- Department of Human Sciences, Society and Health, University of Cassino and Southern Lazio, Cassino, Lazio, Italy

This narrative review critically examines the scope and impact of financial literacy programs targeted at children and adolescents. By synthesizing findings from diverse studies, the review identifies key components of effective financial education, including the integration of experiential learning, the role of digital tools, and the importance of parental involvement. Challenges such as ensuring curriculum relevance in a rapidly evolving financial landscape and addressing the varied learning needs of young populations are discussed. Recommendations for future research include the necessity for longitudinal studies to assess the long-term effects of early financial education and exploration into the digitalization of financial literacy. This review aims to contribute to the development of more inclusive, adaptive, and impactful financial literacy education strategies, underscoring the critical role of comprehensive financial education in preparing young individuals for financial autonomy and resilience.

1 Introduction

Financial literacy among young people today is increasingly important as finances become more complex. Today's youth, specifically those aged 6–18 years, are growing up in the most financially turbulent and challenging world that we have ever seen. This study focuses on students from primary to secondary school, examining the impact of financial education interventions on children and adolescents within this age group. The evolving financial landscape necessitates the early introduction of financial education to this demographic to help them develop the knowledge and skills needed to make informed financial decisions.

Caplinska and Ohotina (2019) highlight that a well-designed financial education curriculum can equip individuals to navigate the complexities of the economy and finance, fostering productivity and adaptability. Moscarola and Kalwij (2021) further stress the significance of early financial literacy education for children, underlining why and how financial literacy should be instilled from a young age. By introducing financial literacy at a young age, individuals can develop the knowledge and skills needed to make informed financial decisions, navigate the intricate financial environment, and contribute to their financial wellbeing and that of society as a whole.

The literature emphasizes the critical importance of early financial education for both individual financial wellbeing and broader societal implications. Letkiewicz and Fox (2014) highlight the role of financial literacy in asset accumulation and informed financial decision-making. Lührmann et al. (2015) stress the practical significance of enhancing financial literacy among teenagers, who generally exhibit lower financial literacy levels compared to adults. These studies underscore the necessity of equipping young individuals with the essential financial knowledge and skills to make informed decisions and navigate the complexities of the financial landscape.

Early financial education plays a pivotal role in shaping individuals' financial behaviors and attitudes. Garg and Singh (2018) discuss the positive relationship between financial education and financial literacy among youth, emphasizing the importance of financial education programs in enhancing financial knowledge. Also Chhatwani and Mishra (2021) suggest that financial literacy is a critical tool to enhance financial wellbeing, indicating the need for early financial education to empower individuals to make sound financial decisions.

Literature suggests that financial literacy is crucial for individual financial wellbeing and broader societal implications. Studies by Eniola and Entebang (2017) and Hussain et al. (2018) highlight the positive impact of early financial education on economic understanding and financial behavior, contributing to overall financial stability. The research by Letkiewicz et al. (2019) and Zhou et al. (2023) further emphasizes the importance of financial literacy in promoting asset accumulation and informed financial decision-making, underscoring the need for comprehensive financial education from a young age. To effectively enhance adolescents' and children's understanding of money management, it is essential to provide them with comprehensive financial education programs from an early age. Research by Marchetti et al. (2021) underscores the importance of introducing financial concepts and skills to children in a structured and engaging manner to establish a solid foundation for their financial literacy development.

Fuente-Mella et al. (2021) highlight that the family serves as the primary source of financial literacy for children, emphasizing the crucial role of parental involvement in teaching children about money management and financial decision-making. Parents can act as role models and mentors, demonstrating responsible financial behaviors that significantly influence children's financial literacy development. Gardynia and Syaodih (2021) discuss the significance of integrating financial literacy education into early childhood learning using cognitive learning theories by renowned psychologists. This approach aids children in grasping fundamental financial concepts and acquiring essential money management skills from a young age, facilitating effective application in real-life scenarios. This early exposure to financial education shapes children's attitudes and behaviors toward money management, laying a robust foundation for their financial wellbeing in adulthood.

Young people can be taught to monitor their spending so that it does not exceed their budget and accounts can be used to this end. All of this can aid them in making conscious decisions that are not based on impulse or influenced by what their friends are doing. The use of technology can help children to engage with the process of deciding how to spend money. For example, comparing prices and features of items that they might wish to buy over the internet. Pahlevan Sharif and Naghavi (2020) stress the importance of financial literacy among today's adolescents and youth, as they are increasingly exposed to financial decision-making. This underscores the necessity of equipping young individuals with the knowledge and skills required to monitor their spending effectively and make informed financial choices.

Despite growing recognition of its importance, financial literacy among children and adolescents remains a significantly underexplored area. Existing research has predominantly focused on adults, leaving a critical gap in understanding how early financial education influences long-term financial behaviors and decision-making. Addressing this gap is essential, as early interventions can shape financial attitudes and capabilities, potentially leading to more financially responsible adults (Mallia et al., 2020; Diotaiuti et al., 2022a,b; Mancone et al., 2024a,b). This research gap underscores the need for comprehensive studies that evaluate the effectiveness of financial literacy programs targeted at younger populations, exploring variables such as age, socio-economic background, and educational content delivery methods.

This study aims to review the existing literature on financial literacy education among children and adolescents. The following research questions were developed to guide the review: (1) What are the key components of effective financial literacy education for children and adolescents? This question seeks to identify the essential elements that contribute to successful financial education programs, including content, teaching methods, and delivery platforms. (2) How do financial literacy education needs differ between primary school children (ages 6–12) and teenagers (ages 13–18)? This issue would explore the developmental differences in financial education needs, addressing how cognitive and behavioral changes impact the design and effectiveness of educational interventions. (3) What evidence exists on the effectiveness of different types of financial literacy interventions (e.g., school-based programs, family workshops, and digital platforms)? This question would focus on evaluating the empirical evidence regarding various intervention types, assessing their impact on financial knowledge, attitudes, and behaviors. (4) What are the theoretical frameworks that underpin financial literacy education for young people? This question aims to identify the theoretical models that inform financial literacy education, including developmental psychology, social learning theories, and behavioral economics. (5) What gaps exist in the current research on financial literacy education for children and adolescents, and what are the implications for future studies? This question highlights areas where further research is needed, providing recommendations for future studies to address current limitations and emerging needs.

2 Methodology

This review systematically examines financial literacy among children and adolescents, focusing on individuals aged 6–18 years. Our geographical scope is global, encompassing studies from diverse economic backgrounds to understand universal and region-specific educational outcomes. The types of financial education interventions reviewed include school-based programs, family and community workshops, and digital learning platforms.

We followed a systematic approach in line with the PRISMA (Preferred Reporting Items for Systematic reviews and Meta-Analyses) framework to ensure a transparent and rigorous selection process. A comprehensive search of academic databases, including PubMed, PsycINFO, ERIC, and Google Scholar, was conducted. The literature considered comprises peer-reviewed articles, educational reports, policy analyses, and seminal books published in the field of financial education.

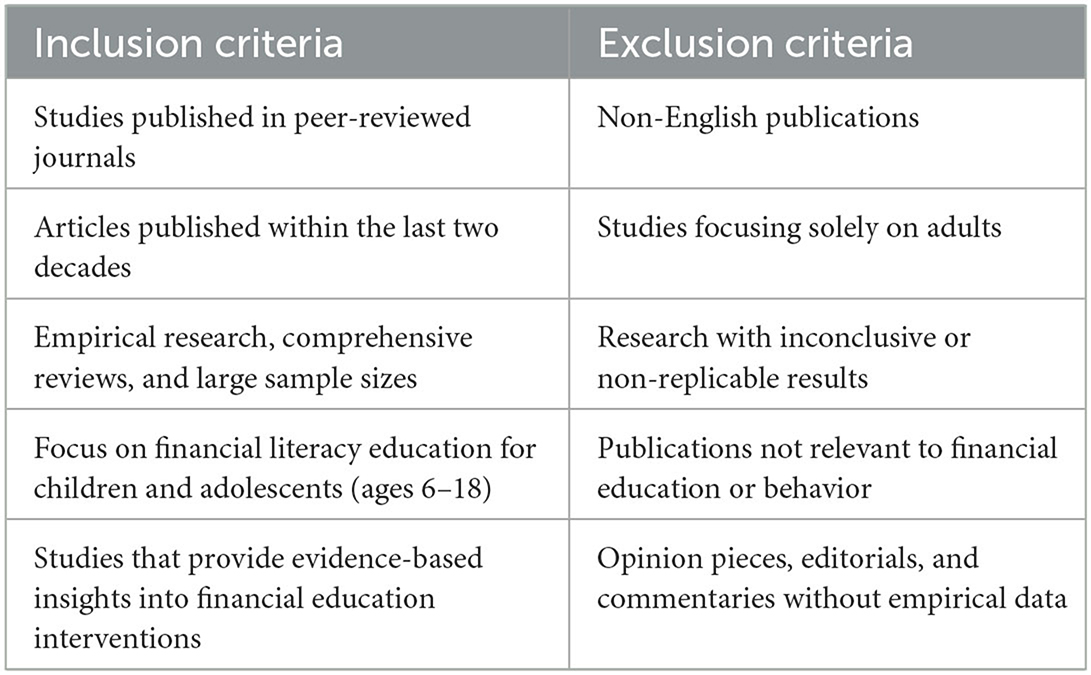

Our search strategy employed a combination of keywords and phrases to capture the breadth of the topic. The exact search string used was: (“financial literacy” OR “financial education”) AND (“children” OR “adolescents” OR “youth”) AND (“financial behavior” OR “financial intervention”) AND (“early financial education” OR “school-based financial programs” OR “family financial workshops” OR “digital learning platforms”). The selection process involved several stages: (1) we identified relevant studies through database searches, employing the specified keywords to cover the broad scope of financial literacy in children and adolescents; (2) titles and abstracts were screened to remove irrelevant studies, duplicates, and articles that did not meet the inclusion criteria; (3) full texts of the remaining articles were assessed for eligibility, focusing on empirical research, comprehensive reviews, and studies with significant sample sizes; (4) final studies were selected based on their contribution to understanding the effects of financial education on young people, with preference given to those published in the last two decades to ensure relevance and contemporary insights. Exclusion criteria eliminated non-English publications, studies focusing solely on adults, and research with inconclusive or non-replicable results. Table 1 presents a detailed summary of the criteria applied.

3 Results

This review examines a total of 80 unique studies on financial literacy, spanning from foundational theories to practical interventions and their effectiveness. The studies cover a broad temporal range, with publications spanning from early foundational works to the most recent research conducted up to 2023. The distribution of the studies is structured into five key sections, reflecting the diversity of approaches and findings in financial literacy research: (1) Theoretical Frameworks: outlines the foundational theories that guide the design of financial literacy education, providing context for the methodologies used. (2) Age-Specific Educational Needs: addresses how financial education requirements differ between primary school children and teenagers due to their cognitive and developmental stages. (3) Types of Financial Literacy Interventions: examines the variety of educational approaches, including school-based programs, family involvement, and digital platforms, highlighting their unique contributions. (4) Effectiveness of Financial Literacy Programs: focuses on studies that evaluate the impact of specific financial literacy interventions, offering evidence-based insights into what works. (5) Factors Influencing Financial Literacy: explores the various demographic, socioeconomic, psychological, and cultural factors that impact financial literacy levels among children, adolescents, and young adults. These categories were chosen to reflect the distinct areas that influence financial literacy education for children and adolescents, allowing for a comprehensive analysis of the literature.

