- 1Faculty of Economics and Business, State University of Malang, Malang, Indonesia

- 2Faculty of Basic and Applied Sciences, Al-Balqa Applied University, Al-Salt, Jordan

- 3Faculty of Teacher Training and Education, Pattimura University, Ambon, Indonesia

In today’s technologically advanced era, personal financial competence is critical for successful living, particularly as individuals face increasing complexities in financial decision-making. This study explores the impact of personal financial education on financial management behavior, digital financial misconceptions, and parental well-being among Generation Z in Indonesia. This quantitative study employed Structural Equation Modeling (SEM) to analyze data from 1,843 high school students across Indonesia. The study focused on the relationships between personal financial education, financial management behavior, digital financial misconceptions, and parental well-being. Data were collected through a cross-sectional survey, with instruments designed to measure each of the key variables. The findings reveal that personal financial education significantly influences financial management behavior, which in turn impacts digital financial misconceptions and parental well-being. Moreover, personal financial education directly affects both digital financial misconceptions and parental well-being, with strong indirect effects mediated through financial management behavior. The results underscore the importance of integrating comprehensive financial education into school curricula to enhance financial literacy and management behaviors. By improving financial management skills and reducing digital financial misconceptions, personal financial education can contribute to better financial outcomes and overall well-being for students and their families. This study highlights the need for educational programs that address the specific challenges posed by digital finance, ensuring that Generation Z is well-equipped to navigate the complexities of modern financial environments.

1 Introduction

Nowadays, personal financial competence is essential for successful living. The technological advancements of our era offer individuals unprecedented access to financial services and products. This accessibility, however, also introduces significant uncertainties and complexities in financial decision-making. Despite these uncertainties, it is crucial for individuals to make informed financial decisions that will significantly impact their economic circumstances in an unpredictable future. This context raises fundamental questions about the institutional mechanisms that influence individuals’ financial choices and their understanding of risk management. Promoting financial education is a primary strategy to encourage individuals to view finance through the lens of future risk management.

Financial education refers to long-term programs aimed at enhancing individuals’ understanding of financial concepts, thereby improving their financial literacy (De Beckker et al., 2021; Senduk et al., 2022). The ultimate goal of financial education is to empower and motivate people to acquire new knowledge and skills, ultimately transforming their financial behaviors—such as making sound financial decisions—from a young age (Johnson and Sherraden, 2007; Lučić et al., 2020; Luksander et al., 2014). Djatmika and Danardana Murwani (2008) further assert that consumers, as learners, construct knowledge to become proficient in problem-solving and making precise purchasing decisions. Financial education is crucial for making sound short-term and long-term financial decisions, highlighting the importance of investing in financial education from an early age for future financial stability (Lučić et al., 2020). Financial education serves as an efficient mechanism for teaching financial literacy in schools and can be a critical component of comprehensive efforts toward future financial well-being (Batty et al., 2020). Although these educational programs vary in size, design, and scope, many are implemented in schools. School-based financial education programs have shown improvements in financial knowledge (Bover et al., 2018; Iterbeke et al., 2020; Maldonado et al., 2022), credit behavior (Frisancho, 2020), budgeting behavior (Bruhn et al., 2016), and saving habits (Berry et al., 2018; Bover et al., 2018; Bruhn et al., 2016). These findings demonstrate the effectiveness of financial education in schools in enhancing financial knowledge along with financial management behaviors, including credit, budgeting, and saving practices. According to Urban et al. (2020), the proven effectiveness of school-based financial education underscores its potential to equip students with the financial knowledge necessary for developing positive financial management behaviors in the future. One way to change an individual’s financial behavior is by learning about personal finance.

Personal finance involves understanding the relationships between values, beliefs, attitudes, emotions, self-esteem, and financial behaviors such as income, spending, borrowing, saving, and investing (Hira, 2016; Wahyono et al., 2021). This perspective underscores the assumption that financial education efforts should focus on improving financial behavior to enhance future financial well-being. Contrary to previous research, Willis (2011) argues that a semester-long high school financial education is insufficient for fully understanding finance. Therefore, financial education must be implemented correctly and comprehensively in schools to contribute effectively to enhancing financial literacy, as suggested by Amagir et al. (2018) and Kaiser and Menkhoff (2018), who advocate for active learning elements like simulations and experiential learning to increase the effectiveness of financial education.

In Indonesia, the government, through institutions like Bank Indonesia, has articulated a national strategy for financial education as a pillar of financial inclusion, targeting students as primary recipients. In 2022, the Financial Services Authority (OJK) surveyed the penetration of financial education among high school students across Indonesia, revealing that 79.4% were unaware of the “SikapiUangmu” app, and 95.2% did not use it, indicating low financial literacy among young people. This aligns with findings by Garg and Singh (2018) that financial literacy rates among the youth are generally low worldwide. Hence, Dini (2022) argue that financial education should be integrated into school curricula as a mandatory subject.

In light of the low financial literacy rates among young people, the integration of financial education into school curricula is not just beneficial but necessary. It is during these formative years that financial behaviors and attitudes are shaped, and the habits developed can have lasting impacts into adulthood. Frisancho (2018) supports the focus on young individuals, emphasizing that early education on financial matters is crucial as children and teenagers are still forming habits and are more receptive to new learning experiences. Moreover, future adults will face increasingly complex financial markets, making it imperative that they are equipped with the necessary skills from a young age. The cost-effective nature of reaching this population through schools and youth organizations also makes this approach more feasible and likely to see high participation rates. Furthermore, the global policy environment has recognized Generation Z as a priority target for financial education efforts (OECD, 2013). This generation represents future economic drivers, and therefore, educating them on financial matters is not only an investment in their individual futures but also in the economic stability of society at large. The ability of Generation Z to navigate digital financial services with greater efficacy and less misconception can significantly influence their future economic outcomes and, by extension, those of their families and communities.

The misconceptions about digital finance among young people, such as the risks of impulsive buying and mismanagement of personal debt, are exacerbated by their high engagement with digital platforms and services. Studies have shown that financial education can mitigate these risks by improving financial behavior and decision-making skills. For instance, Wagner (2015) highlighted that a deeper understanding of interest rates and the true costs of borrowing could prevent financial missteps among the youth. Additionally, Brown et al. (2016) found that financial education enhances debt management skills and promotes responsible payment behaviors, contributing to long-term financial stability. The impact of financial education extends beyond individual benefits, also playing a crucial role in enhancing parents’ wellbeing. Parents’ wellbeing, in this context, refers to the satisfaction derived from their children’s appropriate financial management, which is anticipated to lead to financial independence. This form of wellbeing includes financial satisfaction and happiness, crucial for understanding how financial education, digital financial misconceptions, and parental wellbeing intertwine to shape young individuals’ financial habits and knowledge. In this study, parents’ wellbeing is defined as the achievement of parental satisfaction in terms of financial aspects and the happiness derived from observing their children’s appropriate financial management towards achieving financial independence. This definition helps us explore the intricate relationship between financial education and parental wellbeing.

Research Hypotheses on the Impact of Personal Financial Education on Generation Z in Indonesia:

• H1: There is a positive and significant influence of personal financial education on parents’ wellbeing in Generation Z in Indonesia.

• H2: There is a positive and significant influence of personal financial education on the financial management behavior of Generation Z in Indonesia.

• H3: There is a negative and significant influence of personal financial education on digital financial misconceptions in Generation Z in Indonesia.

• H4: There is a positive and significant influence of financial management behavior on parents’ wellbeing in Generation Z in Indonesia.

• H5: There is a negative and significant influence of financial management behavior on digital financial misconceptions in Generation Z in Indonesia.

• H6: There is a negative and significant influence of digital financial misconceptions on parents’ wellbeing in Generation Z in Indonesia.

• H7: There is a positive and significant influence of personal financial education on parents’ wellbeing through financial management behavior in Generation Z in Indonesia.

• H8: There is a negative and significant influence of personal financial education on digital financial misconceptions through financial management behavior in Generation Z in Indonesia.

• H9: There is a positive and significant influence of personal financial education on parents’ wellbeing through financial management behavior and digital financial misconceptions in Generation Z in Indonesia.

2 Literature review

2.1 Personal financial education and financial management behavior among generation Z

The nexus between personal financial education and financial management behavior in Generation Z has been increasingly underscored in academic and policy circles. As financial landscapes evolve, the need for comprehensive financial literacy that is adapted to digital economies becomes crucial for younger generations who are already entrenched in technology-driven environments. According to studies by Huston (2010) and Lusardi and Mitchell (2014), financial education significantly influences financial behaviors by instilling a profound understanding of financial products and the implications of financial decisions. These studies align with the findings of Fernandes et al. (2014), which suggest that financial literacy enhances both short-term and long-term financial decision-making skills. Further empirical evidence by Bernheim et al. (2001) demonstrated that early exposure to financial education correlates positively with better financial behaviors and increased savings rates among young adults. This is supported by Kaiser and Menkhoff (2017) who found that financial education in schools not only boosts financial knowledge but also translates into improved financial behaviors like enhanced savings and prudent spending. These outcomes highlight the importance of embedding structured financial education into the curriculum, which equips students with the necessary skills to navigate the complexities of modern financial landscapes effectively. Financial education is crucial in equipping individuals with the skills and knowledge necessary for making wise financial decisions, encompassing financial literacy and decision-making. Financial literacy involves understanding basic concepts such as budgeting, savings, investment, and debt management, enabling individuals to manage finances effectively and avoid excessive debt. Studies indicate that good financial literacy reduces bankruptcy risks and enhances financial stability (Lusardi and Mitchell, 2014). Financial decision-making uses this knowledge to make informed choices affecting one’s financial situation, from daily spending to long-term planning. Research shows that increasing financial literacy through education can significantly reduce financial decision-making errors (Fernandes et al., 2014). Recent studies emphasize the importance of integrating knowledge and decision-making in financial education programs, which should include practical exercises like simulations and case studies to apply knowledge in real-life scenarios (Kaiser et al., 2022). Therefore, well-structured financial education programs that reinforce both aspects are essential for improving individuals’ financial well-being.

2.2 Personal financial education and parents’ wellbeing

The impact of personal financial education extends beyond individual financial competence to influence broader social and familial dynamics, notably parents’ wellbeing. As articulated by Joo (2008) and Xiao et al. (2009), effective financial management behavior fostered through financial education can significantly enhance the financial wellbeing of families. This, in turn, affects the overall wellbeing of parents, as they derive psychological comfort from knowing their children are financially literate and capable of managing their financial affairs independently. The relationship between financial education and parental wellbeing is particularly pertinent as financial stress is known to have adverse effects on family dynamics and parents’ mental health. Research by Serdyukov (2017) highlights that innovation in educational practices, including financial education, can lead to improved life outcomes for students, thereby indirectly enhancing parental wellbeing by reducing financial anxiety within the family unit. Moreover, studies by Lusardi and Mitchell (2014) have shown that parents whose children are financially knowledgeable and independent experience higher levels of satisfaction and lower levels of stress, emphasizing the ripple contribution of financial education from individuals to their families.

2.3 Personal financial education and digital financial misconceptions

In the digital age, where financial transactions are increasingly conducted online, personal financial education plays a critical role in mitigating misconceptions associated with digital financial services. According to research by Remund (2010), financial literacy is crucial in navigating digital financial platforms responsibly. Without adequate financial education, Generation Z may be susceptible to common pitfalls in digital finance, such as misunderstanding the terms of online financial products or falling prey to online financial scams. Studies by Panos and Wilson (2020) and Brown et al. (2016) have documented that financial education can effectively reduce digital financial misconceptions by clarifying complex financial concepts and enhancing understanding of digital financial risks. As digital finance continues to evolve, the need for robust financial education that addresses the specific challenges of digital transactions becomes increasingly important to ensure that individuals can make informed and safe financial decisions online.

2.4 Digital financial misconceptions and parents’ wellbeing

The impact of digital financial misconceptions on parents’ wellbeing is a relatively understudied area that holds significant implications for family financial health. Misconceptions about digital financial services can lead to poor financial decisions, which not only affect individuals’ financial stability but also cause stress and anxiety among their parents. This is particularly relevant in the context of Generation Z, who are digital natives and are more likely to engage with digital financial platforms. Research by Lusardi and Mitchell (2014) suggests that reducing digital financial misconceptions through targeted financial education can lead to better financial outcomes for individuals and, by extension, reduce financial stress within families. This reduction in stress contributes to improved parental wellbeing, as parents are less worried about their children’s financial futures.

