- 1Department of Business Administration, Foundation University Islamabad, Islamabad, Pakistan

- 2Department of Economics and Finance, Foundation University Islamabad, Islamabad, Pakistan

- 3Faculty of Management Sciences, Foundation University Islamabad, Islamabad, Pakistan

- 4Management Sciences, Bahria University, Islamabad, Pakistan

The purpose of the study is to observe the impact of policy intervention on financial sustainability using the structural vector autoregression (SVAR) analysis. The population of the study is the manufacturing sector of Pakistan, which is an emerging economy. Data for 249 firms operating in the manufacturing sector are taken, collected from Datastream from 2005 to 2019, with total observations of 2,400. To conduct the analysis, R software is used for its better visualization. Results show that firm performance, corporate governance, and sectoral policies have a positive and long-term impact on financial sustainability, whereas earning management and financialization not only have a negative impact, but this impact affects the operations of the corporate for a longer period. This study would be helpful for policymakers as it gives a framework for financial sustainability based on the policies and strategies developed by the sector.

Introduction

Financial crises over the years have altered the way corporates were operating and used to make their policies (Aqeel et al., 2021a,b, 2022; Li et al., 2021; Wang et al., 2021; Zhou et al., 2021; NeJhaddadgar et al., 2022). Now, corporates enter the market to stay without becoming a going concern (Abbas et al., 2021; Mubeen et al., 2021a,b; Aman et al., 2022; Ge et al., 2022; Liu et al., 2022). They make such strategies that help them function effectively by taking care of all the stakeholders (Abbas et al., 2019b; Hussain et al., 2019, 2021; Mamirkulova et al., 2020; Mubeen et al., 2020, 2021a,b; Abbasi et al., 2021; Azizi et al., 2021; Mamirkulova and Mi, 2022). These financial crises have also taught them that working to get short-term goals and increasing the worth of shareholders can damage in the longer run (Anjum et al., 2017; Abbas, 2020; Maqsood et al., 2021; Raza Abbasi et al., 2021; Rahmat et al., 2022). These shifting trends have instigated an inescapable responsibility for corporates to look after all the stakeholders if they want to be successful and become financially sustainable (Zhang et al., 2012; Asad et al., 2017; Abbas et al., 2019b; Aman et al., 2019; Irfan and Ali, 2019).

Corporates operating in developed nations are far ahead in adopting policies that can help them in sustainable development as compared to the ones working in developing nations (Ali and Irfan, 2020). Input from developing nations is limited in sustainability (Alshehhi et al., 2018) and (Shah et al., 2016), and research related to financial sustainability is also limited (Zabolotnyy and Wasilewski, 2019). This article is an attempt to see the policy interventions of corporates operating in the manufacturing sector of Pakistan to gain financial sustainability by using structural vector autoregression (SVAR). In addition, structural impact on corporate policies devised and implemented from time to time is also carried out by applying SVAR.

Review of Literature

Structural vector autoregression1 models allow the contemporaneous interdependencies between the left-hand-side variables (Deleidi et al., 2021). SVAR models can identify shocks with the help of the Impulse Response Analysis (IRA) or restrictions can be applied by the theory (Yang et al., 2022). It is useful to analyze the dynamics of the model by introducing it to unexpected shocks. The default SVAR model was a scoring algorithm by Amisano and Giannini (1997). The SVAR models are implemented through various software packages like EViews, R, etc. which makes the use of SVAR models simple.

In SVAR models, impulse response functions (IRFs) are usually computed to see the response of the model to a deviation or a shock (Gottschalk, 2001). SVAR models are structural models, which are used to explore the dynamic behavior of the variables from the theoretical viewpoint or a theory-guided view. VAR and SVAR are used in research to address problems of endogeneity and causality. In one study, VAR was used to examine the impact of the growth of public debt in Nigeria. It was observed that debt has a positive impact on the economic growth rate a bidirectional link exists between public debt and economic growth (Egbetunde, 2012). In another study panel, VAR was used to analyze the causal relationship between government debt and economic growth for a sample of 20 developed countries and found a negative relation between the two variables (Lof and Malinen, 2014). Bal et al. (2022) used SVAR to analyze the impact of electricity consumption on economic growth.

Sustainability has become a new mantra for the current century. This concept originated from the 1987 Brundtland Report. The concept encompasses three dimensions: social, economic, and environmental. The pursuit of economic and social impartiality has been a real aim for the past many years. The importance of economic well-being is a renowned phenomenon, but the issue with this economic or financial well-being is to take the output toward a longer time frame where future generations can also benefit from it.

Methodology

For this purpose, structural VAR is used, with the help of IRF, the future intervention of the variables is studied and shocks from each exogenous variable are identified as well. This study followed research procedures for analysis (Yoosefi Lebni et al., 2020; Aman et al., 2021; Khazaie et al., 2021; Moradi et al., 2021; Paulson et al., 2021; Farzadfar et al., 2022). This analysis aids to pinpoint the direction and strength of the impact from each variable. SVAR is conducted to observe the future intervention of the variables, which are part of the framework. The analysis is performed in R software that cannot only help to analyze the data but would also assist in better visualization of the policy interventions (Khattak et al., 2013; Malik et al., 2017; Asad et al., 2020a,b; Ashraf et al., 2020; Zhu et al., 2021). R software is used because of the following reasons, these reasons are also justified by Incerti et al. (2019) and Mizumoto and Plonsky (2016). R software is used because of its cost-effectiveness. It is open-source software and all the packages in R software are also easily available on the internet. Moreover, it is updated by the researchers frequently and the updated version is shared openly. That helps to access the latest syntax.

The SVAR model is used to identify the shocks and trace them out (Pfaff, 2008). Moreover, it is used to identify short-term or long-term policy interventions. Impulse response function IRF helps to identify the shocks caused by each variable and the intensity of the shock as well. The impact in the form of shocks can be seen over the sample period. The packages used for PVAR, and SVAR are vars, urca, plm, panel var, and dev tools.