3.1 Theoretical frameworks

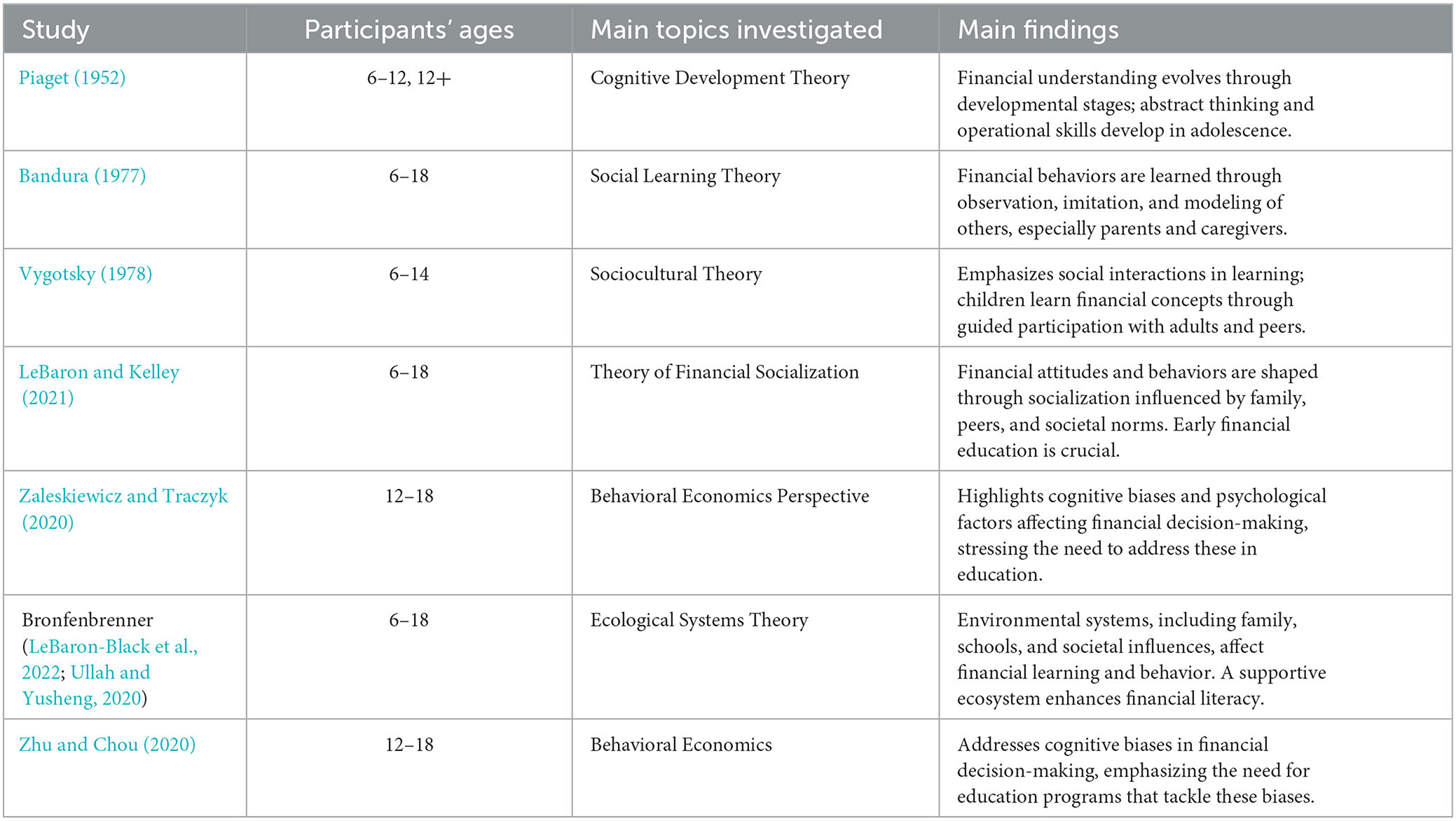

Developmental psychology offers insights into how financial capabilities and the understanding of value evolve with cognitive development. This perspective suggests tailored financial education that grows with the child, introducing more complex concepts as their cognitive abilities mature. The understanding and interaction with financial concepts among children and adolescents are framed within several theories. Piaget (1952)'s Cognitive Development Theory suggests that children's ability to understand complex concepts like finance evolves through specific stages, with abstract thinking and operational skills developing in adolescence. Vygotsky (1978)'s Sociocultural Theory emphasizes the role of social interactions in learning, suggesting that children learn financial concepts through guided participation with adults and peers. Bandura (1977)'s Social Learning Theory highlights the importance of observation, imitation, and modeling, suggesting that children and adolescents learn financial behaviors by observing and mimicking the financial actions of others, especially parents and caregivers. These theories collectively underline the importance of age-appropriate financial education and the influence of social environments on financial literacy development.

Beyond the foundational theories, the Theory of Financial Socialization posits that children and adolescents develop financial attitudes and behaviors through the process of socialization, influenced by family, peers, and societal norms (LeBaron and Kelley, 2021). This theory underscores the importance of early financial education and experiences, suggesting that positive early interactions with money can lead to better financial decisions in adulthood. Additionally, the Behavioral Economics Perspective introduces the idea that cognitive biases and psychological factors influence financial decision-making, highlighting the need for financial education programs to address these biases (Zaleskiewicz and Traczyk, 2020; Zhu and Chou, 2020). Integrating these theories into educational practices can foster a more nuanced understanding of financial literacy among young individuals, preparing them for the financial realities of adult life.

Finally, the Ecological Systems Theory, proposed by Bronfenbrenner, can be applied to understand how various environmental systems, from immediate family and schools to broader societal influences, affect the financial learning and behavior of children and adolescents (LeBaron-Black et al., 2022; Ullah and Yusheng, 2020). This theory emphasizes the interconnectedness of a child's development with their environment, suggesting that a supportive ecosystem can enhance financial literacy. Integrating community resources, policy initiatives, and technology within financial education can create a holistic learning environment that supports the diverse needs of young individuals, fostering a generation that is not only financially literate but also capable of making informed financial decisions in a complex world.

Table 2 presents the key theoretical frameworks that underpin financial literacy education, detailing the studies, participant ages, main topics investigated, and key findings. This table summarizes how different theories, such as Piaget's Cognitive Development Theory, Vygotsky's Sociocultural Theory, and Bandura's Social Learning Theory, contribute to our understanding of financial literacy development.

3.2 Age-specific educational needs

3.2.1 Financial literacy in children

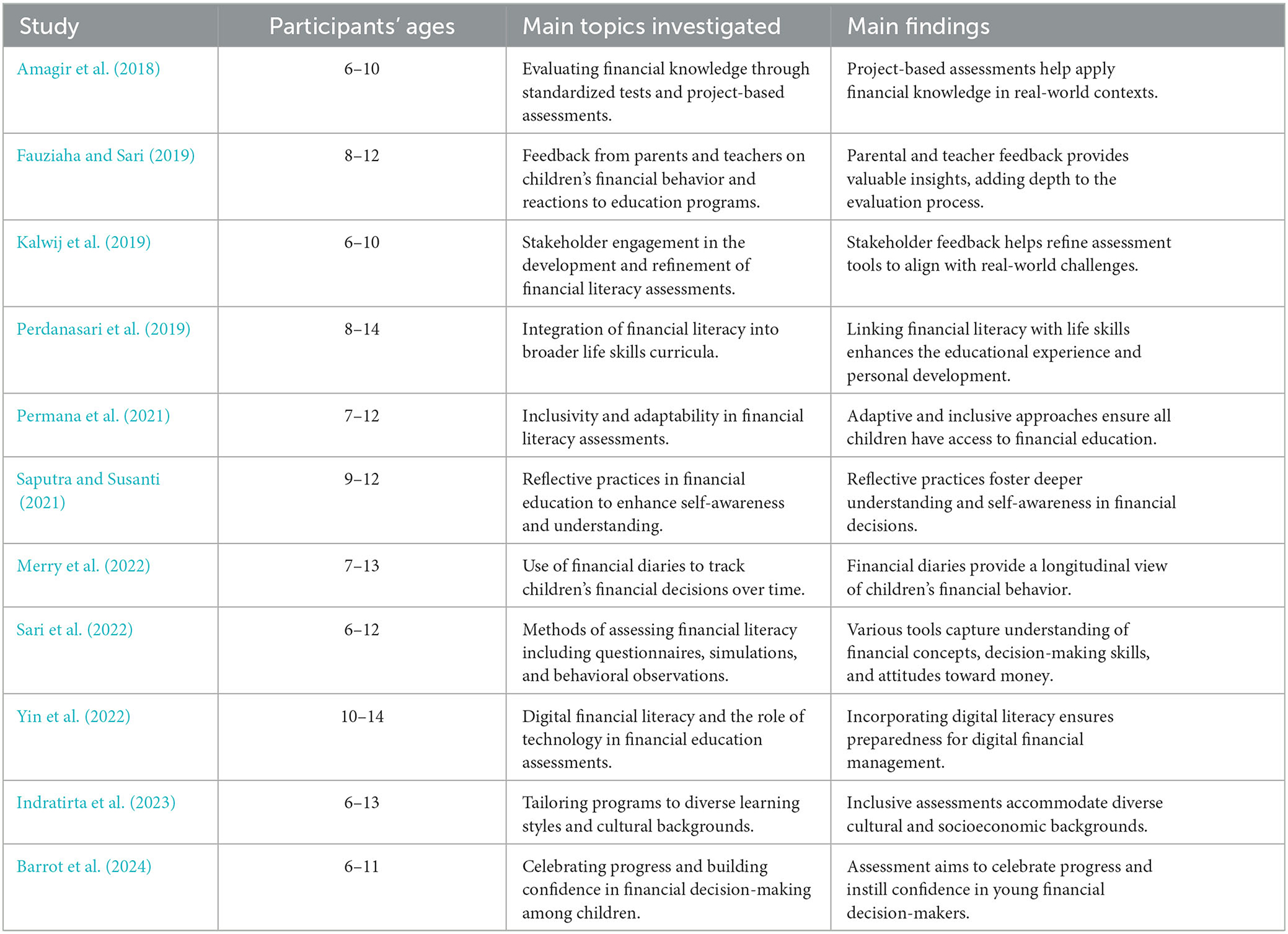

Measuring and evaluating financial literacy in children involves various methods and tools designed to capture their understanding of financial concepts, decision-making skills, and attitudes toward money (Sari et al., 2022; Fauziaha and Sari, 2019; Amagir et al., 2018). Standardized questionnaires and tests are commonly used to assess basic financial knowledge, including concepts of saving, spending, investing, and money use, and can range from multiple-choice questions to open-ended responses requiring detailed answers. Simulations and educational games enable children to engage with simulated financial scenarios, assessing how they apply their knowledge in practical situations such as budgeting, investment decisions, and spending choices. Interviews and behavioral observations, conducted by educators or researchers, provide insights into children's financial understanding, motivations, and attitudes toward money through direct interaction or observation of practical activities (Sari et al., 2022). Financial diaries, where children record their financial decisions like saving pocket money, offer a longitudinal view of their financial behavior and planning ability. Project-based assessments, such as managing a small budget for a school activity or creating a savings plan, help evaluate how children apply financial knowledge in real-world contexts (Merry et al., 2022). Lastly, feedback from parents and teachers offers valuable insights into children's financial behavior and their reactions to specific financial education programs, adding depth to the evaluation process (Fauziaha and Sari, 2019; Amagir et al., 2018). It's also crucial to incorporate feedback mechanisms within these assessment methods to foster a culture of continuous improvement in financial literacy education. Engaging children in reflective practices on their financial decisions and the outcomes of educational games or simulations can deepen their understanding and self-awareness regarding financial matters (Saputra and Susanti, 2021).