2.5 Financial management behavior and parents’ wellbeing

The linkage between the financial management behavior of Generation Z and the wellbeing of their parents is direct and significant. Effective financial behaviors, such as budgeting, saving, and responsible spending, foster financial security and independence among young adults, which in turn alleviates parents’ concerns about their children’s financial futures. Studies by Xiao et al. (2009) and Dew et al. (2020) have shown that parents whose children manage their finances effectively experience higher levels of emotional and psychological wellbeing, due to decreased financial burdens and increased assurance of their children’s financial autonomy.

2.6 Financial management behavior and digital financial misconceptions

The relationship between financial management behavior and digital financial misconceptions is critically important in the digital age. Proper financial management behavior, influenced by comprehensive financial education, can act as a buffer against the risks associated with digital financial services. According to Robb and Sharpe (2009), individuals who exhibit prudent financial behaviors are less likely to fall victim to digital financial misconceptions, such as overestimating the benefits of digital financial products or misunderstanding the risks associated with online transactions. By integrating robust financial education into school curriculums, particularly focusing on the intricacies of digital finance, students can develop sound financial behaviors that protect them against common digital financial errors and misconceptions, ultimately leading to better financial and overall wellbeing.

3 Method

3.1 Design

This quantitative study employs Structural Equation Modeling (SEM) to examine the impact of personal financial education on financial management behavior, parental well-being, and digital financial misconceptions among high school students and their parents in Indonesia. The SEM structural model will include exogenous latent variables such as Personal Financial Education and endogenous latent variables including Financial Management Behavior, Digital Financial Misconceptions, and Parental Well-being. Each manifest variable will be accounted for measurement errors, while endogenous latent variables will consider model errors. The analysis will be conducted using AMOS software to test the overall hypothesis and will adopt the Partial Least Square (PLS) technique for region-based analysis, enabling researchers to effectively model and test the complex relationships among these variables.

3.2 Subject

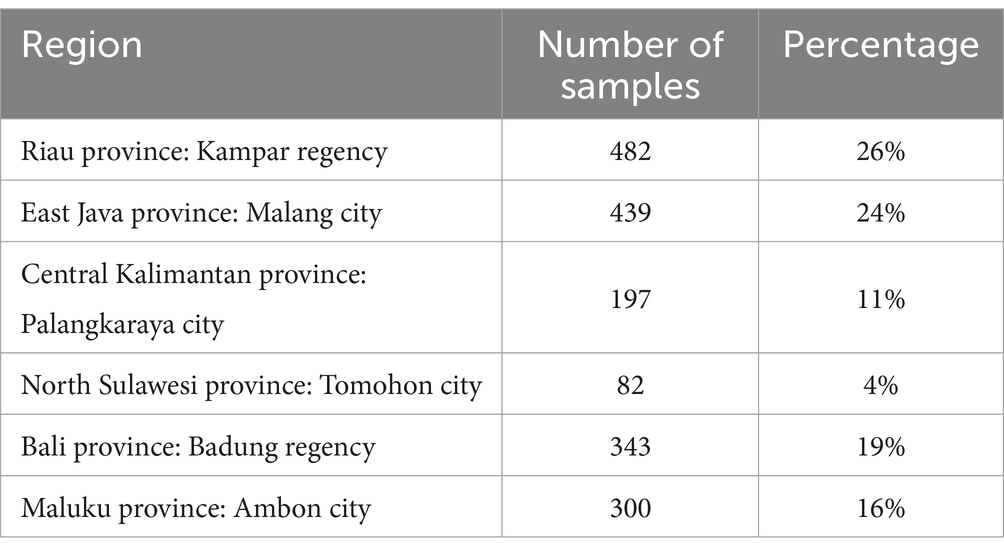

The target population for this study encompasses all high school students in Indonesia, totaling 5,181,572 students for the 2022/2023 Odd Academic Year as reported by the Directorate of Primary and Secondary Education, which also provides a breakdown of the student numbers by gender across provinces. The sampling method employed is multi-stage sampling involving several steps. The first stage is cluster sampling by geographic regions in Indonesia, such as Sumatra, Java, and others, selecting one province randomly from each region. The second stage involves random sampling at the city/district level within the chosen provinces, and finally, schools within those cities/districts are randomly selected for the study.

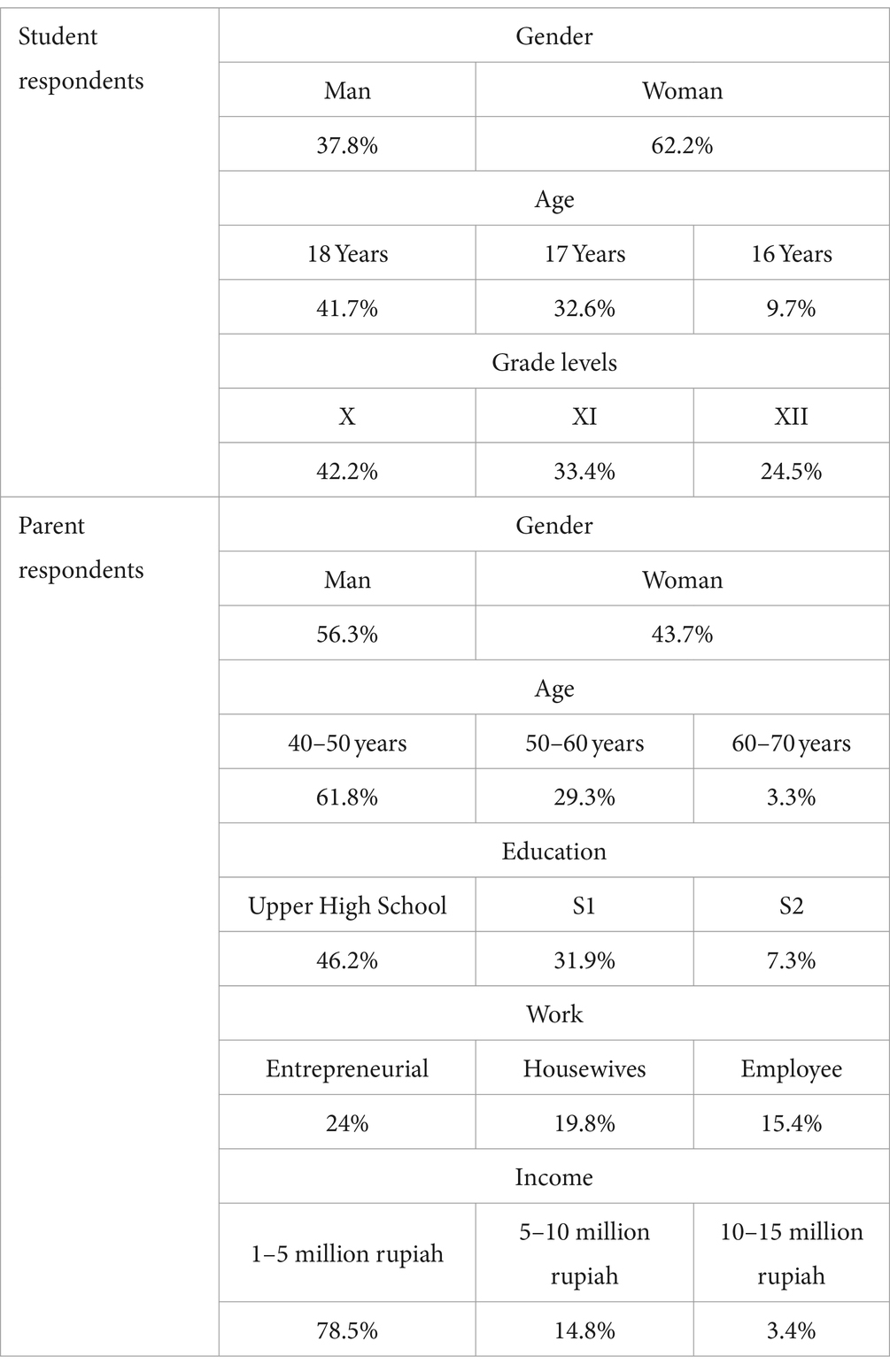

After determining the research site, the sample was determined based on the calculation of a representative sample size with a confidence level of 99% and a margin of error of 3%. The total sample obtained was 1,843 respondents, who were then distributed to schools that had been selected in each region with stratified sampling techniques, considering gender aspects. The distribution of this sample is designed to reflect geographic and demographic diversity, ensuring that the results of the study can represent a broad view of Indonesia’s high school student population, which has significant differences in educational and socioeconomic contexts between regions. Demographic data from 1843 high school students showed that the majority were female (62.2%) with the dominant age range between 14–20 years, of which students born in 2006 formed the largest proportion. In terms of grade level, class X students dominate with a proportion of 42.2%, followed by classes XI and XII.

Meanwhile, the profiles of parents involved in the study reflected variations in employment, education, and economic demographics. Most of the elderly are between 40–50 years old and the majority are male (56.3%). High school graduates dominate their educational background, followed by S1 graduates. In terms of employment, self-employed or entrepreneurial, housewives, and civil servants are the main job categories. In terms of income, most respondents are in the monthly income range of 1–5 million rupiah. This study offers a broad overview of the socioeconomic profile of generation Z families in Indonesia, providing important data for further analysis of education and socioeconomic conditions. Additionally, both student and parent respondents completed an Information and Consent Form, which is included in the Supplementary materials.

