- 1School of Management, Shanghai University, Shanghai, China

- 2School of Finance, Jiangxi University of Finance and Economics, Nanchang, China

The sex ratio at birth in China exhibits a major occurrence of “missing women” due to the high son preference in Chinese culture. Clearly, the large gender discrepancy in China can be explained not only by ethical, moral, or social fairness theories but also by the economic benefits of women's particular abilities, experiences, and talents. This article examines the influence of female chief financial officers (CFOs) on information disclosure violations in order to highlight women's positive contributions. Our data imply that having a female CFO can dramatically lower the number of companies that fail to disclose information. The results are strong after controlling endogeneity with propensity score matching, Heckman's two-stage self-selection model, and CFO change, as well as controlling the gender of the chairman and chief executive officer, utilizing different study periods, and using exogenous shock. We further examined the moderate effects of CFO power and external monitoring, and we found that CFO power magnifies the negative effect of female CFO on violations; the more the power, the more the negative effect of female CFO on violations. We also found that when the firm has effective external monitoring, there are fewer future infractions of information disclosure.

Introduction

Working women who are housewives suffer work-life conflicts and a trade-off between work domain and family life domain since traditional Chinese culture prioritizes women's familial obligations as mothers and wives. The pressures from family, community, and country always push women to weigh family against work. As a result, people assume men are better able to focus on work and produce greater results than women, and thus, men are given more resources and opportunities to work. Due to a lack of law and regulation, explicit gender discriminations have been reported in a range of areas in China, including employment and career advancement in the labor market (Kuhn and Shen, 2013; Gao et al., 2016), access to financial resources (Bellucci et al., 2010), education, and personal health (Qi et al., 2016).

Gender discrimination will prevent females from reaching top management positions and reduce women's willingness to work in the short term, while continued discrimination will lead women to be childless or prefer sons over daughters in order to avoid discrimination happening to their children again, both of which will result in an imbalanced population in China in the long run.

To address this issue, the Chinese government has enacted a slew of gender-focused equal opportunity regulations aimed at increasing women's involvement in the workforce. However, the strong effort to reduce gender discrimination is motivated not only by ethical, moral, or regulatory rules but also by the economic benefits of women's particular abilities, experiences, and talents (Zalata et al., 2019). According to studies on business performance/value, having more women on boards improves board independence, monitoring, advising ability, and resources through greater connections of the firms to the external environment (Terjesen et al., 2009). Female executives also have favorable effects on firm performance/value (Liu et al., 2014). Using a unique sample of listed Chinese companies, we investigated whether female chief financial officers (CFOs) help reduce corporate information disclosure violations.

Compared with the female-fraud studies, we focused on CFOs because their duties are financial and they bear the prime responsibility for reporting accurate and timely financial disclosures for the firm (Ham et al., 2017). Many previous studies have found the value of female chief executive officers (CEOs) or Chairman of the Boards in many aspects, such as financing and investing (Huang and Kisgen, 2013; Faccio et al., 2016), accounting policies and regulations (Francis et al., 2015; Zalata et al., 2019), and social responsibilities (Zalata et al., 2019). Despite the fact that the CFO is one of the most significant positions in the company, few studies are conducted on CFOs. This is why we chose to study the effects of female CFOs rather than female CEOs (McGuinness et al., 2017; Grosser and Moon, 2019). We expected CFO characteristics to have a particularly important influence, incremental to CEOs, on financial disclosure, given the CFO's oversight role.

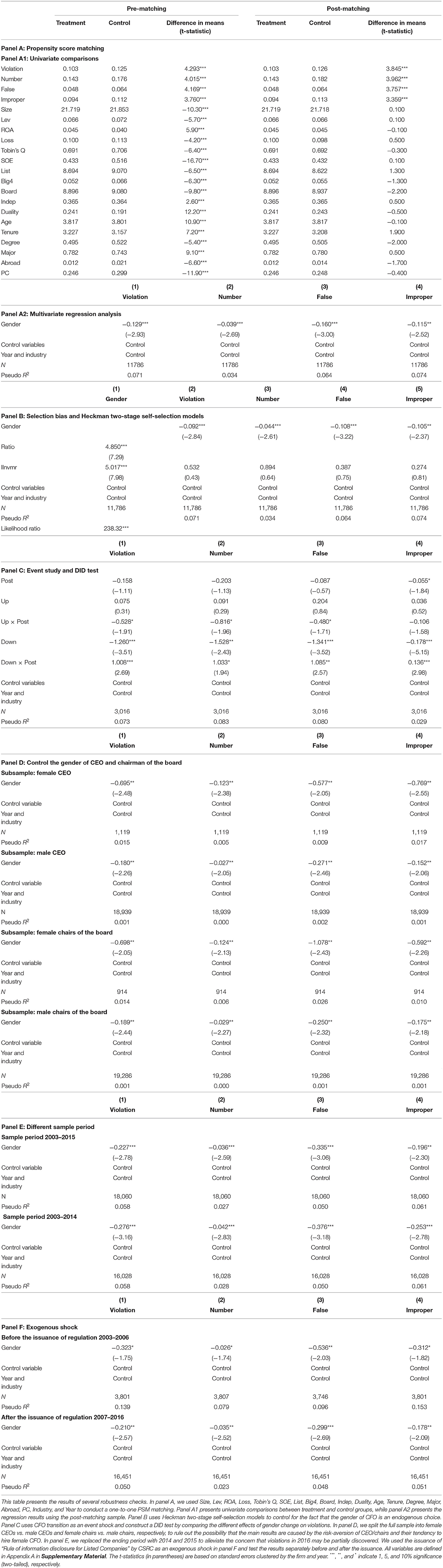

In this article, first we looked at the influence of female CFO on information disclosure violations by using different metrics of violation. We discovered that female CFOs are more cautious with information disclosure than their male counterparts, owing to the fact that companies with female CFOs are less likely to commit information disclosure infractions. Our findings are robust to different measures of information disclosure violations, using the propensity score matching (PSM) method, controlling for the fact that the gender of the CFO is an endogenous choice by using a Heckman self-selection model, using the dissociative identity disorder (DID) test with a sample of firms experiencing a transition from male to female CFOs or vice versa, controlling the gender of the CEO and Chairman of the Board, implementing different samples, and considering an exogenous shock.

Second, we investigated the moderate effect of CFO power on the relationship between CFO gender and disclosure violations. Our results demonstrate that CFO power enhances the female gender's ability to reduce disclosure violations. Therefore, the more powerful a female CFO is, the more crucial their risk-averse personality trait and ethical sensitivity can be in lowering violations, resulting in fewer corporate infractions.

Finally, we investigated the moderate effect of effective external monitoring on the relationship between CFO gender and disclosure violations since effective monitoring can restrain executive opportunities to capture personal benefits. Our results show that external monitoring can amplify the effect of female gender on lowering disclosure violations. As a result, the negative relationship between female CFOs and information disclosure violations is more profound for firms with poorer external monitoring.

Our results contribute to the literature in two ways. First, compared with the current female-fraud studies, we extended the literature focusing on CEO effects on corporate decision-making. Whereas earlier studies have focused on the impact of CEOs or Chairman of the Board of Directors (Palvia et al., 2015), CFOs have more influence and power in corporate financial reporting because they are the direct executors and controllers of the firm's financial disclosure (Jiang et al., 2010). Given the CFO's oversight role, we expected CFO characteristics to have a particularly important influence, incremental to CEOs, on financial misreporting. Our findings show that, rather than sitting on the sidelines, female CFOs can be more proactive and aggressively intervene to reduce firms' violations.