The role of digital literacy in financial education cannot be overstated. With the increasing prevalence of digital financial platforms, incorporating elements of digital financial literacy, such as understanding online transactions, digital wallets, and the basics of online financial security, into assessments can ensure that children are prepared for the digital aspects of financial management. In aligning assessment strategies with contemporary educational standards, it's beneficial to leverage technology not just as a medium for delivering financial education but also for assessing it. Online platforms and apps designed for financial education can offer personalized learning experiences and detailed tracking of progress, enabling educators to tailor interventions to individual needs (Yin et al., 2022).

Ultimately, the goal of assessing financial literacy in children is not only to identify areas for improvement but also to celebrate progress and instill confidence in financial decision-making from a young age. By adopting a comprehensive and adaptive approach to assessment, educators and parents can work together to build a foundation of financial literacy that supports lifelong learning and financial wellbeing (Barrot et al., 2024; Permana et al., 2021).

Building on the holistic approach to financial literacy assessment in children, it's essential to emphasize the importance of adaptability and inclusivity in these educational endeavors. Tailoring financial literacy programs and their assessments to accommodate diverse learning styles, cultural backgrounds, and socioeconomic statuses ensures that all children have the opportunity to develop a robust understanding of financial concepts. This inclusivity fosters an educational environment where financial literacy is seen not just as a set of skills to be acquired, but as a critical component of overall personal development and empowerment (Indratirta et al., 2023).

Engaging stakeholders (parents, educators, financial experts, and the children themselves) in the development and refinement of financial literacy assessments can enhance the relevance and effectiveness of these tools. Stakeholder feedback can identify gaps in the curriculum, uncover innovative teaching methods, and ensure that the assessments are comprehensive and aligned with real-world financial challenges (Kalwij et al., 2019).

In order to support continuous learning and adaptation, the integration of financial literacy education into broader life skills curricula is beneficial. This approach can facilitate the connection between financial decisions and other aspects of life, such as health, career choices, and civic engagement, thereby enriching the educational experience and preparing children for the complexities of adult life.

Assessment of financial literacy in children is a dynamic and multifaceted process that requires ongoing evaluation and adaptation. By embracing a comprehensive, inclusive, and stakeholder-engaged approach, educators and parents can significantly contribute to the development of financially literate, confident, and capable young individuals ready to navigate the financial aspects of their lives successfully (Perdanasari et al., 2019).

Table 3 provides an overview of studies focused on assessing financial literacy in children, highlighting the different approaches used, participant age ranges, main topics investigated, and key findings. This table illustrates how these methods contribute to a holistic evaluation of financial literacy among young learners, offering insights into best practices for engaging and educating children in financial concepts.

3.2.2 Financial literacy in adolescents

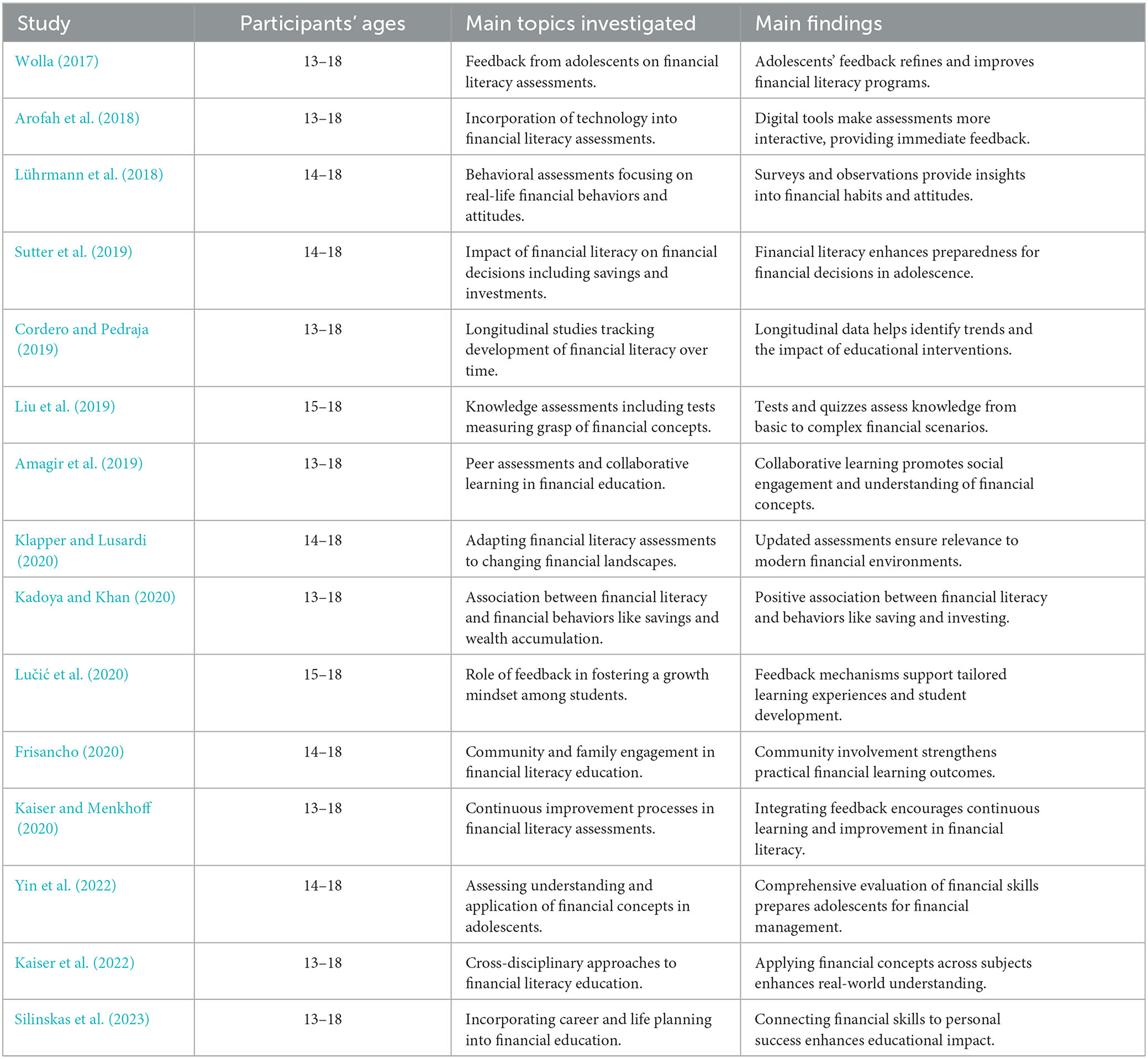

As adolescents face increasingly complex financial decisions, including those related to retirement savings and investments, the need for enhanced financial literacy becomes more pronounced (Sutter et al., 2019). Studies have also highlighted the positive association between financial literacy and various financial behaviors such as savings, investments, and wealth accumulation, indicating that financially literate individuals are better prepared for their financial future (Kadoya and Khan, 2020). Assessing financial literacy in adolescents involves evaluating their understanding and application of financial concepts, skills, and behaviors necessary for making informed financial decisions, a crucial process for preparing young individuals to navigate the complexities of financial management in adulthood (Yin et al., 2022; Liu et al., 2019; Lührmann et al., 2018). Key methods used in this evaluation include knowledge assessments, which typically involve quizzes or tests measuring adolescents' grasp of financial concepts such as saving, budgeting, investing, and borrowing, ranging from simple definitions to complex application scenarios. Behavioral assessments focus on observing real-life financial behaviors, such as saving habits, spending patterns, and the use of financial products, with surveys or interviews gathering data on these behaviors. Attitudinal assessments explore adolescents' attitudes toward money, assessing their confidence in financial decision-making, risk tolerance, and future financial expectations.

Simulations and role-playing scenarios are also employed, allowing adolescents to engage in practical exercises like budgeting, investment decision-making, or negotiating financial contracts, providing a hands-on approach to evaluating financial knowledge application. As digital finance becomes increasingly important, assessing digital financial literacy, including skills in navigating online financial services, understanding digital payment systems, and recognizing online scams, is essential. Curriculum-based assessments are another key component, integrating evaluations into formal education through project-based assessments, portfolio evaluations, and reflective essays on personal financial planning.

Effective assessment of financial literacy in adolescents combines these varied methods to capture a comprehensive view of their financial knowledge, behaviors, and attitudes. These assessments must also be tailored to be age-appropriate and culturally relevant, ensuring they remain accessible and engaging for young learners (Yin et al., 2022; Liu et al., 2019; Lührmann et al., 2018). Integrating feedback mechanisms and continuous improvement processes into the evaluation framework is essential not only to assess current levels of financial literacy but also to foster a growth mindset among students, encouraging ongoing learning and development (Kaiser and Menkhoff, 2020; Lučić et al., 2020; Amagir et al., 2019; Cordero and Pedraja, 2019; Arofah et al., 2018; Wolla, 2017). A comprehensive approach to financial literacy assessment should include various considerations, such as peer assessments and collaborative learning, which motivate adolescents to engage with financial concepts together, promoting teamwork and enhancing their social learning experience. Longitudinal studies provide valuable insights into the development of financial literacy over time, allowing educators to track changes in knowledge, behaviors, and attitudes, and to identify the impacts of financial education interventions.

Incorporating technology into assessments makes evaluations more interactive and accessible, engaging adolescents through online quizzes, financial literacy apps, and virtual simulations that offer immediate feedback and personalized learning experiences. Aligning assessments with real-world financial challenges ensures relevance by reflecting situations adolescents may encounter, such as case studies and discussions of contemporary financial issues. Feedback from adolescents on the assessment process and the financial literacy program itself offers critical insights into effectiveness and areas for improvement, helping tailor future curricula to better meet their needs.

Integrating career and life planning contextualizes the importance of financial skills in achieving personal success, contributing to the holistic development of financially savvy individuals. Cross-disciplinary approaches highlight the interconnected nature of financial literacy with subjects like mathematics, social studies, and technology, helping students apply their broader education practically. Engaging communities and families in the educational process, through workshops and projects, provides real-world contexts for financial decision-making, strengthening learning outcomes.

Adapting assessments to changing financial landscapes ensures that they remain up-to-date with current financial trends, preparing students for future challenges. Promoting ethical and responsible financial behavior evaluates students' understanding of consumer rights, ethical investing, and the social impacts of financial decisions. Incorporating global perspectives helps students appreciate the interconnectedness of the world economy and the importance of understanding diverse financial systems. By adopting these strategies, educators can create a dynamic and responsive financial literacy curriculum that equips adolescents for the complexities of modern financial environments. This approach promotes financial competence, critical thinking, ethical decision-making, and a sense of global citizenship, preparing young people to navigate real financial challenges effectively (Silinskas et al., 2023; Kaiser et al., 2022; Frisancho, 2020; Klapper and Lusardi, 2020).

