- 1School of International Trade and Economics, Central University of Finance and Economics, Beijing, China

- 2Renmin Business School, Renmin University of China, Beijing, China

- 3Business School, Beijing Normal University, Beijing, China

This study addresses a gap in the literature on corporate governance and corporate social responsibility (CSR) by investigating whether and how board independence and institutional ownership moderate the relationship between digital transformation and corporate social performance (CSP). We find that digital transformation increases CSP using a panel dataset of Chinese publicly listed firms between 2014 and 2018. Moreover, we show that this positive impact is more pronounced when firms have higher proportions of independent directors on the board and institutional owners. These findings contribute to a better understanding of CSR dynamics, supporting the formulation and implementation of efficient CSR strategies in the digital era.

Introduction

Over the past decade, the development of digital technologies, platforms, and infrastructures has reshaped all aspects of human life, with no sector or organization being immune. The digital revolution in the private sector, public institutions, and almost all industries has disrupted numerous markets, created new business opportunities, and fundamentally transformed business models (Bresciani et al., 2021; Kraus et al., 2021). These phenomena have increased research efforts in various streams of the business literature, such as marketing (Lamberton and Stephen, 2016; Kannan and Li, 2017), human resource management (Blanka et al., 2022; Fossen and Sorgner, 2022), innovation and entrepreneurship (Yoo et al., 2012; Nambisan et al., 2019; Usai et al., 2021), and business ethics and sustainability (Illia et al., 2017; Cardinali and De Giovanni, 2022; Schiavone et al., 2022). However, additional exploration seems needed.

The literature highlights the impact of digital transformation on firms’ performance, including financial (Kohtamäki et al., 2020; Chouaibi et al., 2022), international (Jin and Hurd, 2018; Li et al., 2018), and innovation performance (Bresciani et al., 2021; Usai et al., 2021). However, little attention has been devoted to its influence on corporate social performance (CSP), defined as the observable organizational outcomes of programs and policies intended to achieve corporate social responsibility (CSR) goals (Wood, 1991; Barnett, 2007; Orlitzky et al., 2017). Moreover, recent studies have investigated the use of digital technologies in green practices (Cardinali and De Giovanni, 2022), such as green innovation (Santoalha et al., 2021) and green supply chains (Ramirez-Peña et al., 2020). However, it is unclear whether a firm’s digital transformation enhances its overall CSP. On the one hand, CSR has become a critical item on top management’s agendas (The Economist, 2008; Aksoy et al., 2020). On the other hand, the drivers of CSP are of increasing relevance for practitioners and researchers (Brower and Mahajan, 2013; Orlitzky et al., 2017). Hence, we investigate whether and how a firm’s digital transformation significantly contributes to its CSP.

To examine the association between digital transformation and CSP, we apply stakeholder theory addressing a firm’s sensitivity to stakeholder needs, the diversity of stakeholder demands, and the exposure to stakeholder monitoring, as proposed by Brower and Mahajan (2013). Following previous studies (Hanelt et al., 2021; Verhoef et al., 2021; Blanka et al., 2022), we consider digital transformation as the adoption and application of digital technologies, such as artificial intelligence (AI), big data analytics (BDA), the Internet of Things (IoT), and information and communication technology to change business models and create or capture corporate value. Such a transformation involves fundamental changes in data acquisition, warehousing, analytics, and implementation (Kohtamäki et al., 2020; Paiola and Gebauer, 2020; Roblek et al., 2021; Vaska et al., 2021), affecting the way companies engage with stakeholders (Stohl et al., 2017; Dunn and Harness, 2019). Besides, digital transformation affects information sharing, exchange, and mutual monitoring between focal firms and their partners (Kouhizadeh and Sarkis, 2018; Cenamor et al., 2019; Ciampi et al., 2022). Hence, we argue that a higher level of digital transformation allows firms to better identify stakeholder expectations, increases the number and range of stakeholder needs, and strengthens firms’ monitoring intensity, thus improving CSP. We also argue that greater digital transformation enhances a firm’s ability to initiate and manage environmentally and socially responsible programs. Thus, we expect a positive relationship between digital transformation and CSP.

The literature has also mostly discarded the role that corporate governance mechanisms play in shaping firms’ digitalization, especially the use of digital technologies to achieve CSR goals. A large body of research (e.g., Crifo et al., 2019; Chen et al., 2020; Zaid et al., 2020; Bolourian et al., 2021) concentrates on the various dimensions of corporate governance for explaining the differences in CSP among firms. However, little is known about the interplay between corporate governance dimensions and digitalization, which affects a firm’s CSR attitudes and behaviors. Recent studies note that digital transformation entails changes in corporate structure, routine, culture, and future vision (Sousa and Rocha, 2019; Blanka et al., 2022), affecting existing business models (Bresciani et al., 2021; Verhoef et al., 2021). Hence, digitalization may be regarded as a crucial determinant of corporate governance. At the same time, digital transformation is a firm’s fundamental and strategic change directed by the board, initiated and implemented by the top management, and monitored by shareholders (Singh and Hess, 2017; Li et al., 2018). Therefore, effective corporate governance and digital transformation will interact, creating synergies between the firm’s decision-making and organizational outcomes, such as CSP.

Moreover, a firm’s ownership structure and its board structure, essential aspects of corporate governance (Jensen and Meckling, 1976; Fama and Jensen, 1983), may explain the notable differences in CSP across firms (Zaid et al., 2020; Beji et al., 2021). Various studies have shown that institutional investors and outside directors urge firms to integrate responsibility and sustainability into their operations (Dyck et al., 2019; García-Sánchez et al., 2019; Chen et al., 2020; Shahbaz et al., 2020). Accordingly, we posit that digital transformation is more likely to drive CSP in the presence of high board independence and institutional ownership levels. A test on a sample of publicly listed Chinese firms in 2014–2018 supports our research hypotheses.

We choose China as our empirical setting for two reasons. First, China has formulated a series of CSR laws and rules, such as regulations on environmental protection and information disclosure of listed companies, and has promoted voluntary CSR initiatives over the past two decades (Liao et al., 2018; Khan et al., 2021, 2022). Second, Chinese government has recently identified digitalization as one of the central parts of its public policy for catching-up with the advanced economies and Chinese firms have been encouraged to use digital mechanisms to transform their business (Lee et al., 2021; Lundvall and Rikap, 2022; Zhai et al., 2022). Therefore, China, as an aspirant economy (Bruton et al., 2021), provides an ideal context for studying our research questions.

The study’s contribution to the literature is threefold. First, it extends the current understanding of the antecedents of CSP by showing that digital transformation is an essential driver of CSP. We combine stakeholder theory and the literature about digitalization to highlight the mechanisms through which digital transformation determines CSP. Therefore, our study uncovers the crucial role of digital elements in the business ethics discussion. Second, we provide empirical evidence that a higher level of digital transformation increases overall CSP. Although previous research has investigated the influence of digital transformation on firm performance, it has largely ignored environmental and social performance. To the best of our knowledge, this study is one of the first attempts to examine the effect of digital transformation on CSP. Third, our study offers a novel theoretical contribution by investigating how corporate governance interacts with digital transformation in the CSP context. It is the first study to examine the moderating role of board independence and institutional ownership in the relationship between digital transformation and a firm’s CSP. In doing so, this study’s findings support the agency and stakeholder theories in the context of the current digital ecosystem.

Theoretical Framework and Hypothesis Development

Effect of Digital Transformation on CSP

Stakeholder theory essentially suggests that stakeholders’ preferences affect an organization’s decision-making and value creation in economic, social, environmental, and governance domains (Donaldson and Preston, 1995; Jones, 1995; Jones and Wicks, 1999). As Brower and Mahajan (2013) and Kang (2013) indicate, firms being more sensitive to their stakeholders’ needs, facing a wider range of stakeholder demands, or more closely scrutinized by multiple stakeholders tend to exhibit higher CSP. Accordingly, we posit that a firm’s digital transformation increases the salience and influence of stakeholders’ demands, thus increasing CSR participation and improving CSP.

First, digital transformation helps firms better communicate and interact with their customers and external partners, increasing sensitivity toward stakeholders’ expectations. For example, the use of big data and IoT allows firms to effectively and efficiently source, store, and share information regarding customers, suppliers, distributors, and other business actors (Kohtamäki et al., 2020; Paiola and Gebauer, 2020), and thus better responds to their needs and wants (Hadjielias et al., 2022; Schiavone et al., 2022). At the same time, the development of new algorithms and AI allows firms to parse, treat, and analyze a vast amount of data, extracting valuable information that helps identify stakeholders’ and societal needs (Cardinali and De Giovanni, 2022). The improved recognition of such needs triggers firms’ CSR engagement (Brower and Mahajan, 2013).

Second, digital transformation is positively related to the number and range of stakeholder demands and social issues that firms face. The use of digital media has significantly increased, changing the way firms communicate with stakeholders regarding CSR (Illia et al., 2017; Dunn and Harness, 2018; Vogler and Eisenegger, 2020). Using digital media (e.g., blogs, forums, and social media, among others), users create, circulate, and consume public information regarding focal firms’ products and services, called user-generated content (UGC). This allows them to quickly reach global audiences without having to pass through the gatekeeping function of media platforms (Kim and Johnson, 2016; Yang et al., 2019; Vogler and Eisenegger, 2020). In this vein, stakeholders may ask for firms’ CSR disclosures, question CSR initiatives, or voice skepticism about CSR efforts via social media (Stohl et al., 2017; Dunn and Harness, 2019). Hence, we argue that digital transformation motivates firms to focus on UGC, use various channels to engage in CSR communication, and maximize communication effectiveness (Illia et al., 2017). As a result, they are more likely to undertake CSR activities in response to large volumes and wide ranges of UGC about CSR.

Finally, digital transparency exposes firms to growing consumer, collaborator, and community pressures to increase environmental and social accountability. On the one hand, the application of digital technologies, such as blockchain and wireless broadband technologies, makes the origin and flow of information related to production, distribution, marketing, and consumption highly transparent, traceable, and available for consultation (Kouhizadeh and Sarkis, 2018; Ciampi et al., 2022). Thus, firms with a higher level of digital transformation may be subject to greater scrutiny and control from stakeholders and induced to engage in social performance initiatives (Gilliland et al., 2010; Orlitzky et al., 2017). On the other hand, with the spread of digital platforms such as cloud, e-commerce, and crowdfunding platforms, many firms are subject to mutual monitoring mechanisms (Cenamor et al., 2019). Hence, to collaborate with partners in the platforms, firms actively engage in CSR activities that reinforce stakeholder trust (Cuypers et al., 2015; Barnett, 2016) as an illegitimate act of one platform adopter is also detrimental to their partners’ reputations (Chou et al., 2017).

