95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Energy Res. , 28 March 2025

Sec. Energy Efficiency

Volume 13 - 2025 | https://doi.org/10.3389/fenrg.2025.1477248

This article is part of the Research Topic Energy Management, Energy Efficiency Policies, and Energy System Studies View all 7 articles

Day-ahead electricity prices in today’s competitive electric power markets have complex features such as high frequency, high volatility, non-linearity, non-stationarity, mean reversion, multiple periodicities, and calendar effects. These complicated features make price forecasting difficult. To address this, this research examines the application of functional data analysis to forecasting day-ahead electric power prices. Compared to classical time series forecasting approaches, functional data analysis is more appealing since it anticipates the daily profile, allowing for short-term projections. This technique uses a functional autoregressive (

Electricity is an essential requirement for all aspects of modern life. However, large-scale energy storage remains a problem, complicating operating plans in the electricity sector. As a result, energy pricing in supply and demand is an issue since it is directly related to the quantity of consumed load. This connection serves as the foundation for all utility economic planning and administration. Furthermore, trustworthy and committed policies in development plans are essential. For example, generation units must prioritize reliability alongside other policies, such as environmental protection and renewable energy infrastructure development. These policies significantly affect the quality of delivered energy (Lago et al., 2021).

Efficient planning in reorganized power systems is separated into four time periods: long-term (more than 10 years), medium-term (1 year), short-term (1 week to 1 month), and immediate planning. These plans must consider load usage, electricity pricing, economic conditions, and yearly electricity prices. Furthermore, the demand load quantity, a time-dependent nonlinear function, must be evaluated daily (day or night), seasonally (hot or cold), and considering local weather conditions (Inglada-Pérez and Gil, 2024; Iftikhar et al., 2023a).

As a result, differing electricity demand patterns and levels vary significantly over time (at least hourly). As mentioned earlier, each phase has significant characteristics that improve managerial performance. During these periods, 1-day forecasting has the most significant impact on power prices. The most crucial advantage of short-term forecasting is that it enhances supply and demand. Therefore, selecting the most accurate and rapid approach for estimating electric power costs is critical and vital (Gonzales et al., 2024; Iftikhar et al., 2023b).

To obtain efficient and accurate one-day-ahead electric power demand and prices, many studies have used classical time series forecasting models, including exponential smoothing, regression analysis, and various machine-learning models such as neural networks, fuzzy neural networks, and support vector machines (Pinhão et al., 2022; Shah et al., 2019). For example, Dudek (2015) employed stochastic models for short-term price forecasting. They utilized the regression trees method to forecast electricity prices and compared the results with those of alternative approaches such as ARIMA, exponential smoothing, and neural networks. Empirical findings indicated that their proposed method outperformed other benchmark techniques regarding predictive accuracy. Li et al. (2020) proposed a new hybrid short-term load forecasting method that combined multivariate linear regression (MLR) and long-short-term memory (LSTM) neural networks. Taheri et al. (2021) suggested forecasting the electricity demand time series employing a hybrid prediction model that combined LSTM with empirical mode decomposition (EMD). Recurrent neural networks (RNNs) can be preferable as they implicitly capture the temporal context available in the time series or sequential data (Gers et al., 2001; Karim et al., 2019; Talebjedi et al., 2024; Baruah and Organero, 2023). A gated recurrent unit (GRU) and LSTM networks have demonstrated efficiency in modeling and forecasting time series data (Coelho et al., 2024). GRU networks are mainly used in classification and are seldom applied in regression problems (Liu et al., 2017; Ugurlu et al., 2018). Fargalla et al. (2024) employed combined neural networks (GRU + MLP, CNN + bidirectional GRU (BiGRU)) for predicting gas production in various reservoirs, showcasing remarkable prediction capabilities. Hippert et al. (2001) conducted a comprehensive review of short-term demand prediction and compared the performance of artificial neural networks with classical TS methods. Their results indicate that artificial neural networks outperform classical techniques. With increasing uncertainty in electrical systems, anticipating electricity demand, generation, and pricing becomes challenging for actors in the electrical market (Rajabi and Estebsari, 2019). Numerous strategies and solutions have been proposed in response to these challenges. However, each method entails its own advantages and disadvantages. As the electricity market integrates more renewable resources with intermittent behavior, the system experiences additional fluctuations and volatility, making the development of superior and efficient forecasting models complex (Chan et al., 2012). To effectively handle complex TS data, it is essential to develop state-of-the-art visualization, modeling, and forecasting techniques to accommodate high- and infinite-dimensional data. Classical methods for multivariate data encounter difficulties when dealing with such complex data, leading to ineffective results. Therefore, alternative approaches, such as functional data analysis (FDA) methods, have been less explored in the literature.

One-day-ahead price forecasting is of utmost importance for market agents and system operators. Overproduction incurs penalties due to the inability to store electricity and the need to instantly meet demand. Price forecasting also facilitates efficient resource management, optimal scheduling, and production planning to minimize generation costs. Retailers heavily rely on price forecasts to secure the best deals for their energy requirements. Hence, predicting the price for the next day is a significant concern for electricity businesses. The advent of smart metering has increased the frequency of electricity consumption data, with measurements now available at intervals as short as every half-hour or even a few minutes. Consequently, forecasting prices for the following day require predicting many price values beyond the traditional, highlighting the need for innovative methodologies such as utilizing functional data methods (Chaouch, 2013; Paparoditis and Sapatinas, 2013; Shah et al., 2022b). FDA is a statistical framework that analyzes and models observed data as curves or functions. Functional time series (FTS) extends this framework to handle time-dependent functional data, enabling the analysis and forecasting of functional observations over time.

