- 1School of Management, Shanghai University, Shanghai, China

- 2John Chambers College of Business and Economics, West Virginia University, Morgantown, WV, United States

The intertemporal stability of research and development (R&D) investment is a key issue in successfully promoting the continuation of innovation activities under high uncertainty in entrepreneurship. R&D smoothing helps firms to navigate the uncertainties of the external environment and maintain the stability of their investments in innovation. Chief executive officers (CEOs) are the most important decision-makers in firms' strategic planning. However, overconfident CEOs may overlook the importance of their firms' strategic actions on innovative activities. Drawing on upper echelons theory, this paper examines how CEO overconfidence affects firms' R&D smoothing. Using a sample of firms listed in China's Growth Enterprises Market between 2013 and 2020, this study finds that CEO overconfidence has a significant negative impact on R&D smoothing. Furthermore, our findings reveal that firms' internal control quality and institutional investor monitoring can mitigate the negative association between CEO overconfidence and R&D smoothing. Our findings provide new insights into the micro-level theoretical explanations for R&D smoothing and offer practical implications for technology-based entrepreneurial firms.

Introduction

As an important innovative activity, research and development (R&D) requires continuous investment (Hall, 2002). Sudden interruptions and the need to restart R&D investments may result in large financial losses (Himmelberg and Petersen, 1994). To succeed in R&D activities, firms must avoid unexpected R&D adjustments (Brown and Petersen, 2011) and smoothen the path for long-term R&D investment. During the Nasdaq Stock Market's volatile period from 1998 to 2002, young firms actively engaging in R&D activities generally used their cash reserves to dampen the volatility in R&D investment by ~75% (Brown and Petersen, 2011). This strategic action is often referred to as R&D smoothing—that is, maintaining the stability of R&D investments over time through establishing and using preventive cash reserves (Brown and Petersen, 2011). R&D smoothing is an important coping strategy for firms when faced with an uncertain external environment. Furthermore, R&D smoothing helps firms to maintain the stability of their investments in innovative activities, particularly in R&D-intensive firms, such as technology-based entrepreneurial firms (TBEFs), which usually have both intelligence- and capital-intensive features. However, TBEFs are often at a disadvantage in terms of market resource competition (Yu and Wang, 2021 and face higher external environmental uncertainty than mature firms. Therefore, R&D smoothing is as a key strategic action for TBEFs to establish strategic competitive advantages.

Previous studies have examined various factors affecting R&D smoothing, including financing constraints (Brown and Petersen, 2011), market timing (Shin and Kim, 2011), and innovation efficiency (Liu et al., 2021). However, these studies lack insight into the micro-foundations of R&D smoothing. More specifically, the literature on the determinants of R&D smoothing mainly focuses on organizational and contingent factors, and individual-level factors are not well-understood. In particular, firms' chief executive officers (CEOs) are their most important decision-makers; thus, CEOs' personal attributes might have a substantial impact on their firms' strategic activities (Lin et al., 2020; Jia et al., 2021; Yu et al., 2022c), which motivates a deeper exploration of CEO-level factors.

Upper echelons theory posits that executives' personal characteristics largely determine organizational decisions (Hambrick and Mason, 1984). Accordingly, TBEF CEOs exhibit high levels of overconfidence (Forbes, 2005) because they tend to have relatively high subjective estimates of their own abilities, judgments, or prospects (Hirshleifer et al., 2012). As a result, overconfident CEOs may overlook the importance of ensuring stable innovation investment when experiencing high environmental uncertainty. In this study, we examine whether and how CEO overconfidence affects TBEFs' R&D smoothing behavior.

In addition, corporate governance may influence CEOs' decision-making behavior (Munari et al., 2010; Chrisman and Patel, 2012; Hoitash and Mkrtchyan, 2022). By increasing principals' decision-making participation, corporate governance can reduce CEOs' excessive control over innovation investment decisions, thereby correcting CEO overconfidence. Therefore, we examine the moderating effect of corporate governance on the relationship between CEO overconfidence and R&D smoothing. Specifically, to incorporate an internal governance perspective, we examine a firm's internal control quality. Internal control refers to the various control and adjustment plans, organizational mechanisms, procedures, and methods implemented within an firm to effectively obtain and use various resources, improve operating efficiency, and achieve established management goals. We posit that high-quality internal controls can monitor and regulate the behaviors of overconfident CEOs. Furthermore, to incorporate external governance perspectives, we examine the moderating effect of the level of monitoring provided by institutional investors. Institutional investor monitoring refers to investors' active exercise of power by participating in corporate governance to supervise and influence executives' decisions. We posit that high levels of institutional investor monitoring can shape overconfident CEOs' decision-making behavior to mitigate the influence of CEO overconfidence on R&D smoothing.

We offer three contributions to the literature. First, by investigating the impact of CEO overconfidence, we provide a new perspective for understanding TBEFs' decisions to engage in R&D smoothing and increase our understanding of the micro-foundations of R&D smoothing behavior. This finding also provides new insights into the economic consequences of CEO overconfidence. Although the literature offers some preliminary insights into the effects of CEO overconfidence on innovation, these studies are limited to the static characteristics of R&D investment. We emphasize that R&D investment is a dynamic process in which CEO characteristics, such as overconfidence, affect R&D smoothing. Second, the literature overlooks the influence of internal controls on overconfident CEOs' intertemporal decision-making behavior. We improve our understanding of R&D smoothing by investigating the moderating effect of internal control quality on shaping overconfident CEOs' intertemporal R&D investment behavior. Third, we add to the literature concerning the governance role of institutional investors. Specifically, we confirm that institutional investors have a role in monitoring CEOs and guiding their appropriate decision-making related to R&D smoothing.

Literature Review and Research Hypothesis

Relationship Between CEO Overconfidence and R&D Smoothing

Upper echelons theory (Hambrick and Mason, 1984) suggests that CEOs' cognitive characteristics can affect firms' strategic decision-making behavior (Nielsen, 2010). Overconfidence refers to individuals' tendency to make relatively subjective estimates of their abilities, judgments, or prospects (Hirshleifer et al., 2012). In other words, it relates to individuals' overestimation of their ability to produce good results (Weinstein, 1980; Alicke, 1985). This phenomenon is especially prominent among senior executives (Langer, 1975; Larwood and Whittaker, 1977; Cooper et al., 1988). Overconfidence results in CEOs overestimating their knowledge and abilities, underestimating risks, and overestimating their ability to control events (Nofsinger, 2005), with a significant effect on their R&D investment decisions (Simon and Houghton, 2003; Galasso and Simcoe, 2011). In particular, CEO overconfidence will likely increase R&D investment in innovation (Galasso and Simcoe, 2011; Hirshleifer et al., 2012). We posit that overconfident CEOs will engage in less R&D smoothing for two reasons.

First, overconfident CEOs of TBEFs tend to overestimate their ability to control future uncertainty. As a result, they tend to reduce their firms' R&D smoothing behavior. Moreover, overconfident CEOs tend to believe that they are equipped to accurately predict future trends; therefore, they may also believe that they are able to control and mitigate future adverse events (March and Shapira, 1987). As a result, overconfident CEOs tend to believe that they can both manage R&D projects that are short of funds and successfully manage any potential future funding issues that may emerge during periods of financial difficulty. As such, overconfident CEOs are often reluctant to respond future adverse events by keeping sufficient cash reserves (Huang et al., 2016).

Second, overconfident CEOs of TBEFs tend to overestimate the positive future prospects of their firm R&D activities and therefore tend to engage in reduced levels of R&D smoothing. Overconfident CEOs also tend to overestimate the likelihood of success and underestimate the possibility of failure (Larwood and Whittaker, 1977), overestimate the expected benefits of a given project (Schrand and Zechman, 2012), and underestimate the foreseeable cost of the project (Schiff and Lewin, 1970). These actions often lead to adverse volatility in R&D investment during the R&D cycle, thereby reducing the stability of TBEFs' R&D expenditures. Overconfident CEOs also often underestimate the likelihood of financial shocks during their R&D activities and underestimate the possibility of changes in the external environment. Thus, overconfident CEOs tend to avoid keeping sufficient cash reserves to maintain the long-term stability of their R&D investments. Therefore, we propose the following hypothesis:

Hypothesis 1. Overconfident CEOs will weaken the level of R&D smoothing of TBEFs.