We also posit that a firm’s digital transformation improves its ability to initiate and manage CSR practices, improving CSP. First, digital technologies may increase combinatorial and radical green innovations (Ciarli et al., 2021; Santoalha et al., 2021). Thanks to digital technologies’ generative, modularized, and combinatorial properties, preexisting non-green technologies may be codified, combined, and recombined in emerging green domains, fostering unexpected recombinant green innovations (Quatraro and Scandura, 2019; Santoalha et al., 2021; Usai et al., 2021). Moreover, digital transformation may boost knowledge creation by changing a firm’s culture and employees’ mindset, ultimately supporting innovation (Sousa and Rocha, 2019). Second, digital technologies applied to production, transportation, supply chains, and recycling may reduce energy consumption, carbon emission, and industrial waste (Cardinali and De Giovanni, 2022). For example, by adopting automation and big data in shipbuilding, firms may predict faults and find welding solutions in advance, improving production efficiency and energy conservation (Ramirez-Peña et al., 2020). Cardinali and De Giovanni (2022) also suggest that Industry 4.0 technologies support circular economy systems, generating new opportunities for firms to improve CSR. Finally, digital applications help improve societal security (Newell and Marabelli, 2015; Vial, 2019). Due to its decentralized structure, blockchain technology may address concerns regarding information transparency and immutability and achieve supply chain sustainability, helping firms realize CSR goals (Kouhizadeh and Sarkis, 2018). Hence, we propose:

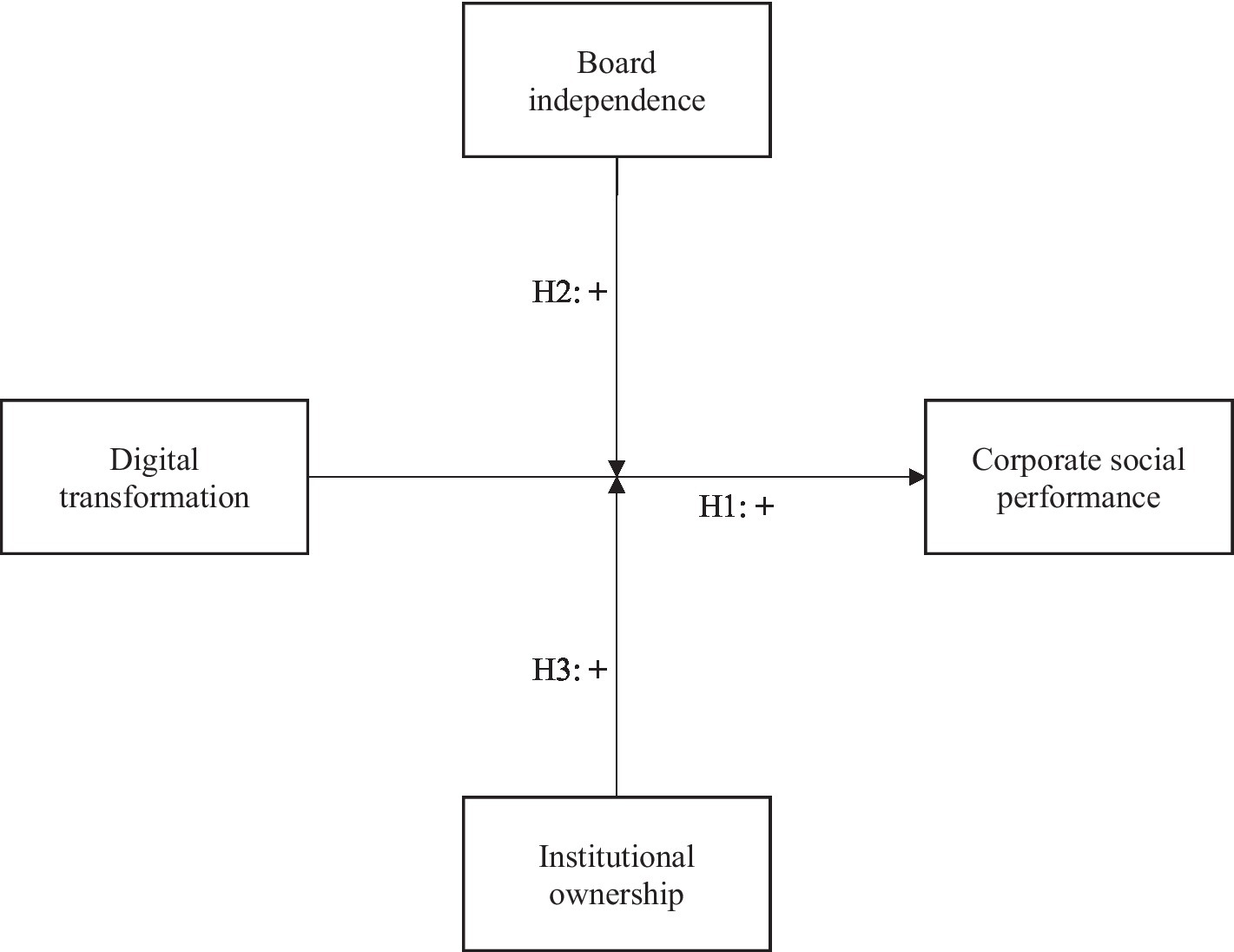

H1: Digital transformation is positively related to a firm’s CSP.

Moderating Effect of Board Independence

Corporate governance affects companies’ CSR strategies and efforts and, thus, their CSP (Aguilera et al., 2007; Barnea and Rubin, 2010). Within corporate governance, company boards play a crucial role in the planning and decision-making process associated with CSR (Rao and Tilt, 2016; Crifo et al., 2019) and in the quality and reliability of CSR disclosure (Khan et al., 2013; García-Sánchez et al., 2019). There are various elements that signify board attributes, and board independence is one of the most important (Zaid et al., 2020; Bolourian et al., 2021). According to agency and stakeholder theories, a board with a larger proportion of independent directors (i.e., external or non-executive members) is more effective in supervising and controlling management (Dalton et al., 1999; Prado-Lorenzo and Garcia-Sanchez, 2010), ensuring that the social and environmental expectations of firms’ stakeholders are appropriately addressed (García-Sánchez et al., 2019). Further, non-executive directors, as outsiders compared to inside directors, safeguard the interests of company stakeholders because they are more likely to prevent opportunistic behaviors and enhance objectivity in the board’s decision-making (Fama and Jensen, 1983; Beasley, 1996). Therefore, we argue that boards with a higher proportion of independent directors are more likely to comply with stakeholder pressures arising from digital transformation and use digital technologies for addressing CSR issues, with a significant impact on CSP.

Previous studies have suggested that independent directors lean more toward environmental and social performance issues than internal directors (Ibrahim and Angelidis, 1995; Ibrahim et al., 2003). Being external to the organization, they receive less pressure from investors and managers, and their opinions are legally protected (Fuente et al., 2017; Liu et al., 2020). With greater independence and objectivity in their analysis of managerial decisions, non-executive directors focus more on satisfying the interests of firms’ stakeholders when pursuing economic goals. They tend to be more conscious of the need to improve the relationship between firms and their stakeholders (Liao et al., 2018; Shahbaz et al., 2020; Zaid et al., 2020). Therefore, a firm with a higher share of external members on the board is more likely to use digital technologies to identify stakeholders’ expectations and have a greater sensitivity to stakeholder needs when engaging in digital transformation.

Moreover, independent directors are more likely to acknowledge environmental and community concerns and be involved in CSR communication. Previous research (e.g., Fuente et al., 2017; Fernández-Gago et al., 2018; García-Sánchez et al., 2019) has observed that a more significant presence of independent directors on the board is related to a more extensive, transparent, and truthful CSR information disclosure. Furthermore, as independent directors generally support sustainable and ethical behaviors (Ibrahim et al., 2003), they are more willing to dialogue with different stakeholders on CSR issues. Hence, firms undergoing digital transformation are more likely to employ digital technologies (e.g., social media, forums, or micro-websites) to dialogue with stakeholders about CSR, respond to CSR demands, and show their commitment to social issues as the number of independent directors increases.

Finally, independent directors’ identity, prestige, and reputation seem closely connected with a firm’s CSR activities (Fernández-Gago et al., 2018). In this regard, leadership plays a crucial role in improving an organization’s environmental performance (Ahmad et al., 2021). Accordingly, boards with more non-executive directors tend to encourage their firms to behave in a more environmentally and socially responsible manner, refraining from negative media exposure and the subsequent loss of credibility (Johnson and Greening, 1999; Zaid et al., 2020). Since digital transformation increases monitoring by multiple stakeholders, independent directors will devote more effort to motivating companies undergoing digital transformation to invest in CSR activities in line with societal values. In addition, independent directors are more likely to stimulate firms to adopt digital technologies to achieve CSR goals, enhancing firms’ reputations and, in turn, their own reputation (Zaid et al., 2020). Thus, we predict:

H2: Board independence positively moderates the relationship between digital transformation and CSP such that higher levels of board independence strengthen the positive effect of digital transformation on CSP.

Moderating Effect of Institutional Ownership

The ownership structure is another critical aspect of corporate governance (Fama and Jensen, 1983), which impacts firms’ CSR policies, procedures, and practices (Oh et al., 2011; Liu et al., 2019; Gao and Yang, 2021). Among multiple types of shareholders, an increasing number of institutional investors have committed to considering the environmental and social impacts of their investment decisions (Chen et al., 2020). With some exceptions (e.g., Brown et al., 2006; Cabral and Sasidharan, 2021), institutional investors (e.g., banks, investment companies, insurance companies, pension funds, and securities firms) tend to integrate sustainability and responsibility into their capital allocation choices, using ownership and monitoring attention to guide companies’ CSP (Graves and Waddock, 1994; Neubaum and Zahra, 2006; Oh et al., 2011; Dyck et al., 2019; Chen et al., 2020).

We argue that firms with a larger proportion of institutional owners are more sensitive and responsive to stakeholders’ needs and likely to invest in CSR activities when undergoing digital transformation. This is because institutional shareholders have additional incentives to detect and prevent opportunistic managerial behaviors and ensure stakeholders’ interests (Jensen and Meckling, 1976; Shleifer and Vishny, 1986). On the one hand, they can meet clients’ growing demands for sustainable investments by incorporating environmental and social responsibility factors into their portfolios and actively engaging in CSR issues with target companies (Dimson et al., 2015; Riedl and Smeets, 2017; Dyck et al., 2019). On the other hand, they can reduce the risks arising from investee firms’ negative externalities and signal their reliability and adherence to ethical values by improving the CSP of investee firms (Cox et al., 2004; Siegel and Vitaliano, 2007; Chen et al., 2020).

Further, institutional investors have more resources, expertise, and ability to monitor and impact firms’ strategic decisions (Oh et al., 2011; Ntim and Soobaroyen, 2013). These decisions include adopting digital technologies in green practices or other socially responsible programs (Cardinali and De Giovanni, 2022; Schiavone et al., 2022). In addition, since institutional investors are influential and cannot easily trade their shares (Shleifer and Vishny, 1986; Oh et al., 2011), they significantly influence firms’ strategic changes, such as digital transformation. At the same time, they tend to be more attentive to CSP, a long-term and essential determinant of sustainable organizational performance (Graves and Waddock, 1994). As a result, a higher level of institutional ownership may induce firms to integrate digital technologies within their CSR strategies since digitalization is not per se a socially responsible tool (Cardinali and De Giovanni, 2022; Fossen and Sorgner, 2022).

Responsible digital transformation, such as using BDA in green innovation and supply chains, may be viewed as a business model innovation (Bresciani et al., 2021; Hanelt et al., 2021; Cardinali and De Giovanni, 2022). We argue that responsible digitalization does not exclusively involve a firm’s resources and capabilities but may also be supported by institutional shareholders. First, institutional owners may help firms finance the resources they need for responsible digitalization and reduce the financial difficulties resulting from this choice to protect their investments against value erosion. Second, institutional investors have advantages in collecting information and engaging in active monitoring (Chen et al., 2007), which are needed to achieve firm innovation (Rong et al., 2017). Third, increased monitoring by institutional investors may shield managers from the reputational consequences of failed innovation (Aghion et al., 2013) and thus promote responsible digitalization. Consequently, we propose:

H3: Institutional ownership positively moderates the relationship between digital transformation and CSP such that higher levels of institutional ownership strengthen the positive effect of digital transformation on CSP.

Figure 1 summarizes the study’s theoretical framework.

Methodology

Data and Sample

This study uses a panel dataset of A-share firms listed on the Shanghai and Shenzhen stock exchanges from 2014 to 2018. We have obtained the data from the China Stock Market and Accounting Research Database (CSMAR) and Chinese Research Data Service Platform (CNRDS), which publish reliable information on listed firms’ financial and economic performance, shareholder backgrounds, details of the top management teams, and other related statistics. These data sources are widely used in research focusing on Chinese-listed firms (e.g., Jin et al., 2021; Meng and Sima, 2022; Zhu et al., 2022). We have obtained CSR data from Hexun, which publishes a CSR index for each listed firm every year. We exclude firms in the financial sector, observations with missing values, and unreliable data. The final sample is an unbalanced panel dataset comprising 2,281 firms and 10,048 firm-year observations.