FTS techniques have found numerous applications in electricity markets. From a functional perspective, it is possible to generate long-term estimates of electricity demand or day-ahead clearing prices. The challenge of forecasting over longer horizons can be addressed by transforming it into a series of one-step-ahead functional forecasts. This can be achieved by segmenting the time series into segments of equal length corresponding to the desired forecast horizon. While various approaches exist for dealing with discrete TS, limited contributions specifically focus on FTS (Horváth and Kokoszka, 2012). From a univariate FTS modeling perspective, the theory of linear FTS in Hilbert space was proposed by Bosq (2000) and Bosq and Blanke (2008) by introducing the functional autoregressive (

As seen in the above studies, the functional time series approach enhances the forecasting accuracy and efficacy of short-term electric power prices better than other methods and models. To test these studies, this research examines the application of functional data analysis to forecasting day-ahead electric power prices. Within the functional data analysis, this study proposes a functional autoregressive (

• To improve the efficiency and accuracy of day-ahead electricity price forecasting, this work proposes novel functional autoregressive (

• Compare the performance of the proposed functional models with various standard time series models with and without exogenous information.

• To evaluate the performance of the proposed functional forecasting models, three different accuracy mean errors are determined: mean absolute error, root mean squared error, and mean absolute percent error; an equal forecast statistical test—the Diebold and Marino test; a visual evaluation.

• In this study, the results of the functional autoregressive with exogenous variables (

• Finally, while this study is limited to the British electricity market, it may be extended and generalized to other energy markets to assess the efficacy of the proposed functional forecasting model.

The rest of this study is structured thus. Section 2 gives an overview of the basics of the FDA. Section 3 presents an overview of the British electricity market and the out-of-sample forecasting results. Section 4 compares the current study’s proposed best model and the literature’s proposed best models. Section 5 summarizes the key conclusions drawn from our study and outlines potential future research directions.

This section addresses certain fundamental concepts that are required for developing functioning models. The TS of electricity prices

where

The eigenfunctions of

The combination eigenvalue of the covariance function

It follows that

The FPCs at time i are represented by the coefficients

The price curves are modeled and forecast through a functional model called the

where

• Fix dimension D and obtain the estimated FPC scores as

• For a fixed-order

• The KL theorem

To increase forecasting accuracy,

where

1. a. Set the dimension D for

b. When dealing with functional exogenous variables with a fixed value of

c. Next, integrate all the exogenous variable vectors into a single vector,

2. Use

3. Using the KL theorem, obtain

The KL expansion provides a 1-day forecast for

This study aims to achieve accurate forecasting using

where

The autoregressive (AR) algorithm is the most popular linear model used in univariate time series forecasting. It regresses the response variable using its

where

The combination of the AR and the moving average (MA) models is called the “autoregressive moving average” model (ARMA) for stationary series. However, a likelihood function could not be derived from performing ML estimation of the parameters until 1970, when the classic Time Series Analysis (Jan et al., 2022) was published, including the full modeling methodology for univariate series, identification, estimations, diagnostics checking, and forecasting. The general form of the ARMA model can be presented thus:

where

To introduce ARIMA (r, d, s), consider

In Equation 9, B is the back-shift operator, and d indicates the series’ differencing. This model is written as “ARIMA (r, d, s)”, where “r” stands for AR order, “d” stands for series differencing, and”s” stands for MA order. The ARIMA

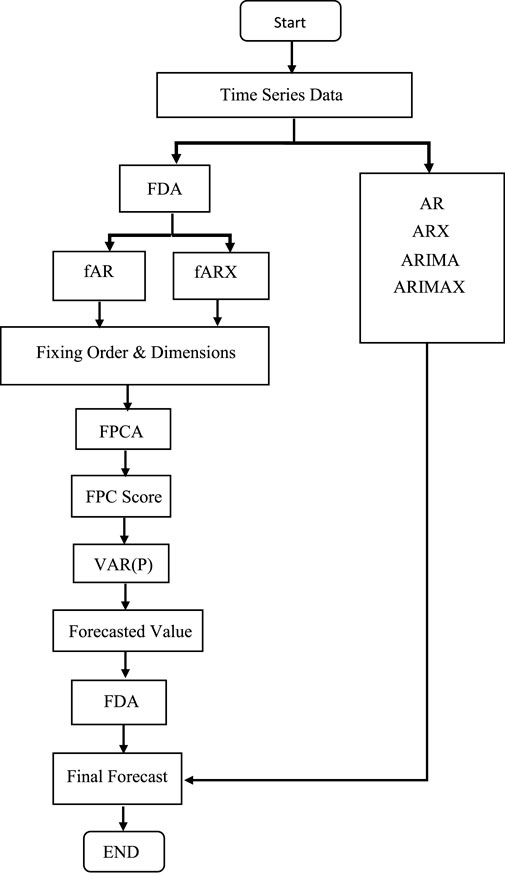

To finish this part of the study, Figure 1 depicts the architecture of the proposed time series functional forecasting approach and the pointwise explanation below:

1. The time series data is divided into two parts: validation data and testing data set. This study uses two different methods: the classical time series model and the functional time series model.

2. Classical time series models such as AR, ARX, ARIMA, and ARIMAX are applied to the data to generate forecasts.

3. The discrete-time series data is converted into functional data using Fourier basis functions.

4. Functional time series models, such as fAR and fARX, are applied to the functional data.

5. The optimal order and dimension of the proposed functional models are determined using the functional final prediction error.

6. Functional principal component analysis is utilized in the proposed functional models.

7. A vector autoregressive model of order p is estimated and forecast using the principal component scores. The fARX model is an extension of the fAR model that incorporates explanatory variables, such as long-run secular trends, yearly periodicity, weekly seasonality, bank holidays, and forecast electricity prices.

8. The forecast vector is converted into functional data using the KL transformation, resulting in the final forecast.

Figure 1. British Electricity Market: architecture of the proposed functional data analysis approach.

