- 1School of Humanities and Social Sciences, Anhui University of Science and Technology, Huainan, China

- 2Department of Management Sciences, COMSATS University of Islamabad, Sahiwal, Pakistan

This study implies finding the linkages among financial inclusion, non-performing loans (NPLs), and economic growth. The study uses large panel data of 21 Organization for Economic Corporation and Development (OECD) countries for the dynamic panel estimation by using the Driscoll-Kraay standard errors with fixed effect. The results of the dynamic panel estimation technique revealed the existence of a long-run relationship among financial inclusion, NPLs, and economic growth. Financial inclusion contributes positively to economic growth by reducing NPLs. Furthermore, NPLs negatively impact financial inclusion as well as economic growth. The study presents important policy recommendations to control NPLs and boost the level of financial inclusion in the selected economies.

Introduction

Poverty is considered the utmost challenge to achieving global sustainable development. “No Poverty” is set to be the foremost goal in the 17 Sustainable Development Goals (SGDs) set by the United Nations (2015). The World Bank road map also attains Universal Financial Access by 2020 to reduce poverty and enhance financial inclusion to the maximum level (WEF, 2017). Extensive empirical research has highlighted the relationship among financial inclusion, growth, and poverty. Financial inclusion means providing affordable financial products and services (like insurance, savings, transactions, credit, and payments) to the deprived sects and individuals of society. It is learned that the access and availability of financial resources are directly linked to poverty reduction (WEF, 2017). Demirguc-Kunt and Klapper (2012) analyzed the global financial inclusion (GFI) database (Global Findex) of 148 economies for investments, credits, payment systems, and risk management systems. The research found that about 50% of adults have formal accounts in financial institutions worldwide. In other words, half of the world's adult population is not included in the formal financial sector.

This study primarily deals with financial inclusion, concerning the assessment and obtainability of formal financial services, like bank deposits, insurance, and credits for all financial stakeholders of the economy. The issue of poverty and low financial inclusion go side by side, which is pertinent in the case of developing countries. The degree of high financial inclusivity entails the environment and circumstances in which the majority of stakeholders are using formal financial systems and services with the stability of capital. This requires monetary easing, a robust legal policy, a low cost of financial services, a variety of financial products, and comfortable and closer access to financial institutions in a country (Allen et al., 2016). As a result, the level of financial inclusion states the level of growth of a country (Beck et al., 2007). Numerous studies have validated the positive linkage of financial inclusion with economic development (Sarma and Pais, 2008; Babajide et al., 2015; Kim et al., 2018).

The willingness and ability of economic players or customers to engage with the formal financial system are one of the critical determinants of financial inclusion and economic growth. But customers' unwillingness and ability to use the formal financing sector creates a void. In this context, the concern about financial literacy remains valid. Likewise, the misuse of formal loans causes an increase in non-performing loans (NPLs), hence financial exclusion. For instance, the personal use of a business loan by a customer restrains his/her ability to repay and results in a bad or NPL. It means that NPLs coined by financial illiteracy are negatively associated with financial inclusion. So, the quality of financial framework and quality of customers are essential to attain financial development, inclusion, and economic growth (Grohmann et al., 2018). Therefore, besides the research on institutional and regulatory determinants of financial inclusion, the customer dynamics also need extended scholarly attention to attain a required level of financial inclusion.

From a broader perspective, the relationship between financial inclusion and economic growth is somehow explained by the level of NPLs in a country. It means that a weak financial system along with NPLs on the part of the household and corporate level triggers strict lending requirements and reduces the level of monetary easing, causing distance between the poor and formal financing sector. Therefore, the financial exclusion caused by NPLs seems to have direct implications on the economic growth of a country. It has been observed that different macroeconomic variables affect financial inclusion and NPLs in unique ways, but NPLs and GDP are directly associated with each other (Beck et al., 2013).

The case of Organization for Economic Corporation and Development (OECD) countries is unique in this regard. OECD is the most prominent group of countries with pioneering efforts to boost financial inclusion. For example, the establishment of an international network on financial education (INFE) in 2008, with 230 member organizations from 100 countries. Later in 2010, INFE and a Russian trust fund introduced a collaborative project to improve financial literacy and inclusion to attain financial stability in OECD countries. Yet the OECD countries recorded the highest level of NPLs, i.e., 4.121% of the total gross loans in 2009. The surpassing NPLs called up strict operational measures and reduced the loaning capacity of financial institutions denting the level of financial inclusion (IMF, 2017). Therefore, it is perceived that along with the other macroeconomic variables, financial inclusion and NPLs are significant challenges for the OECD countries. So, this study explores and presents the case of NPLs, financial inclusion, and economic growth of the OECD countries.