Measurement of the Variables

Dependent Variable

Following previous studies (Huang et al., 2018; Yang et al., 2021; Zhu et al., 2022), we measure firms’ CSP using Hexun’s CSR index, which measures firms’ CSP along five dimensions: shareholder equity responsibility; employee responsibility; supplier, customer, and consumer rights responsibility; environmental responsibility; and social responsibility. Previous studies commonly use these five dimensions to measure CSR (Cahan et al., 2017; Jin et al., 2021). We use the natural logarithms of the total score as the dependent variable in the empirical models.

Key Independent Variable

The key independent variable is the firm’s digital transformation (DT). Following previous studies (Hossnofsky and Junge, 2019; Gong and Ribiere, 2021; Yuan et al., 2021), we construct the digital transformation index by conducting a dictionary-based text analysis of the listed firms’ annual reports. The procedure is as follows. The first step identifies the keywords associated with digital transformation and establishes a dictionary of all variations of the keywords. The second step uses a machine-learning algorithm to obtain the frequency counts of those keywords from sample firms’ annual reports. The third and final step normalizes the frequency counts by the length of a specific section in the annual report (i.e., management discussion and analysis—MD&A) and computes the degree of digital transformation using the dictionary-based method. We construct the index of digital transformation using the CSMAR dataset.

Moderating Variables

The first moderator is the presence of an independent board. Following the previous research (Schnatterly and Johnson, 2014; Chen et al., 2016), we measure board independence as the percentage of independent members on the board who are also members of public organizations or professional institutions, academics, or investors with no direct ties with the firm.

The second moderator is institutional ownership. Following previous studies (Cahan et al., 2017; Harjoto et al., 2017), we measure institutional ownership as the percentage of a firm’s institutional holdings in the total shares outstanding at the end of the year, namely the sum of the shares of different institutional owners. In the CSMAR dataset, institutional owners are common funds, banks, qualified foreign institutional investor (QFII), insurance companies, brokers, security funds, entrust funds, financial companies, and other funding institutions.

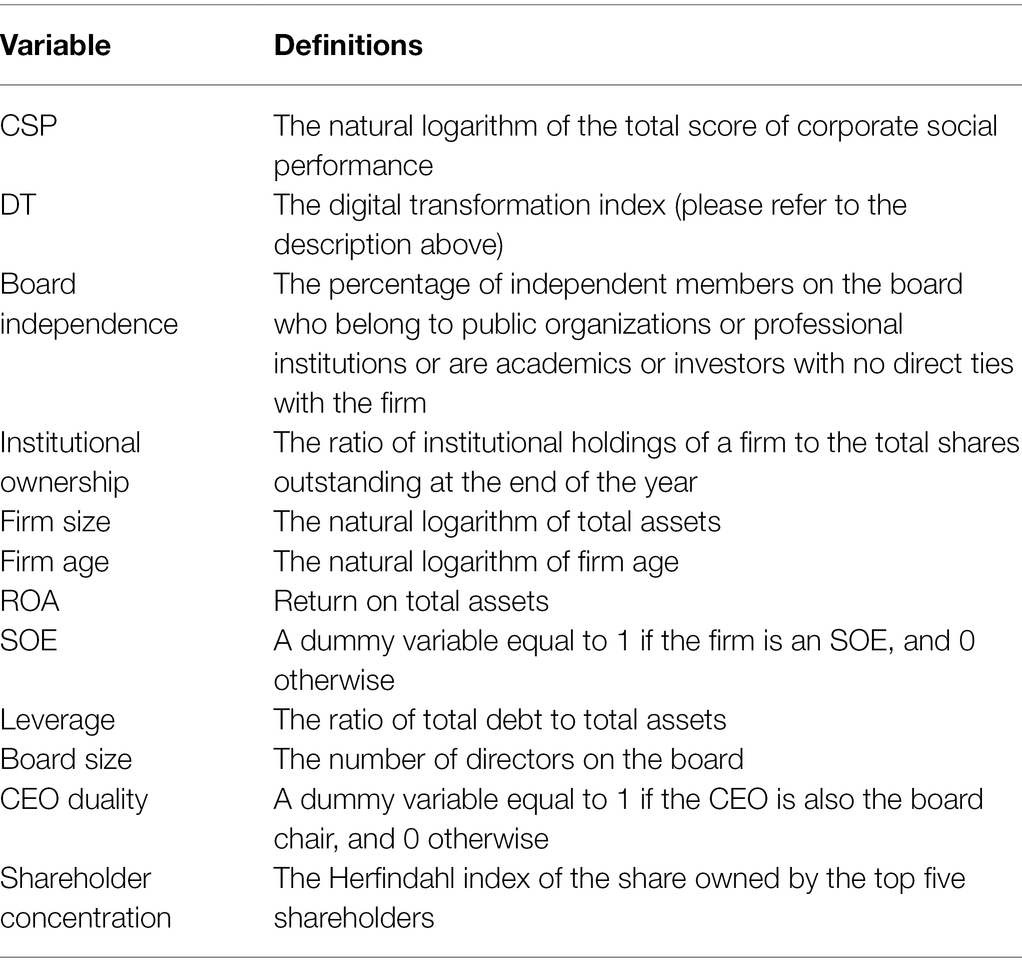

Control Variables

Following previous research (Jin et al., 2021; Meng and Sima, 2022; Zhu et al., 2022), we control for various variables that may affect firms’ CSP. Firm size may influence CSP because larger firms have more resources to engage in CSR; we measure it as the natural logarithm of total assets. Firm age is calculated as the natural logarithm of the firm age, as previous studies indicate that older firms are less likely to favor social practice to gain legitimacy (Marquis and Qian, 2014). We control for return on assets (ROA) because profitability may affect firms’ CSR engagement and performance (Zhu et al., 2022). State ownership may also influence CSP because state-owned enterprises have stronger motivation to pursue and develop bonds with the government, making them more prone to engage in CSR engagement (Marquis and Qian, 2014); we measure it using a dummy variable (SOE) that equals 1 if the firm’s owner is the government, and 0 otherwise. We control for leverage, an indicator of financial risk, because a high level of leverage may hinder CSP (Liao et al., 2018); we measure it as the ratio of total debt to total assets. At the board level, we control for board size and CEO duality. We include board size in the models because larger boards are more inclined to engage in CSR (Jin et al., 2021); we measure it as the number of directors on the board. CEO duality is an indicator of executive power concentration and may affect firms’ CSR decisions (Khan et al., 2021); we measure it using a dummy variable that equals 1 if the CEO is also the board chair, and 0 otherwise. Finally, we measure shareholder concentration using the Herfindahl index of the share owned by the top-five shareholders, as previous studies indicate that ownership concentration affects the CSR decisions of the management team (Zhang et al., 2016). We winsorize the continuous variables at the 1 and 99% levels to eliminate the effects of extreme values. In addition, we include fixed effects in the models to control for the unobserved firm, industry, and city characteristics and common time trends. Table 1 reports the definitions of the variables.

Estimation Strategy

To test the proposed research hypotheses, we estimate the following models:

where i identifies a firm, j represents an industry, c denotes a city, and t is the year. The dependent variable is the logarithm of the CSR scores in the year. is the firm’s digital transformation in the year, and are board independence and institutional ownership. is a vector of control variables. We denote firm fixed effects, industry fixed effects (two-digit industry), city fixed effects, and year fixed effects as , , , and , respectively; is the intercept and is the random error term. Model (1) is the baseline model for testing H1. Model (2) includes an interaction term to test for the moderating hypotheses. We cluster robust standard errors at the firm level to adjust for potential serial correlation and heteroskedasticity in all estimations.

Results

Descriptive Statistics and Correlation Analysis

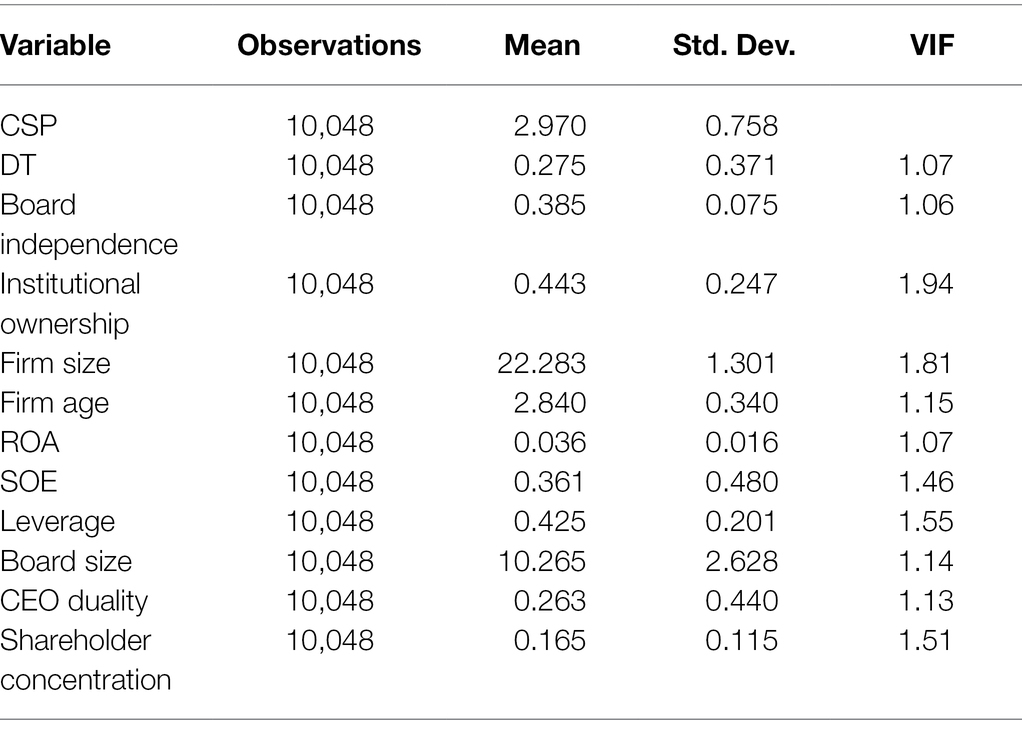

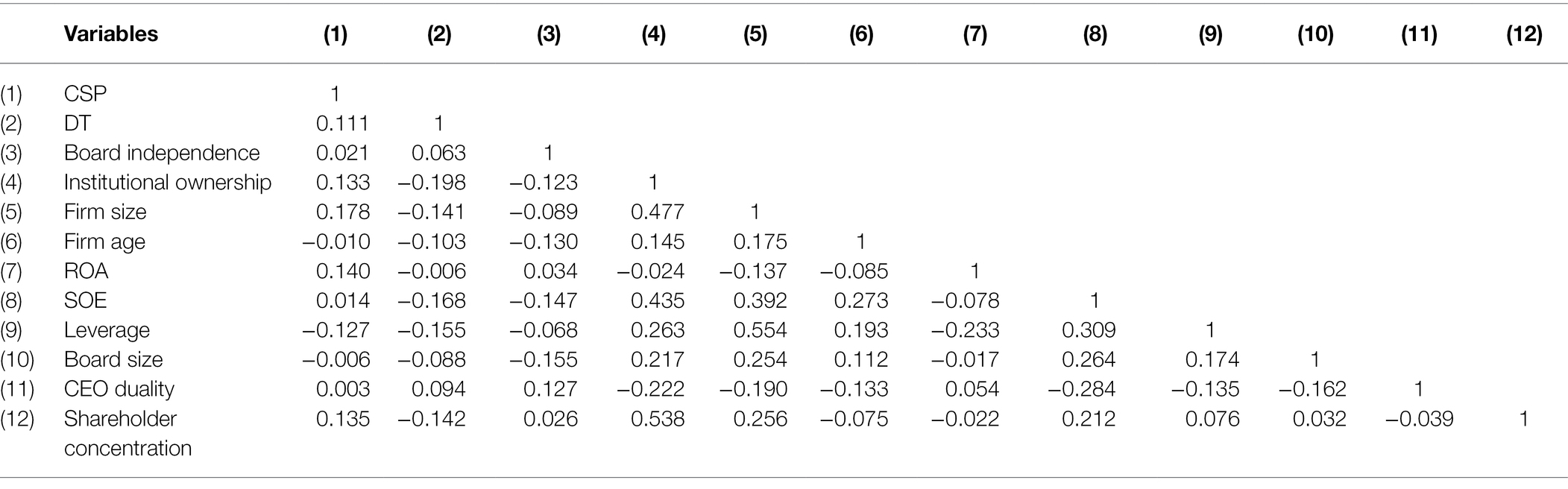

Table 2 reports the descriptive statistics (mean and standard deviation) of the variables, allowing the exploration of the observed variations and supporting the proposed regression models. Table 3 presents the pairwise correlation matrix of all variables. We conduct variance inflation factor (VIF) analysis to address multicollinearity concerns. Table 2 also reports the VIF values of each variable, which range from 1.06 to 1.94, far below the conventional threshold value of 10. This evidence indicates that multicollinearity is not a severe concern in our models.