Table 4 provides an overview of key studies focused on financial literacy in adolescents, detailing the main topics investigated, participants' age ranges, and significant findings from each study. The table includes a variety of assessment methods, such as knowledge and behavioral assessments, digital literacy evaluations, and feedback mechanisms that foster continuous learning and growth.

3.3 Types of financial literacy interventions

Education programs utilize various approaches, including school-based curricula, family involvement, and digital tools. Research has shown that school-based financial education programs effectively improve financial knowledge and behaviors among students. These programs typically cover topics such as spending, saving, budgeting, and investment (Popovich et al., 2020; Kalwij et al., 2019; Amagir et al., 2019; Batty et al., 2015). Involving parents in financial education initiatives has been found to increase the financial literacy of children and adolescents (Amagir et al., 2018).

Digital tools are increasingly integrated into financial education programs to engage students and enhance learning outcomes. These tools offer interactive platforms for students to learn about financial concepts in an engaging manner. Digital tools make financial education more accessible and convenient for students, allowing them to learn at their own pace (Jonker and Kosse, 2022; Johnson et al., 2021).

The effectiveness of financial education programs is influenced by the quality of teacher training and professional development in delivering financial education curricula. Teachers play a crucial role in imparting financial knowledge and skills to students, and their training is vital for the successful implementation of financial education programs (Compen et al., 2019; Collins and Odders-White, 2015). Incorporating innovative approaches and emerging trends significantly enhances the effectiveness and reach of financial literacy education. Programs that integrate financial education with Social and Emotional Learning (SEL) principles focus on developing comprehensive life skills including decision-making, goal-setting, empathy, and self-awareness alongside financial literacy. This holistic approach, recognizing the emotional aspects of financial decision-making, aims to build a more rounded set of life skills (Mahoney et al., 2021).

The use of gamification and competitive learning introduces elements of competition and reward to make learning about finances more engaging. By incorporating leaderboards, badges, and virtual rewards, students are motivated to participate actively and retain the financial concepts they learn (Schöbel et al., 2020; Hamari et al., 2014).

Emerging technologies like Virtual Reality (VR) and Augmented Reality (AR) are beginning to be used in financial education to create immersive learning experiences. For example, VR simulations can immerse students in virtual scenarios requiring financial decisions, such as navigating a supermarket on a budget or choosing between different financial products, thereby enhancing the realism and applicability of financial concepts (Georgiou and Kyza, 2018).

Financial mentorship programs, pairing students with financial mentors from the professional world, offer real-world insights and guidance. These programs can be particularly beneficial for high school and college students as they prepare to enter the workforce and manage their finances independently (Lusardi et al., 2017).

Policy-driven financial education initiatives in some countries and regions mandate financial education in schools, ensuring that all students receive a basic level of financial education, regardless of their background. This recognition of financial education's importance for economic wellbeing is crucial for creating a uniformly financially literate society (OECD, 2020 - OECD/INFE 2020 International Survey of Adult Financial Literacy).

Community-based financial challenges, such as savings competitions or budgeting challenges, encourage learning through participation. These programs involve the community in financial education, helping students apply what they've learned in a supportive, community-driven context (Sherraden et al., 2011).

Customized learning pathways recognize the diversity of learners, adapting to each student's knowledge level, interests, and learning pace. This personalized approach ensures that students remain engaged and receive the support they need to advance their financial literacy (Merry et al., 2022).

By leveraging a mix of traditional and innovative approaches, financial education programs can cater to diverse learning needs and preferences, ensuring that students not only learn financial concepts but also develop the skills and confidence to apply them in their lives. Building upon the diverse and innovative approaches to financial education, it is paramount to consider how these programs can adapt to the evolving societal and technological landscapes. The incorporation of cross-cultural financial literacy programs is becoming increasingly essential in our interconnected world. Such programs offer students insights into global financial systems, diverse economic conditions, and the influence of cultural norms on financial behaviors, preparing them for international opportunities and challenges (Mändmaa, 2019).

Similarly, integrating sustainability and ethical finance concepts into financial literacy education addresses the growing concerns about climate change and social inequality. This approach educates young individuals about the environmental and societal impacts of financial decisions, promoting responsible, and sustainable financial behavior (Thorp et al., 2023; Ye and Kulathunga, 2019).

The application of adaptive learning technologies in financial education personalizes the learning experience. By analyzing students' learning patterns, these technologies can adjust the difficulty of materials and introduce new topics at the most appropriate times, thus enhancing engagement and learning outcomes (Peng et al., 2019; Nicol et al., 2017; Conklin, 2016).

As entrepreneurship becomes a more viable career path for many young individuals, financial education programs are incorporating modules specifically designed to teach entrepreneurial finance. This includes lessons on start-up budgeting, venture capital, and financial planning for small businesses (OECD, 2015). Leveraging big data and analytics in financial education allows educators and policymakers to gauge the effectiveness of different teaching methods and programs. This data-driven approach can identify knowledge gaps, tailor programs to meet those needs, and monitor progress over time (Saleh et al., 2022).

Lastly, ensuring financial education programs are accessible to students with diverse abilities is crucial. This involves the use of assistive technologies, the creation of materials in various formats, and the design of inclusive learning activities that accommodate all learners (Burgstahler, 2020).

As financial education continues to evolve, it is vital for educators, policymakers, and communities to remain abreast of best practices, innovative technologies, and emerging needs. Cultivating a culture of lifelong learning and adapting to the changing financial landscape, financial education programs can empower adolescents and young adults with the knowledge and skills necessary for financial wellbeing and success.

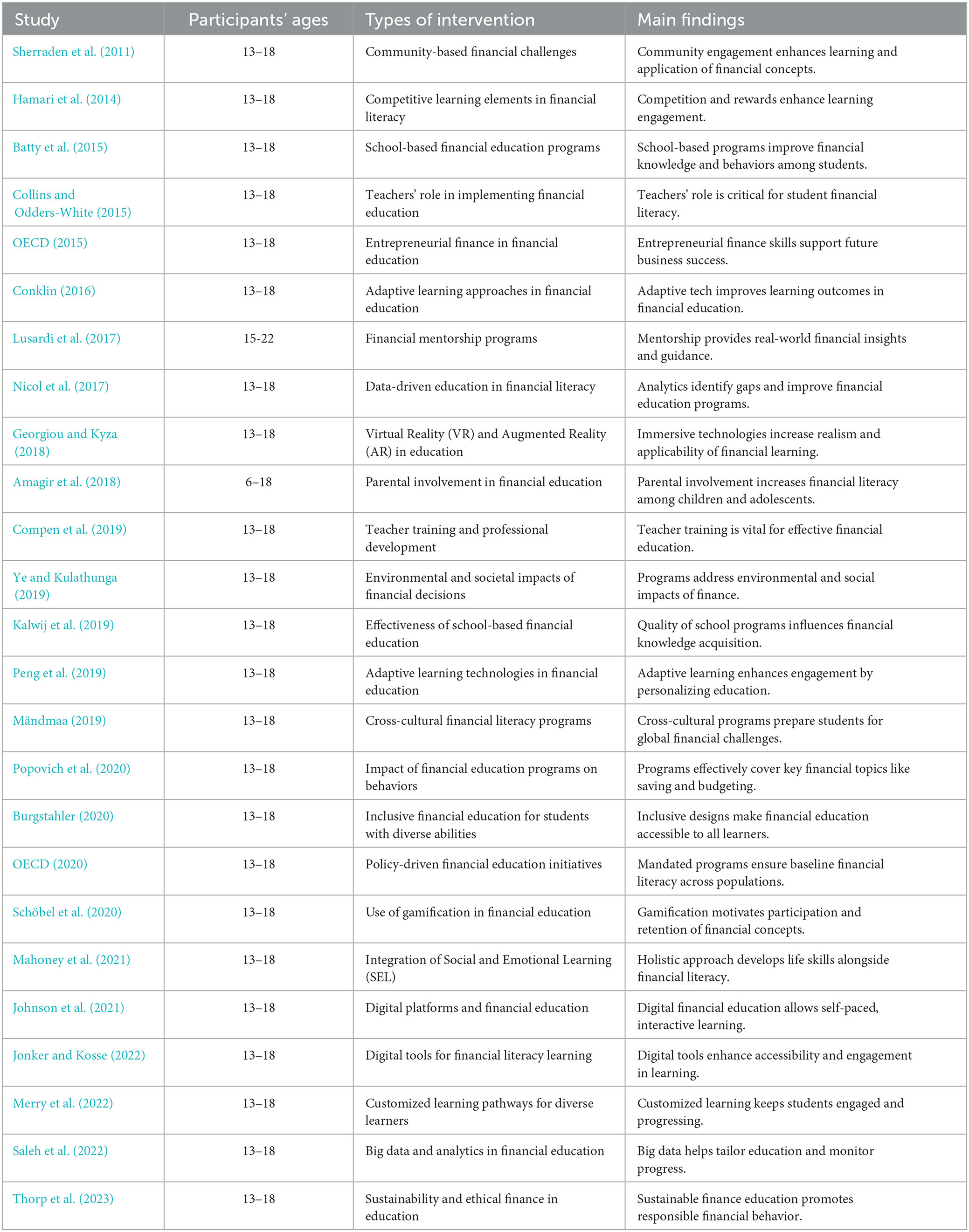

Table 5 presents a comprehensive overview of the different types of financial literacy interventions, categorized by the studies that have examined their effectiveness. This table includes details on the age ranges of participants, types of interventions used, and key findings from each study. The interventions highlighted in Table 4, such as school-based curricula, community challenges, digital platforms, and mentorship programs, demonstrate the diverse approaches used to engage learners and improve financial literacy across different contexts.

3.4 Effectiveness of financial literacy programs

Financial literacy programs have gained traction as essential tools for enhancing financial knowledge, skills, and attitudes among students and adolescents, ultimately aiming to prepare them for effective financial decision-making in adulthood. These programs typically employ a combination of instructional methods, including classroom teaching, interactive workshops, simulations, and digital learning platforms, to cover fundamental financial concepts such as budgeting, saving, investing, and responsible borrowing (Amagir et al., 2018). However, the effectiveness of these initiatives can vary significantly based on factors such as program design, delivery methods, and the demographic characteristics of participants (Skimmyhorn, 2016; Hati, 2017).

One critical factor influencing the success of financial literacy programs is their capacity to engage students through practical applications of financial concepts. Programs that integrate experiential learning components—such as simulations and project-based activities—are often more effective than traditional lecture-based formats. For example, initiatives that allow students to manage virtual budgets or engage in investment simulations can facilitate the translation of theoretical knowledge into practical skills, thereby enhancing overall financial literacy (Frisancho et al., 2021). This aligns with findings that emphasize the importance of active participation in learning processes, which can lead to improved financial behaviors among participants (Lučić et al., 2020).

