- 1State Grid Hubei Electric Power Company Limited Economic and Technical Research Institute, Wuhan, China

- 2State Grid Hubei Electric Power Company Limited, Wuhan, China

- 3College of Electrical and Information Engineering, Hunan University, Changsha, China

Introduction

With the deepening of the reform of the electric power system in China, infrastructure planning of the power grid, as a complex project, will face greater challenges. As a matter of course, the internal and external uncertain factors, such as the imperfection of the structure of the power grid and the transformation of policy conditions, lead to the increasingly severe and complicated investment environment of power grid enterprises (Santos et al., 2017; Dai et al., 2018; Chen et al., 2020). On the one hand, the level of electrification for residents has gradually improved, and the demand for electricity in the whole society has continued to rise because of the rapid growth of the economy. Thus, the amount of investment in the power grid will gradually increase (Tavares and Soares, 2020; Zhang et al., 2022). On the other hand, due to the independence of transmission and distribution, the profit pattern of enterprises has changed, so the investment plan needs to be adjusted accordingly. Some factors fail to be considered in the existing investment allocation method, such as the distribution network status and investment benefit, resulting in unreasonable investment allocation (Liu et al., 2019; Yang et al., 2021). Therefore, a distribution network investment allocation method, which comprehensively takes the distribution network status and investment benefit evaluation index system into account, is proposed in this article to achieve high precision of investment allocation.

Investment Ratio Based on Evaluation of Distribution Network Status

Indicator System

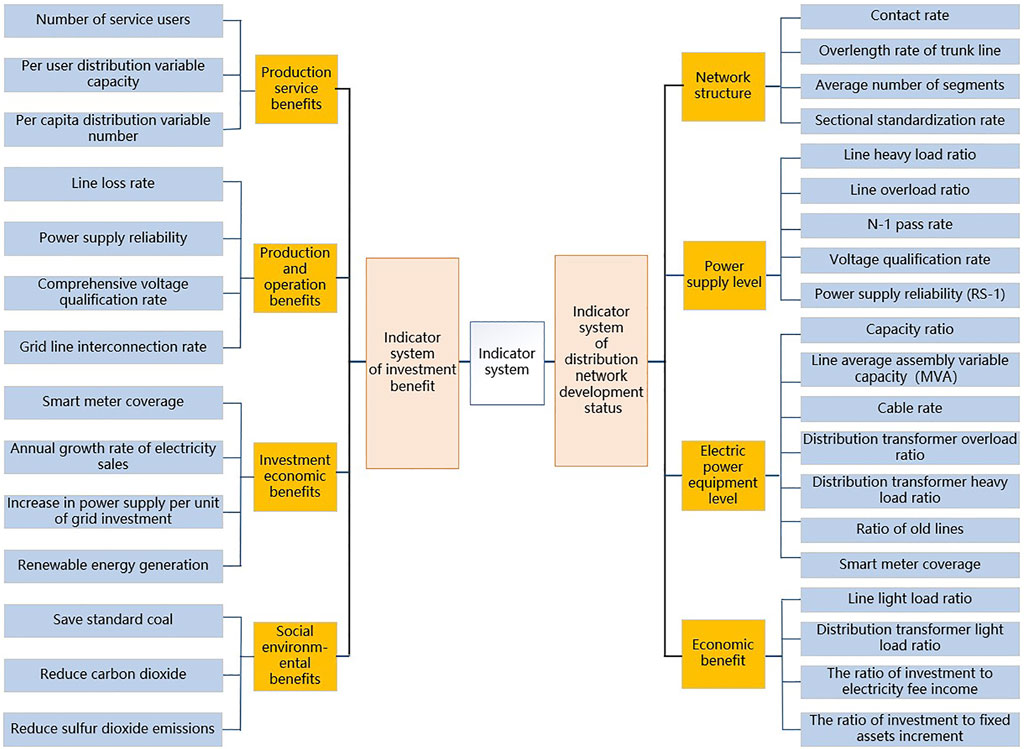

The indicator system to evaluate the distribution network status is based on systematic, scientific, objective, and practical principles to guide the investment orientation for the power network. The indicator system is constructed from four aspects: network structure, power supply level, electric power equipment level, and economic benefit (Chai et al., 2020; Ming et al., 2020; Ning et al., 2021). The weights of the four first-level indicators are 0.2, 0.3, 0.3, and 0.2, respectively. Moreover, 20 typical evaluation indicators are selected, which can be seen in the following figure.