Baseline Results

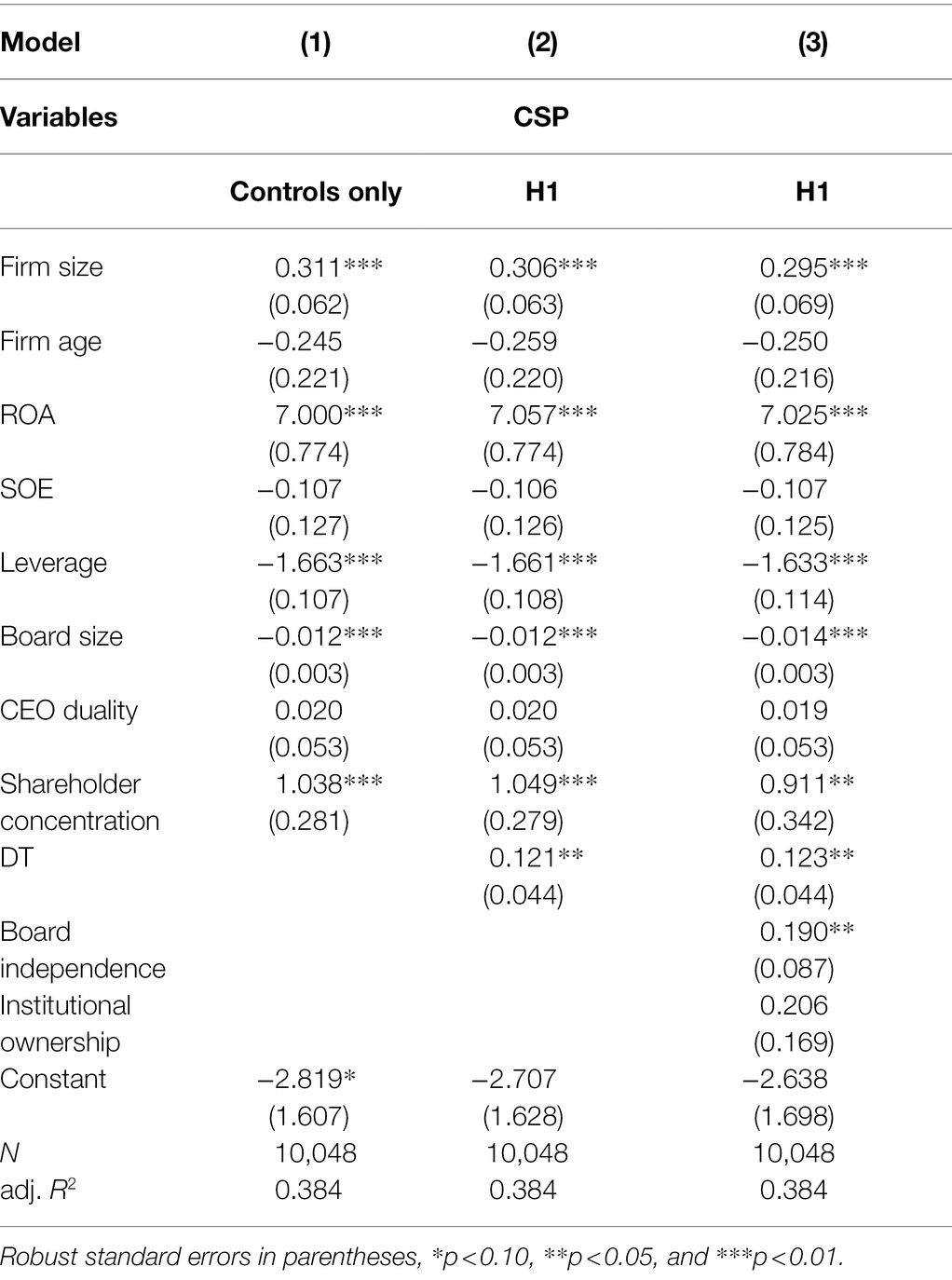

Table 4 presents the baseline regression results based on Equation (1). Model (1) only includes the control variables; Model (2) adds the key independent variable; and Model (3) includes the two moderators. The coefficient on digital transformation is significant and positive at the 5% level in Model (2) (coefficient = 0.121, p = 0.012), supporting H1, namely that digital transformation is positively related to a firm’s CSP. The coefficients on digital transformation are consistent across Models (2) and (3).

