- 1State Grid Hubei Electric Power Co., Ltd., Wuhan, Hubei, China

- 2State Grid Hubei Economic Research Institute, Wuhan, Hubei, China

Against the backdrop of China’s initiative to construct a new power system focusing on new energy, optimizing power grid investment holds significant importance. This study aims to investigate whether the application of artificial intelligence (AI) contributes to power grid investment efficiency. By considering diverse factors, power grid investment efficiency in China is assessed by using a Slack-based measure model. Then we analyze the relationship between AI and power grid investment efficiency, as well as their nonlinear threshold effect. We find a notable increase in China’s power grid investment efficiency, accompanied by evident regional differences. In addition, the utilization of AI exerts a significantly positive effect on power grid investment efficiency. Particularly, such a promoting effect is more pronounced in the China Southern Power Grid cohort and remains significant during the 12th Five-Year Plan period. Moreover, grid investment exhibits a double-threshold effect, and it diminishes the contributing effect of AI on power grid investment efficiency. AI shows a single threshold effect on power grid investment efficiency as electricity sales increase, and the positive impact manifests only when electricity sales surpass a specific threshold. These insights are important for the strategic deployment of power grid projects through using AI.

1 Introduction

To break the monopoly, the unbundling reform was introduced to separate power plants from grids in 2002, marking a vital milestone in China’s power market evolution (Deng et al., 2018). In 2015, China’s government initiated a new round of reform, proposing to build a national unified power market and reshaping the profit model of power grid enterprises (Zeng et al., 2016). Furthermore, to address emissions abatement, China advocated for the construction of a new type of power system in 2021, highlighting the clean transformation of power system (Sun et al., 2023). This focus on achieving emission peaking and carbon neutrality has catalyzed the development of wind and photovoltaic power generation projects, which spurs substantial demand for power investment. However, this shift has also brought uncertainties and challenges in grid investment. Moreover, the reform concerning electricity transmission and distribution tariffs requires power grid enterprises to adjust their revenue models (He et al., 2018). Given the critical role of power grid investment in the business performance of power grid enterprises and its broad impact on residents’ livelihoods, it is of great significance to investigate effective strategies for optimizing power grid investment and enhancing overall efficiency. As a new technological factor, artificial intelligence (AI), which denotes the human-like intelligent actions programmed to execute specific tasks (Goodfellow et al., 2016), exerts a vital role in the transformation and advancement of the energy sector (Li et al., 2023). The integration of AI with emerging technologies like the industrial internet of things, big data analysis, and cloud computing, has the potential to generate adaptable and efficient operating methods and contribute to industrial applications (Liu et al., 2020). Since 2013, China has implemented a succession of national policies to facilitate AI development, such as the New Generation Artificial Intelligence Development Plan, the Development Plan on Smart Manufacturing, and the Overall Layout Plan for the Construction of Digital China (Zhai and Liu, 2023). Consequently, AI’s extensive capacities have led to its rapid expansion across manufacturing, finance, education, logistics, and various other sectors (Miller, 2019). According to the International Data Corporation (IDC), the value of China’s AI market is projected to be 0.91 billion in 2023, with an impressive growth rate of 82.5%.

The widespread applications of AI have attracted considerable scholarly attention, particularly in analyzing its multifaceted influence. Some literature has explored the economic effects associated with AI, including economic development (Lu, 2021; Makridis and Mishra, 2022), productivity (Graetz and Michaels, 2018; Ramachandran et al., 2022), and income (Valentini et al., 2023), etc. Its social implications have also been a focus, like employment (Acemoglu and Restrepo, 2020; Faber, 2020), education (Ara Shaikh et al., 2022), healthcare (Tursunbayeva and Renkema, 2023; Yu et al., 2018), and industrial structure (Zou and Xiong, 2023), etc. Additionally, a growing body of recent literature has shifted its attention to AI’s environmental effects, like climate change adaption (Chen et al., 2023), emissions (Delanöe et al., 2023; Ding et al., 2023), and sustainable development (Chang et al., 2023), etc. Moreover, research on AI’s influence on the energy market has also gained significant attention. For instance, Lyu and Liu (2021) point out that, compared to other digital technologies, AI is the most extensively utilized in the energy sector, enhancing the performance of energy firms and contributing to the development of new energy technologies. As documented by Khalilpourazari et al. (2021) and Lee and Yoo (2021), applying AI can enhance energy efficiency by forecasting energy demand, optimizing energy production and consumption, and enabling intelligent control. Consequently, reduced energy costs and sustainable development can be promoted with the utilization of AI. Chen et al. (2023) state that the implementation of AI can assist power grid operators because of its ability to coordinate the grid by predicting renewable energy production.

These studies provide a foundational understanding of AI’s impact on the energy sector. However, a significant gap remains regarding AI’s influence on power grid investment efficiency. The question of whether AI applications effectively enhance power grid investment efficiency is unresolved and warrants thorough investigation. To address this gap, we, therefore, conduct a study examining the nexus between AI and power grid investment efficiency. Our study involves several key steps. Firstly, we measure power grid investment efficiency across China, considering various factors such as human, financial, and material inputs, as well as outputs including economic performance, grid safety, and environmental impact. Secondly, the relationship of AI on power grid investment efficiency is analyzed. Thirdly, we carry out a heterogeneous analysis for further analysis. Lastly, in light of the possible nonlinear effect, setting grid investment and electricity sales are the threshold variables, respectively, we examine the threshold effect of AI on power grid investment efficiency.

Based on our research, we find that China’s power grid investment efficiency notably increases over the study period, with conspicuous regional variations. The adoption of AI is identified as a significant driver behind this enhancement, exhibiting a positive effect on power grid investment efficiency. Furthermore, such a positive effect demonstrates evident regional heterogeneity. In more detail, AI manifests a stronger contributing effect on power grid investment efficiency in the China Southern Power Grid group compared to the State Grid Corporation of China group, and the positive influence remains significant solely during the 12th Five-Year Plan. Moreover, taking grid investment into account, the impact of AI on power grid investment efficiency shows a double-threshold effect, and AI’s influence on power grid investment efficiency exerts a single threshold effect as electricity sales enlarge.

Thereby, this paper contributes to the present literature on three grounds: First, the electricity transmitted through the power grid is indispensable across all facets of life, and power grid investment can improve social welfare by meeting fundamental life and production needs. However, only limited attention has been paid to power grid investment efficiency (Sun et al., 2019; Tong et al., 2017; Yao et al., 2019). By focusing on power grid investment efficiency in China, this study evaluates it taking multiple factors into consideration, thereby enriching the prior literature with a detailed assessment of the performance of power grid investment. Second, despite the widespread examination of AI’s diverse effects (Agrawal et al., 2023; Czarnitzki et al., 2023; Damioli et al., 2021; Zhao et al., 2022), few studies have investigated its impact on power grid investment efficiency. This study, thus, fills this gap by empirically exploring the nexus between AI and power grid investment efficiency. This exploration not only offers new insights into the benefits associated with AI but also enhances our understanding of how AI can be leveraged to boost power grid investment efficiency. Third, we go beyond analyzing the linear effect of AI on power grid investment efficiency by examining their nonlinear threshold effects, considering variables such as grid investment and electricity sales. The findings can contribute to a comprehensive understanding of the relationship between AI and power grid investment efficiency, offering valuable insights for policymakers and stakeholders in the power sector.

This paper consists of the following three parts: Section 2 introduces the methodology, variables, and data. Section 3 presents and discusses the empirical results. The conclusions and policy recommendations are drawn in Section 4.

