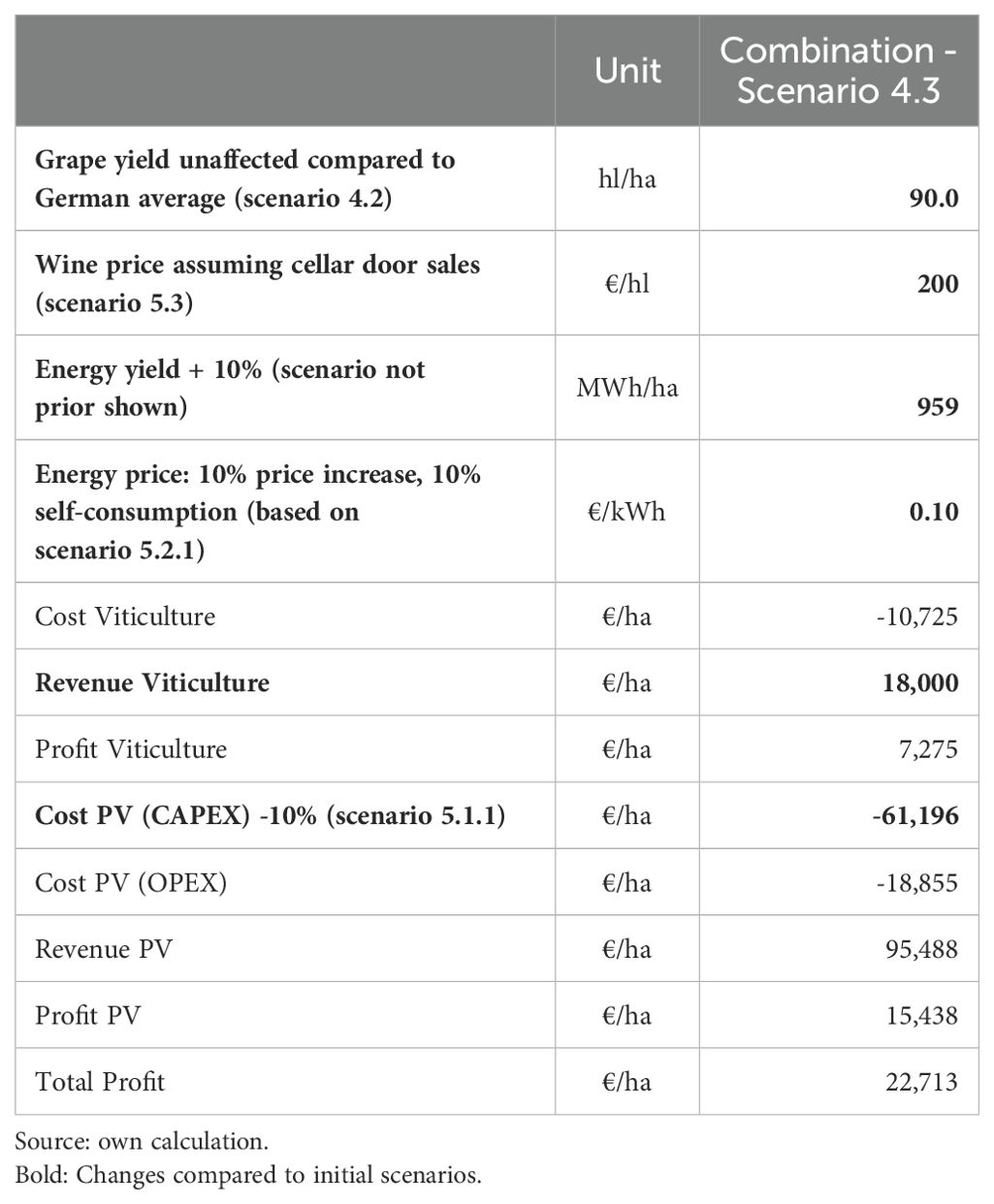

4.7 Scenario with combined strong positive changes in key variables

The adapted scenarios analyzed thus far have identified investment costs and revenue from the PV system as the primary economic drivers for profitability of AVS. Unsurprisingly, the current high investment cost of up to €1.36 million per hectare for the PV system represents the most significant leverage on economic performance. To achieve profitability, either these costs must be substantially reduced, and/or the revenue from feeding-in and/or self-usage of the electric energy must be significantly increased. By contrast, the impact of the viticulture system on the overall economics is relatively minor. Specifically:

- A 10% reduction in CAPEX for the PV system reduces losses by 39%.

