- Finance Department, Budapest University of Technology and Economics, Budapest, Hungary

The paper highlights the importance and relevance of introducing economic studies to primary schools. The research aimed to investigate the appropriate age, environment, type, and composition of presentation for introducing combined economic knowledge. The 190 students participating in the research were students from three primary schools in Hungary from 10 classes. Given the fact that in the case of all of the significant results, a sufficient effect size could be measured, and furthermore, the relevant test value was very high, it is unambiguously proven that the size of the sample (n = 190) that was used for the examination was sufficient. The results suggest that teaching economic and financial knowledge through accounting and making lectures interactive using special tools of positive education is critical to stimulating children’s interest. Eighty percent of the students in the study liked the combined and interactive lecture. Another goal was to investigate whether those that liked the presentation would perform better on the related knowledge test, which proved to be the case. In the two target groups, students in grade 6 outperformed students in grade 3 on the test. An investigation of gender performance is also included in the research. Findings suggest that the respective education may appropriately be developed based on the close relationship between mathematics and accounting. The lectures can be adapted according to any national or international accounting standards (IFRS, etc.) and can be taught in an online classroom as well. The lectures aim to develop children’s independent problem-solving skills so they can adapt the information to their own lives and financial situations. The paper fills a gap in the research by describing a successful attempt to complex economic literacy.

JEL Classification code: A29, M21, M41

Introduction

Keeping pace with globalization and the multitude of various financial products and economic processes would challenge (Willis, 2008) even a professional. The situation is further aggravated by the negative attitude of people toward financial products, a problem that can be encountered worldwide. However, poor financial decisions may entail severe consequences (Amit et al., 2020), not only to individuals but also even to broader society. One solution is modifying peoples’ financial behavior by improving their financial knowledge (Robb and Woodyard, 2012) to contribute to their well-being. While in several countries, education about financial awareness and fundamentals is available, sometimes even for free, the understanding and acquisition of complex economic knowledge is still lacking. In the case of severe economic crises, individual financial awareness no longer suffices. Addressing the former requires system thinking, which combines different subdisciplines of economics and connects private individuals with their economic environment. The importance of education about this subject is highlighted by another problem—a global phenomenon: tax evasion. One solution to this worldwide problem would be the development of an acceptable tax culture, which, however, requires properly designed financial education even at the stage of elementary school, requiring long-term investment that produces durable results (Dobos and Takacs-Gyorgy, 2018). Investment in education is very important for society as a whole—it contributes to the economic growth of a country (Gershanovich, 2004). Moreover, human capital investment in early childhood produces significant and lasting benefits (Abington and Blankenau, 2013).

The experiences children have during childhood can decisively impact how their adult lives develop (Doss, 2019). Many scientific studies claim that financial education should start as early as possible. Children are much more capable of and willing to absorb new concepts than adults. If we introduce children to financial knowledge early, their behavior and attitudes to this subject will change, increasing later success in this area of life (Jones and Chang, 2012).

Children come face to face with the economic environment every day and often show great interest in it. Numerous pieces of scientific literature have proven that students’ interest is a significant factor in their performance. Schools must adapt to children’s interests and use their inherent desire to learn (Education through the millennium, 2001). There is a consensus that parents should be the ones to teach their children; the fact is that children will often encounter the same financial decision-making scenarios as their parents (Jones and Chang, 2012).

The best way to teach young people basic economic and financial facts and skills is to incorporate material about these subjects into classroom lessons, even during elementary school (Kozina et al., 2011; Jayaraman et al., 2021). Based on the research of Kovács et al. (2013), it is known that the majority of students believe that they should primarily acquire the basics of financial awareness at school. Students in the upper grades of elementary school and high schools (Németh et al., 2022) are most open to and motivated about the topics of finance and economics, but the introduction of financial knowledge can start with primary school students in the fifth and sixth grades to help build adequate knowledge (Flores and Simon, 2011). Another unneglectable fact (Blotnicky et al., 2018) is that the age from 12 to 15 is the ideal period for helping children in their choice of career.

Typically, children encounter the economic world through businesses. The first occasions involve when parents take them shopping or to hospitality or entertainment facilities. Later, they get to know about money and payment methods and obtain an understanding of prices. Most of the basic and relevant economic processes and events can be comprehended through understanding the operation of enterprises. Therefore, it is essential to understand these economic and financial processes and to obtain a thorough knowledge of economic and financial foundations. Accounting is the subject most widely encountered in relation to “financial matters” and represents the most suitable approach to imparting financial knowledge (Samkin et al., 2012).

Besides this, accounting plays a very important role for all business organizations and individuals both in business decision-making situations and outside them. It is present everywhere without exception: in addition to its use in the for-profit sector, it is also an integral component of the operations of the public and non-profit sectors. Accounting systems generate data and information, the interpretation and proper utilization of which is essential for operating businesses efficiently. Such information can be used not only to further the interests of a given company but can also be used by individuals to achieve various goals. People with some basic knowledge of accounting are generally better able to assert their interests. Furthermore, knowledge of accounting communication helps financial professionals during negotiations in terms of appropriate behavior and decision-making (Kiss, 2007).

While students’ interest in financial and economic topics can be said to be very favorable (Németh et al., 2022), accounting as a subject does not attract such interest—based on surveys conducted both among college students (Radionova and Stoyanova, 2021) and those in secondary schools (Wells, 2015), a significant number consider it boring. In some countries, accounting is available to students as an optional subject in secondary schools. Teaching economic and financial knowledge combined with accounting may be a solution for dealing with an overcrowded curriculum and overburdened students, as well as increasing interest in the subject (Samkin et al., 2012).

The proportion of students characterized by having a positive attitude toward school decreases with age; a significant drop is observed in the fifth and sixth grades. Furthermore, in primary schools, a significant difference is found between the school grades of girls and boys aged between 10 and 14: girls generally outperform boys, but these results have not been clearly replicated using tests of knowledge (Burusic et al., 2012). I have identified only one survey about the proportion of accounting professionals by gender, which shows the trend to feminization in China (Sun, 2016), but presumably, in most countries, the number of women in this profession is also higher than that of men. At college, a correlation between gender and performance in accounting is also of interest from such a perspective. Results from the field of accounting indicate that or there is no significant relationship between gender and cumulative average grade (Shaban et al., 2015) or that female students perform better in accounting (Syukur, 2021).

The success of introducing a new complex subject is dependent, among other things, on how well the education system is adapted to it. The relationship between accounting and success in mathematics is dealt with in scientific literature. In general, it can be stated that the educational systems of various countries have also been designed accordingly. Accounting and mathematics are closely related to each other, although the deeper system of relationships between them has not yet been mapped (Shaban et al., 2015; Mkhize, 2019). Grades in mathematics-related subjects are significantly positively correlated to the academic performance of accounting students (Shaban et al., 2015).