Investment Ratio Calculation

According to the distribution network status assessment, the difference between the score of each region and the total score is calculated, and the full score of the distribution network evaluation is 100 points. The results are normalized to obtain the ratio of investment allocation. The formula is as follows:

Investment Ratio Based on Evaluation of Investment Benefit

Indicator System

In view of the systematic, comprehensive, and long-term characteristics of the investment benefit analysis of power grid projects, the evaluation indicator system, based on identifying the factors affecting the investment benefit, contains these parts: production service benefits, production and operation benefits, investment economic benefits, and social and environmental benefits. The indexes selected are enumerated in Figure 1.

Indicator Weight Calculation

The indicator system to evaluate investment benefit includes subjective and objective indicators so that the assessment of investment benefit can be more persuasive. The set-valued iterative method is a subjective weighting method, which can reflect experts’ opinions concentratedly. The objective weight can be obtained by the entropy method, and the weight is modified through entropy weight calculation to make the weight scientific, objective, and feasible (Li et al., 2016; Li et al., 2019; Ge et al., 2021). Based on moment estimation theory, this study combines the results of the above two methods to obtain a comprehensive weight.

Considering the thought of moment estimation theory, it follows that the expected values of subjective and objective weight are the actual value of each indicator (Liu et al., 2019; Sakthivel and Sathya, 2021).

The coefficients of colligation of the subjective and objective weight vector can be calculated using the actual value of each indicator, as shown in the following formula:

Suppose the indicators are extracted from two sample systems. The coefficients of colligation of the total subjective and objective weight vectors, derived from the moment estimation theory, can be calculated in the following formula:

A single-objective optimization model is constructed to minimize the deviation between the comprehensive weight and the subjective and objective weight (He et al., 2018; Zhang et al., 2018; Lai et al., 2019) as follows:

Comprehensive Evaluation Result

The TOPSIS method can get the closeness of each scheme to the optimal scheme. Based on the combined weight derived from the above weight methods, a TOPSIS evaluation model for investment benefit is established, assessing the pros and cons of the schemes (Zou et al., 2017). The key steps to calculate the comprehensive evaluation value of distribution network investment benefit based on the TOPSIS method are as follows:

1) Multi-objective decision matrix:

Suppose the index set is

2) Positive and negative ideal solution calculation:

3) Relative distance calculation:

4) Comprehensive evaluation value:

Investment Ratio Calculation

According to the comprehensive evaluation value of investment benefit, the result is normalized, and the investment distribution ratio of each region can be obtained as follows:

Investment Allocation

After obtaining the investment ratios for the distribution network status assessment and investment benefit assessment, the final investment ratio can be obtained by weighted summation (Mohtashami et al., 2017; Ehsan and Yang, 2019). The calculation formula is as follows:

where

In this article, comprehensively considering the network status and investment benefit assessment, the investment in the distribution network can be allocated reasonably. A district’s investment allocation proportion of the network is estimated. When calculating the investment proportion for the distribution network status assessment, the investment proportion is lower for the regions with a higher score of the status of the distribution network. Otherwise, the investment should be increased. When calculating the investment proportion based on the evaluation of investment benefit, the region with a higher score of investment benefit should increase more investment. Otherwise, the investment should be reduced. The estimated investment allocation ratios are reasonable and conform to the above laws. In the end, the investment proportion, which considers the development status of the distribution network and investment benefit, is calculated. A region with a high score of the status of the distribution network has a low investment ratio. After considering the investment benefit, when the investment benefit is excellent, the final investment proportion will be increased. Compared with the methods in the current research, which only consider the status of the distribution network or investment benefit, this method is more reasonable, and the results of investment distribution match the network development trend.