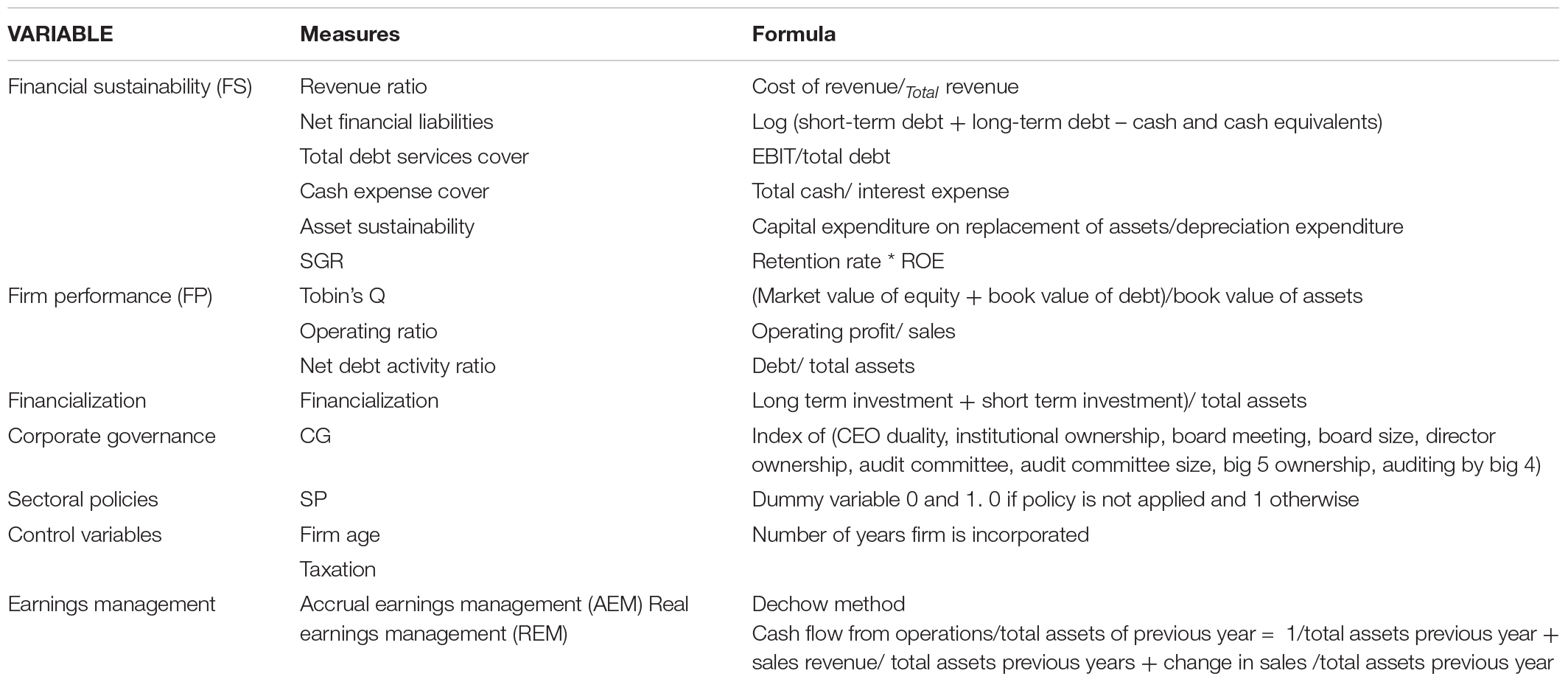

For the study, firm performance, financialization, corporate governance, policies, and earning management are taken as the independent variables and financial sustainability is the dependent variable as shown in Table 1.

The econometric model of the study is:

Where FS is the financial sustainability, FiP is the firm performance, EM is the earning management, SP is the sectoral policies, CGI is the corporate governance index, and firm age and tax are taken as the control variables.

Six models are tested with the help of SVAR. These six models are based on the six determinants of FS financial sustainability. The determinants are explained in the table above. The models for testing are:

Model 1:

Model 2:

Model 3:

Model 4:

Model 5:

Model 6:

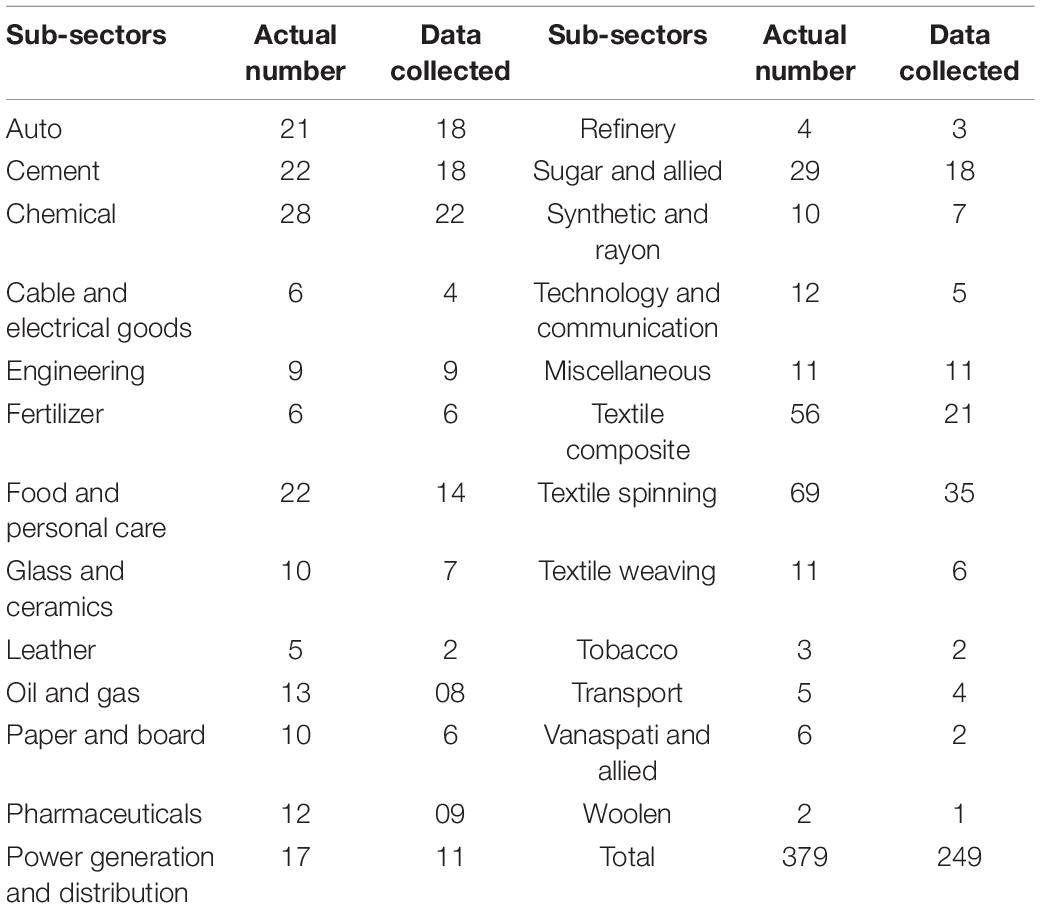

Table 2 shows the number of firms operating in the manufacturing sector and the number of firms from which data are collected.

Data is collected from 2005 to 2019 for 249 firms and excluding the missing and the unavailable data the total count of observations is over 2400.

Analysis

To see the impact of each variable on the endogenous variable, structural vector auto-regression SVAR is carried out. Structural vector autoregression helps to identify the structural shocks and how those shocks would behave over some time. The intensity and the duration of impact can be visually represented also, as done in the following section.