Materials and methods

The target group of the research was primary school students in grades 3 and 6 (hereinafter referred to as students). The 190 students participating in the research were students from three public primary schools in Budapest from 10 classes. Budapest is the capital of Hungary, with a population of almost 1.8 million (2022), accounting for 18% of the population of Hungary. In Hungary, in terms of the number of students, urban public primary schools educate the relevant age group almost in its entirety, and Budapest plays the leading role. Ninety-four students were from five third-grade classes, of whom 50 were boys and 44 girls, and 96 students from five sixth grades, of whom 46 were boys and 50 girls. The size of the sample (n = 190) used for the examination was deemed statistically sufficient (the related statistical tests are included in the section on results).

In line with the theme, students learned about accounting and economic-financial concepts and processes during a lecture that lasted about 30–35 min from the same lecturer in their classroom. When preparing the presentation, I took into account the specificities of the students’ age, what they had learned in school, and their experience with the economic environment. In addition, I used special tools of positive education before, during, and after the presentation. During the presentation, we touched on the following terms and topics: economics, accounting, double-entry bookkeeping, charts of accounts, classes of accounts, economic events, activities of enterprises, services, suppliers, cash, bank accounts, balance sheets, assets, liabilities, equity and debt, intangible assets, tangible fixed assets, inventory, goods, share capital, and current liabilities, etc. The presentation was interactive, and economic-financial-accounting knowledge was presented through lifelike situations appropriate to the students’ age. Parents registered their children for the lecture, thus increasing the validity of the sample by including not only those students who were interested in the topic.

Immediately after the presentation, the students completed a questionnaire, which took a few minutes and then completed a knowledge test. They had a total of 10–15 min for this (completion was not accompanied by any incentives, thereby increasing the validity of the questionnaire responses).

In the case of primary school students, it is necessary to ask questions that are as simple and short as possible. The questionnaire was unstructured and contained three simple, open-ended questions, but only one was used in the research. This question, “Did you like the presentation?” was analyzed based on respondents’ answers. This simple question combined two essential elements. It provided feedback about the presentation and measured interest in the topic. Those who liked the presentation were presumably interested in the topic. To prove this, I defined the answers as yes-no-no, with a textual justification line.

The set of tasks in the knowledge test consisted of a practical and a theoretical part. The practical task involved comprehending three double-entry accounting lines (students were asked to decipher the economic events that had happened). Students could achieve a maximum of 7.5 points for this. The theoretical section, hitherto unknown to students, included three economic-financial-accounting definitions to be explained or described in writing, for which students could earn another three points. A maximum of 10.5 points could thus be earned for all tasks.

The statistical tests used to evaluate the questionnaire and the series of tasks were undertaken using Microsoft Excel and SPSS.

In line with the scientific literature and related findings, I formulated the following hypotheses.

H1: A higher grade for the mathematics subject will be positively correlated with a higher score on the accounting knowledge test.

On the basis of the sample size and the quantitative variables, Pearson’s linear correlation was used to measure the strength of the stochastic relationship.

H2: Liking the presentation will be positively correlated with the results of the accounting knowledge test.

In the case of the quantitative variable, an independent sample t-test was used to compare the two groups in due consideration of the sample size.

H3a: Girl students will outperform boy students in mathematics.

H3b: There is no relationship between gender and the results of the accounting knowledge test/ or girl students will outperform boy students in accounting.

In the case of the quantitative variable, an independent sample t-test was used for comparing the two groups, in due consideration of the sample size.

H4: More than half of the students like the presentation.

A sample proportion test was used for testing the proportion of the relevant population.

H5: Sixth graders will score more points on average.

An independent sample t-test was used to compare the quantitative variables of the two groups.

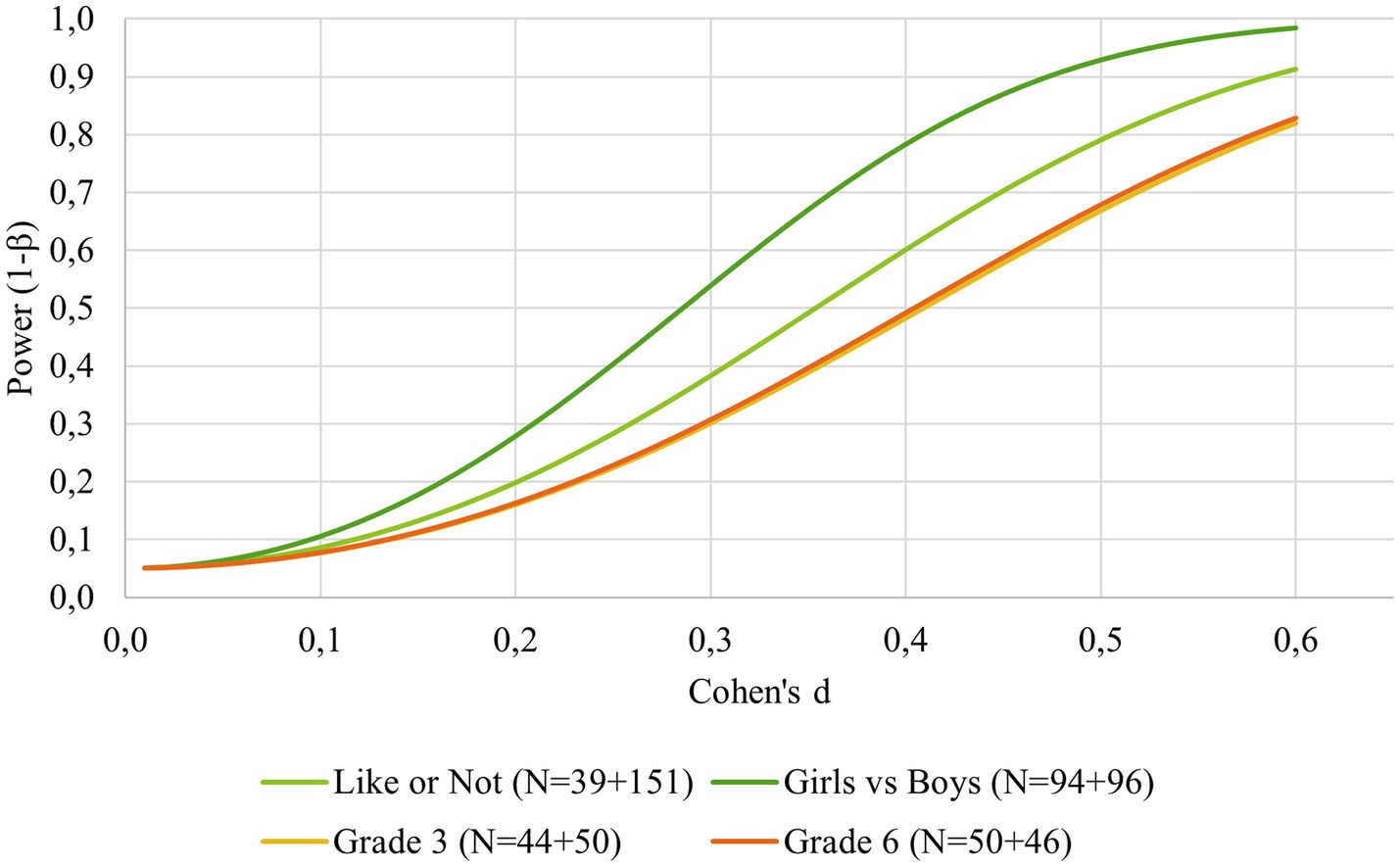

Finally, I made an effect-size calculation. Based on Cohen’s d effect size value, a power analysis is elaborated for the given sample size. The presumption behind measuring the effect size is that the sample size influences the strength of the test, enabling us to examine the test-strength index—for instance, the effect size index—using statistics compiled from the given sample, assuming a given sample size (i.e., this helps determine to what extent a conclusion deduced from the test may be considered reliable).