Discussion and Conclusion

The dimension of the existing investment allocation indicator system for the distribution network is single. It is difficult to achieve high precision of investment distribution. Therefore, this study studies a precise method of investment allocation based on the network status and investment benefit assessment system. Firstly, the distribution network status is evaluated and the investment proportion can be obtained through normalization. Then, an investment calculation model based on the assessment of investment benefit is constructed, and the investment distribution ratio is estimated by normalizing the comprehensive evaluation value of investment benefit. Finally, an investment forecast model of the distribution network is built by balancing the influence of the status of the distribution network and investment benefit on investment allocation. Applying the research results to the decision-making of the investment distribution in a certain area has a guiding significance for investment allocation of the distribution network. In future studies, it is necessary to increase the hierarchy and diversity of the investment allocation indicator system to achieve a more ideal effect of investment distribution.

Author Contributions

JY and SW drafted the manuscript. ZS, JH, and JL participated in the indicator system building. SL reviewed and edited the manuscript. SW and ZS analyzed and interpreted the calculation results. All authors examined and revised the manuscript.

Funding

This work was supported by the State Grid Science and Technology Project (no. 1400-202257234A-1-1-ZN).

Conflict of Interest

JY, SW, ZS, JH, and JL were employed by State Grid Hubei Electric Power Company Limited Economic, Technical Research Institute. SL was employed by State Grid Hubei Electric Power Company Limited.

The remaining author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors would like to thank State Grid Hubei Electric Power Company Limited Economic and Technical Research Institute and State Grid Hubei Electric Power Company Limited for providing necessary research facilities and resources.

References

Chai, Y., Xiang, Y., Liu, J., Teng, F., Yao, H., and Wang, Y. (2020). Investment Decision Optimization for Distribution Network Planning with Correlation Constraint. Int. Trans. Electr. Energ Syst. 30 (7). doi:10.1002/2050-7038.12323

Chen, Y., Li, J., Sheng, K., Yang, T., Xu, X., Han, Z., et al. (2020). Many-criteria Evaluation of Infrastructure Investment Priorities for Distribution Network Planning. IEEE Access 8, 221111–221118. doi:10.1109/ACCESS.2020.3043248

Dai, S., Niu, D., and Han, Y. (2018). Forecasting of Power Grid Investment in China Based on Support Vector Machine Optimized by Differential Evolution Algorithm and Grey Wolf Optimization Algorithm. Appl. Sci. 8 (4), 636. doi:10.3390/app8040636

Ehsan, A., and Yang, Q. (2019). State-of-the-art Techniques for Modelling of Uncertainties in Active Distribution Network Planning: A Review. Appl. Energ. 239, 1509–1523. doi:10.1016/j.apenergy.2019.01.211

Ge, L., Li, Y., Li, S., Zhu, J., and Yan, J. (2021). Evaluation of the Situational Awareness Effects for Smart Distribution Networks under the Novel Design of Indicator Framework and Hybrid Weighting Method. Front. Energ. 15 (1), 143–158. doi:10.1007/s11708-020-0703-2

He, Y. X., Jiao, J., Chen, R. J., and Shu, H. (2018). The Optimization of Chinese Power Grid Investment Based on Transmission and Distribution Tariff Policy: A System Dynamics Approach. Energy Policy 113, 112–122. doi:10.1016/j.enpol.2017.10.062

Lai, Y. Q., Wan Alwi, S. R., and Manan, Z. A. (2019). Customised Retrofit of Heat Exchanger Network Combining Area Distribution and Targeted Investment. Energy 179, 1054–1066. doi:10.1016/j.energy.2019.05.047

Li, C., Liu, X., Zhang, W., Cao, Y., Dong, X., Wang, F., et al. (2016). Assessment Method and Indexes of Operating States Classification for Distribution System with Distributed Generations. IEEE Trans. Smart Grid 7 (1), 481–490. doi:10.1109/TSG.2015.2402157

Li, C., Yin, Z., Wang, X., Zhang, G., Lin, Y., and Wang, Q. (2019). Assessment on Distribution Network Dispatching Based on Analytic Hierarchy Process and Entropy Weight Method. Proc. CSU-EPSA 31 (7), 81–87. doi:10.19635/j.cnki.csu-epsa.000210

