95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Econ. , 19 February 2025

Sec. Energy Economics

Volume 4 - 2025 | https://doi.org/10.3389/frevc.2025.1511074

This article is part of the Research Topic Low-carbon transition of energy infrastructures View all 14 articles

In this paper, we propose the realized EGARCH model with jumps (hereafter REGARCH-Jump model) to model and forecast the crude oil futures volatility. A key feature of the proposed REGARCH-Jump model is its ability to account for the extreme-value information as well as time-varying jump intensity. We apply the REGARCH-Jump model to the Brent crude oil futures price data. Our empirical results provide evidence of the presence of time-varying jumps in the crude oil futures market. More importantly, we show that our proposed REGARCH-Jump model outperforms the GARCH, EGARCH, HAR, and REGARCH models in terms of both empirical return fit and out-of-sample volatility forecast. Moreover, the superior forecast performance of the REGARCH-Jump model is robust to alternative out-of-sample forecast windows. Finally, a Value at Risk (VaR) analysis demonstrates the economic value of the improved volatility forecasts from the REGARCH-Jump model. In summary, our findings highlight the importance of accommodating the extreme-value information and jump dynamics in forecasting the volatility of crude oil futures prices.

As an indispensable energy resource in a country's development, the crude oil plays a vital role in industrial production and transportation. In recent years, major events, such as the outbreak of the COVID-19 pandemic at the beginning of 2020 and the Russia-Ukraine conflict in 2022, have lead to significant impact on the crude oil futures markets, resulting in large fluctuations in crude oil futures price. Notably, this would have adverse effects on economic activities. As a consequence, accurately modeling and forecasting the volatility of crude oil futures prices has become a crucial concern for market participants and policy makers. In fact, crude oil futures volatility plays an important role in asset allocation, risk management and derivative pricing. And there is now a large body of literature on forecasting the volatility of crude oil futures prices (Zhang et al., 2019, 2023; Kazemzadeh et al., 2022; Li et al., 2022; Zhang and Zhang, 2023a,b; Xu et al., 2024).

Given the importance of accurately forecasting the crude oil futures volatility, this paper aims to develop a new volatility model, namely the realized EGARCH model with jumps (hereafter REGARCH-Jump model), to model and forecast the crude oil futures volatility. Our proposed model has the capacity to account for the extreme-value information and the time-varying jumps in the crude oil futures prices. Moreover, the model is able to capture the complex volatility characteristics, such as the time-varying volatility and volatility asymmetry.

This paper contributes to the literature on crude oil futures volatility forecasting in several aspects. Firstly, we extend the REGARCH model to incorporate the dynamic jumps, and propose the REGARCH-Jump model to model and forecast the crude oil futures volatility. Our proposed model can capture the extreme-value information and the time-varying jumps in the crude oil futures prices simultaneously, which has the potential to improve the crude oil futures volatility forecasts.

Secondly, we apply the REGARCH-Jump model to the Brent crude oil futures price data. Our empirical results provide evidence of the presence of time-varying jumps in the crude oil futures market. More importantly, we show that our proposed REGARCH-Jump model outperforms the GARCH, EGARCH, HAR and REGARCH models in terms of both empirical return fit and out-of-sample volatility forecast. Moreover, the superior forecast performance of the REGARCH-Jump model is robust to alternative out-of-sample forecast windows.

Finally, a Value at Risk (VaR) analysis is conducted to demonstrate the economic value of the improved volatility forecasts from the REGARCH-Jump model. We confirm that the REGARCH-Jump model can produce reasonable VaR forecasts.

To facilitate quick reference for readers, Table 1 summarizes the model names and their abbreviations used in this paper. The remainder of the paper is organized as follows. Section 2 reviews relevant literature on crude oil volatility forecasting. In Section 3, we describe the REGARCH-Jump model and the maximum likelihood method for parameter estimation. In Section 4, we introduce the methods used for out-of-sample evaluation. The empirical results are presented in Section 5, and Section 6 concludes the paper.

Accurately forecasting the crude oil futures volatility is important for market investors, risk managers and policy markers, since it has an important influence on investors' financial strategies and policymakers' decisions (Agnolucci, 2009; Wei et al., 2017; Wen et al., 2019; Lyu et al., 2021a,b; Huang et al., 2023). It has been well documented in the literature that financial Volatility exhibits complex characteristics, such as volatility clustering, leverage effects and mean-reverting properties, which poses great challenges in volatility measuring and forecasting. Traditionally, volatility estimator is derived from closing prices, and a variety of volatility models have been proposed to describe its dynamics in the last three decades. Since the seminal work by Engle (1982) and Bollerslev (1986), who propose the generalized autoregressive conditional heteroskedasticity (GARCH)-type models, numerous studies have been devoted to investigating the crude oil volatility modeling and forecasting by using GARCH-type models (see, e.g., Iglesias and Rivera-Alonso, 2022; Hong et al., 2022; Wang et al., 2021; Lin et al., 2020; Pan et al., 2017; Kang and Yoon, 2013). An alternative to the GARCH volatility model is the stochastic volatility (SV) models of Taylor (1986) and Heston (1993). Tsay (2005) presents a review of the two strands of the literature. Lyu et al. (2021a,b) analyse the time-varying effects of global economic uncertainty shocks on the volatilities of Brent and WTI crude oil prices through a time-varying parameter structural vector autoregressive model with stochastic volatility. Essentially, both the GARCH and SV models are return-based models, which are constructed based on daily closing prices, neglecting all intraday price movement, which reduces the predictive power of the models (Pu et al., 2016; Gong and Lin, 2018).

With the increasing availability of intraday high-frequency data, many authors have introduced the realized measures to measure the financial volatility (Andersen et al., 2001; Barndorff-Nielsen and Shephard, 2002, 2004; Kazemzadeh et al., 2023a,b, 2022). Corsi (2009) develop the HAR model based on realized volatility, which effectively captures the long-memory characteristics of volatility. Thanks to its ease of extensibility, the model has gained wide recognition and application. Wen et al. (2016) analyze the impact of stock market uncertainty on the volatility of the crude oil futures market by constructing an HAR model. Furthermore, Zhang et al. (2023) compare the performance of HAR models with different structural changes in forecasting the volatility of the crude oil futures market. Notably, the realized measure contains more information about the current level of volatility, which can provide more accurate volatility estimates (Andersen et al., 2001; Lyócsa et al., 2021). However, the realized measure based on intraday high-frequency data is sensitive to market microstructure noise, which leads to a biased volatility estimate.