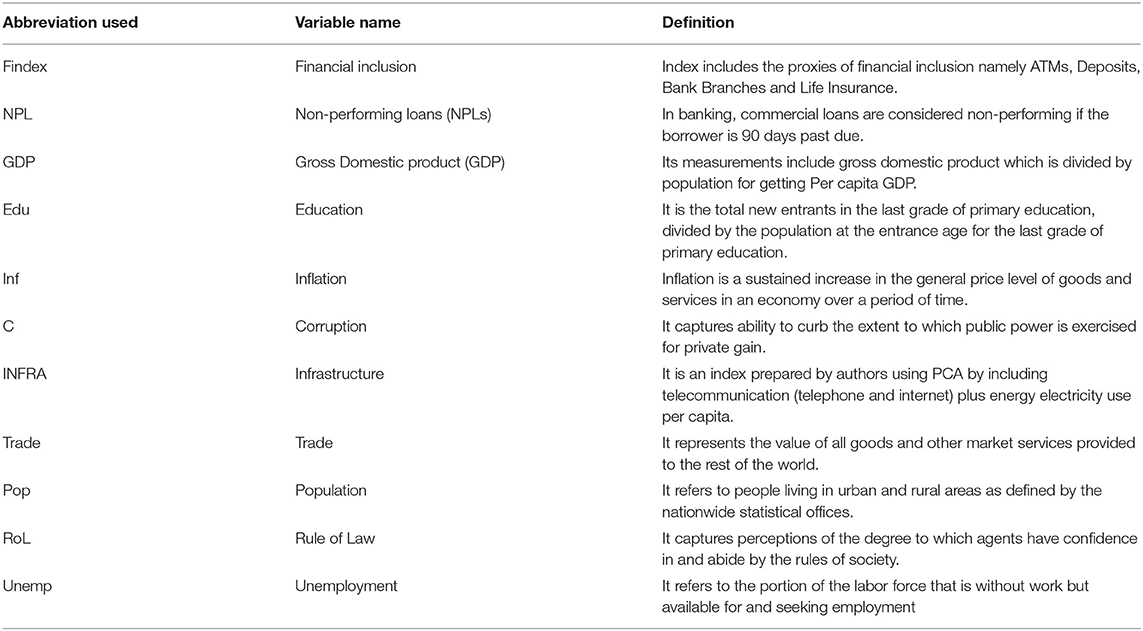

For this purpose, this study assesses the dynamic relationship among financial inclusion, NPLs, and GDP per capita controlled by other economic variables, i.e., population, school education, inflation, trade, urbanization, rule of law, and infrastructure. This study adds to the literature in three ways. To begin with, the studies examine the influence of financial inclusion and NPLs on economic development in the OECD nations. Second, while calculating the impact, we take both the demand and supply sides into account. People's credit requirements are on the demand side, while financial services are provided on the supply side (such as ATMs, bank deposit accounts, and life insurance). Finally, because the OECD nations are intimately linked by geography, commerce, and financial integration, we evaluate the possibility of cross-section dependence. Furthermore, the financial inclusion index namely “Findex” is used as a proxy of financial inclusion. We apply the Driscoll-Kraay standard errors with the fixed effect regression technique. The results of the dynamic panel estimation technique revealed the existence of a long-run relationship among financial inclusion, NPLs, and economic growth. Financial inclusion contributes positively to economic growth by reducing NPLs. Furthermore, NPLs negatively impact financial inclusion as well as economic growth. Table 1 reflects the detail of definitions of variables used in this study.

The sequence of the remaining part of this article is as follows: Section Review of Literature provides a brief review of literature. Section Data and Proxy Measures describes the data set and measurement of the proxy for financial inclusion and economic growth; Section Methodology reflects the methodology of the paper; and Section Conclusion includes the conclusion part of this paper.

Review of Literature

Financial Inclusion and Economic Growth

Since the late 1990s, there has been increasing attention to the term financial inclusion explaining access to financial services for the needy in a country (Leyshon and Thrift, 1993, 1994). The studies have explored the effect of financial inclusion on economic growth. It is known that financial inclusion has a positive relationship with economic growth. For example, Kim et al. (2018) studied the organisation of islamic cooperation (OIC) countries and found a significant positive impact of financial inclusion on economic growth. Similarly, in 11 MENA (the Middle East and North Africa) countries, Naceur and Ghazouani (2007) also reported a positive relationship between financial inclusion and economic growth. Similarly, Makina and Walle (2019) studied the case of Africa, and Cabeza-García et al. (2019) tested a sample of 91 developed and emerging economies and explored that financial inclusion significantly boosts economic growth. Furthermore, it is also believed that financial development adding to financial inclusion can reduce the level of poverty (Boukhatem, 2016). Likewise, Pradhan et al. (2016) examined the relationship between insurance penetration and economic growth for the ASEAN Regional Forum (ARF), revealing short-term co-integration and causality between insurance penetration and economic growth.

H1: There is a positive effect of financial inclusion on economic growth.

However, it is pertinent to note that there could be a potential effect of economic growth on financial inclusion. Based on the modern economic theory, economic activity generates chances to engage with mainstream financial institutions. This situation creates a viable opportunity to observe the effect of economic growth on financial inclusion, where literature seems silent. This study approves the effect of financial inclusion on economic growth and tends to validate the potential effect of economic growth on financial inclusion. Therefore, we postulate that economic growth may have a positive effect on financial inclusion as well. Our hypothesis is:

H2: There is a positive effect of economic growth on financial inclusion.

However, the relationship between NPLs and financial inclusion requires further attention. There is a need for a clear understanding of the factors contributing to financial inclusion. In this regard, the factor of NLPs remains novel.

Non-Performing Loans and Financial Inclusion

The linkage between NPLs and financial inclusion lacks theoretical and empirical understanding. It has been established that financial inclusion may increase the magnitude of NPLs. For example, Chen et al. (2018) reported a positive impact of financial inclusion on NPLs in the context of China. Similarly, Ozili (2019) also found that an efficient and stable financial system leads to a higher NPL rate. To check this stance, we propose the following hypothesis:

H3: There is a negative effect of financial inclusion on NPLs.

However, the literature is silent to report the effects of NPLs on financial inclusion. On the institutional side, it is observed that credit growth has a positive relationship with NPLs, harming banking profitability, and financial inclusion (Vithessonthi, 2016). NPLs become a financial burden for banks and ultimately reduce their loaning capacity. The threat of NPLs lessens the financial inclusion because of the education and consumption behavior of borrowers.

In another view, it is considered that household and small loans intrigue risk insensitive credit extension for banks and other financial institutions. This may cause a lower ratio of NPLs and boost financial inclusion (Calomiris and Kahn, 1991; Song and Thakor, 2007). Although the literature provides ample detail about the effects of financial inclusion on NPLs, the reverse relationship has not been investigated to check the effects of NPLs on financial inclusion. Based on the types and size of loans, it can be concluded that NPLs also affect financial inclusion in the country. This study fills this gap and examines the effect of NPLs on financial inclusion with the help of the following hypothesis:

H4: There is a negative effect of NPLs on financial inclusion.

Non-Performing Loans and Economic Growth

The relation between NPLs and economic growth is widely discussed in the literature. The scholarly discussion has mainly focused on determinants of NPLs, recognizing the negative association of GDP growth and the positive relation of inflation factors with respect to NPLs (Mazreku et al., 2018). Just as a stable financial system promotes economic growth, a poor financial system that struggles with NPLs and inadequate capital could undermine growth (Schumpeter, 1954). In credit modeling, Zeng (2012) views loans to the economy as increasing total demand and thus offering a significant social benefit, whereas NPLs are considered a source of financial pollution (Minsky's Approach to Poverty and Unemployment, 2015).