2 Methodology and data

2.1 Power grid investment efficiency

Building upon the CCR-DEA model developed by Charnes et al. (1978), Tone (2001) introduced the Slack-based measure (SBM) model to calculate efficiency by accounting for input excesses and output shortfalls. Different with the traditional DEA model, SBM, as a non-radial approach, addresses the overestimation issues resulting from the oversight of slack variables (Fukuyama and Weber, 2009). Additionally, it incorporates input and output slacks in efficiency assessment, thereby offering a comprehensive evaluation of inefficiency across all aspects. In our study, to comprehensive measure power grid investment efficiency, both desirable output (economic and safety indicators) and undesirable output (environmental indicator) are taken into consideration. In light of the characteristics and advantages of the SBM model, following Yao et al. (2019), it is, therefore, applied to assess power grid investment efficiency.

Firstly, we set the input-output vector for DMU

Then, the general SBM model is constructed as follows:

In Equation 1,

Furthermore, following the thought of Hu and Wang (2006), power grid investment efficiency is defined as:

In Equation 2,

2.2 Econometric model

2.2.1 Benchmark regression model

The major objective of this study is to explore whether AI can improve power grid investment efficiency. Following the studies of Ni and Obashi (2021) and Huo and Wang (2022), the econometric model is constructed as below:

In Equation 3,

2.2.2 Threshold regression model

The panel threshold model proposed by Hansen (1999) stands as a classical approach examining the nonlinear relationships among variables. In this study, our aim is to investigate the possible nonlinear threshold effect of AI on power grid investment efficiency by taking grid investment and electricity sales into account. Therefore, following Khalifa et al. (2013) and Yang et al. (2019), the panel threshold models are constructed as:

In Equations 4, 5

2.3 Relevant variables

2.3.1 Artificial intelligence

The core independent variable in this study is AI. As AI utilizes a range of technologies, like machine learning, deep learning, and programming and algorithmic processing, to simulate human skills (Liu et al., 2020), precisely quantifying the level of AI applications poses a considerable challenge. Given that the adoption of AI in the production process is achieved predominantly through industrial robots (Chen and Qing, 2022), industrial robots can be employed for measuring AI applications. Therefore, referring to Liu et al. (2020), we adopt the density of industrial robots as a proxy of AI applications based on the practice of Acemoglu and Restrepo (2020). More specifically, the ratio between the stock of industrial robots and overall employment is computed to denote the density (Li et al., 2023), and it reflects the number of industrial robots per thousand workers. The detailed measurement approach is demonstrated in Equation 6 as follows:

In Equation 6,

2.3.2 Power grid investment efficiency

As the dependent variable, power grid investment efficiency is estimated based on the SBM model, which is previously illustrated. Its calculation requires input and output variables. Among them, standing as the input variable, the human, financial, and material resources are indicated by the number of employees, the power grid investment values, and transformer capacity above 35 KV, respectively. The two desirable indicators are denoted by electricity sales and the reliability rate of power supply. Moreover, the undesirable output is reflected by the coal consumption rate for power supply.

2.3.3 Control variables

To mitigate estimation biases associated with omitted variables and minimize the influence of exogenous factors, based on prior studies, the following variables are controlled for: 1) Efficiency of power supply (EPS). It is treated as an essential factor influencing power grid investment efficiency as it is highly related to the performance of grid investment projects. It is reflected by the transmission loss rate of the power grid. The lower the line loss rate, the higher the power supply efficiency; 2) Energy mix (EM). A clean energy mix can be beneficial to attract more investments. To quantify energy mix, it is assessed with the ratio of thermal power generation to overall power generation; 3) Technical progress (TP). Technical progress plays a significant role in improving power grid investment efficiency because it contributes to the utilization of advanced energy technologies, thereby enhancing the success rate of investment projects. It, therefore, is incorporated, measured by the expenditure on research and development (R&D) of industrial enterprises; 4) Economic development (ED). A strong economic foundation could result in more adequate funding allocated towards the expansion and transformation of power grid, potentially boosting power grid investment efficiency. GDP per capita serves as the indicator for economic development; 5) Foreign direct investment (FDI). As increased FDI might reflect a favorable business environment, it is believed to be associated with power grid investment efficiency. It is denoted by the share of FDI to GDP; 6) Urbanization level (UL). With the promotion of urbanization, the enlarged demand for power necessitates grid expansion and additional investment, hence influencing power grid investment efficiency. The ratio of urban population to total population is to indicate urbanization level.

2.3.4 Threshold variables

The threshold variables being investigated in this study include grid investment and electricity sales. 1) Gird investment (GI). In regions with different levels of grid investment, it may generate divergent AI application efficacy, thereby leading to a distinct effect on power grid investment efficiency originating from AI applications. Thus, grid investment is incorporated as a threshold variable, and it is measured by the total amount of grid investment. 2) Electricity sales (ES). Higher power sales generally indicate superior business performance, which exerts a certain influence on attracting external investment. Also, enhanced business performance is associated with more advanced technology in utilizing AI. In light of this, electricity sales might have a threshold effect on the relationship between AI and power grid investment efficiency. Hence, electricity sales from grid entities are incorporated to assess this potential influence.

2.4 Data sources

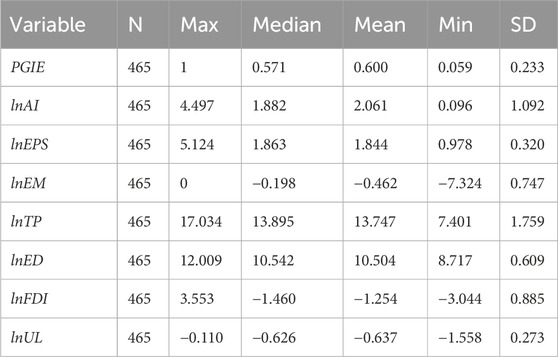

The samples adopted in this research cover 31 provinces, municipalities, and autonomous regions in China. Considering data availability, the study periods span from 2006 to 2020. The data is mainly sourced and collected from the China Electric Power Yearbook, the Compilation of Statistical Data of the Power Industry, China Statistic Yearbook, and China Population and Employment Statistical Yearbook. The data on industrial robots used to represent AI applications is obtained from the International Federation of Robotic (IFR). Additionally, missing data is addressed through linear interpolation. The descriptive statistics of the data are presented in Table 1.

3 Empirical results

3.1 Efficiency level of power grid investment

Based on the SBM approach, the power grid investment efficiency across China’s provinces is calculated. Initially, an analysis is conducted on the overall level of power grid investment efficiency. As illustrated in Figure 1, the evolution of overall efficiency can be divided into four phases. During 2006–2009, the values remained relatively stable, keeping around 0.5. Subsequently, the efficiency values experienced a discernible increase from 0.51 to 0.66 from 2009 to 2013. Nevertheless, a gradual decline in power grid investment efficiency was observed during the period of 2013–2016, with a decrease value of 0.56 in 2016. Further, there was a substantial rise in power grid investment efficiency after 2016. In 2020, its average value reached 0.79, significantly surpassing the value recorded in 2016. It shows that power grid investment efficiency has improved tremendously over these years, reflecting the considerable strides made by power grid enterprises. The progressive improvement in power grid efficiency might be attributed to the issuance of the 13th Five-Year Plan for Power Development which proposes to upgrade and transform distribution grids and promote smart grid construction.