As an alternative, the price range computed from the intraday high and low prices has been proposed to measure volatility. The idea of using price range in finance can be found in Mandelbrot (1971), who employs it to test the existence of long-term dependence in asset prices. The price range incorporates more (extreme-value) information on intra-period trajectory of the prices than the return-based volatility measure that only includes single measurement of the closing prices each period (Wu and Hou, 2020). Numerous studies have shown that the intraday price range is a more efficient measure of financial volatility relative to the commonly used return-based measure, such as the absolute (or squared) return or even the realized volatility from intraday returns. In fact, by employing the extreme-value theory and some well-known properties of range, Parkinson (1980) provide evidence of the superiority of using range as a volatility estimator. Alizadeh et al. (2002) show theoretically, numerically and empirically that range-based volatility estimator is not only highly efficient, but also approximately Gaussian and robust to microstructure noise. Brandt and Jones (2006) find that the range-based EGARCH model has better volatility forecast performance compared to the return-based EGARCH model. More recently, Degiannakis and Livada (2013) show that the price range volatility estimator is more accurate than the realized volatility estimator based on five, or less, equidistance points in time.

To explore the intraday (extreme-value) information for modeling volatility, motivated by the insights of the realized SV model (Shirota et al., 2014; Asai and McAleer, 2022), Hansen et al. (2012) develop a joint model of return and realized measure, namely the realized GARCH (RGARCH) model. The RGARCH model can capture the leverage effect of volatility, and is well suited for situations where volatility changes rapidly to a new level. Using the RGARCH model, Hansen et al. (2012) demonstrate that the inclusion of the realized measures can improve the model's ability to forecast volatility. Further, Hansen and Huang (2016) extend the RGARCH model to incorporate an additional leverage function to capture leverage effect more flexibly. The resulting model is referred to as the REGARCH model. Importantly, the R(E)GARCH model has a simple structure, which can be estimated and filtered easily. In addition, the model can automatically adjust the bias in the realized measures caused by non-trading hours and market microstructure noise. Subsequently, the R(E)GARCH model has attracted a great deal of attention in the literature. For example, Huang et al. (2017) and Tong and Huang (2021) apply the R(E)GARCH model to option pricing, and find that the R(E)GARCH model provide better option pricing performance than the traditional GARCH models. Chen and Watanabe (2019) and Chen et al. (2022) apply the R(E)GARCH model to risk measurement.

Despite the empirical success of the R(E)GARCH model, it does not take into account the presence of jumps in asset prices, which have been well recognized in the literature (see, e.g., Arouri et al., 2019; Pan et al., 2020; Qiao et al., 2020; Guo et al., 2023; Wu et al., 2024; Zhang et al., 2024). The huge changes (i.e., jumps) in asset prices usually cannot be explained by the current level of volatility. In recent years, numerous studies have shown that the occurrence of jumps is time-varying (see, e.g., Chernov et al., 2018; Zhou et al., 2019; Dutta et al., 2021). Most of these studies capture the risk of market crashes by assuming that the intensity of jumps is a function of the variance of asset returns. Although this modeling approach is intuitive and simple, it can not capture the jumps of asset price adequately.

Table 2 summarizes the relevant studies in the literature, while Table 3 provides an overview of the associated econometric models. Motivated by the above insights, in this paper we use price range as a proxy of realized measure, and propose the REGARCH-Jump model to modeling and forecasting the crude oil futures volatility. Notably, our proposed model can capture the extreme-value information as well as the dynamic jumps through assuming the jump intensity is governed by a autoregressive conditional jump intensity process. It is worth pointing out that although significant contributions have been made in the literature on crude oil futures volatility forecasting, few studies have taken into account both the extreme-value information and dynamic jumps in the crude oil futures prices for predicting the crude oil futures volatility.

In this section, we first provide a brief review of the GARCH, the EGARCH, the HAR and the REGARCH models. Then we introduce the extension of the REGARCH model, namely the REGARCH-Jump model, which simultaneously accommodates the extreme-value information and time-varying jump intensity. Finally, we describe the maximum likelihood method for estimation of the parameters of the proposed model.

In financial econometric literature, the GARCH model proposed by Bollerslev (1986) is a popular approach for measuring and forecasting financial volatility. The GARCH model can be written as

where rt = log(Pt/Pt−1) is the log-return on day t, where Pt is the closing price on day t; μ is the conditional mean of rt; ht is the conditional variance of rt; zt is the return innovation, and ϵt is the standardized return innovation.

The EGARCH model was proposed by Nelson (1991), which has the capacity to capture the leverage effect, which has been found to be important for volatility forecasting. The EGARCH model is given by

where the coefficient γ captures the leverage effect when γ < 0.

Based on the Heterogeneous Market Hypothesis, the HAR model proposed by Corsi (2009) aims to capture the volatility dynamics in financial markets, which can be written as

where xt is the realized measure of volatility on day t; and represent the average realized volatility for the past weekly and monthly periods, respectively. (corresponding to lags of 5 days, and 22 days).

Considering the fact that the RGARCH model cannot capture the leverage effect (asymmetric response of volatility to positive and negative shocks) adequately, Hansen and Huang (2016) extend the RGARCH to the REGARCH model, which can be written as

where ut is the realized measure innovation, which is independent of the return innovation ϵt; d(ϵt) and υ(ϵt) are the leverage functions, which are used to capture the leverage effect, satisfying Et−1[d(ϵt)] = Et−1[v(ϵt)] = 0. If d1 < 0, υ1 < 0, it means that there exists leverage effect.