Moderating Effect of Internal Control Quality

Internal governance is important for innovative decision-making behavior (Chrisman and Patel, 2012) and internal governance mechanisms can influence overconfident CEOs' decision-making behavior (Anand and Anjan, 2008); therefore, internal control is one of the most important internal governance mechanisms available to TBEFs. Internal control refers to the various control and adjustment plans, procedures, and methods implemented within an organization to effectively obtain and use various resources, improve operating efficiency, and achieve established management goals. Organizations engage in internal control practices to ensure reasonable business management, legal compliance, and asset security, improve the efficiency and effectiveness of business operations, promote the realization of development strategies, and ensure that financial reports and related information are truthful and complete. Several studies assess the influence of internal control by boards of directors on CEO overconfidence using a variety of variables, including the proportion of independent directors to company directors (Mohamed et al., 2012). The quality of internal control has a negative moderating effect on mergers and acquisitions by overconfident CEOs (Kolasinski and Li, 2013). As such, we posit that when internal control quality is high in TBEFs, the weakening effects of overconfidence on R&D smoothing will be reduced. We elucidate the rationale behind our theory below.

First, TBEFs with high-quality internal control usually use a scientific decision-making process to restrict CEOs' decision-making power (Banerjee et al., 2015) and reduce overconfident CEOs' tendency to make decisions based on their subjective judgment. These aspects will alleviate any negative impact on R&D smoothing from CEO overconfidence. More specifically, by establishing a scientific decision-making mechanism, high-quality internal control practices encourage CEOs to exercise caution when making decisions (and also repeatedly evaluate the potential consequences of their decisions) in addition to strengthening the engagement of internal and external stakeholders in decision-making processes. In this scenario, both sets of stakeholders can supervise decision-making and implementation processes. Increasing principals' decision-making participation reduces overconfident CEOs' excessive control over R&D smoothing decisions, suppresses the CEOs' illusion of control, and addresses CEOs' cognitive biases to alleviate the negative effects of CEO overconfidence on firms' R&D smoothing behavior.

Second, high-quality internal control results in better risk assessment, response procedures, and other risk management systems, as well as review procedures and authorization approvals, among other internal control activities. Improving these mechanisms can effectively prevent overconfident CEOs from overestimating positive future results, which encourages CEOs' preventive behavior. The effective use of these mechanisms can alleviate the negative effects of CEOs' overconfidence on firms' R&D smoothing behavior. High-quality internal control can effectively control and reduce corporate risk (Ashbaugh-Skaife et al., 2009), help companies set goals, ensure the continuity and repeatability of R&D project risk assessment activities, and identify and evaluate various potential risks in a timely fashion, which helps companies achieve their innovative goals. High-quality internal control encourages CEOs of TBEFs to pragmatically evaluate future costs, project benefits, and financial risks; therefore, internal control enable overconfident CEOs to more reasonably predict the future prospects for their R&D activities. These actions can alleviate the negative effects of CEO overconfidence on R&D smoothing. Therefore, we propose the following hypothesis:

H2. Compared with low-quality internal control practices, high-quality internal control decreases the weakening effect of overconfident CEOs on R&D smoothing.

Moderating Effect of Institutional Investor Monitoring

Institutional investors play an important monitoring role in influencing CEOs' innovation decisions (Shleifer and Vishny, 1986; Munari et al., 2010). The monitoring role of institutional investors is an increasingly important external corporate governance mechanism for TBEFs. Institutional investors participate in corporate governance activities by actively exercising power, supervising and influencing management decision-making behavior, and urging companies to improve their operating performance. As firm owners, institutional investors have strong incentives to monitor their executive's behavior and take actions that increase their firm's value (Kang et al., 2018). Institutional investors can influence a company's decision-making behavior in a variety of areas, including mergers and acquisitions (Ferreira et al., 2010), payment policy (Grinstein and Michaely, 2005), executive compensation (Hartzell and Starks, 2003), earnings management (Chung et al., 2002), and hedging policy (Tai et al., 2014). We posit that high institutional investor monitoring in TBEFs reduces the weakening effects of CEO overconfidence on R&D smoothing for two reasons.

First, in TBEFs with high institutional investor monitoring, institutional investors will be more sensitive to risk because of their familiarity with the particularities of R&D activities. As a result, they will encourage firms to fully consider implementing preventive measures to anticipate future uncertainties. As such, institutional investors will negotiate with management and make recommendations to mitigate overconfident CEOs' subjective behavior (Smith, 1996; Carleton et al., 1998; Gillan and Starks, 2000), such as overconfident CEOs overestimating the positive future prospects of their R&D activities. In this way, institutional investors will influence CEOs' decisions and prevent overconfident CEOs from reducing R&D smoothing levels.

Second, the loss of institutional investors (usually major company shareholders) in TBEFs with high levels of institutional investor monitoring will result in certain checks and balances on CEOs' irrational decisions (McCahery et al., 2016). Indeed, CEOs' overtly irrational behavior will usually lead to dissatisfaction among institutional investors and prompt them to sell their shares (Parrino et al., 2003), which affects long-term development. Given this risk, CEOs may be more cautious in considering their ability to control the uncertainty of their future R&D activities and avoid irrational decisions that would prevent the smooth progress of their enterprise's R&D activities. In other words, the threat of losing institutional investors can prevent the negative effects of CEO overconfidence on R&D smoothing behavior. Therefore, we propose the following hypothesis:

H3. Compared with low institutional investor monitoring, high institutional investor monitoring decreases the weakening effect of overconfident CEOs on R&D smoothing.

Materials and Methods

Sample Selection and Data Resources

TBEFs commonly conduct R&D smoothing to protect their R&D investments. To assess the effects of the micro-level factor of CEO overconfidence on the varying levels of R&D smoothing across different companies and whether existing internal and external governance mechanisms can restrain overconfident CEOs' R&D smoothing behavior, we use a sample of firms listed in China's Growth Enterprises Market (or Second-Board Market) between 2013 and 2020. We choose these firms for three reasons. First, firms listed on the Growth Enterprises Market are mainly TBEFs. Second, the independent innovation of firms in the Growth Enterprises Market is mainly characterized by a longer R&D cycle and higher uncertainty. Third, the R&D investment in the model must take the previous year's data. However, the data for R&D investment before 2013 are missing too much information; therefore, we use 2013 as the starting year for our sample.

We obtain our data from the China Stock Market & Accounting Research and WIND databases and the China Listed Firms' Internal Control Index by Shenzhen Dibo Enterprise Risk Management Technology Co., Ltd. We deal with data in the following steps: (1) we exclude companies labeled as ST (i.e., those that have suffered losses for two consecutive years) and *ST (i.e., those that have suffered losses for three consecutive years); (2) we exclude listed companies from the financial industry; (3) we exclude samples from the initial public offering (IPO) year to eliminate the impact of IPO; and (4) because we adopt a systemic generalized method of moments (GMM) estimation, which requires the construction of balanced panel data, we follow Brown and Petersen (2011) and exclude samples for which the main variable is missing in a given sample period. After completing our screening, we select 195 companies with a total of 1,365 observations as the research sample. We use Stata software (v. 15.0; Stata Corp, College Station, TX, USA) to process the data. Our sample size is relatively large; therefore, we winsorize all of the continuous variables at the bottom and top 1% levels to reduce the influence of outliers.

Variable Measurement

R&D Smoothing

Considering the dynamic characteristics of R&D investment, we follow Brown and Petersen (2011) and use the correlation coefficient between the change in cash holdings and R&D investment to measure R&D smoothing.

where RDi;t represents R&D expenditure and ΔCashi;t represents changes in cash holdings in Equation (1). For firms actively using cash holdings to smooth R&D, if the change in cash holdings (ΔCash) is included with other sources of finance in an R&D regression, it will attract a negative coefficient since (holding other sources of finance constant) cash holding reductions free liquidity for R&D and cash holding increases decrease liquidity (Brown and Petersen, 2011). In other words, if firms use cash holdings to smooth R&D, the coefficient β1 of the change in cash holdings should be significantly negative. If firms do not engage in this practice, the coefficient β1 should be approximately zero.