This study has computed numerous quality indicators to compare the models. We convert the anticipated curves into half-hourly electricity pricing data to facilitate comparison. Three average accuracy measures are used to evaluate prediction accuracy and efficiency: 1) mean absolute percentage error (MAPE), 2) mean absolute error (MAE), and 3) root mean square error (RMSE), as well as the Diebold–Mariano equal forecasts statistical test (Quispe et al., 2024; Qureshi et al., 2024).

The MAE is derived by averaging the absolute difference between the prediction and the actual value while ensuring that the negative value does not cancel out the positive values. It can be stated thus:

where

To compute the MAPE, divide the average absolute error for each period by the observed values and multiply by 100. The MAPE effectively measures accuracy when a prediction variable is large (Box, 2013). It is a relative measure of forecast error that highlights the degree of difference between the predicted and actual values. The mathematical expression for the MAPE is

The RMSE grows as the scale of the dependent variable grows. It compares forecasts from many models for the same dataset. The RMSE is the square root of the squared difference on average between the anticipated and actual values. The mathematical definition is:

The Diebold–Mariano (DM) test (McKenzie, 2011) is employed to evaluate the accuracy of the proposed functional time series forecasting models. This statistical test is commonly used in time series analysis to compare the accuracy of two forecasting models. It evaluates whether the errors generated by one model statistically differ from the errors of another (Carbo-Bustinza et al., 2023). To perform the DM test, the forecast errors of each model are calculated using a loss function. These errors are the differences between the observed values

The null and alternative hypotheses of the DM test are

Therefore, the null hypothesis implies no statistically significant difference in forecast accuracy between the models, while the alternative hypothesis suggests that a significant difference exists.

The liberalization of the United Kingdom’s electricity industry can be attributed to the regulatory and structural changes implemented in the late 1980s. These reforms sought to eliminate the state-owned monopoly and establish a competitive wholesale energy market. Recognizing that transmission and distribution are natural monopolies, the main focus of the reforms was the deregulation of the generation and supply sectors. Consequently, in 1990 the UK electricity market underwent reorganization, establishing the England and Wales power pool and dividing the government monopoly into three entities: National Power, Powergen, and Nuclear Energy.

The power pool served as a trading platform for half-hourly transactions. However, market power in the generation industry became a significant concern due to National Power and Powergen holding respective market shares of 50% and 30%. Meanwhile, Nuclear Electric, responsible for supplying the base load of nuclear power, essentially acted as a price taker. Market manipulation by these two corporations led to reduced competition, resulting in the average price remaining approximately 24 per megawatt-hour between 1994 and 1996 (Karakatsani and Bunn, 2008).

A fully liberalized bilateral contracting system replaced the England and Wales power pool with the introduction of New Energy Trading Arrangements (NETA) in 2001 (becoming the British Electricity Trading Transmission Arrangements—BETTA—in 2005). This transition established a more stable market share for electricity companies in the generation and retail sectors. Additionally, the reforms resulted in the creation of three distinct power exchanges: the United Kingdom Power Exchange (UKPX), the UK Automated Power Exchange (APX UK), and the International Exchange (IE, formerly known as the International Petroleum Exchange—IPE). Subsequently, the amalgamation of APX and UKPX into APX Group in 2004, followed by the inclusion of Scotland in the UK power market in 2005, further enhanced market dynamics. This highly competitive and well-developed market exhibits a robust correlation between market price and market fundamentals (Lisi and Pelagatti, 2018).