- A 10% increase in feed-in tariffs reduces losses by 37%.

- A 10% premium on the wine price improves the overall result by just 7%.

Given that only considerable changes to the CAPEX are sufficient to render AVS profitable, it is logical to consider a combination of these changes. An illustrative scenario encompassing combined positive modifications across six key drivers is presented in Table 7. This scenario assumes that the grape yield remains unaffected by shading from the PV system (Scenario 4.2) and that the wine is priced at cellar-door value (Scenario 5.3). Additionally, the energy production yield is increased by 10%, potentially due to a more southerly location of the AVS. Furthermore, energy feed-in tariffs are assumed to be 10% higher, with 10% of the energy being self-consumed at opportunity costs of €0.2035 per kWh (Scenario 5.2.1). This scenario exemplifies a simultaneous combination of substantial, yet conceivable, modifications to six variables under the existing conditions.

Table 7. Effects of combined positive changes in key variables, based on a cultivated area of one hectare (annual costs and revenues).

Under these strong assumptions, both components of the AVS - the energy generation and the viticultural activity - achieve positive results. This leads to a total profit of over €20,000 per hectare per year, ultimately resulting in a positive Net Present Value (NPV) after 31 years. However, the time required to achieve payback still exceeds the recommended useful life of 20 years, as stipulated by tax regulations and the typical duration of external financing.

5 Discussion and future research

The discussion section synthesizes the research findings, delineates the limitations, and proposes an agenda for future research into AVS in viticulture.

5.1 Framework of economic assessment and summary of results

This study has developed a comprehensive framework that integrates a wide array of factors influencing the economic performance of AVS in viticulture. The framework utilizes parameters derived from existing research and expert advice, applied to the geographic and physical conditions of AVS at Geisenheim University. However, the framework’s generality ensures its universal applicability to different locations, regulatory environments, and business conditions.

Under the current cost and revenue conditions, along with the specific geographical context of Geisenheim in Germany, AVS is not economically viable. Positive profit can only be realized after 21 and 41 years if the PV modules have no or low transparency (Scenarios 1 and 2), but this would likely result in insufficient grape yield. In all other scenarios with higher transparency PV modules, the revenues generated from PV never balance the associated costs.

Nine scenarios were developed in this study to assess the influence of different economic drivers on the profitability of AVS. The cost and revenue associated with the PV system have the strongest impact on overall profitability. The PV system could become profitable through various avenues: enhanced returns from more efficient solar panels, a location with greater solar radiation, higher feed-in tariffs, usage of energy with higher opportunity costs (e.g., self-consumption), or reduced costs through economies of scale and technological advancements. For instance, a 10% reduction in CAPEX for the PV system and a 10% increase in feed-in tariffs could reduce losses by 39% and 37%, respectively.

The impact of viticulture on the overall profitability of AVS is comparatively minor. A 10% increase in wine prices or a similar synergistic benefit between PV and viticulture would only decrease losses by 7%.

To make AVS profitable, a combination of positive influences on the cost and income structure is necessary. If six key variables are improved by 10% each, AVS becomes profitable after 31 years.

5.2 Future development of the economic framework

The economic assessment framework utilized in this study encompasses several limitations and simplifications that can be enhanced in future iterations and specific applications. Future improvements should focus on the following seven areas:

1. Grid connection costs: The costs of connecting the AVS to the electric grid depend on the geographical distance and geological and logistical conditions between the AVS and the grid and should be included in the analysis of real business cases.

2. Variable feed-in tariffs: A fixed feed-in tariff per kWh was used for simplification, not accounting for penalties or negative tariffs during periods of oversupply. Annual revenues and profits from the PV system are likely to be significantly impacted by variable feed-in tariffs, which should be considered in real-case scenarios. Future availability of low-cost energy storage systems may buffer peak supply but add to CAPEX.

3. Dynamic revenue and cost streams: The analysis applied here assumes uniform revenue and cost streams over the lifespan of the system. The framework can be extended to a dynamic model with annual variations in revenue and costs, accounting for panel deterioration, expected rising opportunity costs of self-consumed energy, and increasing OPEX, e.g. due to wage increases as well variable costs and revenues for the different stages of a newly planted vineyard.