In modeling credit, Zeng (2012) views loans to the economy as boosting total consumption and hence yielding a positive social utility, while NPLs are viewed as a source of financial pollution (Minsky's Approach to Poverty and Unemployment, 2015; Stiglitz and Andrew, 1981) that negates social utility. Zeng identifies two economic implications of NPLs. First, if NPLs grow, economic growth could decline, causing inefficiency in the allocation of resources. Second, capital requirements will rise as a result of NPL expansion, as capital depletion occurs because funds are stuck in these institutions, making it difficult for banks to finance new, economically viable projects. The NLPs significantly affect banking performance as well as economic growth (Podpiera and Weill, 2008; Campanella et al., 2020). These studies suggested that improving the credit selection criteria avoids the hazard of NPLs. Some researchers (e.g., Podpiera and Weill, 2008; Vithessonthi, 2016) reported that overall economic conditions (i.e., economic crises and normality) could differently affect the banking credit extension and NPLs. Likewise, Partovi and Matousek (2019) stated that NPLs could cause uncertainty, economic downturn, and instability. Many studies state that NPLs are undesirable outputs that contribute to economic growth and banking inefficiency (Kumar et al., 2018; Ozili, 2019).

NPLs reduce the banks' loan granting capacity and weaken their role in economic development. The research indicates that GDP has an inverse relationship with NPLs (Badar and Yasmin Javid, 2013; Khan et al., 2015; Kjosevski and Petkovski, 2017). Louzis et al. (2012) and Endut et al. (2013) also identified macroeconomic variables such as inflation, trade, and illiteracy causing higher NPLs. In general, it is found that there is a negative relationship between NPLs and economic growth. This study testifies this relationship through the following hypothesis:

H5 There is a negative effect of NPLs on economic growth.

The bad quality of loans and credit extension criteria is often blamed for the increasing trend in NPLs and economic crises (Bancel and Mittoo, 2011). In this context, there are a number of studies suggesting regulatory enhancements to overcome the state of increasing NPLs (Carter and McNulty, 2005; Yang, 2017). At the same time, the world has observed the rapid success of microfinancing and its impact on banking efficiency and economic growth (Chatterjee et al., 2006; Collins et al., 2009).

The literature has largely discussed the effect of NPLs on economic growth but the vice versa effect has not been checked so far, especially for the OECD countries. The panel of the OECD countries is diverse with different income and growth levels. It will be interesting to check the effects of economic growth on NPLs for different income levels. This study contributes to highlighting such effects and proposes the following hypothesis:

H6 There is a negative effect of economic growth on NPLs.

The nexus of financial inclusion, NPLs, and economic growth is interesting and imperative to study. The accomplishment of sustainable development goals is not possible without reducing poverty through financial inclusion. The factors associated with financial inclusion are studied in this paper for seeking the attention of policymakers. It is a positive sign and fortune for current researchers that the data released by the World Bank regarding the financial inclusion index are available to the researchers for empirical investigations of the concept of financial inclusion and other relevant factors.

This global index includes primarily the supply side of financial inclusion. NPLs (not addressed by Global Findex) are important demand-side variables that impact financial inclusion and economic development. This research work is an attempt to find more insights into the relationship among NPLs, financial inclusion, and economic growth in the presence of macroeconomic variables.

Data and Proxy Measures

Structuring the Panel Dataset

This research examines the relationship among financial inclusion, NPLs, and economic growth of the OECD countries for the sample period of 2004–2017. The selected sample period for the OECD countries partially covers the timeline of the Sustainable Development Goals by the United Nation. The study considers panel data of 21 OECD countries out of 36 countries, because of the missing values and data limitations. It is argued that 58% of the OECD countries' data may provide generalizable findings. The data of related variables have been retrieved from the Global Democratic and Development Foundation (GFDD), the World Development Indicator (WDI), and the Financial Access Survey (FAS).

Proxy Measures

Financial inclusion entails how many individuals and businesses use financial services. In this context, the variables such as account penetration, deposits, loans, and insurance are important factors in assessing the level of financial inclusion (Demirguc-Kunt and Klapper, 2012; Van der Werff et al., 2013). A study by the World Bank (2018) has used various proxies like financial institution accounts, financial institution loans, electronic means of payment, and debit card ownership on the basis of (percentage, 15+ years) to establish the index of financial inclusion.