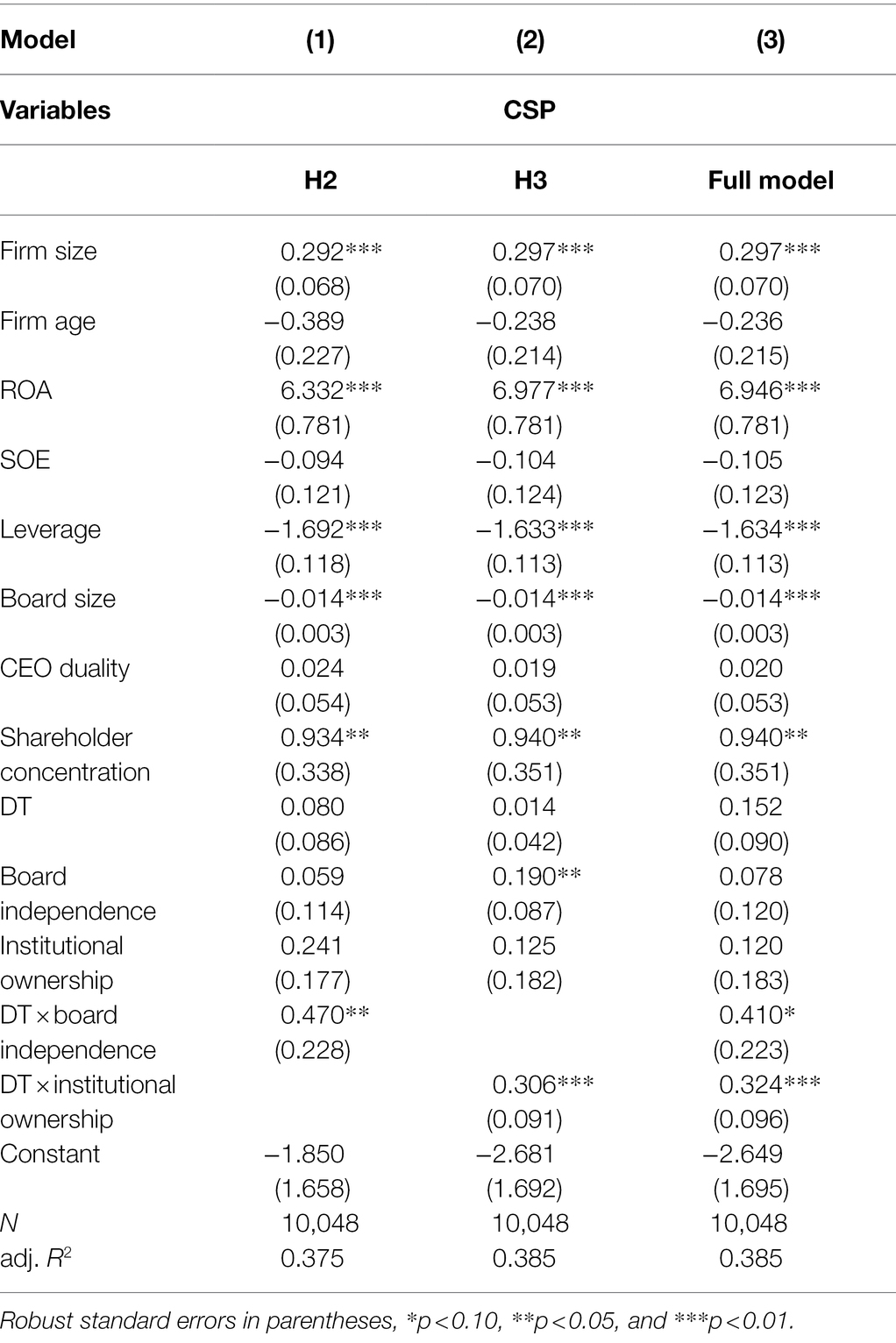

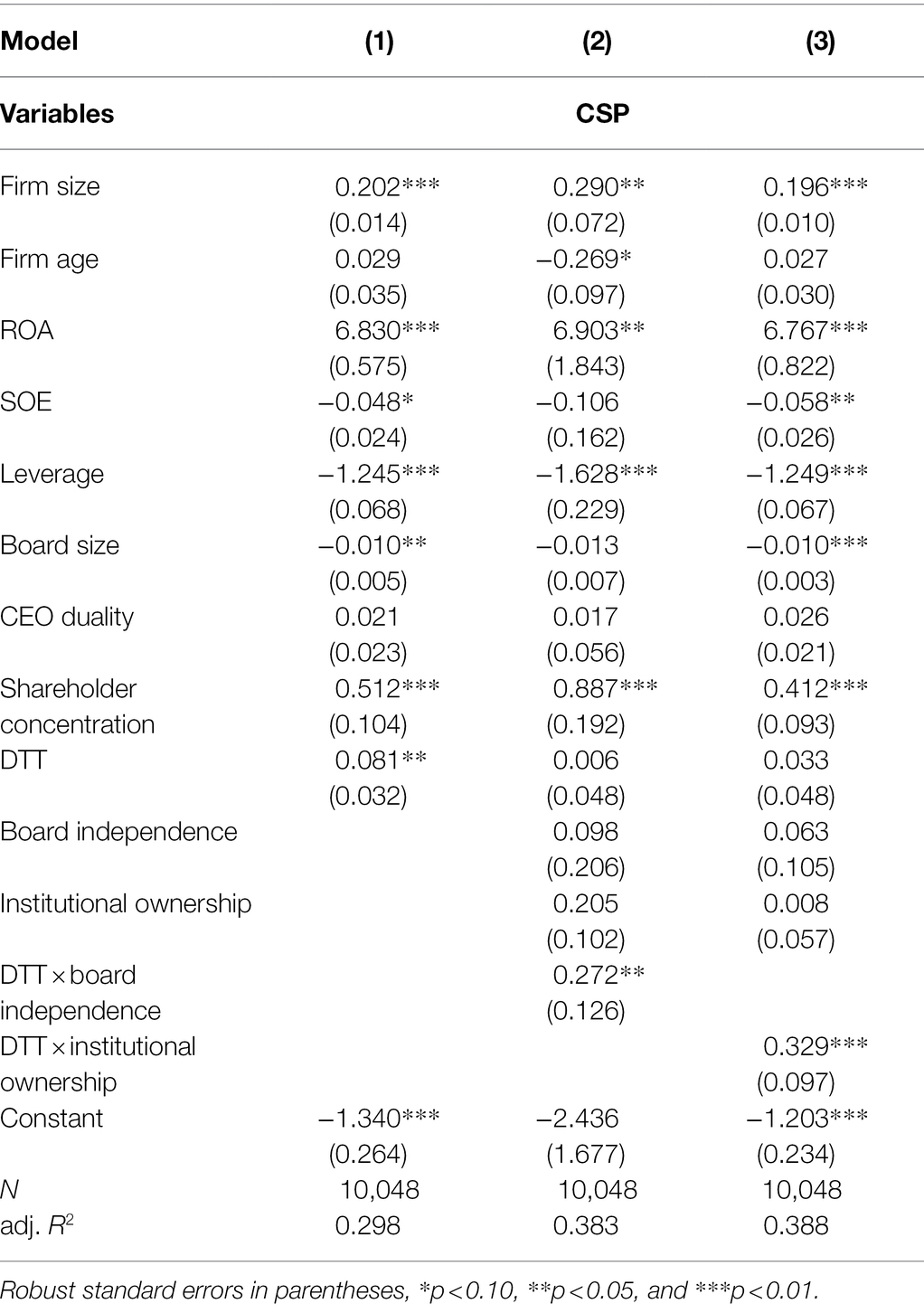

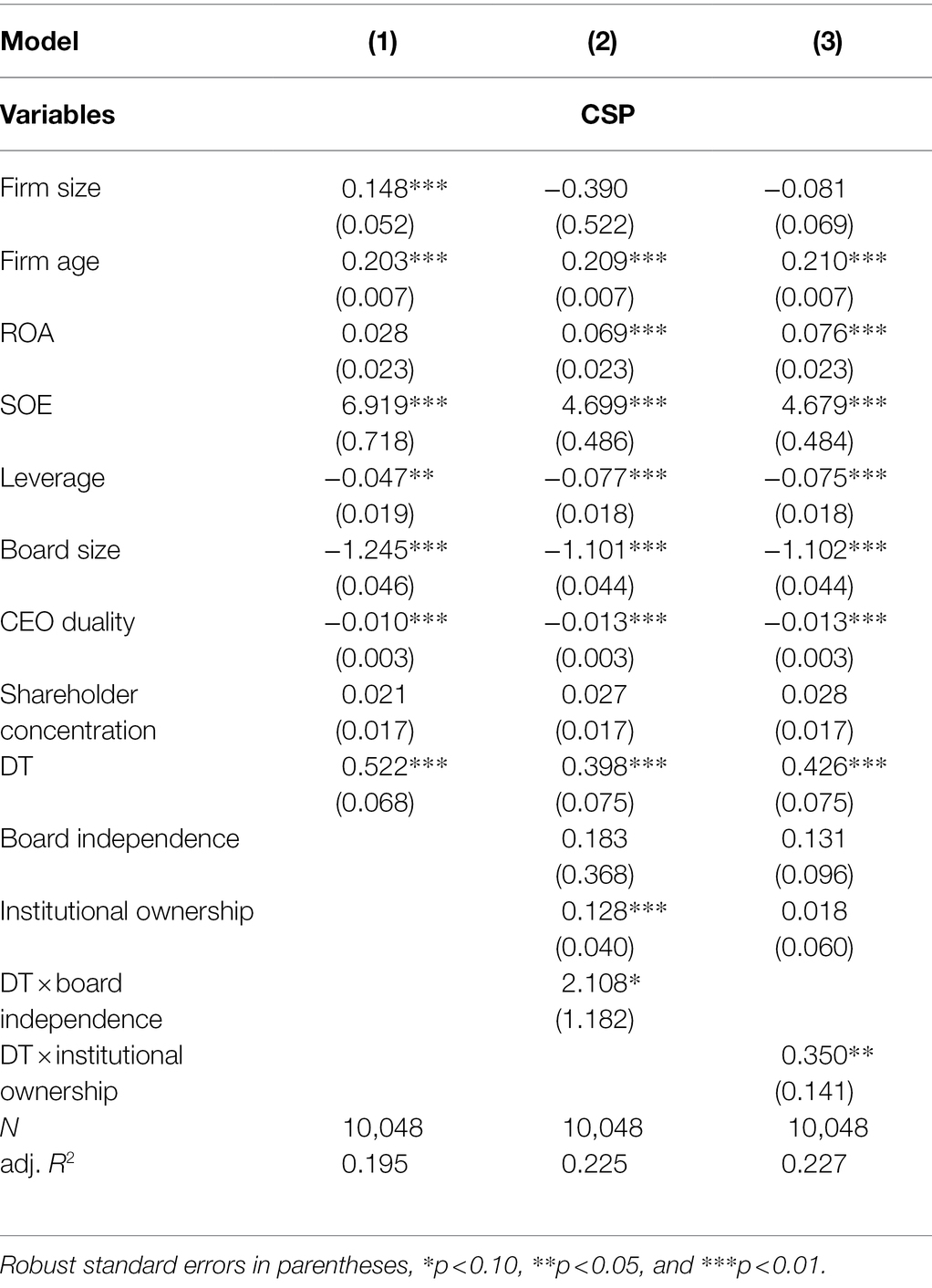

Table 5 presents the results of the moderation regressions based on Equation (2). Model (1) includes the interaction between digital transformation and board independence to test H2. Model (2) includes the interaction between digital transformation and institutional ownership to test H3. Model (3) includes all variables and interactions.

In Model (1) of Table 5, the coefficient on the interaction between digital transformation and board independence is positive and significant at the 5% level (coefficient = 0.470, p = 0.040). To better illustrate the results, we plot the interaction effects of board independence in Figure 2. Overall, the results support H2, indicating that board independence positively moderates the relationship between digital transformation and CSP.

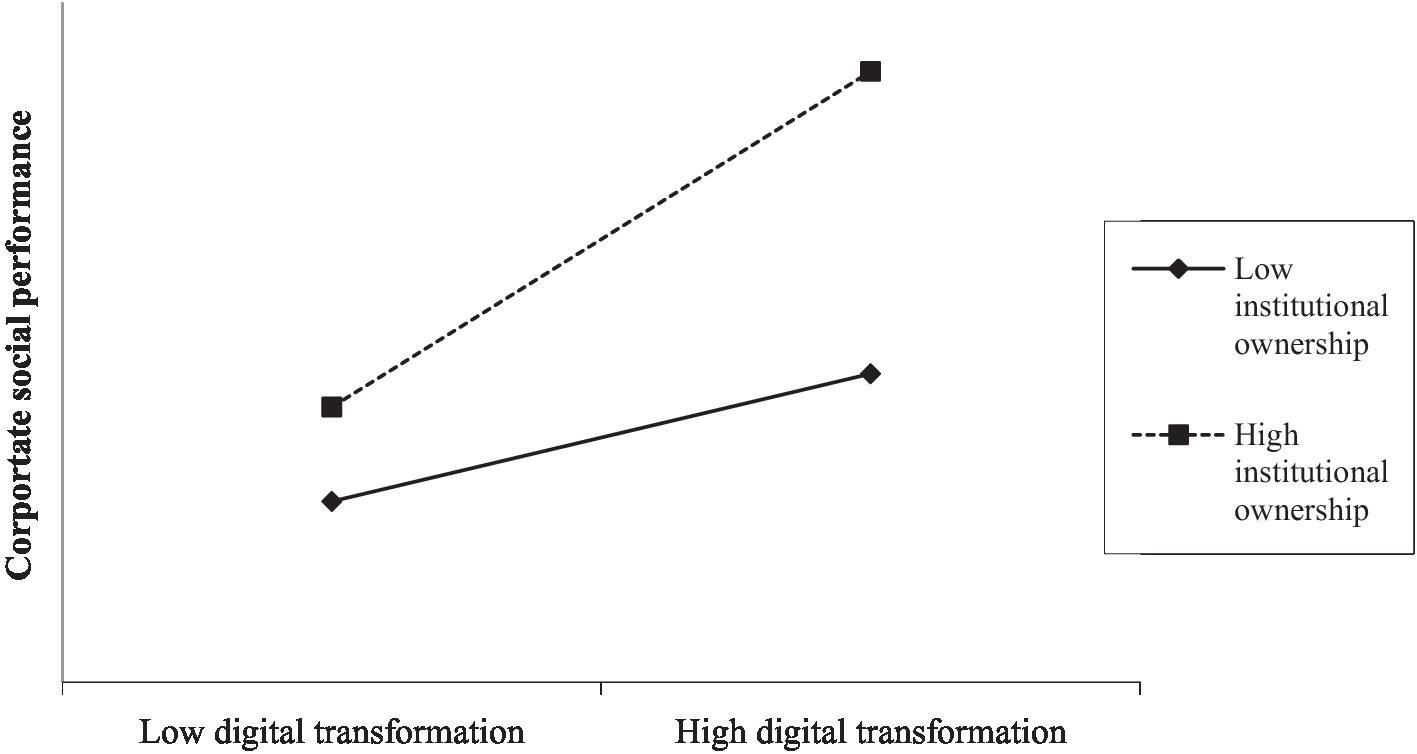

In Model (2) of Table 5, the coefficient on the interaction between digital transformation and institutional ownership is positive and significant at the 1% level (coefficient = 0.306, p = 0.003). We plot the results in Figure 3. The evidence supports H3, namely, that institutional ownership positively moderates the relationship between digital transformation and CSP. The results of Model (3) are consistent with Models (1) and (2).

Regarding the control variables, firm size, ROA, and shareholder concentration have positive and significant effects on CSP, while board size has a negative and significant impact on CSP, mostly consistent with previous studies (e.g., Jin et al., 2021; Zhu et al., 2022). Overall, our results suggest that firms’ digital transformation positively impacts their CSP and that board independence and institutional ownership positively moderate the relationship between digital transformation and CSP.

Robustness Checks

We perform several tests to confirm the robustness of our findings. We first perform regression analyses using alternative measures for the key variables. Then, we use the instrumental variable (IV) two-stage least squares (2SLS) approach to alleviate the endogeneity concern in the research design.