Second, prior research has found that CFO power has mixed results in terms of violations. On the one hand, increasing power magnifies the negative impact of female CFOs on violations; on the other hand, higher power persuades female CFOs to become overconfident and take more risks in their decision-making, resulting in more information disclosure violations. We extended the literature by measuring power in four dimensions, namely, structural power, ownership power, expert power, and prestige power. We showed that CFO power enhances female CFOs' ability to restrict the firm's opportunistic behavior, resulting in fewer information disclosure violations. This finding complements the study on the influence of managers in the firm's decision-making process.

Our results also have some practical implications. First, the sex ratio at birth in China demonstrates a major situation of “missing women” due to the strong son preference in Chinese culture. According to a research published by the World Economic Forum in 2018, China ranks 149th out of 149 nations in terms of Health and Survival gender gaps. Clearly, the enormous gender disparity in China can be explained not only by ethical, moral, or social fairness theories (Sun et al., 2019) but also by the economic benefits of the unique skills, experiences, and talents that women bring to such roles (Carter et al., 2010). By studying the effect of female CFO on information disclosure violations, we discovered that women's distinct morality and risk aversion can effectively limit a firm's susceptibility to information disclosure violations. Our results provide empirical evidence of women's positive contributions to firm, which will aid in the reduction of gender discrimination.

Second, our findings are useful to regulators. We showed that firms with female CFOs are less likely to engage in information violations because female CFOs are more ethical and risk-averse, providing archival evidence that regulators should be more cautious when reviewing the financial reports of male CFOs.

The remainder of this article presents the hypothesis, discusses the data and research methodology, analyzes the empirical results and robust results, and concludes the study.

Hypothesis Development

Female CFOs and Information Disclosure Violations

Traditional financial theory posits that in a perfect capital market with no friction and asymmetric information, managers may choose the optimal investments to maximize the firm's value, with managers' preferences having no influence on investment selection (Croson and Gneezy, 2009). In reality, the decision-maker's preferences and characteristics will have a role in a firm's investment selection due to the agent cost and asymmetric information. Women are less risk tolerant in general than their male counterparts, according to experimental economics and psychology research. Female CEOs and chairwomen are more likely to invest prudently and implement safer company strategies (Francis et al., 2015; Faccio et al., 2016). Because strategic decisions and information disclosure need a significant level of discretion, we can predict that female CFOs will use more conservative ways in information disclosure, resulting in fewer information disclosure violations.

According to behavioral finance, men are often more overconfident than women. Overconfident CEOs are also prone to overestimating investment returns and underestimating risks (Malmendier and Tate, 2008). Recent studies found that female CEOs are less likely than male executives to engage in acquisitions and issue loans (Huang and Kisgen, 2013). Because less overconfident agents may reduce risk to a level that suits their tastes after becoming executives, female executives who become CFOs would provide more conservative financial reports, resulting in fewer fake financial reports (Sun et al., 2019).

Additionally, women also hold fewer corporate board positions than their male counterparts. In our sample, women occupied 12.11% of board seats in China. When it comes to obtaining a new career, women will have a harder time than men (Faccio et al., 2016). According to data from the European Labor Force Survey, the average unemployment rate among women who previously held a managerial position is 3.9%, while this rate is only 2.7% for men. Phelps and Mason (1991) further documented that after leaving a managerial job, women tend to stay unemployed for longer periods than men. Women and men confront different levels of unemployment risk, which will influence their corporate tactics. More specifically, to reduce unemployment risk, women may opt to self-select into low-violation enterprises or lower firm violation once they have become CFOs.

Finally, the gender-ethics framework demonstrates that, in comparison with men, women are more concerned with ethical issues and adhere to higher moral norms (Croson and Gneezy, 2009). This may encourage increased transparency in financial reporting while also discouraging earnings management (Ho et al., 2015). Furthermore, the Sarbanes–Oxley Act holds senior executives personally liable for the accuracy and completeness of financial reports filed by their companies. As a result, female CFOs' conservative thinking and strong opposition to fraud are likely to strengthen compliance with the Sarbanes–Oxley Act and lower the likelihood of corporate information disclosure violations. Given the above analysis, we predict a negative association between the presence of a female CFO and a firm's violation of information disclosure.

H1: Firm with female CFOs will engage in less information disclosure violations.

The Moderate Effects of CFO Power

Given that power is defined as the “capacity of individual actors to exert their will as means of pursing their goals” (Finkelstein, 1992), powerful CFOs can have a greater impact on corporate processes and outcomes. The more decision-making power female CFOs have, the more likely they are to influence the organization through their own risk-averse qualities, resulting in fewer violations in our case. From this perspective, we believe that CFO power enhances the female gender's effectiveness in reducing disclosure violations.

On the contrary, the approach/inhibition theory of power (Keltner et al., 2003) in social psychology posits that power, a fundamental element of human interaction, triggers the behavioral approach system, which leads those in positions of power to focus on the potential rewards of risky behavior while ignoring potential threats (Lewellyn and Muller-Kahle, 2012). Anderson and Galinsky (2006) discovered a link between individual risk taking and the existence of power. Additionally, they also found that power increases optimism in risk perception, which leads to an increase in the proclivity for risk-taking behavior (Anderson and Galinsky, 2006). Prior studies also suggest that powerful CEOs will lead to excessive risk taking (Lewellyn and Muller-Kahle, 2012; Sariol and Abebe, 2017). Following this assertion, power may seduce CFO into riskier behavior such as disclosure violations.

We investigated the moderate effect of CFO power on the link between CFO gender and disclosure violations because the role of CFO power is unclear. As a result, we proposed the following hypothesis:

H2 (a): The negative relationship between female CFOs and information disclosure violations may be stronger when CFOs have more power.

H2 (b): The negative relationship between female CFOs and information disclosure violations may be weaker when CFOs have more power.

The Moderate Effect of External Monitoring

As suggested by Jensen and Meckling (1976), effective monitoring can restrain executive opportunities to capture personal benefits. External monitoring measures, if effective, can mitigate agency problems and create a good corporate governance environment. Furthermore, various studies have proven that excellent corporate governance policies have a positive impact on a company's current and future operating performance (Bhagat and Bolton, 2008). Good governance can increase a company's financial disclosure and transparency, resulting in lower debt and equity costs, as well as higher market valuations and accounting performance (González et al., 2021). Based on this line of reasoning, we presented the following hypothesis:

H3: The negative relationship between female CFOs and information disclosure violations is strengthened with effective external monitoring.