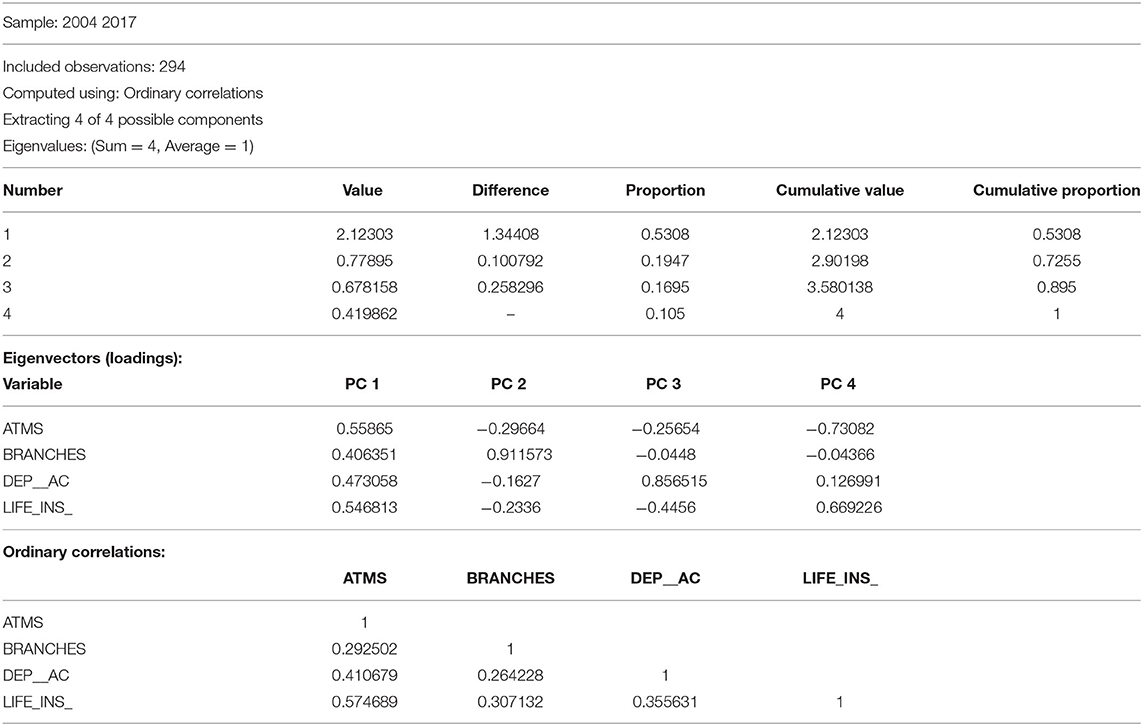

The first proxy to calculate financial inclusion is the proxy for savings “deposit accounts with commercial banks per 1,000 adults” indicated as DEPO (Kim et al., 2018). The second proxy is automated teller machines per 100,000 adults indicated as ATM, which can be a suitable measure of the ownership of accounts. It is assumed that the ownership of accounts indicates how many people or firms have accounts at formal financial institutions. Although the best way to measure this key factor is by counting the number of people or firms who have accounts, the data of the World Bank is limited to 2011. Therefore, we use ATM as a proxy for the ownership of accounts. It is because formal financial institutions generally issue either a debit card or an ATM card tied to an account, the ATM penetration rate will indirectly represent the accounts penetration rate.

To measure the penetration rate of financial institutions, we use proxy of bank branches per 100,000 adults indicated as BRCH. This proxy may be helpful to assess the presence of financial institutions and suitable to infer the access to the financial institutions by the general public and institutions or firms. Life insurance premium volume to GDP (LINSUR) is our fourth proxy to assess the level of insurance penetration. The access to insurance institutions is used to mitigate the financial risk and preserve a person's financial stability from unpredictable accidents. Therefore, LINSUR can be an appropriate proxy to measure the level of awareness regarding risk mitigation and financial stability (Kim et al., 2018).

In addition to the IMF Findex proxy, we have also developed the Findex proxy by employing Principal Component Analysis (PCA) through the above-mentioned proxies. The related statistics of PCA are given in Table 2.

The purpose of this index is to simplify the results showing the effect of financial inclusion on economic growth. We have controlled the external factors by accounting for macroeconomic variables in our econometric analysis. These control variables include inflation (annual%) for consumer prices (INF), population growth rate (POP), trade percentage of GDP (TRADE), unemployment, education, corruption, and infrastructure (Mankiw, 2011; Kim et al., 2018). We used GDP per capita (GDP) as a proxy variable for economic growth and macroeconomic factors for dynamic panel regression to control financial inclusion, NPL, and economic growth. Hence, we set up the macroeconomic variables.

Methodology

This study estimates the models using the robust standard errors proposed by Driscoll and Kraay (1998) for panel regressions with cross-sectional dependence. Specifically, we adopted the xtscc program developed by Hoechle (2007) that produces Driscoll and Kraay (1998) standard errors for linear panel models because they are not only heteroskedasticity consistent but also robust to very general forms of cross-sectional and temporal dependence (Le and Tran-Nam, 2018). Furthermore, the xtscc program works well with both balanced and unbalanced panels, which is the case in this study. It can also handle the missing values (Hoechle, 2007). For comparison and completeness, we estimate Driscoll and Kraay (1998) standard errors for coefficients using the pooled Ordinary Least Squares (OLS)/Weighted Least Squares, fixed-effects (within), and Generalized Least Squares random effects regressions. The Monte Carlo experiments show that, regardless of whether a panel is balanced or not, ignoring spatial correlation in panel regressions leads to overly optimistic (anti-conservative) standard error estimates, which is consistent with Driscoll and Kraay's original finding for small balanced panels. Although the standard errors of Driscoll and Kraay are modestly optimistic, their small sample features are much better than those of the alternative covariance estimators when the cross-sectional dependency is present.

Based on the objective of our study, we present the following models to explain:

Models 1 and 2. Impact of financial inclusion and NPLs on economic growth.

Models 3 and 4. Impact of NPLs and economic growth on financial inclusion.

Models 5 and 6. Impact of financial inclusion and economic growth on NPLs.

Model 1:

Model 2:

Model 3:

Model 4:

Model 5:

Model 6:

where i represents 21 cross-sectional selected OECD countries, t is the period of the proxy measurement from 2004 to 2017, and εit is the error term. In models 1 and 2 specifications, the dependent variable is LnGDP as a proxy variable for economic growth; and in models 2 and 3, LnFindex is the proxy of financial inclusion variables. In models 3 and 4, NPL is the dependent variable that denotes NPLs. In all the models, Inf stands for inflation, trade is self-explanatory, Pop denotes the total population, Edu stands for education, C means Corruption, ROL shows Rule of Law, and INFRA stands for infrastructure in the OECD countries. Infrastructure is an index of three proxies namely energy use, fixed broadband, and phone usage.

Prior to panel regressions, we start our estimations from descriptive statistics followed by correlation, tests for multicollinearity, and heteroskedasticity.

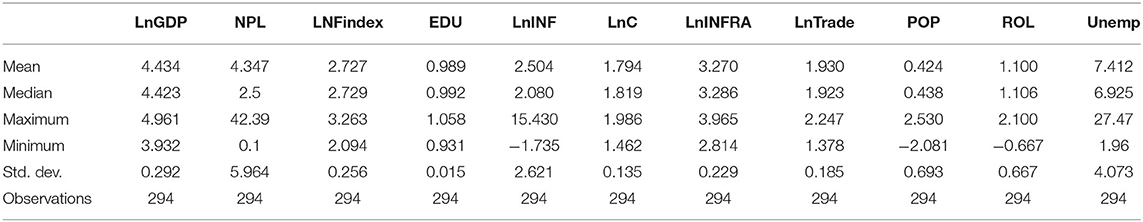

Descriptive Statistics

In this paper, we investigate the dynamic relations among financial inclusion, NPLs, and economic growth in the OECD countries over the period 2004–2017. Table 3 provides descriptive statistics related to our variables of interest and related macroeconomic variables.

According to the descriptive statistics, the mean (median) values of LnGDP, LnNPL, and LnFindex are 4.43 (4.42), 4.34 (2.50), and 2.73 (2.73), respectively. At the same time, the statistics reveal that our sample countries have scattered values of NPLs indicated by the standard deviation of 5.96. This is also indicated by maximum (minimum) values, i.e., 44.39 (0.10). However, the LnFindex depicting financial inclusion has a mean (median) of 2.57 (2.57) with a standard deviation of 0.25. It means that our sample countries have similar indicators of financial inclusion, but the real issue is NPLs indicated in the discussion.