CEO Overconfidence

Four methods can be used to measure CEO overconfidence: (1) stock option-based measure (Malmendier and Yan, 2011); (2) press-based measure (Malmendier and Yan, 2011); (3) management earnings forecasts bias (Lin et al., 2005); and (4) CEOs' relative salary (Hayward and Hambrick, 1997). First, stock option incentives are not implemented widely in China, and the corresponding data cannot be obtained (Firth et al., 2006). Second, scholars widely use financial press-based measure of CEO overconfidence, but because of the lack of relevant databases in China, the operability of this method is relatively low. Third, listed firms in China rarely make performance forecasts in advance. Most earnings forecasts are released near the time of performance disclosure; hence, there is a certain deviation in this measurement indicator. Fourth, considering the availability of data and the actual situation of China's securities market, we follow Hayward and Hambrick (1997) in using the CEOs' relative salary to measure their overconfidence. The higher the CEOs' salary relative to other executives, the more likely CEOs are to be overconfident (Hayward and Hambrick, 1997) and to exercise more power (Brown and Sarma, 2007). More specifically, Hayward and Hambrick (1997) use the ratio of the first-highest salaries divided by the second-highest salaries among executives to measure CEO overconfidence. However, because only the sum of the top three executives with the highest salaries and the sum of the salaries of all executives are disclosed in the accounting reports of listed firms of China, we use the ratio of the sum of the salaries of the top three executives with the highest salaries divided by the sum of the salaries of all executives as a proxy for CEO overconfidence. The higher the ratio, the higher the level of CEO overconfidence.

Internal Control Quality

We select the China Listed Firms' Internal Control Index as the proxy variable of internal control quality. The value range of the index is from 0 to 1,000, where larger values represent higher levels of internal control quality. Considering the value range of this index, we construct dummy variables to make the results easier to analyze. Specifically, if the index is greater than the industry annual median, the value of internal control quality is 1, indicating that the TBEF has a relatively high level of internal control quality, and 0 otherwise.

Institutional Investor Monitoring

We follow Tee (2020) and adopt the institutional investor's shareholding ratio as a proxy variable for the level of institutional investor monitoring, where higher ratios represent higher levels.

Control Variables

In terms of the control variables, we use lagged R&D (RDi;t−1) to consider the effect of the previous period's R&D investment on current R&D investment, and the quadratic term () relates to the adjustment cost of R&D investment (Bond and Meghir, 1994). We control for other major sources of R&D funding, including equity financing (Stki), debt financing (Loan), and cash flow (CF). We also control overconfidence (OC) because it is likely to affect R&D investment (Hirshleifer et al., 2012). We also use the growth rate of operating income (Growth) and market-to-book ratio (Q) as control variables for investment demand. In addition, we control for the size (Size) and age (Age) of the firms and the industry (Indi) and year (Yeart) effects. The model includes firm- (αi) and time-specific (ηt) effects. In addition, i and t represent the firm and year, respectively, and εi;t represents the random error term.

Empirical Model

We follow Brown and Petersen (2011) and Bond and Meghir (1994) in establishing Equation (2) to test H1, based on the theoretical analysis considering the various factors affecting R&D investment:

where OCi;t represents overconfidence. In line with H1, we mainly focus on the coefficient of OC × Δ Cashi;t. If the regression coefficient β2 is significantly positive, it indicates that an overconfident CEO will weaken R&D smoothing.

Based on Equation 2, we build Equation (3) to test H2 regarding the moderating effect of internal control quality on the relationship between CEO overconfidence and R&D smoothing.

where Indi;t represents internal control quality. In line with H2, we mainly focus on the coefficient of Ind × OC × ΔCashi;t. If the regression coefficient β3 is significantly negative, this indicates that internal control quality negatively regulates the weakening effect of CEO overconfidence on R&D smoothing.

Based on Equation 3, we build Equation (4) to test H3 regarding the moderating effect of the level of institutional investor monitoring on the relationship between CEO overconfidence and R&D smoothing.

where Proi;t represents the level of institutional investor monitoring. In line with H3, we mainly focus on the coefficient of Pro × OC × ΔCashi;t. If the regression coefficient β3 is significantly negative, it indicates that the level of institutional investor monitoring reduces the weakening effect of CEO overconfidence on R&D smoothing.

Estimation Method

Our models are dynamic panel regression models because they include the lag term of R&D expenditure. However, the explanatory variables may feature endogeneity problems. Arellano and Bover (1995) and Blundell and Bond (1998) suggest that a systemic GMM estimation should be used to overcome the above two problems. This method has two advantages: (1) instrumental variables or differences can be used to control the unobservable firm- and time-specific effects and (2) the explanatory and explained variables of the lag period can be used as instrumental variables to overcome the model's endogeneity problem.

We estimate our models using one-step systemic GMM estimation. We follow Brown and Petersen (2011) and treat all financial variables (including ΔCash, Stki, Loan, and CF) as potentially endogenous, and we use lagged levels dated t−2 and t−4 as instruments for the regression in differences and lagged differences dated t−1 for the regression in levels. Furthermore, we follow Arellano and Bond (1991) and report the results of serial correlation and overidentification (i.e., Sargan) tests to evaluate the effectiveness of the instrumental variables. In addition, we decentralize the cross terms involved in the model to prevent multicollinearity.

Results

Descriptive Statistics

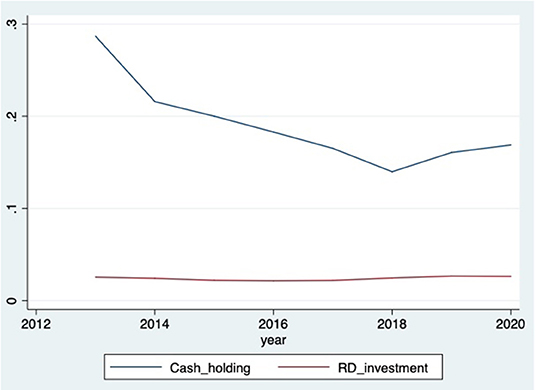

Table 1 lists the results of the descriptive statistical analysis of the main variables. The standard deviation is 0.020 and the maximum value is 0.105, indicating that there are large differences in R&D investment activities between the different firms. The lowest value of changes in cash holdings (ΔCash) is −0.265 and the highest value is 0.439, indicating that there are strong variability and inherent differences in cash holdings. These results confirm that firms use changes in cash holdings to smooth R&D investment. As shown in Figure 1, R&D investment is far smoother than cash holdings from 2013 to 2020. The average ratio of the sum of the salaries of the top three executives with the highest salaries divided by the sum of the salaries of all executives (OC) is 0.436, indicating that CEOs of TBEFs have a higher level of overconfidence.

Figure 1. TBEFs' R&D investment and cash holdings. This figure plots the total R&D investment and cash holdings to the total assets ratios of TBEFs in our sample. R&D investment shows a more stable trend from 2013 to 2020.

Hypothesis Test Analysis

We perform serial correlation and over-identification tests on our three main models. The Arellano–Bond first- and second-order serial correlation tests show that the p value of the M1 statistic for all of the models is 0 (p < 0.05), and the p values of the M2 statistic are 0.986, 0.898, 0.719 and 0.787 for Equations (1) to (4), respectively (p > 0.05), indicating that there is only a first-order serial correlation in the perturbation term but no second-order serial correlation, confirming the null hypothesis that the disturbance term has no autocorrelation. These results indicate that the systemic GMM estimation is used correctly. The results of the overidentification test show that the p values are 0.158, 0.145, 0.211, and 0.221 (p > 0.05) for Equations (1) to (4), respectively, indicating that our hypothesis (i.e., all instrumental variables are valid) cannot be rejected at the 5% significance level. Therefore, there are no overidentification problems in the four models in this study.

