- 1School of Economics and Management, Guangzhou Institute of Science and Technology, Guangzhou, China

- 2School of Economics, Jinan University, Guangzhou, China

In the context of dual-carbon, corporate green transformation, a significant measure of the green effect of Environmental Pollution Liability Insurance (EPLI), garners substantial attention in current research. By leveraging the 2008 EPLI pilot policy as an exogenous event, this paper employs a difference-in-difference model to scrutinize the influence of the EPLI pilot on the green transformation of listed companies. We find that: (1) The EPLI pilot actively promotes corporate green transformation. (2) The pilot policy’s impact on green transformation is mediated through regional green development and enterprise investment efficiency. (3) The pilot policy manifests asymmetric effects on green transformation, influenced by regional, industrial, and enterprise-specific pollution levels, as well as government environmental concerns. (4) The EPLI pilot policy engenders enduring financial implications and contributes to the governance of information. This study is beneficial to enrich the research on the EPLI system and green transformation of enterprises that provide policy suggestions for improving the green financial system and promoting the green transformation of enterprises.

1 Introduction

As a crucial element of green finance, Environmental Pollution Liability Insurance (EPLI) serves as a vital tool for averting environmental risks and mitigating societal pollution. The objective of green finance is to actualize the ecological advancement of society as a whole. It aims to rectify the issue of environmental externalities by redirecting resource allocation and promoting eco-friendly concepts. This, in turn, propels the eco-conscious evolution of microenterprises, leading them to attain their designated objectives (Tolliver et al., 2021). Green innovation stands as a pivotal facet of ecological progress, fostering increased employment opportunities and advancing environmental governance (Kunapatarawong and Martínez-Ros, 2016; Guo et al., 2021). It embodies a pivotal facet of corporate green transformation. For corporations, green innovation yields positive effects on corporate performance, enriching corporate value and competitive advantage, among other benefits (Tang et al., 2018; Tu and Wu, 2021; Hao et al., 2022). Consequently, enterprises are compelled to place significant emphasis on green innovation. They must bolster their green core competencies and uphold an environmentally responsible image to effectively undergo the process of green transformation (Chen, 2008).

EPLI is an insurance that takes the loss caused by a pollution accident to a third party as the subject matter of the corresponding environmental liability by the provisions of the law, and the policyholder can be a sewage disposal enterprise. The policyholder can be a sewage disposal enterprise. The insured enterprise insures the loss caused by the pollution accident in the future and pays the insurance cost to the insurance company at the agreed premium rate according to the provisions of the insurance contract, and the insurance company compensates the corresponding amount according to the provisions of the contract in the event of an environmental accident. EPLI is beneficial to change the existing situation of “enterprises make profits from illegal pollution and everyone pays the bill for environmental damage”, which leads to the liability of environmental pollution loss and promotes the standardization and rationalization of China’s environmental protection responsibility.

Ralston (1979) developed the pollution loss pricing mechanism of EPLI based on the theory of externalities, marking the inception of EPLI research. In its early stages, studies primarily centered around qualitative analysis. They delved into constructing the EPLI market, exploring the role of EPLI in regulating catastrophic risks and assessing its insurability. These studies also scrutinized the influence of EPLI as a public policy on market functioning. Moreover, they proposed normative solutions for EPLI in the face of availability crises (Katzman, 1988; Brockett et al., 2018). Presently, existing research on EPLI remains rooted in qualitative analysis. The focus largely revolves around identifying drawbacks in EPLI products, summarizing experiences from EPLI pilot programs, and offering policy recommendations for establishing a comprehensive EPLI system (Feng et al., 2014a; Feng et al., 2014b). Given the emergence of governmental policies aimed at mitigating environmental pollution due to accidents, Pu et al. (2017) designed EPLI derivatives. They further validated that these products facilitate underwriting activities for insurance companies, effectively serving EPLI’s core purpose as an insurance policy—the function of risk transfer. Notably, EPLI’s primary role involves aiding enterprises in minimizing environmental risks. Joint EPLI ventures additionally enhance the suppression of environmental risks across entire industrial alliances (Gao et al., 2018; Wang et al., 2021). Consequently, EPLI’s utility lies in enticing enterprises to seek insurance coverage. However, it’s crucial to note that only mandatory regulatory policies can compel enterprises to acquire EPLI. Incentive-based regulatory policies, on the other hand, are inadequate for boosting insurance demand (Li et al., 2023).

The literature concerning corporate green transformation primarily centers around the exploration of factors influencing green innovation. Within the realm of macro factors, it has been observed that voluntary and market-based environmental regulations exert a stronger influence on promoting green innovation compared to the impact of command-based environmental regulations (Zhang et al., 2020). Additionally, a range of green financial policies, encompassing regional green financial development, green financial reforms, and green credit policies, contribute favorably to the advancement of corporate green innovation (Huang et al., 2022; Irfan et al., 2022; Wang et al., 2022a). Furthermore, industry synergistic agglomeration and the Belt and Road initiative have been found to have a positive impact on green innovation, whereas local government debt exhibits a negative effect. Interestingly, digital finance emerges as a facilitator for green innovation (Zeng et al., 2021; Chen et al., 2022b; Li et al., 2022; Cao et al., 2023; Ni et al., 2023). Among the micro factors, both corporate governance and quality management show a positive correlation with corporate green innovation. Notably, sources of financing for green innovation encompass both internal and external options. In the context of external financing, the positive effects of government subsidies, equity financing, and debt financing on green innovation sequentially diminish (Amore and Bennedsen, 2016; Li et al., 2018; Xiang et al., 2022). Furthermore, we have to recognize the significance of information innovation and innovation networks for the green transformation of enterprises (Yin and Yu, 2022; Yin et al., 2022b).

Prior research has contended that the EPLI system holds the potential to drive corporate green transformation on a macro scale (Lyu et al., 2022; Shi et al., 2023). However, these studies diverge in their perspectives when examining the micro-level dynamics. Chen et al. (2022a) uncovered that EPLI pilots in China engendered a moral hazard predicament, thereby diminishing firms’ motivation to curtail emissions and consequently exacerbating their environmental outcomes. In contrast, Zhu et al. (2023) demonstrated that EPLI pilots contributed to enhancing firms’ environmental performance. Moreover, the research by Ning et al. (2023) unveiled a positive correlation between EPLI and firms’ green innovation efforts.

Owing to the relatively recent emergence of EPLI in China and the corresponding dearth of available data, research concerning the micro-level effects of EPLI, particularly in terms of its impact on green outcomes, has progressed slowly. In essence, the existing body of research exhibits certain shortcomings, which we elaborate on as follows: Primarily, a significant portion of the studies centered around EPLI remains confined to discussions of institutional enhancements and product design. Few studies delve into the realm of the green financial effects stemming from EPLI (Chen and Xia, 2011; Pu et al., 2017). Secondly, research aimed at understanding corporate green transformation predominantly revolves around the analysis of factors influencing green innovation. This approach often overlooks the critical question of whether corporate green innovation genuinely reflects comprehensive green transformation. Notably, scant attention has been devoted to investigating the interplay between green finance and green innovation (Huang et al., 2022; Irfan et al., 2022). Lastly, the existing body of research concerning the relationship between EPLI and microenterprise green transformation has yielded inconsistent results (Chen et al., 2022a; Zhu et al., 2023). These studies frequently rely on the EPLI-insured list issued by the former Ministry of Environmental Protection (MEP) in 2015–2016. However, this dataset bears notable limitations that hinder its ability to accurately illustrate the green finance impact of EPLI (Ning et al., 2023).

Green development represents a crucial trajectory toward achieving “carbon peaking and carbon neutrality” goals. In this context, green finance emerges as a pivotal instrument within the financial sector, fostering green development. However, the existing green financial market predominantly concentrates on facets like green credit and green bonds. Conversely, the green insurance market’s evolution has been relatively brief, characterized by an imperfect framework. To address this, China’s financial sector has implemented pilot policies to systematically enhance the green insurance market. The strategic utilization of green insurance in risk management, economic compensation, and social oversight to propel green development, particularly in the micro-enterprise domain, holds both pragmatic implications and theoretical significance. This pertains not only to refining the green insurance system but also to fostering sustainable enterprise development. Against this backdrop and research context, we employ the 2008 EPLI pilot as an exogenous event. We focus on Shanghai and Shenzhen’s A-share listed companies, with those within the pilot regions constituting the experimental group, and those outside forming the control group. By employing green innovation as a specific metric for assessing green transformation, we construct a quasi-natural experiment. Employing the difference-in-difference (DID) model, we analyze the influence of the EPLI pilot on enterprises’ green innovation, delving into the broader impact on their green transformation. Our study further probes the underlying mechanisms driving this impact, particularly the role of urban green total factor productivity and internal enterprise investment efficiency. Additionally, we investigate potential asymmetries in this effect under the moderating influences of factors such as regional and industry-specific environmental pollution, enterprise environmental protection measures, and governmental environmental concerns. Ultimately, we substantiate the influence of the EPLI pilot on corporate governance. This entails examining the policy’s effects on enterprises’ environmental protection subsidies, financial risk, bank loans, and information disclosure practices.

This paper’s potential research contributions encompass two principal aspects. Firstly, from a research perspective, we accomplish this by investigating the influence of the EPLI pilot on green innovation—an approach that has not been previously explored. Secondly, in terms of research content, we break new ground by utilizing the 2008 EPLI pilot as an exogenous shock to meticulously assess its impact on the green innovation of listed companies. We delve into both the immediate and dynamic effects of the EPLI pilot. Additionally, we delve into the intricate mechanisms underlying the policy’s impact on green innovation, unraveling the distinct outcomes resulting from the three dimensions of regional, industrial, and enterprise-level regulation. Lastly, we scrutinize the corporate governance implications of the EPLI pilot policy, thereby making a substantial contribution to the realm of research focused on green financial policies.

The rest of the article is organized as follows: in the second part, the theoretical analysis of the research hypotheses is presented. The third part provides the research design. The fourth part presents and analyzes the main empirical results. In the fifth part of the extended study, we analyze the mechanism of action effect, the moderating effect, and the corporate governance effect of the EPLI pilot policy. The last part summarizes and discusses.

2 Theoretical analysis and research hypotheses

2.1 The role of EPLI

EPLI not only encompasses a broad risk management role but also serves as a mechanism for economic compensation and social management. Within this framework, its social management aspect can effectively enact a form of “subrogated regulation.” This facet acts to curtail polluting practices by enterprises, thereby fostering the transition toward green transformation within relevant industries (Zhou and Wang, 2009; Chen and Xia, 2011). Simultaneously, the EPLI system occupies a vital position within the realm of green insurance, operating as a component of green financial policy. Its primary function revolves around channeling financial resources away from polluting sectors and redirecting them towards environmentally sustainable industries. This strategic resource allocation serves to elevate financing costs for polluting industries while reducing financing costs for eco-friendly counterparts. In this manner, it effectively addresses the predicament of environmental externalities (Huang et al., 2022; Irfan et al., 2022; Lin et al., 2023). Furthermore, the EPLI system can be approached as a market-driven environmental regulation, engendering an external regulatory impact on enterprises’ environmental conduct. This additional regulatory dimension collaborates with the “subrogation regulation” function, collectively imposing limitations on capital investments by companies. By doing so, it constrains high-pollution practices while incentivizing environmentally responsible behaviors. The outcome is a reduction in environmental risks and an enhancement of overall environmental performance (Lian et al., 2022; Zhu et al., 2023).