Correlation

Next, the correlation is checked among the study variables. GDP is found positively correlated with financial inclusion and negatively correlated with NPLs. Similarly, NPLs are negatively correlated with financial inclusion. The results are shown in Table 4.

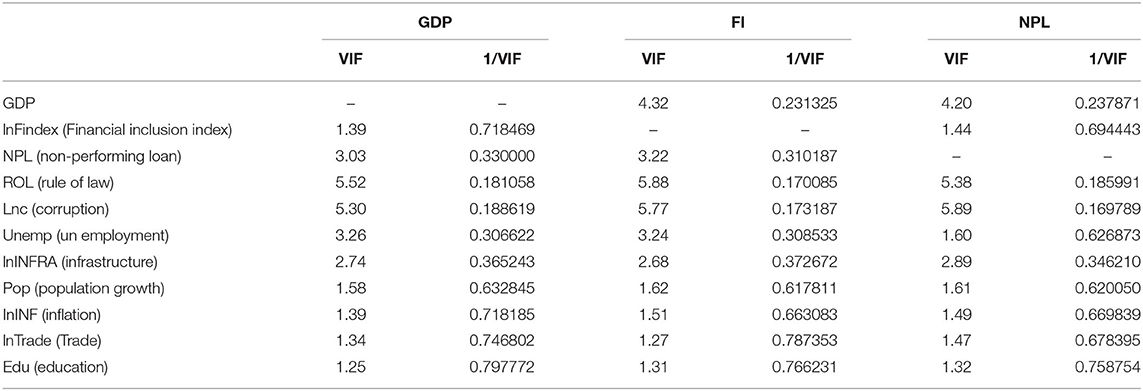

VIF Test for Multicollinearity

Next, this study analyzes the data set for multicollinearity. We use the variance inflation factor (VIF) for this purpose. The VIF measures how much the variance of an estimated regression coefficient increases if our predictors are correlated. Multicollinearity occurs when two or more predictors in the model are correlated and provide redundant information about the response. Multicollinearity was measured by VIF and tolerance. If the VIF value exceeds 4.0, or by tolerance <0.2, then there is a problem of multicollinearity (Hair et al., 2010). The results are shown in Table 5.

Test for Endogeneity

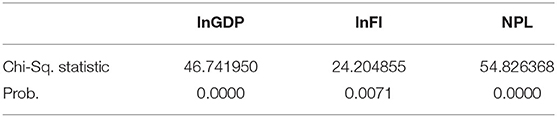

Moving forward, Table 6 confirms the application of fixed effects for our data set due to the existence of endogeneity in data. There exist arbitrarily distributed fixed individual impacts as shown in the results. The null hypothesis is rejected at 1% in favor of fixed effects. But the model cannot be estimated using the OLS techniques due to the existence of endogenous variables. The results are depicted in Table 6.

Test for Heteroskedasticity

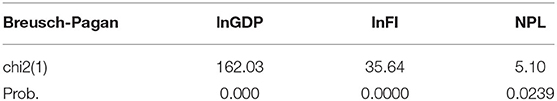

Prior to estimation, the assumption of heteroskedasticity was tested using the Breusch-Pagan test. The results in Table 7 confirm the existence of heteroskedasticity at a 1% level.

Driscoll and Kraay Test for Fixed Effects

This study estimates the models using the robust standard errors proposed by Driscoll and Kraay (1998) for panel regressions with cross-sectional dependence. Specifically, we adopted the xtscc program developed by Hoechle (2007) which produces Driscoll and Kraay (1998) standard errors for linear panel models since they are not only heteroskedasticity consistent but also robust to very general forms of cross-sectional and temporal dependence (Le and Tran-Nam, 2018). The results are reported in Table 8.

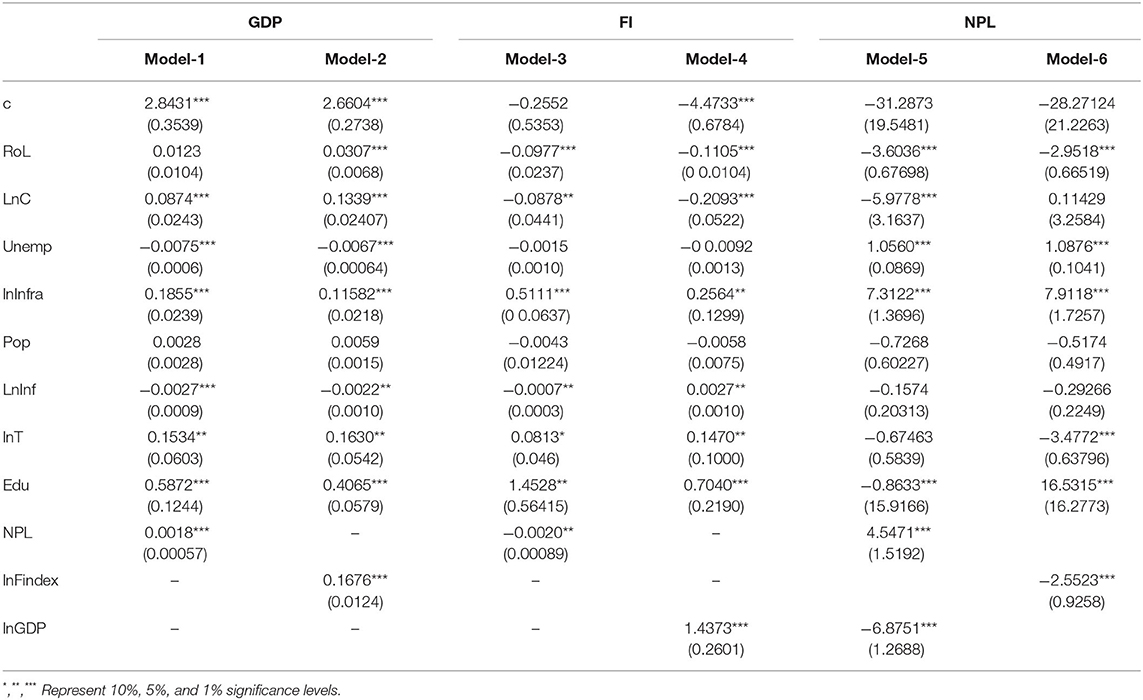

Model 1 shows the effect of NPLs on economic growth. In contrast, inflation, population, trade, education, corruption, and the rule of law represent control variables that may affect the economic growth directly and indirectly. A 1% increase in NPLs increases 0.008% economic growth in the OECD countries. Hence, we reject the hypothesis H5. It implies that NPLs accelerate economic activities in this region of countries and result in increased economic growth. The results of Table 7 reveal that rule of law, corruption, infrastructure, trade, and education have a positive and significant impact on economic growth. It infers that economic growth is increased with the increase in these control variables. However, unemployment and inflation have a negative and significant link with economic growth as per theory. These two variables are unfavorable for economic development with different coefficients.