Results

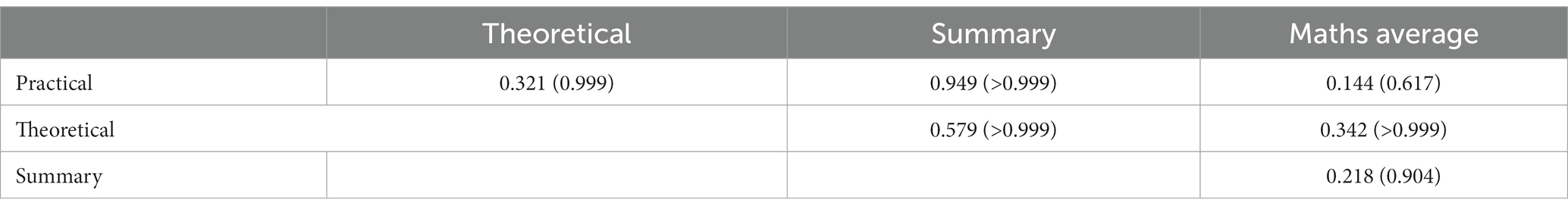

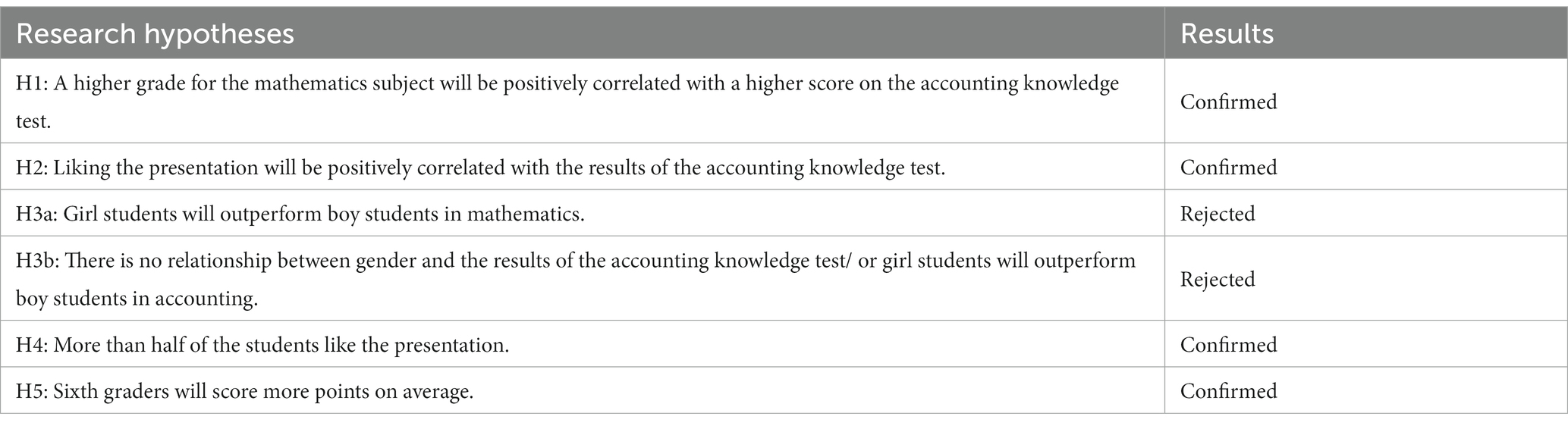

Pearson’s linear correlation was first used to examine the relationship between the practical, theoretical, and summary results for the arithmetical averages of the mathematics grades. The conclusion was that all three accounting-related results were significantly correlated to the weighted average of marks achieved in mathematics. In addition, a weak positive linear relationship can be found in the case of all three variables, which in all three cases was deemed significant. In other words, the results on the practical, theoretical, and summary sections were liable to be higher if the arithmetical average score was also higher. See Table 1.

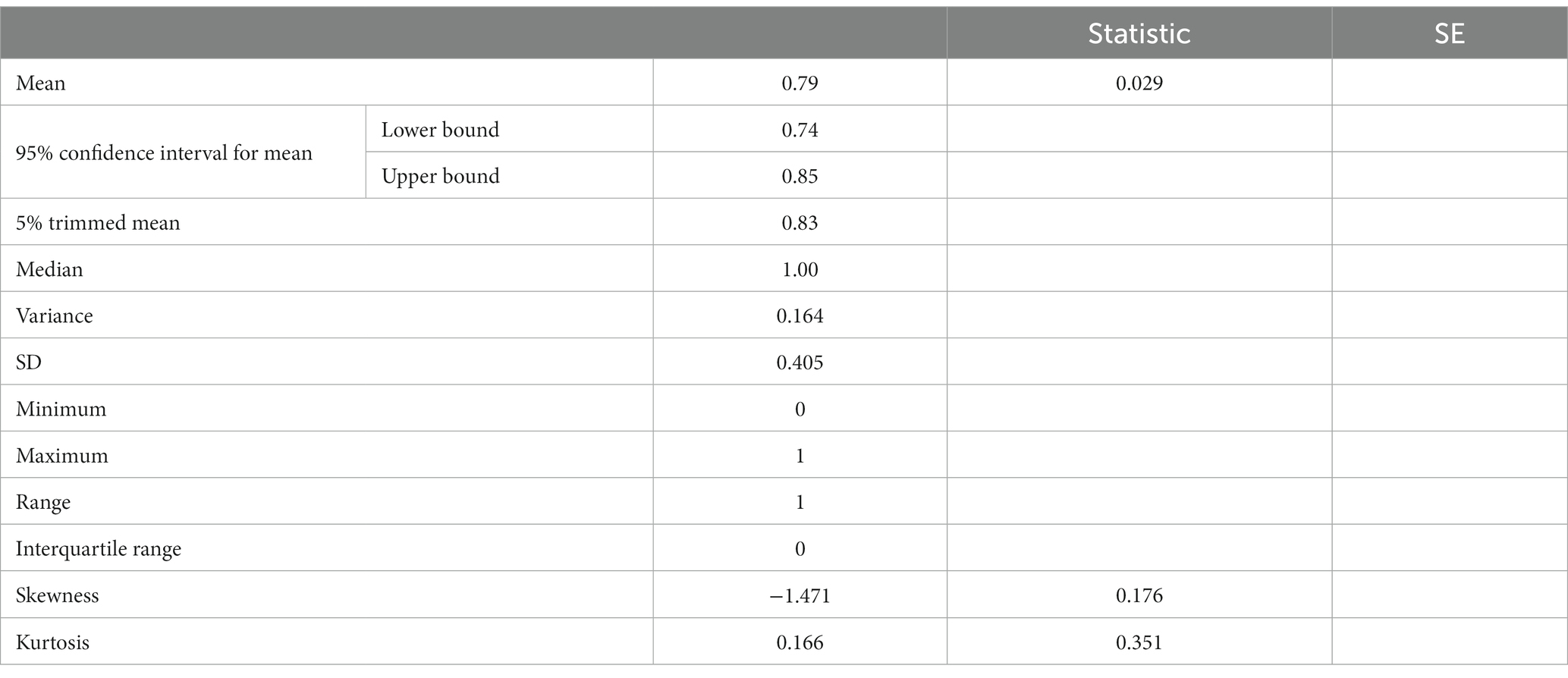

Table 1. Descriptive statistics and correlation coefficients of the variables presented in the analysis.