The timing and duration of financial literacy education also significantly impact its effectiveness. Research indicates that programs integrated into the educational curriculum from an early age and sustained over time yield better outcomes in fostering long-term financial understanding and positive financial behaviors. Early exposure enables students to build foundational knowledge that can be reinforced throughout their educational journey, making them more adept at navigating financial decisions as they mature (Bhandare et al., 2021). Moreover, the relevance of the educational content to the participants' life circumstances is crucial; programs that address the specific challenges faced by different demographic groups, such as low-income students or young women, tend to resonate more effectively with these audiences, enhancing their engagement and retention of financial concepts (Hati, 2017).

Despite the promising outcomes associated with financial literacy programs, several studies have identified limitations that may hinder their overall effectiveness. Issues such as inadequate long-term follow-up, variability in teaching quality, and a lack of integration with broader educational goals can undermine the impact of these initiatives. Programs that focus solely on knowledge dissemination without fostering behavioral change may struggle to effect lasting improvements in participants' financial habits (Suseno et al., 2021; Yin et al., 2022). Continuous reinforcement and practical opportunities to apply learned concepts are essential for ensuring that students retain and utilize the financial knowledge acquired through these programs (Watanapongvanich et al., 2021).

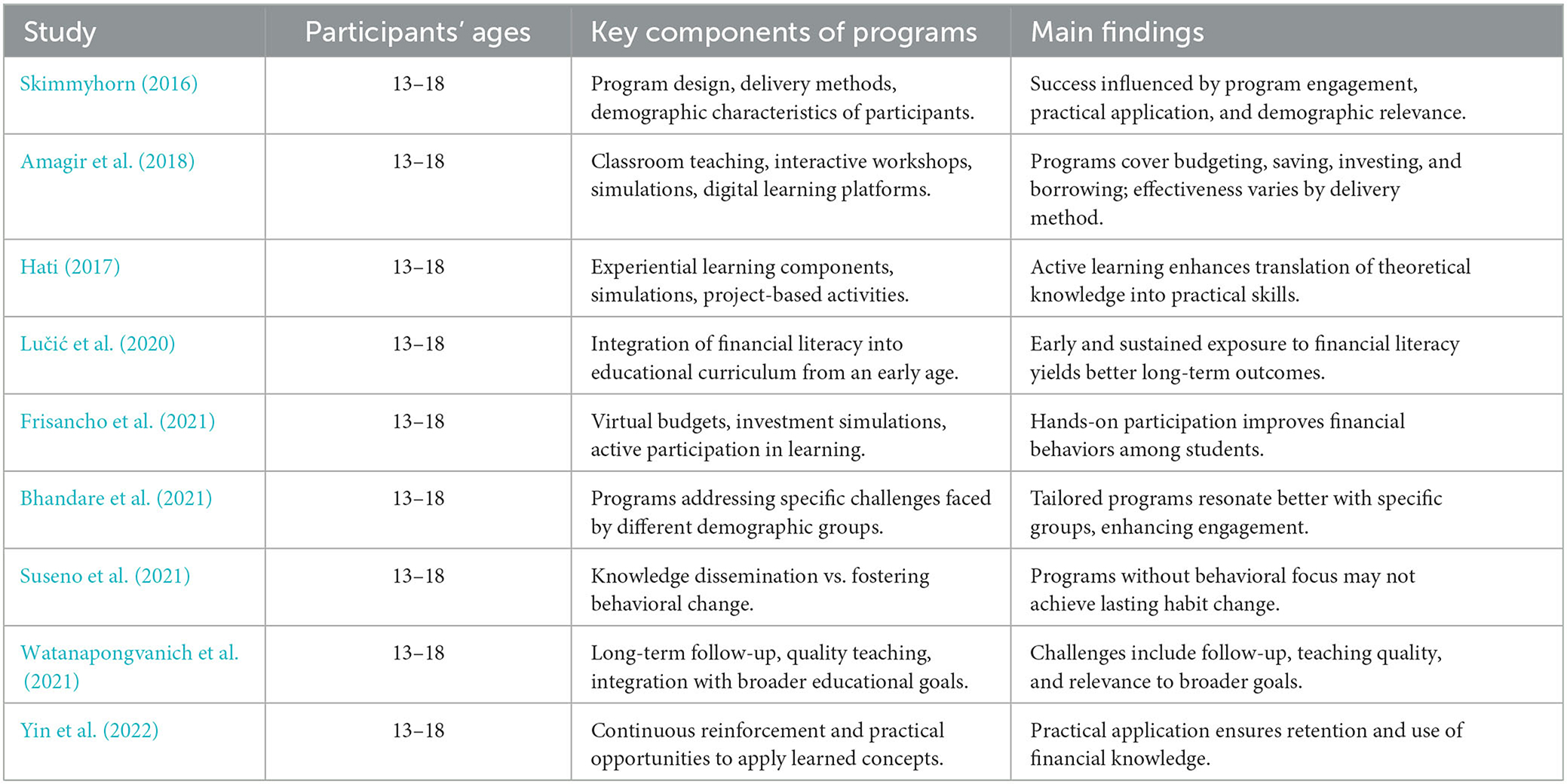

Table 6 provides an overview of key studies examining the effectiveness of various financial literacy programs, highlighting the age ranges of participants, key components of the programs, and main findings. The table includes a range of instructional methods, such as classroom teaching, interactive workshops, simulations, and digital platforms, and evaluates how factors like program design, delivery methods, and the demographic characteristics of participants influence outcomes.

3.5 Factors influencing financial literacy

Research highlights various factors that influence financial literacy among children, adolescents, and young adults, emphasizing the role of financial socialization agents, individual behaviors, and socioeconomic backgrounds. Understanding how children and adolescents comprehend and engage with financial concepts is a crucial area of study that involves various factors. Research has shown that financial literacy among young individuals is influenced by financial socialization agents, financial experiences, and money attitudes (Sohn et al., 2012). Adolescents in economically disadvantaged settings may struggle with grasping complex financial ideas, making it essential to focus on instilling healthy financial behaviors early on (Zhu, 2019). Moreover, the involvement of parents in financial education programs has been found to be effective in enhancing the financial literacy of children and adolescents (Amagir et al., 2020; Van Campenhout, 2015).

The family environment plays a significant role in promoting adolescents' financial confidence, indirectly contributing to their financial literacy skills (Silinskas et al., 2023). Parental influence, discussions about money matters, and monitoring children's financial activities can lead to increased financial knowledge and the development of positive financial attitudes and behaviors (Chawla et al., 2022). Financial literacy is crucial as it can mediate the relationship between experiences during adolescence and financial behavior (Bucciol et al., 2022).

Studies conducted in South Korea (Sohn et al., 2012) and Hong Kong (Zhu et al., 2021) emphasize the impact of parental financial behaviors, financial experiences, and money attitudes in shaping financial literacy, particularly for adolescents from low-income families. These findings suggest that parents who model healthy financial practices can significantly enhance their children's financial understanding.

Research from Ethiopia (Elifneh, 2022), Finland (Silinskas et al., 2021), and Japan (Okamoto and Komamura, 2021) consistently reports low levels of financial literacy among adolescents. Factors such as exposure to financial education at school and home, gender differences, and socioeconomic status have been identified as significant influences on financial literacy levels among youth (Yahiaoui, 2023; Gudjonsson et al., 2022; Venkatesan and Venkataraman, 2018). The influence of family, peers, and individual behaviors on financial literacy has been further highlighted in studies from Saudi Arabia (Alshebami and Aldhyani, 2022), India (Rani and Goyal, 2021), the United Arab Emirates (Suri and Purohit, 2017), and Indonesia (Lantara and Kartini, 2015).

The problem of low financial literacy extends beyond adolescents to young adults and university students, as shown in studies from various countries (Ninan and Kurian, 2021; Amagir et al., 2020; Kaur et al., 2015). Financial literacy is critical for making informed decisions, managing personal finances, and achieving financial wellbeing (Chaulagain, 2021; Yong and Tan, 2017). The relationship between financial literacy, financial behavior, and financial attitudes has been explored across multiple contexts, reinforcing the importance of financial education and practical experience in enhancing financial literacy (Suhana et al., 2022; Yanto et al., 2021).

Studies consistently report low levels of financial literacy in the USA (Lusardi, 2019), India (Kim and Chawla, 2022), South Africa (Nanziri and Leibbrandt, 2018), Japan (Watanapongvanich et al., 2022), and Finland (Silinskas et al., 2021, 2023; Zhu, 2019). A positive correlation exists between financial literacy and educational attainment, with higher schooling levels linked to improved financial knowledge (Lusardi and Mitchell, 2011). Parental influence is also crucial, as responsible financial behaviors by parents are associated with higher financial literacy levels in their children (Zhu and Chou, 2020; Desiyanti and Kassim, 2020).

Cognitive factors also play a role; reductions in both crystallized and fluid intelligence are linked to declines in financial literacy (Okamoto and Komamura, 2021). Insufficient financial knowledge is associated with risky financial behaviors, such as overspending and impulsive purchases (Ravikumar et al., 2022), while higher financial literacy is linked to improved control over such behaviors (Potrich and Vieira, 2018; Paylan and Kavas, 2022).

Financial literacy programs have been shown to provide economic benefits, offering young individuals exposure to basic and advanced financial concepts (Lusardi and Mitchell, 2014; Silinskas et al., 2023, 2021). Parental involvement enhances the effectiveness of these programs, reinforcing financial lessons learned (Fan et al., 2022; Fan and Zhang, 2021; Zhu, 2018; Van Campenhout, 2015). School-based financial education has been shown to improve financial knowledge and attitudes, particularly when incorporating experiential learning approaches that align with students' life events and challenges (Amagir et al., 2018).

Early exposure to financial literacy values significantly improves financial understanding and habits in young people (Phung, 2023; Saputra and Susanti, 2021; Clark et al., 2018). Tailored educational interventions early in life can strengthen financial literacy and are particularly vital in poverty reduction and economic empowerment in developing countries (Moscarola and Kalwij, 2021; Ansong et al., 2023; Koomson et al., 2023; Arini et al., 2020).

Various demographic, socioeconomic, and psychological factors influence financial literacy, including age, gender, education, income, and parental influence. Socioeconomic and demographic variables such as family income and parental education significantly impact financial literacy levels (Respati et al., 2023; Okamoto and Komamura, 2021; Silinskas et al., 2021; Tran, 2022; Mishra et al., 2021; Tavares and Santos, 2020; Nicolini and Haupt, 2019; Garg and Singh, 2018). Psychological factors, such as confidence and motivation, are also crucial, affecting how adolescents perceive and engage with financial education (Silinskas et al., 2023; Khawar and Sarwar, 2021; Tang and Baker, 2016). External factors, including cultural preferences and behavioral biases, further influence financial literacy (Kalmi et al., 2021). Education level plays a significant role, with higher educational attainment linked to better financial literacy, and gender differences suggesting that financial literacy varies between boys and girls (Mishra et al., 2021; Tavares and Santos, 2020; Mancebón et al., 2019). Overall, understanding the factors that influence financial literacy helps educators and policymakers design effective interventions that address these diverse influences and foster financial competence among young individuals.