In the REGARCH model, Equations 11, 13 and 14 are referred to as the return equation, the variance (GARCH) equation and the measurement equation, respectively. The measurement equation relates the ex-post realized measure to the ex-ante conditional variance, with bias-correction coefficients ξ and φ used to correct the bias in the realized volatility measure caused by non-trading hours and market microstructure noise. Consistent with Takahashi et al. (2009), Koopman and Scharth (2012) and Wu et al. (2020), we assume that φ = 1 to facilitate model estimation and to improve out-of-sample performance.

The REGARCH model fall short in capturing the jumps (huge changes) in the asset prices. In light of this, this paper proposes the REGARCH-Jump model that extends the REGARCH model of Hansen and Huang (2016) to incorporate the dynamic jump intensity to model and forecast the volatility of crude oil futures markets. The specification of the REAGRCH-Jump model is as follows

where zt and yt denote the normal component and the jump component, respectively, which are assumed to be independent. The normal component zt is assumed to be distributed as N(0, hz,t), where hz,t is the conditional variance of the normal component, which is governed by the REGARCH dynamic. The jump component yt follows a compound Poisson process with jump intensity hy,t and jump size , where is independently drawn from a normal distribution with mean θ and variance δ2, that is, . The mean and variance of the jump component, yt, are given by θhy,t and , respectively. nt is the number of jumps arriving between t − 1 and t, which follows a Poisson counting process with intensity hy,t, that is, nt ~ Poisson(hy,t). The conditional probability of nt can be written as

Therefore, the conditional expectation of the number of jumps arriving over the time interval (t − 1, t) equals the jump intensity, that is, Et−1[nt] = hy,t. To describe the dynamics of jump intensity process hy,t, we follow Maheu and McCurdy (2004) and assume that it follows the autoregressive conditional jump intensity model:

where ρ > 0, κ > 0, ψ > 0; ζt−1 denotes the jump intensity residual, which can be written as

It is clear that E(ζt−1) = 0. Thus, κ describes the persistence of the jump intensity process. If hy,t is stationary, we have 0 < κ < 1. Then the unconditional jump intensity is given by .

In the measurement Equation 21, ht denotes the total unconditional variance of return, which can be written as

It has been well documented in the literature that the use of intraday high and low prices leads to more accurate estimate of volatility than daily returns (Molnár, 2011; Chou and Liu, 2010). Therefore, in the paper we utilize the intraday price range calculated from the intraday high and low prices as a proxy for the realized measure in the HAR, REGARCH specifications, and their extensions. The intraday price range of Parkinson (1980) is defined as

where Ht and Lt are the high and low prices observed at day t, respectively. The intraday range given by Equation 26 is not only a highly efficient volatility proxy, capturing information regarding the entire intraday trajectory of the price, but also robust to microstructure noise (Alizadeh et al., 2002; Brandt and Jones, 2006). In this paper, we set the HAR, REGARCH specifications, and their extensions.

The proposed REGARCH-Jump model is intuitive and easy to implement. We can use the classical maximum likelihood method to estimate the parameters of the model. To be specific, the log-likelihood function of the REGARCH-Jump model can be written as

where is the vector of model parameters, ℓ(r; Θ) and ℓ(x|r; Θ) are the partial log-likelihood functions for the returns and realized measure, respectively. ft−1(rt) and ft−1(xt|rt) denote the conditional probability density functions of rt and xt, respectively, which can be written as

where Prt−1(nt = j) is the conditional probability of the number of jumps, which is given in Equation 22. It should be noted that the summation in Equation 30 must be truncated when implementing the maximum likelihood estimation. We truncate the summation at 50 jumps per day. In fact, since the tail probability of Poisson distribution at nt ≥ 50 is sufficiently small and negligible, summing to nt = 50 can ensures the accuracy of the estimation process. ft−1(rt ∣ nt = j) in Equation 30 can be written as

In order to calculate the likelihoods (Equations 30–32), it is necessary to determine the normal innovation zt and the number of jumps nt, and further filter the conditional variance hz,t+1 and the conditional jump intensity hy,t+1. This process can be easily implemented by using analytic filtering. Applying Bayes' rule, the filtering density is given by

where the expressions on the right-hand side of the Equation 33 are given by Equations 22, 30 and 32. Prt(nt = j) represents the ex-post inference on nt, or the probability that j jumps have arrived between time t − 1 and t conditional on the information available at time t. The filtered number of jumps is then given by

The actual number of jumps, nt, can be larger than one but is restricted to be less than fifty as mentioned above. According to Christoffersen et al. (2012), the filtering of the normal innovation zt can be written as

Once ñt and are known, we can infer the filtered and easily through Equations 20 and 23.

Finally, the parameters of the REGARCH-Jump model can be estimated via maximum likelihood method by solving

The loss function is commonly used to evaluate the forecasting accuracy of the competing models. In the paper, we employ four popular loss functions, including the mean absolute error (MAE), mean absolute percentage error (MAPE), mean squared error (MSE) and Quasi-likelihood (QLIKE). The four evaluation criteria are defined as

where T is the number of out-of-sample forecasts, ht+1 and ĥt+1(m) denote the measured (true) volatility and forecasted volatility, respectively, and m stands for the GARCH, EGARCH, HAR, REGARCH or REGARCH-Jump models. It is worth noting that MSE and QLIKE are robust loss functions, which could provide a consistent ranking of the volatility models with a conditionally unbiased volatility proxy (Patton, 2011).

Since the true volatility is unobservable, the evaluation and comparison of volatility forecasting models requires the proxy of true volatility. In the paper, we employ the scaled realized volatility (RV) as a proxy of the true volatility. The scaled RV is defined as , where RVt is computed based 5-min intraday returns on day t and . This adjustment is used to account for the non-trading hours.

For robustness, we adopt the model confidence set (MCS) test proposed by Hansen et al. (2011) to examine whether the difference in forecasting performance between the competing models is statistically significant. The MCS method tests a given set of competing models and identifies a set of optimal predictive models or MCS with a certain level of confidence. Specifically, the MCS test relies on an equivalence test δ and an elimination rule e. Let 0 be the initial set of all competing models. Set = 0, and use the equivalence test δ to test the null hypothesis that the competing models have the same expected loss (equal forecasting performance), i.e.,

where duv,t = Losst(u)−Losst(v) is the loss difference between the models u and v. Hansen et al. (2011) propose the following statistics to test the null hypothesis H0,:

where is the average loss difference, and is the bootstrapped estimate of the variance of , i.e., . For a given significance level α, if the null hypothesis H0, is accepted, define . Otherwise, we use the elimination rule to exclude the model that has poor forecasting performance. This process is repeated until no model can be excluded. Finally, the set of surviving models is referred to as the MCS, i.e. the set of optimal predictive models at a given confidence level of 1 − α.