3.3 Instruments

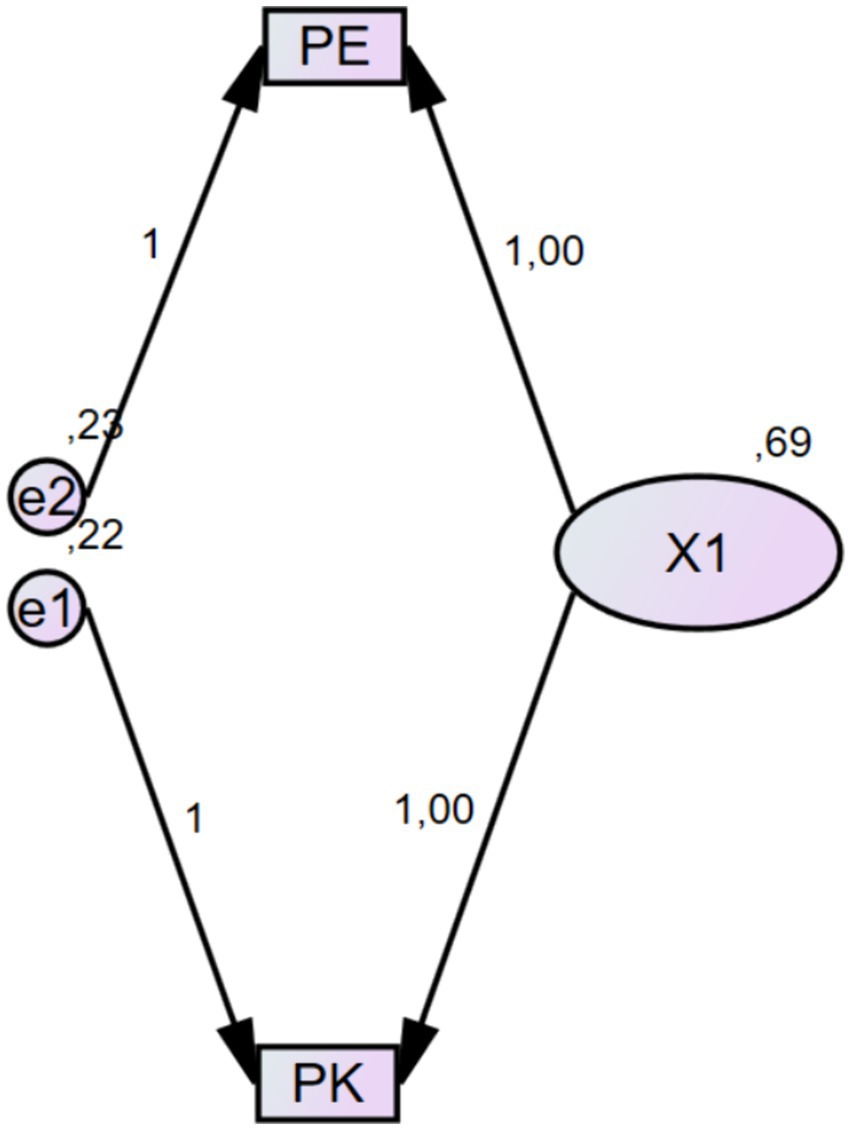

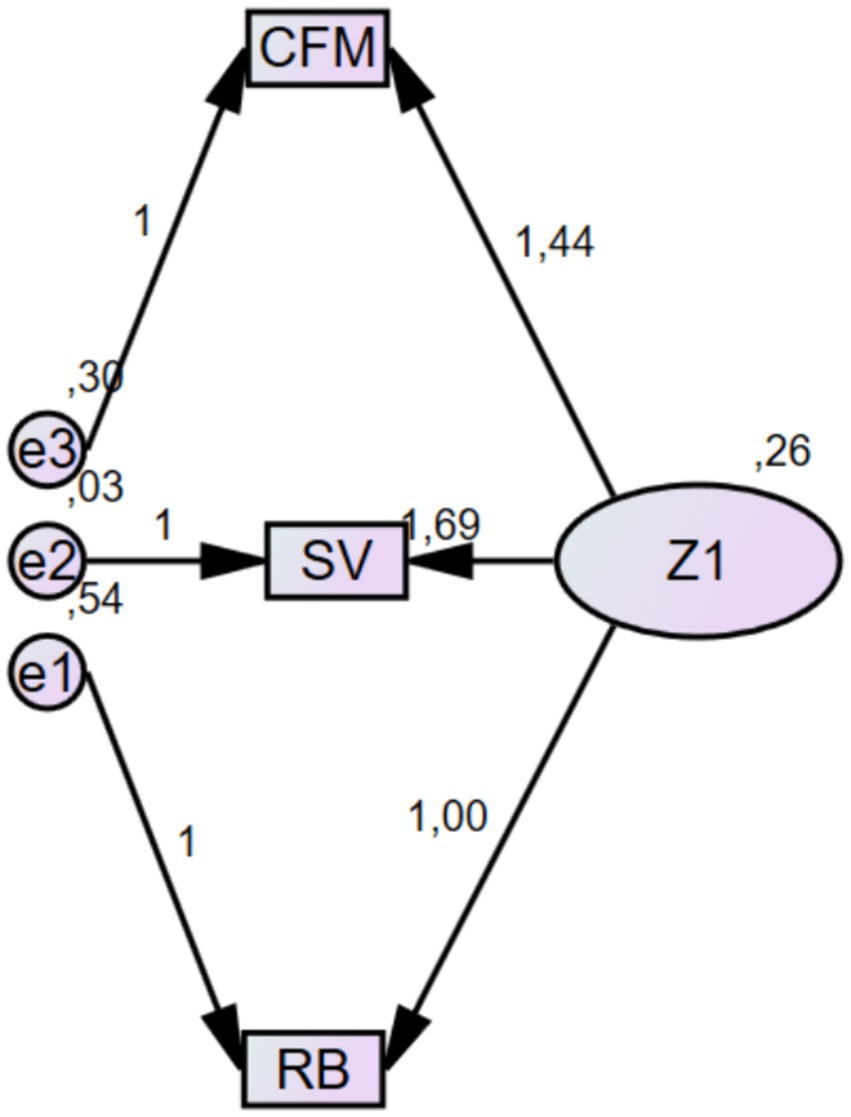

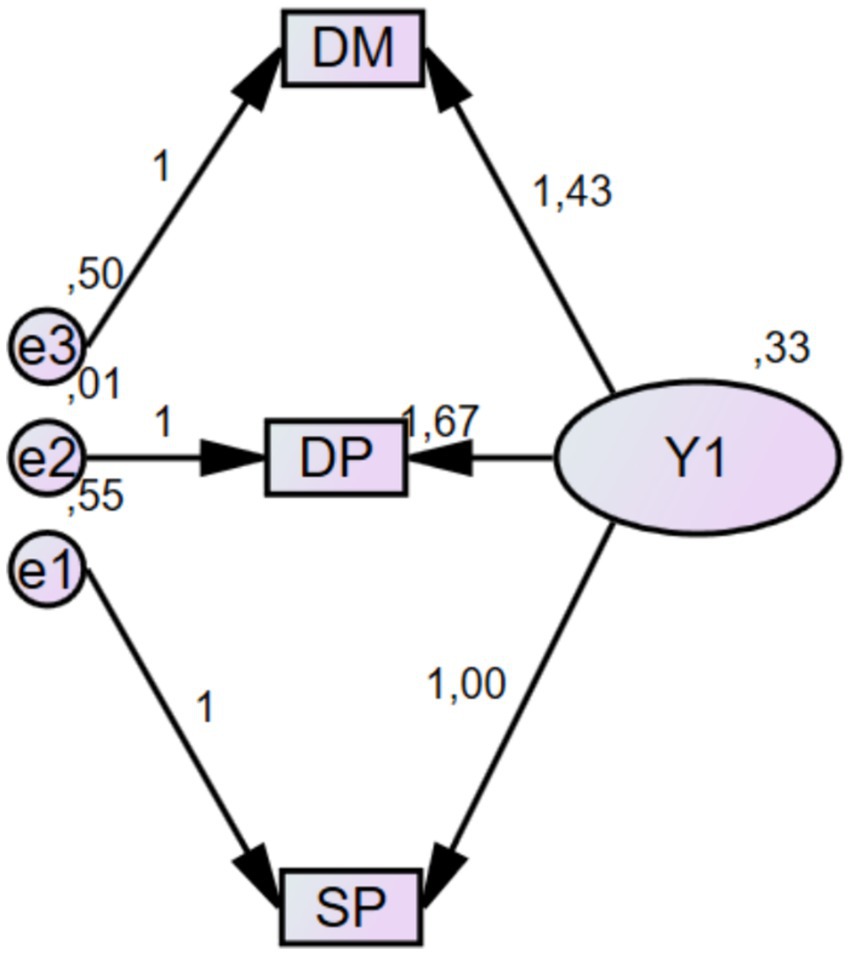

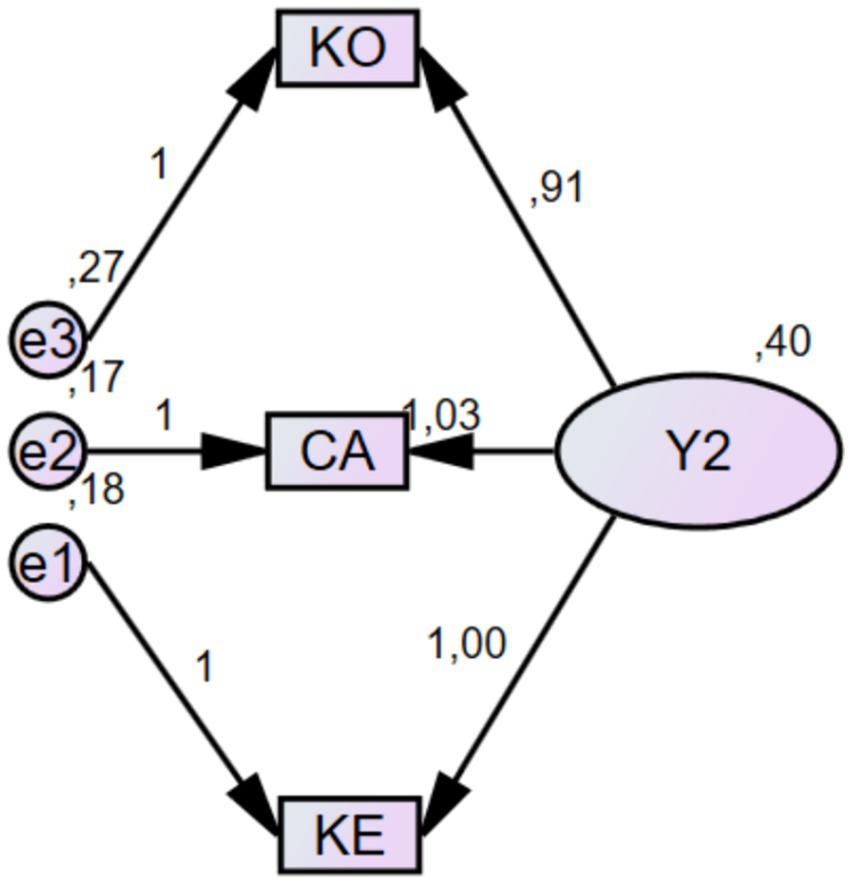

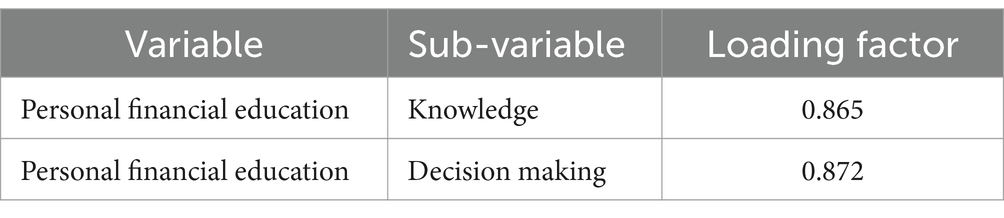

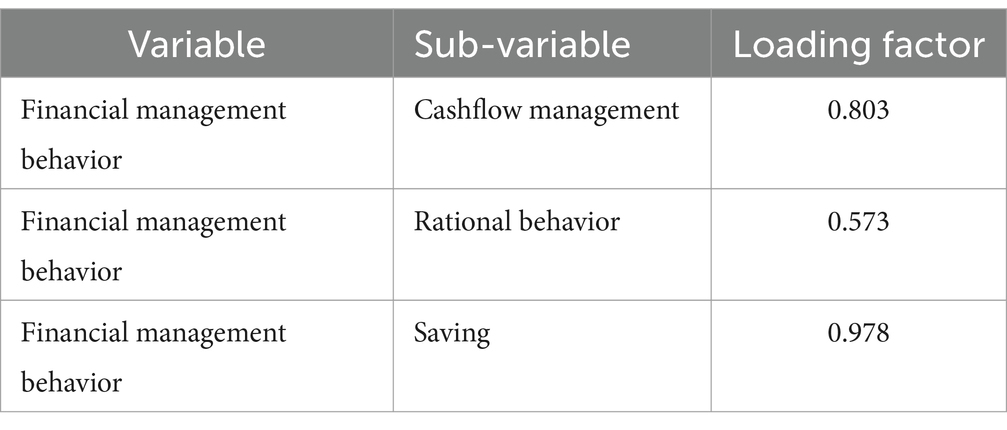

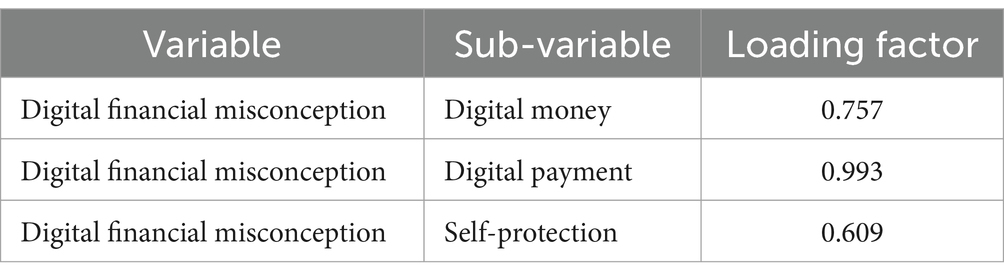

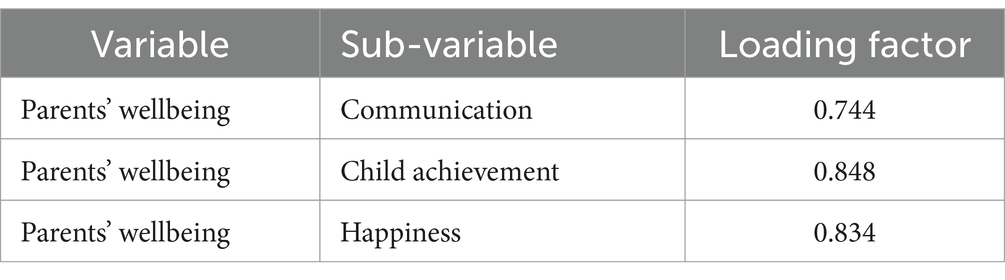

Researchers adopted a cross-sectional survey design to collect primary data from high school students and their parents in Indonesia. The questionnaire, as the main instrument, was developed based on modifications of several instruments that have been tested in the previous literature. Each research variable such as Personal Finance Education (Johan et al., 2021; Jorgensen et al., 2007), Financial Management Behavior (Dew and Jian Xiao, 2010; Strömbäck et al., 2020), Parents’ Wellbeing (Donohue et al., 2001; Hills and Argyle, 2002), and Digital Financial Misconception (Lyons and Kass-Hanna, 2021), is included in the Supplementary materials. The questionnaire was designed with question items in a multiple-choice format using a five-point Likert scale to effectively measure respondents’ responses. Confirmatory factor analysis for each variables in Figures 1–4 and Tables 1–4.