Liu, Y., Wang, M., Liu, X., and Xiang, Y. (2019). Evaluating Investment Strategies for Distribution Networks Based on Yardstick Competition and DEA. Electric Power Syst. Res. 174, 105868. doi:10.1016/j.epsr.2019.105868

Ming, H., Xia, B., Lee, K. Y., Adepoju, A., Shakkottai, S., and Xie, L. (2020). Prediction and Assessment of Demand Response Potential with Coupon Incentives in Highly Renewable Power Systems. Prot. Control. Mod. Power Syst. 5 (2), 124–137. doi:10.1186/s41601-020-00155-x,

Mohtashami, S., Pudjianto, D., and Strbac, G. (2017). Strategic Distribution Network Planning with Smart Grid Technologies. IEEE Trans. Smart Grid 8 (6), 2656–2664. doi:10.1109/TSG.2016.2533421

Ning, G., Fang, B., Qin, D., Liang, Y., and Zheng, L. (2021). Design and Application of Comprehensive Evaluation index System of Smart Grid Based on Coordinated Planning of Major Network and Power Distribution Network. Arch. Electr. Eng. 70 (1). doi:10.24425/aee.2021.136055

Sakthivel, V. P., and Sathya, P. D. (2021). Single and Multi-Area Multi-Fuel Economic Dispatch Using a Fuzzified Squirrel Search Algorithm. Prot. Control. Mod. Power Syst. 6 (2), 147–159. doi:10.1186/s41601-021-00188-w

Santos, S. F., Fitiwi, D. Z., Bizuayehu, A. W., Shafie-khah, M., Asensio, M., Contreras, J., et al. (2017). Impacts of Operational Variability and Uncertainty on Distributed Generation Investment Planning: A Comprehensive Sensitivity Analysis. IEEE Trans. Sustain. Energ. 8 (2), 855–869. doi:10.1109/TSTE.2016.2624506

Tavares, B., and Soares, F. J. (2020). An Innovative Approach for Distribution Network Reinforcement Planning: Using DER Flexibility to Minimize Investment under Uncertainty. Electric Power Syst. Res. 183, 106272. doi:10.1016/j.epsr.2020.106272

Yang, H., Zhang, X., Ma, Y., and Zhang, D. (2021). Critical Peak Rebate Strategy and Application to Demand Response. Prot. Control. Mod. Power Syst. 6 (3), 357–370. doi:10.1186/s41601-021-00206-x

Zhang, K., Zhou, B., Or, S. W., Li, C., Chung, C. Y., and Voropai, N. (2022). Optimal Coordinated Control of Multi-Renewable-To-Hydrogen Production System for Hydrogen Fueling Stations. IEEE Trans. Ind. Applicat. 58 (2), 2728–2739. doi:10.1109/TIA.2021.3093841

Zhang, S., Cheng, H., Li, K., Tai, N., Wang, D., and Li, F. (2018). Multi-objective Distributed Generation Planning in Distribution Network Considering Correlations Among Uncertainties. Appl. Energ. 226, 743–755. doi:10.1016/j.apenergy.2018.06.049

Keywords: distribution network status assessment, investment benefit assessment, combination weighting method, investment allocation, distribution network planning

Citation: Yan J, Lu S, Wang S, Wu A, Sang Z, Huang J and Liu J (2022) A Multi-Level Investment Allocation Indicator System for Distribution Network Planning. Front. Energy Res. 10:889325. doi: 10.3389/fenrg.2022.889325

Received: 04 March 2022; Accepted: 22 March 2022;

Published: 27 April 2022.

Edited by:

Jian Zhao, Shanghai University of Electric Power, ChinaReviewed by:

Xueqian Fu, China Agricultural University, ChinaTing Wu, Harbin Institute of Technology, China

Copyright © 2022 Yan, Lu, Wang, Wu, Sang, Huang and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Aohua Wu, MTA4NTg1OTIxMUBxcS5jb20=

Jiong Yan1

Jiong Yan1 Aohua Wu

Aohua Wu