Data and Methods

Data

Our sample included all firms that were listed on the Shanghai and Shenzhen Stock Exchanges' A-share markets between 2003 and 2016. We chose 2003 as the beginning point because the ownership data were initially accessible in 2003. Because authorities need time to detect a firm's violations and disclose it, we selected 2016 as the end year rather than 2018. As a result, the year in our sample refers to the year in which the violation occurred, not the year in which the authorities disclosed or penalized. After excluding financial organizations (such as banks, insurance companies, and investment trusts) and firms with missing CFO characteristics, we finally received a sample of 20,258 observations representing 2,789 publicly traded companies. The table of industry-year distribution of the sample is provided in Appendix B in Supplementary Material. The data of information disclosure were hand-collected on the website of China's Securities and Regulatory Commission (CSRC). We gathered detailed information on disclosure violations, including the year of the violation, the exact categories of violation, the number of violations, and the authorities who impose the punishment; and we ended up with 2,405 violation records. Other CFO's personal information, accounting, and financial data were obtained from the China Stock Market and Accounting Research Database (CSMAR) and Wind Database.

Variables Definition and Research Methodology

Dependent Variables

We used the following four different methods to assess information disclosure violations in our tests: Violation, Number, False, and Improper. If a firm breached the disclosure regulations in year t, Violation equals 1; otherwise, Violation equals 0. Number is the total number of breaches in year t. We also divided the violations into 2 categories, namely, false disclosure (False) and improper disclosure (Improper). The former refers to when a company's CFO makes incorrect or misleading claims (including false or misleading CSRC reports or financial statements). The latter refers to failing to disclose information on time, or disclosing information that contained a substantial omission, or wrongly using accounting judgment.

Independent Variables

Gender is the gender of the CFO and equals 1 if the CFO is a female and 0 otherwise. Since CSRC requires firms to provide the personal information of the entire management, we immediately identified the gender of a CFO. If the CFO has been replaced, Gender relates to the CFO with long tenure in year t. If the tenure in year t is the same (meaning that a new CFO joins the firm in July, which is just 36 observations in our sample), we referred to the CFO with long tenure during her stay in this firm. In robustness tests, the core results remain the same even if we exclude the 36 observations.

Control Variables

Following the information disclosure literature, we controlled for a vector of CFO, firm, and industry characteristics that may affect a firm's disclosure violation. The control variables include Size (firm's natural log of total assets), Lev (book value of long-term liabilities scaled by total assets), ROA (income before extraordinary items divided by total assets), Loss (dummy variable, and 1 means loss in net income), Tobin's Q (the sum of market value of equity and book value of liability, then scaled by total assets), SOE (dummy variable and 1 for state-owned firm), List (list year of the firm), Big4 (dummy variable, and 1 indicates that financial report is audited by the big 4 audit firms), Board (board size and the number of board directors), Indep (proportion of independent directors), Duality (dummy variable, and 1 indicates that Chairman and CEO are the same person), Age (the natural log value of age of CFO), Tenure (the natural log value of monthly tenure of CFO), Degree (dummy variable, and 1 indicates that CFO has a master's of doctoral degree), Major (dummy variable, and 1 indicates that the college major of CFO is accounting or finance), Abroad (dummy variable, and 1 indicates that CFO has studied or worked abroad before), PC (dummy variable, and 1 implies that the CFO has previous or concurrent work experience in the government or a political position, such as a People's Representative or a Member of Chinese People's Political Consultative Conference). Besides that, we also included industry and year dummies to account for industry and year fixed effects.

Moderating Variables

CFO Power

Finkelstein (1992) proposed that management power originates from four dimensions, namely, structural power, ownership power, expert power, and prestige power. Following Lewellyn and Muller-Kahle (2012) and Lisic et al. (2016) in measuring CEO power, we first used two proxies for CFO structural power. We examined the CFO's title to see if he or she is also a director of the board (Direct). We also examined the CFO's relative compensation (Dcomp), defined as a dummy variable that equals 1 if CFO's total compensation (including salary, bonus, stock grants, and stock options) exceeds the industry-year median. We used whether CFO holds the outstanding share of the company (Dshare) to measure CFO ownership power, higher beneficial ownership gives the CFO greater power. As for expert power, we used CFO tenure (Dtenure) to measure, defined as a dummy variable that equals 1 if the CFO's tenure is longer than the industry-year median. For the CFO's prestige power, we adopted two variables outside, namely, board memberships (Dboard) and educational background (Dedu), for CFO's prestige power. Dboard is a dummy variable that equals 1 if the CFO sits on other corporate boards, and Dedu is a dummy variable that equals 1 if CFO has a master's or doctoral degree.

External Monitoring

Following Lu et al. (2015) and Dong et al. (2018), we employed external monitoring from institutional investor, auditor, analyst, the media, and local market to measure firms' corporate governance. Institutional investor (Dinst) is defined as a dummy variable that equals 1 if the institutional investors' shareholding is greater than the industry-year median. Auditor (Daudit) is also a dummy variable that equals 1 if the financial report has been audited by one of the big 4 auditor firms. We adopted analyst attention (Danalyst) for the monitoring from analysts, and Danalyst is a dummy variable that equals 1 if the number of analysts who follow the firm is greater than the industry-year median. We also used media attention (Dmedia) to assess media monitoring. Dmedia is a dummy variable that equals 1 if the firm's media coverage exceeds the industry-year median. For local market monitoring, we used two variables, namely, regional marketization (DMI) and local trust (Dtrust). DMI is a dummy variable that equals 1 if the province's marketization index (MI)1 where the firm is located is greater than the province-year median (Fan et al., 2013). Dtrust is also a dummy variable that equals 1 if the social trust index2 of the province in which the firm is located is greater than the province-year median. The detailed definitions of all the variables are presented in Appendix A in Supplementary Material.

Methodology

To examine the impact of CFO's gender on information disclosure violations, we used the following regression model:

We used the following empirical model to test the moderate effect of CFO power:

where Ability is a general measure for the six proxies, namely, Direct, Dcomp, Dshare, Dtenure, Dboard, and Dedu.

We used the following empirical model to test the moderate effect of external monitoring:

where Governance is a general measure for the six proxies, namely, Dinst, Daudit, Danalyst, Dmedia, DMI, and Dtrust.

Since the Violation is a dummy variable and Number is a discrete variable that is never below zero, we used the Probit model and Tobit model in regression to control the left-censored sample. At the same time, to control the robustness of results, we reported t-statistics that are computed using heteroskedasticity-robust standard errors clustered by firm and year (Petersen, 2009; Thompson, 2011).