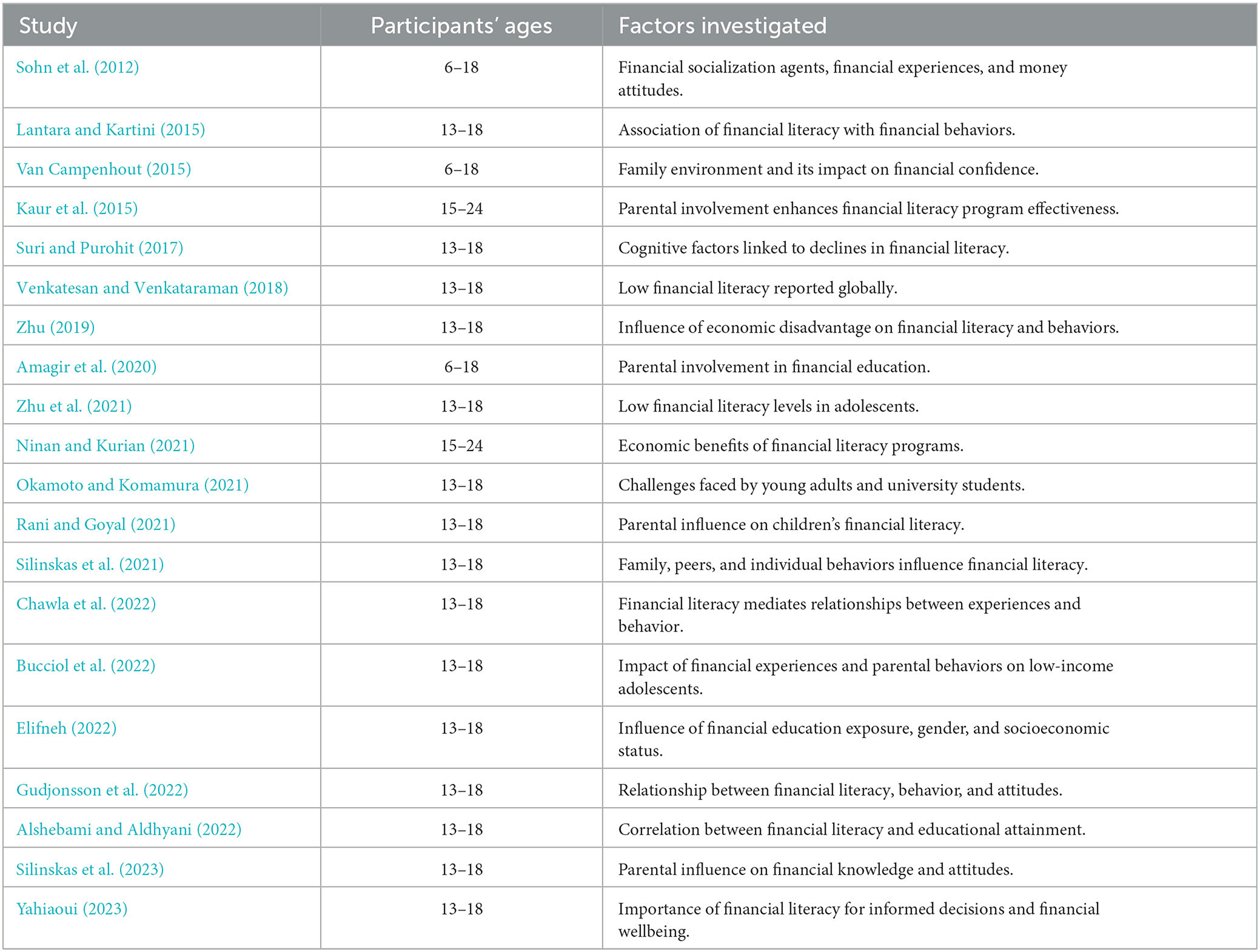

Table 7 presents an overview of key studies that investigate the factors affecting financial literacy in children, adolescents, and young adults. The table highlights the age ranges of participants, specific factors explored, and the main findings of each study. These studies underscore the importance of early financial socialization, the role of family and peers, and the impact of socioeconomic backgrounds on financial knowledge and behaviors.

4 Discussion

The reviewed literature on financial literacy programs highlights the need for educators to employ experiential learning methods and life-event-focused content to enhance the effectiveness of financial education. Financial literacy encompasses the multifaceted ability to understand and effectively apply financial skills, including personal financial management, budgeting, and investing. This concept is crucial for informed decision-making, allowing individuals to navigate financial situations wisely. Lusardi and Tufano (2015) and Lusardi and Mitchell (2014) stress its importance for economic empowerment and the avoidance of financial pitfalls through an understanding of complex financial products and risk management. Huston (2010) further links financial literacy to behaviors and attitudes toward money, suggesting that a proactive financial stance and a willingness to learn are key to sound financial decisions. Swiecka et al. (2020) discuss its role in preventing financial distress and enhancing economic wellbeing. This comprehensive view underscores financial literacy as vital for achieving financial security and underscores the need for educational initiatives to build financial knowledge, skills, and attitudes from a young age, fostering a financially informed society.

Financial literacy is a comprehensive concept that includes knowledge, skills, attitudes, and behaviors necessary for making well-informed financial decisions and effectively managing personal finances. Goyal and Kumar (2021) emphasize that financial literacy not only involves understanding financial concepts but also the ability to apply this knowledge in practical financial decision-making. In the current digital era, the incorporation of technology in financial transactions presents opportunities and challenges, underscoring the need for updated financial literacy frameworks that encompass digital financial services and cybersecurity awareness.

Monteith et al. (2021) highlight the increasing worries about cybercrime, which have been worsened by the epidemic. They emphasize the importance of improving cybersecurity awareness to protect individuals from financial and psychological consequences. Emotional intelligence is increasingly acknowledged for its influence on financial decision-making, as emotions can greatly affect financial actions. Alshebami and Al Marri (2022) examine how financial literacy affects entrepreneurial intention, emphasizing the significance of saving behavior in financial decision-making.

The importance of emotional intelligence in financial decision-making is increasingly recognized, shedding light on the psychological aspects of financial behavior (Sohn et al., 2022). By expanding financial literacy to include emotional dimensions, individuals can embrace a more holistic approach to financial education, preparing them to make well-informed financial decisions in a complex digital environment (Krichen and Chaabouni, 2022; Nurlaily et al., 2022).

Understanding the pivotal role of financial literacy across the spectrum of life stages opens a crucial dialogue on its evolution from youth through adulthood to the golden years. This progression underscores the necessity of a tailored, life-cycle approach to financial education, highlighting the importance of equipping individuals with the knowledge and skills pertinent to their current phase of life (Diotaiuti et al., 2020, 2021a,b). By integrating real-world financial applications, ranging from tax planning to retirement and estate planning, this approach not only enhances the relevance of financial literacy but also prepares individuals to navigate the complexities of financial decision-making throughout their lives, thus cultivating a society that is both resilient and financially informed. For policymakers, it underscores the importance of supporting and mandating comprehensive financial education within school curriculums to ensure young individuals develop necessary financial skills (LeBaron-Black et al., 2023; LeBaron and Kelley, 2021). Parents play a crucial role in reinforcing financial literacy at home, suggesting a collaborative approach involving schools and families is essential for cultivating financially savvy individuals. These findings advocate for integrated efforts among educators, policymakers, and parents to optimize financial literacy outcomes for children and adolescents (Zhao and Zhang, 2020; Pahlevan Sharif and Naghavi, 2020).

Incorporating real-life financial scenarios and experiential learning into educational content significantly enhances the effectiveness of these programs. This approach can better prepare students for the financial decisions they will face in adulthood (Emma and Anya, 2021). Policymakers are prompted to consider these findings when developing educational policies, ensuring that financial literacy is an integral part of the curriculum. For parents, the literature suggests that their active involvement in their children's financial education can profoundly influence their financial behaviors and attitudes, reinforcing the importance of a collaborative effort between schools and families in financial education (Đurišić and Bunijevac, 2017). This integrated approach among educators, policymakers, and parents can significantly contribute to the development of a financially literate generation.

For educators, incorporating practical financial activities and digital tools in the curriculum can make learning more engaging and relevant. Policymakers should focus on creating and supporting policies that integrate financial literacy into national education standards, ensuring consistent access across all schools (Böhm et al., 2023; Sagita et al., 2022; Poon et al., 2022; Salas-Velasco et al., 2021). For parents, actively participating in their children's financial education through discussions and practical financial decision-making activities at home is crucial. These actions can collectively contribute to a robust financial literacy foundation, preparing young individuals for future financial independence and responsibility (Pahlevan Sharif and Naghavi, 2020).

Identifying challenges in teaching financial literacy to young populations includes addressing diverse learning needs, engaging students with relevant and practical content, and integrating financial education effectively within existing curricula. Additionally, limitations in current research often involve a lack of longitudinal studies to measure the long-term impact of financial literacy programs and a need for more comprehensive data on the effectiveness of different teaching methodologies across diverse demographic groups. These challenges and research gaps highlight the need for tailored educational approaches and further investigation into the outcomes of financial literacy education (Henderson et al., 2021).

Further challenges in teaching financial literacy to young populations include maintaining the relevance of financial education in the face of rapidly changing financial landscapes and technologies. There's also the difficulty of engaging parents and communities in financial education efforts, which is crucial for reinforcing learning outside the classroom. In terms of research limitations, there's a need for more culturally sensitive studies that take into account the socioeconomic diversity among learners. Additionally, much of the existing research relies on self-reported data, which may not accurately reflect actual financial behavior or literacy (Kuzma et al., 2022; Huebinger et al., 2021; Al-Bahrani et al., 2019).

In order to enhance financial education strategies, practical suggestions include creating more interactive and engaging learning experiences through simulations and gamification, ensuring content relevance by incorporating current financial trends and technologies, and fostering partnerships between educational institutions, financial experts, and communities to provide real-world learning opportunities. Tailoring financial literacy programs to meet the diverse needs of students and incorporating feedback mechanisms for continuous improvement are also key.

Future research in financial education should explore the long-term impacts of financial literacy programs through longitudinal studies, assessing how early financial education influences adult financial behaviors and wellbeing. Investigating the role of digital financial tools and their effectiveness in enhancing financial literacy among diverse populations can also provide valuable insights. Additionally, examining the socio-economic factors that influence financial education outcomes and developing tailored strategies to address these variables could significantly contribute to the field. Further areas for investigation include the efficacy of financial literacy education across different cultural contexts, understanding the psychological barriers to financial behavior change, and the impact of emerging technologies like blockchain on financial education. Research could also explore the integration of financial literacy with environmental, social, and governance (ESG) principles to promote sustainable financial decisions among young people.

5 Limits of the review

The review's limitations include its scope, focusing primarily on studies that measure immediate outcomes of financial literacy programs without extensive exploration of long-term behavioral changes. Additionally, the diversity of methodologies and populations in the reviewed studies may impact the generalizability of the findings. Future research could benefit from addressing these gaps by incorporating longitudinal studies and a broader range of socio-economic and cultural contexts to provide a more comprehensive understanding of financial literacy education's effectiveness.

6 Conclusions

The main findings emphasize that financial literacy programs are crucial in enhancing financial knowledge and behavior among children and adolescents. Effective strategies include experiential learning, integration of real-life financial scenarios, and parental involvement. Challenges exist, such as adapting to rapid technological changes and addressing diverse learning needs. Future research should focus on longitudinal studies to assess long-term impacts, the role of digital tools, and socio-economic influences on financial education outcomes. Addressing these areas is key to developing more inclusive and impactful financial literacy education.