4. Expected future revenues and cost: Historical prices and costs may be inadequate predictors of future economic performance. Therefore, economic assessments should ideally use anticipated future values for both prices and costs. For instance, the wine price used in the base scenario is based on long-term historical averages and does not take into account the current low bulk wine prices (~€80/hl), which make traditional viticulture unprofitable.

5. Discount rate and structural risk: The applied discount rate of 5.6% reflects historical sectoral and wine business risks but fails to account for emerging structural risks such as climate change (van Leeuwen et al., 2024) and the declining global wine demand, which leads to intense price competition and declining profitability (Del Rey and Loose, 2023). A higher discount rate should be employed to incorporate these additional risks. If future revenue streams are subject to higher discount rates, either investment costs must decrease or revenues need to increase to maintain profitability.

6. Economic life synchronization adding to cost and risk: The economic lifespan of PV components and the vineyard should be synchronized. Establishing an AVS alongside a new vineyard could protect young vines, representing an optimal solution. However, this approach necessitates simultaneous large investments, with new vineyard planting costs in Germany currently estimated at €40-50k. Both viticulture and PV systems are long-term investments with lifespans of at least 20 years, representing high sunk costs. This lump-sum risk should be considered in the analysis by increasing the risk premium for the discount rate.

7. Useful life assumption: The study assumes a useful life of 20 years for the AVS aligning with the tax law prescribed useful life of such an investment. Given market conditions and high uncertainty, wine businesses may be reluctant to invest unless the innovation pays off within 10 years.

5.3 Agenda for future research into AVS

The economic framework and the various scenarios highlight the necessity for more empirical knowledge and parameter estimates. An extensive agenda of required research is suggested here, encompassing several key areas: the viticultural effects of AVS, the quantification of synergistic benefits, the optimal design of viticultural processes, and the assessment of both positive and negative external effects.

5.3.1 Research into the viticultural effects of AVS

The impact of top-mounted PV modules on the viticulture beneath them is currently not well understood. Research is needed in three main areas: (a) the effect of PV modules on the quality and yield of wine, (b) the extent and value of various potential synergistic benefits from PV modules protecting the vines, and (c) the impact of the mounting structure on viticultural processes.

5.3.1.1 Research into the effect of shading on wine quality and yield

Changes in the ingredients and chemical composition of berries and wine due to partial but continuous shading are currently hardly investigated. Therefore, it is crucial to thoroughly understand how PV systems impact vine quality and yield. The scenarios examined in this study identified yield and wine value as the primary drivers for synergistic benefits. Producers of premium and ultra-premium wine, who stand to benefit most from these high synergies, need to discern the effects of PV systems on the quality and composition of their wines. For instance, growers of grand cru wines must be assured that the quality of their wines will not be adversely affected before they adopt AVS solutions. Conversely, producers in the base segment, where a certain quality level suffices, should focus on understanding the impact of PV systems on yield. In this regard, the effects of varying degrees of opacity must also be analyzed.

Long-term trials are necessary to substantiate and potentially revise the assumptions regarding PV’s impact on yield presented in this study’s scenarios. Due to significant annual variations in growing conditions, robust estimates require long-term data series. For example, the first trial year in Geisenheim in 2023, characterized by unusually wet conditions in late summer, resulted in higher yields under PV systems due to better protection from Botrytis cinerea infection. It is important to note that these results are preliminary, as it was the first harvest year under AVS and the buds had developed under non-AVS conditions the previous year. The long-term effects of shading on bud development in subsequent years remain unknown.

5.3.1.2 Synergistic benefits for viticulture

AVS hold significant potential for mitigating the effects of climate change on viticulture. These systems offer numerous benefits, such as reduced need for plant protection, improved water management, decreased risks of late frost, sunburn protection, and hail protection.

A recent analysis of AVS in apple farming has already demonstrated synergies for plant protection. For example, the amount of fungicides needed can be reduced due to less moisture accumulating on leaves and fruits sheltered by PV modules (Trommsdorff et al., 2023). Additionally, AVS can play a critical role in rainwater harvesting and water management, especially on shallow or sandy soils with low water-holding capacity. It will also impact the grapevine water status by reducing the evaporative demand. This ensures that yields remain stable during increasingly hot and dry years, conditions under which grape yields typically decline. Given that drought during heat waves will become an increasingly limiting factor, rainwater harvesting and drip irrigation via AVS may become essential even in German viticulture, and certainly in Southern Europe. Experimental trials are necessary to determine which physical designs of AVS can effectively protect vines from hail. Initial AVS experiments with apple trees indicate that hail may still enter through gable spaces.