Alternative Measures for the Key Variables

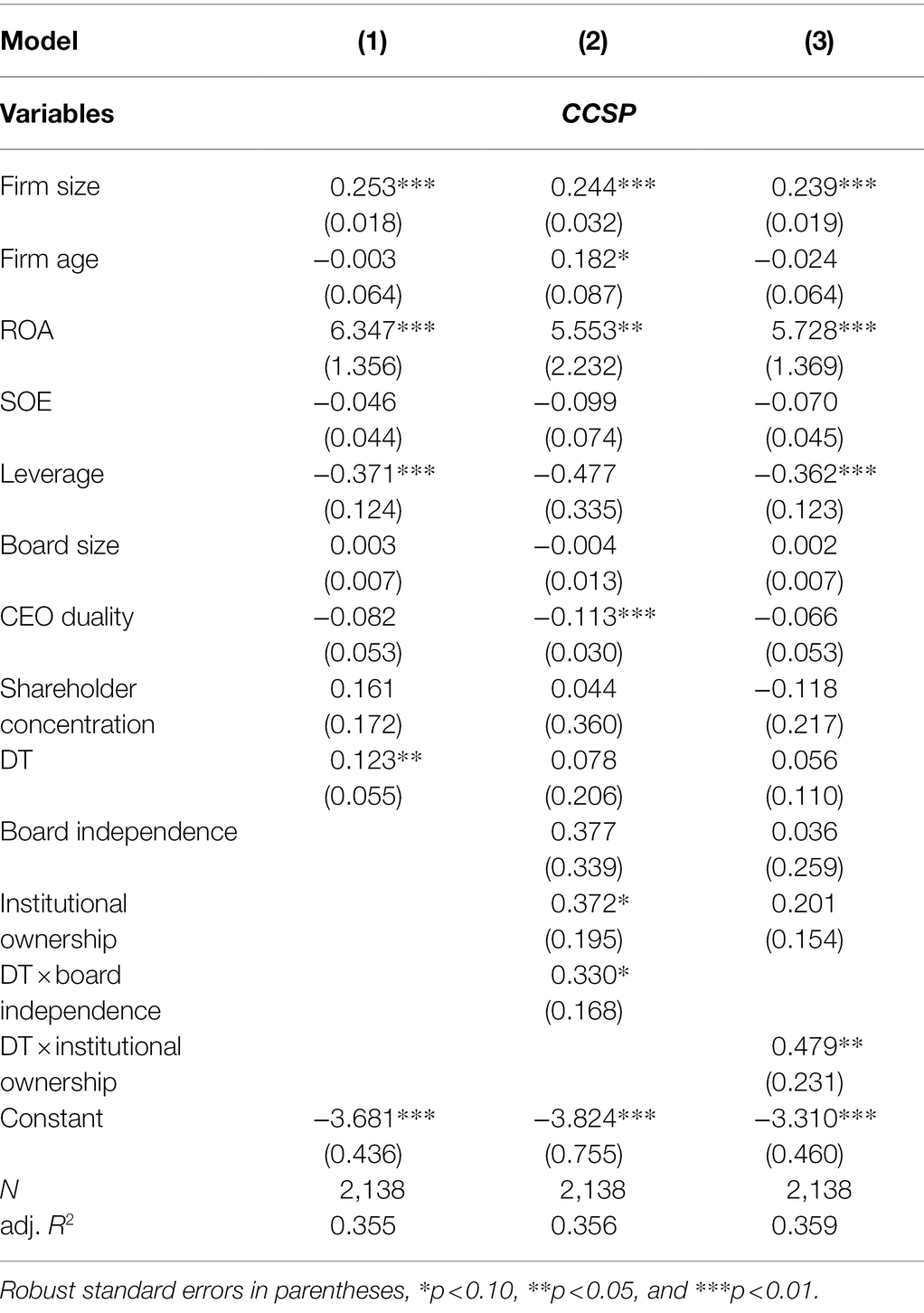

First, we build an alternative proxy for CSP using the China Corporate Social Responsibility database published by the CNRDS, which has collected Chinese-listed firms’ CSP data since 2006 (Jin et al., 2021; Meng and Sima, 2022). The index covers six dimensions of CSR, namely employee relations, corporate governance, diversity, environment, product, and community, similar to the globally used CSR database KLD. The alternative measure for CSP is CCSP, calculated following Jin et al. (2021). However, the database used for analysis includes limited CSR information and only covers approximately 20% of listed firms. (Thus, we only use this data source for the robustness checks.) Table 6 reports the robustness test results, which are consistent with the baseline results.

Second, instead of using the ratio of identified word counts to the total words in MD&A, we build an alternative proxy (DTT) for the independent variable using the total number of identified words related to digital transformation. Results in Table 7 indicate that they align with our main findings.

Endogeneity

Reverse causality may exist between digital transformation and CSP. Therefore, we use the 2SLS approach to address this problem (Hossnofsky and Junge, 2019; Meng and Sima, 2022). Following previous studies (Gupta et al., 2018; Hossnofsky and Junge, 2019), we use the average digital transformation per industry as the instrument, ensuring that it is highly correlated with the firms’ digital transformation and is exogenous to the CSP. We use the “ivreghdfe” command in Stata to perform the 2SLS analysis. First, we need to confirm the instrument’s validity by performing various tests. The results show that it passes the exogeneity and identification tests. Table 8 reports the results of the second-stage 2SLS model; they are consistent with the baseline regression results, indicating that endogeneity is not a relevant concern in this study.

Discussion

Theoretical Implications

This study makes three contributions to the literature. First, it enhances the current understanding of the antecedents of CSP by investigating the effect of firm-level digital transformation on CSP and exploring the underlying mechanisms from a stakeholder theory perspective. Previous studies have mainly documented the adoption of digital technologies in a specific CSR-related activity (Ramirez-Peña et al., 2020; Santoalha et al., 2021; Cardinali and De Giovanni, 2022). They have not examined the impact of organizational digitalization on its overall CSP. Our findings highlight the relevance of digital transformation in shaping a firm’s CSR behaviors and, hence, CSP. This study’s contribution is vital for future business ethics research, as digitalization is an essential driver of CSP. The integration between stakeholder theory and the literature on digitalization may offer novel perspectives to examine firms’ CSR strategies in the digital era.

Second, this is one of the first empirical studies to examine the effect of digital transformation on firms’ CSP. Previous research has mainly focused on the impact of digital transformation on financial, innovation, and internationalization performance (Jin and Hurd, 2018; Bresciani et al., 2021; Chouaibi et al., 2022). In contrast, firms’ social and environmental performance has been largely neglected. We offer evidence that digital transformation improves a firm’s CSP, supporting the assumptions of stakeholder theory (Brower and Mahajan, 2013).

Third, we provide new insights into how digital transformation and different corporate governance dimensions interact and influence CSP. To the best of our knowledge, this is the first study to investigate the interaction between digital transformation and corporate governance (i.e., board independence and institutional ownership). This study shows that as the proportion of independent directors on the board or the percentage of institutional owners increases, the relationship between digital transformation and firms’ CSP strengthens. Hence, we provide additional evidence that firms, managers, investors, and directors in the digital ecosystem behave in ways consistent with agency and stakeholder theories (Dyck et al., 2019; García-Sánchez et al., 2019; Zaid et al., 2020).

Practical Implications

This study discusses how firm-level digital transformation may increase social gains and how corporate governance shapes their relationship. Therefore, it provides meaningful implications for business managers and policymakers.

In terms of management implications, this study emphasizes the importance of reacting to the new challenges of the digital era. CSR is of great value in an emerging economy such as China. Managers should exploit the positive externalities of digital transformation, increasing productivity and efficiency, with substantial social gains. Besides, firms should acknowledge the importance of their board composition and the impact of institutional ownership to encourage engagement in CSR.

Regarding policy implications, the government should implement coherent policies to foster the effective use of digital technologies and accelerate firms’ digital transformation. Coping with the challenges of digital transformation requires coordination across all policy domains. Building a comprehensive approach to digital transformation is vital. In addition, the government is fundamental to increasing awareness and building capacities for improving CSR among firms and stakeholders. Therefore, the government should foster better CSR practices using a multifaceted approach.

Conclusion

Digital economy has contributed increasingly to economic development worldwide. Digital transformation is a widely observed phenomenon in the context of the current digital ecosystem. Thus, it is crucial to explore the impacts of digital transformation on business activities. Meanwhile, the role of corporate governance is important for firms’ strategy and sustainable development. However, the literature mostly neglects the role of corporate governance when studying the social impacts of firms’ digital transformation. By integrating stakeholder theory and the literature on digitalization, this study examines how digital transformation affects firms’ CSP. The study also develops a new conceptual framework to explain how corporate governance shapes the relationship between digital transformation and CSP, considering the moderating role of board independence and institutional ownership. In the empirical analysis, this study employs panel data estimation model and uses a dataset of 2,281 listed firms with 10,048 firm-year observations in China from 2014 to 2018 to test the hypotheses. To summarize, this study finds that digital transformation promotes firms’ CSP. In terms of corporate governance, it shows that higher board independence and institutional ownership levels strengthen the positive effect of digital transformation on CSP. Note that our findings are robust to a broad set of robustness analyses. These findings contribute to a better understanding of CSP in the context of emerging markets, which would also provide implications for the formulation and implementation of efficient CSR strategies in the digital era.

Limitations and Future Research Direction

Although this study considerably contributes to the extant literature, some limitations can be addressed in future research. First, our sample is focused on listed firms since the information about their digital transformation and CSP is publicly available. Future research may well benefit from comparing the digital transformation processes in listed and non-listed firms that affect their CSR behavior. This is because non-listed firms may incur relatively weaker oversight and monitoring from government, media and other stakeholders. Second, it is possible that our research findings may not be completely generalized to other countries given the cross-country differences in institutional, economic and social–cultural conditions. Thus, future studies could test in different contexts to check whether the findings can be extended to other emerging or developed economies. Finally, we adopt a broad measure of digital transformation based on firms’ annual reports. Future research might complement our research by investigating specific components of digital transformation (e.g., digital marketing, digital servitization, digital culture, or digital process management).

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

SM performed conceptualization, methodology, visualization, and writing-original draft. HS did conceptualization, methodology, validation, and writing-original draft. JY was involved in conceptualization, methodology, validation, and writing-review and editing. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the Fundamental Research Funds for the Central Universities and the Humanities and Social Science Fund of Ministry of Education of China (Grant No. 20YJC790099).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aghion, P., Van Reenen, J., and Zingales, L. (2013). Innovation and institutional ownership. Am. Econ. Rev. 103, 277–304. doi: 10.1257/aer.103.1.277

Aguilera, R. V., Rupp, D. E., Williams, C. A., and Ganapathi, J. (2007). Putting the S back in corporate social responsibility: a multilevel theory of social change in organizations. Acad. Manag. Rev. 32, 836–863. doi: 10.5465/amr.2007.25275678

Ahmad, S., Islam, T., Sadiq, M., and Kaleem, A. (2021). Promoting green behavior through ethical leadership: a model of green human resource management and environmental knowledge. Leadersh. Organ. Dev. J. 42, 531–547. doi: 10.1108/LODJ-01-2020-0024

Aksoy, M., Yilmaz, M. K., Tatoglu, E., and Basar, M. (2020). Antecedents of corporate sustainability performance in Turkey: the effects of ownership structure and board attributes on non-financial companies. J. Clean. Prod. 276:124284. doi: 10.1016/j.jclepro.2020.124284

Barnea, A., and Rubin, A. (2010). Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 97, 71–86. doi: 10.1007/s10551-010-0496-z

Barnett, M. L. (2007). Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Acad. Manag. Rev. 32, 794–816. doi: 10.5465/amr.2007.25275520

Barnett, M. L. (2016). The business case for corporate social responsibility: a critique and an indirect path forward. Bus. Soc. 58, 167–190. doi: 10.1177/0007650316660044

Beasley, M. S. (1996). An empirical analysis of the relation between the board of director composition and financial statement fraud. Account. Rev. 71, 443–465.