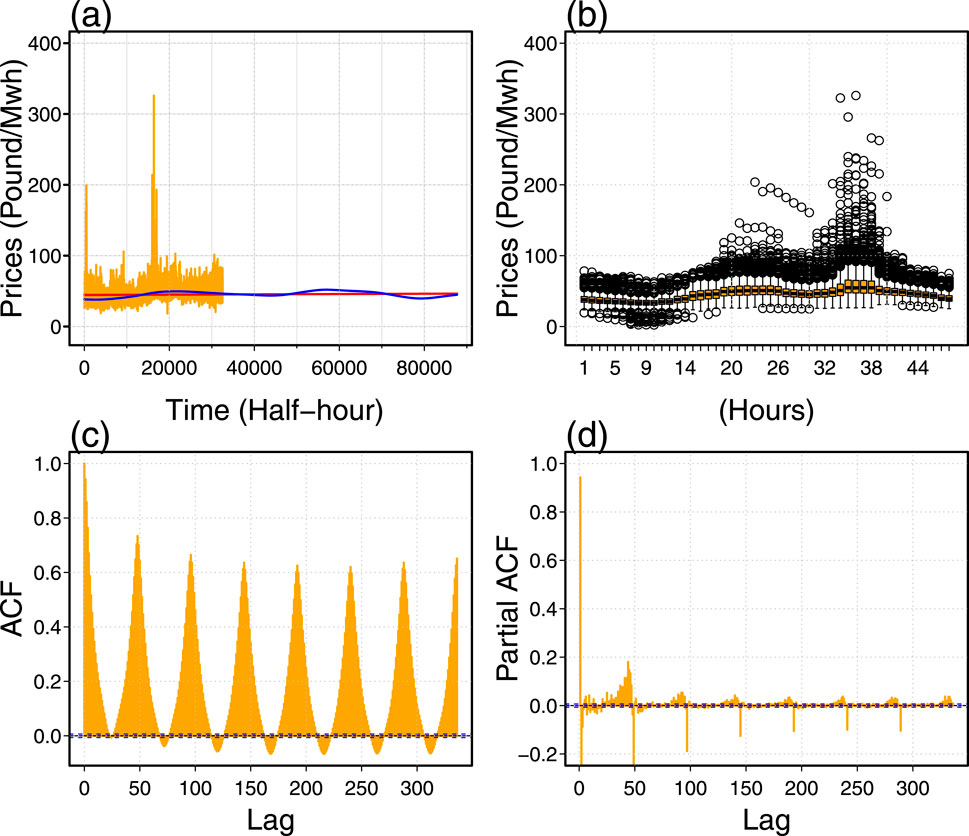

This study aims to accurately and efficiently forecast half-hourly electricity pricing data from APX from January 2018 to December 2022. To achieve this objective, we implemented an FDA to model and forecast the electricity price-time series in the APX. To understand the complex characteristics of electricity price dynamics over time, these characteristics are expected to include missing values, a nonlinear long-run secular trend, pronounced seasonality, high volatility, non-normality, and non-stationarity. A non-stationary process can be defined as one in which statistical features such as mean, variance, and autocorrelation vary with time. This indicates that the data lacks a steady mean or variance, making it difficult to examine using typical statistical approaches that presume stationarity. Thus, the key characteristics of non-stationary data are: a) trends: non-stationary data may show long-term trends in which values grow or decrease with time; b) seasonality: refers to recurrent patterns or cycles that occur at regular periods, such as seasonal influences in sales statistics; c) changing variability: the variability of the data may alter with time, resulting in periods of volatility followed by stability. For instance, Figure 2A shows the half-hourly electricity price time series with a red-line linear and blue-line nonlinear trend component. Figure 2B shows a boxplot for the half-hourly over 6 years, indicating high variations among the 24 hours (48 half hours). Figure 2C shows the autocorrelation plot of the original electricity prices at 336 lags, and Figure 2D shows the partial autocorrelation plot of original electricity prices at 336. These figures clearly illustrate a discernible long-term trend, as well as annual and weak seasonality. Furthermore, non-normality and non-stationarity are also evident from these visual representations.

Figure 2. Characterization of British electricity power prices (2018–2022): time diagrams (a) visualize time fluctuations using long-term linear (blue) and non-linear (red) trend components; (b) half-hour sequence diagrams; (c) autocorrelation function diagrams analyze the correlation of price fluctuations during various past delays; (d) partial autocorrelation function diagrams investigate the relationship between price changes after accounting for the effects of previous delays.

On the other hand, Table 1 summarizes the characteristics of the data before and after data transformations, such as taking the natural logarithm (addressing variance and standard deviation stabilization). For instance, for the electric power time series before and after data transformations, the minimum values: are 2.20 and 0.79, first quartile (37.28 and 3.62); median (43.96 and 3.78); mean (45.51 and 3.79); mode (37.81 and 3.63); third quartile (51.28 and 3.94); standard deviation (12.45 and 0.25); coefficient of variation (27.36 and 6.56); maximum (326.09 and 5.79). It is confirmed from this analysis that the log transformation attained normality in the data since the mean, median, and mode are approximately the same. However, the standard deviation is also much lower than the original series. To this end, further analysis proceeds with the log-transformed electric power price series for modeling and forecasting purposes. Thus, for modeling and forecasting, the log-transformed data are divided into two parts:

• validation data: from

• testing data: from

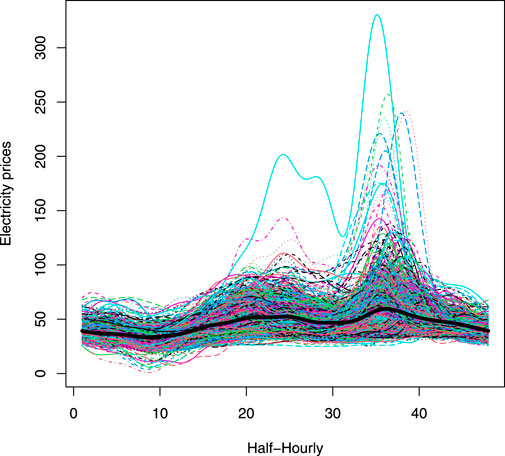

The models were estimated using an extension window approach derived from an annual 1-day out-of-sample forecast. As indicated in Figure 3, the discrete half-hourly electricity price is from

Figure 4. British Electricity Market: functional daily curves for British electricity prices;

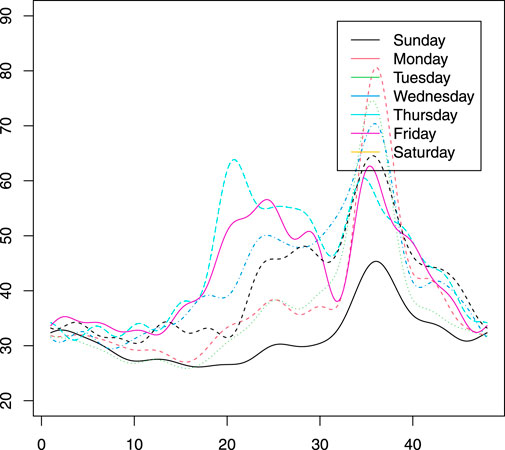

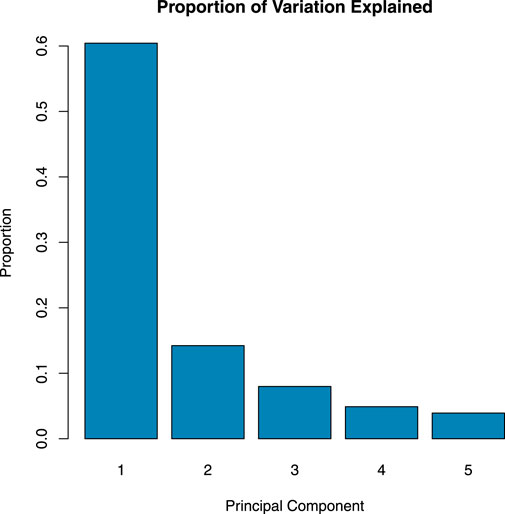

Figure 5 illustrates that the functional representation of electricity prices exhibits lower values during weekends than weekdays, indicating less electricity use over weekends. Figure 6 shows the first five FPCs, which account for a large number of data variations. Figure 7 shows the proportion of variation explained by each FPC. The graphic shows that the first PC accounts for about 60% of all data volatility. Accordingly, the second, third, fourth, and fifth FPCs account for 13%, 8%, 6%, and 5% of total variation.