From the perspective of power grid investment efficiency among different regions in China, large regional disparities can be observed. Overall, the power grid investment efficiency from 2006 to 2020 was highest in South China (0.69), followed by the Northwest (0.63), North (0.62), and Northeast (0.61) regions, whose average values were higher than the national average value of 0.60. This indicates the superior performance of the grid investment in these regions. However, the average values of power grid investment efficiency in East and Central China were computed to be 0.59 and 0.49, respectively, both falling below the national average. Moreover, the South and Northeast regions exerted outstanding performance in power grid investment efficiency between 2013 and 2020, with their highest values reaching 0.83 and 0.95 in 2020. On the contrary, the lowest values were linked to Central China, with values less than 0.40 during 2006–2008. These divergences highlight the pronounced regional variations in power grid investment performance across the country, which signifies the necessity for tailored region-specific policies in terms of enhancing efficiency.

3.2 Artificial intelligence and power grid investment efficiency

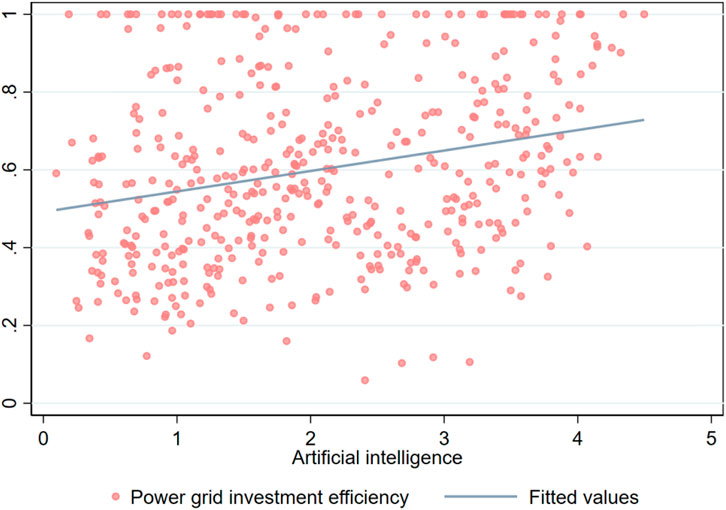

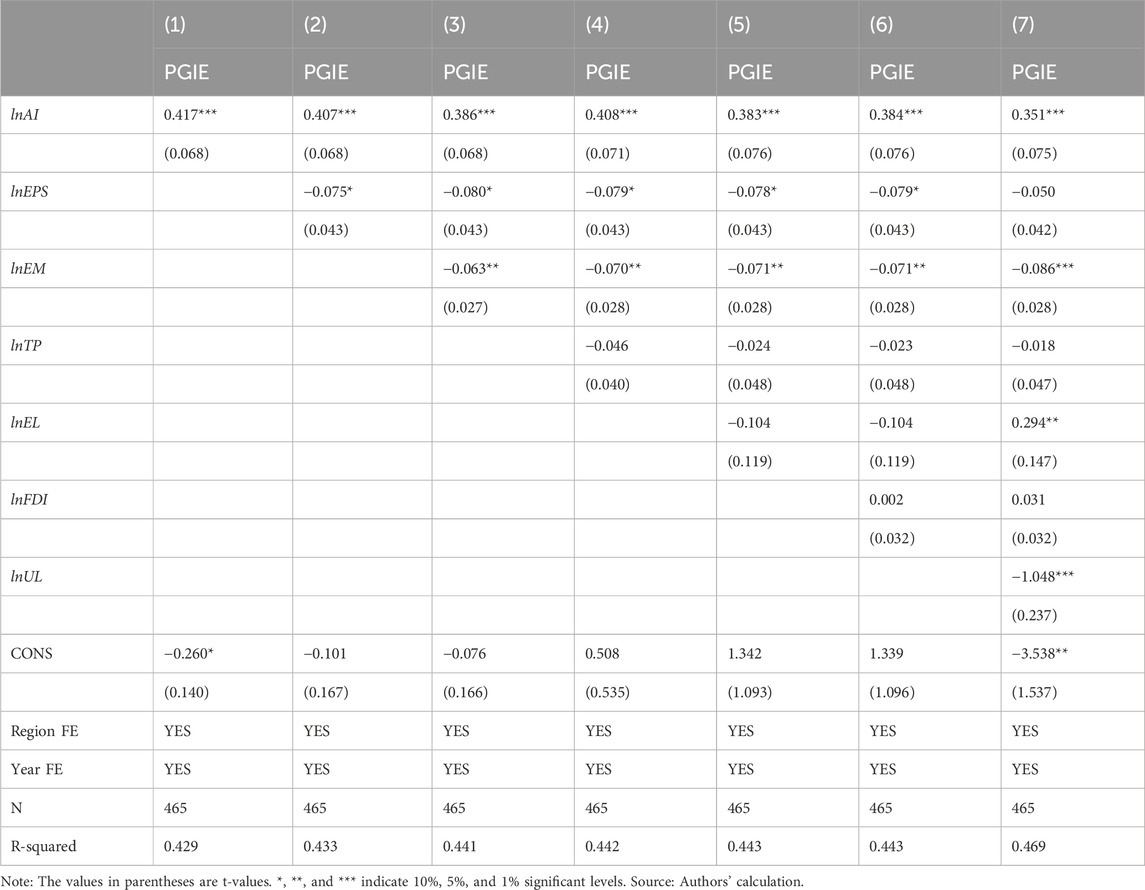

Firstly, a scatter diagram is depicted to illustrate the relationship between AI and power grid investment efficiency. As can be seen in Figure 2, high levels of AI applications are associated with high levels of power grid investment efficiency, which illustrates that a positive correlation exists between the two variables. Further, to quantitatively explore the causality between AI and power grid investment efficiency, Equation 3 is estimated with province-fixed and year-fixed effects. We gradually add the control variables, and regression results are reported in Table 2.

As can be seen, the coefficients of AI in all columns are positive at the 1% significance level, which signifies that it contributes to increase power grid investment efficiency. In more detail, the coefficient is estimated to be 0.351, implying that a 10 percentage of increase in robot penetration rate is associated with 0.0351% enhancement in power grid investment efficiency.

The potential reasons behind this positive effect are as follows: As indicated by Wang et al. (2018), the widespread implementation of smart meters has significantly expanded the reservoir of data about power consumption. This surge in available data provides a robust database for AI, enabling it to gather comprehensive and high-resolution information. Thus, more detailed analyses and precise prediction can be performed, which lays a solid foundation for making well-informed investment decisions. Additionally, AI technology can help to reduce operation costs by identifying any errors or inefficiencies at an early stage. Also, it serves as a powerful tool for investors by assessing the risk of new energy projects under various conditions (Chen et al., 2023). Therefore, power grid investment efficiency can be improved with the implementation of AI. Moreover, as China’s government has proposed to accelerate the construction of a new type of power system to achieve its carbon abatement goals (Han et al., 2022), specific investment has been directed toward this endeavor. The applications of AI play a significant role in promoting energy efficiency and realizing sustainable development (Ahmed et al., 2022), which helps power grid operators with the transformation of the power grid towards the new type of power system. In this regard, the adoption of AI can be conducive to bolstering the enhancement of power grid investment efficiency, and the findings contribute to the prior literature by unveiling the AI’s potential role in power grid investment.