The value of these synergies critically depends on geographical conditions (e.g., water stress, hail risk, late frost risk) and is likely to change as climate change continues (van Leeuwen et al., 2024). Ideally, multiple trials should be conducted in diverse locations to gather sufficient information under different conditions.

Simulations show that the economic value of these synergistic benefits critically depends on the value of the wine produced. The more profitable the vineyard, the greater the value of the synergies. Highly valuable crops, such as grand cru, highly prized single vineyards, and famous appellations like Burgundy or Champagne, benefit most from AVS synergies. These wine-growing areas also have the capacity to absorb the adverse effects of climate change on the economic sustainability of wine production (van Leeuwen et al., 2024). Therefore, future experimental AVS should be tested in viticultural areas with high economic value.

5.3.1.3 Viticultural processes under PV

The physical setup of PV systems affects the feasibility of viticultural processes. With current technology, integrating vines and PV posts within the same row would necessitate increased manual labor in otherwise fully mechanized vineyards. From a cost perspective, this suggests the removal of vines in rows with PV posts. Scenario 5 assumes a 25% reduction in yield due to this configuration, an assumption that needs empirical validation and potential adjustment.

Alternative static constructions and different vineyard designs should be considered to better align existing viticultural technologies with AVS. In the long term, technological solutions such as the deployment of autonomous robots may enable full mechanization even in rows with posts, though this would increase CAPEX.

5.3.2 Research into more cost-efficient PV systems for AVS

The scenario simulations identified the costs and revenues from the PV system as the strongest drivers of profitability for AVS. On the cost side, future experimental trials should aim to find cost-efficient solutions for mounting PV systems.

There are numerous opportunities to increase revenue from electric energy. For instance, selecting locations with higher solar radiation, such as Spain, Italy, or Southern France, can result in greater energy yield. These areas are also the most adversely impacted by climate change. Additionally, employing more efficient panels and viticultural setups that permit higher opacity of the panels can produce more electric energy.

Generally, AVS becomes more profitable as feed-in tariffs and the opportunity costs for self-consumption increase. Similarly, the greater the difference between these two prices, the more attractive it is to use the electric energy within the business or to market it locally. This price differential varies across countries and may fluctuate over time.

Aligning a company’s electricity demand with energy production is crucial. Monitoring the temporal and seasonal patterns of electricity demand in a winery and understanding its flexibility are prerequisites for adjusting the generation and consumption of electric energy. Energy storage systems can increase the share of on-site energy consumption if their benefits outweigh their costs. In the long term, autonomous vineyard management robots could allow vineyard tasks to be performed at night while recharging during the day. This would increase self-consumption and reduce the carbon footprint at the farm level. Additional options include local marketing of electric energy, such as at electric charging stations at the cellar door, and fostering inter-industry co-operations with complementary users of electric energy.

5.3.3 Research into positive and negative external effects of AVS

The economic framework developed in this study focuses on the adaptation of an AVS from the perspective of an individual business. From the viewpoint of a wine business, the decision is driven by profitability - whether the investment will pay off over time and generate a positive return. If not, the wine business should consider investing in more lucrative options, such as roof- or ground-mounted PV systems, or planting grape varieties better adapted to climate change.

A holistic economic assessment from a welfare perspective also includes the positive and negative externalities of AVS. Examples of positive externalities include increased biodiversity (Walston et al., 2024), reduced carbon emissions (if not already accounted for in specific feed-in tariffs), and the preservation of traditional viticultural landscapes. Potential negative external effects include the reduced aesthetic appeal of cultural landscapes due to large AVS installations. While PV systems may provide shade and serve as focal points in the landscape, they inevitably impact the visual appearance of the landscape and its acceptance by society (Fischer et al., 2023; Biró-Varga et al., 2024).

If wine businesses are not financially compensated for these externalities through subsidies, they are unlikely to consider them in their investment decisions. If positive externalities arise, their value should be assessed in long-term viticultural experiments. The AVS installation at Geisenheim will provide valuable information in this regard in the future. A comprehensive assessment of positive and negative external effects of AVS is still necessary.