Figure 5. British Electricity Market: graphic functional description of a single week of electricity prices.

Figure 6. British Electricity Market: five principal components proportion of variation explained by each FPC.

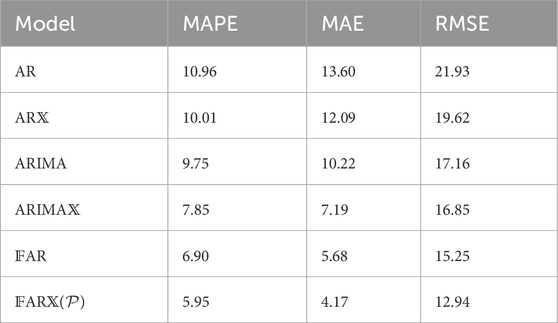

The day-ahead forecasting accuracy of the models is measured using the MAE, MAPE, and RMSE. For instance, Table 2 summarizes the models’ overall accuracy, showing that the functional models outperform the classical time series models (AR, AR

Table 2. British Electricity Market: out-of-sample forecasting error evaluation of functional models and traditional time series models considered.

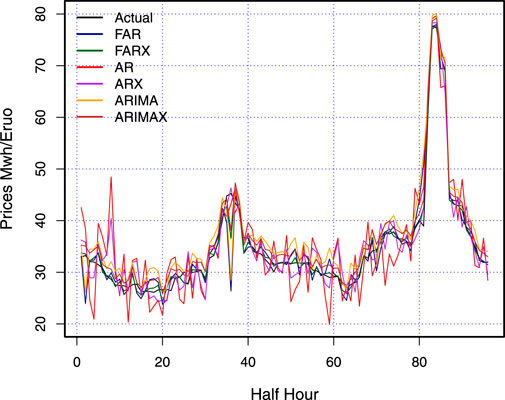

On the other hand, a graphical comparison (Figure 8) shows the original and predicted values for each of the forecasting models that were taken into account in Table 2. The figure demonstrates how well the forecast from the proposed functional model (

Figure 8. British Electricity Market: out-of-sample forecasting error evaluation of the functional models and considered traditional time series models.

After calculating the accuracy measures (MAPE, MAE, and RMSE), the Diebold–Mariano (DM) test was used to statistically assess the superiority of the proposed functional time series models (see Table 3 for the DM statistic p-values). The outcome of this table revealed that the proposed functional time series model (