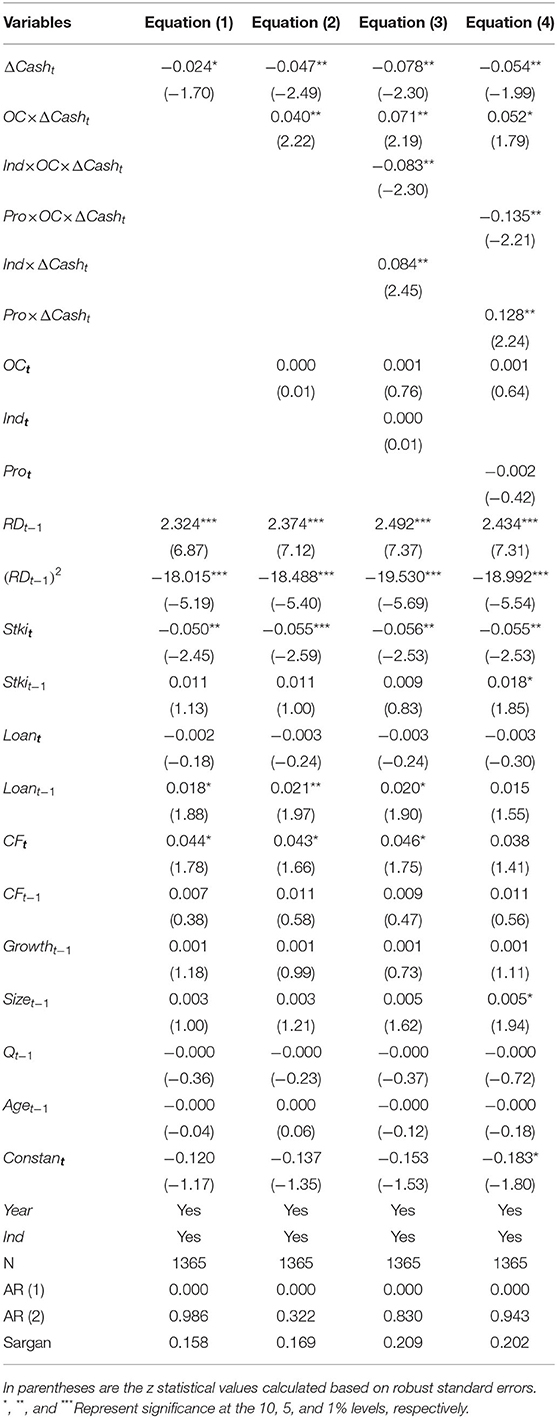

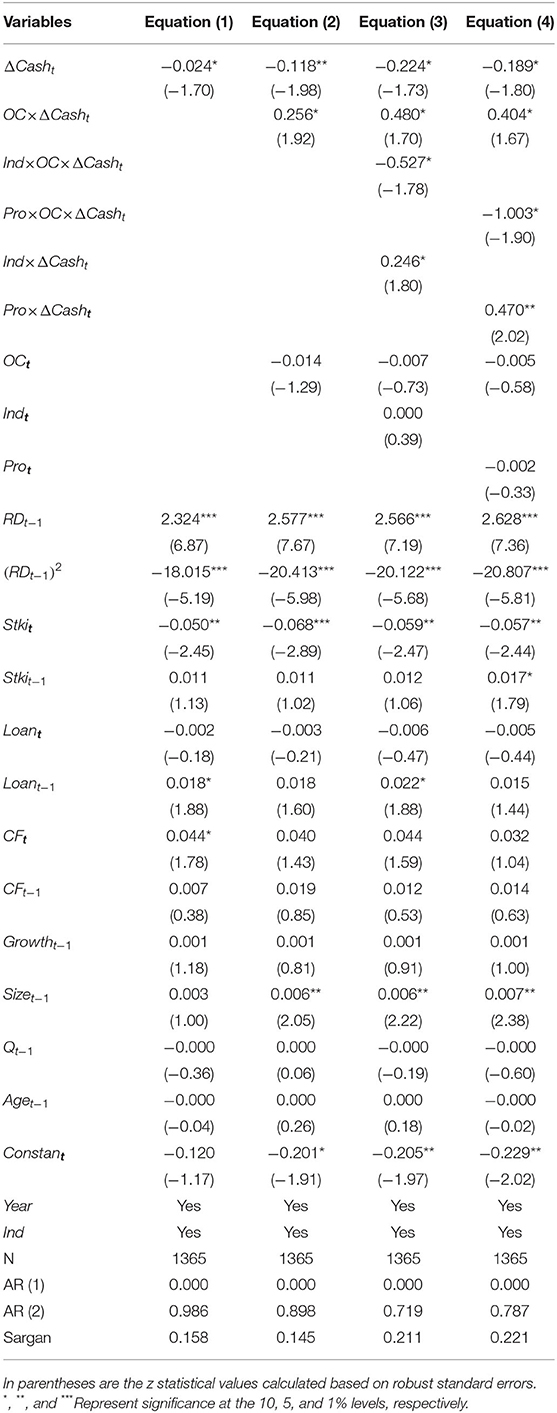

As shown in Table 2, the regression results for Equation (1) demonstrate that the estimated coefficient of changes in cash holdings ΔCash β1 is −0.024 (z = −1.70, p < 0.1), indicating a significant negative correlation between changes in cash holdings and R&D investment. In other words, TBEFs use cash holdings to smooth R&D investment.

Table 2. Test results for the effects of CEO overconfidence on R&D smoothing and the moderating effects of internal and external corporate governance.

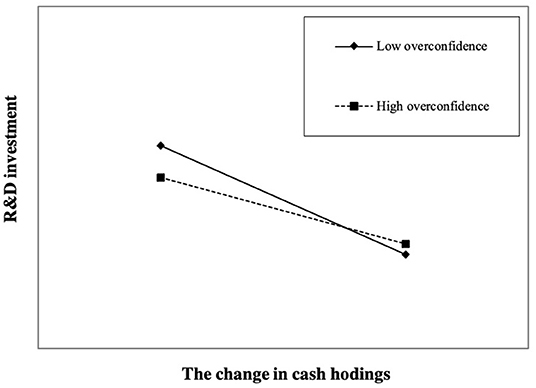

The regression results for Equation (2) demonstrate that the estimated coefficient of changes in cash holdings ΔCash β1 is −0.118 (z = −1.98, p < 0.05), and the estimated coefficient of the multiplicative term of overconfidence and changes in cash holdings is 0.256 (z = 1.92, p < 0.1), which is the opposite sign of the estimated coefficient of ΔCash β1. As shown in Figure 2, high CEO overconfidence reduces the negative correlation between changes in cash holdings and R&D investment, which indicates that the R&D smoothing effect is weaker. Therefore, H1 is supported.

Figure 2. Relationship between CEO overconfidence and R&D smoothing. We plot the interaction effect at different levels of CEO overconfidence according to the result in Table 2, Column (2). A firm with CEO overconfidence equal to one standard deviation above (below) the sample mean is regarded as having high (low) overconfidence. The degree of the negative relationship between cash holding changes and R&D investment represents the level of R&D smoothing; therefore, high overconfidence can weaken the level of R&D smoothing.