5.4 Conclusion

AVS have the potential to play a crucial role in mitigating the effects of climate change on viticulture while simultaneously reducing the carbon footprint. This innovative solution was assessed in this study through the application of plausible assumptions. The general economic framework developed here can be universally applied to future trials under varying conditions.

In their current developmental stage, AVS are not yet market-ready for widespread commercial adoption within the German market, a phenomenon consistent with many emerging innovations in their initial trial phases. Currently, the costs of AVS significantly exceed the returns over a 20-year period, rendering them economically unviable for wine businesses at this time. This study identifies that the costs and revenues associated with PV systems have the greatest impact on economic profitability, followed by the value of the wine produced and the synergistic benefits. The research underscores the necessity for further investigation to obtain reliable empirical estimates for cost and revenue calculations. An extensive agenda for future research in this area has been developed and outlined.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

LS: Conceptualization, Methodology, Project administration, Visualization, Writing – original draft, Writing – review & editing. MW: Conceptualization, Methodology, Project administration, Visualization, Writing – original draft, Writing – review & editing. MT: Supervision, Writing – review & editing. MS: Writing – review & editing. CK: Writing – review & editing. SL: Conceptualization, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abeysinghe S. K., Greer D. H., Rogiers S. Y. (2016). The interaction of temperature and light on yield and berry composition of Vitis vinifera ‘Shiraz’ under field conditions. Acta Hortic. 1115, 119–126. doi: 10.17660/ActaHortic.2016.1115.18

Al-Ghussain L., Samu R., Taylan O., Fahrioglu M. (2020). Sizing renewable energy systems with energy storage systems in microgrids for maximum cost-efficient utilization of renewable energy resources. Sustain. Cities Soc. 55, 102059. doi: 10.1016/j.scs.2020.102059

Al Mamun M. A., Dargusch P., Wadley D., Zulkarnain N. A., Aziz A. A. (2022). A review of research on agrivoltaic systems. Renewable Sustain. Energy Rev. 161, 112351. doi: 10.1016/j.rser.2022.112351

Atia D. M., Hassan A. A., El-Madany H. T., Eliwa A. Y., Zahran M. B. (2023). Degradation and energy performance evaluation of mono-crystalline photovoltaic modules in Egypt. Sci. Rep. 13, 13066. doi: 10.1038/s41598-023-40168-8

Becker A., Dietrich J. (2017). Weinbau und Kellerwirtschaft. 16th. (Darmstadt: Kuratorium für Technik und Bauwesen in der Landwirtschaft e.V. (KTBL-Datensammlung).

Bennett A. W., Loose S.M. (2023). : benchmarking economic sustainability: what factors explain heterogeneity between wine businesses? Sustainability 15, 16686. doi: 10.3390/su152416686

Biró-Varga K., Sirnik I., Stremke S. (2024). Landscape user experiences of interspace and overhead agrivoltaics: A comparative analysis of two novel types of solar landscapes in the Netherlands. Energy Res. Soc. Sci. 109, 103408. doi: 10.1016/j.erss.2023.103408

Burch K. (2021). “In-depth interview,” in Digital trends applied to the vine and wine sector. A comprehensive study on the digitalisation of the sector (Paris, France: OIV publications), 32–34. Available online at: https://www.oiv.int/public/medias/8593/digital-trends-applied-to-the-vine-and-wine-sector.pdf.

Cartechini A., Palliotti A. (1995). Effect of shading on vine morphology and productivity and leaf gas exchange characteristics in grapevines in the field. In Am. J. Enol Vitic. 46, 227–234. doi: 10.5344/ajev.1995.46.2.227

Cura D., Yilmaz M., Koten H., Senthilraja S., Awad M. M. (2022). Evaluation of the technical and economic aspects of solar photovoltaic plants under different climate conditions and feed-in tariff. Sustain. Cities Soc. 80, 103804. doi: 10.1016/j.scs.2022.103804

Del Rey R., Loose S. (2023). State of the International Wine Markets in 2022: New market trends for wines require new strategies. Wine Economics and Policy. 12(1), 3–18. doi: 10.36253/wep-14758

Destatis. (2024). Strompreise für Nicht-Haushalte (Deutschland, Halbjahre: Jahresverbrauchsklassen, Preisarten). Available online at: https://www-genesis.destatis.de/genesis/online?sequenz=tabelleErgebnis&selectionname=61243-0005&language=deabreadcrumb.