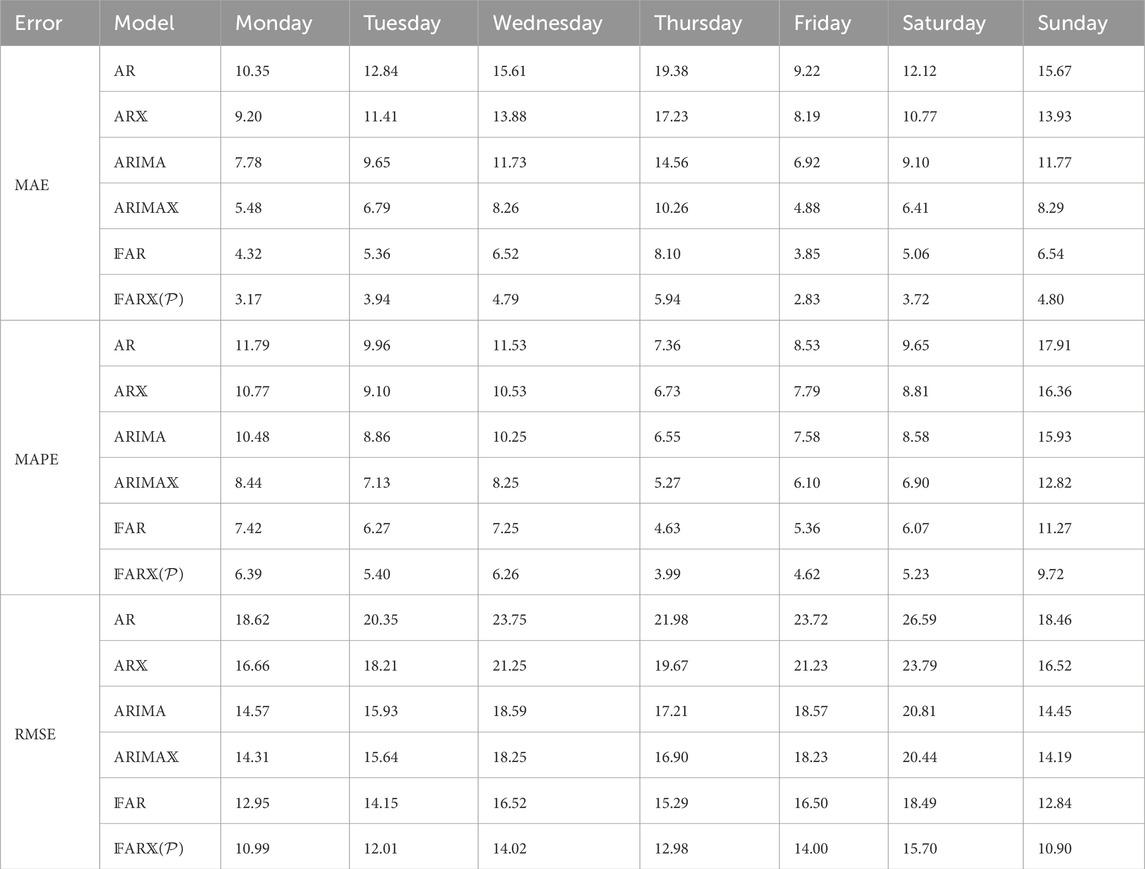

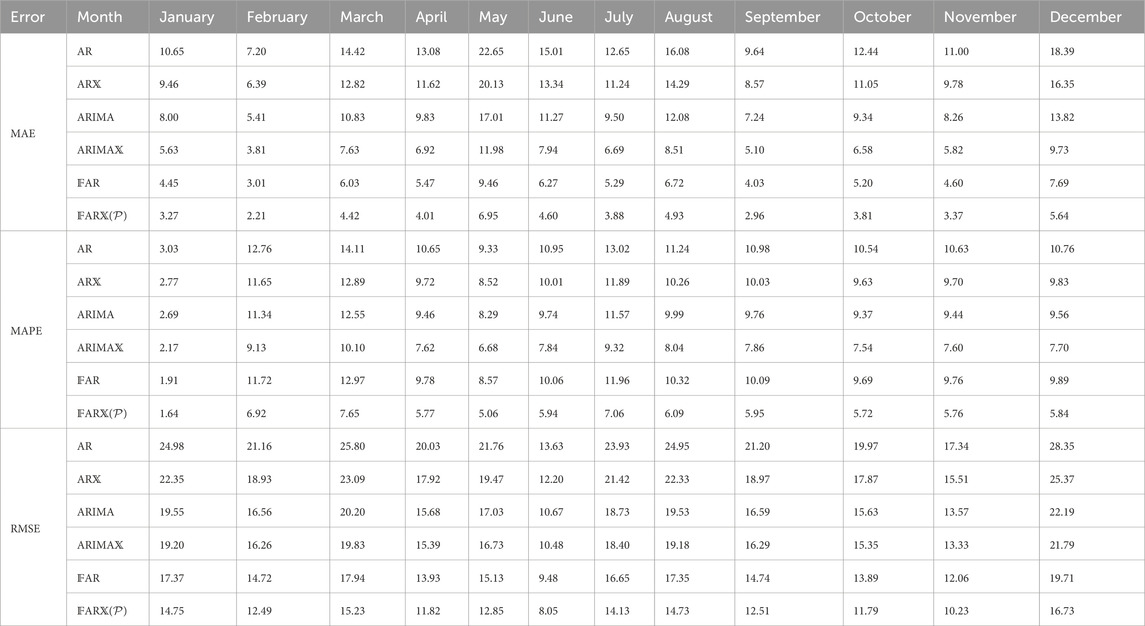

Table 4 displays the weekly forecasting errors for the models under investigation. Monday, Wednesday, Saturday, and Sunday are typically associated with larger weekly errors than Tuesday, Thursday and Friday. Among the models,

Table 4. British Electricity Market: weekly forecasting accuracy metrics evaluation of functional models and traditional time series models considered.

Table 5 presents the monthly forecasting errors for each model considered in this study. It is evident that December, January, and February exhibit relatively higher errors than other months. This can be attributed to increased electricity demand during these months. Nevertheless, the functional models perform better than the standard traditional time series models. Specifically, the direct functional model

Table 5. British Electricity Market: monthly forecasting accuracy evaluation of functional models and traditional time series models considered.

As is evident from the average accuracy errors (MAE, MAPE, and RMSE) and equal forecasting accuracy statistical test (DM test) and graphical results (line plots), the

To sum up this section, we can say that the suggested functional forecasting model with exogenous variables has a high degree of accuracy and efficiency for day-ahead for British electricity prices based on the accuracy mean errors (MAE, MAPE, and RMSE) and equal forecast statistical test (the DM test).

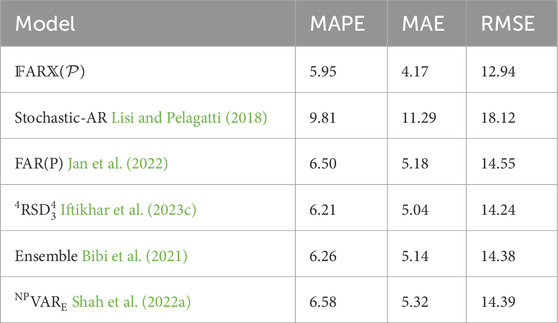

This section compares the best proposed functional (

Table 6. British Electricity Market (pound/MWh): comparison of one-day-ahead average accuracy metrics between proposed functional best models and literature best models.

The proposed functional time series model used in this study has proven to be very accurate and effective in predicting the next-day power price in the British electricity market. These precise forecasts can help sellers (buyers and suppliers) optimize their bid planning, maximize revenue, and better use the resources required to generate electricity. Offering a stable and cost-effective energy system benefits end users. Furthermore, the accurate projection and understanding of energy prices in developing countries can help traders make more effective commercial and trade plans and better asset allocations. Finally, sellers (buyers and suppliers) can create more robust trading strategies based on the proposed

The statistical computing language programming environment R-studio implements analysis models. In comparison, all computations were performed with Intel(R) Core(TM) i7-6600 @ 2.80 GHz CPU. R uses GAM, tsDyn, and forecast libraries to model and predict standard time series forecast models. We wrote our own source code to model and forecast

Forecasting electricity prices in a deregulated power market is complex and crucial. The price time series of electric power exhibits features such as high frequency, long-term trends, multiple seasonal patterns, spikes or jumps, and the effects of bank holidays. Addressing these features is essential for accurate price forecasting. This study has focused on the problem of day-ahead electricity price forecasting using functional data analysis. The electricity prices were modeled and forecast through two functional models, employing four classical time series models (AR, AR

This study focuses entirely on the British electricity market. The idea should include additional electrical markets, such as the European, American, and Chinese markets. Other energy market factors are electricity demand, production, consumption, curves, natural gas pricing, wind speed, and crude oil prices. This will enable a more in-depth assessment of the upgraded functional model’s performance. There are various approaches to broaden the field of future study. Other functional factors, such as temperature, consumer load, fuel, carbon dioxide emission costs, average solar radiation, and wind speed, can be included in the model to improve electricity price forecasting accuracy.