Since the asymptotic distribution of the test statistics T is non-standard, this paper uses a block bootstrap of 105 replications for approximate calculation. In addition, we set the significance level as α = 10%.

For our empirical analysis, we use data on the daily open, high, low and close prices for the Brent crude oil futures. We focus on Brent crude oil futures market due to the fact that Brent crude oil is currently considered to be the global oil pricing benchmark (Dowling et al., 2016; Zavadska et al., 2020). We employ the squared price range () as the realized volatility measure (i.e., xt). The data is obtained from Wind Database of China, and the sample period is from January 4, 2005 to February 28, 2023.

Table 4 presents the descriptive statistics of the daily returns and price ranges of Brent crude oil futures. As can be seen from the table, the return distribution for the Brent crude oil futures is negatively skewed and leptokurtic, while the price range distribution is positively skewed and leptokurtic. The Jarque-Bera statistics indicate that both the return and price range distributions are non-Gaussian. The Ljung-Box Q-statistic for autocorrelation up to 20 lags shows that the price range series is highly autocorrelated, suggesting high persistence of Brent crude oil futures volatility.

Figure 1 presents the time series plots of the daily Brent crude oil futures returns and price ranges. It can be seen from the figure that the well-known behavior of volatility clustering is apparent. In addition, the Brent crude oil futures experience large fluctuations (jumps) during the periods of 2008–2009 global financial crisis (GFC), 2020 COVID-19 pandemic and 2022 Russo-Ukrainian conflict.

In this subsection, we estimate the five competitor models (GARCH, EGARCH, HAR, REGARCH and REGARCH-Jump) using the maximum likelihood method based on the in-sample data covering the period from January 4, 2005 to December 31, 2020. Table 5 reports the maximum likelihood estimates for the five models. As can be seen from the table, the daily coefficient of xt in the HAR model is significantly positive, while the weekly coefficient is significantly negative. This indicates that daily information positively affects crude oil futures volatility, whereas weekly information has a negative impact. Additionally, the estimates of volatility persistence in the GARCH, EGARCH, REGARCH and REGARCH-Jump models are larger than 0.98, suggesting the stylized fact of high volatility persistence. Regarding the leverage parameters, γ, d1, d2, υ1 and υ2, they are all significantly different from zero. In particular, γ, d1 and υ1 are all negative, suggesting the presence of the leverage effect in the Brent crude oil futures market.

Moreover, the jump intensity parameters (ρ, κ, ψ) are all positive and statistically significant, suggesting the presence of time-varying jump intensity and that the REGARCH-jump model is correctly specified. In particular, the parameter κ is estimated to be 0.9578, which provides evidence of high persistence of the conditional jump intensity process. The estimated mean jump size θ in the REGARCH-Jump model is significantly negative, while the estimated jump volatility δ is significantly positive. The unconditional mean of dynamic jump intensity is , implying that jumps arrive at a frequency of 37.6 jumps per year. In addition, the contribution of return jumps to the total return variance is , which is close to the results reported in Christoffersen et al. (2012) (12%~15%), Andersen et al. (2007) (14.6%) and Pan et al. (2020) (11%), suggesting that our estimation results of jump intensity is reasonable.

Finally, we can observe that the REGARCH-Jump model improves the empirical return fit relative to all other models (GARCH, EGARCH and REGARCH) in terms of the partial log-likelihood for the returns ℓ(r) and the full log-likelihood ℓ(r, x).