The results of model 2 in Table 3 reflect the significant positive effect of financial inclusion on economic growth. A 1% increase in financial inclusion causes a 0.167% increase in economic growth; therefore, we accept hypothesis H1. Our findings match with the results of Kim et al. (2018), who reported the same result for OIC countries. This result implies that when credit disbursement is increased in a country, economic activities are grown and the living standard of ordinary people improves. These results indicate an increase in the economic growth rate.

The third model presents the effect of NPLs on financial inclusion. There is a negative effect of NPLs on financial inclusion in the presence of control variables. A 1% rise in NPLs declines the financial inclusion level by 0.0020%; hence, we accept hypothesis H4. An increase in NPLs discourages the financial institutions from decreasing their credit disbursements. From the set of control variables, there is a negative impact of the rule of law, corruption, inflation, unemployment, and population on financial inclusion. Whereas, trade, education, and infrastructure increase the level of financial inclusion in the OECD countries.

Next, the results of model 4 reveal the positive but insignificant effect of economic growth on financial inclusion. It enables us to accept hypothesis H2. This finding state that the rural sector still lacks the financial access. The positive relationship between infrastructure and financial inclusion also endorses that weak infrastructure can be the leading cause of financial deprivation. Similarly, unemployment, population, and corruption also negatively impact the financial inclusion. Furthermore, trade, education, and inflation are positively related to financial inclusion, which has proved to be very helpful in the financial development of the OECD countries.

Model 5 reveals the effect of economic growth on NPLs. The results show that a 1% increase in GDP decreases the NPLs by 6.875% and rejects hypothesis H6. This relationship indicates that when living standards are better in a country, there are very few chances of misuse of credit. But it depends on the behavior of other control variables also. This finding is backed by the GDP growth rates of the OECD countries that GDP rates are increasing and NPL growth is declining.

Model 6, as shown in Table 8, presents the impact of financial inclusion on NPLs. The results show the adverse effects of financial inclusion on NPLs. A 1% increase in financial inclusion reduces the NPLs by 2.552%. This finding suggests that when people have more earning opportunities, they try to consume the loans as per their original purpose and there are fewer chances of NPLs. Control variables also suggest some exciting facts about NPLs. For example, rule of law, education, and trade reduce the NPLs, whereas inflation, corruption, and unemployment cause an increase in NPLs in the OECD countries.

Discussion

In the recent era, the concerns regarding financial inclusion are rapidly growing. Scant literature explores the linkages between financial inclusion and economic growth. There is a need to study the linkages among financial inclusion, NPLs, and economic growth in the presence of macroeconomic variables for the OECD countries. The role of commercial banks in the OECD's banking sector has increasingly improved after reforms and open-up policies. The financial services of commercial banks have greatly enhanced the commodity resources of the banking sector as a whole. However, more financial services could lead to increased credit risks with the continuing growth of commercial banks, raising the question of non-performance loans. After the 2008 global financial crisis, the issue of non-performing commercial banks' loans became difficult to handle (Kauko, 2012). Against this backdrop, various commercial banks started seeking different control measures to alleviate the growth of NPLs, but these initiatives did not produce good results. According to the OECD market characteristics, it can be seen that local governments prefer a more national, rather than bank-specific, oriented emphasis on NPLs from commercial banks that are consistent with their regional economic development policies based on the overall local economy.

The results report the positive link between financial inclusion and economic growth for the OECD countries. The OECD countries need to strengthen the use of mobile banking in the countries. China is an example of such branchless banking. In far-flung rural areas, it is expensive to operate branch banking, therefore, digital finance can facilitate the users significantly. The government should introduce low-interest rates for low-income rural customers encouraging them to adopt a formal financial system. Financial literacy is also important for rural households to utilize formal banking channels and their use. The sample countries of our study include countries having diverse religious beliefs, literacy rates, monetary policies, and other macroeconomic factors. There are different schools of thought about the interest rate. These diverse factors signify the theoretical contribution of this study for financial inclusion.

Conclusion

This study aims to understand the role of NPLs toward financial inclusion and economic growth. This study uses the Driscoll-Kraay standard errors with a fixed effect for a panel of 21 selected OECD countries. The results show a positive effect of NPLs on economic growth, but there is a negative effect of NPLs on financial inclusion in the presence of control variables. Furthermore, the findings of the panel dynamic regression technique reflect the positive and significant effect of financial inclusion on the economic growth of the OECD countries. The results indicate that rule of law, corruption, inflation, unemployment, and population hamper the level of financial inclusion, whereas, trade, education, and infrastructure behave otherwise. To cover the multicollinearity issue, we suggest establishing a financial inclusion index having a variety of factors explaining financial inclusion. Such an index will also be helpful to provide an accurate calculation of multilateral financial inclusion. This study is limited to the OECD countries and checks some well-known economic variables that affect financial inclusion and NPLs.

The study possesses a limitation in the availability of data. The data on financial inclusion is not available earlier than 2004. Similarly, data of all variables of all the OECD countries are also not available; therefore, only 23 countries were selected for analysis. Future studies can be conducted on the same topic by covering more panels and more updated data on study variables.

Data Availability Statement

Publicly available datasets were analyzed in this study. The data that support the findings of this study are available in World Bank Indicators at https://data.worldbank.org/indicator, https://data.imf.org/?sk=E5DCAB7E-A5CA-4892-A6EA-598B5463A34C, and https://www.globalfoundationdd.org.