2.2 Research hypothesis

Considering the green financial impact and the environmental regulatory role of the EPLI system, we posit that the influence of the EPLI pilot on enterprises’ green innovation primarily encompasses four key dimensions:

Firstly, the EPLI pilot performs the essential function of risk transfer through insurance mechanisms, subsequently amplifying the enterprise’s internal governance efficacy and propelling green innovation. Following the EPLI pilot, local businesses can offload environmental risks to insurance providers by procuring EPLI coverage. On one hand, this risk transference curtails the enterprise’s liability for compensating environmental risks, thus freeing up compensation funds and alleviating constraints on internal cash flow. This enhances the efficiency of internal resource utilization. On the other hand, the EPLI coverage prompts insurance companies to intensify their environmental oversight of the enterprise. This heightened supervision enhances information transparency, diminishes asymmetries in environmental information, guides enterprises toward bolstering environmental performance, mitigates environmental risks, and reduces the likelihood of environmental incidents. Consequently, it upgrades the quality of internal environmental information within the enterprise. This, in turn, augments the efficiency of internal information governance, offering more scientific, objective, and efficient information backing for the enterprise’s environmental decision-making. This effect is particularly pronounced for activities such as green innovation and research and development, characterized by heightened risk, prolonged cycles, and gradual effects. As a result, the governance effect of the enterprise’s green endeavors is amplified. Hence, the EPLI pilot enriches enterprises’ internal governance efficiency in resource utilization and information management while simultaneously furnishing innovative resources and informational support for green innovation initiatives.

Secondly, the EPLI pilot contributes to a more judicious allocation of financial resources within the region, fostering the financing of enterprises’ green activities and thus propelling green innovation. Operating as a pivotal component of green finance, the EPLI pilot actively steers financial resources from heavily polluting enterprises towards those championing environmentally conscious initiatives. This strategic reallocation elevates the cost of capital for polluting enterprises while simultaneously reducing the financing burden on environmentally friendly counterparts. Polluting enterprises are compelled to acquire EPLI, thus incurring additional expenditure. Simultaneously, drawing from signaling theory, the acquisition of EPLI implies that enterprises bear elevated environmental risks. This, in turn, may hinder their access to external financing. As a response, these enterprises are prompted to curtail emissions through energy-saving measures, thereby bolstering environmental performance and mitigating external financing constraints. Consequently, green innovation endeavors see a corresponding upsurge. Conversely, for environmentally friendly enterprises, the EPLI pilot fosters a conducive green financing environment. This environment curtails financing costs for environmentally conscious enterprises. Concurrently, these enterprises save on premiums by not purchasing EPLI and are relieved of costs linked to conforming to stringent environmental regulations. In essence, the EPLI pilot’s financing constraints on polluting enterprises act as an impetus for innovation aimed at improving their environmental performance. Meanwhile, the “cost savings” realized by environmentally friendly enterprises under the pilot’s influence serve to propel their green innovation initiatives.

Thirdly, the subrogation effect and the social management function inherent in the EPLI system yield a form of social governance for enterprises, subsequently driving green innovation initiatives. On one hand, in a bid to forestall adverse selection and moral hazard, insurance companies comprehensively grasp and analyze the environmental information of enterprises before EPLI procurement. This scrutiny extends to continuous monitoring of enterprises’ environmental performance throughout the insurance period. The resultant guidance encourages enterprises to amplify their green behaviors while minimizing polluting practices. On the other hand, grounded in signaling theory, EPLI operates as a market signal triggering vigilance from regulators, the public, and investment entities, among other stakeholders. This external oversight proves instrumental in mitigating agency conflicts and harmonizing the divergent goals of enterprises, that seek both profitability and green objectives. Confronted by the pressure of societal supervision, enterprises are compelled to elevate their environmental performance. This dynamic underscores the green governance effect of the EPLI system. In practical terms, this entails a reinforcement of green innovation within corporate endeavors, effectively striking a balance between the pursuit of green transformation and the short-term goals of profitability.

Fourthly, the EPLI pilot imparts the ethos of green development and triggers a shift in the enterprise development paradigm, ultimately fostering green innovation. Serving as a significant institutional framework for sustainable enterprise progress, the pilot EPLI system disseminates the principles of green finance and green development. It draws enterprises’ focus toward ESG (environmental, social, and corporate governance) requisites. Concurrently, given the increasing embrace of the green development philosophy by institutional investors, enterprises have begun integrating green transformation and ESG objectives into their overarching strategies. This strategic alignment facilitates their adaptation to evolving social trends. This alignment is manifested in the allocation of corporate resources toward green investments, projects, and industries. Consequently, the enterprises pivot from resource-intensive and polluting endeavors to greener pursuits. Guided by the tenets of green development, these enterprises transition away from their former crude and polluting development models. The result is a continuous enhancement of their environmental performance. In this vein, enterprises channel efforts into green research and development, harnessing the outcomes of green innovation to drive pollution control and green-centric development. Thus, following the EPLI pilot, the influence of the green concept leads enterprises to emphasize green transformation and ESG strategies. This shift drives active participation in green initiatives and augments enterprises’ willingness to engage in green innovation.

In summary, the EPLI pilot enhances internal governance, optimizes regional resource distribution, reinforces external oversight, and steers green transformation. As a result, it propels the green innovation of enterprises within the pilot region. On this basis, we present the research hypotheses of this study:

H1: Following the EPLI pilot, the green innovation performance of enterprises in the pilot region improves.

Drawing on the preceding analysis, it becomes evident that EPLI pilots wield influence not only in terms of green governance at the micro-enterprise level but also operate as catalysts for green finance and environmental regulation, thereby fostering local green development (Fan et al., 2022; Li et al., 2023). The impact of EPLI pilots on firms’ green innovation predominantly hinges on their capacity to propel green development at the regional scale and to enhance internal governance at the firm level.

The effects of EPLI pilots are as follows: they drive local firms’ green innovation by augmenting the green total factor productivity within pilot districts. This enhancement is rooted in the EPLI system pilots’ ability to optimize district-level resource utilization, facilitate the transition toward environmentally friendly resource flows, elevate the cost associated with pollution, diminish the expense of environmental protection, and mitigate the adverse ramifications of negative environmental externalities within the districts. Simultaneously, the EPLI pilot imposes penalties on heavily polluting industries, projects, and enterprises, curbing individual enterprises’ polluting behaviors. This collective action catalyzes the green upgrading of industries across the entire region, culminating in tangible regional green development. Green total factor productivity (GTFP) stands as a pivotal metric of regional green development, demonstrating a positive correlation with green innovation (Zhao et al., 2022). This relationship emerges from the fact that regional green innovation constitutes a significant component of regional GTFP. Consequently, higher GTFP and elevated efficiency in green innovation output correlate with superior green innovation performance among local enterprises. Therefore, the EPLI pilot serves to facilitate the advancement of local GTFP, subsequently fostering enterprises’ green innovation. This underpins the hypothesis regarding the impact mechanism at the regional level proposed in this study:

H2a: The EPLI pilot influences enterprise green innovation performance through the mediation of regional green total factor productivity.

The EPLI pilot contributes to a heightened output of enterprises’ green innovation by enhancing investment efficiency within the pilot area. The magnitude of enterprise green output is chiefly influenced by the efficiency of allocating green resources and managing environmental information. Investment efficiency serves as an indicative measure of both resource and information efficiency within enterprises. Consequently, the vigor of enterprise green innovation activities is molded by financing constraints, with investment efficiency holding a pivotal role in shaping the outcomes of green innovation endeavors. EPLI pilots exert a mitigating influence on the agency predicament faced by local enterprises, primarily through their external supervision impact. This external oversight, in turn, enhances the internal governance of enterprises, leading to an amelioration in investment efficiency. Concurrently, the EPLI pilot facilitates the provision of green funding for enterprise-level green initiatives via the mechanism of resource allocation. This infusion of resources fosters improved environmental performance within enterprises, thereby enhancing relations with stakeholders. These stakeholders, in turn, contribute environmental information and offer green resource support for the enterprises’ green endeavors. This harmonious synergy serves to augment enterprise investment efficiency, ultimately refining the output of green innovation (Yang et al., 2022). As the EPLI pilot system guides enterprises toward elevating environmental investments to bolster environmental performance, it effectively addresses the issue of underinvestment. This resolution, in turn, yields a positive impact on the efficiency of input and output concerning green innovation. Drawing on the preceding analysis, we posit the following hypothesis regarding the impact mechanism at the firm level:

H2b: Following the EPLI pilot, enterprises’ green innovation performance is influenced by the enhancement of investment efficiency.

External pollution serves as a pivotal determinant impacting firms’ green innovation, thereby imposing limitations on the efficacy of green finance policies (Wang et al., 2022b). This influence may stem from the capacity of regional pollution to influence resource allocation and exert an impact on micro-firm financing constraints. Similarly, corporate pollution conduct detrimentally affects internal corporate governance, eroding financing capability and casting a negative shadow over corporate green innovation (Amore and Bennedsen, 2016). The government assumes a crucial role in regional pollution management, acting as a principal entity in this realm. Government bodies possess the ability to directly allocate resources for environmental governance, employing environmental regulatory fines to curtail corporate pollution activities. Additionally, they leverage environmental governance investments and environmental protection subsidies to steer enterprises toward energy conservation, emissions reduction, and engagement in green initiatives. This approach indirectly fosters environmental pollution management, thereby influencing enterprises’ environmental practices in line with the government’s ecological concerns (Farooq et al., 2021). Hence, there will be an asymmetric impact of internal and external environmental pollution and environmental governance on the green micro effects of the EPLI pilot policy. Based on the above analysis, we put forward the hypothesis of moderation effects:

H3: When firms face lower levels of internal and external environmental pollution and higher levels of environmental governance, the EPLI pilot policy has a stronger facilitating effect on firms’ green transformation.

3 Methodology

3.1 Sample and data source

Given that the initial cohort of EPLI pilots commenced in 2008, followed by the second cohort in 2012, the research scope of this paper encompasses Chinese Shanghai and Shenzhen A-share listed companies spanning from 2004 to 2011. We adhere to four established research conventions to handle the sample in the following manner: (1) Exclude samples categorized as ST, PT, and *ST during the specified period. (2) Exclude samples that were listed in or after 2004. (3) Omit samples operating in the financial sector. (4) Eliminate samples with missing or anomalous data about key variables. Ultimately, we amassed 10,172 annual sample observations, representing 1,813 listed companies. Among these, there are 2,777 observations for companies within the experimental area and 7,395 observations for companies in the non-experimental group. This winnows the main variables by 1% and 99% (Winsorize) to mitigate the influence of outliers on the regression outcomes.

Enterprise green patent data is sourced from the China Research Data Service Platform (CNRDS). Enterprise financial status, government subsidies, and disclosure appraisal data are procured from Cathay Pacific CSMAR and Vantage Wind databases. Regional environmental and economic data are extracted from the statistical yearbooks of each respective province and region. The frequency of usage of green development-related terms is derived from local government work reports.