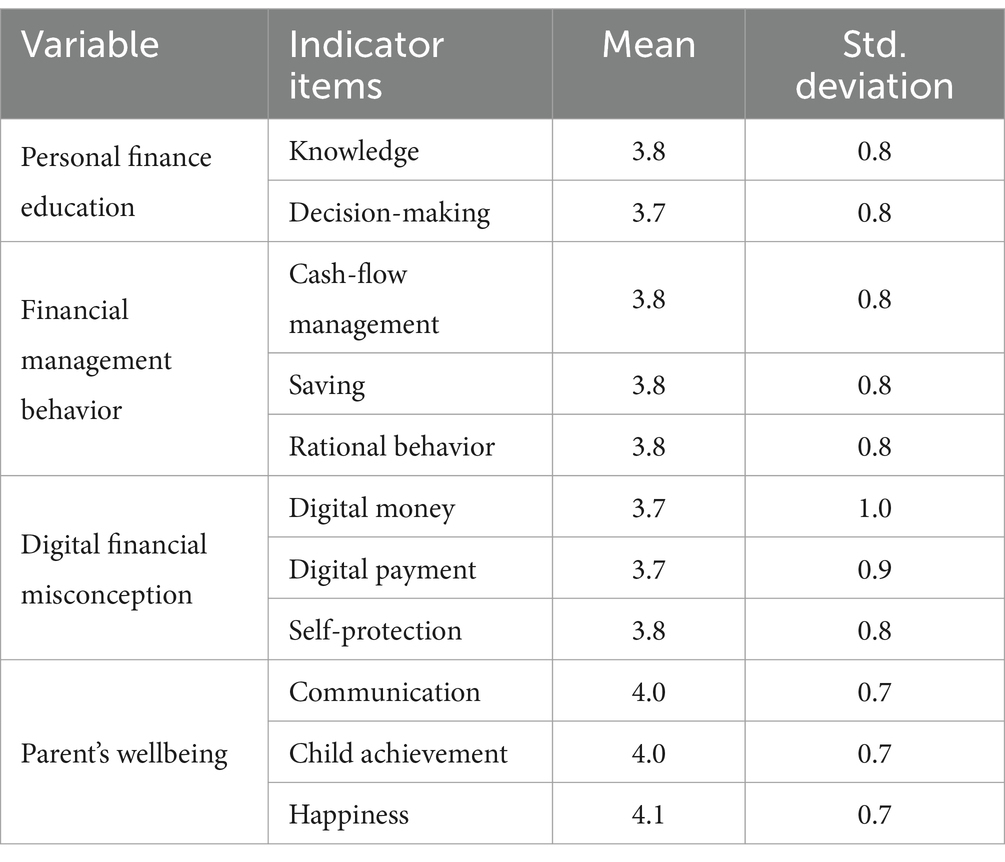

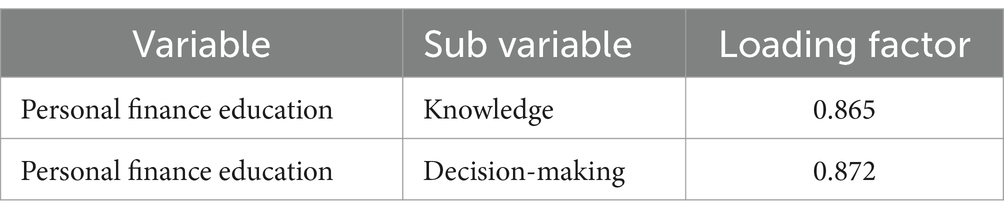

Based on Table 5, it can be concluded that in forming variable X1, which is personal financial education, both sub-variables of knowledge and decision making contribute equally. This is evidenced by the loading factors of each sub-variable, with 86.5% formed by knowledge and 87.2% formed by decision making. This implies that the role of decision making is higher in forming personal financial education (see Figures 5, 6).

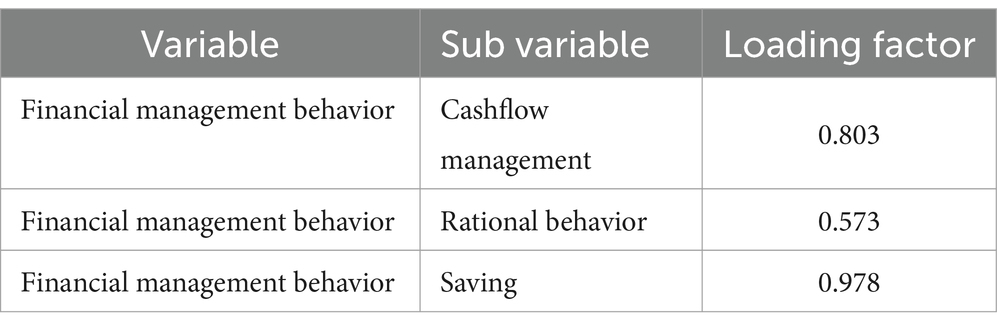

Based on Table 6, the variable of financial management behavior is formed by three sub-variables: cashflow management, rational behavior, and saving. Saving contributes the highest as a sub-variable or indicator with 97.8%, followed by cashflow management with 80.3%, and rational behavior with 57.3%.

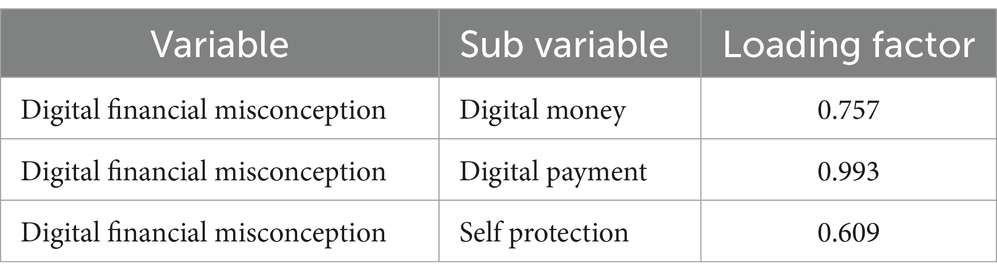

Based on Table 3, the variable of digital financial misconception is formed by three sub-variables: digital money, digital payment, and self-protection. Each sub-variable contributes 60.9% from self-protection, 99.3% from digital payment, and 75.7% from digital money. Therefore, digital payment contributes the highest dominance.

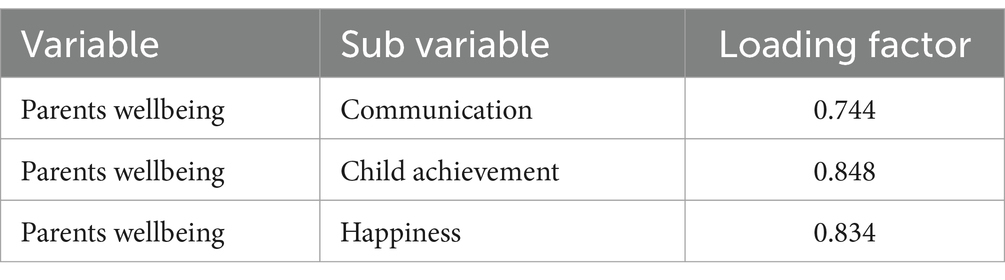

Based on Table 4, the variable of parents’ wellbeing is formed by three sub-variables: communication, child achievement, and happiness. Each sub-variable contributes 74.4% from communication, 84.8% from child achievement, and 83.4% from happiness. Therefore, child achievement has the highest dominance in forming parents’ wellbeing. Table 7 presents a summary of the research instruments used in this study, detailing the variables, the specific instruments employed, their sources, and the number of items included in each instrument.

4 Results

4.1 Descriptive statistics

The data from high school students in Indonesia were analyzed on a scale of 1–5 to understand various variables, including personal financial education, financial management behavior, digital financial misconceptions, and parental well-being, which are included in the Supplementary materials. The data revealed that the level of knowledge and decision-making in financial matters among these students averaged around 3.8. Similarly, their financial management behavior was positively rated with an overall average of about 3.8, demonstrated through indicators such as cashflow management and savings. Regarding digital financial misconceptions, the average ratings for indicators like digital money and digital payments were also around 3.8, indicating a moderate to high level of understanding. Meanwhile, parental well-being, measured through communication, child achievement, and happiness, recorded an average above 4, indicating a high level of well-being as presented in Table 8.