From the sample (n = 190), 151 (i.e., almost 80%) of the students liked the lecture, only seven students deemed the lecture boring, and only five students were not interested in the topic (of note is that all five students were in the sixth grade). Breaking down the results by class reveals that in five third-grade classes, 74 out of 94 students, and in five sixth-grade classes, 77 out of 96 students liked the lecture. This strongly suggests that students in the third and the sixth grade liked the presentation to the statistically same degree.

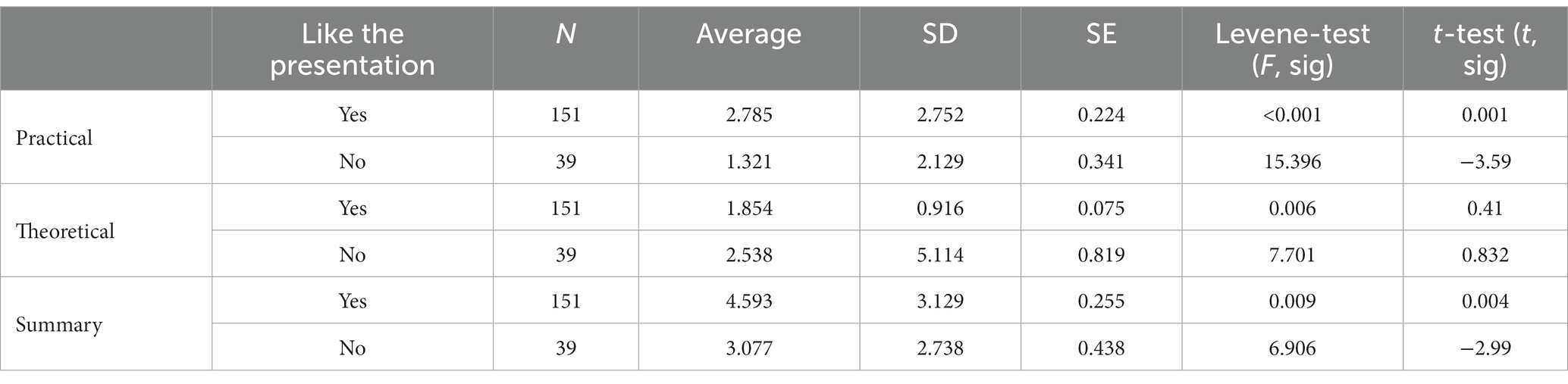

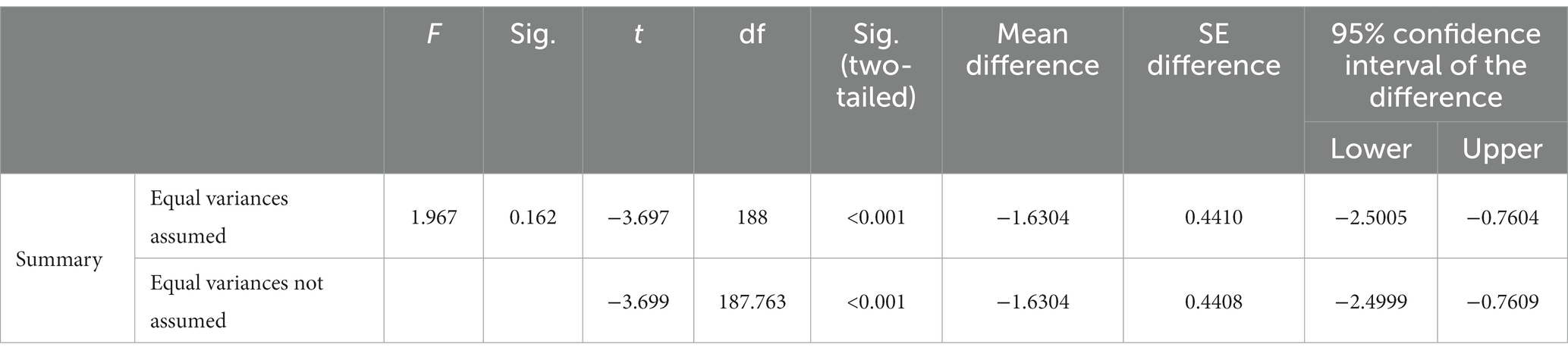

Dividing the 190-strong sample of students into two groups based on their opinion concerning the lecture, we can compare the results of the practical, theoretical, and summary sections with the arithmetical average. In both groups, the sample population numbered over 30, indicating a normal distribution (when comparing the averages of the two sub-samples with a parametric t-test). The t-test was applied based on the result of a Levene’s test; only the results of the appropriate t-tests are presented—see Table 2.