3.2 Variables

3.2.1 Explanatory variable

Digital green innovation is one of the important green innovation contents and an important index to measure the green transformation of enterprises, which plays an important role in the digitalization and decarbonization strategy of agricultural high-end equipment manufacturing enterprises (Yin et al., 2022a).

Citing Amore and Bennedsen (2016) and Tang et al. (2018), we employ the count of green patents (referred to as GI, calculated as the logarithm of the number of independently filed green patents plus one) as a metric to gauge firms’ performance in green innovation. This choice allows us to portray the extent of companies’ endeavors towards environmental sustainability. Furthermore, during the robustness assessment, we substitute the count of green patents (GI) with the count of green invention patents (abbreviated as GCI, calculated by taking the logarithm of the number of independently filed green invention patents plus one) as well as the count of green utility model patents (abbreviated as GUI, calculated by taking the logarithm of the number of independently filed green utility model patents plus one). This alteration permits us to delve into the caliber of enterprises’ green innovation, adding a layer of depth to our analysis.

3.2.2 Mechanism variables

To elucidate the mechanism behind the impact of the EPLI pilot on enterprises’ green transformation, we incorporate specific variables based on the methodologies outlined by Pastor and Lovell (2005) and Richardson (2006). These variables encompass urban green total factor productivity (GTFP) at the regional level and over-investment (OI) at the enterprise level. These measures serve to quantify the extent of regional green development and the efficiency of enterprises’ investment, respectively. The computation of green total factor productivity involves a fusion of an over-efficient SBM model, which takes into consideration undesired outputs, and the Malmquist productivity index. This amalgamation yields a metric for the growth of urban total factor productivity under a global reference data envelopment analysis framework. Concurrently, we gauge underinvestment (LI) through an inefficient investment model, which is formulated as follows:

In the given context, where I signifies new investment (defined as the ratio of cash utilized for procuring fixed assets, intangible assets, and other long-term investments about total assets), Q denotes Tobin’s Q value (calculated as total market capitalization divided by total assets), Leverage represents the leverage ratio (total liabilities divided by total assets), Cash signifies the cash ratio (cash assets divided by total assets), LAge stands for the duration since listing, Size pertains to the firm’s size (logarithmic representation of total assets), and SR stands for excess return (annual return accounting for reinvestment of cash dividends—A-share market composite annual return); λt symbolizes the time-fixed effect, ηj signifies the industry fixed effect, and ζ represents the residual term. Specifically, when ζ>0, it indicates that the firm is overinvesting, whereas when ζ<0, it signifies that the firm is underinvesting. Derived from the aforementioned inefficient investment model, overinvestment (LI) materializes when the residual term (ζ) registers a value below zero.

3.2.3 Moderation variables

According to the above analysis and based on relevant research (Darnall et al., 2008; Hu et al., 2021; Zhang, 2022), we introduce DPI, HPI, HERS, and DGF variables to test the impact of the moderating effects of regional environmental pollution, industry pollution, corporate environmental management, and regional government environmental concerns on the benchmark regression. DPI represents the regional environmental pollution index, which is obtained by the annual normalization of regional industrial wastewater, exhaust gas, and solid waste. HPI is a binary variable for pollution-intensive industries that equals 1 if the firm is in pollution-intensive industries and 0 otherwise. HERS is a dummy variable for an environmental management system, which if the enterprise environmental management system disclosure projects1 are higher than the average value of the annual industry takes the value of 1, otherwise takes the value of 0. DGF is the regional government’s green development concern that is obtained by normalizing the green development word frequency of the regional government’s working report. The green development word frequency is collected manually, and the green development word database is shown in Appendix Table 1.

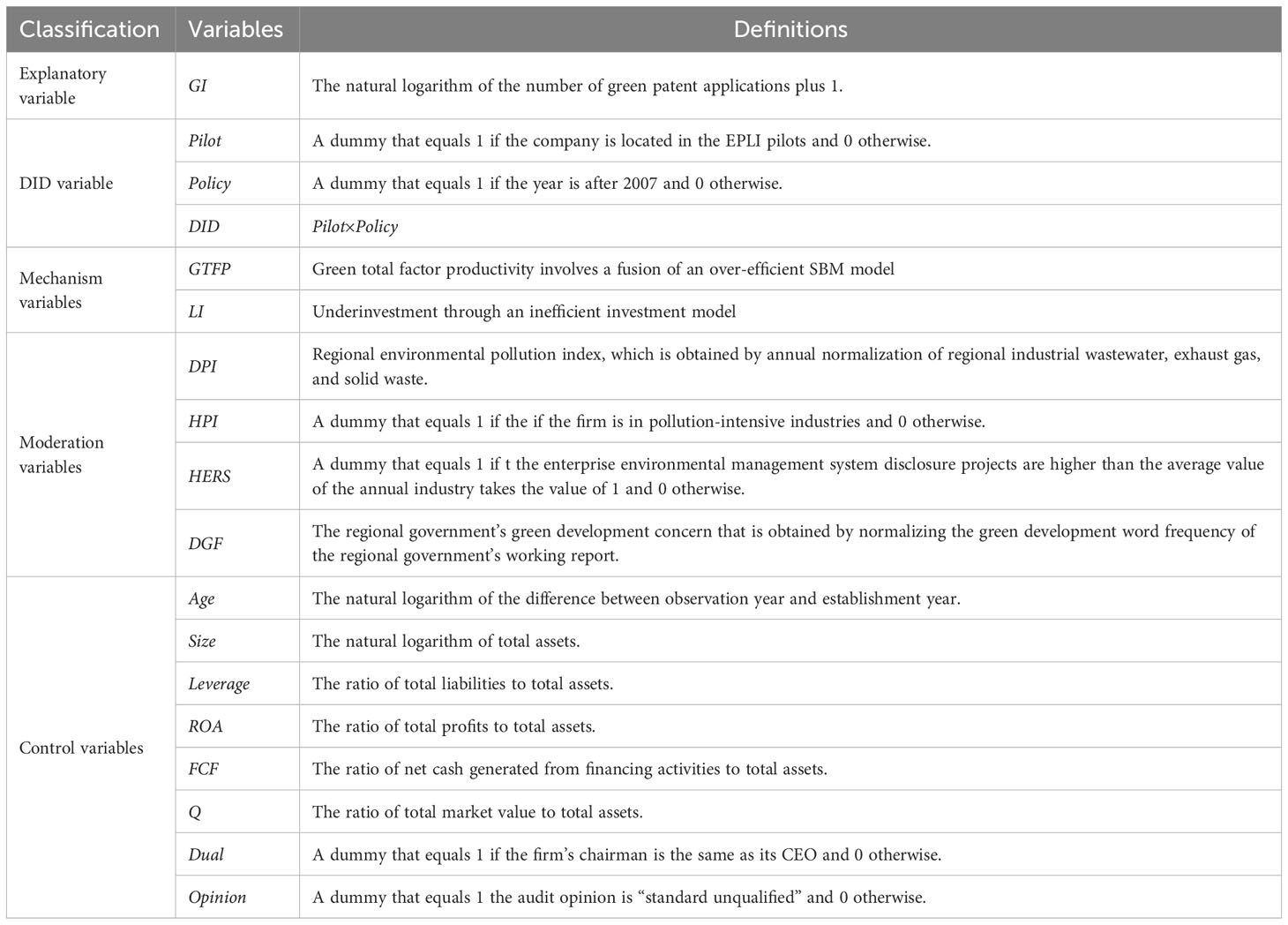

3.2.4 Control variables

Drawing from prior research (Li et al., 2018; Xiang et al., 2022), we incorporate the subsequent corporate financial characteristic variables and all-encompassing governance variables as control measures: year of establishment (Age), firm size (Size), leverage (Leverage), return on assets (ROA), net cash generated from financing activities (FCF), Tobin’s Q (Q, calculated as total market capitalization divided by total assets), Dual, and Audit opinion (Opinion). The precise symbols and corresponding definitions of these variables are detailed in Table 1.

3.3 Model

To assess the fundamental hypothesis H1, we formulated the subsequent DID panel regression model, drawing insights from relevant research (Chen et al., 2022a; Shi et al., 2023; Zhu et al., 2023). This model enables us to delve into the influence of the EPLI pilot on companies’ green innovation:

Where GI signifies the dependent variable, specifically the count of green patents. The term DID represents the primary independent variable, denoting the DID variable. DID= Pilot×Policy, Pilot is a dummy that equals 1 if the company is located in the EPLI pilots and 0 otherwise, Policy is a dummy that equals 1 if the year is after 2007 and 0 otherwise. The symbol X encompasses a collection of control variables, as elaborated in section 3.2.3. The individual fixed effect is captured by δi, while λt stands for the time-fixed effect. The constant term is represented by β0, and ϵ accounts for the residual term. Lastly, the coefficient of the DID variable is denoted as β1.

3.4 Descriptive statistics

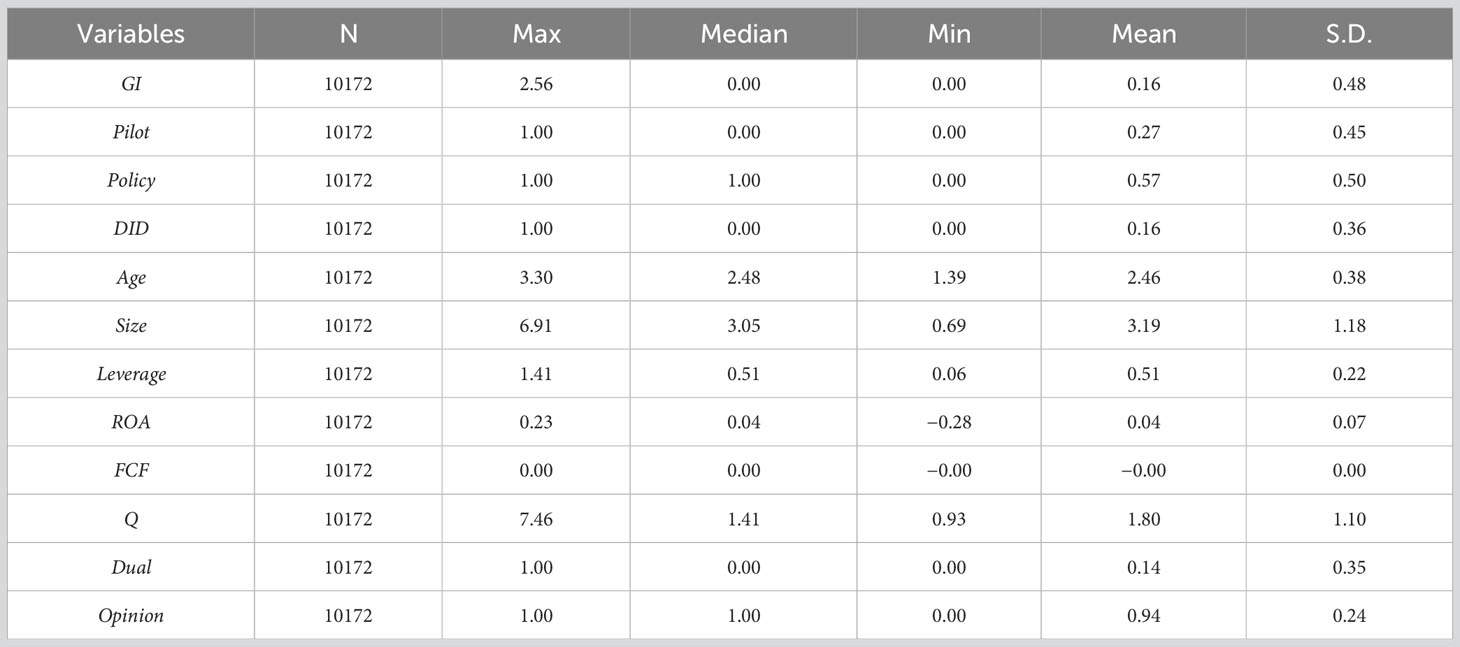

Table 2 presents the descriptive statistics for the principal variables. The findings reveal that, on one hand, the median and mean values of the count of green patents (GI) are 0.16 and 0, respectively. This suggests that a majority of the sampled firms lack instances of green innovations, with the distribution of green patent counts displaying a right-skewed trend. On the other hand, the average value of the binary group variable (Pilot) stands at 0.27, signifying that 27% of the sample represents enterprises in the pilot area, constituting the experimental group. Furthermore, the mean value of the DID variable rests at 0.16, indicating that 16% of the sample is influenced by the EPLI policy pilot.