The R software is used for the analysis, and the package SVARs are installed for the purpose. Structural VAR applies to each model. The variable of interest in the study is financial sustainability, which is studied through different models. The basic purpose of the study is to identify the elements, which help the firm attain financial stability in the longer run. Based on the purpose of the study the restriction imposed on SVAR is BQ or Blanchard and Quah restriction, proposed by Blanchard and Quah (1988), which states imposing restrictions on how stocks influence the endogenous variables in the long run and limiting the response from a variable to a shock. The syntax used to calculate the SVAR in R is:

SVAR estimation:

Model6 ← VAR (dset6, p = 4, type = “const”)

SVAR6 ← BQ (Model6)

summary (SVAR6).

Impulse response function:

irf6 ← irf (SVAR6, impulse = “financialization1,”

response = “log.revratio,” n.ahead = 10)

plot(irf6).

The IRF generated is shown here for all the variables and all the models to get a clear idea of the shocks and behavior of the variables over the period. Estimates for all the models are given as under, showing the values for 10 years as the data is yearly in terms of the estimated contemporaneous impact matrix, estimated identified long-run impact matrix, and covariance matrix of reduced form residuals. The visualization of the SVAR model is also shown:

Model 1

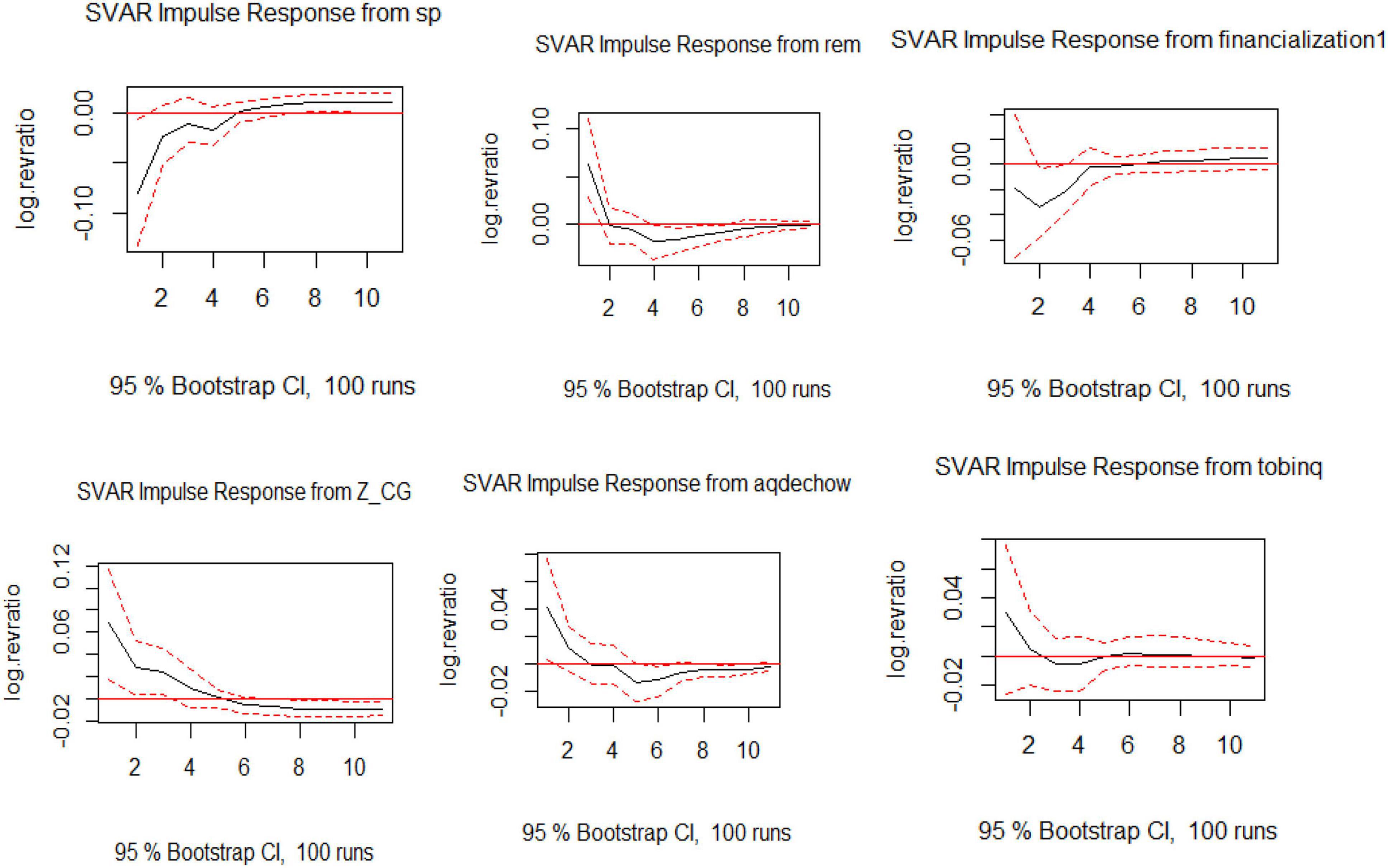

Based on the visualization as presented in Figure 1, the graphs show the effect of each exogenous variable on the endogenous variable. Sectoral policies are showing an upward trend in future years to come, which shows the efficacy of the policies instigated in the various sectors under study. Moreover, the negative impact of financialization subsides over a couple of years and, afterward, stabilizes in the later years. The effect of REM and AEM is very damaging for the revenue ratio of firms, as the impact is a deep plunge that stays the same in the longer term.

Figure 1. Visualization of impulse response function (IRF) for structural vector autoregression (SVAR) for Model 1.