In terms of control variables, the coefficient of energy mix is negative, passing the significant test at the 1% level, which indicates that high shares of thermal power generation demonstrate a downward effect on power grid investment efficiency. It reveals that promoting clean energy generation is conducive to bolstering the enhancement of power grid investment efficiency. In addition, the coefficient of economic development is significantly positive, signifying that economic development exerts a promoting effect on increasing power grid investment efficiency. This is because superior economic development can lay the foundation for the implementation of power grid investment projects, contributing to their success possibility. The negative coefficient of urbanization level implies that urbanization is negatively associated with power grid investment efficiency. Urbanization’s progression necessitates the grid’s expansion to encompass a broader geographical area, involving different types and sizes of electricity demand, which thus brings complexity and uncertainty to the construction of power grids. As a result, the power grid investment efficiency can be negatively affected.

3.3 Robustness exercise

In this section, multiple alternative regressions are estimated to check the robustness of the baseline results, including altering the measurement of key variables, lagging independent variables, and employing additional regression methods. The results are shown in Table 3, and all results are basically consistent with the baseline results. The specific descriptions of these tests are as follows:

Robustness to using alternative data of robot. In column (1), referring to Chen et al. (2022), we adopt the increment data of robots, the new installation number of robots, to reflect the level of robot applications as a proxy of AI. It can be seen that the estimated coefficient of AI is still positive at the 1% level, demonstrating identical results with the main findings.

Robustness to changing the measurement of power grid investment efficiency. To precisely calculate the value of power grid investment efficiency, here we utilize a non-radial directional distance function (NDDF) strategy, which incorporates inefficiencies for all input and output variables. The coefficient of AI in column (2) is estimated to be 0.291, passing the 1% of level significant test, which aligns with the benchmark result.

Robustness to lagging the core independent variable. Considering the possible time lag in the effect of implementing AI on power grid investment efficiency, AI is lagged by one and two periods, respectively. Results are reported in columns (3)–(4). Both coefficients of AI are significantly positive, proving the robustness of the main findings.

Robustness to utilizing the Tobit model for regression. Given that the values of power grid investment efficiency fall between zero and one, this censored nature supports the adoption of the Tobit model (Khoshroo et al., 2013). Therefore, we re-estimated Equation 3 by using the Tobit model. As observed in column (5), the coefficient of AI remains positive, indicating the robustness of our baseline results.

Robustness to employing the Two-stage Least Squares (2SLS) method for estimation. In light of the potential endogenous problem between AI and power grid investment efficiency, the 2SLS is applied to mitigate the endogeneity. Following Hu et al. (2023) and Zhu et al. (2023), we select the data from US to calculate the level of AI applications and then re-estimate Equation 3. The results of the first and second stages are exhibited in columns (6) and (7), respectively. The results in column (6) reflect that the instrumental variable utilizing US’ data is highly associated with AI applications with China’s data. Besides, the Kleibergen-Paap rk Wald F statistic is much higher than the critical value at the 10% level. The relevance of instrumental variables, therefore, is justified, proving the rationality of the instrumental variable. In terms of the second stage results, the coefficient of AI is still positive, in line with the baseline results.

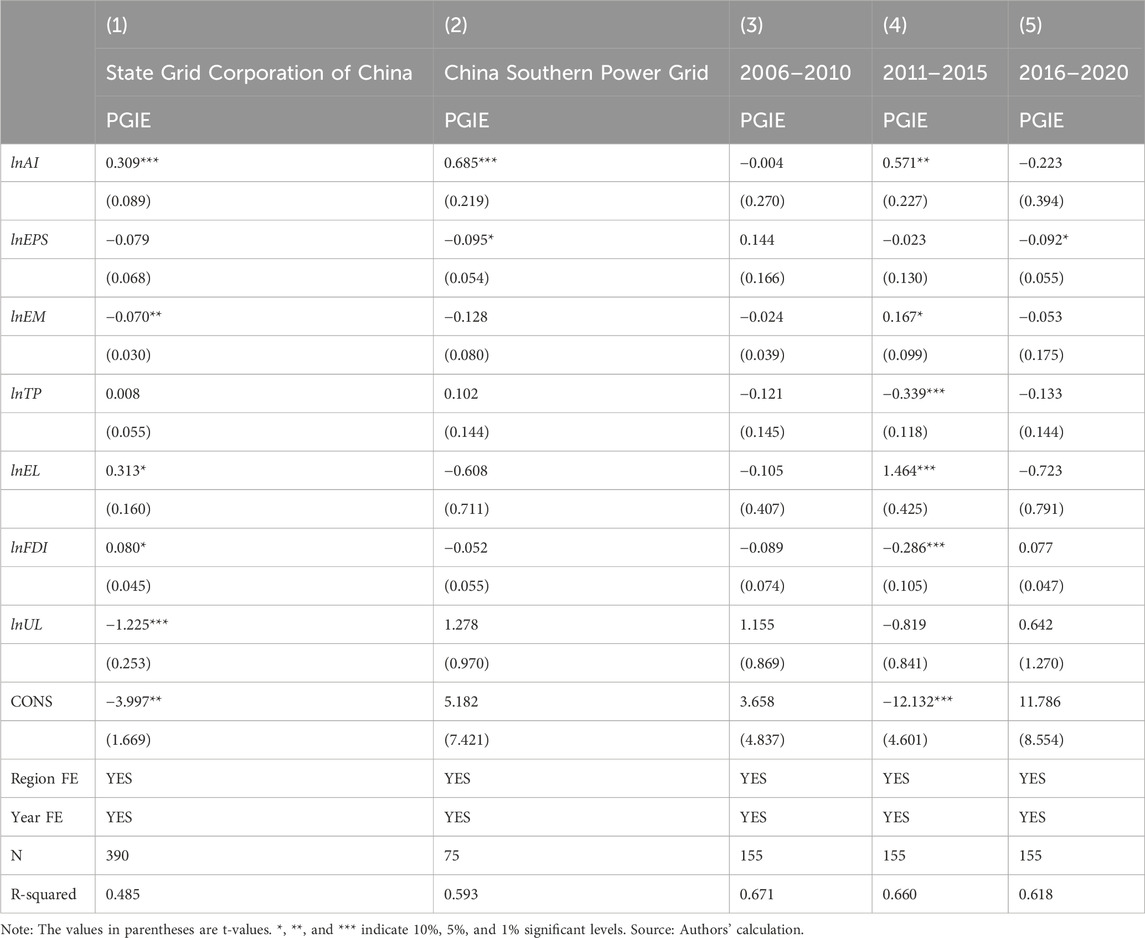

3.4 Heterogeneous analysis

In 2002, to break the monopoly, the State Power Grid Corporation was divided into two grid enterprises. Consequently, the power grids across 26 provinces are managed by the State Grid Corporation of China, and the power grids of the other 5 provinces, including Guangdong, Guangxi, Yunnan, Guizhou, and Hainan, are under the control of the China Southern Power Grid. This might generate distinguished effects of AI on power grid investment efficiency. We, therefore, classify our sample into two cohorts: the State Grid Corporation of China group and the China Southern Power Grid group. The results are reported in Table 4.

The coefficients of AI in column (1) and column (2) are 0.309 and 0.685, both passing the significant level of 1%. The findings indicate a more conspicuous effect of AI applications on power grid investment efficiency in the China Southern Power Grid cohort compared to the State Grid Corporation of China cohort. The potential reasons behind this distinction are as follows. Firstly, China Southern Power Grid, as a regional entity being in charge of Southern China, typically exhibits a more agile and adaptable organizational structure. Such agility empowers China Southern Power Grid to specially address local needs and challenges with precision and responsiveness. The ability to quickly adapt to specific regional demands enhances the effectiveness of AI applications in optimizing power grid investments. In contrast, State Grid Corporation of China, with its broader nationwide coverage, may adopt more centralized decision-making procedures than State Grid Corporation of China. This centralization can sometimes result in delays in the implementation of AI tools and technologies, as these processes require multiple layers of approval and coordination. Therefore, the application of AI has a more noticeable impact on power grid investment efficiency in the China Southern Power Grid group. By comprehending these underlying mechanisms associated with idiosyncratic organization structure, stakeholders can better understand the diverse impacts of AI on different power grid entities, thereby facilitating more effective decision-making processes within the energy sector.