4 Empirical results and discussion

4.1 Parallel trend test

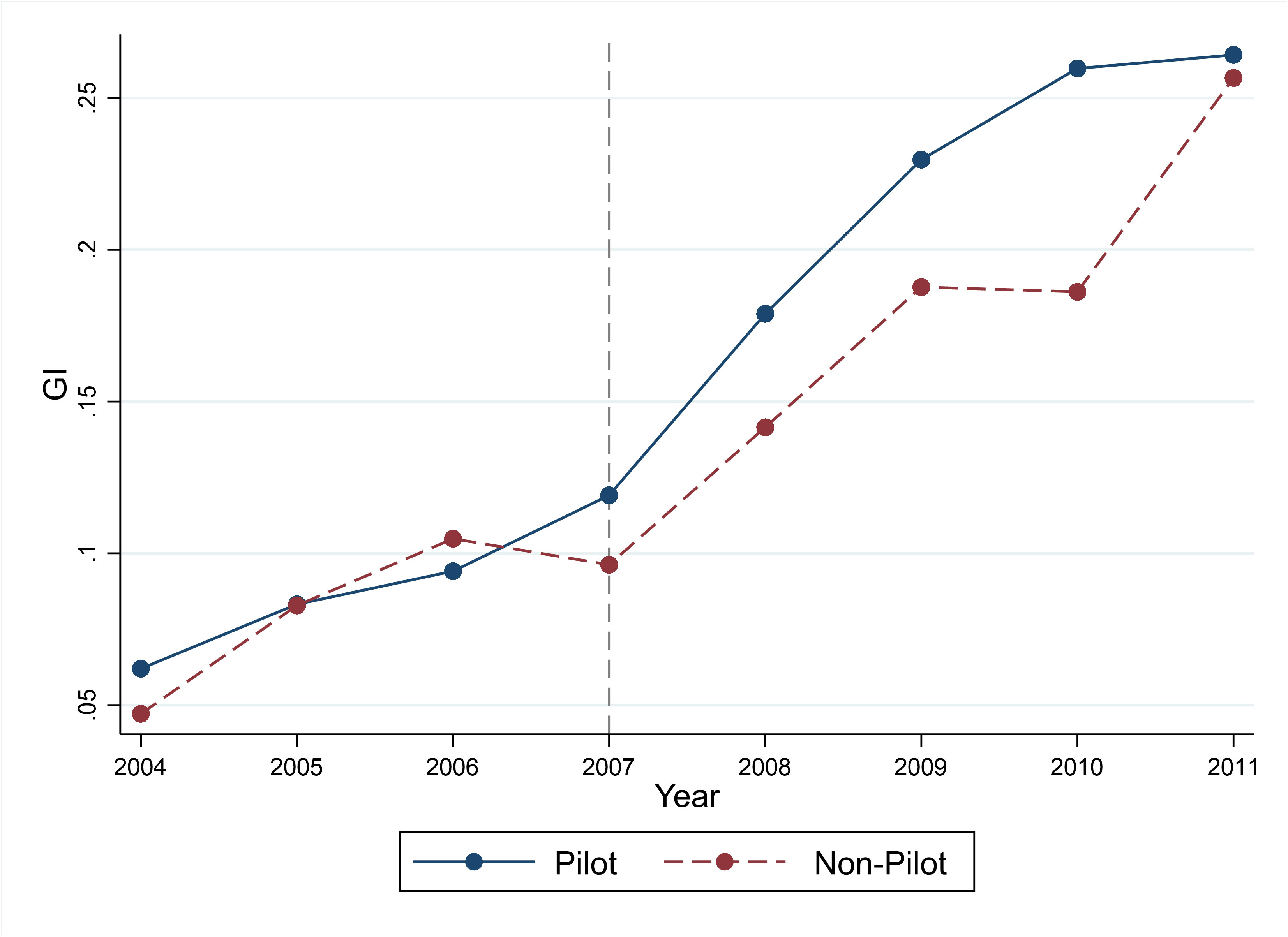

Figure 1 illustrates the temporal trajectory of the average count of green patents for enterprises spanning from 2004 to 2011. The depicted results indicate that during the period preceding the pilot phase, the count of green patents held by zone-based enterprises was essentially comparable to those outside the designated zone. However, following the implementation of the pilot policy, a noticeable contrast emerged. The count of green patents and the growth rate of enterprises situated within the pilot zone surpassed those observed for enterprises in non-pilot zones. These outcomes provide initial corroboration for H1.

Figure 1 Parallel trend test plot. Solid lines represent firms in pilot zones and dashed lines represent firms in non-pilot zones.

4.2 Baseline regression

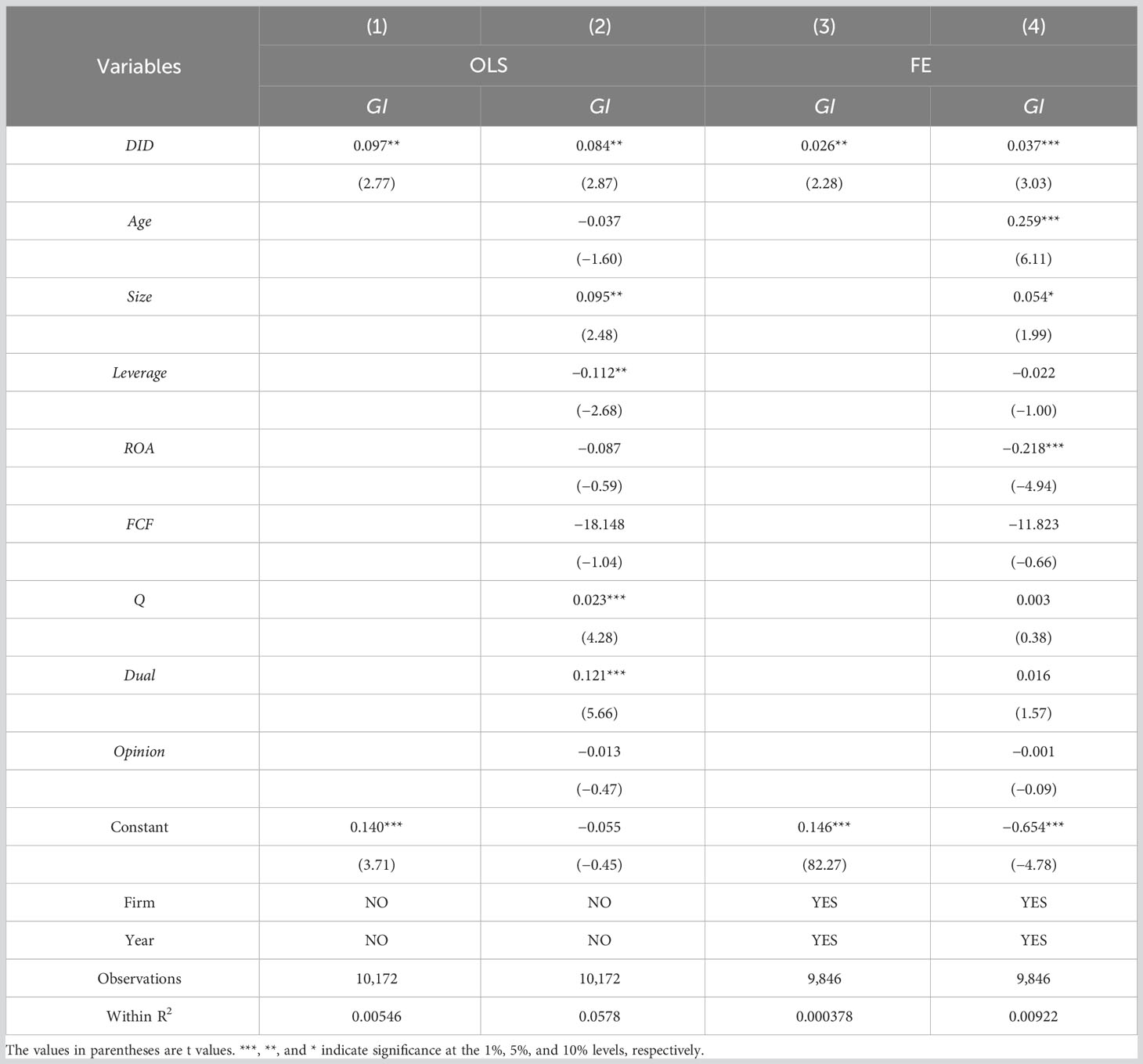

Table 3 presents the outcomes of the baseline regressions. The initial two columns display regressions conducted without fixed effects, using Ordinary Least Squares (OLS). The subsequent two columns showcase regressions incorporating individual and year-fixed effects (FE). The odd-numbered columns pertain to regressions devoid of control variables, while the even-numbered columns correspond to regressions incorporating control variables. From the regression outcomes, the coefficient estimations for the DID variable (DID) amount to 0.097, 0.084, 0.026, and 0.037 in columns (1) through (4). These coefficients exhibit significance at the 5% level for the first three columns and the 1% level for the final column. This underscores that the EPLI pilot exercises a positive influence on the count of green patents held by enterprises. The above regression results collectively endorse the notion that the EPLI pilot policy fosters green innovation among enterprises within the pilot area. Therefore, hypothesis 1 remains substantiated. Following the benchmark regression, a correlation test was executed. The test results affirm that the FE model surpasses the OLS model in performance. Consequently, we consider column (4) as the benchmark for subsequent analysis.

Analyzing the regression results of the control variables reveals the following insights. First, the coefficient estimate for Age stands at 0.259 and is significantly positive at the 1% level. This observation suggests that the longer an enterprise has been established, the more pronounced its green innovation performance tends to be. Second, the coefficient estimates for firm size (Size) register 0.054 and hold statistical significance at the 10% level. This finding indicates that firm size serves as an indicator of financial robustness, implying that enterprises with greater financial strength tend to exhibit elevated levels of green innovation output. Third, the computed coefficient for Return on Assets (ROA) rests at −0.218 and is significantly negative at the 1% level. This highlights that a higher level of profitability is not conducive to green innovation. This phenomenon could arise because heightened profitability often reflects short-term gains for the enterprise. This might, in turn, prompt management to prioritize immediate gains over long-term considerations, thereby hindering the drive toward green innovation.