Dupraz C., Marrou H., Talbot G., Dufour L., Nogier A., Ferard Y. (2011). Combining solar photovoltaic panels and food crops for optimising land use: Towards new agrivoltaic schemes. Renewable Energy 36, 2725–2732. doi: 10.1016/j.renene.2011.03.005

ECB. (2024). Fluctuation of the European Central Bank fixed interest rate from 2008 to 2024. (Statista. Statista Inc.). Available online at: https://www.statista.com/statistics/621489/fluctuation-of-fixed-rate-interest-rates-ecb/ (Accessed November 28, 2024).

Elamri Y., Cheviron B., Lopez J.-M., Dejean C., Belaud G. (2018). Water budget and crop modelling for agrivoltaic systems: Application to irrigated lettuces. In Agric. Water Manage. 208, 440–453. doi: 10.1016/j.agwat.2018.07.001

Eurostat. (2023). Electricity prices components for household consumers - annual data (from 2007 onwards). Available online at: https://bit.ly/3RtWM95 (Accessed November 21 2023).

Eurostat. (2024a). Price indices of the means of agricultural production, input, (2015 = 100) - annual data. Available online at: https://bit.ly/3Rt6Zm4 (Accessed September 11 2024).

Eurostat. (2024b). Labour cost index by NACE Rev. 2 - Index, (2020 = 100). Available online at: https://shorturl.at/QhC3Z (Accessed September 11 2024).

Ferrara G., Boselli M., Palasciano M., Mazzeo A. (2023). Effect of shading determined by photovoltaic panels installed above the vines on the performance of cv. Corvina (Vitis vinifera L.). Scientia Hortic. 308, 111595. doi: 10.1016/j.scienta.2022.111595

Fischer F., Tafel M., Jedicke E. (2023). Agri-Photovoltaik – eine Frage der Akzeptanz. Der Deutsche Weinbau, 36–39.

Fraunhofer ISE. (2024). Agri-Photovoltaik: Chance für Landwirtschaft und Energiewende (Freiburg, Germany: Ein Leitfaden für Deutschland).

Fritsche U. R., Berndes G., Cowie A. L., Dale V. H., Kline K. L., Johnson F. X., et al. (2017). Energy and land use (UN/IRENA: Global Land Outlook Working Paper). Available online at: https://bit.ly/3T8B77u.

Gambetta J. M., Holzapfel B. P., Stoll M., Friedel M. (2020). Sunburn in grapes: A review. Front. Plant Sci. 11. doi: 10.3389/fpls.2020.604691

Garstka L., Jouaux D., Kammann C., Stoll M. (2023). Doppelter nutzen. Der Deutsche Weinbau 6, 32–34.

Gömann H., Bender A., Bolte A. (2015). Agrarrelevante Extremwetterlagen und Möglichkeiten von Risikomanagementsystemen: Studie im Auftrag des Bundesministeriums für Ernährung und Landwirtschaft (BMEL). Braunschweig: Johann Heinrich von Thünen-Institut, 312 p, Thünen Rep 30. doi: doi :10.3220/REP1434012425000

Götzberger A., Zastrow A. (1982). On the coexistence of solar-energy conversion and plant cultivation. Int. J. Solar Energy 1, 55–69. doi: 10.1080/01425918208909875

Hannah L., Roehrdanz P. R., Ikegami M., Shepard A. V., Shaw M.R., Tabor G., et al. (2013). Climate change, wine, and conservation. Proc. Natl. Acad. Sci. United States America 110, 6907–6912. doi: 10.1073/pnas.1210127110

Hannan M. A., Wali S. B., Ker P. J., Rahman M.A., Mansor M., Ramachandaramurthy V. K., et al. (2021). Battery energy-storage system: A review of technologies, optimization objectives, constraints, approaches, and outstanding issues. J. Energy Storage 42, 103023. doi: 10.1016/j.est.2021.103023

Hörnle O., Riedelsheimer J., Trommsdorff M. (2021). Durchführbarkeitsstudie zur Ermittlung möglicher Forschung- und Demonstrationsfelder für Agri-Photovoltaik in Baden-Württemberg (Freiburg, Germany: Fraunhofer ISE). Available online at: https://bit.ly/47z8R2h.