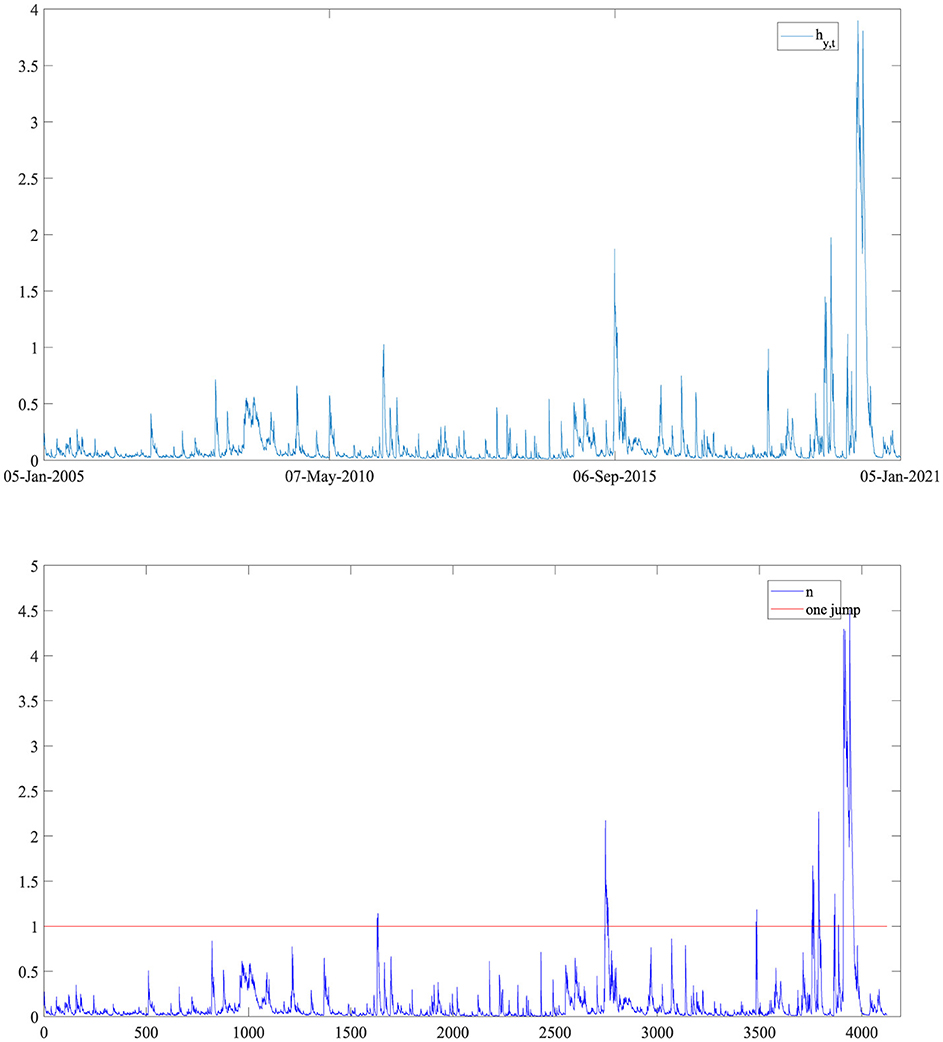

Figure 2 presents the time series plots of the jump intensity and the number of jumps. It is clear that the jumps have a time-varying feature, and the number of jumps related to market uncertainty events have increased during the periods of 2008–2009 global financial crisis, 2015 global oil price decline and 2020 COVID-19 pandemic. Note also that, the number of jumps in most cases is less than one jump per day.

Figure 2. Time series plots of the jump intensify hy,t and the number of jumps nt for the Brent crude oil futures.

In the in-sample analysis, we document that the jump intensity and the number of jumps has time-varying characteristic. Moreover, we show that incorporating the extreme-value information and jump dynamics into the REGARCH model could improve the model's ability to fit the Brent crude oil futures returns. In this subsection, we investigate the importance of accounting for the extreme-value information and jump dynamics for forecasting the crude oil futures volatility relying on our proposed REGARCH-Jump model. Importantly, we compare the out-of-sample forecasting performance of the REGARCH-Jump model with that of the GARCH, EGARCH, HAR and REGARCH models.

The out-of-sample forecast exercise is performed relying on a rolling window scheme. The out-of-sample period is from January 4, 2021 to February 28, 2023. Figure 3 presents the out-of-sample volatility forecasts for the competing models. Table 6 reports the out-of-sample forecast evaluation results based on the four loss functions. As can be seen from the table, the REGARCH model offers smaller loss values (MAE, MAPE, MSE, QLIKE) than the GARCH and EGARCH models. In particular, the REGARCH-Jump model yields the smallest loss values in all cases. Our findings indicate that incorporating the extreme-value information and jump dynamics into volatility model is important for improving the out-of-sample volatility forecasts.

Further, Table 7 presents the MCS test results for the out-of-sample forecasts of competing models. It is clear that the REGARCH-Jump model is always included in the MCS, and always has the highest MCS p-value (p = 1), confirming the superior performance of the REGARCH-Jump model over all other models in forecasting the crude oil futures volatility.

For robustness, we perform the out-of-sample forecast exercise for different out-of-sample windows. To be specific, we consider two alternative out-of-sample windows: 200 and 400. The out-of-sample forecast evaluation results for the alternative out-of-sample windows are reported in Table 8.

In line with the results reported in Tables 6, 7, the REGARCH-Jump model that accounts for the extreme-value information and jump dynamics yields the most accurate volatility forecasts, dominating all other models. This result confirms that the superior performance of the REGARCH-Jump model in forecasting the crude oil futures volatility is robust to alternative out-of-sample forecast windows.

To illustrate the economic value of the improved volatility forecasts from the REGARCH-Jump model, we perform a VaR analysis in this subsection. Accurate measurement of financial market risk is of great significance to the investors, policy makers and regulators who are trying to manage the risk of portfolio as well as to maintain the functioning and the stability of financial markets. The standard tool for measuring market risk is VaR, which is intuitive, simple and easy to compute. It is used by financial institutions and financial regulators worldwide for market risk mointoring and management.

The one-day-ahead forecast of VaR for a given probability (significance level) α satisfies:

According to the definition of VaR in Equation 39, the VaR under the REGARCH-Jump model can be formulated as

where can be written as follows (Chiu et al., 2006):

where ϵα is the left quantile at level α for standard normal distribution, and Sk(rt) is the conditional skewness of returns.

To examine the accuracy of VaR forecast, we perform the backtesting relying on the failure rate test, the likelihood ratio test of unconsitional coverage (Kupiec, 1995) and the likelihood ratio test of consitional coverage (Christoffersen, 1998).

The likelihood ratio test statistic of unconsitional coverage can be written as

where FR is failure rate, that is, FR = T0/T1, T0 is the number of times the VaR is violated, T1 is the total number of VaR forecasts.

The likelihood ratio test statistic of unconsitional coverage (LRuc) can not examine the independence of VaR exceptions. In light of this, Christoffersen (1998) propose the conditional coverage test that can examine the independence of VaR exceptions, which can be written as

where

and Tij is the number of observations with value i followed by j, , , . It is clear that the conditional coverage test LRcc builds on the LRuc and LRind tests.

Figure 4 presents the VaR forecasts for the competing models. Table 9 reports the results of VaR backtesting including the failure rates (FR) test, the likelihood ratio test of unconsitional coverage (LRuc) and the likelihood ratio test of consitional coverage (LRcc) for the five competing models. As can be seen from Table 9, all models have passed the likelihood ratio test at the 10% and 5% significance levels, indicating that they all perform well in measuring the crude oil futures market risk in the cases. Importantly, it is interesting to note that the FR of the VaR forecasts for the REGARCH-Jump model are closer to the corresponding theoretical values (α) under the 95% and 90% confidence levels than the other models.

Regarding the confidence level of 99%, the FR of VaR forecasts of the EGARCH model significantly deviates from the theoretical value (α = 0.01), and all of the models can not forecast VaR accurately in terms of the unconditionally covered likelihood ratio test. However, in terms of the conditionally covered likelihood ratio test, all the models except for the EGARCH model performs well.