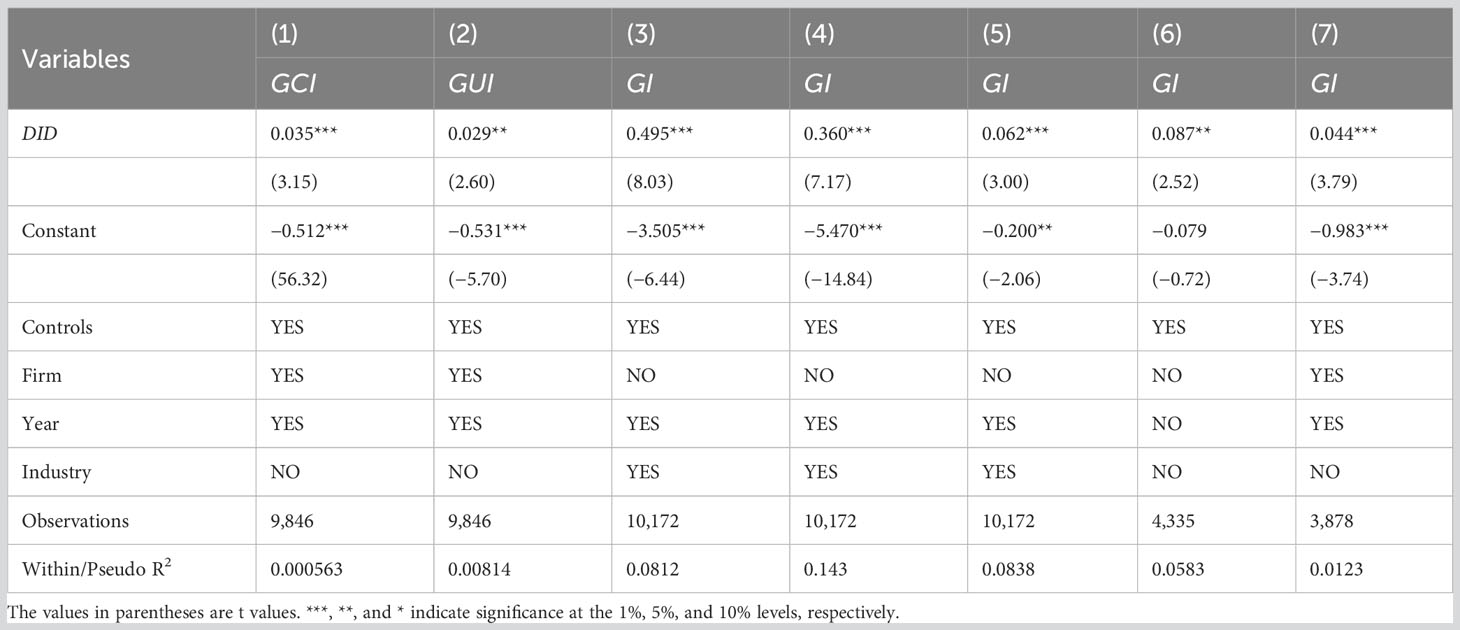

4.3 Robustness check

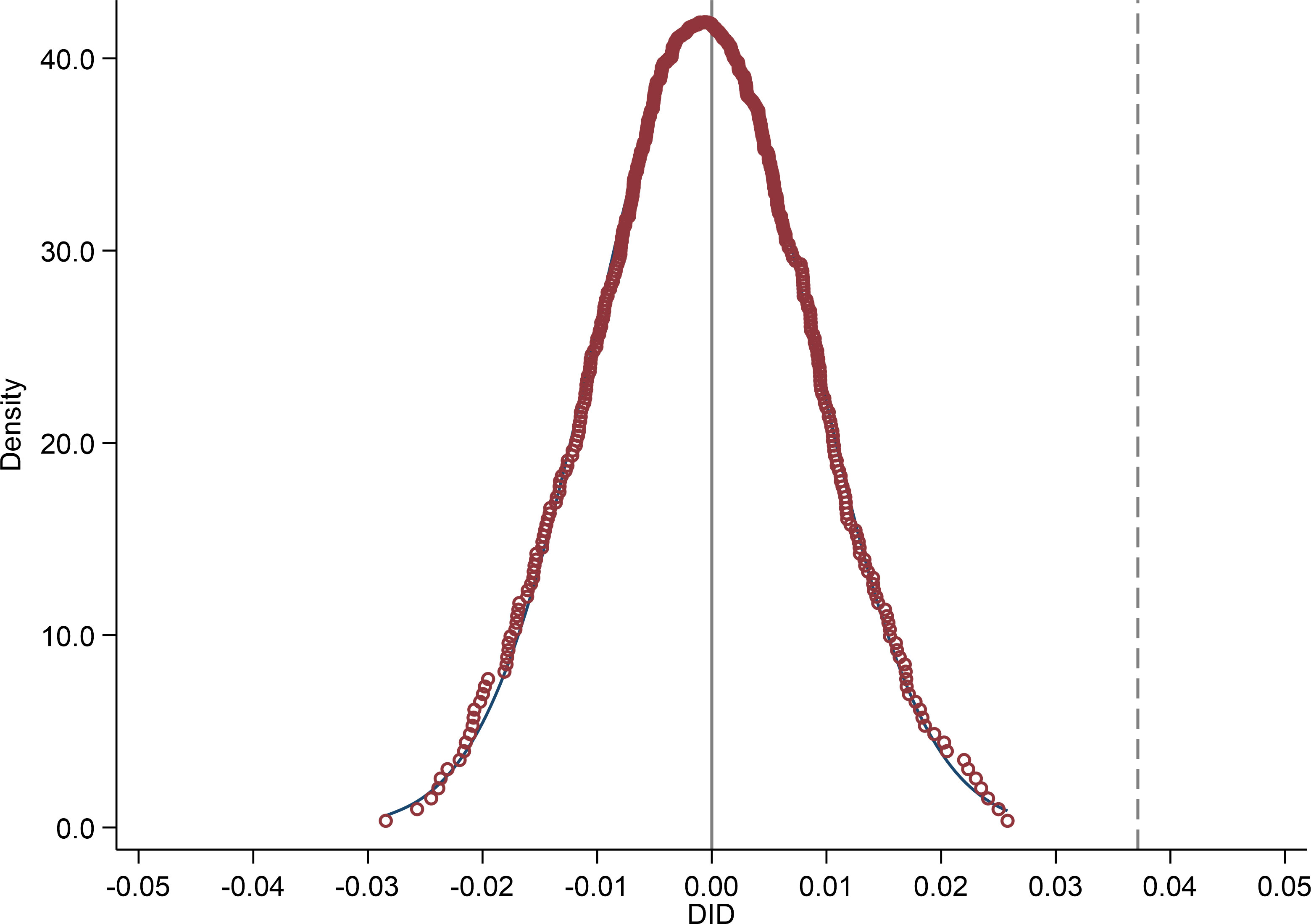

Firstly, a non-parametric replacement method is employed for conducting a placebo test. The outcomes of this test are visually depicted in Figure 2. The 95% and 99% quantiles in the placebo test are 0.015 and 0.023 which are both less than 0.037 (in the baseline regression result). Secondly, following the methodology established by Lian et al. (2022), we replace the count of green patents with the counts of green invention patents (GCI) and green utility patents (GUI). The regression results are showcased in columns (1) and (2) of Table 4. These outcomes indicate that the EPLI pilot possesses a more pronounced positive influence on green invention patents compared to green utility model patents. In essence, the EPLI pilot demonstrates its capacity to significantly foster substantial green transformation within enterprises. Thirdly, leveraging the regression techniques from Hu et al. (2021), Xiang et al. (2022), and Yu et al. (2021), we transform the baseline linear regression into a nonlinear model. This encompassed Poisson regression, negative binomial regression, Tobit regression, and the utilization of two-way fixed effects for both the year and industry. The results of this regression analysis are detailed in Table 4, specifically in columns (3) through (5). Fourthly, we execute a Propensity Matching Score (PSM) approach to create a balanced pairing of samples at a 1:1 ratio between the experimental and non-experimental areas. The paired regression outcomes are displayed in columns (6) and (7) of Table 4. Fifthly, we introduced industry fixed effects, province fixed effects, and provincial economic variables, building upon the benchmark regression, as per the methodologies outlined in Lyu et al. (2022) and Shi et al. (2023). We introduce regional variables including GNP, DFR, and DFI, where GNP stands for the growth rate of gross regional product, DFR denotes financial development (Growth rate of financial output), and DFI signifies fixed-asset investment (Ratio of fixed-asset investment to gross regional product). The results of these regression adjustments are elucidated in Table 5. The robustness tests outlined above consistently corroborate the empirical outcomes established by the benchmark regression, thereby reinforcing the validity of our findings.