Author Contributions

PZ conceptualized the idea of this paper and drafted the initial draft. MZ reviewed and improved this manuscript significantly. QZ supervised this study from beginning till end. SZ reviewed this article and recommended several policies for economic freedom. All authors contributed to the article and approved the submitted version.

Funding

This work was funded by Philosophy and Social Science Planning Youth Project in Anhui Province Regional Studies of International Relations: Deconstruction and Reconstruction from the Perspective of Epistemology (Program Number: AHSKQ2021D39), Research on the Evolution of the ASEAN and AU Institution, a Key Project of the Humanities and Social Science Research Project of Anhui Province Colleges and Universities (Program Number: SK2020A0198), Anhui University of Science and Technology's Introduction of Talents Research Start-Up Fund ASEAN, AU Institution Evolution Research (Program Number: 13200382), and Hefei City 2022 Philosophy and Social Science Planning Youth Project Research on Three Governance Linkage in Rural Revitalization (Program Number: HFSKQN202250).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Allen, F., Demirguc-Kunt, A., Klapper, L., and Martinez Peria, M. S. (2016). The foundations of financial inclusion: Understanding ownership and use of formal accounts. J. Financ. Intermed. 27, 1–30. doi: 10.1016/j.jfi.2015.12.003

Babajide, A. A., Adegboye, F. B., and Omankhanlen, A. E. (2015). Financial inclusion and economic growth in Nigeria. Int. J. Econ. Financ. Issues. doi: 10.1080/00220388.2012.682985

Badar, M., and Yasmin Javid, A. (2013). Impact of macroeconomic forces on nonperforming loans: an empirical study of commercial banks in Pakistan. WSEAS Trans. Bus. Econ. 10, 40–48.

Bancel, F., and Mittoo, U. R. (2011). Financial flexibility and the impact of the global financial crisis. Int. J. Manag. Financ. 7, 179–216. doi: 10.1108/17439131111122157

Beck, R., Jakubik, P., and Piloiu, A. (2013). Non-Performing Loans: What Matters in Addition to the Economic Cycle?

Beck, T., Demirgüç-Kunt, A., and Levine, R. (2007). Finance, inequality and the poor. J. Econ. Growth 12, 27–49. doi: 10.1007/s10887-007-9010-6

Boukhatem, J. (2016). Assessing the direct effect of financial development on poverty reduction in a panel of low- and middle-income countries. Res. Int. Bus. Financ. 37, 214–230. doi: 10.1016/j.ribaf.2015.11.008

Cabeza-García, L., Del Brio, E. B., and Oscanoa-Victorio, M. L. (2019). Female financial inclusion and its impacts on inclusive economic development. Womens. Stud. Int. Forum. 77, 102300. doi: 10.1016/j.wsif.2019.102300

Calomiris, C. W., and Kahn, C. M. (1991). The role of demandable debt in structuring optimal banking arrangements. Am. Econ. Rev. 81, 497–513. doi: 10.2307/2006515

Campanella, F., Gangi, F., Mustilli, M., and Serino, L. (2020). The effects of the credit selection criteria on non-performing loans: evidence on small and large banks in Italy. Med. Account. Res. 28, 251–275. doi: 10.1108/MEDAR-01-2019-0430

Carter, D. A., and McNulty, J. E. (2005). Deregulation, technological change, and the business-lending performance of large and small banks. J. Bank. Financ. 29, 1113–1130. doi: 10.1016/j.jbankfin.2004.05.033

Chatterjee, P., Sarangi, S., de Aghion, B. A., and Morduch, J. (2006). The economics of microfinance. South. Econ. J. 73, 259. doi: 10.2307/20111887

Chen, F. W., Feng, Y., and Wang, W. (2018). Impacts of financial inclusion on non-performing loans of commercial banks: evidence from China. Sustain. 10. doi: 10.3390/su10093084

Collins, D., Morduch, J., Rutherford, S., and Ruthven, O. (2009). Portfolios of the poor: How the world's poor live on $2 a day. Princet. Univ. Press 11, 165–166. doi: 10.1080/09614524.2010.491535

Demirguc-Kunt, A., and Klapper, L. (2012). Measuring financial inclusion. The Global findex database. Policy Research Working Paper 6025. doi: 10.1596/978-0-8213-9509-7

Driscoll, J., and Kraay, A. C. (1998). Consistent covariance matrix estimation with spatially dependent data. Rev. Econom. Statist. 80, 549–560. doi: 10.1162/003465398557825

Endut, R., Syuhada, N., Ismail, F., and Mahmood, W. M. W. (2013). Macroeconomic implications on non-performing loans in Asian Pacific Region. World Appl. Sci. J. 23, 57–60. doi: 10.5829/idosi.wasj.2013.23.eemcge.22011

Grohmann, A., Klühs, T., and Menkhoff, L. (2018). Does financial literacy improve financial inclusion? Cross country evidence. World Dev. 111, 84–96. doi: 10.1016/j.worlddev.2018.06.020

Hair, J. F., Black, W. C., Babin, B. J. Y. A., and Anderson, R. (2010). Multivariate Data Analysis (7th Edition). A Global Perspective. Upper Saddle River: Pearson Prentice Hall.

Hoechle, D. (2007). Robust standard errors for panel regressions with cross-sectional dependence. Stata J. 7, 281–312. Available online at: https://econpapers.repec.org/RePEc:tsj:stataj:v:7:y:2007:i:3:p:281-312

IMF (2017). Global Financial Stability Report. Available online at: https://www.imf.org/en/Publications/GFSR/Issues/2017/09/27/global-financial-stability-report-october-2017#Summary (accessed January 13, 2022).