We further investigate if there exist heterogeneity across different time periods. In light of China’s implementation of the “Five-Year Plan” (FYP) every 5 years to guide socio-economic development, we divide our samples according to the FYP cycles. In more detail, our sample is divided into three groups, including 2006–2010, 2011–2015, and 2016–2020. The results are demonstrated in columns (3) to (5) in Table 4.

As can be seen, the coefficient associated with AI in column (4) is positive at the 1% significant level. In columns (3) and (5), a negative coefficient of AI is found, but it does not pass the significant test, even at the 10% level. The findings signify that only during the period of the 12th FYP period did AI display a positive effect on power grid investment efficiency. This might be linked to the policies implemented during the 12th FYP, when the State Council implemented the Energy Development “12th Five-Year Plan.” It proposed to promote smart grid construction and deepen the electric system reform. Correspondingly, a series of actions were performed in alignment with this directive. It facilitated the integration of advanced technologies into multiple aspects of power grid operations, including real-time data analysis, and predictive maintenance. As a result, AI is treated as a vital tool, exerting a positive impact on enhancing power grid investment efficiency. The findings offer valuable insights for policymakers to leverage AI to optimize power grid investment in future planning cycles.

3.5 Threshold effect analysis

In this section, the panel threshold model, pioneered by Hansen (1999), is employed to test the potential nonlinear relationship between AI applications and power grid investment efficiency, treating the grid investment and electricity sales as thresholds, respectively.

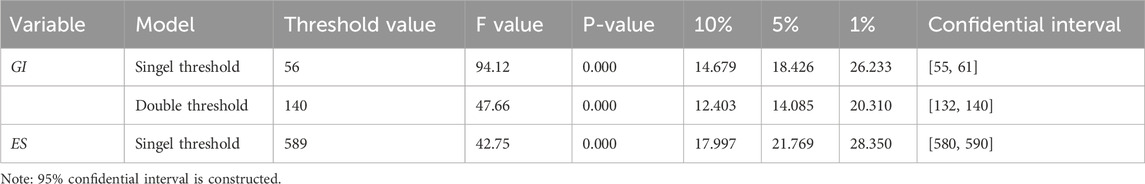

Initially, a vital determination involves identifying the existence of any threshold and its values (Liu et al., 2022). Thus, the threshold tests are carried out, and the results are reported in Table 5. Notably, when grid investment is the threshold variable, there exists a double threshold. The threshold values are estimated to be 56 and 140 respectively, both passing the significant tests. The outcomes suggest that within the impact of AI applications on power grid investment efficiency, the power grid investment has a double threshold effect. Moreover, setting the electricity sales as the threshold variable, there is only a single threshold and its threshold value is 589, demonstrating statistical significance. It indicates that electricity sales play a single threshold effect on the nexus between AI and power grid investment efficiency.

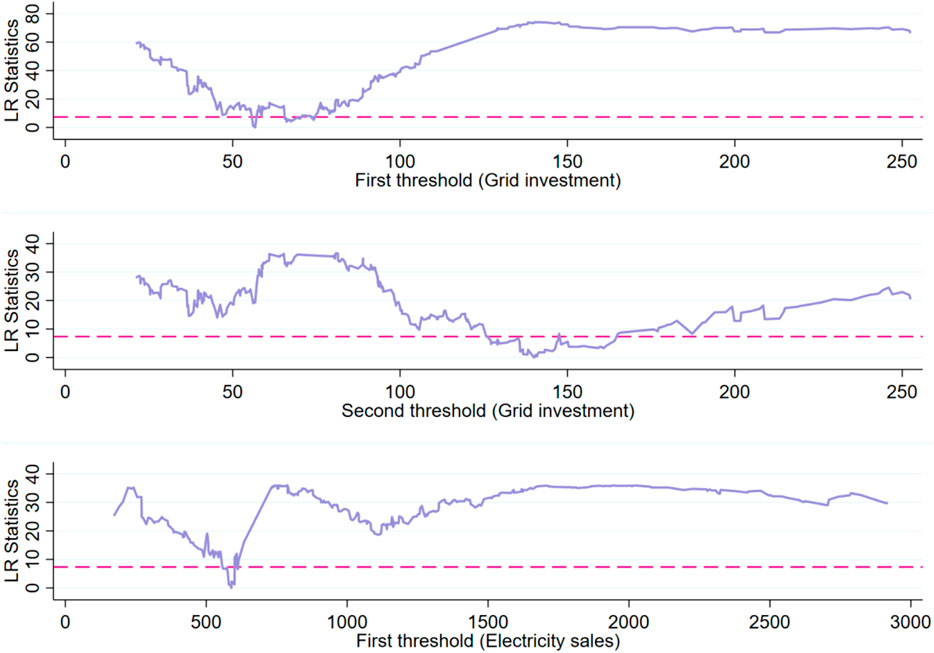

Next, we proceed with the authenticity test for the thresholds to ascertain their alignment with the true values (Zhang et al., 2022). This examination is achieved through the utilization of the likelihood ratio test statistic (LR), and the LR graphs for the threshold estimation of grid investment and electricity sales are demonstrated in Figure 3. As for grid investment, both its first and second threshold values pass the authenticity test within a 95% confidence interval, which verifies the existence of a double threshold for grid investment. In terms of electricity sales, its first threshold value passes the authenticity test, confirming the validation of a single threshold of electricity sales.