5 Extensive research

5.1 Impact mechanism test

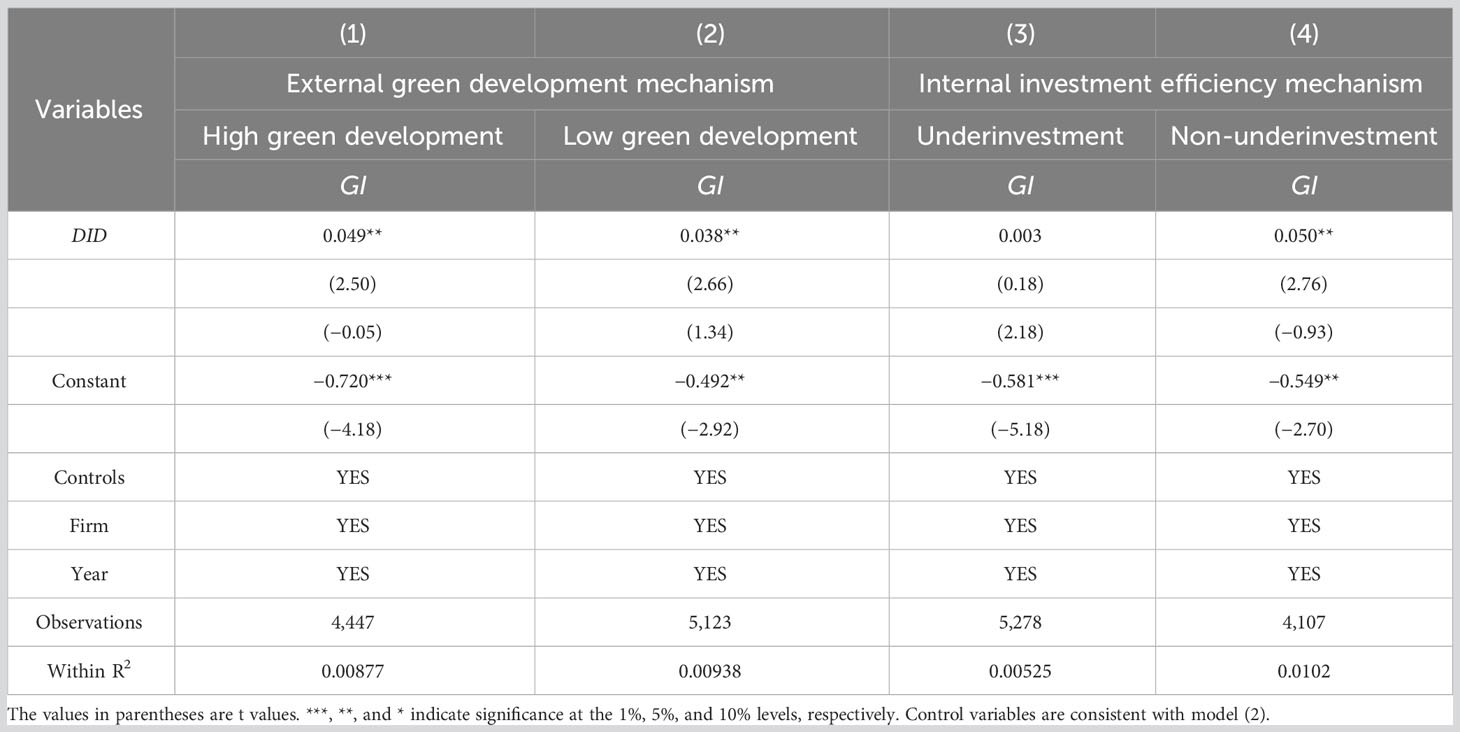

Drawing inspiration from Bostwick et al. (2018) and Stuart (2022), we pursued a bifurcated analysis. Firstly, we recalibrated the regressions based on the annual averages of urban green total factor productivity (GTFP) at the regional level. This entailed categorizing samples above the mean into the “high green development” group, and those below the mean into the “green development” group. The results of these regressions are presented in columns (1) and (2) of Table 6. From the regression outputs, the coefficient estimations for the DID variable (DID) stand at 0.049 and 0.038, both statistically significant at the 5% level. Notably, the coefficient value for the high green development group surpasses that of the low green development group. This indicates that the degree of regional high green development influences the dynamic between the EPLI pilot and local enterprises’ green innovations. This insight suggests that the EPLI pilot, by stimulating regional green development, fosters corresponding local enterprises’ green innovation. Consequently, hypothesis H2a gains support. Conversely, we classified the sample into underinvestment and non-underinvestment groups based on firm-level underinvestment (LI). Within the underinvestment group, the coefficient estimation for the DID variable (DID) is 0.003, lacking statistical significance. In contrast, within the non-underinvestment group, the coefficient estimation for the DID variable (DID) amounts to 0.005, bearing statistical significance at the 5% level. This implies that the EPLI pilot exclusively influences the green innovation of firms in the non-underinvestment group. This observation signifies that the EPLI pilot rectifies underinvestment among local firms, subsequently catalyzing green innovation. Consequently, hypothesis H2b remains unchallenged.

5.2 Moderation effects analysis

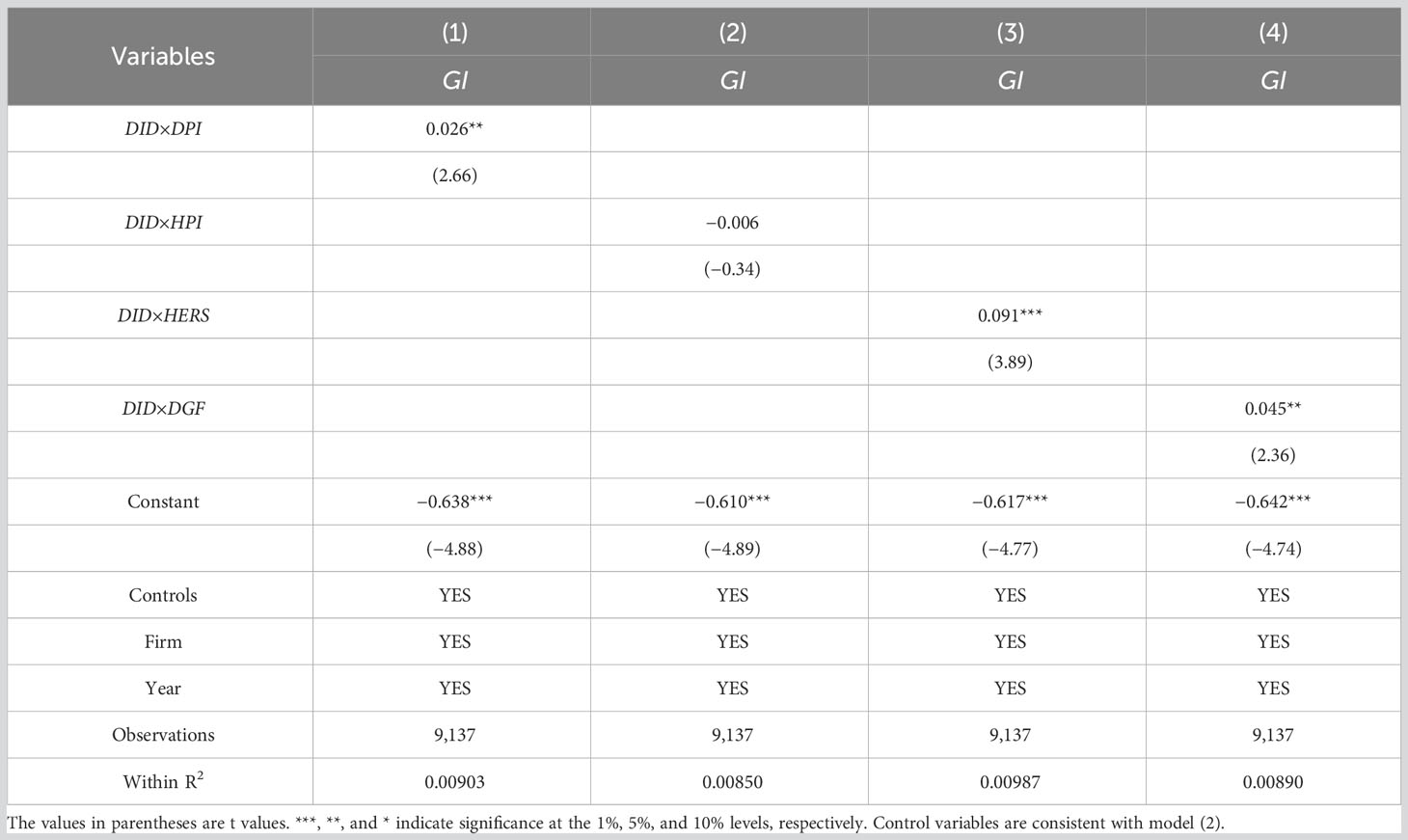

Table 7 presents the regression outcomes concerning the moderating effects. Analysis of these results yields the following conclusions: Firstly, the coefficient estimation for the cross-multiplier of the DID variable and the regional environmental pollution index (DID×DPI) stands at 0.026, displaying statistical significance at the 5% level. However, its magnitude is smaller than that of the coefficient value for the DID variable (DID) in the baseline regression, with a correspondingly reduced significance level. This suggests that a higher degree of regional environmental pollution weakens the promoting impact of the EPLI pilot on green innovation. In other words, as regional environmental pollution worsens, the efficacy of the EPLI pilot in driving enterprises’ green innovation diminishes. Secondly, the coefficient estimation for the cross-multiplication term of the DID variable with the binary variable denoting pollution-intensive industries (DID×HPI) is −0.006, lacking statistical significance. This signifies that industry-related pollution has eroded the positive influence of the EPLI pilot on enterprises’ green innovation. Thirdly, the coefficient estimation for the cross-multiplier of the DID variable and the environmental management system (DID×HERS) is 0.091, signifying statistical significance at the 1% level. This value surpasses that of the DID variable in the baseline regression. This implies that a superior environmental management system aligns with more environmentally conscious enterprises, thereby enhancing the effectiveness of the EPLI pilot in promoting green innovation. Fourthly, the coefficient estimation for the cross-multiplier of the DID variable and the government’s emphasis on green development (DID×DGF) is 0.045, holding statistical significance at the 1% level. Notably, this coefficient value surpasses that of the DID variable (DID) in the baseline regression. This underscores that the regional government’s environmental priorities amplify the impact of the EPLI pilot in fostering enterprises’ green innovation. The above regression results validate hypothesis H3.