4.2 Goodness of fit

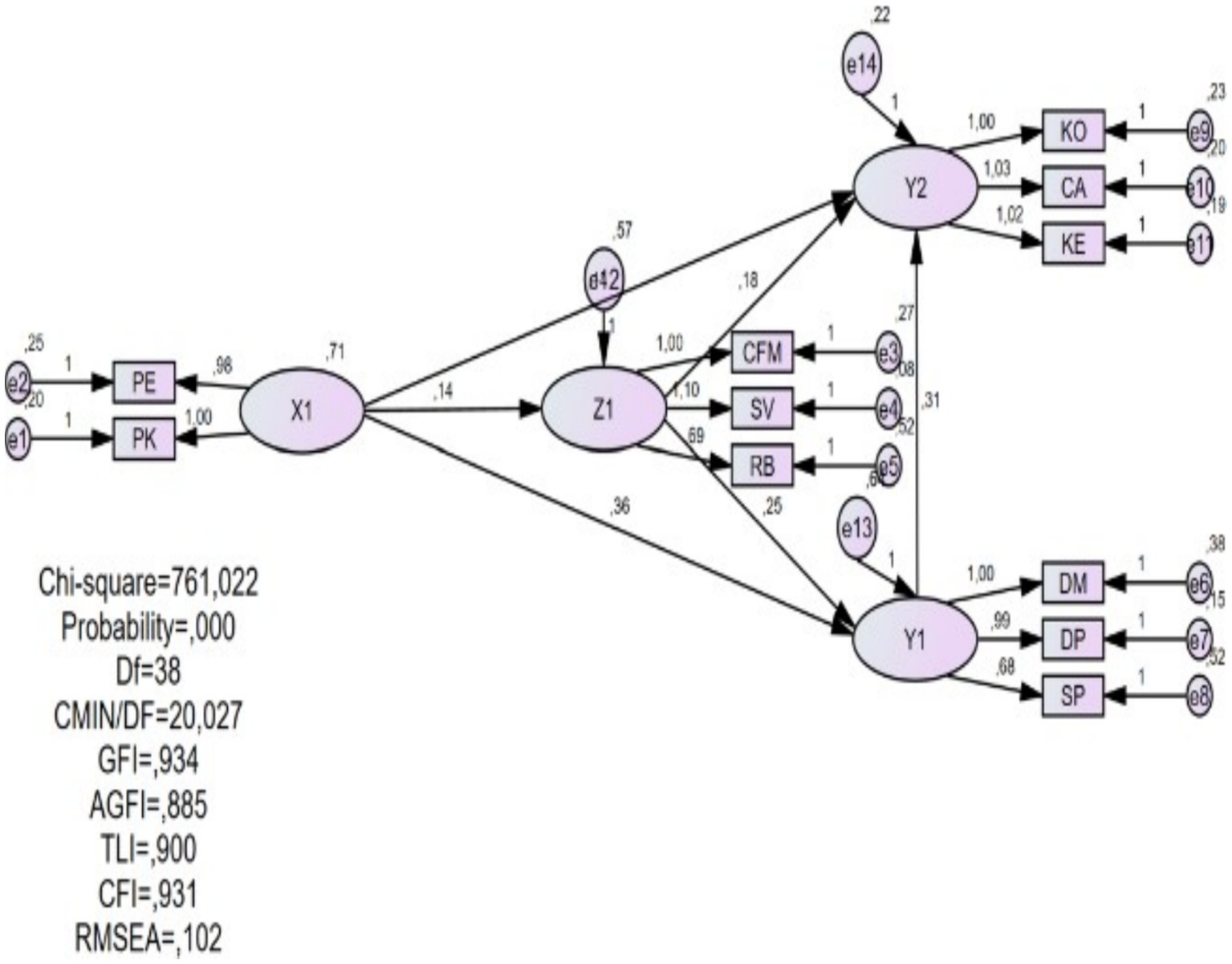

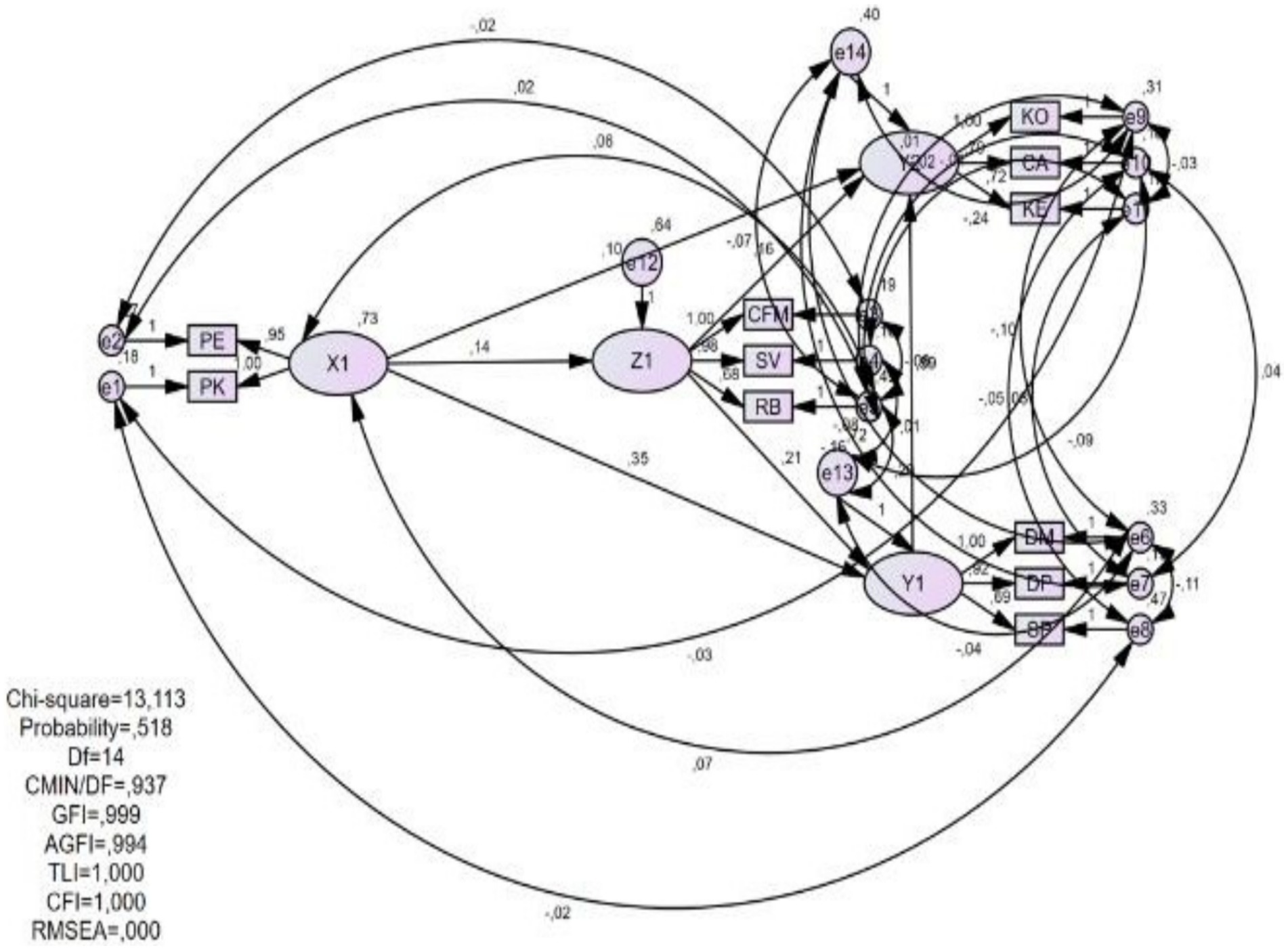

In the research process using Structural Equation Modeling (SEM) with AMOS, the initially proposed model did not meet the required fit values, necessitating a respecification. Respecification of the model involves adjusting the original model (as shown in Figure 1) through modification indices suggested by AMOS to enhance its statistical features. This could include adding or removing paths, incorporating covariances among error terms, or altering constraints within the model. After carrying out the respecification as depicted in Figure 2, all Goodness of Fit (GoF) criteria were successfully met, indicating an excellent fit of the model with the data.

After the respecification process in the SEM-AMOS model, the model fit indicators showed very positive results. A low Chi-square value of 13.113 indicates minimal differences between the observed and predicted covariances, suggesting a good fit. Additionally, a Probability value of 0.518, which exceeds the threshold of 0.05, confirms that the model is statistically viable. The very low CMIN/DF value of 0.937, well below the maximum limit of 2.00, indicates that the model is not overly complex and fits the existing data very well. Furthermore, fit indices such as the TLI (Tucker-Lewis Index), GFI (Goodness of Fit Index), AGFI (Adjusted Goodness of Fit Index), and CFI (Comparative Fit Index) reached values close to perfect (1.000 and 0.999), signifying a very high level of consistency between the model and the collected data. The RMSEA (Root Mean Square Error of Approximation) with an extremely low value of 0.000 indicates that the average estimation error is minimal, nearly ideal.

4.3 Hypothesis testing

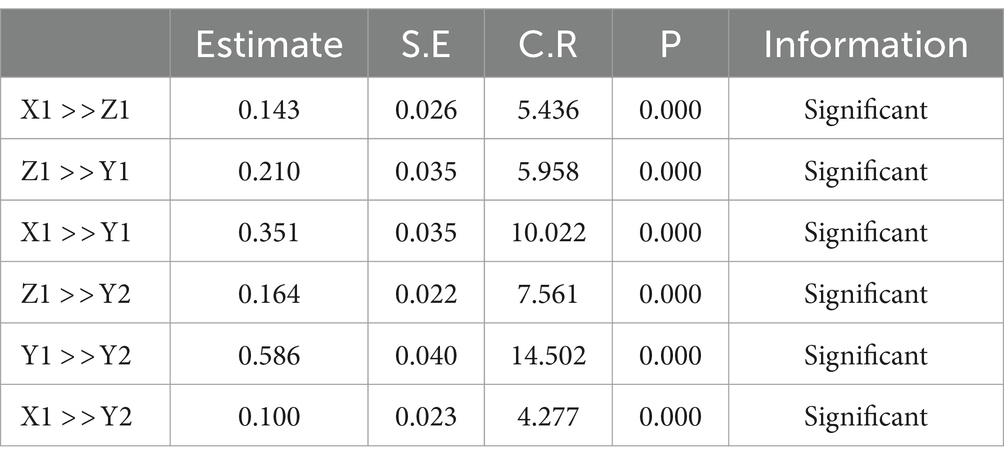

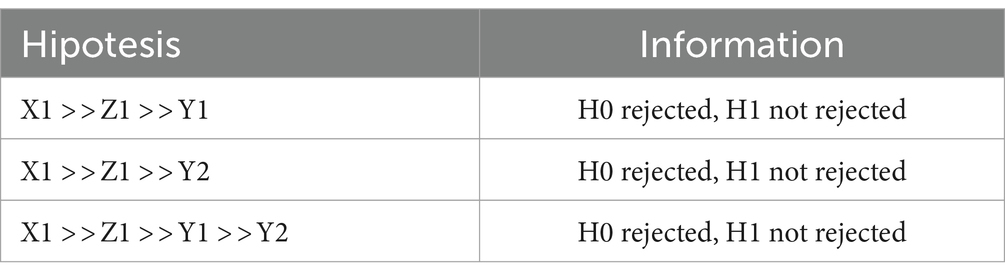

The results of the direct hypothesis testing showed that all relationships between variables were significant. For instance, the influence of X1 (Personal Financial Education) on Z1 (Financial Management Behavior) had a very low p value (0.000), indicating a strong and significant relationship. Other hypotheses, such as the influence of Z1 on Y1 (Digital Financial Misconception) and the direct influence of X1 on Y1, also showed significant results, affirming the strong connections between these variables in the context of personal financial management and digital financial misconceptions.

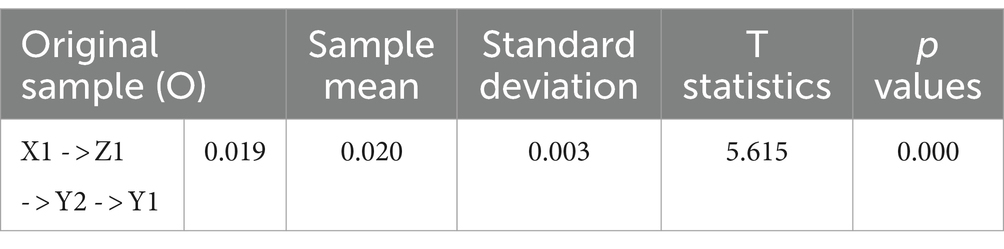

Furthermore, moderation tests through the Sobel Test confirm significant indirect contributions. For example, X1’s indirect influence on Y1 through Z1 shows significance, confirming Z1’s role as a significant mediator in the relationship between personal finance education and digital financial misconceptions. Similarly, X1’s indirect influence on Y2 (Parents Wellbeing) through Z1 is also significant, showing how financial management behavior can affect parental well-being indirectly through personal finance education.

From the more complex Sobel test with two moderations, showing the contribution of X1 on Y2 through Z1 and Y1 simultaneously is also very significant, with very low p values and high T statistics. This confirms that personal finance education variables not only directly affect parental well-being, but also have a strong indirect influence through financial management behaviors and digital financial misconceptions.

The results of the hypothesis test in this study provide strong validation of the proposed theoretical model, showing that personal finance education has a significant influence, both directly and indirectly, on financial management behavior, digital financial misconceptions, and parental well-being. This testing reinforces an understanding of the importance of financial education in influencing other aspects of financial life and well-being (see Tables 9–12).

4.4 Confirmatory factor analysis

The CFA model for Personal Finance Education variable suggests that this variable consists of two subvariables: Knowledge and Decision Making. Based on Table 13, the loading factor for Knowledge is 0.865 and for Decision Making is 0.872, indicating that these two dimensions make a significant and almost equal contribution in shaping the construct of Personal Financial Education. Decision Making has a slightly greater contribution, emphasizing its important role in financial education.

The CFA for Financial Management Behavior explores three subvariables: Cashflow Management, Rational Behavior, and Saving. According to Table 14, saving has the highest loading factor (0.978), followed by Cashflow Management (0.803), and Rational Behavior (0.573). These results suggest that saving is the most critical component of financial management behavior, demonstrating a key role in influencing overall financial practices.

This analysis assesses contributions from Digital Money, Digital Payment, and Self-Protection (Table 15). Digital Payment has a very high loading factor (0.993), making it the most dominant indicator in influencing digital financial misconceptions. Meanwhile, Digital Money and Self-Protection also made significant, albeit lower, contributions of 0.757 and 0.609, respectively.

The Parents Wellbeing variable was measured as a second-order CFA model, with three subvariables: Communication, Child Achievement, and Happiness. Table 16 shows that Child Achievement is the largest contributor (0.848), followed by Happiness (0.834) and Communication (0.744). This suggests that child achievement is the most influential aspect of parental well-being in this context (see Table 17).

Through CFA, this study managed to confirm the factorial structure of each main variable, demonstrating good construct validity and the suitability of each subvariable in building their main construct. This process not only reinforces the reliability of the proposed theoretical model but also ensures that each component of the measured variable is representative and contributes effectively to the broader construct.

5 Discussion

5.1 The contribution of personal financial education on financial management behavior

The influence of Personal Financial Education (X1) on the Financial Management Behavior (Z1) of high school students in Indonesia has been substantiated through hypothesis testing, revealing a p-value of 0.000. This result is significant as it validates the research hypothesis with a regression weight p-value ≤0.05, indicating that personal financial education positively and significantly affects financial management behavior. The hypothesis testing further reveals that the dependent variable contributes 14.3% to this influence. Logically, this suggests that the financial education received by each student significantly impacts their financial management behavior, which encompasses the capacity and actions taken by an individual to manage personal finances towards achieving set financial goals. This is in line with the findings of Topa et al. (2018), who noted that financial management behavior involves how individuals achieve, allocate, and utilize financial resources towards a defined goal. Moreover, a person with robust financial knowledge is likely to make informed decisions concerning investment, funding, and asset management, which subsequently impacts their financial behavior and overall well-being (Adriani, 2021; Sugeng and Suryani, 2023). Fenton et al. (2016) also highlighted the short, medium, and long-term undesirable consequences of inadequate financial management, affecting not only the individual but also their household and, ultimately, society at large. This underscores the importance of proper financial management to mitigate such outcomes. Additionally, Chuah et al. (2000) found that young people are a high-risk group for financial instability due to their propensity to borrow, while (Jorgensen and Savla, 2010) observed poor financial management among the youth, particularly in budgeting and long-term savings planning. This research emphasizes the critical role of financial education in equipping individuals, especially students, with the knowledge necessary for effective financial management, ultimately leading to improved financial well-being (Ahmad et al., 2019; Joo, 2008; Remund, 2010; Sugeng and Suryani, 2020; Urban et al., 2020; Xiao et al., 2009).