Empirical Results

Summary Statistics

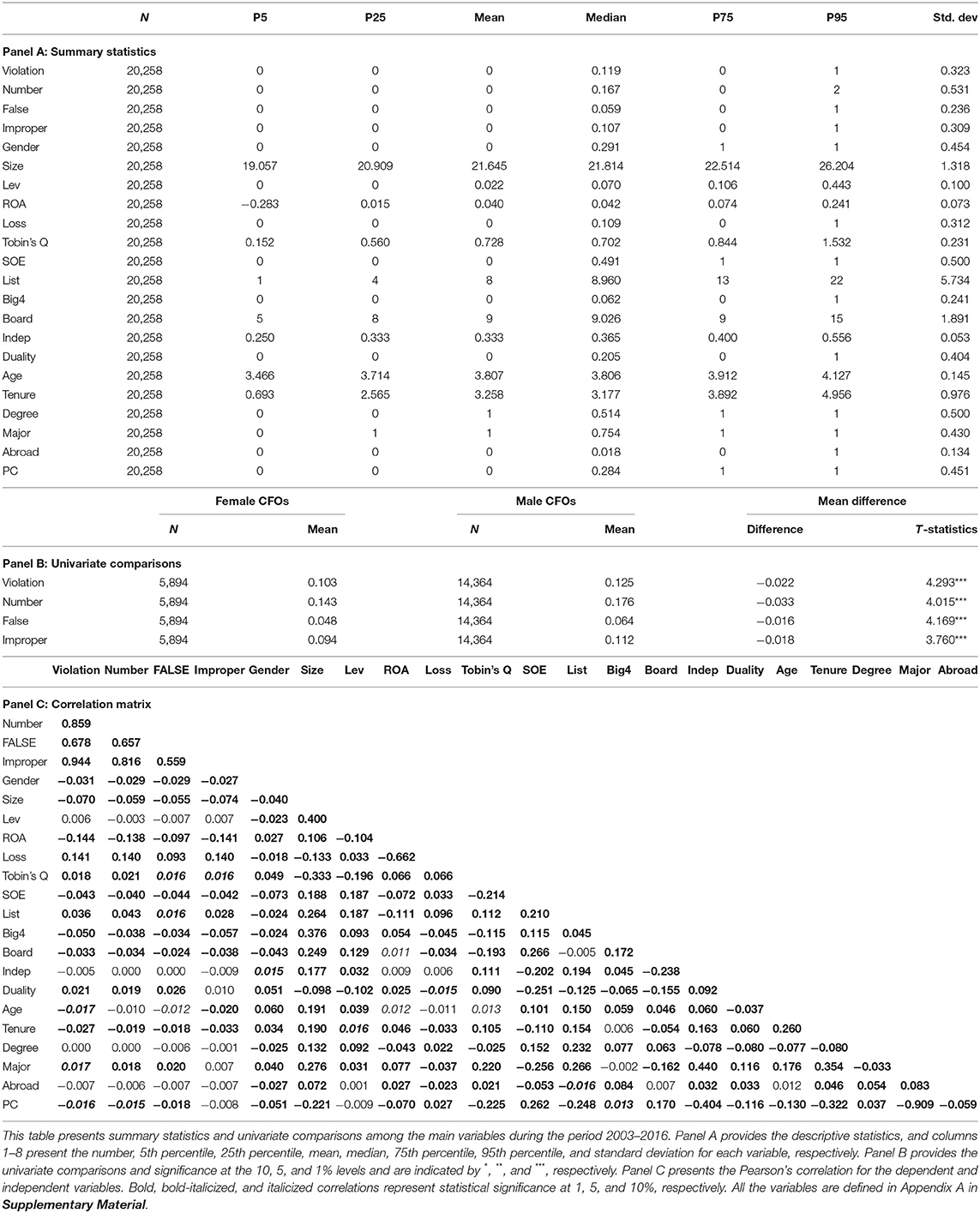

Panel A of Table 1 presents the sample's summary statistics. The mean of Violation for the entire sample is 0.119, implying that 11.9% of the companies in the study have been fined for information disclosure violations. Furthermore, the mean of Number is 0.167, which is higher than the median, showing that some companies have had several violations of information disclosure. The means of False and Improper are 0.059 and 0.107, respectively. The sum of the False and Improper means does not equal the mean of Violation suggests that some firms engage in both false and improper information violations. This finding suggests that the firm as a whole makes more improper disclosures than false disclosures. The mean of gender is 0.29, indicating 29.1% of CFOs are female and females are far more likely to be CFOs than CEOs or Chairman of the Board, as Feng and Johansson (2018) found that 95.9% of Chairman are male. To minimize the effect of outliers, we winsorized all continuous variables at the top and bottom 1% of each variable's distribution.

Panel B presents univariate comparisons of disclosure violations between male and female CFOs. We found that the means of Violation for female and male CFOs are 0.103 and 0.125, respectively. The mean difference of−0.022 is significant at the 1% level. We also found that the means of Number, False, and Improper are all lower for female CFOs (significant at the 1% level). These univariate comparisons support our hypothesis that female CFOs are more cautious about disclosing information than their male counterparts.

Panel C presents the correlation coefficients. Consistent with H1, the gender of CFOs (Gender) is negatively correlated with four different measures of violations (i.e., Violation, Number, False, and Improper), suggesting that female CFOs are related to a lower level of information violations. In addition, panel C shows that the correlations among the control variables are not very high, indicating that multicollinearity should not be a major concern.

Base Results

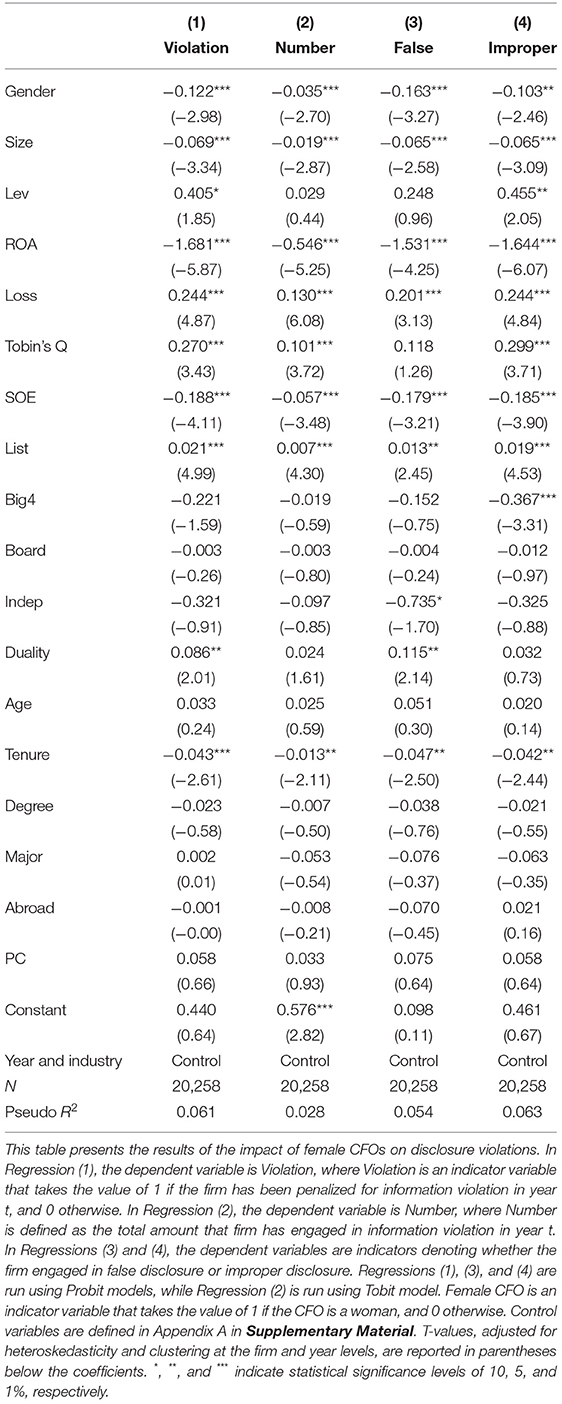

To investigate the relation between CFO gender and information disclosure violation, we started by regressing our measures of violation on CFO gender and other determinants of information disclosure violation We reported our baseline regression results in Table 2. As noted earlier, we used four different measures of violation in our tests, namely, Violation, Number, False, and Improper.