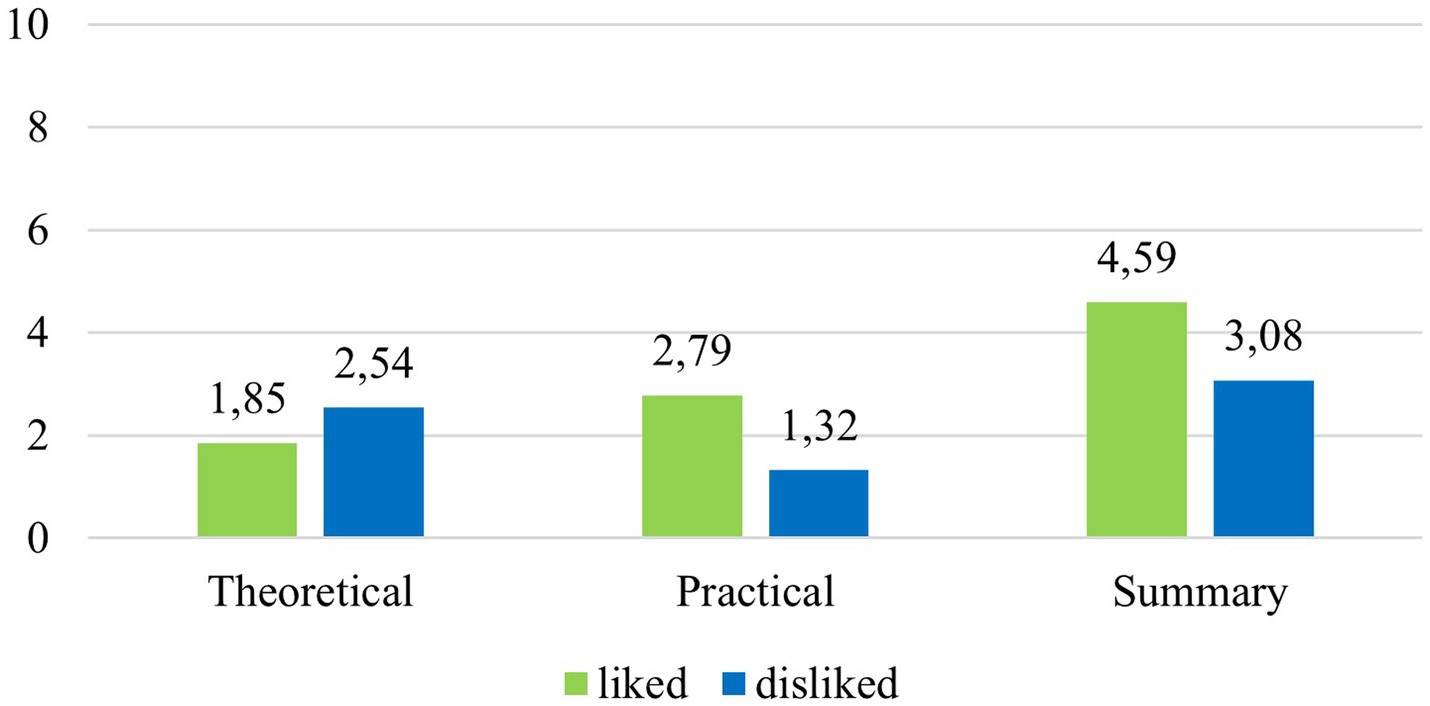

Those who liked the lecture obtained better results on the practical [t(74.373) = −3.590; p = 0.001] and summary tests [t(66,068) = −2,990; p = 0.004] than those who did not like the lecture. The difference in both cases is about 1.5 points (see Figure 1); i.e., the results on the practical test of those who liked the lecture (2.785) were, on average, one-and-a-half points higher than those of those who did not like it (1.321); furthermore, the same tendency was identified in the case of the results for the summary test (did not like: 3.077; liked: 4.593).

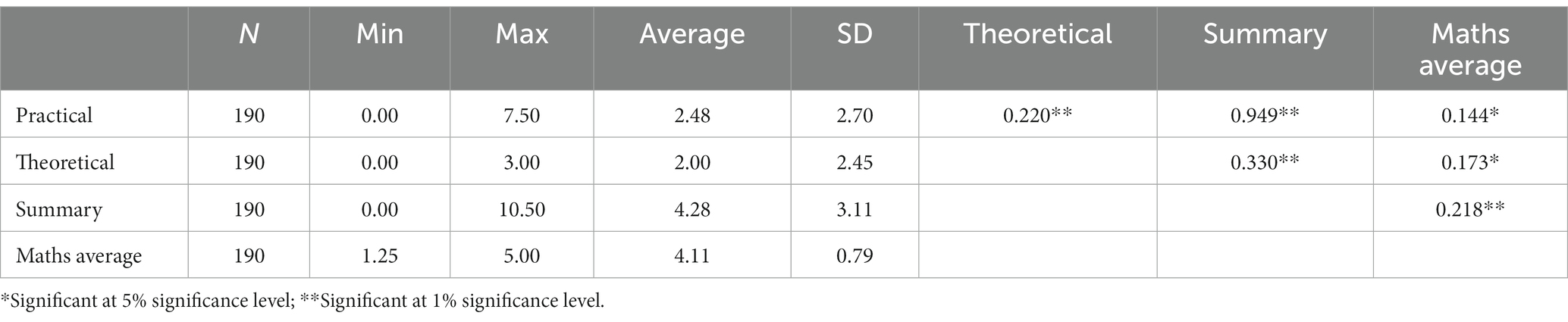

Comparison between the results achieved by girls and boys in accounting and mathematics using the appropriate t-test revealed that a significant difference between the two sexes could be found only in the case of sixth-grade students and only in the case of accounting [Levene F(1;94) = 1.910; p = 0.170; t(94) = 2.484; p = 0.015] (see Table 3). Therefore, on the basis of the results, it can be stated that, on average, the boys’ summary results for the accounting knowledge test were better than those of the girls (5.924 and 4.380, respectively).

Table 3. Comparative statistics for accounting and mathematics results of girls and boys across the entire sample, and broken down by class.