Model 2

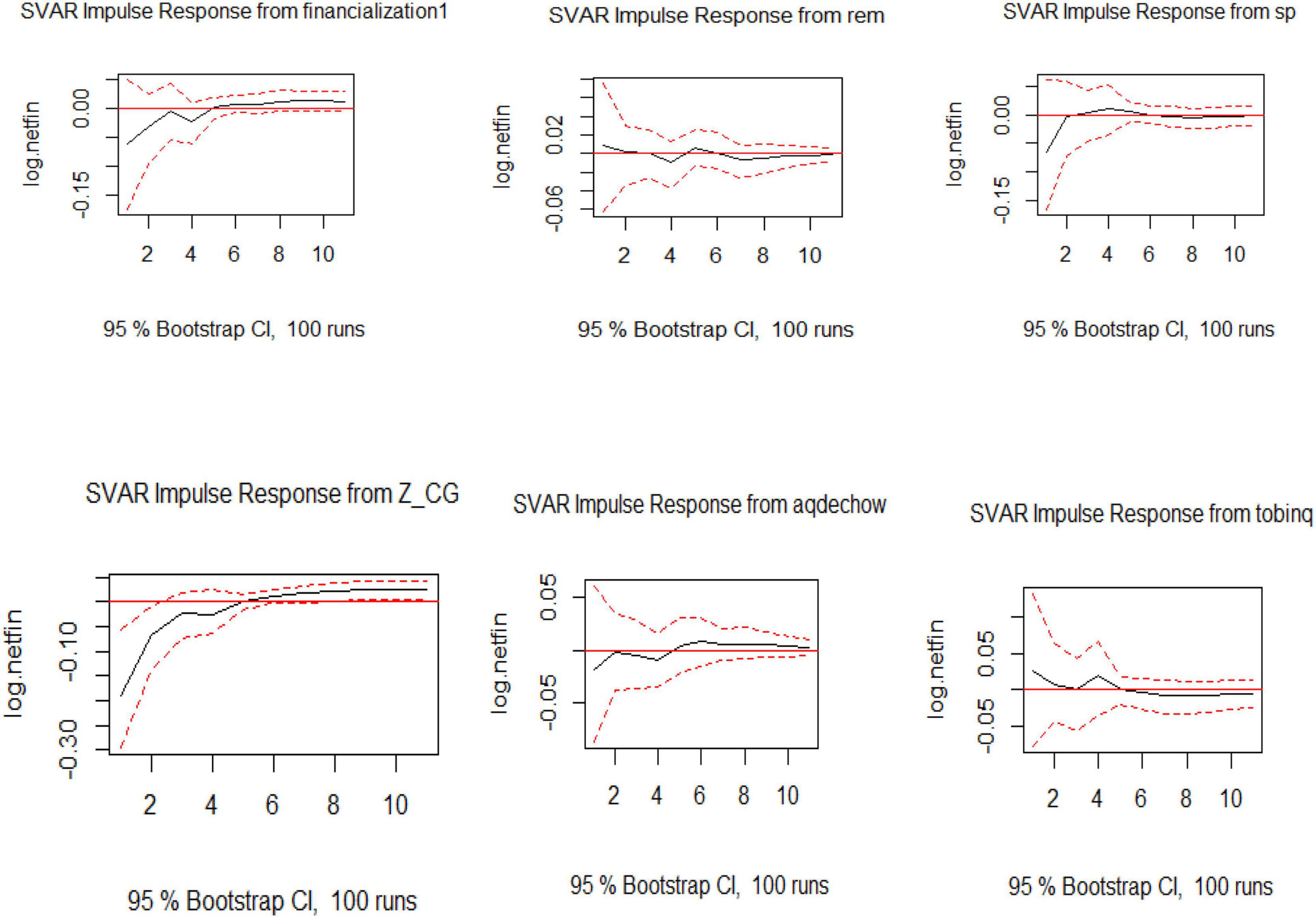

The SVAR analysis is conducted on Model 2 to see the long-term shocks of the variables on the endogenous variable, which is the net financial liability. The dependent variables are financialization, real earning management, accrual earning management, Tobin Q, and sectoral policies. Over 10 years, net financial liability is affected by exogenous variables, but the trend settles down in the longer term. Sectoral policies SP, take the net financial liability upward initially, and then, there is a stabilized effect on the endogenous variable. This shows that the policies developed by sectors are effective and working in a positive direction. Similarly, the impact shown by Tobin Q is downward initially till year 3, then there is a rise in year 4, after which the impact has stabilized in the later years as shown in Figure 2.

Model 3

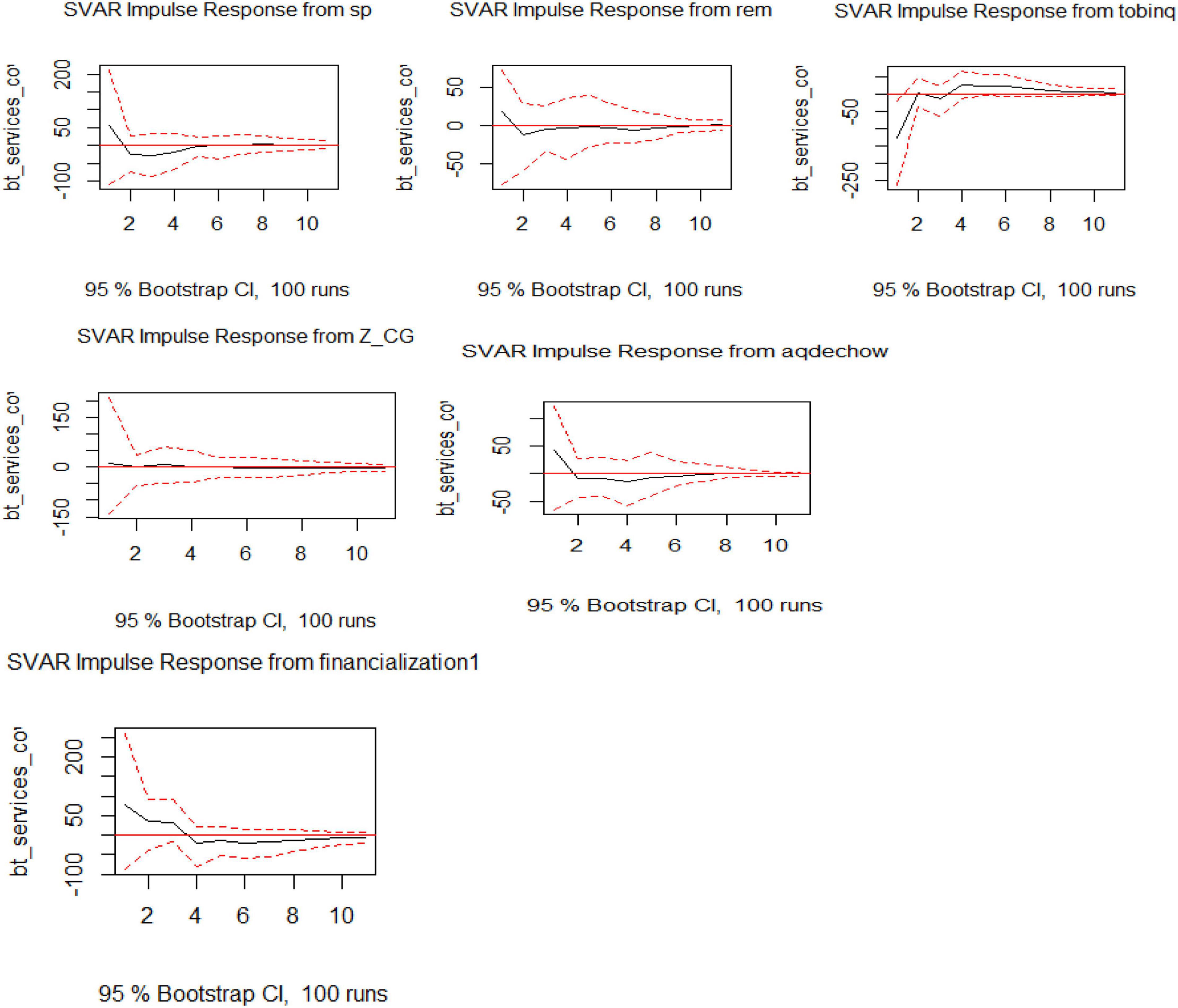

Visualization of SVAR for Model 3 shows the impact of exogenous variables on an endogenous variable, which is debt services cover. The impact of Tobin Q is taking the endogenous variable upward and this hike then persists in the years to come. The impact of REM, AEM, financialization, and SP are downward, and the decline becomes part of the trend in the later years as shown in Figure 3.