IPCC. (2023). Climate change 2023. Synthesis report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change Core Writing Team, Lee H., Romero J. (eds.). (Geneva, Switzerland: IPCC), 184 pp. doi: 10.59327/IPCC/AR6-9789291691647

IWSR. (2024). What’s driving wine’s structural decline? Available online at: https://www.theiwsr.com/whats-driving-wines-structural-decline/ (Accessed July 23, 2024).

Jäger M., Vaccaro C., Boos J., Junghardt J., Strebel S., Anderegg D., et al. (2022). Machbarkeitsstudie Agri-Photovoltaik in der Schweizer Landwirtschaft. (Wädenswil, Switzerland: ZHAW Departement Life Sciences und Facility Management). doi: 10.21256/ZHAW-25624

Jampole E., Chaudhary S. (2023). As utilities and corporations sign solar contracts, stakeholders must weigh performance and longevity. Available online at: https://www.exponent.com/article/shedding-light-solar-panel-degradation (Accessed July 27, 2024).

Khan M.R., Patel M.T., Asadpour R., Imran H., Butt N. Z., Alam M. A. (2021). A review of next generation bifacial solar farms: predictive modeling of energy yield, economics, and reliability. J. Phys. D: Appl. Phys. 54, 323001. doi: 10.1088/1361-6463/abfce5

Loose S., Del Rey R. (2024). State of the international wine markets in 2023 - The wine market at a crossroad: Temporary or structural challenges? Wine Economics Policy. doi: 10.36253/wep-16395

Loose S., Pabst E. (2018). Current state of the German and international wine markets. German J. Agric. Economics 67, 92–101. doi: 10.52825/gjae.v67iSupplement.2089

Loose S., Pabst E. (2019). ProWein business report 2019. Available online at: https://www.hs-geisenheim.de/fileadmin/redaktion/FORSCHUNG/Institut_fuer_Wein-_und_Getraenkewirtschaft/Professur_fuer_Betriebswirtschaft_des_Wein-_und_Getraenkesektors/ProWein_Business_Report/ProWein_Business_Report_2017_Press_Handout.pdf (Accessed July 26, 2024).

Mengel F. (2022). Kosten- und Margenstrukturen im Weinbau (Geisenheim, Germany: Hochschule Geisenheim University).

Müller B., Hardt L., Armbruster A., Kiefer K., Reise C. (2016). Yield predictions for photovoltaic power plants: empirical validation, recent advances and remaining uncertainties. Prog. Photovoltaics 24, 570–583. doi: 10.1002/pip.2616

OIV. (2021). Digital trends applied to the vine and wine sector. A comprehensive study on the digitalisation of the sector. Available online at: https://www.oiv.int/public/medias/8593/digital-trends-applied-to-the-vine-and-wine-sector.pdf (Accessed July 26, 2024).

Olczak P. (2023). Evaluation of degradation energy productivity of photovoltaic installations in long-term case study. Appl. Energy 343, 121109. doi: 10.1016/j.apenergy.2023.121109

Padilla J., Toledo C., Abad J. (2022). Enovoltaics: Symbiotic integration of photovoltaics in vineyards. Front. Energy Res. 10. doi: 10.3389/fenrg.2022.1007383

Pallotti L., Silvestroni O., Dottori E., Lattanzi T., Lanari V. (2023). Effects of shading nets as a form of adaptation to climate change on grapes production: a review. OENO One 57, 467–476. doi: 10.20870/oeno-one.2023.57.2.7414

Schindele S., Trommsdorff M., Schlaak A., Obergfell T., Bopp G., Reise C., et al. (2020). Implementation of agrophotovoltaics: Techno-economic analysis of the price-performance ratio and its policy implications. Appl. Energy 265, 114737. doi: 10.1016/j.apenergy.2020.114737

Smith S. M., Geden O., Gidden M. J., Lamb W. F., Nemet G. F., Minx J. C., et al. (eds.) (2024). “The State of Carbon Dioxide Removal 2024 - 2nd Edition”. doi: 10.17605/OSF.IO/F85QJ

Strub L., Kurth A., Loose S.M. (2021). : The effects of viticultural mechanization on working time requirements and production costs. Am. J. Enology Viticulture 72, 46–55. doi: 10.5344/ajev.2020.20027

Strub L., Loose S.M. (2021). : The cost disadvantage of steep slope viticulture and strategies for its preservation. OENO One 1, 49–68. doi: 10.20870/oeno-one.2021.55.1.4494

Strub L., Loose S. (2023). Geisenheimer Unternehmensanalyse. (Geisenheim, Germany: Hochschule Geisenheim University).