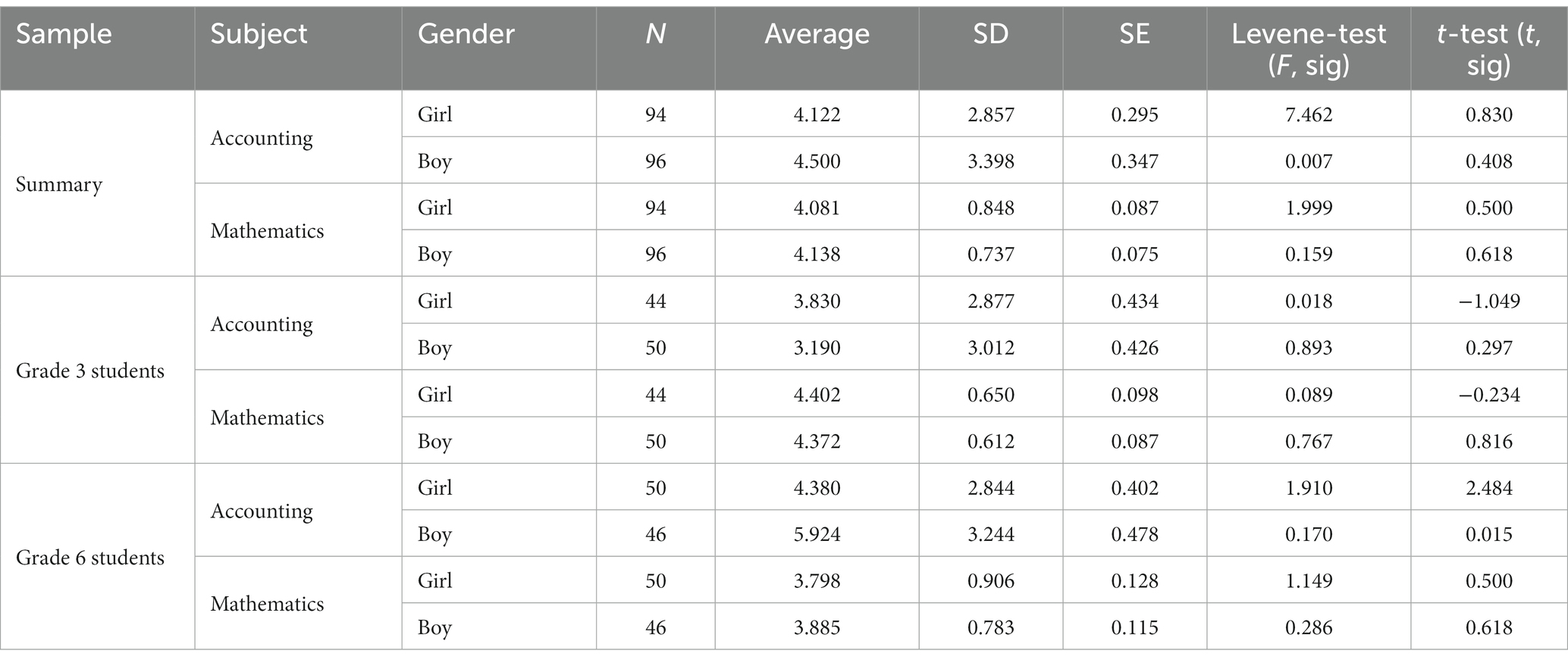

When summarizing the students’ “yes” and “no” answers to the question “Did you like the presentation?” asked in the questionnaire, I found that out of 190 students, 151 liked the presentation. This proportion of the sample, 79.47% (z = 10,059; p < 0,001), is thus significantly larger than the 50% specified in H4. The single sample proportion test and the data are presented in Tables 4, 5.

Table 4. Testing the proportions of “likes” and “dislikes” expressed by students concerning the presentation 1.

Table 5. Testing the proportions of “likes” and “dislikes” expressed by students concerning the presentation 2.

After summarizing the average points achieved in the accounting knowledge test with an independent sample test (Table 6); based on the results, I concluded that sixth graders scored more points on average than third graders regarding the lecture on an identical topic.

Effect-size calculation

While conducting tests, it is not of exclusive importance whether the result is significant, although if the result is significant, the test value and the effect size are of interest. Obviously, we should not disregard the fact that in the event of having a sufficiently large sample (in general, a several-thousand-strong population), significance can be proven for almost any result, even if the effect size is relatively small, even negligible. The headcount of the population covered by this research was 190; on this basis, effect-size and test-score examinations were conducted. In the case of the independent T-test, the effect size was measured with Cohen’s d formula and the correlation was measured with the correlation coefficient (Figure 2). In the case of independent T-tests, the effect size of the significant differences was moderate (Practical—Like presentation or not: 0.555; Summary—Like presentation or not: 0.496 and Grade 6, and Accounting—Girls vs. Boys: 0.508), which (in due consideration of the characteristics of the relevant samples) produced very large effect-size results (0.861; 0.775; and 0.929, respectively), of which two exceed, and the third is close to the 80% threshold that is generally deemed to be acceptable. These indices can be interpreted as percentage values as well as probabilities since they involve the probability of rightfully neglecting the zero hypothesis, which in each case predicted the equality of the expected values of any two compared groups. If, in the course of making comparisons, significant differences can be identified, the probability of the appropriateness of the decision to refuse the equality of the expected values of the scrutinized characteristics of the two groups is at least 77.5%. This means that in the case of three significant differences, the probability of committing a type-2 error (the zero hypothesis is neglected) is 13.9, 22.5, and 7.1%, respectively. Based on this, it is unambiguously proven that the sample size produced sufficient information for arriving at reliable conclusions.

Figure 2. Development of the effect-size index measured with Cohen’s d formula in the case of each t-test.

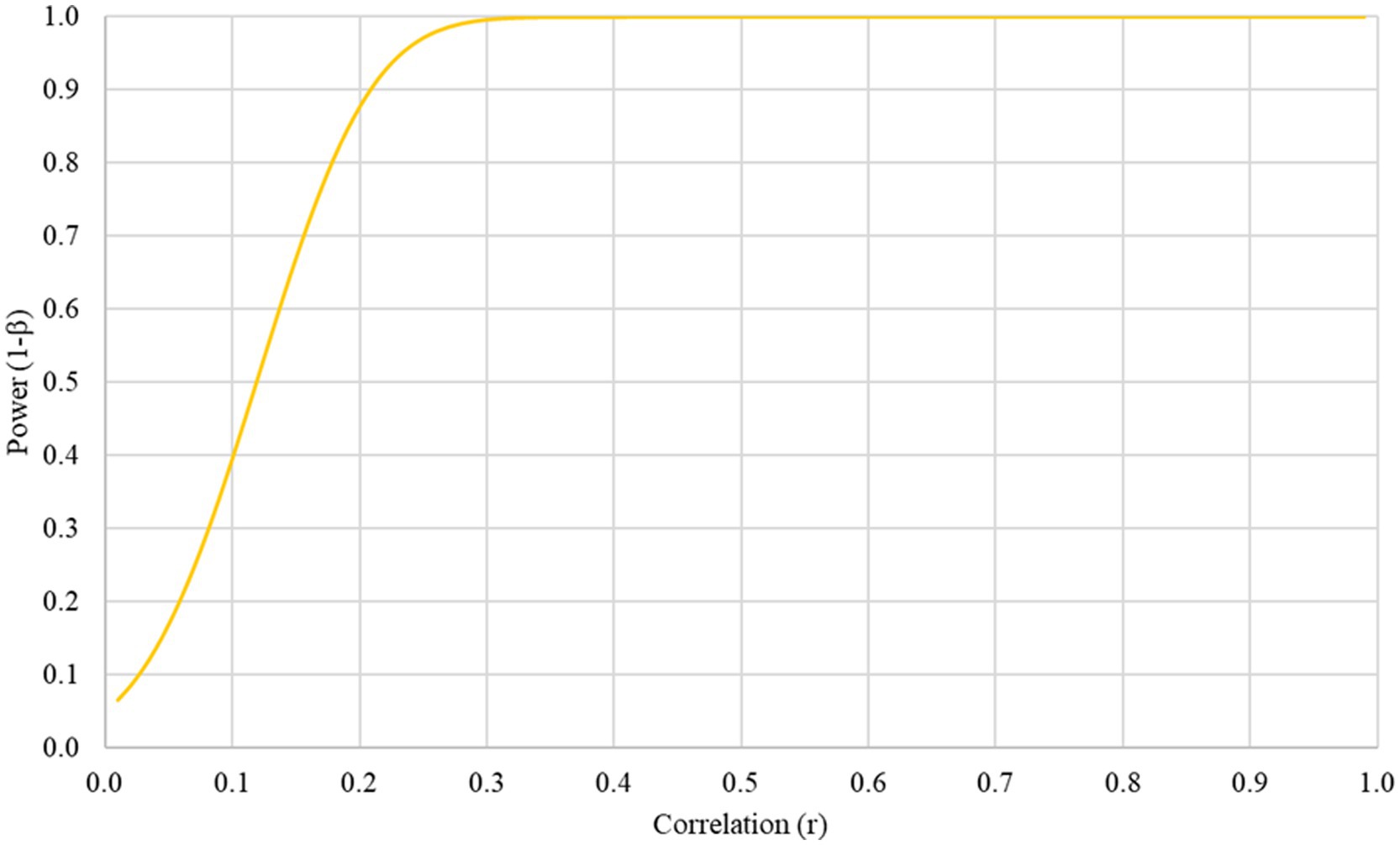

In the case of the correlation coefficients, the effect size, apart from in one case (Practical vs. Maths average), slightly differed from one, meaning that in the case of these examinations, the probability of committing a type-2 error slightly differed from 0%. This proves that in the case of correlation coefficients amounting to 0.2, the very high-test value is convincing evidence for the negligible probability of committing a type-2 error (Table 7). Thus, it is unambiguously proven that the conclusions we arrived at are reliable and that the size of the sample was sufficient.