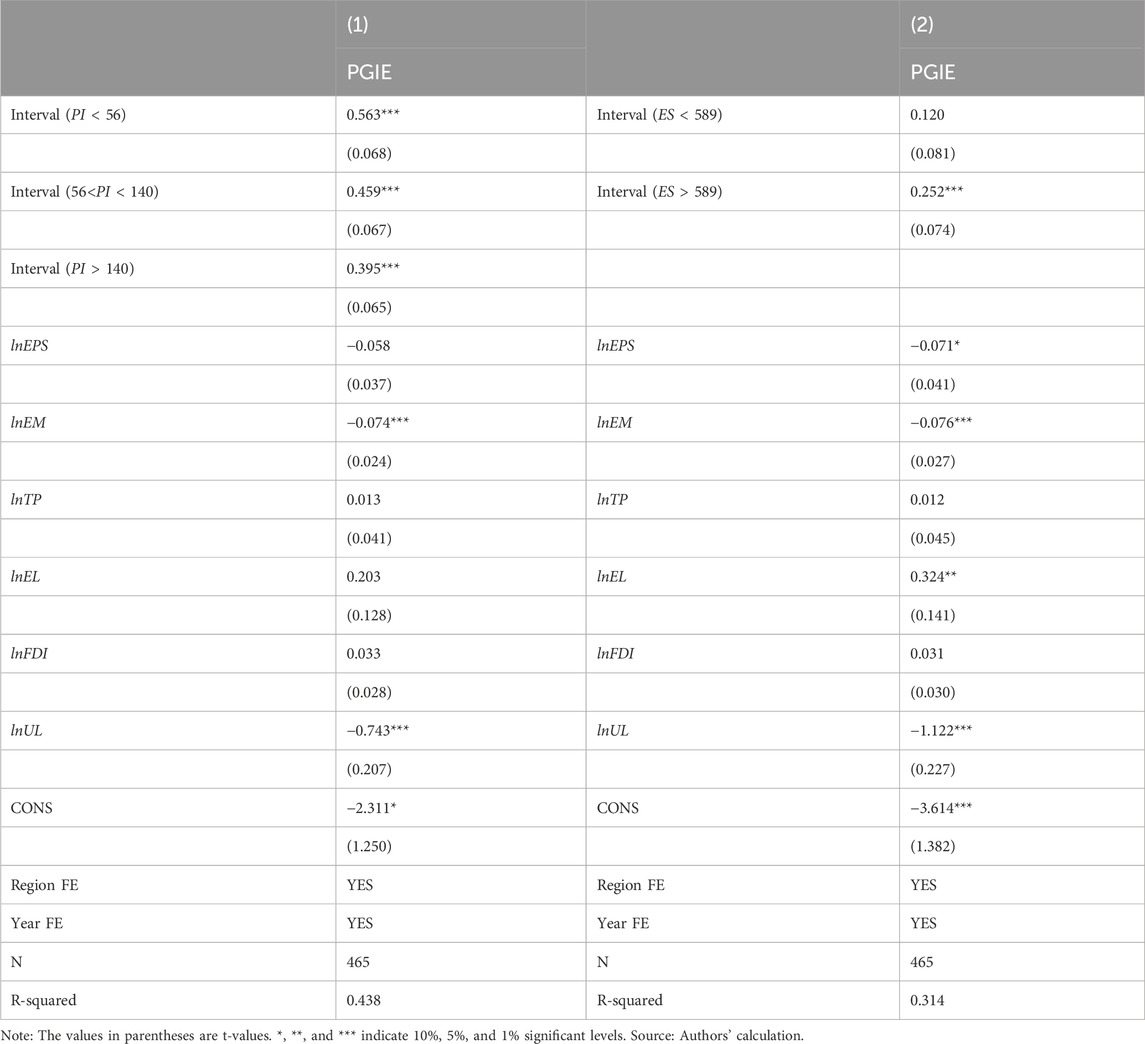

Furthermore, the panel threshold model is applied to estimate Equations 4, 5, and corresponding results are exhibited in Table 6. Column (1) in Table 6 shows the results with power investment as the threshold variable. Notably, the influence of AI and power grid investment efficiency varies depending on power investment and can be divided into three stages. When the amount of power investment falls less than 56, the coefficient of AI on power grid investment is 0.563, passing the significant test. Subsequently, when the power investment increases to the interval [56, 140], the contributing effect of AI on power grid investment efficiency remains significantly positive but drops to 0.459. As the power investment further passes the second threshold value of 140, the promoting effect associated with AI decreases to 0.395. Overall, the contributing effects of AI applications on power grid investment efficiency appear to be more pronounced in the first stage, followed by the second and third stages. This trend implies that with the increasing input of power investment, the promoting effect of AI on power grid investment efficiency becomes progressively weaker. This might be attributed to the diminishing marginal returns. With the initial investment in power grid, the stimulating effect of AI on power grid investment efficiency can be well utilized. However, such a promoting effect cannot be sustained as further applications of AI might come across various technical obstacles, such as integration issues and system compatibility, limiting effectiveness. In addition, increased power investment levels introduce greater complexity in resource allocation. As these investments grow, grid enterprises might require additional resources to manage and coordinate operations, potentially diminishing the impact of AI on power grid investment efficiency. Summing up, while AI enhances power grid investment efficiency, its contributory effect diminishes with higher investment levels on account of diminishing returns and increased complexity.

Column (2) in Table 6 displays the results where electricity sales are treated as the threshold variable. It can be found that AI on power grid investment efficiency has a threshold effect based on electricity sales. Specifically, when electricity sales are less than 589, the effect of AI on power grid investment efficiency fails to achieve statistical significance. This means that, at this stage, AI does not exert a promoting effect on enhancing power grid investment efficiency. Nevertheless, as electricity sales are higher than the threshold value of 589, AI’s impact on power grid investment efficiency is revealed to be 0.252 at the 1% significant level. It indicates that the effective facilitation of power grid investment efficiency by AI only occurs when electricity sales exceed the threshold value. This is due to the fact that insufficient electricity sales imply a lack of robust business performance within power grid enterprises, reflecting some potential challenges and problems. Consequently, AI encounters limitations in its effective utilization under such circumstances, thus constraining its effect on increasing power grid investment efficiency. The reason behind it might be that enterprises with low electricity sales often face financial constraints that limit their ability to invest in and maintain advanced AI technologies. Without sufficient funding, these enterprises cannot fully exploit AI capabilities, leading to limited improvements in efficiency. By contrast, elevated electricity sales reflect better business performances of power grid enterprises. Generally, these enterprises are characterized by abundant resources, enhanced human capital, mature operation systems, as well as advanced technical levels. Mature operational systems provide a solid foundation for integrating AI into various processes, which ensures smoother implementation and greater benefits. As a result, AI can function as a powerful tool for boosting power grid investment efficiency.

4 Conclusion and policy recommendations

Under the backdrop of China’s construction of a new power system based on new energy, this study firstly adopts SBM to assess power grid investment efficiency in China spanning from 2006 to 2020. Next, the linear and nonlinear threshold effects between AI applications and power grid investment efficiency are explored. On the basis of our study, we draw the following conclusion:

(1) There has been a notable improvement in power grid investment efficiency in China, with significant regional disparities; (2) AI applications enhance power grid investment efficiency, which remains robust after performing multiple robustness tests. (3) Heterogeneous analysis reveals a more evident effect of AI applications on power grid investment efficiency in the China Southern Power Grid cohort compared to the State Grid Corporation of China cohort. Additionally, its positive effect on power grid investment efficiency remains significant solely during the 12th FYP period. (4) Grid investment has a double threshold effect, that is, higher grid investment levels are associated with a diminishing positive effect of AI on power grid investment efficiency. A single threshold effect is found for electricity sales, and AI significantly contributes to efficiency only when electricity sales exceed the threshold value.

According to the above conclusion, the following policy recommendations are suggested:

Firstly, given the considerable potential for improving power grid investment efficiency in China, investment in power grid should be boosted and regulated. For example, the government should optimize the evaluation process of grid planning and investment projects by developing a targeted framework, including advanced analytical tools and performance metrics. Transparent regulatory mechanisms should be established to oversee the implementation of grid planning. In addition, significant regional disparities in investment performance necessitate tailored policies considering regional challenges and advantages. For regions with high levels of power grid investment efficiency, the policy focus should be on prioritizing advanced maintenance techniques, renewable integration, and long-term sustainability. Conversely, in regions with lower power grid investment efficiency, targeted and customized guidance such as technical training, should be provided for the grid enterprises to enhance the grid investment performance.

Secondly, given the substantial role of AI applications in facilitating power grid investment efficiency, government initiatives aimed at further accelerating AI applications across various sectors are necessary. For instance, the government should incentivize the comprehensive integration of AI technology with power management systems by offering tax credits or subsidies to contribute to the establishment of the new power system. Based on AI technologies, the government should support projects that develop AI-based systems for real-time monitoring, predictive maintenance, and dynamic load balancing to enhance grid responsiveness and reduce downtime. Moreover, to address those technical barriers, the government should financially support the collaboration between industry, university and research institutions to contribute to the application and transformation of AI technologies.