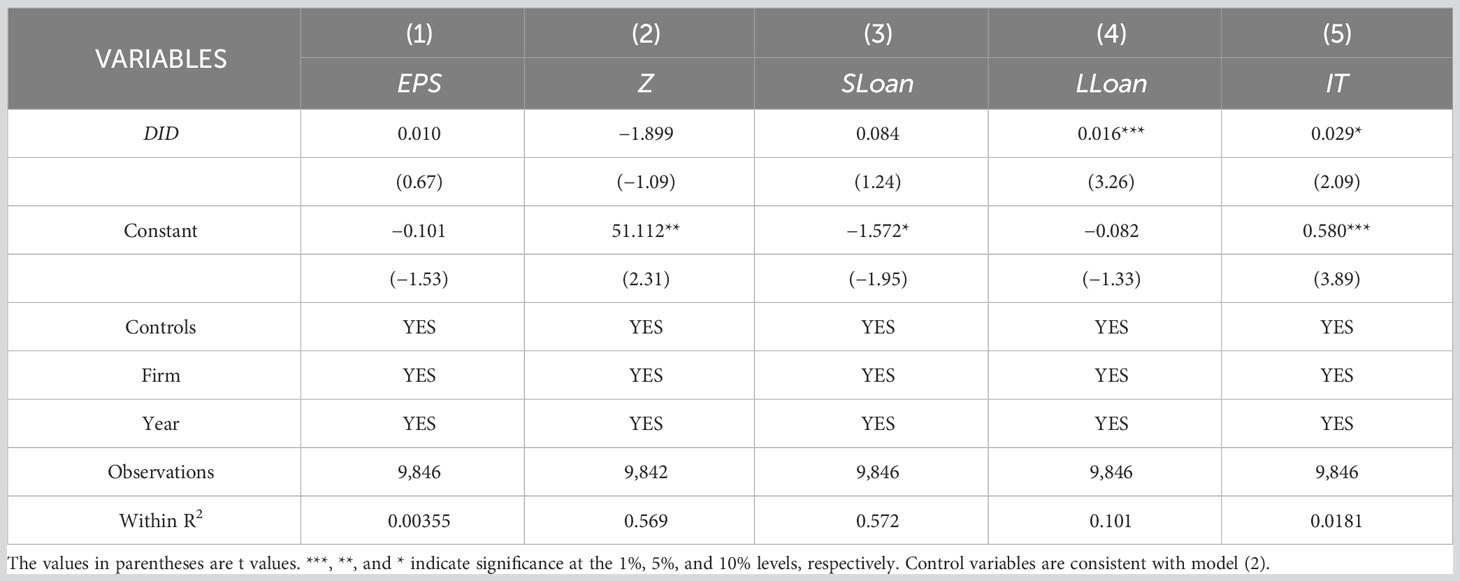

5.3 Corporate governance effects of the EPLI pilot policy

In this section, we delve into the corporate governance implications of the EPLI pilot policy. Firstly, government environmental subsidies wield significant influence over firms’ environmental behaviors and, in turn, contribute positively to firms’ green innovations (Xia et al., 2022). In light of this, we recalibrate the DID regressions by incorporating the environmental subsidy variable (EPS). EPS equals the ratio of environmental subsidy to total assets. The outcomes of these regressions are displayed in column (1) of Table 8. Upon analyzing the regression results, we find that the coefficient estimations for the DID variable (DID) lack statistical significance, indicating that the EPLI pilot has no discernible impact on corporate environmental subsidies. Secondly, green finance policies exert influence over firms’ cost of capital, consequently affecting both their financial risk (Tian and Pan, 2022) and green innovation. In consideration of this, we introduce the z-value (Z)2. The regression outcomes for this scenario are showcased in column (2) of the same table. The results reveal that the coefficient estimations for the DID variable (DID) are not statistically significant, indicating that the EPLI pilot does not engender a noticeable impact on corporate financial risk. Thirdly, external financing serves as a pivotal conduit for green innovation. Particularly noteworthy is the influence of the green credit policy, which has accentuated financing constraints for firms with subpar environmental performance, especially in terms of bank loans, thereby restricting external financing avenues (Xiang et al., 2022). To elucidate this, we introduce short-term loans (Sloan) and long-term loans (LLoan). Columns (3) and (4) showcase the pertinent regression results. Analyzing these outcomes, we ascertain that the coefficient estimation for the DID variable (DID) lacks statistical significance in Column (3), yet holds a significant positive value at the 1% level in Column (4). This indicates that the EPLI pilot does not significantly affect firms’ access to short-term loans, but it does facilitate their attainment of long-term bank loans. Fourthly, existing research underscores that firms with robust disclosure quality tend to encounter less pronounced financing constraints about their green innovations, compared to firms with inadequate disclosure practices. This dynamic is further accentuated by environmental information disclosure, which bolsters the domain of green finance (Yu et al., 2021). To reflect this, we substitute the count of green patents with the disclosure rating (IA). IA denotes the evaluation rank of information disclosure of listed companies, which is divided into excellent, good, qualified, and unqualified four grades, IA equals respectively 3, 2, 1, and 0. Column (5) in Table 8 illustrates the regression results about the information governance impact of the EPLI pilot. Analyzing these findings, we observe that the coefficient estimation for the DID variable (DID) is significantly positive at the 10% level. This signifies that the EPLI pilot policy contributes to diminishing corporate information asymmetry.

To sum up, the EPLI pilot policy yields non-significant effects on government environmental protection subsidies, financial risk, and short-term bank loans. However, it exerts a positive influence on long-term bank loans and disclosure ratings, indicating the presence of a long-term financing effect and an information governance effect stemming from the EPLI pilot.

6 Discussion and conclusion

6.1 Discussion

In this paper, we undertake a comprehensive exploration of the micro-green effects of the EPLI pilot system. Nonetheless, our study does acknowledge two inherent limitations: On one hand, our approach involves constructing a DID model utilizing the EPLI pilot policy to examine its policy effects. However, this methodology may not fully capture the entirety of the green financial effects attributed to EPLI. Based on the previous study, future research could combine the EPLI system with digital green project investment in enterprises and apply it specifically to the new energy-driven construction industry (Dong et al., 2023a).

On the other hand, our study employs green innovation as a sole proxy to gauge enterprises’ green transformation. This approach hinges upon identifying substantial green transformation based on the categorization of green patents, which could be considered somewhat one-sided. Considering these limitations, future research endeavors could be directed toward addressing these gaps. Firstly, the focus could shift towards encompassing all insured enterprises, employing premium data to measure the diverse effects of EPLI. Simultaneously, a comprehensive assessment of green transformation could be undertaken from multiple angles, including aspects such as green investment, social responsibility, ESG scores, and environmental information disclosure. This holistic approach could ascertain whether enterprises demonstrate genuine green transformation, while also investigating potential instances of greenwashing behavior from the vantage point of environmental performance. Also, future researchers can analyze the important role of digital technology in industrial structure upgrading in future research by following (Dong et al., 2023b).

6.2 Conclusion

Addressing the unresolved aspects within existing research concerning EPLI and its implications for enterprises’ green transformation, this study employs the 2008 EPLI pilot as an exogenous event. By treating enterprises within the pilot area as the experimental group and those outside it as the control group, a quasi-natural experiment is constructed. Green innovation is utilized as a proxy variable for gauging green transformation. Employing the Difference-in-Differences (DID) model, this study scrutinizes the influence of the EPLI on enterprises’ green transformation. The outcomes of this study reveal several noteworthy conclusions. Firstly, the EPLI pilot policy demonstrates a fostering effect on enterprises’ green innovation. This observation retains its significance even after undergoing a battery of robustness tests. The policy showcases the potential to drive substantial green transformation among enterprises. Secondly, the EPLI pilot policy positively impacts green innovation by stimulating regional green development and ameliorating firms’ underinvestment. Thirdly, regional pollution and industrial pollution act to temper the promotion effect of the EPLI pilot policy on firms’ green innovation. Notably, the degree of firms’ environmental protection commitment and the environmental concern of local governments wield considerable influence. A higher level of these factors strengthens the positive impact of the EPLI pilot policy on firms’ green innovation. Fourthly, the EPLI pilot policy does not significantly influence environmental subsidies, financial risks, or short-term bank loans. Nevertheless, it aids enterprises within the pilot area in securing long-term bank loans and mitigating information asymmetry. Consequently, the EPLI pilot policy manifests both long-term financing implications and information governance effects.

6.3 Managerial implication

For corporate governance, proactive participation in the green insurance market, coupled with deliberate green transformation, is advocated. Particularly relevant for enterprises with significant environmental impact, such as heavy polluters, is the proactive procurement of EPLI to mitigate environmental risks. Simultaneously, these enterprises should undertake deliberate efforts to harness green innovations in their operations, thereby executing effective environmental governance. This not only elevates their environmental performance but also enables their engagement in green activities conducive to green transformation. Such a proactive approach facilitates the optimization of investment efficiency and the attainment of green returns, ultimately guiding enterprises towards a trajectory of sustainable development.

6.4 Practical/social implications

Based on the study’s findings, this paper presents two distinct policy implications aimed at enhancing EPLI and propelling enterprises’ green transformation for practical/social: on the one hand, there is a call to enhance the enterprise environmental monitoring mechanism to fully leverage the green governance potential of EPLI. Policymakers should establish and refine a comprehensive enterprise environmental monitoring mechanism. This mechanism should incorporate variable rates tailored to individual enterprises’ environmental performances. Furthermore, the establishment of an environmental information-sharing platform is recommended. By scientifically determining EPLI rates for diverse enterprises and industries, policymakers can guide these enterprises to actively participate in the green insurance market. This process will result in an optimized allocation of market resources, thereby fostering favorable conditions for the realization of EPLI’s green governance potential. On the other hand, a robust emphasis on environmental concern and governance is crucial in facilitating regional green development. Local governments should recalibrate their approach, shifting away from exclusive economic development pursuits. Instead, a stronger emphasis on local green development is advised. This shift involves intensified efforts in regional pollution control, including heightened administrative penalties for polluting practices and increased environmental subsidies for eco-friendly initiatives. These measures serve to steer enterprises towards engaging in green practices that ultimately propel green transformation.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material. Further inquiries can be directed to the corresponding author.

Author contributions

LH: Writing – original draft, Conceptualization, Formal analysis, Funding acquisition, Project administration. ZL: Data curation, Software, Writing – original draft, Conceptualization, Formal analysis, Methodology, Visualization, Writing – review & editing. PL: Methodology, Supervision, Writing – review & editing, Project administration, Validation.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by the Guangdong Provincial Key Construction Discipline Research Capacity Enhancement Program (No. 2021ZDJS125), the Guangzhou Institute of Science and Technology Local Financial Policy and Enterprise Digital Transformation Innovation Research Team (No. 2021XBW02) and Jinan University Doctoral Innovation Program (No. 2023CXB003).

Acknowledgments

This is a short text to acknowledge the contributions of specific colleagues, institutions, or agencies that aided the efforts of the authors.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fevo.2023.1294160/full#supplementary-material

Footnotes

- ^ The disclosure projects are following: environmental protection management system, environmental protection education and training, environmental protection special action, environmental incident emergency response mechanism, environmental protection honors or awards, "three simultaneous" system.

- ^ Z=1.2X1+1.4X2+3.3X3+0.6X4+0.999X5. X1 represents the ratio of operating capital to total assets, X2 stands for the ratio of retained earnings to total assets, X3 refers to the ratio of EBITDA to total assets, X4 indicates the ratio of total market capitalization to total liabilities; and X5 denotes the ratio of operating income to total assets.

References

Amore M. D., Bennedsen M. (2016). Corporate governance and green innovation. J. Environ. Econ. Manage. 75, 54–72. doi: 10.1016/j.jeem.2015.11.003

Bostwick V., Fischer S., Lang M. (2018). Semesters or quarters? The effect of the academic calendar on postsecondary student outcomes. American Economic Journal: Economic Policy 14 (1), 40–80. doi: handle/10419/202775

Brockett P. L., Golden L. L., Aird P. R. (2018). How public policy can define the marketplace: the case of pollution liability insurance in the 1980s. J. Public. Pol. Mark. 9 (1), 211–226. doi: 10.1177/074391569000900115

Cao X., Zhao F., Wang Y., Deng Y., Zhang H., Huang X. (2023). The Belt and Road Initiative and enterprise green innovation: evidence from Chinese manufacturing enterprises. Front. Ecol. Evol. 11. doi: 10.3389/fevo.2023.1176907

Chen Y. (2008). The driver of green innovation and green image–green core competence. J. Bus. Ethics. 81, 531–543. doi: 10.1007/s10551-007-9522-1

Chen S. Y., Ding X. X., Lou P. Y., Song H. (2022a). New evidence of moral hazard: Environmental liability insurance and firms’ environmental performance. J. Risk. Insur. 89 (3), 581–613. doi: 10.1111/jori.12380

Chen D., Xia Z. (2011). Risk of environmental pollution and role orientation of governance body. Fudan. J. (Social Sci. Edition) 4, 84–91. doi: en.cnki.com.cn/Article_en/CJFDTOTAL-FDDX201104013.htm

Chen W., Zhu Y. F., He Z. H., Yang Y. (2022b). The effect of local government debt on green innovation: Evidence from Chinese listed companies. Pac-Basin. Financ. J. 73, 101760. doi: 10.1016/j.pacfin.2022.101760

Darnall N., Henriques I., Sadorsky P. (2008). Do environmental management systems improve business performance in an international setting? J. Int. Manag. 14 (4), 364–376. doi: 10.1016/j.intman.2007.09.006

Dong T., Yin S., Zhang N. (2023a). New energy-driven construction industry: digital green innovation investment project selection of photovoltaic building materials enterprises using an integrated fuzzy decision approach. Systems 11, (1). doi: 10.3390/systems11010011

Dong T., Yin S., Zhang N. (2023b). The interaction mechanism and dynamic evolution of digital green innovation in the integrated green building supply chain. Systems 11, (3). doi: 10.3390/systems11030122

Fan M., Yang P., Li Q. (2022). Impact of environmental regulation on green total factor productivity: a new perspective of green technological innovation. Environ. Sci. pollut. Res. Int. 29 (35), 53785–53800. doi: 10.1007/s11356-022-19576-2