Beji, R., Yousfi, O., Loukil, N., and Omri, A. (2021). Board diversity and corporate social responsibility: empirical evidence from France. J. Bus. Ethics 173, 133–155. doi: 10.1007/s10551-020-04522-4

Blanka, C., Krumay, B., and Rueckel, D. (2022). The interplay of digital transformation and employee competency: a design science approach. Technol. Forecast. Soc. Change 178:121575. doi: 10.1016/j.techfore.2022.121575

Bolourian, S., Angus, A., and Alinaghian, L. (2021). The impact of corporate governance on corporate social responsibility at the board-level: a critical assessment. J. Clean. Prod. 291:125752. doi: 10.1016/j.jclepro.2020.125752

Bresciani, S., Huarng, K. H., Malhotra, A., and Ferraris, A. (2021). Digital transformation as a springboard for product, process and business model innovation. J. Bus. Res. 128, 204–210. doi: 10.1016/j.jbusres.2021.02.003

Brower, J., and Mahajan, V. (2013). Driven to be good: a stakeholder theory perspective on the drivers of corporate social performance. J. Bus. Ethics 117, 313–331. doi: 10.1007/s10551-012-1523-z

Brown, W. O., Helland, E., and Smith, J. K. (2006). Corporate philanthropic practices. J. Corp. Financ. 12, 855–877. doi: 10.1016/j.jcorpfin.2006.02.001

Bruton, G. D., Ahlstrom, D., and Chen, J. (2021). China has emerged as an aspirant economy. Asia Pacific J. Manag. 38, 1–15. doi: 10.1007/s10490-018-9638-0

Cabral, C., and Sasidharan, A. (2021). Do regulatory mechanisms affect corporate social performance? Evidence from emerging economies. J. Clean. Prod. 326:129383. doi: 10.1016/j.jclepro.2021.129383

Cahan, S. F., Chen, C., and Chen, L. (2017). Social norms and CSR performance. J. Bus. Ethics 145, 493–508. doi: 10.1007/s10551-015-2899-3

Cardinali, P. G., and De Giovanni, P. (2022). Responsible digitalization through digital technologies and green practices. Corp. Soc. Responsib. Environ. Manag. doi: 10.1002/csr.2249

Cenamor, J., Parida, V., and Wincent, J. (2019). How entrepreneurial SMEs compete through digital platforms: the roles of digital platform capability, network capability and ambidexterity. J. Bus. Res. 100, 196–206. doi: 10.1016/j.jbusres.2019.03.035

Chen, T., Dong, H., and Lin, C. (2020). Institutional shareholders and corporate social responsibility. J. Financ. Econ. 135, 483–504. doi: 10.1016/j.jfineco.2019.06.007

Chen, X., Harford, J., and Li, K. (2007). Monitoring: which institutions matter? J. Financ. Econ. 86, 279–305. doi: 10.1016/j.jfineco.2006.09.005

Chen, C. J., Lin, B. W., Lin, Y. H., and Hsiao, Y. C. (2016). Ownership structure, independent board members and innovation performance: a contingency perspective. J. Bus. Res. 69, 3371–3379. doi: 10.1016/j.jbusres.2016.02.007

Chou, C. Y., Chen, J.-S., and Liu, Y.-P. (2017). Inter-firm relational resources in cloud service adoption and their effect on service innovation. Serv. Ind. J. 37, 256–276. doi: 10.1080/02642069.2017.1311869

Chouaibi, S., Festa, G., Quaglia, R., and Rossi, M. (2022). The risky impact of digital transformation on organizational performance – evidence from Tunisia. Technol. Forecast. Soc. Change 178:121571. doi: 10.1016/j.techfore.2022.121571

Ciampi, F., Faraoni, M., Ballerini, J., and Meli, F. (2022). The co-evolutionary relationship between digitalization and organizational agility: ongoing debates, theoretical developments and future research perspectives. Technol. Forecast. Soc. Change 176:121383. doi: 10.1016/j.techfore.2021.121383

Ciarli, T., Kenney, M., Massini, S., and Piscitello, L. (2021). Digital technologies, innovation, and skills: emerging trajectories and challenges. Res. Policy 50:104289. doi: 10.1016/j.respol.2021.104289

Cox, P., Brammer, S., and Millington, A. (2004). An empirical examination of institutional investor preferences for corporate social performance. J. Bus. Ethics 52, 27–43. doi: 10.1023/B:BUSI.0000033105.77051.9d

Crifo, P., Escrig-Olmedo, E., and Mottis, N. (2019). Corporate governance as a key driver of corporate sustainability in France: the role of board members and investor relations. J. Bus. Ethics 159, 1127–1146. doi: 10.1007/s10551-018-3866-6

Cuypers, I. R. P., Koh, P.-S., and Wang, H. (2015). Sincerity in corporate philanthropy, stakeholder perceptions and firm value. Organ. Sci. 27, 173–188. doi: 10.1287/orsc.2015.1030

Dalton, D. R., Daily, C. M., Johnson, J. L., and Ellstrand, A. E. (1999). Number of directors and financial performance: a meta-analysis. Acad. Manag. J. 42, 674–686. doi: 10.5465/256988

Dimson, E., Karakaş, O., and Li, X. (2015). Active ownership. Rev. Financ. Stud. 28, 3225–3268. doi: 10.1093/rfs/hhv044

Donaldson, T., and Preston, L. E. (1995). The stakeholder theory of the corporation: concepts, evidence, and implications. Acad. Manag. Rev. 20, 65–91. doi: 10.5465/amr.1995.9503271992

Dunn, K., and Harness, D. (2018). Communicating corporate social responsibility in a social world: the effects of company-generated and user-generated social media content on CSR attributions and scepticism. J. Mark. Manag. 34, 1503–1529. doi: 10.1080/0267257X.2018.1536675

Dunn, K., and Harness, D. (2019). Whose voice is heard? The influence of user-generated versus company-generated content on consumer scepticism towards CSR. J. Mark. Manag. 35, 886–915. doi: 10.1080/0267257X.2019.1605401

Dyck, A., Lins, K. V., Roth, L., and Wagner, H. F. (2019). Do institutional investors drive corporate social responsibility? International evidence. J. Financ. Econ. 131, 693–714. doi: 10.1016/j.jfineco.2018.08.013

Fama, E. F., and Jensen, M. C. (1983). Separation of ownership and control. J. Law Econ. 26, 301–325. doi: 10.1086/467037

Fernández-Gago, R., Cabeza-García, L., and Nieto, M. (2018). Independent directors’ background and CSR disclosure. Corp. Soc. Responsib. Environ. Manag. 25, 991–1001. doi: 10.1002/csr.1515

Fossen, F. M., and Sorgner, A. (2022). New digital technologies and heterogeneous wage and employment dynamics in the United States: evidence from individual-level data. Technol. Forecast. Soc. Change 175:121381. doi: 10.1016/j.techfore.2021.121381

Fuente, J. A., García-Sánchez, I. M., and Lozano, M. B. (2017). The role of the board of directors in the adoption of GRI guidelines for the disclosure of CSR information. J. Clean. Prod. 141, 737–750. doi: 10.1016/j.jclepro.2016.09.155

Gao, Y., and Yang, H. (2021). Does ownership matter? Firm ownership and corporate illegality in China. J. Bus. Ethics 168, 431–445. doi: 10.1007/s10551-019-04264-y

García-Sánchez, I. M., Gómez-Miranda, M. E., David, F., and Rodríguez-Ariza, L. (2019). Board independence and GRI-IFC performance standards: the mediating effect of the CSR committee. J. Clean. Prod. 225, 554–562. doi: 10.1016/j.jclepro.2019.03.337

Gilliland, D. I., Bello, D. C., and Gundlach, G. T. (2010). Control-based channel governance and relative dependence. J. Acad. Mark. Sci. 38, 441–455. doi: 10.1007/s11747-009-0183-8

Gong, C., and Ribiere, V. (2021). Developing a unified definition of digital transformation. Technovation 102:102217. doi: 10.1016/j.technovation.2020.102217

Graves, S. B., and Waddock, S. A. (1994). Institutional owners and corporate social performance. Acad. Manag. J. 37, 1034–1046. doi: 10.5465/256611

Gupta, A., Briscoe, F., and Hambrick, D. C. (2018). Evenhandedness in resource allocation: its relationship with CEO ideology, organizational discretion, and firm performance. Acad. Manag. J. 61, 1848–1868. doi: 10.5465/amj.2016.1155

Hadjielias, E., Christofi, M., Christou, P., and Drotarova, M. H. (2022). Digitalization, agility, and customer value in tourism. Technol. Forecast. Soc. Change 175:121334. doi: 10.1016/j.techfore.2021.121334

Hanelt, A., Bohnsack, R., Marz, D., and Marante, C. A. (2021). A systematic review of the literature on digital transformation: insights and implications for strategy and organizational change. J. Manag. Stud. 58, 1159–1197. doi: 10.1111/joms.12639

Harjoto, M., Jo, H., and Kim, Y. (2017). Is institutional ownership related to corporate social responsibility? The nonlinear relation and its implication for stock return volatility. J. Bus. Ethics 146, 77–109. doi: 10.1007/s10551-015-2883-y

Hossnofsky, V., and Junge, S. (2019). Does the market reward digitalization efforts? Evidence from securities analysts’ investment recommendations. J. Bus. Econ. 89, 965–994. doi: 10.1007/s11573-019-00949-y

Huang, J., Hu, W., and Zhu, G. (2018). The effect of corporate social responsibility on cost of corporate bond: Evidence from China. Emerg. Mark. Finance Trade 54, 255–268. doi: 10.1080/1540496X.2017.1332591

Ibrahim, N. A., and Angelidis, J. P. (1995). The corporate social responsiveness orientation of board members: are there differences between inside and outside directors? J. Bus. Ethics 14, 405–410. doi: 10.1007/BF00872102

Ibrahim, N. A., Howard, D. P., and Angelidis, J. P. (2003). Board members in the service industry: an empirical examination of the relationship between corporate social responsibility orientation and directorial type. J. Bus. Ethics 47, 393–401. doi: 10.1023/A:1027334524775

Illia, L., Romenti, S., Rodríguez-Cánovas, B., Murtarelli, G., and Carroll, C. E. (2017). Exploring corporations’ dialogue about CSR in the digital era. J. Bus. Ethics 146, 39–58. doi: 10.1007/s10551-015-2924-6

Jensen, M. C., and Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360. doi: 10.1016/0304-405X(76)90026-X

Jin, H., and Hurd, F. (2018). Exploring the impact of digital platforms on SME internationalization: New Zealand SMEs use of the Alibaba platform for Chinese market entry. J. Asia-Pacific Bus. 19, 72–95. doi: 10.1080/10599231.2018.1453743

Jin, R., Jiang, X., and Hu, H. W. (2021). Internal and external CSR in China: how do women independent directors matter? Asia Pacific J. Manag., 1–36. doi: 10.1007/s10490-021-09783-9

Johnson, R. A., and Greening, D. W. (1999). The effects of corporate governance and institutional ownership types on corporate social performance. Acad. Manag. J. 42, 564–576. doi: 10.5465/256977

Jones, T. M. (1995). Instrumental stakeholder theory: a synthesis of ethics and economics. Acad. Manag. Rev. 20, 404–437. doi: 10.5465/amr.1995.9507312924

Jones, T. M., and Wicks, A. C. (1999). Convergent stakeholder theory. Acad. Manag. Rev. 24, 206–221. doi: 10.5465/amr.1999.1893929

Kang, J. (2013). The relationship between corporate diversification and corporate social performance. Strateg. Manag. J. 34, 94–109. doi: 10.1002/smj.2005

Kannan, P. K., and Li, H. A. (2017). Digital marketing: a framework, review and research agenda. Int. J. Res. Mark. 34, 22–45. doi: 10.1016/j.ijresmar.2016.11.006

Khan, M. K., Ali, S., Zahid, R. M. A., Huo, C., and Nazir, M. S. (2022). Does whipping tournament incentives spur CSR performance? An empirical evidence from Chinese sub-national institutional contingencies. Front. Psychol. 13, 1–19. doi: 10.3389/fpsyg.2022.841163

Khan, A., Muttakin, M. B., and Siddiqui, J. (2013). Corporate governance and corporate social responsibility disclosures: evidence from an emerging economy. J. Bus. Ethics 114, 207–223. doi: 10.1007/s10551-012-1336-0

Khan, M. K., Zahid, R. M., Saleem, A., and Sági, J. (2021). Board composition and social & environmental accountability: a dynamic model analysis of Chinese firms. Sustainability 13:10662. doi: 10.3390/su131910662

Kim, A. J., and Johnson, K. K. P. (2016). Power of consumers using social media: examining the influences of brand-related user-generated content on Facebook. Comput. Human Behav. 58, 98–108. doi: 10.1016/j.chb.2015.12.047

Kohtamäki, M., Parida, V., Patel, P. C., and Gebauer, H. (2020). The relationship between digitalization and servitization: the role of servitization in capturing the financial potential of digitalization. Technol. Forecast. Soc. Change 151:119804. doi: 10.1016/j.techfore.2019.119804