Publicly available datasets were analyzed in this study; the data can be found at: https://www.kaggle.com/datasets/thedevastator/gb-electrical-grid-half-hourly-data-2008-present.

FJ: conceptualization, data curation, formal analysis, investigation, methodology, resources, software, validation, visualization, writing–original draft, and writing–review and editing. HI: conceptualization, formal analysis, funding acquisition, methodology, project administration, resources, software, supervision, visualization, writing–original draft, and writing–review and editing. MT: data curation, formal analysis, investigation, resources, and writing–review and editing. MK: funding acquisition, investigation, project administration, supervision, and writing–review and editing.

The authors declare that no financial support was received for the research, authorship, and/or publication of this article.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Aue, A., Norinho, D. D., and Hörmann, S. (2015). On the prediction of stationary functional time series. J. Am. Stat. Assoc. 110, 378–392. doi:10.1080/01621459.2014.909317

Baruah, R. D., and Organero, M. M. (2023). “Integrating explicit contexts with recurrent neural networks for improving prognostic models,” in 2023 IEEE aerospace conference Germany, (IEEE), 1–8.

Bibi, N., Shah, I., Alsubie, A., Ali, S., and Lone, S. A. (2021). Electricity spot prices forecasting based on ensemble learning. IEEE Access 9, 150984–150992. doi:10.1109/access.2021.3126545

Bosq, D. (2000). Linear processes in function spaces: theory and applications. Germany, Springer Science and Business Media. 149.

Box, G. (2013). “Box and jenkins: time series analysis, forecasting and control,” in A very British affair: six britons and the development of time series analysis during the 20th century Germany, (Springer), 161–215.

Carbo-Bustinza, N., Iftikhar, H., Belmonte, M., Cabello-Torres, R. J., De La Cruz, A. R. H., and López-Gonzales, J. L. (2023). Short-term forecasting of ozone concentration in metropolitan lima using hybrid combinations of time series models. Appl. Sci. 13, 10514. doi:10.3390/app131810514

Chan, S.-C., Tsui, K. M., Wu, H., Hou, Y., Wu, Y.-C., and Wu, F. F. (2012). Load/price forecasting and managing demand response for smart grids: methodologies and challenges. IEEE signal Process. Mag. 29, 68–85. doi:10.1109/msp.2012.2186531

Chaouch, M. (2013). Clustering-based improvement of nonparametric functional time series forecasting: application to intra-day household-level load curves. IEEE Trans. Smart Grid 5, 411–419. doi:10.1109/tsg.2013.2277171

Chen, Y., Chua, W. S., and Koch, T. (2018). Forecasting day-ahead high-resolution natural-gas demand and supply in Germany. Appl. energy 228, 1091–1110. doi:10.1016/j.apenergy.2018.06.137

Chen, Y., and Li, B. (2017). An adaptive functional autoregressive forecast model to predict electricity price curves. J. Bus. and Econ. Statistics 35, 371–388. doi:10.1080/07350015.2015.1092976

Coelho, C., Costa, M. F. P., and Ferrás, L. L. (2024). Enhancing continuous time series modelling with a latent ode-lstm approach. Appl. Math. Comput. 475, 128727. doi:10.1016/j.amc.2024.128727

Dudek, G. (2015). “Short-term load forecasting using random forests,” in Intelligent systems’ 2014: proceedings of the 7th IEEE international conference intelligent systems IS’2014, Warsaw, Poland, September 24-26, 2014, , volume 2: tools, architectures, systems, applications (Springer), 821–828.

Fargalla, M. A. M., Yan, W., Deng, J., Wu, T., Kiyingi, W., Li, G., et al. (2024). Timenet: time2vec attention-based cnn-bigru neural network for predicting production in shale and sandstone gas reservoirs. Energy 290, 130184. doi:10.1016/j.energy.2023.130184

Gers, F. A., Eck, D., and Schmidhuber, J. (2001). “Applying lstm to time series predictable through time-window approaches,” in International conference on artificial neural networks USA, 9 to September 12, 2025, (Springer), 669–676.

Gonzales, S. M., Iftikhar, H., and López-Gonzales, J. L. (2024). Analysis and forecasting of electricity prices using an improved time series ensemble approach: an application to the peruvian electricity market. AIMS Math. 9, 21952–21971. doi:10.3934/math.20241067

Hippert, H. S., Pedreira, C. E., and Souza, R. C. (2001). Neural networks for short-term load forecasting: a review and evaluation. IEEE Trans. power Syst. 16, 44–55. doi:10.1109/59.910780

Horváth, L., and Kokoszka, P. (2012). Inference for functional data with applications, Springer Science and Business Media. 200.