Violation is the dependent variable in Regression (1). Regression (1) is a probit regression with standard errors clustered at the firm and year level. According to the results of Regression (1), firms led by female CFOs are much less likely to be involved in violations than enterprises led by male CFOs. After controlling for several other determinants of violations, the coefficient of female CFO indicates that the violation of firms run by female CFOs is 0.122 lower on average than the violation of firms controlled by male CFOs. This difference appears to be statistically significant and economically significant. This finding provides supportive evidence that female CFOs are more cautious when it comes to information disclosure than their male counterparts.

In terms of the control variables of firm's performance, we found that the coefficients on Size and SOE are negative and significant, indicating that large or state-owned firms are less likely to commit disclosure violations because they are subject to more stringent investor and regulatory oversight. The coefficients on Lev and Loss are both negative and significant, which is in line with our expectations. Firms with higher debt and worse profitability are prone to participate in disclosure violations in order to meet the debt covenant requirements and analysts' forecasts. The coefficients on Tobin's Q and List are both positive and significant, indicating that firms with more investment opportunities and a longer list history are more likely to commit information disclosure violations.

In terms of the control variables of corporate governance, the coefficient on Duality is positive and significant, but the results of Big4, Indep, and board are not significant, indicating that the company's governance mechanisms have played only a partial role in information disclosure monitoring. For the control variables of CFO's personal characteristics, Tenure is inversely related to information disclosure violations, indicating that as the CFO obtains more experience during her tenure, the likelihood of violations decreases.

In Regression (2) of Table 2, we used Number as the dependent variable, and the control variables are the same as in Regression (1). We employed a panel Tobit model with standard errors clustered at the firm and year level. Consistent with the results for Violation, we found that Gender is statistically significant with a coefficient of−0.035, indicating that female CFOs are more conservative than their male colleagues. With regard to the control variables, we found that Size, ROA, SOE, and Tenure are all negative and significant, while Loss, Tobin's Q, and List are positive and significant, which is consistent with our expectations and prior findings.

In Regressions (3) and (4) of Table 2, we presented results in which the specifications are similar to that in Regressions (1) and (2), except that we used False and Improper as the dependent variables and found that Gender is negatively and significantly related with False and Improper. The coefficients of control variables are comparable with those results reported in Regressions (1) and (2).

In summary, our findings in Table 2 revealed that female CFOs are less likely to violate information disclosure laws on all four metrics. These findings corroborate our hypothesis that female CFOs are more cautious and risk-averse when it comes to information disclosure than male CFOs.

Moderate Effect

CFO Power

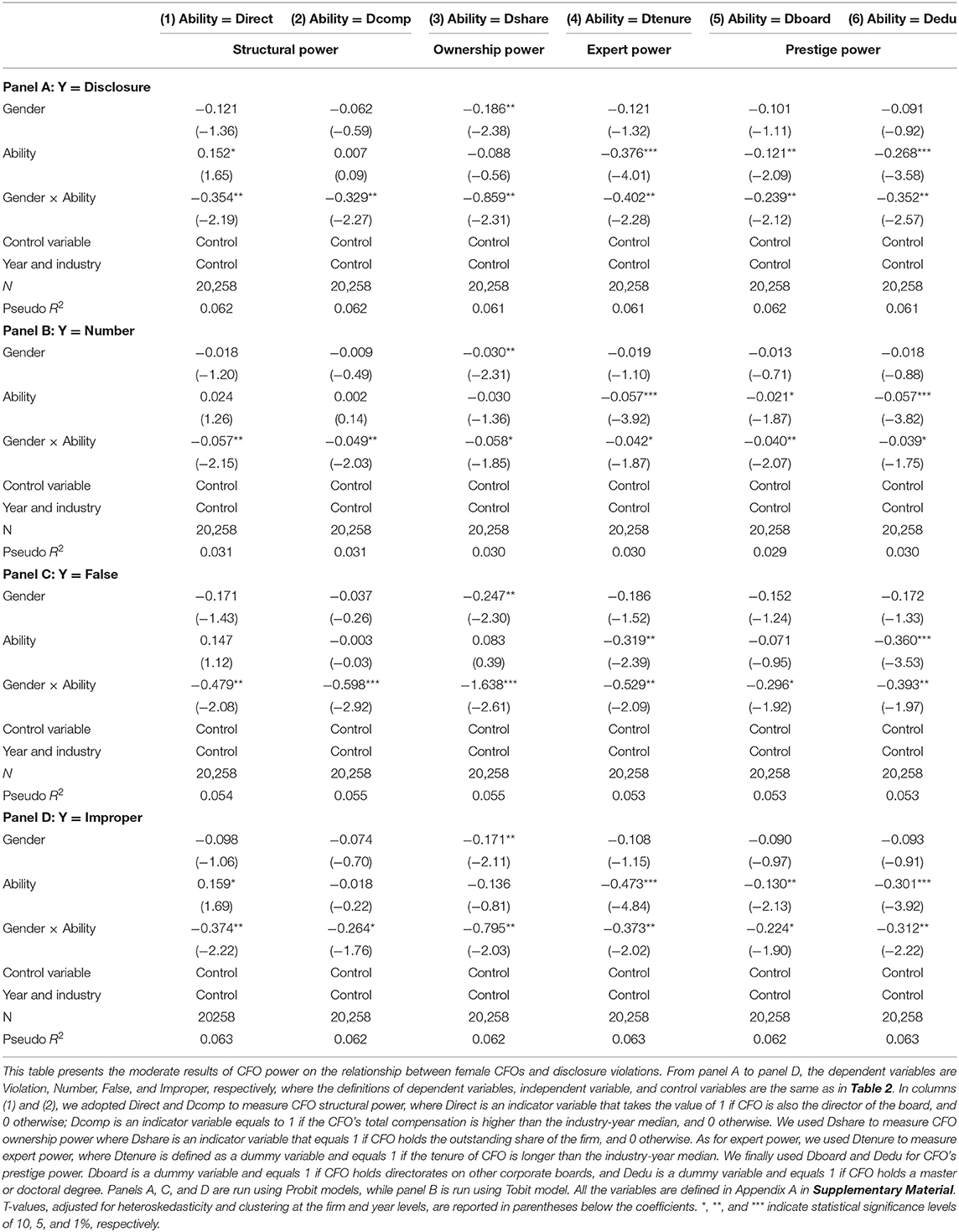

Table 3 presents our results regarding the moderate effect of CFO power. In columns (1)–(6) from panel A to panel D, we found significantly negative coefficients on Gender × Ability, which support our first hypothesis that CFO power significantly strengthens the effectiveness of female CFO in reducing the incidence of disclosure violation. Powerful female CFOs can exercise considerable influence on information disclosure; therefore, their risk-averse trait can play a greater role in reducing violations.