5.2 The contribution of personal financial education on digital financial misconception

The hypothesis testing on the influence of Personal Financial Education on Digital Financial Misconception among high school students in Indonesia indicates a significant positive contribution. This outcome suggests that financial knowledge affects how students interact with digital financial services. Generation Z, which includes these high school students, has grown up with advancing technology, yet often falls prey to digital financial misconceptions such as high credit levels, debt traps, impulsive buying, and poor decision-making. Panos and Wilson (2020) noted that the rise of FinTech can detrimentally affect financial well-being by promoting impulsive consumer behaviors on digital platforms, with mobile users more likely to engage in impulsive buying and to utilize loans. This reflects a broader lack of financial literacy and understanding of financial concepts among consumers. Further, Leong et al. (2017) discuss the risks associated with insufficient financial knowledge in market participants. As future economic drivers, it is crucial to educate Generation Z on financial issues to mitigate risks associated with digital financial usage (Ozili, 2020; Valenzuela Montoya et al., 2022). Liu and Zhang (2021) observed that easy access to online consumer credit can escalate serious financial issues during economic downturns. Cobla and Osei-Assibey (2018) advise students to use financial technology cautiously to maximize productivity and minimize negative influences such as impulsive purchases. Yue et al. (2022) highlight that increased consumption driven by digital financial services usage heightens the risk of falling into debt traps. Addressing these challenges necessitates financial literacy provided through education, as shown in Brown et al. (2016), where mandated financial education in high schools influenced better credit behavior among young people, reducing loan delinquencies. Moreover, financial education helps students understand interest rates better and the implications of irrational behavior in online purchases, reinforcing the hypothesis that financial education positively impacts understanding and mitigating digital financial misconceptions.

5.3 The contribution of personal finance education on parents’ wellbeing

The hypothesis testing conducted on the influence of Personal Financial Education on Parents’ Wellbeing among high school students in Indonesia reveals a significant positive contribution. This finding is consistent with previous tests, suggesting that financial education not only equips students with necessary financial management skills but also enhances the financial satisfaction and happiness of their parents. Parents’ wellbeing in this context refers to the satisfaction derived from their children’s appropriate financial management, which is anticipated to lead to financial independence. This form of wellbeing includes all the ways in which individuals positively experience and evaluate their lives (Tov, 2018). The relationship between parents and children is emotionally potent, such that children’s financial knowledge and independence can greatly impact parents’ satisfaction and happiness (Merz et al., 2009). Financial knowledge, often first learned from parents within the family setting, can significantly enhance children’s self-efficacy in financial matters, benefiting their future financial and relational wellbeing (Okamoto et al., 2024). Higher financial knowledge allows children to manage their finances more effectively, leading to wise financial decisions and eventual financial independence. Independent children relieve parents of financial burdens and can provide support in return. This study confirms that such dynamics enhance parents’ financial peace of mind, which is a critical component of their wellbeing. Parents’ concerns about their current financial situations and their children’s future financial status are major determinants of their wellbeing (Shek, 2003). Effective financial education helps children manage their finances better, easing the financial preparation parents make for their children’s needs, such as education funds. This transition into financial independence and equal parental relationships is a popular conception of adulthood, as parents fully regard their children as adults once they achieve financial independence (Kirkpatrick Johnson, 2013). These insights collectively reinforce the hypothesis that personal financial education positively impacts parents’ wellbeing significantly.

5.4 The contribution of financial management behavior on digital financial misconception

The hypothesis testing results demonstrate that effective financial management behavior has a significant positive impact on mitigating digital financial misconceptions among students. This finding aligns with the logic that well-established financial management practices enable students to make informed decisions, thereby reducing susceptibility to the pitfalls of digital financial services, such as impulsive buying, debt traps, and scams. Good financial behavior entails distinguishing between needs and wants, an understanding crucial to avoiding impulsive purchases, particularly prevalent among students due to the ease of access to digital financial tools (Carbo-Valverde et al., 2020; Lusardi et al., 2010). Additional research by Rahayu (2022) indicates that digital financial literacy in Indonesia remains low, with many only understanding digital payment products but not the broader implications of digital finance. Like the hypothesis on the impact of personal financial education on digital financial misconceptions, this study reinterprets digital financial misconceptions as cautious and careful use of digital finances to avoid impulsive spending, debt traps, and fraud. This theoretical framework extracts from the broader economic behavioral context, where financial behavior incorporates psychological aspects into economic and financial decision-making, blending predictive models with subjective experiences evidenced in these processes (Costa et al., 2019; Senduk et al., 2023). Furthermore, this study reveals that financial management behavior influences an individual’s psychology, where self-concept affects financial behavior. Pinto et al. (2000) suggest that money helps shape lifestyle choices reflecting an individual’s identity, thereby linking personal identity closely with financial management behavior. This understanding suggests that good financial management behavior helps students navigate the digital financial landscape, controlling spending patterns, curbing irrational shopping behaviors, and enhancing consumer discernment, ultimately leading to maximized satisfaction and reduced misconceptions in digital finance.

5.5 The contribution of financial management behavior on parents’ wellbeing

The hypothesis testing results from this study reveal that effective financial management behavior significantly influences parents’ wellbeing positively. The logic behind these results is that students with good financial management behaviors—such as saving habits, proficient cash-flow management, and rational spending—tend to enhance their parents’ wellbeing. This beneficial influence arises because such behaviors encourage a positive outlook towards finances, which eventually leads to financial prosperity for both the students and their parents, indicating an overall improvement in parents’ welfare as suggested by Merz et al. (2009). This study utilizes the family financial socialization theory, which recognizes that interaction patterns among family members affect the development of financial attitudes, knowledge transfer, and financial capabilities (Gudmunson and Danes, 2011). Additionally, social learning theory has been applied to understand how parents’ financial socialization impacts children and adolescents throughout their lifecycle. Children learn behaviors by observing, emulating, being coached in practice, and processing surrounding information (Bandura, 1986). This framework is crucial for comprehending how financial education, digital financial misconceptions, parental wellbeing, and financial management behavior intertwine to shape young individuals’ financial habits and knowledge. Financial education provided by parents equips children with essential money management skills (Gudmunson and Danes, 2011), while misconceptions about digital financial tools can lead to maladaptive behaviors if not corrected (Lusardi and Mitchell, 2014). Moreover, the overall wellbeing of parents plays a significant role in their ability to effectively teach and model positive financial behaviors (Shim et al., 2009). Ultimately, these elements collectively influence the financial management behavior of children and adolescents, highlighting the importance of a holistic approach to financial socialization within the family context (John, 1999). Consumer socialization research suggests that children and adolescents develop consumer attitudes, knowledge, and behaviors from various socialization agents like parents, peers, and schools, with parents being the most prominent agents (Kim et al., 2011; Moschis, 1987). Children and adolescents learn financial practices by observing and modeling their parents’ behaviors. Furthermore, it is essential to recognize that children’s financial management behavior is also supported by their family’s economic conditions. Children from middle and upper-class families often receive more financial support compared to those from lower socioeconomic backgrounds, affecting the continuity and change in parent–child relationships from childhood through to adulthood transitions. The findings of this study thus align with and support the hypothesis that students’ financial management behavior positively impacts their parents’ wellbeing.

5.6 The contribution of digital financial misconceptions on parents’ wellbeing

The hypothesis testing results substantiate that digital financial misconceptions significantly influence parents’ wellbeing, akin to the impact of financial management behavior. Logical reasoning suggests that students who accurately understand and use digital financial tools—such as avoiding excessive online shopping or entrapment in online loans, and not over-relying on parents for payments via cash on delivery (COD)—enhance their parents’ welfare. This contribution is particularly relevant considering the current prevalence of digital money and payment systems, which are reshaping financial behaviors especially among Generation Z, a demographic notably proficient with technology. Maurer (2012) supports this notion, stating that technology changes lifestyles and behaviors, affecting savings habits. Similarly, Panos and Wilson (2020) observed that financial technology could undermine financial wellbeing by encouraging impulsive behaviors when interacting with digital platforms. High school students, who predominantly belong to tech-savvy Generation Z, frequently use smartphones and apps, making them susceptible to poor financial decisions due to ease of access. These incorrect financial decisions impact not only the students but also their parents, echoing prior findings that parents’ primary wellbeing concerns relate to their financial situation and their children’s future financial status (Shek, 2003). As society increasingly adopts FinTech, particularly payment services, Generation Z’s deep engagement with digital services for ordering food, shopping, and paying for transport highlights their integration into digitalization. Misunderstandings in using digital finance logically affect parents, in line with findings illustrating the strong parent–child relationship. The conceptual model by Umberson (1989) indicates that parent–child relationships significantly affect the psychological wellbeing of parents. Therefore, when children fall into impulsive buying due to digital financial misconceptions, it necessitates parental involvement in resolving these issues. Thus, it is evident that improving students’ understanding of digital financial usage can significantly enhance their parents’ wellbeing, confirming that digital financial misconceptions have a direct and significant positive impact on parents’ welfare when addressed properly.

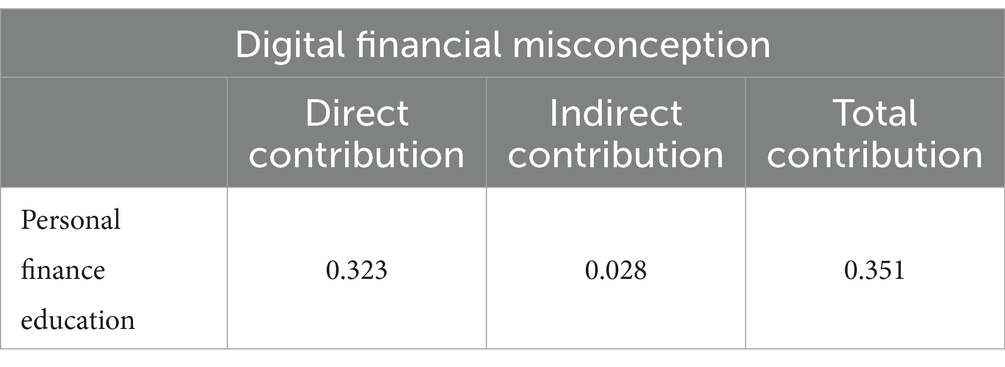

5.7 The influence of personal financial education on digital financial misconceptions through financial management behavior

The research conducted on the impact of Personal Financial Education on Digital Financial Misconceptions through Financial Management Behavior among high school students in Indonesia has shown noteworthy outcomes. Personal financial education directly influences digital financial misconceptions with a direct contribution of 0.323 and an indirect contribution through financial management behavior of 0.028, culminating in a total influence of 0.351. This study corroborates previous research, such as Lusardi et al. (2011), which found that financial education significantly impacts individual financial behaviors, including reducing poor financial management practices and misconceptions in digital finance. This aligns with Chen and Volpe (1998), who noted that higher levels of personal financial education correlate with improved financial knowledge and reduced misconceptions. However, the relatively small indirect contribution through financial management behavior (0.028 compared to the direct contribution of 0.323) indicates that personal financial education more dominantly influences digital financial misconceptions directly rather than through financial management behavior. This underscores the importance of integrating personal financial education with specific attention to the risks of digital financial misconceptions, especially given the significant role of digital finance platforms in current financial practices as highlighted by studies like (Chhillar and Arora, 2022) and the challenges noted by Damayanti et al. (2020) regarding digital finance literacy and potential consumer behaviors. Therefore, developing financial education programs that consider the risks of financial misconceptions due to technology use is increasingly crucial.