Finally, we can observe that, based on the 95% and 90% confidence levels, the VaR forecasts obtained by the GARCH, EGARCH, HAR and REGARCH models are more conservative than that obtained by the REGARCH-Jump model, which may underestimate the risk. In summary, our results provide support for combining the extreme-value information and dynamic jumps for improving the accuracy of VaR forecasts. Note also that there is still room to improve the accuracy of VaR forecasts in extreme risk scenarios.

In this paper, we propose the REGARCH-Jump model, which incorporates the extreme-value information and jump dynamics, to model and forecast the crude oil futures volatility. An empirical analysis based on the daily Brent crude oil futures prices data shows the presence of time-varying jump intensity with high persistence. In addition, we observe that the REGARCH-Jump model outperforms the GARCH, EGARCH, HAR and REGARCH models in terms of both empirical return fit and out-of-sample volatility forecast. Moreover, we confirm that the superior forecasting performance of the REGARCH-Jump model is robust to alternative out-of-sample forecast windows. Finally, a VaR analysis is conducted to demonstrate the economic value of the improved volatility forecasts from the REGARCH-Jump model. We confirm that the REGARCH-Jump model can produce reasonable VaR forecasts. In summary, our findings highlight the importance of accommodating the extreme-value information as well as the jump dynamics in forecasting the volatility of the crude oil futures market.

Our work offers theoretical and methodological insights into modeling and forecasting the crude oil futures volatility, with great significance related to both academic researchers and practitioners. Further extensions and applications of the proposed model are encouraged. For example, incorporating intraday high-frequency data into the realized volatility measure presents a promising area for future research. In addition, future studies could involve applying the model to derivative pricing and asset allocation.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

WS: Methodology, Software, Supervision, Writing – review & editing. HL: Conceptualization, Data curation, Formal analysis, Writing – original draft.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was supported by the National Natural Science Foundation of China [71971001]; Natural Science Foundation of Anhui Province [2208085Y21]; Academic Funding Project for Top Academic Talents in Anhui Universities [gxbjZD2022019]; Outstanding Youth Research Project for Anhui Universities [2022AH020047]; Innovative Research Project for Graduates of Anhui University of Finance and Economics under Grant No. ACYC2023137.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The author(s) declare that no Gen AI was used in the creation of this manuscript.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Agnolucci, P. (2009). Volatility in crude oil futures: a comparison of the predictive ability of GARCH and implied volatility models. Energy Econ. 31, 316–321. doi: 10.1016/j.eneco.2008.11.001

Alizadeh, S., Brandt, M. W., and Diebold, F. X. (2002). Range-based estimation of stochastic volatility models. J. Finance 57, 1047–1091. doi: 10.1111/1540-6261.00454

Andersen, T. G., Bollerslev, T., and Diebold, F. X. (2007). Roughing it up: including jump components in the measurement, modeling, and forecasting of return volatility. Rev. Econ. Stat. 89, 701–720. doi: 10.1162/rest.89.4.701

Andersen, T. G., Bollerslev, T., Diebold, F. X., and Ebens, H. (2001). The distribution of realized stock return volatility. J. Financ. Econ. 61, 43–76. doi: 10.1016/S0304-405X(01)00055-1

Arouri, M., M'saddek, O., and Pukthuanthong, K. (2019). Jump risk premia across major international equity markets. J. Empir. Finance 52, 1–21. doi: 10.1016/j.jempfin.2019.02.004

Asai, M., and McAleer, M. (2022). Bayesian analysis of realized matrix-exponential GARCH models. Comput. Econ. 59, 103–123. doi: 10.1007/s10614-020-10074-6

Barndorff-Nielsen, O. E., and Shephard, N. (2002). Econometric analysis of realised volatility and its use in estimating stochastic volatility models. J. R. Stat. Soc. Ser. B: Stat. Methodol. 64, 253–280. doi: 10.1111/1467-9868.00336

Barndorff-Nielsen, O. E., and Shephard, N. (2004). Power and bipower variation with stochastic volatility and jumps. J. Financ. Econom. 2, 1–37. doi: 10.1093/jjfinec/nbh001

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. J. Econom. 31, 307–327. doi: 10.1016/0304-4076(86)90063-1

Brandt, M. W., and Jones, C. S. (2006). Volatility forecasting with range-based EGARCH models. J. Bus. Econ. Stat. 24, 470–486. doi: 10.1198/073500106000000206

Chen, C. W. S., Lin, E. M. H., and Huang, T. F. J. (2022). Bayesian quantile forecasting via the realized hysteretic GARCH model. J. Forecast. 41, 1317–1337. doi: 10.1002/for.2876

Chen, C. W. S., and Watanabe, T. (2019). Bayesian modeling and forecasting of value-at-risk via threshold realized volatility. Appl. Stoch. Models Bus. Ind. 35, 747–765. doi: 10.1002/asmb.2395

Chernov, M., Graveline, J., and Zviadadze, I. (2018). Crash risk in currency returns. J. Financ. Quant. Anal. 53, 137–170. doi: 10.1017/S0022109017000801

Chiu, C. L., Chiang, S. M., Hung, J. C., and Chen, Y.-L. (2006). Clearing margin system in the futures markets? Applying the value-at-risk model to Taiwanese data. Phys. A Stat. Mech. Appl. 367, 353–374. doi: 10.1016/j.physa.2005.12.034

Chou, R. Y., and Liu, N. (2010). The economic value of volatility timing using a range-based volatility model. J. Econ. Dyn. Control 34, 2288–2301. doi: 10.1016/j.jedc.2010.05.010

Christoffersen, P., Jacobs, K., and Ornthanalai, C. (2012). Dynamic jump intensities and risk premiums: evidence from S&P500 returns and options. J. Financ. Econ. 106, 447–472. doi: 10.1016/j.jfineco.2012.05.017

Christoffersen, P. F. (1998). Evaluating interval forecasts. Int. Econ. Rev. 39, 841–862. doi: 10.2307/2527341

Corsi, F. (2009). A simple approximate long-memory model of realized volatility. J. Financ. Econom. 7, 174–196. doi: 10.1093/jjfinec/nbp001

Degiannakis, S., and Livada, A. (2013). Realized volatility or price range: evidence from a discrete simulation of the continuous time diffusion process. Econ. Model. 30, 212–216. doi: 10.1016/j.econmod.2012.09.027