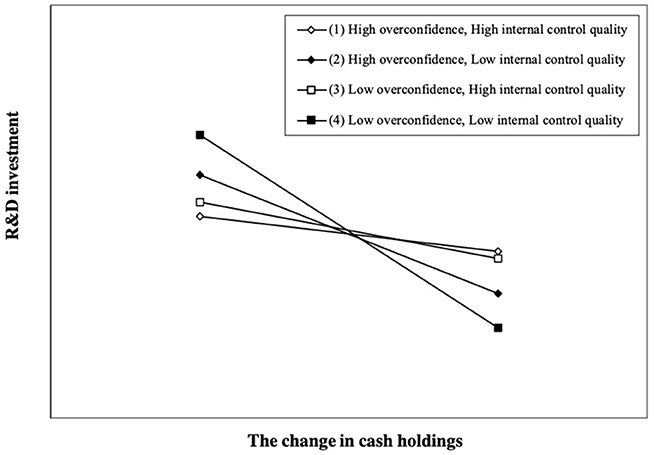

Table 2 shows the regression results of Equation (3) regarding the moderating effect of internal control quality on the relationship between CEO overconfidence and R&D smoothing. The estimated coefficient of OC×ΔCash β2 is 0.480 (z = 1.70, p < 0.1), and the estimated coefficient of Ind×OC×ΔCash β3 is −0.527 (z = −1.78, p < 0.1), which is the opposite sign of the estimated coefficient of OC×ΔCash β2. As shown in Figure 3, high internal control quality reduces the weakening effect of high CEO overconfidence on R&D smoothing. Therefore, H2 is supported.

Figure 3. Moderating role of internal control quality. We plot the interaction effect at different levels of internal control quality according to the result in Table 2, Column (3). A firm with internal control quality equal to one standard deviation above (below) the sample mean is regarded as having high (low) internal control quality. A firm with CEO overconfidence equal to one standard deviation above (below) the sample mean is regarded as having high (low) overconfidence. Compared with low internal control quality firms, high internal control quality firms decrease the weakening effect of high CEO overconfidence on R&D smoothing.

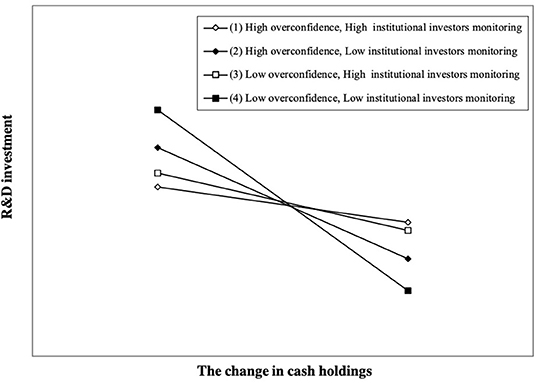

Furthermore, Table 2 features the regression results of Equation (4) regarding the moderating effect of institutional investor monitoring on the relationship between CEO overconfidence and R&D smoothing. The estimated coefficient of OC×ΔCash β2 is 0.404 (z = 1.67, p < 0.1), and the estimated coefficient of Pro×OC×ΔCash β3 is −1.003 (z = −1.90, p < 0.1), which is the opposite sign of the estimated coefficient of OC×ΔCash β2. As shown in Figure 4, high institutional investor monitoring reduces the weakening effect of high CEO overconfidence on R&D smoothing. Therefore, H3 is supported.

Figure 4. Moderating role of institutional investor monitoring. We plot the interaction effect at different levels of institutional investor monitoring according to the result in Table 2, Column (4). A firm with institutional investor monitoring equal to one standard deviation above (below) the sample mean is regarded as having high (low) institutional investor monitoring. A firm with CEO overconfidence equal to one standard deviation above (below) the sample mean is regarded as having high (low) overconfidence. Compared with firms having low institutional investor monitoring, firms with high institutional investor monitoring decrease the weakening effect of high CEO overconfidence on R&D smoothing.

Robustness Check

Alternative Measurement of CEO Overconfidence

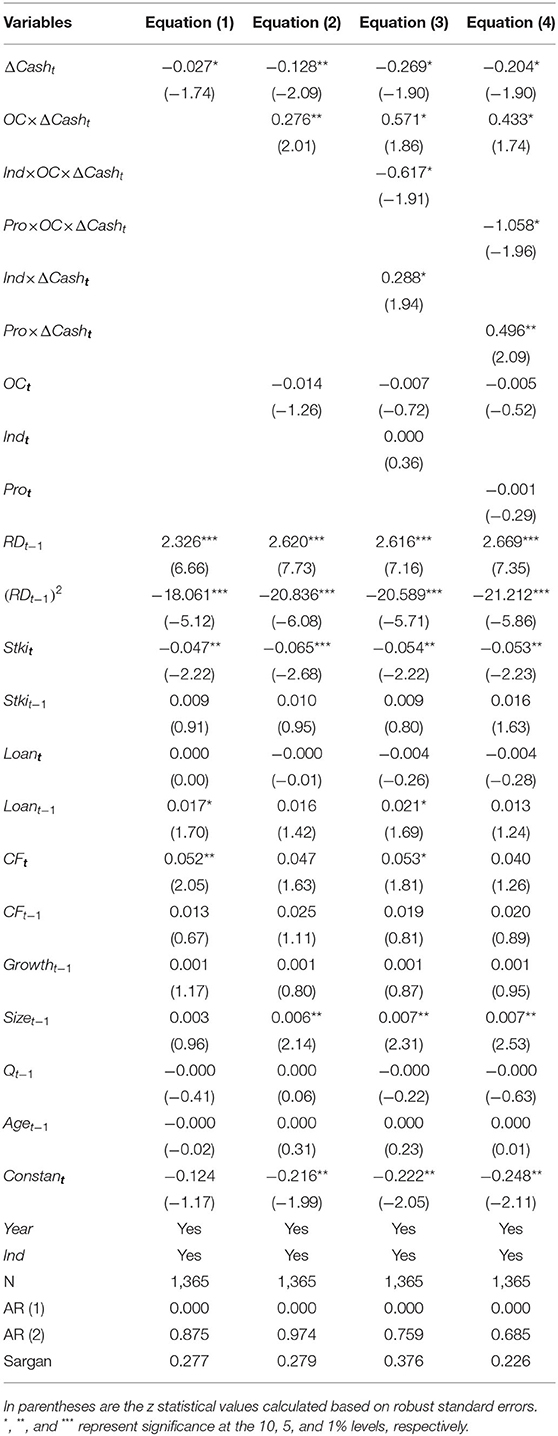

We modify the measurement of the CEO overconfidence variables to check the robustness of our findings. Specially, we construct a dummy variable for CEO overconfidence. If the sum of the salaries of the top three executives with the highest salaries divided by the sum of the salaries of all executives is greater than the annual median, the value of the overconfidence variable is 1, indicating that the CEO has a relatively high level of overconfidence, and 0 otherwise. The results remain unchanged (Table 3).