External Monitoring

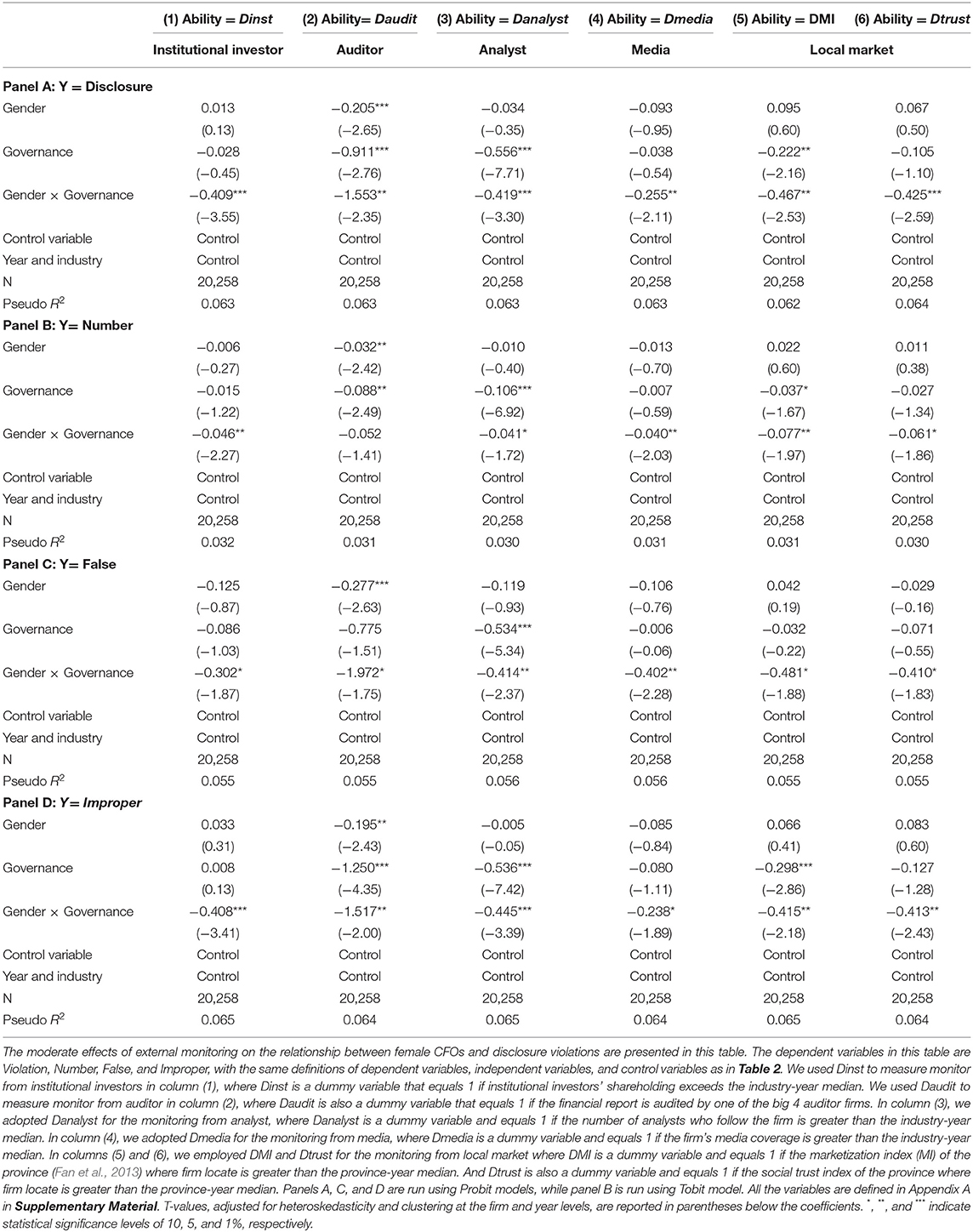

Table 4 presents our results regarding the moderate effect of external monitoring. The results from panel A–panel D in Table 4 show that the interaction coefficients Gender × Governance through columns (1)–(6) are constantly negative and significant, implying that the negative association between female CFOs and information disclosure violation is more pronounced for firms with stronger external monitoring. With the help of effective external monitoring, the female CFO can better reduce firms' information violations.

Robustness Tests

Propensity Score Matching

Table 2 shows, however, that firm and CFO characteristics are highly connected with disclosure violations, implying that non-random selection is a possibility. To address sample selection problems, we used a PSM procedure to see if there are any noticeable differences in the characteristics of firms led by female CFOs vs. firms led by male CFOs. We defined firms with female CFOs as the treatment group and firms with male CFOs as the control group. To conduct a one-to-one PSM matching, we used control variables in the Regression (1), including Size, Lev, ROA, Loss, Tobin's Q, SOE, List, Big4, Board, Indep, Duality, Age, Tenure, Degree, Major, Abroad, PC, Industry, and Year.

After matching, the treatment and control groups appear to be nearly indistinguishable in terms of firm and CFO characteristics, as shown in panel A1 of Table 5. This test further confirmed the validity of our matching strategy. The means of Violation after matching are 0.103 and 0.126 for the treatment and control groups, respectively, and the difference is significant at the 1% level, suggesting that firms with male CFOs are more likely involved in information violation. The results are qualitatively similar for Number, False, and Improper. These provide additional evidence that our main findings are robust to alternative model specifications.

We also ran regressions using the treatment and control groups as samples, as shown in Table 2. Panel A2 of Table 5 shows that the regression results and the coefficients on Gender are all negative and significant under our different measures of violation, namely, Violation, Number, False and Improper, further indicating that the main regression result is robust.

Selection Bias

The primary focus of this article is on whether female CFOs can prevent corporations from violating information disclosure laws. However, firms pick the gender of their CFO, and this underlying choice may potentially affect the inference of the regression results in Table 2. To address the potential concern of selection bias, we adopted two-stage self-selection models. We used the sex ratio in the firm's province as an instrument to evaluate a firm's tendency to hire a female CFO in the first stage, in addition to control the same variables as in Table 2. For each firm, we calculated the predicted probability of hiring a female CFO from the fitted values of the Probit model.

In the second stage, we used the predicted probability to generate an inverse Mill's ratio to proxy for the likelihood of a female CFO, which is indicated in the regression results as “Heckman's lambda.” Regression results in panel B of Table 5 show that the results are qualitatively unchanged, suggesting that selection bias is not a serious concern.

DID Test Using a Sample of CFO Transition

In the previous section, we showed that there is a negative relationship between female CFOs and disclosure violations controlling for other factors that have been shown to affect violations. The negative relationship may be caused by unobservable invisible variables. To partially alleviate the endogeneity caused by unobservable variables, we employed a sample of enterprises that are transitioning from male to female CEOs or vice versa. Focusing on transition firms allows us to compare the risk-taking of the same firms, as led by CFOs of different genders. We used the transition of CFO as an event shock and employed the event study and DID approach to determine the effect of the CFO's gender on the firm's violation.

We began by identifying the samples that have seen a CFO change. To avoid the tenure being too short or too long for CFO to play her role in refraining from disclosure violation, we required a 2-year tenure before and after the change, i.e., the balancing event window is 4 years. We also tested the relationship between female CFO and violations in a 6-year balancing event window, and the results are almost the same as in the 4-year window. Hence, we kept the sample with the 4-year event window and eliminated the firm that has never changed CFO during the research period or firms with less than the 4-year event window.

By comparing CFOs' gender before and after transition, we divided our event study sample into three groups. Group 1 is the control group that has no change of gender before and after the CFO transition, i.e., the CFO is changed from a male CFO to a male CFO or from a female CFO to a female CFO. Group 2 is made up of firms that have switched from a male to a female CFO, while Group 3 is made up of those that have switched from a female to a male CFO. We then constructed variables up and down to distinguish the different groups and use the following empirical model to test our hypothesis:

where Post is a dummy variable that equals 1 if a year is after the CFO transition year, and 0 if a year is before the transition year. Up is a dummy variable that equals 1 if the transition is from a male CFO to a female CFO and 0 if the transition is from a female CFO to a male CFO or the gender stays the same before and after the transition. Down is a dummy variable like Up that equals 1 if the transition is from a female CFO to a male CFO and 0 otherwise. Up × Post and Down × Post are our primary variables of interest.