Dowling, M., Cummins, M., and Lucey, B. M. (2016). Psychological barriers in oil futures markets. Energy Econ. 53, 293–304. doi: 10.1016/j.eneco.2014.03.022

Dutta, A., Bouri, E., and Roubaud, D. (2021). Modelling the volatility of crude oil returns: jumps and volatility forecasts. Int. J. Finance Econ. 26, 889–897. doi: 10.1002/ijfe.1826

Engle, R. F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50, 987–1007. doi: 10.2307/1912773

Gong, X., and Lin, B. (2018). Structural changes and out-of-sample prediction of realized range-based variance in the stock market. Phys. A Stat. Mech. Appl. 494, 27–39. doi: 10.1016/j.physa.2017.12.004

Guo, Y., Li, P., and Wu, H. (2023). Jumps in the Chinese crude oil futures volatility forecasting: new evidence. Energy Econ. 126:106955. doi: 10.1016/j.eneco.2023.106955

Hansen, P. R., and Huang, Z. (2016). Exponential GARCH modeling with realized measures of volatility. J. Bus. Econ. Stat. 34, 269–287. doi: 10.1080/07350015.2015.1038543

Hansen, P. R., Huang, Z., and Shek, H. H. (2012). Realized GARCH: a joint model for returns and realized measures of volatility. J. Appl. Econ. 27, 877–906. doi: 10.1002/jae.1234

Hansen, P. R., Lunde, A., and Nason, J. M. (2011). The model confidence set. Econometrica 79, 453–497. doi: 10.3982/ECTA5771

Heston, S. L. (1993). A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6, 327–343. doi: 10.1093/rfs/6.2.327

Hong, Y., Wang, L., Liang, C., and Umar, M. (2022). Impact of financial instability on international crude oil volatility: new sight from a regime-switching framework. Resour. Policy 77:102667. doi: 10.1016/j.resourpol.2022.102667

Huang, Y., Xu, W., Huang, D., and Zhao, C. (2023). Chinese crude oil futures volatility and sustainability: a uncertainty indices perspective. Resour. Policy 80:103227. doi: 10.1016/j.resourpol.2022.103227

Huang, Z., Wang, T. Y., and Hansen, P. R. (2017). Option pricing with the realized GARCH model: an analytical approximation approach. J. Futures Mark. 37, 328–358. doi: 10.1002/fut.21821

Iglesias, E. M., and Rivera-Alonso, D. (2022). Brent and WTI oil prices volatility during major crises and COVID-19. J. Petrol. Sci. Eng. 211:110182. doi: 10.1016/j.petrol.2022.110182

Kang, S. H., and Yoon, S. M. (2013). Modeling and forecasting the volatility of petroleum futures prices. Energy Econ. 36, 354–362. doi: 10.1016/j.eneco.2012.09.010

Kazemzadeh, E., Ahmadi Shadmehri, M. T., Ebrahimi Salari, T., Salehnia, N., and Pooya, A. (2022). Oil price shocks on shale oil supply and energy security: a case study of the United States. Int. J. Dev. Issues 21, 249–270. doi: 10.1108/IJDI-12-2021-0264

Kazemzadeh, E., Ahmadi Shadmehri, M. T., Ebrahimi Salari, T., Salehnia, N., and Pooya, A. (2023a). Modeling and forecasting United States oil production along with the social cost of carbon: conventional and unconventional oil. Int. J. Energy Sect. Manag. 17, 288–309. doi: 10.1108/IJESM-02-2022-0010

Kazemzadeh, E., Ahmadi Shadmehri, M. T., Ebrahimi Salari, T., Salehnia, N., and Pooya, A. (2023b). The asymmetric effect of eco-innovation on the energy consumption structure: the US as a case study. Manag. Environ. Qual. 34, 214–233. doi: 10.1108/MEQ-02-2022-0036

Koopman, S. J., and Scharth, M. (2012). The analysis of stochastic volatility in the presence of daily realized measures. J. Financ. Econom. 11, 76–115. doi: 10.1093/jjfinec/nbs016

Kupiec, P. (1995). Techniques for verifying the accuracy of risk measurement models. J. Deriv. 3, 73–84. doi: 10.3905/jod.1995.407942

Li, X., Liang, C., Chen, Z., and Umar, M. (2022). Forecasting crude oil volatility with uncertainty indicators: new evidence. Energy Econ. 108:105936. doi: 10.1016/j.eneco.2022.105936

Lin, Y., Xiao, Y., and Li, F. (2020). Forecasting crude oil price volatility via a HM-EGARCH model. Energy Econ. 87:104693. doi: 10.1016/j.eneco.2020.104693

Lyócsa, Š., Molnár, P., and Výrost, T. (2021). Stock market volatility forecasting: do we need high-frequency data? Int. J. Forecast. 37, 1092–1110. doi: 10.1016/j.ijforecast.2020.12.001

Lyu, Y., Tuo, S., Wei, Y., and Yang, M. (2021a). Time-varying effects of global economic policy uncertainty shocks on crude oil price volatility: new evidence. Resour. Policy 70:101943. doi: 10.1016/j.resourpol.2020.101943

Lyu, Y., Wei, Y., Hu, Y., and Yang, M. (2021b). Good volatility, bad volatility and economic uncertainty: evidence from the crude oil futures market. Energy 222:119924. doi: 10.1016/j.energy.2021.119924

Maheu, J. M., and McCurdy, T. H. (2004). News arrival, jump dynamics, and volatility components for individual stock returns. J. Finance 59, 755–793. doi: 10.1111/j.1540-6261.2004.00648.x

Mandelbrot, B. B. (1971). When can price be arbitraged efficiently? A limit to the validity of the random walk and martingale models. Rev. Econ. Stat. 53, 225–236. doi: 10.2307/1937966

Molnár, P. (2011). Properties of range-based volatility estimators. Int. Rev. Financ. Anal. 23, 20–29. doi: 10.1016/j.irfa.2011.06.012

Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59, 347–370. doi: 10.2307/2938260