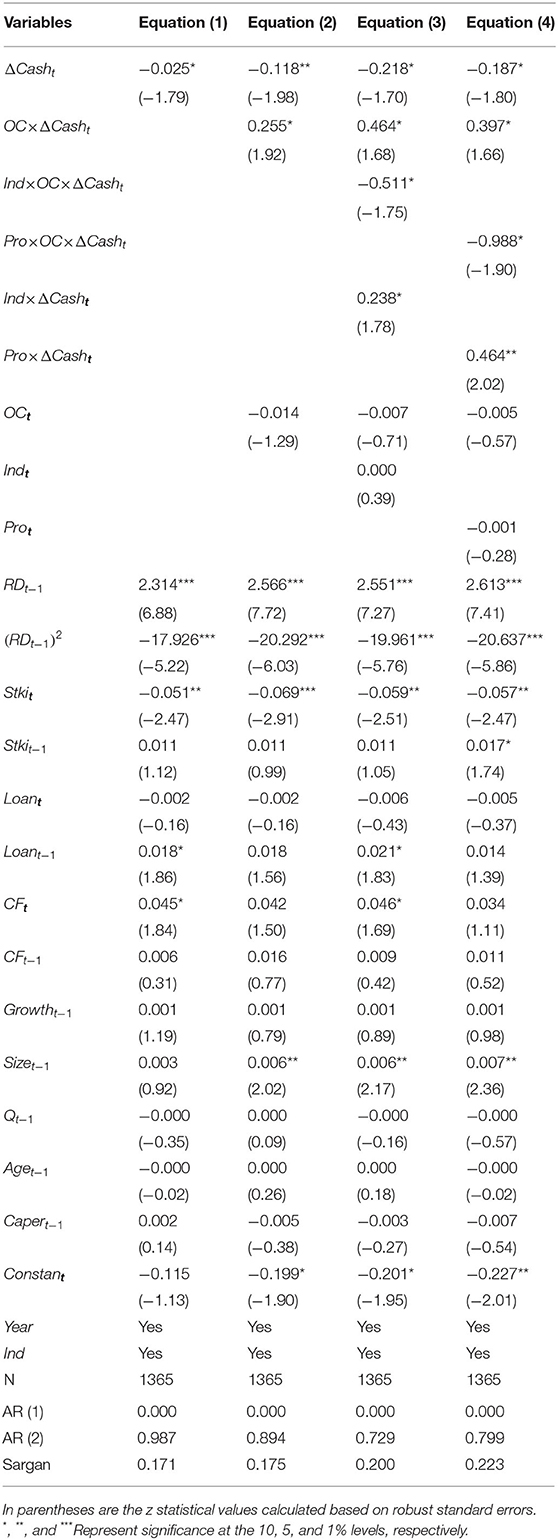

Alternative Estimation Strategies

Our findings are robust to a number of instrument sets. We adjust the instrument set of the core variable (ΔCashi;t) to include levels dated t−2 to t−3 for the regression in differences, and lagged differences dated for the regression in levels. The results remain unchanged (Table 4).

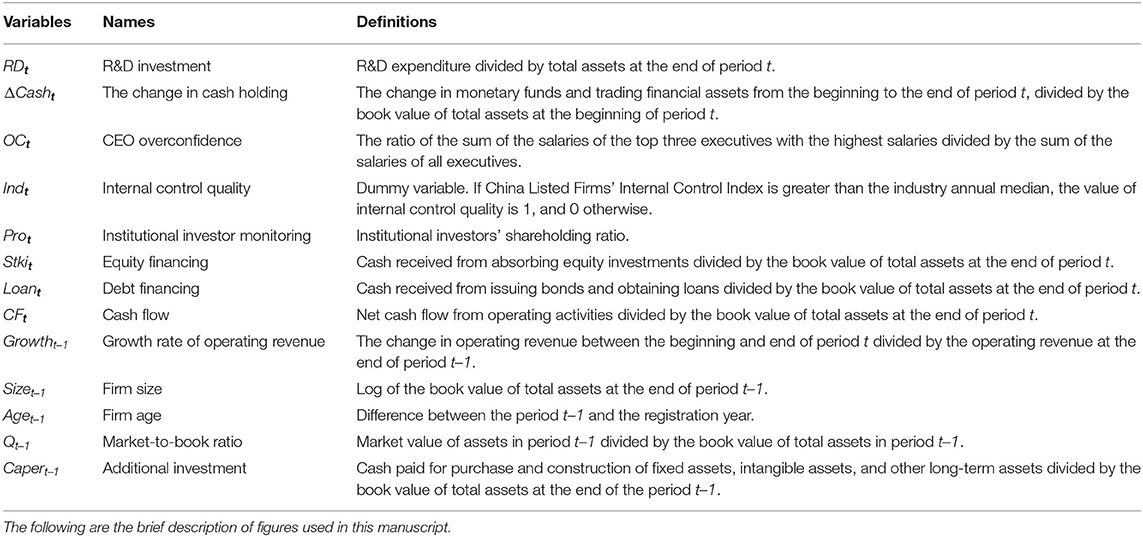

Controlling for Additional Investment

As the investment regressions may also by affected by the TBEFs' short-term investment ability, we also use the additional investment (Capert−1) as a control variable, which is measured by the ratio of Cash paid for purchase and construction of fixed assets, intangible assets, and other long-term assets divided by the book value of total assets at the end of the period t−1. Table 5 lists the results of controlling for TBEFs' new investment and the results remain unchanged.

Discussion

Conclusion

In this study, we use a sample of non-financial firms from China's Growth Enterprises Market between 2013 and 2020 to investigate how CEO overconfidence affects firms' R&D smoothing behavior. We then examine the moderating effects of two types of corporate governance mechanisms (i.e., internal control quality and institutional investor monitoring) on CEO overconfidence and R&D smoothing. The results show that CEO overconfidence has a significant negative impact on TBEFs' R&D smoothing behavior. However, improving these firms' internal and external governance mechanisms can mitigate the negative association between CEO overconfidence and R&D smoothing.

Theoretical and Practical Implications

This study offers several theoretical implications. First, we add to the body of research on the antecedents of TBEFs' R&D smoothing from the upper echelons theoretical perspective, which provides an understanding of the differences in TBEFs' intertemporal dynamic adjustment behavior regarding R&D investments. The impact on R&D smoothing from organizational and contingent perspectives has been explored in the literature (Brown and Petersen, 2011; Shin and Kim, 2011; Liu et al., 2021; Yang et al., 2021). However, CEOs are usually the key decision-makers at firms. By focusing on the CEO-level factors of R&D smoothing, this study adds to the literature on the nexus of the CEO and dynamic, intertemporal R&D investment decisions. This study also responds to calls to investigate the microfoundations of firms' strategic decisions (Yu et al., 2022b).

Our findings further enrich the body of research on the economic consequences of CEO overconfidence. Extending the results of prior studies focusing on the static characteristics of R&D investment (Hirshleifer et al., 2012), we emphasize the long-term dynamic adjustment process of R&D investments and find that CEO overconfidence inhibits R&D smoothing behavior, which represents an intertemporal R&D investment decision. Our results show that firms' current level of R&D investment may yield unfavorable results in the future because of CEOs' unwillingness to engage in measures like R&D smoothing to deal with intertemporal uncertainty and mitigate any future issues. While TBEFs must consider uncertainty (Yu et al., 2018), their unwillingness to engage in R&D smoothing will likely hinder their steady progress in future R&D activities.

Furthermore, we extend the literature on internal control in the context of overconfident CEOs' investment behaviors by considering intertemporal investment behaviors. We provide new insights into the effects of internal control on overconfident CEOs' intertemporal investment decision-making behavior from the perspective of internal governance. Kolasinski and Li (2013) demonstrate that internal control has a negative effect on overconfident CEOs' mergers and acquisitions behavior. Our results show that high-quality internal control can mitigate the inhibitory effect of overconfident CEOs on their R&D smoothing behavior. In other words, improving internal control quality can help firms maintain their R&D activities. This finding reinforces the key role of internal control in corporate governance.

Finally, we add to the literature on the effects of institutional investor monitoring. Earlier studies noted that institutional investors could influence various corporate decisions (Chung et al., 2002; Ferreira et al., 2010; Tai et al., 2014). In extending this stream of literature, our findings demonstrate that a higher level of institutional investor monitoring can control the inhibitory effect of overconfident CEOs on R&D smoothing, which reflects the importance of institutional investors' role in governance.

This study also has several practical implications. First, environmental uncertainty has brought great challenges to firm innovation (Yu et al., 2020; Lou et al., 2022). Therefore, uncertainties could lead to the unsustainability of innovative activities. CEOs' strategic choices matter to TBEFs' innovative activities (Wang X., et al., 2020); therefore, we suggest that CEOs of TBEFs should avoid excessive overconfidence in themselves to maintain the level of R&D smoothing of their firms with a view toward increasing their firms' level of preparedness regarding future uncertainties. Second, compared with mature companies, TBEFs feature lower levels of internal control. However, internal control is a key component in quelling the behavior of overconfident CEOs. Therefore, we suggest that TBEFs, especially those with overconfident CEOs, should focus on internal control. Third, compared with mature companies, institutional investors in TBEFs exert greater control over the CEOs' decisions, especially in situations where CEOs exhibit high levels of overconfidence (Yu et al., 2022a). TBEFs should focus on improving internal control quality and actively improve their institutional investor monitoring to ensure the long-term continuity of their R&D activities.