Given the fact that in the case of all of the significant results, a sufficient effect size could be measured (Figure 3), and furthermore, the relevant test value was very high, it is unambiguously proven that the size of the sample (n = 190) that was used for the examination was sufficient.

Figure 3. Development of the test value as a function of the effect size (linear correlation coefficient).

Section of conclusions

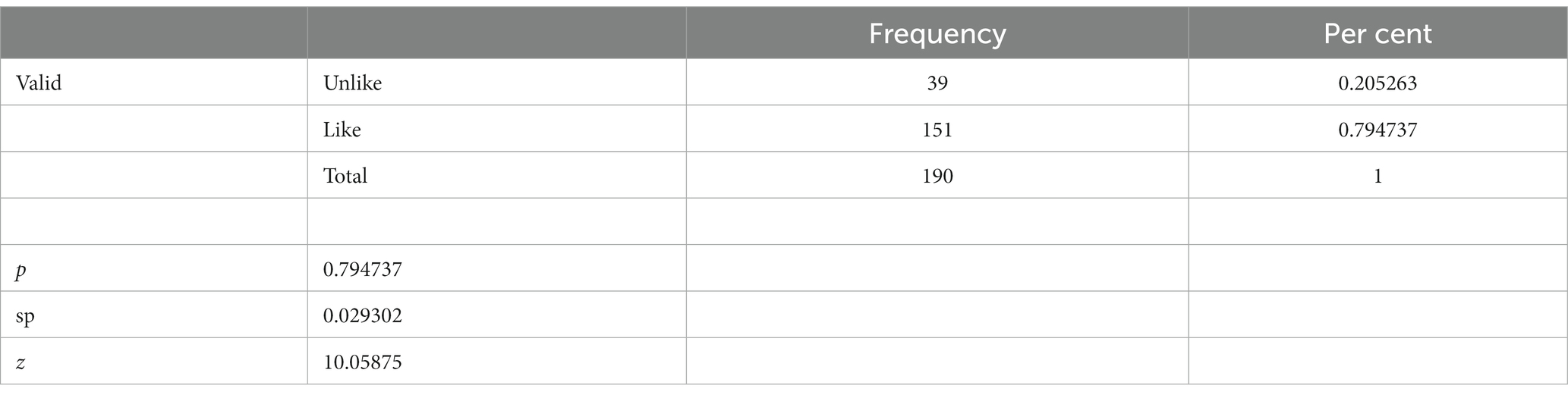

The following table (Table 8) presents a summary of the results of the tests of all of the hypotheses.

Discussion

While education about financial awareness and fundamentals is available in many countries, the understanding and acquisition of complex economic knowledge are still lacking. Therefore, introducing this kind of knowledge to individuals and even wider society is a relevant objective (Greenspan, 2005). Good financial decisions and economic attitudes may contribute to their well-being. Moreover, scientific literature highlights that it is preferable to introduce this knowledge as early as possible. My research focused on examining if accounting, combined with basic economic and financial knowledge, can be introduced into the primary school environment in a mandatory way or as a vocational subject. Referring to the literature, I first considered students in grade six to be of the appropriate age for such an introduction. However, since I also found a lot of scientific literature on the advantages of introducing economic-financial knowledge even earlier, during the lecture and the thematic events, I took into account the specificities in the students’ age, what they had learnt in school, and their life experiences with the economic environment. In light of this, I identified the third grade as the earliest possible time for introducing this complex material in a lecture format.

Using the hypotheses that were constructed based on the literature, I first examined the environment of the target group and the education system based on the close relationship between mathematics and accounting. Then, I assumed a positive relationship between subject grades for mathematics and test results for accounting knowledge. As a result, H1 was successfully verified. However, some students performed well on the accounting knowledge test but were not considered successful at mathematics. Nevertheless, their grades for mathematics may be crucial in the admission processes for specialized training. This indicates that if a complex subject of the former kind were introduced into education, the results of which could be taken into account during admission procedures, such students would also have the opportunity to become part of the economics profession.

My goal was to arouse interest and attract attention, therefore, I tried to make the lecture understandable and practical and to present it using lifelike situations. Before, during and after the presentation, I used the special tools of positive education. In terms of H2 (that those who liked the presentation would perform better on the related test), the hypothesis was verified. The illustration (Figure 1—Summary) shows that even those students who did not like the presentation obtained an average score. I would like to highlight this point because taking the test was not mandatory, and I did not incentivize completion of the test. This suggests that the introduction of this new subject into the education system may be fruitful.

Based on scientific literature about the relationship between gender and results, this aspect cannot be neglected, especially regarding the feminized world of the accounting profession. I put forward two hypotheses: that while girls may perform better than boys at mathematics subjects (H3a), there would be no significant relationship between gender and results on the test of accounting knowledge, or that girls would perform better in this field (H3b). Neither of the hypotheses could be verified. In mathematics, girls did not perform better than boys. Significant differences in terms of gender could only be detected for the sixth graders, and only regarding the accounting knowledge test, on which boys performed better, on average. Based on the results, it seems advisable to increase boys’ interest in this subject and to encourage their choice of a career in this area if they show promise in this area.

I also addressed the following question: whether presenting accounting topics in combination with economic-financial knowledge through lifelike situations and positive education is favorably and positively received (similarly to financial-economic knowledge alone), and whether this combination eliminates the negative perception of accounting as “boring.” I investigated students’ interest in the topic in relation to age (like/dislike, based on their response to the lecture). It was considered a success that a significant proportion of students – 80 % of both the third and sixth graders, even more than 50 %, specified in H4—liked the accounting subject with the addition of some financial and economic topics, and only a tiny proportion of them considered it boring.

The consensus regarding teaching finances is that education begins with children: “the younger, the better” (Jones and Chang, 2012). There was an age difference of roughly 3 years between the two grades. I also examined whether the three-year age gap influenced the results, regardless of the fact that students had received the same lecture. I compiled the lecture in accordance with their life experience and what they had learned at school. Then, I adapted the characteristics of their age to my presentation. Nineteen students achieved at least 90% on the test (9.5 points or more); of these, five students scored 100% from five classes. In terms of results based on the lecture on the same theme, sixth graders scored more points on average.

This subject may be covered in a series of six lectures taught by professionals. In the research, I used the first lecture for my investigations. The lectures can be adapted according to any national or international accounting standards (IFRS, etc.) and can be taught in an online classroom as well. Any economics-related studies could contain this material that covers the economic or financial problems of a given country or individuals. Related homework could be provided through an online platform (such as various financial planning tasks, which students could obtain knowledge of during the lectures). This could include lifelike scenarios such as planning economic events, organizing various programs from a given budget, or solving various financial problems. Model solutions could be presented on the platform, creating a helpful database and community interested in solving such problems and shaping financial and economic attitudes.