Thirdly, considering the threshold effect of grid investment and electricity sales on the nexus between AI and power grid investment efficiency, targeted measures should be adopted focusing on grid investment and electricity sales. Since AI applications exert a diminishing effect on power grid investment efficiency with the promotion of grid investment, strategic attention towards optimizing grid investment becomes crucial. This incorporates complete pre-investment analysis, such as risk assessments, cost-benefit analyses, and potential societal economic and environmental impacts. As higher levels of electricity sales are associated with a more pronounced contributing effect of AI on power grid investment efficiency, the government should effectively employ AI and smart equipment to boost electricity sales through demand forecasting, dynamic pricing and customer engagement tools.

There are two limitations in this paper, which could serve as potential directions for future research. Firstly, while the disparities among different power grid companies regarding AI and power grid investment efficiency have been explored, the underlying factors driving this heterogeneity are not examined. Future research could be conducted to answer what causes the distinct effects on power grid investment efficiency from AI across different power grid companies. Secondly, this study investigates the impacts of AI on power grid efficiency, whereas the various AI technologies are not distinguished. By separately considering different types of AI, it is believed that future research can form more detailed and targeted conclusions.

Data availability statement

Publicly available datasets were analyzed in this study. The data was mainly sourced and collected from the following sources: China Electric Power Yearbook: https://cnki.ctbu.edu.cn/CSYDMirror/area/Yearbook/Single/N2023080234?z=D03 Compilation of Statistical Data of the Power Industry: http://cnki.nbsti.net/CSYDMirror/area/Yearbook/Single/N2022060182?z=D01 China Statistic Yearbook: https://www.stats.gov.cn/sj/ndsj/ China Population and Employment Statistical Yearbook: https://cnki.ctbu.edu.cn/CSYDMirror/area/yearbook/Single/N2024010029?z=D03.

Author contributions

MZ: Writing–original draft, Data curation, Investigation. LM: Writing–original draft, Conceptualization, Methodology. TZ: Writing–review and editing, Formal Analysis. QW: Writing–review and editing, Formal Analysis, Methodology. YZ: Writing–review and editing, Data curation, Resources. LS: Writing–review and editing, Validation, Visualization.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

Authors MZ and QW were employed by State Grid Hubei Electric Power Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., and Restrepo, P. (2020). Robots and jobs: evidence from US labor markets. J. Political Econ. 128, 2188–2244. doi:10.1086/705716

Agrawal, A., McHale, J., and Oettl, A. (2023). Superhuman science: how artificial intelligence may impact innovation. J. Evol. Econ. 33, 1473–1517. doi:10.1007/s00191-023-00845-3

Ahmed, Q. W., Garg, S., Rai, A., Ramachandran, M., Jhanjhi, N. Z., Masud, M., et al. (2022). AI-based resource allocation techniques in wireless sensor internet of things networks in energy efficiency with data optimization. Electronics 11, 2071. doi:10.3390/electronics11132071

Ara Shaikh, A., Kumar, A., Jani, K., Mitra, S., García-Tadeo, D. A., and Devarajan, A. (2022). The role of machine learning and artificial intelligence for making a digital classroom and its sustainable impact on education during covid-19. Mater. Today Proc. 56, 3211–3215. doi:10.1016/j.matpr.2021.09.368

Chang, L., Taghizadeh-Hesary, F., and Mohsin, M. (2023). Role of artificial intelligence on green economic development: oint determinates of natural resources and green total factor productivity. Resour. Policy 82, 103508. doi:10.1016/j.resourpol.2023.103508

Charnes, A., Cooper, W. W., and Rhodes, E. (1978). Measuring the efficiency of decision making units. Eur. J. Operational Res. 2, 429–444. doi:10.1016/0377-2217(78)90138-8

Chen, D., and Qing, Z. (2022). Artificial intelligence and inclusive growth: evidence from international robot data. Econ. Res. 4, 85–102. In Chinese.

Chen, L., Chen, Z., Zhang, Y., Liu, Y., Osman, A. I., Farghali, M., et al. (2023). Artificial intelligence-based solutions for climate change: a review. Environ. Chem. Lett. 21, 2525–2557. doi:10.1007/s10311-023-01617-y

Chen, Y., Cheng, L., and Lee, C.-C. (2022). How does the use of industrial robots affect the ecological footprint? International evidence. Ecol. Econ. 198, 107483. doi:10.1016/j.ecolecon.2022.107483

Czarnitzki, D., Fernández, G. P., and Rammer, C. (2023). Artificial intelligence and firm-level productivity. J. Econ. Behav. and Organ. 211, 188–205. doi:10.1016/j.jebo.2023.05.008

Damioli, G., Van Roy, V., and Vertesy, D. (2021). The impact of artificial intelligence on labor productivity. Eurasian Bus. Rev. 11, 1–25. doi:10.1007/s40821-020-00172-8

Delanöe, P., Tchuente, D., and Colin, G. (2023). Method and evaluations of the effective gain of artificial intelligence models for reducing CO2 emissions. J. Environ. Manag. 331, 117261. doi:10.1016/j.jenvman.2023.117261

Deng, N.-Q., Liu, L.-Q., and Deng, Y.-Z. (2018). Estimating the effects of restructuring on the technical and service-quality efficiency of electricity companies in China. Util. Policy 50, 91–100. doi:10.1016/j.jup.2017.11.002

Ding, T., Li, J., Shi, X., Li, X., and Chen, Y. (2023). Is artificial intelligence associated with carbon emissions reduction? Case of China. Resour. Policy 85, 103892. doi:10.1016/j.resourpol.2023.103892

Faber, M. (2020). Robots and reshoring: evidence from Mexican labor markets. J. Int. Econ. 127, 103384. doi:10.1016/j.jinteco.2020.103384

Fukuyama, H., and Weber, W. L. (2009). A directional slacks-based measure of technical inefficiency. Socio-Economic Plan. Sci. 43, 274–287. doi:10.1016/j.seps.2008.12.001

Graetz, G., and Michaels, G. (2018). Robots at work. Rev. Econ. Statistics 100, 753–768. doi:10.1162/rest_a_00754

Han, T. B., Gao, Z. H., Du, W. X., and Hu, S. Z. (2022). Multi-dimensional evaluation method for new power system. Energy Rep. 8, 618–635. doi:10.1016/j.egyr.2022.03.150

Hansen, B. E. (1999). Threshold effects in non-dynamic panels: estimation, testing, and inference. J. Econ. 93, 345–368. doi:10.1016/s0304-4076(99)00025-1

He, Y., Jiao, J., Chen, R., and Shu, H. (2018). The optimization of Chinese power grid investment based on transmission and distribution tariff policy: a system dynamics approach. Energy Policy 113, 112–122. doi:10.1016/j.enpol.2017.10.062

Hu, J.-L., and Wang, S.-C. (2006). Total-factor energy efficiency of regions in China. Energy policy 34, 3206–3217. doi:10.1016/j.enpol.2005.06.015

Hu, S., Lin, K., Liu, B., and Wang, H. (2023). Does robotization improve the skill structure? The role of job displacement and structural transformation. Appl. Econ. 56, 3415–3430. doi:10.1080/00036846.2023.2206623

Huo, P., and Wang, L. (2022). Digital economy and business investment efficiency: inhibiting or facilitating? Res. Int. Bus. Finance 63, 101797. doi:10.1016/j.ribaf.2022.101797