Comprehensive, age-appropriate financial education plays a pivotal role in nurturing financially literate and capable adults. By starting early and tailoring lessons to fit age-specific understanding and interests, such education lays the foundation for sound financial decision-making. It equips young people with the necessary skills to navigate complex financial landscapes, ensuring they grow into adults who can manage finances effectively, plan for the future, and respond adaptively to economic challenges. This approach fosters a generation that is not only financially savvy but also prepared for lifelong financial wellbeing.

Author contributions

SM: Conceptualization, Investigation, Methodology, Writing – original draft, Writing – review & editing. BT: Conceptualization, Investigation, Writing – original draft. SC: Conceptualization, Investigation, Writing – review & editing. GS: Investigation, Writing – review & editing. AZ: Conceptualization, Investigation, Writing – review & editing. PD: Supervision, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Đurišić, M., and Bunijevac, M. (2017). Parental involvement as a important factor for successful education. Center Educ. Policy Stud. J. 7, 137–153. doi: 10.26529/cepsj.291

Al-Bahrani, A., Weathers, J., and Patel, D. (2019). Racial differences in the returns to financial literacy education. J. Cons. Affairs 53, 572–599. doi: 10.1111/joca.12205

Alshebami, A. S., and Al Marri, S. H. (2022). The impact of financial literacy on entrepreneurial intention: the mediating role of saving behavior. Front. Psychol. 13:911605. doi: 10.3389/fpsyg.2022.911605

Alshebami, A. S., and Aldhyani, T. H. (2022). The interplay of social influence, financial literacy, and saving behaviour among Saudi youth and the moderating effect of self-control. Sustainability 14:8780. doi: 10.3390/su14148780

Amagir, A., Groot, W., Maassen van den Brink, H., and Wilschut, A. (2018). A review of financial-literacy education programs for children and adolescents. Citizenship, Soc. Econ. Educ. 17, 56–80. doi: 10.1177/2047173417719555

Amagir, A., Groot, W., Maassen van den Brink, H., and Wilschut, A. (2019). SaveWise: the design of a financial education program in the Netherlands. Citizenship, Soc. Econ. Educ. 18, 100–120. doi: 10.1177/2047173419870053

Amagir, A., Groot, W., van den Brink, H. M., and Wilschut, A. (2020). Financial literacy of high school students in the Netherlands: knowledge, attitudes, self-efficacy, and behavior. Int. Rev. Econ. Educ. 34:100185. doi: 10.1016/j.iree.2020.100185

Ansong, D., Okumu, M., Nyoni, T., Appiah-Kubi, J., Amoako, E. O., Koomson, I., et al. (2023). The effectiveness of financial capability and asset building interventions in improving youth's educational well-being: a systematic review. Adol. Res. Rev. 2023, 1–16. doi: 10.1007/s40894-023-00223-x

Arini, F. D., Widaningrum, A., and Hadna, A. H. (2020). “Poverty reduction and financial literacy for women in Indonesia,” in Annual Conference of Indonesian Association for Public Administration (IAPA 2019) (Atlantis Press), 241–258. doi: 10.2991/aebmr.k.200301.013

Arofah, A. A., Purwaningsih, Y., and Indriayu, M. (2018). Financial literacy, materialism and financial behavior. Int. J. Multic. Multirel. Underst. 5, 370–378. doi: 10.18415/ijmmu.v5i4.171

Bandura, A. (1977). Self-efficacy: toward a unifying theory of behavioral change. Psychol. Rev. 84, 191–215. doi: 10.1037//0033-295X.84.2.191

Barrot, J. S., Gonzales, J. M., Eniego, A. A., Salipande, A. L., and Olegario, M. L. G. (2024). Integrating financial literacy into the K-12 curriculum: teachers' and school leaders' experience. Asia-Pacific Educ. Resear. 33, 17–25. doi: 10.1007/s40299-022-00704-y

Batty, M., Collins, J. M., and Odders-White, E. (2015). Experimental evidence on the effects of financial education on elementary school students' knowledge, behavior, and attitudes. J. Cons. Affairs 49, 69–96. doi: 10.1111/joca.12058

Bhandare, P., Guha, S., Chaudhury, R. H., and Ghosh, C. (2021). Impact of financial literacy models on the financial behavior of individuals: an empirical study on the indian context. Strat. Change 30, 377–387. doi: 10.1002/jsc.2431

Böhm, P., Böhmová, G., Gazdíková, J., and Šimková, V. (2023). Determinants of financial literacy: analysis of the impact of family and socioeconomic variables on undergraduate students in the Slovak republic. J. Risk Finan. Manag. 16:252. doi: 10.3390/jrfm16040252

Bucciol, A., Manfr,è, M., and Veronesi, M. (2022). Family financial socialization and wealth decisions. BE J. Econ. Anal. Policy 22, 281–309. doi: 10.1515/bejeap-2021-0065

Burgstahler, S. (2020). Creating Inclusive Learning Opportunities in Higher Education: A Universal Design Toolkit. Cambridge, MA: Harvard Education Press, 47–48.

Caplinska, A., and Ohotina, A. (2019). Analysis of financial literacy tendencies with young people. Entrepr. Sustain. Issues 6, 1736–1749. doi: 10.9770/jesi.2019.6.4(13)

Chaulagain, R. (2021). Relationship among financial literacy, attitude and behaviour. Soc. Inquir. 3, 10–29. doi: 10.3126/sijssr.v3i1.46017

Chawla, D., Bhatia, S., and Singh, S. (2022). Parental influence, financial literacy and investment behaviour of young adults. J. Indian Bus. Res. 14, 520–539. doi: 10.1108/JIBR-10-2021-0357

Chhatwani, M., and Mishra, S. K. (2021). Does financial literacy reduce financial fragility during COVID-19? The moderation effect of psychological, economic and social factors. Int. J. Bank Market. 39, 1114–1133. doi: 10.1108/IJBM-11-2020-0536

Clark, S., Paul, M., Aryeetey, R., and Marquis, G. (2018). An assets-based approach to promoting girls' financial literacy, savings, and education. J. Adolesc. 68, 94–104. doi: 10.1016/j.adolescence.2018.07.010

Collins, J. M., and Odders-White, E. (2015). A framework for developing and testing financial capability education programs targeted to elementary schools. J. Econ. Educ. 46, 105–120. doi: 10.1080/00220485.2014.976325

Compen, B., De Witte, K., and Schelfhout, W. (2019). The role of teacher professional development in financial literacy education: a systematic literature review. Educ. Res. Rev. 26, 16–31. doi: 10.1016/j.edurev.2018.12.001

Conklin, T. A. (2016). Knewton (An adaptive learning platform available at: https://www.knewton.com/). Acad. Manag. Lear. Educ. 15:206. doi: 10.5465/amle.2016.0206

Cordero, J. M., and Pedraja, F. (2019). The effect of financial education training on the financial literacy of Spanish students in PISA. Appl. Econ. 51, 1679–1693. doi: 10.1080/00036846.2018.1528336

Desiyanti, R., and Kassim, A. A. M. (2020). Financial literacy among SMEs' owners in sumatera, Indonesia: the role of parents' motivation and experience. J. Bus. Soc. Rev. Emer. Econ. 6, 1130–1138. doi: 10.26710/jbsee.v6i3.1374

Diotaiuti, P., Mancone, S., Falese, L., Ferrara, M., Bellizzi, F., Valente, G., et al. (2022a). Intention to screen for Hepatitis C among university students: influence of different communicative scenarios. Front. Psychiatry 13:873566. doi: 10.3389/fpsyt.2022.873566

Diotaiuti, P., Valente, G., and Mancone, S. (2021b). Validation study of the Italian version of Temporal Focus Scale: psychometric properties and convergent validity. BMC Psychol. 9:19. doi: 10.1186/s40359-021-00561-2

Diotaiuti, P., Valente, G., Mancone, S., and Bellizzi, F. (2021a). A mediating model of emotional balance and procrastination on academic performance. Front. Psychol. 12:665196. doi: 10.3389/fpsyg.2021.665196

Diotaiuti, P., Valente, G., Mancone, S., and Grambone, A. (2020). Psychometric properties and a preliminary validation study of the Italian brief version of the communication styles inventory (CSI-B/I). Front. Psychol. 11:1421. doi: 10.3389/fpsyg.2020.01421

Diotaiuti, P., Valente, G., Mancone, S., Grambone, A., Chirico, A., and Lucidi, F. (2022b). The use of the Decision Regret Scale in non-clinical contexts. Front. Psychol. 13:945669. doi: 10.3389/fpsyg.2022.945669

Elifneh, Y. W. (2022). “Financial literacy among Ethiopian high school teenagers,” in Business, Industry, and Trade in the Tropics (Routledge), 196–213. doi: 10.4324/9781003153580-11

Emma, M., and Anya, S. (2021). A study on financial literacy and need for financial education. J. Enter. Bus. Intell. 1, 137–142. doi: 10.53759/5181/JEBI202101015

Eniola, A. A., and Entebang, H. (2017). SME managers and financial literacy. Global Business Rev. 18, 559–576. doi: 10.1177/0972150917692063

Fan, L., Lim, H., and Lee, J. M. (2022). Young adults' financial advice-seeking behavior: the roles of parental financial socialization. Fam. Relat. 71, 1226–1246. doi: 10.1111/fare.12625

Fan, L., and Zhang, L. (2021). The influence of financial education sources on emergency savings: the role of financial literacy. Family Consumer Sci. Res. J. 49, 344–361. doi: 10.1111/fcsr.12400

Fauziaha, P., and Sari, R. C. (2019). The development of a financial literacy questionnaire for early childhood. Development 7, 305–315.

Frisancho, V. (2020). The impact of financial education for youth. Econ. Educ. Rev. 78:101918. doi: 10.1016/j.econedurev.2019.101918

Frisancho, V., Herrera, A., and Prina, S. (2021). Can a budget-recording tool teach financial skills to youth? Experimental evidence from a financial diaries study. IDB Working Paper Series. doi: 10.18235/0003691

Fuente-Mella, H. D. L., Umaña-Hermosilla, B., Fonseca-Fuentes, M., and Elórtegui-Gómez, C. (2021). Multinomial logistic regression to estimate the financial education and financial knowledge of university students in Chile. Information 12:379. doi: 10.3390/info12090379

Gardynia, N., and Syaodih, E. (2021). “Learning cycle for literacy financial of early childhood education,” in ICOPE 2020: Proceedings of the 2nd International Conference on Progressive Education, ICOPE 2020, 16-17 October 2020, Universitas Lampung, Bandar Lampung, Indonesia (European Alliance for Innovation), 453. doi: 10.4108/eai.16-10-2020.2305227

Garg, N., and Singh, S. (2018). Financial literacy among youth. Int. J. Soc. Econ. 45, 173–186. doi: 10.1108/IJSE-11-2016-0303

Georgiou, Y., and Kyza, E. A. (2018). Relations between student motivation, immersion and learning outcomes in location-based augmented reality settings. Comput. Hum. Behav. 89, 173–181. doi: 10.1016/j.chb.2018.08.011

Goyal, K., and Kumar, S. (2021). Financial literacy: a systematic review and bibliometric analysis. Int. J. Consum. Stud. 45, 80–105. doi: 10.1111/ijcs.12605