Farooq U., Ahmed J., Tabash M. I., Anagreh S., Subhani B. H. (2021). Nexus between government green environmental concerns and corporate real investment: Empirical evidence from selected Asian economies. J. Clean. Prod. 314, 128089. doi: 10.1016/j.jclepro.2021.128089

Feng Y., Mol A. P. J., Lu Y. L., He G. Z., van Koppen C. S. A. (2014a). Environmental pollution liability insurance in China: compulsory or voluntary? J. Clean. Prod. 70, 211–219. doi: 10.1016/j.jclepro.2014.02.027

Feng Y., Mol A. P., Lu Y., He G., van Koppen C. S. (2014b). Environmental pollution liability insurance in China: in need of strong government backing. Ambio 43 (5), 687–702. doi: 10.1007/s13280-013-0436-0

Gao Y., Li Z. W., Wang F. M., Wang F., Tan R. R., Bi J., et al. (2018). A game theory approach for corporate environmental risk mitigation. Resour. Conserv. Recy. 130, 240–247. doi: 10.1016/j.resconrec.2017.12.009

Guo J., Zhou Y., Ali S., Shahzad U., Cui L. (2021). Exploring the role of green innovation and investment in energy for environmental quality: An empirical appraisal from provincial data of China. J. Environ. Manage. 292, 112779. doi: 10.1016/j.jenvman.2021.112779

Hao X., Chen F., Chen Z. (2022). Does green innovation increase enterprise value? Bus. Strateg. Environ. 31 (3), 1232–1247. doi: 10.1002/bse.2952

Hu C., Mao J. H., Tian M., Wei Y. Y., Guo L. Y., Wang Z. H. (2021). Distance matters: Investigating how geographic proximity to ENGOs triggers green innovation of heavy-polluting firms in China. J. Environ. Manage. 279, 111542. doi: 10.1016/j.jenvman.2020.111542

Huang Y. M., Chen C., Lei L. J., Zhang Y. P. (2022). Impacts of green finance on green innovation: A spatial and nonlinear perspective. J. Clean. Prod. 365, 132548. doi: 10.1016/j.jclepro.2022.132548

Irfan M., Razzaq A., Sharif A., Yang X. D. (2022). Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol. Forecast. Soc 182, 121882. doi: 10.1016/j.techfore.2022.121882

Katzman M. T. (1988). Pollution liability insurance and catastrophic environmental risk. J. Risk. Insur. 55 (1), 75–100. doi: 10.2307/253282

Kunapatarawong R., Martínez-Ros E. (2016). Towards green growth: How does green innovation affect employment? Res. Policy 45 (6), 1218–1232. doi: 10.1016/j.respol.2016.03.013

Li X., Shao X., Chang T., Albu L. L. (2022). Does digital finance promote the green innovation of China’s listed companies? Energ. Econ. 114, 106254. doi: 10.1016/j.eneco.2022.106254

Li X. Y., Sun Y., Xie Y. T. (2023). Exploring the effect of policies on environmental pollution liability insurance in China’s highly polluting industries: applying ajzen’s theory of planned behavior. Emerg. Mark. Financ. Tr., 1–20. doi: 10.1080/1540496x.2023.2210714

Li D. Y., Zhao Y. N., Zhang L., Chen X. H., Cao C. C. (2018). Impact of quality management on green innovation. J. Clean. Prod. 170, 462–470. doi: 10.1016/j.jclepro.2017.09.158

Lian G. H., Xu A. T., Zhu Y. H. (2022). Substantive green innovation or symbolic green innovation? The impact of ER on enterprise green innovation based on the dual moderating effects. J. Innov. Knowl. 7 (3), 100203. doi: 10.1016/j.jik.2022.100203

Lin G., Shi Y., Chen H., Chen H. (2023). Revisiting the linkage between green finance and China’s sustainable development: evidence from the pilot zones for green finance reform and innovations. Front. Ecol. Evol. 11. doi: 10.3389/fevo.2023.1264434

Lyu C., Xie Z., Li Z. (2022). Market supervision, innovation offsets and energy efficiency: Evidence from environmental pollution liability insurance in China. Energ. Pol. 171, 113267. doi: 10.1016/j.enpol.2022.113267

Ni L., Yu Y., Wen H. (2023). Impact of fintech and environmental regulation on green innovation: Inspiration from prefecture-level cities in China. Front. Ecol. Evol. 11. doi: 10.3389/fevo.2023.1265531

Ning J. H., Yuan Z. M., Shi F., Yin S. (2023). Environmental pollution liability insurance and green innovation of enterprises: Incentive tools or self-interest means? Front. Environ. Sci. 11. doi: 10.3389/fenvs.2023.1077128

Pastor J. T., Lovell C. A. K. (2005). A global Malmquist productivity index. Econ. Lett. 88 (2), 266–271. doi: 10.1016/j.econlet.2005.02.013

Pu C. Y., Addai B., Pan X. J., Bo P. T. (2017). Securitization product design for China’s environmental pollution liability insurance. Environ. Sci. pollut. Res. 24 (4), 3336–3351. doi: 10.1007/s11356-016-8172-1

Ralston A. (1979). Pollution liability and insurance: an application of economic theory. J. Risk. Insur. 46 (3), 497–513. doi: 10.2307/252461

Richardson S. (2006). Over-investment of free cash flow. Rev. Accounting. Stud. 11 (2-3), 159–189. doi: 10.1007/s11142-006-9012-1

Shi B. B., Jiang L. S., Bao R., Zhang Z. Q., Kang Y. Q. (2023). The impact of insurance on pollution emissions: Evidence from China?s environmental pollution liability insurance. Econ. Model. 121, 106229. doi: 10.1016/j.econmod.2023.106229

Stuart B. A. (2022). The long-run effects of recessions on education and income. Am. Econ. J-Appl. Econ. 14 (1), 42–74. doi: 10.1257/app.20180055

Tang M. F., Walsh G., Lerner D., Fitza M. A., Li Q. H. (2018). Green innovation, managerial concern and firm performance: an empirical study. Bus. Strateg. Environ. 27 (1), 39–51. doi: 10.1002/bse.1981

Tian Y. L., Pan X. F. (2022). Green finance policy, financial risk, and audit quality: evidence from China. Eur. Account. Rev., 1–27. doi: 10.1080/09638180.2022.2109707

Tolliver C., Fujii H., Keeley A. R., Managi S. (2021). Green innovation and finance in Asia. Asian. Econ. Pol. R. 16 (1), 67–87. doi: 10.1111/aepr.12320

Tu Y., Wu W. (2021). How does green innovation improve enterprises’ competitive advantage? The role of organizational learning. Sustain. Prod. Consump. 26, 504–516. doi: 10.1016/j.spc.2020.12.031

Wang J. J., Guo Q., Wang F., Aviso K. B., Tan R. R., Jia X. P. (2021). System dynamics simulation for park-wide environmental pollution liability insurance. Resour. Conserv. Recy. 170, 105578. doi: 10.1016/j.resconrec.2021.105578

Wang H. T., Qi S. Z., Zhou C. B., Zhou J. J., Huang X. Y. (2022a). Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 331, 129834. doi: 10.1016/j.jclepro.2021.129834

Wang Y., Woodward R. T., Liu J. (2022b). The impact of exogenous pollution on green innovation. Environ. Resour. Econ. 81, 1–24. doi: 10.1007/s10640-021-00614-5

Xia L., Gao S., Wei J., Ding Q. (2022). Government subsidy and corporate green innovation-Does board governance play a role? Energ. Pol. 161, 112720. doi: 10.1016/j.enpol.2021.112720

Xiang X., Liu C., Yang M. (2022). Who is financing corporate green innovation? Int. Rev. Econ. Financ. 78, 321–337. doi: 10.1016/j.iref.2021.12.011

Yang M., Hong Y. L., Yang F. X. (2022). The effects of Mandatory Energy Efficiency Policy on resource allocation efficiency: Evidence from Chinese industrial sector. Econ. Anal. Pol. 73, 513–524. doi: 10.1016/j.eap.2021.11.012

Yin S., Dong T., Li B., Gao S. (2022b). Developing a conceptual partner selection framework: digital green innovation management of prefabricated construction enterprises for sustainable urban development. Buildings 12 (6), 721. doi: 10.3390/buildings12060721

Yin S., Wang Y., Xu J. (2022a). Developing a conceptual partner matching framework for digital green innovation of agricultural high-end equipment manufacturing system toward agriculture 5.0: A novel niche field model combined with fuzzy VIKOR. Front. Psychol. 13. doi: 10.3389/fpsyg.2022.924109

Yin S., Yu Y. (2022). An adoption-implementation framework of digital green knowledge to improve the performance of digital green innovation practices for industry 5.0. J. Clean. Prod. 363, 132608. doi: 10.1016/j.jclepro.2022.132608

Yu C. H., Wu X. Q., Zhang D. Y., Chen S., Zhao J. S. (2021). Demand for green finance: Resolving financing constraints on green innovation in China. Energ. Pol. 153, 112255. doi: 10.1016/j.enpol.2021.112255

Zeng W. P., Li L., Huang Y. (2021). Industrial collaborative agglomeration, marketization, and green innovation: Evidence from China’s provincial panel data. J. Clean. Prod. 279, 123598. doi: 10.1016/j.jclepro.2020.123598

Zhang D. Y. (2022). Green financial system regulation shock and greenwashing behaviors: Evidence from Chinese firms. Energy Econ. 111, 106064. doi: 10.1016/j.eneco.2022.106064

Zhang J. X., Kang L., Li H., Ballesteros-Perez P., Skitmore M., Zuo J. (2020). The impact of environmental regulations on urban Green innovation efficiency: The case of Xi’an. Sustain. Cities. Soc 57, 102123. doi: 10.1016/j.scs.2020.102123

Zhao X., Nakonieczny J., Jabeen F., Shahzad U., Jia W. (2022). Does green innovation induce green total factor productivity? Novel findings from Chinese city level data. Technol. Forecast. Soc 185, 122021. doi: 10.1016/j.techfore.2022.122021

Zhou G., Wang l. (2009). China’s environmental pollution liability insurance pilot and related issues analysis. Insurance. Stud. 5), 95–98. doi: en.cnki.com.cn/Article_en/CJFDTOTAL-BXYJ200905019.htm

Keywords: environmental pollution liability insurance, green transition, green insurance, green innovation, environmental regulation

Citation: Hu L, Liu Z and Liu P (2023) Environmental pollution liability insurance pilot policy and enterprise green transformation: evidence from Chinese listed corporates. Front. Ecol. Evol. 11:1294160. doi: 10.3389/fevo.2023.1294160

Received: 14 September 2023; Accepted: 01 November 2023;

Published: 17 November 2023.

Edited by:

Chuanbao Wu, Shandong University of Science and Technology, ChinaReviewed by:

Guangqin Li, Anhui University of Finance and Economics, ChinaShi Yin, Hebei Agricultural University, China

Copyright © 2023 Hu, Liu and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Pengzhen Liu, bGl1cGVuZ3poZW5Ac3R1MjAyMi5qbnUuZWR1LmNu

Ling Hu1

Ling Hu1 Pengzhen Liu

Pengzhen Liu