Kauko, K. (2012). External deficits and non-performing loans in the recent financial crisis. Econ. Lett. 115, 196–199. doi: 10.1016/j.econlet.2011.12.018

Khan, Q. M., Kauser, R., and Abbas, U. (2015). Impact of bank specific and macroeconomic factors on banks profitability: a study on banking sector of Pakistan. J. Account. Financ. Emerg. Econ. 1, 99–110. doi: 10.26710/jafee.v1i2.100

Kim, D. W., Yu, J. S., and Hassan, M. K. (2018). Financial inclusion and economic growth in OIC countries. Res. Int. Bus. Financ. 43, 1–14. doi: 10.1016/j.ribaf.2017.07.178

Kjosevski, J., and Petkovski, M. (2017). Non-performing loans in Baltic States: Determinants and macroeconomic effects. Balt. J. Econ. 17, 25–44. doi: 10.1080/1406099X.2016.1246234

Kumar, R. R., Stauvermann, P. J., Patel, A., and Prasad, S. S. (2018). Determinants of non-performing loans in banking sector in small developing island states: a study of Fiji. Account. Res. J. 31, 192–213. doi: 10.1108/ARJ-06-2015-0077

Le, T. -H., and Tran-Nam, B. (2018). Relative costs and FDI: Why did Vietnam forge so far ahead? Econom. Anal. Policy. 59, 1–13. doi: 10.1016/j.eap.2018.02.004

Leyshon, A., and Thrift, N. (1993). The restructuring of the U.K. financial services industry in the 1990s: a reversal of fortune? J. Rural Stud. 9, 223–241. doi: 10.1016/0743-0167(93)90068-U

Leyshon, A., and Thrift, N. (1994). Access to financial services and financial infrastructure withdrawal: problems and policies. Area 26, 268–275. doi: 10.2307/20003457

Louzis, D. P., Vouldis, A. T., and Metaxas, V. L. (2012). Macroeconomic and bank-specific determinants of non-performing loans in Greece: a comparative study of mortgage, business and consumer loan portfolios. J. Bank. Financ. 36, 1012–1027. doi: 10.1016/j.jbankfin.2011.10.012

Makina, D., and Walle, Y. M. (2019). “Financial inclusion and economic growth: evidence from a panel of selected African countries,” in Extending Financial Inclusion in Africa. doi: 10.1016/B978-0-12-814164-9.00009-8

Mankiw, N. G. (2011). Principles of Economics, 5th Edn. South-Western Cengage Learning. Available online at: http://mankiw.swlearning.com/

Mazreku, I., Morina, F., Misiri, V., Spiteri, J. V., and Grima, S. (2018). Determinants of the level of non-performing loans in commercial banks of transition countries. Eur. Res. Stud. J. 21, 3–13. doi: 10.35808/ersj/1040

Minsky's Approach to Poverty and Unemployment. (2015). Why Minsky Matters: An Introduction to the Work of a Maverick Economist. Princeton, NJ: Princeton University Press. p. 109–136. doi: 10.1515/9781400873494-007

Naceur, S. B., and Ghazouani, S. (2007). Stock markets, banks, and economic growth: Empirical evidence from the MENA region. Res. Int. Bus. Financ. 21, 297–315. doi: 10.1016/j.ribaf.2006.05.002

Ozili, P. K. (2019). Non-performing loans and financial development: new evidence. J. Risk Financ. 20, 59–81. doi: 10.1108/JRF-07-2017-0112

Partovi, E., and Matousek, R. (2019). Bank efficiency and non-performing loans: evidence from Turkey. Res. Int. Bus. Financ. 48, 287–309. doi: 10.1016/j.ribaf.2018.12.011

Podpiera, J., and Weill, L. (2008). Bad luck or bad management? Emerging banking market experience. J. Financ. Stab. 4, 135–148. doi: 10.1016/j.jfs.2008.01.005

Pradhan, R. P., Arvin, M. B., Hall, J. H., and Nair, M. (2016). Innovation, financial development and economic growth in eurozone countries. Appl. Econom. Lett. 23, 1141–1144. doi: 10.1080/13504851.2016.1139668

Sarma, M., and Pais, J. (2008). “Financial inclusion and development: a cross country analysis,” in Annual Conference Human Development Capability Association, New Delhi. doi: 10.1002/jid

Song, F., and Thakor, A. V. (2007). Relationship banking, fragility, and the asset-liability matching problem. Rev. Financ. Stud. 20, 2129–2177. doi: 10.1093/rfs/hhm015

Stiglitz, J. E., and Andrew, W. (1981). Credit rationing in markets with imperfect information. Am. Econom. Rev. 71, 393–410. Available online at: http://www.jstor.org/stable/1802787 (accessed January 15, 2022).

United Nations (2015). Transforming Our World: The 2030 Agenda for Sustainable Development. UN Doc. A/70/L (2015). Available online at: https://sustainabledevelopment.un.org/post2015/transformingourworld (accessed January 13, 2022).

Van der Werff, E., Steg, L., and Keizer, K. (2013). It is a moral issue: the relationship between environmental self-identity, obligation-based intrinsic motivation and pro-environmental behaviour. Glob. Environ. Change 23, 1258–1265. doi: 10.1016/j.gloenvcha.2013.07.018

Vithessonthi, C. (2016). Deflation, bank credit growth, and non-performing loans: evidence from Japan. Int. Rev. Financ. Anal. 45, 295–305. doi: 10.1016/j.irfa.2016.04.003

World Bank. (2018). Financial Inclusion. Available online at: https://www.worldbank.org/en/topic/financialinclusion/overview#1 (accessed August 1,2, 2020).

Yang, C. C. (2017). Reduction of non-performing loans in the banking industry: an application of data envelopment analysis. J. Bus. Econ. Manag. 18, 833–851. doi: 10.3846/16111699.2017.1358209

Keywords: financial inclusion, non-performing loans (NPL), economic growth, Organization for Economic Corporation and Development (OECD), Driscoll-Kraay standard errors

Citation: Zhang P, Zhang M, Zhou Q and Zaidi SAH (2022) The Relationship Among Financial Inclusion, Non-Performing Loans, and Economic Growth: Insights From OECD Countries. Front. Psychol. 13:939426. doi: 10.3389/fpsyg.2022.939426

Received: 09 May 2022; Accepted: 30 May 2022;

Published: 04 July 2022.

Edited by:

Naeem Akhtar, University of Engineering and Technology, PakistanReviewed by:

Irfan Khan, Beijing Institute of Technology, ChinaRana Umair Ashraf, University of Warsaw, Poland

Copyright © 2022 Zhang, Zhang, Zhou and Zaidi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Peng Zhang, emhhbmdwZW5nNjY2NTIxJiN4MDAwNDA7MTYzLmNvbQ==

Peng Zhang1*

Peng Zhang1* Syed Anees Haider Zaidi

Syed Anees Haider Zaidi