Limitations and Opportunities

Our study has some limitations that offer opportunities for the nexus of the CEO and dynamic, intertemporal R&D investment decisions. First, we assume that the external environment will not affect overconfident CEOs' intertemporal decision-making behavior when we examine the relationship between CEO overconfidence and R&D smoothing behavior. There is no evidence for how overconfident CEOs affect R&D smoothing behavior when their TBEF exists in a dynamic external environment. However, there are opportunities for adding additional business environment factors (Zhao et al., 2019; Wang B., et al., 2020) into the theoretical model of the relationship between CEO overconfidence and R&D smoothing to expand the generalizability of the results of our study. We also assume that CEOs' overconfidence is a personal characteristic that does not change over time. As our study focuses on the differences in overconfidence levels between CEOs across a variety of companies, we note that some CEOs are more likely to be overconfident than others. Therefore, our study does not consider changes in CEOs' personal overconfidence levels over time. In addition, in the measurement of CEO overconfidence, there is a certain deviation because of the data. These factors provide opportunities for improving the method for measuring CEO overconfidence. Finally, this study only understands the micro-foundations of R&D smoothing strategic decision-making behavior from the perspective of CEO overconfidence. Future studies could explore the use of new technologies, such as physiological and neuroscientific tools (Yu et al., 2022b), to further understand the effect of CEOs' emotions on their R&D smoothing decision-marking processes.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

The research was supported by the Natural Science Foundation of China (71972126, 71772117), Innovation Program of Shanghai Municipal Education Commission (2019-01-07-00-09-E00078).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alicke, M. D. (1985). Global self-evaluation as determined by the desirability and controllability of trait adjectives. J. Pers. Soc. Psychol. 49, 1621–1630. doi: 10.1037/0022-3514.49.6.1621

Anand, M. G., and Anjan, V. T. (2008). Overconfidence, CEO selection, and corporate governance. J. Finance 63, 2737–2784. doi: 10.1111/j.1540-6261.2008.01412.x

Arellano, M., and Bond, S. R. (1991). Some specification tests for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58, 277–298. doi: 10.2307/2297968

Arellano, M., and Bover, O. (1995). Another look at the instrumental-variable estimation of error-components models. J. Econ. 68, 29–52. doi: 10.1016/0304-4076(94)01642-D

Ashbaugh-Skaife, H., Collins, D. W., Kinney, W. R., and Lafond, A. R. (2009). The effect of SOX internal control deficiencies on firm risk and cost of equity. J. Account. Res. 47, 1–43. doi: 10.1111/j.1475-679X.2008.00315.x

Banerjee, S., Humphery-Jenner, M., and Nanda, V. (2015). Restraining overconfident CEOs through improved governance: evidence from the Sarbanes–Oxley Act. Rev. Financ. Stud. 28, 2812–2858. doi: 10.1093/rfs/hhv034

Blundell, R., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 87, 115–143. doi: 10.1016/S0304-4076(98)00009-8

Bond, S., and Meghir, C. (1994). Dynamic investment models and the firm's financial policy. Rev. Econ. Stud. 61, 197–222. doi: 10.2307/2297978

Brown, J. R., and Petersen, B. C. (2011). Cash holdings and RandD smoothing. J. Corp. Finance 17, 694–709. doi: 10.1016/j.jcorpfin.2010.01.003

Brown, R., and Sarma, N. (2007). CEO overconfidence, CEO dominance and corporate acquisitions. J. Econ. Bus. 59, 358–379. doi: 10.1016/j.jeconbus.2007.04.002

Carleton, W. T., Nelson, J. A., and Weisbach, M. S. (1998). The influence of institutions on corporate governance through private negotiations: evidence from TIAA-CREF. J. Finance 53, 1335–1362. doi: 10.1111/0022-1082.00055

Chrisman, J. J., and Patel, P. C. (2012). Variations in RandD investments of family and nonfamily firms: behavioral agency and myopic loss aversion perspectives. Acad. Manag. J. 55, 976–997. doi: 10.5465/amj.2011.0211

Chung, R., Firth, M., and Kim, J. (2002). Institutional monitoring and opportunistic earnings management. J. Corp. Finance 8, 29–48. doi: 10.1016/S0929-1199(01)00039-6

Cooper, A. C., Woo, C. Y., and Dunkelberg, W. C. (1988). Entrepreneurs' perceived chances for success. J. Bus. Venturing. 3, 97–108. doi: 10.1016/0883-9026(88)90020-1

Ferreira, M. A., Massa, M., and Matos, P. (2010). Shareholders at the gate? Institutional investors and cross-border mergers and acquisitions. Rev. Financ. Stud. 23, 601–644. doi: 10.1093/rfs/hhp070

Firth, M., Fung, P. M. Y., and Rui, O. M. (2006). Corporate performance and CEO compensation in China. J. Corp. Finance. 12, 693–714. doi: 10.1016/j.jcorpfin.2005.03.002

Forbes, D. P. (2005). Are some entrepreneurs more overconfident than others? J. Bus. Venturing 20, 623–640. doi: 10.1016/j.jbusvent.2004.05.001

Galasso, A., and Simcoe, T. S. (2011). CEO overconfidence and innovation. Manage. Sci. 57, 1469–1484. doi: 10.1287/mnsc.1110.1374

Gillan, S. L., and Starks, L. T. (2000). Corporate governance proposals and shareholder activism: the role of institutional investors. J. Finance Econ. 57, 275–305. doi: 10.1016/S0304-405X(00)00058-1

Grinstein, Y., and Michaely, R. (2005). Institutional holdings and payout policy. J. Finance 60, 1389–1426. doi: 10.1111/j.1540-6261.2005.00765.x

Hall, B. H. (2002). The financing of research and development. Oxf. Rev. Econ. Policy 18, 35–51. doi: 10.1093/oxrep/18.1.35

Hambrick, D., and Mason, P. (1984). Upper echelons: the organization as a reflection of its top managers. Acad. Manag. Rev. 9, 193–206. doi: 10.2307/258434

Hartzell, J. C., and Starks, L. T. (2003). Institutional investors and executive compensation. J. Finance 58, 2351–2374. doi: 10.1046/j.1540-6261.2003.00608.x

Hayward, M. L. A., and Hambrick, D. C. (1997). Explaining the premium paid for large acquisitions: Evidence of CEO hubris. Adm. Sci. Q. 42, 103–127. doi: 10.2307/2393810

Himmelberg, C. P., and Petersen, B. C. (1994). RandD and internal finance: a panel study of small firms in high-tech industries. Rev. Econ. Stat. 76, 38–51. doi: 10.2307/2109824

Hirshleifer, D., Low, A., and Teoh, S. H. (2012). Are overconfident CEOs better innovators? J. Finance 67, 1457–1498. doi: 10.1111/j.1540-6261.2012.01753.x

Hoitash, U., and Mkrtchyan, A. (2022). Internal governance and outside directors' connections to non-director executives. J. Account. Econ. 73:101436. doi: 10.1016/j.jacceco.2021.101436

Huang, M. W., Lambertides, N., and Steeley, J. M. (2016). Motives for corporate cash holdings: the CEO optimism effect. Rev. Quant. Finance Account. 47, 699–732. doi: 10.1007/s11156-015-0517-1

Jia, Y., Tsui, A., and Yu, X. (2021). Beyond bounded rationality: CEO reflective capacity and firm sustainability performance. Manag. Organ. Rev. 17, 777–814. doi: 10.1017/mor.2021.4

Kang, J. K., Luo, J., and Na, H. S. (2018). Are institutional investors with multiple blockholdings effective monitors? J. Financ. Econ. 128, 576–602. doi: 10.1016/j.jfineco.2018.03.005

Kolasinski, A. C., and Li, X. (2013). Can strong boards and trading their own firm's stock help CEOs make better decisions? Evidence from acquisitions by overconfident CEOs. J. Financ. Quant. Anal. 48, 1173–1206. doi: 10.1017/S0022109013000392

Langer, E. J. (1975). The illusion of control. J. Pers. Soc. Psychol. 32, 311–328. doi: 10.1037/0022-3514.32.2.311

Larwood, L., and Whittaker, W. (1977). Managerial myopia: self-serving biases in organizational planning. J. Finance 62, 194–198. doi: 10.1037/0021-9010.62.2.194