Model 4

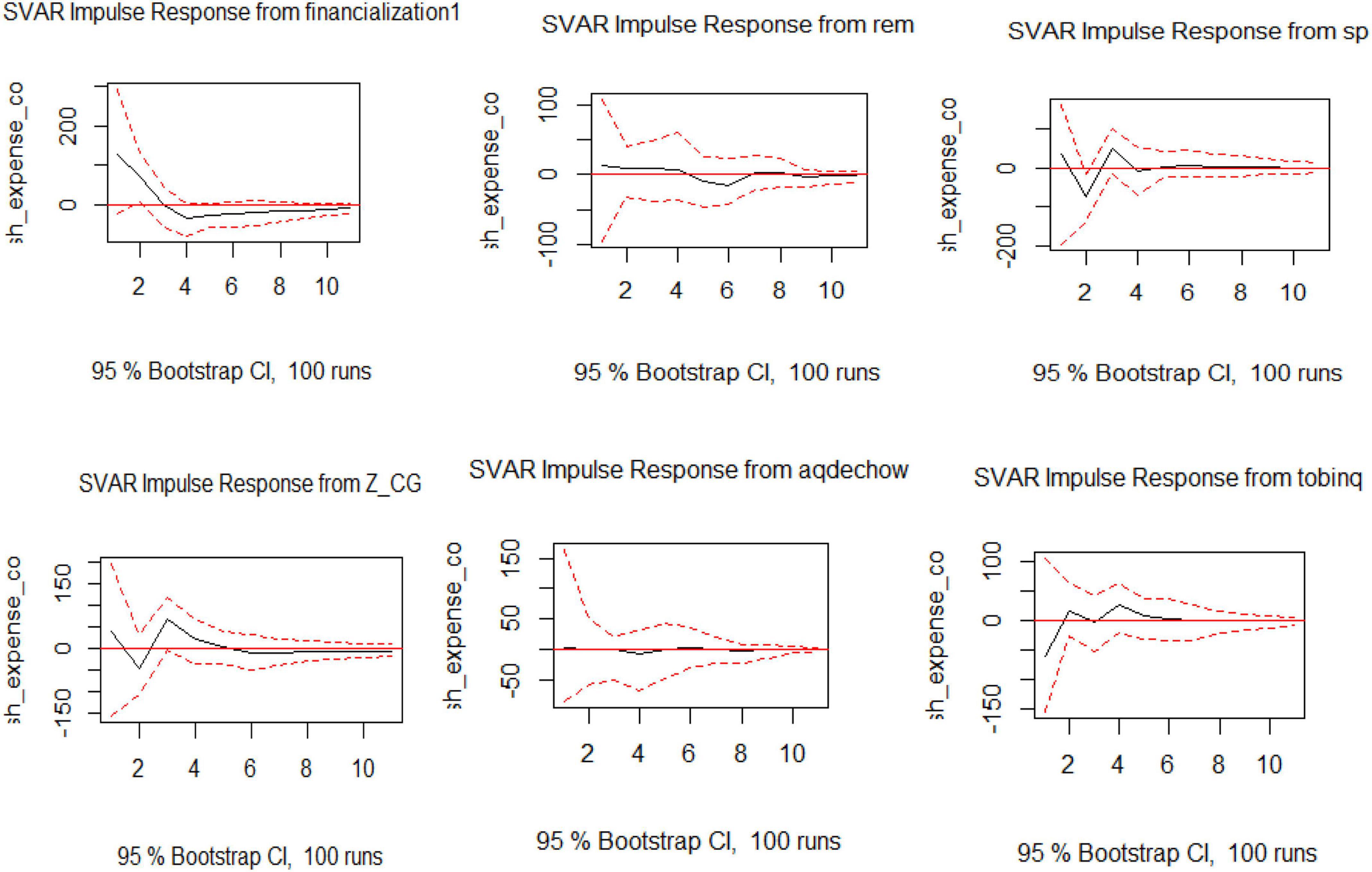

The IRF shows the impact of the exogenous variable on cash expense cover as part of Model 4. The IRF of SVAR shows financialization has a great negative impact, which is long-lasting, and firms cannot return to their initial position because of financialization. REM and AEM are not affected gravely; whereas the Tobin Q is showing a positive impact and the influence is for a longer period. Furthermore, SP is keeping a stabilized pattern over the time frame as shown in Figure 4.