Khalifa, S., Seck, O., and Tobing, E. (2013). Housing wealth effect: evidence from threshold estimation. J. Hous. Econ. 22, 25–35. doi:10.1016/j.jhe.2012.08.004

Khalilpourazari, S., Khalilpourazary, S., Özyüksel Çiftçioğlu, A., and Weber, G.-W. (2021). Designing energy-efficient high-precision multi-pass turning processes via robust optimization and artificial intelligence. J. Intelligent Manuf. 32, 1621–1647. doi:10.1007/s10845-020-01648-0

Khoshroo, A., Mulwa, R., Emrouznejad, A., and Arabi, B. (2013). A non-parametric Data Envelopment Analysis approach for improving energy efficiency of grape production. Energy 63, 189–194. doi:10.1016/j.energy.2013.09.021

Lee, J., and Yoo, H. J. (2021). An overview of energy-efficient hardware accelerators for on-device deep-neural-network training. IEEE Open J. Solid-State Circuits Soc. 1, 115–128. doi:10.1109/ojsscs.2021.3119554

Li, J., Ma, S., Qu, Y., and Wang, J. (2023). The impact of artificial intelligence on firms’ energy and resource efficiency: empirical evidence from China. Resour. Policy 82, 103507. doi:10.1016/j.resourpol.2023.103507

Liu, H., Shi, H., Chu, J., Wu, J., and Yuan, Z. (2022). Threshold effects in the relationship between internet development and express delivery industry environmental efficiency. J. Clean. Prod. 340, 130815. doi:10.1016/j.jclepro.2022.130815

Liu, J., Chang, H., Forrest, J. Y.-L., and Yang, B. (2020). Influence of artificial intelligence on technological innovation: evidence from the panel data of China's manufacturing sectors. Technol. Forecast. Soc. Change 158, 120142. doi:10.1016/j.techfore.2020.120142

Lu, C.-H. (2021). The impact of artificial intelligence on economic growth and welfare. J. Macroecon. 69, 103342. doi:10.1016/j.jmacro.2021.103342

Lyu, W., and Liu, J. (2021). Artificial Intelligence and emerging digital technologies in the energy sector. Appl. Energy 303, 117615. doi:10.1016/j.apenergy.2021.117615

Makridis, C. A., and Mishra, S. (2022). Artificial intelligence as a service, economic growth, and well-being. J. Serv. Res. 25, 505–520. doi:10.1177/10946705221120218

Miller, T. (2019). Explanation in artificial intelligence: insights from the social sciences. Artif. Intell. 267, 1–38. doi:10.1016/j.artint.2018.07.007

Ni, B., and Obashi, A. (2021). Robotics technology and firm-level employment adjustment in Japan. Jpn. World Econ. 57, 101054. doi:10.1016/j.japwor.2021.101054

Ramachandran, K. K., Apsara Saleth Mary, A., Hawladar, S., Asokk, D., Bhaskar, B., and Pitroda, J. R. (2022). Machine learning and role of artificial intelligence in optimizing work performance and employee behavior. Mater. Today Proc. 51, 2327–2331. doi:10.1016/j.matpr.2021.11.544

Sun, J., Ruze, N., Zhang, J., Zhao, H., and Shen, B. (2019). Evaluating the investment efficiency of China’s provincial power grid enterprises under new electricity market reform: empirical evidence based on three-stage DEA model. Energies 12, 3524. doi:10.3390/en12183524

Sun, Y., Zou, Y., Jiang, J., and Yang, Y. (2023). Climate change risks and financial performance of the electric power sector: evidence from listed companies in China. Clim. Risk Manag. 39, 100474. doi:10.1016/j.crm.2022.100474

Tone, K. (2001). A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Operational Res. 130, 498–509. doi:10.1016/s0377-2217(99)00407-5

Tong, J., Zhu, B., Wen, M., and Miu, Z. Z. (2017). “DEA based research on investment efficiency of power grid marketing project,” in International conference on mathematics, modelling and simulation technologies and applications (MMSTA) (Xiamen: PEOPLES R CHINA), 545–550.

Tursunbayeva, A., and Renkema, M. (2023). Artificial intelligence in health-care: implications for the job design of healthcare professionals. Asia Pac. J. Hum. Resour. 61, 845–887. doi:10.1111/1744-7941.12325

Valentini, E., Compagnucci, F., Gallegati, M., and Gentili, A. (2023). Robotization, employment, and income: regional asymmetries and long-run policies in the Euro area. J. Evol. Econ. 33, 737–771. doi:10.1007/s00191-023-00819-5

Wang, Y., Chen, Q., Hong, T., and Kang, C. (2018). Review of smart meter data analytics: applications, methodologies, and challenges. IEEE Trans. Smart Grid 10, 3125–3148. doi:10.1109/tsg.2018.2818167

Yang, X. L., He, L. Y., Xia, Y. F., and Chen, Y. F. (2019). Effect of government subsidies on renewable energy investments: the threshold effect. Energy Policy 132, 156–166. doi:10.1016/j.enpol.2019.05.039

Yao, X., Huang, R., and Du, K. (2019). The impacts of market power on power grid efficiency: evidence from China. China Econ. Rev. 55, 99–110. doi:10.1016/j.chieco.2019.02.006

Yu, K.-H., Beam, A. L., and Kohane, I. S. (2018). Artificial intelligence in healthcare. Nat. Biomed. Eng. 2, 719–731. doi:10.1038/s41551-018-0305-z

Zeng, M., Yang, Y., Wang, L., and Sun, J. (2016). The power industry reform in China 2015: policies, evaluations and solutions. Renew. Sustain. Energy Rev. 57, 94–110. doi:10.1016/j.rser.2015.12.203

Zhai, S., and Liu, Z. (2023). Artificial intelligence technology innovation and firm productivity: evidence from China. Finance Res. Lett. 58, 104437. doi:10.1016/j.frl.2023.104437

Zhang, L., Mu, R., Zhan, Y., Yu, J., Liu, L., Yu, Y., et al. (2022). Digital economy, energy efficiency, and carbon emissions: evidence from provincial panel data in China. Sci. Total Environ. 852, 158403. doi:10.1016/j.scitotenv.2022.158403

Zhao, P., Gao, Y., and Sun, X. (2022). How does artificial intelligence affect green economic growth? Evidence from China. Sci. Total Environ. 834, 155306. doi:10.1016/j.scitotenv.2022.155306

Zhu, H., Sang, B., Zhang, C., and Guo, L. (2023). Have industrial robots improved pollution reduction? A theoretical approach and empirical analysis. China and World Econ. 31, 153–172. doi:10.1111/cwe.12495

Keywords: artificial intelligence, power grid investment, investment efficiency, nonlinear threshold effect, China’s power grid enterprises

Citation: Zhou M, Ma L, Zhang T, Wu Q, Zhou Y and Sun L (2024) Artificial intelligence empowerment in China’s energy landscape: enhancing power grid investment efficiency. Front. Energy Res. 12:1441540. doi: 10.3389/fenrg.2024.1441540

Received: 31 May 2024; Accepted: 28 August 2024;

Published: 16 September 2024.

Edited by:

Fengtao Guang, China University of Geosciences Wuhan, ChinaCopyright © 2024 Zhou, Ma, Zhang, Wu, Zhou and Sun. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Li Ma, bWFsaTIwMjQ4OEAxNjMuY29t, bWFyeWVkdUBzaW5hLmNvbQ==

Ming Zhou1

Ming Zhou1 Li Ma

Li Ma Yingbo Zhou

Yingbo Zhou