Lin, C. Y., Chen, Y., Ho, P. H., and Yen, J. F. (2020). CEO overconfidence and bank loan contracting. J. Corp. Finance 64:101637. doi: 10.1016/j.jcorpfin.2020.101637

Lin, Y., Hu, S., Chen, M., Chan, K., and Rhee, S. G. (2005). Managerial optimism and corporate investment: some empirical evidence from Taiwan. Pacific-Basin Finance J. 13, 523–546. doi: 10.1016/j.pacfin.2004.12.003

Liu, D., Li, Z., He, H., and Hou, W. (2021). The determinants of RandD smoothing with asset sales: evidence from RandD-intensive firms in China. Int. Rev. Econ. Finance 75, 76–93. doi: 10.1016/j.iref.2021.03.013

Lou, Z., Chen, S., Zhang, C., Yin, W., and Yu, X. (2022). Economic policy uncertainty and firm innovation: evidence from a risk-taking perspective. Int. Rev. Econ. Finance 77, 78–96. doi: 10.1016/j.iref.2021.09.014

Malmendier, U., and Yan, G. T. (2011). Overconfidence and early-life experiences: the effect of managerial traits on corporate financial policies. J. Finance 66, 1687–1733. doi: 10.1111/j.1540-6261.2011.01685.x

March, J. G., and Shapira, Z. (1987). Managerial perspectives on risk and risk taking. Manage. Sci. 33, 1404–1418. doi: 10.1287/mnsc.33.11.1404

McCahery, J. A., Sautner, Z. S., and Starks, L. T. (2016). Behind the scenes: the corporate governance preferences of institutional investors. J. Finance 71, 2905–2932. doi: 10.1111/jofi.12393

Mohamed, B. E., Baccar, A., and Fairchild, R. (2012). Does corporate governance affect managerial optimism? Evidence from NYSE panel data firms. Int. J. Euro Mediterr. Stud. 5, 41–56. doi: 10.1007/s40321-012-0004-6

Munari, F., Oriani, R., and Sobrero, M. (2010). The effects of owner identity and external governance systems on RandD investments: a study of Western European firms. Res. Policy. 39, 1093–1104. doi: 10.1016/j.respol.2010.05.004

Nielsen, S. (2010). Top management team diversity: a review of theories and methodologies. Int. J. Manag. Rev. 12, 301–316. doi: 10.1111/j.1468-2370.2009.00263.x

Nofsinger, J. R. (2005). Social mood and financial economics. J. Behav. Finance 6, 144–160. doi: 10.1207/s15427579jpfm0603_4

Parrino, R., Sias, R. W., and Starks, L. T. (2003). Voting with their feet: institutional ownership changes around forced CEO turnover. J. Finance Econ. 68, 3–46. doi: 10.1016/S0304-405X(02)00247-7

Schrand, C. M., and Zechman, S. L. C. (2012). Executive overconfidence and the slippery slope to financial misreporting. J. Account. Econ. 53, 311–329. doi: 10.1016/j.jacceco.2011.09.001

Shin, M., and Kim, S. (2011). The effects of cash holdings on RandD smoothing of innovative small and medium sized enterprises. Asian J. Technol. Innov. 19, 169–183. doi: 10.1080/19761597.2011.630501

Shleifer, A., and Vishny, R. W. (1986). Large shareholders and corporate control. J. Polit. Econ. 94, 461–488. doi: 10.1086/261385

Simon, M., and Houghton, S. M. (2003). The relationship between overconfidence and the introduction of risky products: evidence from a field study. Acad. Manag. J. 46, 139–149. doi: 10.2307/30040610

Smith, M. P. (1996). Shareholder activism by institutional investors: evidence from CalPERS. J. Finance 51, 227–252. doi: 10.1111/j.1540-6261.1996.tb05208.x

Tai, V. W., Lai, Y. H., and Lin, L. (2014). Local institutional shareholders and corporate hedging policies. North Am. J. Econ. Finance 28, 287–312. doi: 10.1016/j.najef.2014.03.009

Tee, C. M. (2020). Political connections and income smoothing: evidence of institutional investors' monitoring in Malaysia. J. Multinat. Financ. Manag. 55:100626. doi: 10.1016/j.mulfin.2020.100626

Wang, B., Liu, Y., and Parker, S. K. (2020). How does the use of information communication technology affect individuals? A work design perspective. Acad. Manage. Ann. 14, 695–725. doi: 10.5465/annals.2018.0127

Wang, X., Dass, M., Arnett, D. B., and Yu, X. (2020). Understanding firms' relative strategic emphases: an entrepreneurial orientation explanation. Ind. Mark. Manag. 84, 151–164. doi: 10.1016/j.indmarman.2019.06.009

Weinstein, N. (1980). Unrealistic optimism about future life events. J. Pers. Soc. Psychol. 39, 806–820. doi: 10.1037/0022-3514.39.5.806

Yang, J. Y., Wang, L., Sun, Z. Y., Zhu, F. M., Guo, Y. H., and Shen, Y. (2021). Impact of monetary policy uncertainty on R&D investment smoothing behavior of pharmaceutical manufacturing enterprises: Empirical research based on a threshold regression model. Int. J. Environ. Res. Public Health. 18:11560. doi: 10.3390/ijerph182111560

Yu, X., Li, Y., Su, Z., Tao, Y., Nguyen, B., and Xia, F. (2020). Entrepreneurial bricolage and its effects on new venture growth and adaptiveness in an emerging economy. Asia Pac. J. Manag. 37, 1141–1163. doi: 10.1007/s10490-019-09657-1

Yu, X., Li, Y., Zhu, K., Wang, W., and Wen, W. (2022a). Strong displayed passion and preparedness passion of broadcaster in live streaming e-commerce increases consumer neural engagement. Front. Psychol. Forthcoming.

Yu, X., Liu, T., He, L., and Li, Y. (2022b). Micro-foundations of strategic decision-making in family business organisations: a cognitive neuroscience perspective. Long Range Plann. 102198. doi: 10.1016/j.lrp.2022.102198

Yu, X., Tao, Y., Tao, X., Xia, F., and Li, Y. (2018). Managing uncertainty in emerging economies: the interaction effects between causation and effectuation on firm performance. Technol. Forecast. Soc. Change 135, 121–131. doi: 10.1016/j.techfore.2017.11.017

Yu, X., Tao, Y., Wang, D., and Yang, M. M. (2022c). Disengaging Pro-Environmental Values in B2B Green Buying Decisions: Evidence From a Conjoint Experiment. Industrial Marketing Management. 105, 240–252. doi: 10.1016/j.indmarman.2022.05.020

Yu, X., and Wang, X. (2021). The effects of entrepreneurial bricolage and alternative resources on new venture capabilities: evidence from China. J. Bus. Res. 137, 527–537. doi: 10.1016/j.jbusres.2021.08.063

Zhao, H., Liu, W., Li, J., and Yu, X. (2019). Leader-member exchange, organizational identification, and knowledge hiding: The moderating role of relative leader?member exchange. J. Organ. Behav. 40, 834–848. doi: 10.1002/job.2359

Appendix

Keywords: CEO overconfidence, R&D smoothing, intertemporal decision-making, internal control, institutional investors, upper echelons theory, technology-based entrepreneurial firm, uncertainty in entrepreneurship

Citation: Huang Y, Wang X, Li Y and Yu X (2022) CEO Overconfidence, Corporate Governance, and R&D Smoothing in Technology-Based Entrepreneurial Firms. Front. Psychol. 13:944117. doi: 10.3389/fpsyg.2022.944117

Received: 14 May 2022; Accepted: 20 June 2022;

Published: 13 July 2022.

Edited by:

Umair Akram, RMIT University, VietnamCopyright © 2022 Huang, Wang, Li and Yu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yu Huang, YWR5X2h5QHNodS5lZHUuY24=; Xiaoyu Yu, eXV4aWFveXVAc2h1LmVkdS5jbg==

Yu Huang

Yu Huang Xinchun Wang

Xinchun Wang Yuanqin Li

Yuanqin Li Xiaoyu Yu

Xiaoyu Yu