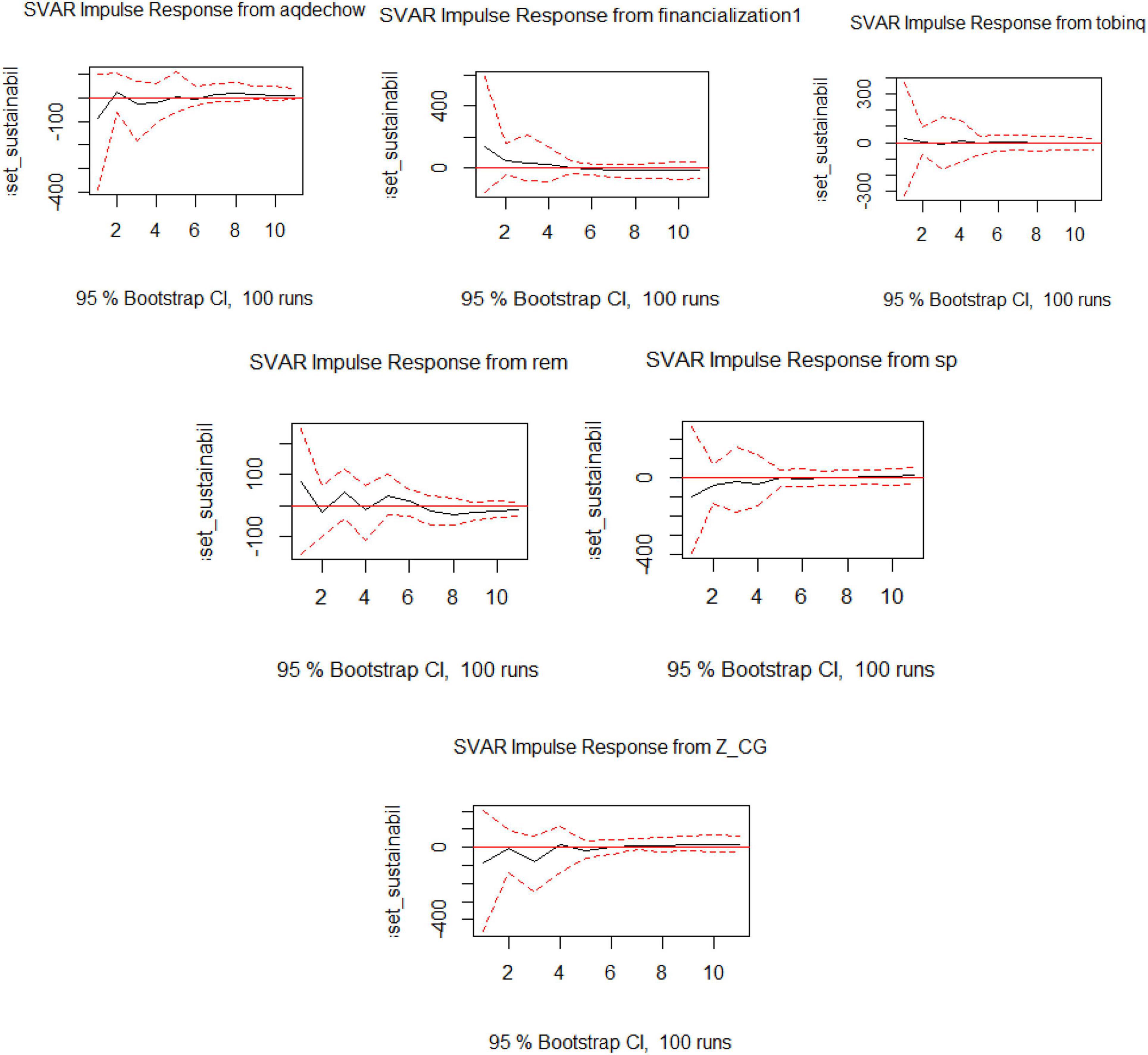

Model 5

The IRF shows the impact of the exogenous variable on asset sustainability as part of Model 5. The impact of financialization is downward sloping and its impact continues for the longer term. The influence of REM and AEM is not very damaging, as the upward trend is balanced out by a downward trend of the same effect. The effect of SP is also stabilized over the period as shown in Figure 5.

Model 6

The IRF shows the impact of the exogenous variable on SGR as part of Model 6. The impact on SGR from the exogenous variables is not very intense and stabilizes in the longer run. The downward trend from REM and AEM even outs in a year or two to balance the impression. The effect of SP is upward, which shows the effectiveness of the sectoral policies as shown in Figure 6.

The SVAR analysis shows that firm performance, corporate governance, and sectoral policies have a positive and long-lasting positive impact on financial sustainability (Badar and Irfan, 2018; Asad et al., 2020a,b; Yan et al., 2020; Ali et al., 2021; Zhu et al., 2021), whereas earning management and financialization have a negative impact that affects financial sustainability for the years to come.

Conclusion

The basic aim of a corporation is to stay in the market for a longer period. For that, they make strategies and policies for sustainable development, but not all the policies, as clear from the past, are fruitful for industrial growth. This study conducts a policy intervention anals.

Data Availability Statement

The original contributions presented in this study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work, and approved it for publication.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

- ^ The SVAR is appealing for many reasons, including the fact that all the variables included in the SVAR system are treated as endogenous and interdependent. Furthermore, the model can capture the static and dynamic interdependencies present in the data series using a minimum set of restrictions. In addition, the SVAR model explicitly accounts for variations in the transmission of shocks among the variables.

References

Abbas, J. (2020). The Impact of Coronavirus (SARS-CoV2) Epidemic on Individuals Mental Health: the Protective Measures of Pakistan in Managing and Sustaining Transmissible Disease. Psychiatr. Danub. 32, 472–477. doi: 10.24869/psyd.2020.472

Abbas, J., Mahmood, S., Ali, H., Ali Raza, M., Ali, G., Aman, J., et al. (2019a). The Effects of Corporate Social Responsibility Practices and Environmental Factors through a Moderating Role of Social Media Marketing on Sustainable Performance of Business Firms. Sustainability 11:3434. doi: 10.3390/su11123434

Abbas, J., Raza, S., Nurunnabi, M., Minai, M. S., and Bano, S. (2019b). The Impact of Entrepreneurial Business Networks on Firms’ Performance Through a Mediating Role of Dynamic Capabilities. Sustainability 11:3006. doi: 10.3390/su11113006

Abbas, J., Wang, D., Su, Z., and Ziapour, A. (2021). The Role of Social Media in the Advent of COVID-19 Pandemic: crisis Management, Mental Health Challenges and Implications. Risk Manag. Healthc. Policy 14, 1917–1932. doi: 10.2147/RMHP.S284313

Abbasi, K. R., Adedoyin, F. F., and Hussain, K. (2021). The impact of energy depletion and renewable energy on CO2 emissions in Thailand: fresh evidence from the novel dynamic ARDL simulation. Renewable Energy 180, 1439–1450. doi: 10.1016/j.renene.2021.08.078

Ali, M. H., Irfan, D. M., and Zafar, S. (2021). Effect of Leadership Styles on Education Quality in Public Universities with the Interaction of Organizational Politics: using the Partial Least Square Algorithm. J. Soc. Sci. Hum. 1, 1–13.

Ali, R. A., and Irfan, M. (2020). The Impact of Corporate Governance, Fundamental and Macroeconomic Factors on Stock Prices: an Evidence from Sugar and Allied Industry of Pakistan. Int. J. Enterprise Information Syst. 40, 1329–1341.

Alshehhi, A., Nobanee, H., and Khare, N. (2018). The Impact of Sustainability Practices on Corporate Financial Performance: literature Trends and Future Research Potential. Sustainability 10:494. doi: 10.3390/su10020494

Aman, J., Lela, U., and Shi, G. (2021). Religious Affiliation, Daily Spirituals, and Private Religious Factors Promote Marital Commitment Among Married Couples: does Religiosity Help People Amid the COVID-19 Crisis? Front. Psychol. 12:657400. doi: 10.3389/fpsyg.2021.657400

Aman, J., Mahmood, S., Nurunnabi, M., and Bano, S. (2019). The Influence of Islamic Religiosity on the Perceived Socio-Cultural Impact of Sustainable Tourism Development in Pakistan: a Structural Equation Modeling Approach. Sustainability 11:3039. doi: 10.3390/su11113039

Aman, J., Shi, G., Ain, N. U., and Gu, L. (2022). Community Wellbeing Under China-Pakistan Economic Corridor: role of Social, Economic, Cultural, and Educational Factors in Improving Residents’ Quality of Life. Front. Psychol. 12:816592. doi: 10.3389/fpsyg.2021.816592

Amisano, G., and Giannini, C. (1997). Topics in Structural VAR Econometrics. 2nd edition. Berlin: Springer-Verlag.

Anjum, M. N., Xiuchun, B., Shuguang, Z., and McMillan, D. (2017). Analyzing predictors of customer satisfaction and assessment of retail banking problems in Pakistan. Cogent Bus. Manag. 4:1338842. doi: 10.1080/23311975.2017.1338842

Aqeel, M., Raza, S., and Aman, J. (2021a). Portraying the multifaceted interplay between sexual harassment, job stress, social support and employees turnover intension amid COVID-19: a Multilevel Moderating Model Foundation University. J. Bus. Econ. 6, 1–17.