If the base results are robust that a female CFO can refrain from violations, we can see the coefficient of Up × Post is positive, while Down × Post is negative, indicating that when a firm changes from a male (or female) CFO to a female (or male) CFO, it is less (more) likely to be involved in disclosure violations after the transition.

In Panel C of Table 5, the interaction coefficient of Up × Post is negative and both economically and statistically significant, while the coefficient of Down × Post is positive for all four measures of information disclosure violation. This shows that the transition from a male CFO to a female CFO has a statistically significant and economically meaningful impact on disclosure violations. Specifically, the coefficient on Up × Post is −0.528 and is significant at the 10% level for the variable Violation, indicating that Violation is about −0.528 lower for the post-transition period (under the control of no gender change) as compared with the pre-transition period, comparing to an increase of 1.008 of Violation due to change from male CFO to female CFO. This finding provides supportive evidence that CFO transitions are associated with changes in corporate risk-taking. In particular, transitions from male to female CEOs are associated with a reduction in information violations. Female CFOs are more conservative in information disclosure decision-making than their male counterparts.

Control the Gender of CEO and Chairman of the Board

Recent studies found that female CEOs or Chairman of the Boards are more risk-averse than their male counterparts. They are more likely to finance and invest more conservatively (Huang and Kisgen, 2013; Faccio et al., 2016), more conservative in accounting policies (Francis et al., 2015; Zalata et al., 2019), more likely to follow rules and regulations (Lanis et al., 2017; Adhikari et al., 2019), and take more responsibility in social events (McGuinness et al., 2017; Grosser and Moon, 2019). These researches raise concerns that our earlier findings may cause by the risk-aversion of female CEOs/chairmen and their tendency to hire female CFOs, not the risk-aversion of female CFOs themselves.

To alleviate the above concerns, we divided the full sample into female CEO vs. male CEO and female chairs vs. male chairs and tested the relationship between female CFOs and information disclosure violations, respectively. The results are in panel D of Table 5.

In the four subsamples of female CEO, male CEO, female chairs, and male chairs, the regression results represent that the coefficients on Gender are negative and significant at 5% level for our four measures of violations, indicating that our base results are not caused by the gender of CEOs/Chairman of the Board.

Different Sample Periods

As mentioned earlier, due to the time lag between the incidence of violation and revelation of regulators, we used 2016 as the end of our research period instead of 2018. It could be possible that the violation in 2016 may not be fully discovered; for this reason, we replaced our ending period with 2014 and 2015, respectively. The coefficients on Gender in Regressions (1) to (4) are negative and significant at 1–5% levels, as shown in panel E of Table 5.

Exogenous Shock

In addition, in 2007, the CSRC released the “Rule of information disclosure for Listed Companies,” which demonstrates the need of information disclosure and limits the CFO's violations. Hence, we took this event as an exogenous shock and divided the sample into 2003–2006 and 2007–2016, to see if female CFOs have a different impact on information disclosure violations. The results in panel F of Table 5 are similar to Table 2, representing that female CFOs can reduce firms' information disclosure violations before and after the regulation.

Summary

Using China's listed companies from 2003 to 2016, we investigated whether female CFOs can reduce information disclosure violations. We found that female CFOs can reduce a firm's information disclosure violation because they have higher risk aversion and ethical moral standards.

To explore the moderate effect of CFO power on the relationship between CFO gender and disclosure violation, we followed Finkelstein (1992) and measured CFO power on four dimensions, namely, structural power, ownership power, expert power, and prestige power. The results showed that CFO power can significantly strengthen the effectiveness of female CFO in lowering the incidence of disclosure violation, and firms with more powerful female CFOs appear to have fewer violations. We finally studied the external monitoring from institutional investors, auditors, analysts, media, and local market, and the results represent that the negative relationship between female CFOs and violations is more pronounced for firms with stronger external monitoring.

Our results are robust after using different proxies in measuring violation, conducting a one-to-one PSM matching, controlling for the fact that the gender of CFO is an endogenous choice by using a Heckman self-selection model, partially controlling endogeneity with event study and DID method, ruling out the effect of female CEO/chairman, and employing different sample periods and exogenous shock.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

YZ: main idea design and paper writing. JX and NY: data gathering and analyzing. JW: revision of the paper and reading proof. All authors contributed to the article and approved the submitted version.

Funding

This study was funded by the National Natural Science Foundation of China (No. 71802101) and Shanghai Pujiang Program (No. 21PJC058).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fpsyg.2022.902472/full#supplementary-material

Footnotes

1. ^The MI is a widely used index that measures the market and legal development in China's 31 provinces, autonomous regions, and municipalities from 1997 to 2014 (Fan et al., 2013; Lu et al., 2015). The index is jointly published annually by the National Economic Research Institute and the China Reform Foundation. Since our sample period extends beyond 2014, we matched cases after 2014 with the index value for 2014. Our results are qualitatively unchanged if we use the average index value between 2003 and 2014 instead.

2. ^The Social trust index (Wang et al., 2017) is widely used in recent studies (Dong et al., 2018) and is collected from the 2017 report of the Business Environment Index for China's Provinces, which provides the magnitudes of social trust in 2006, 2008, 2010, 2012, 2014, and 2016 among China's provinces. Since the survey is conducted biannually, we do not have an index in 2007, 2009, 2011, 2013, and 2015. Following Dong et al. (2018), we used the index from the last year as the index for the current year. Our results are qualitatively unchanged if we use interpolation to fill in the data. For example, for 2007, we used the average indexes of 2006 and 2008.

References

Adhikari, B. K., Agrawal, A., and Malm, J. (2019). Do women managers keep firms out of trouble? Evidence from corporate litigation and policies. J. Account. Econ. 67, 202–225. doi: 10.1016/j.jacceco.2018.09.004

Anderson, C., and Galinsky, A. D. (2006). Power, optimism, and risk-taking. Eur. J. Soc. Psychol. 36, 511–536. doi: 10.1002/ejsp.324

Bellucci, A., Borisov, A., and Zazzaro, A. (2010). Does gender matter in bank-firm relationships? Evidence from small business lending. J. Bank. Financ. 34, 2968–2984. doi: 10.1016/j.jbankfin.2010.07.008

Bhagat, S., and Bolton, B. (2008). Corporate governance and firm performance. J. Corp. Financ. 14, 257–273. doi: 10.1016/j.jcorpfin.2008.03.006

Carter, D. A., D'Souza, F., Simkins, B. J., and Simpson, W. G. (2010). The gender and ethnic diversity of US boards and board committees and firm financial performance. Corp. Gov. Int. Rev. 18, 396–414. doi: 10.1111/j.1467-8683.2010.00809.x

Croson, R., and Gneezy, U. (2009). Gender differences in preferences. J. Econ. Lit. 47, 448–474. doi: 10.1257/jel.47.2.448

Dong, W., Han, H., Ke, Y., and Chan, K. C. (2018). Social trust and corporate misconduct: evidence from China. J. Bus. Ethics. 151, 539–562. doi: 10.1007/s10551-016-3234-3