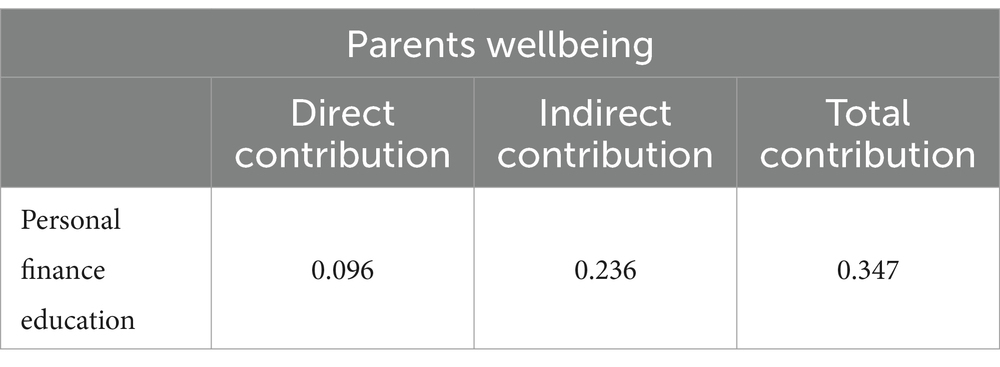

5.8 The contribution of personal financial education on parents’ wellbeing through financial management behavior

The research findings demonstrate that personal financial education significantly impacts the financial management behavior of high school students in Indonesia, which in turn influences their parents’ wellbeing. Specifically, personal financial education has a substantial direct contribution (coefficient of 0.096) and a more considerable indirect impact through improved financial management behavior (coefficient of 0.236), totaling an contribution of 0.347 on parents’ wellbeing. This underscores the critical role of personal financial education in enhancing family welfare through the intermediary of financial management behavior, with financial behavior serving as a reinforcing variable for the influence of personal financial education on parents’ wellbeing. Firli and Dalilah (2021) support these findings, highlighting that financial literacy and attitudes significantly influence personal financial management behaviors. While personal financial education is a pivotal factor in enhancing parental welfare through prudent financial management by students, it is not the sole influencer. Parental involvement in financial education also plays a significant role in overall family welfare, as shown by Matobobo et al. (2016), who found that parental participation in school financial management can improve financial efficiency and reduce family financial burdens. Moreover, Jariwala (2023) suggests that financial education workshops enhance financial communication between mothers and teenagers, affecting family dynamics, while (LeBaron and Kelley, 2021) emphasize the importance of parental financial education during childhood in fostering healthier financial behaviors in young adulthood. Additionally, Maldonado et al. (2022) highlight the positive impact of parental involvement in their children’s financial education, particularly for financially disadvantaged students. Thus, the development and implementation of personal financial education programs that involve parents are crucial for improving financial understanding and behaviors, enhancing the financial wellbeing of families overall.

5.9 The influence of personal financial education on parents’ wellbeing through financial management behavior and digital financial misconceptions

The Sobel test findings reveal that personal financial education significantly enhances parents’ wellbeing through two pathways: financial management behavior and digital financial misconception. This indicates that personal financial education not only improves financial management skills among high school students in Indonesia but also helps mitigate the risks associated with digital financial misconceptions. As students receive quality personal financial education, they are more likely to adopt sound financial behaviors, thereby alleviating the financial burden on their families and enhancing their parents’ financial happiness and stability. Enhanced financial understanding and management skills acquired through education enable students to better support their parents financially, thus improving overall family wellbeing. Chhillar and Arora (2022) emphasize that adeptness in personal financial management helps students make wiser financial decisions and build a more stable financial future. Jariwala (2023) also supports the importance of financial education in fostering communication about money between parents and children. Moreover, the rapid development of digital finance underscores the need for strong financial knowledge as the ease of using digital financial technologies can lead to suboptimal financial decisions that jeopardize family wellbeing. Panos and Wilson (2020) express concerns that online financial education programs might increase the risk of digital financial misconceptions, particularly concerning complex concepts like risk/reward trade-offs with derivatives. This research underscores the need for educational institutions to design effective personal financial education programs that consider the impacts of technology, particularly FinTech, aiming to reduce digital financial misconceptions while enhancing basic financial understanding as a primary focus to improve financial literacy in Indonesia. This study offers valuable insights into how FinTech influences personal financial education and parental wellbeing through students’ financial management behavior and digital financial misconceptions, highlighting the need for a carefully crafted financial education program responsive to technological advancements in financial services.

6 Conclusion

The comprehensive analysis in this study underscores the pivotal role of personal finance education in shaping financial management behaviors, understanding digital financial misconceptions, and enhancing parental well-being among high school students in Indonesia. The descriptive statistics reveal a moderately high level of financial literacy, management behaviors, and understanding of digital finances among students, with parental well-being also rated highly. The structural equation modeling confirms the robustness of the revised theoretical model, indicating an excellent fit with the data and validating the significant direct and mediated relationships among the studied variables. These findings highlight the critical impact of financial education on students’ capabilities to manage finances effectively and mitigate digital misconceptions, which in turn contributes positively to the well-being of their parents, emphasizing the interconnected nature of financial knowledge, behavior, and overall familial welfare. This study not only reinforces the importance of integrating financial education into school curricula but also provides empirical evidence supporting the effectiveness of such educational interventions in promoting healthier financial and familial ecosystems.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the patients/ participants was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

FS: Conceptualization, Data curation, Writing – original draft. ED: Conceptualization, Investigation, Writing – review & editing. HW: Methodology, Supervision, Writing – original draft. MC: Data curation, Formal analysis, Writing – original draft. OM: Software, Visualization, Writing – review & editing. PA: Formal analysis, Project administration, Visualization, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. The author extends gratitude to the Universitas Negeri Malang (UM) Number: 3.4.93/UN32/KP/2024, Center for Higher Education Funding (BPPT) under the Ministry of Education, Culture, Research, and Technology (KEMENDIKBUDRISTEK) of the Republic of Indonesia, and/or the Educational Fund Management Institution (LPDP) under the Ministry of Finance (KEMENKEU) of the Republic of Indonesia (BPI Identification Number: 202101121338) for their financial support.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/feduc.2024.1460374/full#supplementary-material

References

Adriani, J. (2021). Factors affecting financial behaviors. Int. J. Rev. Manag. Bus. Entrep. 1, 191–204. doi: 10.37715/rmbe.v1i2.2427

Ahmad, A., Butt, B. S. M., and Iram, S. (2019). Drivers influencing financial behavior among management students in Narowal. Int. J. Acad. Res. Bus. Soc. Sci. 9, 656–666. doi: 10.6007/ijarbss/v9-i2/5602

Amagir, A., Groot, W., Maassen Van Den Brink, H., and Wilschut, A. (2018). A review of financial-literacy education programs for children and adolescents. Citizenship, Social and Economics Education, 17, 56–80. doi: 10.1177/2047173417719555

Bandura, A. (1986). Social foundations of thought and action: a social cognitive theory. Prentice-Hall. Available at: https://books.google.co.id/books?id=HJhqAAAAMAAJ

Batty, M., Collins, J. M., O’Rourke, C., and Odders-White, E. (2020). Experiential financial education: a field study of my classroom economy in elementary schools. Econ. Educ. Rev. 78:14:102014. doi: 10.1016/j.econedurev.2020.102014

Bernheim, B. D., Garrett, D. M., and Maki, D. M. (2001). Education and saving: the long-term effects of high school financial curriculum mandates. J. Public Econ. 80, 435–465. doi: 10.1016/S0047-2727(00)00120-1

Berry, J., Karlan, D., and Pradhan, M. (2018). The impact of financial education for youth in Ghana. World Dev. 102, 71–89. doi: 10.1016/j.worlddev.2017.09.011

Bover, O., Hospido, L., and Villanueva, E. (2018). The impact of high school financial education on financial knowledge and choices: evidence from a randomized trial in Spain. SSRN Electronic Journal. doi: 10.2139/ssrn.3116054

Brown, M., Grigsby, J., Van Der Klaauw, W., Wen, J., and Zafar, B. (2016). Financial education and the debt behavior of the young. Rev. Financ. Stud. 29, 2490–2522. doi: 10.1093/rfs/hhw006

Bruhn, M., de Souza Leão, L., Legovini, A., Marchetti, R., and Zia, B. (2016). The impact of high school financial education: evidence from a large-scale evaluation in Brazil. Am. Econ. J. Appl. Econ. 8, 256–295. doi: 10.1257/app.20150149

Carbo-Valverde, S., Lacomba-Arias, J. A., Lagos-García, F. M., Rodriguez-Fernandez, F., and Verdejo-Román, J. (2020). Brain substrates explain differences in the adoption and degree of financial digitalization. Sci. Rep. 10:17512. doi: 10.1038/s41598-020-74554-3

Chen, H., and Volpe, R. P. (1998). An analysis of personal financial literacy among college students. Financ. Serv. Rev. 7, 107–128. doi: 10.1016/S1057-0810(99)80006-7

Chhillar, N., and Arora, S. (2022). Personal financial management behavior using digital platforms and its domains. J. Financ. Manag. Market. Inst. 10:98. doi: 10.1142/S2282717X22500098

Chuah, S.-C., Kamaruddin, J. N., and Singh, J. K. (2000). Factors affecting financial management behaviour among university students. Malaysian J. Cons. Family Econ. 25, 154–174.

Cobla, G. M., and Osei-Assibey, E. (2018). Mobile money adoption and spending behaviour: the case of students in Ghana. Int. J. Soc. Econ. 45, 29–42. doi: 10.1108/IJSE-11-2016-0302

Costa, D. F., Carvalho, F. M., and Moreira, B. C. M. (2019). Behavioral economics and behavioral finance: a bibliometric analysis of the scientific fields. J. Econ. Surv. 33, 3–24. doi: 10.1111/joes.12262

Damayanti, L. E., Susilaningsih,, and Indriayu, M. (2020). Financial literacy in student financial management behavior in the digital age. Proceedings of the 4th international conference on learning innovation and quality education, 1–4.

De Beckker, K., De Witte, K., and Van Campenhout, G. (2021). The effect of financial education on students’ consumer choices: evidence from a randomized experiment. J. Econ. Behav. Organ. 188, 962–976. doi: 10.1016/J.JEBO.2021.06.022

Dew, J., Dean, L., Duncan, S. F., and Britt-Lutter, S. (2020). “A review of effectiveness evidence in the financial-helping fields” in Family relations, (Blackwell Publishing Ltd.) 69, 614–627.

Dew, J., and Jian Xiao, J. (2010). Financial behavior scale 2 financial behavior scale: development and validation.

Dini, J. P. (2022). Analisis Implementasi Pendidikan Keuangan pada Jenjang Pendidikan Anak Usia Dini (PAUD). Jurnal Pendidikan Anak Usia Dini 6, 2429–2438. doi: 10.31004/obsesi.v6i3.1925

Djatmika, E. T., and Danardana Murwani, F. (2008). Analisis tentang Dimensi-Dimensi Gaya Belajar Konsumen. Available at: https://www.neliti.com/id/publications/110959/analisis-tentang-dimensi-dimensi-gaya-belajar-konsumen

Donohue, B., Decato, L. A., Azrin, N. H., and Teichner, G. A. (2001). Satisfaction of parents with their conduct-disordered and substance-abusing youth. Behav. Modif. 25, 21–43. doi: 10.1177/0145445501251002

Fenton, R., Nyamukapa, C., Gregson, S., Robertson, L., Mushati, P., Thomas, R., et al. (2016). Wealth differentials in the impact of conditional and unconditional cash transfers on education: findings from a community-randomised controlled trial in Zimbabwe. Psychol. Health Med. 21, 909–917. doi: 10.1080/13548506.2016.1140903

Fernandes, D., Lynch, J. G., and Netemeyer, R. G. (2014). Financial literacy, financial education, and downstream financial behaviors. Manag. Sci. 60, 1861–1883. doi: 10.1287/MNSC.2013.1849

Firli, A., and Dalilah, A. (2021). Influence of financial literacy, financial attitude, and parental income on personal financial management behaviour: a case study on the millennial generation in Indonesia. Int. J. Trade Glob. Mark. 14, 206–212. doi: 10.1504/IJTGM.2021.114066

Frisancho, V. (2018). The impact of school-based financial education on high school students and their teachers: Experimental evidence from Peru. doi: 10.2139/ssrn.3305510

Frisancho, V. (2020). The impact of financial education for youth. Econ. Educ. Rev. 78:101918. doi: 10.1016/j.econedurev.2019.101918

Garg, N., and Singh, S. (2018). Financial literacy among youth. Int. J. Soc. Econ. 45, 173–186. doi: 10.1108/IJSE-11-2016-0303

Gudmunson, C. G., and Danes, S. M. (2011). Family financial socialization: theory and critical review. In. J. Fam. Econ. Iss. 32, 644–667. doi: 10.1007/s10834-011-9275-y

Hills, P., and Argyle, M. (2002). The Oxford happiness questionnaire: a compact scale for the measurement of psychological well-being. Personal. Individ. Differ. 33, 1073–1082. doi: 10.1016/S0191-8869(01)00213-6

Hira, T. K. (2016). “Financial sustainability and personal finance education” in Handbook of consumer finance research. ed. J. J. Xiao (Springer International Publishing), 357–366.