Aqeel, M., Rehna, T., and Shuja, K. H. (2022). Comparison of Students’ Mental Wellbeing, Anxiety, Depression, and Quality of Life During COVID-19’s Full and Partial (Smart) Lockdowns: a Follow-Up Study at a 5-Month Interval. Front. Psychiatry 13:835585. doi: 10.3389/fpsyt.2022.835585

Aqeel, M., Shuja, K. H., Rehna, T., Ziapour, A., Yousaf, I., and Karamat, T. (2021b). The influence of illness perception, anxiety and depression disorders on students mental health during COVID-19 outbreak in Pakistan: a Web-based cross-sectional survey. Int. J. Hum. Rights Health 15, 17–30.

Asad, A., Basheer, M. F., Irfan, M., Jiang, J., and Tahir, R. (2020a). Open-Innovation and knowledge management in Small and Medium-Sized Enterprises (SMEs): the role of external knowledge and internal innovation. Revista Argentina de Clínica Psicológica 29, 80–90.

Asad, A., Hameed, W. U., Irfan, M., Jiang, J., and Naveed, R. T. (2020b). The Contribution of Microfinance Institutes in Women-Empowerment and role of Vulnerability. Revista Argentina de Clínica Psicológica 29, 223–238.

Asad, A., Irfan, M., and Raza, H. M. (2017). The Impact of HPWS in Organizational Performance: a Mediating Role of Servant Leadership. J. Managerial Sci. 11, 25–48.

Ashraf, M. S., Akhtar, N., Ashraf, R. U., Hou, F., Junaid, M., and Kirmani, S. A. A. (2020). Traveling Responsibly to Ecofriendly Destinations: an Individual-Level Cross-Cultural Comparison between the United Kingdom and China. Sustainability 12:3248.

Azizi, M. R., Atlasi, R., Ziapour, A., and Naemi, R. (2021). Innovative human resource management strategies during the COVID-19 pandemic: a systematic narrative review approach. Heliyon 7:e07233. doi: 10.1016/j.heliyon.2021.e07233

Badar, M. S., and Irfan, M. (2018). Shopping Mall Services and Customer Purchase Intention along with Demographics. Germany: Springer Verlag.

Bal, D. P., Patra, S. K., and Mohanty, S. (2022). Impact of sectoral decompositions of electricity consumption on economic growth in India: evidence from SVAR framework. Environ. Sci. Pollution Res. [Epub ahead of print]. doi: 10.1007/s11356-022-19352-2

Blanchard, O. J., and Quah, D. (1988). The dynamic effects of aggregate demand and supply disturbances. Am. Econ. Rev. 79, 655–673. doi: 10.3386/w2737

Deleidi, M., Romaniello, D., and Tosi, F. (2021). Quantifying fiscal multipliers in Italy: a Panel SVAR analysis using regional data. Papers Regional Sci. 100, 1158–1177. doi: 10.1111/pirs.12620

Egbetunde, T. (2012). Public debt and economic growth in Nigeria: evidence from Granger causality. Am. J. Economics 2, 101–106. doi: 10.5923/j.economics.20120206.02

Farzadfar, F., Naghavi, M., Sepanlou, S. G., Saeedi Moghaddam, S., Dangel, W. J., Davis Weaver, N., et al. (2022). Health system performance in Iran: a systematic analysis for the Global Burden of Disease Study 2019. Lancet 399, 1625–1645. doi: 10.1016/s0140-6736(21)02751-3

Ge, T., Ullah, R., Sadiq, I., and Zhang, R. (2022). Women’s Entrepreneurial Contribution to Family Income: innovative Technologies Promote Females’ Entrepreneurship Amid COVID-19 Crisis. Front. Psychol. 13:828040. doi: 10.3389/fpsyg.2022.828040

Gottschalk, J. (2001). An Introduction to the SVAR Methodology: Identification, Interpretation and Limitations of SVAR Models. Germany: Kiel Institute of World Economics.

Hussain, T., Wei, Z., Ahmad, S., Xuehao, B., and Gaoli, Z. (2021). Impact of Urban Village Disamenity on Neighboring Residential Properties: empirical Evidence from Nanjing through Hedonic Pricing Model Appraisal. J. Urban Planning Dev. 147:04020055. doi: 10.1061/(asce)up.1943-5444.0000645

Hussain, T., Wei, Z., and Nurunnabi, M. (2019). The Effect of Sustainable Urban Planning and Slum Disamenity on The Value of Neighboring Residential Property: application of The Hedonic Pricing Model in Rent Price Appraisal. Sustainability 11:1144. doi: 10.3390/su11041144

Incerti, D., Thom, H., Baio, G., and Jansen, J. P. (2019). R You Still Using Excel? The Advantages of Modern Software Tools for Health Technology Assessment. Value Health 22, 575–579. doi: 10.1016/j.jval.2019.01.003

Irfan, M., and Ali, M. H. (2019). Attitude of Customers Towards Adopting of Mobile Banking (M-Banking (An Empirical Study From Pakistan). Innovative Syst. Design Eng. 10, 30–33.

Khattak, M. A. O., She, Y., Memon, Z. A., Syed, N., Hussain, S., and Irfan, M. (2013). Investigating critical success factors affecting ERP implementation in Chinese and Pakistani enterprises. Int. J. Enterp. Inform. Syst. 9, 39–76.

Khazaie, H., Lebni, J. Y., Mahaki, B., Chaboksavar, F., Kianipour, N., and Ziapour, A. (2021). Internet Addiction Status and Related Factors among Medical Students: a Cross-Sectional Study in Western Iran. Int. Q Commun. Health Educ. [Epub ahead of print]. doi: 10.1177/0272684X211025438

Li, Z., Wang, D., Hassan, S., and Mubeen, R. (2021). Tourists’ Health Risk Threats Amid COVID-19 Era: role of Technology Innovation, Transformation, and Recovery Implications for Sustainable Tourism. Front. Psychol. 12:769175. doi: 10.3389/fpsyg.2021.769175

Liu, Q., Qu, X., Wang, D., and Mubeen, R. (2022). Product Market Competition and Firm Performance: business Survival Through Innovation and Entrepreneurial Orientation Amid COVID-19 Financial Crisis. Front. Psychol. 12:790923. doi: 10.3389/fpsyg.2021.790923

Lof, M., and Malinen, T. (2014). Does sovereign debt weaken economic growth? Panel VAR Analysis Economics Lett. 122, 403–407.

Malik, M. S., Majeed, S., and Irfan, M. (2017). Impact of IT Investment on productivity of manufacturing organizations: evidence from Textile Sector of Pakistan. South Asian J. Banking Soc. Sci. 2, 75–87.