It is necessary for all children to learn about fundamental economic principles and processes; it can be the key to their well-being. The most appropriate way to encourage this learning is at school with the help of professionals. The key to arousing children’s interest is using complex and interactive presentations of the type that I used in my research. Through such presentations, it is possible for children to understand fundamental economic and financial concepts and processes. Understanding accounting can create a strong and complex knowledge base about economic matters. Further, students’ knowledge would be enriched in another scientific field—which in the opinion of many students who study in the economic field, is “unprestigious” (Radionova and Stoyanova, 2021).

Results suggest that introducing this subject to multiple age groups is appropriate. This complex knowledge can be introduced to primary schools in Grade 3 and could be repeated more deeply in Grade 6. The most efficient solution may be for students to acquire an understanding of the subject through a series of lectures in both the third and sixth grades. To conclude, the results suggest that introducing such a complex subject to students of primary school age is a relevant objective. The paper fills a gap in the research by describing a successful attempt to complex economic literacy.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

Ethical review and approval was not required for the study involving human participants in accordance with the local legislation and institutional requirements. Written informed consent to participate in this study was not required from the participant’s legal guardians/next of kin in accordance with the national legislation and the institutional requirements.

Author contributions

The author confirms being the sole contributor of this work and has approved it for publication.

Acknowledgments

I would like to thank all participants and contributors of the research.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abington, C., and Blankenau, W. (2013). Government education expenditures in early and late childhood. J. Econ. Dyn. Control. 37, 854–874. doi: 10.1016/j.jedc.2012.12.001

Amit, N., Ismail, R., Zumrah, A. R., Mohd Nizah, M. A., Tengku Muda, T. E. A., Tat Meng, E. C., et al. (2020). Relationship between debt and depression, anxiety, stress, or suicide ideation in Asia: a systematic review. Front. Psychol. 11:1336. doi: 10.3389/fpsyg.2020.01336

Blotnicky, K. A., Franz-Odendaal, T., French, F., and Joy, P. (2018). A study of the correlation between STEM career knowledge, mathematics self-efficacy, career interests, and career activities on the likelihood of pursuing a STEM career among middle school students. Int. J. STEM Educ. 5. doi: 10.1186/s40594-018-0118-3

Burusic, J., Babarovic, T., and Seric, M. (2012). Differences in elementary school achievement between girls and boys: does the teacher’s gender play a role? Eur. J. Psychol. Educ. 27, 523–538.

Dobos, P., and Takacs-Gyorgy, K. (2018). “Measurement possibilities of motivations and attitudes influencing the formation of unethical business behavior—The effect of self-esteem on the black economy.” in 16th International Conference on Management, Enterprise and Benchmarking Proceedings: MEB 2018. 3, 51–75. Available at: http://kgk.uni-obuda.hu/sites/default/files/MEB%202018_Proceedings_w.pdf

Doss, C. (2019). How much regulation? A fuzzy regression discontinuity analysis of student literacy skills in prekindergarten vs. transitional kindergarten. Educ. Finance Policy. 14, 178–209. doi: 10.1162/edfp_a_00242

Education through the millennium. (2001). Hungarian national textbook Publisher. Available at: http://www.edu.u-szeged.hu/~csapo/publ/2001_Csapo_Vidakovich.pdf

Flores, L. A. H., and Simon, J. S. (2011). Financial education of basic schooling students. A comparative diagnosis between city and rural schools. Rev. Cienc. Estrateg. 19, 11–34.

Gershanovich, E. A. (2004). “Investment in education: measuring private and public returns.” in 8th Korea/Russia International Symposium on Science and Technology.

Jayaraman, J. D., Jambunathan, S., and Adesanya, R. (2021). Preparedness of early childhood teachers to teach financial literacy: evidence from the US. Education 50, 1121–1136. doi: 10.1080/03004279.2021.1939399

Jones, D. A., and Chang, M. (2012). Multiplayer online role playing game for teaching youth finance in Canada. Int. J. Online Pedagog. Course Des. 2, 44–59. doi: 10.4018/ijopcd.2012040104

Kovács, P., Révész, B., and Ország, G. (2013). The measure of financial culture and attitude. 439–447. Available at: http://eco.u-szeged.hu/download.php?docID=40014

Kozina, F. L., Percic, T., and Koch, V. (2011). Critical point in financial learning process of primary school children in Slovenia. Probl. Educ. 21st century. 30, 35–46.

Mkhize, M. V. (2019). Transdisciplinary relationship between mathematics and accounting. J. Transdiscip. Res. South Afr. 15, 1–18. doi: 10.4102/td.v15i1.451

Németh, E., Béres, D., Huzdik, K., Deák-Zsótér, B., and Mészáros, A. (2022). Tanárok pénzügyi kultúrája. Public Fin. Q. Hungary 67, 7–32. doi: 10.35551/PSZ_2022_1_1

Radionova, N., and Stoyanova, R. (2021). The practical importance of accounting education for future managers. Strateg. Policy Sci. Educ. Strateg. Obrazovatel. Nauchnata Politika 29, 242–249. doi: 10.53656/str2021-3-2-prac

Robb, C. A., and Woodyard, A. (2012). Financial knowledge and best practice behavior. J. Financ. Couns. Plan. 3, 60–70. doi: 10.4148/jft.v3i1.1453

Samkin, G., Low, M., and Taylor, J. (2012). Incorporating financial literacy into the secondary school accounting curriculum: a New Zealand perspective. Australas. Acc. Bus. Fin. J. 6, 5–30.

Shaban, A., Bekirogullari, Z., and Minas, MY (2015). “The relationship between mathematics grades and the academic performance of the accounting Students’ Department (a case study on accounting department students at Al-Zaytoonah University of Jordan)” in BE-CI International Conference on Business & Economics-Book Series European Proceedings of Social and Behavioural Sciences, 4, 35–41.

Sun, F. (2016). “Research on the status quo of female accounting Professionals’ career development” in Proceedings of 2016 International Symposium-Female survival and development. 357–361.

Syukur, M. (2021). Roles of gender, study major, and origins in accounting learning: a case in Thailand. Int. J. Manag. Educ. 19:100555. doi: 10.1016/j.ijme.2021.100555

Wells, P. K. (2015). New Zealand high school Students’ perception of accounting: how and why those perceptions were formed. Acc. Educ. 24, 461–479. doi: 10.1080/09639284.2015.1072727

Keywords: accounting, education, economics, primary school, mathematics, well-being, positive education, gender performance

Citation: Nagy J (2023) Economics in primary schools: an empirical experiment from Hungary. Front. Educ. 8:1062099. doi: 10.3389/feduc.2023.1062099

Edited by:

Xiang Hu, Renmin University of China, ChinaReviewed by:

Pedro Gil-Madrona, University of Castilla-La Mancha, SpainBogdan N. Nicolescu, University of Pitesti, Romania

Copyright © 2023 Nagy. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Judit Nagy, bmFneS5qdWRpdEBmaW5hbmNlLmJtZS5odQ==

Judit Nagy

Judit Nagy