Gudjonsson, S., Minelgaite, I., Kristinsson, K., and Pálsdóttir, S. (2022). Financial literacy and gender differences: women choose people while men choose things? Admin. Sci. 12:179. doi: 10.3390/admsci12040179

Hamari, J., Koivisto, J., and Sarsa, H. (2014). “Does gamification work?–a literature review of empirical studies on gamification,” in 2014 47th Hawaii International Conference on System Sciences (IEEE), 3025–3034. doi: 10.1109/HICSS.2014.377

Hati, S. R. H. (2017). Exploring the motivation toward and perceived usefulness of a financial education: program offered to low-income women in indonesia. ASEAN J. Commun. Engag. 1:17. doi: 10.7454/vol1iss1pp17-28

Henderson, G. E., Beach, P., and Coombs, A. (2021). Financial literacy education in Ontario: an exploratory study of elementary teachers' perceptions, attitudes, and practices. Canad. J. Educ. 44, 308–336. doi: 10.53967/cje-rce.v44i2.4249

Huebinger, R. M., Hussain, R., Tupchong, K., Walia, S., Fairbrother, H., and Rogg, J. (2021). Survey-based evaluation of resident and attending financial literacy. Western J. Emer. Med. 22:1369. doi: 10.5811/westjem.2021.8.53016

Hussain, J., Salia, S., and Karim, A. (2018). Is knowledge that powerful? Financial literacy and access to finance: an analysis of enterprises in the UK. J. Small Bus. Enter. Dev. 25, 985–1003. doi: 10.1108/JSBED-01-2018-0021

Huston, S. J. (2010). Measuring financial literacy. J. Consumer Affairs 44, 296–316. doi: 10.1111/j.1745-6606.2010.01170.x

Indratirta, N. P., Handayati, P., and Juliardi, D. (2023). Effect of financial literacy on the financial behavior of the millennial generation about the dangers of fraudulent investment and flexing affiliations. J. Bus. Manag. Econ. Dev. 1, 355–365. doi: 10.59653/jbmed.v1i02.154

Johnson, J., Spraggon, D., Stevenson, G., Levine, E., and Mancari, G. (2021). Impact of the futuresmart online financial education course on financial knowledge of middle school students. J. Finan. Couns. Plan. 32, 368–386. doi: 10.1891/JFCP-19-00061

Jonker, N., and Kosse, A. (2022). The interplay of financial education, financial inclusion and financial stability and the role of Big Tech. Contemp. Econ. Policy 40, 612–635. doi: 10.1111/coep.12578

Kadoya, Y., and Khan, M. S. R. (2020). What determines financial literacy in Japan? J. Pension Econ. Finance 19, 353–371. doi: 10.1017/S1474747218000379

Kaiser, T., Lusardi, A., Menkhoff, L., and Urban, C. (2022). Financial education affects financial knowledge and downstream behaviors. J. Financ. Econ. 145, 255–272. doi: 10.1016/j.jfineco.2021.09.022

Kaiser, T., and Menkhoff, L. (2020). Financial education in schools: A meta-analysis of experimental studies. Econ. Educ. Rev. 78:101930. doi: 10.1016/j.econedurev.2019.101930

Kalmi, P., Trotta, G., and KaŽukauskas, A. (2021). Energy-related financial literacy and electricity consumption: survey-based evidence from Finland. J. Consumer Affairs 55, 1062–1089. doi: 10.1111/joca.12395

Kalwij, A., Alessie, R., Dinkova, M., Schonewille, G., Van der Schors, A., and Van der Werf, M. (2019). The effects of financial education on financial literacy and savings behavior: evidence from a controlled field experiment in Dutch primary schools. J. Consumer Affairs 53, 699–730. doi: 10.1111/joca.12241

Kaur, M., Vohra, T., and Arora, A. (2015). Financial literacy among university students: a study of Guru Nanak Dev University, Amritsar, Punjab. Asia-Pacific J. Manag. Res. Innov. 11, 143–152. doi: 10.1177/2319510X15576178

Khawar, S., and Sarwar, A. (2021). Financial literacy and financial behavior with the mediating effect of family financial socialization in the financial institutions of Lahore, Pakistan. Fut. Bus. J. 7, 1–11. doi: 10.1186/s43093-021-00064-x

Kim, J., and Chawla, I. (2022). 26 The Role of Socialization in Shaping Personal Finance Attitudes and Behaviors. Berlin: De Gruyter Handbook of Personal Finance 451. doi: 10.1515/9783110727692-026

Klapper, L., and Lusardi, A. (2020). Financial literacy and financial resilience: evidence from around the world. Financ. Manag. 49, 589–614. doi: 10.1111/fima.12283

Koomson, I., Villano, R. A., and Hadley, D. (2023). The role of financial literacy in households' asset accumulation process: Evidence from Ghana. Rev. Econ. Househ. 21, 591–614. doi: 10.1007/s11150-022-09603-z

Krichen, K., and Chaabouni, H. (2022). Entrepreneurial intention of academic students in the time of COVID-19 pandemic. J. Small Bus. Enter. Dev. 29, 106–126. doi: 10.1108/JSBED-03-2021-0110

Kuzma, I., Chaikovska, H., Levchyk, I., and Yankovych, O. (2022). Formation of financial literacy in primary school students. J. Effic. Respons. Educ. Sci. 15, 142–155. doi: 10.7160/eriesj.2022.150302

Lantara, I. W. N., and Kartini, N. K. R. (2015). Financial literacy among university students: empirical evidence from Indonesia. J. Indonesian Econ. Bus. 30:247. doi: 10.22146/jieb.10314

LeBaron, A. B., and Kelley, H. H. (2021). Financial socialization: a decade in review. J. Fam. Econ. Issues 42, 195–206. doi: 10.1007/s10834-020-09736-2

LeBaron-Black, A. B., Curran, M. A., Hill, E. J., Freeh, M. E., Toomey, R. B., and Speirs, K. E. (2022). Parent financial socialization scale: development and preliminary validation. J. Family Psychol. 36:943. doi: 10.1037/fam0000927

LeBaron-Black, A. B., Curran, M. A., Hill, E. J., Toomey, R. B., Speirs, K. E., and Freeh, M. E. (2023). Talk is cheap: Parent financial socialization and emerging adult financial well-being. Fam. Relat. 72, 1201–1219. doi: 10.1111/fare.12751

Letkiewicz, J. C., and Fox, J. J. (2014). Conscientiousness, financial literacy, and asset accumulation of young adults. J. Consumer Affairs 48, 274–300. doi: 10.1111/joca.12040

Letkiewicz, J. C., Lim, H., Heckman, S. J., and Montalto, C. P. (2019). Parental financial socialization: is too much help leading to debt ignorance among college students? Family Cons. Sci. Res. J. 48, 149–164. doi: 10.1111/fcsr.12341

Liu, C. L., Chang, D. F., and Chuang, C. M. (2019). Investigation of the financial literacy among high school students. ICIC Expr. Lett. Part B 10, 387–393. doi: 10.24507/icicelb.10.05.387

Lučić, A., Barbić, D., and Uzelac, M. (2020). The role of financial education in adolescent consumers' financial knowledge enhancement. Market-TrŽište 32, 115–130. doi: 10.22598/mt/2020.32.spec-issue.115

Lührmann, M., Serra-Garcia, M., and Winter, J. (2015). Teaching teenagers in finance: does it work? J. Bank. Fin. 54, 160–174. doi: 10.1016/j.jbankfin.2014.11.009

Lührmann, M., Serra-Garcia, M., and Winter, J. (2018). The impact of financial education on adolescents' intertemporal choices. Am. Econ. J. 10, 309–332. doi: 10.1257/pol.20170012

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss J. Econ. Stat. 155, 1–8. doi: 10.1186/s41937-019-0027-5

Lusardi, A., and Mitchell, O. S. (2011). Financial literacy around the world: an overview. J. Pension Econ. Finance 10, 497–508. doi: 10.1017/S1474747211000448

Lusardi, A., and Mitchell, O. S. (2014). The economic importance of financial literacy: theory and evidence. Am. Econ. J. 52, 5–44. doi: 10.1257/jel.52.1.5

Lusardi, A., Samek, A., Kapteyn, A., Glinert, L., Hung, A., and Heinberg, A. (2017). Visual tools and narratives: new ways to improve financial literacy. J. Pension Econ. Finance 16, 297–323. doi: 10.1017/S1474747215000323

Lusardi, A., and Tufano, P. (2015). Debt literacy, financial experiences, and overindebtedness. J. Pension Econ. Finance 14, 332–368. doi: 10.1017/S1474747215000232

Mahoney, J. L., Weissberg, R. P., Greenberg, M. T., Dusenbury, L., Jagers, R. J., Niemi, K., et al. (2021). Systemic social and emotional learning: promoting educational success for all preschool to high school students. Am. Psychol. 76:1128. doi: 10.1037/amp0000701

Mallia, L., Chirico, A., Zelli, A., Galli, F., Palombi, T., Bortoli, L., et al. (2020). The implementation and evaluation of a media literacy intervention about PAES use in sport science students. Front. Psychol. 11:368. doi: 10.3389/fpsyg.2020.00368

Mancebón, M. J., Ximénez-de-Embún, D. P., Mediavilla, M., and Gómez-Sancho, J. M. (2019). Factors that influence the financial literacy of young Spanish consumers. Int. J. Consum. Stud. 43, 227–235. doi: 10.1111/ijcs.12502

Mancone, S., Corrado, S., Beatrice, T., Spica, G., and Diotaiuti, P. (2024b). Integrating digital and interactive approaches in adolescent health literacy: a comprehensive review. Front. Public Health 12:1387874. doi: 10.3389/fpubh.2024.1387874

Mancone, S., Corrado, S., Tosti, B., Spica, G., Di Siena, F., Misiti, F., et al. (2024a). Enhancing nutritional knowledge and self-regulation among adolescents: efficacy of a multifaceted food literacy intervention. Front. Psychol. 15:1405414. doi: 10.3389/fpsyg.2024.1405414

Mändmaa, S. (2019). Financial literacy – what and why should we improve. Eurasian J. Soc. Sci. 7, 12–28. doi: 10.15604/ejss.2019.07.02.002

Marchetti, A., Rinaldi, T., Lombardi, E., Massaro, D., and Valle, A. (2021). “Learning to wait, be altruistic, and fair: a primary school training in economic education,” in Financial Education and Risk Literacy, Behavioural Financial Regulation and Policy (BEFAIRLY) series (Cheltenham, UK: Edward Elgar Publishing), 112–122. doi: 10.4337/9781789908855.00014

Merry, K. E., Webster, F. R., and Kucharczyk, S. (2022). Investing in students with extensive support needs: steps to integrate personal financial literacy in inclusive settings for educators, students, and families. Inclusive Pract. 1, 156–170. doi: 10.1177/27324745221128931

Mishra, D. K., Malik, S., Chitnis, A., Paul, D., and Dash, S. S. (2021). Factors contributing to financial literacy and financial inclusion among women in Indian SHGs. Univ. J. Account. Finance 9, 810–819. doi: 10.13189/ujaf.2021.090427

Monteith, S., Bauer, M., Alda, M., Geddes, J., Whybrow, P. C., and Glenn, T. (2021). Increasing cybercrime since the pandemic: concerns for psychiatry. Curr. Psychiatry Rep. 23, 1–9. doi: 10.1007/s11920-021-01228-w