Huston, S. J. (2010). Measuring financial literacy. J. Consum. Aff. 44, 296–316. doi: 10.1111/j.1745-6606.2010.01170.x

Iterbeke, K., De Witte, K., Declercq, K., and Schelfhout, W. (2020). The effect of ability matching and differentiated instruction in financial literacy education. Evidence from two randomised control trials. Econ. Educ. Rev. 78:101949. doi: 10.1016/j.econedurev.2019.101949

Jariwala, H. V. (2023). Do financial education workshops enhance parent–adolescent communication about money? Manag. Financ. 49, 829–846. doi: 10.1108/MF-09-2021-0469

Johan, I., Rowlingson, K., and Appleyard, L. (2021). The effect of personal finance education on the financial knowledge, attitudes and behaviour of university students in Indonesia. J. Fam. Econ. Iss. 42, 351–367. doi: 10.1007/s10834-020-09721-9

John, D. R. (1999). Consumer Socialization of Children: A Retrospective Look At Twenty‐Five Years of Research. J. Consum. Res. 26, 183–213. doi: 10.1086/209559

Johnson, E., and Sherraden, M. S. (2007). From financial literacy to financial capability among youth. The. J. Sociol. Soc. Welf. 34. doi: 10.15453/0191-5096.3276

Jorgensen, B. L., Allen, K., and Hayhoe, C. (2007). Financial literacy of college students: Parental and peer influences.

Jorgensen, B. L., and Savla, J. (2010). Financial literacy of young adults: the importance of parental socialization. Fam. Relat. 59, 465–478. doi: 10.1111/j.1741-3729.2010.00616.x

Kaiser, T., and Menkhoff, L. (2017). Does financial education impact financial literacy and financial behavior, and if so, when? World Bank Econ. Rev. 31, 611–630. doi: 10.1093/wber/lhx018

Kaiser, T., and Menkhoff, L. (2018). Active learning fosters financial behavior experimental evidence. Available at: http://www.diw.de/discussionpapers

Kaiser, T., Lusardi, A., Menkhoff, L., and Urban, C. (2022). Financial education affects financial knowledge and downstream behaviors. J. Financ. Econ, 145, 255–272. doi: 10.1016/j.jfineco.2021.09.022

Kim, J., LaTaillade, J., and Kim, H. (2011). Family processes and adolescents’ financial behaviors. J. Fam. Econ. Iss. 32, 668–679. doi: 10.1007/s10834-011-9270-3

Kirkpatrick Johnson, M. (2013). Parental financial assistance and young adults’ relationships with parents and well-being. J. Marriage Fam. 75, 713–733. doi: 10.1111/jomf.12029

LeBaron, A. B., and Kelley, H. H. (2021). Financial socialization: a decade in review. J. Family Econ. Issues 42, 195–206. doi: 10.1007/s10834-020-09736-2

Leong, C., Tan, B., Xiao, X., Tan, F. T. C., and Sun, Y. (2017). Nurturing a FinTech ecosystem: the case of a youth microloan startup in China. Int. J. Inf. Manag. 37, 92–97. doi: 10.1016/j.ijinfomgt.2016.11.006

Liu, L., and Zhang, H. (2021). Financial literacy, self-efficacy and risky credit behavior among college students: evidence from online consumer credit. J. Behav. Exp. Financ. 32:569:100569. doi: 10.1016/j.jbef.2021.100569

Lučić, A., Barbić, D., and Uzelac, M. (2020). The role of financial education in adolescent consumers’ financial knowledge enhancement. Market-Trziste 32, 115–130. doi: 10.22598/mt/2020.32.spec-issue.115

Luksander, A., Béres, D., Huzdik, K., and Németh, E. (2014). Analysis of the factors that influence the financial literacy of young people studying in higher education. Available at: https://ideas.repec.org/a/pfq/journl/v59y2014i2p220-241.html

Lusardi, A., and Mitchell, O. S. (2014). The economic importance of financial literacy: theory and evidence. J. Econ. Lit. 52, 5–44. doi: 10.1257/jel.52.1.5

Lusardi, A., Mitchell, O. S., Alesina, A., Alessie, R., Botticini, M., and Campbell, J., et al. (2011). Nber working paper series financial literacy and planning: implications for retirement wellbeing financial literacy and planning: Implications for retirement wellbeing. Oxford University Press. 16–39.

Lusardi, A., Mitchell, O. S., and Curto, V. (2010). Financial literacy among the young. J. Consum. Aff. 44, 358–380. doi: 10.1111/j.1745-6606.2010.01173.x

Lyons, A. C., and Kass-Hanna, J. (2021). A methodological overview to defining and measuring “digital” financial literacy. Finan. Plan. Rev. 4:1113. doi: 10.1002/cfp2.1113

Maldonado, J. E., De Witte, K., and Declercq, K. (2022). The effects of parental involvement in homework: two randomised controlled trials in financial education. Empir. Econ. 62, 1439–1464. doi: 10.1007/s00181-021-02058-8

Matobobo, M., Kurebwa, M., Wadesango, N., and Wadesango, V. (2016). Parental involvement in the schools’ financial management: issues and challenges. J. Soc. Sci. 47, 1–9. doi: 10.1080/09718923.2016.11893537

Maurer, B. (2012). Mobile money: communication, consumption and change in the payments space. J. Dev. Stud. 48, 589–604. doi: 10.1080/00220388.2011.621944

Merz, E. M., Consedine, N. S., Schulze, H. J., and Schuengel, C. (2009). Wellbeing of adult children and ageing parents: associations with intergenerational support and relationship quality. Ageing Soc. 29, 783–802. doi: 10.1017/S0144686X09008514

Moschis, G. P. (1987). Consumer socialization: a life-cycle perspective. Lexington Books. Available at: https://books.google.co.id/books?id=0jwfAQAAIAAJ

OECD . (2013). Advancing National Strategies for financial education. Available at: http://www.oecd.org/finance/financial-education/G20_OECD_NSFinancialEducation.pdf%5Cnhttp://www.sciencedirect.com/science/article/pii/S0186104215721455

Okamoto, R. M., Saxey, M. T., Wikle, J. S., and LeBaron-Black, A. B. (2024). Confident commitment: financial self-Efficacy’s indirect association with romantic relationship flourishing through financial behaviors. J. Fam. Econ. Iss. 45, 35–44. doi: 10.1007/s10834-023-09903-1

Ozili, P. K. (2020). Contesting digital finance for the poor. Digit. Pol. Regul. Govern. 22, 135–151. doi: 10.1108/DPRG-12-2019-0104

Panos, G. A., and Wilson, J. O. S. (2020). Financial literacy and responsible finance in the FinTech era: capabilities and challenges. European J. Finance 26, 297–301. doi: 10.1080/1351847X.2020.1717569

Pinto, M. B., Parente, D. H., and Palmer, T. S. (2000). Materialism and credit card use by college students. Psychol. Rep. 86, 643–652. doi: 10.2466/pr0.2000.86.2.643

Rahayu, R. (2022). Analisis Faktor-Faktor yang Mempengaruhi Tingkat Literasi Keuangan Digital-Studi pada Generasi Z di Indonesia. Reviu Akuntansi Dan Bisnis Indonesia 6, 73–87. doi: 10.18196/rabin.v6i1.142682

Remund, D. L. (2010). “Financial literacy explicated: the case for a clearer definition in an increasingly complex economy” in Second special issue on financial literacy, vol. 44, 276–295. doi: 10.1111/j.1745-6606.2010.01169.x

Robb, C. A., and Sharpe, D. L. (2009). Effect of personal financial knowledge on college students’ credit card behavior. Available at: http://ssrn.com/abstract=2224225

Senduk, F. F., Mintarti, S. U., Djatmika, E., and Churiyah, M. (2022). Do Financial Education Will Save Your Life in Digitalization Era? A Bibliometric Analysis. SSRN Electronic Journal. doi: 10.2139/ssrn.4163661

Senduk, F. F. W., Djatmika, E. T., Widjaja, S. U. M., and Churiyah, M. (2023). Financial education in the digitalization era: A bibliometric analysis. Paper presented at the International Conference on Research in Education and Science (ICRES), Cappadocia, Turkey: International Society for Technology, Education, and Science. 192–211.

Serdyukov, P. (2017). Innovation in education: what works, what doesn’t, and what to do about it? J. Res. Innov. Teach. Learn. 10, 4–33. doi: 10.1108/jrit-10-2016-0007

Shek, D. T. L. (2003). Economic stress, psychological well-being and problem behavior in Chinese adolescents with economic disadvantage. J. Youth Adolesc. 32, 259–266. doi: 10.1023/A:1023080826557

Shim, S., Xiao, J. J., Barber, B. L., and Lyons, A. C. (2009). Pathways to life success: A conceptual model of financial well-being for young adults. J. Appl. Dev. Psychol, 30, 708–723. doi: 10.1016/j.appdev.2009.02.003

Strömbäck, C., Skagerlund, K., Västfjäll, D., and Tinghög, G. (2020). Subjective self-control but not objective measures of executive functions predicts financial behavior and well-being. J. Behav. Exp. Financ. 27:100339. doi: 10.1016/j.jbef.2020.100339

Sugeng, B., and Suryani, A. W. (2020). Enhancing the learning performance of passive learners in a Financial Management class using Problem-Based Learning. J. Univ. Teach. Learn. Pract. 17, 1–20. doi: 10.53761/1.17.1.5

Sugeng, B., and Suryani, A. W. (2023). Using the theory of planned behaviour to investigate Indonesian accounting educators’ pedagogical strategies in online delivery. Accounting Education, 33, 164–192. doi: 10.1080/09639284.2023.2168127

Topa, G., Hernández-Solís, M., and Zappalà, S. (2018). Financial management behavior among young adults: the role of need for cognitive closure in a three-wave moderated mediation model. Front. Psychol. 9:2419. doi: 10.3389/fpsyg.2018.02419

Tov, W. (2018). Well-being concepts and components. In Handbook of subjective well-being. Salt Lake City, UT: Noba Scholar. 1–15. https://ink.library.smu.edu.sg/soss_research/2836

Umberson, D. (1989). Relationships with Children: Explaining Parents’ Psychological Well-Being. J. Marriage Fam. 51:999. doi: 10.2307/353212

Urban, C., Schmeiser, M., Collins, J. M., and Brown, A. (2020). The effects of high school personal financial education policies on financial behavior. Econ. Educ. Rev. 78:101786. doi: 10.1016/j.econedurev.2018.03.006

Valenzuela Montoya, M. M., López Torres, V. G., and Aguilar Sandoval, K. G. (2022). Debt and financial education in university students. Revista Venezolana de Gerencia 27, 198–211. doi: 10.52080/rvgluz.27.97.14

Wagner, J. (2015). An analysis of the effects of financial education on financial literacy and financial behaviors. Available at: http://digitalcommons.unl.edu/businessdisshttp://digitalcommons.unl.edu/businessdiss/50

Wahyono, H., Narmaditya, B. S., Wibowo, A., and Kustiandi, J. (2021). Irrationality and economic morality of SMEs’ behavior during the Covid-19 pandemic: Lesson from Indonesia. Heliyon, 7:e07400. doi: 10.1016/j.heliyon.2021.e07400

Willis, L. E. (2011). The financial education fallacy. Am. Econ. Rev. 101, 429–434. doi: 10.1257/aer.101.3.429

Xiao, J. J., Tang, C., and Shim, S. (2009). Acting for happiness: financial behavior and life satisfaction of college students. Soc. Indic. Res. 92, 53–68. doi: 10.1007/s11205-008-9288-6

Keywords: financial education, digital financial literacy, youth financial behavior, parental well-being, structural equation modeling

Citation: Senduk FFW, Djatmika ET, Wahyono H, Churiyah M, Mahasneh O and Arjanto P (2024) Fostering financially savvy generations: the intersection of financial education, digital financial misconception and parental wellbeing. Front. Educ. 9:1460374. doi: 10.3389/feduc.2024.1460374

Edited by:

Amjad Islam Amjad, School Education Department, PakistanReviewed by:

Maura Pilotti, Prince Mohammad bin Fahd University, Saudi ArabiaMuhammad Jamil, Government College Women University Sialkot, Pakistan

Copyright © 2024 Senduk, Djatmika, Wahyono, Churiyah, Mahasneh and Arjanto. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Feibry Feronika Wiwenly Senduk, ZmVpYnJ5LmYuMjEwNDMxOUBzdHVkZW50cy51bS5hYy5pZA==

Feibry Feronika Wiwenly Senduk

Feibry Feronika Wiwenly Senduk Ery Tri Djatmika1

Ery Tri Djatmika1 Madziatul Churiyah

Madziatul Churiyah Omar Mahasneh

Omar Mahasneh