Faccio, M., Marchica, M. T., and Mura, R. (2016). CEO gender, corporate risk-taking, and the efficiency of capital allocation. J. Corp. Financ. 39, 193–209. doi: 10.1016/j.jcorpfin.2016.02.008

Fan, J. P., Wong, T. J., and Zhang, T. (2013). Institutions and organizational structure: the case of state-owned corporate pyramids. J. Law Econ. Organ. 29, 1217–1252. doi: 10.1093/jleo/ews028

Feng, X., and Johansson, A. C. (2018). Living through the Great Chinese Famine: early-life experiences and managerial decisions. J. Corp. Financ. 48, 638–657. doi: 10.1016/j.jcorpfin.2017.11.012

Finkelstein, S. (1992). Power in top management teams: dimensions, measurement, and validation. Acad. Manage. J. 35, 505–538. doi: 10.5465/256485

Francis, B., Hasan, I., Park, J. C., and Wu, Q. (2015). Gender differences in financial reporting decision making: evidence from accounting conservatism. Contemp. Account. Res. 32, 1285–1318. doi: 10.1111/1911-3846.12098

Gao, H., Lin, Y., and Ma, Y. (2016). Sex discrimination and female top managers: evidence from China. J. Bus. Ethics. 138, 683–702. doi: 10.1007/s10551-015-2892-x

González, M., Guzmán, A., Tellez, D. F., and Trujillo, M. A. (2021). What you say and how you say it: information disclosure in Latin American firms. J. Bus. Res. 127, 427–443. doi: 10.1016/j.jbusres.2019.05.014

Grosser, K., and Moon, J. (2019). CSR and feminist organization studies: towards an integrated theorization for the analysis of gender issues. J. Bus. Ethics. 155, 321–342. doi: 10.1007/s10551-017-3510-x

Ham, C., Lang, M., Seybert, N., and Wang, S. (2017). CFO narcissism and financial reporting quality. J. Account. Res. 55, 1089–1135. doi: 10.1111/1475-679X.12176

Ho, S. S., Li, A. Y., Tam, K., and Zhang, F. (2015). CEO gender, ethical leadership, and accounting conservatism. J. Bus. Ethics. 127, 351–370. doi: 10.1007/s10551-013-2044-0

Huang, J., and Kisgen, D. J. (2013). Gender and corporate finance: are male executives overconfident relative to female executives?. J. Financ. Econ. 108, 822–839. doi: 10.1016/j.jfineco.2012.12.005

Jensen, M. C., and Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency cost and ownership structure. J. Financ. Econ. 3, 305–360. doi: 10.1016/0304-405X(76)90026-X

Jiang, J. X., Petroni, K. R., and Wang, I. Y. (2010). CFOs and CEOs: who have the most influence on earnings management?. J. Financ. Econ. 96, 513–526. doi: 10.1016/j.jfineco.2010.02.007

Keltner, D., Gruenfeld, D. H., and Anderson, C. (2003). Power, approach, and inhibition. Psychol. Rev. 110, 265. doi: 10.1037/0033-295X.110.2.265

Kuhn, P., and Shen, K. (2013). Gender discrimination in job ads: evidence from china. Q. J. Econ. 128, 287–336. doi: 10.1093/qje/qjs046

Lanis, R., Richardson, G., and Taylor, G. (2017). Board of director gender and corporate tax aggressiveness: an empirical analysis. J. Bus. Ethics. 144, 577–596. doi: 10.1007/s10551-015-2815-x

Lewellyn, K. B., and Muller-Kahle, M. I. (2012). CEO power and risk taking: evidence from the subprime lending industry. Corp. Gov. Int. Rev. 20, 289–307. doi: 10.1111/j.1467-8683.2011.00903.x

Lisic, L. L., Neal, T. L., Zhang, I. X., and Zhang, Y. (2016). CEO power, internal control quality, and audit committee effectiveness in substance versus in form. Contemp. Account. Res. 33, 1199–1237. doi: 10.1111/1911-3846.12177

Liu, Y., Wei, Z., and Xie, F. (2014). Do women directors improve firm performance in China?. J. Corp. Financ. 28, 169–184. doi: 10.1016/j.jcorpfin.2013.11.016

Lu, H., Pan, H., and Zhang, C. (2015). Political connectedness and court outcomes: evidence from Chinese corporate lawsuits. J. Law Econ. 58, 829–861. doi: 10.1086/684290

Malmendier, U., and Tate, G. (2008). Who makes acquisitions? CEO overconfidence and the market's reaction. J. Financ. Econ. 89, 20–43. doi: 10.1016/j.jfineco.2007.07.002

McGuinness, P. B., Vieito, J. P., and Wang, M. (2017). CSR performance in China: the role of board gender and foreign ownership. J. Corp. Financ. 42, 72–99. doi: 10.1016/j.jcorpfin.2016.11.001

Palvia, A., Vähämaa, E., and Vähämaa, S. (2015). Are female CEOs and chairwomen more conservative and risk averse? Evidence from the banking industry during the financial crisis. J. Bus. Ethics. 131, 577–594. doi: 10.1007/s10551-014-2288-3

Petersen, M. A. (2009). Estimating standard errors in finance panel data sets: comparing approaches. Rev. Financ. Stud. 22, 435–480. doi: 10.1093/rfs/hhn053

Qi, W., Min, D., and Bo., A. (2016). Revisiting Gender Inequality: Perspectives From the People's Republic of China. Berlin: Springer.

Sariol, A. M., and Abebe, M. A. (2017). The influence of CEO power on explorative and exploitative organizational innovation. J. Bus. Res. 73, 38–45. doi: 10.1016/j.jbusres.2016.11.016

Sun, J., Kent, P., Qi, B., and Wang, J. (2019). Chief financial officer demographic characteristics and fraudulent financial reporting in China. Account. Financ. 59, 2705–2734. doi: 10.1111/acfi.12286

Terjesen, S., Sealy, R., and Singh, V. (2009). Women directors on corporate boards: a review and research agenda. Corp. Gov. Int. Rev.17, 320–337. doi: 10.1111/j.1467-8683.2009.00742.x

Thompson, S. B. (2011). Simple formulas for standard errors that cluster by both firm and time. J. Financ. Econ. 99, 1–10. doi: 10.1016/j.jfineco.2010.08.016

Wang, X., Fan, G., and Ma, G. (2017). Business Environment Index for China's Provinces. Beijing: Social Sciences Academic Press (in Chinese).

Keywords: female CFO, information disclosure violations, CFO power, external monitoring, China

JEL Classifications: G30, G41, M14

Citation: Zhao Y, Xiong J, Wang J and Ye N (2022) CFO Gender, Corporate Risk-Taking, and Information Disclosure Violations. Front. Psychol. 13:902472. doi: 10.3389/fpsyg.2022.902472

Received: 23 March 2022; Accepted: 20 June 2022;

Published: 13 July 2022.

Edited by:

Sara Palermo, University of Turin, ItalyCopyright © 2022 Zhao, Xiong, Wang and Ye. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jingjing Wang, MDgxMDI1MDI1QHNodS5lZHUuY24=

Yujie Zhao

Yujie Zhao Jiaxin Xiong2

Jiaxin Xiong2