Iftikhar, H., Bibi, N., Canas Rodrigues, P., and López-Gonzales, J. L. (2023a). Multiple novel decomposition techniques for time series forecasting: application to monthly forecasting of electricity consumption in Pakistan. Energies 16, 2579. doi:10.3390/en16062579

Iftikhar, H., Turpo-Chaparro, J. E., Canas Rodrigues, P., and López-Gonzales, J. L. (2023b). Day-ahead electricity demand forecasting using a novel decomposition combination method. Energies 16, 6675. doi:10.3390/en16186675

Iftikhar, H., Turpo-Chaparro, J. E., Canas Rodrigues, P., and López-Gonzales, J. L. (2023c). Forecasting day-ahead electricity prices for the Italian electricity market using a new decomposition—combination technique. Energies 16, 6669. doi:10.3390/en16186669

Inglada-Pérez, L., and Gil, S. G. y. (2024). A study on the nature of complexity in the Spanish electricity market using a comprehensive methodological framework. Mathematics 12, 893. doi:10.3390/math12060893

Jan, F., Shah, I., and Ali, S. (2022). Short-term electricity prices forecasting using functional time series analysis. Energies 15, 3423. doi:10.3390/en15093423

Karakatsani, N. V., and Bunn, D. W. (2008). Forecasting electricity prices: the impact of fundamentals and time-varying coefficients. Int. J. Forecast. 24, 764–785. doi:10.1016/j.ijforecast.2008.09.008

Karim, F., Majumdar, S., Darabi, H., and Harford, S. (2019). Multivariate lstm-fcns for time series classification. Neural Netw. 116, 237–245. doi:10.1016/j.neunet.2019.04.014

Kokoszka, P., and Reimherr, M. (2013). Determining the order of the functional autoregressive model. J. Time Ser. Analysis 34, 116–129. doi:10.1111/j.1467-9892.2012.00816.x

Lago, J., Marcjasz, G., De Schutter, B., and Weron, R. (2021). Forecasting day-ahead electricity prices: a review of state-of-the-art algorithms, best practices and an open-access benchmark. Appl. Energy 293, 116983. doi:10.1016/j.apenergy.2021.116983

Li, J., Deng, D., Zhao, J., Cai, D., Hu, W., Zhang, M., et al. (2020). A novel hybrid short-term load forecasting method of smart grid using mlr and lstm neural network. IEEE Trans. Industrial Inf. 17, 2443–2452. doi:10.1109/tii.2020.3000184

Lisi, F., and Pelagatti, M. M. (2018). Component estimation for electricity market data: deterministic or stochastic? Energy Econ. 74, 13–37. doi:10.1016/j.eneco.2018.05.027

Lisi, F., and Shah, I. (2020). Forecasting next-day electricity demand and prices based on functional models. Energy Syst. 11, 947–979. doi:10.1007/s12667-019-00356-w

Liu, B., Fu, C., Bielefield, A., and Liu, Y. Q. (2017). Forecasting of Chinese primary energy consumption in 2021 with gru artificial neural network. Energies 10, 1453. doi:10.3390/en10101453

McKenzie, J. (2011). Mean absolute percentage error and bias in economic forecasting. Econ. Lett. 113, 259–262. doi:10.1016/j.econlet.2011.08.010

Paparoditis, E., and Sapatinas, T. (2013). Short-term load forecasting: the similar shape functional time-series predictor. IEEE Trans. power Syst. 28, 3818–3825. doi:10.1109/tpwrs.2013.2272326

Pinhão, M., Fonseca, M., and Covas, R. (2022). Electricity spot price forecast by modelling supply and demand curve. Mathematics 10, 2012. doi:10.3390/math10122012

Quispe, F., Salcedo, E., Iftikhar, H., Zafar, A., Khan, M., Turpo-Chaparro, J. E., et al. (2024). Multi-step ahead ozone level forecasting using a component-based technique: a case study in lima, Peru. AIMS Environ. Sci. 11, 401–425. doi:10.3934/environsci.2024020

Qureshi, M., Iftikhar, H., Rodrigues, P. C., Rehman, M. Z., and Salar, S. A. (2024). Statistical modeling to improve time series forecasting using machine learning, time series, and hybrid models: a case study of bitcoin price forecasting. Mathematics 12, 3666. doi:10.3390/math12233666

Rajabi, R., and Estebsari, A. (2019). “Deep learning based forecasting of individual residential loads using recurrence plots,” in 2019 IEEE milan PowerTech (IEEE), 1–5.

Shah, I., Iftikhar, H., and Ali, S. (2022a). Modeling and forecasting electricity demand and prices: a comparison of alternative approaches. J. Math. 2022, 3581037. doi:10.1155/2022/3581037

Shah, I., Iftikhar, H., Ali, S., and Wang, D. (2019). Short-term electricity demand forecasting using components estimation technique. Energies 12, 2532. doi:10.3390/en12132532

Shah, I., Jan, F., and Ali, S. (2022b). Functional data approach for short-term electricity demand forecasting. Math. problems Eng. 2022, 1–14. doi:10.1155/2022/6709779

Taheri, S., Talebjedi, B., and Laukkanen, T. (2021). Electricity demand time series forecasting based on empirical mode decomposition and long short-term memory. Energy Eng. J. Assoc. Energy Eng. 118, 1577–1594. doi:10.32604/ee.2021.017795

Talebjedi, B., Laukkanen, T., and Holmberg, H. (2024). Integration of thermal energy storage for sustainable energy hubs in the forest industry: a comprehensive analysis of cost, thermodynamic efficiency, and availability. Heliyon 10, e36519. doi:10.1016/j.heliyon.2024.e36519

Keywords: electric power market, functional data analysis, day-ahead electricity price forecasting, classical time series models, functional time series models

Citation: Jan F, Iftikhar H, Tahir M and Khan M (2025) Forecasting day-ahead electric power prices with functional data analysis. Front. Energy Res. 13:1477248. doi: 10.3389/fenrg.2025.1477248

Received: 07 August 2024; Accepted: 25 February 2025;

Published: 28 March 2025.

Edited by:

A. S. M. Monjurul Hasan, University of Technology Sydney, AustraliaReviewed by:

Burcin Cakir Erdener, National Renewable Energy Laboratory (DOE), United StatesCopyright © 2025 Jan, Iftikhar, Tahir and Khan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hasnain Iftikhar, aGFzbmFpbkBzdGF0LnFhdS5lZHUucGs=; Mehak Khan, bWVoYWtraGFuM0Bob3RtYWlsLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.