Pan, Z., Bu, R., Liu, L., and Wang, Y. (2020). Macroeconomic fundamentals, jump dynamics and expected volatility. Quant. Finance 20, 1345–1371. doi: 10.1080/14697688.2020.1736317

Pan, Z., Wang, Y., Wu, C., and Yin, L. (2017). Oil price volatility and macroeconomic fundamentals: a regime switching GARCH-MIDAS model. J. Empir. Finance 43, 130–142. doi: 10.1016/j.jempfin.2017.06.005

Parkinson, M. (1980). The extreme value method for estimating the variance of the rate of return. J. Bus. 53, 61–65. doi: 10.1086/296071

Patton, A. J. (2011). Volatility forecast comparison using imperfect volatility proxies. J. Econom. 160, 246–256. doi: 10.1016/j.jeconom.2010.03.034

Pu, W., Chen, Y., and Ma, F. (2016). Forecasting the realized volatility in the Chinese stock market: further evidence. Appl. Econ. 48, 3116–3130. doi: 10.1080/00036846.2015.1136394

Qiao, G., Yang, J., and Li, W. (2020). VIX forecasting based on GARCH-type model with observable dynamic jumps: a new perspective. N. Am. J. Econ. Financ. 53:101186. doi: 10.1016/j.najef.2020.101186

Shirota, S., Hizu, T., and Omori, Y. (2014). Realized stochastic volatility with leverage and long memory. Comput. Stat. Data Anal. 76, 618–641. doi: 10.1016/j.csda.2013.08.013

Takahashi, M., Omori, Y., and Watanabe, T. (2009). Estimating stochastic volatility models using daily returns and realized volatility simultaneously. Comput. Stat. Data Anal. 53, 2404–2426. doi: 10.1016/j.csda.2008.07.039

Tong, C., and Huang, Z. (2021). Pricing VIX options with realized volatility. J. Futures Mark. 41, 1180–1200. doi: 10.1002/fut.22201

Tsay, R. S. (2005). Analysis of Financial Time Series. Hoboken, NJ: John Wiley & Sons. doi: 10.1002/0471746193

Wang, L., Ma, F., Hao, J., and Gao, X. (2021). Forecasting crude oil volatility with geopolitical risk: Do time-varying switching probabilities play a role? Int. Rev. Financ. Anal. 76:101756. doi: 10.1016/j.irfa.2021.101756

Wei, Y., Liu, J., Lai, X., and Hu, Y. (2017). Which determinant is the most informative in forecasting crude oil market volatility: fundamental, speculation, or uncertainty? Energy Econ. 68, 141–150. doi: 10.1016/j.eneco.2017.09.016

Wen, F., Gong, X., and Cai, S. (2016). Forecasting the volatility of crude oil futures using HAR-type models with structural breaks. Energy Econ. 59, 400–413. doi: 10.1016/j.eneco.2016.07.014

Wen, F., Zhao, Y., Zhang, M., and Hu, C. (2019). Forecasting realized volatility of crude oil futures with equity market uncertainty. Appl. Econ. 51, 6411–6427. doi: 10.1080/00036846.2019.1619023

Wu, H., Li, P., Cao, J., and Xu, Z. (2024). Forecasting the Chinese crude oil futures volatility using jump intensity and Markov-regime switching model. Energy Econ. 134:107588. doi: 10.1016/j.eneco.2024.107588

Wu, X., and Hou, X. (2020). Forecasting volatility with component conditional autoregressive range model. N. Am. J. Econ. Finance 51:101078. doi: 10.1016/j.najef.2019.101078

Wu, X., Xia, M., and Zhang, H. (2020). Forecasting VaR using realized EGARCH model with skewness and kurtosis. Fin. Res. Lett. 32:101090. doi: 10.1016/j.frl.2019.01.002

Xu, Y., Liu, T., and Du, P. (2024). Volatility forecasting of crude oil futures based on Bi-LSTM-attention model: the dynamic role of the COVID-19 pandemic and the Russian-Ukrainian conflict. Resour. Policy 88:104319. doi: 10.1016/j.resourpol.2023.104319

Zavadska, M., Morales, L., and Coughlan, J. (2020). Brent crude oil prices volatility during major crises. Fin. Res. Lett. 32:101078. doi: 10.1016/j.frl.2018.12.026

Zhang, L., Chen, Y., and Bouri, E. (2024). Time-varying jump intensity and volatility forecasting of crude oil returns. Energy Econ. 129:107236. doi: 10.1016/j.eneco.2023.107236

Zhang, Y., Wahab, M. I. M., and Wang, Y. (2023). Forecasting crude oil market volatility using variable selection and common factor. Int. J. Forecast. 39, 486–502. doi: 10.1016/j.ijforecast.2021.12.013

Zhang, Y. J., Yao, T., He, L. Y., and Ripple, R. (2019). Volatility forecasting of crude oil market: can the regime switching GARCH models beat the single-regime GARCH models? Int. Rev. Econ. Finance 59, 302–317. doi: 10.1016/j.iref.2018.09.006

Zhang, Y. J., and Zhang, H. (2023a). Volatility forecasting of crude oil futures market: Which structural change-based HAR models have better performance? Int. Rev. Financ. Anal. 85:102454. doi: 10.1016/j.irfa.2022.102454

Zhang, Y. J., and Zhang, H. (2023b). Volatility forecasting of crude oil market: which structural change based GARCH models have better performance? Energy J. 44, 175–194. doi: 10.5547/ej44-1-Zhang

Keywords: volatility forecasting, crude oil futures, extreme-value information, jump dynamics, realized EGARCH model

Citation: Shu W and Luo H (2025) Forecasting crude oil futures volatility with extreme-value information and dynamic jumps. Front. Environ. Econ. 4:1511074. doi: 10.3389/frevc.2025.1511074

Received: 14 October 2024; Accepted: 28 January 2025;

Published: 19 February 2025.

Edited by:

Le Wen, University of Auckland, New ZealandReviewed by:

Emad Kazemzadeh, Ferdowsi University of Mashhad, IranCopyright © 2025 Shu and Luo. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Huiyu Luo, dWZlaHlsdW9AMTYzLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.