Mamirkulova, G., and Mi, J. (2022). Economic Corridor and tourism sustainability amid unpredictable COVID-19 challenges: assessing community well-being in the World Heritage Sites. Front. Psychol. 12:797568. doi: 10.3389/fpsyg.2022.797568

Mamirkulova, G., Mi, J., Mahmood, S., Mubeen, R., and Ziapour, A. (2020). New Silk Road infrastructure opportunities in developing tourism environment for residents better quality of life. Global Ecol. Conservation 24:e01194. doi: 10.1016/j.gecco.2020.e01194

Maqsood, A., Rehman, G., and Mubeen, R. (2021). The paradigm shift for educational system continuance in the advent of COVID-19 pandemic: mental health challenges and reflections. Curr. Res. Behav. Sci. 2:100011. doi: 10.1016/j.crbeha.2020.100011

Mizumoto, A., and Plonsky, L. (2016). R as a Lingua Franca: advantages of Using R for Quantitative Research in Applied Linguistics. Appl. Linguistics 37, 284–291. doi: 10.1093/applin/amv025

Moradi, F., Tourani, S., Ziapour, A., Hematti, M., Moghadam, E. J., and Soroush, A. (2021). Emotional Intelligence and Quality of Life in Elderly Diabetic Patients. Int. Q. Commun. Health Educ. 42, 15–20. doi: 10.1177/0272684X20965811

Mubeen, R., Han, D., Alvarez-Otero, S., and Sial, M. S. (2021a). The Relationship Between CEO Duality and Business Firms’ Performance: the Moderating Role of Firm Size and Corporate Social Responsibility. Front. Psychol. 12:669715. doi: 10.3389/fpsyg.2021.669715

Mubeen, R., Han, D., and Hussain, I. (2020). The Effects of Market Competition, Capital Structure, and CEO Duality on Firm Performance: a Mediation Analysis by Incorporating the GMM Model Technique. Sustainability 12:3480. doi: 10.3390/su12083480

Mubeen, R., Han, D., and Raza, S. (2021b). Examining the relationship between product market competition and Chinese firms performance: the mediating impact of capital structure and moderating influence of firm size. Fron. Psychol. 12:709678. doi: 10.3389/fpsyg.2021.709678

NeJhaddadgar, N., Ziapour, A., Zakkipour, G., Abolfathi, M., and Shabani, M. (2022). Effectiveness of telephone-based screening and triage during COVID-19 outbreak in the promoted primary healthcare system: a case study in Ardabil province. Iran. J. Public Health 30, 1301–1306. doi: 10.1007/s10389-020-01407-8

Paulson, K. R., Kamath, A. M., Alam, T., Bienhoff, K., Abady, G. G., and Kassebaum, N. J. (2021). Global, regional, and national progress towards Sustainable Development Goal 3.2 for neonatal and child health: all-cause and cause-specific mortality findings from the Global Burden of Disease Study 2019. Lancet 398, 870–905. doi: 10.1016/s0140-6736(21)01207-1

Pfaff, B. (2008). VAR, SVAR, and SVEC Models: implementation Within R Package vars. J. Statistical Soft. 27, 1–32. doi: 10.18637/jss.v027.i04

Rahmat, T. E., Raza, S., Zahid, H., Mohd Sobri, F., and Sidiki, S. (2022). Nexus between integrating technology readiness 2.0 index and students’ e-library services adoption amid the COVID-19 challenges: implications based on the theory of planned behavior. J. Educ. Health Promot. 11:50. doi: 10.4103/jehp.jehp_508_21

Raza Abbasi, K., Hussain, K., Fatai Adedoyin, F., Ahmed Shaikh, P., Yousaf, H., and Muhammad, F. (2021). Analyzing the role of industrial sector’s electricity consumption, prices, and GDP: a modified empirical evidence from Pakistan. AIMS Energy 9, 29–49. doi: 10.3934/energy.2021003

Shah, K., Arjoon, S., and Rambocas, M. (2016). Aligning Corporate Social Responsibility with Green Economy Development Pathways in Developing Countries. Sustainable Dev. 24, 237–253. doi: 10.1002/sd.1625

Wang, C., Wang, D., Duan, K., and Mubeen, R. (2021). Global Financial Crisis, Smart Lockdown Strategies, and the COVID-19 Spillover Impacts: a Global Perspective Implications From Southeast Asia. Front. Psychiatry 12:643783. doi: 10.3389/fpsyt.2021.643783

Yan, R., Basheer, M. F., Irfan, M., and Rana, T. N. (2020). Role of Psychological factors in Employee Well-being and Employee Performance: an Empirical Evidence from Pakistan. Revista Argentina de Clínica Psicológica 29:638. doi: 10.24205/03276716.2020.1060

Yang, Y., Zhang, S., Zhang, N., Wen, Z., Zhang, Q., Xu, M., et al. (2022). The Dynamic Relationship between China’s Economic Cycle, Government Debt, and Economic Policy. Sustainability 14:1029. doi: 10.3390/su14021029

Yoosefi Lebni, J., Khorami, F., Khosravi, B., Jalali, A., and Ziapour, A. (2020). Challenges Facing Women Survivors of Self-Immolation in the Kurdish Regions of Iran: a Qualitative Study. Front. Psychiatry 11:778. doi: 10.3389/fpsyt.2020.00778

Zabolotnyy, S., and Wasilewski, M. (2019). The Concept of Financial Sustainability Measurement: a Case of Food Companies from Northern Europe. Sustainability 11:5139. doi: 10.3390/su11185139

Zhang, Q., Irfan, M., Khattak, M. A. O., Zhu, X., and Shah, M. S. (2012). Critical success factors for successful lean six sigma implementation in Pakistan. Interdisc. J. Contemp. Res. Bus. 4, 117–124. doi: 10.1371/journal.pone.0225669

Zhou, Y., Draghici, A., Mubeen, R., Boatca, M. E., and Salam, M. A. (2021). Social Media Efficacy in Crisis Management: effectiveness of Non-pharmaceutical Interventions to Manage COVID-19 Challenges. Front. Psychiatry 12:626134. doi: 10.3389/fpsyt.2021.626134

Keywords: SVAR, R software, financial sustainability, impulse response function, financialization, firm performance, corporate governance, sectoral policies

Citation: Ahmed S, Ellahi N, Waheed A and Aman N (2022) Policy Intervention and Financial Sustainability in an Emerging Economy: A Structural Vector Auto Regression Analysis. Front. Psychol. 13:924545. doi: 10.3389/fpsyg.2022.924545

Received: 20 April 2022; Accepted: 18 May 2022;

Published: 05 August 2022.

Edited by:

Muhammad Irfan, Bahauddin Zakariya University, PakistanReviewed by:

S. Bano, Shanghai University of Sport, ChinaAzhar Abbas, University of Agriculture, Faisalabad, Pakistan

Copyright © 2022 Ahmed, Ellahi, Waheed and Aman. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Sarah Ahmed, c2FyYWgucWFpbUBmdWkuZWR1LnBr

Sarah Ahmed1*

Sarah Ahmed1* Nazima Ellahi

Nazima Ellahi