Kouhizadeh, M., and Sarkis, J. (2018). Blockchain practices, potentials, and perspectives in greening supply chains. Sustainability 10:3652. doi: 10.3390/su10103652

Kraus, S., Schiavone, F., Pluzhnikova, A., and Invernizzi, A. C. (2021). Digital transformation in healthcare: analyzing the current state-of-research. J. Bus. Res. 123, 557–567. doi: 10.1016/j.jbusres.2020.10.030

Lamberton, C., and Stephen, A. T. (2016). A thematic exploration of digital, social media, and mobile marketing: research evolution from 2000 to 2015 and an agenda for future inquiry. J. Mark. 80, 146–172. doi: 10.1509/jm.15.0415

Lee, C. H., Wang, D., Desouza, K., and Evans, R. (2021). Digital transformation and the new normal in China: how can enterprises use digital technologies to respond to covid-19? Sustainability 13:10195. doi: 10.3390/su131810195

Li, L., Su, F., Zhang, W., and Mao, J. (2018). Digital transformation by SME entrepreneurs: a capability perspective. Inf. Syst. J. 28, 1129–1157. doi: 10.1111/isj.12153

Liao, L., Lin, T. P., and Zhang, Y. (2018). Corporate board and corporate social responsibility assurance: evidence from China. J. Bus. Ethics 150, 211–225. doi: 10.1007/s10551-016-3176-9

Liu, T., Liu, H., Zhang, Y., Song, Y., Su, Y., and Zhu, Y. (2020). Linking governance structure and sustainable operations of Chinese manufacturing firms: the moderating effect of internationalization. J. Clean. Prod. 253:119949. doi: 10.1016/j.jclepro.2019.119949

Liu, T., Zhang, Y., and Liang, D. (2019). Can ownership structure improve environmental performance in Chinese manufacturing firms? The moderating effect of financial performance. J. Clean. Prod. 225, 58–71. doi: 10.1016/j.jclepro.2019.03.267

Lundvall, B. Å., and Rikap, C. (2022). China’s catching-up in artificial intelligence seen as a co-evolution of corporate and national innovation systems. Res. Policy 51:104395. doi: 10.1016/j.respol.2021.104395

Marquis, C., and Qian, C. (2014). Corporate social responsibility reporting in China: symbol or substance? Organ. Sci. 25, 127–148. doi: 10.1287/orsc.2013.0837

Meng, S., and Sima, Y. (2022). Foreign competition and corporate social responsibility: the role of the firm–government relationships. Chin. Manag. Stud. doi: 10.1108/CMS-07-2021-0302

Nambisan, S., Wright, M., and Feldman, M. (2019). The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Res. Policy 48:103773. doi: 10.1016/j.respol.2019.03.018

Neubaum, D. O., and Zahra, S. A. (2006). Institutional ownership and corporate social performance: The moderating effects of investment horizon, activism, and coordination. J. Manage. 32, 108–131. doi: 10.1177/0149206305277797

Newell, S., and Marabelli, M. (2015). Strategic opportunities (and challenges) of algorithmic decision-making: a call for action on the long-term societal effects of ‘datification. J. Strateg. Inf. Syst. 24, 3–14. doi: 10.1016/j.jsis.2015.02.001

Ntim, C. G., and Soobaroyen, T. (2013). Black economic empowerment disclosures by south african listed corporations: the influence of ownership and board characteristics. J. Bus. Ethics 116, 121–138. doi: 10.1007/s10551-012-1446-8

Oh, W. Y., Chang, Y. K., and Martynov, A. (2011). The effect of ownership structure on corporate social responsibility: empirical evidence from Korea. J. Bus. Ethics 104, 283–297. doi: 10.1007/s10551-011-0912-z

Orlitzky, M., Louche, C., Gond, J. P., and Chapple, W. (2017). Unpacking the drivers of corporate social performance: a multilevel, multistakeholder, and multimethod analysis. J. Bus. Ethics 144, 21–40. doi: 10.1007/s10551-015-2822-y

Paiola, M., and Gebauer, H. (2020). Internet of things technologies, digital servitization and business model innovation in BtoB manufacturing firms. Ind. Mark. Manag. 89, 245–264. doi: 10.1016/j.indmarman.2020.03.009

Prado-Lorenzo, J. M., and Garcia-Sanchez, I. M. (2010). The role of the board of directors in disseminating relevant information on greenhouse gases. J. Bus. Ethics 97, 391–424. doi: 10.1007/s10551-010-0515-0

Quatraro, F., and Scandura, A. (2019). Academic inventors and the antecedents of green technologies. A regional analysis of Italian patent data. Ecol. Econ. 156, 247–263. doi: 10.1016/j.ecolecon.2018.10.007

Ramirez-Peña, M., Sánchez Sotano, A. J., Pérez-Fernandez, V., Abad, F. J., and Batista, M. (2020). Achieving a sustainable shipbuilding supply chain under I4.0 perspective. J. Clean. Prod. 244:118789. doi: 10.1016/j.jclepro.2019.118789

Rao, K., and Tilt, C. (2016). Board composition and corporate social responsibility: the role of diversity, gender, strategy and decision making. J. Bus. Ethics 138, 327–347. doi: 10.1007/s10551-015-2613-5

Riedl, A., and Smeets, P. (2017). Why do investors hold socially responsible mutual funds? J. Finance 72, 2505–2550. doi: 10.1111/jofi.12547

Roblek, V., Meško, M., Pušavec, F., and Likar, B. (2021). The role and meaning of the digital transformation as a disruptive innovation on small and medium manufacturing enterprises. Front. Psychol. 12:592528. doi: 10.3389/fpsyg.2021.592528

Rong, Z., Wu, X., and Boeing, P. (2017). The effect of institutional ownership on firm innovation: evidence from Chinese listed firms. Res. Policy 46, 1533–1551. doi: 10.1016/j.respol.2017.05.013

Santoalha, A., Consoli, D., and Castellacci, F. (2021). Digital skills, relatedness and green diversification: a study of European regions. Res. Policy 50:104340. doi: 10.1016/j.respol.2021.104340

Schiavone, F., Leone, D., Caporuscio, A., and Lan, S. (2022). Digital servitization and new sustainable configurations of manufacturing systems. Technol. Forecast. Soc. Change 176:121441. doi: 10.1016/j.techfore.2021.121441

Schnatterly, K., and Johnson, S. G. (2014). Independent boards and the institutional investors that prefer them: drivers of institutional investor heterogeneity in governance preferences. Strateg. Manag. J. 35, 1552–1563. doi: 10.1002/smj.2166

Shahbaz, M., Karaman, A. S., Kilic, M., and Uyar, A. (2020). Board attributes, CSR engagement, and corporate performance: what is the nexus in the energy sector? Energy Policy 143:111582. doi: 10.1016/j.enpol.2020.111582

Shleifer, A., and Vishny, R. W. (1986). Large shareholders and corporate control. J. Polit. Econ. 94, 461–488. doi: 10.1086/261385

Siegel, D. S., and Vitaliano, D. F. (2007). An empirical analysis of the strategic use of corporate social responsibility. J. Econ. Manag. Strateg. 16, 773–792. doi: 10.1111/j.1530-9134.2007.00157.x

Singh, A., and Hess, T. (2017). How chief digital officers promote the digital transformation of their companies. MIS Q. Exec. 16, 1–17.

Sousa, M. J., and Rocha, Á. (2019). Skills for disruptive digital business. J. Bus. Res. 94, 257–263. doi: 10.1016/j.jbusres.2017.12.051

Stohl, C., Etter, M., Banghart, S., and Woo, D. (2017). Social media policies: implications for contemporary notions of corporate social responsibility. J. Bus. Ethics 142, 413–436. doi: 10.1007/s10551-015-2743-9

The Economist (2008). Just good business: a special report on corporate social responsibility. Econ. Available at: https://www.economist.com/special-report/2008/01/19/just-good-business (Accessed April 7, 2022).

Usai, A., Fiano, F., Petruzzelli, A. M., Paoloni, P., Briamonte, M. F., and Orlando, B. (2021). Unveiling the impact of the adoption of digital technologies on firms’ innovation performance. J. Bus. Res. 133, 327–336. doi: 10.1016/j.jbusres.2021.04.035

Vaska, S., Massaro, M., Bagarotto, E. M., and Dal Mas, F. (2021). The digital transformation of business model innovation: a structured literature review. Front. Psychol. 11:3557. doi: 10.3389/fpsyg.2020.539363

Verhoef, P. C., Broekhuizen, T., Bart, Y., Bhattacharya, A., Dong, J. Q., Fabian, N., et al. (2021). Digital transformation: a multidisciplinary reflection and research agenda. J. Bus. Res. 122, 889–901. doi: 10.1016/j.jbusres.2019.09.022

Vial, G. (2019). Understanding digital transformation: a review and a research agenda. J. Strateg. Inf. Syst. 28, 118–144. doi: 10.1016/j.jsis.2019.01.003

Vogler, D., and Eisenegger, M. (2020). CSR communication, corporate reputation, and the role of the news media as an agenda-setter in the digital age. Bus. Soc. 60, 1957–1986. doi: 10.1177/0007650320928969

Wood, D. J. (1991). Corporate social performance revisited. Acad. Manag. Rev. 16, 691–718. doi: 10.5465/amr.1991.4279616

Yang, M., Ren, Y., and Adomavicius, G. (2019). Understanding user-generated content and customer engagement on facebook business pages. Inf. Syst. Res. 30, 839–855. doi: 10.1287/isre.2019.0834

Yang, H., Shi, X., and Wang, S. (2021). Moderating effect of chief executive officer narcissism in the relationship between corporate social responsibility and green technology innovation. Front. Psychol. 12:717491. doi: 10.3389/fpsyg.2021.717491

Yoo, Y., Boland, R. J., Lyytinen, K., and Majchrzak, A. (2012). Organizing for innovation in the digitized world. Organ. Sci. 23, 1398–1408. doi: 10.1287/orsc.1120.0771

Yuan, C., Xiao, T., Geng, C., and Sheng, Y. (2021). Digital transformation and division of labor between enterprises: vertical specialization or vertical inte gration. China’s Ind. Econ. 9, 137–155.

Zaid, M. A. A., Abuhijleh, S. T. F., and Pucheta-Martínez, M. C. (2020). Ownership structure, stakeholder engagement, and corporate social responsibility policies: the moderating effect of board independence. Corp. Soc. Responsib. Environ. Manag. 27, 1344–1360. doi: 10.1002/csr.1888

Zhai, H., Yang, M., and Chan, K. C. (2022). Does digital transformation enhance a firm’s performance? Evidence from China. Technol. Soc. 68:101841. doi: 10.1016/j.techsoc.2021.101841

Zhang, J., Marquis, C., and Qiao, K. (2016). Do political connections buffer firms from or bind firms to the government? A study of corporate charitable donations of Chinese firms. Organ. Sci. 27, 1307–1324. doi: 10.1287/orsc.2016.1084

Keywords: digital transformation, corporate social responsibility, board independence, institutional ownership, corporate governance

Citation: Meng S, Su H and Yu J (2022) Digital Transformation and Corporate Social Performance: How Do Board Independence and Institutional Ownership Matter? Front. Psychol. 13:915583. doi: 10.3389/fpsyg.2022.915583

Edited by:

Muhammad Kaleem Khan, Liaoning University, ChinaReviewed by:

R. M. Ammar Zahid, Yunnan Technology and Business University, ChinaMuqaddas Khalid, Lahore Garrison University, Pakistan

Muhammad Wasim Hussan, Universiti Malaysia Sabah, Malaysia

Copyright © 2022 Meng, Su and Yu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jiajie Yu, eXVqaWFqaWVAYm51LmVkdS5jbg==

†These authors have contributed equally to this work and share first authorship

Shuang Meng

Shuang Meng Huiwen Su

Huiwen Su Jiajie Yu

Jiajie Yu