Tiffon-Terrade B., Simonneau T., Caffarra A., Boulord R., Pechier P., Saurin N., et al. (2022). Delayed grape ripening by intermittent shading to counter global warming depends on carry-over effects and water deficit conditions. OENO One 57, 71–90. doi: 10.20870/oeno-one.2023.57.1.5521

Trommsdorff M., Dhal I. S., Özdemir Ö.E., Ketzer D., Weinberger N., Rösch C. (2022a). “Agrivoltaics: solar power generation and food production,” in Solar energy advancements in agriculture and food production systems (Elsevier), 159–210.

Trommsdorff M., Gruber S., Keinath T., Hopf M., Hermann C., Schönberger F., et al. (2022b). Agrivoltaics: opportunities for agriculture and the energy transition. A guideline for Germany (Freiburg, Germany: Fraunhofer ISE).

Trommsdorff M., Hopf M., Hörnle O., Berwind M., Schindele S., Wydra K. (2023). Can synergies in agriculture through an integration of solar energy reduce the cost of agrivoltaics? An economic analysis in apple farming. Appl. Energy 350, 121619. doi: 10.1016/j.apenergy.2023.121619

Unfiltriert Versicherungsmakler GmbH. (2024). Die Ernteversicherung für den Weinbau. Available online at: https://www.unfiltriert.com/versicherung/fuer-das-weingut/hagelversicherung-frostversicherung-fuer-winzer-und-weinbauern (Accessed June 13, 2024).

Valle B., Simonneau T., Sourd F., Pechier P., Hamard P., Frisson T., et al. (2017). Increasing the total productivity of a land by combining mobile photovoltaic panels and food crops. Appl. Energy 206, 1495–1507. doi: 10.1016/j.apenergy.2017.09.113

van Leeuwen C., Darriet P. (2016). The impact of climate change on viticulture and wine quality. In J. Wine Econ 11, 150–167. doi: 10.1017/jwe.2015.21

van Leeuwen C., Sgubin G., Bois B., Ollat N., Swingedouw D., Zito S., et al. (2024). Climate change impacts and adaptations of wine production. Nat. Rev. Earth Environ. 5, 258–275. doi: 10.1038/s43017-024-00521-5

Walston L. J., Hartmann H. M., Fox L., Macknick J., McCall J., Janski J., et al. (2024). If you build it, will they come? Insect community responses to habitat establishment at solar energy facilities in Minnesota, USA. Environ. Res. Lett. 19, 14053. doi: 10.1088/1748-9326/ad0f72

Weselek A., Ehmann A., Zikeli S., Lewandowski I., Schindele S., Högy P. (2019). Agrophotovoltaic systems: applications, challenges, and opportunities. A review. Agron. Sustain. Dev. 39, 35. doi: 10.1007/s13593-019-0581-3

Wirth H. (2022). Aktuelle Fakten zur Photovoltaik in Deutschland (Freiburg, Germany: Fraunhofer ISE).

Wittke M. (2023). An economic analysis of the integration of agrivoltaics in viticulture (Germany: Rheinische Friedrich-Wilhelms-Universität Bonn).

Keywords: agrivoltaics, economic sustainability, profitability, renewable energy, viticulture

Citation: Strub L, Wittke M, Trommsdorff M, Stoll M, Kammann C and Loose S (2024) Assessing the economic performance of agrivoltaic systems in vineyards – framework development, simulated scenarios and directions for future research. Front. Hortic. 3:1473072. doi: 10.3389/fhort.2024.1473072

Received: 30 July 2024; Accepted: 08 November 2024;

Published: 05 December 2024.

Edited by:

Giuseppe Ferrara, University of Bari Aldo Moro, ItalyReviewed by:

Andreas M. Savvides, The Cyprus Institute, CyprusLuigi Roselli, Faculty of Agricultural Science, University of Bari Aldo Moro, Italy

Copyright © 2024 Strub, Wittke, Trommsdorff, Stoll, Kammann and Loose. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Larissa Strub, bGFyaXNzYS5zdHJ1YkBocy1nbS5kZQ==

Larissa Strub

Larissa Strub Maximilian Wittke2

Maximilian Wittke2 Manfred Stoll

Manfred Stoll Claudia Kammann

Claudia Kammann